Biden/Xi Meet Wednesday in S.F. with Military, Iran, Economic Issues High on Agenda

House GOP offers two-step plan to fund gov’t; 2018 Farm Bill, orphan programs extended

Washington Focus

House Republicans are proposing a two-tiered stopgap funding plan (link) to extend current spending levels for some gov’t agencies. This plan aims to avoid a partial government shutdown after Nov. 17.

Key details:

- The proposed stopgap measure would extend funding for certain agencies until mid-January and others until early February.

- Agencies covered by the Military Construction-VA, Agriculture, Energy-Water, and Transportation-HUD bills would have their funding extended until Jan. 19. For the remaining eight bills, the extension would be until Feb. 2.

Of note: House Speaker Mike Johnson (R-La.) hopes his strategy will keep the government’s lights on without sparking a GOP rebel rebellion. But many conservative House Republicans (especially the gang of rebels) have demanded that any spending plan include deep spending cuts. If the two-step plan doesn't pass, House Republicans will turn to what they call a full-year continuing resolution, keeping spending flat — although it would contain "appropriate adjustments to meet our national security priorities."

Johnson on Sunday suggested his plan would buy lawmakers time to negotiate individual spending bills, which fiscal conservatives have demanded. “Washington’s spending addiction cannot be broken overnight,” he said on the social media site X. “But I will not allow end of year megabus spending packages to continue under my leadership.”

Already one rebel Republican, Rep. Chip Roy of Texas, said he would oppose the plan because it would continue current spending levels with no changes or conditions — what is known in Washington shorthand as a “clean” funding extension. “It’s 100% clean,” Roy wrote on social media. “And I 100% oppose.” Some other GOP conservatives have noted opposition. Johnson will need some Democratic votes given his narrow majority and opposition by fiscal conservatives.

Meanwhile, the White House Office of Management and Budget has already begun its initial communications with agencies on how to prepare for a possible government shutdown.

The House GOP measure would extend farm bill programs and several health care-related provisions temporarily, but contains no supplemental aid for Israel, Ukraine or border management funding, which President Joe Biden requested and which Johnson framed as a way for Republicans to put themselves in a stronger bargaining position for negotiations with the Senate and the White House on an emergency national security spending bill that would not be subject to the threat of a shutdown.

White House Press Secretary Karine Jean-Pierre criticized the plan, calling it a recipe for more chaos and shutdowns and urging House Republicans to work in a bipartisan way to prevent a shutdown.

The House Rules Committee is set to take up the legislation on Monday afternoon, setting up a vote on the House floor as early as Tuesday. If the plan is approved by the House, it's uncertain whether the Senate will accept it. Democrats in the Senate have concerns about including the Defense appropriations bill in the first tranche.

In the Senate, there are differing opinions on the stopgap plan, with some senators considering a more conventional stopgap measure that extends spending for all agencies until Jan. 19 and does not include aid to Israel or Ukraine. Senate Majority Leader Chuck Schumer (D-N.Y.) has teed up a procedural vote Monday afternoon to advance placeholder legislation for temporary funding, likely into January.

— The four leaders of the House and Senate Agriculture Committees released the following statement on a farm bill extension: “As negotiations on funding the government progress, we were able to come together to avoid a lapse in funding for critical agricultural programs and provide certainty to producers. This extension is in no way a substitute for passing a 5-year Farm Bill and we remain committed to working together to get it done next year.”

The stopgap measure extends the farm bill through September 2024. The extension includes funding for the 21 “orphan” programs and for the Foundation for Food and Agriculture Research.

— Netanyahu: ‘There could be' a potential deal to free hostages from Gaza. Israeli Prime Minister Benjamin Netanyahu said Sunday that "there could be" a potential deal to free at least some of the approximately 240 people who were taken hostage by Hamas on Oct. 7. When asked on NBC News' Meet the Press about how close Israel is to getting some of the hostages out of the Gaza Strip, which is governed by Hamas, Netanyahu responded: "I can say that we weren't close at all until we started the ground operation. In fact, we heard that there was an impending deal of this kind or that kind, and then we learned that it was all hokum, it was nothing, but the minute we started the ground operation things began to change."

When host Kristen Welker pressed the prime minister further on whether there was a potential deal, he said: "There could be, but I think the less I say about it, the more I’ll increase the chances that it materializes." Four hostages, including two U.S. citizens, were released from Gaza last month.

Meanwhile, a Biden administration official told NBC on Sunday that a deal is being considered to release about 80 women and children in exchange for Palestinians held by Israel. The official also said the U.S. is looking at other potential options and it is unclear whether it will succeed.

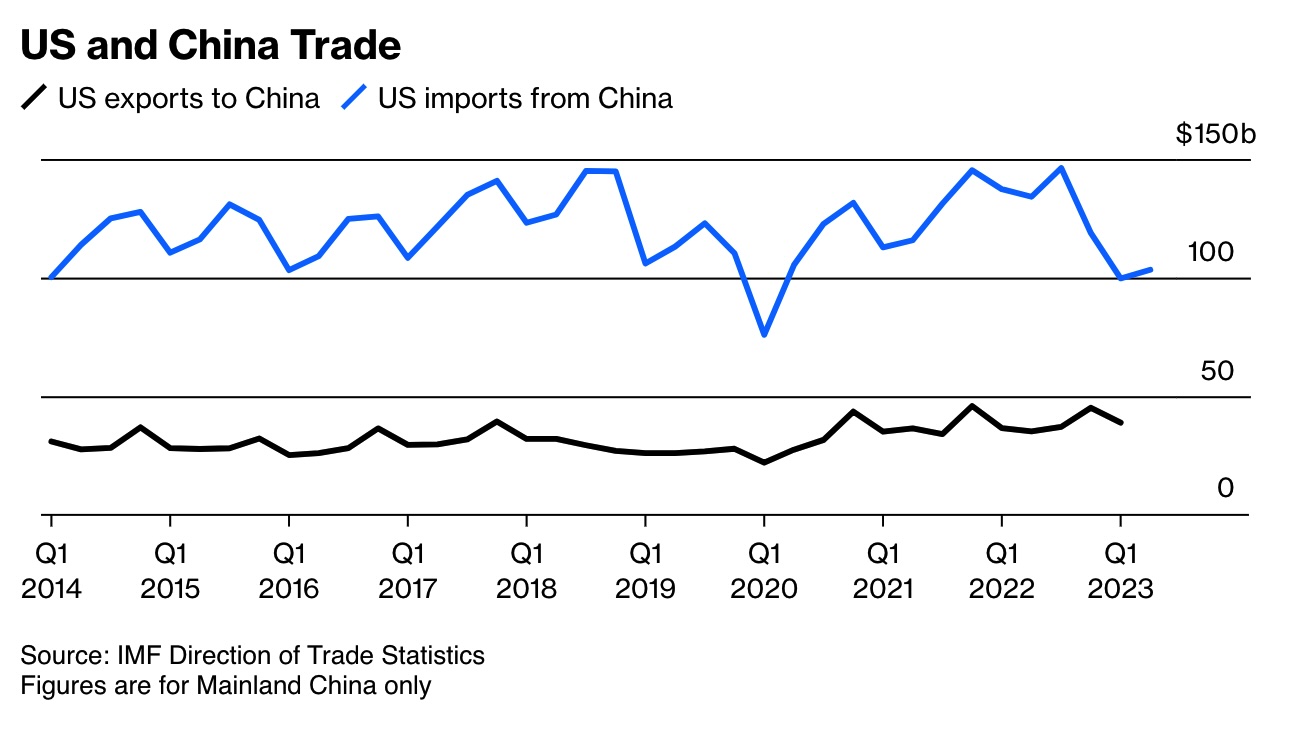

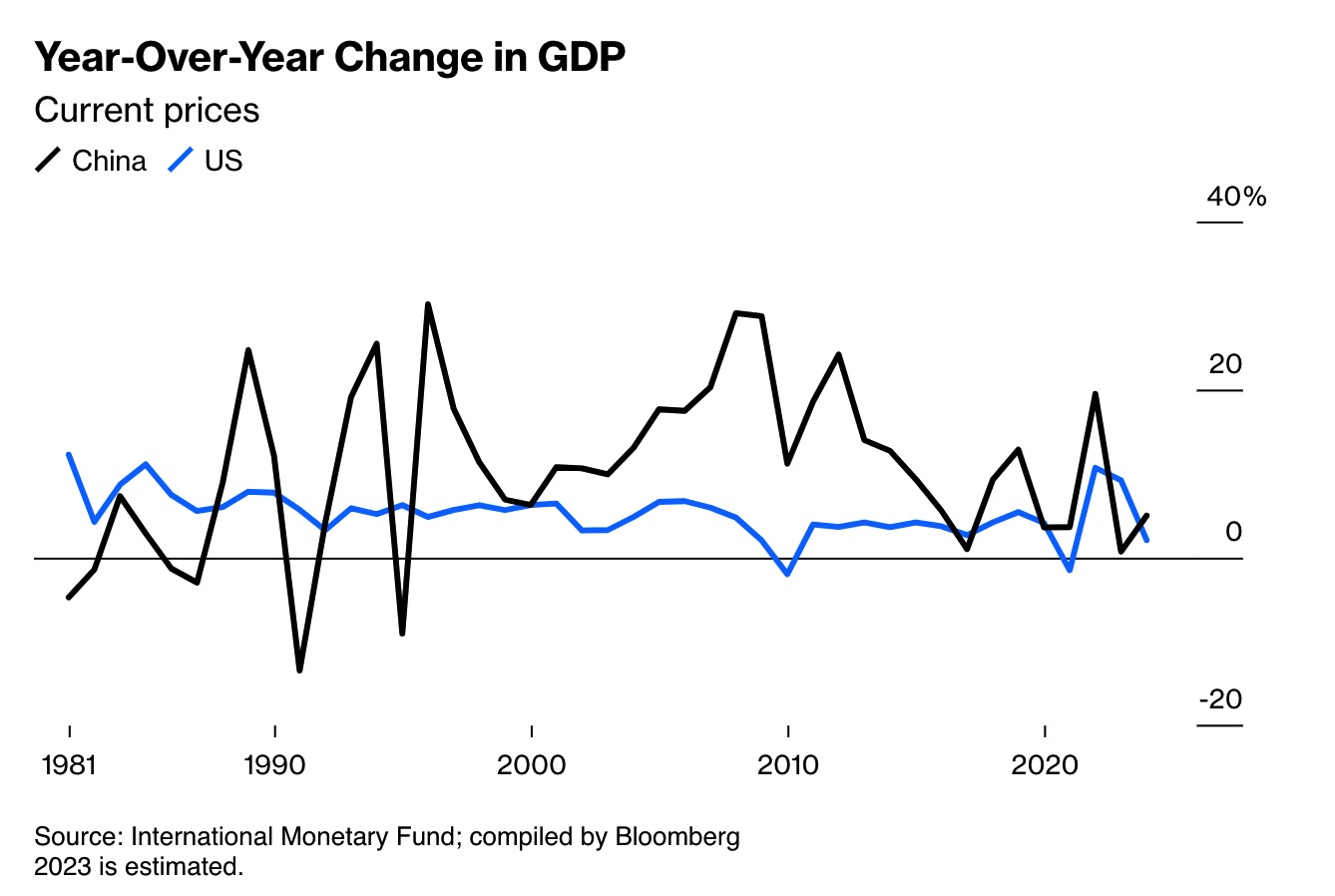

— President Biden and Chinese leader Xi Jinping plan to meet Wednesday during the Asia-Pacific Economic Cooperation summit in San Francisco.

The White House cited a resumption of U.S./China military communications as a priority ahead of this week’s meeting. “The Chinese have basically severed those communication links,” U.S. National Security Advisor Jake Sullivan said on CNN’s State of the Union. “President Biden would like to re-establish them. And he will look to this summit as an opportunity to try to advance the ball on that.” The issue “has been a priority” for Biden and “we need those lines of communication so that there aren’t mistakes or miscalculations or miscommunication,” he said on CBS’s Face the Nation. Sullivan said a military hotline should also be restored between top defense officials “all the way down to the tactical, operational level.”

Iran is also on the agenda. “Certainly, the question of Iran’s nuclear program and the threat it poses will be on the agenda, as will the threat that Iran poses to regional stability, and the threat it poses to U.S. forces in the region,” Sullivan said on CBS.

Of note: A group of Chinese President Xi Jinping’s “old friends” from Iowa have been invited to a dinner he will attend in California— 38 years after they welcomed the then-unknown party official for a hog roast, farm tours and a Mississippi River boat “This has been a heck of a journey — we can’t figure it out. We don’t even know why he likes us!” said Sarah Lande, an 85-year-old Muscatine resident who has maintained connections with Xi since he made his first visit to the U.S. as the leader of a food processing delegation from China’s Hebei Province in 1985. ride as they showed him how capitalists do agriculture, Bloomberg reports (link).

— A hearing Tuesday (Nov. 14) on artificial intelligence in agriculture will be held by the Senate Ag Committee. Witnesses scheduled to testify at the hearing include Jahmy Hindman, Senior Vice President and Chief Technology Officer at Deere and Co.; Mason Earles from the AI Institute for Next-Generation Food Systems at the University of California, Davis; and Todd Janzen, the Administrator of the Ag Data Transparent Organization. This hearing underscores the growing interest and importance of AI in agriculture, as it can significantly impact the efficiency and productivity of the industry.

— Rep. Abigail Spanberger (D-Va.) announced her intention to leave Congress after her current term. She plans to focus on running for the governor of Virginia in the 2025 election. This campaign launch might be announced soon. Spanberger is expected to enter the Democratic primary for the governor's race, where she will likely face competition from Richmond Mayor Levar Stoney. The Virginia governor's seat is anticipated to be a highly contested position for candidates from both political parties.

Spanberger's decision not to seek re-election to her congressional seat could present a challenge for Democrats, as it would leave an open seat in a fairly competitive congressional district that they would need to defend.

— Moody's Investors Service revised its outlook on the United States' credit rating from stable to negative. However, they have maintained the top Aaa rating for U.S. credit, unlike other major credit rating agencies such as S&P, which downgraded U.S. credit to AA+ in 2011, and Fitch, which followed suit in August.

Moody's decision to change the outlook is primarily attributed to concerns about the federal deficit, which they see as a significant factor affecting the country's fiscal strength. They expressed worry that the risks to the U.S.'s fiscal health have increased and may not be entirely mitigated by the nation's unique credit strengths.

Moody's also noted that in an environment of rising interest rates, without effective fiscal measures to reduce government spending or increase revenues, they anticipate that the U.S.'s fiscal deficits will remain substantial, which would weaken the affordability of the country's debt.

Furthermore, the agency highlighted concerns about political polarization within the U.S. Congress, emphasizing that this could hinder the ability of successive administrations to reach a consensus on a fiscal plan to address the declining debt affordability.

Despite these concerns, they believe that the U.S. still possesses significant credit strengths, including exceptional economic strength, strong institutional and governance capabilities, and the crucial roles played by the U.S. dollar and Treasury bond market in the global financial system.

Key Hearings and Events

Monday, Nov. 13:

- President Joe Biden meets with Indonesian President Joko Widodo at the White House and later welcomes the Vegas Golden Knights to celebrate their 2023 Stanley Cup victory.

- Russia blocking grain exports. Atlantic Council virtual discussion on “Moscow's weaponization of food: Holodomor and blockage of grain exports today.”

- APEC and climate issues. Brookings Institution's Center for East Asia Policy and the Japan Economic Foundation discussion on “APEC (Asia Pacific Economic Cooperation) summit 2023: The future of climate and trade policies in a world of geopolitical divides.”

Tuesday, Nov. 14:

- Asia-Pacific Economic Cooperation CEO Summit (link), San Francisco (through Nov. 16). Click here for agenda, here for speakers.

- AI and agriculture. Senate Ag Committee hearing on “Innovation in American Agriculture: Leveraging Technology and Artificial Intelligence.”

- Agriculture policy issues. R Street Institute virtual discussion on “Farm Facts and Fairy Tales: Are Today's Agricultural Policies Aligned with the Real World?”

- Food insecurity. Center for Strategic and International Studies discussion on “The United States' Role in Combating Global Food Insecurity: Key Findings from the 2023 State of Food Security and Nutrition (SOFI) Report.”

- China report to Congress. U.S./China Economic and Security Review Commission holds the release of its 2023 Annual Report to Congress.

- China’s economy. Peterson Institute for International Economics and Foreign Affairs magazine virtual discussion on “Who killed the Chinese economy?”

- COP28. Atlantic Council discussion on “The Road to COP28: The Energy Transition in Central America.”

- U.S. exit from Afghanistan. House Foreign Affairs Committee hearing on “Examining the Biden Administration's Afghanistan Policy Since the U.S. Withdrawal.”

- EPA and energy. House Energy and Commerce Environment, Manufacturing, and Critical Materials Subcommittee hearing on “Clean Power Plan 2: EPA's Effort to Jeopardize Reliable and Affordable Energy for States.”

- Mexico’s next president. Wilson Center's Mexico Institute discussion on “Mexico's Next President: Challenges and Recommendations.”

Wednesday, Nov. 15:

- FTC antitrust policies. Competitive Enterprise Institute discussion on the Federal Trade Commission and its chair Lina Khan, focusing on the “critical need for Federal Trade Commission reform and a vision for sensible antitrust policy.”

- U.S./EU relations. German Marshall Fund of the United States and the Foundation for European Progressive Studies hold the virtual sixth annual State of the Unions event.

- Aging issues. Joint Economic Committee hearing on “Aging Americans and a Waning Workforce: Demographic Drivers of our Deficit.”

Thursday, Nov. 16:

- U.S. trade policy. Washington International Trade Association virtual discussion on “the new paradigm in U.S. trade policy and its implications for the U.S. and the world.”

- Supreme Court ethics. Senate Judiciary Committee markup to vote on authorization for subpoenas relating to the Supreme Court ethics investigation.

- Climate summit. Energy Department and the Elected Officials to Protect America hold the 2023 National Climate Emergency and Energy Security Summit, with the theme “IRA (Inflation Reduction Act/Climate Bill) Implementation.”

Friday, Nov. 17:

- U.S. digital trade shift. Washington International Trade Association (virtual discussion on “The U.S. Walks Away from Negotiations of Key Digital Trade Rules.”

Economic Reports for the Week

Key economic reports come Tuesday with the Consumer Price Index report and Wednesday via an update on Retail Sales.

Monday, Nov. 13

- Treasury Budget: Expectations for the monthly Treasury statement center on a deficit of $49.8 billion for October, the first month of the new fiscal year. That would compare with a deficit of $87.8 billion in October a year ago and a deficit of $170.9 billion a month ago, in September.

- Federal Reserve. Fed Governor Lisa Cook delivers opening remarks at a Fed conference in Washington.

Tuesday, Nov. 14

- Consumer Price Index: Excluding the volatile food and energy components, the CPI is expected to rise 0.3% in October, matching September's gain. The core CPI will likely gain 4.1% on a year-on-year basis in October, also matching the previous month's gain.

- NFIB Small Business Optimism Index: The index has been below the historical average of 98 for 21 months in a row. October's consensus is 90.5 versus 90.8 in September.

- Earnings report: Home Depot

- Federal Reserve. Fed Governor Lisa Cook delivers opening remarks at a Fed conference in Washington.

Wednesday, Nov. 15

- MBA Mortgage Applications

- Producer Price Index: Producer prices in October are expected to edge 0.1% higher on the month versus a 0.5% increase in September. The annual rate in October is seen at 2.0% versus September's 2.2% increase. October's ex-food ex-energy rate is seen rising 0.3% on the month.

- Retail sales: October sales are expected to fall 0.3% following September's strong 0.7% rise. That would the first month-over-month drop since the 0.9% slump in March. Excluding automobiles, gasoline, building materials and food services, retail sales are expected to rise 0.1% in October after climbing 0.6% the month before.

- Business inventories in September are expected to rise 0.4% to match a 0.4% rise in August.

- Empire State Manufacturing: November's Empire State index is expected to improve slightly to minus 3.0 after October's minus 4.6. Both new orders and unfilled orders in this report have been in contraction.

- Atlanta Fed Business Inflation Expectations

- Earnings report: Target

- Federal Reserve. Fed Vice Chair for Supervision Michael Barr testifies before the House Financial Services Committee on oversight of financial regulators.

Thursday, Nov. 16

- Jobless claims for the Nov. 11 week are expected to come in at 222,000 versus 217,000 in the prior week.

- Import and Export Prices: Import prices edged 0.1% higher in September with October's expectations at a 0.3% fall. Export prices, which in September rose 0.7%, are expected to fall 0.2%.

- The Philadelphia Fed manufacturing index in November is expected to edge lower to minus 11.0 versus October's minus 9.0 in a report, however, that showed increases for both new orders and shipments.

- Industrial Production and Capacity Utilization: After a better-than-expected 0.3% rise in September, industrial production is expected to fall 0.3% in October. Manufacturing output is also expected to fall 0.3% after rising 0.4%. Capacity utilization is expected to ease to 79.4% following September's 79.7% rate.

- NAHB Housing Market Index: Forecasters expect the housing market index to hold steady in November after falling a sharp 5 points in October to a much lower-than-expected 40.

- Kansas City Fed Manufacturing Index

- Treasury International Capital

- Fed Balance Sheet

- Money Supply

- Earnings report: Macy’s

- Federal Reserve. Fed Governor Lisa Cook to speak on Global Linkages and Spillovers at San Francisco Fed conference; Fed Vice Chair for Supervision Michael Barr to speak virtually on Bank Supervision and Regulation at a European Systemic Risk Board meeting and will speak on the same topic later in the day at the US Treasury Market Conference in New York; Fed Governor Christopher Waller to speak on Central Bank Digital Currency at a conference in Stockholm, Sweden; Cleveland Fed President Loretta Mester, New York Fed President John Williams scheduled to speak.

Friday, Nov. 17

- Housing Starts and Permits: Housing starts in October are expected to hold steady at a 1.350 million annual rate versus September's 1.358 million rate that, though up sharply from August's 1.269 million, was nevertheless lower than expected. Permits, at 1.473 million in September, are expected to slow slightly to a 1.463 million rate.

- Earnings report: Walmart

- Federal Reserve. Chicago Fed President Austan Goolsbee, San Francisco Fed President Mary Daly scheduled to speak.

Key USDA & international Ag & Energy Reports and Events

The International Grains Council is scheduled to release its monthly report Thursday.

Monday, Nov. 13

Ag reports and events:

- CFTC Commitments of Traders

- Export Inspections

- Crop Progress

- Feed Grains Database

- Season Average Price Forecasts

- Wheat Data

- Holiday: Canada, Colombia, Malaysia, Singapore

Energy reports and events:

- World Energy Capital Assembly, London (through Nov. 14)

- Reuters Energy Transition Europe 2023, London (through Nov. 14).

- OPEC Monthly Oil Market Report

- Earnings: EnBW

Tuesday, Nov. 14

Ag reports and events:

- Meat Price Spreads

- Oil Crops Outlook

- Dairy Monthly Tables and Dairy Quarterly Data

- Feed Outlook

- Rice Outlook

- Wheat Outlook

- France agriculture ministry’s latest crop estimates

- EU weekly grain, oilseed import and export data

- FT Commodities Asia Summit in Singapore, day 1

- Holiday: India

Energy reports and events:

- API weekly U.S. oil inventory report

- FT Commodities Asia Summit in Singapore (through Nov. 15)

- IEA Monthly Oil Market Report

- Wood Mackenzie’s Gas, LNG & the Future of Energy conference, London (through Nov. 15)

- World Energy Capital Assembly, London (last day)

- Reuters Energy Transition Europe 2023, London (last day)

- Earnings: RWE

Wednesday, Nov. 15

Ag reports and events:

- Broiler Hatchery

- Food Dollar Series

- Feed Grains: Yearbook Tables

- Cost-of-Production Forecast

- Rural America at a Glance

- FranceAgriMer monthly grains balance sheet

- EIA weekly US ethanol inventories, production, 10:30am

- UK’s Agricultural Industries Confederation conference

- FT Commodities Asia Summit in Singapore, day 2

- Malaysia’s Nov. 1-15 palm oil exports

- Holiday: Brazil

Energy reports and events:

- EIA weekly U.S. oil inventory report

- U.S. weekly ethanol inventories

- Genscape weekly crude inventory report for Europe’s ARA region

- China industrial production for October including gas and power generation, crude oil and refining

- FT Commodities Asia Summit in Singapore, (last day). Click here for agenda, here for speakers

- Wood Mackenzie's Gas, LNG & the Future of Energy conference, London (last day)

- WTI December options expire

- Earnings: SSE

Thursday, Nov. 16

Ag reports and events:

- Weekly Export Sales

- Livestock, Dairy, and Poultry Outlook

- Sugar and Sweeteners Outlook

- IGC monthly grains report

- Port of Rouen data on French grain exports

- Earnings: GrainCorp

Energy reports and events:

- EIA natural gas storage change

- Insights Global weekly oil product inventories in Europe’s ARA region

- Singapore onshore oil-product stockpile weekly data

- JODI-Oil World Database Update

- Earnings: Cepsa 3Q

Friday, Nov. 17

Ag reports and events:

- CFTC Commitments of Traders report

- Peanut Prices

- Food Expenditure Series

- Cattle on Feed

- Turkey Hatchery

- FranceAgriMer’s weekly crop condition report

Energy reports and events:

- Baker Hughes weekly U.S. oil/gas rig counts

- China publishes October output data for oil products and base metals

Saturday, Nov. 18

- China’s second batch of October trade data, including agricultural imports, LNG and pipeline gas imports, oil products trade breakdown

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |