Fed's Key Inflation Rate Cools in May as Spending Slows

Survey shows production costs a concern for ag economists

|

In Today’s Digital Newspaper |

Independence Day schedule. Grain and livestock markets will be open on Monday, July 3 for a full trading session. Government offices will also be open on Monday. Markets and government offices will be closed Tuesday, July 4 for Independence Day.

USDA daily export sale: 132,000 metric tons of soybeans to China during the 2023-2024 marketing year.

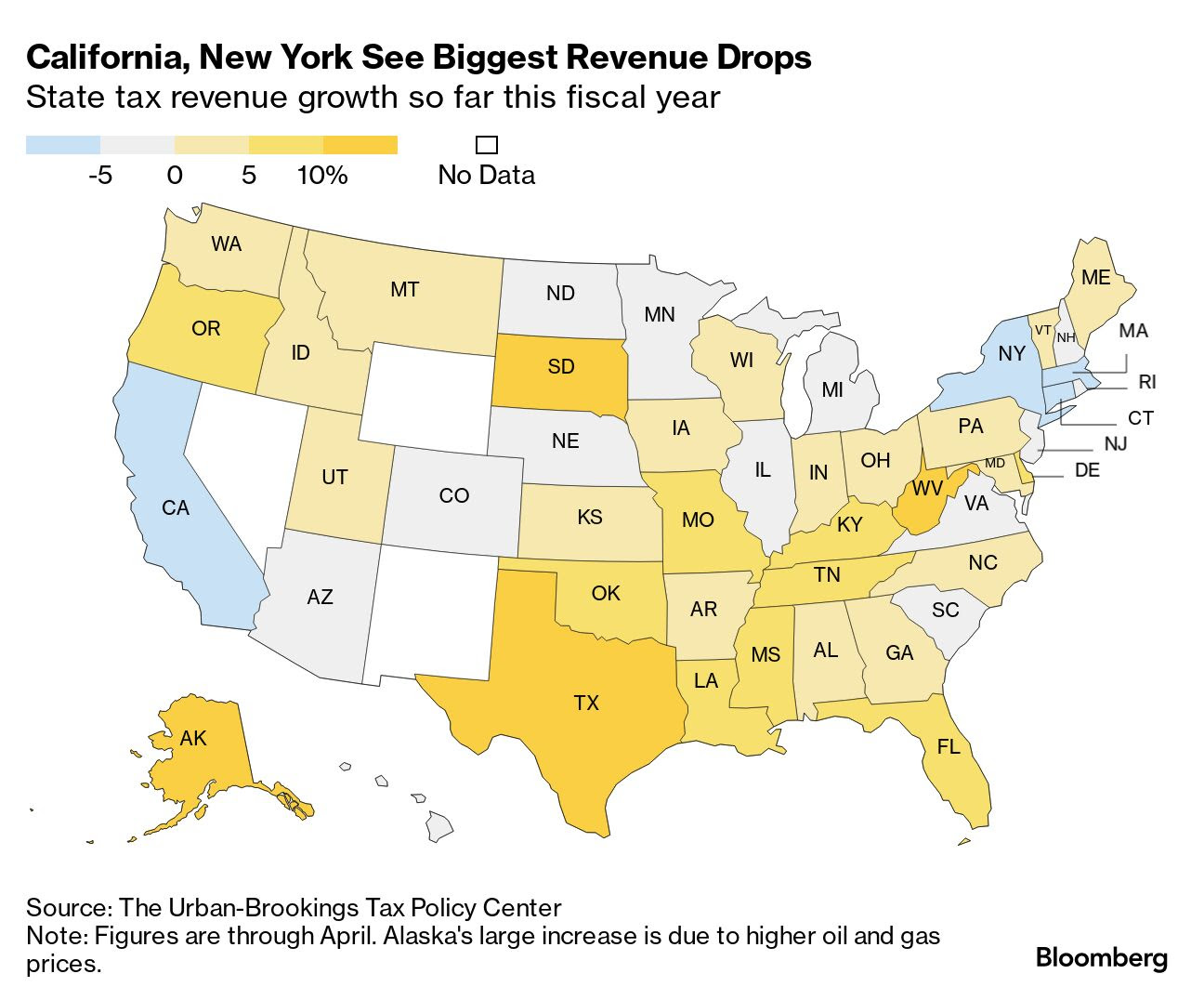

The Federal Reserve's central inflation rate indicated that core price pressures eased slightly in May due to a dip in consumption. This development bolstered S&P 500 futures and is likely to keep the Federal Reserve on track for a rate hike on July 26. The Personal Consumption Expenditures (PCE) price index, seen as a barometer of inflation, increased by 0.1% in May, dropping the annual inflation rate to 3.8%. This matches expectations and reduces from 4.4% in April, marking the lowest point since April 2021. More in Markets section.

Dr. Mark Jeschke from Corteva's Pioneer has been analyzing the impacts of smoke, originating from Canadian wildfires, on crop yields in the Midwest states. Persistently hazy conditions caused by these wildfires have resulted in reduced visibility and affected air quality. Details in Markets section.

SCOTUS ends affirmative action. Supreme Court ruled that universities’ consideration of race in admissions — an approach, known as affirmative action, that gives a leg up to black, Hispanic and Native American applicants — is unconstitutional. In a 6-3 decision, the court’s conservative justices sided with plaintiffs who had argued that such policies at Harvard and the University of North Carolina discriminate against whites and Asians. Until now universities could not set quotas but could consider race to attain a diverse student body. President Joe Biden criticized the ruling and described the Supreme Court as “not a normal court.” Biden said he would ask the Department of Education to help maintain diversity in universities.

The U.S. Supreme Court is set to issue a ruling on a controversial case involving student loan forgiveness. Several states have filed a case against President Joe Biden's administration, contending that the effort to relieve approximately $430 billion in student loan debt oversteps his authority. This ruling is among the last ones expected as the court's session draws to a close. The initial arguments for the case were heard in February. According to the proposed plan, up to $10,000 in federal student debt would be forgiven for people earning less than $125,000 annually. In addition, individuals who received Pell grants, typically awarded to lower-income students, would have up to $20,000 in debt forgiven. Today's decision will address the contentious issue of whether the President has the jurisdiction to introduce such a broad forgiveness program.

Put-in, Surovikin-Out. U.S. officials reportedly believe that Sergei Surovikin, a Russian general, was detained by Russian authorities over his links to Yevgeny Prigozhin. Surovikin has not been heard from since the weekend; Western intelligence suggested that he knew of Prigozhin’s mutiny plans in advance. Before a demotion in January, Surovikin led Russia’s forces in Ukraine and embraced the Wagner Group’s involvement. More in Russia & Ukraine section.

Various states and groups are continuing to challenge the Biden administration's Waters of the U.S. (WOTUS) rule. They have appealed to a federal judge, hoping to stop the implementation of this rule following a U.S. Supreme Court decision which concluded that the Environmental Protection Agency (EPA) had exceeded its jurisdiction. The plaintiffs have filed a motion in the U.S. District Court for the Southern District of Texas, seeking the rule's cancellation. However, the Supreme Court's decision did not nullify the entire WOTUS rule that was finalized earlier this year by the administration. The plaintiffs insist that the rule is incongruent with the Supreme Court's decision. Despite these ongoing legal challenges, the Biden administration announced earlier this week their plan to introduce a final revision of the WOTUS regulation by Sept. 1.

Independence Day holiday weekend will witness approximately 50.7 million Americans traveling 50 miles or more, according to the AAA. Predictions show that 43.2 million people will opt for a car ride, 4.17 million prefer a flight, and 3.36 million will choose a bus, cruise, or train for their travels.

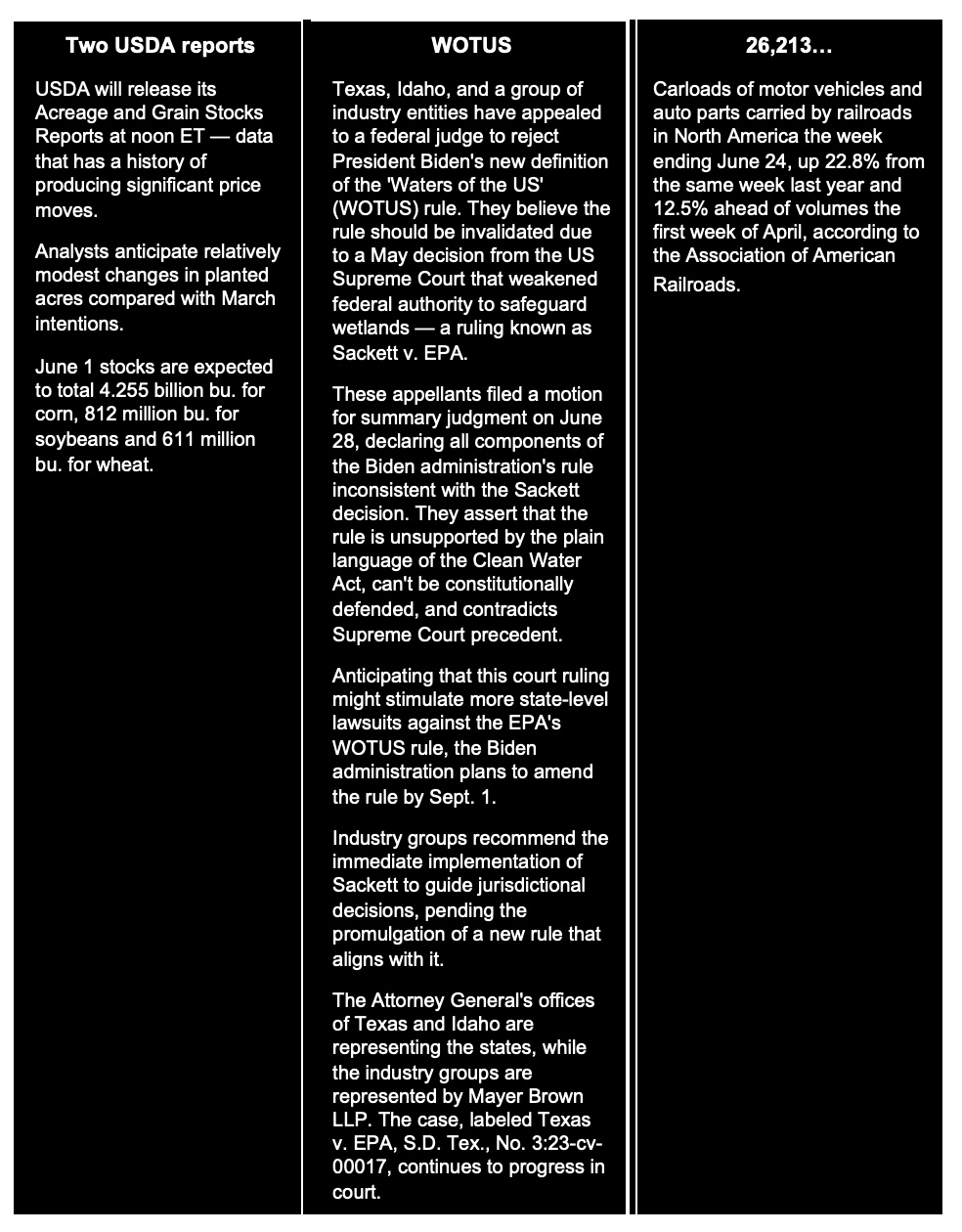

Six fast-growing states in the South — Florida, Texas, Georgia, the Carolinas and Tennessee — are contributing more to U.S. GDP than the Northeast for the first time in data going back to the 1990s.

Survey shows production costs a concern for ag economists. The Ag Economists’ Monthly Monitor, a new survey of nearly 50 agricultural economists from across the country, is a joint effort between the University of Missouri and Farm Journal. The June monitor shows the perceived financial health of U.S. agriculture has moved slightly lower over the past year, and economists expect that trend to continue over the next 12 months. Details below.

Moscow is intensifying its control over the global wheat market following Russia's invasion of Ukraine. Meanwhile, Russian Foreign Minister Sergei Lavrov described the West’s attitude to the Black Sea grain deal as “outrageous,” noting if leaders were worried about global food security, they would unblock Russian fertilizer supplies frozen at European ports. More in Russia & Ukraine section.

China news of note include:

• Manufacturing activity in China contracted for a third straight month in June.

• China asks foreign banks about dollar deposit rates

• China has 'hidden' foreign-exchange reserves estimated at around $3 trillion, and it is a potential risk to the global economy.

• The Dutch government said that it would require companies to seek permission before exporting equipment used to create advanced semiconductors.

• China’s sow herd declines.

Hunt for fraud in carbon markets deepens with new CFTC unit.

Interior Dept. nixes call to limit and phasedown oil & gas production on federal lands, waters.

New Jersey legislators have approved a ban on gestation cages commonly used to confine pregnant pigs, sending the bill to Gov. Phil Murphy. Details in Livestock section.

Sens. Tammy Baldwin (D-Wis.) and Roger Marshall (R-Kan.) introduced the Reliable Rail Service Act. More in Congress section.

Trump says may skip first Republican debate, hold rival event: Reuters.

Senate Republicans appear to have a favorable chance of regaining the majority in 2024. However, the results of primaries in West Virginia, Montana, and Arizona could greatly influence this outcome. More in Politics & Elections section.

Nearly 670 people were arrested across France as riots, triggered by the killing of a teenager by police, went into their third consecutive night. Unrest spread from Nanterre, a suburb of Paris where the shooting occurred, to other cities including Marseille, Lille and Lyon. Emmanuel Macron, France’s president, is leaving an EU leaders’ summit in Brussels early in order to hold an emergency cabinet meeting.

|

MARKET FOCUS |

Equities today: Asian and European stock markets were mostly higher in quieter overnight trading. U.S. Dow opened up around 170 points and at this writing is over 200 points higher.

U.S. equities yesterday: The Dow and S&P 500 finished higher while the Nasdaq ended in negative territory. The Dow rose 269.76 points, 0.80%, at 34,122.42. The Nasdaq eased 0.42 point, 0.00%, at 13,591.33. The S&P 500 was up 19.58 points, 0.45%, at 4,396.44.

With one trading day left in the second quarter...

• The S&P 500 is up 14.5%.

• The tech-heavy Nasdaq composite index is up 29.9%.

• The small-cap Russell 2000 is up 6.8%.

Agriculture markets yesterday:

- Corn: Nearby July futures led the complex lower falling 9 cents to $5.81, while December futures fell 8 1/4 cents to close at $5.28 1/2.

- Soy complex: November beans rose 3/4 cents to $12.65 3/4, finishing the near the session low. July meal gained $1.20 to $403.00, while July soyoil rose 121 points to 60.83 cents.

- Wheat: December SRW wheat fell 2 1/4 cents at $6.84 1/2, near the session low today and hit a two-week low. December HRW wheat dropped 6 3/4 cents to $8.01 1/2, near the session low. December HRS wheat rose 7 1/4 cents to $8.35.

- Cotton: December cotton rose 167 points to 79.03 cents, finishing near the session high and at the highest level since June 22.

- Cattle: August live cattle rose 62 1/2 cents to $174.50 and near the session high. August feeder cattle gained $2.125 to $242.375, near the session high and hit a three-week high.

- Hogs: Summer hog futures turned higher after opening poorly Thursday. Nearby July closed $1.175 higher at $95.45, while most-active August advanced $1.225 to $92.325. The deferred contracts slipped again.

Ag markets today: Corn, soybean and wheat futures firmed amid corrective buying during the overnight session as traders await USDA’s reports later this morning. As of 7:30 a.m. ET, corn futures were trading mostly 3 cents higher, soybeans were mostly 16 to 26 cents higher, SRW wheat futures were 4 to 5 cents higher, while HRW and HRS wheat were mostly 7 to 8 cents higher. Front-month crude oil futures and the U.S. dollar index were both trading just above unchanged.

Market quotes of note:

- Today’s inflation data could add to a slew of economic data so far this week supporting the prospect of higher interest rates for longer in the U.S. "The path to lower inflation will likely be bumpy and protracted which may, at times, feel like one step forward and two steps back," Insight's Emin Hajiyev says in a note. "Curbing the [headline] PCE inflation rate from 4.4% to 2% may be more challenging than curtailing it from 7% to 4%." Economists surveyed by WSJ expect May core PCE to keep April's 4.7% annual pace, while slowing slightly to 0.3% from 0.4% in the monthly reading.

- U.S. economy. “We have systematically underestimated the resilience of the American economy.” — Carl Tannenbaum, chief economist at Northern Trust.

- Rosy economy. Goldman Sachs analysts say that the economic news — Thursday's better-than-expected GDP revision, for example — looks likely to keep coming in rosy. "We think the macro news is still most likely to lead us to climb further up the 'Wall of Worry,'" they wrote in a recent client note.

The Federal Reserve's central inflation rate indicated that core price pressures eased slightly in May due to a dip in consumption. This development bolstered S&P 500 futures and is likely to keep the Federal Reserve on track for a rate hike on July 26.

The Personal Consumption Expenditures (PCE) price index, seen as a barometer of inflation, increased by 0.1% in May, dropping the annual inflation rate to 3.8%. This matches expectations and reduces from 4.4% in April, marking the lowest point since April 2021.

The Federal Reserve typically prioritizes core inflation, which disregards volatile food and energy prices, over other components. In May, core prices rose by 0.3%, with the 12-month core inflation rate recording at 4.6%, slightly lower than the anticipated 4.7%.

Following a shift in approach by Federal Reserve Chair Powell last year, core PCE services excluding housing, dubbed 'supercore services', have become a focal point. This aligns with the Fed's belief that the tight labor market and high wage growth are the primary drivers of persistent inflation.

Official reports omit changes in core nonhousing service prices, a relatively recent point of interest for the Federal Reserve and investors. Data for these services, including health care, haircuts, and hospitality, show prices went up by 0.4% month-over-month and 4.6% year-over-year.

Impact: In response to the recent PCE inflation report, market projections for a quarter-point rate hike during the Federal Reserve's meeting on June 25-26 dipped from 89% to 87%. The probability for an additional quarter-point hike in September is now 21%, down from 27% the previous Thursday.

Personal income rose by 0.4% in May, identical to forecasts, while personal consumption expenditures only increased by 0.1%, falling short of the expected 0.2% rise. When adjusted for inflation, consumer spending didn't change in May after recording a 0.6% increase in April.

Independence Day holiday weekend will witness approximately 50.7 million Americans traveling a distance of 50 miles or more, according to the AAA (link). Predictions show that 43.2 million people will opt for a car ride, 4.17 million prefer a flight, and 3.36 million will choose a bus, cruise, or train for their travels. AAA has also provided recommendations on the optimal times for departure each day and forecasted the periods when congestion will be the heaviest in different metropolitan areas. Today has been predicted by the TSA as the peak day for flying, with 2.82 million passengers expected to board flights. Throughout the seven-day travel period, it is estimated that 17.7 million individuals will be taking flights.

Regarding potential weather disruptions and delays, the Federal Aviation Administration (FAA) highly recommends that travelers stay updated with real-time information on their website, fly.faa.gov.

South wins over North. Six fast-growing states in the South — Florida, Texas, Georgia, the Carolinas and Tennessee — are contributing more to U.S. GDP than the Northeast for the first time in data going back to the 1990s. Some 2.2 million people moved to the Southeast in just over two years, bringing $100 billion in new income to the region.

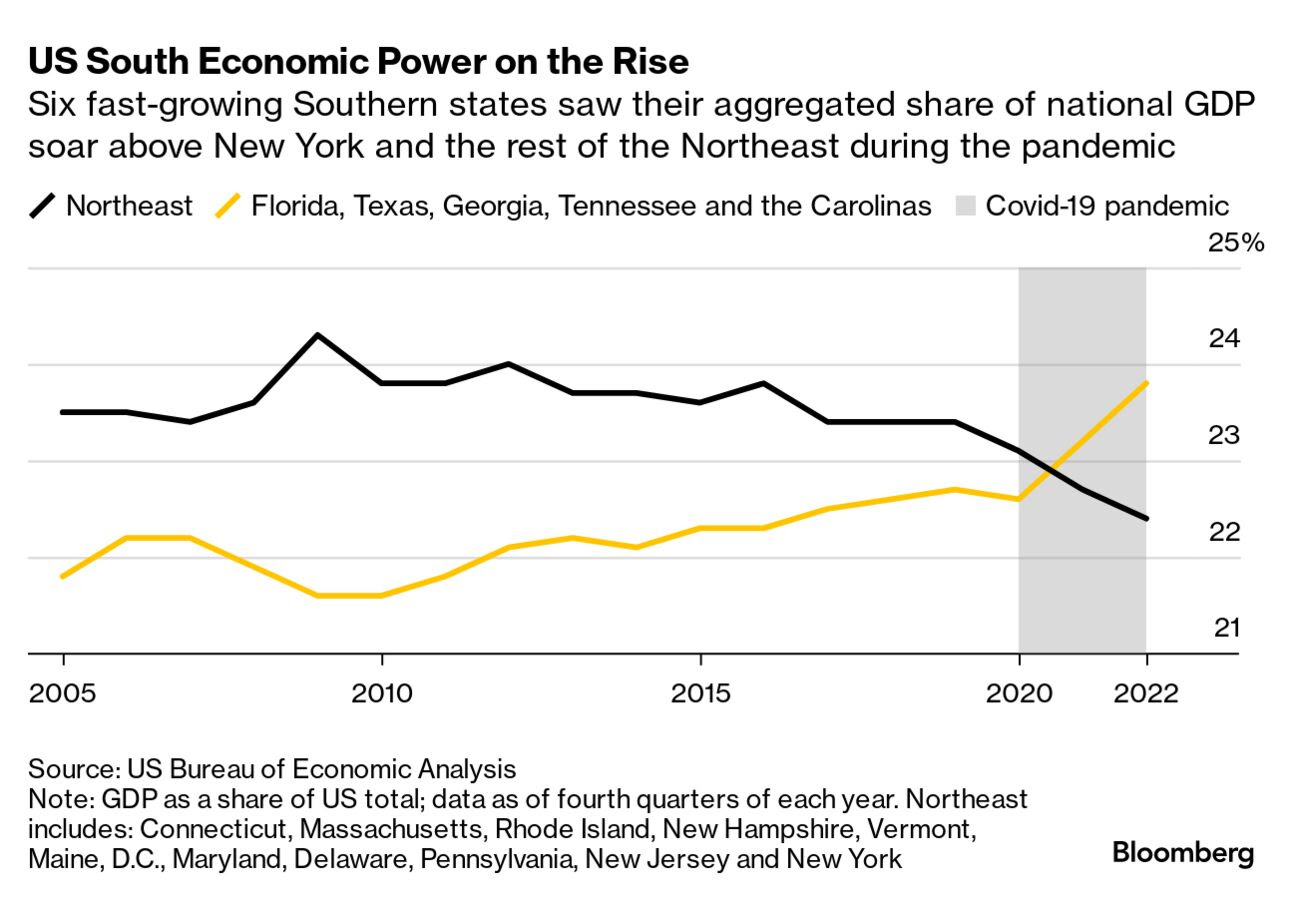

States once awash in cash now face deficits as market volatility and population shifts lead to a reversal of fortunes. Link to more via Bloomberg.

- California’s mega surplus of about $100 billion last year has flipped to a $32 billion deficit following the tech bust and the end of Covid funding.

- Revenue in 16 other states, including New York, is down this year through April, according to the Urban Institute.

- It’s a different picture in red states such as Florida and Texas, where levies are collected primarily on sales rather than income. That’s adding to gains as consumers keep spending.

Inflation in the Eurozone fell to 5.5% in June, down from 6.1% in May, the slowest rate this year. But core inflation, which strips out volatile food and fuel costs, rose slightly to 5.4%, up 0.1 percentage point compared with a month earlier. That will encourage the ECB to continue to raise interest rates when it meets in July.

Survey shows production costs a concern for ag economists. The Ag Economists’ Monthly Monitor, a new survey of nearly 50 agricultural economists from across the country, is a joint effort between the University of Missouri and Farm Journal. The June monitor shows the perceived financial health of U.S. agriculture has moved slightly lower over the past year, and economists expect that trend to continue over the next 12 months. Link for details.

Highlights from the first Ag Economists’ Monthly Monitor include:

- Perceived financial health of U.S. agriculture is trending lower and is expected to continue to decline over the next 12 months.

- Production costs, global competition, geopolitical risks, drought and demand headwinds are among the main drivers.

- Majority of agricultural economists expect farm income to drift lower, with some expecting levels to land closer to the five-year average in 2024.

- High production expenses are the biggest obstacle in 2023.

- 2023 crop yield estimates vary widely among the economists surveyed.

- Economists expect crop prices to drift lower in 2023 and 2024.

- Beef cow supplies are forecast to continue to decline this year.

Comments: One reader emailed: “Tyne Morgan and Scott Brown’s Ag Economist panel is a welcome addition to the sector. It disarms some of those so cold animals that are on Twitter. It is real economic perspective… all that most of those Twitter analysts want to do is move the market.”

Market perspectives:

• Outside markets: The U.S. dollar index was weaker amid strength in several currencies against the greenback ahead of inflation data. The yield on the 10-year US Treasury note was higher, trading around 3.87%. Crude oil futures eased, with U.S. crude around $69.70 per barrel and Brent around $74.40 per barrel. Gold and silver futures were weaker ahead of US inflation figures, with gold around $1,913 per troy ounce and silver around $22.61 per troy ounce.

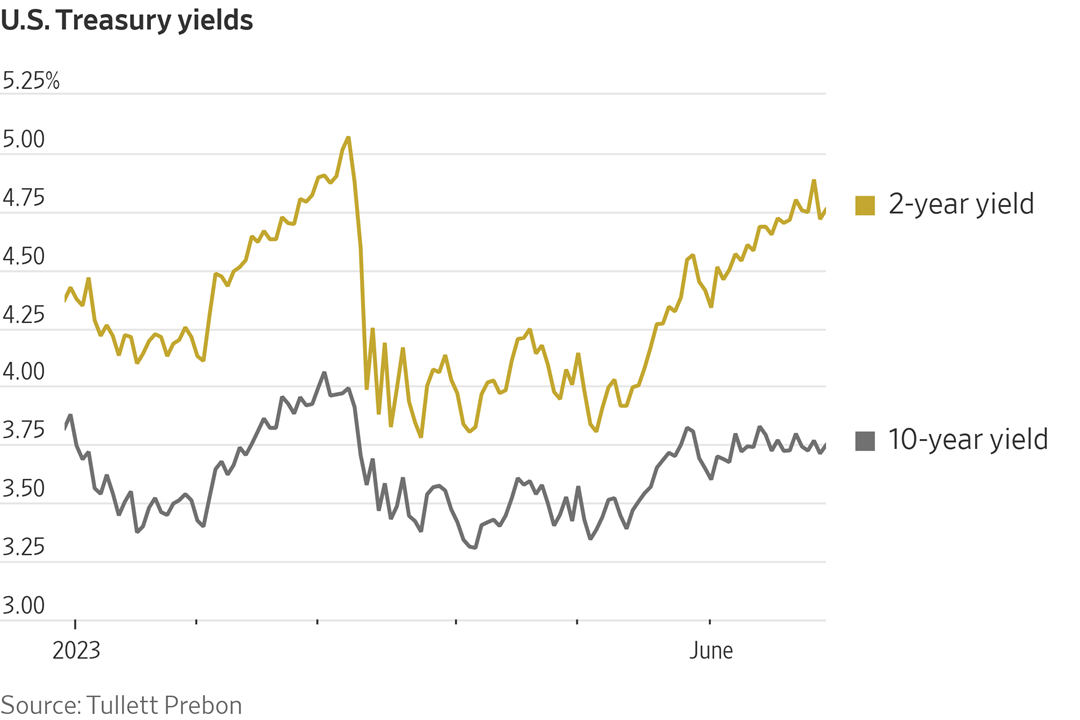

• Treasury yields resume climb. The rise in government-bond yields during the second quarter of the year is a trend driven by persistent signs of a strong economy and a more stable banking sector. Treasury yields, which started climbing at the outset of the quarter, were initially suppressed due to fears of an impending banking crisis that could disrupt monetary and credit flows. However, these fears were gradually allayed as the economy and markets successfully weathered the turbulence, even during a contentious debt-ceiling debate that almost led to government default. Recent employment reports signal persisting strength in the labor market, which accompanies declining inflation rates. This enhances optimism that the Federal Reserve can manage rising prices without precipitating a recession. However, analysts caution that the aggressive rate hikes implemented by the central bank since early 2022 could potentially impair growth in the future. Throughout this period, investor confidence has led to an increase in yields on Treasury bonds. These yields typically rise with expectations of economic activity, inflation, and Federal Reserve's interest rate policies. Hence, heightened economic prospects and expectations for the Federal Reserve's monetary stance have pushed yields higher.

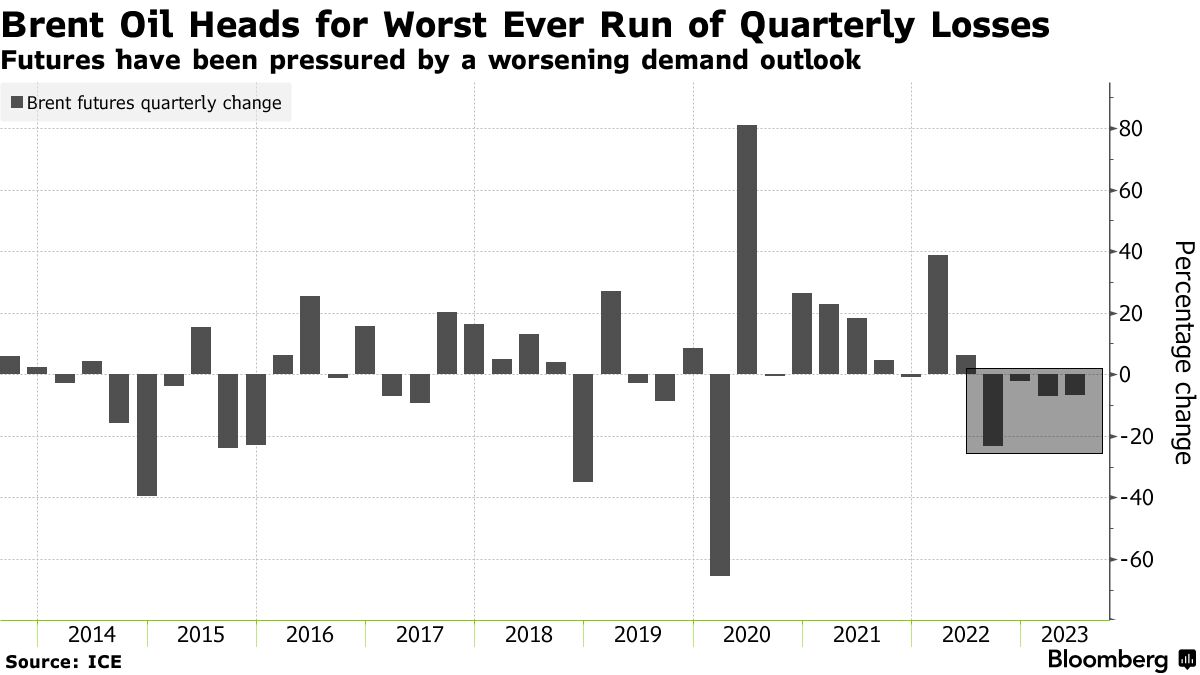

• Brent crude oil headed for its longest run of quarterly losses in data going back more than three decades as persistent concerns over demand weighed on prices. The market has faced headwinds from aggressive interest-rate hikes to China’s sluggish economy and resilient Russian supply.

• Is smoke from wildfires affecting crop yields? Mark Jeschke, Ph.D., Agronomy Manager for Corteva’s Pioneer, writes about this topic (link).

Highlights:

• Wildfires in western North America have gotten worse in recent years and will almost certainly continue to increase in frequency and intensity.

• In the Corn Belt region, noticeable levels of smoke in the air during summer and fall have now become commonplace.

• The potential impact of wildfire smoke on crop growth is complex and involves competing effects that can both enhance and suppress photosynthesis.

• There are three primary factors associated with wildfire smoke with the capability to directly impact crops: reduced total solar radiation and elevated ozone, which are both negative, and increased diffusion of solar radiation, which could potentially be positive.

• Based on what is known about the effects of reduced solar radiation and ozone on crops, it’s very plausible that wildfire smoke could cause reductions in crop yields.

• The effects of wildfire smoke on both agricultural and natural ecosystems are likely to be an active area of research in coming years, as smoky days become more common.

• Ag trade: South Korea purchased 134,000 MT of corn in two separate tenders – 65,000 MT of to be sourced from the U.S. or South America and 69,000 MT to be sourced from South America or South Africa – and 50,000 MT of U.S. milling wheat.

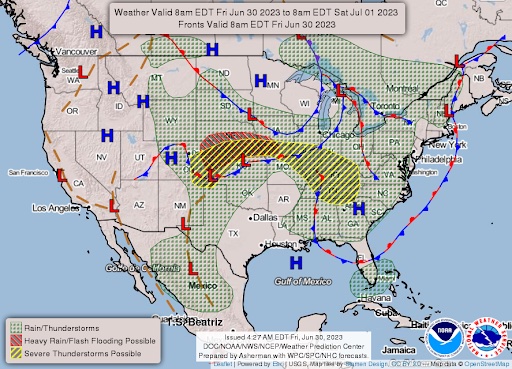

• NWS weather outlook: More severe thunderstorms and areas of heavy rain to track eastward from the central Plains to the Ohio Valley for the next couple of days... ...Excessive Heat Warnings and Advisories across much of California into the Desert Southwest as well as through the lower and mid-Mississippi Valley... ...Air Quality alerts over parts of the Midwest, Great Lakes, central Appalachians, Northeast, and Mid-Atlantic.

Items in Pro Farmer's First Thing Today include:

• Corrective gains in grains overnight

• Argentina expects big recovery in wheat production

• French wheat crop ratings continue to decline

• Slightly negative H&P Report

• Northern cash cattle trade steady

|

RUSSIA/UKRAINE |

— In documents shared exclusively with CNN, Russian General Sergey Surovikin was covertly a VIP member of the Wagner private military company. This is the same group that recently underwent a brief but impactful insurrection, creating chaos within Russia's military forces. Presently, the whereabouts of Surovikin are unknown since the quelling of the rebellion.

— On an international visit, former U.S. Vice President Mike Pence, while in Ukraine, addressed the uncertainty around Putin's full control over his military. In a conversation with CNN's Erin Burnett, Pence expressed that Putin's command post-revolt is still an "open question."

— The White House is seriously contemplating the approval of a transfer of controversial cluster munition warheads to Ukraine as a part of their counteroffensive measures. While this could bolster Ukraine's military prowess, it also presents the risk of significant collateral damage, particularly the potential harm to civilians.

— Sanctioned Russian cargo ships are increasingly using Turkey as a strategic hub for transporting weaponry and other wartime provisions, putting a spotlight on the difficulty of enforcing international maritime transport sanctions. Shipping records viewed by the Wall Street Journal (link) reveal a high frequency of Russian vessel visits to Turkish ports since the invasion of Ukraine, with over 100 stops on Turkey's coast since May 2022.

Russia is apparently utilizing civilian cargo ships, including those owned by private companies, to transport military supplies. This tactic partially circumvents a prohibition on Russian and Ukrainian warships from entering the Black Sea. In some instances, these civilian ships have been chartered by Russia's military.

These events raise concerns about escalating tensions between the U.S. and Turkey, which is emerging as an important economic corridor for Russia. Jared Malsin of the Wall Street Journal reports that Russia's use of Turkish ports could further strain the already strained U.S.-Turkey relations. Furthermore, this situation underscores Turkey's significant role in regional maritime transport.

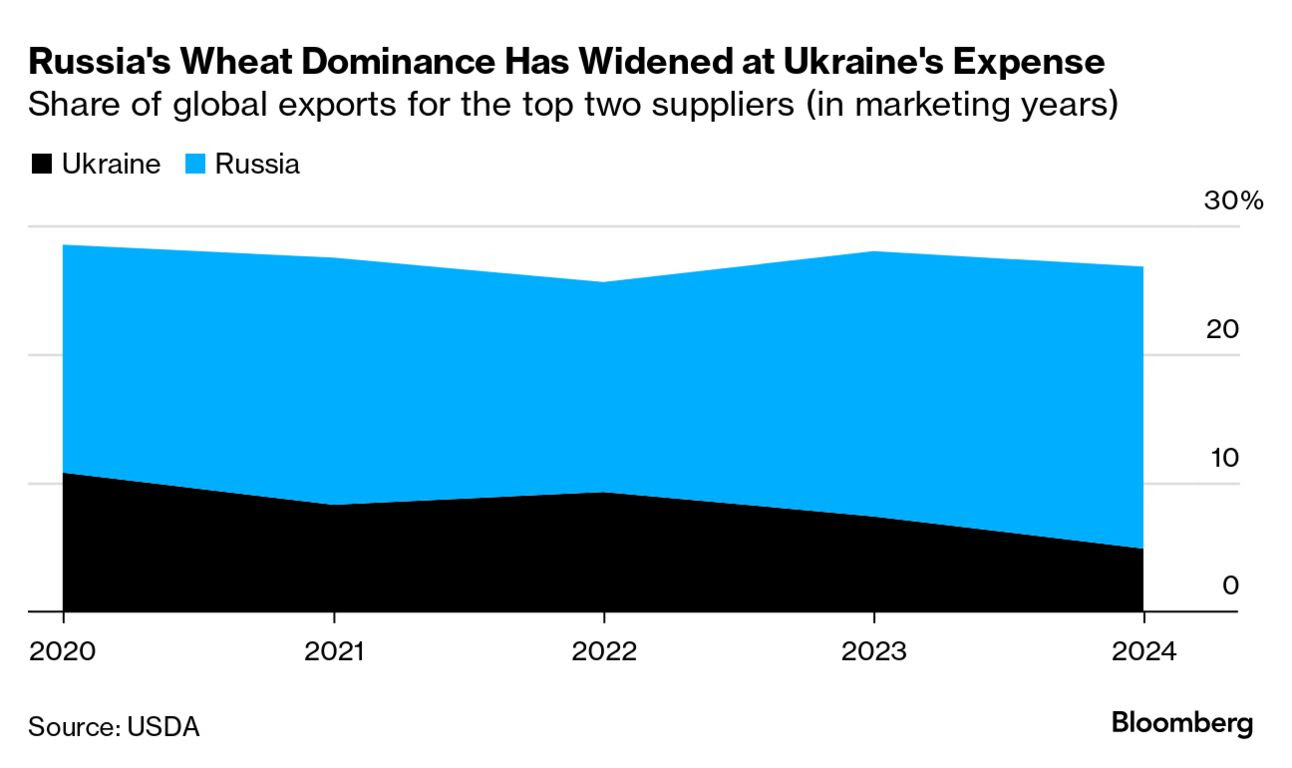

— Moscow is intensifying its control over the global wheat market following Russia's invasion of Ukraine. Despite a tumultuous political climate internally and internationally, wheat has become a significant power broker for the Kremlin in the international food supply chain. It's estimated that one fifth of all wheat exports in the upcoming season, beginning July 1, will originate from Russia, according to USDA. On the other hand, Ukraine is projected to experience a substantial decrease in its wheat export share, expected to shrink to around 5% — a halving from its pre-invasion levels. Link to more via Bloomberg.

— Lavrov: West’s attitude two Black Sea grain deal ‘outrageous’. Russian Foreign Minister Sergei Lavrov described the West’s attitude to the Black Sea grain deal as “outrageous,” noting if leaders were worried about global food security, they would unblock Russian fertilizer supplies frozen at European ports. Lavrov reiterated that as it stands now, Russia sees no grounds to extend the deal beyond July 17.

|

POLICY UPDATE |

— NCBA files legal motion to strike down Biden WOTUS rule. The National Cattlemen’s Beef Association (NCBA) and several litigation partners filed a motion in the U.S. District Court for the Southern District of Texas on June 28 to challenge the Biden administration's Waters of the U.S. (WOTUS) rule. The NCBA argues that this rule is not in line with the Supreme Court's decision in the case of Sackett v. EPA. Link to motion.

Background. During the Sackett v. EPA case, the Supreme Court had unanimously ruled that the Environmental Protection Agency (EPA) had exceeded its authority under the Clean Water Act. Accordingly, the NCBA is pushing for a full rewrite of the Biden administration’s WOTUS definition to be in compliance with this Supreme Court decision.

While the Sackett case did not directly involve agriculture, it had implications for the sector due to the EPA’s overregulation. Considering this, the NCBA had filed an amicus brief in support of the Sackett family during their lawsuit against the EPA and Army Corps of Engineers. The points raised in the NCBA’s brief were incorporated into the Supreme Court's final ruling.

In conjunction with the motion related to the Sackett case, the NCBA and associated partners have also filed a lawsuit against the Biden administration’s WOTUS rule in a separate attempt to block its enforcement. They had already secured temporary halts to the rule in 27 states and are now seeking a summary judgement, which would request the court to strike down the entire Biden administration WOTUS rule based on the Supreme Court’s ruling in the Sackett case.

NCBA's Chief Counsel Mary-Thomas Hart emphasized the organization's commitment to advocating for America’s cattle producers against what they see as overbearing WOTUS regulations in Washington.

Of note: The Biden administration told a federal district court in North Dakota earlier this week that it was “developing a new rule to amend the WOTUS rule consistent with” the Supreme Court decision in Sackett v. EPA, the wetlands case.

|

CHINA UPDATE |

— Manufacturing activity in China contracted for a third straight month in June. The manufacturing purchasing managers’ index was 49, up from 48.8 in May but below 50 (anything above that is an expansion in activity). China’s economic recovery is slowing in various sectors. Earlier this week Li Qiang, China’s prime minister, claimed that the economy was still on track to reach the government’s 5% annual growth target.

— China asks foreign banks about dollar deposit rates. China’s central bank has surveyed some foreign banks in the past week about the interest rates they offer to their clients for dollar deposits, people familiar with the matter told Reuters, as authorities step up efforts to slow the yuan’s depreciation. The central bank also guided one commercial lender to lower such rates, one of the sources said, as recent weakness in the Chinese currency prompts authorities to more closely scrutinize foreign exchange dealings. The move could potentially nudge companies, especially exporters, to convert more of their foreign exchange receipts into the yuan.

— China has 'hidden' foreign-exchange reserves estimated at around $3 trillion, and it is a potential risk to the global economy, according to Brad Setser, a former U.S. trade and Treasury official who wrote about the topic in a report on The China Project, a New York-based news platform. He alleges that these reserves are not reported in the official books of the People's Bank of China, but rather appear as 'shadow reserves' in the assets of other entities like state commercial lenders and policy banks. Setser notes that while official reserves have remained largely stable, these hidden reserves have likely increased with China's growing export surplus. The practice, according to him, lacks transparency and could have significant global ramifications given China's centrality to the global economy.

An illustration of the extent of China's financial influence is its Belt and Road Initiative, an infrastructure plan which was, in part, funded by these reserves. Moreover, Setser points out that despite domestic debt problems, China remains a massive global creditor due to its substantial accumulation of foreign exchange.

Brad Setser currently serves as a senior fellow at the Council on Foreign Relations, a New York-based think tank.

— The Dutch government said that it would require companies to seek permission before exporting equipment used to create advanced semiconductors. ASML, a Dutch firm, is the world’s largest producer of photolithographic machines, which use light to etch circuits onto silicon wafers. The machines are critical for chipmaking. America has been pressuring the Netherlands to restrict China’s access to semiconductor technology.

— China’s sow herd declines. China’s sow herd declined 0.6% in May from the previous month to 42.58 million head, according to the country’s ag ministry. However, the sow herd was still 1.6% larger than May 2022. China’s hog slaughter in May jumped 11% from year-ago. China’s hog slaughter through the first five months of this year topped year-ago levels by 9.9%.

|

ENERGY & CLIMATE CHANGE |

— Hunt for fraud in carbon markets deepens with new CFTC unit. The regulator said Thursday that it is establishing a new enforcement task force to combat environmental fraud in both derivative markets and carbon credit markets

— Interior Dept. nixes call to limit and phasedown oil and gas production on federal lands, waters. The U.S. Department of Interior (DOI) has turned down a request from the Center for Biological Diversity to limit and phase down oil and gas production on federal lands and waters. This proposal asked the agency to establish maximum production levels for such activities and progressively reduce them. Laura Daniel-Davis, the DOI Principal Deputy Assistant Secretary for Land and Mineral Management, responded in a letter that the agency does not have the resources to implement such rulemaking. She also mentioned ongoing lease sales for oil and gas exploration.

The Center for Biological Diversity put forward this request citing harm to the climate caused by oil and gas production on federal lands and waters. While acknowledging the urgency of the climate crisis, the DOI stated that it is focusing its limited resources to deal with this issue in other ways.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— New Jersey weighs new plan to ban pig crates. New Jersey legislators have approved a ban on gestation cages commonly used to confine pregnant pigs, sending the bill to Gov. Phil Murphy. This comes about ten years after his predecessor, Chris Christie, vetoed a similar proposal. The new legislation would obligate the New Jersey Department of Agriculture to implement new rules requiring that pork sold in the state come from pigs born to mothers who had a minimum of 24 square feet of space and were able to lie down and turn around.

Although there aren't many large pig farms in New Jersey, animal rights advocates argue this move would better the conditions for the country's six million breeding sows, many of whom spend a considerable part of their pregnancies in restrictive metal gestation cages. Animal rights activists are hopeful Gov. Murphy will sign the legislation, which they assert has the backing of over 93% of New Jersey residents. They also argue that cage confinement leads to a higher prevalence of diseases among sows and piglets, posing potential risks to humans.

The approval of this bill follows a decision by the U.S. Supreme Court to uphold California's Proposition 12, requiring all pork sold in the state to meet similar standards regarding the treatment of pregnant pigs, despite challenges from the pork industry.

The U.S. pork industry, a sector worth $26 billion annually, has opposed such bans, claiming that they necessitate costly overall industry changes, which will increase pork prices nationwide. They also argue that these laws put an undue financial strain on pork producers in other states, as states with gestation cage bans import the majority of their pork.

A nationwide ban on pig gestation crates is being proposed by Democrats in Congress, but has been met with opposition from House Republicans in Midwest states who have introduced a counter bill to repeal agricultural commerce restrictions. The Biden administration sided with pork producers in the legal challenge against California's Proposition 12, claiming it disrupts the national pork market.

|

POLITICS & ELECTIONS |

— Trump says may skip first Republican debate, hold rival event: Reuters. Trump to Reuters: "Why would I give them time to make statements? Why would I do that when I'm leading them by 50 points and 60 points?” Link for more via Reuters.

— Republican Presidential candidate Mike Pence earned over $4.8 million from speaking, writing and consulting since the start of 2022, according to a financial disclosure report, including from his memoir So Help Me God.

Democratic candidate Marianne Williamson, who has published 15 books since 1992, earned more than $1.3 million over the past 18 months.

— The numbers that show Trump's strength. Charlie Cook of the Cook Political Report with Amy Walter, writes: “In reviewing the results of the NBC News poll released Sunday, I am reminded of how important it is to distinguish between wishful thinking and objective analysis, particularly when it comes to a figure as polarizing as former President Trump. These days we hear a lot of smart, experienced, and usually wise political pros predicting either that Trump will be overtaken in his bid to be the Republican presidential nominee next year, or that if nominated, Trump has no chance of winning a general election. In many cases, they have a thinly disguised, if disguised at all, personal animus to Trump, which, I think, colors their analysis.”

— Senate 2024 elections. Senate Republicans appear to have a favorable chance of regaining the majority in 2024. However, the results of primaries in West Virginia, Montana, and Arizona could greatly influence this outcome. Link for more via The Hill.

In Montana, Rep. Matt Rosendale (R-Mont.) is leading early polls despite previous defeat by Sen. Jon Tester (R-Mont.) in 2018. Despite this, Republican strategists believe Tim Sheehy, an entrepreneur and former Navy SEAL, might be a stronger contender against Tester in the general election.

West Virginia Gov. Jim Justice is backed by Senate Republican Leader Mitch McConnell but could face a tough primary challenge from Rep. Alex Mooney (R-W.Va.), who is supported by the Club for Growth, a well-funded conservative advocacy group.

In Arizona, former TV anchor Kari Lake might run for Sen. Kyrsten Sinema's seat, posing a considerable challenge as she enjoys popularity among the GOP base. However, her repeated denial of the 2020 election results could be detrimental. Sinema will also face competition from progressive Rep. Ruben Gallego (D-Ariz.). Interestingly, former Arizona Gov. Doug Ducey will become the CEO of Citizens for Free Enterprise, ruling out his candidacy against Sinema.

The Republicans' edge lies in the electoral map; Democrats have to defend 23 seats in 2024, with eight vulnerable incumbents. Notably, Republicans also have good pickup opportunities in Nevada and Ohio, and Democrats need to remain alert to maintain their seats in Michigan, Pennsylvania, and Wisconsin. Democrats currently control 51 Senate seats, meaning Republicans would have to gain two seats or win the presidency and gain a seat to flip the majority.

|

CONGRESS |

— Sens. Tammy Baldwin (D-Wis.) and Roger Marshall (R-Kan.) introduced the Reliable Rail Service Act (S 2071) on June 28. The Act intends to clearly define the obligations of Class I rail carriers and has gained support from the National Grain and Feed Association (NGFA), whose President and CEO Mike Seyfert acknowledged the need for clarity in understanding the common carrier obligation, which has been ambiguous for several decades. Seyfert said the measure is aimed at helping regulators deal with any service disruptions that impact livestock producers, grain exporters, and processing facilities.

The Reliable Rail Service Act takes its roots from the Staggers Act of 1980, which dictated that rail carriers must serve the larger shipping public based on reasonable requests, a principle called the common carrier obligation. Despite being more than four decades old, the common carrier obligation remains vaguely defined, lacking specific criteria.

This Act serves to clearly establish the common carrier obligation, setting guidelines for the Surface Transportation Board (STB) to decide whether a railroad is fulfilling its duties to provide service. In case a carrier fails to meet its obligation, the Act imbues the STB with the power to set service standards that are consistent with the requesting shipper's needs.

|

OTHER ITEMS OF NOTE |

— Supreme Court outlaws affirmative action in college admissions in landmark decision. The Supreme Court struck down affirmative action programs at Harvard University and the University of North Carolina Thursday, ruling that both institutions were in violation of the Fourteenth Amendment and federal civil rights law.

The decision essentially ends the practice of overt racial consideration in higher education admissions and overturns for all intents and purposes the high court’s 2003 ruling in Grutter v. Bollinger, which found that colleges could consider race as one factor in the admissions process to achieve a diverse student body. “Eliminating racial discrimination means eliminating all of it,” Chief Justice John Roberts wrote in the majority opinion. “And the Equal Protection Clause, we have accordingly held, applies ‘without regard to any differences of race, of color, or of nationality’—it is ‘universal in [its] application.’”

The chief justice concluded his opinion by saying that while colleges can consider an applicant’s “discussion of how race affected his or her life, be it through discrimination, inspiration, or otherwise … universities may not simply establish through application essays or other means the regime we hold unlawful today.”

“[T]he student must be treated based on his or her experiences as an individual—not on the basis of race,” Roberts went on. “Many universities have for too long done just the opposite. And in doing so, they have concluded, wrongly, that the touchstone of an individual’s identity is not challenges bested, skills built, or lessons learned but the color of their skin. Our constitutional history does not tolerate that choice.”

Roberts was joined in his opinion — which exempts America’s military academies — by all five of his colleagues on the court’s conservative wing: Justice Samuel Alito, Justice Clarence Thomas, Justice Amy Coney Barrett, Justice Brett Kavanaugh and Justice Neil Gorsuch. In his concurrence, Thomas wrote that “the Constitution continues to embody a simple truth: Two discriminatory wrongs cannot make a right.” “[B]oth Harvard and UNC have a history of racial discrimination. But, neither have even attempted to explain how their current racially discriminatory programs are even remotely traceable to their past discriminatory conduct,” added Thomas, one of two black justices on the current court.

The court’s three liberals, Sonia Sotomayor, Elena Kagan, and Ketanji Brown Jackson dissented in the UNC case, while Jackson — a graduate of Harvard College and Harvard Law School as well as a former member of the university’s Board of Overseers, recused herself from the case involving the Ivy League school.

Over the past 45 years, the Supreme Court has allowed educational institutions to factor race into their admissions decisions to counteract historic underrepresentation of Black and Latino students, acknowledging the barriers these groups have historically faced within American society. However, conservative members of the court, led by Justice Clarence Thomas, counterargue that such racial preferences are both illegal and unwarranted. Liberal justices opposed the ruling, expressing concern that it retracts multiple decades of legal precedent and undermines the constitutional principle of equal protection.

— More than 400 people were arrested across France this Thursday following a series of protests that ignited across the country. The public unrest, which has now seen its third night, initially sparked off due to the fatal police shooting of a 17-year-old boy named Nahel. This incident took place in Nanterre during a police traffic stop and was captured on video, which has since been widely circulated and viewed. The killing of Nahel has triggered debate and concern about potential racial prejudice involved in the incident and whether the police officer who fired the shot was acting unlawfully.

In response, approximately 6,000 people participated in a march to honor Nahel on Thursday. Amidst the escalating tensions, President Emmanuel Macron is reportedly holding crisis meetings for the second consecutive day and has appealed to French citizens to allow the justice system to appropriately handle the situation.

— U.S. Department of Justice arrested three investors from Florida on charges of insider trading related to a SPAC deal involving former President Donald Trump's social media company. The individuals are said to have made over $22 million in unlawful profits by trading shares of Digital World Acquisition Corp., the Special Purpose Acquisition Company (SPAC) that took Trump's business, Truth Social, public. The charges claim that these men acted on non-public information, gaining significant profits in October 2021 when the news about Digital World Acquisition Corp. planning to acquire Truth Social became public, which led to a significant increase in the stock price. Neither former President Trump nor any of his family members have been implicated in this insider trading case.

— Cotton AWP eases. The Adjusted World Price (AWP) for cotton declined to 63.57 cents per pound, effective today (June 30), down from 65.50 cents per pound the prior week. This marked the third weekly decline in the AWP. Meanwhile, USDA announced that Special Import Quota #11 would be established July 6 for the import of 37,110 bales of Upland Cotton, applying to supplies purchased not later than October 1 and entered into the U.S. not later than Jan. 1, 2024.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |