U.S. Jobs Surge by 336,000 in September, Surprisingly Strong Increase

Reference price increase debate | Gas prices tumble | Exxon seeking acquisition of Pioneer

|

Today’s Digital Newspaper |

MARKET FOCUS

- Stunning report as job increases nearly double pre-report expectations

- Exxon Mobil in advanced talks for $60 billion acquisition of Pioneer Natural Resources

- U.S. achieves record gas exports in first half of 2023

- Workers at Chevron Corp. liquefied nat gas facilities in Australia plan to resume strikes

- Oil prices plummet, bringing relief to drivers and central bankers

- U.S. trade gap narrows to $58.3 billion in August 2023, lowest since September 2020

- U.S. ag trade records third consecutive deficit despite increased exports

- Ag markets today

- Ag trade update

- NWS weather outlook

- Pro Farmer First Thing Today items

RUSSIA & UKRAINE

- Russia conducted missile strike on Thursday near eastern Ukrainian city of Kupiansk

- Russia attacks Ukrainian grain storage

- Russia resumes seaborne diesel exports with new restrictions after recent ban

POLICY

- Battle over need for higher reference prices continues

CHINA

- Second Fukushima wastewater release draws muted response

TRADE POLICY

- WTO slashes 2023 global trade growth forecast

- EU and U.S. leaders negotiating an interim deal on steel and aluminum trade

ENERGY & CLIMATE CHANGE

- Global renewable fuels capacity set to triple to 17.5 billion gallons by 2025

LIVESTOCK & FOOD INDUSTRY

- Highly pathogenic avian influenza (HPAI) confirmed in S.D. commercial turkey flock

- Global food prices remain steady in September despite sugar price surge

- Vilsack heads to Iowa to talk about independent meatpacking capacity

POLITICS & ELECTIONS

- Wasserman’s five takeaways on McCarthy’s ouster

- Democrats will be favored to win a new heavily Black district

- Cornel West opts for independent presidential bid over Green Party Run

CONGRESS

- House Republican calls for rule change after McCarthy ouster

- Congressional stalemate: Key areas in jeopardy due to lack of House speaker

OTHER ITEMS OF NOTE

- Cotton AWP edges higher

- Moody's downgrades Egypt's credit rating due to inflation and currency challenges

- Today’s calendar of events

|

MARKET FOCUS |

— Equities today: Asian and European stocks were mixed but mostly higher overnight. U.S. Dow opened around 50 points lower and the drifted still lower. In Asia, Japan -0.3%. Hong Kong +1.6%. China closed. India +0.6%. In Europe, at midday, London +0.5%. Paris +0.8%. Frankfurt +0.9%.

U.S. equities yesterday: All three indices registered small losses after a late push had them trading higher only to see them ease into the close. The Dow was down 9.98 points, 0.03%, at 33,119.57. The Nasdaq fell 16.18 points, 0.12%, at 13,219.83. The S&P 500 declined 5.56 points, 0.13%, at 4,258.19.

The benchmark 10-year notes rose 5/32, to yield 4.7144%. Meanwhile, the two-year notes gained 2/32, yielding 5.0204%. The 30-year bonds fell 6/32, yielding 4.8912%. The closely watched yield curve between two- and 10-year notes steepened 30.9 basis points.

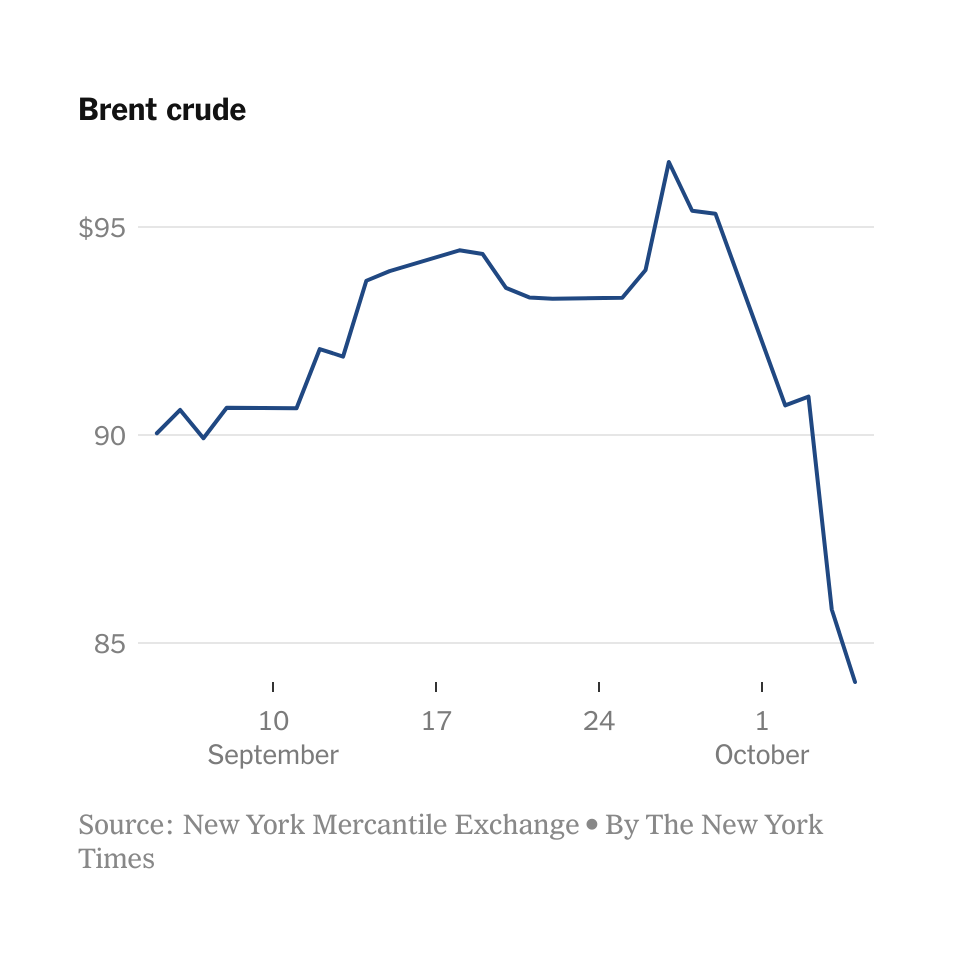

Oil prices fell about 2%, extending the previous session's losses of nearly 6%, as worries about fuel demand outweighed an OPEC+ decision to maintain oil output cuts, keeping supply tight. Global benchmark Brent crude futures and U.S. West Texas Intermediate (WTI) crude futures have declined about $10 a barrel in less than 10 days after edging close to $100 in late September. The combined percentage drop over the last two days was the steepest since May for both crude benchmarks. Brent futures were 1.91% lower at $84.17 per barrel, while U.S. WTI crude futures were down 2.10% at $82.45 a barrel. Ed Morse, Citi’s global head of commodities research, says the price of Brent could fall to around $74 next year.

— Agriculture markets yesterday:

- Corn: December corn futures rallied 11 1/2 cents to $4.97 1/2, the highest close in nearly two months.

- Soy complex: November soybeans rose 7 3/4 cents to $12.80 3/4, the highest close since Sept. 28. December meal rallied $5.20 to $377.20 after marking the lowest intraday level since June 12. December soyoil fell 71 points to 55.28 cents, the lowest close since June 29.

- Wheat: December SRW wheat rose 18 1/4 cents to $5.78 1/4. December HRW wheat gained 24 cents at $6.90 1/2. Prices closed near their session highs. December spring wheat rose 19 3/4 cents to $7.31 1/2.

- Cotton: December cotton closed 47 points lower at 86.54 cents, and closed below the 40-day moving average for the first time since Sept. 22.

- Cattle: December live cattle fell 65 cents to $185.375, nearer the session low and hit a four-week low. November feeder cattle closed down 12 1/2 cents at $250.30.

- Hogs: Futures rebounded strongly Thursday, with the expiring October contract rising 97.5 cents to $80.90 and most-active December leaping $3.10 to $72.275.

— Ag markets today: Corn, soybeans and wheat spent time on both sides of unchanged while holding in tight trading ranges overnight. As of 7:30 a.m. ET, corn futures were trading fractionally lower, soybeans were 3 to 4 cents higher and wheat futures were steady to 2 cents lower. Front-month crude oil futures and the U.S. dollar index were both trading just above unchanged.

Wholesale beef market struggling to find a bottom. Choice boxed beef prices firmed $1.00 on Thursday, while Select fell a dime. Despite the modest uptick in Choice prices, they are trading at the lowest level since April and showing no signs of any significant rebound. Seasonally, the market should begin to strengthen, especially given tight market-ready supplies. But with signs of demand destruction from high prices earlier this year that retailers are passing onto consumers, the struggles in the wholesale market appear likely to continue.

Seasonal cash hog slide continues. The CME lean hog index is down 58 cents, extending the seasonal slide. With market-ready supplies building, traders anticipate the price slide will continue. October lean hog futures finished Thursday $2.80 below today’s cash quote (as of Oct. 4), while December hogs held an $11.425 discount.

— Quotes of note:

- Fedspeak: Federal Reserve Bank of San Francisco President Mary Daly said policymakers can hold interest rates steady if the labor market and inflation continue to cool or financial conditions remain tight. “If we continue to see a cooling labor market and inflation heading back to our target, we can hold interest rates steady and let the effects of policy continue to work,” Daly said Thursday at an event hosted by The Economic Club of New York. “Importantly, even if we hold rates where they are today, policy will grow increasingly restrictive as inflation and inflation expectations fall,” Daly said. “So, holding rates steady is an active policy action.”

- Bonds present attractive opportunity amidst economic uncertainty: J.P. Morgan Asset Management's Bob Michele. Michele, the Global Head of Fixed Income, Currency, and Commodities at J.P. Morgan Asset Management, says owning bonds remains favorable in both a soft landing and recession scenario. In his quarterly outlook, Michele notes that "Yields typically fall after a central bank's last rate hike, generating significant capital gains," and emphasized that the market's focus would be on whether the last rate hike has occurred and the economic landscape that follows. Despite a recent uptick in yields over the past six months, Michele views this as a compelling opportunity to invest in bonds. He suggests that it might be prudent to exercise caution in swiftly determining the direction of the economy but asserts that the present moment is favorable for purchasing bonds while they are available at discounted prices.

- “We don’t want to be the German car industry of news publishing.” — Emma Tucker, the Wall Street Journal’s new editor in chief, telling staff that the newspaper needed to adapt to avoid a fate similar to that of German carmakers that have fallen behind in electric vehicles. Since taking the top job in February, Tucker has sought to refocus on business news and the paper’s digital audience, and has jettisoned senior editors.

- Warning. “If we’re headed towards the climate where there is deepening friction between the U.S. and China, your organizations are going to feel it.” — Jacob Helberg, a member of the U.S.-China Economic and Security Review Commission.

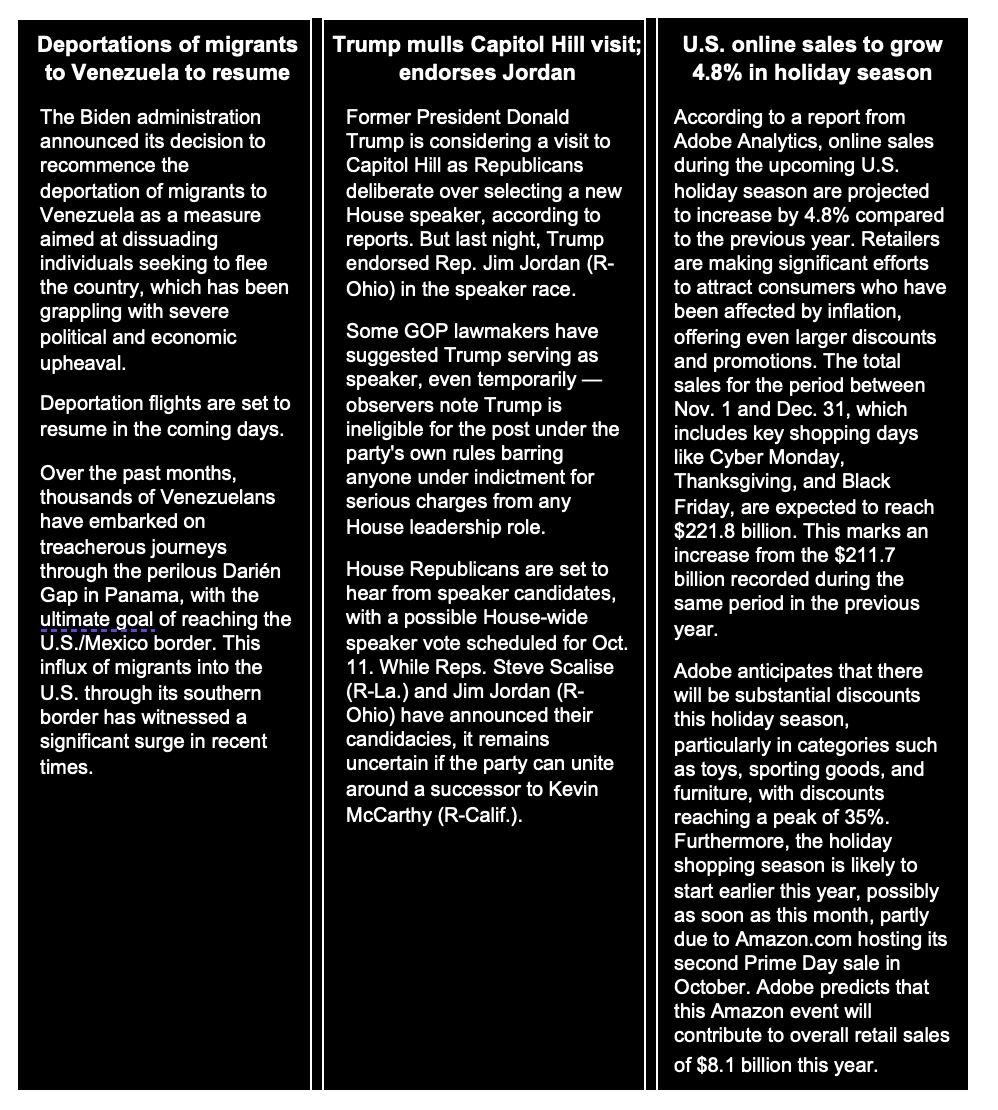

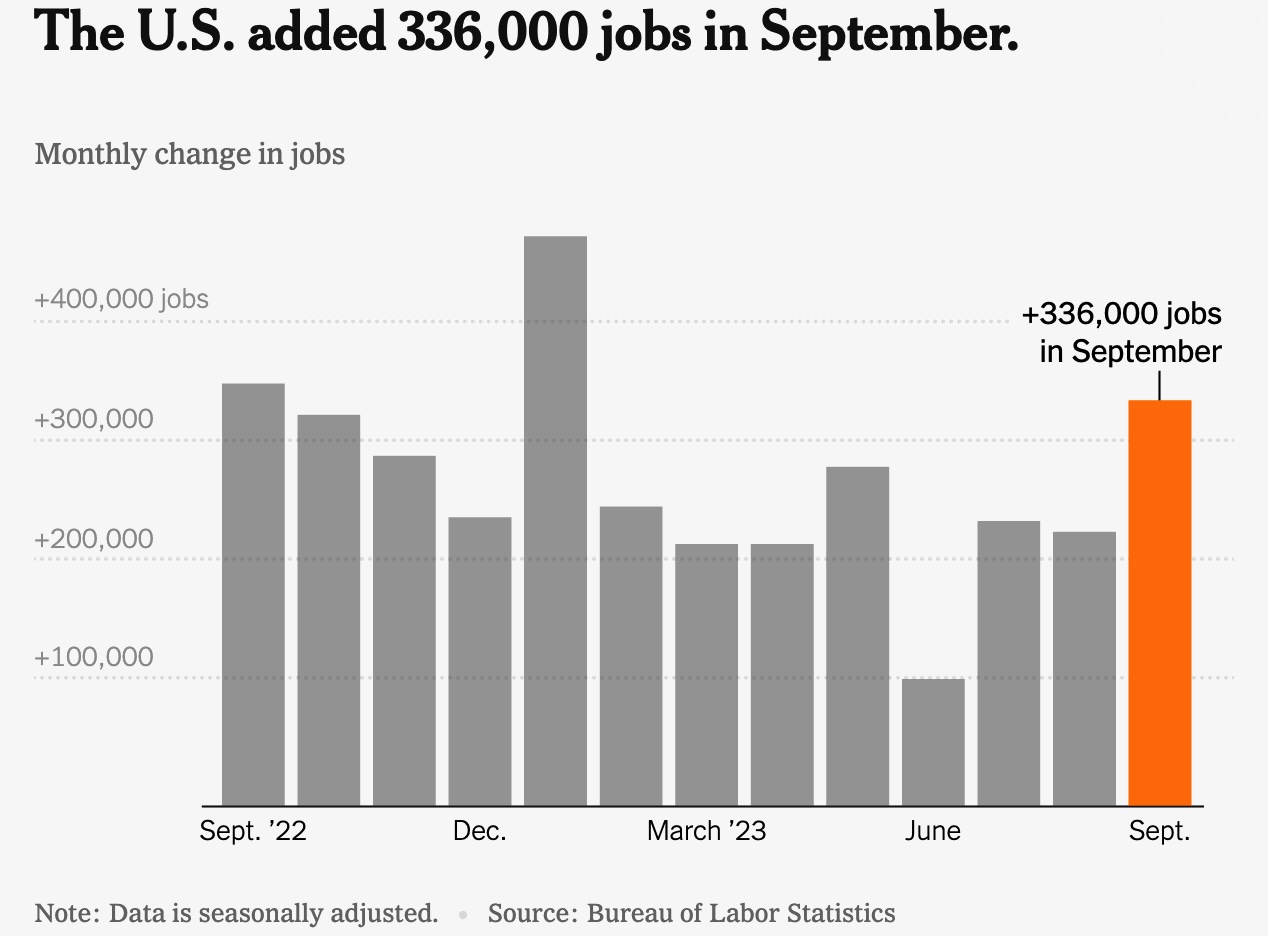

— U.S. nonfarm payrolls surge by 336,000 in September, outpacing expectations and indicating labor market resilience amid Fed tightening. In September 2023, U.S. nonfarm payrolls recorded a robust increase of 336,000, marking the strongest job gain in eight months. This figure significantly surpassed market forecasts of 170,000 and came on the heels of an upwardly revised 227,000 jobs added in August. The notable job growth in September, well above the estimated monthly requirement of 70,000-100,000 to keep up with the expansion of the working-age population, signals that the labor market is gradually easing while maintaining resilience, despite the Federal Reserve's ongoing tightening measures. (Source for chart: New York Times)

The gains in employment were particularly prominent in key sectors, including leisure and hospitality, with 96,000 jobs added, surpassing the average monthly increase of 61,000 over the preceding 12 months. Government employment also saw an uptick of 73,000 jobs, exceeding the 47,000 monthly average over the past year. Other notable sectors contributing to job growth included health care (41,000), professional, scientific, and technical services (29,000), and social assistance (25,000).

However, several major industries, including mining, quarrying, and oil and gas extraction, construction, manufacturing, wholesale trade, retail trade, financial activities, and other services, experienced minimal changes in employment during the same period.

Other highlights and comments:

- July and August were revised upward by a collective 119,000 jobs.

- The unemployment rate remained at 3.8%, as reported by the Bureau of Labor Statistics.

- September was the 33rd consecutive month of job growth.

- The labor force participation rate for men between the age of 25 and 54 surged to 89.6%, finally exceeding its prepandemic level, while the rate for women in the same age bracket sank to 77.4%.

- Wages, as measured by average hourly earnings for workers, rose 0.2% from the previous month and 4.2% from September 2022.

- Experts warn against concluding too much from this month’s data. September figures frequently feature quirks from seasonal adjustments, as teachers return to work and summer workers in leisure and hospitality leave their jobs. Goldman Sachs reckoned that Friday’s tally ultimately will be upgraded by about 45,000.

- The ongoing strike of 25,000 United Auto Workers employees, though that began after Labor’s survey and so isn’t figured in last month's totals, economists said.

- President Biden is scheduled to address the jobs report in remarks from the White House at 11:30 a.m. ET. He is likely to tout the strong report as evidence that “Bidenomics” is working.

- Initial market reaction: S&P 500 futures slid 0.9% in early Friday stock market action, following the jobs report.

— U.S. trade gap narrows to $58.3 billion in August 2023, lowest since September 2020. The U.S. trade deficit decreased to $58.3 billion in August 2023, marking the lowest level since September 2020 and surpassing earlier forecasts of a $62.3 billion deficit. This improvement was driven by a combination of rising exports and declining imports.

Key Points:

- Export Growth: Exports surged by 1.6% to reach $256 billion, marking a five-month high. Leading the way were exports of crude oil, travel (reaching levels not seen since December 2019), fuel oil, computer accessories, pharmaceutical preparations, semiconductors, and financial services. However, exports of passenger cars, trucks, buses, and special purpose vehicles experienced declines. Exports of foods, feeds and beverages were the lowest since August 2020.

- Import Decrease: Imports, on the other hand, declined by 0.7% to $314.3 billion. Notably, imports of cell phones and other household goods, semiconductors, and electric apparatus decreased. However, imports of crude oil, finished metal shapes, travel, and transport recorded increases.

- Improved Balance with China: The trade deficit with China notably narrowed by $1.3 billion, reaching a five-month low of $22.7 billion. This improvement was attributed to a $0.2 billion decrease in exports to $10.9 billion and a $1.4 billion decrease in imports to $33.7 billion.

Bottom line: The shrinking trade deficit suggests a healthier balance in the U.S. trade relationship, driven by a boost in exports and a reduction in imports. This development may have implications for the broader economic landscape and trade policies moving forward.

— U.S. ag trade records third consecutive deficit despite increased exports. In August, the U.S. ag sector witnessed a notable improvement in its exports, reaching a value of $12.48 billion, compared to $12.17 billion in July. However, this boost in exports was overshadowed by a surge in imports, which amounted to $16.10 billion, up from $15.75 billion in July. As a result, the U.S. ag trade deficit for August hit a record high of $3.62 billion. This marked the third consecutive month in which the sector experienced a trade deficit exceeding $3 billion.

Fiscal year (FY) 2023 has seen a total of seven monthly trade deficits, tying the previous record set in fiscal year 2022. Cumulatively, agricultural exports in FY 2023 have reached $166.02 billion, while imports stand at $180.03 billion, leading to a trade deficit of $14.01 billion.

USDA projects ag exports for FY 2023 will reach $177.5 billion, while imports are expected to surge to a record high of $196.5 billion, resulting in a substantial trade gap of $19 billion. Achieving these forecasted levels would require agricultural exports in September to reach $11.48 billion, with imports totaling $16.47 billion. Historically, U.S. ag exports tend to decline in value during September. But USDA's overall forecasts align closely with what is anticipated to be the final result.

Of note: The U.S. has now recorded trade deficits in three out of the last five fiscal years, with the exact magnitude of the shortfall being the only remaining question.

Looking ahead, the outlook for U.S. ag trade appears less favorable, as USDA expects exports to decrease to $172 billion in FY 2024, while imports are projected to reach a new record of $199.5 billion. This scenario would leave a substantial shortfall of $27.5 billion in the trade balance.

Market perspectives:

— Outside markets: The U.S. dollar index was lower ahead of the Employment report as the euro, yen and British pound were all firmer against the U.S. currency. The yield on the 10-year U.S. Treasury note was firmer, trading around 4.75% ahead of the jobs report, with a mixed tone in global government bond yields. Crude oil futures were under pressure, with U.S. crude around $81.90 per barrel and Brent was around $83.75 per barrel. Gold and silver futures were higher ahead of the jobs update, with gold around $1,834 per troy ounce and silver around $21.22 per troy ounce.

— Exxon Mobil in advanced talks for potential $60 billion acquisition of Pioneer Natural Resources, a prominent shale-focused producer. Pioneer's CEO, Scott Sheffield, is set to retire by the end of the year. If finalized, this deal could be valued at up to $60 billion, making it Exxon's most significant acquisition since its merger with Mobil in 1999. Exxon has been actively seeking acquisitions in the Permian Basin of Texas and New Mexico for several years. If the deal goes through, Exxon would become the largest producer in this oil field, with an estimated daily output of around 1.3 million barrels, surpassing the production of many OPEC nations. Both Exxon and Pioneer have refrained from commenting on these developments, citing them as "market rumors" when contacted by Bloomberg.

Of note: Exxon’s profits climbed to a record $59 billion last year and its cash hoard grew to nearly $29.5 billion. Pioneer spent $11 billion on acquisitions two years ago. Pioneer shares were up more than 10% in premarket trading, while Exxon’s stock was down more than 2%.

— U.S. achieves record gas exports in first half of 2023. Rising liquefied natural gas and gas pipeline exports propelled total U.S. natural gas exports to a first-half record of 20.4 Bcf/d, marking a 4% year-over-year increase, the Energy Information Administration reported. Concurrently, reduced gas imports during this period compared to the first half of 2022 solidified the U.S. position as a net gas exporter.

— Workers at Chevron Corp. liquefied natural gas facilities in Australia plan to resume strikes, threatening global supplies just as Europe and Asia approach their winter heating seasons. European benchmark gas prices rose.

— Oil prices plummet, bringing relief to drivers and central bankers. Oil prices have experienced a sharp decline after reaching high levels just last week. U.S. crude oil prices dropped by 5.6% to $84.22 a barrel, marking the most significant one-day decline in a year. Prices fell even further to $82.24 a barrel, reaching a five-week low. This comes as a stark reversal after recent spikes in oil prices, where some predictions even suggested prices could reach $100 a barrel.

The drop in oil prices is already translating into lower gas prices, with the national average for regular gas falling to $3.77 a gallon. Gas prices will tumble to nearly $3.50 a gallon nationally over the next few weeks, Andy Lipow, president of consulting firm Lipow Oil Associates, told CNN. Tom Kloza, global head of energy analysis at the Oil Price Information Service, told CNN he expects an even bigger tumble — to as low as $3.25 a gallon by Halloween. Pointing to sinking wholesale prices, Kloza said retail prices should drop each day by between 1.5 cents and 2.5 cents a gallon going forward.

This decline in gas prices is seen as welcome news for consumers dealing with high living costs and rising borrowing expenses. It is also a relief for officials in the White House and the Federal Reserve, as high oil prices had the potential to impact consumer confidence and inflation. The drop in gas prices is likely to influence the Fed's decision to maintain interest rates at its next meeting. Joe Brusuelas, chief economist at RSM, wrote in a report on Wednesday that the drop in oil and gasoline prices will help convince the Fed to keep interest rates steady at its next meeting, which concludes on Nov. 1.

A government report revealing an unexpected increase in gasoline inventories contributed to this reversal, raising concerns about weakening demand for gasoline. However, the oil market remains subject to rapid changes, and factors like OPEC+ supply cuts or geopolitical disruptions could impact prices again in the future.

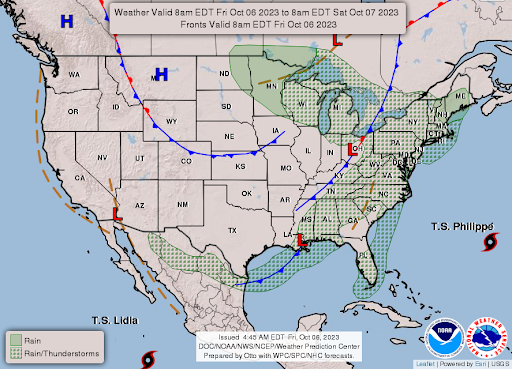

— NWS weather outlook: There is a Slight Risk of excessive rainfall over parts of the Northeast on Saturday... ...There is a Freeze Warnings/Watches over parts of the Northern/Central Plains overnight Friday... ...Temperatures will be 10 to 15 degrees below average over parts of the Northern/Central Plains and the Upper Mississippi Valley.

Items in Pro Farmer's First Thing Today include:

• Quiet overnight grain trade

• Exchange warns Argentine farmers need rain to plant corn

|

RUSSIA/UKRAINE |

— Russia conducted a missile strike on Thursday near the eastern Ukrainian city of Kupiansk, resulting in the deaths of at least 51 people, including a child. This attack is considered one of the deadliest against civilians since the onset of the war. The missile strike, carried out by Moscow's forces, targeted a cafe and a shop in the village of Hroza, situated in the Kharkiv region. These establishments had local residents inside at the time of the attack.

Ukrainian Defense Minister Rustem Umerov expressed the urgent need for more defense systems in Kyiv to protect the country from acts of terror. There are concerns about a potential reduction in military aid from Western allies, making it crucial for Ukraine to bolster its defense capabilities.

The United Nations' humanitarian coordinator in Ukraine conveyed that the images emerging from the scene of the missile strike are profoundly distressing, highlighting the devastating impact on civilians in the region.

— Russia attacks Ukrainian grain storage. Russian drones attacked port infrastructure in Ukraine’s Odesa region, damaging a grain silo near the Danube River. A Turkish-flagged general cargo ship hit a mine yesterday in the Black Sea off the coast of Romania and sustained minor damage.

— Russia resumes seaborne diesel exports with new restrictions after recent ban. Russia decided to allow the resumption of seaborne exports of diesel fuel, just weeks after imposing a ban that had significant global market repercussions. The ban had been instituted in response to domestic fuel cost increases that contributed to inflation concerns ahead of Russia's presidential elections in March. Link for details via Bloomberg.

Under the updated regulations, diesel shipments can restart, provided that the fuel is delivered to Russian ports via pipelines, particularly to the western ports that account for most exported volumes. This move is expected to provide relief to importers, as Russia is a major seaborne exporter of diesel-type fuels.

The new rules are set to free up approximately 90% of the pre-ban seaborne export volumes, estimated at around 630,000 barrels per day. However, the regulations also stipulate that producers must retain at least 50% of their diesel output within the country, ensuring domestic supply.

Impacts: The lifting of the ban caused key metrics for diesel traders to decline temporarily, with the fuel's premium over crude oil falling before recovering. The prompt timespread, which provides insights into market tightness and supply urgency, also saw fluctuations. Additionally, exporters who do not produce their own diesel but purchase volumes from the domestic market will now face high export duties, set at 50,000 rubles (approximately $500) per ton, close to the current price of Russian inter-seasonal diesel on the SPIMEX commodity exchange.

The Russian government is also fully restoring subsidies to refiners to meet domestic fuel demand and compensate for price differences between domestic and international markets. This decision followed a reduction in subsidies last month, which had been criticized by President Vladimir Putin for exacerbating domestic fuel market conditions.

|

POLICY UPDATE |

— Battle over need for higher reference prices continues. Today’s FarmDoc daily article (link) says this: “We examine how, with the effective reference price calculation enacted in the 2018 Farm Bill, over 90% of all base acres in the United States will experience an increase in the PLC price trigger in the coming years without Congress needing to do anything more than extend those provisions. So, what justifies the demand for higher reference prices if 90% of all base acres will see an increase and the reason the rest won’t is because the SRP (statutory reference price) is so high already?”

The escalation provision in the 2018 Farm Bill allows for reference prices, which determine subsidy payments, to increase by up to 15% if there is an extended period of high market prices.

Key points in the article:

- This escalation could lead to significant increases in reference prices, which could add billions of dollars to the cost of crop supports.

- The effective reference price for corn could reach a maximum of $4.26 per bushel in three of the next five marketing years, while soybeans could hit a maximum of $9.66 per bushel in marketing years 2025, 2026, and 2027. Wheat's effective reference price could peak at $6.01 per bushel in marketing year 2027.

- These increases would be substantial compared to the statutory reference prices, which currently stand at $3.70 per bushel for corn, $8.40 per bushel for soybeans, and $5.50 per bushel for wheat.

- Cotton, rice, and peanuts would not benefit from this reference price escalator, but other crops like oats would see increases.

- The articles notes that the decision on how to fund these increases is crucial, especially as it could impact USDA land stewardship programs.

Comments: Nearly all farm groups are asking for increased reference prices. FarmDoc’s opposition seems out of place. FarmDoc points to an expected increase already expected due to an escalator clause in the 2018 Farm Bill that they didn’t like at the time. Congress passed it anyway. The increase FarmDoc mentions is due to higher crop prices of the crops subject to the increase. But the trouble with this is that what goes up must come down and the escalator cannot prevent that. Moreover, not all crops enjoyed the higher prices, so the escalator won’t help them. This is the reason farm groups are asking for an increase.

|

CHINA UPDATE |

— Second Fukushima wastewater release draws muted response in China, South Korea, and Hong Kong. Japan's second release of treated wastewater from the Fukushima Daiichi nuclear plant garnered a relatively muted response in China, South Korea, and Hong Kong compared to the first discharge.

In Hong Kong, a pro-China group staged a smaller protest compared to the first release, accusing Japan of endangering global food safety.

China's state broadcaster, China Central Television, reported the release but did not provide live coverage on its mobile app as it did previously. China's Foreign Ministry expressed opposition to Japan's move, urging Tokyo to engage in sincere communication with neighboring countries and handle the nuclear-contaminated water responsibly.

South Korea is monitoring the situation and will ensure that public health and safety are not compromised.

Despite the calmer response, mainland China and Hong Kong are maintaining their bans on Japanese seafood, imposed in response to the first wastewater release. Hong Kong's environment secretary stated that the seafood ban would continue if Japan continues to release nuclear-contaminated water. Mainland China has also upheld its blanket ban on Japanese seafood, despite Japan's assurances of safety.

|

TRADE POLICY |

— WTO slashes 2023 global trade growth forecast. The World Trade Organization (WTO) halved its growth forecast for global goods trade this year, saying persistent inflation, higher interest rates, a strained Chinese property market and the war in Ukraine had cast a shadow over its outlook. WTO projected global merchandise trade volumes would increase by just 0.8% this year, compared with its April estimate of 1.7%. WTO said the trade slowdown was broad-based, involving a larger number of countries and goods, though particularly iron and steel, office and telecoms equipment, textiles and clothing.

For 2024, it said goods trade growth would pick up to 3.3%, up a tick from its April estimate of 3.2%.

— European Union and U.S. leaders are negotiating an interim deal on steel and aluminum trade that would avert the reimposition of Trump-era tariffs on billions of dollars of transatlantic commerce. They want to announce a provisional accord at an Oct. 20 summit.

|

ENERGY & CLIMATE CHANGE |

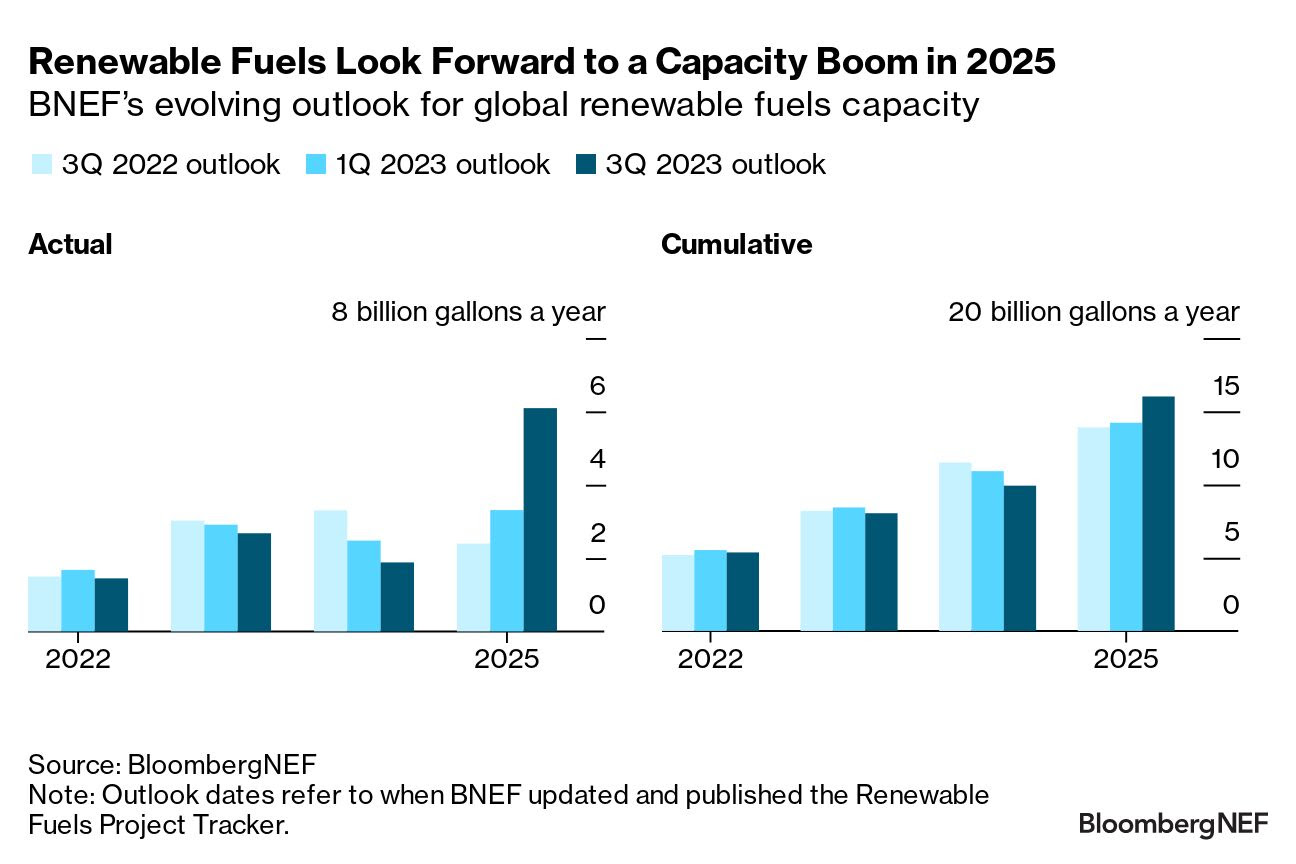

— Global renewable fuels capacity set to triple to 17.5 billion gallons by 2025. According to BloombergNEF, global renewable fuels capacity is projected to surge to a cumulative 17.5 billion gallons by 2025, marking a significant increase from the 2022 figure, which was less than one-third of this capacity. The growth in annual additions to renewable fuel capacity has been consistent, but several projects initially planned for deployment in the current and upcoming years have been delayed or put on hold as developers seek greater policy certainty in key markets. Consequently, 2025 is poised to be a pivotal year, with an estimated 6.1 billion gallons of new capacity set to come online.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Highly pathogenic avian influenza (HPAI) confirmed in South Dakota commercial turkey flock. USDA’s Animal and Plant Health Inspection Service (APHIS) confirmed the presence of highly pathogenic avian influenza (HPAI) in a commercial turkey flock located in Jerauld County, South Dakota. This outbreak has affected a total of 47,300 birds. Notably, this is the first instance of HPAI confirmed in a commercial poultry operation in the United States since April 19 when similar cases were identified in commercial turkey meat bird flocks in Dickey County, North Dakota, and Beadle County, South Dakota. Those affected locations were subsequently released from control areas in May and June.

Of note: Up until this recent confirmation in South Dakota, HPAI cases had primarily been detected in non-poultry operations or live bird markets. The surge in confirmed HPAI cases occurred late last fall and during the winter, impacting both commercial turkey operations and egg layer flocks. As a result, there will be heightened vigilance to monitor for potential additional cases in the coming days and weeks.

— Global food prices remain steady in September despite sugar price surge. In September, global food prices showed minimal change, with the Food Price Index compiled by the U.N. Food and Agriculture Organization (FAO) registering at 121.5, just slightly down from August's upwardly revised figure of 121.6 in August, leaving it 10.7% under year ago and 24.0% below the March 2022 record. Despite this stability, food prices remained 10.7% lower than the same period last year and 24.0% below the record high observed in March 2022.

The marginal increase was primarily driven by a substantial rise in sugar prices and higher corn prices worldwide. Corn prices saw a notable 7% uptick after seven consecutive months of decline, attributed to increased demand for Brazilian corn, sluggish farmer sales in Argentina, and elevated US barge freight rates due to low water levels on the Mississippi River.

Sugar prices surged by 9.8% from August, marking the second consecutive monthly increase and reaching the highest levels seen since November 2010. This increase in sugar prices raised concerns about tighter global supplies in the upcoming 2023/24 season.

However, these price hikes were partially offset by declining prices in vegetable oils, dairy, and meat. Vegetable oil prices fell by 3.9%, marking the second consecutive monthly decrease as international prices continued to ease due to higher seasonal production.

Bottom line: While the FAO index for 2022 stood at 143.7 and 125.7 in 2021, indicating some alleviation of pressure on importing countries, it also signifies that food prices, overall, remain elevated compared to previous years.

Of note: Domestic food price inflation remains high, with people in Venezuela, Lebanon, Argentina, Turkey and Egypt particularly hard-hit, according to the World Bank. In real terms, food price inflation exceeded overall inflation in 79% of the 165 countries where data are available. The most recently available monthly data show rates of increase above 5% in:

- 53% of low-income economies (vs. 63% in prior reading)

- 86% of lower-middle-income economies (vs. 80% prior)

- 64% of upper-middle-income economies (vs. 67% prior)

- 70% of high-income economies (vs. 79% prior)

— Vilsack heads to Iowa to talk about independent meatpacking capacity. As part of the Biden administration’s “investing in America” tour, USDA Secretary Tom Vilsack will visit Iowa to discuss the expansion of independent meatpacking capacity and Virginia to talk about healthy school food. Link for details.

|

POLITICS & ELECTIONS |

— Wasserman’s five takeaways on McCarthy’s ouster. David Wasserman of the Cook Political Report with Amy Walter says the recent ouster of Rep. Kevin McCarthy (R-Calif.) from the House Speakership has left the Republican Party in a state of turmoil, with significant implications for the 2024 battle for control of the House. He notes this development marks a departure from the historical dynamics of party discipline, with Democrats now displaying remarkable unity while Republicans grapple with internal divisions.

Wasserman’s five key takeaways:

- Impact on McCarthy's Fundraising Apparatus: McCarthy's removal not only sidelines the largest fundraising machine in House GOP leadership history but also raises questions about his political future. Instead of courting major donors and recruiting top-tier candidates, McCarthy must now decide whether to run for re-election in California (Dec. 8 filing deadline).

- Continued Chaos on the Republican Side: Despite McCarthy's exit, the Republican Party still faces internal divisions. It is uncertain whether any candidate can garner enough support to secure the speakership and satisfy the demands of both the Freedom Caucus and moderate members.

- Democrats' Advantage: The GOP's internal strife plays into the hands of Democrats, who can capitalize on the perception that congressional Republicans are unable to govern effectively. Vulnerable Republicans must convince voters they are not responsible for any potential shutdown or dysfunction.

- No Realistic Prospects for Democratic Assistance: Unlike the past, it is unlikely that Democrats would collaborate with a Republican speaker to pass crucial legislation. McCarthy's previous objections to certifying the 2020 election results and his ties to Trump made it impossible to establish goodwill with centrist Democrats.

- Potential for More GOP Retirements: The uncertainty and upheaval within the Republican Party could prompt more GOP members, especially those in competitive districts, to consider retiring from Congress. This would complicate the party's path to a more functional majority in 2024.

- GOP's Midterm Own-Goals: McCarthy's role in recruiting diverse and appealing candidates was instrumental in securing Republican victories in 2020 and 2022. However, weak MAGA-style candidates who won primaries in some districts cost the GOP otherwise winnable seats, contributing to the turmoil and instability in the party.

Bottom line: The fallout from McCarthy's ouster has created a challenging landscape for Republicans, with significant implications for the upcoming midterm elections in 2024.

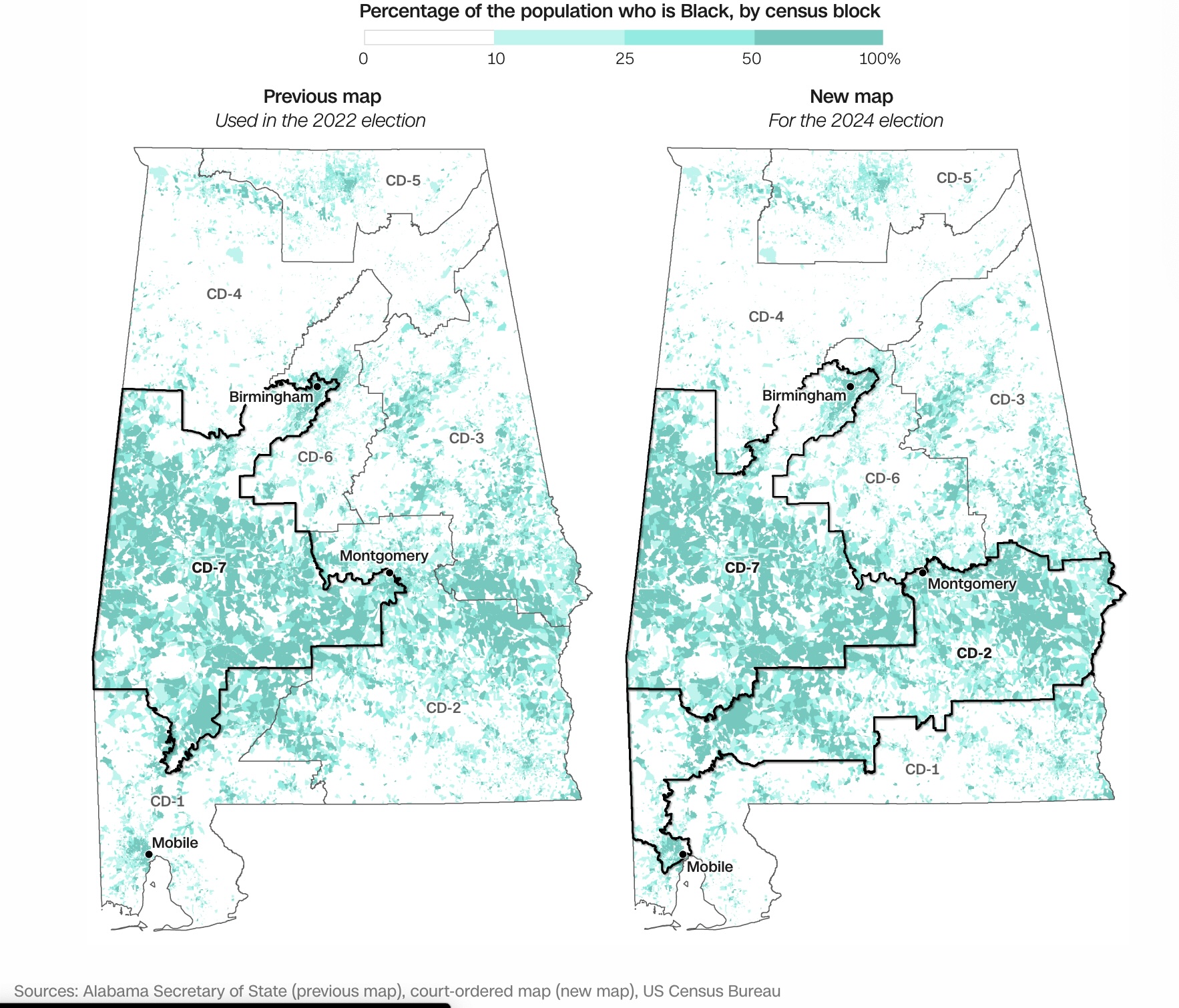

— Democrats will be favored to win a new heavily Black district and two Alabama Republicans could end up running against each other under the redistricting plan adopted Thursday by a panel of federal judges. The new lines will go into effect for the 2024 election and would link Mobile to Montgomery with a revised 2nd District. Republican state officials may appeal the order to the Supreme Court, where the case has been twice already, including last month. The Supreme Court earlier this year upheld the judges’ initial finding that the map violated the Voting Rights Act (VRA).

The new map alters the 1st and 2nd districts, currently represented by GOP Reps. Jerry Carl and Barry Moore respectively. The two could face off against each other in the newly drawn 1st District.

Datapoints noted by Punchbowl News: “President Joe Biden won the newly configured 2nd district by 12 points in 2020. Yet in the recent 2022 midterms, Alabama GOP Gov. Kay Ivey won the seat by roughly two points and Sen. Katie Britt (R-Ala.) lost the district by under a point.

Of note: A similar VRA suit against Louisiana will go before a panel of judges on the U.S. Court of Appeals for the 5th Circuit on Friday.

— Cornel West opts for independent presidential bid over Green Party Run, easing concerns for Biden. Academic and activist Cornel West has decided against a presidential run on the Green Party ticket and has chosen to pursue an independent bid instead, the Wall Street Journal reports (link). This decision has implications for his ballot access and could potentially reduce concerns about West playing a spoiler role in the 2024 presidential campaign, which could have impacted President Joe Biden's chances of re-election.

|

CONGRESS |

— House Republican calls for rule change after McCarthy ouster: Demands for a higher threshold to remove the speaker. In the aftermath of Rep. Kevin McCarthy's (R-Calif.) removal from the House Speakership, several Republican lawmakers are calling for a rule change to prevent such ousters in the future. They argue that a higher threshold should be established to ensure greater stability within the party and avoid leadership upheavals.

Rep. Garret Graves (R-La.), a close ally of McCarthy, asserts that any Republican aspiring to become the next speaker should push for a rule change to prevent similar situations. The aim is to avoid allowing such internal challenges to persist.

Reverting to Pelosi-era rules. Many Republicans propose returning to the rules used during Nancy Pelosi's tenure as speaker, where a majority of one party had to endorse a motion to call a vote for unseating the speaker. This would create a higher threshold for removal.

Suggested threshold: Rep. Darrell Issa (R-Calif.) suggests implementing a threshold of 100 members to trigger a vote to remove the speaker. He emphasizes the need to prevent unilateral decisions and ensure broader support within the party.

Support from Main Street Caucus. The center-right Main Street Caucus and other moderate Republicans support altering the rule to prevent swift speaker removals.

Rep. Carlos Gimenez (R-Fla.) called the vote against McCarthy “despicable” and said he would not support any candidate until there’s a “commitment” to change the rule. “No one can govern effectively while being threatened by fringe hostage takers,” Gimenez posted on X.

Rep. Lauren Boebert (R-Colo.), a member of the far-right Freedom Caucus, expresses willingness to forgo the motion to vacate if Rep. Jim Jordan (R-Ohio) were elected speaker, illustrating the potential for unconventional solutions to address internal party disputes.

Bottom line: Calls for a rule change underscore the ongoing debate within the Republican Party about how to maintain leadership stability and unity in the face of internal divisions. The next speaker will be stronger than McCarthy, no matter who it is.

— Congressional stalemate: Key areas in jeopardy due to lack of House speaker. Work in Congress has come to a standstill as the search for a new House speaker among Republicans delays critical legislative matters, affecting Ukraine aid and crucial business legislation. Here are the key areas impacted (link for more details via Bloomberg item):

- Ukraine Aid: The White House's request for funding to support Ukraine's defense against Russia's invasion faces uncertainty due to hardline Republican opposition. The next House speaker's stance on this issue remains unclear, further complicating matters, but a growing number of House Republicans are waiting on detailed answers to where funding already given Ukraine has gone.

- Government Funding: Kevin McCarthy's ouster, following his support for short-term funding to keep the government open, creates uncertainty regarding future funding efforts for fiscal year (FY) 2024. Analysts warn of an increased risk of a government shutdown when current funding expires on Nov. 17.

- Defense Legislation: The National Defense Authorization Act, a critical defense policy bill, may be delayed due to House gridlock. This bill is essential as it authorizes pay increases and compensation for troops. Delays in the House could impact this important legislation.

- Chip Plant Construction: Legislation within the defense bill aims to expedite planning and construction of new semiconductor plants in the U.S. Delaying this measure could hinder vital projects, including those by companies like Taiwan Semiconductor Manufacturing Co. and Intel Corp.

- Marijuana Banking: Legislation offering federal protections to banks serving cannabis businesses could face challenges. The bill's fate may depend on the stance of the next House speaker, as it has significant implications for the financial services industry.

- Business Tax Breaks: Extending tax breaks, such as allowing companies to deduct research and development costs in one year, is a priority for business lobbying groups. However, negotiations could be impacted by the leadership vacuum and political priorities.

- Farm Bill: A new farm bill is at risk of delays due to political clashes. While Congress typically extends the existing subsidy system in such cases, it could affect farmers and food assistance programs.

|

OTHER ITEMS OF NOTE |

— Cotton AWP edges higher. The Adjusted World Price (AWP) for cotton rose to 72.36 cents per pound, effective today (Oct. 6), up from 72.27 cents per pound the prior week and the third week it has moved by only a small amount. Meanwhile, USDA announced that Special Impot Quota #25 would be established Oct. 12 for 39,634 bales of upland cotton, applying to supplies purchased no later than Jan. 9, 2024, and entered into the U.S. no later than April 8.

— Moody's downgrades Egypt's credit rating due to inflation and currency challenges, on par with Nigeria and Bolivia. Moody's, a prominent ratings agency, has downgraded Egypt's credit rating to one of its lowest levels, citing the nation's soaring inflation and ongoing foreign-currency shortages. Egypt's sovereign debt rating now stands on par with that of Nigeria and Bolivia. Egypt is currently striving to fulfill the conditions of a $3 billion bailout package from the International Monetary Fund (IMF). The IMF is advocating for another currency devaluation and is pushing for Egypt to adopt a more adaptable exchange-rate system.

— Calendar of events today include:

Friday, Oct. 6:

• Federal Reserve. Fed Governor Christopher Waller speaks on Payments at a Bookings Institution event.

• Trump indictments. The Heritage Foundation holds a discussion on "The Trump Indictments: Is the Justice System Rigged?"

• China’s tactics. The Federalist Society for Law and Public Policy Studies holds a virtual discussion on "The Economic Power Play: Examining China's Coercive Tactics."

• Economic sustainability. Final day of the US Chamber of Commerce (USCC) 2023 Sustainability and Circular Economy Summit.

• Economic reports. Employment | Consumer Credit

• Energy reports. BTC loading program (November) | ICE weekly Commitments of Traders report for Brent, gasoil | Baker-Hughes Rig Count | CFTC Commitments of Traders | Shell 3Q update | Holiday: China.

• USDA reports. ERS: Livestock and Meat International Trade Data NASS: Peanut Prices

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |