House Ag Chairman Thompson Signals Farm Bill Could Include Prop 12 Override Language

House, Senate leaders plan for votes next week on bipartisan deal to avert debt default

|

In Today’s Digital Newspaper |

Weekly sales update from USDA notes China soybean sales cancelations. USDA Export Sales data for the week ended May 11 reflected sales cancelations on corn that were previously known but also included soybean sales cancellations. Activity for 202-/23 included net sales reductions of 271,151 metric tons of corn, 3,710 metric tons of sorghum, and 119,180 metric tons of soybeans. But there were net sales of 61,971 running bales of upland cotton. Sales for 2023-24 of 187,000 metric tons of soybeans were reported. For 2023, net sales of 2,905 metric tons of beef and 5,190 metric tons of pork were reported.

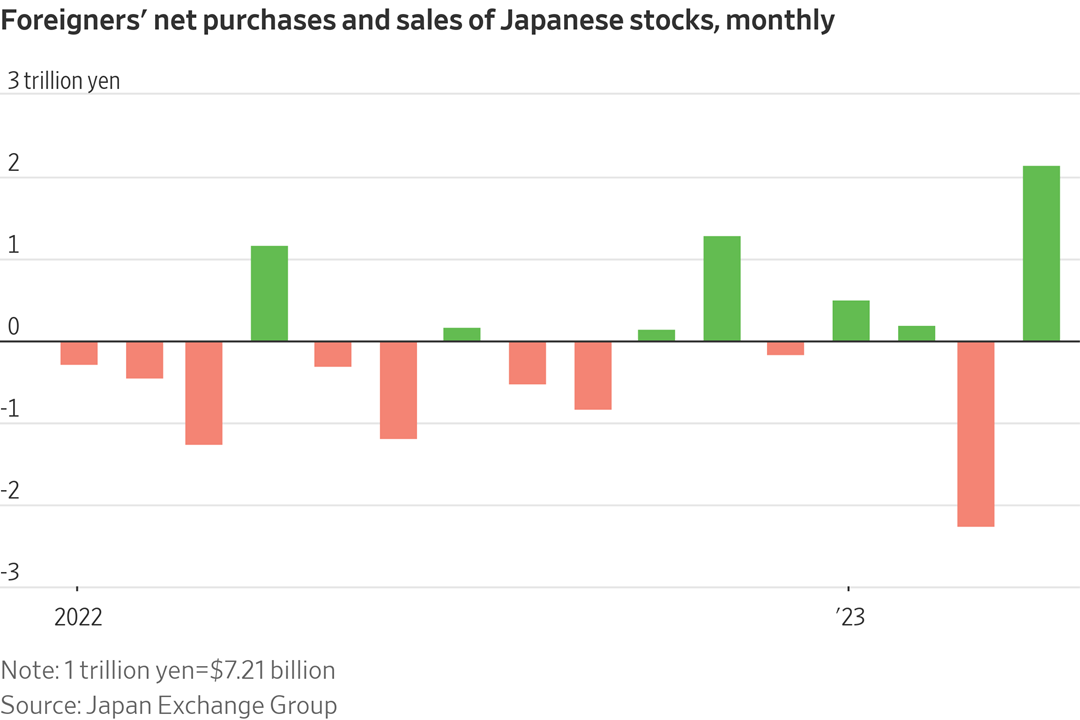

Is a U.S. rate increase back on the table? Market futures today are pricing in a nearly 40% chance that the Fed will raise interest rates at its meeting next month, after a sharp escalation in recent days that puts in doubt a highly anticipated pause in rate increases. More in Markets section. Another quarter-percent increase is a “serious possibility,” Jim Reid, a strategist at Deutsche Bank, wrote to investors today. And Quincy Krosby, the chief global strategist at LPL Financial, wrote that Fed officials had been sending a message: Don’t even start pricing in a pause in rate increases, let alone a cut. The latest signal on the Fed’s thinking could come in a speech this morning by its chairman, Jay Powell.

An explosion derailed a freight train in the Russian-occupied region of Crimea, the latest in a series of blasts to hit Russian infrastructure. Meanwhile, Ukraine shot down 16 drones and three missiles overnight, as Russia continued a campaign of air strikes including the 10th attack on the capital this month.

$3 billion: How much more the U.S. has to spend on arms for Ukraine after discovering the Pentagon overcounted the value of the weaponry it has sent so far. Details below.

The U.S. and Taiwan agreed to boost trade ties, the first tangible results under an initiative announced last year that faces vehement opposition from Beijing. The agreement will streamline customs, reduce wait times for trucks and vessels and improve regulation, the U.S. said, as part of a broader drive to deepen trade ties amid heightened tensions with China.

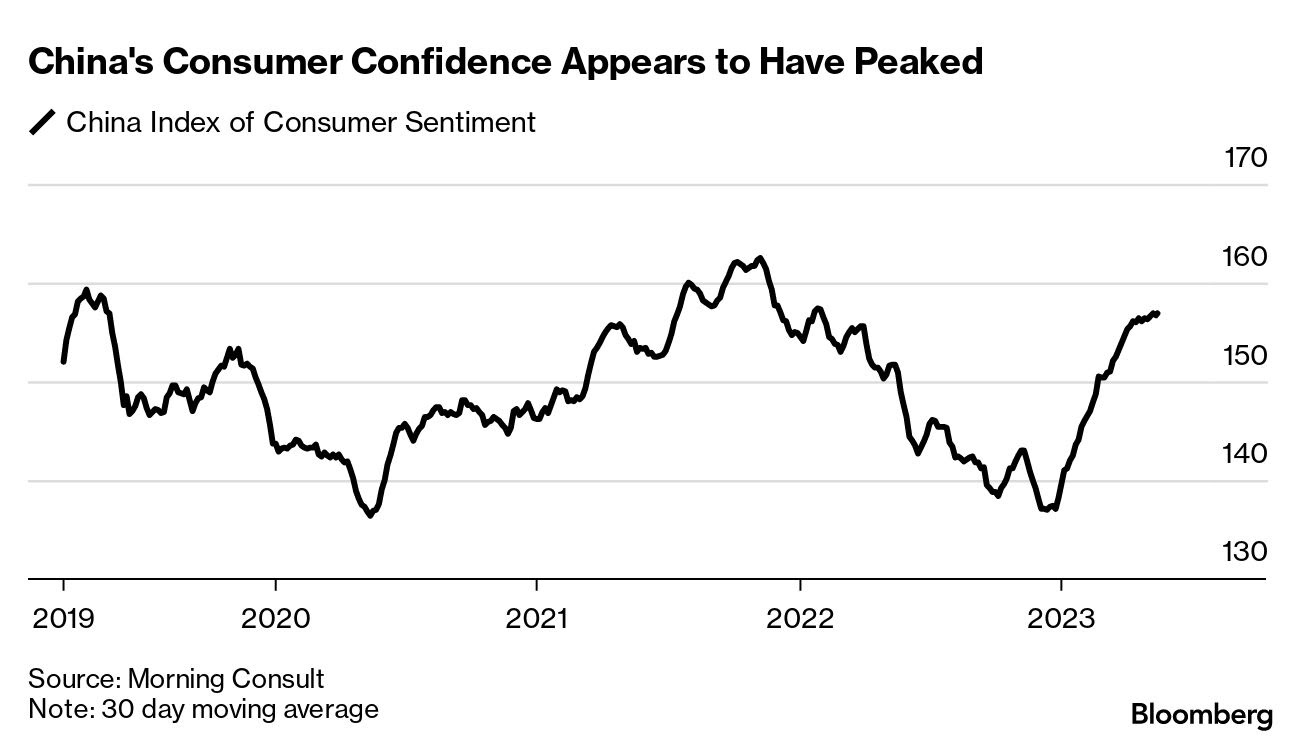

Signs are increasing that China’s economic recovery may be losing steam. The country saw faster-than-expected growth in the first quarter, buoying hopes that the world’s second-biggest economy could help the world ward off a slowdown or even a recession. But recent official data suggests China may have already released most of its pent-up demand after years of harsh Covid-19 restrictions. Lower-than-expected retail sales, shrinking imports, and worse-than-anticipated bank-loan data have added to worries. “As disappointment kicks in, we see a rising risk of downward spiral,” analysts from the investment bank Nomura said.

“The world needs a prosperous Central Asia,” Xi Jinping said Friday, toward the end of a two-day summit in the Chinese city of Xi’an with counterparts from Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan and Uzbekistan — former Soviet republics with which Beijing has steadily cultivated ties since they became independent nations in the early 1990s. The Chinese leader, who outlined plans to increase trade in the region while “resolutely opposing external forces interfering in our internal affairs,” spoke as Beijing deepens its diplomatic activity across Eurasia. This week, China sent a special envoy, Li Hui, to meet with officials in Kyiv, Warsaw, Paris, Berlin and Moscow, as part of Beijing’s first significant effort to push for a negotiated settlement to Moscow’s war in Ukraine. More in China section.

Disney cancelled plans to build a corporate campus near Orlando, Florida and move more than 2,000 jobs there. A tax credit on the nearly $1 billion site would have allowed Disney to recoup up to $570m over 20 years. But the firm has fallen out with Florida’s Republican governor, Ron DeSantis, in a tit-for-tat starting with its opposition to anti-LGBT legislation pushed by the governor.

House Ag Chair G.T. Thompson (R-Pa.) told Agri-Talk Thursday morning that the new farm bill could provide Prop 12 override language. See Policy section for details.

The U.S. is resorting to purchases of European wheat after a drought upended crop markets, pushing local prices higher. Details in Markets section.

Food prices are poised to ease further as the weather factor swings to El Nino in 2H, according to Bloomberg Intelligence. That’s deflationary in nature vs. the inflationary La Niña, which was in force from September 2020 until March this year.

NCBA tells House Ag subcommittee its priorities for the 118th Congress. During a hearing Wednesday, Todd Wilkinson, President of the National Cattlemen’s Beef Association (NCBA), listed the group’s priorities. See Livestock section for details.

The Supreme Court unanimously rejected efforts to hold Twitter, Google and Facebook culpable for Islamic State attacks because they hosted terrorist material on their sites, but sidestepped any fuller reckoning with Section 230, the foundational internet law that shields social-media platforms from liability for user-generated content.

Dianne Feinstein’s illness is more complicated than initially disclosed. The Democratic senator from California, who recently returned to Washington after a two-month absence to recover from shingles, has also been suffering from Ramsay Hunt syndrome, the New York Times reports. The condition, which causes paralysis, has added to concerns that Feinstein cannot effectively do her job.

|

MARKET FOCUS |

Equities today: Asian and European stock markets were mostly higher overnight. U.S. stock indexes are pointed toward firmer openings. In Asia, Japan +0.8%. Hong Kong -1.4%. China -0.4%. India +0.5%. In Europe, at midday, London +0.4%. Paris +0.7%. Frankfurt +0.7%.

U.S. equities yesterday: All three major indices registered a second day of gains, with the Dow ending up 115.14 points, 0.31%, at 33,535.91. The Nasdaq rose 188.27 points, 1.51%, at 12,688.84. The S&P 500 gained 39.28 points, 0.94%, at 4,198.05.

The S&P 500 is up 1.8% this week, set for its best week since end-March when markets were in panic mode around a banking crisis dragging down the economy (highest level since Aug. 25 on Thursday.) U.S. regional bank stocks are up 8.5%, set for their biggest weekly rise since January 2022 — cheering Wednesday's strong deposit growth at Western Alliance Bancorp, after two weeks of sharp falls.

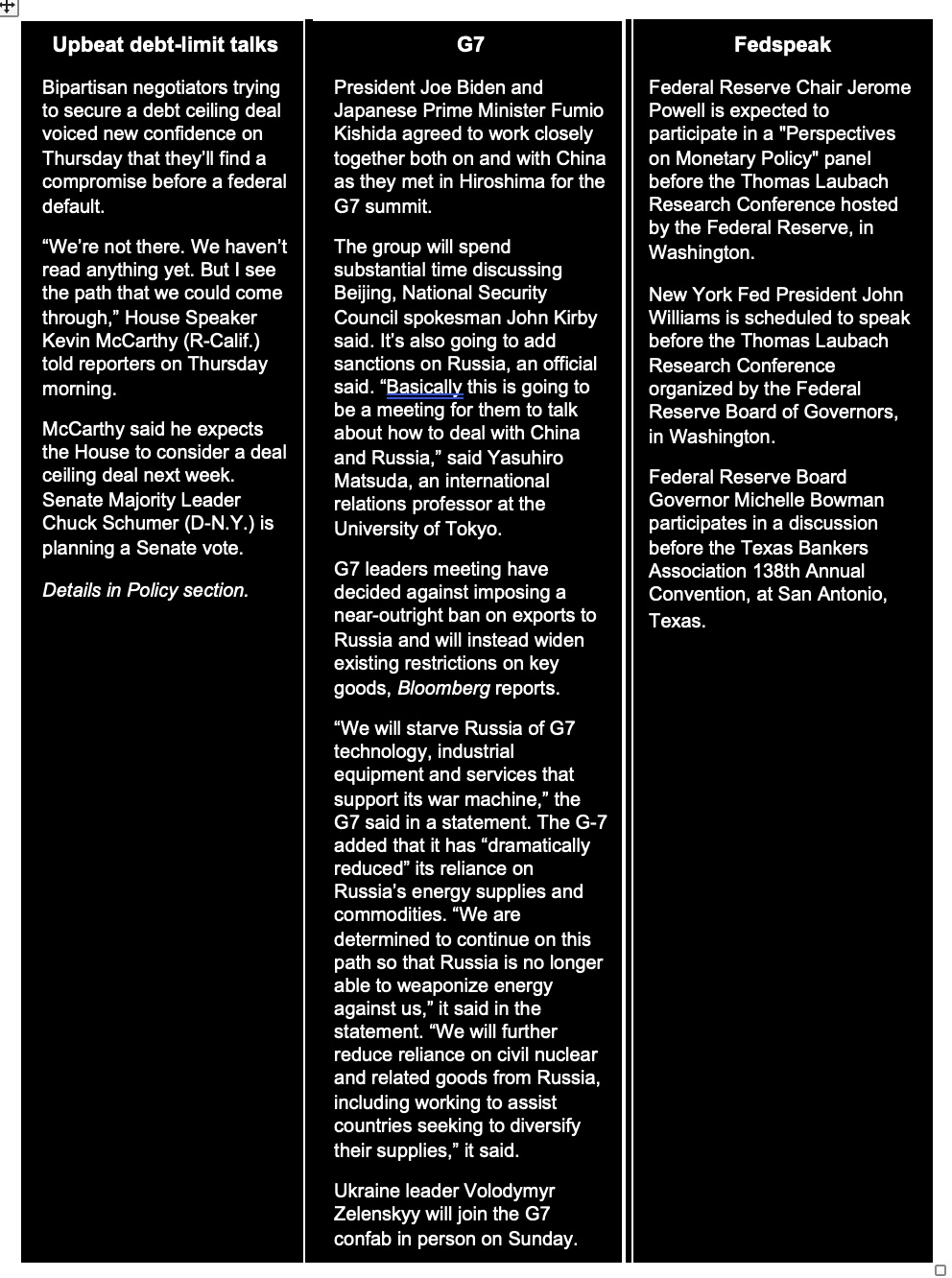

Japan is back, at least for foreign investors. Net purchases and sales of Japanese stocks by foreigners have surged and the country's benchmark stock index, the Nikkei 225, notched a 33-year high Friday. Part of the reason for the rally in Japanese shares is that Warren Buffet last month said he has more Japanese stocks in Berkshire Hathaway’s portfolio than any other country, save for the U.S.

Agriculture markets yesterday:

- Corn: July corn futures led the complex lower, closing 6 1/4 cents lower to $5.55 1/4.

- Soy complex: July soybeans fell 3 3/4 cents to 13.33 1/4, a mid-range close after reaching the lowest level since July 25, 2022. July meal fell $11.20 to $414.10, while July soyoil rose 88 points to 47.29 cents.

- Wheat: July SRW wheat fell 13 3/4 cents to $6.11 3/4. Prices closed near mid-range and hit a two-week low. July HRW wheat dropped 28 1/2 cents to $8.57 and nearer the session low. July spring wheat futures fell 31 1/4 cents to $8.28 1/2.

- Cotton: July cotton fell 28 points to 86.66 cents, after reaching the highest level since Feb. 13.

- Cattle: June live cattle rose 70 cents to $165.525, nearer the session high and hit a three-week high. August feeder cattle gained $3.35 at $234.50. Prices closed near the session high and hit a contract high.

- Hogs: Although most hog contracts declined Thursday, nearby June futures rose 42.5 cents to settle at $85.30.

Ag markets today: Corn, soybean and wheat futures traded mildly higher on corrective buying during overnight trade. As of 7:30 a.m. ET, corn futures were trading 2 to 5 cents higher, soybeans were 5 to 10 cents higher, SRW wheat was around a nickel higher, HRW wheat was 1 to 3 cents higher and HRS wheat futures were around 3 cents higher. Front-month crude oil futures were about 75 cents higher, and the U.S. dollar index was more than 250 points lower this morning.

Market quotes of note:

- Some Fed officials are hawkish again. The case for a rate pause is unclear, Dallas’s Lorie Logan said, expressing disappointment in the lack of progress on inflation. The voting member added she has an open mind ahead of the June meeting as new data trickles in. While the Fed has made some progress on inflation, Logan said today, there's still a long way to go. St. Louis Fed's Jim Bullard made similar points in an interview with the Financial Times. He was more direct, however, saying that he would be inclined to raise interest rates further in June. (Bullard doesn't get a vote until 2025, having rotated off the Federal Open Market Committee this year.) Meanwhile, Governor Philip Jefferson said he’s watching for any delayed effects from past hikes. Jefferson said that "progress on inflation remains a challenge," but didn't indicate whether he would support a hike or a pause next month. Several other Fed officials have appeared in public since late last week. Fed Gov. Michelle Bowman and Cleveland Fed President Loretta Mester argued the Fed hasn’t made enough progress on inflation to stop now. Minneapolis Fed President Neel Kashkari told a conference in that city this week that the Fed has “more work to do on our end.” Despite multiple rate increases, taking the benchmark from near zero to over 5% since last year, inflation is still running twice as high as the Fed’s 2% target. On Thursday, the bond market assigned about a 40% chance of a rate increase at the FOMC meeting next month, up from around 10% a week ago. Bottom line: As Fed officials’ comments have shown, the June decision will be the most contentious in a long time.

- A debt-limit deal means the Treasury Department needs to sell a lot of Treasury bills to replenish its dwindling cash buffer and maintain its ability to pay obligations. By some estimates, that borrowing could top $1 trillion by the end of September. That would suck liquidity from the banking sector and tighten the U.S. economy. Bank of America Corp.’s estimates it would have the same economic impact as a quarter-point interest-rate hike.

- Sevens’ Report on what the stronger dollar means for markets: “We are concerned with the fundamental impact of the new uptrend in the dollar and, historically speaking, dollar strength can be pretty detrimental to risk assets. From a fundamental standpoint, a stronger dollar has a negative impact on the broader stock market because roughly 40% of S&P 500 constituents’ revenue is generated outside the U.S., so in different currencies. A strengthening dollar will begin to weigh on overseas sales, and that will start to be a drag on total revenue and ultimately profits for U.S. based companies, including large caps. And a stronger dollar is the last thing corporate America needs right now with a consumer who is clearly cutting back while valuations are already stretched. Bottom line, the dollar has made substantial progress at establishing a bottom in the 101 area in recent weeks, and if we are on the brink of a new leg higher in the Dollar Index, expect that to become a renewed source of pressure on the broader U.S. equity market. Looking back in time to the last few major bear markets in stocks, the dollar rallied meaningfully through the dot-com bubble bursting, the GFC, and the onset of the Covid pandemic. So it is clear that keeping tabs on what the dollar is doing is a critical practice, especially during times when the yield curve is deeply inverted and indicating a high likelihood of recession.”

- Bank of America reiterated a call to sell U.S. stocks, saying tech and artificial intelligence are forming a bubble and the Fed’s rate hikes may not be over. AI for now is its own “baby bubble.”

On tap today:

• Federal Reserve Chair Jerome Powell speaks at a Fed research conference at 11 a.m. ET.

• Additional Fed speakers: New York's John Williams at the Fed research conference at 8:45 a.m. ET and governor Michelle Bowman to the Texas Bankers Association at 9 a.m. ET.

• Baker Hughes rig count is out at 1 p.m. ET.

• CFTC Commitments of Traders report, 3:30 p.m. ET.

Deere blew past earnings expectations and raised fiscal-year financial guidance on strong sales for its tractors and precision agriculture equipment. Deere reported fiscal second-quarter earnings per share of $9.65 from about $16 billion in equipment sales. Wall Street was looking for earnings per share of $8.58 on equipment sales of $14.9 billion, according to FactSet. A year ago, Deere reported earnings of $6.81 a share on sales of $12 billion. For all of fiscal 2023, Deere expects net income of between $9.25 billion and $9.5 billion. In February, management said it expects fiscal 2023 net income of $8.75 billion to $9.25 billion. Deer shares were up 3.4% in premarket trading Friday.

Previous high crop prices are not the only reason the company’s shares are trading at double their pre-pandemic levels. The Economist notes the firm has been bringing its products into the digital age. It has added driverless tractors, drones and weed-spotting sprayers to its product line, and has been hiring techies laid off by Silicon Valley firms. In January John Deere’s boss gave the opening address at the Consumer Electronics Show — “a clear testament to its changing corporate identity.”

Bottom line: Even though crop commodity prices continue to come down from last year's peak, which spurred spending from growers to upgrade their fleets, executives have reiterated that order books are still robust. The company's precision agriculture division's retail sales outpaced other segments with a 53% jump in revenue. Operating profit increased 105% year-over-year.

Perspective: Deere must finally have supply chain issues solved. Hopefully, for farmers, parts issues too.

WSJ’s CEO Council Summit May 23-24. Treasury Secretary Janet Yellen, Bank of England Governor Andrew Bailey, UBS Chairman Colm Kelleher and Barclays CEO C.S. Venkatakrishnan will discuss the global economic outlook at WSJ’s annual CEO Council Summit in London.

Germany producer inflation slows to 25-month low. The annual producer inflation in Germany eased for the seventh straight month to a 25-month low of 4.1% in April, aligning closely with forecasts of 4% and indicating a gradual reduction in inflationary pressures within Europe's largest economy. Energy inflation eased further with the cost of electricity falling by 2.9% while capital goods prices surged by 6.8%.

Disney cancels planned Florida campus that would have brought 2,000 jobs. Walt Disney Co. canceled plans to open a new Florida campus and bring about 2,000 jobs to the state as the company continues its long brawl with the state's Republican governor, Ron DeSantis. The company cited "new leadership and changing business conditions" as the reason for canceling the campus in the Orlando community of Lake Nona. The plan faced considerable pushback, especially as the political climate in the state became openly hostile toward Disney and DeSantis embraced legislation that many people viewed as anti-LGBTQ+.

Syngenta Group is preparing to move forward with plans for an initial public offering on Shanghai’s main board after its hearing to join a Nasdaq-style venue was canceled. The Chinese-owned seed giant proposes a 65 billion yuan ($9.3 billion) offering.

Japan’s consumer prices excluding fresh food rose 3.4% in April from a year ago, quickening from the previous month and in line with estimates. That’s likely to support views that the central bank may have to revise its price outlook, bringing the BOJ a step closer to policy normalization.

Details: Food prices increased the most since August 1976 (8.4% vs 7.8% in March). Also, cost accelerated for transport (1.8% vs 1.6%), clothes (3.8% vs 3.6%), furniture & household utensils (10.0% vs 9.4%), medical care (1.7% vs 1.3%), and education (1.3% vs 0.9%). Meanwhile, inflation eased slightly for both housing (1.2% vs 1.3%) and miscellaneous (1.2% vs 1.3%). At the same time, prices of fuel, light, and water charges declined further (-3.8% vs -2.8%), mainly due to electricity (-9.3% vs -8.5%). Core inflation increased to a 3-month high of 3.4% in April from 3.1% in the previous two months, matching market forecasts while staying above the Bank of Japan's 2% target for the 13th month.

Why unlimited vacation isn’t as great as it sounds. Bloomberg recently ran an analysis item by Jo Constantz on the topic of unlimited vacation. Companies such as Microsoft, Adobe, Netflix, and Goldman Sachs have begun shifting from offering employees a set amount of paid time off to unlimited vacation policies. These policies can help recruit and retain talent, fight burnout, save on unused time payouts, and provide executives more flexibility. However, there are downsides for both employers and employees, the Bloomberg analysis notes.

For employers, the policy may backfire if the company culture discourages leave-taking, leading employees to feel duped. The policy may also not be enough to prevent burnout, there can be potential for abuse leading to productivity issues, and overlapping vacation times may leave the company short-staffed.

For employees, the policy may not work well with hourly employees and can result in inequity and inconsistency as it often depends on manager approval. Research suggests that employees often take less time off with unlimited vacation policies, out of fear of overstepping boundaries or losing competitive edge.

Despite its challenges, unlimited vacation time is a highly sought-after benefit, especially in the tech industry where competition for talent is fierce. However, it is still relatively rare, with only around 6% of employers offering it according to a 2022 survey.

Market perspectives:

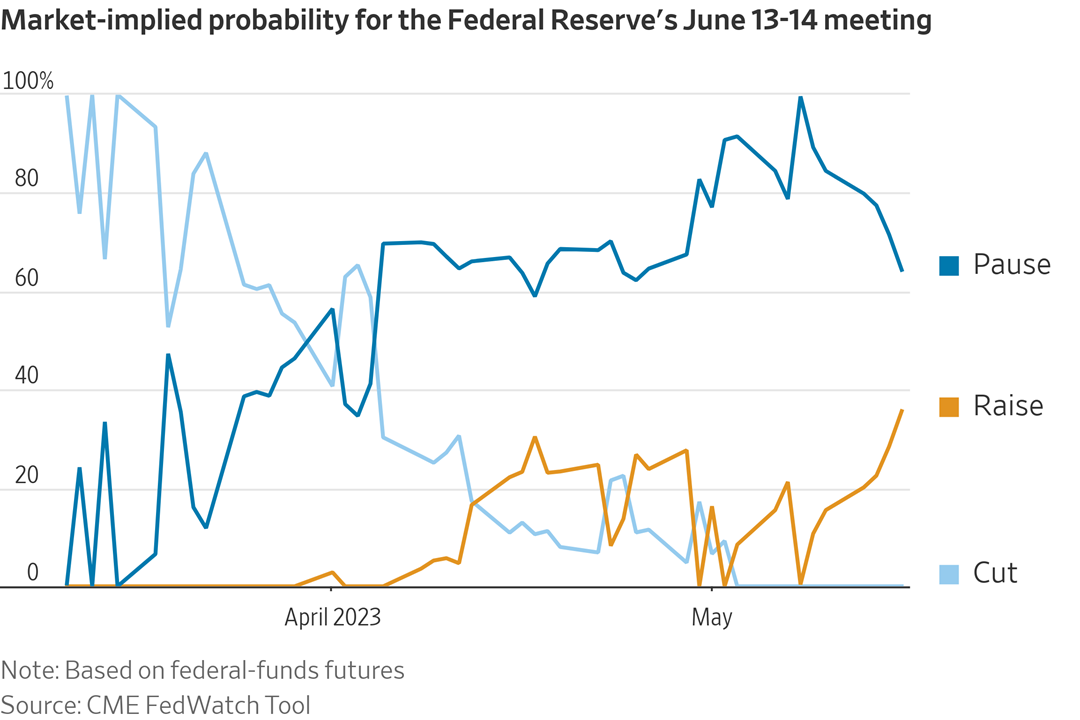

• Outside markets: The U.S. dollar index was weaker as the euro and British pound were firmer against the greenback. The yield on the 10-year U.S. Treasury was firmer, trading around 3.66%, with a higher tone in global government bond yields. Crude oil futures are higher, with US crude around $72.80 per barrel and Brent around $76.85 per barrel. Gold and silver futures were higher ahead of US market action, with gold around $1,965 per troy ounce and silver around $23.74 per troy ounce.

• Yields on U.S. Treasurys have climbed to their highest levels since the week that Silicon Valley Bank collapsed, highlighting a rebound in investors’ expectations for economic growth and inflation. Treasury yields are still well below where they were in early March. But they have now broken through the top of a trading range that had prevailed for two months, surprising investors who have been touting bonds as a hedge against recession risks. Yields, which rise when bond prices fall, have now climbed on longer-term Treasurys for five straight sessions, bringing the yield on the 10-year note to 3.647% as of Thursday — its highest close since March 10, the day that Silicon Valley Bank was seized by the government following a run by depositors.

• China’s central bank vowed to curb speculation in the FX market, sending the offshore yuan higher against the dollar. It will correct one-way bets and curb speculation when necessary.

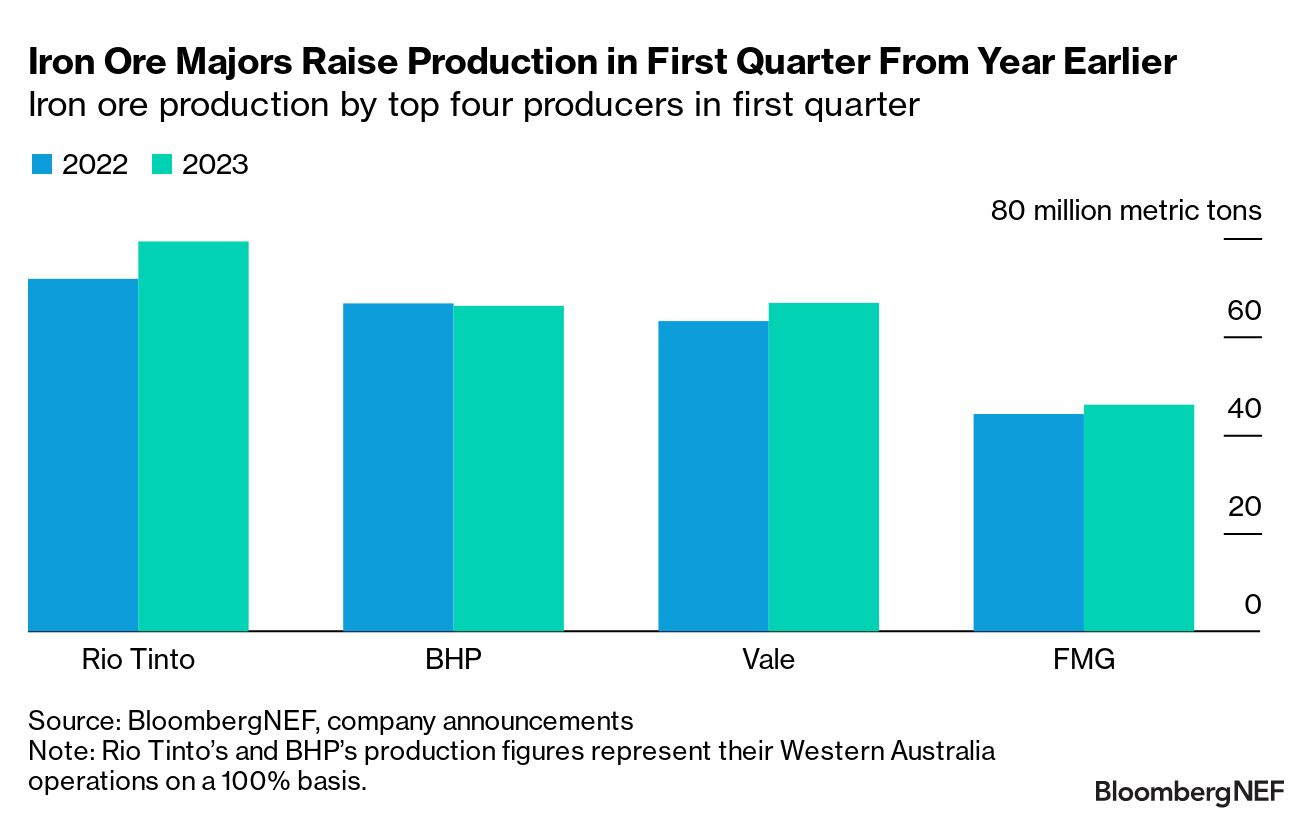

• The iron ore market is set to be comfortably supplied this year. Total iron ore production from the top four miners — Vale SA, Rio Tinto Group, BHP Group and Fortescue Metals Group Ltd. — reached 258 million metric tons in the first quarter, 5% more than a year earlier. Rio Tinto produced the most in the first quarter, with a year-on-year increase of 11% to 79.3 million tons. BHP is the only miner among the four that saw production fall from the first quarter of 2022.

• The U.S. is resorting to purchases of European wheat after a drought upended crop markets, pushing local prices higher, Bloomberg reports (link). At least two cargoes of Polish grain have arrived in Florida this year, with more expected over the next few months, Bloomberg said, citing people familiar with the matter. Crop handler Andersons supplied the wheat to Ardent Mills’s flour factory in Tampa, the people said “It’s an unusual trade route, but it makes sense because US wheat is expensive,” said Miroslaw Marciniak, a market analyst at InfoGrain in Warsaw.

Stunted wheat crops are turning blue in drought-ravaged Kansas. Link to details.

• Ag trade: South Korea purchased 65,000 MT of corn expected to be sourced from South America or South Africa.

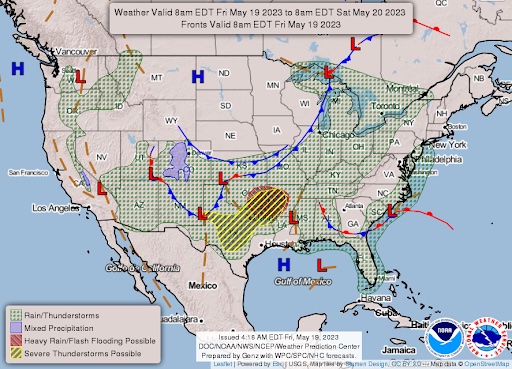

• NWS weather outlook: Soggy and cool weather from the Great Lakes to the Northeast heading into the weekend... ...Severe thunderstorms and flash flooding possible for the Southern Plains into the Lower Mississippi Valley on Friday... ...Well above average, record-breaking warmth continues for interior portions of the Northwest into the weekend.

Items in Pro Farmer's First Thing Today include:

• Modest corrective rebound in grains overnight

• Russia raises base price for calculating wheat export tax

• Cattle on Feed Report to confirm shrinking feedlot supply

• Still waiting on active cash cattle trade

• Hog futures premium still wider than normal

|

RUSSIA/UKRAINE |

— The Pentagon has revised its estimate of the value of weapons sent to Ukraine, freeing up $3 billion worth of weapons that could be given from existing stocks, according to Pentagon and State Department officials cited by the New York Times (link). The change is significant given the Biden administration has been under bipartisan pressure to explain how it intends to keep supplying Ukraine with weapons without approaching Congress for more money before the fiscal year ends.

The Biden administration uses the presidential drawdown authority to provide aid to Ukraine, a program that allows them to draw from existing weapons stocks instead of waiting for defense contractors to manufacture weapons under new contracts. As per the administration's calculations, however, funds for this authority have been running low. Congress approved $14.5 billion in drawdown authority to last through the fiscal year, ending on September 30, 2023. As of last Wednesday, only $2.7 billion of that remained, which congressional aides believe is not sufficient to sustain the current pace and size of military aid packages without running out of funds by late summer.

The Biden administration has thus far resisted the idea of asking Congress for more funds for Ukraine before the fiscal year ends, possibly due to the current negotiations over the debt ceiling. However, this reluctance has caused concern among congressional officials who worry that any resulting delays could jeopardize Ukraine's capabilities, especially as the country enters a critical phase of the war.

The newly discovered $3 billion in drawdown funds is reportedly due to an error in the previous valuation. Yet, congressional aides remain frustrated by what they perceive as a lack of transparency from the White House regarding its accounting practices and plans for continuing to supply Ukraine with weapons past the summer.

Upshot: The administration is also planning to reflect the same change in their remaining drawdown authority to supply weapons to Taiwan.

— The United Kingdom imposed more sanctions on Russia under a legislation to be introduced later in the year. “The U.K. is today announcing a ban on Russian diamonds, an industry worth $4 billion in exports in 2021, as well as imports of Russian-origin copper, aluminum and nickel,” Prime Minister Rishi Sunak’s office said in a Friday release.

However, the additional efforts to squeeze Russia’s economy are unlikely to make a significant impact, according to George Washington University research professor of international affairs, Robert Orttung. “The new restrictive sanctions on Russia will have minimal impact on world trade. None of these measures are likely to get Russia to stop its war on Ukraine since Putin is fully committed to that and the sanctions are not harming Russia’s ability to operate on a day-to-day basis,” he said in an email to CNBC. “Since China and India are not participating in the sanctions, Russia still has plenty of trading partners,” he added.

— Erdogan hails ‘special relationship’ with Putin ahead of crucial Turkey runoff vote. Turkey has a “special” and growing relationship with Russian President Vladimir Putin despite mounting pressure on Ankara to help bolster Western sanctions against Moscow, Turkish President Recep Tayyip Erdogan said in an exclusive interview with CNN ahead of next week’s presidential election runoff. “We are not at a point where we would impose sanctions on Russia like the West have done. We are not bound by the West’s sanctions,” Erdogan told CNN’s Becky Anderson. “We are a strong state and we have a positive relationship with Russia… Russia and Turkey need each other in every field possible,” he added.

Erdogan is the apparent frontrunner in the Turkish presidential race which heads to a runoff vote on May 28. He and his principal rival, Kemal Kilicdaroglu, have diverged on several foreign policy issues, including diplomacy with the West and Russia. Kilicdaroglu has vowed to repair years of strained diplomacy with the West. He has also said he would not seek to emulate Erdogan’s personality-driven relationship with Putin, and instead recalibrate Ankara’s relationship to Moscow to be “state-driven.”

|

POLICY UPDATE |

— Debt-limit update:

- House Speaker Kevin McCarthy (R-Calif.) is optimistic that congressional negotiators could reach a deal to raise or suspend the debt ceiling in time to hold the first vote on it next week. The comments marked a significant shift for McCarthy, who has been warning for months that the political process was stalled, and the nation faced a very real prospect of debt default. “I just believe where we were a week ago and where we are today is a much better place,” said McCarthy. “I see the path that we can come to an agreement,” McCarthy told reporters in the Capitol. “And I think we have a structure now and everybody’s working hard, and I mean, we’re working two or three times a day, then going back getting more numbers.” McCarthy spoke while a small group of White House negotiators met on Capitol Hill with McCarthy’s team reach a deal that needs to pass the Republican majority House and the Democratic controlled Senate, ahead of a potential June 1 deadline, the soonest date the Treasury could run out of cash to pay debts already incurred.

- McCarthy said that if Democrats negotiated with him earlier, he would’ve been forced into a less advantageous deal for Republicans. “Had they worked with us early on, this process would already be done. It probably would’ve looked different,” McCarthy said. “They’ve made a mistake.”

- Bottom line: Negotiators are making progress towards a bipartisan deal to raise the $31.4 trillion U.S. debt limit ahead of a potential breach that could hit as early as June 1, 2023. The two parties have begun to exchange offers and are hoping to reach a framework for a deal by Sunday, but legislative text would likely take another day or so to complete. The deal may fall between a clean debt limit increase sought by Democrats and a House-passed GOP bill proposing a combination of a debt limit increase, a decade of spending caps, expanded work requirements for some welfare benefits, and a recall of unspent pandemic aid.

Key elements of the potential deal include, according to Roll Call:

- The deal could possibly involve a few years of spending caps, not 10 as the GOP had initially sought.

- Work requirements for welfare beneficiaries might not touch the Medicaid program as Republicans had originally wanted.

- The debt limit extension could be longer than what Republicans initially wanted, potentially extending past next year's elections. (One report says the Biden administration is aiming for a debt-hike extension into 2025.)

- Negotiators are currently in dispute over the length of caps on discretionary spending. Democrats are pushing for no more than two years of caps, in line with subsequent debt limit deals, while Republicans are advocating for something between two and ten years.

- One of the main points of contention is whether to expand work requirements for recipients of lower-income benefits. The GOP's proposal to include this in the deal has been labeled a "nonstarter" by House Minority Leader Hakeem Jeffries (D-N.Y.).

- There's also a suggestion by some Democratic senators to invoke the 14th Amendment to the Constitution to raise the debt limit, which is considered an untested option that would likely face court challenges.

- Assuming a deal is reached by Monday, the House and Senate are prepared to reconvene and vote on the issue next week.

These negotiations come amid a time crunch to avert a potential debt limit breach that could severely impact the U.S. economy.

— Farm Bureau president stresses importance of farm bill. Zippy Duvall, president of the American Farm Bureau Federation, testified Thursday before the Senate Agriculture Committee’s Subcommittee on Commodities, Risk Management, and Trade, underscoring the importance of the farm bill. He said the bill impacts all American families and contributes to national security by ensuring a robust food supply. Link to AFBF testimony.

In response to questions from lawmakers, Duvall highlighted two key issues concerning farmers. Firstly, they want crop insurance to remain in place and expanded for specialty crops, which currently lack this support. Secondly, they are concerned about the mismatch between the Title I reference prices and the cost of production, which fails to provide an effective safety net.

Sen. Cindy Hyde-Smith (R-Miss.) asked about the potential impact of cutting funding for vital farm and nutrition programs. Duvall warned such a move would introduce more uncertainty to the markets. He emphasized these programs constitute a public-private investment in agriculture, enabling affordable food prices, supporting farmers through calamities, and assisting those needing help via nutrition programs.

Answering Senate Ag Chair Debbie Stabenow's (D-Mich.) question on investments to make American farmers more competitive, Duvall highlighted the deficit in research and development funding compared to countries like China. He explained that investment in R&D keeps the agricultural sector competitive, sustainable, and environmentally friendly, and brings efficiency through innovation.

Finally, Duvall indicated strong farmer interest in conservation programs funded by the farm bill. Duvall stated that if these programs are market-based, voluntary, and science-driven, farmers will participate. He revealed that 140 million acres across America are already involved in these conservation initiatives.

|

PERSONNEL |

— Biden administration is expected to withdraw the nomination of Michael Delaney to serve on the First Circuit Court of Appeals, according to reports. Several Democrats on the Judiciary Committee were resisting supporting Delaney, in part because of his past work defending a school in a civil lawsuit over sexual assault. Delaney was not called up for a vote on Thursday in the panel.

— Former Trump official joins Heritage. Michael McKenna, who served as deputy assistant to the president and deputy director of the Office of Legislative Affairs during the Trump administration, will provide policy and communications support for Heritage’s Center for Energy, Climate, and Environment at The Heritage Foundation.

|

CHINA UPDATE |

— China sent a naval flotilla – led by one of its most powerful destroyers – on a 12-day circumnavigation of Japan’s main islands in a display of military power in the lead-up to the G7 summit.

— President Xi Jinping said China is ready to help Central Asian nations bolster their security and defense capabilities as he wrapped a summit of the region’s leaders, underscoring Beijing’s efforts to deepen its influence. The gathering came as G7 leaders were meeting to discuss, among other things, measures to counter perceived Chinese threats to global economic security.

— Chinese officials have rebuffed U.S. Defense Secretary Lloyd Austin’s request to meet with Li Shangfu — the defense minister sanctioned by Washington in 2018 — at an event they’ll both be attending in June in Singapore.

— China’s economy is at risk of being caught in a confidence trap as the post-Covid recovery loses steam, presenting Beijing with a problem that can’t easily be solved with traditional tools such as interest rate cuts and infrastructure stimulus, according to Bloomberg (link). Evidence of low business and consumer sentiment was everywhere in data this week that showed economic activity losing momentum in April.

— China put its state-security czar in charge of its U.S. corporate crackdown. Putting Chen Yixin in charge is part of a broader push by Chinese leader Xi Jinping to defend the Communist Party’s ideological and economic security against the West and displace technocrats whose backgrounds in economics and finance once made them key to establishing China’s credibility with global investors and businesses, the WSJ reports (link). The shift risks alienating U.S. companies, many of which have slowed their expansion in China as Xi exerts greater state control over the country’s economy.

|

TRADE POLICY |

— Fourteen countries in U.S.-led Indo-Pacific trade talks are nearing an agreement on supply chain coordination and may announce a deal as soon as next week, trade sources signal.

— The U.S. and Taiwan agreed to boost trade ties, streamlining customs, reducing wait times for trucks and vessels and improving regulation, the USTR’s office said. It’s the first tangible results under an initiative announced last year that faces vehement opposition from Beijing. The pact isn’t a free-trade deal and doesn’t resolve more difficult issues, like tariffs. The U.S./Taiwan Trade Initiative was established in June of last year. The U.S. is additionally proposing a favorable tax arrangement for Taiwan to encourage investments in sectors like semiconductors and high-end technology within the U.S.

Background: The Taiwan trade initiative came shortly after President Joe Biden launched the Indo-Pacific Economic Framework for 13 other countries in the region. This strategy was crafted to counteract China's clout, but it didn't include Taipei. China, which regards Taiwan as part of its territory, has voiced opposition to the trade discussions, arguing that any move to formalize such relationships disturbs the delicate status quo surrounding Taiwan. The U.S./China relationship has further deteriorated over the issue of Taiwan, particularly after visits by high-ranking officials including then-House Speaker Nancy Pelosi (D-Calif.) last year.

|

ENERGY & CLIMATE CHANGE |

— The U.S. ‘fast-tracked’ a power project. After 17 years, it just got approved, the Wall Street Journal reports (link). Some in Washington say the project shows why permitting process should be overhauled.

In brief: The SunZia project, a massive power line and wind farm planned in the Western U.S., was "fast-tracked" by the Obama administration in 2011 but only just received the necessary permit, after a 17-year process. This has spurred calls in Washington for a revamp of the country’s infrastructure project approval rules, with proponents arguing that the current system is convoluted, slow, and rife with duplicative paperwork. The SunZia project, which is set to be the largest wind energy project in the U.S., is being developed by Pattern Energy across three counties in rural New Mexico. Once operational, it will deliver electricity to large markets in Arizona and California.

— Biodiesel and renewable diesel in focus. The Office of Management and Budget (OMB) is reviewing the final volume levels under the Renewable Fuel Standard (RFS) for 2023 and beyond, with early focus on biodiesel and renewable diesel. So far, three meetings have been scheduled with industry groups — the National Oilseed Processors Association (NOPA) on May 23, NATSO, which represents truck stops, on May 31, and the Clean Fuels Alliance of America (formerly the National Biodiesel Board) on June 1.

The Environmental Protection Agency's (EPA) proposed levels for biomass-based biodiesel and advanced biofuels have faced criticism, with detractors claiming they do not reflect the expansion that renewable diesel has seen and is planning for. The Clean Fuels Alliance of America, along with other groups, has urged EPA Administrator Michael Regan to increase the proposed biomass-based biodiesel and advanced biofuels levels. They argue that the current proposed volumes do not align with industry investments and plans to expand production and availability of these fuels by 2025.

EPA is required to finalize the RFS levels for 2023 by June 14, as per a consent agreement reached in court with Growth Energy.

— The Biden administration has announced a $51 million funding opportunity, named "Ride and Drive Electric," aimed at enhancing the resilience, performance, and reliability of the U.S. electric vehicle (EV) charging network. The initiative will be managed by the Joint Office of Energy and Transportation, which was established under the Bipartisan Infrastructure Law to aid in building a nationwide EV charging infrastructure. The Joint Office is co-administered by the Departments of Energy (DOE) and Transportation (DOT).

Concept papers for the funding opportunity are due by June 16, with full applications required by July 28. This timeline implies that the implementation of any resultant improvements from this initiative will likely take some time to come into effect.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— House Ag Chairman Thompson signals farm bill could include Prop 12 override language. In an interview Thursday morning on AgriTalk (link), House Ag Chairman G.T. Thompson (R-Pa.) was asked if there is any effort to include some language in the new farm bill that will or could override the Supreme Court Proposition 12 ruling.

Thompson told AgriTalk: “I was completely disappointed with the United States Supreme Court. I'm not sure how they missed the constitution and the Interstate Commerce provisions of the constitution, but it is what it is. There was some indication by one of the justices that perhaps they didn't have enough clarity. The farm bill legislatively would be the place to draw those lines. Producer simply cannot operate in a system where one state can dictate production standards for the entire country, that is so wrong. I can't even think about the negative consequences that would have on this industry. So I'm going to continue reviewing the decisions and looking for opportunities for solutions. We need to ensure that hardworking farmers and ranchers who put the food on the table, the American people can do so without being unduly burdened by excessive regulation. The House has acted in the 2014, 2018 Farm Bills in this space so I think we can expect that the Agriculture Trade Suppression Act or, or effectively nicknamed the Eats Act will be introduced again. That would prevent states and local jurisdictions from interfering with the production. So I think the act is a pretty good starting point for any legislative solution in the farm bill.”

Of note: Prop 12 could have trade impacts on the USMCA. Canada’s pork sector is investigating. Link for details.

— The meat industry is urging U.S. lawmakers to counteract a Supreme Court ruling that allows states to set their own animal welfare standards and regulate meat sales. This call follows the Supreme Court's endorsement of California's Proposition 12, which mandates larger living spaces for certain farm animals and bans the sale of meat and eggs from out-of-state farms that fail to comply with these standards.

Farm groups contested these rules, especially the requirement for individual sows to have 24 square feet of floor space. The standard industry practice is to use sow crates that restrict the animal's movements significantly.

Bryan Burns of the North American Meat Institute stated that the Supreme Court's decision could instigate similar regulations in Massachusetts and encourage other states to adopt stringent animal welfare laws. Burns warns this could result in a chaotic state-by-state trade barrier situation, disrupting interstate commerce.

The National Pork Producers Council, whose members include meat processors, cautioned that the ruling's impact could extend far beyond the farming industry. Subcommittee chair Rep. Tracey Mann (R-Kan.) echoed this sentiment, describing the ruling as potentially leading to "unthinkable, unscientific regulatory overreach against all producers."

During the Supreme Court debates in October, the pork industry sought a rigid interpretation of the dormant commerce clause, which prohibits state laws that could disproportionately burden or discriminate against interstate trade. California’s solicitor general, Michael Mongan, responded by asserting that Proposition 12 would only affect farmers wishing to sell pork in the state, citing that California voters were willing to pay higher prices for products they didn't deem morally objectionable or potentially unsafe.

— NCBA tells House Ag subcommittee its priorities for the 118th Congress. During a hearing Wednesday, Todd Wilkinson, President of the National Cattlemen’s Beef Association (NCBA), listed the following NCBA priorities:

- Pass the 2023 Farm Bill

- Nullify USDA’s Harmful Packers & Stockyards Rules

- Defend the Beef Checkoff

- Promote Animal Health and Disease Preparedness

- Correct the Record on Cattle’s Climate and Conservation Benefits

- Develop New and Existing Export Markets for U.S. Beef

- Reduce Regulatory Burdens for Cattle Producers

- Reauthorize Livestock Mandatory Reporting

- Expand Beef Processing Capacity

Bottom line: NCBA said these recommendations are to promote a robust and resilient cattle industry, supporting risk management, conservation, and health initiatives, while avoiding potential regulatory pitfalls.

Regarding the 2023 Farm Bill, NCBA is urging Congress to consider the following key elements:

1. Protect Animal Health: NCBA emphasizes the importance of tackling animal diseases that threaten the livestock industry. In this regard, it proposes:

- Mandatory funding for the National Animal Vaccine and Veterinary Countermeasures Bank (NAVVCB) at $153 million per year to boost response to disease outbreaks.

- Allocation of $70 million per year for the National Animal Disease Preparedness and Response Program (NADPRP) at USDA's Animal and Plant Health Inspection Service (APHIS).

- Providing $10 million per year in mandatory funding for the National Animal Health Laboratory Network (NAHLN), with additional authorization for appropriations of $45 million per year. This program helps in disease surveillance and diagnosis.

2. Promote Voluntary Conservation Programs: NCBA supports programs like the Environmental Quality Incentives Program (EQIP) and the Conservation Stewardship Program (CSP) that directly aid cattle producers in their conservation efforts. It calls for the reinstatement of the EQIP livestock-related set-aside removed by the Inflation Reduction Act. It also suggests amendments to the Conservation Reserve Program (CRP) to allow grazing as a mid-contract management tool and for emergency haying.

3. Reinforce Disaster Programs: NCBA recommends maintaining the Livestock Indemnity Program (LIP) and Livestock Forage Program (LFP) which help farmers and ranchers recover from catastrophes like natural disasters and livestock predation.

4. Support Risk Management Programs: NCBA advocates for continued backing for risk management programs like the Livestock Risk Protection (LRP) and Pasture, Rangeland, Forage (PRF) programs that help cattle producers handle market volatility. It advises Congress to resist attempts to withdraw support for these resources.

5. Oppose a Standalone Livestock Title: NCBA requests that Congress avoid creating a separate livestock title in the Farm Bill, fearing that such a move could introduce unwanted mandates or obstacles during conference negotiations.

— Is there an end in sight to these stubbornly high food prices? Many economists and analysts are expecting things to cool down soon. The U.N.’s food price index is down about 20% from a record set a year ago and further declines are expected. Analysts at Bloomberg Intelligence expect the U.N. gauge — a measure of internationally traded commodities— to slide further as La Niña weather pattern shifts to deflationary El Niño in the second half of the year.

— For 65 years, a Batista ruled over JBS. Now, after a five-year hiatus, a member of the founding family is once again on deck to take the reins at what’s now the largest meat producer in the world. Link to details via Bloomberg.

|

HEALTH UPDATE |

— CVS Health, Walgreens and Johnson & Johnson are among the major companies injecting more than $50 billion into communities across the country over the next two decades after settling charges that their business practices stoked the opioid epidemic killing thousands of people in the United States each year, the Washington Post reports. Most of that cash must be directed toward mitigating harm caused by the epidemic or preventing future substance abuse. That’s in stark contrast to the tobacco settlement fiasco of the late 1990s, in which the vast majority of funds didn’t go to antismoking efforts but instead to things like plugging budget gaps, property-tax relief and subsidizing tobacco farmers. The $54 billion windfall comes from a string of legal battles over the last decade.

|

POLITICS & ELECTIONS |

— Florida GOP Gov. Ron DeSantis is set to announce 2024 presidential run next week. DeSantis, 44, will likely file paperwork declaring his candidacy on May 25, according to reports, with a more formal launch the following week. DeSantis will be Donald Trump’s biggest rival for the Republican nomination — he is currently coming in second to the former president in polls.

— Summary of key insights from a book about the 2022 midterm elections. The Center for Politics’ latest book — The Red Ripple: The 2022 Midterm Elections and What They Mean for 2024 — is now available. Edited by the Crystal Ball team of Larry J. Sabato, Kyle Kondik, and J. Miles Coleman along with Center for Politics colleague Carah Ong Whaley, The Red Ripple brings together top political journalists, analysts, and academics to examine every facet of the 2022 election and what the results will mean for the nation moving forward. Five key insights from the book:

- Change vs Status Quo: The election cycle from 2006 to 2022 has been characterized by constant shifts in political power, with most elections resulting in a change of control of Congress or the White House. However, the 2022 midterms were somewhat unusual. While Republicans gained control of the House, their victory was smaller than expected, and they lost ground in the Senate. The Democrats gained governorships and managed to reelect most of their incumbents, suggesting that this election was a "semi-status quo" election with some push for change from voters.

- Presidential Voting Patterns: Voting patterns in the 2022 House and Senate elections closely mirrored those in the 2020 presidential elections. The results of these races have become increasingly nationalized, and the party that carried a state or district in the presidential election typically also wins in Senate and House elections.

- Localized Electoral Shifts: Local changes in electoral coalitions continue to have a significant impact on election outcomes. Notable trends include an increased reliance by Nevada Democrats on Washoe County, a traditionally Republican area, due to demographic and economic shifts that have been beneficial for the Democrats.

- Mixed Turnout Patterns: Turnout for the 2022 midterms was about 46%, slightly lower than the 2018 turnout but still above the century's average. While turnout was generally lower, a few states saw an increase, with the most crucial electoral states showing mixed patterns.

- Role of Abortion Issues: Abortion didn't dominate the election but still played a significant role in certain areas and close contests. With the potential future absence of federal guidance on reproductive rights and the possibility of fluctuating state laws, abortion is likely to remain an important issue in electoral politics, particularly in close races.

The book discusses these findings in more detail, exploring the implications for future elections and the 2024 presidential race. While reproductive rights are not expected to be the top issue on voters' minds, they are anticipated to continue to be a significant electoral factor.

|

CONGRESS |

— House Rules Committee to meet on Monday, May 22, to consider measures addressing the deadly fentanyl crisis (HR 467), “overturning a misguided trucking emission rule” (SJRes. 11), and nullifying the Biden Administration's “unfair student loan bailout scheme” (HRes. 45).

— Dems rip GOP appropriations package for USDA, FDA. The fiscal year (FY) 2024 Agriculture, Rural Development, Food and Drug Administration, and Related Agencies spending plan has been cleared by the House Appropriations Agriculture Subcommittee. However, it faced criticism from Democrats, particularly Ranking Member Sanford Bishop of Georgia, who argued that the spending reductions in the package would negatively affect healthcare and other services in rural areas. Bishop also condemned the withdrawal of $2 billion in aid intended for financially distressed farmers.

The proposed plan, which features a discretionary funding mark of $25.3 billion (2.1% below the FY 2023 mark), also includes $8 billion in rescissions from the FY 2022 budget reconciliation package and unspent Covid funds.

Bottom line: The spending plan will now proceed to the full panel and is expected to pass the House. But veteran congressional watchers say the focus should be on the Senate which will eventually clear a bipartisan bill. Of note, House Republicans did not cut fundng from the previously passed Inflation Reduction Act (IRA/climate bill) but instead cut from other areas, including rural electric funding.

— Concerns mount re: Sen Dianne Feinstein (D-Calif.). A week after returning to the Senate following a roughly three-month absence due to health complications, 89-year-old Democrat Sen. Dianne Feinstein's fitness for office is being questioned. Feinstein had been recuperating from shingles at her California home and had been absent from Capitol Hill since February. On Thursday, her office confirmed that she had experienced broader health complications following her shingles diagnosis, including Ramsay Hunt syndrome and encephalitis. This contradicted an earlier denial from the senator herself.

Feinstein's return to the Senate on May 10 restored the full attendance of the Senate Democratic Caucus, which had been partially absent with both Feinstein and Pennsylvania Sen. John Fetterman missing for much of the spring. Her return also reinstated the Democrats' one-seat margin on the powerful Judiciary Committee, a crucial advantage in advancing President Biden's judicial nominations.

|

OTHER ITEMS OF NOTE |

— Cotton AWP edges higher. The Adjusted World Price (AWP) for cotton moved up to 68.10 cents per pound, effective today (May 19), a slight increase from 67.97 cents per pound the prior week. This marked the fourth consecutive week the AWP has been below 70 cents per pound, but it remains well above the 52-cent mark that would trigger any payments.

— U.S. Supreme Court declined to weaken tech companies’ shield from liability over user-generated content. Plaintiffs had argued that Twitter and Google bore legal responsibility for hosting terrorism-related posts. At a hearing in February the justices seemed disinclined to disrupt the legal status quo.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum |