Oil Market Surges as Iran Dispatches Warship to Red Sea

Tesla vs China | Prop 12 begins | India food-security challenges | Ukraine grain exports

|

Today’s Digital Newspaper |

MARKET FOCUS

- China’s BYD unseats Tesla

- Logistics back to prepandemic capacity

- Rising minimum wages may not impact low-paid workers

- Bitcoin surpasses $45,000 for first time since April 2022

- Ag markets today

- India's food-security challenges have global implications

- NWS weather outlook

- Pro Farmer First Thing Today items

CONGRESS

- Summing up Congress in 2024: Don’t expect much

RUSSIA & UKRAINE

- Ukraine exports 13 MMT grain via Black Sea shipping corridor

CHINA

- China's manufacturing PMI falls below 50 for third straight month in December

- China is pressing women to have more babies; many are saying no

ENERGY & CLIMATE CHANGE

- Fewer electric vehicle models eligible for the $7,500 consumer tax credit in U.S.

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- California's Proposition 12 officially becomes law

- Cal-Maine to buy shuttered Tyson chicken plant in Missouri

POLITICS & ELECTIONS

- Chris Sununu encourages Chris Christie to drop out of the presidential race

|

MARKET FOCUS |

— Equities today: Asian and European stock markets were mixed overnight. U.S. Dow opened around 175 points lower. In Asia, Japan closed. Hong Kong -1.5%. China -0.4%. India -0.5%. In Europe, at midday, London -0.3%. Paris -0.4%. Frankfurt -0.2%.

U.S. equities Friday: All three major indices eased lower on the final trading day of 2023 in light trade volume. But despite the lower finish, all three notched solid gains for the year, with the Dow up 14%, the S&P 500 gained 24% and the Nasdaq rose 43%. On Friday, the Dow was down 20.56 points, 0.05%, at 37,689.54. The Nasdaq declined 83.78 points, 9.56%, at 15,011.35. The S&P 500 fell 13.52 points, 0.28%, at 4,769.83.

— Tesla has lost its position as the world’s most popular maker of electric vehicles to Chinese rival BYD despite quarterly sales that beat analysts’ estimates. Elon Musk's Tesla reported Tuesday that it produced 494,989 units and delivered 484,507 vehicles during the fourth quarter. For the full year, vehicle deliveries grew 38% to 1.81 million while production increased 35% to 1.85 million units. The company delivered 461,538 Model 3/Y vehicles in Q4 and 22,969 "other models." Tesla currently produces the Model 3, Model Y, Model S, Model X and Cybertruck.

Sales by BYD, the country’s dominant automaker, topped 3 million last year. BYD produces both hybrid and full battery-powered cars. While total production surpassed Tesla, BYD sold 1.6 million battery-only passenger cars and 1.4 million hybrids, putting Tesla on top for battery-only production.

— Agriculture markets Friday:

- Corn: March corn futures lost 3 cents on the session to $4.71 1/4, losing 1 3/4 cents on the week.

- Soy complex: March soybeans fell 14 cents to $12.98 and gave up 8 1/4 cents on the week. March soymeal fell $4.70 to $386.00 and lost $5.10 week-over-week. March soyoil rose 20 points to 48.18 cents but is down 84 points from a week ago. Year-over-year, March soybeans are down 7%.

- Wheat: March SRW futures lost 3 1/2 cents to $6.28, though gained 11 3/4 cents on the week. March HRW futures dropped 1 3/4 cents to $6.42 while gaining 19 cents on the week. March spring wheat futures fell 2 cents, settling at $7.23 1/2. SRW futures lost 21% on the year.

- Cotton: December March cotton futures surged early though faced profit taking as the session went on, ultimately rising 5 points on the session to 81.00 cents, marking a 124-point gain for the week. Cotton futures lost 3% on the year.

- Cattle: February live cattle futures fell 42.5 cents on the day to $168.50, marking a 2.5 cent loss on the week. March feeder cattle futures fell 2.5 cents before settling at $223.10, marking a $1.30 loss on the week. Live cattle futures gained 7% on the year while feeders gained 21%.

- Hogs: February lean hog futures fell 47.5 cents to $67.975, losing $3.375 on the week. On the year, lean hog futures fell 22%.

— Ag markets today: There was no overnight trade in the grain markets due to the New Year’s holiday. Grain and livestock markets resumed trading at 9:30 a.m. ET. Front-month crude oil futures were more than $1.50 higher, and the U.S. dollar index was nearly 700 points higher this morning.

Cash cattle traded higher. Cash cattle prices firmed last week, though trading volume was relatively light. Packers have fresh contract supplies available to start the new month, which could limit their willingness to actively bid for cattle, though there’s a general belief they are short bought on needs coming out of the holidays.

Cash hog prices still searching for a seasonal low. The CME lean hog index is down 22 cents to $65.35 (as of Dec. 28), extending the seasonal slide. February lean hog futures ended last Friday $2.625 above the cash index, suggesting traders anticipate a low to posted early in the new year.

— Quotes of note:

- Treasury is watching. “We expect financial institutions will undertake every effort to ensure that they are not witting or unwitting facilitators of circumvention and evasion.” — Treasury Secretary Janet Yellen, on an executive order late last month that authorized possible new sanctions targeting Russia, including against foreign banks that help finance the country’s military-industrial base.

- Logistics back to prepandemic capacity. “We’re back to where our main carriers, our main relationships we had prepandemic, can handle our capacity and what we need service-wise.” — Jon Cargill, finance chief of retailer Hobby Lobby Stores, on changing shipping needs.

- Returns hangover. “We’re heading for a trillion-dollar problem here.” — Gartner’s Tom Enright, on retail returns.

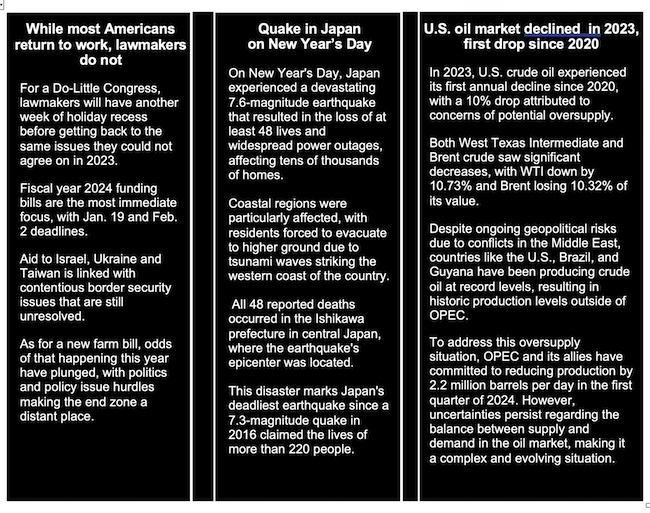

— Rising minimum wages may not impact low-paid workers. In recent years, substantial raises in pay have made minimum wage laws somewhat irrelevant, even in states that have aggressively raised them. Traditionally, at the start of each year, many states adjust the minimum wage to account for the cost of living or legal requirements. Prior to the pandemic, this often meant a welcome pay raise for low-wage workers. However, labor shortages in recent years have caused wages for many workers, such as cooks, housekeepers, and grocery clerks, to increase at a faster rate than what was mandated by state minimum wage laws. As a result, while minimum wages are increasing on paper, many low-paid workers may not notice a significant change in their paychecks due to market-driven wage increases. Link to more via the Wall Street Journal.

Market perspectives:

— Outside markets: The U.S. dollar index was higher, with the euro and British pound both weaker against the U.S. currency. The yield on the 10-year U.S. Treasury note was firmer, trading around 3.96%, with a higher tone in global government bond yields. Crude oil futures were higher on continued geopolitical worries, with U.S. crude around $73.20 per barrel and Brent around $78.60 per barrel. Gold and silver were mixed, with gold firmer around $2,074 per troy ounce and silver weaker around $24.06 per troy ounce.

— The price of oil increased after a continuous decline over the past four trading sessions. This uptick in oil prices can be attributed to rising geopolitical tensions. Specifically, Iran dispatched a warship to the Red Sea following an incident where the U.S. Navy destroyed three Houthi boats. Iran dispatched a warship to the Red Sea, a move that risks ratcheting up tensions in the Middle East. As a result of these developments, the price of West Texas Intermediate (WTI) crude futures surged by more than 2%, bringing it to a level above $73 per barrel. Additionally, Brent crude oil was trading at approximately $78.70 per barrel. These price movements indicate that market participants are reacting to the increased uncertainty and potential disruptions in the global oil supply chain caused by the geopolitical tensions in the region.

— Bitcoin began the new year by scaling new heights, surpassing $45,000 for the first time since April 2022 amid growing expectations that the SEC could approve a spot bitcoin ETF as early as next week.

— India's food-security challenges have global implications. The country's reliance on government price controls and trade policies has made its food production highly susceptible to the effects of climate change. This issue is significant not only because India has a massive population to feed but also because it is a major player in the international food export market. The Wall Street Journal examines (link) the intricacies of India's tightly regulated agricultural market and the complex political dynamics surrounding its food-pricing system.

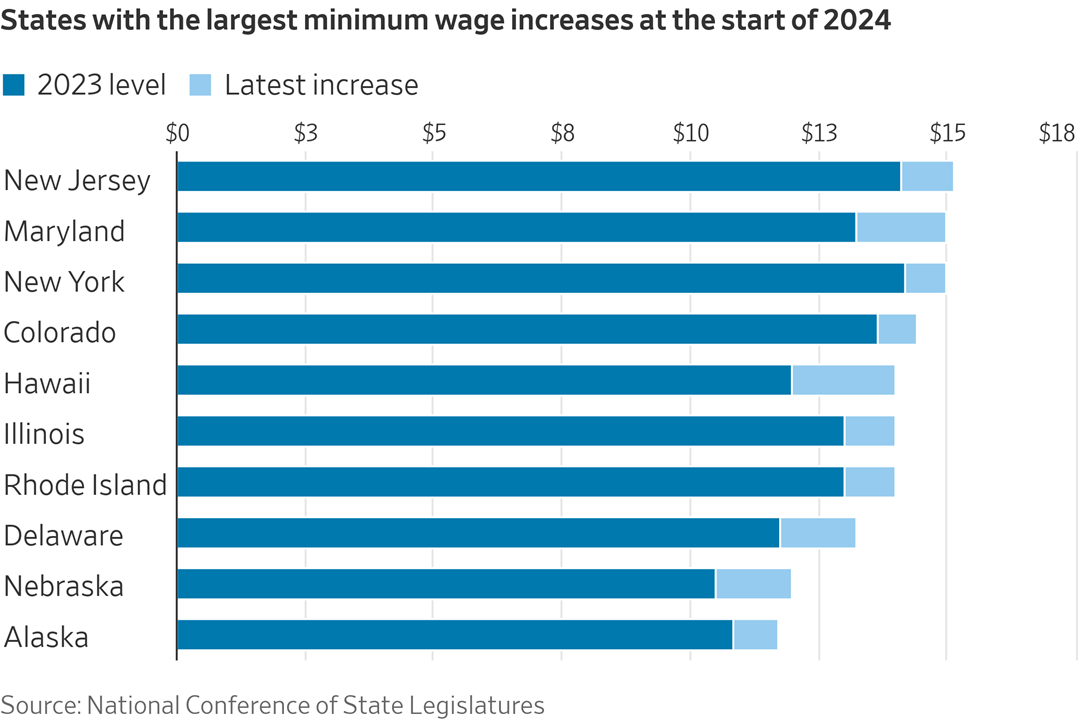

— NWS weather outlook: Pacific system to bring coastal/lower elevation rain and mountain snows to California and the Pacific Northwest Tuesday, spreading into the Great Basin and Southwest Wednesday... ...Moderate to locally heavy rainfall expected with showers and thunderstorms for portions of Texas and the Gulf Coast... ...Lake-effect snows downwind from the Great Lakes over the next couple of days.

Items in Pro Farmer's First Thing Today include:

• No overnight grain trade

• Cordonnier lowers Brazilian soybean crop forecast

• Brazil rains better than expected but still variable

• Slight decline in soy crush expected

• Eurozone PMI expands slightly but factory sector still in contraction

|

CONGRESS |

— This sums up Congress for 2024: “Look, it’s divided government in a presidential year. I don’t see us moving a lot of good legislation,” said Rules Committee Chair Tom Cole (R-Okla.). “I think the appropriations bills, and whatever the two sides agree to be passed, is probably the best we’re going to get.” The Senate returns Jan. 8 and the House on Jan. 9.

|

RUSSIA/UKRAINE |

— Ukrainian Deputy Prime Minister Oleksandr Kubrakov said the country has managed to export 13 million metric tons (MMT) of grain via its Black Sea shipping corridor, according to a post on the social media platform X.

|

CHINA UPDATE |

— China's manufacturing PMI falls below 50 for third straight month in December. In December, China's official Purchasing Managers' Index (PMI) for the manufacturing sector fell to 49, down from 49.4 in November. This marks the third consecutive month that the PMI has remained below the critical threshold of 50, which indicates a contraction in manufacturing activity rather than expansion. The result was lower than the expectation of 49.8. Both new orders, both domestically and internationally, declined further into contraction territory. Additionally, the measure of companies' willingness to hire new employees dropped to 47.9 from November's 48.1, indicating that China's manufacturing sector is facing challenges due to the global economic slowdown and weak domestic spending.

The services sector in China showed a similar trend, with its PMI remaining unchanged at 49.3. This suggests that consumers in China are still cautious about spending, likely due to concerns about job security and the property market.

These economic indicators reflect the broader challenges and uncertainties faced by China's economy, both domestically and globally.

— Many young women in China are choosing not to have more children due to government pressures, harassment, and concerns about the sacrifices of child-rearing. This trend has created a crisis for the Communist Party, which is eager to address the aging population issue by encouraging more births, the Wall Street Journal reports (link). However, the declining number of babies in China is leading the country towards a demographic collapse. Projections suggest that China's population, currently at about 1.4 billion, may decrease to roughly half a billion by 2100. This situation has resulted in women being held responsible for the demographic challenge China is facing.

|

ENERGY & CLIMATE CHANGE |

— Just 13 electric vehicle models are now eligible for the $7,500 consumer tax credit in the U.S. That's due to tighter rules surrounding sourcing battery components made by Chinese manufacturers. Vehicles that are still eligible for the full tax credit include variants of Tesla's Model Y, Rivian's R1T pickup, Stellantis' Jeep Wrangler 4xe, General Motors' Chevrolet Bolt and Ford's F-150 Lightning pickup truck. Nissan's Leaf and Tesla's Cybertruck fell off the list, but still qualify for a $3,750 tax credit.

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— California's Proposition 12 has officially become law, marking the culmination of over six years of political efforts by animal activists. Proposition 12 (link), which was passed by California voters in 2018, imposes strict regulations on the sale of food products derived from farm animals that are not raised according to specific standards. While the egg and veal requirements of Prop 12 had already gone into effect, the pork provisions were initially delayed to allow non-compliant pork to clear the supply chain. As of Jan. 1, 2024, only compliant animal products can be sold in California.

The pork industry opposed Proposition 12 and took the legal battle to the Supreme Court, which ultimately ruled that states have the authority to restrict meat sales.

USDA modified a weekly report on hog marketings to show the premium that was being paid for hogs raised in compliance with “animal confinement legislation,” such as Prop 12. In late December, the premium was an average $4.92 per 100 pounds.

Since the passage of Proposition 12 in California, 14 other states have enacted similar laws.

— Cal-Maine Foods to acquire a Tyson Foods chicken broiler processing plant, hatchery, and feed mill in Dexter, Missouri. This Tyson facility had been shut down in 2023. Initially, Cal-Maine intends to convert this plant into an egg-grading facility, and they plan to make further investments in the future. Additionally, the company plans to enter into agreements with contract farmers previously associated with Tyson, aiming to repurpose their facilities to support egg production.

|

POLITICS & ELECTIONS |

— Chris Sununu encouraged Chris Christie to drop out of the presidential race to clear the way for Nikki Haley. The New Hampshire governor offered his logic in terms of polling numbers in his state, which holds its presidential primary on Jan. 23. An American Research Group poll published Dec. 21 put Haley within 4 percentage points of Trump.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |