USDA Sees Food Price Inflation at 1.2% in 2024 for All Foods, Down From 2.9% in November

Restaurant prices expected to increase 4.9%, up from 4.3% in November

|

Today’s Digital Newspaper |

MARKET FOCUS

- U.S. banking sector: potential losses of up to $160 billion

- U.S. economy grows 4.9% in Q3 2023, strongest since Q4 2021

- Phila. Fed president: central bank should begin to reduce rates, but not immediately

- Biden sticking to "Bidenomics" message despite worries among Democrats

- New sanctions re: Russia oil income

- Auction for oil & gas leasing rights in Gulf of Mexico generates $382 million in revenue

- Houthi rebels taunt Red Sea shippers

- Global shippers of crude oil and fuels facing increased expenses

- Ag markets today

- NASS reviews crop reporting

- India’s exports could drop more than $4 billion due to shipment curbs .

- Rice prices reach 15-year high

- Indonesia makes rice purchases

- Ag trade update

- NWS weather outlook

- Pro Farmer First Thing Today items

CONGRESS

- Schumer sees Trump as major threat to Ukraine aid/border deal

ISRAEL/HAMAS CONFLICT

- Biden says efforts to secure new ceasefire for hostage deal continue

PERSONNEL

- Senate sends several nominations back to Biden administration

CHINA

- U.S. general breaks military talks freeze with Chinese counterpart

- No sales of U.S. wheat to China in weekly update

- Taiwan accuses China of economic coercion over tariff suspension

- China to cease export of various rare-earth technologies

- China’s central bank set to cut deposit rates for its state-owned banks on Friday

- China’s commerce ministry to work with central bank/gov’t re: exchange rate volatility

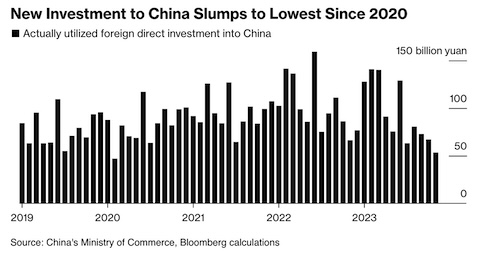

- China’s foreign direct investment drops to near four-year low

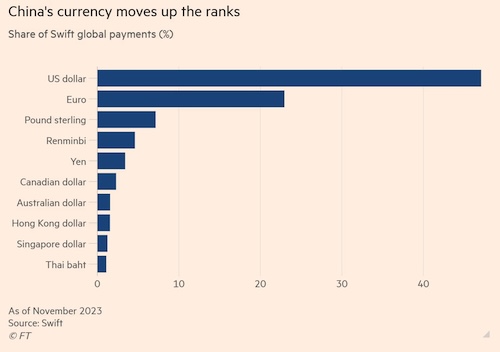

- Renminbi/yuan overtakes yen in global payments due to low interest rates

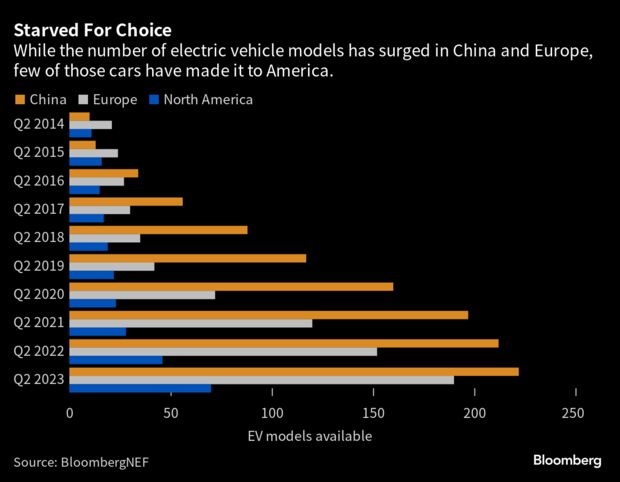

- U.S. considering raising tariffs on Chinese EVs and other goods

TRADE POLICY

- Sen. Marshall criticizes Biden administration’s Border rail crossing closure

ENERGY & CLIMATE CHANGE

- EU will initiate an antidumping investigation into import of Chinese biodiesel

- Soybean oil experiencing big growth as feedstock for renewable diesel production

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- More HPAI finds in Kansas, California, South Dakota

- USDA: Food price inflation at 1.2% in 2024 for all foods, down from 2.9% in November

OTHER ITEMS OF NOTE

- U.S. reaches agreement with Venezuela to secure release of 10 Americans

|

MARKET FOCUS |

— Equities today: Asian and European stock markets were mixed overnight. U.S. Dow opened around 225 points higher and then went over 300 points higher before going back to around 200 points higher. In Asia, Japan -1.6%. Hong Kong flat. China +0.6%. India +0.5%. In Europe, at midday, London -0.5%. Paris -0.5%. Frankfurt -0.6%.

U.S. equities yesterday: All three major indices registered losses and ended at their lows for the day. The Dow lost 475.92 points, 1.27%, at 37,082.00 (its first decline in 10 days). The Nasdaq dropped 225.28 points, 1.50%, at 14,777.94. The S&P 500 fell 70.02 points, 1.47%, at 4,698.35.

— Agriculture markets yesterday:

- Corn: March corn futures fell 3 cents before settling at $4.69 3/4.

- Soy complex: March soybeans fell 6 3/4 cents to $13.15 3/4, nearer the session low and hit a seven-week low. March soybean meal dropped $3.70 to $388.70, nearer the session low and hit a two-month low. March bean oil closed down 8 points at 50.76 cents and near mid-range.

- Wheat: March SRW futures slipped 12 3/4 cents before settling at $6.10, near session lows. March HRW futures dropped 16 1/2 cents to $6.25, near session lows. Spring wheat futures slipped 10 1/4 cents to $7.18.

- Cotton: March cotton fell 25 points to 79.21 cents and nearer the session low.

- Cattle: Continued talk of firming cash prices seemed to boost cattle futures Wednesday. Expiring December live cattle futures climbed $1.575 to $170.025, while most-active February gained $1.525 to $170.30. January feeder futures surged $2.15 to $224.05, with the deferred contracts posting even larger advances.

- Hogs: Hog futures dipped Wednesday, with the drop taking some of the premium out of the 2024 contracts. Nearby February slid 32.5 cents to $70.225.

— Ag markets today: Corn, soybeans and wheat traded in narrow ranges during the overnight session. As of 7:30 a.m. ET, corn futures were trading mostly a penny higher, soybeans were 1 to 2 cents lower and wheat futures were 4 to 6 cents higher. Front-month crude oil futures were around 50 cents lower, and the U.S. dollar index was down nearly 400 points.

Cash cattle hopes building. Cash sources noted feedlots passed on a smattering of steady cash cattle bids on Wednesday as they were encouraged by strong gains in futures. That suggests this week’s eventual trade will take place at higher prices. Packers are thought to be short-bought on slaughter needs, despite upcoming holiday-shortened production schedules and freshly available contract supplies when the calendar flips to January.

Cash hog index ticks up. The CME lean hog index firmed 17 cents to $66.54 (as of Dec. 19). While it’s going to take stronger and sustained price gains in the cash index to convince traders the seasonal low is in place, the $3.685 premium February futures held to today’s cash quote on Wednesday’s close signals they anticipate a cash market bottom is close.

— Quotes of note:

- Fedspeak. Federal Reserve Chair Jerome Powell was asked at a recent gathering what he does for fun. He paused, then grinned. “For me, a really big party — this is as fun as it gets — is a really good inflation report,” he said to laughter at Spelman College in Atlanta earlier this month.

Meanwhile, Fed Bank of Philadelphia President Patrick Harker said the central bank should begin to reduce rates — though not immediately.

- President Biden is sticking to his "Bidenomics" message despite worries among Democrats about the 2024 election. “When you increase the middle-class, the poor have a shot and the wealthy still do very well. The middle-class does well and we all do well. That’s what we call Bidenomics.” — President Biden.

- New sanctions re: Russia oil income. “Participants in the maritime transport of Russian oil...must adhere to the compliance guidelines agreed upon by the Price Cap Coalition or face the consequences.” — Deputy Treasury Secretary Wally Adeyemo, on the new sanctions targeting upstart trading companies that have kept oil income flowing to the Kremlin.

— U.S. banking sector is facing a significant challenge with potential losses of up to $160 billion due to anticipated defaults on commercial real estate loans, according to a study by researchers from Columbia, Stanford, U.S.C., and Northwestern. Commercial real estate values are predicted to decline by more than $500 billion in 2024, and Morgan Stanley has estimated that lenders may need to renegotiate over $1.5 trillion of their commercial real estate portfolios by the end of 2025 to prevent defaults.

This looming wave of losses poses a risk to banks, especially smaller regional ones, with the potential for dozens to over 300 of them to face solvency issues. Commercial real estate is a crucial component of many banks' lending operations, accounting for a market estimated at around $20 trillion. Factors contributing to the sector's vulnerability include post-pandemic office vacancies, the work-from-home trend, the highest interest rates in decades, and a slowing economy.

Regulators share concerns about this situation, with the Financial Stability Oversight Council (FSOC) designating commercial real estate as the most significant financial risk to the economy in its recent annual report. Additionally, the FSOC warns that the commercial real estate crunch could lead to reduced lending in other areas by banks.

— NASS reviews crop reporting. USDA's National Agricultural Statistics Service (NASS) conducts a comprehensive review of its estimating programs every five years following the Census of Agriculture. The objective is to ensure that the annual estimating programs focus on the most relevant commodities and states within U.S. agriculture. This review considers various sources of information, including data from the agricultural census and public input.

NASS has initiated the program review process and is inviting public feedback. To provide comments or information for consideration regarding a specific NASS program, individuals can email nass@nass.usda.gov with "NASS Program Review" in the subject line. The deadline for submitting feedback is Jan. 5, 2024.

— U.S. economy grows 4.9% in Q3 2023, strongest since Q4 2021. The U.S. economy experienced an annualized growth rate of 4.9% in the third quarter of 2023, which was slightly below the 5.2% growth rate in the second estimate but matched the 4.9% initially reported in the advance estimate. This growth represents the strongest performance since the fourth quarter of 2021.

Consumer spending increased less than initially anticipated, with a growth rate of 3.1% compared to the 3.6% reported in the second estimate, though it still marked the most significant gain since the fourth quarter of 2021. The slowdown in consumer spending was primarily driven by a decrease in services spending.

Private inventories contributed 1.27 percentage points to the overall growth, slightly lower than the 1.4 percentage points in the second estimate. Both exports (5.4% vs. 6%) and imports (4.2% vs. 5.2%) showed slower growth than initially expected.

On a positive note, nonresidential investment was revised higher, showing a 1.4% increase (compared to 1.3% in the second estimate). Investment in structures saw a significant surge, surpassing expectations with an 11.2% growth rate (compared to 6.9%). Additionally, both residential investment (6.7% vs. 6.2%, marking the first rise in nearly two years) and government spending (5.8% vs. 5.5%) were revised higher, contributing to the overall economic growth.

Market perspectives:

— Outside markets: The U.S. dollar index was weaker, with the euro and British pound both firmer against the U.S. currency. The yield on the 10-year U.S. Treasury note was firmer, trading around 3.85%, with a mixed-to-mostly lower tone in global government bond yields. Crude oil futures were under pressure, with U.S. crude around $73.40 per barrel and Brent around $78.85 per barrel. Gold and silver futures were narrowly mixed ahead of US market action, with gold firmer around $2,049 per troy ounce and silver weaker around $24.53 per troy ounce.

— An auction for oil and gas leasing rights in the Gulf of Mexico recently concluded, generating $382 million in revenue. The Bureau of Ocean Energy Management (BOEM) revealed that Hess Corp. emerged as the top bidder in the auction, making a total of 20 bids and offering $88.2 million. Anadarko, owned by Occidental Petroleum, was also a significant participant, bidding $74.2 million for 49 successful bids. This auction made available 73 million acres of leasable land in the Gulf of Mexico, and it is expected to be the last of its kind until 2025. The Biden administration has announced plans to pause future oil and gas lease sales for two years. Instead, they have outlined a schedule to hold three such sales over the next five years, scheduled for 2025, 2027, and 2029.

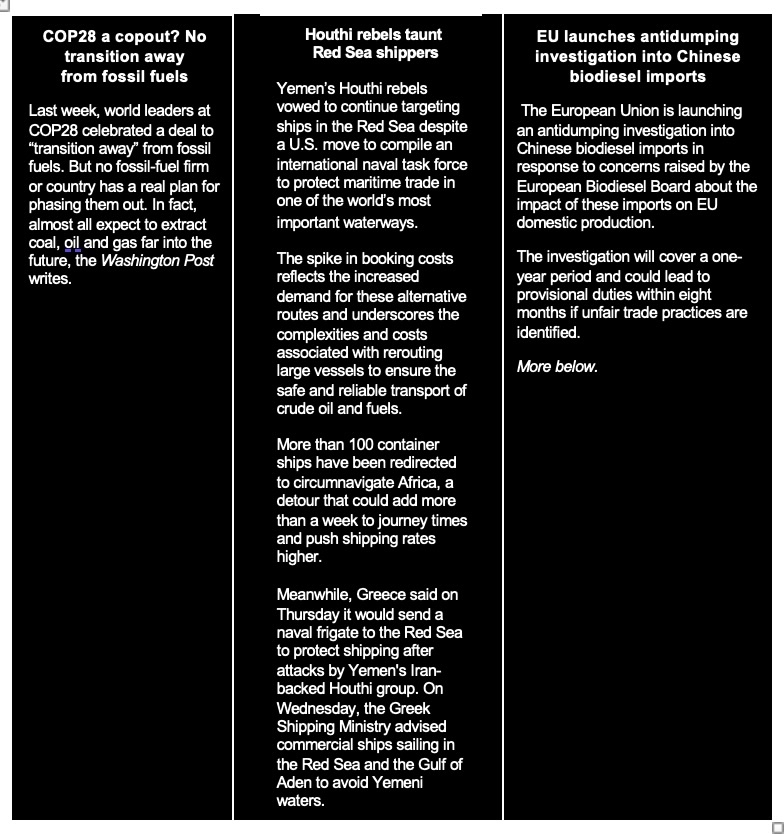

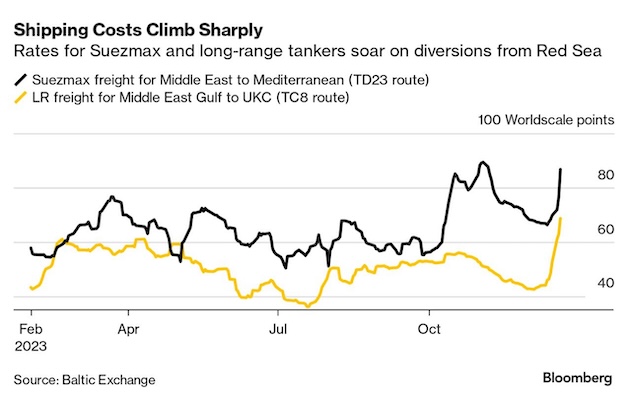

— Global shippers of crude oil and fuels are facing increased expenses when booking tankers for extended routes to avoid potential disruptions at the Suez and Panama canals. Chartering costs for Suezmax tankers, the largest type capable of fully laden transit through the Suez Canal, have risen significantly as more ships choose to take longer routes around Africa to avoid navigating the Red Sea and the Suez Canal itself. This decision is driven by concerns about possible interruptions or delays in these critical maritime passages, prompting shippers to opt for longer, but potentially safer, journeys.

— India’s exports could drop more than $4 billion due to shipment curbs. India’s exports could drop by about $4 billion to $5 billion this year due to trade restrictions on wheat, rice and sugar, a person familiar with the matter told Reuters. The source also said basmati rice exports from India may be impacted if attacks in the Red Sea by the Houthi group persists, noting longer shipping routes could lift prices 15% to 20%.

— Rice prices reached a 15-year high due to growing concerns about rising demand and the potential impact of El Niño on the grain supply, which is a staple food for many people in Asia and Africa. Specifically, Thai white rice, a benchmark for Asian markets, has surged by 2.5% to reach $650 per ton, marking the highest level since October 2008. This surge follows a previous rally in August, triggered by export restrictions imposed by leading rice exporter India and threats to the Thai rice crop due to dry weather. Although prices dipped in September and October, they accelerated their upward trajectory in November.

India, another major rice producer, is grappling with rising rice prices, despite export restrictions and good harvests. Rice costs have risen by approximately 12% annually for the past two years, leading officials to urge rice millers to reduce retail prices.

Additionally, Indonesia has announced plans to purchase 2 million tons of rice from Thailand by the end of the following year, causing local millers to hold off on sales in anticipation of higher prices (see next item). The strength of the Thai currency has also played a role in driving prices up.

Outlook: While there may be potential limitations to further price increases due to looming supplies from Vietnam and Thailand, the market is expected to maintain relatively high price levels into the early months of the following year. This is due to lingering concerns about food security and India's export restrictions.

— Indonesia makes rice purchases. Indonesia’s food procurement agency Bulog confirmed it had filed a tender earlier this month for more than 500,000 MT of rice as part of the import quota for 2023. The purchases will be from Thailand, Vietnam, Pakistan and Myanmar, with more than 300,000 MT sourced from Thailand. Indonesia is said to be seeking 1 MMT of rice from the private sector and 1 MMT in government-to-government deals. Bulog said last month the government would set next year’s rice import quota at 2 MMT, down from this year’s quota of 3.8 MMT.

— Ag trade update: South Korea purchased 16,000 MT of non-GMO soybeans, with 12,000 expected to be sourced from the U.S. and 4,000 MT from Canada. Thailand passed on a tender to buy 197,300 MT of optional origin feed wheat.

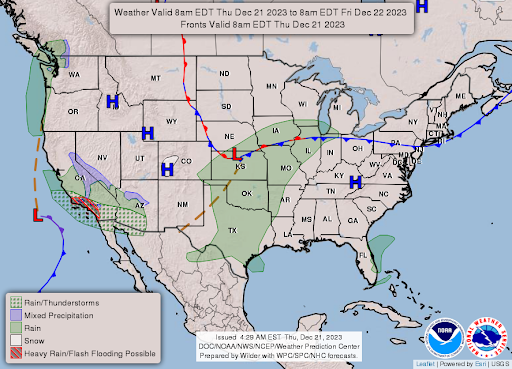

— NWS weather outlook: There is a Moderate Risk of excessive rainfall over parts of Southern California on Thursday... ... There is a Slight Risk of excessive rainfall over parts of Southern California and the Southwest on Friday... ...Light to moderate snow over the Cascades/Northern Intermountain Region/Central Rockies and snow at the higher elevations over parts of the Southwest, Great Basin, and Southern Rockies on Friday.

Items in Pro Farmer's First Thing Today include:

• Quiet overnight grain trade

• Strategie Grains expects slightly smaller EU wheat crop

• China’s FDI down 10% through November

|

CONGRESS |

— Schumer sees Trump as major threat to Ukraine aid/border deal. Politico reports (link) Senate Majority Leader Schumer (D-N.Y. sees former President Donald Trump as “a major threat to the fate of any future deal to pair stricter border policy with billions of dollars in foreign aid.” In an interview, Schumer “made clear... that he’s counting on the ideological middle of the GOP to save President Joe Biden’s national security spending package — not just from conservative pressures, but from Trump’s scorn.” Schumer “expects roughly five Senate Republicans to vote for a deal no matter what, 15 to vote against it no matter what, and that the rest could all be swayed by Trump as the presidential primary formally kicks off next month.” Schumer said, “He is a huge political force in that party. ... And the question is… will they do the right thing, even though they know that Donald Trump will in a nasty, vicious way, attack them?”

|

ISRAEL/HAMAS CONFLICT |

— Biden says efforts to secure new ceasefire for hostage deal continue. President Biden said on Wednesday he did not expect an Israel-Hamas deal for the release of hostages held in Gaza to be struck soon. However, Biden stressed that the U.S. is “pushing for one.” In addition, National Security Council spokesman John Kirby “said on Wednesday that the talks on a new hostage deal are “serious” and stressed the Biden administration hopes “it will lead somewhere,” while Secretary of State Blinken said “the U.S. and Israel both want to see a release of hostages in return for a pause in the fighting.” Blinken said the problem is still Hamas refusing to relaunch negotiations.

|

PERSONNEL |

— As the Senate left Washington, several nominations were sent back to the Biden administration. This included nominations for USDA and the Commodity Futures Trading Commission (CFTC), among others. Two nominations in particular, Basil Gooden's appointment as USDA undersecretary for rural development and Summer Mersinger's reappointment as a CFTC commissioner, had previously received unanimous approval from the Senate Agriculture Committee earlier in the month. However, the Senate did not take any action on these nominations.

Additionally, the Senate failed to act on two nominations for membership on the National Transportation Safety Board — the nominees were J. Todd Inman and Alvin Brown.

Of note: Failure to act on these nominations was due to Sen. Josh Hawley's (R-Mo.) objection to including them in a year-end legislative package.

|

CHINA UPDATE |

— U.S. general breaks military talks freeze with Chinese counterpart. General C.Q. Brown, the chair of the Joint Chiefs of Staff in the United States, broke the nearly year-and-a-half-long impasse between the U.S. and Chinese militaries by speaking with his Chinese counterpart, General Liu Zhenli. This communication marks the first interaction between senior military officials of the two countries since November when the leaders of both nations agreed to restart military communications. The Chinese had frozen all talks in retaliation for a visit to Taiwan by then-House Speaker Nancy Pelosi (D-Calif.) in August 2022.

Of note: This conversation between Generals Brown and Liu signals a potential thaw in military relations between the United States and China. One example: China has signed off on the first delivery of a Boeing Co. 787 jet since April 2021, an indication strained U.S./China trade relations may be easing and a potential precursor to the more significant resumption of 737 Max deliveries.

— No sales of U.S. wheat to China in weekly update. USDA’s weekly Export Sales report for the week ended Dec. 14 did not contain any sales of U.S. wheat to China but there were sales of other commodities. Activity for 2023-24 included net sales of 136,296 metric tons of corn, 237,233 metric tons of sorghum, 700,448 metric tons of soybeans, and 68,390 running bales of upland cotton. No activity for 2024-25 was reported. For pork and beef, net sales of 397 metric tons of beef and 2,758 metric tons of pork were reported for 2023 delivery, and net sales for 2024 of 817 metric tons of beef and 10,994 metric tons of pork were reported.

— Taiwan accuses China of economic coercion over tariff suspension. Taiwan's government accused China of employing "typical economic coercion" by suspending tariff cuts on 12 items scheduled to take effect on Jan. 1. In response, China stated that it was merely reacting to barriers erected by Taiwan, which it claims are in violation of a trade agreement between the two nations. This development comes as Taiwanese voters prepare to participate in elections on January 13, with the issue of how to handle China expected to be a central theme in the political discourse.

— China to cease export of various rare-earth technologies. This move has the potential to create challenges for the U.S. and other Western countries in their efforts to secure essential raw materials for various strategic purposes. Rare-earth elements, consisting of 17 different elements, are crucial components in a wide range of applications, including wind turbines, military equipment, and electric vehicles. By restricting the export of these materials, China could exert control over the global supply chain, making it more difficult for other nations to access these critical resources for their technological and industrial needs.

— China’s central bank is set to cut deposit rates for its state-owned banks on Friday, three sources with knowledge of the matter told Reuters, providing room to reduce lending costs amid the faltering economy. Rates for 1-year and 2-year time deposits will be cut by 10 basis points (bps) and 20 bps, respectively, and rates for 3- and 5-year time deposits will be cut by 25 bps, the sources said. In addition, lenders will cut rates for 1-year and 2-year large-scale certificates of deposit (CDs) by 10 bps and 25 bps, respectively, and cut rates for 3-year and 5-year large-scale CDs by 30 bps, the sources said. State-owned Industrial and Commercial Bank of China announced it would cut interest rates on some deposits from Friday.

— China’s commerce ministry said it will work with the central bank and government to manage exchange rate fluctuations in 2024, should the yuan start to rebound against the dollar and make already weak Chinese exports more expensive. “We will work with the People’s Bank of China, State Administration of Foreign Exchange and other departments... to effectively deal with the risk of exchange rate fluctuations,” said a commerce ministry spokesperson. “(We) will support enterprises through hedging and cross-border renminbi settlement,” she added.

— China’s foreign direct investment drops to near four-year low. A measure of foreign investment into China fell to the lowest in nearly four years in November, underlining how geopolitical tensions and a slowing economy have combined to convince foreign companies to slow their expansion. Link to details via Bloomberg.

— Renminbi/yuean overtakes yen in global payments due to low interest rates. China’s currency, the renminbi (RMB), surpassed the yen's share of global payment transactions for the first time in nearly two years. This shift is attributed to China's low interest rates, which have enhanced the appeal of its currency for financing trade with the second-largest global economy. Data from international payments platform Swift, released on Wednesday, revealed that the renminbi's share of global payments increased to 4.6% in November, up from 3.6% the previous month. This milestone marked the first time since January 2022 that the renminbi surpassed the yen, making it the fourth most-used global currency, following the pound sterling, euro, and U.S. dollar. Beijing has been actively working to increase the international profile of its currency as part of a broader strategy to reduce China's vulnerability to the long-standing dominance of the US dollar in global finance. Link/paywall to details via Financial Times.

— U.S. is considering raising tariffs on Chinese EVs and other goods as it tries to limit reliance on Asia’s biggest economy and shield its own green industry, the Wall Street Journal reports (link). Chinese EVs are already subject to a 25% tariff, which has helped prevent subsidized Chinese automakers from making inroads into the U.S. market.

China comments. Asked Thursday about the report, a spokesman for China’s foreign ministry told reporters that tariffs “violate the principles of market economy and fair competition and undermine the security of the global industrial supply chain.” China “firmly opposes this and urges the U.S. side to abide by the WTO rules and provide a fair, just and nondiscriminatory business environment,” Wang Wenbin said at a regular press briefing, describing such measures as “protectionism.”

Trade relations with China are emerging as a significant issue in the 2024 presidential election. Former President Trump had made confronting China a central theme of his presidency, and during his campaign, he argued that President Biden's clean energy initiatives would ultimately benefit China. Some other Republicans have also attempted to portray President Biden as being lenient on China. Robert Lighthizer, who played a key role in shaping trade policy during the Trump administration and continues to advise the former president, has been in contact with congressional Republicans regarding trade matters, according to sources familiar with the situation. Lighthizer has testified before the House select committee on China, where he advocated for the United States to increase tariffs on Chinese imports.

|

TRADE POLICY |

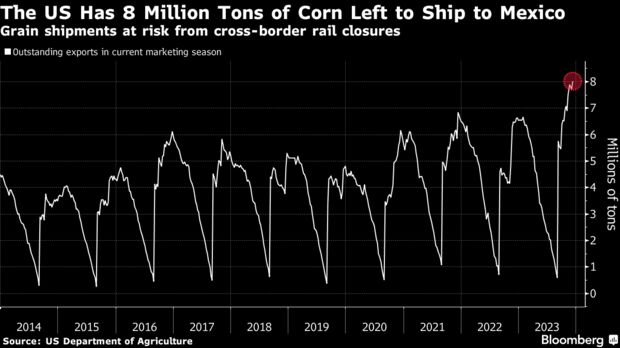

— Sen. Marshall criticizes Biden administration’s Border rail crossing closure. Sen. Roger Marshall (R-Kan.) blasted President Biden and the Department of Homeland Security (DHS) Secretary, Alejandro Mayorkas, for the administration's decision to close two major rail crossings at the U.S. southern border. He said this “ill-advised decision stops nearly 45% of the rail cars passing between the U.S. and Mexico and leaves more than $200 million of daily commerce stranded on the track.” Without any prior notice, the El Paso and Eagle Pass railroad crossings were abruptly closed by DHS's Customs and Border Protection on Monday. The move stifles international commerce and has left millions worth of goods stuck in limbo, hurting producers' bottom lines right before the holidays. The Biden administration has not indicated when they will reopen freight operations at these locations.

"The Biden Administration's approach to addressing the national security threats at our southern border has been ill-advised since he stepped foot in the Oval Office,” Sen. Marshall said. “Mexico remains one of the U.S.'s top trading partners and the destination for agricultural goods raised and produced in Kansas. Biden's announcement to close two additional U.S.-Mexico rail crossings will have substantial and noticeable impacts on our state's family farms and ranches. Targeting rail traffic that allows farmers to move goods and grain while looking the other way as millions of illegal immigrants flood into the interior of our country is a clear display of poor judgment."

More than 40 U.S. food companies and associations sent a letter addressed to Mayorkas urging the government to reopen the El Paso and Eagle Pass international rail crossings in Texas.

Trade disruptions will allow Mexico an opportunity to source commodities from other countries, undercutting years of productive trade relations between the two countries.

Of note:

- Since Monday, railroads have had to hold over 100 train sets, equivalent to more than 100,000 rail cars and 10,000,000 tons of commodities and goods.

- Roughly two-thirds of all U.S. agricultural exports to Mexico move via rail.

- Mexico is one of the U.S. and Kansas’ top export markets. U.S. goods and services trade with Mexico totaled an estimated $855.1 billion in 2022. Eagle Pass and El Paso accounted for a total of $33.95 billion in rail traffic to and from Mexico in the last year.

- Mexico is the top export destination for Kansas wheat. Nearly 70% of wheat exported is moved by rail to Mexican flour mills.

- Top exports to Mexico include oil and natural gas products, motor vehicle products and petroleum and coal products.

- In 2021, the U.S. exported more than $2.6 billion of soybeans and more than $4.7 billion of corn to Mexico.

|

ENERGY & CLIMATE CHANGE |

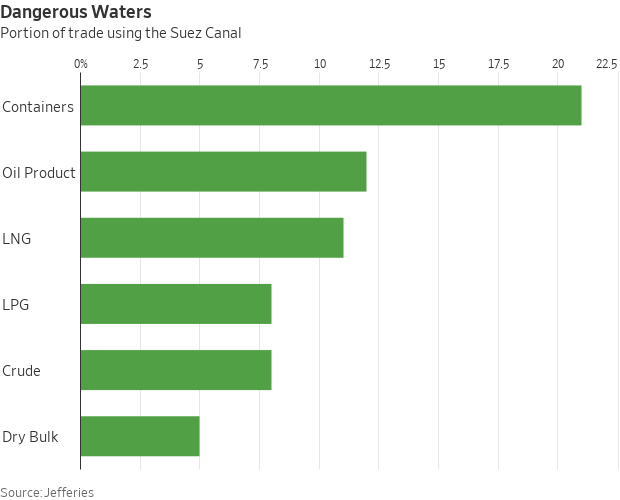

— EU will initiate an antidumping investigation into the import of Chinese biodiesel. This move comes in response to complaints from the European Biodiesel Board (EBB) and concerns that these imports have led to a decrease in domestic biodiesel production within the EU. The investigation will span from Oct. 1, 2022, to Sept. 30, 2023, covering a one-year period. This investigation is separate from another ongoing EU investigation looking into whether Indonesia has been circumventing EU duties on biodiesel by routing shipments through China and the U.K.

The entire investigation process is expected to last up to 14 months, during which the EU authorities will assess whether antidumping measures are warranted. However, within eight months, provisional duties could potentially be imposed on Chinese biodiesel imports if the investigation finds sufficient evidence of unfair trade practices.

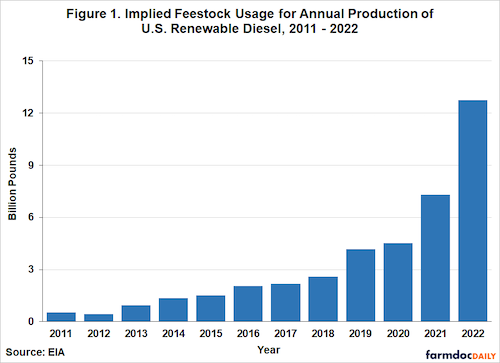

— Soybean oil is experiencing significant growth as a feedstock for renewable diesel production, according to agricultural economists from the University of Illinois (link). They noted that soybean oil's share of the feedstock market has tripled in recent years, reaching 27.4%, while other feedstock sources have remained stagnant or decreased.

The economists highlighted that soybean oil has been the most prominent winner in the renewable diesel boom among individual feedstocks. In just two years, its market share has surged by 18.2 percentage points. Yellow grease, which includes used cooking oil, remains the leading feedstock with 29.1% of the market, the same as at the beginning of the decade. In contrast, the share for tallow, which was once dominant, has fallen to 15.3%, and corn oil accounts for 15.5% of the market, down by 3.3 points.

The use of feedstock for renewable diesel has increased significantly, from just over 2 billion pounds in 2017 to nearly 13 billion pounds in 2022. Various vegetable oils and animal fats are used in renewable diesel production, with a conversion rate of 8.5 pounds of feedstock per gallon of fuel.

Renewable diesel is predominantly consumed in California, driven by the state's Low-Carbon Fuel Standard, which serves as an incentive. Renewable diesel is produced through a different process than biodiesel and is chemically equivalent to petroleum diesel.

USDA estimates that 47% of U.S. soybean oil production, equivalent to 12.8 billion pounds, will be used in biofuels for the 12 months starting on October 1. This marks a significant increase from two years ago when 40% of soybean oil production, or 10.4 billion pounds, went into biofuels. USDA's long-term projection suggests that 49% of soybean oil production, totaling 13.6 billion pounds, will be used for biofuels in the year beginning Oct. 1, 2024, and 14 billion pounds the following year.

The researchers noted that approximately 55% of U.S. biodiesel is produced from soybean oil, maintaining its dominant position in the biodiesel industry.

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— More HPAI finds in Kansas, California, South Dakota. USDA’s Animal and Plant Health Inspection Service (APHIS) has confirmed highly pathogenic avian influenza (HPAI) in additional commercial operations in several states that have already reported cases. Cases confirmed Dec. 18 included Sonoma County, California (497,700 commercial table egg layer birds) and Edmunds County, South Dakota (1,000 birds at a commercial upland game producer). Dec. 19 confirmations announced by APHIS include Muskegon County, Michigan (47,900 commercial turkey meat birds); Rice County, Kansas (800,000 commercial table egg layer birds); and Sonoma County, California (3,500 commercial duck meat birds).

— USDA now sees food price inflation at just 1.2% in 2024 for all foods, down from 2.9% in November, and the smallest rise in food prices since they increased 0.9% in 2017, according to USDA’s Economic Research Service (ERS). Food at home (grocery) prices are now seen falling 0.6% in 2024, down from an outlook for an increase 1.6% in November, and would be the steepest decline in grocery prices since they fell 1.3% in 2016. Prices also decreased in 2017 by 0.2%. Restaurant prices, however, are now expected to increase 4.9%, up from 4.3% in November and the highest forecast since USDA started releasing their 2024 outlook in July.

|

OTHER ITEMS OF NOTE |

— Argentina's President Milei announces controversial economic reforms, prompting protests. Argentine President Javier Milei introduced additional changes to government operations, sparking protests from citizens who are opposing these policies. The president unveiled economic reforms that eliminate export limits, relax regulations in various sectors, privatize many government-owned companies, and reduce protections for renters, employees, and shoppers.

While protesters were allowed to rally, the government has made it clear that they will not tolerate road blockades, and public aid could be cut off for those who obstruct roads. Patricia Bullrich, the security minister, emphasized that citizens can demonstrate in squares and other public spaces, but streets will remain open.

Milei has used a constitutional mechanism that allows him to modify laws without Congress' approval in cases of "extreme need and urgency" to enact these changes. These policy shifts have sparked public protests, highlighting the challenges faced by the government in implementing these reforms.

Here’s a list of Milei’s initial policy changes, whose architect was Federico Sturzenegger, a former central bank chief during the government of Mauricio Macri:

- Prepare all state-owned companies to be privatized

- Authorize the shareholder control of Aerolineas Argentinas to be partly of completely transferred to private parties

- Deregulate satellite Internet services to allow SpaceX’s Starlink to operate in Argentina

- Eliminate price controls on prepaid healthcare plans

- Eliminate the monopoly of tourism agencies to deregulate the sector

- Repeal the current Rent Law that limits price increases in a bid to normalize the real estate market

- Repeal the current Land Law that limits ownership of land by foreigners in a bid to promote investments

- Scrap the current Supply Law that allows the government to set minimum and maximum prices and profit margins for goods and services of private companies

- Eliminate the Economy Ministry’s price observatory to “avoid the persecution of companies”

— U.S. reached an agreement with Venezuela to secure the release of 10 Americans who had been held in the country following months of negotiations between the two nations. This deal also involves the extradition of Leonard Francis, a former military contractor known as "Fat Leonard," who orchestrated the largest corruption scandal in U.S. Navy history. President Biden expressed his gratitude for the resolution on Wednesday, stating that he was relieved that the Americans' ordeal was finally over and that their families could be reunited. He also emphasized that Leonard Francis would face justice for the crimes he committed against the U.S. government and the American people. In exchange for the extradition of Francis, Biden made a challenging decision to grant clemency to Alex Saab, who is alleged to be a financier for Venezuela's President Nicolas Maduro. This exchange reflects a significant development in U.S./Venezuela relations and highlights the complex diplomatic considerations involved in securing the release of American citizens held abroad.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |