Blinken to Visit Beijing Within Weeks: Bloomberg | Chinese Exports Plunge

Dam explosion in Ukraine put major strain on ag sector | Stabenow: No new funding for farm bill

|

In Today’s Digital Newspaper |

Abbreviated report today as I am traveling to Naples, Florida, to speak at the 86th annual convention of the Cotton Warehouse Association of America. And this year I will have 100% cotton shirts to wear….

— U.S. equities on Tuesday: The Dow ended up 10.42 points, 0.03%, at 33,573.28. The Nasdaq rose 46.99 points, 0.36%, at 13,276.42. The S&P 500 rose 10.06 points, 0.24%, at 4,283.85.

— Agriculture markets yesterday:

- Corn: July corn futures closed up 10 1/2 cents at $6.08, near the session high and at a five-week high close.

- Soy complex: July soybeans rose 3 1/4 cents to $13.53 1/4, closing above the 20-day moving average. November soybeans rose a nickel to $11.84 3/4. July meal dropped $4.50 to $396.70, notching a low-range close, while July soyoil climbed 166 points to 50.92 cents, the highest close since May 11.

- Wheat: July SRW wheat rose 3 3/4 cents to $6.27 3/4. Prices closed nearer the session low after hitting a three-week high early on. July HRW wheat fell 2 cents to $8.20 ¼, near mid-range. Spring wheat futures fell 3 3/4 cents to $8.16 1/2.

- Cotton: July cotton rose 55 points to 85.34 cents, nearer the session high.

- Cattle: August live cattle futures rose $2.225 to a record close at $175.5, while expiring June futures rose $2.675 to $176.825. August feeder futures rose 65 cents to close at a contract high $243.25. August live cattle futures marched higher for the eighth contract high in as many trading days.

- Hogs: Expiring June hog futures jumped $2.975 to $88.30 Tuesday, while the August contract leapt $2.875 to $84.50.

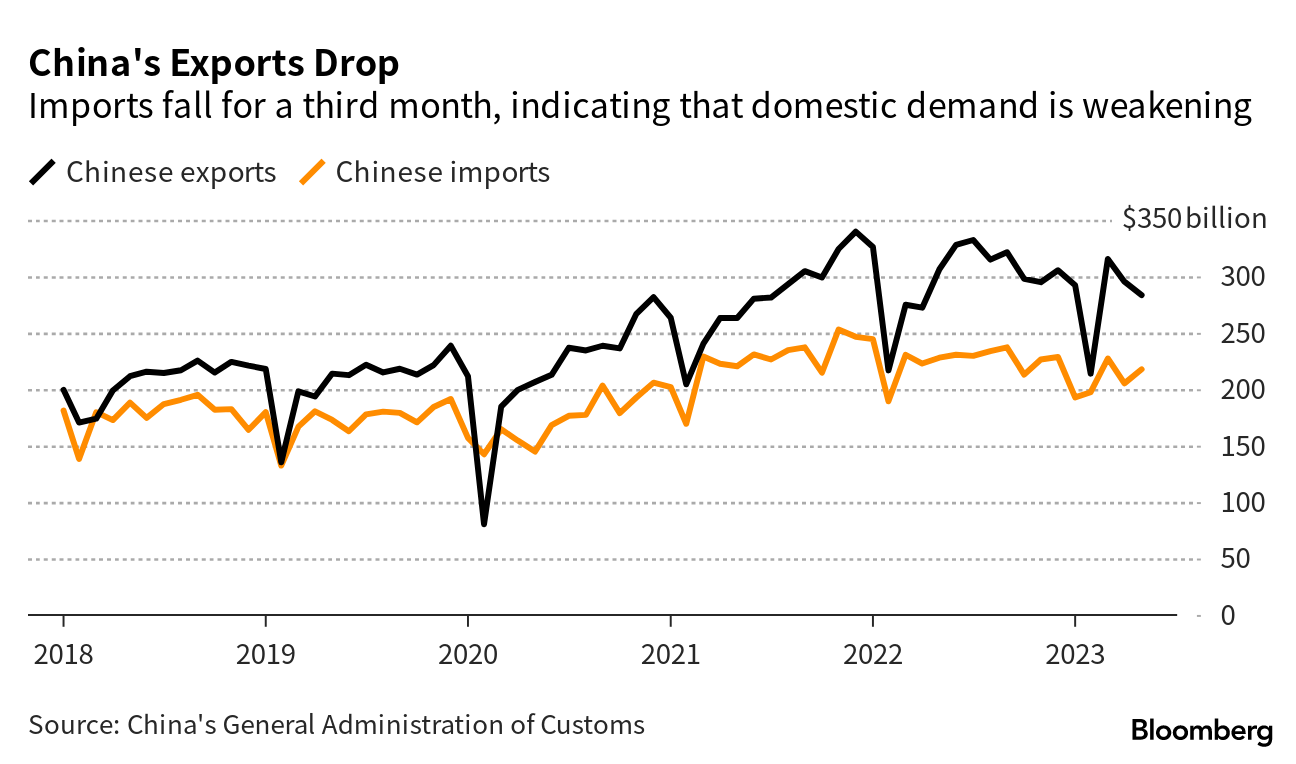

China’s exports fall more than expected in May. Overseas shipments shrank 7.5% in dollar terms from a year earlier, missing consensus for a 1.8% drop. Imports fell less than expected. The data may prompt a rate cut as soon as this month.

Details: Exports from China shrank 7.5% year-over-year to a three-month low of $283.5 billion in May 2023, reversing from an 8.5% growth in April while pointing to the first fall since February and the steepest decline in four months. The latest print was worse than the market consensus of a 0.4% decline, as global demand was insufficient to sustain a recovery in outbound shipments. Among major trade partners, exports to the U.S. plunged by 18.2% from a year earlier, while those to the EU slumped by 26.6%. By contrast, shipments to Russia surged by 114%, particularly energy. Considering the first five months of the year, exports were up 0.3% from the same period in 2022.

— Secretary of State Antony Blinken plans to visit Beijing within weeks for talks with top officials, possibly including Xi Jinping. This would replace a trip planned for February that was called off after the U.S. shot down an overflying Chinese balloon. U.S.-listed Chinese shares gained on the news. Link for details via Bloomberg. The Hang Seng Tech index jumped as much as 2.9% on the news.

— The Turkish lira plunged as much as 7.1%, the most in more than a year, as traders said state lenders had halted dollar sales to defend it.

— Senate Ag Chair Debbie Stabenow, (D-Mich.) said there will be no new funding for the new farm bill. This means any increase in funding for programs will require reallocating money from other parts of the bill. She expressed her disappointment at new savings from the debt ceiling bill not being allocated to the farm bill. Despite asking the House and Senate Budget Committee for even a few billion dollars, their requests were unmet.

Stabenow specifically warned the audience at the Nutrition Incentive Hub's National Convening Tuesday that they should not expect additional funding for the Gus Schumacher Nutrition Incentive Program, which aims to provide fresh produce to low-income individuals. She emphasized that a win in this scenario may look like preserving the current funding to maintain the program before moving forward.

Stabenow stressed she will not allow conservation funding from the Inflation Reduction Act to be redirected, highlighting the importance of addressing the climate crisis and mitigating risks faced by farmers.

— A major dam explosion in southeastern Ukraine has put significant strain on the country's agriculture sector, which is vital for Kyiv's revenue and the global export of grains and other produce, the Wall Street Journal reports (link). Following the explosion, grain prices have risen worldwide, impacting global food inflation and worsening food shortages. The event has also increased the vulnerability of Europe's largest nuclear-power plant and resulted in flooding of grain-storage facilities.

Ukraine is a significant contributor to global agricultural exports, and the country's recent conflict with Russia has increased food prices. Agriculture is crucial for Ukraine, representing over half of its export revenue, enabling the financing of its fightback against Russia's invasion.

The damage to land and crops is yet to be assessed, and irrigation canals have stopped functioning, adding uncertainty to the situation. Ukraine's agricultural output is expected to decline 36% compared to 2021, and the country's already limited availability of necessary resources, such as fertilizer, could be further constrained by the war.

The estimated cost for the eventual reconstruction of Ukraine's agriculture sector has reached around $411 billion. Before the war, agriculture accounted for 10% of Ukraine's GDP, 40% of its exports, and 14% of its jobs. Now, it represents 52% of the country's export revenue. However, the dam explosion threatens to critically destabilize this key sector.

— What Ukraine’s dam collapse means for the war. A major dam in southern Ukraine was severely damaged in an explosion on Tuesday, unleashing a massive new humanitarian crisis and surge in floodwaters while casting doubt on the long-term safety and viability of a nearby nuclear power plant. Foreign Policy magazine writes (link) that the destruction of the dam and power plant “could reverberate across the battlefields and cities of southern Ukraine just as Kyiv readies a major counteroffensive against Russian forces.”

The situation surrounding the rupture of the dam in Russian-controlled territory is still developing. Ukraine, NATO, and the EU have accused Russia of destroying the Nova Khakovka dam, which they claim is a war crime causing a massive technological disaster and putting thousands of civilians at risk. Ukrainian Foreign Minister Dmytro Kuleba and the operator of the Nova Khakovka hydroelectric facility have placed the blame on Russia as well. However, Russia has countered these claims by suggesting that Ukrainian saboteurs were behind the explosion that led to the dam's breach.

The article says it is important to note that dams and water-related infrastructure have been used in warfare throughout history, often to halt advances, deny territory, or deprive the enemy of water and electricity. While this tactic is not new, the breach of the Nova Khakovka dam marks a grim new episode in the war in Ukraine due to the threat it poses to thousands of civilian lives and potential ecological disaster in southern Ukraine.

Approximately 40,000 people living in at-risk flooding zones near the dam, which contained around 18 million cubic meters (approximately 4.76 billion gallons) of water, are now at risk. Officials are scrambling to evacuate civilians, and the destruction of the dam is anticipated to have a significant impact on agriculture in southern Ukraine and water supplies to Crimea. The International Committee of the Red Cross has raised concerns about the resulting humanitarian situation and the damage to critical infrastructure. This attack on the dam seems to be an extension of Russia's ongoing efforts to undermine Ukraine's energy infrastructure and ability to resist.

— Farmer sentiment has reached its lowest point since July 2022 due to declining crop prices, as the Purdue University/CME Group Ag Economy Barometer fell 19 points to 104 in May. This decline, driven mainly by falling corn, soybean, and wheat bids, has led to reduced expectations for strong financial performances in the coming year. The Farm Financial Performance Index has dropped 17 points, reflecting the influences of crop price weakness, uncertainty due to U.s. bank failures, and rising interest rates. Consequently, the Farm Capital Investment Index also decreased, negatively impacting investment in large machinery and construction.

In the short term, expectations for farmland values have weakened, but long-term outlooks remain more optimistic. Nearly half of the survey respondents believe that the Crop Insurance Title will be the most important aspect of the upcoming farm bill, with 45% of corn and soybean growers expecting Congress to establish higher reference prices for their crops.

— RFS update. The Biden administration has decided to abandon a plan to include the electric vehicle (EV) industry in the nation's biofuel blending program, Reuters reported. This move will lead to the removal of nearly 2 billion credits that the ambitious expansion was expected to generate. The final rule is set to be finalized no later than June 14. This decision takes the administration further away from allowing EVs to generate valuable credits under the Renewable Fuel Standard (RFS), which companies like Tesla have advocated for over the past two years. The EV program could have contributed to President Joe Biden's goal of electrifying the automotive industry to combat climate change. The White House declined to comment on this development, and the Environmental Protection Agency (EPA), responsible for administering the RFS, did not respond to requests for comment. Presently, the White House is reviewing a final rule on biofuel blending mandates for the years 2023, 2024, and 2025.

— The Treasury Department has updated the criteria for electric vehicle (EV) tax credits, making all Tesla Model 3 sedans eligible for the full $7,500 tax credit. As part of a Biden administration plan to increase EV adoption, this change increases the number of eligible EV models to 22, including models from General Motors, Ford, and Volkswagen. Before this change, only the performance version of the Model 3 was eligible for the $7,500 credit, while the long-range Model 3 qualified for a reduced credit of $3,750. Tesla's Model S and Model X are not eligible for any tax credit. The tax credits are part of the Inflation Reduction Act, which aims to reduce U.S. reliance on China in the EV battery supply chain by requiring specific North American and domestic content in the vehicles' batteries.

— A bipartisan group of lawmakers is pushing for a bill that would allow schools to serve whole and 2% milk. A bill was approved Tuesday by the House Education and Workforce Committee in a 26-13 vote. “We have seen students opt out of consuming milk altogether if they don’t have access to a variety that they enjoy,” Rep. GT Thompson (R.-Pa.), the chairman of the House Ag Committee, said during Tuesday’s debate. “Let’s face it: the only way to benefit from milk’s essential nutrients is to consume it.”

This proposal has been supported by more than 100 lawmakers and the dairy industry, who argue that children are more likely to drink milk if it has a better taste. However, opponents contend that children can receive the same nutrients from lower-fat milk without consuming excessive saturated fat.

The bill, if passed, would reverse the rules implemented in 2012 that only permitted schools to serve nonfat or 1% milk for children over the age of two. Schools participating in USDA’s school meals program haven’t been permitted to serve either whole milk — which has 3.25% milk fat — or 2% milk, since 2012, when new rules went into effect The debate involves the question of whether saturated fat from dairy products is different from saturated fat from other food sources. Researchers are still divided on this issue.

— New information suggests the Ukrainian military was involved in a covert attack on the Nord Stream natural gas pipeline, previously unreported, where divers directly reported to the commander in chief of the Ukrainian armed forces. The plan was shared on Discord by an alleged Air National Guard member three months before the bombings and was obtained by the Washington Post. The European intelligence report asserts that the attack was linked to the Ukrainian government, though corroborating evidence was not immediately available. The CIA shared the report with Germany and other European countries. The Ukrainian plan reportedly kept President Zelensky out of the loop, allowing him plausible deniability should the plot be discovered. Despite initial skepticism, the CIA and European intelligence agencies have begun to take the information more seriously. Link to more via the WaPo.

— House Speaker Kevin McCarthy (R-Calif.) declined to commit to providing additional financial support for Ukraine, which puts him in direct conflict with Senate Republicans who seek more military spending beyond what Congress passed last week. While McCarthy supports Ukraine, he questions the need for a supplemental spending package and believes senators are attempting to bypass the agreement. This stance highlights the delicate balance McCarthy is trying to maintain between defense hawks within the GOP and a growing bloc of anti-interventionist Republicans. Proponents of additional funding argue it is necessary for the U.S. to counter China and help Ukraine defeat Russia. Senate Minority Leader Mitch McConnell (R-Ky.) contends that assisting Ukraine benefits the U.S. by weakening Russia and acting as a deterrent to other potential threats. Congress has authorized $113 billion in military, economic and humanitarian assistance since Russia invaded the country last year. Currently, the Pentagon has sent nearly $40 billion in security assistance to Ukraine and has about $2 billion remaining for direct military aid under presidential authority. An accounting error of around $3 billion was discovered last month, giving the Defense Department more flexibility to provide further aid to Ukraine without needing additional congressional support.

— Border arrests have decreased by around 70% after the expiration of Title 42, a pandemic-era measure, and the new set of stricter rules for asylum seekers implemented by the Biden administration. After the end of Title 42 on May 11, the number of arrests of migrants crossing the border illegally fell from over 10,000 per day to an average of 3,400 a day. This decline in apprehensions challenged predictions that lifting the policy would cause an unprecedented surge in migration at the border.

The decrease in arrests is likely due to post-Title 42 policies that impose even stricter consequences for illegal border-crossers. Under these new rules, migrants must prove they have applied for asylum and been rejected in another country before being eligible in the United States. Ineligible individuals are quickly deported and may face jail time if they attempt to cross the border again and get caught.

In a complementary move, the administration has introduced a mobile app to enable migrants to make appointments to enter the US through legal ports of entry and submit their asylum claims, aiming to reduce the incentive for illegal border crossings. These new restrictions have resulted in fewer arrests, despite Republican lawmakers and the Biden administration's prior expectations of increased border chaos.

During fiscal year 2022, agents made a record 2.2 million arrests, and so far in this fiscal year, about 1.3 million arrests have been made.

— Jim Mulhern, President and CEO of the National Milk Producers Federation (NMPF), has announced that he will retire by the end of this year, concluding a decade-long tenure in his current position and capping a 45-year career in U.S. agricultural and dairy policy. Mulhern began his career in 1979 working for a Midwest dairy cooperative, and he was asked to lead NMPF in 2013. Under Mulhern's leadership, the organization experienced significant change, such as guiding NMPF through two completed farm bills, the COVID-19 crisis, and several industry-related challenges.

Before joining NMPF, Mulhern worked on Capitol Hill, served as chief of staff to Wisconsin Senator Herb Kohl, and was a partner at Fleishman-Hillard, followed by managing partner at Watson/Mulhern LLC. Throughout his career, Mulhern provided strategic counsel to numerous Fortune 500 companies and focused on food and agriculture policy challenges.

Under Mulhern's guidance, NMPF has spearheaded an update of federal milk marketing orders and advanced fairer economic policies for dairy farmers, while supporting increased transparency in marketplace regulations. The organization has also consistently worked to enhance dairy exports through collaboration with partners such as the U.S. Dairy Export Council.

The process of selecting a new top executive for NMPF will be discussed at the NMPF's Board Meeting this week in Arlington, Va.

— Mary Mazanec, the Director of the Congressional Research Service (CRS), will resign on June 30 in the wake of mismanagement allegations at Capitol Hill's in-house think tank, Bloomberg reports. Librarian of Congress Carla Hayden informed the staff of Mazanec's resignation via email and has appointed her as a temporary senior adviser responsible for special projects.

Mazanec faced criticism from members of the House Administration Subcommittee on Modernization during a hearing last month. Subcommittee Chairwoman Stephanie Bice highlighted the agency's high attrition rates, outdated technology, and low morale. Bice also questioned Mazanec about the lack of clarity regarding the use of $20 million allocated for modernization efforts in 2018.

The agency also has come under fire in recent years from Sen. Chuck Grassley (R-Iowa), who questioned the agency’s findings on the economic impact of the 2017 tax overhaul.

— Republican contenders. Former New Jersey Gov. Chris Christie filed to run for the 2024 Republican presidential nomination. He believes he is best positioned to take on Trump and then appeal to independents in a general election. Also, former Vice President Mike Pence will formally announce his campaign today and take part in a CNN town hall this evening.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |