EPA Will Not Be Granting Small Refiner Exemptions for RFS

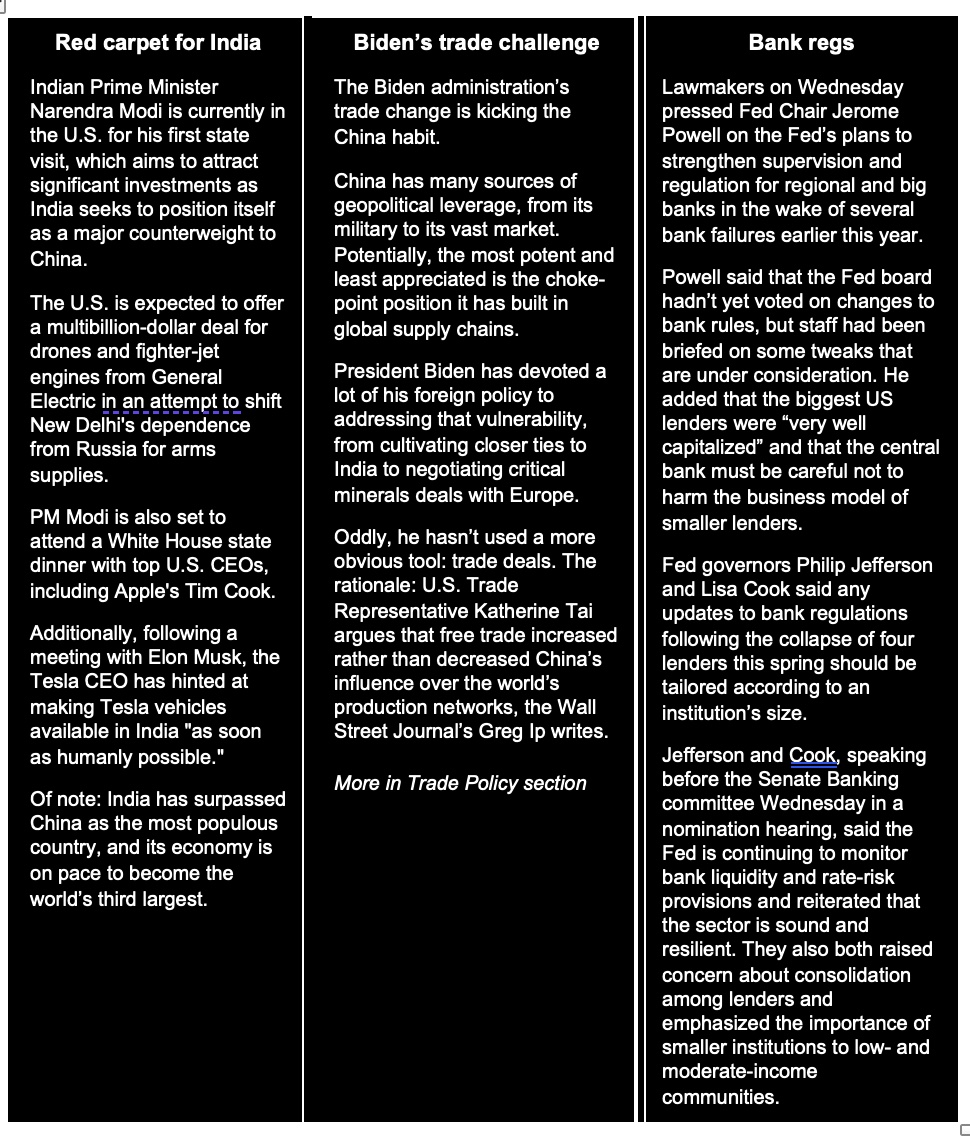

Biden laying out red carpet for India | Biden’s trade policy challenge | ‘Cultivated chicken’

|

In Today’s Digital Newspaper |

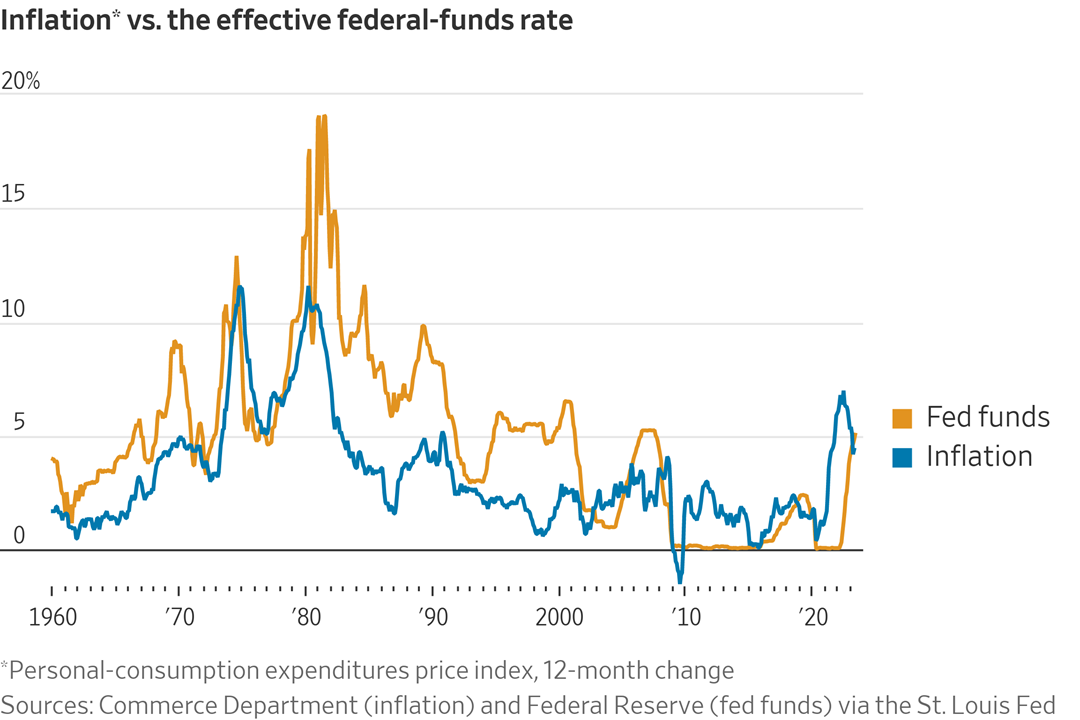

Bottom line for Fed Chair Jerome Powell’s appearance before the House Financial Services Committee on Wednesday: Higher rates ahead with a lag. Updated forecasts showed that 16 of the Fed’s 18 policy committee members expect another interest-rate hike, and a majority expect two more this year. Powell said the Fed will decide “meeting by meeting,” based on incoming data and implications for economic activity, inflation, and risks. More in Markets section.

Note: USDA Weekly Export Sales data pushed back to Friday due to Monday’s government holiday.

The United Food and Commercial Workers International Union (UFCW), which represents 1.3 million essential workers in grocery stores, meatpacking plants, and other essential industries across North America, today announced agreement with PSSI to offer union contracts to workers across the country.

The United States is presenting India with a multibillion-dollar weapons deal, featuring the purchase of cutting-edge U.S. drones and joint production of jet-fighter engines. This unprecedented move comes during Indian Prime Minister Narendra Modi's White House visit and demonstrates a shift in policy as Washington sees India's strategic importance in countering China and curbing Russian influence in developing countries. Previously, the U.S. had been hesitant to share advanced weaponry with India due to its ongoing relationships with Russia for military equipment.

Ukrainian forces targeted the Chonhar bridge with missile strikes, significantly affecting supplies to Russian front-line troops in southern Ukraine. This attack could potentially weaken Moscow's position in the region while Kyiv seeks to reclaim lost territory. The Russian-appointed head of Kherson province, Vladimir Saldo, shared footage of the partially destroyed bridge, acknowledging that, while it may not directly impact Russia's military plans, it would cause complications for local residents' mobility.

Ukrainian officials, including Foreign Ministry Ambassador Olha Trofimtseva, are expressing doubt about Russia remaining in the Black Sea Grain Initiative. Meanwhile, the future of the Russian natural gas transit agreement with Ukraine is uncertain. More in Russia/Ukraine section.

America’s population is older than ever, with a record-high median age of 38.9. In 1980, the median was 30.

EPA will not be granting small refiner exemptions for the RFS, as the final volume requirements announced Wednesday rely on the projection that no gasoline or diesel produced by small refineries will be exempt from RFS requirements under the Clean Air Act. More below.

EPA assumes there will be rising production of sustainable aviation fuel (SAF), but that will cut into renewable diesel production. More in Energy section.

Is the renewable diesel industry headed for a cliff? That’s the headline of a WSJ article. More in Energy section.

Russia may halt gas shipments to Europe via Ukraine next year as Kyiv and Moscow are unlikely to renew their transit contract, Ukraine’s Energy Minister German Galushchenko told the Financial Times.

The Bank of England raises rates by more than expected. The central bank today increased rates by 0.5 percentage points, defying predictions that it would opt for a quarter-point rise. The decision was announced a day after the latest data showed that headline inflation in Britain was stuck at 8.7% in May, higher than economists had forecast. More in Markets section.

Drought is forcing the Panama Canal to constrain traffic. The implications for energy markets, gas in particular, could be far-reaching, slowing existing routes while also creating opportunities for new ones.

California to allow whole pork meat not compliant with Prop 12 to be sold through year-end. Details in Livestock section.

Lab-grown ‘cultivated chicken’ products head to restaurants. Eat Just and Upside Foods, two food industry start-ups, received approval from USDA for commercial sales of cultivated chicken meat, which is protein created in a laboratory from harvested cells. The product will be on menus at restaurants in Washington, D.C., and San Francisco. More in Food section.

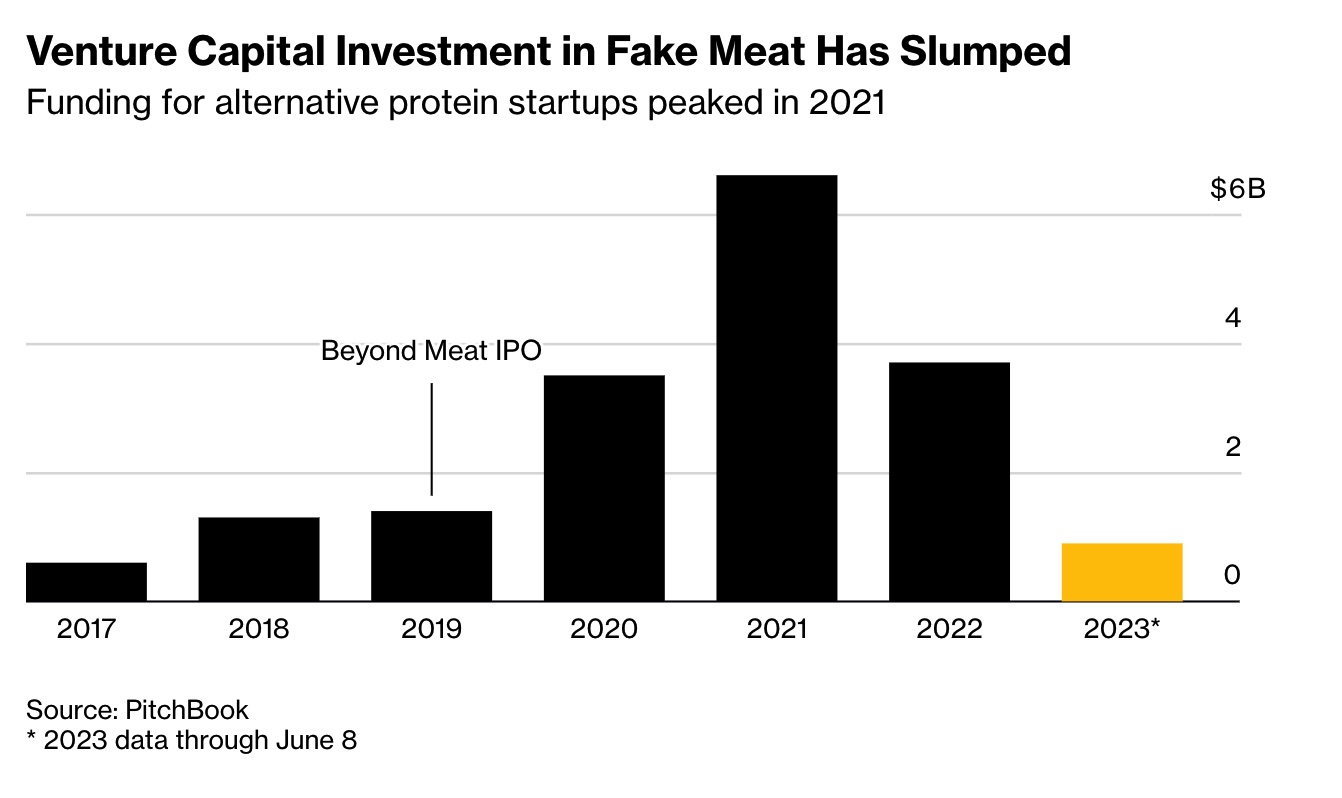

A big shakeout in the fake-meat sector is here, and it’s widening. Beyond Meat, which has seen its market value drop over 90% from its peak, has had multiple rounds of layoffs in the past year, as has Impossible Foods. More in Food section.

The Senate Banking Committee approved a major overhaul of banking regulations. More in Congress section.

|

MARKET FOCUS |

Equities today: Global stock markets were mostly lower overnight. U.S. opened 35 points lower. In Asia, Japan -0.9%. Hong Kong closed. China closed. India -0.5%. In Europe, at midday, London -0.9%. Paris -1.4%. Frankfurt -0.8%.

U.S. equities yesterday: The Dow fell 102.35 points, 0.30%, at 33,951.52. The Nasdaq lost 165.09 points, 1.21%, at 13,502.20. The S&P 500 was down 23.02 points, 0.52%, at 4,365.69.

The VIX index of volatility, sometimes known as the fear index, closed Wednesday at the lowest level since January 2020.

Agriculture markets yesterday:

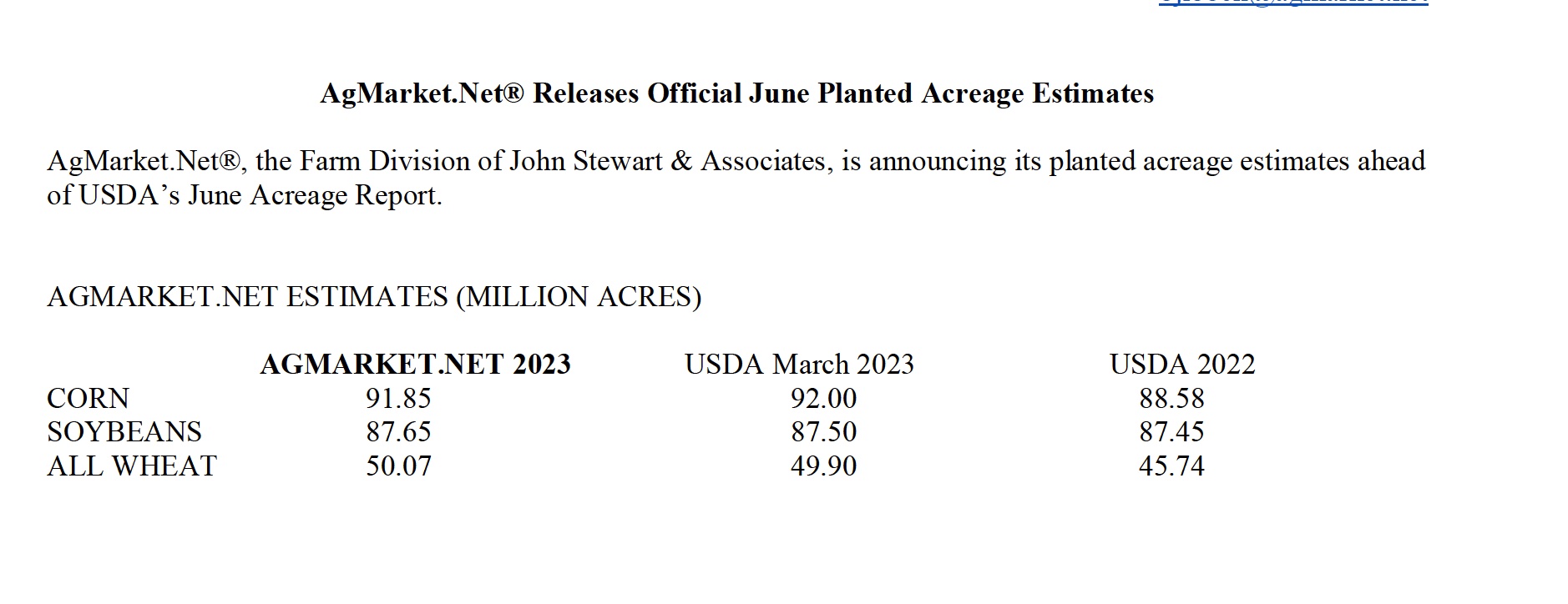

- Corn: July corn surged 27 1/4 cents to $6.71, finishing above the 200-day moving average and at the highest level since Jan. 17. December corn rallied 31 1/4 cents to $6.28 3/4, the highest close since Oct. 14.

- Soy complex: November soybeans rose 34 1/4 cents to $13.77 and near the session high. Prices hit a three-month high. August soybean meal gained $27.20 to $437.30 and nearer the session high. Prices hit a two-month high. August bean oil closed down the 400-point limit at 54.73 cents.

- Wheat: July SRW futures rallied 38 3/4 cents and settled at $7.34 1/2, the highest close in four months. July HRW futures closed 37 3/4 cents higher at $8.73 3/4 and near the session high. July spring wheat rose 29 3/4 cents to $8.78 3/4.

- Cotton: December cotton fell 18 points to 80.52 cents and near mid-range.

- Cattle: August live cattle futures rose 5 cents to $169.75 despite early session weakness, while expiring June futures rose 12.5 cents to $177.25. August feeder futures fell $4.425 after gapping lower on the open and closed near session lows.

- Hogs: Nearby July lean hog futures fell $1.10 to $94.75 Wednesday, while most-active August dipped 42.5 cents to $92.775.

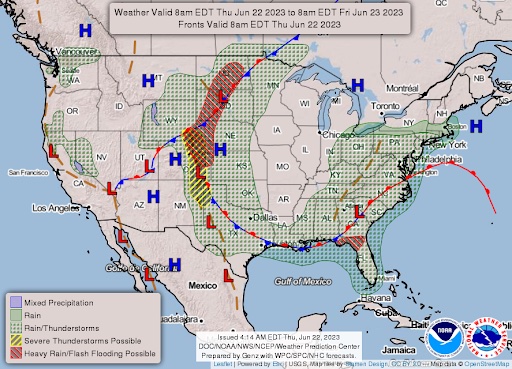

Ag markets today: Corn, soybean and wheat futures pulled back from recent strong gains overnight, while soyoil faced heavy followthrough selling after yesterday’s limit-down performance. As of 7:30 a.m. ET, corn futures were trading 6 to 10 cents lower, soybeans were 14 to 24 cents lower, winter wheat futures were 6 to 8 cents lower and spring wheat was 2 to 3 cents lower. Front-month crude oil futures were around $1.50 lower, and the U.S. dollar index was near unchanged.

Market quotes of note:

- Fed Bank of Atlanta President Raphael Bostic said he supports holding the central bank’s target-rate level and that it’s prudent to give time for inflation to ease in response to past moves.

- Be a lawyer, not an investment banker? “It used to be you’d say someone is an investment banker, and that was a big deal. Now it’s like meh. … If I had to pick my favorite buyers, it would be big-time lawyers.” — Lisa Lippman, a Manhattan real estate broker, on an apparent power shift on Wall Street: Bankers are no longer the top moneymakers. Managing directors who aren’t in high-ranking leadership roles at banks make an average of between $1 million and $2 million most years, including bonuses often paid largely in stock, unchanged from where it was two decades ago. Equity partners at top law firms, meanwhile, can make around $3 million or more a year— more than triple what they were pulling in two decades ago. Link for more via the WSJ.

- “We are in this weird foggy environment where it is hard to figure out where the road is." — Chicago Fed President Austan Goolsbee said Wednesday at the Wall Street Journal’s Global Food Forum in Chicago.

On tap today:

• U.S. jobless claims are expected to fall to 256,000 in the week ended June 17 from 262,000 one week earlier. (8:30 a.m. ET) UPDATE: In the week ending June 17, 264,000 Americans filed for unemployment benefits, which is higher than market expectations and matches the previous week's upwardly revised value. This figure marks the highest number since October 2021, signaling a softening in the U.S. labor market after a long period of tightness. This shift is believed to be a result of the Federal Reserve's aggressive tightening campaign affecting businesses. To account for weekly fluctuations, the four-week moving average increased by 8,500 to 255,750, while seasonally unadjusted claims dropped by 1,237 to 250,037.

• Federal Reserve Chair Jerome Powell presents the central bank's semi-annual monetary policy report on Capitol Hill at 10 a.m. ET.

• U.S. existing home sales are expected to fall to an annual pace of 4.25 million in May from 4.28 million one month earlier. (10 a.m. ET)

• Conference Board's leading economic index for May is expected to fall 0.7% from the prior month. (10 a.m. ET)

• Kansas City Fed's manufacturing survey is expected to tick down to minus 2 in June from minus 1 one month earlier. (11 a.m. ET)

• Additional Fed speakers: Governor Michelle Bowman and Cleveland's Loretta Mester on the postpandemic economy at 10 a.m. ET, and Richmond's Thomas Barkin on inflation at 4:30 p.m. ET.

Bank of England raises rates by 50bps, to 5%, marking a 13th consecutive increase, and pushing borrowing costs to their highest level since the 2008 financial crisis. Most investors were expecting a smaller 25bps increase although the odds for a bigger 50bps hike strengthened after a hot inflation print. The BOE said it may raise its key interest rate again in the coming months if there are fresh signs that inflation is set to stay high for longer than it expects. The central bank last month forecast that inflation would fall to its target of 2% by the end of 2024, about nine months later than it had expected at the start of the year. The U.K. economy has barely grown since Russia’s invasion of Ukraine sent energy and food prices surging in early 2022. The BOE had expected to see a winter recession, but raised its growth forecasts in May as the economy proved more resilient than it had expected. However, economists worry that a sharp rise in borrowing costs, coming on top of higher energy and food prices, could push the U.K. into economic contraction.

Federal Reserve Chairman Jerome Powell indicated that the central bank might raise interest rates in the coming months but at a slower pace than before, Powell told the House Financial Services Committee on Wednesday. “Given how far we’ve come, it may make sense to move rates higher but to do so at a more moderate pace,” Powell said. He compared the Fed’s latest action to a driver that, after pulling off the highway, proceeds at a slower speed to avoid missing the ultimate destination. “We never used the word ‘pause,’ and I wouldn’t use it here today,” Powell said.

Powell explained why the Fed held rates steady in June, calling it a combination of the five percentage points of rate hikes so far, the uncertain lag effect on the economy from monetary policy, and the potential for tighter credit conditions to slow economic activity.

Though rates were left unchanged last week, the Fed aims to strike a balance between curbing inflation and preventing a significant economic slowdown. With inflation and economic activity not quite slowing as anticipated, Fed officials still predict two more rate increases this year. This tighter financial condition may raise borrowing costs, lower stock prices, and strengthen the dollar. The wait-and-see approach will continue for the remainder of the year, however, as the Fed monitors incoming data on inflation and economic activity.

Asked specifically about the impact of the Fed’s policy moves on low- and moderate-income communities, Powell emphasized that getting inflation under control benefits those families the most, because they “suffer most immediately and worse from high inflation.”

Powell today will testify before the Senate Banking Committee. The Fed chair’s semiannual report to Capitol Hill comes as inflation remains more than double the bank’s 2% target even after 10 straight interest-rate increases. Core PCE, the Fed’s preferred inflation gauge, was up 4.7% year-over-year in April.

America’s population is older than ever, with a record-high median age of 38.9. In 1980, the median was 30. The median age in the U.S. reached a record high of 38.9 in 2022, primarily due to low birthrates. The trend indicates an aging population that poses challenges for the workforce, economy, and social programs and is similar to several European and Asian nations. While the U.S. remains younger than its European peers, the country is becoming more diverse. Southern and Western states have attracted the most new residents recently, with their demographics becoming more dynamic.

Market perspectives:

• Outside markets: The U.S. dollar index was slightly, with only the yen slightly weaker against the greenback. The yield on the 10-year U.S. Treasury was slightly higher, around 3.73%, with a mostly higher tone in global government bond yields. Crude oil futures were under pressure, with U.S. crude trading around $71.20 per barrel and Brent around $75.75 per barrel. Gold and silver were lower ahead of U.S. market action, with gold around $1,935 per troy ounce and silver around $22.55 per troy ounce.

• The price of bitcoin surpassed $30,000 for the first time in two months following announcements that institutional players like BlackRock, Wisdom Tree and Invesco are seeking permission to offer exchange-traded funds tracking the price of bitcoin. The cryptocurrency market’s value has recovered to $1.22 trillion from a recent low of $1.06 trillion after the SEC charged crypto exchanges Binance and Coinbase for the sale of unregistered securities.

• The oil market has been experiencing an unusual trend this year, with the price gap between low-quality and high-quality crude oil narrowing. A Bloomberg article lists several factors are contributing to this anomaly:

- OPEC+ production cuts have increased the prices of heavier oil in the Middle East.

- High US crude exports have depressed prices for benchmark grades like Brent and West Texas Intermediate, with average shipments rising by a million barrels daily compared to the previous year.

- A key pricing window affecting Dubai crude saw a particularly busy period in June, with more than 900 Dubai partials traded, leading to 35 crude cargoes from Oman and UAE changing hands.

These factors together have made heavier, sulfur-rich crude oil more expensive while causing lighter, high-quality crude to become relatively less pricey.

• Chinese exports of used cooking oil to Singapore reached a record high in May, with shipments increasing by 18% compared to April and nearly doubling from the same period last year. This surge in demand can be attributed to the expansion of Neste Oyj's renewable fuel plant, which is the world's largest renewable-diesel refinery and sustainable aviation fuel producer.

• Officials managing the Panama Canal will impose stricter measures on large ships crossing the waterway, which has been hit by the worst drought in more than a century. As a result of the shallower waters, container ships will face lower limits on the weight they can carry. The new restrictions will take effect on Sunday.

• AgMarket.Net announced its planted acreage estimates ahead of USDA’s June Acreage Report:

• U.S. farmers are facing a crisis as the pork industry undergoes a difficult cycle. The world's largest hog producer, Smithfield Foods' CEO Shane Smith, predicts that some U.S. hog producers may start selling their corn instead of using it as animal feed. This comes because of growers losing up to $80 per head due to dwindling demand from China and rising feed costs. The situation has been exacerbated by the worst corn crop conditions since 1992, causing prices to soar and putting farmers in a tough spot. Additionally, stricter animal welfare laws in California have further increased production costs. The American meat market is facing a glut, and Smith believes it might take until the end of 2024 to normalize. Link for more via Bloomberg.

• Ag trade: Japan purchased 92,529 MT of wheat in its weekly tender, including 32,106 MT U.S., 25,978 MT Canadian and 34,445 MT Australian.

• NWS weather outlook: Heat wave to persist from eastern/southern New Mexico across much of Texas... ...Wet weather across much of the eastern U.S. and the Plains... ...Critical Risk of Fires across much of New Mexico.

Items in Pro Farmer's First Thing Today include:

• Grain, soy markets face heavy pressure overnight

• India’s wheat crop much lower than gov’t estimate

• Cattle futures holding up despite weakening cash fundamentals

• Cash hog fundamentals continue to strengthen

|

RUSSIA/UKRAINE |

— Vladimir Saldo, a Russian official in occupied southern Ukraine, claimed that Ukraine struck a bridge linking the city of Kherson with the Crimean peninsula. He said British Storm Missiles were deployed in an attack “ordered by London.” On Wednesday Volodymyr Zelenskyy, Ukraine’s president, admitted that his country’s counter-offensive against Russia has been “slower than desired.”

— The future of the Russian natural gas transit agreement with Ukraine is uncertain, as suggested by Ukrainian energy minister German Galushchenko in an interview with the Financial Times. According to Galushchenko, the chances of renewing the agreement, which is set to expire at the end of 2024, are slim. As a result, Ukraine is preparing for the potential stoppage of supplies. Though the flows of Russian natural gas to Europe have decreased significantly, the termination of the transit agreement could lead to higher gas prices in Europe. This situation highlights the importance of securing stable gas supplies and emphasizes the need for diversified energy sources to maintain energy security in the region.

— Ukrainian officials, including Foreign Ministry Ambassador Olha Trofimtseva, are expressing doubt about Russia remaining in the Black Sea Grain Initiative. This follows Russia's discovery of an alternative ammonia transportation route, without needing to use the pipeline through Ukraine to the port of Odesa. Trofimtseva posted on Telegram that there is a 99.9% chance Russia will exit the grain corridor agreement in July.

|

CHINA UPDATE |

— Can sanctions threat deter China from invading Taiwan? Yes and No — Measures taken against Moscow over Ukraine would be much trickier to apply to Beijing, according to a new analysis. Link to WSJ article.

|

TRADE POLICY |

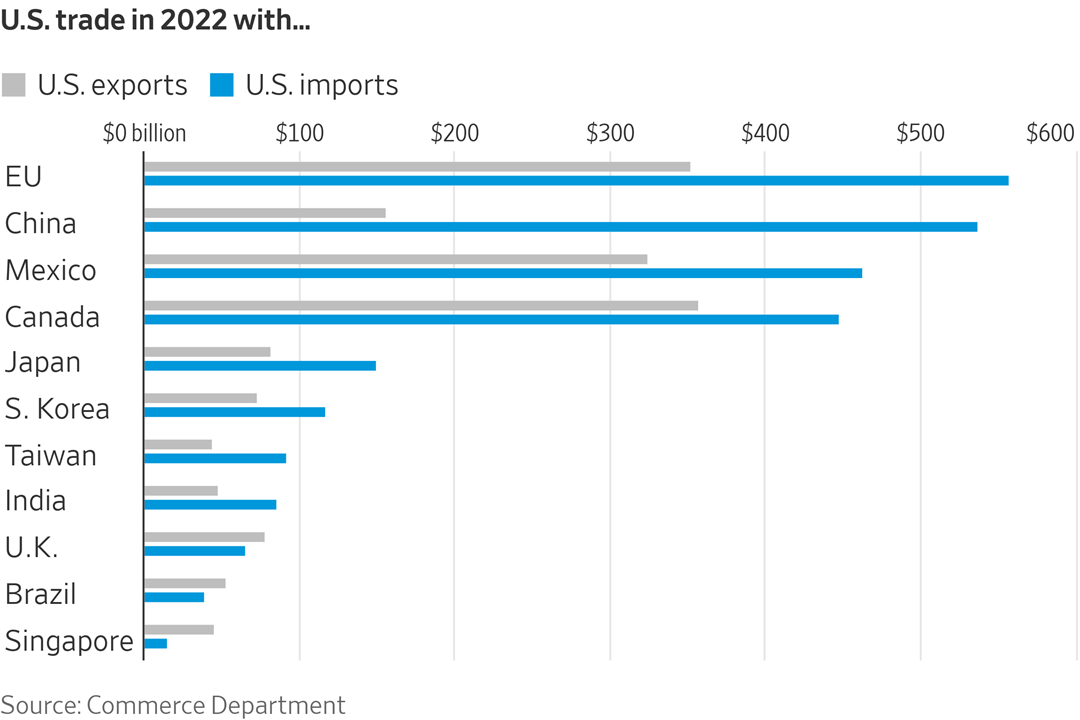

— Biden administration officials want to avoid trade deals whose rules boost China’s role in supply chains. Wall Street Journal writer Greg Ip writes (link) that “President Biden has devoted a lot of his foreign policy to addressing that vulnerability, from cultivating closer ties to India, which aspires to become an alternative manufacturing base to China, to negotiating critical minerals deals with Europe. Oddly, he hasn’t used a more obvious tool: trade deals. Biden has turned aside pleas to join pacts such as the Trans-Pacific Partnership, an accord between 12 Pacific Rim economies, or use access to the U.S. market as a tool of diplomacy.”

China has built a choke-point position in global supply chains, increasing its geopolitical leverage. Despite efforts by President Biden to address this vulnerability by cultivating ties with other countries and negotiating minerals deals, trade deals have been underutilized and even avoided. U.S. Trade Representative Katherine Tai's speech offers insight into this, Ip notes, as she argues past trade deals empowered China's influence over production networks.

China can benefit from free-trade agreements it isn't a part of through "rules of origin." Critics argue that these rules allowed Chinese elements to enter the U.S. duty-free, despite not being part of certain agreements. Asian countries want the U.S. to rejoin trade pacts, but doing so would leverage existing supply chains linked to China and increase dependence on Beijing.

Tai did not single out China in her speech. Instead, Biden's administration aims to replace what they dub the discredited free trade orthodoxy with a focus on domestic growth and industrial policy, dubbed "Bidenomics." “We decided to replace this theory with what the press has now called ‘Bidenomics,’” President Biden told a campaign-style event in Philadelphia on Saturday. “I don’t know what the hell that is. But it’s working.”

Still, most problems attributed to trade agreements are linked to China's central role in global supply chains.

Upshot: The Biden administration believes that trade agreements that further increase dependency on potentially hostile countries could undermine U.S. security, so creating resilient supply chains should be a priority when negotiating future deals. If properly managed, trade can help to create more diverse and secure options for countries like the U.S.

|

ENERGY & CLIMATE CHANGE |

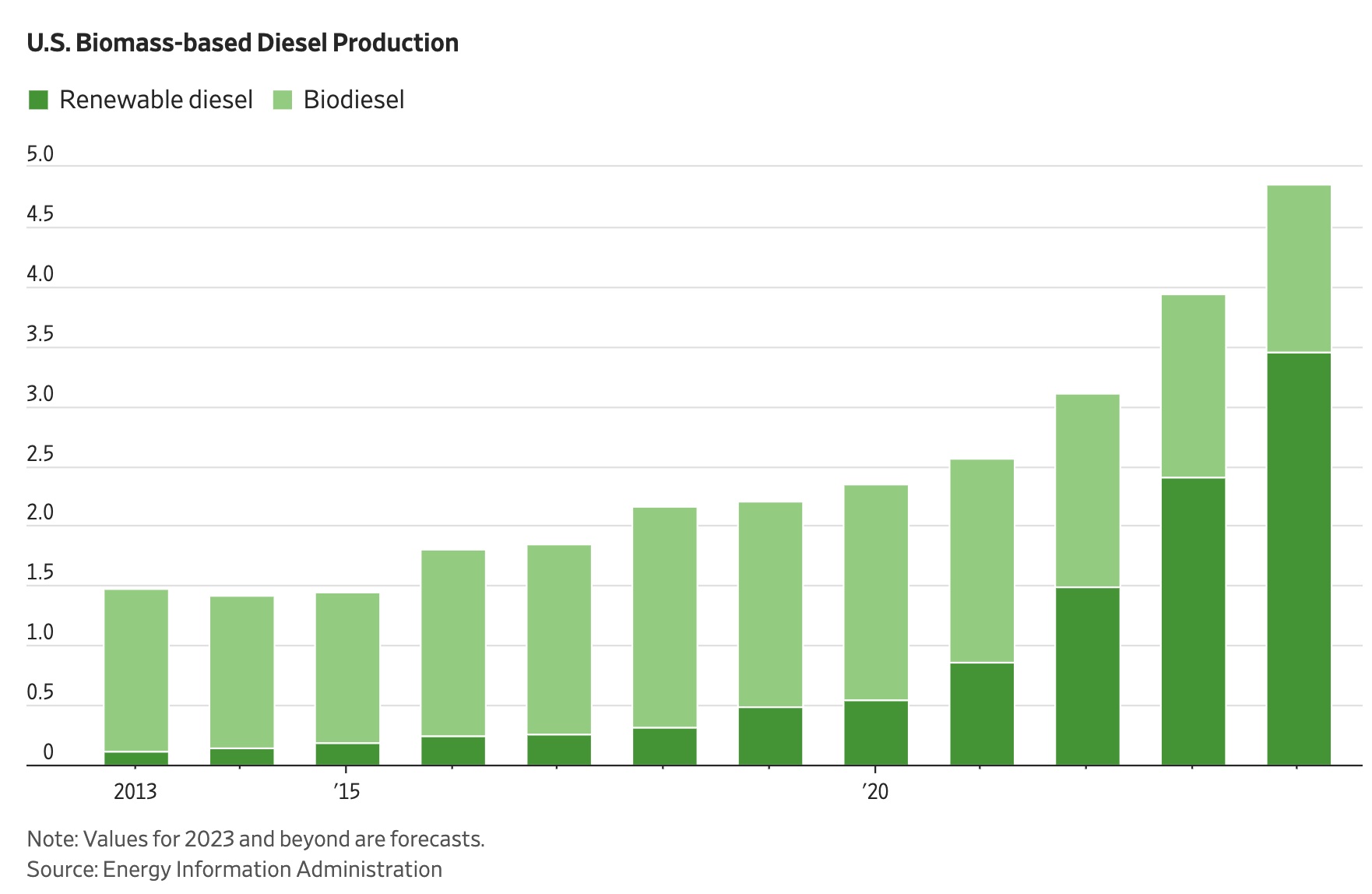

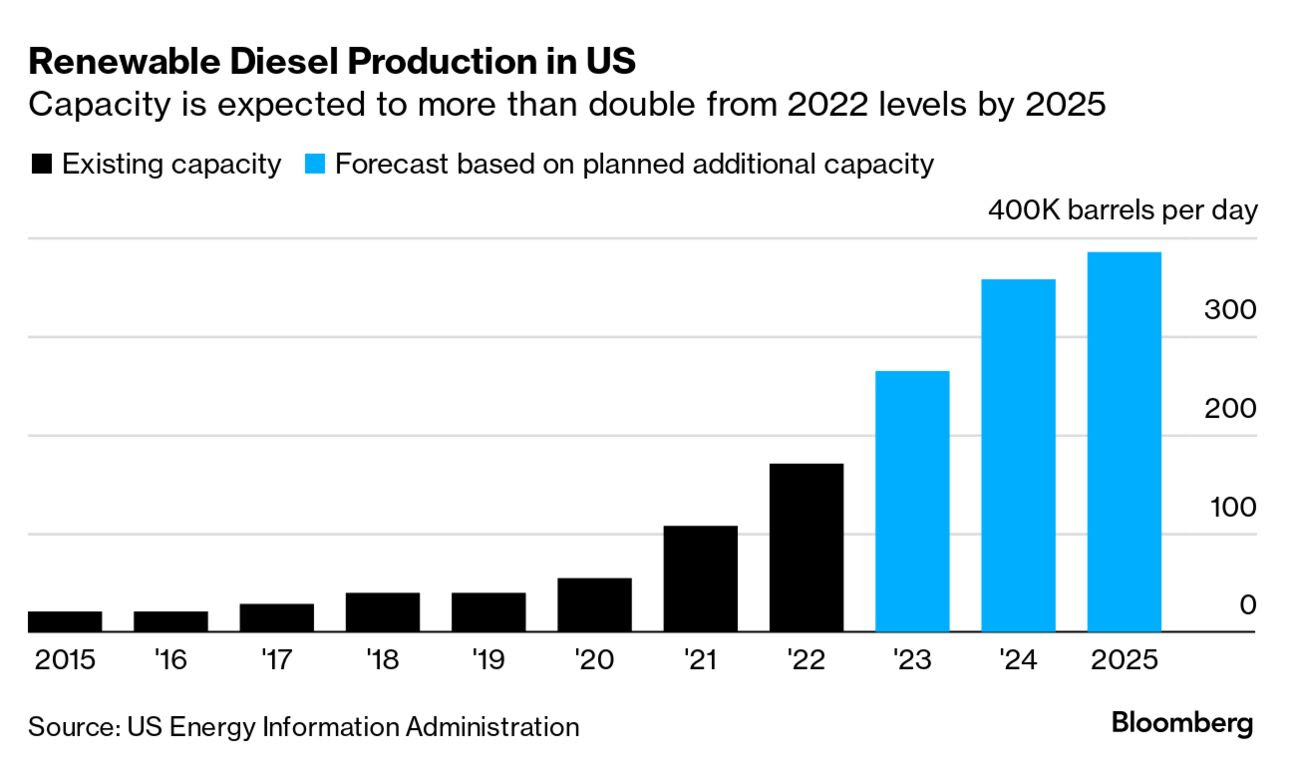

— Is the renewable diesel industry headed for a cliff? That’s the title of a Wall Street Journal article (link). Low-carbon trucking fuel industry witnessed a boom due to government incentives; however, a new federal rule may hinder its growth, the article informs. The EPA mandates the use of renewable diesel and biodiesel, which are costlier than petroleum-based fuels, but have lower carbon emissions. Nevertheless, the EPA's newly announced required amounts for 2021-2025 are significantly lower than the growing renewable diesel industry's expectations.

The total required volume for renewable diesel and biodiesel in 2024 is 3.04 billion gallons, while the EIA estimates that 3.4 billion gallons will be produced this year, with projections of 5.5 billion gallons of production capacity next year. This discrepancy might lead to "significant financial chaos,” as it would affect the value of credits that producers depend on to make their products profitable, the WSJ article notes.

State-level government programs in California, Oregon, Washington, and potentially New York could offer some relief to producers.

Meanwhile, the renewable diesel boom has impacted soybean oil and conventional diesel markets, as soybean oil feedstock demand increases and conventional diesel demand falls to its lowest in two decades.

— EPA will not be granting small refiner exemptions for the RFS, as the final volume requirements announced Wednesday rely on the projection that no gasoline or diesel produced by small refineries will be exempt from RFS requirements under the Clean Air Act.

Background. The Clean Air Act (CAA) allowed for exemptions to be granted for small refiners, a topic that has become controversial in recent years, prompting EPA to reverse some prior granted small refinery exemptions (SREs) and halt granting them. EPA said that the final volume requirements “are based on our projection that no gasoline or diesel produced by small refineries will be exempt from RFS requirements pursuant to CAA” based on the agency’s current statutory requirements. If that were to change in the future, EPA said it would not alter the requirements spelled out in this rule. “Even were EPA to grant an SRE in the future for 2023-2025, we do not plan to revise the percentage standards to account for such an exemption,” EPA stated.

— EPA assumes there will be rising production of sustainable aviation fuel (SAF), but that will cut into renewable diesel production. “Historically, greater incentives have been available for renewable diesel production, which has caused many of these production facilities to maximize renewable diesel production,” EPA explained. “In the near term, we expect that any increase in SAF production will result in a corresponding decrease in renewable diesel production.”

But renewable diesel production capacity is clearly on the rise, having reached 2.9 billion gallons as of January 2023. “A number of parties have announced plans to build new renewable diesel production capacity with the potential to begin production by the end of 2025,” EPA said. “This new capacity includes new renewable diesel production facilities, expansions of existing renewable diesel production facilities, and the conversion of units at petroleum refineries to produce renewable diesel.”

Still, EPA said that they “expect that renewable diesel production through 2025 will be limited to a level below production capacity primarily due to limited feedstock availability.”

EPA noted the Energy Information Administration (EIA) “currently projects that renewable diesel production capacity could reach nearly 6 billion gallons by 2025, though it is possible that not all these announced projects will be completed, and not all of those that are completed will necessarily produce renewable diesel in the 2023–2025 timeframe addressed by this rule.”

EPA in 2023 is requiring the use of 2.82 billion gallons of biomass-based diesel, generally made from soybean and canola oil — a 2.2% increase over the 2.76 billion gallons mandated last year. The mandates, including those for 2024 and 2025, are well below the increase sought by producers. Soybean oil, a key feedstock in making biomass-based diesel, plunged 7% in Chicago to the daily price limit set by the exchange.

— Ford gets $9.2 billion for EV battery plant in Biden green tech push. It’s one of the biggest loans to a U.S. carmaker in more than a decade — and a watershed moment in Biden’s $400 billion plan to go all in on green technologies. Link for details.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— California to allow whole pork meat not compliant with Prop 12 to be sold through year-end. The California Department of Food and Agriculture’s Animal Care Program has announced that a decision by the Sacramento Superior Court has modified its order relative to pork and enforcement of Proposition 12 in the state. The new court order will still let the injunction against enforcement expire July 1, “except with respect to certain noncompliant whole pork meat that is already in the stream of commerce (as detailed in the Court’s order), which may be sold through December 31, 2023.”

Statement from NPPC CEO Bryan Humphreys:

“It is welcome news to America’s pig farmers and consumers that California recognized the challenging situation the July 1 Proposition 12 implementation date will have on our industry and food supply. Granting six months of additional relief for products in the supply chain allows grocery stores to remain stocked so the 40 million Californians have uninterrupted access to affordable, safe and nutritious pork products, especially with rising food prices.

“We appreciate Governor Newsom, Attorney General Bonta, and the California Department of Food and Agriculture for their efforts over the past month to find a solution to achieve a smoother transition for the entire pork value chain, including our foreign trading partners.

“While this temporary solution does not solve the challenges and uncertainty California Proposition 12 brings to our industry, NPPC looks forward to working with Congress to find a permanent solution to this problem.

Link to NPPC California Proposition 12 Resources Page.

— U.S. approves chicken made from cultivated cells, nation’s first ‘lab-grown’ meat. U.S. regulators for the first time have authorized two California-based companies, Upside Foods and Good Meat, to sell lab-grown chicken products in restaurants and (eventually) supermarkets.

Both have said they have already begun production for sale: Eat Just will launch with restaurants owned by chef José Andrés in Washington, DC, and Upside will debut at chef Dominique Crenn’s restaurant Bar Crenn in San Francisco.

Background. Cultivated meat, also called cell-based or lab-grown protein, is produced by taking animal stem cells from a live animal or a fertilized egg, and putting them into a medium that lets them grow, ultimately creating a product that looks and tastes like traditional meat. The cells grow inside vessels that keep them at the right temperature, with a mixture of amino acids, sugars, and other nutrients to help them grow. The cells are harvested and formed into shapes like chicken breasts or meatballs. The Food and Drug Administration had given both companies a green light months before, saying their lab-grown chicken is safe for human consumption. Good Meat, which is owned by Eat Just, has been selling products in Singapore since December 2020.

Good Meat, the cell-based division of Eat Just, can now begin production for sale at two facilities. It has received a grant of inspection from the USDA for its demonstration plant at its Alameda, California, headquarters; its contract manufacturer, Joinn Biologics, received the same for its facility.

Upside also got a grant of inspection and can begin commercial production at its innovation center in Emeryville, California.

Although Upside and Good Meat’s lab-grown chicken is currently more expensive than conventional meat, the companies are progressing to produce increasingly affordable cell-cultivated products. They have initially partnered with exclusive restaurants for distribution of their products. Over 150 companies worldwide are working on cell-based alternatives for various meats, including beef, pork, lamb, and fish.

Advocates say lab-grown meat is much less likely to be infected by E. coli bacteria and other contaminants that might be found in processing facilities, while there could also be reduced exposure to antibiotics by taking farm animals out of the equation. Harm to them and the environment is also cited as an advantage, though some say cultivated meat could require even more energy and emit more greenhouse gases.

Executives at Upside and Good Meat have been quick to note that their products are meat, not substitutes like the Impossible Burger or offerings from Beyond Meat, which are made from plant proteins and other ingredients. However, consumer polling indicates there are initial concerns about the concept, as well as the high costs associated with mass-producing lab-grown meat.

— The fake-meat sector is experiencing a significant shakeout as interest rates surge and money becomes less readily available. As a result, investors are pulling back, which coincides with increased output costs due to inflation. These factors, combined with the consumers' growing selectivity, are impacting the competitive and saturated market.

|

HEALTH UPDATE |

— Omicron’s new variant Arcturus rapidly spreading worldwide, causing pink eye. A new Covid-19 variant, Omicron XBB. 1.16, also called Arcturus, was first discovered in January 2023. One of the characteristics of Arcturus infection is conjunctivitis, otherwise known as pink eye. It is spreading rapidly in many countries, including the United States, the U.K., Australia, Singapore, China, and India.

— U.S. intelligence agencies may never find covid’s origins, officials say. The agencies are expected to release declassified material on what they have learned about Covid’s origins. People briefed on the material say there is no smoking gun. Link to more via the New York Times.

|

CONGRESS |

— On Wednesday, the House of Representatives voted in a party-line vote to censure Rep. Adam Schiff (D-Calif.), a central figure in the Democrats' investigations into former President Donald Trump. Schiff is accused of misleading the American public in his role as then-chairman of the House Intelligence Committee during the congressional investigation into ties between Russia and the Trump campaign, as well as his actions leading up to Trump's first impeachment. Schiff, who is currently campaigning for a California Senate seat, has denied the accusations, calling them "false and defamatory."

— The Senate Banking Committee approved a major overhaul of banking regulations. The nearly unanimous agreement includes provisions for harsher penalties for executives of failed banks, increased oversight of the Federal Reserve, and additional measures intended to address the recent regional banking crisis. This bipartisan action is expected to push House Republicans to consider similar legislation.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |