U.S./China Trade/Policy Frictions Mount, But Yellen on Way to Beijing

Negotiations deadlock between Teamsters union and UPS

|

In Today’s Digital Newspaper |

A new U.S./China trade war? Beijing on Monday announced export controls on gallium and germanium—two obscure minerals key to the production of semiconductors, electric vehicles and aerospace manufacturing. And now the Biden administration is set to restrict Chinese companies’ access to U.S. cloud-computing services that use AI chips. Gallium and germanium both feature on the U.S. government’s list of minerals “critical to the U.S. economy and national security.” Chinese state-run newspaper the Global Times said it shows “China will not be passively squeezed out of the global semiconductor supply chain.” A former Chinese vice commerce minister described it as a “well-thought-out heavy punch.”

China’s President Xi Jinping urged countries to avoid decoupling and cutting international supply chains, just a day after announcing the export controls. Treasury Secretary Janet Yellen’s visit to China Thursday is another sign that both sides want progress. Experts don’t expect big breakthroughs, especially as the trade fight shows little sign of abating. But China’s stuttering economy and Beijing’s focus on elections in the U.S. and Taiwan next year are driving a calculation by Chinese policymakers that it is still worth engaging, says the New York Times.

The National Audit Office of China's 2022 audit report reveals major issues in the country's rural development programs.

A federal judge has restricted some Biden administration officials from communicating with social media companies. The judge, an appointee of former President Donald Trump, handed down the win to GOP states in a lawsuit accusing the government of going too far in efforts to combat Covid-19 disinformation. Details below.

U.S. equities have performed solidly this year. The first half was the Nasdaq’s best in 40 years, and the S&P 500′s strongest since 2019. The Dow was positive, too, although the blue-chip index’s gains lagged the others. After a strong first half, the S&P 500 is historically more likely to rise in the second half and tends to notch bigger advances.

U.S. rivals are challenging the dollar. Stablecoins could help defend it. More in Markets section.

Automotive sales in the U.S. have surpassed bleak predictions with an estimated rise of 12%-14% in new-vehicle sales in the first half of the year versus the same period last year.

Democrats: Biden’s electric car plan threatens rural America

Saudi Arabia and Russia's agreement to cut oil production through at least August may provide a significant opportunity for U.S. oil producers.

More than 300,000 UPS workers hurtled toward a strike after the company failed to reach an agreement with the Teamsters, threatening to plunge the U.S. supply chain into disruption. More info below.

The BC Maritime Employers Association (BCMEA), a group of port owners in Canada, has suggested that a 'course change' is required in ongoing negotiations with the International Longshore and Warehouse Union Canada (ILWU Canada).

Volodymyr Zelenskyy, Ukraine’s president, claimed Russia had placed “objects resembling explosives” on the roofs of buildings at the Zaporizhia nuclear power plant, Europe’s biggest. Russia seized control of the plant, in south-eastern Ukraine, in February 2022. Zelenskyy said he had discussed Russia’s “dangerous provocations” at Zaporizhia with Emmanuel Macron, France’s president, who agreed to “keep the situation under maximum control together.” More in Russia & Ukraine section.

Negotiations over the Black Sea Grain Initiative are underway, as U.N. officials attempt to extend the agreement past its July 18 expiration.

More than a dozen U.S. states and local jurisdictions have raised their minimum wages, bringing significant pay increases to low-wage workers across the country.

Payments for Phase 2 of the Emergency Relief Program (ERP) are nearing the $2 million mark, having reached $1.853 million so far. As of July 2, a total of 961 recipients have benefited from these payments.

USDA’s Foreign Agricultural Service (FAS) set the tariff-rate quota (TRQ) levels for fiscal year (FY) 2024. More in Trade Policy section.

Southern Ag Today takes a look at the potential price protection a producer has if they purchased crop insurance by considering the futures price as of the afternoon of June 30, 2023, relative to the Projected Crop Insurance Price released by USDA/RMA in the winter.

Thailand is preparing contingency plans to deal with a potential drought that could last years and squeeze global supplies of sugar and rice.

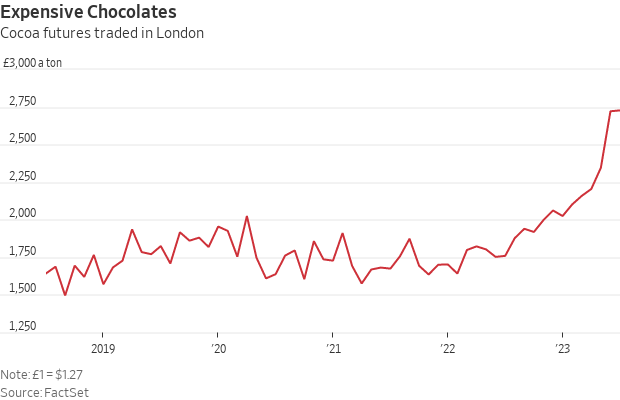

Global commodities markets are signaling bitter news for consumers. More in Food section.

A group of bipartisan Representatives have reintroduced the Farm Workforce Modernization Act. Details in Congress section.

|

MARKET FOCUS |

Equities today: Asian and European stock markets were mostly lower in overnight trading. U.S. Dow opened around 150 points lower. In Asia, Japan -0.3%. Hong Kong -1.6%. China -0.7%. India -0.1%. In Europe, at midday, London -0.5%. Paris -0.6%. Frankfurt -0.5%.\

U.S. equities Monday: The Dow and S&P recovered from initial declines to end higher while the Nasdaq traded both sides of unchanged in the shortened trading session ahead of the Tuesday U.S. holiday. The Dow rose 10.87 points, 0.03%, at 34,418.47. The Nasdaq rose 28.85 points 0.21%, at 13,816.77. The S&P 500 was up 5.21 points, 0.12%, at 4,455.59.

After a strong first half, the S&P 500 is historically more likely to rise in the second half and tends to notch bigger advances, according to a CFRA analysis. The S&P 500 finished the first half up 16%. The S&P 500 has gained an average of 4.2% during all second halves since 1945, rising 69% of the time. When the S&P 500 is coming off a first-half gain of 10% or more, the broad index on average adds 8% in the second half and moves higher 82% of the time, according to CFRA.

Agriculture markets Monday:

- Corn: December corn futures settled 1 1/4 cents lower at $4.93 1/2.

- Soy complex: November soybeans settled 10 1/2 cents higher at $13.53 3/4.

- Wheat: September SRW wheat dropped 9 1/4 cents to $6.41 3/4. September HRW wheat fell 3 1/2 cents to $7.96 1/2. September HRS wheat declined 7 3/4 cents to $8.09 1/4.

- Cotton: December cotton firmed 104 points to 81.41 cents.

- Cattle: August live cattle finished 35 cents lower at $176.825. August feeder cattle ended 32 1/2 cents higher at $247.90, despite corrective buying in the corn market for much of the day.

- Hogs: July hogs firmed $2.175 to $97.825.

Ag markets today: There was no overnight grain trade due to Tuesday’s federal holiday. Grain and livestock markets resumed trade at 8:30 a.m. CT.

Market quotes of note:

- Negotiations between the Teamsters union and UPS reached a deadlock on Wednesday. The union, representing over 340,000 UPS employees, stated that the company abandoned the discussions early in the day. The Teamsters shared that after lengthy negotiations, UPS did not present a final offer, insisting the company had nothing further to offer. The union highlighted that its members have collectively agreed to authorize a potential strike. With the current contract set to expire on July 31, no further meetings are scheduled at present. Despite the impasse, UPS remains optimistic about reaching an agreement, noting there is nearly a month left for negotiations. The company stated in a Wednesday announcement that it has not exited the negotiations and urges the union to adhere to its responsibility to continue discussions. “We have nearly a month left to negotiate,” UPS said in a statement Wednesday. “We have not walked away, and the union has a responsibility to remain at the table.”

- Drop in the Eurozone manufacturing PMI —o 43.4 in June from 44.8 in May — indicates that the downturn in manufacturing in the bloc is intensifying, Melanie Debono, senior Europe economist at Pantheon Macroeconomics says in a note. A downward revision to the German index more than offset an upward revision to France's, pulling the overall measure below the advance estimate, Debono says. Weak demand is to blame, with new orders falling at the sharpest rate since October, she says. The manufacturing input price index declined to its lowest since July 2009, which has convinced firms to cut selling prices, suggesting disinflation has further to run, she notes. But with services inflation still high and keeping the core inflation rate up, the European Central bank will still raise rates further, she adds.

- U.S./China relations. The Chinese are looking beyond the United States, and 2023. “Beijing policymakers are hedging their bets,” Rana Mitter, director of Oxford University’s China Center, told the New York Times’ DealBook. “They believe that the Biden administration is using softer language but in practice seeking to contain China. They are therefore waiting to see what happens in the key elections of 2024, and also seeking to create warmer dialogue with the EU, U.K. and other major trading states.”

In May 2023, the Eurozone saw a decrease in producer prices by 1.5% from the previous year. This surpassed market expectations of a 1.3% decline, and comes after a revised 0.9% increase recorded in April. This marks the first drop in producer prices since December 2020. One of the key factors driving this drop was a considerable decrease in energy costs, which retrenched by 13.3%, along with a 1.5% drop in the cost of intermediate goods. Without counting energy, producer price inflation also slowed down to 3.4% year-on-year in May, a decline from the 5.1% noted in April. Overall, on a monthly basis, producer prices experienced a decrease for the fifth consecutive month, falling by 1.9%.

More than a dozen U.S. states and local jurisdictions have raised their minimum wages, bringing significant pay increases to low-wage workers across the country. As of July 1, Oregon and Nevada increased their hourly minimum wages to $14.20 and $11.25 respectively. Similarly, Washington, DC raised its minimum wage to $17 per hour. The increased wage rate also applies to 15 cities and counties, most of which are located in California. In Los Angeles, for instance, the minimum wage now stands at $16.78 per hour following a 74-cent increase, while in San Francisco and Berkeley, it amounts to $18.07 after a $1.08 rise. These wage boosts are majorly tied to inflation adjustments, following similar wage increases implemented in several states earlier this year.

Putin, Xi and Modi met virtually. Top leaders from Russia, China, and India, three major powers seeking to reshape a world currently dominated by the U.S., attended a virtual meeting of the Shanghai Cooperation Organization. Each leader advanced their unique concerns amidst the backdrop of shifting alliances and regional blocs formed to counter Western influence. The annual confab — established by Russia and China in 2001 and inclusive of Pakistan and several Central Asian nations — provided no firm indications of alliance changes. However, it gave insights into how the group, designed to offset Western sway, might align and balance their differing agendas.

In terms of China and India, the escalating tension centered on border disagreements and India's role in the Quad, a U.S.-led security coalition seen by China as an effort to contain its power, was notably absent from discussions.

President Xi Jinping of China reinforced his long-standing objections against the U.S., urging an end to "hegemonism" and "power politics." Meanwhile, India's Prime Minister Narendra Modi called on the forum to denounce nations that manipulate terrorism as a policy tool— a concealed jab at Pakistan, which India charges with supporting militants in the disputed Kashmir region.

Russia's President Vladimir Putin advocated for a new "multipolar" world, showing unity with countries not allied with the West. Putin also leveraged the conference to demonstrate resilience and domestic stability, following an uprising by the Wagner mercenary group.

U.S. rivals are challenging the dollar. Stablecoins could help defend it. In a commentary item in Barron’s (link), Corey Then, former Obama administration member and current Vice President of global policy at Circle, emphasizes the growing threat to the U.S. dollar’s global dominance. The challenge is stemming from countries like Russia and China, who have been increasingly conducting their bilateral trades in yuan instead of dollars. Remarkably, it's the first year where cross-border transactions with China will be settled more in yuan than in dollars.

With a focus on reducing dollar usage, technology is noted as a pivotal factor, with more than 110 countries considering the launch of their own central bank digital currencies (CBDCs). In fact, China launched its digital yuan pilot back in 2019, now held by about 300 million people.

Despite these challenges, the leading status of the dollar isn't lost yet, Then writes, but he notes there's need for modernization to maintain this status. The U.S. dollar's infrastructural backend has been described as “aging rails,” slowing down and increasing the cost of transactions, particularly those of an international nature.

Stablecoins, however, provide a potential solution. Blockchain-backed tokens, which are pegged to the dollar and other financial instruments like U.S. Treasury bills, could make transactions faster, more cost-effective, and even programmable, according to Then.

The implications of stablecoins are multifaceted — they make it possible to transform physical dollars into their digital counterparts with ease, enabling them to operate at the speed and scale offered by the internet. This digital form of currency, because of its negligible cost of use, could increase the usability and competitive standing of the dollar compared to other forms of currency.

These arguments have not fallen on deaf ears within the U.S. government, Then observes. Treasury Secretary Janet Yellen and Federal Reserve Chairman Powell have both acknowledged the potential contributions of well-structured and properly supervised stablecoins to the payments industry. In November 2021, the President’s Working Group on Financial Markets called for legislative groundwork for payment stablecoins.

Legislation designed to protect consumers and regulate stablecoins is currently being written by the U.S. House Financial Services Committee, with a set date for votes on July 19. By doing this, Then says the U.S. hopes to avoid an incoherent regulatory environment that could encourage rogue actors to look for jurisdictions with poor oversight and weak consumer safeguards.

Message emphasized by Then: The U.S. needs to act swiftly to regulate and promote the use of payment stablecoins, or risk other global players defining the financial rules of the future. By advancing such legislation, he concludes, the U.S. stands to protect the dollar's standing as a global reserve currency, and potentially streamline its usage at a global scale through the internet.

Automotive sales in the U.S. have surpassed bleak predictions with an estimated rise of 12%-14% in new-vehicle sales in the first half of the year as compared to the same period last year. Despite concerns about interest rates and inflation, consumer behavior has been driven by pent-up demand due to the pandemic. This demand surge has maintained high average prices for vehicles — contrary to analysts' expectations. In fact, the average price paid for new vehicles rose by approximately 3%, reaching around $46,000 in June, as reported by J.D. Power.

Market perspectives:

• Outside markets: The U.S. dollar index was higher, with weakness in the yen and British pound against the greenback. The yield on the 10-year U.S. Treasury note is lower, trading around 3.84%, with a mixed tone in global government bond yields. Crude oil futures show mixed markets, with U.S. crude solidly higher around $71.25 per barrel while Brent was slightly weaker around $76.05 per barrel. Gold is higher and silver lower, with gold around $1,936 per troy ounce and silver weaker around $22.08 per troy ounce.

• The yen is undergoing a swift devaluation, nearing the ¥145 to the dollar mark, which is close to the rate that last instigated Tokyo's intervention to stabilize its currency. Comparatively, the U.S. dollar has been losing value, falling over 7% since its peak in September. This depreciating trend of the dollar combined with Japan's refusal to normalize its monetary policy, despite signs of inflation, has contributed to the yen's volatility.

• Bitcoin experienced an 84% increase from January through June, surpassing the $30,000 mark and marking its best first half since 2019. This upturn overshadows stocks, including the tech-influenced Nasdaq. Its bounce back follows a difficult bear market and a crash caused by the allegations of fraud against crypto exchange FTX in 2022, which resulted in Bitcoin reaching multiyear lows. Now, the digital asset has more than doubled, with expectations for continued growth despite regulatory scrutiny.

A Barron’s article (link) says Bitcoin's 2023 rally can in part be attributed to changes in the Federal Reserve's policy with signs indicating that inflation is slowing and that interest rates may cease increasing. However, the fundamental driver of Bitcoin's increase is expected to be new interest from institutional investors, like BlackRock and Fidelity, that applied to launch Bitcoin exchange-traded funds (ETFs).

Future triggers for crypto growth, the article notes, encompass potential approval of Bitcoin ETFs by the Securities and Exchange Commission. Regulatory clarity also remains a concern, with many considering the pending case between the SEC and token issuer Ripple as a potential precedent-setter.

Continued global adoption of digital currencies is another area of interest, especially in regions experiencing currency crises. Despite crypto markets suffering from low trading volumes and liquidity issues, predictions for the rest of 2023 remain optimistic with expected increased adoption and underlying growth.

However, Bitcoin's future price remains problematic to predict due to the lack of fundamentals. Targets for year-end range from $40,000 to, more conservatively, $35,000, but many expect Bitcoin to hit new record highs by 2024. Despite notable challenges, the overall sentiment leans towards cryptos continuing to rise, the article concludes.

• Saudi Arabia and Russia's agreement to cut oil production through at least August may provide a significant opportunity for U.S. oil producers, including Exxon Mobil and Chevron, to expand their market share. Saudi Arabia intends to curtail production by one million barrels daily through the next month while Russia plans to slash 500,000 barrels a day. These reductions come atop cuts already being made by OPEC.

As U.S. firms are on track to increase oil production this year, the agreement could facilitate their market dominance, analysts note. Average US oil production for the year is projected to rise to 12.6 million barrels a day compared to 11.9 million last year, per the Energy Information Administration's data.

The production cut strategy by the Saudis serves the objective of elevating oil prices, with Brent crude presently trading around $76 per barrel. Exxon and Chevron have ramped up production in the Permian Basin, asserting their capability to produce oil there for many years.

But the effects of a vigorous global campaign of interest-rate hikes, coupled with difficulties China encountered recovering from the Covid-19 pandemic, have seen prices drop by over 10% since the start of the year. This holds even after accounting for OPEC's commitment to supply reductions.

Looking ahead, average gasoline prices have also been declining, down to $3.529 a gallon, a decrease of $1.28 compared to last year's prices. With reduced gas demand and rising supply, gas pump prices should be relatively stable, adds the EIA.

• The BC Maritime Employers Association (BCMEA), a group of port owners in Canada, has suggested that a 'course change' is required in ongoing negotiations with the International Longshore and Warehouse Union Canada (ILWU Canada). Talks have currently reached a standstill, with the BCMEA believing they've reached their limit concerning the core issues on the table. BCMEA's statement expressed the need for ILWU Canada to reconsider their position and strike to reach a balanced agreement.

The economic impact of the strike is also significant, with CNBC reporting MarineTraffic data showing a backlog of 24 vessels at the Ports of Vancouver and Prince Rupert, collectively carrying 181,458 containers worth $12 billion. As for any potential rerouting of cargo, the U.S.' International Longshoremen’s Association announced it will not accept any goods diverted from the ports affected by worker strikes.

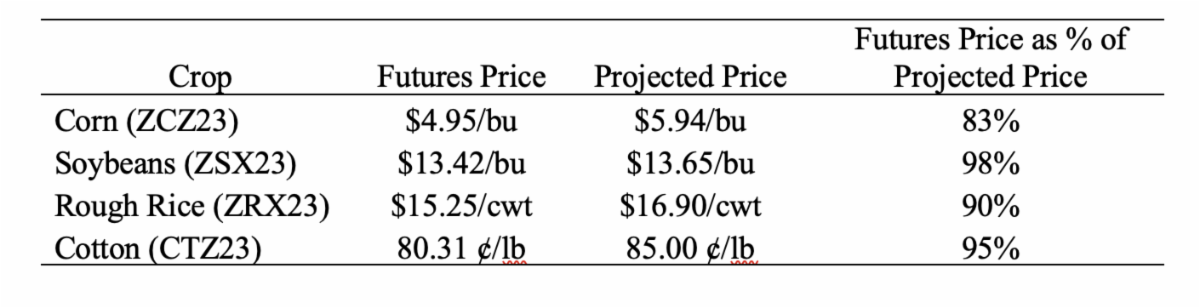

• Price and crop insurance impacts. Southern Ag Today took a look (link) at the potential price protection a producer has if they purchased crop insurance by considering the futures price as of the afternoon of June 30, 2023, relative to the Projected Crop Insurance Price released by USDA/RMA in the winter (see table below). Results: Harvest month futures contracts for corn, soybeans, rice, and cotton are lower relative to their respective Projected Price with corn having a substantially lower price.

Says Southern Ag Today: “If the 2023 growing season were to end today, holding 2023 harvest yield the same as APH yield, 85% Revenue Protection would already trigger an indemnity for corn with ZCZ23 being 83% of the Projected Price. The current harvest month corn futures price would also trigger an indemnity under Enhanced Coverage Option (ECO) and Supplemental Coverage Option (SCO), assuming no difference in the county expected harvest yield and established APH. This is because ECO and SCO trigger an indemnity once county-level revenue falls below 95% and 86% of the county-level revenue guarantee, respectively. We also see ECO would trigger an indemnity for rice, assuming no change in the expected harvest yield.”

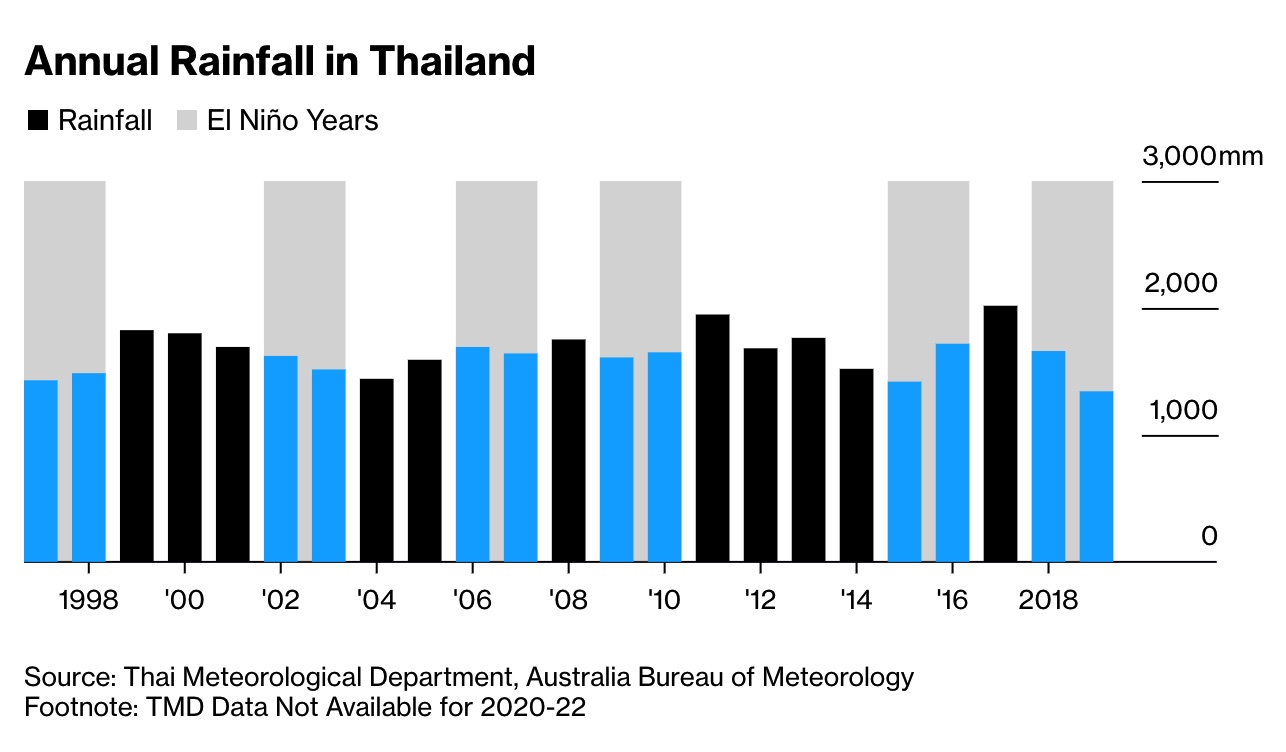

• Thailand is preparing contingency plans to deal with a potential drought that could last years and squeeze global supplies of sugar and rice. Rainfall may be as much as 10% below average this season, and an El Niño could lower precipitation even further over the next two years. Link to Bloomberg item for details.

• Holiday ag demand news: Algeria purchased between 200,000 and 250,000 MT of durum wheat expected to be sourced mostly from Mexico. Thailand purchased 60,000 MT of feed wheat expected to be sourced from Romania or Bulgaria. South Korea passed on a tender to buy up to 69,000 MT of optional origin corn. Taiwan tendered to buy 56,000 MT of U.S. milling wheat. Japan is seeking 115,717 MT of milling wheat in its weekly tender and tendered to buy 60,000 MT of feed wheat and 20,000 MT of feed barley. Tunisia tendered to buy 100,000 MT of soft milling wheat and 100,000 MT of durum wheat.

• Global temperatures set a record. Yesterday saw an average worldwide temperature of 17.2 degrees Celsius (about 63 degrees Fahrenheit), the latest example of extreme weather battering people from China to India to Texas. Some analysts say the return of the El Niño phenomenon is likely to fuel temperature rises, and climate officials urged more action on cutting the use of fossil fuels.

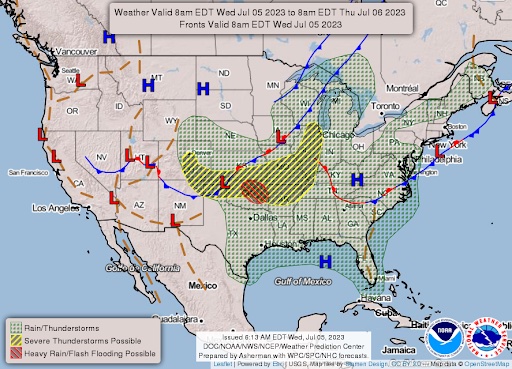

• NWS weather outlook: Heat reaches its peak intensity over portions of the Pacific Northwest today as Excessive Heat Warning and Critical Fire Risk in effect over Arizona... ...More strong to severe storms likely across the central Plains through the next couple of days with periods of heavy to excessive rainfall possibly leading to flash flooding.

Items in Pro Farmer's First Thing Today include:

• More rain chances

• Consultant leaves U.S. corn, bean yields unchanged

• Corn CCI rating inches higher but still well below year-ago and average

• Mexico expects bigger corn crop

• China to shuffle pork reserves

• Packers may have to pay up for cattle this week

• Cash hog fundamentals continue to strengthen

|

RUSSIA/UKRAINE |

— Negotiations over the Black Sea Grain Initiative are underway, as U.N. officials attempt to extend the agreement past its July 18 expiration. They are focusing on a memorandum of understanding in the pact that seeks to boost Russian fertilizer and agricultural product exports. U.N. trade chief Rebeca Grynspan emphasizes the importance of continuing this initiative for maintaining stability in global food and fertilizer markets and reducing prices. However, Russia remains unyielding in its stance against the extension.

Russian authorities have declined a proposal for the Russian Agricultural Bank to establish a subsidiary with access to the SWIFT payment systems for grain exports. Maria Zakharova, Russian Foreign Ministry spokesperson, labeled the plan as "deliberately unworkable" due to the months necessary for setting up the unit. Additionally, Zakharova dismissed a U.N. proposition to generate an alternate payment channel between Rosselkhozbank and the U.S. bank, JP Morgan. Even though the EU reportedly considered the plan, the West hasn't shown intent to restore SWIFT access, a crucial tool for managing international transactions like grain exports.

Dmitry Peskov, a Kremlin spokesman, said no decision has been made concerning the termination of the grain deal. The situation continues to unfold.

— The situation surrounding Ukraine's Zaporizhzia nuclear power plant continues to draw attention amidst the ongoing conflict with Russian invaders. The plant, which is the largest in Europe, was seized by Russia during its early invasion efforts. Since this event, both sides have been involved in back-and-forth accusations about the facility. The latest development includes claims by Ukraine President Volodymyr Zelenskyy based on their intelligence sources. He released a statement on Twitter alleging that the Russian military has positioned objects that resemble explosives on the rooftops of several power units within the Zaporizhzhia plant. His message suggests to some that these actions might be an attempt to either simulate an attack or serve a different, as yet unknown purpose.

|

POLICY UPDATE |

— Payments for Phase 2 of the Emergency Relief Program (ERP) are nearing the $2 million mark, having reached $1.853 million so far. As of July 2, a total of 961 recipients have benefited from these payments. Furthermore, USDA has decided to extend the signup period for this phase of the program. Originally scheduled to end on June 2, the signup date has been moved to July 14, giving more time for potential recipients to enroll.

|

CHINA UPDATE |

— Xi Jinping is intensifying his focus on the Xiong’an megacity project, aiming to transform three Hebei counties into a high-tech hub to rival Shenzhen. This initiative was a topic of discussion at the recent Politburo meeting, where new guidelines were introduced including relocating non-capital functions away from Beijing and ramping up the implementation of eco-friendly, advanced, and tech-oriented infrastructure. The slow progress of the project, despite heavy investment, questions Xi's broader capacity to implement his vision, says Trivium China.

Businesses willing to shift from Beijing to Xiong'an might have an opportunity to secure favorable terms with local authorities, given Xi's dedication to ensuring Xiong’an's success, Trivium notes.

Meanwhile, Xi has expressed concerns about the party's readiness to handle internal and international challenges. During the Politburo study session on Friday, the topic was the innovation of Party theory which has shaped significant social and economic reforms in the past, such as Deng Xiaoping’s socialist market theory and Xi's "new development concept." Xi emphasized the urgent requirement for new ideas to navigate the novel challenges China faces.

Calls for updating Party theory have also been made to better aid the development of the private sector.

Upshot, according to Trivium: Future changes to Party theory may be anticipated, given Xi's call to the nation's top officials to consider updates. It's wise to keep an eye on this development as it may herald significant economic and social changes.

— In response to Western restrictions on its semiconductor sector, China has imposed export controls on several industrial products and materials, most notably germanium and gallium. The Ministry of Commerce announced that effective from August 1, exporters will need to obtain a license.

These retaliatory measures are significant as China hadn't largely initiated direct retaliation against U.S. semiconductor restrictions until 2023. The restrictions could disrupt Western production of semiconductors and dual-use technologies. However, the extent to which China will enforce this ban and its ability to prevent circumvention of these export controls is still unclear.

China is the leading global producer of both germanium and gallium. According to 2022 data from the U.S. Geological Survey, China generated approximately 67% of the global germanium supply and 86% of gallium. These elements have important applications in the semiconductor industry, including the production of gallium nitride semiconductors and solar panels.

Of note: In a contrasting July 4 speech, Chinese President Xi Jinping called on nations to “reject the moves of setting up barriers, decoupling and severing supply chains.”

— Goldman downgrades Chinese banks. Goldman Sachs downgraded three of China’s top banks on Wednesday, deepening worries with the banking sector and the country’s weakening economy. The firm downgraded Agricultural Bank of China from “Neutral” to “Sell,” and cut both Industrial and Commercial Bank of China and Industrial Bank from “Buy” to “Sell.”

— China’s Defense Ministry on Wednesday accused the U.S. of turning Taiwan into a powder keg with its latest sales of military equipment worth a total of $440.2 million to the self-governing island democracy.

— The National Audit Office of China's 2022 audit report reveals major issues in the country's rural development programs. Widespread corruption and misuse of central government funds are significantly slowing down the progress of these initiatives.

Two crucial problems were identified. Firstly, the management of funds designated for rural development and job creation projects is poor. More than RMB 7 billion (around $967 million) has been wasted on failing projects due to mismanagement. In addition, approximately RMB 2.3 billion (around $318 million) was invested into projects that were improperly registered and are now involved in ownership disputes. Rural programs in 15 counties have been unsuccessful in job generation, and another 15 have failed to design systems to distribute the benefits from poverty alleviation projects to the rural poor.

The second issue stems from local governments shifting funds intended for rural projects to other purposes, thereby breaching certain regulations. Many have violated the requirement to match 50% of central funding for rural revitalization programs. A province, which received RMB 130 million (about $18,000) to renovate rural schools, instead used these funds for urban schools. Furthermore, since 2019, provinces have not remedied the loss of 1.4 million mu (230,631 acres) of farmland that was used for development, resulting in the loss of farmland equivalent to the size of Hong Kong.

Upshot, according to China watchers: Addressing local corruption and building the capacity to operate profitable agribusinesses present significant challenges. These hurdles will continue to obstruct Chinese President Xi Jinping's plans to rejuvenate China's rural regions.

|

TRADE POLICY |

— USDA’s Foreign Agricultural Service (FAS) set the tariff-rate quota (TRQ) levels for fiscal year (FY) 2024. The department has established the in-quota aggregate quantity of raw cane sugar at 1,117,195 metric tons raw value (MTRV) and the in-quota aggregate quantity of certain sugars, syrups, and molasses (also known as refined sugar) at 232,000 MTRV. These amounts are the minimum required under US World Trade Organization commitments. Link for details.

The Office of the U.S. Trade Representative (USTR) is responsible for allocating these quantities among supplying countries and regions. The FY 2024 specialty sugar TRQ will be distributed in five tranches. The first tranche of 1,656 MTRV will open on Oct. 2, 2023. The subsequent tranches are scheduled as follows: the second tranche of 60,000 MTRV on Oct. 9, 2023, the third tranche of 60,000 MTRV on Jan. 19, 2024, and the fourth tranche of 45,000 MTRV on April 15, 2024. The final tranche, a fifth, will open on July 15, 2024, for another 45,000 MTRV. The second through fifth tranches will be reserved for organic sugar and other specialty sugars, which are not currently produced commercially in the United States or reasonably available from domestic sources.

|

ENERGY & CLIMATE CHANGE |

— Dems: Biden’s electric car plan threatens rural America. The Biden administration's plan to increase electric vehicle (EV) adoption and reduce automotive pollution is drawing criticism (link) from certain Democratic lawmakers, Reps. Mary Peltola of Alaska and Marie Gluesenkamp Perez of Washington. The plan would effectively require automakers to ensure that two out of every three cars and light trucks sold in 2032 are electric models.

The lawmakers' primary concern is the risk this plan may pose to rural America due to insufficient EV charging infrastructure. They feel this rapid transition to EVs, set to kick off with model year 2027, lacks a robust plan for adequate charging infrastructure development. Without such a plan, they argue, the move could limit consumer choice and potentially lead to an unfavorable situation in rural areas, where charging stations may not be as readily available as in urban settings.

Upshot: This criticism underscores the complex challenges surrounding the shift to electric vehicles, particularly the need to balance environmental goals with practical infrastructure needs and consumer choice.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— The recent decline in venture capital funding for plant-based meat start-ups, according to data from PitchBook, attracted $75.2 million in funding in the first quarter, across 22 deals, significantly down from $703 million gained during the same period the past year. This marks the lowest level of funding since 2018. Reasons for the downturn include a weaker economic outlook and rising interest rates, which are stifling enthusiasm for the industry. This decline also follows a marked drop last year when funding support from venture capital, a major source of financing for start-ups, fell to $1.5 billion — half of what it was in 2021.

— Global commodities markets are signaling bitter news for consumers. Global cocoa prices are at a 38-year high, driven by strong demand, an international production shortfall, and poor weather forecasts in the dominant production region of West Africa, the Wall Street Journal reports (link). This has caused benchmark cocoa futures prices in London to surge by over 32% this year, making it one of the most lucrative investments in the first half of the year. Consequently, U.S. chocolate candy prices have increased more than 20% since 2021, despite a downward trend in other commodities. In addition, sugar and coffee prices are also witnessing a surge, causing concerns in retail markets.

|

HEALTH UPDATE |

— A community-driven research initiative is educating outdoor workers on the need to heed their body's warnings when working in extremely hot conditions, potentially risking their income for their safety, according to a report by Sarah DiGregario for the Washington Post (link). With the effects of climate change worsening, outdoor workers are among the first to experience dangerous levels of heat exposure.

The Farmworker Association of Florida's study found signs like headaches, exhaustion, and wheezing, often experienced by outdoor workers in high temperatures, can be early indicators of serious health issues such as organ failure or even death. The study emphasizes the importance of workers taking breaks, finding shade, and drinking water when these symptoms arise, regardless of whether their employer facilitates these actions or not.

Although the Occupational Safety and Health Administration advises employers to adapt work conditions during hot weather by providing water, rest, and shade for workers, these are recommendations rather than federally mandated regulations. Consequently, numerous employers do not implement these suggestions. States that have imposed heat protection regulations for outdoor farmworkers currently include only California, Oregon, Colorado, and Washington.

|

POLITICS & ELECTIONS |

— Republican presidential contender and Florida Gov. Ron DeSantis is now worth about $1.2 million, up from $319,000 a year ago, thanks to his recent book deal with HarperCollins. The Courage to Be Free is a classic campaign book, in line with others that have created small fortunes for politicians, including Barack Obama, Elizabeth Warren and Pete Buttigieg.

|

CONGRESS |

— A group of bipartisan Representatives have reintroduced the Farm Workforce Modernization Act. The bill, HR 4319, aims to offer a workforce solution for the agricultural industry, a sector considered vital to the nation's economy. Key representatives championing the bill include Zoe Lofgren (D-Calif.), Dan Newhouse (R-Wash.), amongst others. Following a previous passage in both the 116th and 117th Congress, this bill aims to renovate the H-2A agricultural guest worker program to provide stability for both farms and farmworkers.

The bill’s proponents believe labor shortages are contributing to higher food prices and that the workforce needs stabilization to safeguard the future of farming and the US food supply.

Rep. Lofgren highlighted the importance of reform to meet the growing needs of the agricultural sector, while Rep. Dan Newhouse emphasized the bill's role in creating a "secure, reliable agriculture labor program."

The bill originated from eight months of negotiations in 2019, involving farmers, stakeholders in agriculture, labor organizations, and farmworker advocates. If passed, this will be the first major agriculture labor reform legislation enacted since 1986.

Key features of the proposed legislation include modifying the H-2A program for increased employer flexibility, ensuring worker protection, establishing programs allowing agricultural workers to earn legal status, and making the program more accessible and responsive for various industries with year-round labor needs.

|

OTHER ITEMS OF NOTE |

— Judge delivers major blow to Biden administration in social media censorship case. A historic ruling by federal Judge Terry A. Doughty has granted an injunction prohibiting multiple Biden administration officials and various government agencies, including the Justice Department and the FBI, from working with big tech firms to censor posts on social media. This move came in response to a lawsuit brought by attorneys general in Louisiana and Missouri against alleged censorship-by-proxy actions of the Biden administration, which were claimed to manipulate social media companies to suspend accounts or remove posts.

According to the injunction, government officials and agencies cannot communicate or put pressure on social-media companies to remove or suppress content containing protected free speech. This also includes agencies influencing social media companies to alter their guidelines for content moderation or flagging content for removal or suppression.

Louisiana Attorney General Jeff Landry, who filed the lawsuit, has called this case a significant First Amendment issue, believing it to be one of the most considerable attempts by the federal government to limit American speech in the nation's history. His comments suggest that the evidence presented in the case points to a vast initiative by multiple federal agencies to suppress speech based on its content.

While some exceptions were made by the judge for instances of criminal activity or threats to national security, the preliminary ruling is considered a victory by the Republican attorneys general. They oppose alleged efforts by the Biden administration to leverage big tech companies for censorship-by-proxy. The attorneys general anticipate an appeal of the ruling, which they are prepared to fervently defend, with the expectation that the case might eventually reach the U.S. Supreme Court.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |