Biden Officials Finding It Harder Than Expected to Implement $3 Billion Climate-Smart Programs

Farm bill timeline | EPA active | Europe rethinks fossil fuels strategy | China talks U.S. relations

|

In Today’s Digital Newspaper |

President Biden said he’s not prepared to invoke the 14th Amendment to avert a debt limit breach, but didn’t rule out the possible executive action. “I’ve not gotten there yet,” he said when asked about the possibility in a weekend interview with MSNBC. The president’s suggestion he could consider the historically unprecedented legal maneuver if Congress refused to act indicates that views on the possibility may be shifting within the administration but if announced would result in legal challenges.

Don’t expect any major breakthroughs from the White House talks. Rep. Patrick McHenry (R-N.C.) said this weekend that he was feeling a level of “modest pessimism” that a debt limit deal would get done in time to avoid a messy default.

Senate Minority Leader Mitch McConnell (R-Ky.) and more than 40 Republican senators have signed a letter addressed to Senate Majority Leader Chuck Schumer (D-N.Y.) stating that they will not back any bill to raise the federal borrowing limit without substantial spending and budget reforms. Impact: Senate Democrats will need GOP votes to get anything cleared in the chamber on debt limit/suspension. More in Congress section.

Fed funds futures predict a 90% chance that the Fed keeps rates at 5% to 5.25% at the June meeting and more than a 70% chance that cuts begin in September.

Ag balance sheets good today, but will endure heightened volatility. Rising interest rates and higher farm expenses will pressure farm finances ahead, according to the latest quarterly economic outlook published by ag credit lender Farmer Mac. More in Markets section.

The U.S. is expecting to see an influx of border crossings when Title 42, the Trump-era policy that allowed officials to swiftly expel migrants who crossed the border illegally during the Covid-19 pandemic, expires on Thursday. Also on Thursday, the House is set to vote on Republicans' wide-ranging border security package. Last month, House Majority Leader Steve Scalise (R-La.) said Republicans have the necessary votes to pass the legislation in the chamber.

The Justice Department is investigating whether crypto exchange Binance Holdings Ltd. or company officials allowed the movement of money through its platforms in violation of sanctions related to Russia's invasion of Ukraine.

Natural gas purchases needed to refill Europe’s storage sites are slower than usual for this time of year despite a recent price drop with some buyers betting on a further slump. Meanwhile, Europe seems to be rebranding its push for biofuels and away from fossil fuels.

USDA Secretary Tom Vilsack and others probably thought it would not be hard giving away $3 billion for climate smart programs. More in Energy & Climate Change section.

On the farm policy front, USDA on Friday released details of a rice aid program, while veteran farm bill watchers say put your silencer headphones on until September because it will take that long to get things together to write any new farm bill. More in Policy section.

The Wall Street Journal describes what others have noted about the Biden administration’s trade policy: it’s different. In just the past year, the Biden administration has opened talks with Japan, the European Union, and more than 20 countries from India to Peru on cross-border economic links. Terms that generally aren’t part of these discussions: “free trade” and “tariffs.” More under Trade Policy section.

EPA will be active this week, including another trip to Congress by EPA Administrator Michael Regan. More in Energy & Climate Change section.

U.S. and Taiwan in talks for $500 million in free weapons. Taiwanese defense minister says the island will receive free supplies — including missiles and training — besides its existing orders.

Heat waves continue to engulf much of Asia, an ominous sign for what awaits the rest of the northern hemisphere this summer. In Europe, Spain and Portugal recorded their hottest April on record. More on weather below.

When I grow up, I want to be a whistleblower. Why? The SEC just gave $279 million to an unnamed individual. More below.

|

MARKET FOCUS |

Equities today: Global stock markets were mixed but mostly higher overnight. U.S. stock indexes are pointed toward mixed openings. In Asia, Japan -0.7%. Hong Kong +1.2%. China +1.8%. India +1.2%. In Europe, at midday, London closed. Paris +0.2%. Frankfurt +0.1%.

U.S. equities Friday: A big rise on Friday for all three major indices only allowed the Nasdaq to register a slight gain for the week. The Dow fell 1.2%, the S&P 500 was down 0.8% while the Nasdaq edged up 0.1%. On Friday, the Dow was up 546.64 points, 1.65%, at 33,674.38. The Nasdaq rose 269.01 points, 2.25%, at 12,235.41. The S&P 500 gained 75.03 points, 1.85%, at 4,136.25.

Crude oil prices fell for the third straight week, as turmoil in the banking sector and the Federal Reserve's latest interest rate hike strengthened fears that the economy is headed for a downturn. West Texas Intermediate crude futures, the U.S. benchmark for oil, last week fell briefly below $70 a barrel for the first time since late March. Crude prices this year have also fallen well below record highs from 2022, when Russia's invasion of Ukraine sent prices soaring above $100 a barrel. Meanwhile, oil prices saw a flash-crash early Thursday, falling briefly to about $63 a barrel, with analysts saying that indicates Wall Street is fearful about how a potential recession could stymie oil demand.

The VIX, Wall Street's fear gauge, rose roughly 9% this week after falling for six straight weeks.

ChatGPT, a chatbot powered by artificial intelligence, can pick stocks better than your fund manager, analysts say. A recent experiment found that the bot far outperformed some popular UK investment funds — and funds managed by HSBC and Fidelity were among those selected. Between March and April, a dummy portfolio of 38 stocks gained 4.9% while 10 leading investment funds clocked an average loss of 0.8%, the results showed.

Agriculture markets Friday:

- Corn: July corn futures rose 7 1/2 cents today to $5.96 1/2, marking a rise of 11 1/2 cents on the week. December corn finished the day 6 1/4 higher at $5.34 3/4, rising 7 cents on the week.

- Soy complex: July soybeans rose 18 3/4 cents to $14.36 1/2, the highest close since April 21 and gained 17 1/4 cents on the week. July meal rose $1.50 to $426.10 but fell $6.30 week-over-week. July soyoil rose 185 points to 54.33 cents, gaining 266-points from a week ago.

- Wheat: July SRW wheat futures rose 15 1/4 cents to $6.60 1/4, nearer the session high and for the week gaining 26 1/2 cents. July HRW wheat jumped 34 3/4 cents to $8.33, nearer the daily high and on the week gaining 75 3/4 cents. Spring wheat futures rose 24 cents, closing near session highs at $8.36 and gaining 32 1/4 cents on the week.

- Cotton: July cotton rose 214 points to 83.90 cents, marking the highest close since April 18. The contract gained 310 points on the week.

- Cattle: After surging in early trading, June live cattle futures ended Friday at $161.975, up just 35 cents on the day and down $3.50 on the week. May feeder futures fell $1.125 to end Friday at $202.525; that marked a weekly plunge of $8.45.

- Hogs: June lean hog futures fell $3.375 to $83.775 and hit a contract low. For the week, June hogs lost $7.925.

Ag markets today: Soybeans and wheat extended last week’s gains amid followthrough buying during overnight trade, while corn posted two-sided trade. As of 7:30 a.m. ET, corn futures were trading a penny lower to 2 cents higher, soybeans were 2 to 6 cents higher, SRW wheat futures were 1 to 2 cents higher, HRW wheat was 6 to 11 cents higher and HRS wheat was 10 to 11 cents higher. Front-month crude oil futures were nearly $2.00 higher, and the U.S. dollar index was more than 100 points lower this morning.

Market quotes of note:

- Ignore the hysteria on AI and jobs. The WSJ’s Andy Kessler notes that a study found that 60% of employment in 2018 was in roles that didn’t exist in 1940. Link for details.

- Drop anchor or anchors aweigh? Mohamed El-Erian, president of Queens’ College at Cambridge university (“Dr. Doom” to some), said the expectation was still that a last-minute deal would be struck between Democrats and Republicans. If that failed, “we should expect another layer of financial volatility in a system that has already lost many of its anchors… It would come at a time when the global system is facing growth and inflation headwinds, and is also keen to contain the banking tremors to a particular sector of the U.S. system,” he added.

- Federal Reserve Bank of St. Louis President James Bullard said policymakers will probably have to push rates higher to cool inflation, but said he would wait and see what the data show before deciding what move to support in June.

- “You should write your obituary and then try to figure out how to live up to it.” — Berkshire Hathaway's Warren Buffett, speaking at his company’s annual shareholder meeting on Saturday. While Buffett said banks may not be out of the woods yet, he said he believes deposits are safe. The Oracle of Omaha said he has also seen slowing activity at some of Berkshire’s businesses. The conglomerate does not plan to take full control of oil giant Occidental Petroleum, Buffett said. Buffett warned about the current level of government spending: “It’s madness to just keep printing money. It’s very hard to see how you recover once you let the genie out of the bottle, and people lose faith in the currency.” Munger had a rejoinder to the fervor over AI: “I am personally skeptical of some of the hype that’s gone into artificial intelligence. I think old-fashioned intelligence works pretty well.”

On tap today:

• U.S. wholesale inventories for March are expected to increase 0.1% from the prior month.(10 a.m. ET)

• USDA Weekly Grain Export Inspections report, 11 a.m. ET.

• Federal Reserve's senior loan officer survey for the second quarter is out at 2 p.m. ET.

• USDA Crop Progress report, 4 p.m. ET.

• Fed speakers: Chicago's Austan Goolsbee appears on Yahoo Finance at 11 a.m. ET and Minneapolis' Neel Kashkari moderates a panel on the minimum wage at 4:45 p.m. ET

Ag balance sheets good today but… Rising interest rates and higher farm expenses will pressure farm finances ahead, according to the latest quarterly economic outlook published by ag credit lender Farmer Mac. Link to report. When working capital declined from 2014 to 2018, farmers were able to utilize short-term financing at relatively low interest rates. “However, the average interest rate on agricultural production loans is 48% higher today than during that period,” the report says.

Ag banks entered 2023 better positioned to confront the current economic period of rising interest rates than Silicon Valley Bank, which defaulted in March. “The rising and elevated interest rate environment may continue to stretch bank liquidity and cause financial stress, but ag lenders came into 2023 in an excellent position to endure heightened volatility,” the report concludes.

Many Americans are being priced out of new cars. From the Washington Post (link):

- The numbers: The average price for a new car hit $48,008 in March, up 30% from March 2020. The average monthly car payment hit $730 last month.

- Why this is happening: Rising interest rates have made loans more expensive. And carmakers have largely abandoned cheaper models because of a chip shortage.

Home goods retailer Christmas Tree Shops has filed for Chapter 11 bankruptcy as part of a restructuring plan, making it the latest retailer to file for bankruptcy, though company officials said the decision would not result in mass layoffs. The company attributed the bankruptcy to high inflation, recent interest rate hikes and dropping consumer demand for home goods and seasonal decorations. Link for details via Forbes.

Germany industrial output falls more than expected. Industrial production in Germany declined 3.4% month over month in March, reversing from an upwardly revised 2.1% rise in February and worse than forecasts of a 1.3% fall. The automotive sector was the biggest drag, with manufacture of motor vehicles and parts sinking 6.5%. Considering Q1 2023, production was 2.5% higher compared with the previous quarter.

Market perspectives:

• Outside markets: The U.S. dollar index was weaker as several foreign currencies were higher against the greenback ahead of U.S. trading. The yield on the 10-year U.S. Treasury note was higher, trading around 3.48%, with a mixed tone in global government bond yields. Crude oil has advanced, with U.S. crude around $73.35 per barrel and Brent around $77.15 per barrel. Gold and silver futures were mixed, with gold firmer around $2,029 per troy ounce and silver weaker around $25.85 per troy ounce.

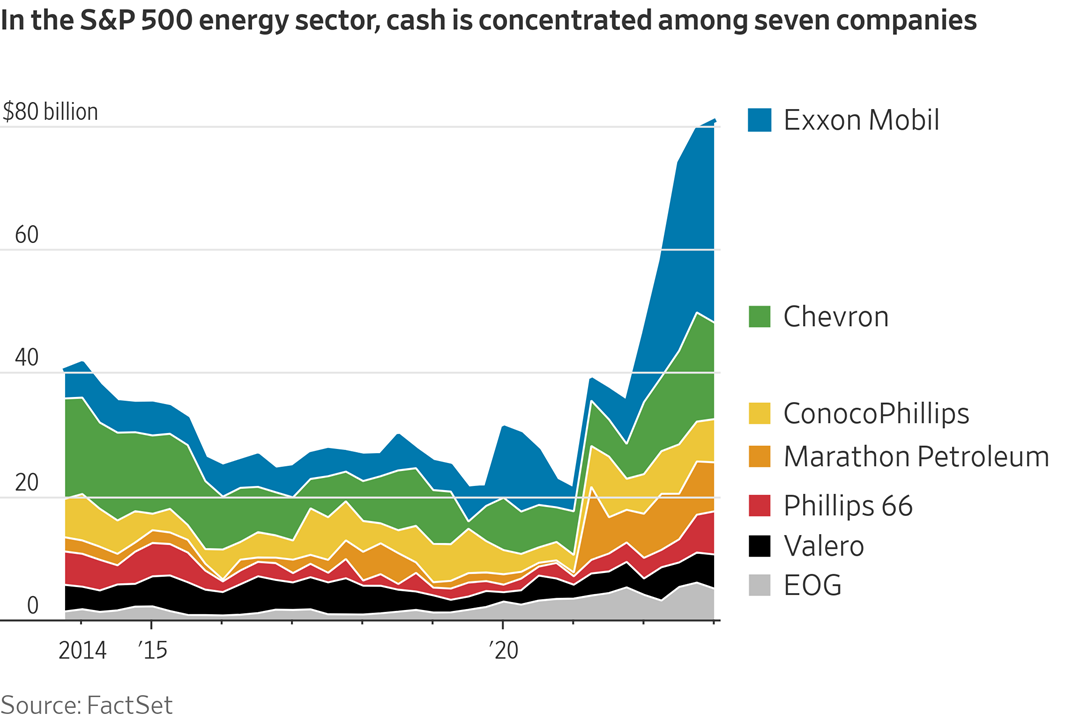

• Oil-and-gas companies have built up a mountain of cash with few precedents in recent history. Wall Street has a few ideas on how to spend it — and new drilling isn’t near the top of the list, the WSJ reports (link). It says companies that previously chased growth and funneled money into speculative drilling investments have instead tried to appease investors by boosting dividends and repurchasing shares.

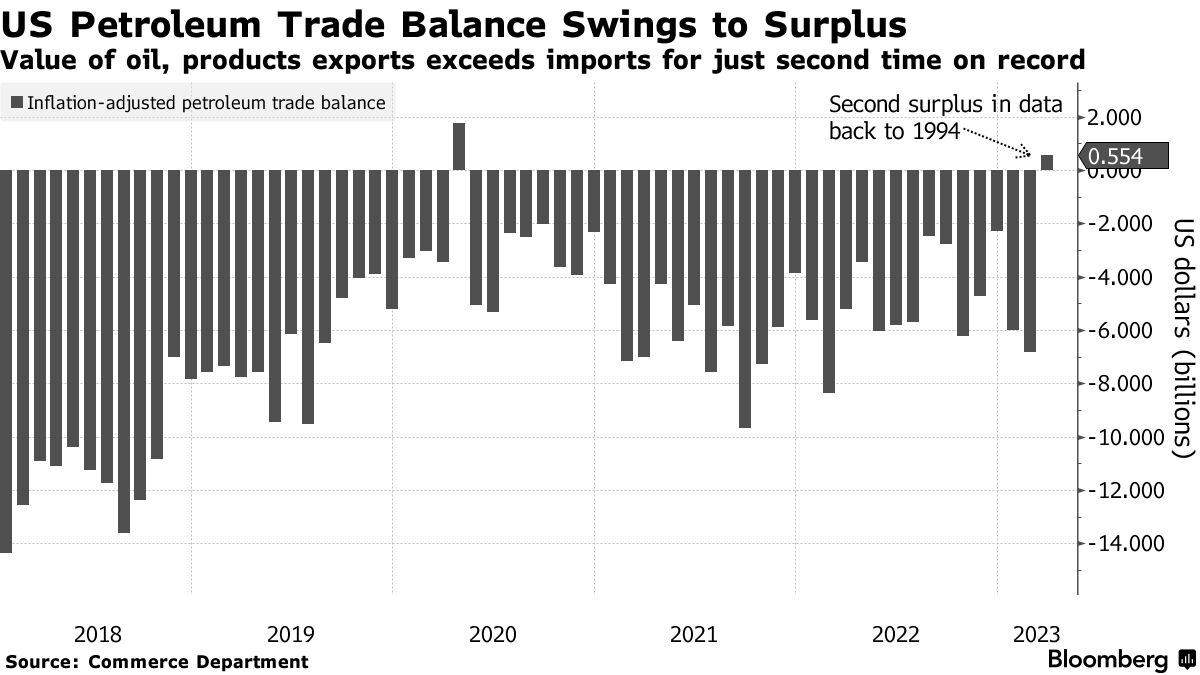

• For just the second time in Commerce Department records back to 1994, the U.S. registered a petroleum-trade surplus after adjusting for inflation. Exports of oil and products surged more than 24% in March to a record $27.6 billion in the biggest monthly advance since 2017. The nation imported $27.1 billion in petroleum, the least since November, data released last week showed.

• The Shanghai Futures Exchange, China’s largest and most notable base metals bourse, is preparing to launch an alumina futures contract — its first major addition since the Covid pandemic began. Bloomberg says the catch is that this contract — due as early as June, according to securities officials familiar with the situation — will have to contend with an all-too-familiar problem: oversupply. China has been curbing expansion of its mammoth aluminum capacity, but there’s no such effort when it comes to alumina, the intermediate product. Alumina output could rise 30% in the next few years thanks to new plants and upgrades, hitting 130 million tons a year, according to industry analysts including China-based Aladdiny. Of note: Only 90 million tons of alumina are needed to support China’s domestic refined metal production, which has been capped at 45 million tons.

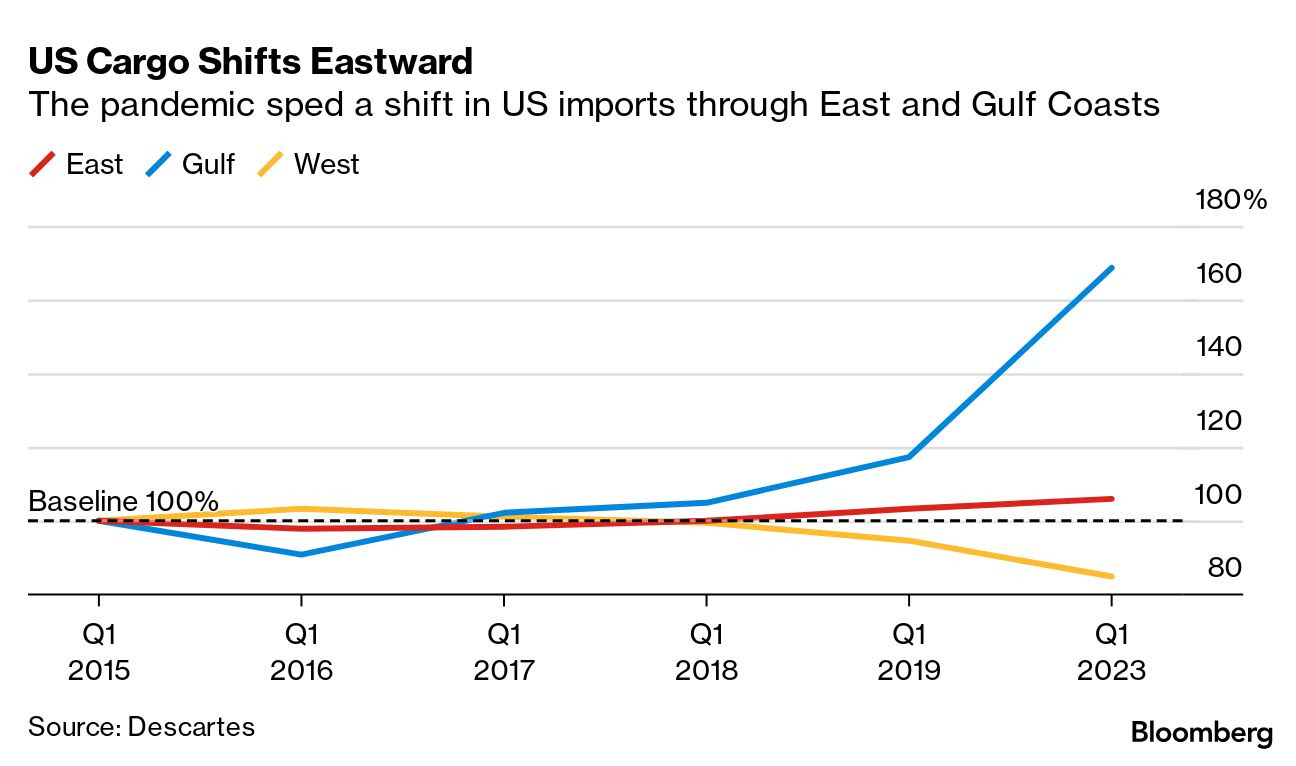

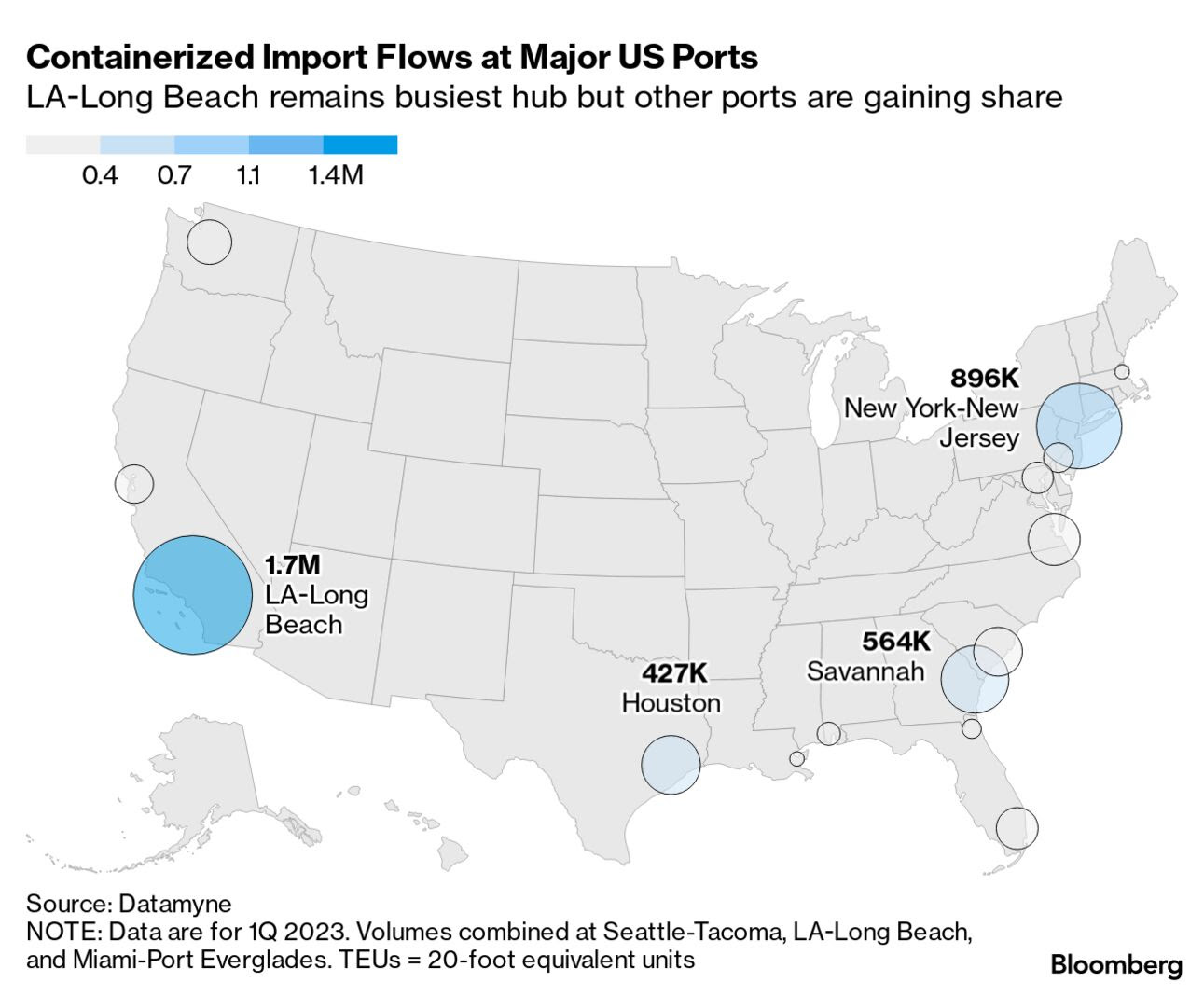

• Los Angeles-Long Beach docks will struggle to stay the U.S’ No. 1 ocean-freight gateway over the long run. Bloomberg reports (link) that a shift to other ports is getting supercharged by simmering West Coast port labor talks — which are set to hit the one-year mark this week (see next item) — as well as the near-shoring of factory production amid rising tensions with China, and U.S. population growth shifting to the Sunbelt states.

• An agreement in the long-running contract talks between unionized longshore workers and employers at West Coast ports may be on the horizon. Some shipping officials are growing optimistic that a deal could be reached by June, the Wall Street Journal reports (link), potentially clearing away uncertainty that has been hanging over U.S. importers heading into the crucial fall selling season. The recent agreement on issues around automation use cleared one major hurdle, and a deal on staffing at non-automated container terminals puts the sides on track to nail down wages and benefits terms. That would mark the last major issue on the table. It still could take months to get a series of local agreements and rank-and-file votes completed, but the fears of widespread disruptions will likely fade with a tentative coast-wide contract. One matter apparently unresolved, however, is the length of the deal.

• Sugar high continues. India and Thailand, two of the biggest exporters, had lackluster crops this season and are expected to face production woes next year, while more Indian cane crops are being turned into ethanol instead of the sweetener. Sugar is near its highest in over a decade.

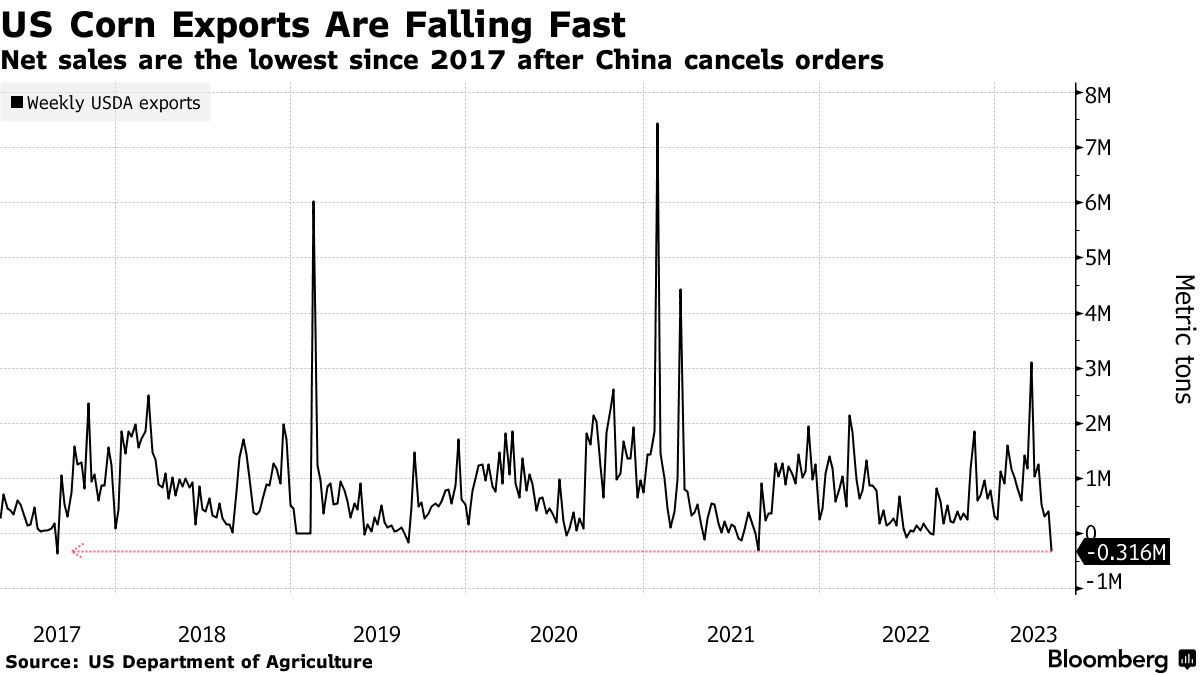

• U.S. corn exports are falling fast. USDA will provide an update on U.S. exports this Friday via the WASDE report, the first outlook for the upcoming 2023-24 season. A massive Brazilian corn harvest has meant product from the U.S. — traditionally the biggest corn producer and exporter — is more expensive than shipments from South America, making it less attractive for buyers. The cancellation of U.S. sales by China could force the USDA to trim its outlook for exports.

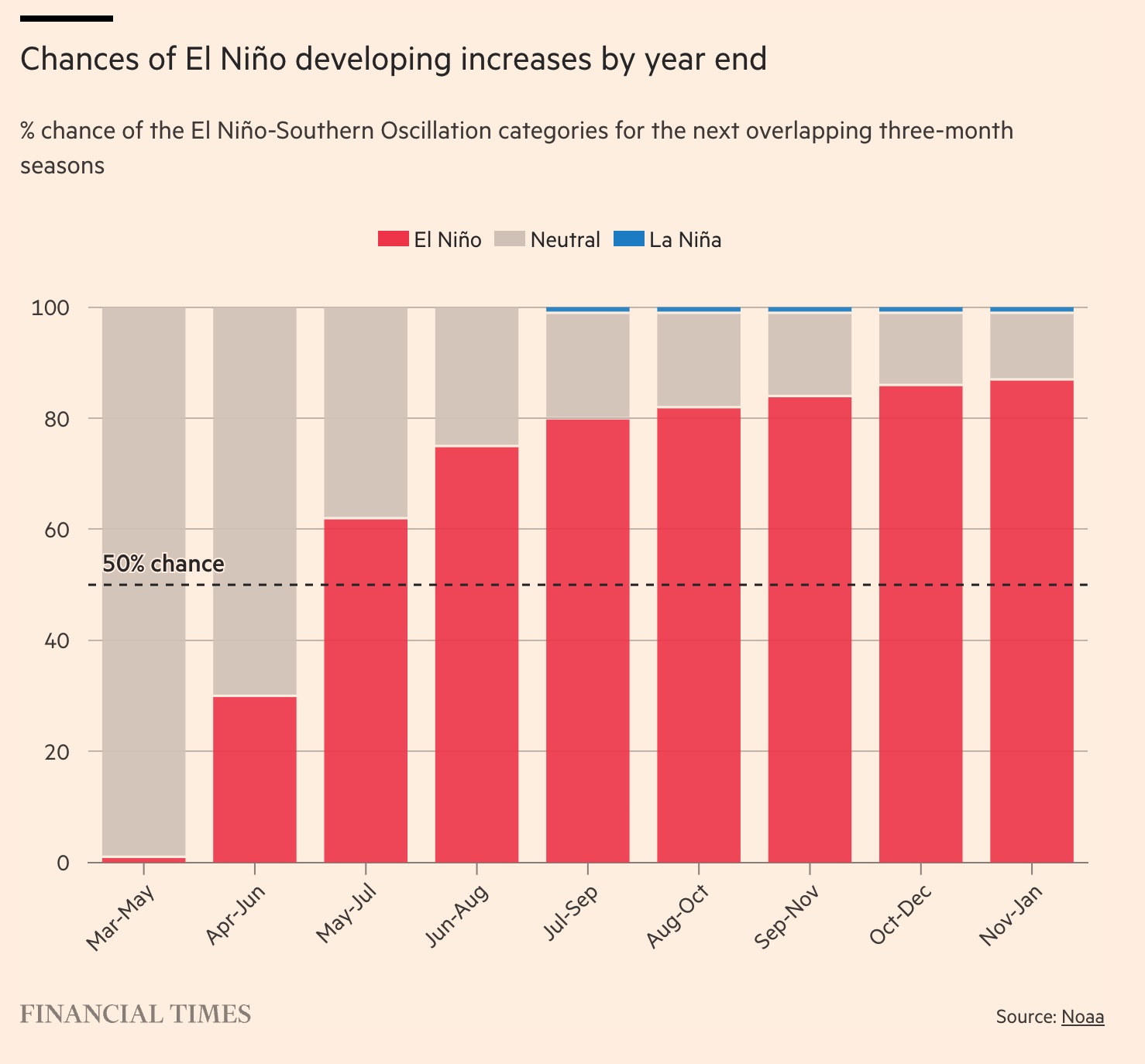

• Will El Niño return for a heated-up 2023? Meteorologists calculate the chances of the weather phenomenon that warms the surface of the Pacific Ocean. Link (paywall) for some answers and great graphics via a Financial Times article.

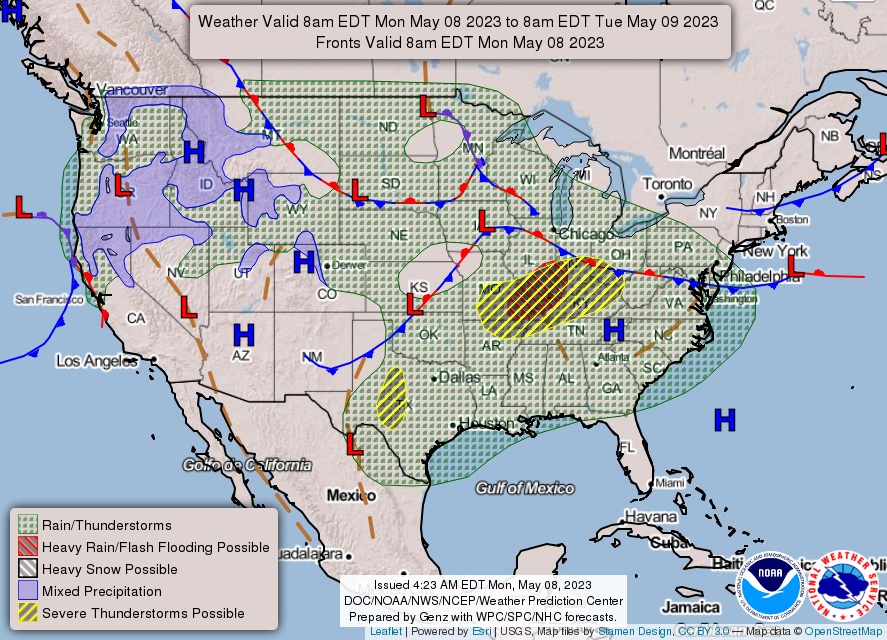

• NWS weather outlook: Severe storms and flash flooding expected today from the southern & central Plains to the central Appalachians today... ...More severe weather and possible flash flooding anticipated on Tuesday from the central & southern Plains to the Carolinas... ...Summer-like heat in portions of the Heartland & South the first half of the week; the Northeast cools off on Tuesday, the West Coast stays cool through mid-week.

Items in Pro Farmer's First Thing Today include:

• Mostly firmer grain market tone to start the week

• Rainy, warm week ahead

• Key week for cattle trade

• Hog premiums continue to shrink

|

RUSSIA/UKRAINE |

— Russia to supply Wagner group more weapons and ammunition after threat to withdraw. In an audio message released on Sunday, the owner and financier of the notorious Wagner mercenary group, Yevgeny Prigozhin, withdrew his threat to pull his troops out of the Bakhmut area, after securing a pledge from the government. "Last night we received an order to fight (...). They promise to give us all the ammunition and weapons we need to continue operations," Prigozhin said. "We are assured that everything necessary will be provided to our flanks (around Bakhmut) so that the enemy does not break through, and we are told that we can act in Artiomovsk (the Soviet name for Bakhmut) as we see fit," he added.

— The DOJ is investigating whether Binance was used illegally to let Russians skirt U.S. sanctions and move money through the world’s biggest cryptocurrency exchange.

— Russia still not satisfied with its end of Black Sea grain deal. Russia remains unsatisfied with how the issue of its agricultural exports as part of the Black Sea grain deal is being resolved, TASS news agency quoted Deputy Foreign Minister Sergei Vershinin as saying on Saturday after the latest talks with a top United Nations official. The Kremlin said Russian President Vladimir Putin had not yet responded to proposals from U.N. Secretary-General Antonio Guterres on how to extend and improve the deal.

Meanwhile, Ukrainian officials say Russia has effectively stopped the Black Sea grain deal by refusing to register incoming vessels.

|

POLICY UPDATE |

— USDA implements Congress-authored $250 million in assistance for rice producers. USDA on Friday announced it would begin sending pre-filled applications to rice producers for its new Rice Production Program (RPP). The program will provide up to $250 million in assistance to rice farmers based on 2022 planted and prevented planted acres. The funding was allocated via the fiscal year 2023 Omnibus appropriations bill.

Of note: Producers will receive an initial payment of not more than 1 cent per pound and if funds remain, another payment of not more than 1 cent per pound will be used. Those who do not receive a pre-filled application but reported eligible rice to FSA by the acreage reporting deadline can still apply in person by July 10.

— Best advice if you are watching the next farm bill saga: Wait until September. If you are tired or perplexed about the complex farm bill nuances, just wait until September. That is when farm bill leaders say the bill will likely be written and surface. Reason: Fallout from the debt limit/suspension/budget cut debate could take that long to be factored into farm bill writing.

|

CHINA UPDATE |

— Senate Appropriations Committee is planning a two-step process to examine US competitiveness with China. On Wednesday, Chair Patty Murray (D-Wash.) plans a closed-door, full committee session for lawmakers to hear privately from officials from the Defense, State, and Commerce departments as the committee prepares to work with other panels on follow-on legislation to last year’s Chips and Science Act. Meeting with lawmakers will be Ely Ratner, assistant secretary of Defense for Indo-Pacific security affairs at DOD; Daniel Kritenbrink, assistant secretary of State for East Asian and Pacific affairs; and Thea Rozman Kendler, assistant secretary of Commerce for export and administration at the Bureau of Industry and Security.

— China FX reserves rose $21 billion in April to $3.205 trillion, higher than expected and the highest since February last year.

— Beijing: Relations with U.S. on ‘cold ice,’ but stabilizing ties a ‘top priority’. China’s foreign minister said Monday a “series of erroneous words and deeds” by the United States had placed relations between the two superpowers on “cold ice,” but stabilizing ties is a “top priority.” Qin Gang made the comments during a meeting in Beijing with U.S. ambassador Nicholas Burns, their first since a dispute over a Chinese balloon shattered efforts to mend ties earlier this year. Qin said US actions and words had undermined “hard-won positive momentum” following Chinese leader Xi Jinping’s meeting with President Joe Biden in Indonesia last year. “The agenda of dialogue and cooperation agreed by the two sides has been disrupted, and the relationship between the two countries has once again hit the cold ice,” he said according to a Chinese Foreign Ministry statement.

In a brief post on Twitter, Burns said he and Qin discussed “challenges in the U.S./China relationship and the necessity of stabilizing ties and expanding high-level communication.”

— China’s largest trade fair was not a triumphant return for the world’s manufacturing hub. Instead, the mood was downbeat as factories grapple with a global slowdown and a scarcity of U.S. buyers.

Meanwhile, China is expected to roll out new policies to protect supply chains and boost its birth rate.

— China launches grain supply enforcement measures. China’s agriculture ministry launched a law enforcement campaign to stabilize grain supply in 2023. The ministry will investigate the illegal occupation of farmland, fake farm inputs, and illegal sales of GMO seeds, it said.

— Taiwan investment. A bipartisan group of U.S. senators introduced legislation that would allow President Joe Biden to sign a tax agreement with Taiwan, addressing an issue that businesses on both sides have pointed to as a barrier for further investment.

Meanwhile, Taiwan’s exports fell in April at a slower pace than the month before.

|

TRADE POLICY |

— Africa’s free-trade area — if successfully implemented — could significantly boost economic growth and living standards amid rising geopolitical tensions and climate change, the IMF said.

Separately, a free-trade agreement between Australia and the U.K. takes effect May 31.

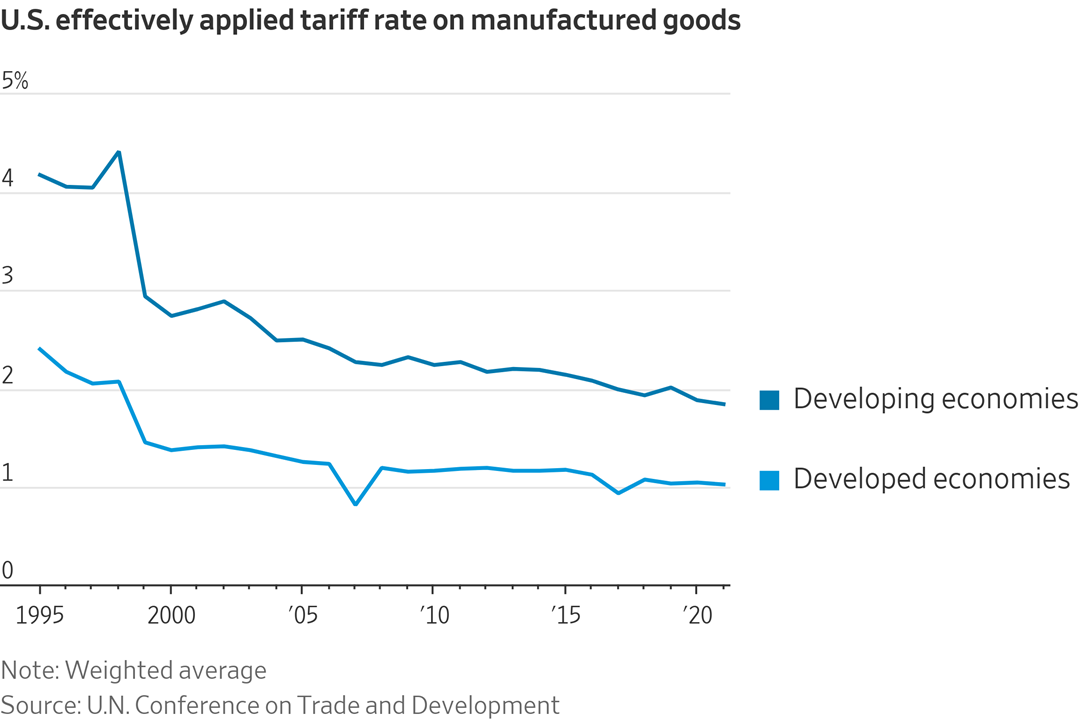

— In new world of trade diplomacy, free trade and tariffs take a back seat. The Wall Street Journal describes (link) what others have noted about the Biden administration’s trade policy: it’s different. In just the past year, the Biden administration has opened talks with Japan, the European Union, and more than 20 countries from India to Peru on cross-border economic links. Terms that generally aren’t part of these discussions: “free trade” and “tariffs.”

“Welcome to the new world of trade deals,” the WSJ article says. “It’s no longer about slashing duties, but a host of other issues — from digital copyright to air quality and technology and product standards — often brokered in government-level agreements rather than full-blown treaties.”

— USTR seeks input on definition of ‘specialty sugar’ under U.S. sugar TRQs. The Office of the U.S. Trade Representative (USTR) is requesting public comments on the definition of “specialty sugar” under the U.S. tariff-rate quota (TRQ) system that was last updated via a final rule May 29, 1996. But the update did not make clear whether the definition of specialty sugar reflected what had been in an interim final rule from Oct. 4, 1990, that specialty sugar would require “no further refining, processing or other preparation prior to consumption, other than incorporation as an ingredient in human food.”

Some stakeholders have suggested to USTR that they amend the definition of specialty sugar to reflect that criterion. Comments are due July 7, according to the notice (link) in today’s Federal Register.

|

ENERGY & CLIMATE CHANGE |

— USDA Secretary Tom Vilsack and others probably thought it would not be hard giving away $3 billion for climate smart programs. A backlash is building against a $3 trillion clean-energy push. The WSJ reports (link) the federal government has ignited a green-energy investment spree, though the road to spending that money is increasingly hitting speed bumps. County-by-county battles are raging as wind and solar projects balloon in size, edge closer to cities and encounter mounting pushback in several U.S. communities. Even in states with a long history of building renewables, developers don’t know if they can get local permits or how long it might take, the WSJ article concludes.

— EPA Administrator Michael Regan will face tough questioning from House Republicans during a House Energy and Commerce subcommittee hearing Wednesday on the EPA’s funding request. Lawmakers will question Regan on the agency’s spending in fiscal 2023, but also on ensuring the agency’s agenda does not inhibit increased energy production or expanded domestic manufacturing, lawmakers said in a press release (link).

— EPA this week is reportedly expected to release a proposal to limit emissions from coal and natural gas power plants, and the anticipated plan will likely rely on states and plant owners installing carbon-capture systems at their facilities despite delays for similar projects. Environmentalists charge the limited deployment of carbon-capture technology shows a lack of policy support, as critics say the systems are still too expensive and have not yet been "adequately demonstrated," a legal threshold that the EPA must consider in setting the new standards. Link for more via Bloomberg.

— In a push to reduce emissions near ports and along truck routes, EPA is seeking input on two programs aimed at slashing pollutants: the $3 billion Clean Ports Program and the $1 billion Clean Heavy-Duty Vehicle Program. The agency is collecting information about zero-emission trucks, including availability, market price and their performance, as well as zero-emission port equipment, electric charging stations and other necessary infrastructure. Link for more via Reuters.

— On Thursday, Energy Secretary Jennifer Granholm will appear before another House Energy and Commerce subcommittee to discuss her department’s budget request. GOP lawmakers said they would question Granholm on complementary remarks she made recently about China’s climate efforts, saying “they raise serious questions about your judgment and priorities as Secretary of Energy,” according to a press release (link).

— The Biden administration proposed a rule Friday to improve the detection and repair of methane leaks from gas pipelines, updating decades-old standards. The proposal, issued by the Pipeline and Hazardous Materials Safety Administration, requires pipeline operators to establish advanced leak detection programs aimed at finding and repairing all gas leaks.

— Teck Resources and Canadian Pacific Kansas City will test hydrogen fuel-cell locomotives to transport coal under a new agreement. Link for details.

— Europe has a new idea for COP28 as phasing out fossil fuels hasn’t worked. Expecting resistance to emissions cuts in Dubai, some climate hawks have started focusing on a global goal for renewables.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Rubio bill would exclude soda and prepared desserts from SNAP. The Supplemental Nutrition Assistance Program (SNAP) provides vital assistance to millions of low-income Americans, but it urgently needs reform, Sen. Marco Rubio (R-Fla.) wrote in a commentary item in the Wall Street Journal (link). Over 20% of SNAP spending “goes to unhealthy food and drinks, costing taxpayers billions and contributing to the nation's obesity and diabetes crises,” he noted. “This issue has received bipartisan support for change, with progressive mayors and former agriculture secretaries expressing concern over the program's contribution to poor nutrition.”

Rubio said the next farm bill provides an opportunity to align SNAP with the nutrition standards of other major programs, such as the National School Lunch Program and the Special Supplemental Nutrition Program for Women, Infants, and Children. A proposed bill would exclude soda and prepared desserts from SNAP, focusing on healthier food and beverages. “This reform could promote healthier diets, reduce medical expenses, and address food deserts in low-income neighborhoods,” Rubio said.

Although the proposal faces opposition, Rubio wrote the need for change has been acknowledged across party lines. “It is crucial to prioritize diet quality and make it a core SNAP objective, as suggested by USDA Secretary Tom Vilsack.”

— Tyson Foods cuts 2023 sales outlook. Tyson Foods reported a loss in its second quarter and cut its full-year forecasts for sales due to declining demand, now expecting 2023 sales to be between $53 billion to $54 billion vs their prior outlook sales would be from $55 billion to $57 billion.

Tyson said beef prices fell 5.4% and pork prices were down 10.3% in its second quarter, with CEO Donnie King labeling the current protein market as challenging. Beef sales volumes were down 3%, the firm said. Economic concerns by consumers have resulted in meat packers struggling with margins as they have had to increase prices for their products.

|

HEALTH UPDATE |

— Republican and Democratic lawmakers are rolling out proposals that aim to reduce drug spending by insurers, government agencies and patients, with many of them targeting the companies that manage drug benefits. Party differences could make passing proposals difficult, and some powerful healthcare companies, which own pharmacy-benefit managers, are trying to fend off many of the measures. Yet analysts expect some sort of legislation will make the cut because surveys show voters of all kinds agree that drugs cost too much, and lawmakers seeking re-election could benefit by pointing to a new law. Link for details via the Wall Street Journal.

— CDC director to exit in June. CDC Director Rochelle Walensky will depart her position leading the CDC at the end of June, the agency said. “The end of the Covid-19 public health emergency marks a tremendous transition for our country, for public health, and in my tenure as CDC Director,” Walensky said in a statement. The administration can name a new CDC leader without having to go through Senate confirmation, but that will change as of Jan. 1, 2025.

|

CONGRESS |

— Senate Republicans say no to any clean debt-limit increase. This weekend, a group of 43 Senate Republicans, including Mitch McConnell (R-Ky.), said they would oppose a vote to lift the debt limit with no strings attached, saying “substantive spending and budget reforms” must be part of the package. “Our economy is in free fall due to unsustainable fiscal policies,” GOP senators said in the letter. “This trajectory must be addressed with fiscal reforms.” Link to letter. Upshot: That is more than enough to stop a “clean” Democratic debt limit hike bill in the chamber.

Republican senators who didn’t sign the letter included moderates — Susan Collins of Maine, Lisa Murkowski of Alaska and Mitt Romney of Utah.

— Rail safety bill moves forward to first Senate panel vote. In response to the East Palestine, Ohio, train derailment three months ago, the Senate Commerce, Science, and Transportation Committee is set to vote on rail safety legislation (S 576) on Wednesday. Sponsored by Ohio Sens. Sherrod Brown (D) and JD Vance (R), the bill proposes increased requirements for hazardous material transportation and crew size regulations. While the Senate committee appears to agree on key provisions, the legislation may face resistance in the House as some Republicans call for waiting on the NTSB's full investigation. Transportation Secretary Pete Buttigieg urges lawmakers to act quickly to improve rail safety and increase fines for railroad violations.

Of note: Derailments occur about 1,000 times per year, but the high-profile incident drew new interest from Congress.

The Biden administration over the weekend announced a rail vehicle replacement grant program that will spend $700 million on six projects in six states to update their rolling stock in rail public transportation systems.

— Bank failures are the focus for this week:

- The Financial Services panel will dig down on the federal response to collapsed financial firms on Wednesday with witnesses including Margaret E. Tahyar of Davis Polk & Wardell and Jonathan Gould of Jones Day.

- The GAO’s preliminary review of Silicon Valley Bank and Signature Bank will come under the committee’s scrutiny on Thursday. Witnesses have yet to be announced.

- KPMG is cooperating with a Senate inquiry into its relationship with three failed banks and strongly defends the quality of its audits.

- The SEC is investigating the conduct of First Republic Bank executives before the government seizure and sale to JPMorgan Chase.

|

OTHER ITEMS OF NOTE |

— Whistleblower gets $279 million. The Securities and Exchange Commission (SEC) said it has given $279 million — its largest-ever award — to an unnamed whistleblower who provided information and assistance that led to an enforcement action for which the agency did not provide details. SEC Division of Enforcement Director Gurbir Grewal said in a statement that the large award is meant to incentivize witnesses to disclose potential securities law violations and that the whistleblower program has led to the SEC's recovery of more than $4 billion in ill-gotten gains and interest.

— Tucker Carlson is reportedly ready to hit back at Fox News. The star conservative anchor plans to enlist allies to attack his former employer, in hopes that it will release him from a contract that ends in 2025 to let him join a rival news outlet or start a new one, according to Axios. Associates of Carlson also accused Fox News of leaking damaging details about him, something the network denies.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum |