House GOP Leaders Rallying Members to Streamline Legislative Progression of Farm Bill

Dollar falls to lowest level since April 2022 | China’s trade woes continue | Calif.’s 'Skittles' bill

|

In Today’s Digital Newspaper |

Abbreviated report today.

— USDA daily export sale: 315,704 metric tons of soybeans to Mexico during the 2023-2024 marketing year.

— Equities: Asian and European stock markets were mixed to firmer in overnight trading. U.S. stock indexes are pointed toward firmer openings. The S&P 500 and the Nasdaq both closed Wednesday at their highest levels since April 2022. The Dow also finished the day higher, as the consumer price index for June showed cooler-than-expected inflation data for June, indicating that the economy could be heading for a soft landing, after all. In Asia, Japan +1.5%. Hong Kong +2.6%. China +1.3%. India +0.3%. In Europe, at midday, London +0.4%. Paris +0.8%. Frankfurt +0.6%.

— Grain markets: Corrective buying overnight. Soybeans led a corrective rebound in the grain and soy markets overnight. As of 7:30 a.m. ET, corn futures were trading 5 to 6 cents higher, soybeans were 20-plus cents higher, the winter wheat markets were 1 to 2 cents higher and spring wheat was mostly 6 cents higher. Front-month crude oil futures were near unchanged, and the U.S. dollar index was down more than 250 points this morning.

— Analyst and grain trader Richard Crow on the corn market: “The S/D report for corn had USDA adjusting demand lower by reducing exports in the old crop and some for ethanol. Feed and Residual was increased due to the stocks report. Old crop ending stocks were lowered 50 million bushels. USDA had to adjust for the [additional] acres in the new crop. The difference between USDA and private trade was in the yield. USDA lowered yield 4 b/a, to 177, whereas the private trade was using 173 to 175. For the new crop usage, USDA left everything unchanged. The feed and residual should have been increased; the exports could have been lowered. The corn market is a function of the corn yield going forward. As shown in the s/d on Wednesday, a 177 yield is a bearish production number. For corn to hold a $5 CZ price, the corn yield may need to be in the 173 bu/ac area. If the yield should be lower, the corn values are undervalued. The adjustments are going to come from supply, demand has room for adjustment if Brazil’s production stays elevated. The “wild card” for corn may be Brazil’s production going forward. Corn under $5 may not allow margin enough for their operations. The corn market will be watching crop conditions each Monday. The conditions have a higher correlation to yield once the corn crop is pollinated.”

— Ag trade: South Korea purchased 68,000 MT of corn expected to be sourced from South America. Japan purchased 123,770 MT of wheat in its weekly tender, including 30,164 MT of U.S., 62,806 MT of Canadian and 30,800 MT of Australian.

— West Texas Intermediate (WTI) crude futures reached above $76 per barrel on Thursday, marking their highest point in nearly two months. This rise, the third consecutive one, derives from cooler-than-anticipated U.S. inflation data, stoking expectations that the Federal Reserve could soon halt its cycle of raising interest rates. Simultaneously, China's crude oil imports have surged to a three-year high, indicating strong demand even amidst signs of a broader economic downturn.

The International Energy Agency (IEA), predicting a record-breaking year for global oil demand, suggests this robust demand will withstand economic challenges and potential rate rises, although growth is expected to slow slightly.

OPEC, too, remains positive about global oil demand. It has raised its growth forecast for 2023, anticipating a minor slow-down in 2024 due to strong fuel consumption in China and India. The organization foresees an increase in oil demand to 2.25 million barrels per day (bpd) in 2024, up from 2.44 million bpd the previous year. Interestingly, OPEC increased its oil production in June by 91,000 bpd to 28.19 million bpd, with Iran and Iraq driving most of this growth, despite ongoing output cuts.

— Delta Air Lines reported record-breaking quarterly revenue and per-share earnings. These strong results seem to be driven by lower fuel prices, high demand for premium seats, and robust international travel. The airline has also raised its full-year earnings guidance. Delta's positive Q2 earnings announcement, the first among U.S. airlines this quarter, should set a hopeful tone for the rest of the industry amidst booming travel demand. Delta's Q3 outlook also exceeds Wall Street's predictions, with CEO Ed Bastian projecting the current trends to persist throughout the year.

— There will be earnings reports from several major financial institutions on Friday, including BlackRock, JPMorgan Chase, Wells Fargo, and Citigroup. Observers want insight into how these banks are adapting and progressing following the destabilizing collapse of Silicon Valley Bank in March. They will also be examining preparations for upcoming changes in the banking landscape, including stricter capital requirements and increased regulatory oversight. Additionally, the focus will be on the banks' exposure to commercial real estate, particularly in light of recent shifts brought on by the pandemic. With remote work becoming more prevalent, the valuation of office buildings is predicted to decrease notably. McKinsey, a highly respected consulting firm, estimates a potential loss in value of up to $800 billion in this sector because of these changes.

— Farm bill update. Rep. Garret Graves (R-La.), a significant ally of House Speaker Kevin McCarthy (R-Calif.), revealed that House GOP leaders are rallying their party members to streamline the legislative progression of the upcoming farm bill. During an interview with Politico, Graves stated that efforts are being made to ensure input from varying partisan factions within their caucus, ranging from the Freedom Caucus to Main Street to Problem Solvers. The aim of these discussions is to preempt and address potential hurdles before the bill reaches the floor for consideration. Graves confirmed that discussions around the legislation have already been initiated, indicating advanced planning to ensure the bill's smooth passage when it reaches the House floor for debate and voting.

— USDA Secretary Tom Vilsack said tackling climate change can boost farm revenue through the adoption of climate-smart practices. During a recent event, he highlighted the potential of sustainable aviation fuel which could consequently double the biofuel industry size. Vilsack expressed confidence in the agriculture industry reaching net-zero emissions before many other major industries.

Under USDA, the climate-smart initiative has expanded to $3.1 billion, having received around 1,000 project applications. Vilsack commented this isn't solely about climate change, but also farm income and safeguarding opportunities for smaller producers.

But there has been political resistance. Vilsack's use of a $30-billion CCC fund (for crop and conservation payments) to launch the Partnerships for Climate-Smart Commodities initiative has drawn opposition. The Republican-controlled House Appropriations Committee voted to limit Vilsack's access to this fund, with provisions included in the annual USDA/FDA spending bill, which may face a floor vote soon. In addition, three Republican senators proposed a bill to restrict fund withdrawals without Congress's specific authorization.

As noted Wednesday, the Biden administration will allocate $300 million to enhance the accuracy of measuring and reporting greenhouse gas emissions and carbon sequestration associated with climate-smart agriculture and forestry. This, according to Vilsack, will serve as a critical link between farming practices and markets willing to pay for demonstrated greenhouse gas and carbon reductions.

— California's 'Skittles' bill, which seeks to ban certain food additives, has made progress in the state's legislature. The bill was approved with a 5-1 vote by the Senate Committee on Environmental Quality. The legislation, presented in February, calls for a state-wide ban on processed foods and beverages containing five specific substances, including brominated vegetable oil, potassium bromate, propylparaben, red no. 3, and titanium dioxide. This ban, originally set to take effect in 2025, but now postponed to 2027, holds implications not only for candy manufacturers but also for a wide range of products such as sauces, soups, and baked goods. Despite progressing to another Senate committee for voting, the bill faces heavy opposition from the food and drink industry.

— Saudi Arabia is projected to rank below Russia as the biggest oil producer within the OPEC+ alliance, according to the International Energy Agency (IEA). The kingdom has been significantly reducing its oil output in recent months to revive low oil prices that have negatively impacted its revenues. This effort, however, is overridden by robust production from non-OPEC+ producers like the U.S.

A unilateral reduction of 1 million barrels per day by Saudi Arabia is slated to commence this month. Concurrently, there is a slowdown in Russia's production as well, albeit at a slower rate. As a result, Saudi's oil production is anticipated to drop to a two-year low of nine million barrels per day, positioning it as the second-largest producer in the OPEC+ alliance for the first time since early 2022. This cutback is seen as a risky move by Saudi Arabia and its Energy Minister Abdulaziz bin Salman, aiming to bolster the kingdom's oil revenue by sacrificing its market share. On average, an oil price of about $80 per barrel is required for Saudi Arabia to balance its state budget and finance extensive infrastructure projects.

Russia has also pledged to reduce oil output, but the process has been slow. The IEA reports a slide in Russia's oil exports by 600,000 barrels per day in June, attaining its lowest since March 2021. Nevertheless, this could be a strategy by Russia to maintain its domestic consumption levels while lowering exports.

Upshot: Despite these moves by Saudi Arabia, previous output reductions agreed upon by the wider OPEC+ group in April, amounting to about 1.6 million barrels per day, have seemingly failed to significantly influence the falling oil prices. This was in addition to the 2 million barrels per day reduction decided in October 2022. As for oil markets, they won’t tighten as sharply as previously thought in the months ahead as demand growth slows, the IEA said. The agency cut its forecast for 2023 consumption, citing faltering economies. But the rest of the year will still be marked by supply shortages.

— In June 2023, China's exports experienced a significant downturn of 12.4% year on year, surpassing the market prediction of a 9.5% fall. This slump, deeper than May's 7.5% drop, represents the largest decline since February 2020, as elevated inflation in primary markets and geopolitical uncertainties curtailed external demand.

Imports also fell for the fourth consecutive month, recording a 6.8% drop as a result of weakening domestic demand.

“We see little respite for China’s exports in the second half, as the U.S. is likely to enter a mild recession, while the Eurozone economy probably will remain weak,” Duncan Wrigley, chief China economist at Pantheon Macroeconomics, wrote in a note after the data release.

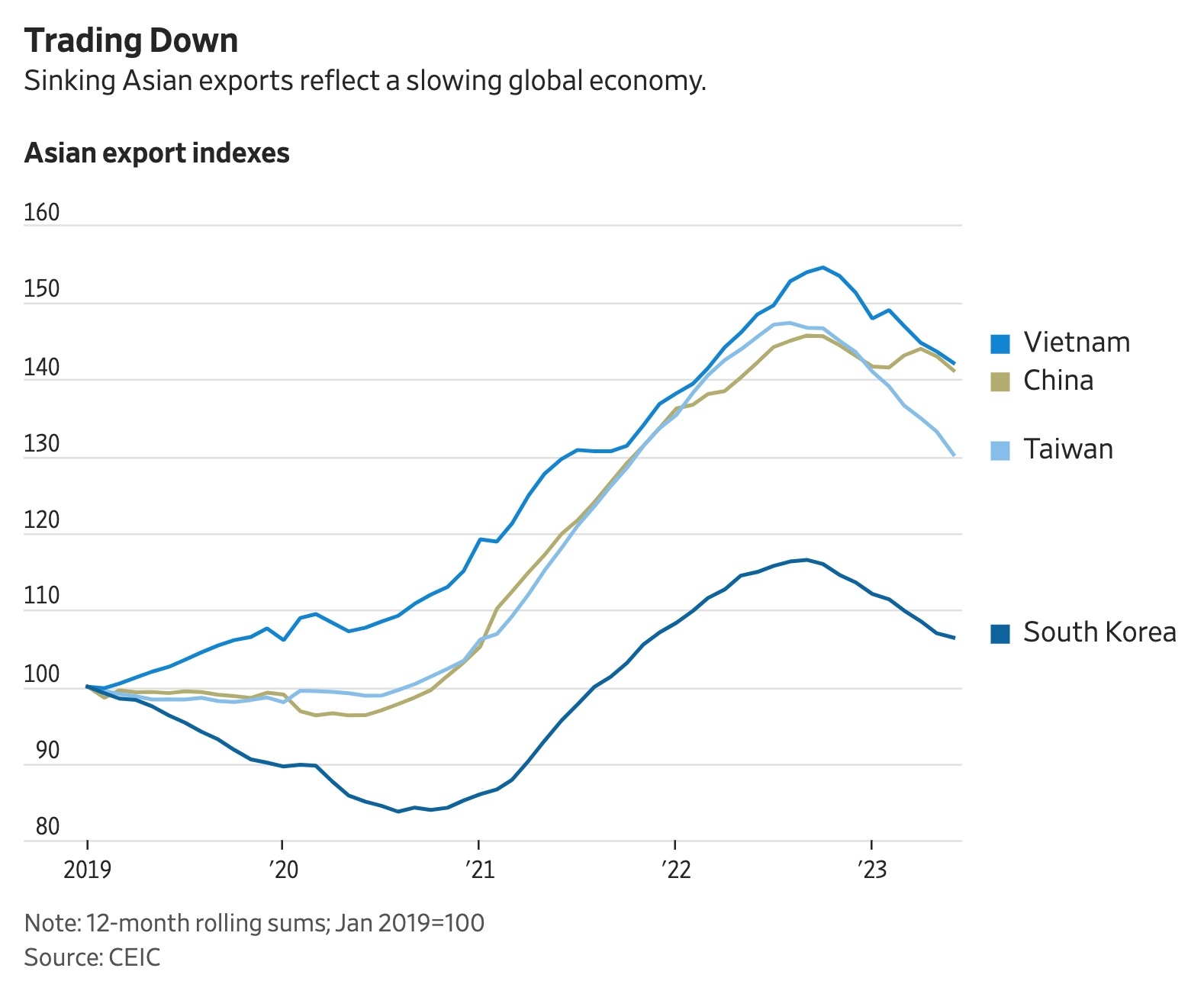

Of note: China isn’t the only Asian export powerhouse reporting sinking overseas sales. Exports from Taiwan fell 23% in June compared with a year earlier, while Vietnamese exports were down 11%. Exports from South Korea were down 6%, according to official figures compiled by data provider CEIC.

— June Chinese soybean imports up sharply from year-ago. China imported 10.27 MMT of soybeans during June. While that was down from the record of 12.02 MMT in May it was up 24.5% from the 8.25 MMT imported in June 2022. Through the first half of 2023, China imported 52.58 MMT of soybeans, up 13.6% from the same period last year. Chinese soybean imports are expected to be between 10 MMT and 11 MMT this month, but demand is likely to slow after that amid weakened feed demand from the hog industry.

— Chinese meat imports rise. China imported 670,000 MT of meat in June, up 12.1% from May and 11.1% more than last year. China doesn’t break down the preliminary meat trade data by category, but the increase was driven by pork imports, which have been on the rise since late 2022. During the first half of 2023, China imported 3.81 MMT of meat, up 10.2% from the same period last year.

— U.S. inflation continues to decline, with the top-line consumer price index (CPI) falling to 3% year-over-year in the previous month, the lowest since March 2021, down from 4% in May. This decrease is mainly due to dropping energy and slowing food prices. Meanwhile, service prices and the core index (which excludes food and energy) remain high, with the core CPI descending to 4.8%.

Shelter costs, including rent, have been the primary contributors to price increases. Despite some areas reporting a decrease in rent prices, high housing costs and rising interest rates continue to make homes less affordable and push rent prices up. Car insurance and healthcare costs are also rising, as providers and insurers pass on increased costs to consumers.

On the bright side, real wages have started to grow, with real average hourly earnings increasing 0.2% last month and up by 1.2% over the past year. However, they remain 3.2% lower than in December 2020, contributing to public dissatisfaction with the economic situation despite low unemployment.

With real interest rates positive again and the money supply reduced by 4% over the last year, there are signs of monetary tightening. However, analysts say that by historical standards, these conditions are not exceptionally strict. The market is calling for cautious action from the Fed, guided by its mission to combat inflation, ideally taking advantage of the current stable labor market.

Market impact: Traders are betting the end of the tightening cycle is near with the odds of a September hike falling. The Fed is still expected to hike in July.

Of note: Harvard University economist Jason Furman looks at seven different underlying inflation indexes over three-, six- and 12-month periods, then adjusts them to mimic the price index of personal-consumption expenditures, the basis for the Fed’s 2% target. The median of all those measures had fallen to 2.8% in June from 4% in April. “I’m nervous about the euphoria” around the June CPI, Furman said, according to the WSJ. That said, he was “pleasantly surprised” at the progress on underlying inflation. He thinks that without a rise in unemployment, inflation will end the year around 3.5%; he expected 4% several months ago. He thinks that is still too high for the Fed: “A full-on soft landing would still require a decent amount of luck.”

— The U.S. dollar experienced a significant drop, reaching a 15-month low following the recent Consumer Price Index (CPI) data indicating that U.S. inflation has dropped to its lowest point in two years. Despite early year projections suggesting the opposite, the dollar seems to be on shaky ground as US.S. interest rates approach a peak. The aggressive tightening stance of the Federal Reserve is reportedly affecting the world's top economy.

Top financial managers are forecasting that the dollar's downturn is likely to persist, considering the current conditions. Consequently, investors are strategically placing their bets to assess which foreign currencies might benefit from the dollar's decline. Jim Leaviss, Chief Investment Officer of Public Fixed Income at M&G Investments, observed that numerous currency opportunities are present at this moment. He pointed out that several emerging market currencies appear to be undervalued, hence offering potentially profitable investment opportunities.

— EPA asks Eighth Circuit to halt WOTUS action. The Environmental Protection Agency (EPA) requested the Eighth Circuit to halt its appeal concerning an injunction that is currently blocking implementation of a new wetlands protection rule in 24 states. This comes because of the agency's decision to revise its current rule, temporarily suspending several ongoing legal challenges directed at it. The EPA is aiming to formulate a new regulation by September 1, in accordance with a Supreme Court ruling from May that significantly reduced the scope of federal regulators' authority over wetland regulation.

— The Senate Banking Committee approved three of President Joe Biden's nominees for the Federal Reserve, advancing them to the full Senate for further consideration. Among the nominees is Philip Jefferson, who is slated to be the next vice chair and received unanimous support from the committee during the Wednesday vote. The other two nominees supported by the committee to be sent for Senate consideration are Lisa Cook, who has been nominated to serve a full term as a member of the Fed's board of governors, and Adriana Kugler, another pick from President Biden for the Fed's board.

— Russia pitches use of local currencies in appeal to ASEAN. Russian Foreign Minister Sergey Lavrov on Thursday appealed to Southeast Asian countries to work together to revive flagging trade with his country, using a forum to pitch the use of national currencies, rather than dollars, to evade Western sanctions. The sanctions have led to a 4.4% drop in trade between Russia and ASEAN member states, the Russian foreign ministry said in a statement.

— Domino's Pizza announced it is partnering with Uber Technologies, signaling a shift away from its longstanding position of not working with digital marketplaces. The pizza chain plans to join the Uber Eats and Postmates platforms in several markets, including the U.S., Canada, and the U.K. According to Domino's CEO, Russell Weiner, the company and its operators intend to secure a billion dollars in new sales as a result of the Uber deal. Despite the collaboration, Domino's will continue to handle its own pizza deliveries. The move indicates changing consumer behaviors and the increasingly blurred boundaries between major restaurant chains and third-party delivery apps like Uber Eats and DoorDash, especially given their growth since the onset of the pandemic. The broad reach and logistical capabilities of these apps, including their ability to source delivery drivers, highlight their potential for gaining a larger share of the market.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |