Stabenow Bows to Reality, Now Supports One-Year Farm Bill Extension; Touts More Funding

U.S. economy posts sizzling 4.9% GDP in third quarter, but slowdown expected ahead

|

Today’s Digital Newspaper |

MARKET FOCUS

- U.S. GDP grew at 4.9% annual pace in the third quarter, better than expected

- U.S. Treasury expected to announce substantial increases in auction sizes

- Growing U.S. oil inventories

- UAW & Ford reach tentative deal to end strike, 16,600 autoworkers set to return soon

- Ag markets today

- USDA daily export sale: 110,000 MT soybeans to China during 2023-2024 MY

- Indonesia considers extending rice give-away program to tackle soaring rice prices

- Ag trade update

- NWS weather outlook

- Pro Farmer First Thing Today items

CONGRESS

- New House Speaker Mike Johnson (R-La.) takes the reins

- House to complete work on energy and water appropriations

- Biden asking Congress for $56 billion for domestic programs

ISRAEL/HAMAS CONFLICT

- Israeli PM Netanyahu signals ground incursion into Gaza amid humanitarian issues

RUSSIA & UKRAINE

- Ukraine suspends Black Sea grain corridor due to Russian warplane threat

POLICY

- Stabenow calls for one-year extension, hails extra Senate farm bill funding potential

CHINA

- China’s hog numbers down from year-ago

- Hefty soybean sales, additional wheat business to China confirmed by USDA

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- USDA forecasts modest grocery price increase in 2024

- Cold Storage report: Beef, pork stocks remain well below average

- Food insecurity surges by 30% as pandemic aid wanes, highest levels since 2014

- USDA strengthens animal welfare standards for organic livestock

HEALTH UPDATE

- Study: Slight boost in stroke risk for older adults getting Covid-19 /flu vaccines together

OTHER ITEMS OF NOTE

- Current water conservation plans will prevent critical Colorado River reservoir levels

|

MARKET FOCUS |

— Equities today: Asian and European stocks were mixed overnight. U.S. Dow opened 25-30 points lower. In Asia, Japan -2.1%. Hong Kong -0.2%. China +0.5%. India -1.4%. In Europe, at midday, London -0.7%. Paris -0.8%. Frankfurt -1.5%.

U.S. equities yesterday: The Dow ended down 105.45 points, 0.32%, at 33,035.93. The Nasdaq lost 318.65 points, 2.43%, at 12,821.22. The S&P 500 declined 60.91 points, 1.43%, at 4,186.77.

— Agriculture markets yesterday:

- Corn: December corn fell 4 cents to $4.80, the lowest close this month.

- Soy complex: January soybeans fell 6 cents to $13.08 1/2 and near mid-range. December soybean meal lost $5.00 at $429.20 and nearer the session low. Prices hit a contract high early on. December bean oil rose 128 points at 52.60 cents and near the session high.

- Wheat: December SRW wheat fell 2 cents to $5.68 1/2, a two-week low close, while HRW lost 14 cents, closing at $6.49, a fresh near-term low. December spring wheat fell 7 1/2 cents to $7.20 3/4.

- Cotton: December cotton rose 88 points at 83.81 cents and nearer the session high.

- Cattle: Expiring October live cattle futures rose $1.125 to $181.125, while most-active December rose 80 cents to $179.425. October feeder futures, which go off the board at noon Thursday, climbed 55 cents to $239.975, while November feeders jumped $2.625 to $238.05.

- Hogs: The late slowdown in the seasonal cash decline appeared to spur renewed buying in hog futures Wednesday, with nearby December futures bouncing $1.125 to $67.50. The numbers in the belatedly released USDA report on slaughter hogs traded Monday placed the official quote for Monday’s hog index at $78.67, down 40 cents from last Friday.

— Ag markets today: Grain markets traded on both sides of unchanged overnight, with corn weaker, beans near unchanged and wheat firmer this morning. As of 7:30 a.m. ET, corn futures were trading a penny lower, soybeans were narrowly mixed, winter wheat markets were 1 to 3 cents higher and spring wheat was mostly 3 to 5 cents higher. Front-month crude oil futures were around $1.50 lower, and the U.S. dollar index was about 300 points higher.

Choice beef finding a little footing. Choice boxed beef prices firmed $1.52 on Wednesday to $307.50, which is $10.74 off the Oct. 4 low. Select beef dropped $2.34 to $281.66 but are also off their lows earlier this fall. While packer margins remain in the red, they have improved with wholesales prices, especially Choice beef, finding some recent support.

Traders narrow discount in December hog futures. The CME lean hog index is down another 26 cents to $78.41 (as of Oct. 24), extending the persistent seasonal slide. December lean hog futures firmed $1.125 on Wednesday, narrowing the front-month contract’s discount to $10.91. That’s slightly less than the five-year average decline from now until contract expiration in mid-December.

— Quotes of note:

- ~30%: The Fed’s proposed cut in the fees merchants pay to many banks when consumers use debit cards. Businesses, which have wanted a decrease for years, would pay large card issuers 14.4 cents plus 0.04% of the transaction amount, instead of 21 cents plus 0.05%—the level the central bank set in 2011. The Fed has never lowered the cap before. Banks who pocket the fees oppose the change and disagree with merchants’ position that credit- and debit-card swipe fees drive up costs for U.S. shoppers.

- “There are many ways to climb the mountain that is achieving carbon neutrality.” — Toyota Chairman and former Chief Executive Akio Toyoda, when asked about electric-vehicle challenges including a recent lull in U.S. demand. He has long said that the auto industry should hedge its bets by continuing to invest in hybrid gasoline-electric cars and other options beyond just EVs.

- 42%: The percentage of chief risk officers surveyed by KPMG who said regulatory changes are the most significant challenge their organization will face in the upcoming years.

- U.S. Treasury expected to announce substantial increases in auction sizes: CreditSights. The group’s analysts anticipate that the U.S. Treasury will soon announce "broad increases" in auction sizes, with expectations of adjustments to various note durations, including 2-year, 3-year, 5-year, 7-year, and 10-year notes. The analysts suggest a monthly increase of $2 billion for the 2-year, 3-year, and 5-year notes, a $1 billion monthly increase for the 7-year note, and a $2 billion monthly increase for the original issue and subsequent reopenings of the 10-year note. These projected increases, while significant, are anticipated to occur at a slower pace compared to the recommendations made by the Treasury Borrowing Advisory Committee in August. While the augmented Treasury supply may not necessarily lead to a renewed surge in yields, it is likely to maintain yields at elevated levels in the near term, as noted by the analysts.

— U.S. GDP grew at a 4.9% annual pace in the third quarter, better than expected. The U.S. economy demonstrated robust growth in the third quarter of 2023, expanding at an annualized rate of 4.9%, marking the most robust GDP growth since the final quarter of 2021. This performance exceeded market forecasts of 4.3% and followed a 2.1% increase in the preceding three months, according to the advance estimate.

The third-quarter increase in real GDP was driven by rises in consumer spending, private inventory investment, exports, state and local government spending, federal government spending, and residential fixed investment. However, this growth was partially offset by a decrease in nonresidential fixed investment.

Looking forward to the final quarter of the year, experts anticipate a potential slowdown in GDP growth due to factors such as the resumption of student loan repayments in October and UAW strikes (although Ford reached a tentative accord with the UAW as noted). The Federal Reserve anticipates the U.S. economy to achieve a 2.1% growth rate for the year, reflecting a more tempered outlook compared to the recent robust performance.

Market perspectives:

— Outside markets: The U.S. dollar index was higher, with the euro and British pound weaker. The yield on the 10-year U.S. Treasury note was trading slightly lower, around 4.93%, with a mixed tone in global government bond yields. Crude oil futures were under significant pressure, with U.S. crude around $82.70 per barrel and Brent around $86.75 per barrel. Gold and silver futures were little changed, with gold around $1,995 per troy ounce and silver around $23.10 per troy ounce.

— Growing U.S. oil inventories. An Energy Information Administration report Wednesday showed inventories at the U.S.’ biggest storage hub at Cushing, Oklahoma, increasing by 213,000 barrels, inching away from their operational minimums. U.S. stockpiles rose by 1.37 million barrels last week.

— UAW and Ford reach tentative deal to end strike, 16,600 autoworkers set to return soon. The United Auto Workers (UAW) union and Ford, its largest employer, came to a tentative agreement aimed at bringing an end to a strike that will see approximately 16,600 autoworkers back on the job in the coming days. The agreement includes a provision for workers to receive a minimum of 25% more in compensation until 2028. While the UAW expressed its satisfaction with the tentative deal with Ford, more than 29,000 other union members remain on strike at America's two other unionized automakers, General Motors and Stellantis, responsible for producing vehicles under well-known brands such as Jeep, Ram, Dodge, and Chrysler. The strike, ongoing since Sep. 15, has had a significant impact on some of the largest and most profitable factories in the United States.

— USDA daily export sale: 110,000 MT soybeans to China during 2023-2024 marketing year.

— Indonesia considers extending rice give-away program to tackle soaring rice prices. Indonesia is contemplating an extension of its initiative to provide 10 kilograms (22.05 pounds) of rice monthly to approximately 21.3 million lower-income households as a response to surging rice prices. This extension could potentially stretch through March, surpassing the original September-November timeline, which was recently prolonged until December. The country's food procurement agency, Bulog, attributed the need for the extension to supply disruptions linked to the El Niño weather phenomenon. They emphasized having ample rice stocks to continue the program, supported by recent approvals for rice imports totaling 3.8 million metric tons, with contracts for 700,000 metric tons already in place. Bulog currently holds 1.48 million metric tons of rice stocks. Indonesia, like other Asian nations, has taken multiple measures to address escalating food prices, with El Niño-induced production reductions being a significant contributing factor.

— Ag trade update: Taiwan purchased 52,000 MT of U.S. milling wheat.

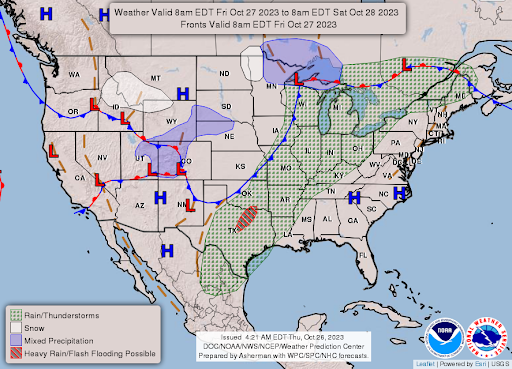

— NWS weather outlook: Significant early season winter storm continues from the Northern Rockies through the Northern Plains Thursday, tapering off Friday... ...Heavy rainfall with the threat of scattered flash flooding for Southern Plains and Upper Great Lakes... ...Much above average temperatures for the East as winter-like cold spreads southward in the Northern/Central Plains.

Items in Pro Farmer's First Thing Today include:

• Varied price tone in grains overnight

• Southeast Australia frost has low impact

|

CONGRESS |

— New House Speaker Mike Johnson (R-La.) takes the reins of the bitterly divided House Republican majority. Wednesday’s vote was the first unanimous election since John Boehner (R-Ohio) won the post in 2011. Johnson’s victory vaulted him from the vice chairmanship of the House Republican Conference to the chamber’s top position. Johnson, 51, is the 56th speaker of the House. The following are some of the pressing issues Johnson faces and some additional perspective on his speakership:

- WSJ editorial question on key issues ahead: “The question is whether the Republican malcontents will let him govern in a way they refused his deposed predecessor, Kevin McCarthy. It won’t take long to find out. Government funding expires Nov. 17, and America’s friends in Israel, Ukraine and Taiwan need military help to defend themselves.”

- Johnson pledged to try to “restore the people’s faith in this House.” He cited sending aid to Israel, fixing a “broken” southern border, and reining in federal spending as his top legislative priorities. Johnson pledged that his office “is going to be known for decentralizing power.”

- “I’m sure that he will,” said Rep. Bob Good (R-Va.) when asked whether Johnson can expect more cooperation from conservatives/rebels than McCarthy did. Good was one of the eight Republican rebels who backed the motion to vacate McCarthy. “He’s a partner in our conservative agenda, not an obstacle to that. Secondly, he has a level of trust and respect that has been lacking in our House speaker leadership. That’s why we have a new speaker.” Good added that “the previous speaker obviously left [Johnson] in a difficult situation by doing four spending bills in nine months. Let me say that again — four spending bills in nine months. That’s the reason why [McCarthy] is no longer speaker.”

- Johnson is proposing a stopgap bill that lasts until either Jan. 15 or April 15, “in order to ensure the Senate cannot jam the House with a Christmas omnibus.” This is in concert with the prevailing understanding that a continuing resolution is needed. But the question on a continuing resolution (CR) is under what conditions. Some right-wing House members demand any spending stopgap include conservative policy measures, something the Senate would surely reject, while other Republicans say they’ll refuse to support any short-term spending bill. Some, however, indicated they’d give Johnson more leeway than they granted McCarthy.

- Foreign aid: Rep. Matt Gaetz (R-Fla.), who led the push to oust McCarthy, said “continuing resolutions are not a part of [Johnson’s] plan.” He also said Johnson won’t dare bring up Ukraine funding since half the GOP conference opposes it. Johnson said Wednesday that he wanted to hear “objectives” from the White House as to what it wants to accomplish in Ukraine. Johnson’s first act of business was a resolution supporting Israel. There’s bipartisan support for aiding Israel, but Democrats and some Senate Republicans want to send money to Ukraine at the same time. Johnson, like many House Republicans, is a skeptic of Ukraine aid as the country tries to fight off a Russian attack. The issue could split the House GOP and set up another standoff with the White House and Senate.

- Key FY 2024 unknown: Whether Johnson will adhere to the fiscal year (FY) funding levels agreed to in the debt-limit compromise or if he’ll move forward with conservative demands for $100 billion more in cuts. Under the debt limit deal, Congress effectively faces an April 30 deadline to pass all 12 appropriations bills, or all discretionary spending will automatically be cut 1% across the board. The Senate hasn’t passed any appropriations bills, but is nearing a vote on a three-bill “minibus” package. The House passed four appropriations bills and rejected one (Agriculture) after debating it.

- White House additional spending request: Johnson will have to contend with a $56 billion domestic spending request the Biden administration sent yesterday. Top Democratic appropriators want to move on the items — including $23.5 billion for programs related to natural disaster recovery, $16 billion for child care providers, and $6 billion for free and affordable internet — possibly packaged with Ukraine and Israel aid. Republicans haven’t expressed interest.

- New farm bill: A Johnson letter to members (link) said he wanted a new farm bill debated in the House in December, but key unresolved issues remain among top farm bill leaders. While reports have surfaced of some additional funding being made available in the Senate, the additional funding is far from the level needed to significantly improve the Title I farmer safety net.

- Rep. Stephanie Bice (R-Okla.) and Nicole Malliotakis (R-N.Y.) are running to replace Johnson as House Republican Conference vice chair.

- OMB director Shalanda Young and campaign co-chair Cedric Richmond both hail from Johnson’s home state of Louisiana.

- Rep. Troy Carter, the only Democrat in the Louisiana delegation and someone who served with Johnson in the state legislature, expects President Biden and Johnson to get along. Johnson, he said, won’t resort to “flame throwing and hand grenade launching… He is someone that ideologically, we couldn’t be further apart, but he’s a decent individual,” Carter said. “He’s a decent human being and one that is civil, respectful and one that I believe we can work with.”

- Bottom line: A big part of Johnson’s job is to bring order to the recent Republican chaos. The initial test will be how Johnson deals with the threat of another government shutdown pending a Nov. 17 deadline on additional action on FY 2024 spending, and White House requests for aid to Israel, Ukraine, Taiwan and for border security.

— House to complete work on energy and water appropriations. House members are scheduled to start voting by 11:30 a.m. ET on amendments to the Energy and Water Development appropriations bill for fiscal year (FY) 2024 (HR 4394). A structured rule adopted earlier this month teed up 60 amendments for consideration, including in en bloc packages. Votes were postponed on several proposals debated yesterday, and more remain to be debated today.

Details: The Energy Department, Army Corps of Engineers, and related agencies would receive $52.4 billion in discretionary funding for FY 2024 under HR 4394. The amount would be $1.6 billion less than the FY 2023 enacted level and $7.5 billion less than the White House request, according to the House Appropriations Committee report on the measure. The measure would total $58 billion before the rescission of $5.6 billion in unobligated funds from Democrats’ tax, health, and climate law, according to a summary from committee Republicans. The bill would also block funding for several actions, including a Biden administration rule implementing the new definition of “navigable waters” under the Clean Water Act.

— President Biden is asking Congress for $56 billion for domestic programs, as part of an emergency request. The request comes in addition to the $106 billion Biden is asking for Israel, Ukraine, and other foreign assistance programs, and includes $23 billion to respond to natural disasters and $16 billion for childcare funding.

- Food Aid: The administration is asking for more than $1 billion for farmers growing crops that will then be distributed to countries abroad, amid growing concern over the impact of the wars in Ukraine and the Middle East on global food security. The food aid request comes as Americans faced food insecurity more in 2022 than one year before, marking first annual increase of struggling households in more than a decade. Roughly 17 million households suffered difficulty at some time, a new USDA study found.

- Disasters: The request comes as the government is working to respond to high-profile disasters including fires in Hawaii and hurricanes in Florida. It includes $9 billion for FEMA’s disaster relief fund, as well as $2.8 billion for housing needs. The $23 billion for disaster aid would be on top of the $16 billion that Congress included in the continuing resolution passed last month to help FEMA address the increasing cost of disaster aid. The fires on Maui alone this year took a hefty bite out of FEMA’s disaster fund.

- Childcare: The childcare request comes as millions of parents are expected to soon lose out on subsidies backed by a $24 billion program passed during the pandemic that funded childcare workers’ salaries and training programs.

- Broadband: The White House requests $6 billion for the Affordable Connectivity Program. Over 20 million households have enrolled for the program, which can provide a subsidy of up to $30 per month toward broadband service for low-income people.

|

ISRAEL/HAMAS CONFLICT |

— Israeli Prime Minister Netanyahu signals ground incursion into Gaza amid humanitarian issues. Israeli Prime Minister Benjamin Netanyahu revealed plans for a ground incursion into Gaza and emphasized the recent airstrikes were merely the beginning of the operation. This development occurs amid a humanitarian crisis in Gaza, marked by a looming shortage of life-saving fuel and a crippled healthcare system. While U.S. military advisers are reportedly urging Israel to avoid a full-scale ground assault, mounting international pressure is urging Israel to permit urgently needed humanitarian aid into the besieged enclave. An increasing number of countries are also advocating for a "humanitarian pause" in the conflict, but as Israel intensifies its airstrikes, concerns are rising that the crisis could spiral further out of control.

|

RUSSIA/UKRAINE |

— Ukraine suspends Black Sea grain corridor due to Russian warplane threat. Ukraine has suspended its newly established Black Sea grain corridor in response to what has been identified as a threat posed by Russian warplanes. Reuters, citing information from Ukraine-based consultant Barva Invest, reported this development. On the social media platform Telegram, Barva Invest announced, "We would like to inform you of a temporary suspension of vessel traffic to and from (the ports). The current ban is in force on Oct. 26, but it is possible that it will be extended." The group further disclosed that the Ukrainian military had requested a de facto suspension of the corridor due to concerns over heightened Russian military activity in the area. Prior to the suspension, more than 40 cargo vessels had utilized the corridor to transport 1.5 million metric tons (MMT) of various commodities, including grains, oilseeds, vegoils, and meals, out of Ukrainian ports.

|

POLICY UPDATE |

— Stabenow calls for one-year extension, hails extra Senate farm bill funding potential. Senate Ag Committee Chair Debbie Stabenow (D-Mich.) added her voice to those calling for a one-year extension of the 2018 Farm Bill to prevent permanent law from kicking in and to allow lawmakers to work out details of the next version of the bill.

“It would be irresponsible to allow vital programs and the farm safety net to lapse and revert to Depression-era policies in January. We can’t allow that to happen,” Stabenow said. “Given the chaos in the House, I know we will need an extension.” Stabenow told CQ Roll Call in an interview that she would have preferred a three-month extension, but that USDA has indicated implementing commodity programs via a short extension or multiple extensions would be difficult. She expressed a hope that both chambers could generate their bills and work out differences by spring.

She also touted a commitment by Senate Majority Leader Chuck Schumer (D-N.Y.) to find spending offsets that will increase funding for crop insurance, dairy, commodities and other areas. “I won’t go into specifics,” she said. “We’re talking several billion dollars. It’s enough to do things.” In a statement (link), Stabenow said: “I am committed to finding new ways to bring additional resources into the farm bill to meet critical needs for our producers. We should all be grateful that Leader Schumer has committed to finding several billion dollars in additional resources through bipartisan offsets outside the farm bill. It’s almost unheard of to get a commitment to add new money to the farm bill — I remember not long ago when Senate leadership told us to cut $23 billion from the farm bill.”

“Crop insurance and [export] markets” are the top two concerns of farmers, said Stabenow. She pointed to analyses showing that a so-called escalator clause in the 2018 Farm Bill would automatically increase reference prices for some major crops. She said improvements in the federally subsidized crop insurance program would deliver immediate benefits to farmers while higher reference prices would not be felt until fall 2025.

She noted the pay-fors would be chosen based on bipartisan support. Stabenow rejected suggestions that land stewardship funding should be reduced to pay for larger spending on commodity subsidies. And it would be “unconscionable to further cut” SNAP, she said.

Stabenow also said they would want some 21 “orphan” programs included in the extension, referring to programs that are not authorized beyond fiscal year (FY) 2023, are not a part of the baseline or both.

Bottom line: Stabenow said she and Senate Ag Ranking Member John Boozman (R-Ark.) were committed to producing a bipartisan farm bill. “We can get this done,” she said, “in the coming months.”

Comments: A “few billion dollars” will not be enough to adequately reform the Title I safety net. But a one-year extension will give always creative Ag panel staffers and their leaders additional time to find more funding, as is evident from Stabenow’s comments. Stabenow is correct on the need for a one-year extension as it is the only viable means of providing certainty to growers. However, as noted, the level of new dollars is not enough to address the needs.

|

CHINA UPDATE |

— China’s hog numbers down from year-ago. China’s sow herd at the end of September totaled 42.4 million head, down 2.8% from last year, the ag ministry said. The pig herd dropped 0.4% to 44.23 million head.

— Hefty soybean sales, additional wheat business to China confirmed by USDA. USDA’s weekly Export Sales data for the week ended Oct. 19 included more than 1 million metric tons of soybean sales along with additional wheat and sorghum sales. Net sales for 2023-24 included 65,000 metric tons of wheat, 172 metric tons of corn, 68,000 metric tons of sorghum, 1,166,974 metric tons of soybeans, and 98,548 running bales of upland cotton. No sales were reported for 2024-25. Net sales for 2023 of 3,18 metric tons of beef and 3,389 metric tons of pork were also reported.

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— USDA forecasts modest grocery price increase in 2024, returning to near pre-pandemic levels. USDA released its food price forecasts for 2024, indicating a modest increase in grocery prices, nearing pre-pandemic levels. In 2023, food prices are expected to rise by 5.8% compared to 2022, with restaurant prices increasing by 7.1%, and grocery prices by 5.1%. These projections are consistent with the September outlook and represent a 0.1 percentage point decrease from the August forecast.

For 2024, food prices are predicted to rise by 2.1%, with a 1% increase in grocery store prices and a 4.4% increase in restaurant prices. Notably, the expected grocery price increase in 2024 would be the lowest since 2019, when it was 0.9% before the pandemic.

In 2023, price increases are anticipated for several food categories, including beef and veal (3.8%), dairy products (4.0%), fats and oils (8.9%), processed fruits and vegetables (8.5%), and more. The only category USDA expects to decline in 2023 compared with 2022 is pork where a decrease of 0.8% is forecast. However, in 2024, USDA expects declines in prices for categories such as eggs (14.5%), dairy products (0.6%), fresh fruits and vegetables (0.1%), and fresh vegetables (0.5%).

USDA has been adjusting its 2024 food price forecasts monthly. Grocery store price forecasts have remained at a 1.0% rise since July, while overall food price forecasts began at 2.4% for 2024. Restaurant prices were initially projected to increase by 4.5%.

For 2024, USDA expects declines for eggs (14.5%), dairy products (0.6%), fresh fruits and vegetables (0.1%) and fresh vegetables (0.5%). By contrast, those prices are seen rising in 2023 by 0.4% for eggs, 4.0% for dairy products, 0.7% for fresh fruits and vegetables, with fresh vegetables seen up 1.0%.

Of note: External factors, including Federal Reserve monetary policy and geopolitical tensions such as the Russian invasion of Ukraine, could affect these forecasts. High energy prices may particularly impact restaurant food price inflation. While consumers are expected to experience lower increases in 2023 compared to previous years, the forecasts still exceed the 10-year averages for all food, restaurant, and grocery prices. For 2024, the current outlook suggests that all food and grocery prices will be below their 20-year averages, while restaurant prices are expected to remain above that level.

— Cold Storage report: Beef, pork stocks remain well below average. USDA’s Cold Storage Report showed frozen beef stocks climbed more than average during September, largely because the previous month’s figure was revised down 15.1 million pounds. Pork stocks declined last month, whereas there is normally a small buildup in supplies.

Beef stocks at the end of September totaled 420.2 million lbs., up 24.8 million lbs. (6.3%) from August, which was greater than the five-year average increase of 11.1 million lbs. during the month. But beef inventories dropped 105.9 million lbs. (20.1%) from year-ago and were 60.7 million lbs. (12.6%) below the five-year average.

Frozen pork inventories totaled 462.8 million lbs., down 6.5 million lbs. (1.4%) from August, whereas the average over the past five years was a 3.0-million-lb. increase during September. Pork stocks fell 74.3 million lbs. (13.8%) from last year and were 69.4 million lbs. (13.0%) lower than the five-year average. Frozen ham inventories at 149.5 million lbs. dropped 4.8 million lbs. and were 10.0 million lbs. under September 2022. Belly stocks at 29.6 million lbs. declined 7.2 million lbs. during September and were 6.9 million lbs. under year-ago.

Total poultry stocks declined 12.5 million lbs. (1.0%) from August and were virtually unchanged versus September 2022. Chicken breast meat inventories increased 15.5 million lbs. last month to a September record 236.586 million lbs., up 28.7 million lbs. (13.8%) from last year.

— USDA report: Food insecurity surges by 30% as pandemic aid wanes, reaching highest levels since 2014. A recent USDA report (link) revealed that more than 44 million Americans experienced food insecurity in the past year, marking the highest number since 2014. This surge in food insecurity occurred simultaneously with the reduction of pandemic assistance measures. Food insecurity is defined as individuals having difficulty obtaining sufficient food due to a lack of resources or money.

Background. The USDA report, based on a December Census Bureau survey, assessed households' ability to afford balanced meals and whether they had to skip or reduce meals due to financial constraints. The report disclosed that this increase in food insecurity is alarming and urged Congress to protect funding for public nutrition programs such as WIC (Women, Infants, and Children) and SNAP (Supplemental Nutrition Assistance Program/food stamps).

USDA Secretary Tom Vilsack expressed concern, stating that these findings are unacceptable, and it highlights the growing problem of food insecurity as the pandemic began to wane in 2022.

Perspective: In the previous report from 2021, 33.8 million people, or 10.4% of the U.S. population, experienced food insecurity, continuing a decade-long trend of improvement. However, last year, the total surged by 30% to 44.2 million people, representing 13.5% of Americans, reaching the highest number since 2014 when 48.1 million people (15.4% of the population) were food-insecure.

Of note: One-fifth of all children (13.4 million) lived in food-insecure households. Approximately 55% of food-insecure households participated in one or more of USDA's largest nutrition programs, including WIC, SNAP, and school lunch.

— USDA strengthens animal welfare standards for organic livestock, aims to elevate organic farming practices. USDA is set to implement enhanced animal welfare regulations for organic livestock, offering more consistent and stringent standards for the treatment of animals on organic farms. USDA Secretary Tom Vilsack announced the forthcoming regulation, which is expected to come into effect by the end of the year. Link to a pre-publication version of the rule. Link to a USDA fact sheet on the rule.

The new rule mandates unlimited outdoor access for animals, aligning with industry norms, and prohibits the use of small enclosed "porches" that some poultry farms have utilized. Additionally, the regulation requires producers to provide sufficient space for cattle, hogs, and poultry to engage in natural behaviors, including standing up, turning around, lying down, fully stretching their limbs, and conducting activities such as rooting for pigs. These requirements set organic farming apart from conventional agriculture, where practices like housing egg-laying hens in "battery" cages and restraining pregnant sows in sow crates are common.

Vilsack highlighted USDA's goal of creating a fairer, more competitive, and transparent food system through this regulation, emphasizing the importance of consistent animal welfare practices in organic production.

The Organic Trade Association (OTA) welcomed the animal welfare rule, stating that it would level the playing field for organic producers and provide consumers with confidence that organic meat, poultry, dairy, and eggs have been produced in humane conditions with ample outdoor access. In 2022, sales of organic food exceeded $60 billion, according to the OTA (link).

|

HEALTH UPDATE |

— Study finds slight increase in stroke risk for older adults receiving Covid-19 and flu vaccines together. A recent study has revealed that Covid-19 vaccinations may slightly elevate the risk of stroke in older adults, especially when administered concurrently with specific flu vaccines. The safety signal was identified during an analysis of Medicare claims data conducted by FDA experts. This study marks the second instance where an increased stroke risk has been associated with seniors receiving both Covid-19 and flu vaccinations. Some experts are suggesting that individuals concerned about this risk might consider scheduling their vaccinations at separate times rather than concurrently.

|

OTHER ITEMS OF NOTE |

— Federal analysis suggests current water conservation plans will prevent critical Colorado River reservoir levels in the short term. The federal government has conducted an analysis indicating that the existing plans for reducing water use along the Colorado River should be effective in preventing reservoirs from reaching critically low levels over the next three years. The Biden administration announced these findings, highlighting that the voluntary water use cuts committed by California, Arizona, and Nevada earlier this year are likely to mitigate the immediate risk of reservoir depletion. The U.S. Bureau of Reclamation credited a wet year and above-average snowpack in the Rocky Mountains as key factors that have contributed to the reduced risk of water supply crises until the end of 2026 when the current shortage management rules expire.

In May, these three states pledged to reduce water use by 3 million acre-feet over three years, equivalent to a 14% reduction across the Southwest. These conservation efforts, primarily supported by federal funds, provide an opportunity to discuss new long-term river management rules for the next two decades.

Despite improvements, the two largest Colorado River reservoirs, Lake Mead and Lake Powell, remain at low levels. Lake Mead is currently at 34% capacity, and Lake Powell is at 37%.

Outlook: While the short-term water-saving measures have helped stabilize reservoir levels, addressing the chronic water-supply deficit and climate change effects will require larger, long-term reductions in water use. Federal officials are also considering options for new long-term river management rules, set to take effect from 2027, as part of a comprehensive strategy to ensure the sustainability of the Colorado River Basin.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |