Hot Jobs Report, but Mixed Analysis as Unemployment Rate Rose to 3.7%

Former USTR Lighthizer takes on China | USDA official updates on ERP | Prop 12 update

|

In Today’s Digital Newspaper |

New-crop soybean sales to China reported in USDA’s weekly update. USDA Export Sales data for the week ended May 25 included U.S. corn, sorghum and upland cotton sales to China for 2022-23 and new-crop sales of soybeans to China. For 2022-23, there were net reductions of 45 metric tons of wheat, net sales of 70,831 metric tons of corn, 128,000 metric tons of sorghum, 7,018 metric tons of soybeans and 221,744 running bales of upland cotton. For 2023-24, sales of 265,000 metric tons of soybeans and 8,800 running bales of upland cotton. For 2023, net sales of 3,411 metric tons of beef and 951 metric tons of pork were reported.

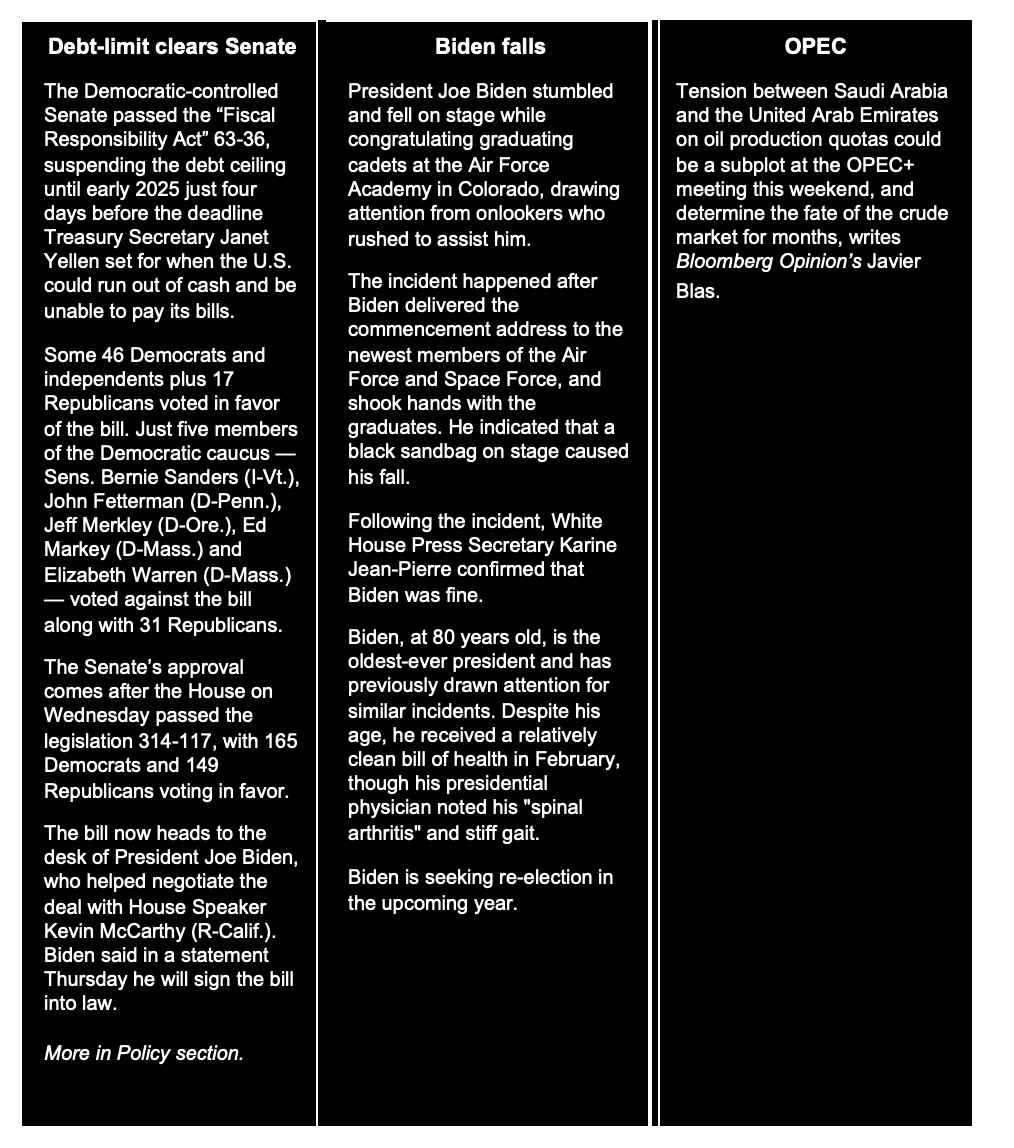

The U.S. unemployment rate unexpectedly ticked up last month despite the labor market gaining significantly more jobs than expected — adding to mixed messages about the economy as the Federal Reserve decides whether it should pause its aggressive campaign to tame rising prices for the first time in more than a year. Total employment increased by 339,000 in May — far exceeding economist projections of 190,000 after gains in April also unexpectedly climbed, according to data released Friday by the Labor Department. March and April’s totals were both revised upward for a net gain of 93,000 jobs. Wages grew a solid 4.3% in May over the prior year. More in Markets section.

Odds for a June rate hike increased after the jobs report. Traders were pricing in about a 38% chance of another quarter-point hike, according to CME Group data.

Exxon and Chevron are close to finalizing deals to drill in Algeria. The WSJ reports the U.S. energy giants are in advanced negotiations with the North African nation on agreements that would allow them to drill for the first time in the gas-rich country, according to the Algerian energy minister and people familiar with the discussions. See Energy section for details.

We have several farm policy updates in the Policy section, including an update on the ERP from a USDA official, including initial thoughts on 2022. Meanwhile, House Speaker Kevin McCarthy (R-Calif.) is giving hints that top GOP officials may press farm-state lawmakers for additional work requirements for safety net programs via the farm bill debate. Also, USDA said it would consider a proposal from the National Milk Producers Federation to amend provisions used to set the minimum price paid to farmers for fresh milk.

Another update on implementation of California’s Prop 12 is in the Livestock section.

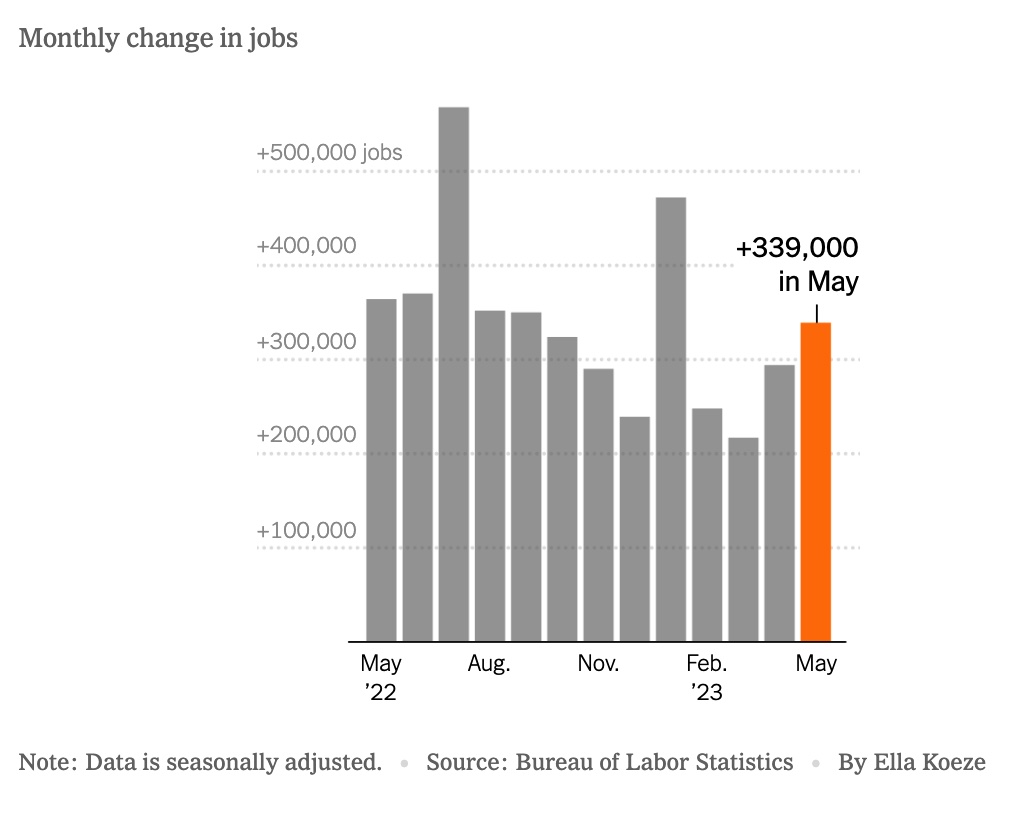

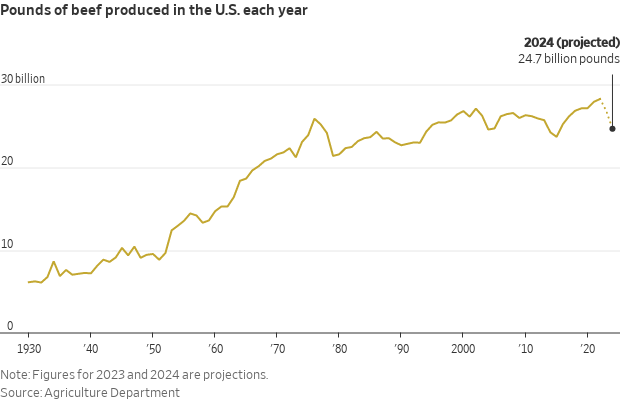

Behind the near record-level prices for beef is a rapidly shrinking supply of cattle. Years of persistent drought conditions, which make cattle more expensive to raise, pandemic disruptions and widespread cost increases have prompted ranchers to sell off livestock, bringing the number of cattle in the U.S. to its lowest level in nearly a decade. Ranchers say they are running out of reasons to replace the livestock they send to slaughter, let alone enlarge their herds. Consumers could see higher prices for burgers and steaks, especially during the summer grilling season. More on WSJ’s look at the industry in Livestock section.

Several trade policy updates below, but a key one is what former USTR Robert Lightheizer says about China.

USDA lowers interest rate on ownership, operating loans for June. USDA direct ownership loans will carry a 4.5% interest rate in June, down from 5% in May, with direct operating loans at 4.75% after being at 5% in May. Commodity loans disbursed by USDA in June will have a 5.75% interest rate, up from 5.625% in May.

|

MARKET FOCUS |

Equities today: Asian and European stock markets were mostly higher overnight. U.S. Dow opened around 225 points higher and is now over 300 points higher. In Asia, Japan +1.2%. Hong Kong +4%. China +0.8%. India +0.2%. In Europe, at midday, London +1%. Paris +1.3%. Frankfurt +1.2%.

U.S. equities yesterday: The Dow rose 153.30 points, 0.47%, at 33,061.57. The Nasdaq gained 165.70 points, 1.28%, at 13,100.98. The S&P 500 was up 41.19 points, 0.99%, at 4,221.02.

The global mergers and acquisitions (M&A) sector is facing a significant slowdown, with little sign of imminent recovery, according to new data from Refinitiv. As of the end of May, announced worldwide M&A totaled $1.07 trillion, marking a 42% year-on-year decrease and representing one of the slowest starts to a year in the past decade. The only slower period was in 2020 during the onset of the pandemic when deal activity had not reached $1 trillion by this time. The number of transactions has also fallen by 14% compared to the same period in 2022, hitting a three-year low with 21,301 deals. This slowdown persists despite the announcement of several large-scale takeovers this year, including Pfizer's planned $43 billion acquisition of cancer-drug specialist Seagen and Newmont's $19 billion bid for rival miner Newcrest. The lack of deal activity has triggered layoffs at major banks such as Lazard and Morgan Stanley, which are cutting jobs to decrease costs. John Waldron, president of Goldman Sachs, stated at a recent conference that his firm is also planning additional cuts, expected to affect senior executives like managing directors, due to the challenging business environment.

U.S. retailers, after clearing their excess inventory from the past year, are now facing a decline in consumer demand for discretionary goods like apparel and accessories. Macy’s, for instance, has reduced its full-year outlook on sales and profits, indicating a potential struggle ahead for department stores. At the end of the last quarter, Macy’s inventory was down 7% year-on-year, aligning with its sales decline. The retail chain is now focusing on "inventory discipline" to respond swiftly to changes in consumer behavior.

Agriculture markets yesterday:

- Corn: July corn fell 1 1/2 cents to $5.92 1/2, near the session low after marking an intraday high of $6.06.

- Soy complex: July soybeans closed up 29 3/4 cents at $13.29 1/2. July soybean meal rose $8.00 to $401.40. July bean oil gained 166 points to 47.86 cents. Prices closed nearer their session highs in all three markets.

- Wheat: July SRW futures rallied 16 1/2 cents before settling at $6.10 3/4. July HRW futures rallied 12 cents to $8.02 1/2, settling in the middle of today’s range. July HRS futures closed 9 cents higher at $7.89.

- Cotton: July cotton closed up 294 points at 86.42 cents and nearer the session high.

- Cattle: Live cattle futures rocketed higher Thursday, with the nearby June contract soaring $5.775 to $174.925 and most-active August leaping $4.70 to $172.425. August feeder futures jumped $2.475 to $241.65.

- Hogs: June lean hogs rallied 97.5 cents today to settle at $83.55, despite deferred contract weakness, as evidenced by the August contract closing $1.825 lower to $80.025.

Ag markets today: Corn futures are extending losses early this morning, while soybeans and wheat are mixed. As of 7:30 a.m. ET, corn futures were trading 3 to 8 cents lower, soybeans were 3 cents lower to a penny higher, SRW wheat futures were steady to 2 cents higher, HRW wheat was fractionally to a penny lower and HRS wheat was narrowly mixed. Front-month crude oil futures were more than $1.00 higher, and the U.S. dollar index was modestly weaker.

Market quotes of note:

- ECB President Christine Lagarde said there’s “no clear evidence” that core inflation has peaked and pledged to lift rates further. “We still have ground to cover to bring interest rates to sufficiently restrictive levels,” she said.

- U.S. jobs report. "The data show that job growth is continuing at a rapid pace, but wage pressures are not building," says Rubeela Farooqi, chief U.S. economist of High Frequency Economics. Despite the vigorous job gains, she says the modest wage increase should keep the Fed on track to hold rates steady this month.

- U.S. jobs report. “The U.S. labor market continues to demonstrate grit amid chaos – from inflation to high-profile layoffs and rising gas prices,” said Becky Frankiewicz, president and chief commercial officer of Manpower Group. “With 339,000 job openings, we’re still rewriting the rule book and the U.S. labor market continues to defy historical definitions.”

U.S. economy adds more jobs than expected in May. The U.S. economy created 339,000 jobs in May, compared to market expectations of 190,000 and following a rise of 294,000 in April (March and April’s totals were both revised upward for a net gain of 93,000 jobs). Job gains occurred in professional and business services, government, health care, construction, transportation and warehousing, and social assistance. It marked the 29th straight month of positive job growth.

Meanwhile, the unemployment rate rose to 3.7% from 3.4% but remained close to five-decade lows but the highest since October 2022 and above market expectations of 3.5%. Despite this uptick, the jobless rate remained historically low and suggested the labor market remained tight. The number of unemployed people increased by 440,000 to 6.10 million and employment levels declined by 310,000 to 160.72 million.

Average hourly earnings increased by 4.3% year-over-year, compared to a 4.4% estimate.

Perspective: Economists have consistently underestimated the strength of the labor market: The number of hires has come in above expectations in 14 of the past 17 months.

Chemical makers to set aside $1.19 billion to settle PFAS-related claims in U.S. Chemical manufacturers Chemours Co, DuPont de Nemours Inc, and Corteva Inc announced they will establish a $1.19 billion fund to settle PFAS-related drinking water claims in the United States. The companies are embroiled in numerous lawsuits across the U.S., accused of polluting drinking water with perfluoroalkyl and polyfluoroalkyl substances (PFAS), often referred to as "forever chemicals.” Chemours has agreed to contribute half of the designated amount, with DuPont and Corteva covering the remainder. Consequently, Chemours will take a pre-tax charge of $592 million in the current quarter related to the fund. PFAS, known for their use in nonstick coatings like Teflon for decades, have been linked to cancer, hormonal dysfunction, weakened immune systems, and environmental damage. The companies anticipate finalizing a formal agreement by the second quarter of 2023.

Japan’s fertility rate fell for a seventh consecutive year in 2022, reaching a new low of 1.257 births per woman. The pandemic exacerbated the country’s woes of an ageing and shrinking population: deaths shot up by 9% to a record 1.57 million last year, and marriage rates have slowed. The government plans to spend 3.5 trillion yen ($25 billion) a year to support parents in the hope of reversing the trend.

Market perspectives:

• Outside markets: The U.S. dollar index was weaker ahead of the US jobs report, with the euro and British pound shifting between slight losses and gains against the greenback. The yield on the 10-year U.S. Treasury note was higher, trading around 3.62%, with a mostly higher tone in global government bond yields. Crude oil moved solidly higher, with U.S. crude around $71.47 per barrel and Brent around $75.70 per barrel. Gold and silver were little changed ahead of the Employment report, with gold around $1,995 per troy ounce and silver around $23.98 per troy ounce.

• China is breaking drilling records. Chinese oilmen are currently drilling the deepest ever oil well in the country’s history in the westernmost Xinjiang region, spudding the borehole as deep as 10,000 meters (32,800 feet) as Beijing seeks to ramp up domestic oil production.

• Commodity markets are showing signs of instability, as key commodities such as oil and copper experience price declines due to weak industrial data and growing fears of recession among the world's largest economies, Bloomberg notes. In the past two months, oil prices in London have dropped 12%, while copper has fallen around 7%. However, the price of zinc, another important metal used to galvanize steel and for metal castings in various industries, is indicating that a more severe downturn may be imminent, according to the item. As a good proxy for the automotive and construction sectors, particularly in China, zinc prices have plunged 20% since early April. Aside from a pandemic-related decrease in 2020, this is close to the lowest level since 2016. Even Goldman Sachs, which is generally bullish on commodities, has recently adopted a bearish stance on zinc, Bloomberg observes. The bank has revised its forecast from a deficit to an oversupply for this year and anticipates a historic surplus of 659,000 tons by 2025.

• Meat markets in the U.S. are in turmoil. The supply of cattle across the country is shrinking as ranchers respond to fast-rising costs and widespread drought conditions by selling off livestock, setting the stage for higher consumer prices. The Wall Street Journal reports (link) the number of cattle in the U.S. is at its lowest level in nearly a decade and beef production is on track to drop by more than 2 billion pounds in 2024, the biggest annual decline since 1979. Shrinking herds is a weighty bet since rebuilding can take years. The impact is reaching across supply chains, from meatpackers to restaurants and burger joints. Live cattle futures have been hitting record highs and Tyson Foods, Cargill, JBS and National Beef are paying more to secure supplies. Restaurants are already bracing for price increases as earlier agreements run out and suppliers strike new, more expensive deals. “We’re spending $1 million to make $4,000.” — Ryan Stromberger, a Nebraska rancher.

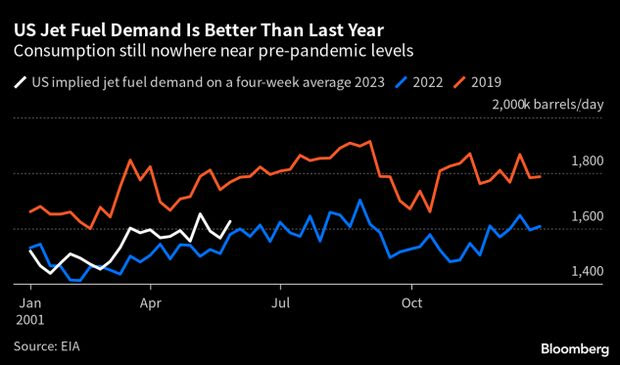

• Record air travel this summer to boost U.S. jet fuel demand. A record number of passengers are expected to fly on US airlines this summer, bolstering jet fuel consumption and oil demand. US airlines will carry 257 million passengers from June through August, topping 2019 levels by around 1%, according to industry group Airlines for America.

• Drought triggers construction restrictions in Arizona due to groundwater scarcity. Arizona state officials have imposed restrictions on the development of new subdivisions in the Phoenix area due to a severe lack of groundwater. This move signals the beginning of the end for the construction boom that had previously made Phoenix the fastest growing metropolitan region in the United States. The state is currently grappling with a historic 23-year drought, which, combined with rising temperatures, has depleted the level of the Colorado River. This water scarcity threatens the water supply for 40 million Americans across Arizona and six other states, including residents of Phoenix who depend on the Colorado River's water delivered via an aqueduct.

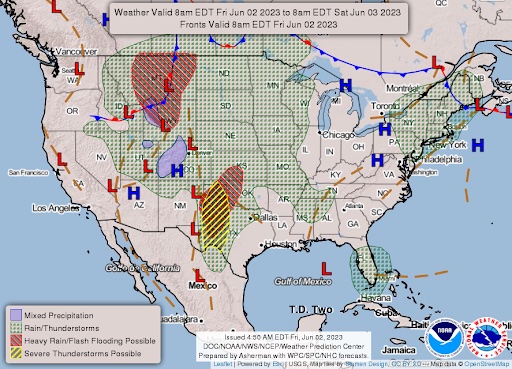

• NWS weather outlook: There is a Moderate Risk of excessive rainfall over parts of the Southern High Plains and a second area over parts of the Northern Rockies/High Plains... ...There is an Enhanced Risk of severe thunderstorms over parts of the Southern High Plains... ...There is a Slight Risk of excessive rainfall over parts of the Southern High Plains on Saturday.

Items in Pro Farmer's First Thing Today include:

• Corn weaker, soybeans and wheat mixed overnight

• Russia slashes wheat export tax

• Brazil Supreme Court upholds suspension of forest reduction for Ferrograo grain railway

• Sharply higher cash cattle trade

• Cash hogs end mini skid

|

RUSSIA/UKRAINE |

— Ukraine’s possible membership of NATO is the hot topic at its Oslo meeting. France is pushing for a concrete path, but Germany is urging more caution. Volodymyr Zelenskyy made an unexpected appearance at a summit in Moldova as Russia rained more missiles down on Kyiv.

— Russia claimed to have repelled three cross-border attacks in its western Belgorod region, carried out by what it described as pro-Ukrainian militants. Ukraine denied involvement in the raids, which it said were carried out by Russian volunteer fighters. The Russian Volunteer Corps, a pro-Ukrainian and anti-Putin militia based in Ukraine, took responsibility for an attack on the town of Shebekino in Belgorod.

— Russia’s Federal Security Service (FSB) accused an American intelligence agency of hacking thousands of iPhones, some of which belonged to Russian nationals and those working at embassies in Russia. The FSB did not specify which agency it was referring to. It also claimed that Apple works with American intelligence agencies. The firm said it had not helped any government breach iPhones.

— The Pentagon agreed to buy Starlink satellite internet terminals from Elon Musk’s SpaceX for use by the Ukrainian military, months after the two sides bickered over costs. The military did not specify how much it plans to pay SpaceX for the terminals, and further details were not revealed for “security reasons.”

— Europe prepares 11th Russia sanctions package. The European Commission is expected to present its 11th package of Russia sanctions next week, targeting Chinese firms that shipped banned goods to Russia, banning Russian flows through the northern Druzhba pipeline and forbidding the transit of EU-bound goods through Russian territory.

— U.N. tries to save Black Sea grain deal. The United Nations has proposed that Ukraine, Russia, and Turkey start preparatory work for the transit of Russian ammonia through Ukraine, wary that the “continuous slowdown of implementation” of the Black Sea grain export deal could lead to a collapse soon. Link to more via Reuters.

|

POLICY UPDATE |

— The Senate late Thursday voted, 63-36, to pass the bipartisan measure to suspend the nation’s borrowing limit until early 2025 and cap future spending, sending the legislation to President Biden’s desk with just days to go before a potential U.S. debt default. The Fiscal Responsibility Act sailed through the Senate one day after it overwhelmingly passed the House with more Democratic support than Republican.

Votes of note: Progressive lawmakers, including Sens. John Fetterman (D-Pa.), Elizabeth Warren (D-Mass.) and Bernie Sanders (I-Vt.) voted with conservative members, such as Sens. Rand Paul (R-Ky), Mike Lee (R-Utah) and Ted Cruz (R-Texas), against the bill backed by Majority Leader Chuck Schumer (D-NY) and Minority Leader Mitch McConnell (R-Ky.). Like the House vote, more Senate Democrats voted in favor of the bill than Senate Republicans. Forty-six Senate Democrats voted for it compared to 17 Republicans.

The Senate struck down all 11 amendments to the bill proposed by senators in 11 straight votes before the bill’s final passage. Senate Majority Leader Chuck Schumer (D-NY) warned that any change to the bill would “almost guarantee default.”

A key request: Besides the amendment votes, Republicans demanded that Schumer commit to bringing up all 12 appropriations bills this year to avoid an across-the-board spending cut that the legislation calls for.

In between votes on amendments, Schumer read a statement on the Senate floor that was negotiated with Republicans asserting that the debt ceiling bill will not constrain efforts to pass emergency aid packages for Ukraine and respond to national security threats such as China. “This debt ceiling deal does nothing to limit the Senate’s ability to appropriate emergency supplemental funds to ensure our military capabilities are sufficient to deter China, Russia, and our other adversaries, and respond to ongoing and growing national security threats, including Russia’s evil ongoing war of aggression against Ukraine, our competition ongoing with China and its growing threat to Taiwan, Iranian threats to American interests and those of our partners in the Middle East or any other emerging security crisis,” Schumer declared.

“Nor does this debt ceiling limit the Senate’s ability to appropriate emergency supply supplemental funds to respond to various national issues, such as disaster relief, combating the fentanyl crisis, or other issues of national importance,” Schumer added.

President Biden announced he will address the public on Friday regarding the legislation and said he hopes to sign the bill into law “as soon as possible.”

— Update on ERP. A USDA official told us FSA will use the same methodology for the Emergency Relief Program (ERP) for 2022 as it did in 2020 and 2021, which required producers to fill out an application and provide revenue information via Phase 2. The key change for 2022 is that Phase 1 and 2 will be rolled out simultaneously, rather than a staggered approach, to ensure more consistent determination of payment factors. Phase 2 payments for 2020 and 2021 are capped at $2,000. After July 14, USDA will determine demand for assistance and make payments applying the appropriate factor to ensure it does not exceed the funds. The USDA official said, “I think it is highly unlikely that we will be issuing the remaining 25% payment for Phase 1. We don’t have the authority to roll the money over to 2022. Funds for 2020/2021 expire December 31, 2023.”

The extended deadline for ERP Phase 2 from June 2 to July 14, the USDA official said, aims to provide independent parties, who have cooperative agreements with the USDA, time to reach out to underserved communities and educate producers on the new revenue loss concept.

— NYT analyzes debt ceiling deal. The debt ceiling deal recently passed by the House, which will raise the nation's borrowing limit and reduce the federal deficit, is only part of a larger agreement. The full deficit savings will be around two-thirds of what the bill accounts for as it requires further spending authorization in a second set of bills expected in the coming months, according to a New York Times analysis (link). These "agreed-upon adjustments" will increase federal spending and direct the funds towards areas in the budget that the current bill cuts the most.

Deficit reduction. Instead of a total deficit reduction of $1.5 trillion over a decade, as projected by the Congressional Budget Office (CBO), the full package will likely reduce deficits by about $1 trillion over the same period.

The second half of the deal, not yet up for vote, includes an incentive for Republicans to pass it: if they don't do so by the end of next April, defense spending will be automatically cut, an outcome they would prefer to avoid.

The current bill's savings largely come from spending caps on non-defense discretionary spending, which includes programs like domestic law enforcement, environmental protection, and air traffic control. However, many side deals between the White House and House Speaker Kevin McCarthy (R-Calif.) would re-infuse money into domestic spending, reducing the effects of the caps. These side deals could potentially increase the deficit by $138 billion for the first two years.

Changes are also made to the defense budget, food assistance program (SNAP), and the cash assistance program (TANF). However, these adjustments are not expected to result in significant savings to the federal deficit. The bill also pulls back some unspent Covid relief money, and reduces new funding available to the Internal Revenue Service over the next decade.

The budget cuts do not apply across the board, and major programs like Social Security and Medicare are not affected. These changes and budget forecasts depend largely on Congress's actions in the future and are based on 10-year increments.

— House GOP leadership will press for further worker requirements for safety net programs in farm bill. The House overwhelmingly approved a debt ceiling bill that also curbs federal spending, causing House Speaker Kevin McCarthy (R-Calif.) to hint at further tightening work requirements for safety net programs. The legislation expands expand work requirements for “able-bodied adults without dependents” under the Supplemental Nutrition Assistance Program (SNAP) to older individuals. Under current rules, individuals ages 18 through 49 can’t receive SNAP benefits for more than three months in three years if they don’t meet additional work requirements. The measure would increase the age limit to adults ages 50 to 52 in fiscal 2024 and then up to age 54 beginning in fiscal 2025. The measure also would exempt homeless individuals, veterans, or certain individuals in foster care from the work rules that apply to able-bodied adults without dependents.

McCarthy did not specify which programs he meant when he spoke about work requirements. House Republicans also have pursued stronger work requirements for participants in the cash welfare program Temporary Assistance for Needy Families (TANF). The debt limit bill did not go as far on TANF as a House-passed bill to cut federal spending.

The next farm bill is already considered a potential target for reducing SNAP eligibility and spending. Some Republicans have proposed expanding the 90-day limit to individuals aged 18 to 65.

But Senate Ag Chair Debbie Stabenow (D-Mich.) earlier this week made clear that the workers requirements for SNAP is now a settled affair and should not and will not be part of the next farm bill.

— Milk pricing plan. USDA said it would consider a proposal from the National Milk Producers Federation to amend provisions used to set the minimum price paid to farmers for fresh milk. Link for details.

|

CHINA UPDATE |

— Federal lawmakers have been banging the drum about China potentially turning drones from Beijing’s industry giants into remote aerial surveillance machines. A Forbes investigation (link) reveals that state and local agencies across the East Coast, including the police, have registered thousands of Chinese flying machines from companies Autel and DJI, the world’s biggest drone maker valued at $16 billion.

|

TRADE POLICY |

— U.S. signs trade agreement with Taiwan; China reacts negatively. U.S. Trade Representative Katherine Tai signed the agreement under an initiative that started about a year ago. The agreement strengthens and deepens the economic trade ties with Taiwan. It also pledges to facilitate bilateral trade and investment flows, improve the regulatory process, encourage cooperation of trade and Customs enforcement and establishes a foundation to overcome trade challenges and advance new trade opportunities.

China is not very happy about the U.S./Taiwan Initiative, with a Chinese Foreign Ministry spokesperson saying the U.S. has moved gravely violates the One-China principle and the three China/U.S. joint communiques and contravenes the US’ own commitment to maintaining only unofficial relations with Taiwan. The spokesperson went on to say the U.S. needs to stop official interaction with Taiwan.

The annual Section 301 report from the U.S Trade Representative says that it's pressing Taiwan for more intellectual property protections. This agreement does some of that.

This is one of the few trade agreements the Biden administration has signed.

— Former USTR Robert Lightheizer comments on China and other trade issues. On Larry Kudlow’s show on Fox Business, Lighthizer said “The fundamental question is do you believe China is an existential threat and a lethal adversary? This is probably the strongest adversary that we have ever faced in the United States as a country, literally in our history. This is a hostile country that has enormous resources and is focused on being number one in the world and taking over. They think that our system of freedom, democracy, open economies, they think that's a bad system. And they think totalitarianism and communism is the system of the future. And they go all around the world selling that idea. And every time we show weakness, show that we don't understand what we're involved with, we help them sell their system, and we hurt ourselves. So to me, the fundamental question is, Does the president understand that? Lots of people in this administration are smart, good people that do understand it. The question is, will they prevail in the internal debate and right now, you'd have to say they're not prevailing.”

Lighthizer noted China has been “threatening our aircraft, threatening our ships in the military, having a spy balloon come across the U.S., insulting our Cabinet officials. All of that is part of a scheme. It's coordinated. It's dictated by Beijing, and it's designed really to show that they are taking over from the United States and the status quo right now favors them. We should do strategic decoupling. Right now we’re shifting around $700 billion a year of American wealth to the Communist Party of China every single year. This great miracle that they've had this economic miracle rising these Chinese out of poverty, almost all of it was done with American dollars. Literally, we have built the greatest, the biggest army in the world and it's in China. We built the biggest Navy in the world and it's in China. We are building the best technology in the world, and it's in China. It's all being done with American dollars. And it's it is insanity. There's no precedent in history. It is total madness. We should have tariffs, we should demand balanced trade. We should disentangle our technology, and we should severely restrict incoming and outgoing investment. If we do those things, then the status quo will favor us. At that point you can talk about détente. At least we're not creating the enemy that is gonna devour us.”

Lighthizer continued: “If you look at the trade deficit in goods, for example, with $380 billion, there's this this silly thing called de minimis in which they probably get another $150 billion or $180 billion from us. They get more trade benefits through countries like Vietnam, how much money that they make by selling fentanyl via Mexico and killing our children. I mean, if you add it all up, look at their economic growth this year, it is probably going to be maximum $800 billion. That is about how much we give them every year. It is insane. It's absolutely insane.”

The Biden administration will review Phase 1 of the U.S./China trade agreement via Section 301. Lighthizer said “The way I analyze what we did with the Phase 1 agreement and the tariffs, I think we began this process of strategic decoupling within the context that we had at that time. So should these tariffs be lifted? Absolutely not. If they do, I will tell you right now it's a sign that nobody understands what is going on and that business or other special interests have basically taken over the reins of government. In my judgment, we should double the tariffs that we put in place right now. And take the next step towards decoupling for sure. We shouldn't and I don't think that this review is going to lead to that conclusion. The question will be after the election, whether or not the president gets re-elected, whether he would then do something. It's hard for me to believe it is so unpopular that they would do something like that before the election. But after that would be equally damning if he wins, of course. If the Republicans win, then my guess is the tariffs go up and we move in the direction of decoupling.”

Asked two key items about trade policy, Lighthizer said: “Number one, President Trump raised the alarm on China. Second, we have to change our trade policy to focus on workers… not businesses, but the workforce. Not the globalists… the workforce, the communities, the families.”

Analysis: A veteran trade policy analyst told us: “I think Main Street sees it. Wall Street doesn’t want to. Corporate America fuels a lot of the populism across our political spectrum because they are wedded to globalism and China is a prime example. They want to turn the other cheek hoping that China doesn’t do what we all see them doing because their P&L is so dependent on the Chinese market.”

Another veteran Washington contact emailed: “It’s very hard to argue against what Lighthizer says… we need to wake up to what the CCP’s objectives are… and their focus on ensuring they happen. This view is not popular with the American public… but we are literally asleep while all this is happening… and if we don’t get our act together some day the tipping point will be reached… and it will be too late.”

— Biden administration officials defend the Indo-Pacific Economic Framework agreement. U.S. Trade Representative Katherine Tai and Commerce Secretary Gina Raimondo have defended the ongoing negotiations concerning the Indo-Pacific Economic Framework (IPEF) in a letter to the Senate Finance Committee. The committee, chaired by Sen. Ron Wyden (D-Ore), has voiced concerns about the IPEF, indicating that lawmakers haven't been adequately informed about the progress of these negotiations. Unlike many international agreements, this deal does not require congressional approval.

In their letter, Tai and Raimondo cited several briefings and meetings provided to lawmakers and staff during the negotiation process. They have pledged their commitment to collaborating with Congress on the deal and reassured lawmakers that they will have access to the text of the agreement before it is shared with non-government stakeholders and foreign partners.

|

ENERGY & CLIMATE CHANGE |

— Mobil and Chevron are in advanced discussions with Algeria for a deal to drill for gas in the country, marking their first operations in the North African nation, the Wall Street Journal reports (link). As Europe seeks alternative gas supplies following Russia's invasion of Ukraine, Algeria is becoming an increasingly important supplier. The Algerian state oil-and-gas company, Sonatrach, is negotiating with the American companies to exploit conventional gas and the country's extensive shale gas reserves.

Algeria has three pipeline connections to Europe, giving it a competitive edge over other distant suppliers such as the U.S. and Qatar. Exxon and Chevron are looking to invest their large cash reserves, searching for new production sources as growth limitations are emerging in the US shale sector. The companies are also betting on increasing demand for natural gas as nations shift away from coal to reduce greenhouse gas emissions.

Chevron has already signed an agreement to access data on three Algerian oil-and-gas basins. As only 47% of Algeria's 1.5 million square kilometer area with proven oil and gas reserves is currently being exploited, the country offers plenty of opportunities. Algeria has also passed a law in 2019 offering more generous terms to foreign oil-and-gas producers to attract investment.

Algeria is seeking the expertise of Chevron and Exxon to develop its shale gas resources, which are the third largest in the world. However, the government prioritizes conventional gas resources due to public concern about the potential water contamination from shale gas production.

— Exxon Mobil Corp. is betting that a better way to frack will double the amount of oil it can pump from shale fields. Hydraulic fracturing, which gave rise to a production boom in the U.S., is only able to recover about 10% of the crude in a reservoir. New drilling methods may prove critical as output growth slows. Link to more via Bloomberg.

— A decaying tanker off Yemen that holds four times the amount of oil leaked in the Exxon Valdez disaster in 1989 is at risk of causing a major ecological crisis. A salvage operation is finally moving ahead after years of delays, the New York Times says (link).

— In the transportation sector, the shift towards electric power in the trucking industry is proving to be expensive, the Wall Street Journal reports (link). Daimler Truck and Toyota-owned manufacturer Hino have recently agreed to collaborate in Japan to navigate the technological changes and high costs associated with electric vehicles. Truck manufacturers are beginning to increase production of EVs using battery technology borrowed from the car industry, but questions around the optimal power source remain with hydrogen fuel cells and hydrogen-run internal combustion engines also under consideration. Tesla's Semi truck's quiet launch and its use by PepsiCo mainly for light cargoes underscore the limitations of the current battery technology.

— RFS update. The Office of Management and Budget (OMB) has held or scheduled a total of 35 meetings concerning the Environmental Protection Agency's (EPA) final levels for the Renewable Fuels Standard (RFS) from May 23 to June 13, with the most recent one being with PBF Energy.

These meetings have primarily revolved around renewable fuels to generate electricity, with discussions touching on topics such as Renewable Identification Numbers (RINs) for the production of electricity from renewable fuel sources, also known as eRINs.

BP's meeting on May 31 concentrated on bioenergy, whereas NATSO, representing truck stop operators, highlighted the impact of RIN prices on potential expansion in renewable natural gas. Vanguard Renewables also advocated for the EPA to establish an eRIN program for biogas used to generate electricity.

However, reports suggest that the EPA has decided to delay issuing a final rule on its plans for creating the eRIN effort. This has led to dissatisfaction from Vanguard, which expressed its frustration and disappointment in a letter to EPA Administrator Michael Regan on May 19.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— The California Department of Agriculture (CDFA) is increasing its education and outreach efforts regarding Proposition 12, following the U.S. Supreme Court's decision to uphold the program. Their updated Q&A (link) states that their priority lies in registering pork distributors as they gear up for full implementation by January 1, 2024. This will involve the introduction of third-party certification to ensure compliance.

The CDFA acknowledges that some products procured before July 1, 2023, will still be in circulation and that there will be a transition period throughout the rest of the year. The department intends to focus its limited resources on ensuring all required distributors are registered, accrediting third-party certifying agents to offer more options to producers and distributors, and certifying these producers and distributors.

So far, the CDFA has released a list of 587 registered distributors under the initiative and currently lists five accredited certifying agents located in Missouri, Arkansas, Iowa, Virginia, and Michigan. To facilitate this process, the agency has announced it will be hosting three webinars this month for various parts of the food system, ahead of the July 1 enforcement date.

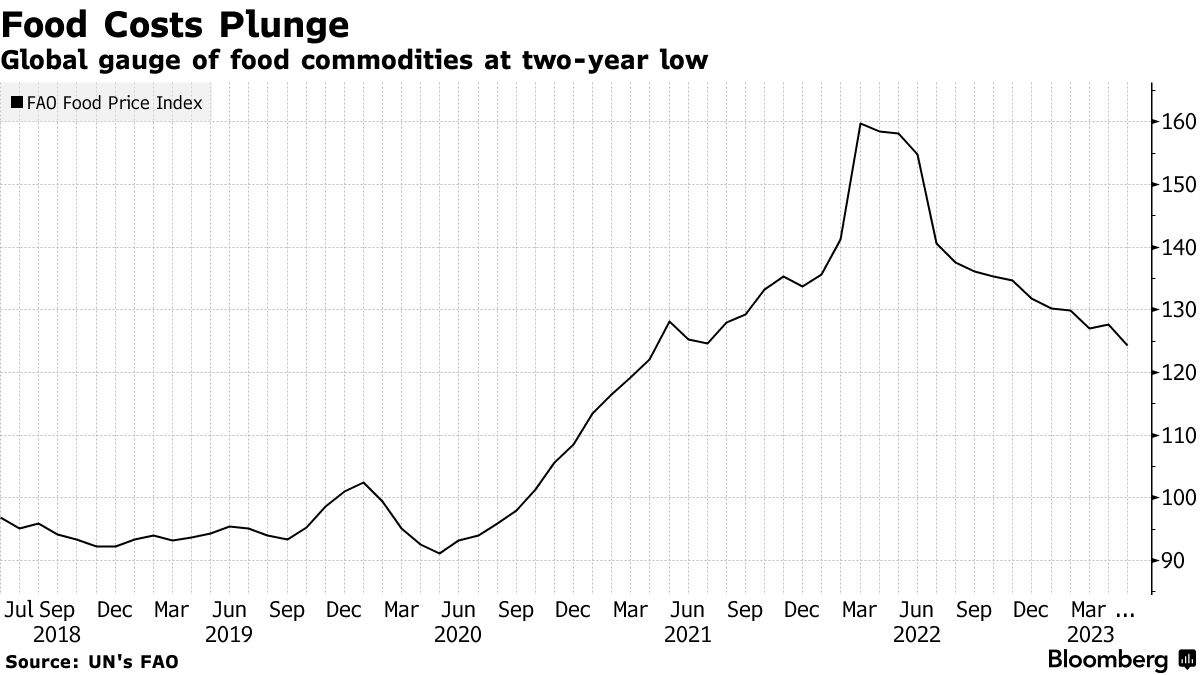

— Global food prices have reached a two-year low due to declines in cereal grains, vegetable oils, and dairy, according to the U.N. Food and Agriculture Organization (FAO) Food Price Index. The index fell to 124.3 points in May, down 2.6% from April and around 22% below the record set in March 2022.

Contributing factors include a 9.8% fall in world corn prices, leading to a 4.8% decline in overall cereal grain prices for the month, along with a 3.5% fall in wheat prices. China's cancellation of U.S. corn purchases also influenced this trend. Meanwhile, international rice prices continued to rise.

Vegetable oil prices fell 8.7% in May and are now 48.2% below levels from the previous year due to prolonged weak global import purchases coinciding with increased outputs in major producing countries. Dairy prices also fell, with a 3.2% decline led by a sharp drop in international cheese prices.

On the other hand, sugar prices rose by 5.5% for a fourth consecutive monthly increase.

Meat prices also increased by 1%, driven by continued Asian demand for poultry and tight U.S. beef supplies.

|

CONGRESS |

— A top House Republican accuses the FTC’s chair of “abuse of power.” Rep. James Comer of Kentucky, who leads the House Oversight Committee, opened an investigation into Lina Khan, citing concerns about her expansive approach to antitrust regulation. The inquiry marks the latest pushback against the Biden administration’s tougher stance on mergers and acquisitions.

— The Senate voted to overturn President Joe Biden’s student loan forgiveness program in a symbolic rebuke of the plan that would partially forgive debts of approximately 40 million borrowers. Despite picking up a few Democratic supporters, the GOP-backed legislation is doomed to fail as Biden has vowed to veto it. About one in five Americans — 45 million — owe $1.7 trillion for student loans.

|

OTHER ITEMS OF NOTE |

— Yesterday, the Supreme Court issued two rulings that were in favor of corporations, potentially impacting future public business ventures and labor strikes.

Firstly, the justices unanimously dismissed a case against Slack, a workplace messaging app, filed by a shareholder accusing the company of misleading investors prior to its 2019 direct listing. The plaintiff, Fiyyaz Pirani, alleged that Slack did not adequately disclose pertinent information on issues such as service outages and competition from Teams, Microsoft’s competing platform. Slack argued that the lawsuit was invalid because Pirani purchased unregistered shares not included under the securities laws. The justices rejected Pirani's argument, leading him to have to prove his shares were registered in a lower court. This decision limits the number of shareholders who can conveniently sue over misleading registrations. Paul Grewal, Chief Legal Officer of crypto exchange Coinbase, welcomed the decision, suggesting on Twitter that the ruling serves as a warning that federal securities laws have boundaries set by Congress.

In another case, the court made it easier for employers to sue striking workers. In an 8-1 ruling, the justices supported a concrete company that claimed its workers intentionally damaged the company during industrial action. This ruling overruled a Washington State court decision that the damage was incidental and protected under the National Labor Relations Act. Some legal experts have expressed concerns that this decision may deter workers from participating in strikes.

— Lawsuit seeks to force EPA to regulate coated seeds. Two environmental groups, the Center for Food Safety and the Pesticide Action Network North America, have filed a lawsuit against the Environmental Protection Agency (EPA), claiming that the agency wrongly exempted insecticide-coated seeds from regulation. The groups argue that these seeds should be assessed and registered as pesticides, as the neonicotinoid insecticides typically used on the seeds are causing significant harm to birds, pollinators, beneficial insects, and endangered species.

The lawsuit, filed in a federal court in San Francisco, aims to compel the EPA to classify these seeds as pesticides. Currently, the agency considers them as "treated articles" and in 2022, it refused a petition from the Center for Food Safety to initiate a rulemaking process for regulating the seeds as pesticides.

The coated seeds, which are broadly utilized as a protective measure against pests such as soybean aphids, are used on an estimated 150 million acres of cropland each year. The lawsuit refers to the severe ecological impacts of neonicotinoids, including harm to aquatic life and the significant decline in bee populations, likening the situation to a second "Silent Spring." The groups demand the EPA to stop exempting coated seeds from the pesticide registration process.

— AWP registers decline. The Adjusted World Price (AWP) for cotton fell to 66.91 cents per pound, effective today (June 2), down from 69.08 cents per pound the prior week. This also marked the end of what had been four straight weeks of increases after the AWP had fallen under 70 cents per pound the week of April 28.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |