Did Fed Chair Powell Say Anything New in 60 Minutes Interview?

USDA finalizes child nutrition program rule aligning with 2020 Dietary Guidelines as dairy industry eyes whole milk re-introduction

|

Today’s Digital Newspaper |

MARKET FOCUS

- In interview, Powell says inflation has come down, but job “not done”

- Sevens Report: Did Fed Chair Powell really say anything new?

- Houthis promise ‘escalation’ after U.S., British strikes in Yemen

- McDonald’s revenues miss expectations amid war in the Middle East

- Tyson Foods exceeded market expectations in its first quarter

- OECD issues caution on inflation, adjusts U.S. rate cut forecast

- Eurozone producer price deflation depends in December

- Saudi Arabia significantly increased oil exports from its Muajjiz terminal last month

- Ag markets today

- USDA daily export sale: 155,000 MT corn to Mexico during 2023-2024 marketing year

- Contact on Brazil ag sector comments on corn and soybean production

- Australia rejects livestock ship's request for month-long journey to Israel

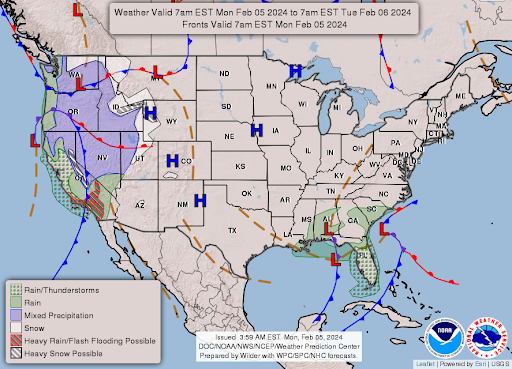

- NWS weather outlook

- Heavy rains inundated California, raising the risk of life-threatening floods

- Pro Farmer First Thing Today items

CONGRESS

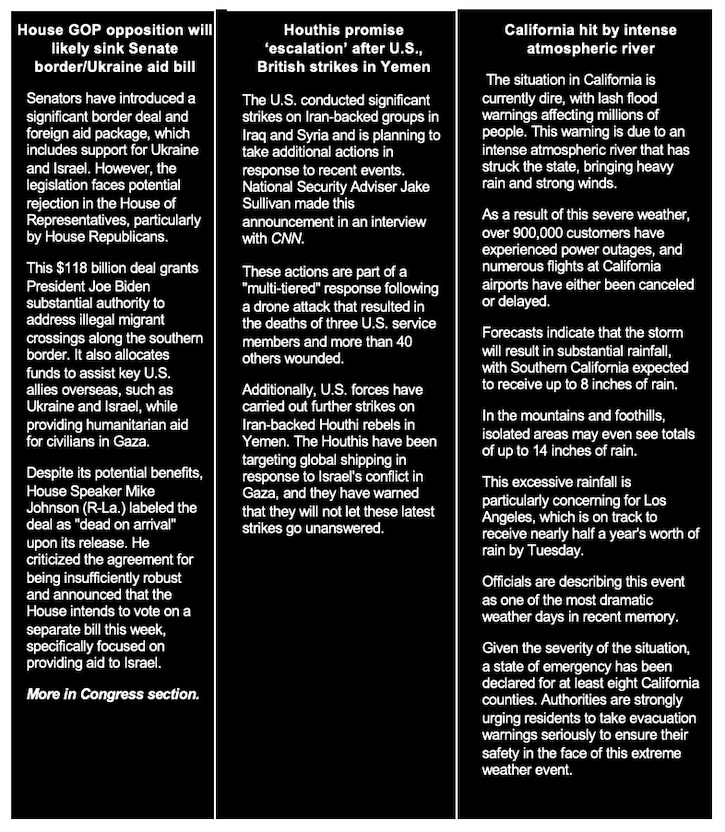

- House GOP opposition will likely sink Senate border/Ukraine aid bill

RUSSIA & UKRAINE

- Kremlin weighing interview with Putin by former Fox News host Tucker Carlson

- Turkish President to address allowing Ukrainian grain exports to transit Black Sea

- January weather did not impact Ukrainian winter crops

POLICY

- Unresolved Reference Prices hinder progress on new farm bill in Congress

CHINA

- China commits to stabilizing markets following significant decline in share prices

- China discovers substantial crude oil reserve in its central region

- Trump factor is looming over China’s markets

- German trade gap with China narrows for first time in five years

- Foreign Policy: How Primed for War Is China?

- China to further develop high-yield crop varieties to increase ag production

TRADE POLICY

- Trump floats higher tariffs exceeding 60% on Chinese goods if re-elected

- Trade policy events/hearings on tap this week

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- USDA finalizes child nutrition program rule aligning with 2020 Dietary Guidelines

- Dairy industry eyes whole milk re-introduction

POLITICS & ELECTIONS

- NBC News poll: Biden trails Trump by 5 Points with registered voters

OTHER ITEMS OF NOTE

- Back by other governors, Abbott promises to continue defying Biden on border security

- FT: Iran used two major UK banks to covertly move money worldwide

|

MARKET FOCUS |

— Equities today: Asian and European stock markets were mixed in overnight trading. U.S. Dow opened around 180 points lower. In Asia, Japan +0.5%. Hong Kong -0.2%. China -1%. India -0.5%. In Europe, at midday, London +0.5%. Paris +0.1%. Frankfurt +0.3%.

China committed to stabilizing its markets following a significant decline in share prices to a five-year low. The China Securities Regulatory Commission (CSRC) did not provide specific measures but expressed a commitment to attract more long-term investments. A state-backed think tank called for the establishment of a stocks-stabilization fund in Beijing. A growing amount of Chinese capital is flowing into foreign equities, as investors look for alternatives to the domestic market.

U.S. equities Friday: The Dow gained 134.58 points, 0.35%, at 38,654.42. The Nasdaq rose 267.31 points, 1.74%, at 15,628.95. The S&P 500 added 52.42 points, 1.07%, at 4,958.61.

For the week, the S&P 500 and Dow each added 1.4% and the Nasdaq Composite rose 1.1%, all higher for the fourth straight week.

For the year, the Dow is up 2.6%, the S&P 500 is up 4.0% and the Nasdaq is up 4.1%.

Historically, the month of February is a relatively flat month for the S&P 500 and Nasdaq 100 indices, while the Dow has posted negative returns on average and the Russell 2000 Index has posted gains.

— Keeping oil prices lower was an outage at BP's 435,000 bpd oil refinery in Whiting, Indiana, following a power loss that disrupted operations on Thursday. Power at the refinery had been restored by midday on Friday, BP had not yet set a date for restarting the plant. WTI traded down $1.54 or -2% to close at $72.28. Brent traded down $1.37 or -1.7% to close at $77.33.

— McDonald’s revenues miss expectations amid war in the Middle East. The fast-food giant said that comparable store sales rose just 3.4% in the fourth quarter, the slowest growth rate since late 2020. Expectations had already been lowered after McDonald’s warned of a “meaningful business impact” in the Middle East, particularly because of “misinformation” about franchisees’ responses to the war in Gaza.

— Tyson Foods exceeded market expectations in its first quarter revenue and profit report. However, the company mentioned that it is still evaluating its operations following the closure of several chicken plants in the United States over the past year. In the third quarter, Tyson Foods saw a 9.2% decrease in operating income, with its beef segment incurring an operating loss of $117 million compared to an income of $129 million in the same quarter the previous year. Despite this, the beef segment's sales increased by 6.3%, primarily driven by a 10.5% rise in prices.

— A lot of fourth quarter results this week, with another 100 S&P 500 companies are scheduled to report.

Monday: Caterpillar, McDonald’s, Simon Property Group, and Tyson Foods — Tyson is expected to report lower earnings per share and net income compared to a year ago and flat revenue, Eikon estimates show. Tight cattle supplies have raised costs for U.S. beef processors, but producers still sent more of the animals than expected to feedlots last fall in a potential boost to Tyson. Reuters notes the meat company has closed several U.S. chicken plants in a bid to improve results, and investors will watch to see whether the cutbacks are paying off. Tyson recently opened new U.S. facilities to produce chicken nuggets and bacon and could face start-up costs in its prepared foods division.

Tuesday: BP, Chipotle Mexican Grill, Eli Lilly, Ford Motor, and Spotify Technology.

Wednesday: Alibaba Group Holding, CVS Health, PayPal Holdings, Uber Technologies, Walt Disney and Bunge, which is expected to report a fall in fourth-quarter revenue, as improvement in supply had lowered crop prices in the quarter.

Thursday: ConocoPhillips, Expedia Group, FirstEnergy, and Take-Two Interactive Software.

Friday: Enbridge and PepsiCo.

— Ag markets today: Soybeans posted light two-sided trade overnight, while the corn and wheat markets weakened. As of 7:30 a.m. ET, corn futures were trading 1 to 3 cents lower, soybeans were 2 cents lower to a penny higher and wheat futures were 5 to 9 cents lower. Front-month crude oil futures were modestly lower, while the U.S. dollar index is around 350 points higher.

Bullish cash cattle expectations. Packers actively raised cash cattle prices last week and bought a lot of cattle. While that could slow their appetite for cattle this week, it also indicated they were more short bought on near-term slaughter needs than expected. Cash sources come into the week anticipating firmer cash prices, though active trade isn’t likely until after midweek.

Cash hogs climb while pork cutout stabilizes. The CME lean hog index is up another 41 cents to $73.12 as of Feb. 1, continuing the seasonal climb over the past month, and is now 27 cents above last year at this time. February lean hog futures finished last Friday at a $2.33 premium to today’s cash quote. Meanwhile, the pork cutout value slipped 19 cents on Friday and is holding in the upper-$80.00 range.

— Agriculture markets yesterday:

- Corn: March corn futures fell 4 1/2 cents to $4.42 3/4, marking a 3 1/2 cent loss on the week.

- Soy complex: March soybeans fell 14 3/4 cents to $11.88 1/2, a near eight-month-low close and lost 20 3/4 cents on the week. March Soymeal fell $4.90 to $356.80 but gained $7.80 from a week ago. March soyoil fell 87 points to 44.73 cents and lost 220 points week-over-week.

- Wheat: March SRW wheat futures fell 1 3/4 cents to $5.99 3/4 and nearer the session low. For the week, March SRW lost 1/2 cent. March HRW wheat futures rose 4 1/4 cents to $6.25 and near mid-range. For the week, March HRW rose 1/4 cent. March spring wheat rose 3 3/4 cents to $6.99 3/4 but lost 3 3/4 cents on the week.

- Cotton: March cotton rose 62 points to 87.11 cents and gained 274 points on the week.

- Cattle: April live cattle futures rose 57 1/2 cents to $183.75, closing near mid-range, reaching a nearly three-month high and gaining $2.075 for the week. March feeder cattle futures lost 7 1/2 cents to $244.80, nearer the session low after hitting a 3.5-month high early on. For the week, March feeders rose $5.10.

- Hogs: Expiring February hog futures slipped 35 cents to $75.45 Friday, while most-active April futures gained 7.5 cents to close at $83.825. That represented a weekly rise of 57.5 cents.

— Quotes of note:

- Did Fed Chair Powell really say anything new? Says the Sevens Report: “Powell’s 60 Minutes interview is being framed as hawkish but in reality, Powell didn’t say anything new as this was his main message: Rates cuts are coming sooner than later, but a March cut is unlikely.”

- An economic official in Beijing said China will come up with an action plan to attract foreign investment but offered no details about when it would be released or what it would contain. Chinese investors are selling their stocks rapidly, unwinding margin debt in a potential sign of forced liquidation.

— In interview, Federal Reserve Chair Jay Powell says he expects three rate cuts in 2024. Powell confirmed in a Sunday interview on CBS’ 60 Minutes that the central bank's rate-setters still anticipate making approximately three quarter-point rate cuts in 2024. Powell mentioned that nearly all members of the Federal Open Market Committee (FOMC) expect the Fed to reduce rates from their current range of 5.25%-5.5% at some point this year.

Although new projections are set to be released on March 20, Powell stated that nothing significant has occurred since December that would prompt a dramatic shift in forecasts. He explained that if the economy were to weaken, the Fed could reduce rates sooner and more rapidly. Conversely, if inflation proves more persistent, rate cuts might be delayed and gradual.

Previously, markets had anticipated six rate cuts starting in March, but Powell's recent comments, along with a strong January jobs report, tempered those expectations. The interview took place before the release of non-farm payrolls data, which showed the addition of 353,000 jobs.

Powell emphasized the strength of the labor market and expressed optimism that it would continue to perform well. However, some Fed officials have expressed concerns about potential wage growth and rising service prices, complicating the central bank's task of managing inflation.

Powell's "base case" is that inflation will continue to decline in the first half of the year due to lower readings from the previous year. He noted that the U.S. central bank targets inflation on a 12-month basis and cited the high inflation readings in the first five months of the previous year. This lower inflation, according to Powell, could lead to rate cuts around the middle of the year.

He also remarked on the historically unusual situation where previous interest rate increases did not cause a more pronounced economic slowdown. Powell indicated that the Fed is planning to gradually dial back its restrictive policy stance as the right time approaches, emphasizing the continued strength of the economy and labor market.

Asked to respond to young potential homeowners who don’t believe they can afford a mortgage, Powell said the work the Fed is doing is to create price stability. “Interest-sensitive spending like mortgages and buying, you know, durable goods and things like that, that’s going to be expensive for a while. That’s going to slow the economy down. But this is all part of getting back to a place of price stability when interest rates can be low again on a sustainable basis.”

Powell said the possibility of a recession isn’t elevated right now. “We just finished a year in which the economy grew 3.1%. That’s a really healthy growth rate,” he said. “The fourth quarter growth rate was actually a little better than that. So, growth is fine.”

Asked about the possibility of another real estate led banking crisis, as commercial real estate values are dropping, Powell said large banks have a manageable problem, but small and regional banks with concentrated commercial real estate exposures are challenged. “We’re working with them,” Powell said. “This is something we’ve been aware of for, you know, a long time, and we’re working with them to make sure that they have the resources and a plan to work their way through the expected losses. There will be expected losses.” Powell acknowledged that while it is a “sizable problem” he said it “doesn’t appear to have the makings of the kind of crisis things that we’ve seen sometimes in the past, for example, with the global financial crisis.”

— OECD issues caution on inflation, adjusts U.S. rate cut forecast. The Organization for Economic Cooperation and Development (OECD) released interim economic forecasts, expressing caution regarding the ongoing inflationary trend that began in 2021. The organization believes it's too early to determine whether this inflation will subside by 2025, emphasizing that central banks should remain vigilant.

Of note: The OECD has adjusted its prediction for the first U.S. interest rate cut, anticipating it will occur in the second quarter of this year, which is earlier than its earlier forecast from November, which expected such a move in the second half of the year. Additionally, the OECD has slightly improved its outlook for the global economy compared to previous assessments. It has also raised its growth forecast for the U.S. in 2024, projecting it to be 2.1%, up from the earlier estimate of 1.5%. This indicates a relatively more positive economic outlook for the U.S. in the near term.

— Eurozone producer price deflation depends in December. In December 2023, industrial producer prices in the Eurozone experienced a significant year-on-year decrease of 10.6%, the largest drop in three months, slightly worse than the anticipated 10.5% decline. This decline was primarily driven by a substantial decrease in energy prices, which fell by 27.5% year-on-year, accelerating from the previous month's 23.9% decrease. Costs for intermediate goods also decreased, albeit at a slightly slower rate, down by 4.9% compared to a 5.1% fall in the previous month.

Inflation rates for various categories of goods also showed a slowdown in December compared to the previous month. Capital goods experienced a lower inflation rate at 2.8% (down from 3.1%), durables at 3.0% (down from 3.5%), and non-durables at 3.2% (down from 3.6%).

When excluding energy prices, producer prices still decreased by 0.4%, maintaining the same pace of decline as the previous month.

On a monthly basis, producer prices declined by 0.8% in December, representing the most substantial monthly drop since May of the same year.

Market perspectives:

— Outside markets: The U.S. dollar index was firmer ahead of U.S. trading, with the euro and British pound both weaker against the greenback. The yield on the 10-year U.S. Treasury was firmer, trading around 4.11%, with a higher tone in global government bond yields. Crude oil futures were weaker ahead of U.S. trading, with U.S. crude around $72 per barrel and Brent around $77.20 per barrel. Gold and silver were lower ahead of US market action, with gold around $2,038 per troy ounce and silver around $22.46 per troy ounce.

— Government bond yields around the world were higher on Monday, with the yield on the U.S. 10-year Treasury note, seen as a proxy for global borrowing costs, rising to 4.08%, after Fed Chair Powell reiterated in an interview (see details above) that a March interest-rate cut is unlikely. German 10-year Bund yield, which is the benchmark in Europe, went up to 2.27% and the UK 10-year approached 4%.

— Saudi Arabia significantly increased oil exports from its Muajjiz terminal last month, allowing them to avoid areas in the southern Red Sea.

— USDA daily export sale: 155,000 MT corn to Mexico during 2023-2024 marketing year.

— Contact on Brazil ag sector comments on corn and soybean production. Says the source after talking with Brazilian traders and analysts: “We are using a 146 MMT Brazil bean crop and 119 Brazil corn crop. Many farmers in Brazil will lose money on soybeans and corn this year. It is possible next year acreage will be unchanged vs a normal 3-5% increase in acres. Some land might be put back into pasture or other crops. The safrinha corn crop looks like it will be a loss for most farmers but what is the alternative? Plant it and hope for the best until the banker steps in and says you are done. There will be a lot of land that potentially changes hands as foreign investors come in to buy land at a 20-30% discount from the high levels of the past year or two. Access to capital is a big thing. There will most likely be less crop stored by the farmer this year because they can’t get the credit to store the crop. It may make the crop seem bigger than it is.”

— Australia rejects livestock ship's request for month-long journey to Israel. Australia declined a request from a livestock exporter to send a ship carrying 1,500 cattle and 14,000 sheep on a month-long journey to Israel around the Horn of Africa. This decision came after the ship had initially been redirected back to Australia, as it abandoned its route through the Red Sea to reach Israel. The vessel has been stationed off the West Australian coast for about a week, during which several hundred cattle were already unloaded. The Australian government stated that the exporter's application was deemed unsatisfactory but did not provide specific reasons for the rejection. However, they did confirm that the animals remained in good health, according to a Reuters report.

— NWS weather outlook: Life threatening Flash Flooding continues for Southern California Monday (see related item in Black Box above)... ...Heavy Snow for parts of the Sierra Nevada, Great Basin, Northern Rockies, and Four Corners Region... ...Much above average high temperatures continue for the Northern/Central Plains and Upper Midwest.

Items in Pro Farmer's First Thing Today include:

• Beans mixed, corn and wheat lower overnight

• Some relief coming for dry areas of Argentina, mixed bag for Brazil

• Rapid soybean harvest, safrinha corn planting continues in Brazil.

|

CONGRESS |

— Senate unveils $118 billion bill combining border reform, foreign aid, and immigration changes. The Senate on Sunday unveiled a comprehensive bipartisan bill with the dual goals of reducing illegal border crossings and supporting Ukraine and Israel. The legislation is set for an initial Senate vote as early as Wednesday, but faces stiff opposition from some Republicans. Link to text of bill.

Key elements of the bill include:

- Immigration Process Reform: The bill aims to revamp the asylum process at the border to expedite case resolutions and deportations for migrants who do not meet the criteria for asylum claims. It also establishes higher standards for asylum claims to prevent the system from becoming overwhelmed.

- Financial Support: The legislation allocates approximately $118 billion for various purposes, including funding for Ukraine, Israel, Taiwan, U.S. border changes, and humanitarian aid in conflict zones. Approximately $60 billion is designated for Ukraine, $14.1 billion for Israeli security assistance, and around $20 billion for implementing new border policies — for transportation for deportation, shelters, more than 4,000 new asylum officers, more border agents, anti-fentanyl trafficking efforts and other resources.

- Bipartisan Support: Senate Majority Leader Chuck Schumer (D-N.Y.) views the bill as a significant step toward enhancing national security, with provisions aligned with Republican priorities. It does not include a pathway to citizenship for "Dreamers," who were brought to the U.S. as children.

- Bipartisan Opposition: Some provisions have been chided by some Republicans, including the potential for codifying up to 5,000 illegal entries per day in limited circumstances. It also doesn’t include a restoration of former President Donald Trump’s Remain in Mexico policy, which many Republicans insist is a must-have. House Republican Conference Chairwoman Elise Stefanie (R-N.Y.) called it “an absolute non-starter” that she said would “further incentivize thousands of illegals to pour in across our borders daily.” She called for the restoration of Remain in Mexico and other Trump era immigration policies instead. Meanwhile, some progressive Democrats are expected to vote against what would be one of the most restrictive border bills of the century.

- Uncertain Passage: While President Biden has expressed support for the bill, its prospects for passage remain highly uncertain. Opposition from some Republicans, including former President Donald Trump, adds complexity to the political landscape. The bill's fate will be determined by the Senate's votes and further deliberations in the House, but veteran congressional watchers say the Senate approach will not clear the House and that position could help defeat it in the Senate.

- Border Process Changes: The bill seeks to end the practice of "catch and release" by introducing a new process for migrants at the border. It includes faster processing, detention, or release with monitoring devices for migrants, along with stricter eligibility criteria for asylum seekers. The bill also grants temporary authority to "shut down" the border to asylum seekers under specific conditions.

- Immigration Enforcement and Compensation: The legislation provides resources for increased Immigration and Customs Enforcement detention beds, more border patrol agents, deportation officers, and asylum officers. It allocates funds for deportations and establishes a fund to compensate cities that have been housing large migrant populations.

- Legal Immigration Reforms: While not addressing Dreamers, the bill introduces smaller changes to the legal immigration system, including the creation of 50,000 additional Green Cards annually for five years and protections for the children of long-term visa holders. It includes a pathway to permanent status for Afghans evacuated and brought to the U.S. under humanitarian parole. It also adds another 250,000 work and family-based immigrant visas for the next five fiscal years. It also protects from deportation the children of H-1B visa holders who come to the country legally, but often "age out" by turning 18 before they are able to receive a green card because of long backlogs.

- Targeting Illicit Fentanyl: The bipartisan Fend Off Fentanyl Act, which addresses the illicit fentanyl supply chain, is part of the package.

Bottom line: The bill represents an attempt to address border security and international support while facing political challenges and partisan division. With key House Republicans saying the Senate deal is “dead on arrival,” its chances appear doomed, especially as House Speaker Mike Johnson (R-La.) says the House will consider a standalone aid bill involving aid to Israel but not Ukraine.

|

RUSSIA/UKRAINE |

— Kremlin is weighing an interview with President Vladimir Putin by former Fox News host Tucker Carlson, who is visiting Moscow. Putin’s spokesman, Dmitry Peskov, declined to comment Monday, telling reporters on a conference call that the Kremlin would inform them if an interview is planned, according to the state-run Tass news service. Carlson, 54, has used his media platform to question U.S. support for Ukraine, defend the Kremlin and support Trump. State-run Russian television frequently airs clips from his interviews. Trump, who is seeking re-election in November, has said that he would consider Carlson as a possible running mate.

— Turkish President Tayyip Erdogan is set to address the issue of allowing Ukrainian grain exports to transit the Black Sea during his meeting with Russian President Vladimir Putin on Feb. 12. Turkish Foreign Minister Hakan Fidan mentioned that Erdogan would explore "new methods" for transporting Ukrainian grain to the global market, suggesting the potential for an alternative mechanism. However, specific details regarding these new methods were not provided. Russia has previously rejected the revival of the Black Sea grain deal, which had previously facilitated the export of Ukrainian agricultural products to the global market.

— January weather did not impact Ukrainian winter crops. Weather conditions in late January did not have a negative impact on the condition of Ukrainian winter grain crops, analyst APK-Inform quoted state weather forecasters as saying. Forecasters said minimum soil temperatures decreased, but they “were above critical freezing temperatures.”

|

POLICY UPDATE |

— Unresolved reference prices hinder progress on new farm bill in Congress. The progress on writing a new farm bill in Congress is hindered by the unresolved issue of reference prices, according to farm policy analyst Jonathan Coppess (link). Farm groups and congressional allies are prioritizing higher reference prices, which play a significant role in increasing crop subsidies. However, there has been no public proposal in the past year regarding the specific crops or reference price levels to be increased, making it impossible to analyze the potential impacts of such changes.

The farm bill discussions have been in the hands of the leaders of the Senate and House Agriculture committees (and key staff) from both Democratic and Republican parties, known as the "four corners," without reaching a resolution. There have been vague statements from these leaders and reports of a deadlock over higher reference prices and how to fund them, with climate funding being a common point of contention.

Raising reference prices would come at a substantial cost, estimated at $20 billion over 10 years for a 10% increase and $50 billion for a 20% increase, according to unofficial estimates. In comparison, the Congressional Budget Office (CBO) estimated that the existing commodity support programs would cost nearly $62 billion over the same period.

|

CHINA UPDATE |

— China discovered a substantial crude oil reserve estimated at 107 million tonnes in its central region, marking a significant step toward enhancing energy security and reducing reliance on oil imports. This newly identified oilfield, located in the Sanmenxia basin of Henan province, was confirmed during drilling activities. While China has a relatively high level of crude oil production on a global scale, it faces high demand due to being the world's largest industrial producer. The country relies on overseas imports for over 70% of its crude oil needs, and last year, it imported 564 million tonnes, with Russia surpassing Saudi Arabia as the top oil seller to China. China's focus on energy security has led to intensified efforts to explore domestic oil sources, including this substantial discovery.

Of note: Analysts say the discovery could account for nearly one-third of China’s total oil and gas production.

— Trump factor is looming over China’s markets. Fears of heightened trade war if former president is re-elected weigh on sentiment. Link/paywall to Financial Times article.

— German trade gap with China narrows for first time in five years. Germany’s trade deficit with China shrank for the first time since 2018 — helping to more than double the country’s overall surplus. Link to Bloomberg article for details.

— Foreign Policy: How Primed for War Is China? Risk signals for a conflict are flashing red. Link for details.

— China is planning to further develop high-yield crop varieties as part of its efforts to increase agricultural production. According to state media reports citing a rural policy document, China aims to boost domestic production and reduce its reliance on imports by focusing on biotechnology and mechanization in agriculture. The policy blueprint from the State Council emphasizes stabilizing the area used for grain cultivation, improving crop yields, and promoting the use of agricultural machinery and equipment. Additionally, the policy places importance on expanding soybean cultivation and developing high-oil, high-yield crop varieties. This move is significant because soybeans are a major agricultural import for China. The policy also addresses the challenge of a declining rural population and the migration of farmers to urban areas.

|

TRADE POLICY |

— Trump floats higher tariffs on Chinese goods if re-elected. Former President Donald Trump hinted at imposing tariffs on Chinese goods exceeding 60% if re-elected, signaling a more aggressive stance towards China, which is the primary supplier of goods to the United States. In response to a Washington report about considering a flat 60% tariff on Chinese imports, Trump stated in an interview on Fox News’ Sunday Morning Futures that it might actually be higher than that. He dismissed concerns about sparking a trade war, emphasizing his aim to hold China accountable for what he perceives as an unfair advantage.

During his previous presidency, Trump initiated tariffs on Chinese imports in 2018, which escalated to include various products. China retaliated with its own tariffs on U.S. imports like soybeans and poultry. The Biden administration largely maintained these tariffs, although they faced criticism from business groups for potentially driving up prices and impacting U.S. competitiveness.

Trump's proposal to increase tariffs could have significant economic implications, given the substantial trade relationship between the U.S. and China. Some lawmakers, including Reps. Mike Gallagher (R-Wis.) and Raja Krishnamoorthi (D-Ill.), have advocated for measures to restrict economic ties between the two countries.

Trump also clarified a previous comment about being a "dictator for a day" in a second term, explaining that it was meant to signal immediate action on border security and fossil fuels, not a literal claim of dictatorial power.

— Trade policy events/hearings on tap this week include:

- Monday: Mexico elections. The Wilson Center's Mexico Institute and Inter-American Dialogue hold a virtual discussion with Mexican National Action Party presidential candidate Xochitl Galves, focusing on nearshoring, migration, energy and security, as well as her party's platform.

- Monday: BRICS expansion. The Federalist Society for Law and Public Policy Studies' International & National Security Law Practice Group holds a virtual discussion on "BRICS (Brazil, Russia, India, China and South Africa) Expansion and Corresponding Implications."

- Tuesday: U.S. trade. U.S. Trade Representative Katherine Tai will be in Chicago and will deliver remarks on U.S. trade policy at the University of Chicago.

- Tuesday: LNG export ban. House Energy and Commerce Energy, Climate, and Grid Security Subcommittee hearing on "Politics Over People: How Biden's LNG (liquefied natural gas) Export Ban Threatens America's Energy and Economic Security."

- Wednesday: G7 trade ministers. U.S. Trade Representative Katherine Tai will participate in a session with G7 trade ministers.

- Wednesday: Red Sea transportation situation. Federal Maritime Commission holds a meeting of the Informal Public Hearing on the Impact of Current Conditions in the Red Sea and Gulf of Aden Regions to hear from stakeholders in the supply chain on how operations have been disrupted by attacks on commercial shipping, steps taken in response to these events, and the resulting effects.

- Wednesday: WTO ministerial. House Ways and Means Trade Subcommittee hearing on "Advancing America's Interests at the World Trade Organization's 13th Meeting."

- Wednesday: USMCA auto trade provisions. Office of the US Trade Representative holds a public hearing to receive oral testimony concerning the operation of the United States-Mexico-Canada Agreement with respect to trade in automotive goods.

- Wednesday: USAID panel on food security, climate change. U.S. Agency For International Development holds a virtual meeting of the advisory committee for a conversation between US Agency for International Development Administrator Samantha Power and Paul Weisenfeld, chair of the Advisory Committee on Voluntary Foreign Aid (ACVFA), as well as two discussion panels featuring ACVFA members on key agency priorities such as democratic governance, food security, climate change, private sector engagement, and inclusive development.

- Thursday: LNG export approval pause. Senate Energy and Natural Resources Committee hearing on "Administration's Pause on LNG (liquefied natural gas) Export Approvals and the Department of Energy's Process for Assessing LNG Export Applications."

- Thursday: Red Sea shipping impacts. S&P Global's Journal of Commerce holds a virtual discussion on "The Trans-Pacific Container Shipping Outlook: Analyzing the Red Sea Crisis and a Disruptive Year Ahead."

- Thursday: Foreign direct investment in U.S. International Trade Administration holds a virtual meeting of the United States Investment Advisory Council to continue to discuss matters related to foreign direct investment in the United States and the programs and policies to promote and retain such investments across the country.

- Thursday: World economy and deglobalization. Washington Post Live holds a virtual discussion on "World Economy, Deglobalization and Geopolitical Pressure Points." International Monetary Fund Managing Director Kristalina Georgieva participates.

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— USDA finalizes child nutrition program rule aligning with 2020 Dietary Guidelines; dairy industry eyes whole milk re-introduction. USDA submitted its final rule to the Office of Management and Budget (OMB) regarding the revision of meal patterns under child nutrition programs to align them with the 2020 Dietary Guidelines. This rule has been under consideration since late 2022 when the USDA initially proposed it. The revisions are of particular significance to the dairy industry because there has been a push to reintroduce whole milk into the school lunch program.

Notably, Senate Ag Committee Chair Debbie Stabenow (D-Mich.) halted legislative efforts at the end of 2023 that aimed to mandate the inclusion of whole milk in school lunches. Instead, she encouraged those advocating for this change to engage with the USDA as the agency worked on aligning child nutrition programs with the 2020 Dietary Guidelines.

USDA is planning to release the final rule in April, which will provide clarity on how child nutrition programs will be adjusted to meet the dietary recommendations outlined in the 2020 Dietary Guidelines.

|

POLITICS & ELECTIONS |

— NBC News poll: Biden trails Trump by 5 Points with registered voters. NBC News reports (link) a new national NBC News poll of 1,000 registered voters (1/26-1/30) shows President Biden trailing former President Donald Trump by 42% to 47%, while Biden also “trails...Trump on major policy and personal comparisons, including by more than 20 points on which candidate would better handle the economy,” and his “deficit versus Trump on handling immigration and the border is greater than 30 points.” NBC News says the poll “shows Trump holding a 16-point advantage over Biden on being competent and effective, a reversal from 2020, when Biden was ahead of Trump on this quality by 9 points before defeating him in that election,” and “Biden’s approval rating has declined to the lowest level of his presidency in NBC News polling — to 37% — while fewer than 3 in 10 voters approve of his handling of the Israel-Hamas war.” NBC News also says while “perhaps the best news in the poll for Biden is that he pulls ahead of Trump when voters are asked about their ballot choice if the former president is convicted of a felony,” the two-point margin is “within the margin of error.”

|

OTHER ITEMS OF NOTE |

— With backing from other governors, Abbott promises to continue defying Biden on border security. Reuters reports (link) Texas Governor Greg Abbott (R) was joined by 13 Republican governors at Shelby Park on Sunday as he “vowed to defy the Biden administration and maintain state control of a U.S. border hotspot ‘as long as it takes.’” Abbott added that Shelby Park will stay under state control “as long as it takes to maintain security and to eliminate crossings,” but said he would relinquish control immediately if President Biden “were to step up and do exactly what we’re doing here and stop people from crossing the border illegally.” Meanwhile, the AP reports (link) that migrants “are moving further down the river and crossing elsewhere,” but “crossings in recent weeks are down overall along the entire U.S. border, including areas without such a heavy security presence.” However, the surge in illegal immigration remains “a political liability for President Joe Biden and an issue that Republicans are eager to put front and center to voters in an election year.”

— Iran used two major UK banks, Lloyds and Santander UK, to covertly move money worldwide as part of a sanctions-evasion scheme supported by Iranian intelligence services, according to the Financial Times (link/paywall). This scheme involved British front companies secretly owned by a sanctioned Iranian petrochemicals company, the Petrochemical Commercial Company (PCC), located near Buckingham Palace.

The PCC and its UK subsidiary, PCC UK, have been under US sanctions since November 2018. Documents and records indicate that despite these sanctions, PCC UK continued to operate through a complex network of front entities in the UK and other countries.

The article reveals that PCC UK used UK-based companies to receive funds from Iranian front entities in China while concealing their true ownership through "trustee agreements" and nominee directors. One such company, Pisco UK, was registered to a British national named Abdollah-Siauash Fahimi but was controlled by PCC. Pisco UK used a business account with Santander UK.

Another front company, Aria Associates, had an account with Lloyds and was officially owned by Mohamed Ali Rejal, who was identified as the deputy chief executive of PCC UK. Emails showed that funds from China were transferred to Aria Associates' Lloyds account without indicating any connection to PCC.

Both Lloyds and Santander UK have stated their commitment to sanctions compliance. Santander UK mentioned that they have closed Pisco's account, but Lloyds did not comment on individual customers.

The article highlights concerns from British officials and experts regarding the operation of IRGC-connected entities in the UK and the need to take stronger actions against such activities. It also mentions that European banks found to have breached US sanctions on Iran faced significant penalties in the past.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |