Biden’s Trade Policy Comes Under Attack

More U.S. corn to China | State of U.S. dairy industry | Ag checkoffs | FAPRI vs CBO

|

In Today’s Digital Newspaper |

USDA daily export sale: 178,000 metric tons corn to China during 2022-2023 marketing year.

More sales of U.S. corn to China. USDA data for the week ended March 23 showed additional sales of U.S. corn to China during the week. For 2022-23, net sales of 709,158 tonnes of corn, 56,930 tonnes of sorghum, 153,038 tonnes of soybeans and 85,021 running bales of upland cotton were reported. No sales for 2023-24 were reported. Sales for 2023 of 2,520 tonnes of beef and 135 tonnes of pork were also reported. Sales of U.S. corn to China increased in the data reported by USDA the past two weeks and there have been additional sales announced via USDA’s daily export sales reporting system over the past week that will be included in the sales data to be released next Thursday. Sales have totaled more than 2.9 million tonnes in the past two weekly reports alone.

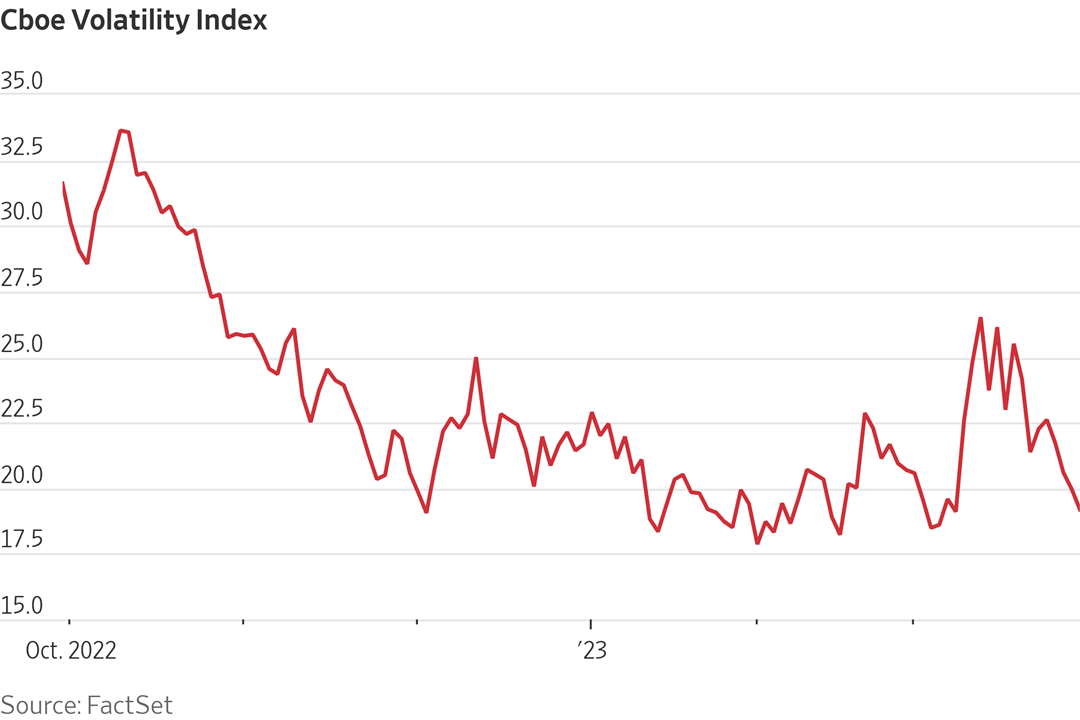

Wall Street's "fear gauge" indicates that traders are already betting banking turmoil is behind us. The Cboe Volatility Index, or VIX, hovered around 19 on Wednesday, a level indicative of complacency. Also, bigger concerns for the housing sector haven't materialized, with pending home sales rising for a third straight month in February and mortgage applications increasing over the past week

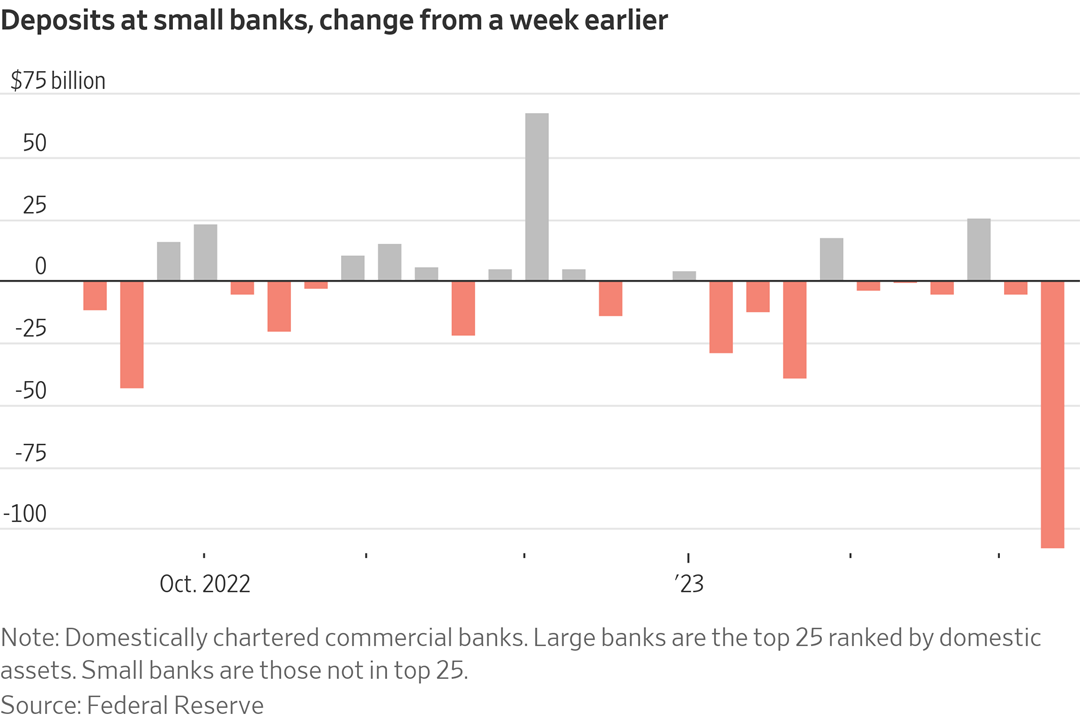

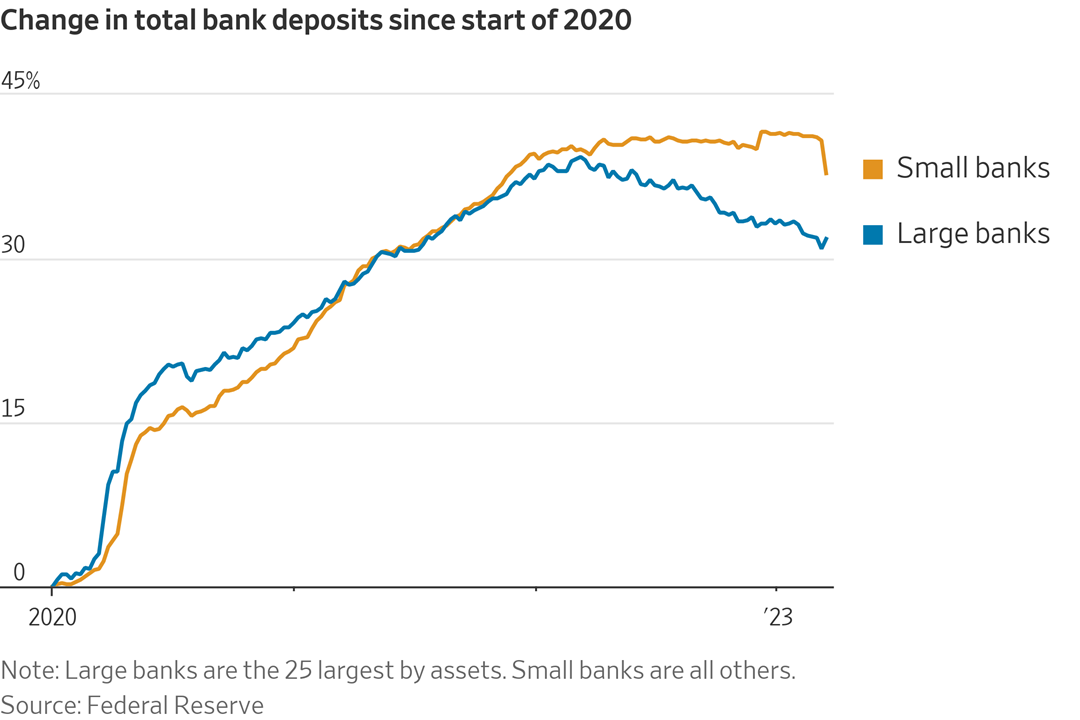

But the WSJ notes that small banks are losing deposits to big banks. Their customers are about to feel it. More in market section.

Short sellers made $14.3 billion in paper profit from their bearish bets on global banking stocks in March, according to analytics firm S3 Partners, as the collapse of U.S. lender Silicon Valley Bank reverberated across the sector.

The Nasdaq 100 Index, a heavyweight collection of technology companies, closed in bull-market territory yesterday as investors flooded back into many of the stocks that took a bashing last year. The Nasdaq fell 32.5% last year, making it one of the worst performing indexes in 2022. The tech-heavy benchmark is now up more than 20% from its closing low on Dec. 28.

Is Spain a bellwether for disinflation? The Sevens Report: “Spanish CPI, which was the first inflation indicator to warn of the stall in disinflation, rose just 3.3% y/y, less than the 3.8% expectation and much lower than the 6% y/y reading last month. That’s offering some initial hope that disinflation has restarted.

Moscow’s Federal Security Service said it had detained Wall Street Journal reporter Evan Gershkovich, a U.S. citizen, for what it described as espionage. “The Wall Street Journal vehemently denies the allegations from the FSB and seeks the immediate release of our trusted and dedicated reporter, Evan Gershkovich,” the WSJ said. More in Russia/Ukraine section.

Ukrainian officials admitted that Russian forces have had some success in their assault on Bakhmut, a contested town in the country’s east. Ukrainian troops, however, are “holding” on, according to the army. Meanwhile, Rafael Grossi, the head of the UN’s nuclear watchdog, visited the Zaporizhia nuclear power station — which is occupied by Russia — and called for “every possible measure” to protect the plant.

Taiwan’s president, Tsai Ing-wen, arrived in New York, as she transits through America en route to Belize and Guatemala. Tsai was greeted by crowds of supporters and protesters. She is expected to meet House Speaker Kevin McCarthy (R-Calif.) on her way back. China said any meeting “could lead to serious confrontation.” The U.S. urged China not to “overreact” as such trips by Taiwanese leaders were a “common occurrence.”

House Republicans' budget proposal is still months away, complicating debt-ceiling talks with President Biden. The chairman of the House Budget Committee, Texas Rep. Jodey Arrington, said in an interview with the WSJ that the GOP budget process could push it past the deadline for Congress to act on raising the debt ceiling and avoid a U.S. default on debt payments and other government obligations. Instead, he and other Republicans want to start talks immediately on a shorter list of demands for this year, without a formal budget in hand. For more, see the Policy section.

A scathing attack on President Biden’s trade policy come via Adam Posen, president of the Peterson Institute for International Economics. See Trade Policy section.

Texas Reps. Vicente Gonzalez and Henry Cuellar, both Democrats, said they plan to vote for Republicans’ energy and permitting bill.

Fuel retailers are in DC to push for an EPA waiver extending sales of lower-cost E15 biofuel blends this summer.

There’s a major push for reform in various ag-related checkoff programs. And if you think the debate on a new farm bill is contentious, the history of past attempts at checkoff reform says this is the battle to watch. But most of the battle on this topic is behind closed doors.

Top priorities for dairy executives in 2023 are explored in McKinsey’s fifth annual survey of dairy executives as well as almost 50 interviews with industry leaders. See details below.

Dozens of tech leaders, including Elon Musk, signed a letter calling for artificial intelligence labs to stop developing powerful AI systems for at least six months, citing "profound risks to society and humanity… Recent months have seen AI labs locked in an out-of-control race to develop and deploy ever more powerful digital minds that no one —- not even their creators — can understand, predict, or reliably control," the letter said. If a pause is not put in place soon, the letter said governments should step in and create a moratorium. But naysayer note that China and other countries would continue their AI research.

Pope Francis was hospitalized after complaining of breathing difficulties and is being treated for a respiratory infection.

|

MARKET FOCUS |

Equities today: Global stock markets were mixed to higher overnight. U.S. Dow opened around 170 points higher but is currently up around 85 points. In Asia, Japan -0.4%. Hong Kong +0.6%. China +0.7%. India closed. In Europe, at midday, London +0.9%. Paris +1.4%. Frankfurt +1.3%.

U.S. equities yesterday: The Dow rose 323.35 points, 1.00%, at 32,717.60 The Nasdaq gained 210.16 points, 1.79%, at 11,926.24. The S&P 500 added 56.54 points, 1.42%, at 4,027.81.

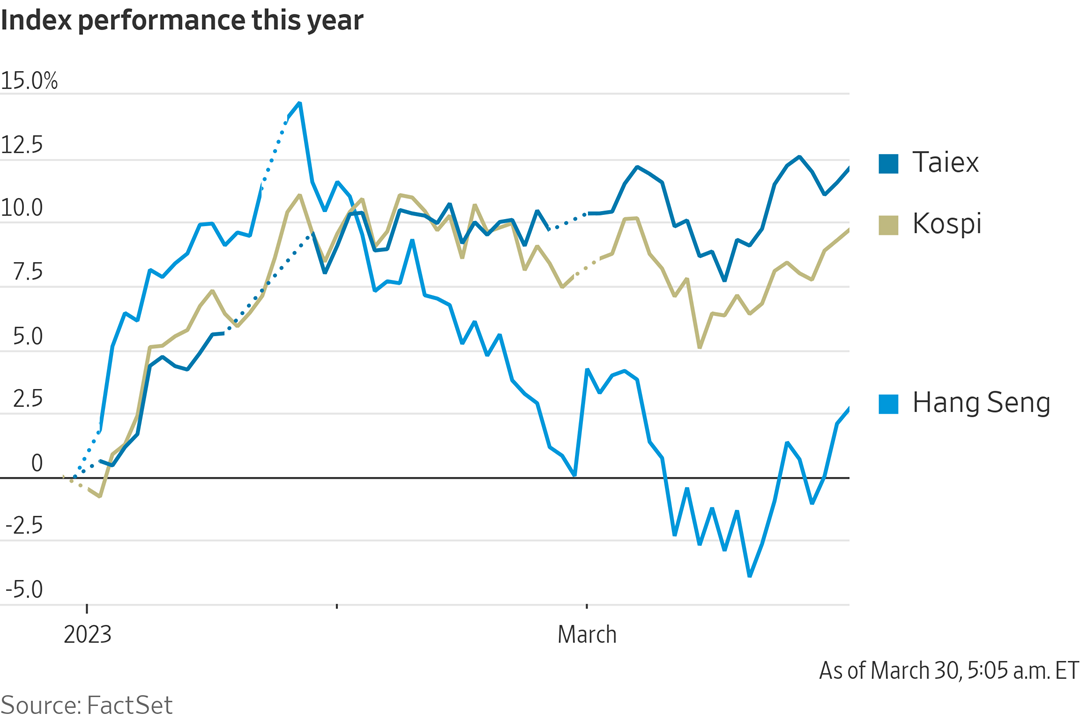

Asia’s best-performing stock index this year: Taiwan's Taiex index has gained more than 12% since the start of 2023, according to FactSet data. The only Asian benchmark that comes close is South Korea's Kospi, which is up 9.7%.

Agriculture markets yesterday:

- Corn: May corn rose 3 1/4 cents to $6.50 1/2, marking a mid-range close.

- Soy complex: May soybeans rose 9 1/2 cents at $14.77 1/4 and nearer the session high. May soybean meal rose 30 cents at $458.20 and nearer the session low. May bean oil gained 33 points at 55.38 cents, nearer the session high on more short covering.

- Wheat: May SRW futures rose 5 cents and settled at $7.04 3/4, nearly 20 cents off the day’s high. May HRW futures fell 2 cents and settled at $8.70 1/2, near the bottom of today’s trading range. Spring wheat futures fell 4 1/2 cents to $8.78, near the daily low.

- Cotton: May cotton rose 24 points to 82.76 cents, ending the session above the 40-day moving average.

- Cattle: Nearby April live cattle futures climbed 87.5 cents to $165.825 Wednesday, while the June contract gained 75 cents to $159.65. Expiring March feeder futures slipped 27.5 cents to $191.45, but the May future jumped $1.725 to $202.525.

- Hogs: April lean hogs fell 97 1/2 cents to $76.775. June lean hogs dropped $1.90 at $90.825. Prices closed nearer the session lows.

Ag markets today: Price action was light and two-sided overnight, but a mostly firmer tone has developed this morning. As of 7:30 a.m. ET, corn futures were trading 1 to 4 cents higher, soybeans were 2 to 4 cents higher, SRW wheat futures were around 2 cents higher, HRW wheat was 5 to 7 cents higher and HRS wheat was mostly 1 to 2 cents higher. Front-month crude oil futures were around 65 cents higher, and the U.S. dollar index was about 225 points lower.

Technical viewpoints from Jim Wyckoff:

On tap today:

• U.S. jobless claims are expected to rise to 195,000 in the week ended March 25 from 191,000 one week earlier. (8:30 a.m. ET) UPDATE: The number of Americans filing for unemployment benefits rose by 7,000 from the previous week to 198,000 on the week ending March 25, slightly above expectations of 196,000. While surpassing expectations, the result remained at a low level by historical standards and continued to point to a stubbornly tight labor market, in line with the hot payroll figures for February and the Federal Reserve's outlook of low unemployment. The four-week moving average, which removes week-to-week volatility, rose by 2,000 to 198,250. On a seasonally unadjusted basis, initial claims rose by 10,906 to 223,913, with significant increases in Michigan (+4,465) and Massachusetts (+2,693).

• U.S. gross domestic product for the fourth quarter is expected to expand at a 2.7% annual pace from the prior quarter, unchanged from a previous reading. (8:30 a.m. ET) UPDATE: The U.S. economy expanded an annualized 2.6% on quarter in the last three months of 2022, slightly down than initial estimates of a 2.7% rise. Consumer spending rose 1%, below 1.4% in the second estimate, as spending on services advanced much less than initially estimated (1.6% vs 2.4%). Also, spending on goods went down 0.1%, compared to initial estimates of a 0.5% decline, with jewelry leading the drop. Also, the contribution from net trade was revised lower (0.42 pp vs 0.46 pp), with both exports (-3.7% vs -1.6%) and imports (-5.5% vs -4.2%) falling more. Meanwhile, private inventories added 1.47 to the growth, in line with the second estimate, led by petroleum, coal products and utilities. Fixed investment declined less (-3.8% vs -4.6%), due to equipment (-3.5% vs -3.2%) while intellectual property products increased (6.2% vs 7.4%). Residential investment continued to contract although at a slightly smaller pace (-25.1% vs -25.9%). Considering full 2022, the GDP expanded 2.1%.

• USDA Weekly Export Sales report, 8:30 a.m. ET.

• Federal Reserve speakers: Boston's Susan Collins to the National Association for Business Economics at 12 p.m. ET, Richmond's Thomas Barkin to the Virginia Council of CEOs at 12:45 p.m. ET, and Minneapolis's Neel Kashkari to the Minnesota Housing Partnership Investor Council at 1 p.m. ET.

• U.S. Treasury Secretary Janet Yellen speaks to the National Association for Business Economics at 3:45 p.m. ET.

• China's official purchasing managers indexes for manufacturing and services sectors are out at 9:30 p.m. ET.

WSJ: Small banks are losing to big banks. Their customers are about to feel it. The collapse of Silicon Valley Bank and Signature Bank is testing Americans’ faith in the regional and community banks that supply credit to a big chunk of the nation’s entrepreneurs and businesses, including many in the ag sector. The 25 biggest U.S. banks gained $120 billion in deposits in the days after SVB collapsed, according to Federal Reserve data. All the U.S. banks below that level lost $108 billion over the same period, the largest weekly decline in smaller banks’ deposits in dollar terms on record. The WSJ reports (link) that “the panic has subsided, but the deposit swings could have long-lasting repercussions for the communities served by smaller banks. Banks need deposits to make loans; if deposits fall, lending is almost sure to follow.”

WSJ: A slow-motion banking crisis. In recent decades financial crises have tended to be fast-moving and violent. They usually revolve around a handful of companies or countries, and often climax over a weekend, before Asian markets open. That template is grounds for hope that the worst of the current turmoil may have passed. But Wall Street Journal writer Greg Ip writes (link) that another template is also possible: “a corrosive, slow-motion crisis that could force many banks in coming years to shrink or be acquired, a process that also hampers the supply of credit.”

Market perspectives:

• Outside markets: The U.S. dollar index was weaker on strength in the euro and British pound. The yield on the 10-year U.S. Treasury note was firmer, trading around 3.58%, with a firmer tone in global government bond yields. Crude oil was higher, with U.S. crude around $73.50 per barrel and Brent around $78.05 per barrel. Gold and silver futures were registering gains, with gold around $1,992 per troy ounce and silver around $24.05 per troy ounce.

• North American rail traffic fell 4.8% in the week ended March 25, according to AAR, with automotive and agriculture leading gains and intermodal declining significantly. But a surge in China coal imports could spur demand in the coming months, according to Bloomberg Intelligence.

• Sugar is becoming ever more expensive, raising costs for the industry and keeping up pressure on food inflation. Prices of refined sugar surged to the highest in more than a decade this week, while the raw variety is near the costliest in over six years. Supply is tightening, mainly because India, one of the top shippers, has cut exports and more sweetener is being diverted to biofuel. Link to more via Bloomberg.

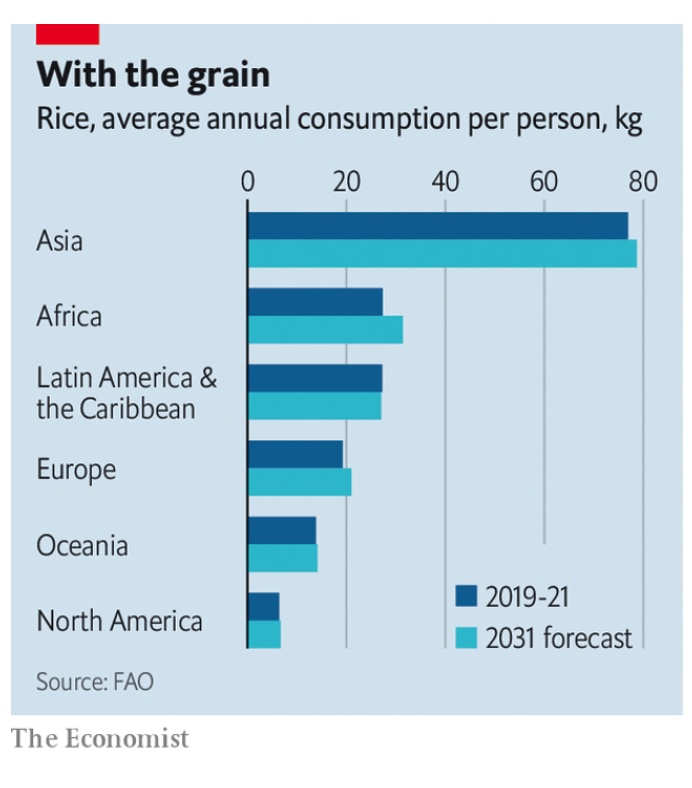

• 77kg, the amount of rice the average Asian consumes a year according to the United Nations. Link for details.

• Ag trade: Turkey purchased 395,000 MT of milling wheat from unspecified origins.

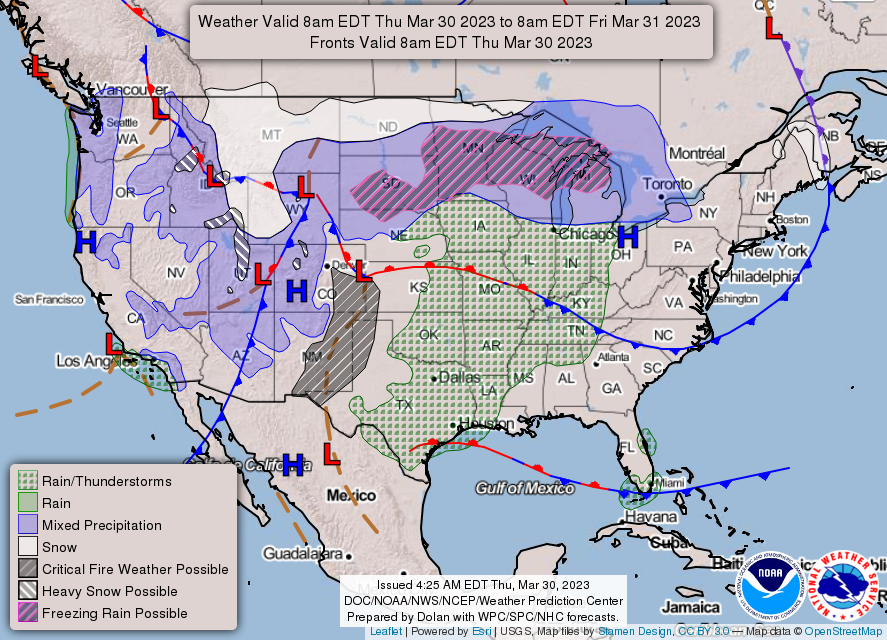

• NWS weather outlook: Strong storm system will result in severe thunderstorms and heavy rain for the Plains/Mississippi Valley; Critical Risk of Fire Weather for the Central/Southern High Plains... ...Heavy snow, blizzard conditions, and accumulating freezing rain forecast for the Northern Plains and Upper Midwest Friday... ...Locally heavy mountain snow over the Intermountain West ahead over another Pacific storm system impacting the Pacific Northwest Friday.

Items in Pro Farmer's First Thing Today include:

• Mostly firmer grain prices this morning

• Argentine grain inspectors to launch strike

• H&P Report expected to show contraction phase has ended

• Not if cash cattle will strengthen, but how much

• Cash hog market weakens again

|

RUSSIA/UKRAINE |

— Russia’s security service arrested Wall Street Journal reporter Evan Gershkovich, a U.S. citizen, on espionage charges. The paper said it is “deeply concerned” for his safety. The move is likely to escalate tensions between Russia and the U.S. The FSB, Russia’s main security agency, said it had detained Gershkovich, alleging that, “acting on the instructions of the American side,” he had collected information constituting a state secret about the activities of an enterprise of Russia’s “military-industrial complex.” The WSJ said it vehemently denies the allegations and seeks his immediate release. The FSB said an espionage case had been opened against him. Gershkovich, a U.S. citizen, is accredited to work as a journalist in Russia by the country’s foreign ministry, the FSB said.

Nonprofit advocacy group Reporters Without Frontiers lists Russia as one of the worst countries for independent journalism, saying it’s gotten even worse since the nation’s forces invaded Ukraine.

— Western tank employment coming. As Russia's Wagner mercenary group continues to suffer major losses in the key area of Bakhmut, Ukraine's defense minister said Wednesday that Western tanks will likely be deployed as early as next month. German Leopard tanks, which have begun arriving in Ukraine, will be part of the counteroffensive campaign in April or May, Ukrainian Defense Minister Oleksii Reznikov said. Germany also said this week it will increase military support to Ukraine by $13 billion.

— Perspective on Cargill and Viterra exiting Russian grain export market. We previously have reported that the two biggest western shippers of Russian grain, Cargill Inc. and Viterra, will halt purchases for export in a shift that observers say will give local firms more control over shipments.

Viterra and Cargill both ranked in the top six exporters of Russian wheat in the first half of the season.

Two of the big Russian firms that could benefit from the traders’ exit are state-backed, Bloomberg reports (link). Grain Gates, the second-biggest exporter, is a partner of Demetra Trading. State-controlled VTB Group is one of the shareholders of Demetra. OZK, which is also known as United Grain Co., is owned by the state and Demetra.

|

POLICY UPDATE |

— Time for checkoff reform. More than 130 agricultural and food groups want the House and Senate Agriculture committees to tighten the rules governing checkoff programs. The coalition supports the Opportunities for Fairness in Farming Act, which would prohibit checkoff programs from contracting with organizations that lobby on agricultural policy and require them to publish checkoff program budgets and expenditures. Publishing such information could prove very revealing for a few groups.

— Big difference between FAPRI and CBO on commodity price forecasts could impact new farm bill. The Food and Agricultural Policy Research Institute at the University of Missouri is out with its new forecast of farm program costs (link). They signal significantly higher commodity prices than the Congressional Budget Office (CBO) is using for its estimate. The big difference could impact the drive to update Title I safety net programs.

Also, FAPRI thinks many producers will choose ARC over PLC because of the existing caps on PLC reference prices (and thus the push for adjustments), which means FAPRI projects much higher costs for ARC and lower payments for PLC than CBO currently projects.

— House Republicans aren’t planning any more detailed debt-limit proposals, according to the Budget Chairman Jodey Arrington (R-Texas), who said the bullet points in the letter Speaker Kevin McCarthy (R-Calif.) sent to President Joe Biden represent the conference’s position. McCarthy’s call for discretionary spending limits, rescinding unspent Covid funds, stricter welfare work requirements, energy-permitting measures, and border security resources are effectively the Republican offer on the debt limit, Arrington told reporters yesterday. Arrington also said a budget resolution would have to wait, adding the blueprint will come “when we’re done here” with budget hearings.

“We need action on the debt limit immediately because of the state of the fiscal union,” Arrington said. “We have to get consensus on… what the fiscal controls are and move forward.” But those fiscal controls are what Democrats are chafing at as they want to see a “clean” debt limit increase — one that does not have any spending-reduction ties. As for the Republican budget plan, Arrington told reporters after a hearing that they are getting closer to agreement on a plan that could cut the deficit by at least $3 trillion over 10 years. “I think the will's there in our conference, and we're making great strides and getting agreement on what will go into our budget,” Arrington said. “And it will be starkly different than the president's proposal.”

— Vilsack comments on several topics during Wednesday Senate Ag Appropriations hearing. Some highlights:

- Said USDA deserves more funding rather than the across-the-board cuts that some Republicans have proposed. “This budget is at a critical point, a transformational point,” Vilsack said, adding he is disturbed by proposals from Republicans if Congress is to agree to raise the debt ceiling.

- The “most conservative” proposals from Republicans, Vilsack said, would result in 250,000 mothers and children not getting food assistance through the Supplemental Nutrition Assistance Program for Women, Infants and Children (WIC), 40,000 rural rental units for lower income people being lost, 84,000 farmers not getting technical assistance and 6,600 farmers not getting the credit they need to stay in farming.

- Vilsack again noted that despite record farm income in recent years, 50% of farmers did not make a profit and 40% made most of their money from off-farm jobs, leaving only the 10% of farmers with more than $1 million in sales to make substantial incomes from farming and ranching.

- Vilsack said federal pay scales are not competitive with the private sector, adding that the Farm Service Agency has a hard time retaining loan officers and said the Animal and Plant Health Inspection Service has the same problem with veterinarians. Vilsack said the problem is not limited to USDA but is a government-wide problem. Vilsack said he asked the Office of Personnel Management to provide a better understanding of how to reclassify some positions to be able to recruit employees.

- School meals. Sen. Susan Collins (R-Maine), ranking member on the full Senate Appropriations Committee, said school food service directors in her state have told her that USDA’s proposed rule to reduce sugar and sodium in school meals will result in foods that “won’t taste like anything” the students are used to eating and will end up in garbage cans. “An uneaten meal is not nutritious,” Collins said. Vilsack said USDA has reached out to school food service professionals, calling them “heroes during the pandemic,” and signaling there would be an announcement this week of an extension of the comment period on the rule. He further said that many of the reduced-sugar products are already in the marketplace and used in the adult and child care program, and said some of the problem should be addressed by a longer implementation period and grants to rural schools.

- Concentration in cattle industry. Sen. John Hoeven (R-N.D.) said, “We have to do more to address the concentration in the slaughter industry, particularly in cattle,” and said he hopes to make the cattle contract library permanent in the new farm bill. Hoeven also noted concerns about the cost of cattle identification tags.

|

CHINA UPDATE |

— Taiwan President Tsai Ing-wen arrived for her first trip to the U.S. in over three years, in the face of threats from China. Tsai’s presence in the U.S. is nonofficial, in line with U.S. policy toward China, and is technically considered a transit, according to U.S. officials. Taiwan predicts a less severe reaction from China to an expected meeting between President Tsai Ing-wen and U.S. House Speaker Kevin McCarthy, according to a senior Taiwan security official. Tsai arrived in New York on her way to Central America, and will stop off in Los Angeles next week on her way back. The White House urged China not to use a "normal" stopover as a pretext to increase aggressive activity.

— Ursula von der Leyen, the president of the European Commission, said the EU must have a “bolder” approach to a “more assertive” China, in a speech ahead of a visit to the country next week. Von der Leyen called for stricter controls over trade in sectors with military importance, such as AI. She also implied that an EU/China commercial pact, agreed in 2020 but never implemented, might be shelved.

— Zelenskyy urges China’s Xi to Visit Ukraine. Ukrainian president warns that Moscow would be emboldened by a victory in the eastern city of Bakhmut. Link to details.

|

TRADE POLICY |

— Taking on the Biden administration trade policy. Adam Posen, president of the Peterson Institute for International Economics, blasts the “worker centered” trade policy of President Biden. Posen, a former Bank of England policy maker and Federal Reserve economist, penned a scathing review of Biden’s trade policies in Foreign Policy magazine (link). Posen writes that that the Biden administration’s effort to “take away production from others in a zero-sum way” will ultimately backfire and leave America worse off in the end. Some of his comments:

- Decoupling from China will raise costs for U.S. consumers and businesses.

- Disregarding the interests of U.S. allies will erode U.S. influence abroad.

- Made in America policies raise costs and make U.S. exports less competitive.

- Subsidy races breed corruption and stifle innovation.

- Friend-shoring will increase the fragility of global supply chains.

- Industrial planning will not significantly reduce income inequality.

U.S. Trade Representative Katherine Tai testified that previous trade deals have made the U.S. economy more vulnerable and led to the decline of American industries. “We are not pursuing traditional fully liberalizing trade agreements, because we see those as part of the problem that we are trying to correct for,” Tai told the Senate Finance Committee.

— Vilsack comments on biotech corn trade dispute with Mexico. By banning imports of genetically modified white corn, President Andrés Manuel López Obrador of Mexico has put himself “in a political situation that is very hard for him to move out of,” USDA Secretary Tom Vilsack told senators during a Wednesday hearing.

|

ENERGY & CLIMATE CHANGE |

— The most affordable EV on the market today: The Chevy Bolt, which with government subsidies now costs $26,200 to own, less than most combustion models.

Meanwhile, Cox data show that monthly payments and interest charges for consumers with lower credit scores have soared. A buyer with a sub-prime FICO credit score of 580 is paying $1,180 a month, reflecting a 19.4% interest rate, for a $50,000 vehicle. A buyer with a strong 760 FICO score would pay $835 on a 6.3% note for the same vehicle, Cox found.

— Interior gets $264 million in oil-drilling auction. The Department of Interior (DOI) offshore lease sale for oil and gas exploration in the Gulf of Mexico saw oil companies bid $264 million for the rights to drill on tracts in the 1.7-million-acre sale. Chevron offered $108 million for the rights on 75 tracts while BP won bids on 37 tracts for $46.6 billion and Shel Plc submitted 21 successful bids totaling $20.1 billion.

Perspective: The sale saw a 38% increase in bids from the previous auction, marking the most offered in a sale since 2017.

— Biden DOE releases offshore wind energy strategy. The Department of Energy (DOE) Wednesday released its Offshore Wind Energy Strategy outlining the administration’s plans to meet a goal of deploying 30 gigawatts (GW) of offshore wind energy by 2030 and 110 GW or more by 2050. There are currently 40 GW of offshore wind in various stages of development.

One of the goals in the strategy is to lower costs for the effort, from $73 per megawatt-hour (MWh) to $51 per MWh by 2030, and to develop a domestic supply chain, and inform sustainable deployment of fixed-bottom offshore wind.

The plan also aims to reduce floating offshore wind energy efforts costs by over 70% to $45/MWh by 2035.

— The Treasury Department's guidance on domestic electric vehicle battery sourcing requirements, which is expected on Friday, will result in fewer vehicles receiving the full or partial $7,500 tax credit, according to a U.S. official (link). Meanwhile, sometimes centrist Sen. Joe Manchin (D-W.Va.) said during an industry conference that he would be "willing to go to court" to fight for his interpretation of the battery sourcing law he wrote last year, as he anticipates the Treasury Department will be too lax with the restrictions.

— EU sets higher renewable energy content. European Union (EU) governments reached a provisional agreement to boost renewable energy targets, agreeing to set a goal of getting 42.5% of energy from renewable sources like wind and solar by 2030, with the potential for the target to reach 45%.

The current goal by 2030 is for 32% to come from renewable sources.

The EU as a whole got 22% of its energy from renewable sources in 2021, but there are wide variations within the 27-country bloc.

The EU also has a goal of getting 29% of energy used the transport sector coming from renewables by 2030.

The new targets are seen boosting significant investment in wind and solar installations, upping production of renewable gasses and updating the bloc’s power grids to bring in more renewable energy.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Top priorities for dairy executives in 2023. To gain insights into the strategic priorities of dairy industry leaders in today’s world, McKinsey conducted its fifth annual survey of dairy executives as well as almost 50 interviews with industry leaders. Link to article which examines the results, exploring dairy executives’ top strategic priorities of growth, resilience, and sustainability. Despite current geopolitical and economic volatility, McKinsey said it heard “great excitement and optimism for the future of dairy in North America.”

— Italy plans to ban lab-grown food. The Italian government approved a draft bill banning lab-grown food. Italy’s biggest farmers’ association, Coldiretti, lobbied for the ban. The government has said the goal is to “safeguard our nation’s heritage.” Critics of the bill, however, which would need to be passed by both houses of parliament to be turned into law, say the government has “committed a new crime” by prohibiting an environmentally friendly technology.

|

POLITICS & ELECTIONS |

— Quinnipiac poll: Biden leading Trump, trailing DeSantis. President Joe Biden leads former President Donald Trump in a new Quinnipiac University poll released Wednesday, but trails likely GOP contender Ron DeSantis. According to the poll, Biden would defeat Trump 48% to 46% if the 2024 presidential election was held today, but he would lose to DeSantis by that same margin. The difference is due to more independent voters favoring the Florida governor.

|

CONGRESS |

— Senate votes to repeal Biden/EPA WOTUS rule. The Senate on Wednesday passed a resolution, 53–43, to repeal a Biden administration regulation of U.S. waters and wetlands — the Waters of the U.S. (WOTUS) rule. The disapproval resolution passed the House on March 9, 227–198. It was passed in accordance with the Congressional Review Act, which allows Congress to strike down regulations within 60 days of passage. However, President Joe Biden is expected to veto the resolution. It is unlikely Republicans would get the needed two-thirds majority to override a veto. In June 2021, the Environmental Protection Agency (EPA) and the Department of the Army announced that they would revise what qualifies as “waters of the United States” (WOTUS). The regulation was published in the Federal Register on Jan. 18 and took effect on March 20. A court ruling halted the new regulation in two states — Texas and Idaho.

— The House is set to approve the GOP's energy package in a vote today despite a veto threat from President Joe Biden and a guarantee that the slate of bills would be "dead on arrival" in the Democratic-controlled Senate. The Lower Energy Costs Act includes provisions that would boost domestic oil and gas production, expedite permitting for energy projects and repeal parts of the Inflation Reduction Act.

— Senate voted 66-30 to revoke the law that authorized the Iraq war, more than two decades after Congress approved it. The bill now heads to the House, where it has bipartisan support but isn’t guaranteed to get a vote, due to continued opposition from some Republicans. The Biden administration supports the repeal effort and says the two authorizations that the Senate voted on will have no impact on current overseas missions.

— Fetterman set to return to Senate on April 17. Sen. John Fetterman (D-Pa.) plans to return to the Senate the week of April 17 after more than a month of inpatient treatment for depression, according to reports. Fetterman began receiving treatment at Walter Reed National Military Medical Center in mid-February. Republicans are awaiting the return of Minority Leader Mitch McConnell (Ky.) after his recovery from a fall.

Democrats hope moving closer to full strength for their next five-week work period will give them room to move Biden administration picks, among them Labor secretary nominee Julie Su and federal court nominees without GOP support. Feinstein’s absence prevented the Judiciary Committee from approving more picks in recent weeks.

|

OTHER ITEMS OF NOTE |

— Pope Francis was hospitalized yesterday as he had breathing difficulty in recent days and is seeking treatment for a respiratory infection, the Vatican said. He had delivered his weekly address earlier in the day. It’s less than two weeks until Easter Sunday, one of the busiest times of year for the pope. The 86-year-old’s schedule has been cleared through the end of the week.

— Pause on AI research? Elon Musk and Steve Wozniak are among hundreds of high-profile technologists, entrepreneurs and researchers urging AI labs to “immediately pause” work on artificial intelligence systems for at least six months so humanity can evaluate the risks of the “out-of-control race” to deploy ever more advanced products.

— Gold digger. He was digging for gold in Australia — and found a nugget worth $160,000. Link for more.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum |