McConnell Nearly Dismisses Possibility of Extra Funding for Next Farm Bill

Supreme Court ruling to impact 2024 House races

|

In Today’s Digital Newspaper |

USDA daily export sale: 170,706 metric tons of corn for delivery to Mexico. Of the total, 21,340 metric tons is for delivery during the 2022-2023 marketing year and 149,366 metric tons is for delivery during the 2023-2024 marketing year.

President Joe Biden’s team are seeking to make “Bidenomics” a thing. Their argument: Three signature pieces of legislation stepping up federal spending on infrastructure, the semiconductor industry and the green transition mark a turning point after decades of underinvestment. Republicans stress the economy remains plagued by high inflation because of Biden’s first big package — a $1.9 trillion spending bill that was mostly cash transfers to households and states.

Natural gas prices have significantly decreased compared to last year. See Markets section.

The Federal Reserve is set to release the results of its annual bank stress tests later today following the recent banking crisis triggered by Silicon Valley. Despite the regional bank failures, experts anticipate the 23 lenders being tested will show capital more than regulatory minimums, securing their buybacks and dividends.

The leader of the Wagner group, Yevgeny Prigozhin, has arrived in Belarus according to the country's President, Alexander Lukashenko. This development follows a recent military insurrection by the Wagner group, posing a significant challenge to the Russian leadership. Lukashenko claims to have intervened, preventing Russian President Vladimir Putin from taking aggressive action against the Wagner group and its leader. Lukashenko also mentioned advising Putin to engage in dialogue with Prigozhin and his commanders before resorting to violence. More in Russia & Ukraine section.

Mercenary leader Yevgeny Prigozhin originally intended to capture Defense Minister Sergei Shoigu and chief of staff Gen. Valery Gerasimov during their planned visit near the Ukraine border, the Wall Street Journal reports. But Russia’s FSB intelligence agency learned of the plot two days before it was to be executed, according to Western officials, and Prigozhin accelerated it. That premature launch was among the factors that could explain its ultimate failure after 36 hours, when Prigozhin called off his Wagner paramilitary group’s armed march on Moscow that had initially faced little resistance. More in Russia & Ukraine section.

A new U.S./China competition bill could be a potential avenue for enacting tax policy, even after similar efforts came up short last year. Meanwhile, the WSJ reports More below.

Senate Republican leader Mitch McConnell (Ky.) nearly dismissed the possibility of extra funding for the upcoming 2023 farm bill. McConnell pointed out that new spending might be challenging, especially as the early-month debt limit agreement imposed a cap on expenditure. Sen. John Boozman (R-Ark.), the Senate Agriculture Committee's majority leader, acknowledged the confidential activities surrounding the bill and highlighted the need for risk management tools for farmers due to increasing interest rates, input costs, and weaker forecasts for commodity prices. More in Policy section.

The 2023 Farm Act in North Carolina has been enacted, allowing state agencies to regulate only those wetlands defined as 'waters of the United States' under the federal Clean Water Act.

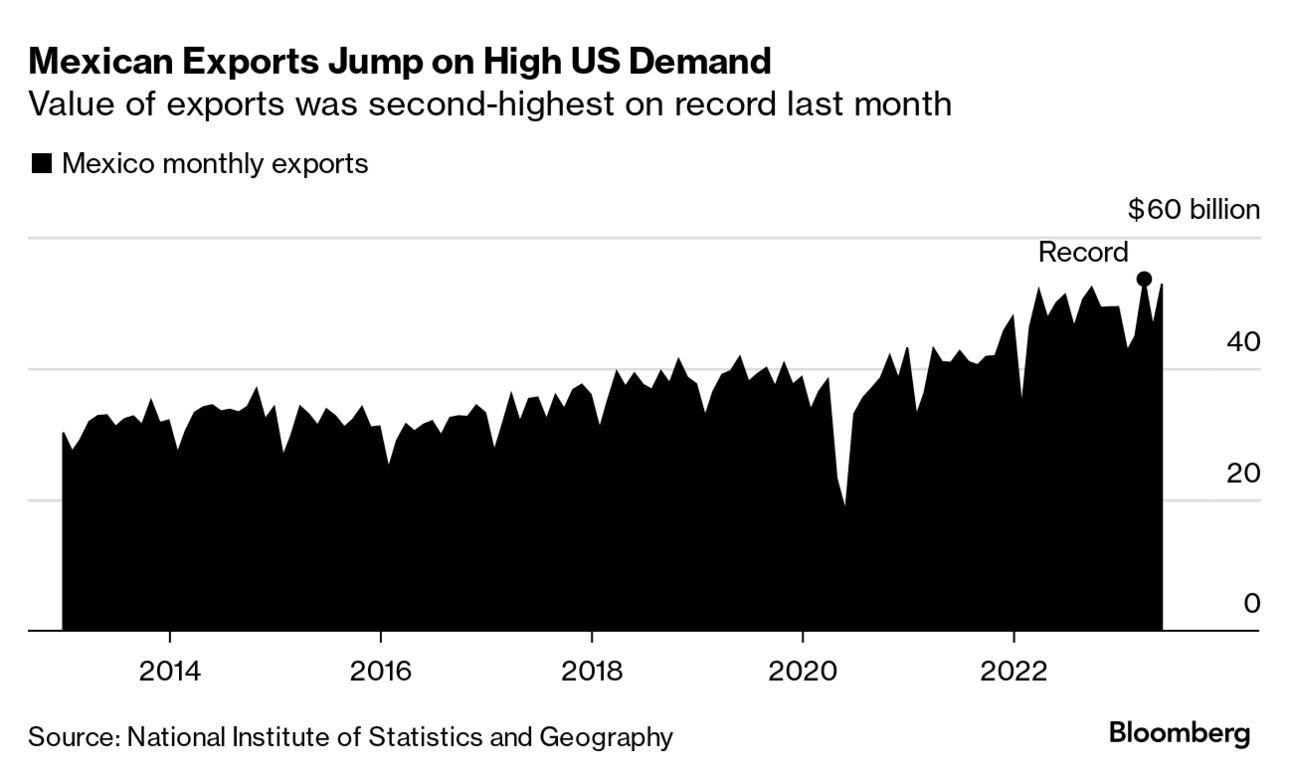

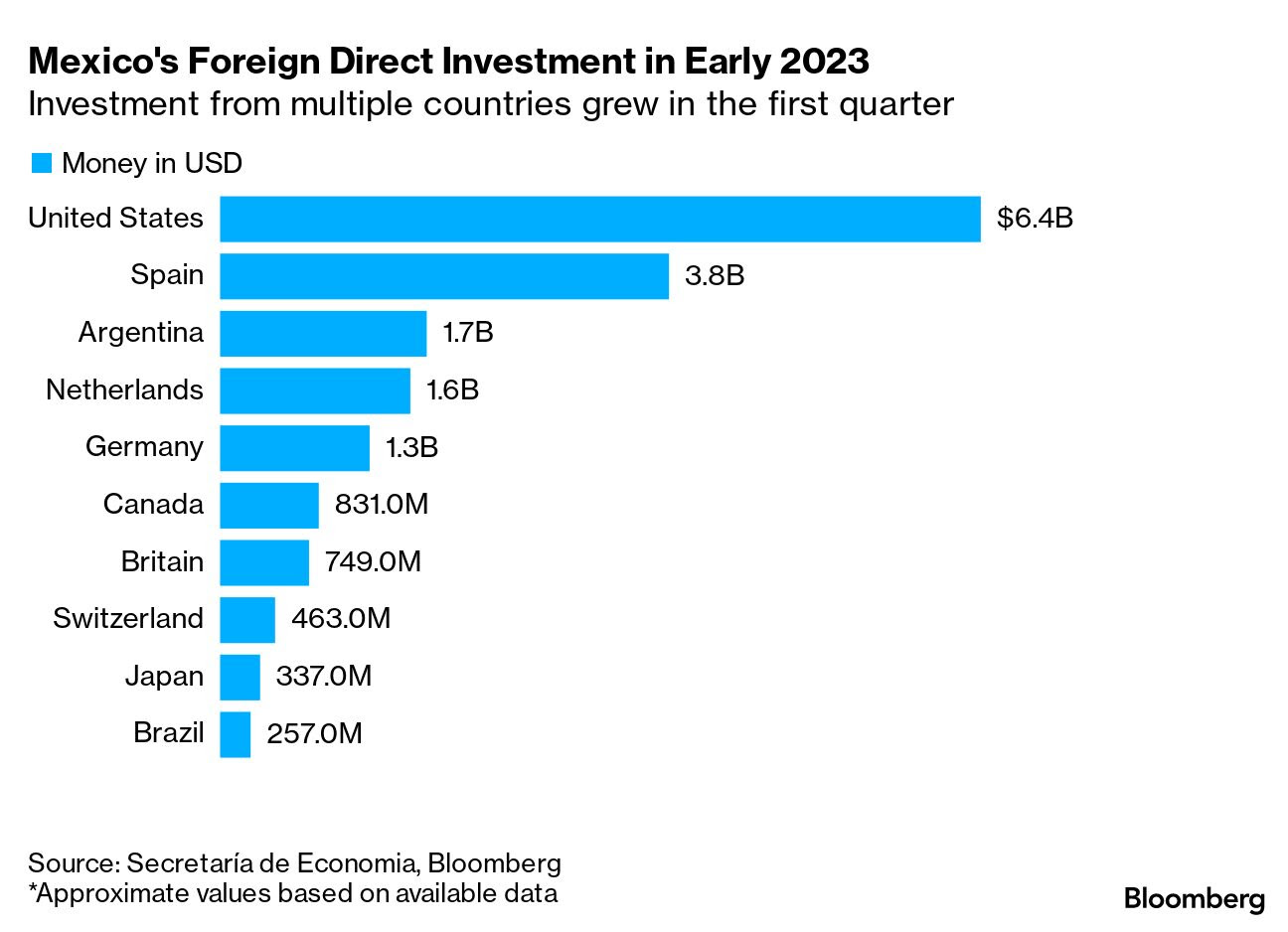

Mexico has been a key beneficiary of reworking the global supply chains that’s seeing companies find ways to be closer to the U.S. economy. More in Markets section.

Odds of Russia exiting Black Sea grain deal remain high. Meanwhile, Ukraine’s wheat crop could be ‘significantly higher’ than expected. More info in Russia & Ukraine section.

USDA… dubbed the U.S. Department of Announcements… continues to live up to that banner with several announcements yesterday detailing millions of dollars for several programs. More in Policy section.

The increased transition towards electric vehicles (EVs) could potentially face a significant hurdle due to a shortage of lithium.

In 2022, the U.S. energy industry experienced an increase in employment, adding 300,000 jobs, a 3.8% rise, according to the U.S. Energy and Employment Report by the Department of Energy (DOE). More in Energy section.

Everything you need to know about lab-grown meat now that it’s here is the title of a Forbes article that we digest in Food section.

FDA Commissioner Robert Califf announced updates to the proposed creation of the Human Foods Program.

France will initiate a vaccination program for all ducks in the country this October as a defense against avian influenza.

Brazil reports first farm-level HPAI case. More below.

Five cases of malaria have been identified in the U.S. More in Health section.

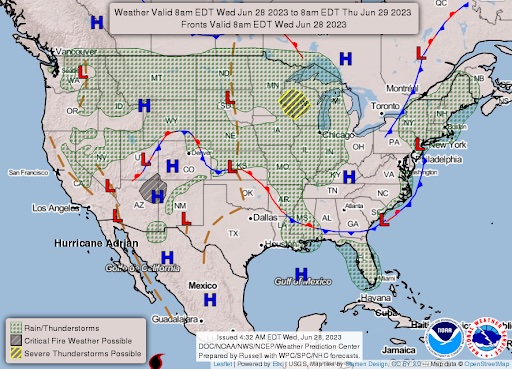

The southern parts of the United States are currently experiencing a severe heat wave, with millions of people enduring high triple-digit temperatures and extreme humidity levels. Here's the key points:

• Accelerating extreme weather: Some forecasters point out the increasing frequency of such heat waves as an impact of the ongoing climate crisis. This suggests that these extreme weather conditions could become a more common occurrence rather than being rare events, implying that preparedness and adaptation measures might need to increase.

• Persistent High Temperatures: Adding to the severity is the fact that temperatures, even during the night, are not dropping sufficiently, providing little to no cooling relief especially for those without access to air conditioning. There are expectations that up to 180 nighttime heat records may be potentially broken in the coming days.

• Impact on Air Travel: These extreme weather conditions aren't limited to just the scorching temperatures. Powerful storms have swept through various pockets of the country, including the Mid-Atlantic and parts of the Northeast, leading to a significant number of delays and cancellations of U.S. flights. Given that these regions are home to many bustling airports, the effect on air travel is substantial. Airlines also point to lingering air traffic control staffing shortages at the Federal Aviation Administration.

The Supreme Court's recent redistricting rulings appear to be in favor of the Democrats in terms of future House races. An earlier decision this month could potentially lead to the introduction of more districts in Alabama (see related item below), Louisiana, and Georgia that have a majority black population or close to it. However, the implementation of this is still pending further court decisions. Another ruling that came out on Tuesday upheld the authority of state courts to decide if district maps and voting rules are in violation of their state laws. This effectively dismissed an innovative legal argument brought forward by the Republicans in North Carolina. When considered together, these decisions could enhance Democrats' chances of securing three additional House seats in 2024, which would help to balance out any potential gains that the Republicans might make. This is significant for balance of power in the House of Representatives. More on this in Politics & Elections section.

|

MARKET FOCUS |

Equities today: Asian and European stock markets were mixed overnight. U.S. Dow opened around 60 points lower. A WSJ article released late Tuesday stated the U.S. was considering more restrictions on chip exports to China, and that’s weighing on sentiment and the chip stocks. In Asia, Japan +2%. Hong Kong +0.1%. China flat. India +0.8%. In Europe, at midday, London +0.7%. Paris +0.9%. Frankfurt +0.8%.

U.S. equities yesterday: All three major indices registered gains in the wake of solid economic data which consumer attitudes rising to the highest level since January 2022. The Dow rose 212.03 points, 0.63%, at 33,926.74. The Nasdaq moved up 219.89 points, 1.65%, at 13,555.67. The S&P 500 gained 498.59 points, 1.15%, at 4,378.41.

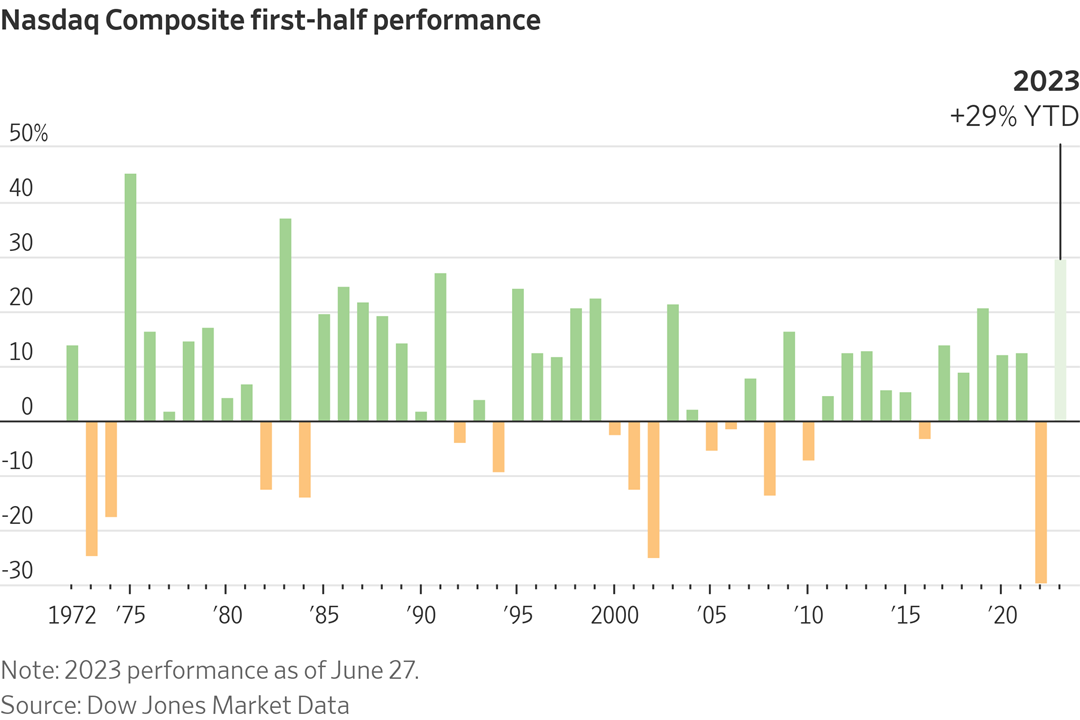

The tech-heavy Nasdaq index is up 29% this year through Tuesday's close, on pace for its best first-half performance since 1983.

Agriculture markets yesterday:

- Corn: December corn futures fell 27 1/4 cents to $5.61, ending nearer the session low.

- Soy complex: July soybeans fell 14 1/4 cents to $6.23, marking a low-range close. November soybeans fell 28 3/4 cents to $12.94 1/4, ending the session below the 10-day moving average. July meal closed $7.30 lower to $407.30, while July soyoil rose 104 points to 60.55 cents.

- Wheat: December SRW wheat closed down 39 1/2 cents to $7.16 1/4. December HRW wheat closed down 27 1/2 cents at $8.40 1/2. Prices closed nearer their session lows today. December Spring wheat fell 26 cents to $8.53 3/4.

- Cotton: December cotton fell 80 points to 77.06 cents, the lowest close since Nov. 29.

- Cattle: August live cattle futures rallied $1.90 on the day to close at $172.50, while expiring June futures closed $1.60 higher at $179.3. August feeder cattle futures surged $4.825 to close at $238.5.

- Hogs: Hog futures traded mixed Tuesday, with nearby July futures climbing 72.5 cents to $94.125 and August surging $1.00 to $91.05. The deferred contracts declined.

Ag markets today: Soybeans, wheat and new-crop corn futures faced followthrough selling overnight, while July corn futures pivoted around unchanged. As of 7:30 a.m. ET, corn futures were mixed with July 2 cents higher and December 10 cents lower. Soybeans were 10 to 18 cents lower and wheat futures were 7 to 10 cents lower. Front-month crude oil futures were near unchanged, and the U.S. dollar index was around 150 points higher.

Market quotes of note:

- Airline cancelations. United Airlines CEO Scott Kirby told employees, “The FAA frankly failed us this weekend.” The FAA shot back with a curt response: “We will always collaborate with anyone seriously willing to join us to solve a problem.” This year’s summer travel season is off to a turbulent start with bad weather delaying and canceling thousands of flights this week. Airlines also point to lingering air traffic control staffing shortages at the Federal Aviation Administration (FAA).

- Costco cracks down. “We don’t feel it’s right that nonmembers receive the same benefits and pricing as our members,” the company said. The bulk-selling company is cracking down on shoppers using membership cards that don’t belong to them, checking for photo IDs more often. Costco said it noticed an increase in membership card abuse since it expanded its self-checkout lanes at stores.

- Ukraine sees Putin’s end coming. “I think the countdown has started,” a top advisor to Ukraine President Volodymyr Zelenskyy said, according to the BBC.

Australia CPI inflation eases to 13-month low. The Consumer Price Index (CPI) in Australia saw a year-on-year increase of 5.6% in May 2023, a deceleration compared to the 6.8% growth reported for April 2023. This figure came in lower than market expectations, which predicted an increase of 6.1%. This decrease establishes the annual inflation rate recorded in May as the lowest since April 2022. The deceleration has been largely attributed to a slower increase in prices related to housing and transport. Food and non-alcoholic beverages, however, maintained a steady inflation pace at 7.9%. The CPI figure for May that excludes fluctuating items such as fruit, vegetables, and fuel, came down to 6.4% compared to 6.5% in April. The overall inflation continues to be significantly above the 2-3% target range set by the Reserve Bank of Australia.

Mexico has been a key beneficiary of reworking the global supply chains that’s seeing companies find ways to be closer to the U.S. economy. Total Mexican exports rose 5.8% from a year earlier in May to $52.9 billion, the second-highest reading on record, the country’s statistics institute reported on Tuesday. Sales of manufactured goods have made up 88.6% of all exports so far in 2023. Much of that corresponds to automotive shipments to the U.S., which jumped 31% in value from a year ago. Another trend: Mexico’s northern states are a favorite destination for companies that aim to position their own operations or link with suppliers closer to the U.S., a process known as nearshoring which often means shifting production capacity away from China. Chinese companies are also setting up in Mexico to avoid American tariffs.

Market perspectives:

• Outside markets: The U.S. dollar index was firmer, with the euro and British pound weaker. The yield on the 10-year U.S. Treasury note was weaker, trading around 3.72%, with a mostly lower tone in global government bond yields. Crude oil futures remain lower ahead of U.S. market action, with U.S. crude around $67.30 per barrel and Brent around $72.10 per barrel. Gold and silver are under pressure, with gold around $1,916 per troy ounce and silver around $22.72 per troy ounce.

• Japanese policymakers and business leaders appear much calmer about the recent slide in the yen than they were about last year’s intervention-triggering collapse — a sign they see the weakness as temporary.

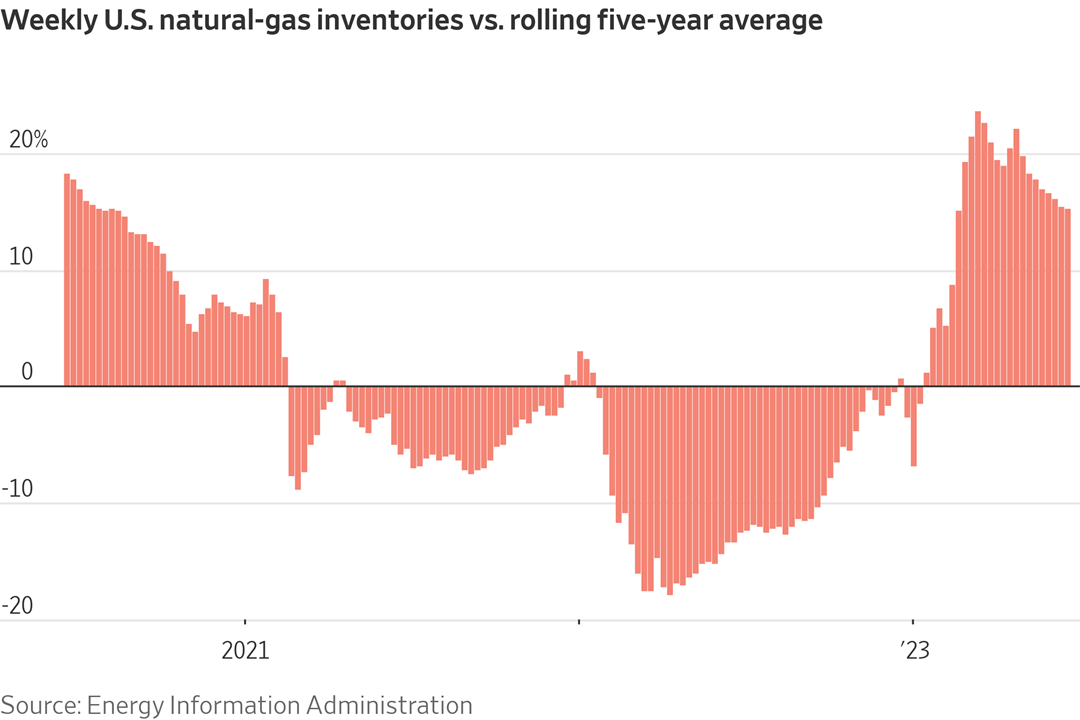

• Natural gas prices have significantly decreased compared to last year. Cheaper natural gas is likely to result in lower electricity bills for many American households, especially during the summer as the use of air conditioners increases. Manufacturers of a range of products, such as chemicals, cat litter, fertilizer, paper, wallboard and steel, have revealed that reduced gas bills are helping to relieve cost pressures and improve profit margins. Although there was a 22% rally in natural gas prices this month due to extreme temperatures in Texas and elsewhere, analysts do not anticipate a similar price surge this summer as experienced in 2022, when energy markets were significantly impacted by Russia's invasion of Ukraine. Goldman Sachs Group analysts project that prices will continue to hover around the current level this summer. They have revised their forecast of summer prices, now predicting an average of $2.85 per million British thermal units, down from a previous forecast of $3.30.

• UPS labor contract talks. With less than five weeks to go before the expiration of a UPS labor contract, talks to renew the agreement have moved into a critical phase as negotiators begin hammering out pay raises for about 340,000 workers.

• The Biden administration announced new sanctions targeting the Wagner Group’s gold-mining activities in Africa as part of a bid to hamper the mercenary group’s ability to fund itself, days after it mounted a mutiny against President Vladimir Putin’s forces.

• Ag trade: Thailand rejected all offers in its tender to buy 55,000 MT of feed wheat.

• NWS weather outlook: There is a Slight Risk of severe thunderstorms over parts of the Upper Mississippi Valley on Wednesday, moving to the Middle Mississippi/Ohio Valleys on Thursday... ...Excessive Heat Watches/Warnings and Advisories over parts of the Southern Rockies, Southern Plains, Middle/Lower Mississippi Valley, Central Gulf Coast... ...Air Quality alerts over parts of the Upper/Middle Mississippi Valley, Great Lakes, Western Ohio Valley, Central Appalachians, and Mid-Atlantic.

Items in Pro Farmer's First Thing Today include:

• Followthrough selling in grains overnight

• Canadian acreage report out this morning

• Wholesale beef prices continue to fall

• Pork cutout tops $100

|

RUSSIA/UKRAINE |

— Prigozhin arrives in Belarus. Alexander Lukashenko, Belarus’s president, confirmed that Yevgeny Prigozhin, the leader of the Wagner mercenary group, had arrived in his country. Lukashenko, who claims to have helped negotiate an end to Wagner’s short-lived mutiny, said that Vladimir Putin, Russia’s president, had considered killing Prigozhin.

Meanwhile, Jens Stoltenberg, NATO’s chief, said the alliance had increased its military presence on its eastern flank after Prigozhin’s move to Belarus.

— WSJ: Wagner’s Prigozhin planned to capture Russian military leaders. In an exclusive report (link) by the Wall Street Journal, it has been revealed that Yevgeny Prigozhin, a notorious mercenary leader, had planned to capture key figures in Russian military leadership. Western officials claim that Prigozhin expedited his plot when Russia's domestic intelligence agency, the FSB, learned of the conspiracy. They suggest the early launch and subsequent exposure of the plot could account for its eventual failure after 36 hours.

Prigozhin's initial plan was to capture Defense Minister Sergei Shoigu and Gen. Valery Gerasimov, the Chief of Russia’s General Staff, during a visit to a region bordering Ukraine. However, the FSB discovered the conspiracy two days in advance leading Prigozhin to develop an alternative course of action.

Despite the failure of the coup, this event has raised concerns regarding President Putin's authority, as Moscow appeared incapable of stopping Prigozhin's troops, known as Wagner, from nearing the capital city, even though the Kremlin was aware of the plans.

The intel indicates that Prigozhin counted on part of Russia’s armed forces to side with the rebellion against their own leadership. The preparations saw large amounts of ammunition, fuel, and military equipment gathered in the days leading up to the planned mutiny.

After being informed of the leak, Prigozhin acted fast and managed to seize the strategic city of Rostov, indicating some regular force commanders might have been involved in the mutiny. Western intelligence believes Prigozhin had communicated his intentions to top military officers, but it remains unclear who passed this information to the FSB.

The rebellion ended in a standoff, mediated by Belarusian President Alexander Lukashenko, who offered to host the Wagner troops as a form of personal security against possible Russian aggression. The stationing of Wagner troops in Belarus is believed to be a guarantee for Lukashenko’s security.

However, no evidence suggests that regular forces switched sides to join Wagner, and this event has led to large-scale purges within the Russian armed forces. The indecisiveness shown during the rebellion serves as a reason behind these purges, says former Defense Ministry official Mikhail Zvinchuk.

— Odds of Russia exiting Black Sea grain deal remain high. The probability of Russia’s withdrawal from the Black Sea grain deal in July remains high, although talks continue, Russian RIA news agency reported. Russian officials have repeatedly said Moscow would end the deal after the current extension expires on July 17 if its demands aren’t met.

— Ukraine’s wheat crop could be ‘significantly higher’ than expected. Ukraine’s 2023 wheat production may far exceed official expectations of 17 MMT. Grain traders union UGA said “expected yields are quite high” after surveying farmers. UGA said based on the ag ministry’s planted acreage figures, this year’s crop could reach 23.5 MMT to 24 MMT. UkrAgroConsult raised its total grain production forecast by 900,000 MT to 46.4 MMT due to expected bigger wheat and corn crops.

|

POLICY UPDATE |

— McConnell: Extra funding for farm bill ‘hard to come by.’ Senate Minority Leader Mitch McConnell (R-Ky.) today warned that the tight spending atmosphere after the debt ceiling debate will limit any additional money for the next farm bill. “New spending is going to be hard to come by” for the farm bill, McConnell (R-Ky.) said at a University of Kentucky agriculture event on the reauthorization of the farm bill. The comments reinforce the idea that House and Senate Agriculture committees would need to remain at or below baseline spending levels for the around $1.5 trillion food and farm legislation; both parties have requested more funds. Efforts by some farm-state lawmakers are looking at "efficiencies" in moving some funding round via various titles of the farm bill. Also, the House Budget panel is working with Ag Chair G.T. Thompson (R-Pa.) regarding crop insurance program ideas. Link to listen to the news conference.

McConnell comments: “I have proudly served on the Agriculture Committee since my first day in the Senate and understand exactly how important the Farm Bill is to agricultural communities across Kentucky,” said McConnell. “I’m glad the Committee’s Ranking Member, Senator Boozman, joined me in Fayette County with Commissioner Ryan Quarles and Dean Nancy Cox to hear farmers’ priorities for the Farm Bill firsthand. I look forward to continuing our conversations about how we can help keep America’s food supply abundant and affordable while empowering Kentucky’s farmers to do what they do best – feed our nation.”

Boozman: “Stakeholder input is a vital part of the process. That’s why it is important to get out of Washington and hear directly from those on the ground who utilize farm bill programs to ensure their concerns are being addressed and their needs are being met.” Boozman highlighted the changed global context since the last farm bill in 2018, citing high interest rates, inflation, and input costs. He also emphasized the importance of risk management tools to ensure the agricultural capacity of the U.S. with the changing environmental and economic conditions. The ongoing war in Ukraine and potential animal pandemics were also noted as significant factors impacting agriculture.

Bottom line: Boozman expressed confidence in the process of crafting the farm bill, hoping for an effective outcome. He has consistently said he will not support a farm bill that doesn’t provide for an increase in the Price Loss Coverage program’s reference prices.

Of note: University of Kentucky College of Food and Agriculture Dean Nancy Cox addressed concerns about public research funding, acknowledging competition from China, but also emphasizing the opportunities at hand. The university has broken ground on a new Agriculture Department research facility to help keep U.S. research competitive.

What was not said: McConnell didn't comment on the possibility of running for re-election in 2026.

— USDA will commit a minimum of $500 million towards wildlife conservation efforts over the next five years, USDA Undersecretary for Farm Production and Conservation Robert Bonnie announced Tuesday. The funding, part of President Biden's Investing in America agenda, will emphasize support for farmers, ranchers, and forest owners, with the aim of conserving key geographical areas across the country.

The investment marks an extension of the USDA's Working Lands for Wildlife initiative, which merges advanced scientific insights with localized knowledge to create a unified vision and common goals for conserving resources within a specific ecosystem. The new resources will be derived from the Agricultural Conservation Easement Program and the Environmental Quality Incentives Program, each contributing $250 million.

The targeted conservation approach aims to protect the habitats of key species like sage grouse and longleaf pine, along with contributing to the conservation of others such as bobwhite quail. Bonnie also mentioned that funding from the Inflation Reduction Act will assist in recovery efforts for the northern bobwhite, with over 3.5 million acres assigned to alleviate greenhouse gases.

Reaction: The National Association of Conservation Districts (NACD) expressed its support for the strategy, noting the significance of voluntary conservation actions that improve wildlife habitats, adding its eagerness to collaborate with USDA and other associates to spearhead landscape-scale conservation. Meanwhile, President and CEO of the National Wildlife Federation, Collin O’Mara, acknowledged the pivotal role of working lands in maintaining wildlife habitats, ensuring clean water, and combating climate change. He lauded the expansion and investment into the Working Lands for Wildlife program as a landmark moment, viewing it as a crucial step toward securing a variety of species, including elk and songbirds, across the country.

— Farm bill wish list grows. A bipartisan group of lawmakers, spearheaded by Sen. Tammy Baldwin (D-Wis.) and Susan Collins (R-Maine), along with Rep. Chellie Pingree (D-Maine), is urging the Senate and House Agriculture Committee leaders to tackle the issue of PFAS water contamination in the upcoming farm bill. This information came to light through a letter (link) sent on Tuesday. The group is advocating for the inclusion of two specific bills in the broader agricultural legislation. These are the Healthy H2O Act and the Relief for Farmers Hit With PFAS Act. These bills push for the provision of grants for water testing and treatment technology, as well as other financial aid to rural communities and farmers impacted by PFAS.

— The 2023 Farm Act in North Carolina has been enacted, allowing state agencies to regulate only those wetlands defined as 'waters of the United States' under the federal Clean Water Act. This legislation, which Governor Roy Cooper (D) initially vetoed, was passed this week by a Republican supermajority. As a result, North Carolina has joined an estimated 24 other states that do not have their own wetland regulations and depend on the now-limited federal protections. This data is according to a recent report by the Environmental Law Institute. It now falls to these states to determine if and how they will address wetland regulation at the state level, either through their legislatures or regulatory agencies.

|

CHINA UPDATE |

— China is increasingly concerned about the potential instability in Russia after the recent Wagner paramilitary group uprising. The Chinese special envoy for Ukraine visited the country for talks with officials, reportedly to gauge the determination of Kyiv's counteroffensive, as even limited success could trigger further destabilization in Russia. Analysts suggest that internal unrest in Russia is one of China's worst fears, and while they currently continue to support Russia, they may be considering alternative political scenarios. This uncertainty surrounding Russia's stability may also impact China's potential plans to retake Taiwan, as they no longer have a strong ally in Russia. For more, link to NikkeiAsia.

— Profits at China’s industrial firms fell by 18.8% year-on-year in the first five months of 2023, partly because of weakening demand. In May industrial earnings contracted by 12.6% from a year earlier. China’s post-Covid economic recovery is stuttering on many fronts, including retail sales, exports and youth unemployment, which hit a record high of 20.8% in May.

— The "New China 2.0 Competition Bill" is being presented as a potential instrument to enact a bilateral plan that includes a carbon border adjustment mechanism. The goal of this mechanism would be to tax imports from China and other countries that don't adhere to stringent environmental standards, as is done in the United States. This move would aim to level the playing field by effectively penalizing countries for lax environmental regulations.

The proposal is being spearheaded by Sen. Chris Coons (D-Del.), who is chair of the Appropriations State and Foreign Operations subcommittee, one of the groups involved in the bill's creation. Another key figure in the process is Sen. Kevin Cramer (R-N.C.). Earlier this month, they proposed a separate bill designed to establish the foundations for a more comprehensive, bipartisan carbon tax legislation. This implies a broader approach to tackling environmental concerns, transcending party lines for the common goal of mitigating climate change.

— The Biden administration. is planning to tighten technology restrictions on China by potentially requiring chip makers to obtain licenses before shipping advanced chips to China and other nations deemed a concern, the Wall Street Journal reports (link). The move, anticipated to take place as early as next month, could hinder China's progress in AI technology development. Expanding on previously announced measures, the licensing may limit the distribution of top-tier chips to Chinese tech industry.

The Biden administration is also examining the possibility of implementing constraints on the provision of cloud services to Chinese AI companies. This action would aim to prevent these companies from circumventing chip bans by leveraging cloud services. The sources who provided the updates wished to remain anonymous, but are reportedly familiar with the matter.

— Chinese leader Xi Jinping reaffirmed his commitment to promoting economic development and protecting foreign investors' rights amid concerns over China's unpredictable policymaking and economic slowdown. He made these remarks during a meeting with New Zealand Prime Minister Chris Hipkins in Beijing.

Meanwhile, Chinese Premier Li Qiang attended a "Summer Davos" dialog in Tianjin where he assured entrepreneurs from around the globe of China's willingness to collaborate. Amidst this, he cautioned against the politicization of economies and championed companies taking the lead in risk-proofing their supply chains.

High-profile figures like Bernard Arnault, CEO of LVMH, JPMorgan Chase & Co. CEO Jamie Dimon, Tesla's Elon Musk, and Apple's Tim Cook have recently visited China, highlighting renewed business interest.

Recent instances like a clampdown on foreign consultancy firms, part of an anti-espionage campaign, and stringent regulations on various industries have stoked fears among foreign investors. Some European and American companies have expressed growing difficulties in doing business and are reconsidering their investments in China.

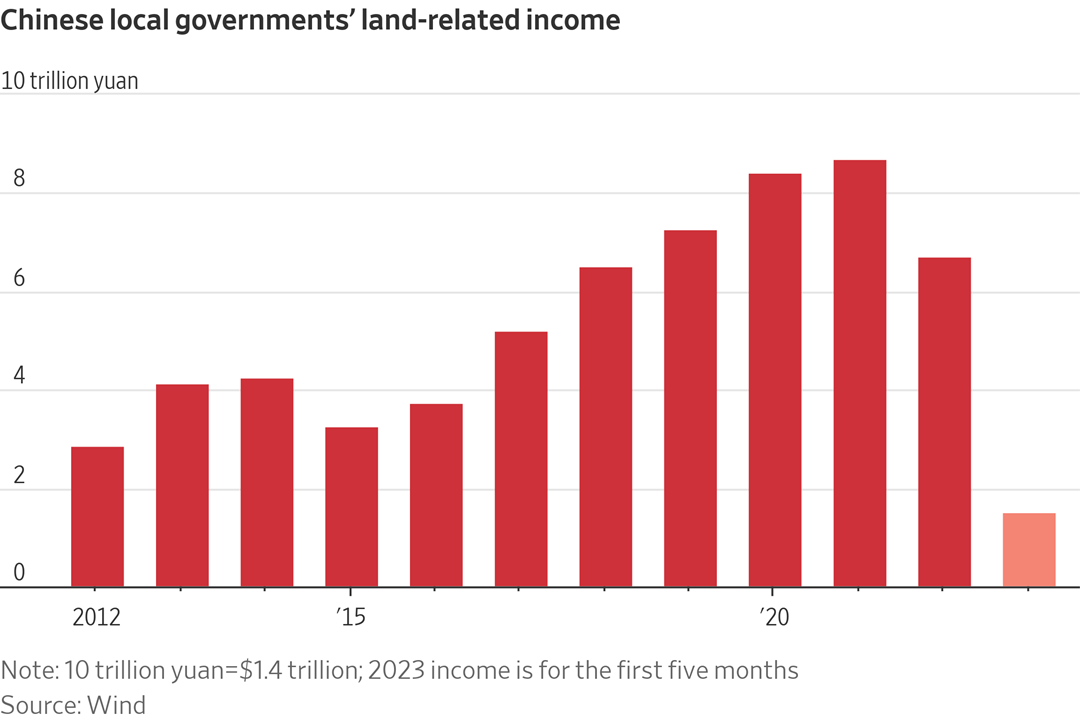

— Landing in trouble. Local governments in China have traditionally depended on land sales as a significant source of their income. However, a notable decline in the property market has reportedly led to some fraudulent practices. The National Audit Office of China disclosed on Monday that 70 local authorities had manipulated their financial incomes through fabricated land sales, accruing a total of $12 billion falsely last year.

|

ENERGY & CLIMATE CHANGE |

— The increased transition towards electric vehicles (EVs) could potentially face a significant hurdle due to a shortage of lithium, a vital ingredient for the development of rechargeable batteries. This issue is expected to hit the global lithium market towards the end of this decade due to the widened adoption of EVs. Benchmark Mineral Intelligence, a source for information on the mineral industry, has stated that $51 billion or more will be necessary in investments to fulfill the anticipated demand for rechargeable batteries. If these investments are not made in time, there could be a serious slowdown in the growth of the EV market.

— In 2022, the U.S. energy industry experienced an increase in employment, adding 300,000 jobs, a 3.8% rise, according to the U.S. Energy and Employment Report by the Department of Energy (DOE). The growth rate of jobs in this sector exceeded that of general job growth.

The clean energy sector witnessed significant growth by adding 114,000 jobs. The battery electric vehicle sector saw the most rapid growth, with an increase of 28,400 jobs, a 27% rise, affirming it as the fastest-growing sector in energy technology.

Although the fuel sector saw the highest numerical increase of jobs, significant growth was seen particularly in natural gas, with a 24.1% increase equating to 51,100 jobs, and in petroleum fuels with a 12.5% increase equals 58,100 jobs.

Despite this growth, the petroleum fuels sector still remained 117,100 jobs below pre-pandemic levels in 2019.

Of note: Other areas such as power transmission, distribution and storage, energy efficiency, and electric power generation saw growth rates below the energy sector's average. The coal electric power generation sector, on the other hand, experienced a decline, losing around 6,800 jobs, a decrease of roughly 9%.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Everything you need to know about lab-grown meat now that it’s here. That’s the title of a Forbes article written by Chloe Sorvino (link). It provides an analysis of the realities surrounding lab-grown meat, also referred to as "cultivated meat", following its approval in the United States. While the technological innovation is impressive, the piece raises several issues that may hinder its success and widespread adoption.

- Cost: Lab-grown meat is incredibly expensive to produce, costing in the range of thousands or even hundreds of thousands per ounce. Despite the high costs, brands are setting prices similar to regular meat to entice consumers, resulting in substantial losses.

- Profitability: Given its current cost structure, lab-grown meat might not be profitable for years, if ever.

- Production Process: Creating cultivated meat requires expensive facilities and equipment such as bioreactors, which is further adding to overall costs.

- Taste: The experience of eating lab-grown meat needs to appeal to consumers, posing a challenge for the products to be flawless and desirable.

- Environmental Impact: Contrary to popular belief, the process of producing lab-grown meat uses a significant amount of energy and could potentially be more damaging to the environment than conventional meat production if renewable energy sources aren't utilized.

- Health Concerns: Experts indicate that these proteins could be considered as ultra-processed, and there is little research currently on the potential long-term impacts of consuming such foods.

- Intellectual Property: Patent wars may likely occur between companies, each having unique formulas for producing lab-grown meat.

- Economic factors: Even with advancements in this technology, the high production costs mean that it will likely become a luxury item affordable only to the wealthiest consumers, doing little to address food scarcity and affordability issues.

Bottom line: It's apparent that while lab-grown meat is an innovative development, there are several significant hurdles to overcome to make it a legitimate alternative to conventional meat sources. This goes beyond obtaining regulatory approval to factors such as cost, taste, health implications, environmental impact, and economic disparities.

— Food and Drug Administration (FDA) Commissioner Robert Califf announced updates to the proposed creation of the Human Foods Program (HFP), with additional adjustments to the Office of Regulatory Affairs (ORA). The decision derives from the complicated human food and manufacturing landscape in conjunction with growing public health concerns.

Earlier changes announced by FDA this year focused on modernizing and streamlining their food program, including field operations, to address an array of challenges. Recent feedback from employees and stakeholders has contributed to a broad rethink of this strategy and recognition of a unique chance to align field work with the priorities of program offices and centers.

The updated proposal includes repositioning several of ORA's laboratories and merging its compliance functions with those of the new HFP and other agency product centers. These changes are expected to optimize resources and better address the public health mission in a complex environment.

Reaction: Senior Vice President of Regulatory and Scientific Affairs for the International Dairy Foods Association (IDFA), Joseph Scimeca, applauded the announced changes. The revisions, he said, are particularly welcomed for focusing on inspections, outbreak investigations, and reducing duplicated efforts. The IDFA is also urging FDA to reassign relevant cooperative program staff, specifically those overseeing the Grade A dairy program, to the new Human Foods Program.

— France will initiate a vaccination program for all ducks in the country this October as a defense against avian influenza, according to an announcement made by a French farm ministry official. The duration and seasonal scope of the vaccination campaign, i.e. whether it will only run in fall and winter or continue throughout the year, is yet to be determined, dependent on budget allocations.

The vaccination announcement coincides with the confirmation that the recent outbreak of avian flu has been successfully contained, after culminating in the slaughter of 10 million birds this season.

France is the first country to introduce such an expansive vaccination effort. Although some countries have contemplated similar actions, fear of trade impacts has been a deterrent. This stems from certain countries banning imports of vaccinated poultry. It's a precautionary measure implemented due to the inability of tests to differentiate between vaccinated and infected birds.

The U.S. has not committed to a nationwide vaccination effort.

On a global scale, avian influenza continues to be a significant issue, with approximately 200 million birds culled worldwide because of the disease.

— Brazil reports first farm-level HPAI case. Brazil’s ag ministry reported the first case of highly pathogenic avian influenza (HPAI) in farm-raised birds in the municipality of Serra, Espirito Santo. The Brazilian Association of Animal Protein said because it is a backyard outbreak and not from a commercial flock, this does not change Brazil’s status as free of the disease before the World Organization for Animal Health.

|

HEALTH UPDATE |

— Five cases of malaria have been identified in the U.S., marking the first time since 2003 that the disease has been acquired within the country, federal health officials said. Link to more via the WSJ.

|

POLITICS & ELECTIONS |

— The Supreme Court on Tuesday dismissed the "independent state legislature" theory in a major decision with a 6-3 vote, with Chief Justice John Roberts writing for the 6-3 majority. Justices Neil Gorsuch, Clarence Thomas and Samuel Alito dissented. This legal theory, which has been supported by some conservatives, argued that state legislatures have the authority to set election rules with minimal oversight from state courts. The rejection of this theory came in a case revolving around North Carolina's congressional map and is expected to curb a conservative push to further empower state legislatures in election-related matters.

Roberts wrote: “The Elections Clause does not vest exclusive and independent authority in state legislatures to set the rules regarding federal elections. Marbury v. Madison famously proclaimed this Court’s authority to invalidate laws that violate the Federal Constitution. But Marbury did not invent the concept of judicial review… James Madison extolled judicial review as one of the key virtues of a constitutional system, and the concept of judicial review was so entrenched by the time the Court decided Marbury that Chief Justice Marshall referred to it as one of society’s ‘fundamental principles.’ The Elections Clause does not carve out an exception to that fundamental principle. When state legislatures prescribe the rules concerning federal elections, they remain subject to the ordinary exercise of state judicial review.”

Upshot: The court found that state courts still must act within “ordinary bounds” when reviewing laws governing federal elections. That gives another set of tools for those who lose election lawsuits in state courts to try to persuade federal judges to overturn those rulings.

The ruling in the case of Moore v. Harper has significant implications for the administration of federal elections in the United States. Here's why it matters, according to analysts:

- Checks and Balances: The decision confirms that state legislatures do not have absolute power over the conduct of federal elections. This means that their decisions can be evaluated, questioned, and potentially overturned by other government officials, providing an important check and balance.

- Preventing Partisan Supremacy: At a time when many state legislatures are dominated by a single party, the ruling makes it more difficult for these legislatures to potentially bypass laws or accepted norms to maintain their party's dominance. This ensures the integrity of the democratic process.

- Impact on Future Elections: Given these changes, this verdict could play a significant role in moderating the powers of state lawmakers looking to amend election laws. This power shift could, in turn, influence which political party controls Congress in the future. It means alterations made to favor a particular party might be more meticulously scrutinized and challenged, upholding the basic principles of fairness and non-partisanship in election conduct.

- Legal Precedent: Furthermore, the involvement of both conservative and liberal justices in delivering this ruling sets a strong bipartisanship precedent for future cases concerning election law, emphasizing the importance of observing state laws and upholding the constitution over partisan objectives.

Bottom line: It reaffirms the balance of power among governmental authorities and upholds the principles of democracy and fair elections.

— Alabama governor calls special session to redraw congressional districts. Alabama has seven congressional districts, but only one is majority-Black despite the demographic making up 27% of the state. According to the Supreme Court’s ruling, the state legislature must add a second majority-Black district to bring the map more in line with the state’s representative population. Justices John Roberts and Brett Kavanaugh joined the three liberal justices in the 5-4 decision earlier this month. The special session will begin July 17. “It is critical that Alabama be fairly and accurately represented in Washington,” Governor Kay Ivey said in a statement Tuesday. The special session is only authorized to make new maps, with Ivey saying the issue is “too urgent and too important.” The legislature must pass new maps by July 21. It takes five days to pass legislation in the Alabama legislature, giving them the minimum number of days to pass the new maps.

— House Speaker Kevin McCarthy (R-Calif.) expressed doubt Tuesday about whether Donald Trump is the best bet for the GOP to regain the White House next year. “Can he win that election? Yeah, he can,” McCarthy told CNBC’s Squawk Box morning show. “The question is, is he the strongest to win the election? I don’t know that answer… But can anyone beat Biden? Yeah, anybody can beat Biden,” the Speaker went on. “Can Biden beat other people? Yes, Biden can beat them. It’s on any given day.” But later Tuesday, McCarthy tried to walk back the comment, telling Breitbart that Trump is “stronger today than he was in 2016.” McCarthy accused the media of attempting to drive a wedge between Republicans. He added that Trump is “Biden’s strongest political opponent.”

|

OTHER ITEMS OF NOTE |

— South Koreans woke up a year or two younger after their country scrapped its traditional method of counting age. Under the old system, South Koreans were considered a year old when they were born. A year was added to citizens’ age every Jan. 1. Babies born on New Year’s Eve became two the following day. The government has now adopted the internationally accepted method.

— Rising interest in camping means prime spots are selling out across the country — but not all campers who reserve spots show up. States are responding with stricter no-show policies and fees.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |