FOMC Likely to Leave Benchmark Interest Rate Unchanged, Powell Comments Key

U.S. airlines back ethanol industry position on aviation fuel credit | GAO report on sugar program

|

Today’s Digital Newspaper |

MARKET FOCUS

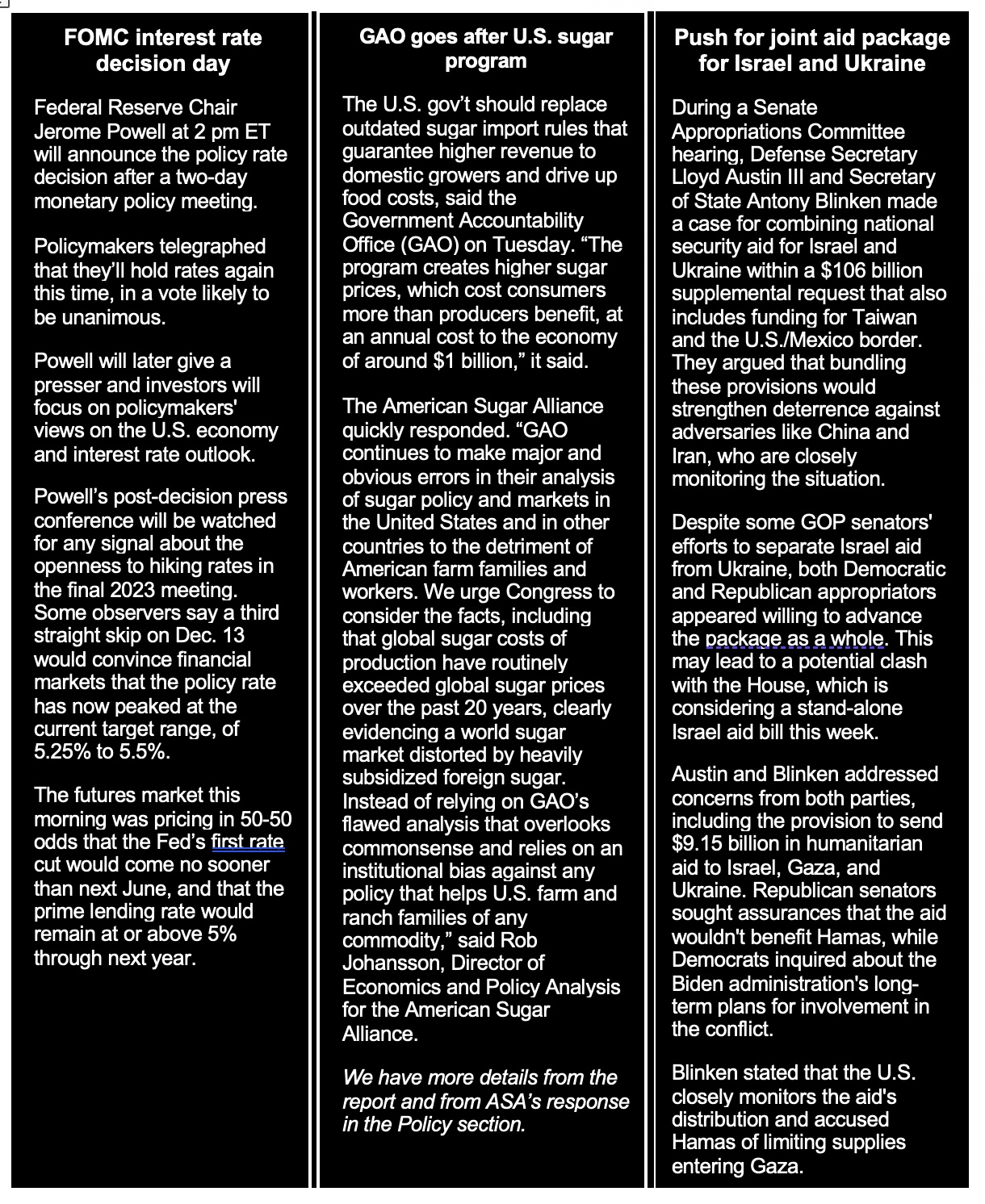

- FOMC interest-rate decision today but focus will be on rate outlook ahead

- Major court ruling rocks U.S. home sale market

- Bank of Japan Intervenes in bond market to curb rising yields after recent policy tweak

- Canadian GDP remains unchanged, posing challenge to BOC’s growth projections

- How a movie impacted Biden re: artificial intelligence

- Ag markets today

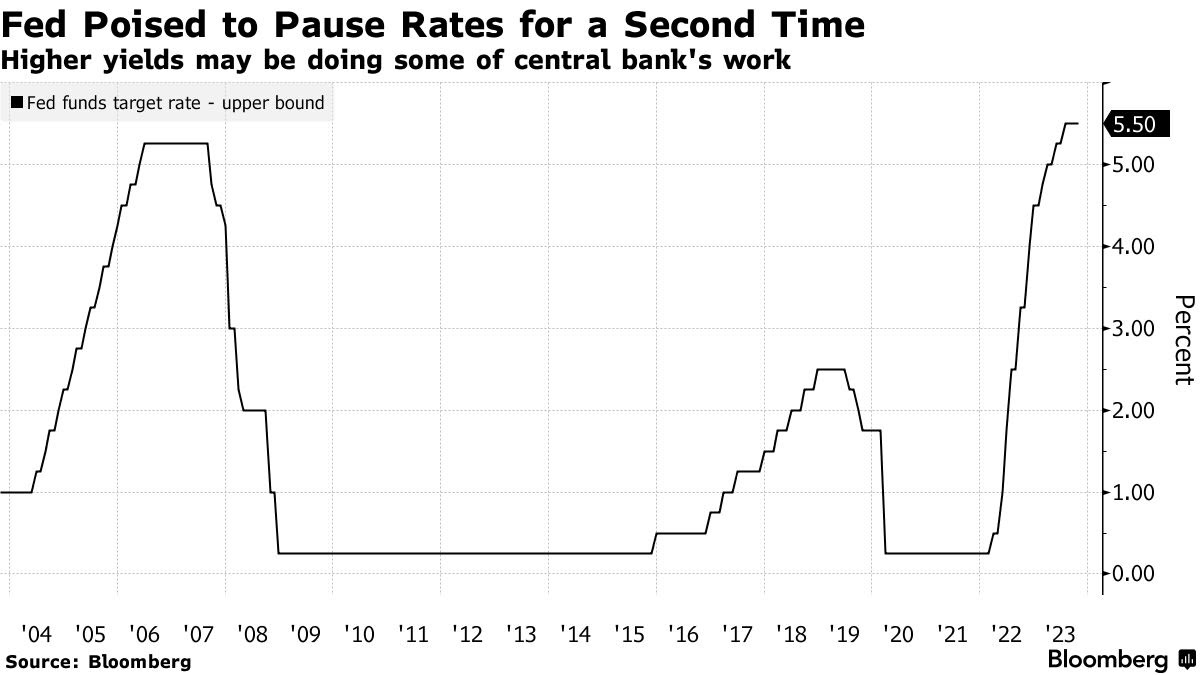

- A month’s worth of sugar exports have piled up in Brazilian ports

- Ag trade update

- Economists urge better preparation for El Niño impacts on food, power, human health

- NWS weather outlook

- Pro Farmer First Thing Today items

CONGRESS

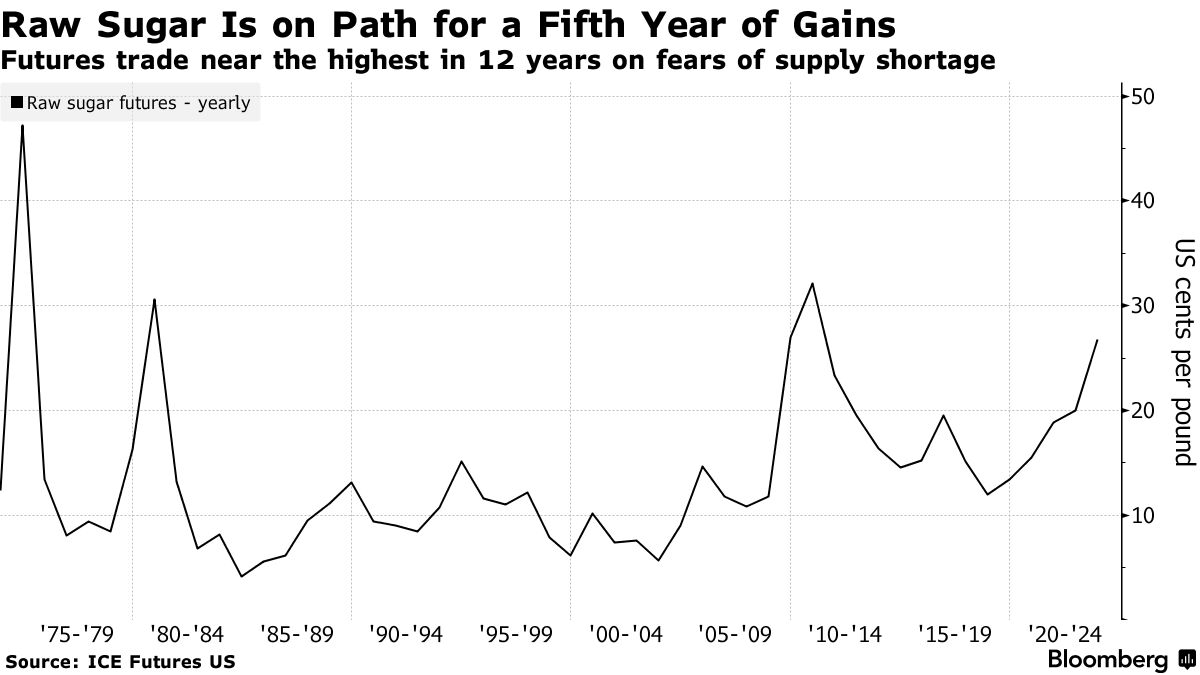

- Senate Republicans push for policy changes in U.S./Mexico border provision

- Senators aim to pass their three-bill government-funding package today

- Senate push for shorter stopgap sets up collision with House GOP

ISRAEL/HAMAS CONFLICT

- Group of foreigners and wounded Palestinians were allowed to leave Gaza

RUSSIA & UKRAINE

- Ukraine unveils plan to regulate food exports, address tax evasion, boost revenue

POLICY

- One year farm bill extension linked with CR under discussion

- ERP timeline for 2022 losses

- GAO: Sugar program costs consumers more than it benefits farmers; growers respond

PERSONNEL

- Senate confirms Jack Lew as Israel ambassador

CHINA

- China's factory activity contracts unexpectedly in October

- China commits to long-term mechanism to address local debt risks

ENERGY & CLIMATE CHANGE

- Canada PM Trudeau rules out further carbon tax exemptions

- Airlines advocate for GREET model for sustainable aviation fuel (SAF) eligibility

- President Biden launches rural initiative in Minnesota, unveiling billions in spending

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- Pork producers seek partial ruling in ongoing Question 3 case

- Update on Kroger/Albertsons merger

- Another HPAI case confirmed in commercial turkey flock in Buena Vista County, Iowa

POLITICS & ELECTIONS

- Sen. Kyrsten Sinema (I-Ariz.) in third place in a three-way Senate race in Arizona

- New York Times explores why Burgum is staying in Republican presidential primary

- Nearly two-thirds of Republican caucusgoers: Trump 'can win election vs Biden

- Wasserman’s 2024 House overview: ‘A year out, the House is a game of inches’

OTHER ITEMS OF NOTE

- Former Major League baseball slugger Frank Howard died on Oct. 30 at age 87

|

MARKET FOCUS |

— Equities today: Asian and European stocks were mixed to firmer overnight. U.S. Dow opened up around 45 points and then went slightly lower, then returned to higher values.

U.S. equities yesterday: The Dow gained 129.91 points, 0.38%, at 33,052.87. The Nasdaq rose 61.75 points, 0.48%, at 12,851.24. The S&P 500 gained 26.98 points, 0.65%, at 4,193.80.

For the month of October, the S&P 500 was 2.2% lower. The Nasdaq lost 2.8% and the Dow lost 1.4%.

— Agriculture markets yesterday:

- Corn: December corn futures rose 1/2 cent to $4.78 3/4 and nearer the session low.

- Soy complex: November soybeans rose 4 1/2 cents to $12.87 after trading at the lowest level since Oct. 13 earlier in the session. December meal rose $4.50 to $431.00, while December soyoil dropped 97 points to 51.42 cents.

- Wheat: December SRW wheat fell 9 3/4 cents to $5.56 1/4 and near the session low. Prices hit a two-week low today. December HRW wheat dropped 15 3/4 cents at $6.19 1/4. Prices closed near the session low and hit a more-than-two-year low. December spring wheat fell 8 1/2 cents to $7.09 1/4.

- Cotton: December cotton fell 169 points to 81.22 cents, marking the lowest close since July 14.

- Cattle: December live cattle futures closed 30 cents higher at $183.55, though expiring October futures went off the board 37.5 cents lower at $183.75. November feeder cattle futures rose just 2.5 cents before settling at $237.70, near mid-range.

- Hogs: Hog futures continued their recent advance, with the nearby December contract climbing 55 cents to $71.725.

— Ag markets today: Corn, soybeans and wheat held in relatively tight trading ranges during two-sided trade overnight. As of 7:30 a.m. ET, corn futures were trading fractionally higher, soybeans were mostly 2 cents lower and wheat futures were mostly 4 to 7 cents higher. Front-month crude oil futures were more than $1.00 higher, and the U.S. dollar index was around 250 points higher.

Steady/firmer cash cattle prices expected. Last week’s average cash cattle price dropped $2.13, but late-week trade was notably higher than initial price action. That has most cash sources expecting steady/firmer cash prices this week, despite packers having fresh contract supplies available with the flip of the calendar. Packers have been slow to establish early cash bids, so active trade is not likely until Thursday or Friday.

Cash hog/futures spread continues to narrow. The recent rise in lean hog futures continued Tuesday, with the December contract up 55 cents to $71.725. The seasonal decline in the CME lean hog index extended another 38 cents to $77.13 (as of Oct. 30). That narrows the discount the lead contract holds to the cash index to $5.405, suggesting traders anticipate a less-than-average decline in the cash market from now until mid-December.

— Quotes of note:

- Fedwatch. Futures fell and Treasuries gained ahead of the Fed’s rate decision today. A hawkish pause is expected. That may be a big mistake, writes former NY Fed chief Bill Dudley (link). Wall Street is divided on what comes next. Economists at Vanguard and Bank of America say the Fed will probably have to raise interest rates again to blunt inflation. But Mohit Kumar, chief financial economist at Jefferies, said that “the bar for another hike is high.”

- Canadian GDP remains unchanged in August, posing challenge to Bank of Canada's growth projections. In August, Canada's Gross Domestic Product (GDP) remained stagnant for the second consecutive month, a development that provides the Bank of Canada with further evidence that higher interest rates are effectively curbing demand. This performance places the third-quarter growth well below the central bank's initial projection of 0.8%, according to strategists at TD Securities who add this suggests the data may encourage the Bank of Canada to exercise additional patience in its monetary policy decisions. However, policymakers will closely monitor whether softer economic growth effectively dampens inflation before abandoning any potential plans for further rate hikes. TD Securities anticipates a contraction of 0.2% in the third quarter and 0.1% in the fourth quarter, which they believe would align with a gradual and controlled economic slowdown for Canada, particularly given the continued tightness in the labor market.

- How a movie impacted Biden re: artificial intelligence. “If he hadn’t already been concerned about what could go wrong with A.I. before that movie, he saw plenty more to worry about.” — Bruce Reed, the deputy White House chief of staff, who said President Biden grew more concerned about the perceived dangers of artificial intelligence in the wrong hands after watching Mission: Impossible — Dead Reckoning Part One.

— Major court ruling rocks U.S. home sale market. A significant court ruling in Missouri against the National Association of Realtors (NAR) and large brokerages has the potential to disrupt the home buying and selling business in the United States. The lawsuit, brought by Midwestern homeowners, accused the NAR and brokerages of conspiring to artificially inflate commissions by obliging homeowners to pay buyers' agent fees when listing their properties.

The court's decision, which took less than three hours, favored the plaintiffs, awarding them nearly $1.8 billion in damages, which could potentially be trebled to over $5 billion by the presiding judge. This ruling has been described as an "earthquake" in the real estate industry.

Under the current system, homeowners who do not agree to the terms, which often include fees averaging around 5% to 6% of the total transaction, may not have their homes displayed on the primary database used by most home-listing services. This restriction, according to the plaintiffs, limits the ability of buyers and sellers to negotiate lower commission rates and results in thousands of dollars being added to home prices.

The potential implications of lower commissions have already impacted publicly traded brokerages, with eXp World Holdings experiencing an 8.7 percent decline in its shares and Compass falling 6%.

The NAR announced its intention to appeal the ruling, while other defendants in the case, such as Berkshire Hathaway's HomeServices of America and Keller Williams, are considering appeals. However, the industry's legal challenges are far from over, with the NAR facing another antitrust lawsuit, and the Justice Department seeking to reopen a settlement related to brokerage fees reached during the Trump administration.

Market perspectives:

— Outside markets: The U.S. dollar index was stronger, with most foreign currencies weaker against the greenback. The yield on the 10-year U.S. Treasury note was little changed around 4.89%, with a higher tone in global government bond yields. Crude oil futures moved sharply higher ahead of U.S. gov’t inventory data due later this morning, with U.S. crude around $82.80 per barrel and Brent around $86.75 per barrel. Gold and silver futures were weaker, with gold around $1,992 per troy ounce and silver around $22.78 per troy ounce.

— Bank of Japan Intervenes in bond market to curb rising yields after recent policy tweak. The Bank of Japan (BOJ) took an unexpected step by entering the bond market to slow down the increase in sovereign yields. This move comes just a day after the BOJ announced a loosening of its control over debt prices. The central bank's unscheduled purchase operation was prompted by the 10-year bond yield reaching 0.97%, marking a fresh decade-high. However, it's important to note that this yield is still below the 1% cap that the BOJ had previously removed in favor of a more flexible policy approach.

Market reaction to this intervention was relatively muted, with traders trimming one basis point off the 10-year yield, which later recovered half of that loss. Bond futures also pared losses, and the yen, sensitive to interest rate shifts, experienced only a slight retreat against the dollar.

This move indicates that the BOJ is committed to remaining active in the market even after adjusting its bond-yield cap. Governor Kazuo Ueda, after announcing the policy tweak, expressed the belief that yields would not rise significantly beyond 1%. However, many analysts see this as part of the BOJ's broader strategy to normalize its monetary policy in response to inflation in Japan, which is nearing a four-decade high. Aligning its policy with more hawkish stances held by other central banks is also seen to address the issue of a weak yen.

Of note: The BOJ's reduced presence in the debt market, where it holds over 50% of outstanding bonds, could potentially encourage more active participation from investors. Observers in global markets are closely monitoring whether the rise in yields will prompt Japanese investors to repatriate funds and reduce their extensive holdings in assets like US Treasuries, European, and Australian bonds.

Perspective: On July 27, just before Governor Ueda's first yield-curve control adjustment, the 10-year yield stood at a mere 0.44%, highlighting the significant change in market conditions since then.

— Ag trade update: South Korea purchased 125,000 MT of corn – 57,000 MT of optional origin and 68,000 MT expected to be sourced from South America or South Africa – and tendered to buy 177,000 MT of rice, mostly from the United States. Jordan tendered to buy up to 120,000 MT of optional origin milling wheat.

— A month’s worth of sugar exports have piled up in Brazilian ports, just as the world is desperate for the top producer to help ease the global shortages that have sent prices to their highest since 2011. Link to details via Bloomberg.

— Economists urge better preparation for El Niño impacts on food, power, and human health. Writing in the New York Times (link), three economists specializing in sustainable development, Amir Jina, Jesse Anttila-Hughes, and Gordon McCord, emphasize the importance of preparing for the El Niño-Southern Oscillation (ENSO) climate phenomenon. ENSO, with its recurring phases like El Niño, La Niña, or neutral, can have significant global weather impacts on temperature and precipitation. The authors argue that the predictability of ENSO events, which can often be forecasted many seasons in advance, should be leveraged to prevent damage to various sectors, including food systems, power supplies, and human health. While some countries already prepare for ENSO events, developing nations may not adequately address the threats they pose, such as droughts or heavy rains that can lead to malnutrition in children.

The authors call for organizations like the United Nations and wealthier nations to do more to support these vulnerable countries in preparing for and mitigating the impacts of ENSO events. Currently in an El Niño phase, characterized by warmer-than-usual sea surface temperatures, it is crucial to use this knowledge to prevent severe hunger and its long-term consequences for children in affected regions.

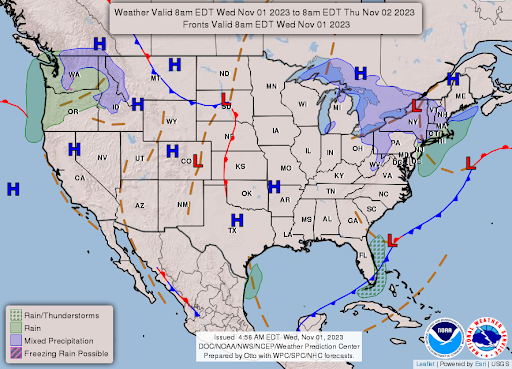

— NWS weather outlook: Record setting cold and subfreezing temperatures to span much of the central and southern United States... ...Atmospheric River ushers in wet weather to the Pacific Northwest by tonight.

Items in Pro Farmer's First Thing Today include:

• Corn and wheat firmer, beans weaker this morning

• Soy crush expected to rise, corn ethanol use anticipated to drop in September

• Fed widely expected to continue monetary policy pause

|

CONGRESS |

— Senate Republicans push for policy changes in U.S./Mexico border provision amid broader spending package discussions. Senate Minority Leader Mitch McConnell (R-Ky.) called for Democrats to accept a substantial U.S./Mexico border provision as part of a larger supplemental spending package. While President Biden requested $13.6 billion for border security, congressional Republicans from both chambers are emphasizing the need for policy changes to address the flow of individuals crossing the border, not just additional funding. House Republicans have been advocating for measures, such as those in their border and immigration package (HR 2), to prevent the release of asylum seekers into the United States.

Although Majority Leader Chuck Schumer (D-N.Y.) urged the Senate to act swiftly on providing aid to Israel, the Senate has not yet produced a bill and instead scheduled an Appropriations Committee hearing featuring Defense Secretary Lloyd Austin and Secretary of State Antony Blinken.

Senators have also announced another hearing for the following week, featuring testimony from Homeland Security Secretary Alejandro Mayorkas and Health and Human Services Secretary Xavier Becerra.

Senate Appropriations Chair Patty Murray (D-Wash.) and Vice Chair Susan Collins (R-Maine) are currently crafting a supplemental spending bill. Sen. Collins emphasized the interconnected threats posed by Russia, Iran, and China, highlighting the need to protect national security interests and the international order established following World War II.

— Senators aim to pass their three-bill government-funding package today, the chamber’s first vote on passage of an appropriations measure for fiscal year (FY) 2024 — Military Construction-VA (S 2127), Agriculture (S 2131) and Transportation-HUD (S 2437) appropriations bills. Senators adopted two amendments yesterday to bar funding for Chinese entities and for drones linked to China, Russia, Iran, North Korea, Venezuela, or Cuba.

The House has passed five of its 12 FY 2024 appropriations bills, including a Homeland Security bill (HR 4367) that it is not sending on until the Senate acts on a House border security bill (HR 2). The House returns Wednesday with plans to start consideration of its Interior-Environment (HR 4821), Legislative Branch (HR 4364) and Transportation-HUD (HR 4820) appropriations bills.

House Speaker Mike Johnson (R-La.,) has laid out an aggressive schedule for consideration of the remaining spending bills with plans to bring to the floor — the Financial Services (HR 4664) and Commerce-Justice-Science (HR 5893) bills next week, and the Labor-HHS-Education (HR 5894) and Agriculture (HR 4368) bills the week of Nov. 13. The House did not muster enough votes to pass the Agriculture spending bill in September.

Federal gov’t funding runs out Nov. 17.

— Senate push for shorter stopgap sets up collision with House GOP. Senate appropriators are considering a continuing resolution (CR) that would run until mid-December, which would put the chamber on a collision course with new House Speaker Mike Johnson (R-La.,) who’s been pushing to kick final spending decisions until Jan. 15.

|

ISRAEL/HAMAS CONFLICT |

— Group of foreigners and wounded Palestinians were allowed to leave Gaza, Arab TV channels reported. The Israeli military said a Gaza refugee camp hit in a deadly strike overnight was used as a training center by Hamas, designated a terrorist group by the U.S. U.S. Secretary of State Antony Blinken returns to the region later this week.

|

RUSSIA/UKRAINE |

— Ukraine unveils plan to regulate food exports, address tax evasion, and boost revenues for war efforts. Ukraine revealed its strategy for regulating food exports, with a focus on registering food export companies, in a bid to tackle issues such as the substantial portion of agricultural products being purchased with cash, resulting in unpaid taxes and the concealment or delay of foreign currency earnings held abroad. According to a recent government resolution reported by Reuters, only companies registered with the State Agrarian Register, classified as value-added taxpayers, and free from tax debts or delays in foreign currency return will be permitted to export Ukrainian goods. The government aims to safeguard the rights of agricultural entities conducting legal economic activities through these measures. The initiative seeks to address the challenge of generating funds for agricultural exports conducted in cash, where taxes often go uncollected. These efforts are critical for generating additional revenues to meet the needs of Ukraine's ongoing conflict with Russia.

|

POLICY UPDATE |

— One year farm bill extension linked with CR under discussion. Senate Ag Committee leaders are considering using a continuing resolution (CR) as a legislative vehicle to pass a one-year extension of the 2018 farm bill before January. Ranking member John Boozman (R-Ark.) and Chairwoman Debbie Stabenow (D-Mich.) agree on the need for the extension while working on a new bill to replace the expired 2018 Farm Bill. They hope to attach the extension to a stopgap funding bill required when the current CR expires on Nov. 17.

Stabenow had initially preferred a three-month farm bill extension, but USDA explained that shorter extensions would be challenging to administer.

Timeline. The Senate and House Agriculture committees are working on draft texts for their respective farm bills, with the possibility of finalizing a version by spring. A farm bill extension would provide security for farmers and ensure the availability of risk management tools and financial support.

The committees have not yet decided which, if any, of the 21 so-called "orphan programs" would be part of the extension, potentially requiring offsets or additional funding sources.

— ERP timeline for 2022 losses. FSA expects to begin mailing Track 1 application forms for 2022 losses on or around Nov. 8, 2023, to producers who received federal crop insurance indemnities, and to begin mailing forms to producers who received NAP payments on or around Nov. 8, 2023. For Track 2, FSA began accepting applications on Oct. 31, 2023.

— GAO: U.S. sugar program costs consumers more than it benefits farmers; sugar growers respond. In a recent report (link), the Government Accountability Office (GAO) commented on the U.S. sugar program, alleging that it imposes greater costs on consumers than it delivers benefits to farmers. The sugar program, aimed at limiting sugar supplies, including imports to maintain prices, has long been a subject of debate among some groups and lawmakers. GAO was asked to review the program by Rep. Earl Blumenauer (D-Ore.), Ranking Member of the House Ways and Means Subcommittee on Trade, and by Rep. Ann McLane Kuster (D-N.H.).

The GAO's findings indicate that the program results in increased domestic sugar production and higher profits for farmers, contributing an estimated annual benefit of $1.4 billion to $2.7 billion. However, GAO says this advantage comes at a substantial cost to consumers, with an estimated burden of $2.5 billion to $3.5 billion annually, ultimately resulting in a net cost to the economy of approximately $1 billion per year. The program's impact on industries heavily reliant on sugar, such as confectionery manufacturing, has also been linked to job losses.

GAO said it reviewed agency documents and data and interviewed federal officials, academics, and industry stakeholders including groups representing sugar producers and sugar using industries. GAO also conducted a literature review on the effects of the U.S. sugar program on the economy and trade.

In response to these findings, GAO recommended USDA assess the effectiveness of the current method and alternative methods for allocating raw sugar tariff-rate quotas. Additionally, the Office of the U.S. Trade Representative has been urged to evaluate alternative allocation methods in accordance with U.S. law and international obligations, with the aim of validating or modifying its quota methods. Quota administrators said that modernization could be a fraught process, since sugar-exporting nations might challenge U.S. reforms under world trade rules or use them as justification for changing the rules on U.S. exporters.

U.S. sugar growers respond. “GAO continues to make major and obvious errors in their analysis of sugar policy and markets in the United States and in other countries to the detriment of American farm families and workers. We urge Congress to consider the facts, including that global sugar costs of production have routinely exceeded global sugar prices over the past 20 years, clearly evidencing a world sugar market distorted by heavily subsidized foreign sugar. Instead of relying on GAO’s flawed analysis that overlooks commonsense and relies on an institutional bias against any policy that helps U.S. farm and ranch families of any commodity,” said Rob Johansson, Director of Economics and Policy Analysis for the American Sugar Alliance (ASA).

“It is also unfortunate that GAO’s report ignores the economic contributions of domestic sugar production to local communities, including 151,000 jobs and $23 billion in economic activity, as well as the serious harm done to these communities due to foreign subsidies that profoundly distort the global market and harm U.S. farm families. GAO continues to utilize old studies and estimates that have been discredited. More recent economic studies conclusively demonstrate that any savings from cheaper sugar to the big multinational corporations that buy and use sugar in their products are not passed to American consumers. Instead, they add to the record profits of the users.”

When interviewed by GAO, the ASA pointed out the benefits provided by current U.S. sugar policy.

- The policy ensures a reliable and sustainable supply of sugar to American households and food companies that is delivered just-in-time to customers in the form that they need it.

- The strong and resilient U.S. sugar supply chain allows food companies to run their factories without pause or huge storage facilities, saving them hundreds of millions each year.

- The policy levels the playing field for American sugarbeet and sugarcane farmers and sugar factory workers who face unfair competition resulting from the distorted world sugar market.

- The policy supports American sugarbeet and sugarcane farmers, allowing them to continually increase productivity and to meet some of the highest labor and environmental standards in the world.

- The policy benefits U.S. consumers and food manufacturers by addressing an increasingly unstable and unpredictable global market, where other sugar-producing countries are restricting exports in order to protect their own consumers from food insecurity.

- The policy is designed to cost taxpayers $0. USDA and FAPRI show that over the next 10 years, the program is expected to cost $0. It has cost $0 over the past 10 years.

U.S. sugar policy is supported by a large coalition of agricultural and stakeholder groups across America.

ASA said it remains committed to engaging in thoughtful discussions to ensure a well-informed approach to the future of the sugar industry, safeguarding both consumer interests and the vitality of American agriculture.

|

PERSONNEL |

— Senate confirms Jack Lew as Israel ambassador. The Senate on Tuesday confirmed former Treasury Secretary Jack Lew, 68, as the new U.S. ambassador to Israel, setting him up to take on the critical role amid the country’s battle against Hamas. Senators voted 53-43, with two Republicans (Rand Paul, of Kentucky, and Lindsey Graham of South Carolina.) joining with every present Democrat. Tom Nides, the former U.S. Ambassador to Israel, left the post in July. Stephanie Hallett, a career diplomat, has been the top official at the U.S. Embassy in the interim.

Background. Lew, who is Jewish, has been active in pro-Israel advocacy circles. He was White House chief of staff for the last two years of President Barack Obama’s first term and then treasury secretary from 2013 to 2017.

|

CHINA UPDATE |

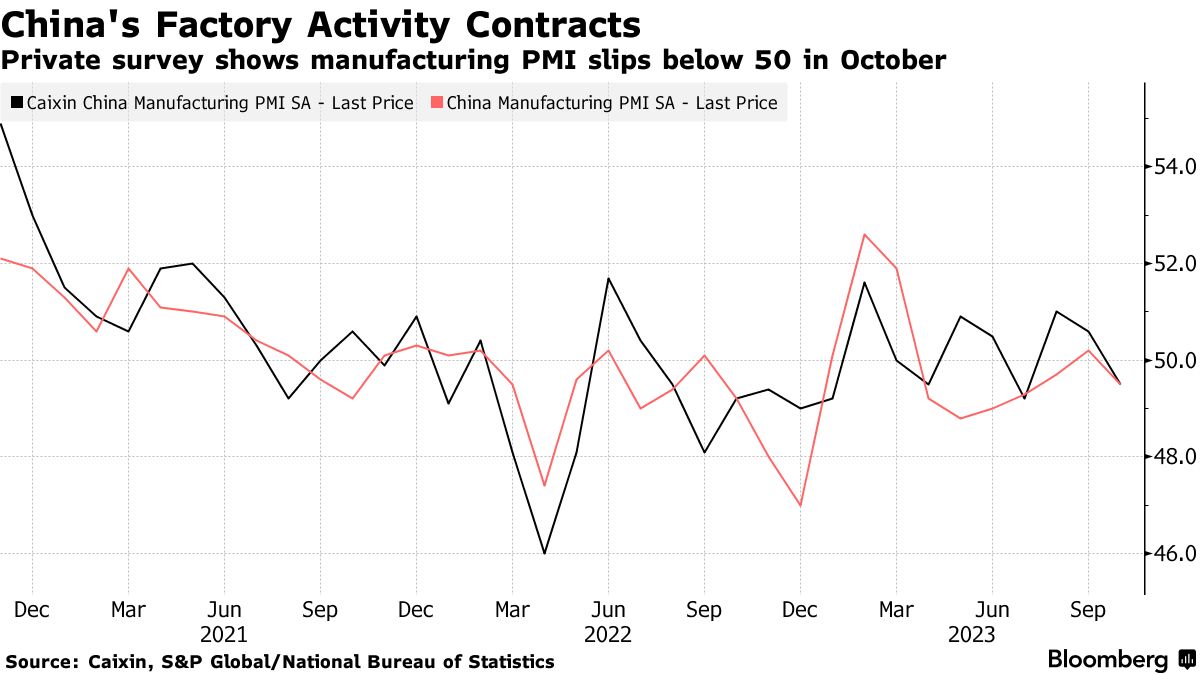

— China's factory activity contracts unexpectedly in October, signaling economic challenges. In an unexpected turn, China's Caixin China General Manufacturing Purchasing Managers' Index (PMI) dropped to 49.5 in October 2023 from 50.6 in September, falling short of market expectations, which had forecasted a reading of 50.8. This decline marks the first contraction in factory activity since July and is indicative of ongoing challenges in the country's economic recovery. Additionally, the report reveals a renewed drop in output, declining foreign sales for the fourth consecutive month, and a 13-month low in business confidence.

— China commits to long-term mechanism to address local debt risks at key policy meeting. China pledged to establish a long-term mechanism to address debt risks associated with local authorities during the Central Financial Work Conference, which President Xi Jinping attended. The conference also emphasized the need for Communist Party control over the financial system, funding for innovation, hi-tech manufacturing, green technology, and support for small-to-medium-sized companies. This commitment to resolving local government debt risks includes the optimization of debt structures for both central and local governments. Analysts suggest this may involve the central government taking on more funding responsibilities, while local governments work to reduce implicit debt problems, potentially involving deleveraging.

China initiated a debt swap program worth over 1 trillion yuan ($137 billion) in September to replace hidden debt with lower-interest-rate bonds. Several regions have released their refinancing plans in response to this program.

The conference also emphasized the timely handling of risks at small and medium-sized financial institutions, including local banks, with the aim of supporting large state-owned financial institutions to become "better and stronger." Additionally, the Communist Party's control over the financial sector and the crackdown on corruption were highlighted. The conference underlined the importance of a "centralized and unified" leadership approach in the financial sector.

China also reiterated its commitment to opening up its financial sector to attract foreign financial institutions and long-term funds, promoting Shanghai and Hong Kong as international financial centers. The statement stressed the need for balance between financial opening and security.

Regarding real estate, the conference emphasized the need to meet the "reasonable" financing needs of real estate companies and called for equal treatment of all developers, regardless of ownership, in terms of financing.

Bottom line: While the conference addressed several key financial issues, some analysts believe that the meeting lacked urgency in providing tangible plans to resolve immediate problems.

|

ENERGY & CLIMATE CHANGE |

— Canada PM Trudeau rules out further carbon tax exemptions. Canadian Prime Minister Justin Trudeau ruled out any further carve-outs from the federal carbon tax scheme, amid mounting pressure from provinces seeking measures like an exemption on home heating oil announced last week.

— Airlines advocate for GREET model for sustainable aviation fuel (SAF) eligibility. Several airlines, including Delta Airlines, Jet Blue, and Southwest, have joined forces with the U.S. biofuels industry to urge the Biden administration to consider using the Greenhouse Gases, Regulated Emissions, and Energy Use in Technologies (GREET) model from the Department of Energy alongside the International Civil Aviation Organization (ICAO) model. Signatories also include prominent ethanol companies like Poet and Archer-Daniels-Midland Co., and was also signed by Deere & Co. and crop trader Bunge Ltd. This joint approach aims to determine eligibility for clean fuel subsidies, particularly for sustainable aviation fuel (SAF).

Background. The call for action is in response to the Inflation Reduction Act (Climate Bill). Under the act, SAF producers must demonstrate that their fuel reduces emissions by 50% compared to traditional gasoline, using an emissions model developed by the International Civil Aviation Organization (ICAO) or an equivalent methodology.

In a letter (link) addressed to Treasury Secretary Janet Yellen, major airlines, along with industry giants GE Aerospace and Boeing, expressed support for incorporating the Department of Energy’s Greenhouse Gases, Regulated Emissions, and Energy Use in Technologies (GREET) model as an alternative to the ICAO model.

The authors note: “With the right market signals, we can de-carbonize aviation and spur a new wave of U.S. innovation and clean energy jobs. However, modeling uncertainty today is a multiyear development problem due to the buildout schedules of SAF production facilities.” Section 40B of the IRA cannot be implemented or used effectively if bio-innovators do not urgently receive clarity and certainty on this issue, they noted.

The ethanol industry perceives the GREET model as more effective in substantiating the requisite climate benefits to secure subsidies under the Inflation Reduction Act (IRA/Climate Bill). Conversely, environmental organizations argue that the GREET model underestimates the emissions associated with ethanol production, particularly the environmental impact of land clearance for growing the required crops.

The GREET model, if incorporated, would simplify the qualification process for credits related to clean aviation fuel, such as SAF. The airlines and companies backing this proposal argue that clear market signals can help decarbonize aviation while fostering innovation and creating clean energy job opportunities in the United States.

The letter sent by these stakeholders highlights the complexity of modeling uncertainties in the current context, emphasizing the need for a multiyear development solution. The decision regarding which model to adopt will ultimately rest with the Treasury Department, with an expected decision to be made next month. In the meantime, USDA has announced plans to update the GREET model in the coming weeks.

— President Biden launches rural initiative in Minnesota, unveiling billions in spending. President Joe Biden has initiated a series of events focused on rural areas across 15 states with the participation of 13 top administration officials. The first event kicks off in Northfield, Minnesota, where President Biden will visit a farm and introduce a $5 billion spending plan for various rural programs. Link to White House fact sheet.

The announcement includes several key allocations:

- $1.7 billion for climate-smart agriculture practices.

- $1.1 billion for clean water and infrastructure projects.

- $2 billion for economic development initiatives spanning nine states and Puerto Rico.

- $274 million in grants and loans to expand access to high-speed internet in eight states

- $145 million in grants and loans through the Rural Energy for America Program, which helps farmers and small businesses pay for energy efficiency and renewable energy work.

USDA Secretary Tom Vilsack said during a White House teleconference on Tuesday that $1.1 billion of the new conservation funding would go to the Regional Conservation Partnership Program, which supports public-private projects to carry out soil and water conservation at landscape scale. The funding will aid in the adoption of climate-smart practices. “This is not only going to help agriculture work toward the president’s vision of a net-zero [greenhouse gas emissions] future for American agriculture, it’s going to help to create new income opportunities for thousands of small and midsize farming operations as they sequester carbon and reduce greenhouse gas emissions, which will ultimately qualify them for a series of ecosystem service market credits,” he said.

This rural-focused initiative aims to address critical needs in rural communities, including sustainability, infrastructure, and economic development, while also working toward expanding access to high-speed internet in underserved areas.

Republicans respond. “Biden is traveling to rural America and bringing with him higher production costs for our farmers, rising energy prices, more expensive grocery bills, and global unrest,” said Republican members of the House Agriculture Committee on social media (link).

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— Pork producers seek partial ruling in ongoing Question 3 case. Pork producers have requested a Massachusetts federal court to proceed with a partial summary judgment in their challenge to Massachusetts' Question 3 (Q3) and its constitutionality. Question 3, which was voted on in 2016 and became effective on Aug. 23, 2023, prohibits the sale of uncooked whole pork meat that does not meet the state's sow housing requirements.

In July, Triumph Foods filed a lawsuit contesting the law, arguing that discriminatory trade restrictions like Q3 and similar laws affect the ability to establish resilient and reliable food supply chains across the United States. The lawsuit also claimed that such laws harm small businesses, employees, consumers, and government-funded agencies, emphasizing the importance of free and fair interstate commerce.

In May, the U.S. Supreme Court ruled against the National Pork Producers Council (NPPC) and the American Farm Bureau Federation in their challenge of California's Proposition 12 animal confinement law, which shares similarities with Massachusetts' Question 3.

In August, a settlement was reached that allowed pork to move through Massachusetts if it was sold outside the state. Then, in October, a group of 13 attorneys general from various states filed an amicus brief arguing against Question 3. They contended that the law could lead to inconsistent regulations by different states, disrupting national markets and causing significant financial harm to pork producers nationwide.

Of note: California has delayed compliance with Proposition 12 until Dec. 31.

— Update on Kroger/Albertsons merger. United Food and Commercial Workers members will meet with FTC Chair Lina Khan and Colorado Attorney General Philip Weiser in Colorado about the union members’ opposition to the proposed Kroger/Albertsons merger.

— Another HPAI case confirmed in commercial turkey flock in Buena Vista County, Iowa. The Iowa Department of Agriculture and Land Stewardship and USDA’s Animal and Plant Health Inspection Service (APHIS) have confirmed a positive case of highly pathogenic avian influenza (HPAI) in Buena Vista County, Iowa. The affected site is a commercial turkey flock.

|

POLITICS & ELECTIONS |

— Sen. Kyrsten Sinema (I-Ariz.) is in third place in a three-way Senate race in Arizona via an internal GOP poll, shared with Republican senators by NRSC Chair Steve Daines. It shows that Democratic Rep. Ruben Gallego leads with 41%, Republican Kari Lake follows with 37%, and Sinema trails at 17%. Daines noted that Sinema is currently more popular with Republicans than Democrats, but observers say this could change once Lake and GOP-aligned outside groups begin running ads. In a head-to-head matchup, Gallego leads Lake 49%-44%. Daines and NRSC Executive Director Jason Thielman reportedly believe that Sinema has little chance of getting re-elected, and Senate Republicans anticipate that Lake, a strong supporter of Donald Trump and a 2020 election denier, will be the GOP nominee. Lake is leading Pinal County Sheriff Mark Lamb 58%-27% in the GOP primary, according to the poll.

— The New York Times explores why North Dakota Gov. Doug Burgum is staying in the Republican presidential primary, even as he struggles to break through in polling as he’s sunk millions of his own money into the race. Link to article.

— Nearly two-thirds of Republican caucusgoers say Donald Trump 'can win an election against Joe Biden, regardless of his legal challenges, a new Iowa Poll finds. A new Des Moines Register/NBC News/Mediacom Iowa Poll asked likely Republican caucusgoers for their view on the election effects of Trump’s court battles. He faces charges related to the Jan. 6 attack, possible election interference in Georgia, classified documents in Florida and hush money payments in New York. Nearly two-thirds of respondents, 65%, say Trump “can win an election against Joe Biden, regardless of his legal challenges.” Another 32% say his legal challenges “will make it nearly impossible for him to win an election against Joe Biden.” Some 4% of respondents say they aren’t sure. The poll of 404 likely Republican caucusgoers was conducted Oct. 22-26 by Selzer and Co. and has a margin of error of plus or minus 4.9 percentage points. Link for details.

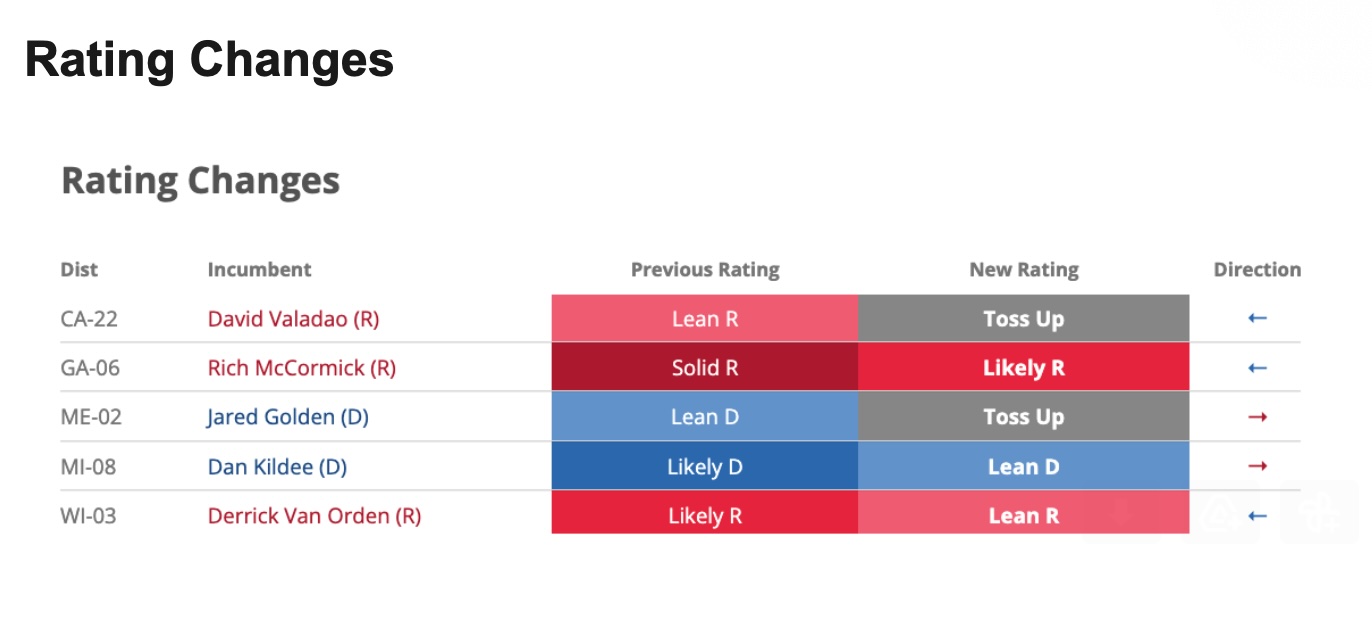

— Wasserman’s 2024 House overview: ‘A year out, the House is a game of inches.’ In an insightful analysis, David Wasserman of the Cook Political Report with Amy Walter provides a comprehensive overview of the upcoming 2024 House elections. As the dust settles from recent political events, Wasserman highlights the significance of the ongoing battle for control of the House of Representatives.

The recent upheaval in the House, triggered by a small faction within the Republican Conference challenging Kevin McCarthy's (R-Calif.) speakership, underscores the GOP's fervent desire to expand their majority. Meanwhile, House Democrats are confident that they can flip the five seats needed to regain control by portraying Republicans as "dysfunctional" and unworthy of leadership.

Wasserman breaks down the numbers, revealing that Democrats have a strong opportunity to recapture at least five seats. Notably, there are 18 Republicans representing districts that President Joe Biden carried in 2020, compared to only five Democrats in districts won by former President Donald Trump. This disparity provides Democrats with a strategic advantage, especially in states like California and New York, where presidential-level turnout could sway districts in their favor.

One key observation is that many of the "Biden Republicans" in these contested districts are freshmen with less established political reputations. Democrats are capitalizing on this by highlighting these Republicans' support for figures like Speaker Mike Johnson and Rep. Jim Jordan, portraying them as aligned with the conservative Freedom Caucus.

Wasserman delves into the evolving dynamics of the House GOP campaign apparatus, particularly with the transition of leadership from McCarthy to Mike Johnson (R-La.). While McCarthy has been a formidable fundraiser and recruiter, Johnson is expected to carry on the legacy of the Congressional Leadership Fund Super PAC, maintaining continuity in political operations.

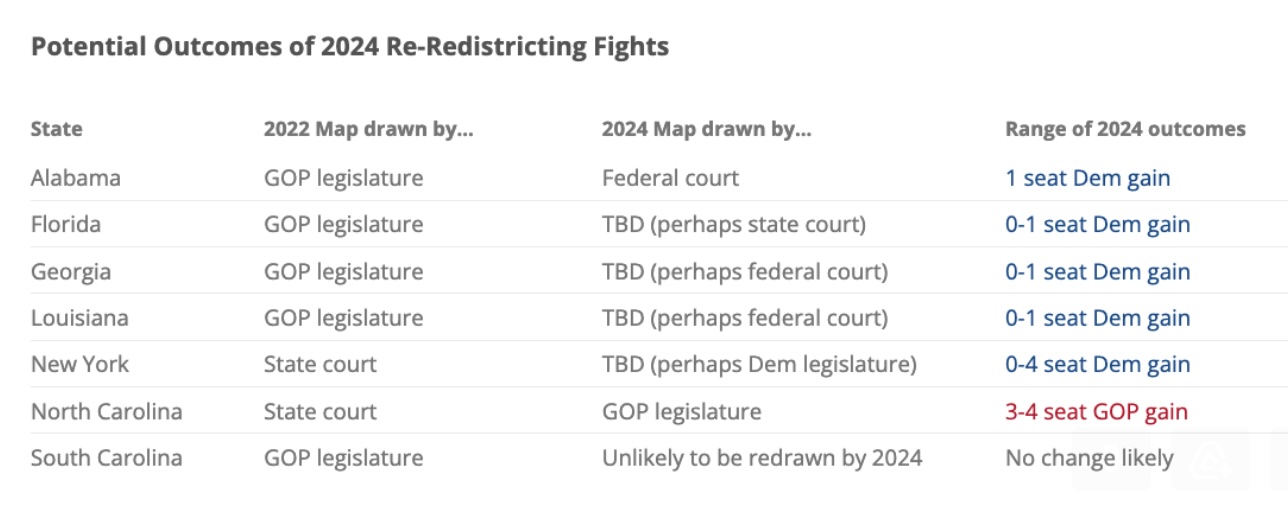

The report also discusses looming legislative challenges, including the expiration of the continuing resolution, border funding, and a potential Biden impeachment inquiry, all of which could shape the political landscape. However, Wasserman emphasizes that the outcome of the 2024 House race will likely hinge on three critical factors: redistricting battles, candidate recruitment, and the influence of the top of the ticket.

The redistricting landscape is complex, with ongoing litigation and gerrymandering efforts in various states, including North Carolina, Alabama, Louisiana, Georgia, Florida, and New York. The outcome of these legal battles could determine whether the 2024 re-redistricting results in a net gain for either party or remains largely unchanged.

Bottom line: As the nation approaches the 2024 House elections, Wasserman's analysis paints a vivid picture of the challenges and opportunities facing both Democrats and Republicans in their quest for control of the House of Representatives.

|

OTHER ITEMS OF NOTE |

— Former Major League baseball slugger Frank Howard died on Oct. 30 at age 87. Throughout his career, Howard had a close connection with Washington, D.C., where he played seven seasons with the Washington Senators, from 1965 to 1971.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |