G.T. Thompson: House Farm Bill Chairman’s Mark in Three Weeks, Seeks Passage in 2024

Stabenow crafting crop insurance plan with tough choices for farmers

|

Today’s Digital Newspaper |

Modified report today as I will give a speech this morning in Effingham, Illinois,

at an Illinois Farm Credit meeting.

— Equities, today: Asian and European stock markets were mixed to firmer overnight. U.S. stock index futures are set to open modestly higher. In Asia, Japan flat. Hong Kong +0.8%. China +0.4%. India -0.4%. In Europe, at midday, London +0.1%. Paris +0.8%. Frankfurt +0.6%.

U.S. equites, yesterday: The Dow ended down 94.45 points, 0.25%, at 37,266.67. The Nasdaq declined 88.73 points, 0.59%, at 14,855.62. The S&P 500 was down 26.77 points, 0.56%, at 4,739.21.

— OPEC said it expects global oil demand to remain robust in 2024 and 2025, due to a strong global growth forecast and slowing inflation. Oil prices ticked up on the news. In contrast with OPEC’s forecast, the IEA said that growth in oil demand will halve in 2024 because of China’s slow economic recovery and greater take-up of electric vehicles.

— Ag markets today: Corn, soybeans and spring wheat contracts traded higher overnight amid light corrective buying, while the winter wheat markets favored the downside. As of 7:30 a.m. ET, corn futures were trading a penny higher, soybeans were mostly 6 cents higher, SRW wheat was 2 cents lower, HRW wheat was steady to fractionally lower and HRS wheat was 2 to 3 cents higher. Front-month crude oil futures were near unchanged, while the U.S. dollar index was about 150 points lower.

Cattle slaughter slowly rebounding. Wednesday’s estimated cattle slaughter improved to 118,000 head, though that was still 3,712 head below last year. The week-to-date tally stood at 341,000 head, up from last week but still well behind last year. Most beef plants are expected to run sizable Saturday kills to make up for holiday and weather-related downtime. As slaughter regulates, packer demand for cash cattle is expected to improve and support cash cattle prices.

Cash hog rally gaining steam. The CME lean hog index is up another 49 cents to $67.34 (as of Jan. 16), marking the sixth gain in the last seven days. The index is now $2.29 off what appears to be the seasonal low posted at the beginning of January. February lean hog futures finished Wednesday $4.11 above today’s cash quote.

— Ag markets yesterday:

Corn: March corn fell 1 1/4 cents to $4.42 1/4 after notching a fresh contract low early on.

Soybeans: March soybeans fell 21 1/2 cents to $12.05 3/4 and near the session low. Prices closed at a six-month-low close today. March soybean meal dropped $12.40 t0 $358.70 and near the session low. March bean oil closed up 45 points at 47.70 cents and near the session high.

Wheat: March SRW rose 1/2 cent to $5.82 1/2 and closed near the session low, while March HRW fell 7 1/2 cents to $5.94, a fresh contract low. March spring wheat fell 10 1/2 cents to $6.80 1/4.

Cotton: March cotton rose 37 points at 81.70 cents and near mid-range.

Cattle: After spending much of Wednesday in negative territory, cattle and feeder markets staged a late rebound and closed mostly higher Wednesday. Nearby February live cattle were the exception, skidding 2.5 cents to $173.10, while expiring January feeders surged 87.5 cents to $228.425 and most-active March climbed 95 cents to $229.775.

Hogs: February lean hog futures rose 67.5 cents before settling at $71.45, near session highs.

— G.T. Thompson (R-Pa.) wants to fast track farm bill for 2024 passage. In an interview with Bloomberg, the House Ag Chairman revealed:

- Timeline: Thompson intends to advance the farm bill through his Agriculture Committee before March. He mentioned that in about three weeks, they will start with a Chairman's Mark to unveil the bill, with the goal of completing committee action by March.

- Floor time: The timeline depends on securing floor time from House Speaker Mike Johnson (R-La.). This suggests that the bill's progress will be contingent on House leadership's support and scheduling. But our sources say it was Johnson who was pressing Thompson to get something done during House floor action in March.

- Previous delays: The $1.5 trillion, five-year farm bill reauthorization was initially planned for the previous year but was deferred to 2024. Congress provided some breathing room by agreeing to a one-year extension of the 2018 Farm Bill through Sept 30.

— Senate Ag Chair Debbie Stabenow (D-Mich.) sends letter to colleagues outlining the goals and priorities regarding the new farm bill, with a focus on supporting American farmers and addressing their challenges. Key points in the letter (link/pdf):

- Gives thanks to bipartisan work on the Committee for drafting and negotiating the new farm bill.

- Emphasizes strengthening the farm safety net in the upcoming bill.

- Says the 2018 Farm Bill laid a strong foundation for American farmers, covering various aspects such as crop insurance, commodity programs, research, marketing assistance, trade, and assistance for low-income families.

- Notes the new farm bill presents an opportunity to modernize and improve the safety net for American farmers.

- Highlights five key principles for modernizing the safety net, including targeting active farmers, providing choices and flexibility, timely assistance, expanding program reach, and addressing emerging risks.

- Stresses crop insurance as a crucial tool that has seen improvements and expansion.

- Calls for more options and affordability in crop insurance for all commodities (see next item).

- Mentions the Title I farmer safety net needs updates to Agriculture Risk Coverage (ARC) and Price Loss Coverage (PLC) programs.

- Says she will consideration increasing the "effective reference price" for covered commodities.

- Recognizes the emerging challenges faced by farmers, including supply chain challenges and higher input costs.

- Focuses on supporting beginning, small, and medium-sized farms against various risks.

- Commits to providing bipartisan solutions without taking funds from nutrition or conservation programs.

- Mentions efforts to bring new resources into the farm bill, including trade promotion programs and outside funding sources.

- Calls for creativity and the right tools to make improvements to the safety net for farmers.

— Key proposal in Stabenow letter to colleagues. Stabenow is working on a plan for crop insurance that would bolster the crop insurance program, but would force farmers to choose either crop insurance or the farmer safety net programs currently available — Price Loss Coverage and Agriculture Risk Coverage. In her letter, Stabenow says:

“Farmers want coverage for a greater share of the risk, better affordability, and a more straightforward and streamlined process. The 2018 Farm Bill provided cotton farmers with a choice between the traditional base acre programs and a highly subsidized and streamlined area-based crop insurance policy. The next Farm Bill should give a similar option to all commodities.

“The Committee can also continue to expand crop insurance options to more specialty crop and livestock producers while making crop insurance more affordable for beginning farmers. This means improving and streamlining policies like the Whole Farm Revenue Protection and Micro Farm Insurance programs to help small and diversified farmers. But it also means making sure there are agents and companies marketing the improved options in the places and communities where there is unmet need. We need to make sure USDA has the right tools to step in if farmers or agents are being denied or discouraged from certain insurance products.”

Comments: Says one farm bill analyst: “The cotton choice did not work out well. That is why cotton farmers were put back into the commodity title in 2017. Crop insurance is absolutely vital to producers. But it is not designed to handle every peril a farmer faces. Multiple years of depressed prices are not addressed by crop insurance. High and rising foreign subsidies, tariffs, and non-tariff trade barriers are not addressed by crop insurance. That is the job of the commodity title. As we head into lower commodity prices again, lawmakers should not repeat the same mistakes as in the past where some farm bills were written as though crop prices would always be high. At some point, we ought to learn from the past as we chart the future. 2024 would be a good year in which to start.”

Perspective: When cotton farmers were put back into the commodity title in 2018, they could elect into STAX for the year for certain cotton acreage or into PLC but not both. That was mainly a budget exercise proposed to ensure that cotton’s re-entrance into Title I was fully paid for. It wasn’t meant as some major policy precedent.

Of note: According to Politico, Stabenow said that by forcing farmers to choose between crop insurance and the safety net programs, that would help "justify a very high federal subsidy."

— Targeted strikes in twin Middle East incidents underscore escalating regional tensions. The U.S. launched more strikes on Yemen’s Houthis overnight, citing an “imminent threat” to merchant vessels and U.S. Navy ships in the Red Sea area. Hours later, Pakistan launched retaliatory missiles against militants in Iran in the latest incident to roil the wider region. Oil prices rose. The attacks have had consequences for the global economy as they have effectively closed off the Red Sea — one of the main trade routes for container ships.

Of note: Iran is embroiled in an escalating spat with its southeastern neighbor Pakistan, which targeted locations inside Iran a day after deadly Iranian strikes on separatists in Pakistani territory. The new strikes mean both countries have now taken the extraordinary step of attacking militants on each other's soil at a time of expanding conflict in the Middle East and the wider region.

Earlier the Biden administration redesignated the Houthis as a terrorist organization. The new classification, which will come into force in 30 days, will require American institutions to freeze funds belonging to the group.

— Livestock carrier from Australia diverts amid Red Sea situation. A livestock carrier that left Australia for the Middle East appears to have diverted toward Africa, a first indication that ships loaded with animals could face longer journeys due to the escalating conflict in the Red Sea. Link to details via Bloomberg.

— Ukraine: Talks underway on UN-brokered grain deal. Ukraine’s ambassador to Turkey said “certain negotiations” were underway regarding the UN-brokered Black Sea grain export initiative that ended last summer. “Unfortunately, this grain initiative is not functioning at the moment, although certain negotiations are ongoing to find a format for possible assistance from international partners to Ukraine,” Vasyl Bodnar said, though he provided no details.

— China approves several GMO soybean, corn varieties. China approved additional varieties of genetically modified soybeans and corn for import and production while expanding their planting areas nationwide, as part of a drive to improve food security and reduce imports. China’s ag ministry approved the domestic production of six more GMO varieties of corn, two of soybeans and one of cotton, and another two of gene-edited soybeans. The planting zones for most of the varieties were expanded from “ecologically suitable” areas to the whole country, according to the notice. Previously, some corn varieties were restricted to the northern or southern producing areas. For imports, the ministry approved gene-modified insect- and herbicide-resistant soybean variety, DBN8002, developed by Beijing Dabeinong Technology Group Co Ltd, which had been licensed for planting in Argentina since 2022. China also approved a Corteva Inc herbicide-tolerant corn variety DP202216. The new approvals extend for five years, effective from Jan. 2, 2024.

— China’s grain imports surged in 2023. China imported 3.59 MMT of corn, 660,000 MT of wheat, 1.22 MMT of barley and 540,000 MT of sorghum during December. That pushed the annual totals to 22.18 MMT of corn (up 12.3% from 2022), 11.49 MMT of wheat (up 29.4%), 9.67 MMT of barley (up 83.0%) and 4.87 MMT of sorghum (down 51.5%).

— China’s December pork imports fall sharply from year-ago. China imported 90,000 MT of pork during December, unchanged from November but 54.3% less than last year. For 2023, China imported 1.55 MMT of pork, down 11.7% from the previous year.

— The Senate will begin voting on the CR to fund the federal gov’t through early March at 12:30 p.m. ET today. There will be several votes, including amendments that will be rejected. The short-term spending measure is expected to clear the Senate and will then be sent to the House where it faces GOs. P conservative opposition but widespread support among Democrats.

Of note: The Washington area is bracing for a major snowstorm into late week. The House leadership will face pressure to bring up the CR today instead of Friday.

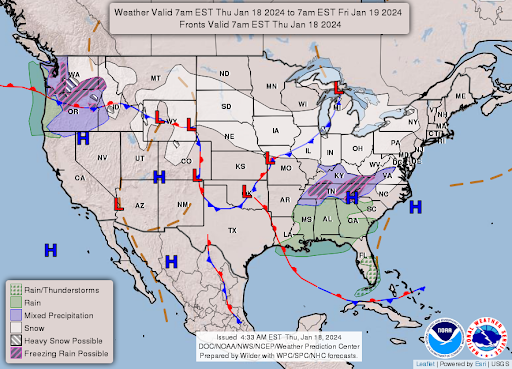

— NWS weather: Heavy mountain snows for the Northwest/Rockies; additional ice over the Columbia Basin... ...Bands of heavy lake-effect snow continue for the Great Lakes with hazardous snow across the Midwest and Mid-Atlantic by Friday... ...Another Arctic blast expected late this week.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |