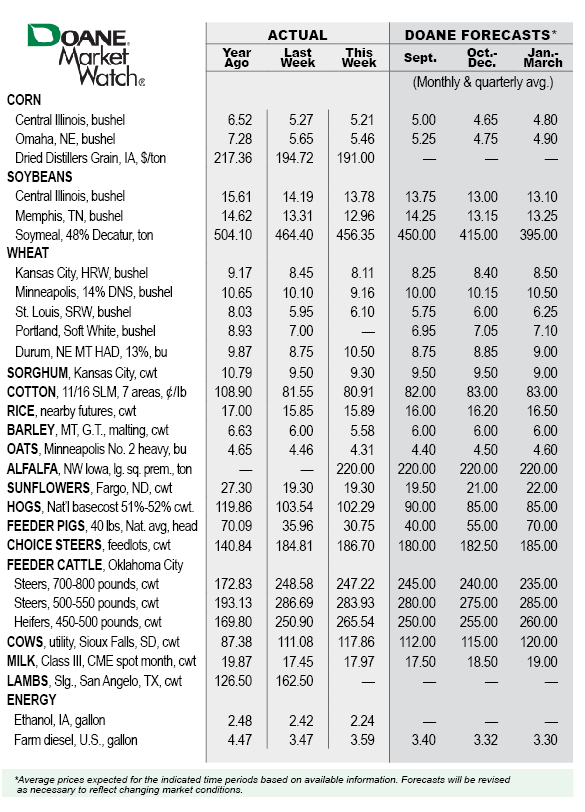

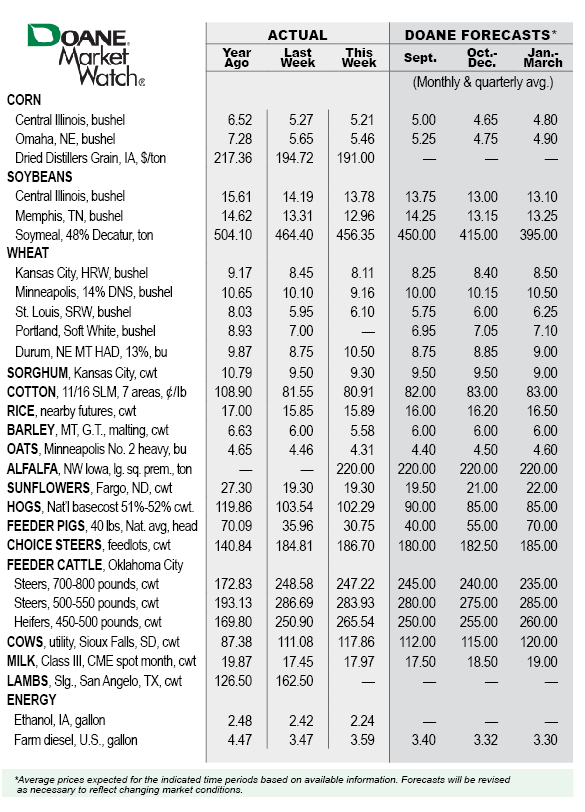

Market Watch | August 10, 2023

Our Market Watch table features monthly and quarterly price outlooks along with weekly prices for a variety of ag markets.

Our Market Watch table features monthly and quarterly price outlooks along with weekly prices for a variety of ag markets.