Inflation Cools with Fed Expected to ‘Skip’ Rate Hike on Wednesday, Possibly Raise in July

Xi prepares China for ‘extreme circumstances’

|

In Today’s Digital Newspaper |

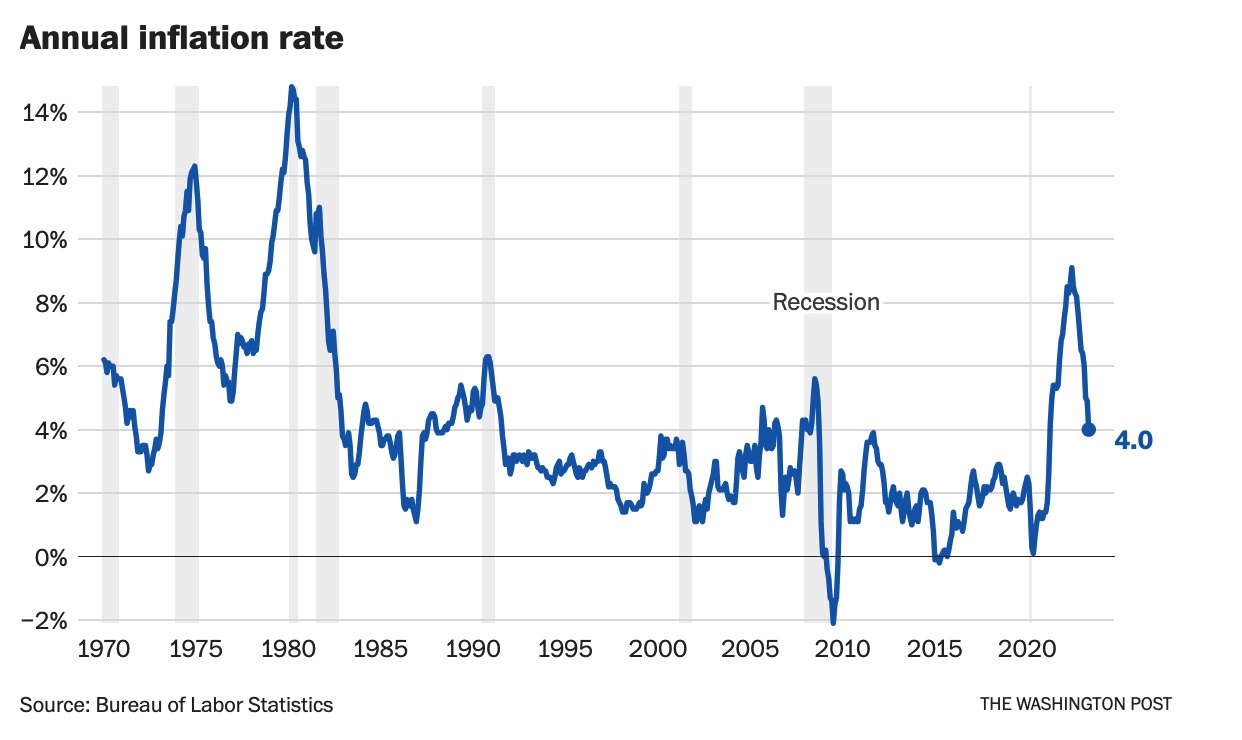

The Federal Reserve kicks off its two-day policy-setting meeting today, just as markets will start processing the latest consumer price index report, a key indicator of inflation. With the report showing inflation is cooling, analysts say that should encourage the Fed’s policymakers to skip a rate hike this month, with expectations that a rate boost could still come in July.

The arrival of the first El Niño in almost four years foreshadows new damage to a fragile global economy as the world struggles to recover from Covid and the war in Ukraine grinds on. It may turn into the costliest El Niño cycle since meteorologists started keeping track. More in Markets section.

U.S. agribusiness Bunge Ltd. agreed to buy Glencore-backed Viterra for $8.2 billion in stock and cash, creating a trading giant capable of competing with the biggest agricultural players. Viterra shareholders will own about 30% of the combined business after the transaction. More details below.

Office occupancy rates in New York reached the highest last week since Covid. But cities like DC and San Francisco have yet to break the 50% mark.

Chinese leader Xi Jinping is urging the nation to prepare for potential extreme scenarios or conditions amidst escalating tensions between the U.S. and China. Xi's emphasis on "extreme circumstances" comes as U.S. Secretary of State Antony Blinken plans to visit China this month to rebuild lines of communication. More in China section.

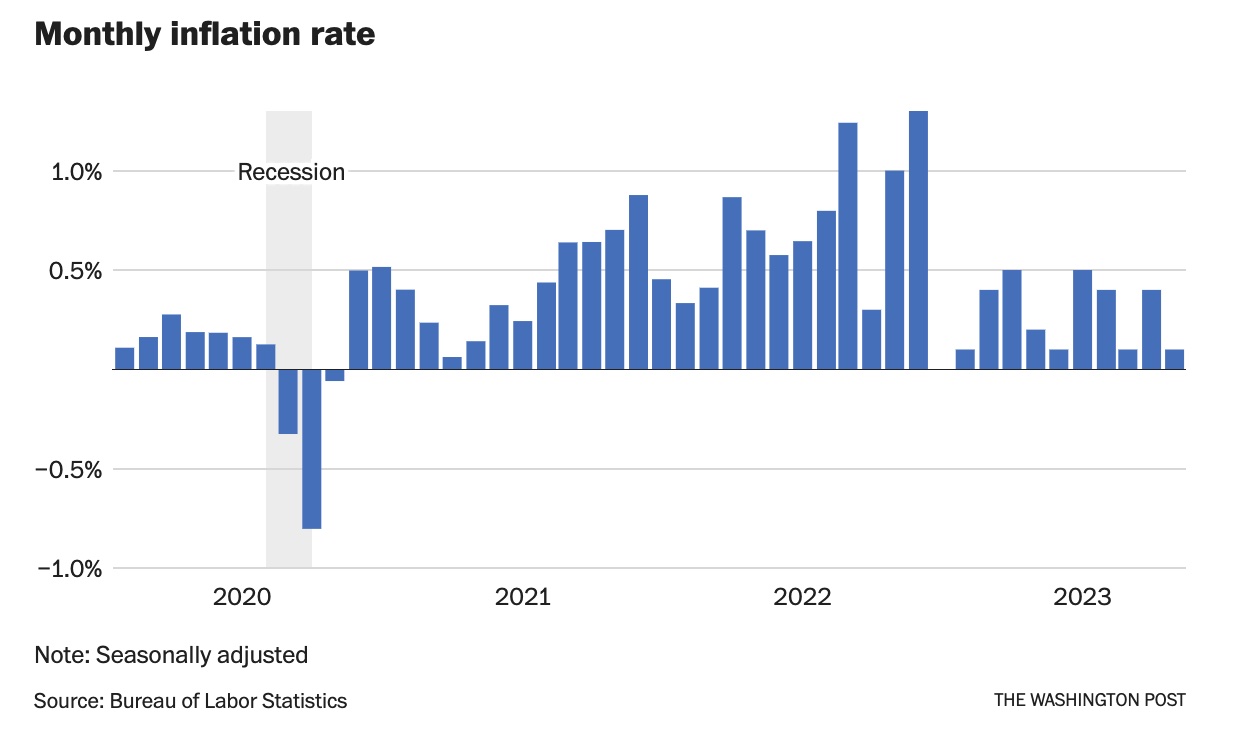

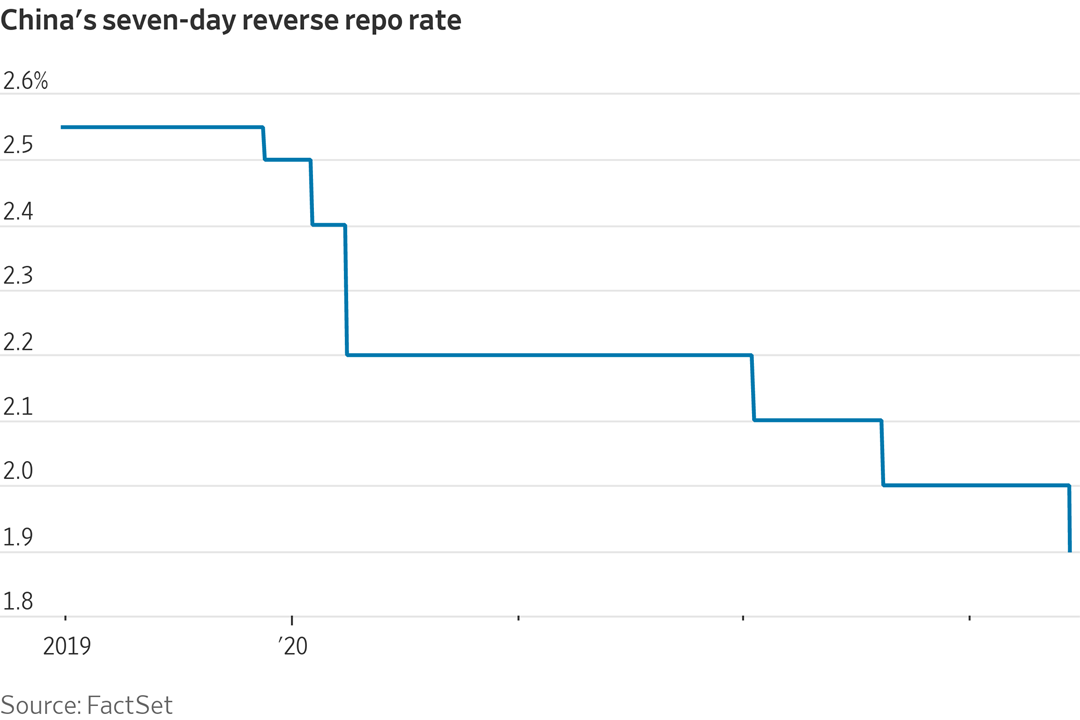

China’s central bank eased its monetary policy by trimming a key lending rate. The central bank cut its seven-day reverse repurchase operations to 1.9% from 2.0%. This latest move is a further attempt by the Chinese government to boost Chinese economic growth, which is slowing. More in China section.

Treasury Secretary Janet Yellen is set to cast international financial institutions as counterweights to China, and will head to Paris next week.

The United Nations’ aid chief, Martin Griffiths, said that the breach of the Nova Kakhovska dam on the Dnipro river in Ukraine will significantly impact global food security. Speaking to the BBC, he said food prices were bound to rise due to the environmental destruction of “a bread basket” for the world. Ukraine is a major producer of wheat, barley, corn and oilseeds.

Policy items today include:

- The signing of the Fiscal Responsibility Act on June 3 has impacted USDA aid efforts, as it rescinds unobligated funds under specific programs.

- USDA accepted 1,065,409 acres out of 1,185,888 acres offered for enrollment into the Conservation Reserve Program (CRP) via the general signup which ended April 7.

- The National Milk Producers Federation (NMPF) has outlined its priorities for the 2023 Farm Bill.

- USDA allocated $714 million in grants and loans to expand high-speed internet access to rural residents, farmers, and businesses across 19 states.

Renewable diesel industry officials are urging the EPA to increase biofuel targets for 2023-2025 to avoid negatively affecting Renewable Identification Number (RIN) prices and renewable diesel producer margins. More in Energy section.

Beef industry hearing. The House Judiciary Subcommittee will hold a hearing on Tuesday, titled "Where's the Beef? Regulatory Barriers to Entry and Competition in Meat Processing."

This week, livestock owners are required to obtain prescriptions from veterinarians to purchase medically important antibiotics for their animals. Details in Livestock section.

In the Food section:

- As consumer habits change, the food-delivery industry is facing difficulties in adapting.

- Drive-throughs at White Castle, McDonald’s, Wendy’s and Dunkin’ are testing chatbots that employ conversational-style AI algorithms to take orders.

- Fast-food restaurant owners in California are facing challenges as they battle against unions and Democratic legislators.

Former President Donald Trump is facing arrest today on 37 criminal charges relating to alleged mishandling of classified documents post-presidency. This marks the second arrest for Trump, who is currently a frontrunner for the 2024 Republican nomination. He is slated to surrender at a Miami federal courthouse this afternoon, where his fingerprints will be taken, and he will be informed of the charges against him. This occurs just two months after his arraignment in Manhattan over state charges tied to a 2016 hush-money payment made to an adult film actress. As Trump's legal team prepares, local Miami officials are increasing security measures due to the influx of protesters expected around the courthouse.

|

MARKET FOCUS |

Equities today: Global stock markets were mostly higher overnight. U.S. Dow opened around 50 points higher and then surged over 200 points higher. In Asia, Japan +1.8%. Hong Kong +0.6%. China +0.2%. India +0.7%. In Europe, at midday, London -0.1%. Paris flat. Frankfurt +0.1%.

U.S. equities yesterday: All three major indices opened the week with solid gains with an eye toward Wednesday’s Fed meeting conclusion. The Dow gained 189.55 points, 0.56%, at 34,066.33. The Nasdaq rose 202.78 points, 1.53%, at 13,461.92. The S&P 500 was up 40.07 points, 0.93%, at 4,338.93.

Apple shares closed at an all-time high — bringing this year's advance above 41%, compared with 35% for the Nasdaq 100. Apple now has a market capitalization of $2.89 trillion — putting it in striking distance of a historic $3 trillion valuation.

Agriculture markets yesterday:

- Corn: July corn rose 13 cents to $6.17 1/4 after trading at the highest level since April 21. December corn rose 18 3/4 cents to $5.49 1/4, near the session high, notching a six-week high close.

- Soy complex: July soybeans fell 13 3/4 cents to $13.72 3/4, despite November futures rising 4 3/4 cents to $12.09, a three-week high. July soybean meal futures rose 20 cents after trading in a volatile range, ending the day at $397.4. July soyoil closed 61 points lower at 53.98 cents after failing to overcome technical resistance.

- Wheat: July SRW futures rose 3 1/2 cents to settle at $6.33 3/4, the highest close since May 16, while December SRW wheat rose 4 1/2 cents at $6.62 1/2, nearer the session high. July HRW wheat fell 1 1/4 cents at $7.96 1/2 and near mid-range. July spring wheat futures rose 2 1/2 cents to $8.14 1/4.

- Cotton: July cotton fell 55 points to 83.49 cents, the lowest close since May 31.

- Cattle: August live cattle futures rose $1.35 to $173.20. August feeder cattle gained 5 cents to $239.05. Prices closed nearer their session highs.

- Hogs: August lean hog futures led the complex higher today, rising $3.425 to $87.375.

Ag markets today: Corn and soybeans were supported overnight by the bigger-than-expected declines in crop condition ratings, while wheat faced price pressure. As of 7:30 a.m. ET, corn futures were trading 3 to 4 cents higher, soybeans were mostly 10 to 16 cents higher, SRW wheat was 2 to 3 cents lower, HRW wheat was 6 to 7 cents lower and HRS wheat was 4 to 7 cents lower. Front-month crude oil futures were around $1.25 higher, and the U.S. dollar index was more than 300 points lower.

Market quotes of note:

- Central banks will succeed in bringing inflation back down to target, Richard Clarida, Pimco's global economic advisor, and former vice chair of the Federal Reserve, says in a webinar. "Central banks don't abandon the inflation target," he says. "They will do everything to anchor inflation expectations to target." Both the Federal Reserve and the European Central Bank target 2% inflation. Speaking at the same webinar, Andrew Balls, chief investment officer for fixed income at Pimco, says that inflation falling back to target will be positive for fixed income assets.

- China. “We must be prepared for worst-case and extreme scenarios.” — Chinese President Xi Jinping, signaling the potential for escalating conflict with the West.

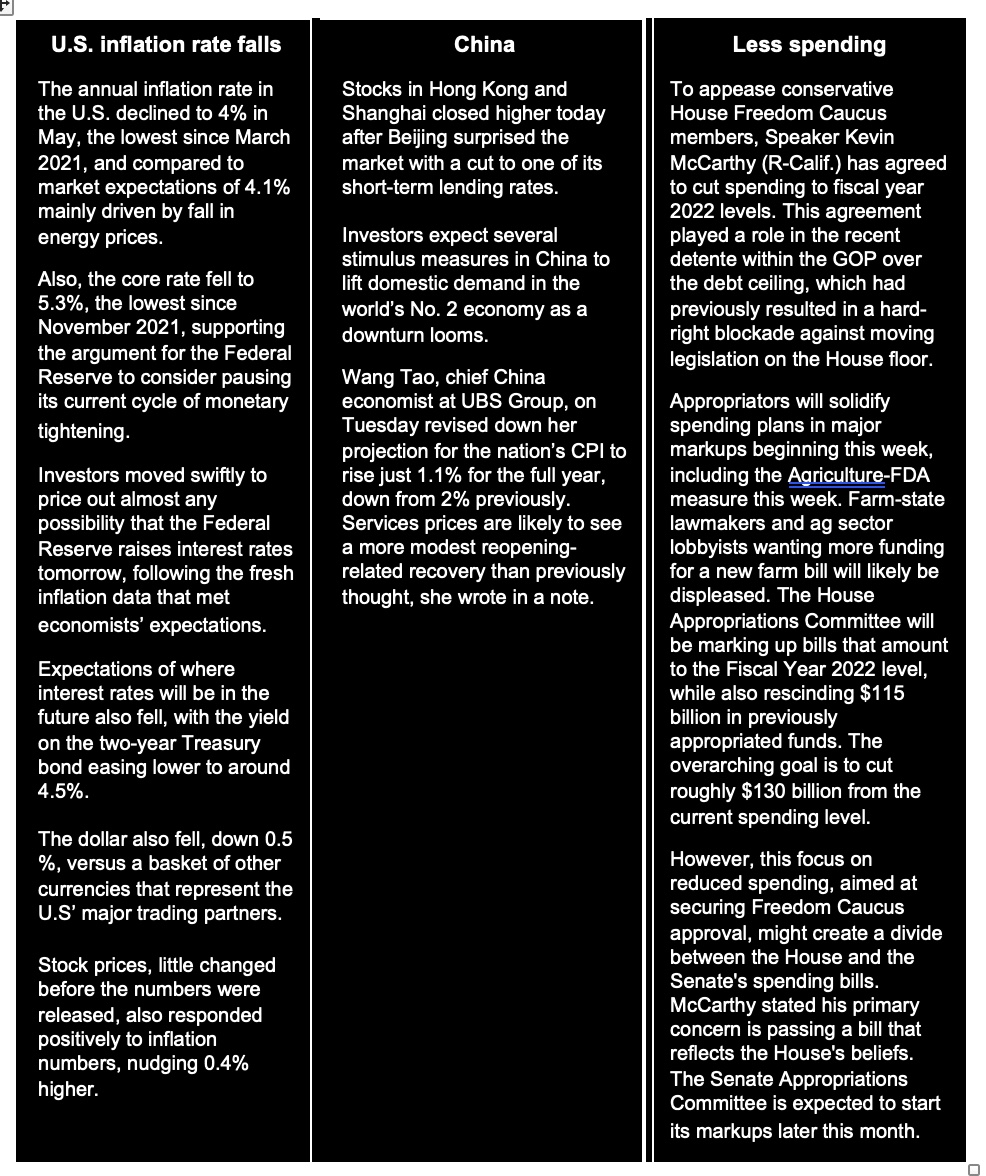

- U.S. inflation. “The bigger question for inflation is, where is it going? Where does it settle out?” said Peter Boockvar, chief investment officer at Bleakley Financial Group. “Are we just going to go back to this 1-to-2 percent inflation trend that we got so used to? Or is there something so structural that after the spike, after the comedown, are we going to settle at 3 [percent]?” He added: “That plays into: How high do rates stay, and for how long?”

On tap today:

• U.S. consumer price index for May is expected to rise 0.1% from one month earlier and 4% from one year earlier. Excluding food and energy, the CPI is forecast to increase 0.4% and 5.3%, respectively. (8:30 a.m. ET) UPDATE: See item below.

• Treasury Secretary Janet Yellen appears before a House panel at 10 a.m. ET.

• Bank of England Gov. Andrew Bailey appears at a House of Lords committee hearing at 10 a.m. ET.

• FOMC: Federal Reserve begins a two-day policy meeting.

Inflation eased last month to a multiyear low, a possible cause for optimism ahead of a crucial Federal Reserve meeting decision Wednesday on interest rates. Consumer prices rose 4% in May year over year, the Labor Department said this morning, coming in slightly below consensus economist estimates of 4.1%, and an improvement from the 4.9% annual rate clocked in April (and a 40-year high of 9.1% last June). That’s the lowest inflation rate since March 2021, when prices rose at 2.6% on an annual basis. Still, inflation remains far above the Fed’s 2% goal.

Core inflation, which excludes historically volatile food and energy prices, rose 0.4% last month, in line with expectations of 0.4%.

May’s increase in inflation was driven by rising housing prices along with higher used vehicles and food prices, the Labor Department said. Energy prices declined 3.6% in May from April.

- Cereal and baking products increased 0.1% in May from April but still registered a 10.7% rise from year-ago marks.

- Bakery products rose 0.2% for the month and had an annual rate of 11.4%.

- Meats increased 0.5% for the month but were only 0.4% higher than they were in May 2022, with beef and veal prices up 1.5% from April and 1.0% from May 2022. Pork prices edged up 0.1% in May but are 2.9% cheaper than they were in May 2022.

- Dairy and related products fell 0.6% in May but are still 4.6% more expensive than they were one year ago.

- Other foods were steady in May but had an annual rate of 8.6%.

- Egg prices have come well off the lofty increases seen previously, declining 13.8% for the month and are now 0.4% below where they were in May 2022.

New York office occupancy has surpassed 50% for the first time since the pandemic, as workers return amidst stricter return-to-office mandates from major employers in tech, law, and finance. Remote work has caused over $12 billion per year in losses to New York's economy, per Bloomberg analysis. Other cities, such as Washington and San Francisco, have not yet reached 50% occupancy.

Agricultural firms Bunge and Viterra have officially announced their merger in a cash and stock deal that has been in the works for several weeks. The agreement involves certain affiliates of Glencore, the Canada Pension Plan Investment Board, and British Columbia Investment Management, the Wall Street Journal reports. The merger is expected to generate about $250 million in pre-tax synergies annually within the first three years. Viterra shareholders will receive 65.6 million Bunge shares worth $6.2 billion and $2 billion in cash, while Bunge assumes $9.8 billion of Viterra debt. The deal is expected to close in mid-2024, with Viterra shareholders owning around 30% of the combined company. After Bunge's planned $2 billion repurchase of stock, Viterra's ownership stake will increase to around 33%.

In May, the U.S. budget deficit reached $240 billion, primarily due to increased government spending and declining tax receipts. Spending totaled $548 billion, a 20% increase from May 2022, with the largest expenditures going towards Medicare, Social Security, and interest on the national debt. The Federal Deposit Insurance Corporation (FDIC) also contributed to the spending due to bank failures, though it expects to recover most of the amount through bank asset sales and industry fees.

Meanwhile, government receipts stood at $307.5 billion, a 21% decrease from the same period last year. The cumulative budget deficit for fiscal year (FY) 2023 now stands at $1.16 trillion, slightly lower than the $1.38 trillion seen at this time in FY 2022.

Market perspectives:

• Outside markets: The U.S. dollar index was weaker, with the euro and British pound both firmer against the greenback. The yield on the 10-year U.S. Treasury note was weaker, trading around 3.72%, with a mostly lower tone in global government bond yields. Crude oil futures continued to gain after sizable losses Monday, with U.S. crude around $68.60 per barrel and Brent around $73.50 per barrel. Gold and silver were modestly higher ahead of the CPI report, with gold around $1,973 per troy ounce and silver around $24.21 per troy ounce.

• The Chinese yuan has weakened against the U.S. dollar over the past three months, and went past 7.16 per dollar in mainland China’s tightly controlled currency market on Tuesday. In Hong Kong, the more freely tradable offshore yuan traded above 7.17 per dollar, near where it was in November 2022. China’s central bank looks set to cut a benchmark interest rate this week, a move that will put more pressure on its currency as the U.S. Federal Reserve prepares to stand pat.

• Oil prices continue to experience a sharp decline, with Brent crude reaching its lowest settlement since late 2021. Factors influencing the fall include concerns about Chinese demand, the potential for a U.S. recession, and strong crude flows from Russia. Despite Saudi Arabia's pledge to cut production in July, Brent crude has dropped 5.5% since the announcement eight days ago. The ongoing pressure in the energy sector has led Goldman Sachs to reduce its year-end forecasts for oil.

• Forecasting crop production is often difficult due to fluctuating local weather conditions and diverse crop conditions. Southern Ag Today notes (link) that in the case of upland cotton, predicting its production becomes even more complicated because of its unique plant biology. Major crops that can replace cotton in the U.S. include corn, sorghum, wheat, soybeans, and peanuts, with the first three being annual grasses and the latter two being annual legumes.

Annual crops' aggregate yields typically have a strong correlation with weekly crop condition rates because their sole reproductive goal is to produce as much seed as possible under the given weather and soil conditions. However, upland cotton, a perennial plant, has mixed growth habits that make forecasting its production challenging. It can switch between vegetative and reproductive growth, which makes it hard to visually correlate crop conditions and yields in areas like Texas.

Texas alone accounts for over half of the U.S. cotton planted acreage, and its diverse planting dates ranging from March-April in the south to May-June in the northwest only add to the complexity. The year 2023 has been particularly difficult in terms of weather, with severe drought conditions in the first quarter followed by widespread rain since April. This has both benefited the developing crops in southern Texas and complicated planting in the northwest.

The mid-year shift in weather makes it difficult to predict if Texas will experience more or less cotton production. The situation may become clearer towards early fall when more reliable yield forecasts will be available. With changing weather patterns and much of the growing season still left, there is potential for further shifts, making crop production estimations highly uncertain.

• Ag trade: Iran tendered to buy 120,000 MT of corn from Brazil, Europe or the Black Sea region and 120,000 MT of soymeal from Brazil or Argentina. Japan tendered to buy 60,000 MT of feed wheat and 20,000 MT of feed barley.

• The number of wildfires burning in Canada’s top energy-producing Alberta province is on the rise again. The province had 76 active wildfires yesterday, up from 71 on Friday, with 23 out of control.

• The first El Niño in almost four years threatens an already fragile global economy struggling with Covid-19 recovery and Russia's war in Ukraine. The warming phase can result in widespread challenges, such as power grid strain, public health emergencies, increased fire risks, and devastation to infrastructure. Bloomberg Economics modeling shows (link) that previous El Niño events significantly affected global inflation and GDP growth, with vulnerable countries like Brazil, Australia, and India hit the hardest. The combination of this El Niño cycle with extreme weather and accelerated climate change may lead to the costliest cycle on record, exacerbating stagflation risks. Central banks are limited in what they can do in response to El Niño's supply-side effects.

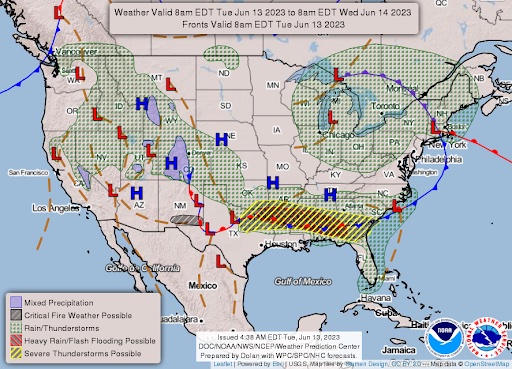

• NWS weather outlook: Severe thunderstorm and excessive rainfall threat located across the Lower Mississippi Valley and Southeast over the next few days... ...Locally heavy rain possible within scattered thunderstorms throughout the Intermountain West, Rockies, and central High Plains today... ...Triple digit heat to expand throughout most of Texas by the end of the week.

Items in Pro Farmer's First Thing Today include:

• Corn and soybeans firmer, wheat weaker overnight

• Consultant lower U.S. corn, soybean yield forecasts

• Corn, soybean and spring wheat CCI ratings decline

• Packer demand for cash cattle may slow

• Cash hogs rise, pork cutout slips

|

RUSSIA/UKRAINE |

— Pentagon prodded to send Ukraine long-range tactical missiles. The House Armed Services Committee is pressing the Pentagon to send the Army Tactical Missile System to Ukraine as part of its annual defense authorization bill draft proposal released Monday.

Meanwhile, Senate Minority Leader Mitch McConnell (R-Ky.) praised U.S. military aid to Ukraine that he said is helping its counteroffensive against Russia, defending the billions of dollars spent just days after House Speaker Kevin McCarthy (R-Calif.) signaled wariness over further funds that may breach new caps on spending.

|

POLICY UPDATE |

— The signing of the Fiscal Responsibility Act on June 3 has impacted USDA aid efforts, as it rescinds unobligated funds under specific programs.

On June 2, the FSA halted CFAP 1, CFAP 2, PATHH, PLIP, SMHPP, and OTECP to avoid unauthorized obligations. FSA halted the Coronavirus Food Assistance Program 1 (CFAP 1), CFAP 2, Pandemic Assistance for Timber Harvesters and Haulers (PATHH), Pandemic Livestock Indemnity Program (PLIP), Spot Market Hog Pandemic Program (SMHPP), and Organic and Transitional Education and Certification Program (OTECP) on June 2 so as not to incur any “unauthorized obligations.” Only the national FSA office can process CFAP 1 approvals. OTECP and PARP applications are still being processed, but the payment processing status for PARP has yet to be determined.

As of June 11, payments under CFAP 1, CFAP 2, and Phase 1 of the Emergency Relief Program (ERP) remained mostly unchanged. ERP Phase 2 payments have crossed the $1 million threshold, totaling $1.23 million for 653 recipients, averaging $1,878 per payment.

— USDA accepted 1,065,409 acres out of 1,185,888 acres offered for enrollment into the Conservation Reserve Program (CRP) via the general signup which ended April 7. The new contracts would start October 1. USDA said that producers submitted offers to reenroll 891,000 acres of ground that were currently under a CRP contract with new offers totaling 295,000 acres submitted. Based on the level offered and accepted, over 89% of acres were deemed acceptable. However, the level of acres that are actually enrolled can decline from the level deemed eligible as sometimes producers do not opt to follow through with the enrollment. The national average rental rate on those acceptable acres is $64 per acre.

CRP acres amounted to 23 million at the end of April 2023, with contracts on 1.98 million acres set to expire by the end of September.

A total of 1.186 million acres were submitted for new contracts, indicating that over 1 million acres may exit the CRP.

Meanwhile, 761,000 acres were offered through the continuous signup process, though only 60,359 acres were enrolled by April end.

The 23 million acres in CRP includes 8.4 million acres via general signups, 8.3 million acres via continuous signups, and 6.4 million acres through the CRP Grasslands program. Under CRP Grasslands, payments are made on what are working lands where producers protect grasslands from conversion while being able to hay and graze those acres. Results of the latest Grasslands signup that ran through May 26 have not yet been announced.

Payments to CRP contract holders on Oct. 1 will amount to $1.797 billion — $483 million from general signups, $1.214 billion from continuous signups, and $99 million for Grasslands. Average rental rates for general signups are $57.40 per acre, $15.58 per acre for Grasslands and $147.59 per acre for continuous enrollments. CRP rental rates and acreage may be debated during future farm bill discussions.

CRP acreage is capped at 27 million for fiscal year (FY) 2023 under the 2018 Farm Bill. The Grasslands CRP results have been the biggest factor CRP acreage totals rising as enrollments in 2021 totaled 2.5 million acres and 3.1 million acres in 2022 — over 87% of the total Grasslands acres enrolled have been in the last two years alone.

— The National Milk Producers Federation (NMPF) has outlined its priorities for the 2023 Farm Bill, including measures related to commodities, conservation, trade, and nutrition. Key proposals include continuing and improving the Dairy Margin Coverage (DMC) risk management program, and updating milk pricing formulas under the Federal Milk Marketing Order (FMMO). For conservation, NMPF seeks policies supporting the dairy industry's goal of reaching net-zero greenhouse gas emissions by 2050 and emphasizes feed and manure management. In terms of trade, the NMPF prioritizes increased funding for trade promotion provisions and protecting the use of common food names. Nutrition-wise, the NMPF aims to enhance federal nutrition programs such as SNAP by promoting the purchase of dairy products and endorsing the SNAP Dairy Nutrition Incentives Program, which expands healthy milk options for beneficiaries.

— USDA allocated $714 million in grants and loans to expand high-speed internet access to rural residents, farmers, and businesses across 19 states. USDA Secretary Tom Vilsack emphasizes that high-speed internet is vital for rural prosperity, and the Bipartisan Infrastructure Law — which includes $65 billion for internet connectivity under the Internet for All initiative — will help make rural America more attractive for living, working, and raising families. USDA has supported 142 ReConnect Program projects since the Biden administration began, providing high-speed internet access to over 314,000 rural Americans.

States receiving investments in this $714 million round include Alaska, Arkansas, Arizona, California, Georgia, Idaho, Kansas, Kentucky, Minnesota, Missouri, Montana, New Mexico, Ohio, Oklahoma, Oregon, South Carolina, Tennessee, Utah, and Washington.

This is the fourth round of funding under the ReConnect program. Applicants to ReConnect Program funding must serve a rural area that lacks access to service at speeds of 100 megabits per second (Mbps) download and 20 Mbps upload.

Applicants must also commit to building facilities capable of providing high-speed internet service with speeds of 100 Mbps (download and upload) to every location in the proposed service area.

Additionally, to ensure that rural households that need internet service can afford it, all awardees will be required to apply to participate in the Bipartisan Infrastructure Law’s Affordable Connectivity Program (ACP). The ACP offers a discount of up to $30 per month towards internet service to qualifying low-income households and up to $75 per month for households on qualifying Tribal Lands.

|

CHINA UPDATE |

— The U.S. has been increasing its efforts to prepare evacuation plans for Americans residing in Taiwan in the face of a potential Chinese invasion. The Messenger's Lili Pike and Jim LaPorta have reported (link) on this development, which has gained momentum in the past few months. While the U.S. continues to assert that a Chinese war on Taiwan is not a foregone conclusion, they are taking precautionary measures due to their past experiences with Afghanistan, Ukraine, and Sudan. However, the island's unique geographical features present various challenges for successful evacuations.

— Chinese leader Xi Jinping is urging the nation to prepare for potential extreme scenarios or conditions amidst escalating tensions between the U.S. and China. Xi's emphasis on "extreme circumstances" comes as U.S. Secretary of State Antony Blinken plans to visit China this month to rebuild lines of communication. Although both countries are attempting to mend ties, Xi's focus on withstanding prolonged tensions with the West indicates that his main priority is to create a geopolitically resilient economy less reliant on foreign markets and technology. This strategy includes preparing for the possibility of increased U.S. and Western sanctions. Additionally, there seems to be a growing emphasis on China's eventual reunification with Taiwan, which the Chinese government considers part of their goal for national revival. Link for more via the Wall Street Journal.

— China is said to be considering a broad package of stimulus to support the real estate market and bolster domestic demand. Further rate cuts are under consideration and regulators may promote its high-yield bond market to expand financing channels.

China’s central bank unexpectedly trimmed a key lending rate, a sign of policy makers’ growing unease over a sputtering recovery that likely foreshadows further steps to nudge China’s economy back on track.

— China’s new loans rise but shy of expectations. China’s new bank loans rose to 1.36 trillion yuan ($190.18 billion) in May, up from 718.8 billion yuan in April but shy of the 1.6 trillion yuan economists expected. Outstanding yuan loans in May grew 11.4% from last year, which was shy of the 11.6% expected. Broad M2 money supply in May grew 11.6% on year, below 12.1% forecast in a Reuters poll.

— The United States will rejoin UNESCO and pay over $600 million in back dues in a move intended in part to curb China’s influence in the organization. Former President Donald Trump withdrew the U.S. from UNESCO in 2018 over years-long concerns about anti-Israel bias stemming from the agency’s admittance of Palestine in 2011.

|

ENERGY & CLIMATE CHANGE |

— Renewable diesel industry officials are urging the EPA to increase biofuel targets for 2023-2025 to avoid negatively affecting Renewable Identification Number (RIN) prices and renewable diesel producer margins. The EPA's proposed RVOs are considered outdated, as they don't consider the expected growth in renewable diesel production capacity. Current predictions suggest capacity will reach 4.1 billion gallons by the end of 2023, 5.5 billion in 2024, and 5.9 billion by 2025. EPA by court order is expected to make its decisions by June 14.

Dave Kettner, president of Virent, warns that not adjusting the EPA proposal could endanger the burgeoning low carbon fuels market by devaluing advanced biofuels. The Advanced Biofuels Association (ABFA) will be presenting their concerns to the White House Office of Management and Budget.

The agency’s final targets are expected to exceed the 2.82 billion-gallon requirement originally proposed for this year but still fall short of what’s sought by biodiesel producers. “The EPA’s proposed numbers would almost flatline demand despite growth in the industry,” said Scott Gerlt, chief economist for the American Soybean Association.

Chevron Corp.’s head of renewable fuels, Kevin Lucke, said even the American Petroleum Institute lobby group urged the Biden administration to boost the targets. “I would dare say they didn’t look around in industry and really understand what people were building already,” he said. Chevron is one of the companies building out US renewable fuels capacity. That expansion has been bumpy, though: The current spike in construction costs and interest rates prompted Cargill Inc. and Exxon Mobil Corp. to pull back.

Looking ahead, Michael McAdams, ABFA President, does not anticipate congressional involvement in the issue in the coming years. John Campbell, managing director at investment bank Ocean Park Advisors, says growth is inevitable as the world adopts more climate-friendly energy solutions. “Renewable diesel expansion is coming, and it’s going to be very large,” he said.

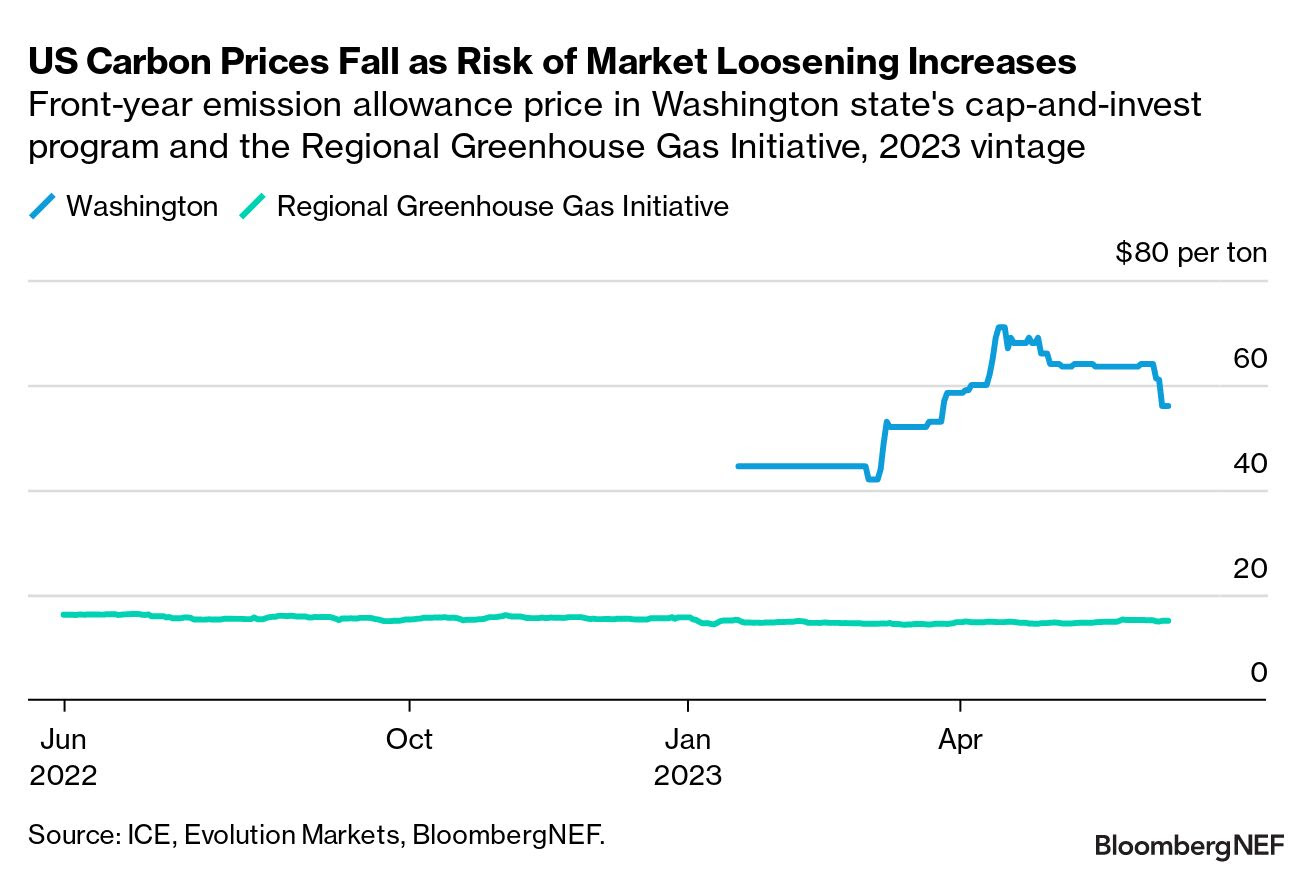

— Bearish signals emerged from the latest round of U.S. carbon allowance auctions. Washington state cleared at $56.01 per metric ton, triggering a mechanism that responds to high prices and will see more permits auctioned in August, placing downward pressure on the market. Meanwhile, the Regional Greenhouse Gas Initiative, which covers power-sector emissions in the Northeast, settled at $12.73 per short ton. Lower gas-fired generation and Virginia moving a step closer to exiting are weighing on prices.

— The Department of Energy (DOE) announced an investment of over $192 million in efforts to improve battery recycling for electric vehicles (EVs) and other uses. Of this, $125 million will go towards the Consumer Electronics Battery Recycling, Reprocessing, and Battery Collection funding opportunity, targeting educational initiatives, lower recycling costs, and local government and retailer recycling programs. Additionally, $60 million will be allocated to the Advanced Battery R&D Consortium funding to advance the domestic EV battery supply chain. The DOE will also extend its Lithium-Ion Battery Recycling Prize, providing $7.4 million in awards for innovative solutions in collecting, sorting, storing, and transporting spent lithium-ion batteries.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Beef industry hearing. The House Judiciary Subcommittee will hold a hearing on Tuesday, titled "Where's the Beef? Regulatory Barriers to Entry and Competition in Meat Processing." The hearing aims to explore the impact of government regulations on the meat industry, particularly how these regulations create barriers for small- and medium-sized businesses. Witnesses include representatives from various farms and councils.

The focus of the hearing is expected to be the Processing Revival and Intrastate Meat Exemption Act (PRIME Act), which would enable individuals states to permit intrastate distribution of custom-slaughtered meat, has been introduced in both the House and Senate.

The North American Meat Institute (NAMI), however, argues that such a measure would jeopardize food safety and undermine consumer confidence.

— This week, livestock owners are required to obtain prescriptions from veterinarians to purchase medically important antibiotics for their animals, as per the FDA's announcement. As a step in a multiyear campaign to preserve antimicrobial efficacy for human disease treatment, these new restrictions have been put in place.

Background. Over a two-year transition period, drug companies have voluntarily changed the marketing status of the affected antibiotics or removed them from over-the-counter sales. GFI No. 263, which came into effect in June 2021, impacted 4% of sales of these types of antibiotics for food-bearing and companion animals. GFI No. 213 had already been implemented in 2017, putting an end to using these antibiotics for weight gain in cattle, hogs, and poultry. The drugs are still available for disease prevention and treatment in livestock, under veterinary supervision. Farmers and ranchers can still access appropriate antimicrobials for their animals by consulting a licensed veterinarian.

Link to FDA “frequently asked questions” about GFI No. 263.

Link to FDA list of antibiotics affected by GFI No. 263.

— As consumer habits change, the food-delivery industry is facing difficulties in adapting. Grubhub, a Chicago-based takeout pioneer, is laying off about 15% of its workforce to reduce costs and stay competitive amidst well-funded rivals and declining demand. Sales for food-delivery companies had surged during the early stages of the Covid-19 pandemic, but they have since plateaued due to customers returning to dine-in experiences. Grubhub, which used to be the market leader, has now fallen to third place behind DoorDash and Uber Eats. Other food businesses are facing similar challenges, with DoorDash cutting around 1,250 employees (6% of its workforce) last year, and Blue Apron laying off 10% of its workforce in December and selling its logistics assets in the past month. Link for more via the Wall Street Journal.

— Drive-throughs at White Castle, McDonald’s, Wendy’s and Dunkin’ are testing chatbots that employ conversational-style AI algorithms to take orders. One advantage for the employer: The robots are never shy about encouraging add-ons. As for customers, some request human intervention—but others say they are sick of cranky fast-food workers who can’t hear their orders through defective speaker boxes, and are ready for a robot revolution.

— Fast-food restaurant owners in California are facing challenges as they battle against unions and Democratic legislators. After qualifying for a referendum to overturn the FAST Act, introduced to establish a 10-member council with the authority to rule on wages and working conditions, the joint-employer provision is now being reintroduced by Democrats in retaliation. The legislation, supported by the powerful Service Employees International Union (SEIU), aims at making corporations legally liable for their franchisees' labor violations, which could potentially disrupt the franchise business model. While SEIU believes this legislation is necessary, the majority of California restaurant franchises strongly oppose the bill, fearing it would interfere with their freedom to operate independently. The joint-employer legislation is seen as an attempt to silence businesses opposing progressive one-party rule in California.

|

POLITICS & ELECTIONS |

— West Virginia. Politico reports (link) that while Sen. Joe Manchin (D-W.Va.) has not said if he is seeking re-election, “millions of dollars are pouring into the West Virginia Senate race.” The race is a prime target for Republicans to flip. National Republicans have landed their top recruit, Gov. Jim Justice, and “outside cash is already pouring in to support” him.

|

CONGRESS |

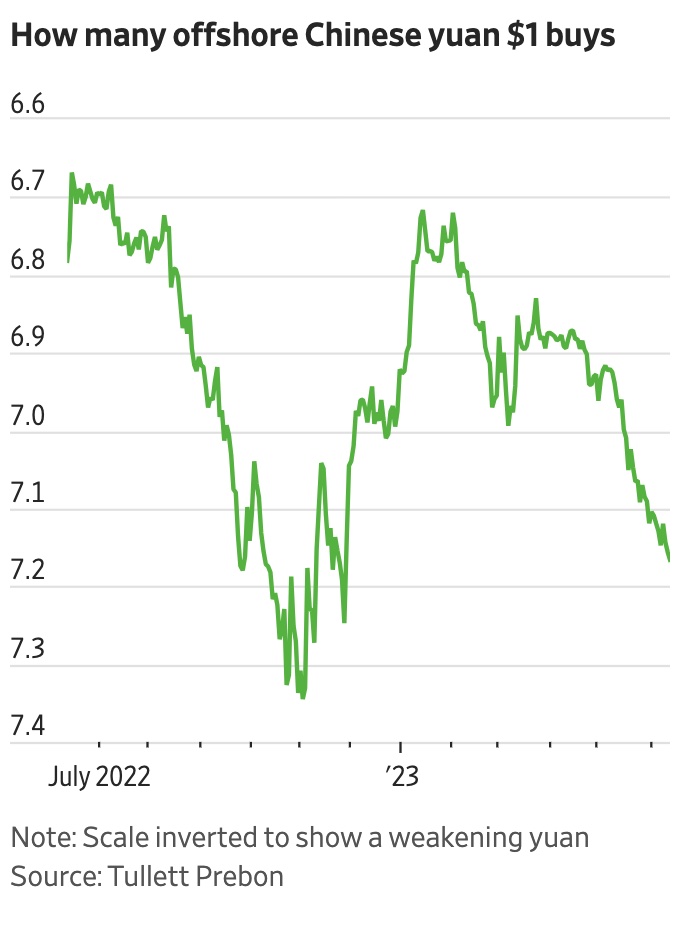

— Hard-right House Republicans have reached an agreement with GOP leadership to end the recent chamber standstill. The deal came after conservatives were assured of more involvement in decision-making processes, with members offering different accounts of the extent of the power-sharing arrangement. The far-right faction expects to have a say in this year's major spending debates, although this may create challenges for Speaker Kevin McCarthy (R-Calif.). While McCarthy managed to suppress the conservative rebellion on Monday night, it is evident that the far-right members may be willing to stall proceedings again if their power-sharing terms are not met. Differences already appear in the understandings of the agreement, with Rep. Matt Gaetz (R-Fla.) anticipating a public release of the written deal, and McCarthy expressing more caution. McCarthy allegedly told the hard-liners that he would not have agreed to the debt ceiling deal with President Biden if he'd known it would lead to such disarray among the Republicans.

— The House Appropriations Committee, led by Chair Kay Granger (R-Texas), has set spending allocations for fiscal year (FY) 2024 at $1.471 trillion, which is $119 billion below the caps established in the debt limit package. The nondefense sectors of the budget will face major reductions, amounting to around $159 billion less than FY 2023 levels. However, the plan also aims to recover about $115 billion in unspent funds from previous allocations, bringing the actual spending closer to the $1.59 trillion cap. While the specific sources of these unspent funds have not been disclosed, it is expected to come from agencies like the IRS, EPA, and USDA. The House Appropriations Committee is set to discuss relevant bills this week, while the Senate is not expected to agree with the proposed reductions by House Republicans and intends to adhere to the original debt limit package.

— SNAP measure unveiled. A new Democratic bill aims to make permanent the exemptions to work requirements for certain vulnerable individuals in the Supplemental Nutrition Assistance Program (SNAP). These exemptions, set to expire in 2030, were part of the debt ceiling negotiations and include veterans, homeless people, and young adults aging out of foster care.

The proposed Food Access and Stability Act, backed by Democratic Reps. Yadira Caraveo (Colo.), Jahana Hayes (Ct.), and Emilia Sykes (Ohio), seeks to solidify these work exemptions as part of Democrats' strategy to expand, rather than cut, the nutrition aid program.

However, this legislation may face challenges in the GOP-controlled House due to potential costs, as even temporary exemptions are estimated to increase SNAP spending by $2.1 billion over a decade. GOP lawmakers have disputed these calculations, but with Speaker Kevin McCarthy (R-Calif.) pushing for further SNAP changes, Democratic concerns remain.

House Agriculture Chairman “GT” Thompson (R-Pa.) said dealing with the SNAP work requirement debate now, rather than in the fall’s farm bill, takes away a partisan obstacle that’s delayed such legislation in the past.

|

OTHER ITEMS OF NOTE |

— Texas Governor Greg Abbott has announced a new plan to deter migrants from crossing the Rio Grande, which involves installing chain-linked orange buoys in the deeper parts of the river. Created by Maj. Gen. Thomas Suelzer and Steve McCraw, the buoy strategy aims to protect the Texas border without causing harm to migrants. A 1,000-foot set of buoys will be installed near Eagle Pass, Texas, costing around a million dollars. However, skeptics argue that the floating barrier will not be effective in shallow parts of the river, and smugglers may simply cut the barrier or hoist people over them. Aaron Reichlin-Melnick of the American Immigration Council voiced concerns about the barrier's effectiveness and the potential danger it poses to river crossings and rescues.

— Despite widespread agreement on the need for immigration reform in the United States, Congress hasn't managed to pass any significant changes to the system since 1986. Based on an opinion article in The New Yorker (link), the cause of this inaction appears to be conflict and hostility between parties in Congress. Yet, a potential solution seems clear, the author writes: a compromise bringing together stronger border security, which Republicans prioritize, and broader legal immigration options, which Democrats focus on. But due to political stalemate, people are suffering under an outdated and inefficient system. Migrants attempting a dangerous and costly journey to the U.S., overwhelmed law enforcement agents, and communities grappling with the challenges of integrating newcomers all pay the price. Upshot: The situation reveals a much more intricate problem than many acknowledge.

— Oracle founder Larry Ellison passed Bill Gates to become the world’s fourth-richest person as the stock was boosted by AI optimism. He has a net worth of $129.8 billion, Bloomberg’s Billionaires Index shows.

— The Dept. of Education has confirmed that student loan payments for tens of millions of borrowers will resume in October. Previously, the pandemic-related pause on federal student loan payments was set to end this summer, but the official date had remained uncertain. The repayment suspension has been extended eight times since March 2020, however, a new law passed this month addressing the debt ceiling has prevented further extensions. Borrowers are now anxiously awaiting the Supreme Court's decision on whether the Biden administration will be permitted to proceed with its student loan forgiveness program, with a verdict anticipated later in June or July.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |