ASA Survey Reveals Concerns Over EPA's Herbicide Strategy for Soy Farmers

Is China favoring U.S. sorghum over corn? | Fed policy | U.S. crop sector shifts focus to domestic market with biofuels

|

Today’s Digital Newspaper |

MARKET FOCUS

- Fed officials more worried about cutting rates too soon

- Nvidia surges as quarterly sales tripled from a year ago

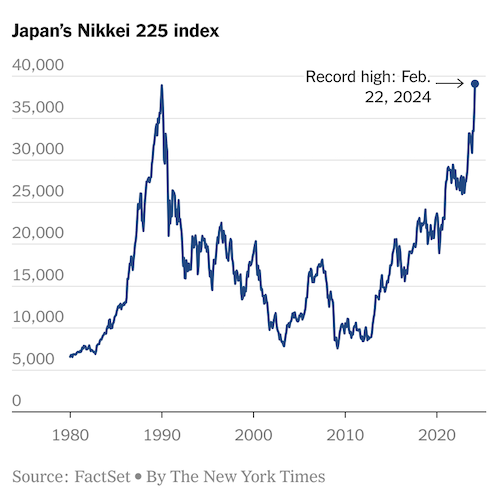

- Japan stocks surge to highest level since 1980s, reflecting economic turnaround

- AT&T customers report major outage, disrupting phone service across U.S.

- Boeing replaces head of 737 Max program

- Fed minutes show no rush to lower rates; discussions on balance sheet underway

- Eurozone inflation eases in January

- Eurozone business activity inches up

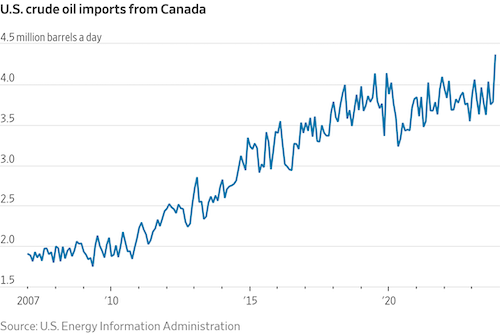

- U.S. drivers may face rising oil prices as Canada pipeline capacity expands

- Yellen to make critical trip about critical minerals

- Houthi rebels continue to attack ships in Red Sea

- Ag markets today

- USDA daily export sale: 126,000 MT sorghum to China, 2023-2024 marketing year

- India’s rice prices reach record high again

- Ag trade update

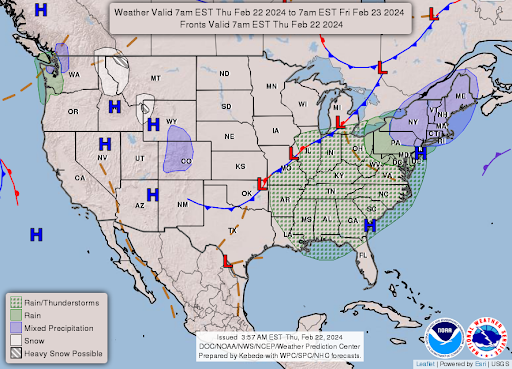

- NWS weather outlook

ISRAEL/HAMAS CONFLICT

- White House and Arab states are ramping up efforts to broker a deal

RUSSIA & UKRAINE

- NATO Sec.-Gen.: Ukraine has right to strike Russian military targets outside borders

- Polish Prime Minister refuses to meet with Ukraine’s Zelenskyy at border

POLICY

- ASA survey reveals concerns over EPA's herbicide strategy for soy farmers

- Analyst: U.S. crop sector shifts focus to domestic market with biofuels

CHINA

- U.S. lawmakers' visit to Taiwan could heighten tensions with China

- China to revitalize "panda diplomacy" with San Diego Zoo and Madrid's Zoo

- China’s property foreclosures surge, new home prices continue to slide

- China’s drive to boost oilseed crop faces frigid weather threat

ENERGY & CLIMATE CHANGE

- Granholm tries to reassure U.S. pause on new LNG exports is not a ban

- Stanton County, Neb., rejects carbon pipeline proposal

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- Nestlé warns that inflation will hurt growth

- House leaders negotiate nutrition assistance amid shutdown threat, faces criticism

- Two populist senators oppose meatpacking riders

- U.S., Mexico, & Canada meat groups sign accord on trade and animal disease issues

OTHER ITEMS OF NOTE

- Biden mulls executive actions to address immigration issues at southern border

|

MARKET FOCUS |

— Equities today: Asian and European stock markets were mixed but mostly firmer in overnight trading. Japan’s Nikkei stock index Thursday hit a record high for the first time in 34 years. The Nasdaq opened up over 300 points higher. The Dow opened over 200 points higher. In Asia, Japan +2.2%. Hong Kong +1.5%. China +1.3%. India +0.7%. In Europe, at midday, London +0.2%. Paris +1.1%. Frankfurt +1.4%.

U.S. equities yesterday: A late push in equities lifted the Dow and S&P 500 into positive territory by the close and pared losses for the Nasdaq. The Dow rose 48.44 points, 0.13%, at 38,612.24. The Nasdaq was down 49.91 points, 0.32%, at 15,580.87. The S&P 500 gained 6.29 points, 0.13%, at 4,981.80.

— Nvidia’s quarterly sales tripled from a year ago, surpassing Wall Street’s heightened expectations, and the company indicated momentum from the artificial-intelligence boom remains strong. Fourth-quarter revenue reached $22 billion, beating expectations. It forecast $24 billion of sales for its current quarter and pointed to surging demand from its data-center business, where sales jumped fivefold from a year earlier. Nvidia’s shares surged 13% following the chipmaker’s bumper results, which have boosted global technology stocks.

— Japan stocks surge to highest level since 1980s, reflecting economic turnaround. Japan's Nikkei stock index reached a historic high, surpassing levels not seen since the late 1980s — the Nikkei Stock Average of 225 shares closed at 39,098.68, above the previous record of 38,915.87 set in 1989. This milestone comes amid Japan's recovery from a prolonged period of economic stagnation, marked by a real estate crash and deflation in the early 1990s. The Covid-19 pandemic acted as a catalyst for change, driving inflation and prompting companies to enhance productivity and profitability. Billionaire investor Warren Buffett capitalized on the growing strength of Japanese firms by acquiring significant stakes in the country's trading houses. With optimism surrounding Japan's economic resurgence, expectations of continued stimulus from the central bank, and a bullish stock market outlook, the nation faces the challenge of swiftly exiting the recession experienced in the latter half of last year.

— AT&T customers report major outage, disrupting phone service across U.S. AT&T and Cricket appear to be primarily impacted, according to outage reports. Users of T-Mobile and Verizon, too, were reporting outages on Thursday, but it appears that AT&T and Cricket, which use the same network, were suffering the most, according to DownDetector. As of Thursday at 9 a.m. ET, about 74,000 users reported AT&T outages, while more than 13,000 Cricket users reported. In a statement to several news outlets on Thursday, AT&T confirmed the outage and urged users to use Wi-Fi calling in the meantime. “Some of our customers are experiencing wireless service interruptions this morning. We are working urgently to restore service to them,” it said in a statement. T-Mobile and Verizon said that they are not suffering outages. “We did not experience an outage,” T-Mobile told news outlets. “Our network is operating normally.” “Verizon’s network is operating normally,” Verizon told outlets Thursday. “Some customers experienced issues this morning when calling or texting with customers served by another carrier. We are continuing to monitor the situation.”

— Boeing replaces the head of its 737 Max program. Ed Clark, who oversaw the factory that makes the 737 Max 9, was the most prominent executive to be ousted in a leadership shake-up at the aerospace giant. The changes represent the biggest move Boeing has made yet in the wake of an episode in which a door plug on an Alaska Airlines 737 Max 9 fell off mid-flight.

— Ag markets today: Wheat futures led a round of corrective buying in the grain markets during overnight trade. As of 7:30 a.m. ET, corn futures were trading around a penny higher, soybeans were 3 to 4 cents higher, SRW wheat was 5 to 6 cents higher, HRW wheat was 7 to 11 cents higher and HRS wheat was 10 to 11 cents higher. Front-month crude oil futures were modestly weaker, while the U.S. dollar index was down around 275 points.

Packers continue to slow cattle slaughter runs. Estimated slaughter totaled 349,000 head through the first three days this week, 14,000 head below last week and 4,247 head below last year. Cash sources expect the weekly tally to fall below 600,000 head, with some as low as 590,000 as packers try to control tight supplies amid highly negative margins. That also means packers won’t likely be very active with cash cattle bids after buying a lot of cattle the past two weeks. And feedlots appear in no hurry to move cattle at lower prices with Friday afternoon’s Cattle on Feed Report expected to be bullish.

Cash hog rally gaining steam. The CME lean hog index jumped another $1.17 to $77.97 as of Feb. 20, marking back-to-back days of $1.00-plus gains. The cash index is outpacing futures, with the premium in the April contract down to $8.005 as of Wednesday’s close.

— Agriculture markets yesterday:

- Corn: March corn fell 7 3/4 cents to $4.11 and a fresh contract low close.

- Soy complex: May soybeans fell 18 1/2 cents to $11.65. May soybean meal lost $5.00 at $336.70. May bean oil closed down 50 points at 45.42 cents. All three markets closed nearer their session lows.

- Wheat: May SRW fell 1 1/4 cents to $5.78, marking a high-range close, while May HRW fell 6 1/2 cents to $5.74 1/2. May spring wheat fell 4 cents to $6.61 1/2.

- Cotton: May cotton gained 154 points at 93.23 cents and nearer the session high.

- Cattle: Anticipation of seasonal strength continued supporting cattle futures Wednesday. The exception was provided by the nearby contract. The February live cattle contract slid 42.5 cents to $183.975, while most-active April rose 37.5 cents to settle at $187.70. March feeder futures skidded 2.5 cents to $251.35, while the deferred contracts posted moderate gains.

- Hogs: April lean hogs closed 30 cents higher to $85.975, though the contract settled near the middle of today’s range.

— Quotes of note:

- AI surging. “Accelerated computing and generative AI have hit the tipping point. Demand is surging worldwide across companies, industries and nations.” — Jensen Huang, Nvidia CEO and founder.

- Elections and the Fed. “I don’t think the FOMC is all that concerned about the optics of cutting rates in May or June in an election year,” Wells Fargo senior economist Mike Pugliese said. “But what I do think matters quite a lot is the outcome of the election itself.” Wells Fargo released a new analysis this week that backs up the idea that election considerations don’t play a major role in Fed monetary policy decisions. The bank’s economists found that the Fed has adjusted its policy rate nearly the same number of times in presidential years as non-election years.

— Fed minutes show no rush to lower rates; discussions on balance sheet underway. The Federal Reserve's meeting minutes from Jan. 30-31 indicate a consensus among U.S. central bankers that there is no urgency to decrease interest rates. They are beginning discussions on adjusting the balance sheet runoff. Post-meeting comments from Fed officials have been largely aligned, emphasizing the potential negative consequences of premature rate cuts. Richmond Fed President Thomas Barkin remarked that recent job and inflation data have made the Fed's decision-making more challenging, rather than easier. While additional Fed officials will speak today, significant deviation from the current stance appears unlikely.

— Eurozone inflation eases in January. Consumer inflation in the euro zone slipped to 2.8% above year-ago in January, in line with the preliminary estimate and down from a 2.9% rise the previous month. Core inflation, excluding food and energy prices, rose 3.6% annually. An even narrower measure excluding alcohol and tobacco increased 3.3% from year-ago.

— Eurozone business activity inches up. HCOB’s preliminary euro zone composite purchasing managers index compiled by S&P Global rose to 48.9 this month from January’s 47.9. That marked the ninth consecutive month of falling output, though the contraction was the weakest since last June, as stabilization of output in the service sector offset a further steep downturn in manufacturing. Business confidence within the bloc improved for the fifth successive month in February, rising to the highest level since last April, amid hopes of reduced cost of living pressures and expectations of lower interest rates in the year ahead.

Market perspectives:

— Outside markets: The U.S. dollar index was weaker, with the euro, British pound, and yen all higher against the greenback. The yield on the 10-year U.S. Treasury note was firmer, trading around 4.34%, with a mixed tone in global government bond yields. Crude oil futures turned lower ahead of U.S. gov’t inventory data that was delayed a day by the Monday U.S. holiday. U.S. crude was around $77.65 per barrel while Brent was around $82.80 per barrel. Gold and silver futures were higher ahead of U.S. economic data, with gold around $2,036 per troy ounce and silver around $23.01 per troy ounce.

— U.S. drivers may face rising oil prices as Canada pipeline capacity expands. For years, U.S. drivers have enjoyed artificially cheap oil imported from Canada. But that could be changing in the coming months as new pipeline capacity comes on stream, eliminating a cause of the price discount.

— India’s rice prices reach record high again. India’s parboiled rice export prices climbed to fresh record highs on limited supplies and slight improvement in demand. India’s 5% broken parboiled variety was quoted at record $546 to $554 per metric ton, up $4 from last week. Vietnam’s 5% broken rice was offered at $625 to $630 per metric ton, down from $637 to $640 a week ago. Thailand’s 5% broken rice prices were quoted at $615 per metric ton, up from last week’s $610 rate.

— USDA daily export sale: 126,000 MT sorghum to China, 2023-2024 marketing year.

— Ag trade update: Japan purchased 115,921 MT of milling wheat, including 30,435 MT U.S., 51,586 MT Canadian and 33,900 MT Australian. South Korea tendered to buy 136,400 MT of milling wheat – 50,000 MT from the U.S., 50,000 MT from Australia and 36,400 MT from Canada. Tunisia tendered to buy 100,000 MT optional origin soft milling wheat.

— NWS weather outlook: Pleasantly mild across most of the country through the end of the week... ...Showers and thunderstorms from the Gulf Coast to the Ohio Valley on Thursday.

|

ISRAEL/HAMAS CONFLICT |

— White House and Arab states are ramping up efforts to broker a deal that would pause the fighting in Gaza and free hostages held by Hamas, with Washington dispatching a top official to Israel Thursday at a time when the war is on the brink of escalation.

|

RUSSIA/UKRAINE |

— NATO Secretary-General: Ukraine has right to strike Russian military targets outside its borders. Jens Stoltenberg, NATO's Secretary-General, has affirmed Ukraine's right to strike "Russian military targets outside Ukraine" under international law, marking a significant shift in rhetoric. Stoltenberg emphasized Ukraine's right to self-defense in the face of Russian aggression, including the ability to target legitimate Russian military sites beyond its borders. This statement comes amid escalating tensions and as NATO allies consider providing advanced weaponry to Ukraine. The debate over such actions is likely to intensify, especially with the potential deployment of F-16 fighter jets armed with long-range missiles. While Russia has issued warnings against further Western support to Ukraine, Stoltenberg underscored Ukraine's resilience and its ability to conduct effective military operations, despite challenges on the battlefield.

— Polish Prime Minister refuses to meet with Ukraine’s Zelenskyy at border. Polish Prime Minister Donald Tusk said there was no need to meet with Ukrainian President Volodymyr Zelenskyy at the border to defuse a farmer blockade that has disrupted grain shipments from Ukraine. Tusk pledged at a Warsaw briefing Thursday to introduce a special regime on the frontier to ensure safe passage for humanitarian and military aid for Kyiv despite the protests. Tusk said the cabinets of the two countries had agreed to meet in the Polish capital on March 28.

|

POLICY UPDATE |

— ASA survey reveals concerns over EPA's herbicide strategy for soy farmers. The American Soybean Association (ASA) conducted a survey to assess the potential impacts of the Environmental Protection Agency's (EPA) proposed Herbicide Strategy on soy farmers. The Herbicide Strategy aims to align herbicide registrations with the Endangered Species Act (ESA). The survey results indicate significant concerns among soybean producers regarding their ability to comply with the proposed regulations and the potential financial and operational burdens they may face.

Key findings from the survey include:

- Around 99% of respondents would have compliance obligations under the Herbicide Strategy.

- Approximately 80% of producers would likely be non-compliant with the proposed regulations, facing moderate to extreme costs to become compliant.

- Herbicide-resistant weeds pose a major challenge for growers, limiting their flexibility to alter their herbicide mix.

- Most respondents cannot easily remove herbicides from their lineup to meet the efficacy point requirements under the Herbicide Strategy.

- While some mitigations such as no-till or reduced tillage are utilized by over half of the farmers, other options are scarcely adopted.

- Only 21% of respondents would meet the efficacy point requirements with current practices in place.

- A significant portion of producers anticipate moderate to extremely costly adoption of new practices to comply with the Herbicide Strategy.

The Herbicide Strategy applies to a wide range of herbicides and includes over 900 listed species. It delineates areas with different requirements based on the presence of endangered species. The proposal entails significant costs for farmers to implement runoff conservation practices and large spray buffers.

ASA, along with numerous other groups, expressed concerns to the EPA during the public comment period. The deadline for finalizing the Herbicide Strategy has been extended to Aug. 30 to allow for more consideration of public comments and input regarding the practicality and effectiveness of mitigation measures.

ASA plans to engage with the EPA and other stakeholders to address the challenges posed by the Herbicide Strategy and advocate for changes that alleviate the concerns raised in the survey. They will also participate in discussions regarding the Vulnerable Species Pilot Program, which has similar implications for soybean growers.

— Analyst: U.S. crop sector shifts focus to domestic market with biofuels. According to agricultural economist Scott Irwin of the University of Illinois, the U.S. crop sector is transitioning to a more domestic market-oriented approach due to biofuels policy. The surge in ethanol production, utilizing corn, and the rise of renewable diesel fuel, primarily derived from soybean oil, have significantly reduced exports of these commodities. Irwin suggests that this shift marks a strategic direction for U.S. agriculture, starting with the Renewable Fuel Standard in 2005 and gaining momentum with the renewable diesel boom.

“My explanation is that the U.S. crop sector is in the process of reinsulating itself from the world market,” wrote Irwin in a blog (link) that cited the 1996 Freedom to Farm law — which removed most federal controls over what farmers plant — as the end of U.S. supply management policies. “Apparently, U.S. crop farmers prefer insulated domestic markets.”

Alternative viewpoint. While some argue that this shift is deliberate, others, like Pat Westhoff of the University of Missouri, see it as an effort to expand markets rather than insulate U.S. agriculture. The allure of exports has diminished in recent years due to trade war disruptions, pandemic-related concerns, and uncertainty in supply chains.

|

CHINA UPDATE |

— Lawmakers' visit to Taiwan, led by Rep. Mike Gallagher, could heighten tensions with China. A visit to Taiwan by lawmakers, spearheaded by House China Chair Rep. Mike Gallagher (R-Wis.), may further strain relations between the island and China. The delegation is set to engage with key Taiwanese figures, including President Tsai Ing-wen and President-elect Lai Ching-te, during their three-day visit beginning today.

— China to revitalize "panda diplomacy" with San Diego Zoo and Madrid's Zoo. After recalling pandas loaned to foreign zoos in recent years, China intends to send a pair of pandas — a male and a female — to San Diego by late summer. Discussions are also underway to renew cooperation with the National Zoo in Washington, D.C., and Austria's Schönbrunn Zoo, according to the Chinese Embassy. Link to details via the South China Morning Post.

— China’s property foreclosures surge, new home prices continue to slide. The number of foreclosed properties for sale in China rose at a faster pace in January, a sign of the country’s continued economic struggles. New listings of foreclosed properties nationwide rose 48% in January from a year earlier, compared with 37% in 2023, according to a report by real estate agency China Index Holdings. Meanwhile, China’s new home prices dropped 0.4% from year-ago in December – the sixth straight monthly decline and the steepest pace since March amid persistently weak demand despite efforts from the government to mitigate the impact of a prolonged property downturn.

— China’s drive to boost oilseed crop faces frigid weather threat. Cold weather in China this week could seriously damage the rapeseed crop, just as Beijing struggles to grow more of the oilseed to boost security of food supplies. Link to more via Bloomberg.

|

ENERGY & CLIMATE CHANGE |

— Energy Secretary Jennifer Granholm tries to reassure that the U.S. pause on new liquefied natural gas (LNG) exports is not a ban and won't hinder relationships with allies or their energy access. She stresses that the review process will take "months" and will only impact 12 projects, excluding those already approved.

Meanwhile, Granholm highlighted the Biden administration's careful restocking of the Strategic Petroleum Reserve (SPR) to avoid market disruption.

— Stanton County, Neb., rejects carbon pipeline proposal. The board of Stanton County, located in northeastern Nebraska, unanimously declined a conditional use permit for Summit Carbon Solutions. The company sought to construct a carbon dioxide pipeline spanning five states. Nebraska has no state regulations concerning carbon pipelines, but counties that have zoning ordinances require companies to obtain conditional use permits to build in that county. Link for details via the Iowa Capital Dispatch.

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— Nestlé warns that inflation will hurt growth. The maker of Nescafe coffee, chocolate bars and pet food sees “unprecedented inflation” sapping customers’ spending power, as its 2023 profits fell short of expectations. Earlier this month, Krispy Kreme and Heineken also warned that inflation would drive up input costs and chill sales.

— House leaders negotiate nutrition assistance amid shutdown threat, faces criticism. House leaders are negotiating an agreement to provide additional nutrition assistance for new mothers and young children, which could resolve a key issue in federal funding negotiations as a partial government shutdown looms. However, the proposed deal is facing criticism for its potential trade-off: implementing a pilot program to restrict food stamp purchases to nutrient-dense items. The agreement would bolster funding for WIC, addressing its $1 billion shortfall, but Rep. Andy Harris (R-Md.) is advocating for the SNAP-choice pilot initiative in exchange. Critics, including advocates for WIC and grocery industry groups, oppose the trade-off, arguing that it would add complexity and drive up food costs. Despite some support for the pilot program from former USDA secretaries, advocates warn that without additional funding, states may have to deny assistance to millions of eligible recipients, exacerbating the shortfall in the WIC program.

— Two populist senators oppose meatpacking riders. Two farm-state senators, Jon Tester (D-Mont.) and Chuck Grassley (R-Iowa), asked their colleagues to oppose riders on the USDA funding bill that would prevent the agency from enforcing new rules promoting competition in the meatpacking industry. In a letter (link), the senators oppose weakening the Packers and Stockyards Act to protect family farmers and consumers. They emphasize the Act's role in ensuring fair practices in the meat industry and highlight concerns about big ag consolidation. Tester and Grassley previously introduced the Meatpacking Special Investigator Act (link) and advocating for producers impacted by anti-dumping duties.

— U.S., Mexico, and Canada meat groups sign agreement on trade and animal disease issues. The North American Meat Institute, the Canadian Meat Council (CMC), and Consejo Mexicano de la Carne (COMECARNE) signed a Memorandum of Understanding (MOU) to collaborate on enhancing trade, reducing regulatory barriers, and improving information sharing among the three countries. The MOU was signed during the COMECARNE annual convention in Mexico.

Additionally, the groups have finalized a joint statement of coordination to address foreign animal diseases, sustainability, and non-tariff trade barriers. These barriers include challenges related to packaging, labeling policies, and burdensome regulations affecting meat production and processing efficiency. The documents have been submitted to regulatory agencies in the US, Mexico, and Canada to convey the groups' perspectives and priorities.

|

OTHER ITEMS OF NOTE |

— Biden administration is contemplating unilateral executive actions to address immigration issues at the southern border, following House Republicans' reluctance to support a bipartisan Senate immigration agreement. These actions may involve restricting asylum claims by migrants and could include utilizing Section 212(f) powers previously used by former President Donald Trump. Although the legality and scope of such measures are disputed, conservatives have urged Biden to consider them, though their viability in court is uncertain.

The border situation has suddenly become a focal point for Biden, particularly regarding securing assistance for Ukraine amid a new Russian offensive. The House's refusal to advance aid for Ukraine, Israel, and Taiwan without border restrictions underscores the political impasse.

Biden's potential actions signal the increasing importance of border and migration issues as a key topic in the upcoming 2024 elections.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |