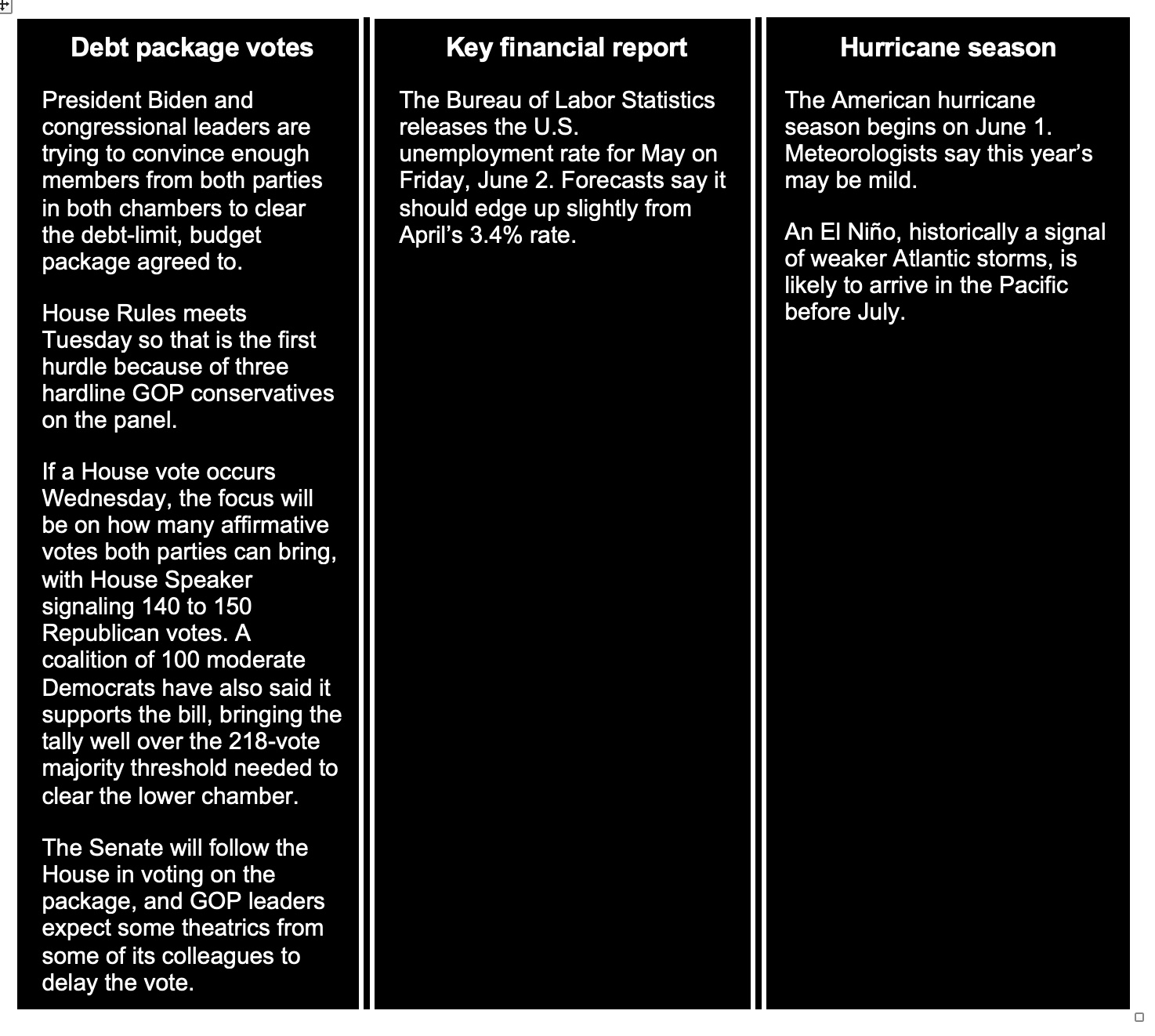

If Debt-limit Package Clears House Rules, Enough Votes Likely to Clear House Floor: Sources

Senate also has votes to clear package, but timeline could be delayed

|

In Today’s Digital Newspaper |

WSJ: The United Arab Emirates has pressed the U.S. to make more muscular moves to deter Iran after the Islamic Republic’s military seized two oil tankers in the Gulf of Oman in recent weeks, U.S. and Gulf officials said.

“I feel very good about it,” President Joe Biden said Monday afternoon outside the White House regarding the debt-limit package agreement. When asked what he would say to Democratic lawmakers who have reservations about the debt-limit/budget agreement, Biden responded: "Talk to me.” Biden has been personally calling lawmakers to support the bill.

Asked about the concerns of some Hill Democrats that the deal would lead low-income Americans to go hungry, President Biden responded that it was a “ridiculous assertion.”

Hardline conservatives said the debt-limit package will not produce the scale of spending cuts they wanted, while liberal Democrats said they were uncomfortable with concessions Biden made on safety-net programs. Biden officials are planning to hold half a dozen briefings over the next two days for congressional Democrats about changes to specific areas.

Russia's Defense Ministry has blamed Ukraine for an alleged drone attack on Moscow today that damaged buildings and injured two people. Meanwhile, Ukrainian cities continue to experience barrage after barrage of Russian missile and drone strikes, but the country’s forces have appeared unfazed as counteroffensive training and planning continues.

Ho hum… Russia warns Black Sea grain deal in jeopardy.

Ballooning debts, tepid consumption and worsening relations with the West are hobbling China’s chances of extending the growth miracle that transformed it into a rival to the U.S. for global power and influence, economists say. Instead of expanding at 6% to 8% a year as was common in the past, China may soon be heading toward growth of only 2% or 3%, some economists say. That drop could make China less important for some foreign companies, and less likely to significantly surpass the U.S. as the world’s biggest economy. More in China section.

China’s rejection of a meeting between Secretary of Defense Lloyd Austin and Li Shangfu in Singapore is the latest rebuff of US efforts to strengthen military communications and a setback for White House efforts to restore ties with key officials amid heightened tensions. China had demanded that the U.S. lift sanctions imposed on Li in 2018 over the role he played overseeing an arms purchase from Russia.

British grocery chains reportedly weigh capping prices. Retailers are in talks with government ministers on voluntary limits for staple items.

The Wall Street Journal looks at the big decline in hog prices and hog sector profits. Details in Markets section.

Massachusetts is gearing up for their version of Prop 12 and pork. More in Livestock section.

The Dept. of Justice responds to comments on proposed settlement in poultry industry info sharing on worker wages.

A new agreement between the U.S. and 13 other Asia-Pacific nations is aimed at moving supply chains away from dependence on China. More in Trade Policy section.

OMB has now scheduled 29 meetings related to the final rule from the Environmental Protection Agency (EPA) on the Renewable Fuel Standard (RFS) levels for 2023 and beyond.

USDA’s Natural Resources Conservation Service (NRCS) has partnered with others to launch three regional projects aimed at measuring and monitoring the impact of climate-smart agricultural practices on soil carbon. More in Energy & Climate Change section.

Turkey’s President Recep Tayyip Erdogan won a historic third term, extending his 20 years at the top of Turkey's political landscape. Erdogan defeated challenger Kemal Kilicdaroglu in Sunday's runoff election after failing to win an outright majority in the first round of votes in mid-May.

|

MARKET FOCUS |

Equities today: Asian and European stock markets were mostly firmer overnight. U.S. stock indexes are pointed toward higher openings. In Asia, Japan +0.3%. Hong Kong +0.2%. China +0.1%. India +0.2%. In Europe, at midday, London -0.6%. Paris -0.4%. Frankfurt +0.5%.

The electric-car maker's CEO Elon Musk is expected to arrive in China this week to meet Chinese officials and tour Tesla's factory in Shanghai, according to media reports. Its stock rose 2.9% premarket.

U.S. equities: On Friday, the Dow rose 328.69 points, 1.00%, at 33,093.34. The Nasdaq was up 277.59 points, 2.19%, at 12,976.69. The S&P 500 gained 54.17 points, 1.30%, at 4,205.45.

The Dow fell 1% in last week's stock market trading. The S&P 500 index edged up 0.3%. The Nasdaq composite jumped 2.5%. The small-cap Russell 2000 closed flat.

The 10-year Treasury yield climbed 13 basis points for the week to 3.82%, the highest point since early March. The odds of a Fed rate hike next month have jumped to 70%.

Agriculture markets Friday:

- Corn: July corn futures rose 13 1/4 cents, ending the week 49 1/2 cents higher at $6.04. December futures finished the day 18 1/2 cents higher, rising 35 3/4 cents on the week to $5.34 1/2.

- Soy complex: July soybeans rose 13 1/4 cents to $13.37 1/4 and gained 30 cents for the week, while July meal rose $5.00 to $402.20 but lost $6.90 week-over-week. July soyoil closed 30 points higher at 48.82 cents and gained 155 points on the week.

- Wheat: July SRW wheat futures rose 11 3/4 cents to $6.16 and nearer the session high. For the week, July SRW rose 11 cents. July HRW wheat gained 1 1/4 cents to $8.19 1/4 and nearer the session low. For the week, July HRW lost 5 cents. July spring wheat rose 12 1/2 cents to $8.18, gaining 14 cents on the week.

- Cotton: July cotton surged 323 points to 83.35 cents but still lost 337 points on the week.

- Cattle: June live cattle hit another contract high at $168.40 Friday before ending the day just 5 cents higher at $167.35 on the close. That represented a weekly gain of $1.625. August feeder future suffered a late drop, falling 77.5 cents and settling at $233.925, which marked a $1.175 weekly slide.

- Hogs: June lean hog futures fell $1.575 to $76.075, hit another contract low and for the week dropped $6.95.

Ag markets today: Soybeans and wheat faced heavy pressure coming out of the holiday weekend, while corn modestly favored the downside in mixed trade. As of 7:30 a.m. ET, corn futures were trading fractionally higher to 3 cents lower, soybeans were 11 to 13 cents lower, SRW wheat futures were 6 to 8 cents lower, HRW wheat was 15 to 16 cents lower and HRS wheat was 8 to 13 cents lower. Front-month crude oil futures were nearly $1.00 lower, and the U.S. dollar index was around 165 points lower this morning.

Market quotes of note:

- Sevens report on debt-limit agreement: “From a market standpoint, the news may cause a temporary knee-jerk rally, but this will not be a sustainable positive and is not a reason to buy stocks by itself, as extending the debt ceiling merely removes a potential catastrophic negative and does not add anything new and positive into the macro set up. Conversely, the deal will not be a material negative for growth, either, as it does not drastically reduce federal spending (i.e. putting more pressure on an already slowing economy).”

- Brace for the intense pressure on commercial real estate to spread to house prices, Elon Musk says. "Commercial real estate is melting down fast. Home values next," the tech billionaire tweeted.

- Nvidia, the world’s most valuable chipmaker, announced the creation of a new AI-supercomputer platform that will help other tech firms build generative AI models similar to ChatGPT. Potential users could include Meta and Microsoft. Jensen Huang, Nvidia’s chief executive, said the world was reaching “a new computing era” in which the barrier to coding has been dramatically lowered.

- Olam Group, one of Asia’s biggest agricultural commodity traders, said the listing of its agribusiness unit in Saudi Arabia won’t be completed by the first half of the year as planned.

- The U.K.'s economy could fall into an extended period of stagnation as high interest rates slow down business investment, says ABN Amro senior economist Bill Diviney in a note. "With rates expected to stay higher for longer, we now expect a prolonged period of stagnation," he says. Diviney says that even with economic stagnation, the BOE's 2% inflation target is unlikely to be achieved sustainably.

On tap today:

• S&P CoreLogic Case-Shiller national home price index for March is out at 9 a.m. ET.

• Conference Board's consumer confidence index is expected to fall to 99.0 in May from 101.3 one month earlier. (10 a.m. ET)

• Federal Reserve Bank of Dallas's manufacturing survey is expected to rise to minus 19.5 in May from minus 23.4 one month earlier. (10:30 a.m. ET)

• USDA Weekly Grain Export Inspections report, 11 a.m. ET.

• Richmond Fed President Thomas Barkin speaks on monetary policy at 1 p.m. ET.

• USDA Crop Progress report, 4 p.m. ET.

Spain inflation rate slows to near 2-year low. Spain's consumer price inflation dropped to 3.2% in May, from 4.1% the month before and below the market consensus of 3.5%, a preliminary estimate showed. It was the lowest rate since July 2021 as fuel prices declined and cost of food and non-alcoholic beverages rose at a slower pace. The core inflation rate eased to 6.1%, also the lowest since July 2021.

Market perspectives:

• Outside markets: The U.S. dollar index was weaker, with the British pound and euro both firmer against the greenback. The yield on the 10-year US Treasury note was lower, trading around 3.73%, with a mostly lower tone in global government bond yields. Pressure has continued on crude oil, with U.S. crude trading under $71.85 per barrel and Brent under $76 per barrel. Gold and silver futures are higher, with gold around $1,979 per troy ounce and silver around $23.43 per troy ounce.

• The World Gold Council reported its survey shows 24% of central banks intend to increase their gold holdings in 2023. Reasons include higher inflation, geopolitical turmoil and interest rate worries.

• The $54 billion U.S. pork industry is being whipsawed by supply and demand forces. Years of rapid expansion have left the sector oversupplied as demand is waning, costs are rising and new regulations are looming. The Wall Street Journal reports (link) hog farmers are being squeezed and some are even being driven out of business as they lose money at the worst rate in decades. The impact is cascading through supply chains, as businesses from hog farms to processing plants scale back operations and meatpacking companies including Smithfield Foods, Tyson Foods and JBS wrestle with shrinking profits. The turbulence is the result of rapid changes in markets. Booming overseas demand led many producers to expand operations, particularly after hog herds in China were devastated by African swine fever. Trade wars cut into that business, and more recently the strong U.S. dollar has made U.S. pork more expensive abroad.

• California water agency overestimates supply. The California Department of Water Resources routinely overestimates the state’s water supplies during drought and has made only limited progress in accounting for climate change in its water-supply forecasts. Link to details via the Los Angeles Times.

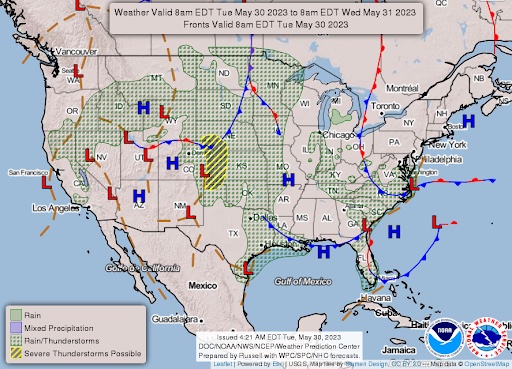

• NWS weather outlook: Widespread scattered showers and thunderstorms continue across large portions of the central U.S., the northern Rockies and northern Great Basin... ...Showery conditions spreading farther south into the southern Mid-Atlantic today followed by increasing chance of thunderstorms across southern Florida on Wednesday... ...Much above average temperatures expected along the northern tier of the nation, while cooler than normal conditions accompany the showers across the Southeast.

Items in Pro Farmer's First Thing Today include:

• Soybeans and wheat weaker, corn mostly lower overnight

• Warm, dry week for Corn Belt

• Russia raises calculation price for grain export duty, won’t increase state reserves

• Brazil corn estimates raised

• Bullish cash cattle hopes

• Hog futures well below the cash index

|

RUSSIA/UKRAINE |

— Russia warns Black Sea grain deal in jeopardy. Russia warned the West on Monday a deal allowing Ukrainian grain to be exported from the Black Sea would cease unless a United Nations agreement aimed at overcoming obstacles to Russian grain and fertilizer exports was fulfilled. “If everything remains as it is, and apparently it will, then it will be necessary to proceed from the fact that it [the deal] is no longer functioning,” Russian Foreign Minister Sergei Lavrov said.

— Russia sets first half 2023-24 fertilizer export quota. Russia set its quota for the export of fertilizers at 16.3 MMT for June 1 through Nov. 30. It increased the quotas for the export of urea, ammonium nitrate, complex NPK fertilizers and monoammonium phosphate by almost 2 MMT.

— In response to his remarks regarding the conflict in Ukraine, Russia has issued an arrest warrant for Senator Lindsey Graham (R-S.C.). The action followed a meeting Graham had with Ukrainian President Volodymyr Zelenskyy, where Graham appeared to express satisfaction with the outcome of U.S. financial support towards Ukraine, stating that "the Russians are dying" and describing the American military aid as "the best money we’ve ever spent."

Although the comments were made separately during their conversation and weren't necessarily linked, they were edited together in a brief video clip released by Zelenskyy’s office.

Russia's Investigative Committee, the nation's primary criminal investigative body, has launched a criminal inquiry against Graham following these remarks, although the specific crime he is accused of remains unclear.

Graham swiftly responded to the arrest warrant, indicating on Twitter that he considered it a badge of honor coming from "Putin’s corrupt and immoral government." He further expressed that the animosity he has elicited from Putin’s regime due to his commitment to Ukraine brings him immense joy.

As a final retort, Graham offered a challenge to his Russian "friends," stating that he would submit to the jurisdiction of the International Criminal Court if they do the same. He invited them to present their best case, suggesting a meeting at The Hague, the location of the International Court.

— Russia said it downed eight drones aimed at Moscow, the biggest attack on the capital since Russia invaded Ukraine. The Defense Ministry blamed Kyiv, which hasn’t commented. Moscow’s mayor said several residential buildings were damaged and no one was seriously injured.

The attack came as Russia launched a third round of strikes in 24 hours on Kyiv, Ukraine’s capital, following a rare daytime attack on Monday.

— Russians plowed money into black-market dollars and filled bank accounts abroad in recent months, a response to persistent economic anxiety over the war in Ukraine and worries that the situation might only worsen in the months and years ahead. Link to more via the Wall Street Journal.

|

POLICY UPDATE |

— President Joe Biden and House Speaker Kevin McCarthy (R-Calif.) reached a bipartisan framework deal to raise the debt ceiling and implement many spending cuts demanded by Republicans. However, the deal avoids broader budget reductions sought by the GOP and maintains key domestic programs championed by Biden. Link to our special report providing some of the details in the package which is expected to be voted on Wednesday in the House, and then the Senate — Senate Majority Leader Chuck Schumer (D-N.Y.) warned his colleagues to prepare for a vote Friday or potentially into the weekend. Link to a House Republican summary of the package. Link to a White House fact sheet. Link to 99-page text of bill.

President Biden said “there is no reason why it shouldn’t get done by the 5th,” when asked by a reporter outside of the White House on Monday if there was “no question” the bill would pass.

The bill under consideration has to navigate through the House Rules Committee before reaching the House floor. The House Rules Committee, a potent entity, controls the flow of most legislation. As part of his Speaker of the House election, McCarthy appointed three conservative Republicans to this committee. However, two of these appointees, Reps. Ralph Norman (R-S.C.) and Chip Roy (R-Texas), have suggested they would reject the bill. Despite this, the legislation might still accumulate sufficient backing to pass through the Rules Committee, which is expected to deliberate on the bill on Tuesday.

A Rules snag? According to a statement made on Twitter prior to the meeting, Roy mentioned that McCarthy pledged to move legislation out of the committee — comprising nine Republicans and four Democrats — only if there was a unanimous agreement among the Republicans. However, others say that view of the agreement is disputed. Senior GOP sources acknowledged that there was an agreement for seven Republican committee members to agree to move forward to advance a bill to the floor, but they flatly dispute that there was a deal for all nine to sign off for legislation to advance. “I have not heard that before. If those conversations took place, the rest of the conference was unaware of them,” said Rep. Dusty Johnson of South Dakota. “And frankly, I doubt them.” If Massie were to join Roy and Norman and vote against the rule at Tuesday’s meeting, he could effectively stall the measure in committee. But in January, Massie told CNN he was reluctant to vote against rules to stop bills in their tracks. “I would be reluctant to try to use the rules committee to achieve a legislative outcome, particularly if it doesn’t represent a large majority of our caucus,” Massie said at the time. “So I don’t ever intend to use my position on there to like, hold somebody hostage — or hold legislation hostage.”

During a House GOP press call yesterday, 16 Republicans spoke in favor of the bill, including Freedom Caucus member and Homeland Security Committee chair Mark Green (R-Tenn.).

Given the close split in the House of Representatives, McCarthy can afford to lose only four Republican votes on the legislation before needing Democratic support for it to pass. House Minority Leader Hakeem Jeffries (D-N.Y.) indicated on CBS that Republicans had committed to providing at least 150 votes in favor of the deal (McCarthy has also been quoted as saying 140 GOP votes). To reach the typical 218-vote threshold required for passage, Democrats would need to contribute the remaining votes.

However, the deal has drawn criticism from many progressive Democratic members, who have expressed dissatisfaction with the spending restrictions on domestic programs. They have also objected to provisions that reduce funding for the Internal Revenue Service and alter work requirements for food stamp recipients. Rep. Greg Casar (D-Texas), who serves as the whip for the House's progressive caucus, referred to the deal as a "ransom payment" during an appearance on MSNBC. Biden urged Democrats to talk to him directly if they had any reservations about the bill.

Some Democrats noted their support for the deal, including the leadership of the New Democrats, a large group of centrist House Democrats. “Compromise depends on give and take and this bill required concessions from both sides,” the leaders of the group wrote in a statement on Monday afternoon.

House bottom line: McCarthy reportedly believes he can whip at least 140 votes, while a coalition of 100 moderate Democrats have also said it supports the bill, bringing the tally well over the 218-vote majority threshold needed to clear the lower chamber.

The Senate can speed up votes if all 100 senators agree. But Sen. Mike Lee (R-Utah), a fiscal hawk, said on Twitter Thursday that “I will use every procedural tool at my disposal to impede a debt-ceiling deal that doesn’t contain substantial spending and budgetary reforms.” Others could delay a Senate vote for days if senators, including Sens. Tim Kaine (D-Va.), Mike Lee (R-Utah) and Lindsey Graham (R-S.C.), make good on their promises to introduce procedural hurdles or demand changes in protest of the legislation. Kaine is seeking an amendment to remove permits for a natural gas pipeline, Graham wants more defense spending in the bill and Lee has said the legislation doesn’t go far enough to cut federal spending.

Here are the key provisions in the bill:

- Debt Limit Increase: The bill suspends the debt ceiling until Jan. 1, 2025. The Treasury Department's "extraordinary measures" would also be replenished during this period, pushing the next potential default date several months later.

Suspending the debt limit for a period of time is different than setting it at a new fixed level. It essentially gives the Treasury Department the latitude to borrow as much money as it needs to pay the nation’s bills during that time period, plus a few months after the limit is reached, as the department employs accounting maneuvers to keep up payments.

That’s different than the bill passed by House Republicans, which raised the limit by $1.5 trillion or through March 2024, whichever came first. Under the new legislation, the debt limit will be set at whatever level it has reached when the suspension ends. For political reasons, Republicans tend to prefer suspending the debt limit rather than raising it, because it allows them to say they did not technically green-light a higher debt limit. - Spending Caps: The bill proposes limits on overall discretionary spending for the next two fiscal years. Defense spending would increase by about 3% next year, while nondefense spending would remain essentially unchanged. (With annual inflation still over 4%, both amount to a real dollar cut.) Discretionary spending caps would be imposed for six years as part of the agreement, though only enforced by across-the-board cuts during the first two years. Funding would be allowed to grow 1% annually.

Although Republicans had initially called for 10 years of spending caps, this legislation includes just 2 years of caps and then switches to spending targets that are not bound by law — essentially, just suggestions.

The White House estimates that the agreement will yield $1 trillion in savings over the course of a decade from reduced discretionary spending. A New York Times analysis of the proposal — using White House estimates of the actual funding levels in the agreement, not just the levels in the legislative text — suggests it would reduce federal spending by about $55 billion next year, compared with Congressional Budget Office forecasts, and by another $81 billion in 2025. If spending then returned to growing as the budget office forecasts, the total savings over a decade would be about $860 billion. - Appropriations Incentives: To motivate Congress to pass their annual appropriations bills and not sidestep new budget caps, a 1% spending cut would be enforced if the 12 spending bills aren't passed by the end of the year. This cut applies evenly to defense and nondefense accounts. The provision applies only to fiscal 2024 and 2025 spending measures.

Upshot: Democrats see the looming military cuts as a particularly strong incentive for Republicans to strike a deal to pass appropriations bills by the end of the year. - One innovation is a statutory “administrative pay-go” requirement that federal agencies offset new costs in regulation with comparable cost reductions elsewhere. The Government Accountability Office will flag violations, giving Congress an opening to vote down the regulation on a majority vote, a la the Congressional Review Act. President Biden could veto the vote of disapproval, but the debate will elevate public understanding of regulatory costs.

- Covid Aid Clawbacks: Around $28 billion in unspent relief money from the pandemic would be reclaimed from various programs. Some programs such as veterans health care and Covid-19 treatment and vaccine research are exceptions.

Of note: According to an administration official, the deal leaves intact funding for two key Covid programs: Project NextGen, which aims to develop the next generation of coronavirus vaccines and treatments, and an initiative to offer free coronavirus shots to the uninsured. - IRS Rollbacks: After criticism against President Biden’s push for $80 billion in Internal Revenue Service (IRS) funding, the bill would divert part of that money, $1.4 billion, originally intended to boost tax enforcement and counter fraud. There's an informal understanding that another $10 billion of the mandatory IRS funding would be repurposed in each of fiscal year 2024 and 2025.

Upshot: The debt limit agreement would immediately rescind $1.38 billion from the IRS. and ultimately repurpose another $20 billion over two fiscal years from the $80 billion it received through the Inflation Reduction Act. Administration officials said they had agreed to reprogram $10 billion of extra IRS money in each of the 2024 and 2025 fiscal years. to maintain funding for some nondefense discretionary programs. As for the IRS, officials suggested the IRS might simply pull forward some of the money earmarked for later years, then return to Congress later to ask for more money. - Work Requirements: For SNAP nutrition benefits, work requirements would apply to adults up to 54 years old, a gradual increase from the current 49. The bill would also fully exempt veterans, the homeless, and those recently in foster care. The deal would also cut the number of annual exemptions from work requirements states can grant, from 12% of SNAP beneficiaries to 8%. The agreement preserves some tightening of existing work requirements for the Temporary Assistance for Needy Families (TANF) program, but with protections for low-income children.

The age limit will be phased in over three years, beginning in fiscal year 2023. It includes a technical change to the TANF funding formula that could cause some states to divert dollars from the program.

The bill would exempt veterans, the homeless and people who were children in foster care from food-stamp work requirements — a move White House officials say will offset the program’s new requirements, and leave roughly the same number of Americans eligible for nutrition assistance moving forward. - Environmental Permitting: The bill introduces a "shot clock" for federal environmental reviews, limiting them to one or two years. The Mountain Valley Pipeline in West Virginia would receive congressional approval.

The Mountain Valley Pipeline is a natural gas project in West Virginia. The $6.6 billion project is intended to carry gas about 300 miles from the Marcellus shale fields in West Virginia across nearly 1,000 streams and wetlands before ending in Virginia. - Student Loan Repayment: The bill ends the student loan repayment pause that has been in place since the Trump administration at the end of August, as we await the Supreme Court's decision on Biden’s student loan relief program.

Upshot: It does not move forward with the measure that House Republicans wanted to include that would halt Biden’s policy to forgive between $10,000 and $20,000 in student loan debt for most borrowers. That initiative, which the Biden administration rolled out last year, is currently under review by the Supreme Court and could ultimately be blocked.

— If the debt-limit package is approved by Congress, can it happen for other bipartisan issues? Could be, say some congressional veterans. Confining dissent to the progressive and hardline conservative wings of their parties, Democrats and Republicans may find this approach would work on other topics that have thus far failed to get much traction.

— Key ag-related questions regarding the debt-limit package:

- Will getting this passed increase chances of a new farm bill this year or early in 2024? Some sources say yes, noting that the SNAP worker requirements will or should no longer be a hurdle in completing a new farm bill.

- Will Ag panel leaders get any of the additional/flexible clawback funding included in the debt-limit package? Answer: Too soon to tell, but this will be one of the questions asked should the package clear Congress and be signed into law. One veteran Capitol Hill watcher said: “When I was on the Hill, I liked when people told me what they needed. I hated when they tried to tell me how to make it happen. Drove me nuts.”

— Congressional leaders in essence are telling appropriators to finish their job, or else… If the House and Senate fail to enact the 12 appropriations bills by the end of this calendar year, all discretionary accounts are subject to a 1% cut basis the debt-limit agreement. This automatic sequester would apply to accounts Democrats have disguised as “emergency” (infrastructure dollars, etc.). Republicans say this is protection against the Democratic Senate that wants another year-end omnibus spending blowout. Some observers say the first “regular order” budget in years would give the House GOP leverage to win more policy victories in negotiations with the Senate.

— Senate Majority Leader Chuck Schumer entered into the farm bill reauthorization by stumping for the Dairy Margin Coverage program, WRVO reports (link). Schumer said the program is a lifeline to farmers and without it, it could lead to supply chain disruptions and a loss of revenue into the economy.

|

CHINA UPDATE |

— Covid-19 origin. George Gao, the former chief of the Chinese Center for Disease Control, told the BBC that China’s government had carried out an investigation into the Wuhan Institute of Virology over the origins of Covid-19. He believes that the government cleared the lab of any wrongdoing. Nonetheless, Gao said that observers could not “rule out” the theory that Covid-19 leaked from a lab.

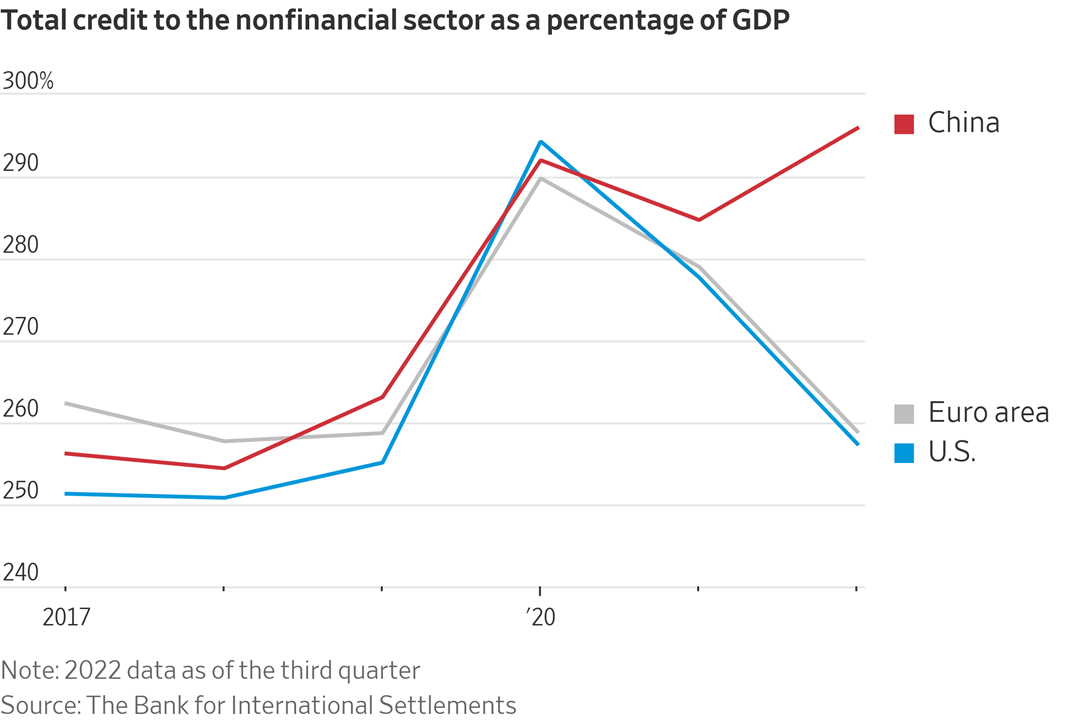

— China’s era of rapid growth is over. Its recovery from zero-Covid is stalling. And now the country is facing deep, structural problems, including a fading property boom, ballooning debt, tepid consumption and worsening relations with the West. Economists say these issues are hobbling China’s chances of extending the growth miracle that transformed it into a rival to the U.S. for global power and influence, the Wall Street Journal reports (link).

— China’s first domestically produced passenger jet began its maiden commercial flight. It marks an important milestone in the county’s efforts to compete with Western firms, such as Boeing and Airbus. Yet the C919 jet—made by the state-owned Commercial Aircraft Corporation of China—still relies heavily on imported parts, including for its engines. China’s government wants to reduce that dependence.

— China’s sow herd declines in April but bigger than year-ago. China’s sow herd declined 0.5% in April to 42.8 million head, according to the country’s ag ministry. However, it was still 2.6% larger than last year.

— China will send its first civilian astronaut to space on Tuesday, according to officials. So far, all Chinese astronauts have been members of the People’s Liberation Army. Tuesday’s mission to the Tiangong space station is part of China’s growing attempts to catch up with America’s space capabilities. It is aiming to land astronauts on the moon by 2030 and establish a lunar base.

— China has formally declined a U.S. request for a meeting between Defense Secretary Lloyd Austin and China’s new Defense Minister Li Shangfu. The proposed meeting was intended to occur during the upcoming annual Shangri-La Dialogue security forum in Singapore. The Biden administration continues to seek open lines of communication with Beijing, but has been unwilling to meet Beijing’s demand for lifting sanctions on Li, placed in 2018 due to his approval of purchasing Russian jet fighters and missiles, as a precondition for the meeting between Austin and Li. This refusal is considered an unusually blunt move by China, showing the limitations of the tentative rapprochement between these two global powers.

The Pentagon announced China's decision and expressed its belief in the importance of maintaining open military-to-military communication between Washington and Beijing to ensure competition doesn't escalate into conflict. This comes after a prolonged U.S. effort to secure the meeting, including a personal letter from Austin to Li. China's refusal could potentially cause concern among Southeast Asian allies who are apprehensive about being caught between the two powers.

Relations between China and the U.S. have been strained since February, following several contentious events including the U.S. shooting down a suspected Chinese surveillance balloon, warnings issued to Beijing against arming Russia in the Ukraine conflict, and Taiwan's President making a stopover in the U.S. Despite these incidents, some diplomatic meetings have been held, including between national security advisor Jake Sullivan and his Chinese counterpart, and between Commerce Secretary Gina Raimondo and her Chinese counterpart, Wang Wentao.

China appears to have been strategically choosing which U.S. officials to meet, seeming to favor those handling economic issues over national security matters.

|

TRADE POLICY |

— A new agreement between the U.S. and 13 other Asia-Pacific nations is aimed at moving supply chains away from dependence on China. The accord was reached in meetings over the weekend of the U.S-led Indo-Pacific Economic Framework, and delivers an early win in a new U.S.-led initiative to strengthen economic ties in a region critical to trade in electronics and consumer goods. The Wall Street Journal reports (link) the supply-chain agreement is part of the Biden administration’s effort to forge stronger manufacturing and trading links among friendly nations. One key element is a mechanism to prevent and respond to emergencies similar to the semiconductor shortages that arose during the Covid-19 pandemic. The framework still faces skepticism, with U.S. lawmakers and policy makers worried about trade’s impact on American jobs and leaders in Asia concerned about the impact on their own labor forces.

|

ENERGY & CLIMATE CHANGE |

— RFS update. The Office of Management and Budget (OMB) has now scheduled 29 meetings related to the final rule from the Environmental Protection Agency (EPA) on the Renewable Fuel Standard (RFS) levels for 2023 and beyond.

Upcoming meetings include sessions with the American Soybean Association (June 1), Hitachi Zosen Inova USA, LLC, a firm focusing on sustainable waste-to-energy and renewable gas (June 7), Waste Management (June 8), Anew Climate, DTE Vantage, Iogen Corp., and Opal Fuels (June 9), Bridge to Renewables and General Motors (June 9), the Advanced Biofuels Association (June 13), and Vespene Energy (June 13).

EPA had previously committed in court to finalize the RFS levels by June 14. The scheduling of these meetings suggests they are on track to meet this deadline.

— Measuring climate-smart ag practices on soil carbon. USDA's Natural Resources Conservation Service (NRCS) has partnered with Iowa State University, Michigan State University, American Climate Partners, and the University of Texas at El Paso to launch three regional projects aimed at measuring and monitoring the impact of climate-smart agricultural practices on soil carbon. The NRCS is investing $8 million in these initiatives.

These projects support the Conservation Evaluation and Monitoring Activity (CEMA), a new agency program that provides financial aid to farmers and ranchers to measure organic carbon levels in their soils before and after implementing conservation practices. Samples taken from up to one meter deep in the soil will be tested for organic carbon levels and results shared with the producer. The regional projects aim to train individuals in soil sampling and raise awareness among producers about CEMA.

The effort complements other soil carbon monitoring initiatives, such as the Farm Service Agency's $10 million Monitoring, Assessment and Evaluation (MAE) effort, which measures and monitors soil carbon in Conservation Reserve Program (CRP) lands. The CEMA and MAE initiatives form part of the USDA's broader strategy to improve the climate outcomes of farm and conservation programs and enhance the department's greenhouse gas accounting for the agricultural and forestry sectors.

This strategy also includes new investments under the Inflation Reduction Act (IRA), such as support for a National Soil Carbon Monitoring Network, and work within USDA’s $3.1 billion Partnerships for Climate Smart Commodities program.

NRCS Chief Terry Cosby emphasized the importance of healthy soils to sequester carbon, highlighting soil health management practices as a key part of the strategy for climate-smart agriculture and forestry.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Following a recent Supreme Court ruling on California’s Prop 12 and pork, Massachusetts' local meat industry is concerned about a potentially significant increase in pork prices due to the possible enactment of a 2016 animal welfare law. This law could take effect as soon as mid-July and would mandate that all "whole pork" items sold in the state must comply with certain animal welfare standards.

- Supreme Court Ruling: The Supreme Court upheld a Californian law requiring pork products sold in the state to meet certain guidelines concerning pig pen size. A similar law was approved in Massachusetts seven years ago, and it is now slated to come into effect.

- Impact on Pork Products: The Massachusetts law covers all uncooked "whole pork" items like bacon, ham, chops, ribs, roasts, or cutlets made entirely of pork meat. However, combined pork products like hot dogs are not included. Local pork sellers anticipate a significant increase in pork prices as a result.

- Roots of the Law: The Act to Prevent Cruelty to Farm Animals was overwhelmingly approved by Massachusetts voters in 2016. It set certain animal welfare standards for eggs, veal, and pork sold in the state. However, the pork regulations were delayed due to legal challenges to a similar law in California.

- Challenge from the Pork Industry: Industry groups argue that meeting the new standards will increase the cost of production and hence the price of pork. Only 4% of U.S. pork currently meets the new Massachusetts and California standards, according to some estimates.

Jim Monroe, a spokesperson for Smithfield Foods, which slaughters 30 million hogs a year and is the country’s largest pork producer, said the company spent $360 million to convert its 400 corporate-owned farms to a so-called group-housing system that provides sows with more room, which debuted in 2017. While some animal rights groups hailed the Smithfield system as more humane, others contend gestational crates remain a significant part of Smithfield’s operations. - Massachusetts timeline: Local pork-sellers are waiting for guidance on how to proceed. The attorney general’s office said any petition for a rehearing on the California law would need to be filed by June 5, and if none is made, the high court will issue its final judgment the week of June 12. That would then trigger a 30-day deadline of July 12 for the pork regulations to go into effect.

A spokesman for Attorney General Andrea Campbell said her office is “reviewing the decision and will provide updates when we have more to say about next steps.” Lawmakers so far have been mum about any legislative fixes.

State Senator Jason Lewis, who sponsored the Massachusetts bill, said in a statement that he “is pushing hard for this law to go into effect and start being enforced as soon as possible.” But even as they await guidance, restaurants, grocery stores, and food banks are bracing for the impact. - Impact on Low-Income Households: The implementation of the law might result in a near doubling of pork prices, which could disproportionately affect people near or below the poverty line. Many immigrant populations and food banks rely heavily on pork, raising concerns about accessibility and affordability.

- Response from Supporters: Supporters of the law argue that it reflects public sentiment against the inhumane treatment of farm animals. They acknowledge that there might be some price implications, but they believe that the voters were aware of this when they approved the measure.

- Preparation for law implementation: Restaurants and food service industries in Massachusetts are preparing for the potential effects of the law, with some considering price hikes and changes to their menus. However, proponents believe that pork producers will need to adapt to these changes, as consumers increasingly demand ethically raised food.

— DOJ responds to comments on proposed settlement in poultry industry info sharing on worker wages. The Department of Justice (DOJ) has responded to public comments on a proposed final judgment regarding allegations that major U.S. poultry companies — Cargill, Inc., Wayne Farms, LLC, and Sanderson Farms, Inc. — conspired with the consulting firm Webber, Meng, Sahl and Company to share wage data on workers. The response was published in the Federal Register (link) and has been filed in the U.S. District Court for the District of Maryland.

The DOJ stated that it believes the proposed remedies are in the public interest and address the harm alleged in the complaint. The final judgment prohibits the defendants from conspiring to assist their competitors in making compensation decisions, exchange current and future, disaggregated, and identifiable compensation information, and facilitate this anticompetitive agreement.

The DOJ received no comments regarding the consulting firm and five comments concerning the poultry companies. However, it noted that many comments addressed issues beyond the case and thus did not alter the DOJ's view on the final judgment. While acknowledging other significant issues in the poultry industry, the DOJ contends that the final judgment addresses the case at hand in the public interest.

— British grocery chains reportedly weigh capping prices. Retailers are in talks with government ministers on voluntary limits for staple items, according to The Guardian (link), in response to the soaring inflation in food prices that has plagued Europe. Link to more via the New York Times.

|

POLITICS & ELECTIONS |

— Recep Tayyip Erdogan secured another five-year term as Turkey’s president after comfortably winning a run-off election. With nearly all ballots counted, he had received 52.1% of the vote; his challenger, Kemal Kilicdaroglu, took 47.9%. Kilicdaroglu called the result “unfair” but did not dispute it. “The only winner today is Turkey,” said Erdogan. The lira neared a fresh record low, of about 20 to the dollar, following the results.

High on Erdogan’s agenda will be tackling an impasse in relations with Western allies over his willingness to do business with Russia and his defense of what he sees as Turkey’s own long-term interests, the Wall Street Journal notes. Erdogan at times has frustrated U.S. and European leaders for deepening economic ties with Moscow, accepting billions of dollars in Russian money that have helped keep the Turkish economy from tipping into insolvency while at the same time selling drones and other crucial weapons to Ukraine and barring Russian warships from entering the Black Sea.

— Pedro Sánchez, Spain’s prime minister since 2018, called a general election on July 23. The vote was originally scheduled for the end of the year, but the socialist leader said that the results of local elections on Sunday—in which his Spanish Socialist Workers’ Party and Podemos, its junior ally, suffered defeat to conservative rivals—prompted him to hasten the electoral schedule.

|

OTHER ITEMS OF NOTE |

— North Korea told Japan that it plans to launch a satellite in the coming days, just weeks after Kim Jong Un said his country had built its first spy satellite. The Japanese government urged North Korea to keep it grounded. Japan also said it would “take destructive measures” against missiles landing in its territory; North Korea will need to use missiles for its launch.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |