EPA Set to Allow Emergency Summer Sales of E15

Debt-limit update | Reports Fed watches signal another 25bp hike in rates | Iran seizes oil

|

In Today’s Digital Newspaper |

A report due today from the Fed will examine what happened with SVB and who’s responsible. Randal Quarles, former vice chair of supervision at the Fed, told CNN that he doesn't expect the report to uncover any smoking guns. However, new details could shed light on how the bank imploded and what, if anything, could have been done to prevent it. Quarles said the report will likely hint at or formally propose more restrictive banking regulation without outlining specifics. In particular, he thinks there will be a lot of discussion around rolling back rules that allowed banks the size of SVB to skirt certain capital and liquidity requirements they had been subjected to in prior years. Meanwhile, the House Oversight Committee is investigating the role of the Federal Reserve’s San Francisco regional bank and other state and federal banking regulators in Silicon Valley Bank’s collapse in March. Committee chairman James Comer (R-Ky.) told San Francisco Fed President Mary Daly it may have “failed to adequately supervise SVB.”

Officials are coordinating talks to rescue First Republic Bank, Reuters reports, citing three unidentified people familiar with the matter. The FDIC, Treasury Department, and Federal Reserve have started to orchestrate meetings in recent days with companies about putting together a lifeline for the lender. Alternatively, the FDIC could simply shut down First Republic and sell off the parts. Or the bank could be bought by others more immediately. State officials can make this easier by offering guarantees against losses. That’s what happened when UBS bought Credit Suisse in a regulator-brokered deal. Shares in First Republic were up nearly 10% in premarket trading, after having jumped yesterday, presumably in hopes that a rescue will emerge. But the bank’s stock is still at about $6, from $150 it traded at a year ago.

Banks borrowed more from the Federal Reserve for the second week in a row. The Fed said borrowing the week ending April 26 rose $11.3 billion. Small to midsize banks have used an emergency Fed program to prevent failures and stabilize the U.S. financial system.

Meanwhile, the FDIC is expected to propose a special assessment on banks to repay losses to the deposit insurance fund after the FDIC covered uninsured deposits at SVB and Signature Bank, which also collapsed in March.

Russia hurled missiles at cities across Ukraine as people slept, killing at least 16 people in the first large-scale air strikes in nearly two months. The early-morning attacks were carried out as Kyiv prepares to launch a counteroffensive to try to retake Russian-occupied territory.

The Bank of Japan kept ultra-low interest rates but announced a plan to review its past monetary policy, laying the groundwork for new Governor Kazuo Ueda to gradually phase out his predecessor's massive stimulus program.

The Biden administration is bracing for a surge of migrants at the U.S./Mexico border when a Covid-era border restriction known as Title 42 lifts next month. On May 11, when the coronavirus public health emergency ends, the restriction will expire, meaning border authorities will no longer be able to quickly expel certain migrants. The Biden administration is preparing new rules to deport asylum seekers. The new rules would make nearly all migrants who illegally cross the border into the U.S. rapidly deportable to Mexico or their home countries and open new migrant-processing centers to create some legal pathways for asylum seekers. The ACLU is pledging to sue against the asylum ban and a group of Republican-led states already challenging a humanitarian sponsorship programs for Venezuelans and others. Meanwhile, House GOP leaders said when they return May 9, they plan to begin debate on a border security and immigration reform measure. Details in Congress section.

|

MARKET FOCUS |

Equities today: Global stock markets were mostly higher overnight. U.S. Dow opened around 80 points lower but turned slightly higher in early morning trading. In Asia, Japan +1.4%. Hong Kong +0.3%. China +1.2%. India +0.8%. In Europe, at midday, London -0.3%. Paris -0.8%. Frankfurt -0.4%.

ExxonMobil and Chevron reported profits today that solidly beat analysts’ expectations, even as crude prices fell from last year’s heights. ExxonMobil posted the highest first-quarter profit in its 140-year history as oil production soared from new wells in the U.S. and off the coast of South America. Chevron Corp. reported better-than-expected results as refining profits rebounded amid climbing fuel demand.

U.S. equities/markets yesterday: All three major indices closed with solid gains after the government reported first quarter GDP was 1.1%, slowing greater than expected as a figure of around 1.9% had been anticipated. The Dow closed up 524.29 points, 1.57%, at 33,826.16. The Nasdaq rose 287.89 points, .243%, at 12,142.24. The S&P 500 gained 79.36 points, 1.96%, at 4,135.35. Gold and the dollar were little changed. Oil prices rose after Russia said OPEC+ sees no need for further output cuts.

CME Fed funds futures are heavily expecting a 0.25% rise in the Fed funds rate when the Fed meeting concludes May 3. Probabilities for a hike were at nearly 84% compared with just over 16% for no change.

Agriculture markets yesterday:

- Corn: July corn futures fell 19 1/2 cents to $5.81 1/2, falling to the lowest level since July 22.

- Soy complex: July soybeans fell 11 cents to $14.03 3/4, the lowest close since March 23. July meal was unchanged at $427.40, while July soyoil fell 167 points to 50.83 cents.

- Wheat: July SRW wheat fell 12 3/4 cents at $6.29 1/4, near the session low and hit a 22-month-low. July HRW wheat dropped 18 cents at $7.65 1/4, near the session low and hit a 14-month low. July spring wheat fell 28 cents to $7.85.

- Cotton: July cotton rose 204 points to 80.40 cents, closing nearer the session high.

- Cattle: Expiring April live cattle futures surged 92.5 cents to $175.45 Thursday, while most-active June futures rose 62.5 cents to $165.20. April feeder futures went off the board at noon, being unchanged at $202.675. May feeder futures advanced $1.25 to $211.525.

- Hogs: June lean hogs fell 17 1/2 cents to $90.10, nearer the session high and hit a three-week high early on.

Ag markets today: Soybean futures traded higher overnight, while corn and SRW wheat failed to sustain earlier corrective buying. As of 7:30 a.m. ET, corn futures were trading mostly 2 to 3 cents lower, soybeans were 3 to 10 cents higher, SRW wheat was fractionally to a penny lower, HRW wheat was around 2 cents higher and HRS wheat was 2 to 4 cents higher. Front-month crude oil futures were modestly firmer while the U.S. dollar index was more than 500 points higher.

Market quotes of note:

- World Bank to ECB: Tread carefully. While backing further rate hikes, the International Monetary Fund said today that the European Central Bank (ECB) needs to tread carefully. “The recent banking-sector problems illustrate how liquidity strains and financial stress can surface abruptly,” the Washington-based lender said. “Another stress episode could erode buffers, especially among banks with weaker fundamentals, and sharply tighten credit and broader financial conditions.”

- Doubling defaults. U.S. corporate defaults doubled to 20 in the first quarter of 2023 from 10 in the previous quarter, according to a report from Moody’s Investors Service published Thursday. Moody’s said it expects that “higher interest rates, slower economic growth and limited market liquidity will fuel more defaults among lower-rated debt issuers in the months ahead.”

- “SVB faced a novel channel of bank-run risk that is unique to the social-media era,” wrote Dr. Tony Cookson, an associate professor of finance at the University of Colorado’s business school, and his colleagues. “We do not expect this risk to go away."

- What Chipotle CFO fears. Jack Hartung, chief financial officer at Chipotle Mexican Grill Inc. “When I think about the various pieces of the economy, if GDP slows a bit, but employment stays strong — so in other words, unemployment stays low — I think that would be a great scenario,” Hartung told CFO Journal’s Jennifer Williams-Alvarez in an interview. “The concern I have is if there’s a recession driven by unemployment. If unemployment starts to soar, that’s when people really pull back.”

- U.S. SRW wheat ‘cheapest in world.’ Says Richard Crow, grain trader and analyst: “The wheat market has adjusted to where SRW is the cheapest wheat in the world. If one wanted SRW quality, the crop could compete in several locations. SRW is knocking at the door of being a feed grain in the U.S.”

On tap today:

• Earnings: Ares Management Corp., Avantor Inc., First Hawaiian Inc., Gentex Corp. and New York Community Bancorp Inc. are among the companies reporting earnings today.

• U.S. employment-cost index for the first quarter is expected to increase 1.0% from the prior quarter. (8:30 a.m. ET) UPDATE: Compensation costs for civilian workers in the U.S. increased 1.2% on quarter in the three months to January 2023, following a 1.0% rise in the previous period and above market expectations of 1.1%. Both wages and salaries and benefits costs rose by 1.2% from the last quarter of 2022. Year-on-year, compensation costs for civilian workers grew by 4.8%.

• U.S. consumer spending for March is expected to be unchanged from the prior month. Personal income is forecast to rise 0.2%. (8:30 a.m. ET) UPDATE: Personal spending in the U.S. remained unchanged from the previous period in March 2023, following a downwardly revised 0.1% increase in February and compared with market forecasts of a 0.1% decline. The lack of growth can be attributed to the still-elevated inflation rate and higher borrowing costs, which put a strain on consumer spending. Consumption of services saw a 0.4% increase, driven by higher spending on housing and utilities as well as healthcare services. In contrast, consumption of goods decreased by 0.6%, with lower spending on motor vehicles and parts as well as gasoline and other energy goods.

• U.S. personal consumption expenditures price index excluding food and energy for March is expected to increase 0.3% from one month earlier and 4.5% from one year earlier. (8:30 a.m. ET) UPDATE: The PCE price index in the U.S. rose 0.1% in March, easing from a 0.3% advance in February. The core PCE price index was up 0.3%, the same as in the previous month and in line with expectations. On a yearly basis, the PCE inflation slowed to 4.2%, the lowest since May 2021, while the core index eased to 4.6%, matching December's 13-month low but slightly above market expectations of 4.5%. The core rate for February was revised up to 4.7% otherwise this would have been a steady reading on the rate of inflation.

• Chicago Business Barometer is expected to fall to 43.5 in April from 43.8 one month earlier. (9:45 a.m. ET)

• University of Michigan consumer sentiment index for April is expected to hold at 63.5, unchanged from a preliminary reading. (10 a.m. ET)

• Baker Hughes rig count is out at 1 p.m. ET.

• CFTC Commitments of Traders report, 3:30 ET.

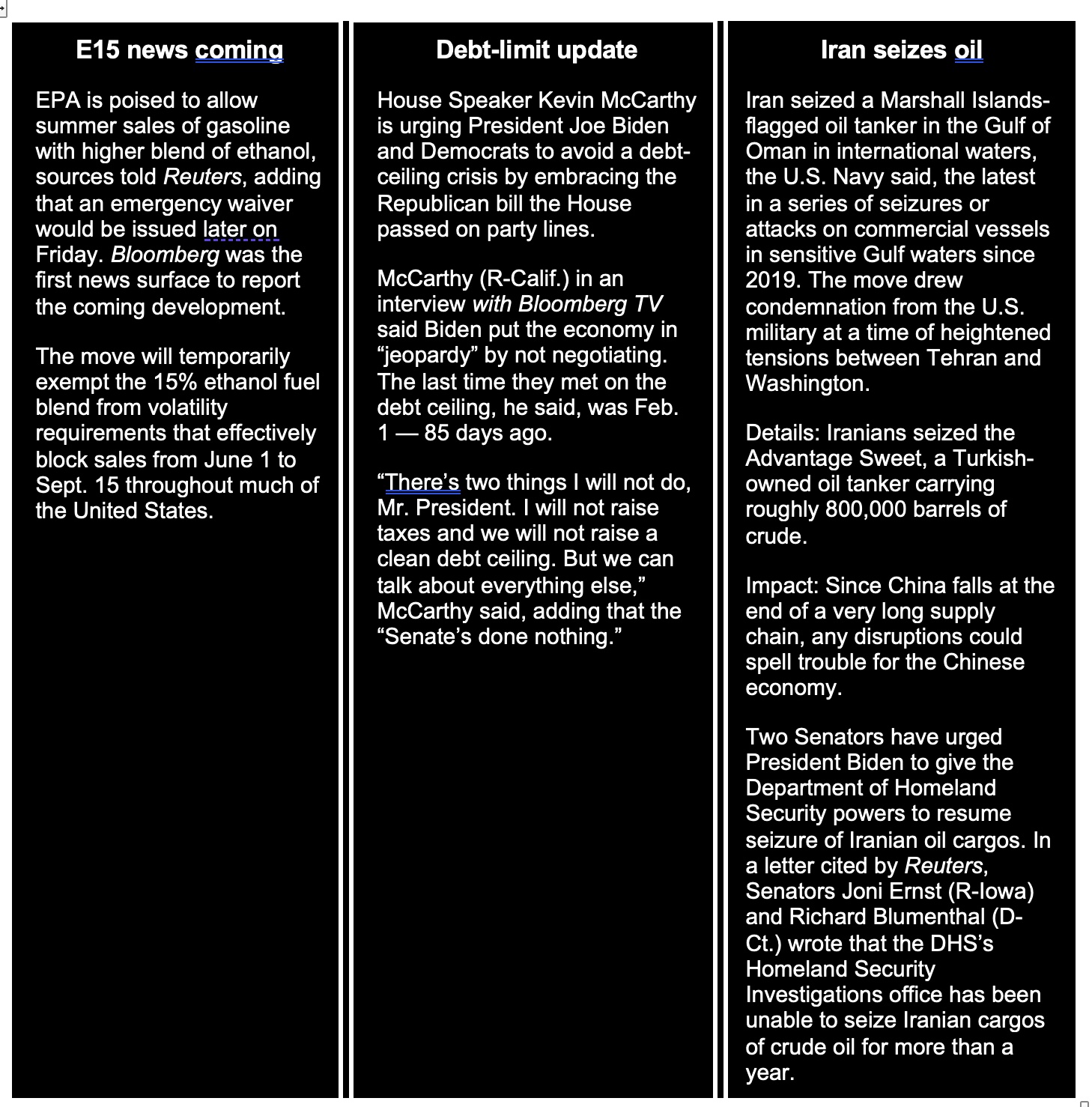

Eurozone GDP grows marginally in Q1. The Eurozone economy grew by just 0.1%, missing market consensus of a 0.2% expansion, amid a surge in inflation and following the fastest pace of policy tightening by the ECB in over 20 years. Among the bloc's largest economies, Germany registered no growth, while the economies of France, Italy and Spain expanded.

The Bank of Japan maintained its key short-term interest rate at -0.1% and that of 10-year bond yields at around 0% in April by a unanimous vote but modified guidance on its policy rate by removing reference toward the need to guard against risks from the Covid pandemic and to keep interest rates at "current or lower levels.” In newly appointed Governor Kazuo Ueda's first meeting, the board also decided to conduct a broad-perspective review of the monetary path, with a planned time frame of around 1 to 1-1/2 years, saying its policies "have interacted with and influenced wide areas of Japan's economy.”

Meanwhile, officials cut their 2022 GDP growth forecast to 1.2% from 1.9% in January amid weaker private consumption. For FY 2023, the bank slashed its GDP outlook to 1.4% from 1.7%. The CPI reading for FY 2022 remained around 3%, while for the following year, it was revised slightly higher to 1.8% from 1.6%.

Impact: Japan's yen fell to its lowest in six weeks and Tokyo's Nikkei 225 jumped 1.4%.

Mexico GDP expands more than expected. The Mexican economy expanded by 1.1% quarter-on-quarter in the three months ending March of 2023, accelerating from the 0.5% growth in the previous quarter and surpassing market expectations of a 0.8% advance. It was the sharpest expansion since the second quarter of 2022, underscoring the resilience of the Mexican economy from Banxico's aggressive rate-hike cycle.

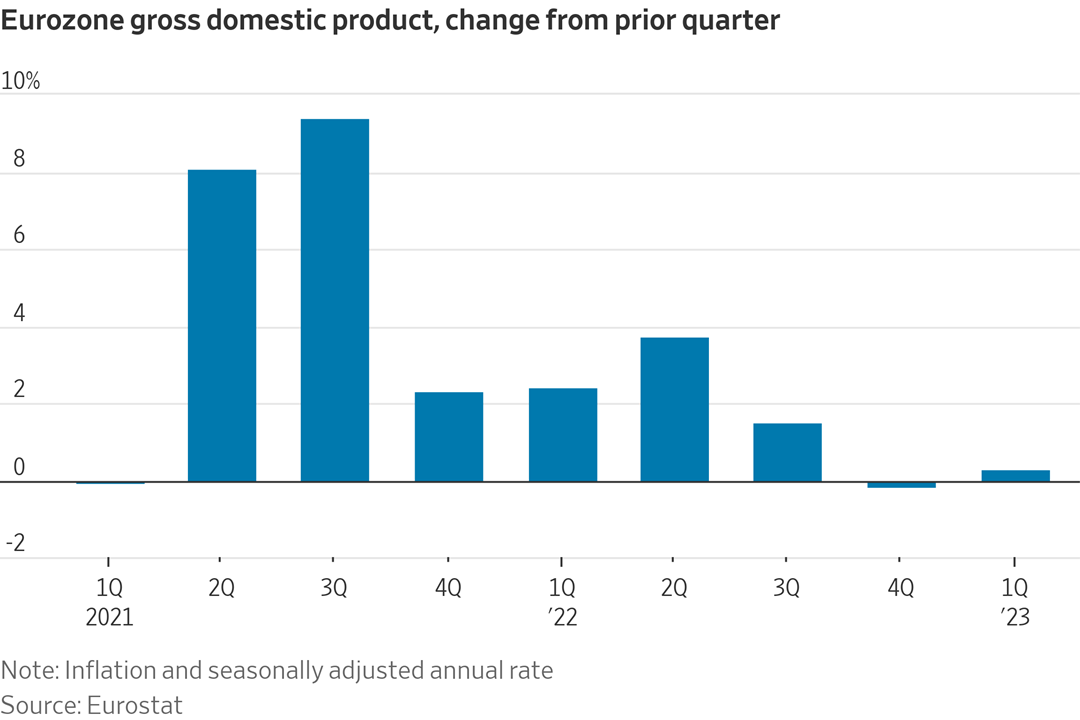

Dissecting Q1 GDP report: inflationary. U.S. economic growth slipped in the first quarter amid still-high inflation and rising interest rates, adding to worries about a possible recession later this year. The GDP tally came in at 1.1%, below expectations of 2% growth and a significant slowdown from 2.6% growth in the fourth quarter. While consumption, the main driver of the economy, was a bright spot, businesses pulled back sharply, drawing down inventories, cutting equipment purchases and reducing housing investment. Many economists expect the economy to slow even more as the year progresses, predicting a recession in the second half of the year as the Federal Reserve continues its campaign to cool the economy and lower inflation.

Financial system stresses will tighten credit by twice as much as expected by Federal Reserve Chair Jerome Powell, said economists surveyed by Bloomberg, tipping the economy into recession.

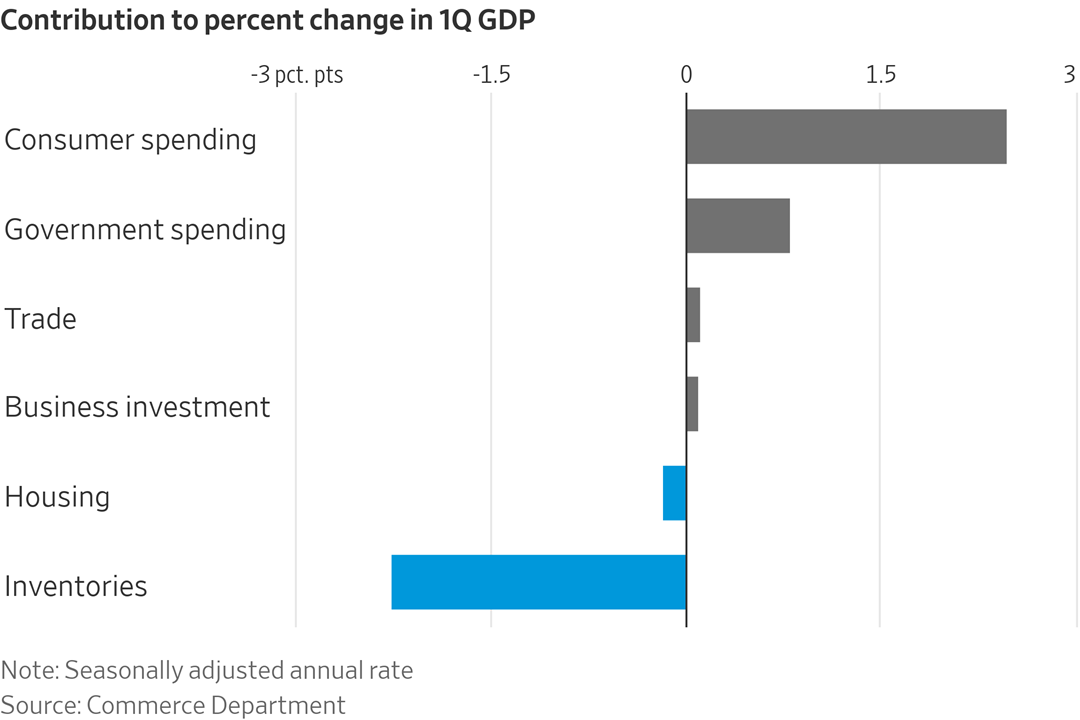

Peak-season pressure is starting to reach pricing in container shipping’s spot market. Costs to ship boxes from Asia to the U.S. West Coast have surged this month, the Wall Street Journal reports (link), as container lines try to reverse a monthslong slide in rates that has hit carrier earnings and raised alarms about a bigger financial hit later this year. Xeneta says rates have jumped 34%, or $425, over the past two weeks. That suggests the market has accepted a big part of the $600 general rate increases that shipping lines rolled out at the start of the month. Experts say the carriers are trying to get U.S. importers to sign peak-season contracts rather than sitting back to see if spot rates will keep dropping. Their bigger hope is probably that importers follow through by boosting their shipping volumes in the coming months.

Latest job-cut announcements:

- Lyft Inc. said Thursday that it is cutting over 1,000 additional jobs, days after a new chief executive took over and following a round of layoffs of 700 people in November.

- Dropbox Inc. will cut 500 jobs, about 16% of its workforce, amid slowing growth and an industrywide push toward artificial intelligence.

- Gap Inc. said it is eliminating 1,800 jobs as part of a broad restructuring aimed at making the company more nimble and less bureaucratic.

Market perspectives:

• Outside markets: The U.S. dollar index was higher, with the euro and British pound both weaker. The yield on the 10-year US Treasury note was weaker, trading around 3.47%, with a lower tone in global government bond yields. Crude oil moved higher, with U.S. crude around $75.10 per barrel and Brent around $78.75 per barrel. Gold and silver were mixed ahead of economic reports, with gold weaker around $1,991 per troy ounce and silver firmer around $25.05 per troy ounce.

• NGFA supports targeted approach to rail safety. The National Grain and Feed Association (NGFA) today urged leaders of the Senate Committee on Commerce, Science and Transportation to pass bipartisan, targeted rail safety legislation. In a letter (link) sent April 28 to Chairwoman Maria Cantwell (D-Wash.) and Ranking Member Ted Cruz (R-Texas), NGFA and 47 other members of the Agricultural Transportation Working Group said legislation should reduce the risk of future derailments while also ensuring a “reliable, economically sustainable” railroad freight transportation system. “We support Congressional efforts to improve rail safety and believe there are targeted, common-sense provisions that can address this important issue to prevent future incidents,” the groups stated.

Provisions supported by the working group include:

- Standardization and expanded use of defect detectors, which help carriers prevent accidents.

- Increased funding for first responder training to meet new authorized levels set by the Infrastructure Investment and Jobs Act.

- Recommended improvements for track maintenance programs.

- Full funding of the Department of Transportation’s Pipeline and Hazardous Materials Grant Program, which is funded by hazardous materials registration fees paid by both the shippers and transportation carriers to support emergency response planning and training.

The letter also outlined several areas of concern that could create new supply chain disruptions.

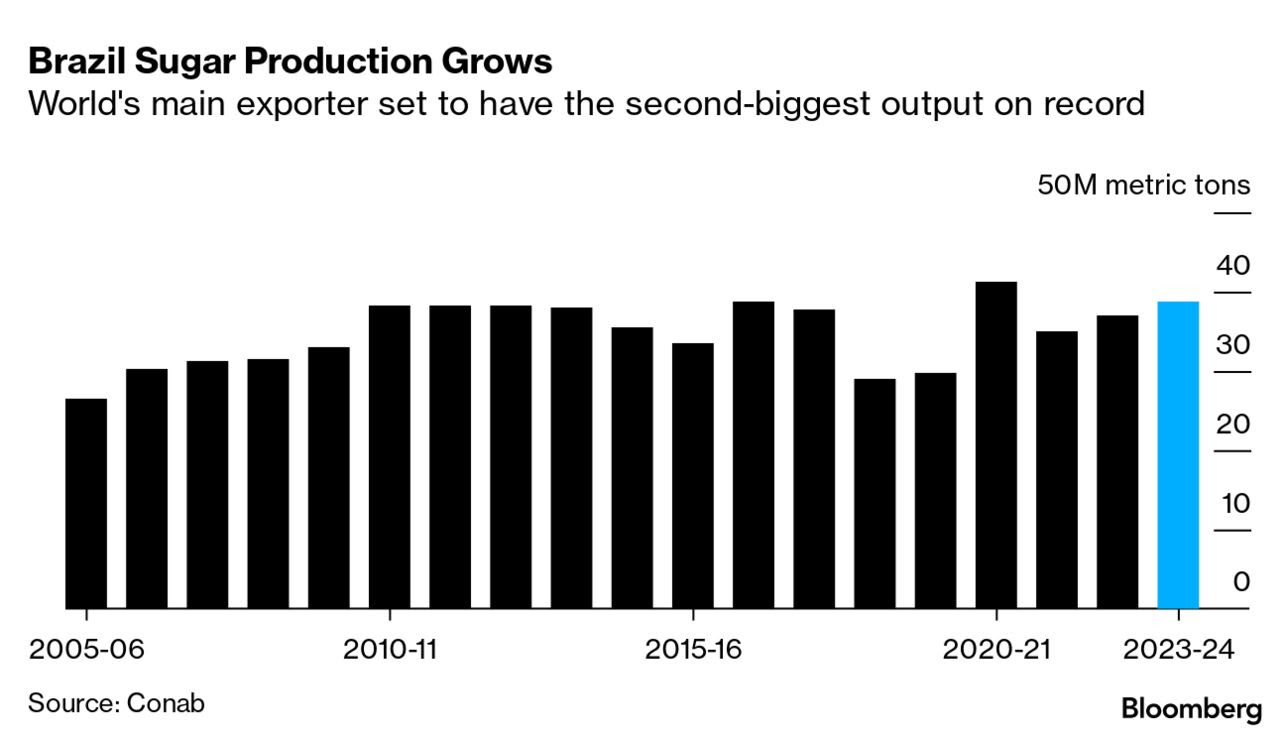

• Brazil is set to harvest its second-biggest sugar crop on record, a relief for global markets that have seen futures surge to an 11-year high because of tight supplies. The world’s top exporter will boost sugar output by 4.7% this season, Conab said. A large Brazilian crop could help ease pressure in global markets after lackluster harvests in other big producers like India and Thailand.

• Flooding halts barge traffic on Upper Mississippi River. All locks and dams above Lock 17 (near New Boston, Illinois) on the Mississippi River are closed for three weeks due to flooding, according to USDA’s Grain Transportation Report. Expected high waters could potentially close river traffic as far south as Lock 22 (near Saverton, Missouri) for two weeks, starting around May 5. Restricted barge traffic will slow grain movement down the river and fertilizer movement up from the Gulf. Link for details.

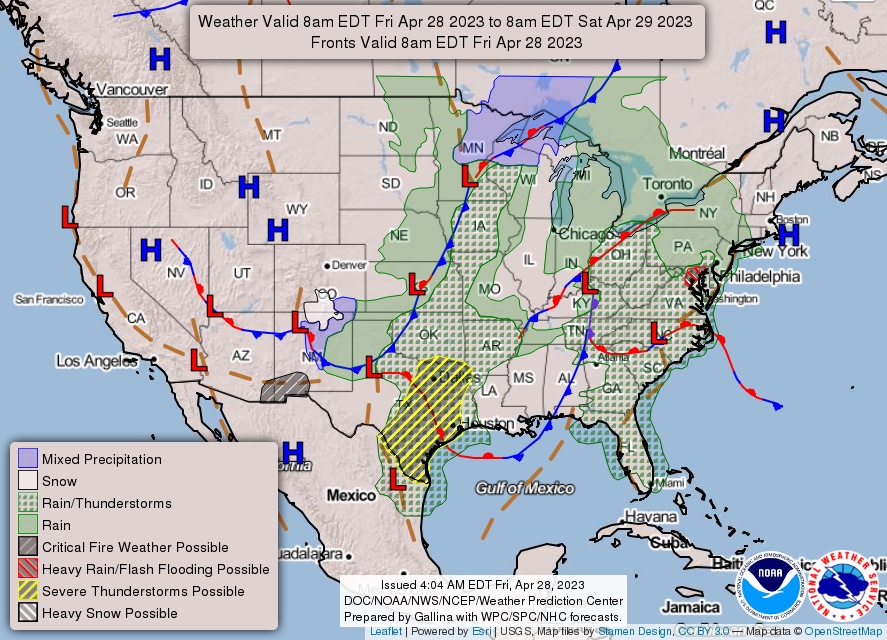

• NWS weather outlook: Multiple rounds of showers and thunderstorms will lead to increased heavy rainfall chances across Eastern Seaboard and Gulf Coast through Sunday... ...Severe thunderstorms possible in eastern Texas on Friday ahead of advancing cold front... ...Warm and dry conditions expected this weekend west of the Continental Divide.

Items in Pro Farmer's First Thing Today include:

• Varied grain price tone this morning

• French wheat conditions record-high

• Packers slow playing cash cattle trade

• Cash hog fundamentals still sputtering

|

RUSSIA/UKRAINE |

— Overnight Russian missile attacks across Ukraine killed at least 16 people, the first large-scale aerial offensive in weeks. Ukrainian officials said they shot down most of the barrage, which included a strike on an apartment building. Russian forces have recently changed tactics to make it harder for Ukrainian air defenses to detect missiles, the Institute for the Study of War said. The latest assault comes as Kyiv plans a long-touted counteroffensive against Russian-occupied territory.

— The Biden administration has imposed sanctions on the leading security services in Russia and Iran for what it said was a pattern of wrongfully detaining Americans in an effort to use them for political leverage.

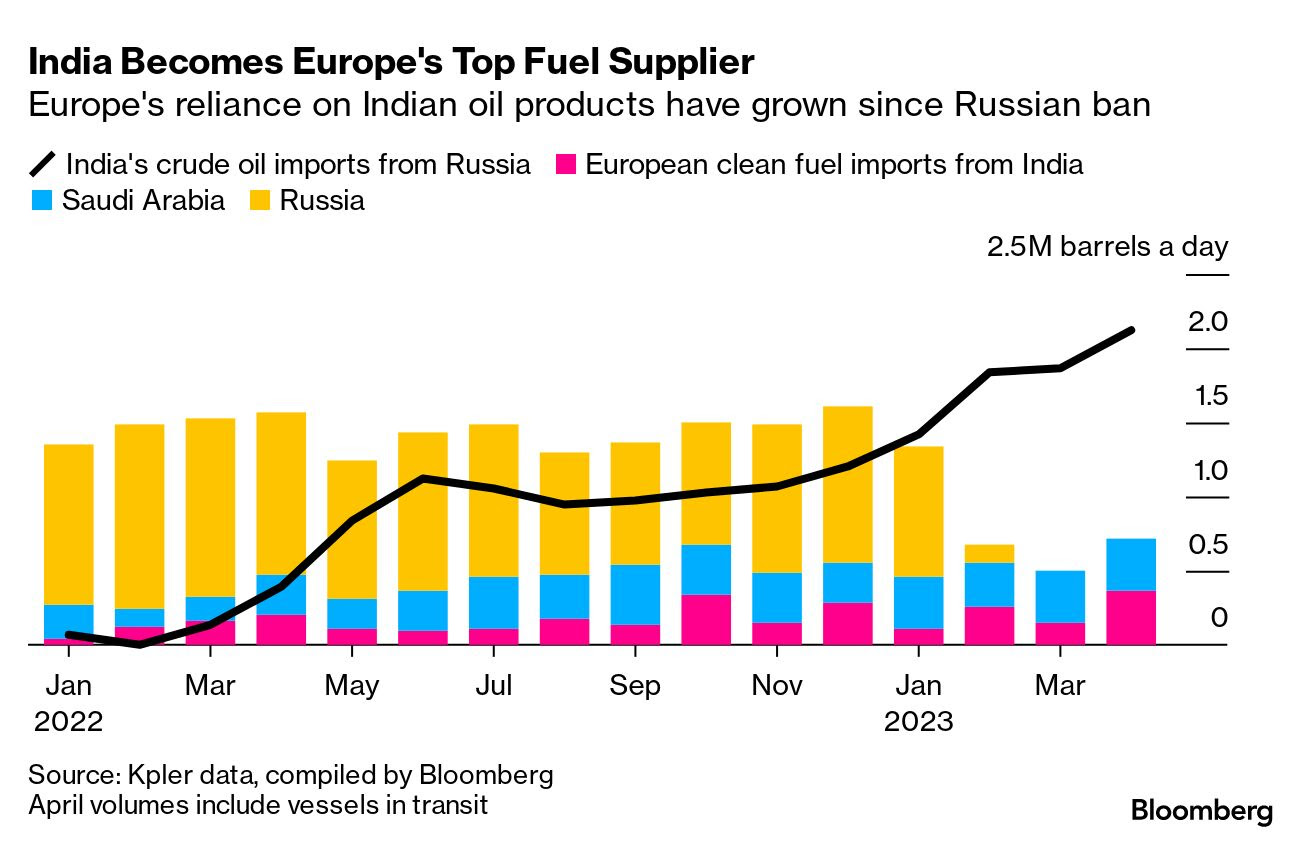

— Russian oil is still powering Europe with help from others. European Union rules that ban any seaborne imports of Russian products don’t prevent countries such as India from buying cheap crude from Moscow, turning it into diesel and other fuels, and shipping it back to Europe at a markup. The Asian nation is on track to become the largest supplier of refined products to the continent this month while also purchasing record amounts of Russian crude, according to data compiled by Bloomberg from analytics firm Kpler.

|

POLICY UPDATE |

— President Biden continues to refuse to cave to GOP demands to attach budget cuts to raising the $31.4 trillion debt limit, although he has signaled openness to “separate” budget discussions. “I’m happy to meet with [House Speaker Kevin McCarthy, but not on whether or not the debt limit gets extended,” Biden said. “That’s not negotiable.”

|

CHINA UPDATE |

— Chinese authorities questioned Shanghai workers at consulting firm Bain & Co., underlining the mounting uncertainties facing foreign executives and businesses operating in China after a series of detentions and investigations.

|

TRADE POLICY |

— Mexican official criticizes U.S. request for consultations on its GMO policy. The Biden administration’s request for consultations under the U.S.-Mexico-Canada Agreement (USMCA) over Mexico’s plans to halt imports of GMO corn for food is simply the U.S. administration bowing to pressure from seed companies and is an “unacceptable violation” of Mexican law, Mexican Deputy Agriculture Minister Victor Suarez said Thursday in Mexico City. "The United States' request to Mexico follows the interests of seed, agrochemical, and other food-producing oligopolies.”

He also reiterated the Mexican stance that the ban on imports of GMO corn for food use “does not affect U.S. corn producers in any way.” The country originally had included GMO corn for feed use in its restrictions, but scaled the ban back to only corn imported for food use. “It is the U.S.' own agricultural and trade policies, as well as its food development model, which distorts prices and creates gaps between small-scale producers and large transnationals,” Suarez stated.

The Biden administration argues that the even limiting the ban on imports to GMO corn for food use is not a science-based decision. USDA Secretary Tom Vilsack has noted “hundreds” of studies showing the safety of GMO corn and U.S. officials have taken issue with Mexico indicating they want to study the safety of GMO corn for food use.

|

ENERGY & CLIMATE CHANGE |

— Biden/EPA administration officials have decided to issue an emergency waiver that will allow widespread sales of higher-ethanol E15 gasoline this summer, following a strategy used last year to help tamp down high pump prices, Bloomberg reports. The waiver, set to be announced by the Environmental Protection Agency on Friday, will temporarily exempt the 15% ethanol fuel blend from volatility requirements that effectively block sales from June 1 to Sept. 15 throughout much of the country.

EPA’s action had to be announced prior to May 1 to allow terminal operators to continue selling E15 in certain areas of the country. With the action, retail outlets will be able to continue selling E15 as of June 1, the start of the summer driving season when E15 fuel usually can no longer be sold in about two-thirds of the country.

Sen. Chuck Grassley (R-Iowa) likes the coming announcement. This from a Grassley tweet: “Grassley tweet: Seeing reports that EPA will issue last minute waiver 2 allow E15 for summer driving which is common sense + about time since consumers can save $$ at the pump w higher blends of ethanol and gas price$ continue 2 rise. Seeing reports that EPA will issue last minute waiver 2 allow E15 for summer driving which is common sense + about time since consumers can save $$ at the pump w higher blends of ethanol and gas price$ continue 2 rise.”

Bottom line: An analysis conducted for the pro-ethanol group Growth Energy said that when summertime E15 sales were greenlighted last year, the blend cost nearly $1-per-gallon less than conventional E10 in some areas. However, industry analysts say the E15 decision won't have the impact on ethanol demand or gas prices proponents expect.

— SEC climate rules poised for fall release, ex-Commissioner says. The SEC likely will issue its rules requiring corporate reporting on greenhouse gas emissions and other environmental matters after this summer, former SEC Commissioner Robert Jackson said Thursday. The SEC will miss the April completion date it was targeting in its regulatory agenda for rules requiring corporate reporting on greenhouse gas emissions and other environmental matters. Instead, the release of the final climate disclosure rules “looks more like the fall,” former SEC Commissioner Robert Jackson said Thursday. Jackson left the commission in 2020. Link to WSJ article for more details.

— California regulators are expected to vote to ban sales of new diesel big rigs by 2036 and require all trucks to be zero emission by 2042. The California Air Resources Board will vote on the Advanced Clean Fleets rule today. Adoption is widely expected.

Details: The fleets rule would bar truck manufacturers from selling any combustion-engine vehicles in the state starting in 2036. The requirements would gradually take effect for different categories of vehicles.

— USDA begins implementing $3.1 billion climate-smart program. Some $3.1 billion — three times more than originally planned — will be spent on 141 pilot projects to offer incentives that encourage producers to adopt climate-mitigating practices on working lands. “The game’s changing. Farming is no longer about what food is produced; it’s also about how food is produced,” said Vilsack in webcast remarks. “The world is demanding more sustainable products across the board.”

What’s new: USDA said 29 projects involving 45 major commodities in the Partnerships for Climate-Smart Commodities program were already active. Vilsack said negotiations were complete with the majority of 70 projects selected last fall for $2.8 billion in support. “We’re looking forward to seeing these projects hit the ground running now to enroll farmers and landowners in these exciting efforts.”

USDA announced a “learning network” that will share information about which project practices and approaches are successful. “We plan to make available our findings from this effort so that we can all work together to make the most climate-smart commodity markets move forward,” said Vilsack.

When in full operation, the projects will involve more than 60,000 farms and 25 million acres of working lands, including woodlands, using such practices as nutrient management and cover crops to sequester a combined 60 million tonnes of carbon in the soil and in trees, said USDA. The projects will run from one to five years.

Link to USDA’s home page for the climate-smart initiative.

|

HEALTH UPDATE |

— The anti-obesity drug tirzepatide could become the top-selling drug of all time. The treatment, trademarked Mounjaro, mimics a hormone which controls hunger. It is already approved for treating diabetes but is likely to also be approved for obesity this year. Trials show that obese patients on the drug lose 16% of their body weight, on average, in 17 months. The market for the treatment is vast: One doctor pointed out that if a quarter of the 140 million obese Americans used the similar $15,000-a-year drug semaglutide, it would cost $500 billion — nearly twice the total U.S. spending on prescription drugs. Tirzapetide outperforms semaglutide and its owner Eli Lilly has invested hugely in manufacturing, the Financial Times reported.

|

CONGRESS |

— Perspective on Congress. “I spent most of my career traveling at 17,000 miles per hour, not at the pace of the United States Senate,” said Sen. Mark Kelly (D-Ariz.), a former astronaut and Navy pilot. “It’s a different kind of pace. We’ve got a lot of issues out there we’re facing right now.”

— House GOP readies border security and immigration reform bill and signals votes are there. The new proposal merges language from the Judiciary and Homeland Security committees to focus on both border security and immigration reform. The legislation tackles fentanyl smuggling, visa overstays, parole authority and asylum seekers. It would also restore the Trump administration’s “Remain in Mexico” policy, which forces migrants seeking asylum to stay in Mexico until their U.S. court date.

The bill is scheduled to come to the floor as soon as the House returns in May. Lawmakers will head out for a week-long recess on Friday but are scheduled to return May 9.

Meanwhile, the Biden administration announced new steps to try to control migrant arrivals as the end of Title 42 nears. The Biden administration will send asylum and refugee officers to Latin America to help process potential migrants before they reach the United States as part of an effort to revamp its immigration policies before a pandemic-era expulsion policy expires next Month. The Homeland Security Department also notified Congress that it will reprogram funds to support its new border efforts, with officials on Thursday pleading with lawmakers to provide additional resources. The administration is preparing to ramp up expedited removals of border crossers, expand legal pathways for immigrants and implement a restrictive new asylum rule as the policy known as Title 42 that immediately turned away more than two million migrants is set to end May 11. While officials stressed the administration is planning to tighten control of the border and quickly reject migrants without valid asylum claims, they acknowledged the end of Title 42 — first instituted under President Trump — will likely lead to a significant uptick in encounters at the border.

— Solar panel legislation. The House today plans to vote on legislation (HJRes. 39) to use the Congressional Review Act (CRA) to cancel a two-year suspension of tariffs on solar panels from Southeast Asia. The measure has five Democratic cosponsors, and Sen. Joe Manchin (D-W.Va.) has said he’d back it in the Senate.

Background: The Biden administration, using emergency authorities under a 1930 trade law, issued the suspension of new duties on solar panels from Cambodia, Malaysia, Thailand, and Vietnam on June 6, 2022, to boost US solar projects and ease the immediate economic effects of an ongoing Commerce Department trade investigation related to China.

What’s next: If a rule is disapproved under the CRA, the agency can’t issue a similar regulation unless Congress passes a separate law allowing it. The Senate can fast-track a disapproval resolution, allowing passage with a simple majority. The minority party can force a vote if they have sufficient support. If the Senate doesn’t act on the resolution within 60 legislative or session days of receiving notification of the rule or its publication in the Federal Register, whichever is later, the expedited procedures no longer apply.

The White House “strongly opposes” HJRes 39, according to an April 25 statement of administration policy, which said the president would veto the bill if he was presented with it. “This rule is necessary to satisfy the demand for reliable and clean energy while ensuring Commerce is able to rigorously enforce U.S. trade laws, hold trading partners accountable, and defend U.S. industries and workers from unfair trade actions,” the Office of Management and Budget (OMB) wrote. “Passage of this joint resolution would undermine these efforts and create deep uncertainty for jobs and investments in the solar supply chain and the solar installation market,” OMB added.

|

OTHER ITEMS OF NOTE |

— Cotton AWP falls back under 70 cents. The Adjusted World Price (AWP) for cotton declined to 66.53 cents per pound, effective today (April 28), down from 70.82 cents per pound the prior week. The AWP had moved back above 70 cents the past two weeks.

— Questions on Erdogan’s health. Turkish President Recep Tayyip Erdogan has been off the campaign trail for several days — just weeks before a tough election — after falling ill during a live TV interview. Turkey’s May 14 election will be tight: The economy is struggling, Erdogan’s response to devastating February earthquakes was criticized, and his main opponent is ahead in the polls. During the interview, the screen went blank after Erdogan failed to answer a question. Speculation spread that he had suffered a heart attack, but his office said it was a stomach flu. After undergoing gastrointestinal surgery in 2011, Erdogan dismissed reports that he had cancer.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum |