U.S. Adds Robust 311,000 Jobs in February Despite Fed's Rate Hikes, Jobless Rate Ticks Up

USDA wants FSA to become ‘lender of first opportunity’

|

In Today’s Digital Newspaper |

U.S. economy adds more jobs than expected, 311,000, but unemployment rate ticks higher at 3.6%. Details below.

Today’s jobs report shifted expectations on the Fed rate decision at the March 21-22 meeting. CME Fed funds futures probabilities for a 25-basis-point increase reached 51.6% in the wake of the jobs data with a 50-basis-point increase falling to 48.4%. Just one day ago, those stood at 68.3% for the bigger rise and 31.7% for the smaller increase.

Silicon Valley bank shares halted after plunging 64% in pre-market — VC Funds tell firms to withdraw funds. Shares of Silicon Valley Bank Financial Group were halted after plunging further in pre-market Friday, following measures it took to shore up its financial position Thursday, prompting some venture capital funds to urge their portfolio firms to withdraw funds — and raising fears of a bank run. More on the topic in Market section.

A dead-on-arrival Biden budget is far more a messaging exercise than anything else. And that is the clear goal of the proposals which White House sources know have no chance to be approved. It lays out the president’s policy priorities for the second half of his term and could test some themes of his expected re-election campaign. Today’s dispatch explores some of the key proposals Biden wants across most of the U.S. government.

President Biden, speaking in Philadelphia, said he’s ready to meet with House Speaker Kevin McCarthy (R-Calif.) to discuss funding the government in the fiscal year that begins this fall at “any time… if he has his budget” — a barb aimed at House Republicans, who have not reached consensus about their demands. The president later told reporters, “I'm ready to meet with him tomorrow if he shows me the budget."

Ukraine's capital restored most of its power supply on Friday, officials said, as the country again responded swiftly and defiantly to the latest Russian missile and drone barrage targeting critical infrastructure.

President Joe Biden and European Commission President Ursula von der Leyen are set to unveil today a plan that the White House hopes will help turn the page on the ongoing spat between the U.S. and European Union over electric vehicle tax credits.

Norfolk Southern CEO apologized for the Ohio train derailment. In testimony before the Senate yesterday, Alan Shaw said he was “deeply sorry” about the incident. But the railway chief stopped short of offering to pay for long-term damage to the community of East Palestine, or endorsing rail safety legislation.

The U.S. has privately urged some of the world’s largest commodity traders to shed concerns over shipping price-capped Russian oil, according to a report in the Financial Times.

Source: White House in initial talking stage to push new trade agreements ahead. More in Trade Policy section.

|

MARKET FOCUS |

Equities today: Global stock markets were mostly lower overnight. The Dow opened around 50 points lower. In Asia, Japan -1.7%. Hong Kong -3%. China -1.4%. India -1.1%. In Europe, at midday, London -1.7%. Paris -1.3%. Frankfurt -1.4%.

U.S. equities yesterday: The Dow finished down 543.54 points, 1.66%, at 32,254.86. the Nasdaq declined 237.65 points, 2.05%, at 11,338.35. The S&P 500 fell 73.69 points, 1.85%, at 3,918.32.

Agriculture markets yesterday:

- Corn: May corn futures fell 14 cents and settled at $6.11 2/4, the lowest level since August 2022.

- Soy complex: May soybeans fell 7 cents to $15.10 3/4 and nearer the session low. May soybean meal rose $1.20 at $486.90 and near mid-range. May soybean oil dropped 202 points at 57.06 cents, near the session low and hit a seven-month low.r

- Wheat: May SRW futures fell 21 3/4 cents to settle at $6.65 3/4, near the session low. May HRW futures fell 23 cents to $7.77 1/4, also on the session low. Spring wheat futures fell 22 3/4 cents to $8.15 3/4.

- Cotton: May cotton fell 44 points at 82.18 cents and nearer the session low.

- Cattle: Nearby April live cattle futures slid 65 cents to $164.80 Thursday, while most-active April feeder futures fell 92.5 cents to $199.15.

- Hogs: April lean hogs edged 67.50 cents lower to $85.075, a mid-range close after marking the highest intraday level since Feb. 27.

Ag markets today: Soybeans traded higher on corrective buying early in the overnight session but are weaker this morning, while corn and wheat pivoted around unchanged. As of 7:30 a.m. ET, corn futures were trading fractionally to a penny higher, soybeans were 3 to 6 cents lower, winter wheat futures were 1 to 3 cents higher and spring wheat was steady to 2 cents lower. Front-month crude oil futures were around 75 cents lower, and the U.S. dollar index is down about 100 points.

Technical viewpoints from Jim Wyckoff:

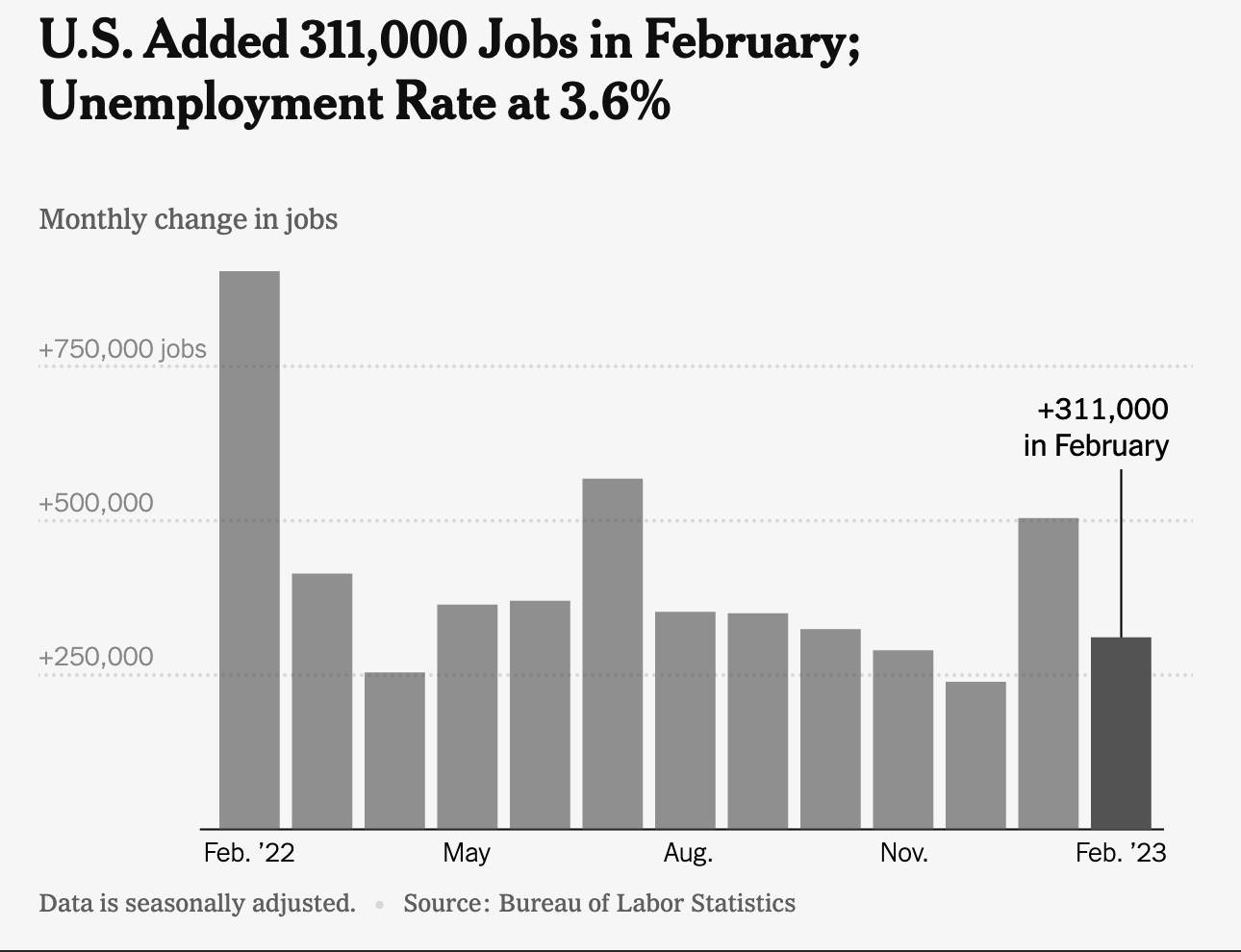

U.S. economy adds more jobs than expected. The U.S. economy created 311,000 jobs in February, above market expectations of 205,000 and the 183,000 monthly average between 2010 and 2019. Biggest job gains occurred in leisure and hospitality, retail trade, government, and health care. Employment declined in information and in transportation and warehousing. Meanwhile, the jobless rate rose to 3.6%, from 3.4%.

Job gains were an average of 343,000 the past six months. The December and January numbers were revised down slightly, with January down 13,000 and December down 21,000 from prior marks.

In February, average hourly earnings — a measure of wage growth — rose 0.2%. Over the year through February, hourly earnings are up 4.6%.

Bottom line: A mixed report. More jobs added than expected, but unemployment and participation rate ticked up. The prime age labor force participation — the number of people working or looking for work — is back to 83.1%, the pre-pandemic mark. The Fed will remain cautious.

Market impacts: Stocks initially rose following the numbers, with the S&P 500 coming back from earlier losses to trade 0.2% higher, but U.S. equities opened lower. The two-year Treasury yield, which is sensitive to changes in interest rate expectations, slumped, erasing a gain over the past couple of weeks.

The jobs report also shifted expectations on the Fed rate decision at the March 21-22 meeting. CME Fed funds futures probabilities for a 25-basis-point increase reached 51.6% in the wake of the jobs data with a 50-basis-point increase falling to 48.4%. Just one day ago, those stood at 68.3% for the bigger rise and 31.7% for the smaller increase. (Source of chart: New York Times)

On tap today:

• U.S. payrolls are expected to have grown by 225,000 in February. (8:30 a.m. ET) UPDATE: See the report’s key features in item above.

• Treasury Secretary Janet Yellen speaks to a House committee on the president's budget. (9 a.m. ET)

Biden meets von der Leyen. President Joe Biden will host European Commission President Ursula von der Leyen at the White House today at 2 p.m. ET. They are expected to discuss the war in Ukraine and joint cooperation in climate policy, energy security, and critical supply chains — and Biden’s Inflation Reduction Act has been a key sticking point.

Today’s confab follows von der Leyen’s trip to Canada, during which she and Canadian Prime Minister Justin Trudeau discussed forging a “green alliance.” “We want to create, as an overarching topic, basically as an umbrella, a green alliance between the European Union and Canada,” she said. “It is to create good and well-paying jobs, to promote growth, to boost our energy and climate cooperation across the board.”

Fed Chairman Jerome Powell on U.S. debt: “We can service this debt,” Powell told senators earlier this week. “That’s not the problem. The problem is that we’re on a path where the debt is growing substantially faster than the economy, and that’s kind of, by definition, in the long run unsustainable.” Powell said solutions are up to Congress and the White House.

SVB Financial Group, a Silicon Valley bank catering to the tech industry, reported a larger-than-expected decline in deposits, sending shares of the entire banking sector tumbling, the Wall Street Journal reports (link). The moves are a sign that higher interest rates are squeezing banks. As rates rise, the market value of banks’ existing bonds falls since prices fall as yields rise. That’s putting banks in a precarious position if they have to sell to cover deposit withdrawals. Says the WSJ article: “Higher rates have hurt the tech firms that make up SVB’s client base, driving down the bank’s deposits. SVB's predicament could be a sign of deeper trouble. The Federal Deposit Insurance Corp. reported last month that banks’ unrealized losses on some types of assets totaled $620 billion as of Dec. 31, up from $8 billion a year earlier.”

Japan: The yield on the 10-year JGB fell below 0.4%, the lowest since January 23, and nearly 11bps below the top end of the BoJ's target of 0.5%, where it has been since late February after the Bank of Japan maintained its ultra-easy monetary stance in March. In his last policy meeting, Governor Haruhiko Kuroda kept overnight interest rates steady at -0.1% and preserved the bond-buying policy to control yields. The new Governor, Kazuo Ueda, is expected to end the long-term yield control policy this year. Meanwhile, the Japanese parliament has already confirmed Ueda's appointment as the new BoJ Governor starting April 9.

Market perspectives:

• Outside markets: The U.S. dollar index was weaker as the yen and British pound were firmer against the greenback. The yield on the 10-year U.S. Treasury note was lower, trading around 3.81%, with a lower tone in global government bond yields. Crude oil was under pressure, with U.S. crude around $74.90 per barrel and Brent around $80.85 per barrel. Futures were weaker in Asian action, with US crude around $75.30 per barrel and Brent around $81.25 per barrel. Gold and silver were higher ahead of the jobs report, with gold around $1,839 per troy ounce and silver around $20.20 per troy ounce.·

• Freeport LNG closer to completing first phase of restart. Freeport LNG received permission from the Federal Energy Regulatory Commission to resume operations at the final of its three liquefaction trains and other facilities included in the first phase of its restart process. Trains 2 and 3 have achieved full commercial operations and are producing over 1.5 Bcf/d of LNG, the company said.

• Ag trade: South Korea purchased 68,000 MT of corn to be sourced from the U.S., South America or Black Sea.

• La Niña has ended, and El Niño may be on the way. The climate pattern that tends to bring drier, warmer conditions to the southern half of the United States and wetter weather to the northern half has ended, NOAA said Thursday. Link for details via the New York Times.

• California, after enduring its worst drought in 1,200 years, has more water than it has seen in decades. Only 3% of the state remains in extreme drought, versus more than one-third last year, according to the U.S. Drought Monitor. Yet another “atmospheric river” will dump snow and rain on the Sierra Nevada mountain range this weekend, much of it already buried under 200% of normal snowpack.

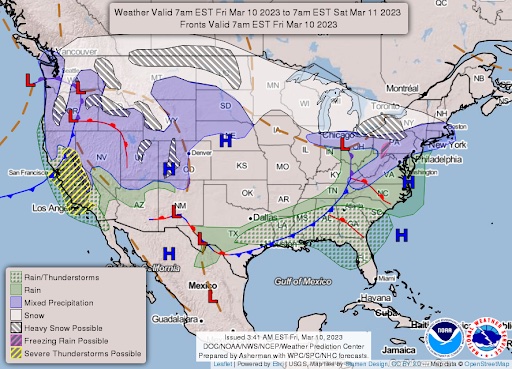

• NWS weather outlook: Heavy snow over the higher elevations over the Lower Great Lakes and Upper Midwest; Pockets of rain/freezing rain over parts of the Central Appalachians on Friday and the Middle Missouri Valley on Saturday... ...There is a Slight Risk of severe thunderstorms over parts of the Southern Plains and Lower Mississippi Valley on Saturday.

Items in Pro Farmer's First Thing Today include:

• Beans weaker, corn and wheat mixed

• Small decline in Russian wheat export tax

• Slow developing cash cattle market

• Hog traders remain cautious

|

RUSSIA/UKRAINE |

— Ukraine says Russia is running out of artillery shells, claiming key warehouses in central Russia are now almost entirely bare, and warehouse stocks elsewhere are being emptied and routed to the front lines. They also allege "improper storage and violation of service rules and regulations" have led to "visible signs of rust damage" on about half of Russia's existing artillery stockpiles. As a result, Ukrainian officials say they're expecting a noticeable "shortage in the artillery units of the Russian army within the next 2-3 months."

- German authorities said they searched a vessel that may have transported explosives used in the attack on the Nord Stream pipelines last year, signaling an investigation may yield more on who was behind it. The strike triggered a wave of accusations, with Russia blaming it on sabotage by the U.S., Ukraine and Poland.

- Russian and Belarusian players will be allowed to enter Wimbledon this year under strict conditions, though confirmation of the decision isn’t expected until next month, the Daily Mail reported. Players would be expected to compete under a neutral flag.

|

POLICY UPDATE |

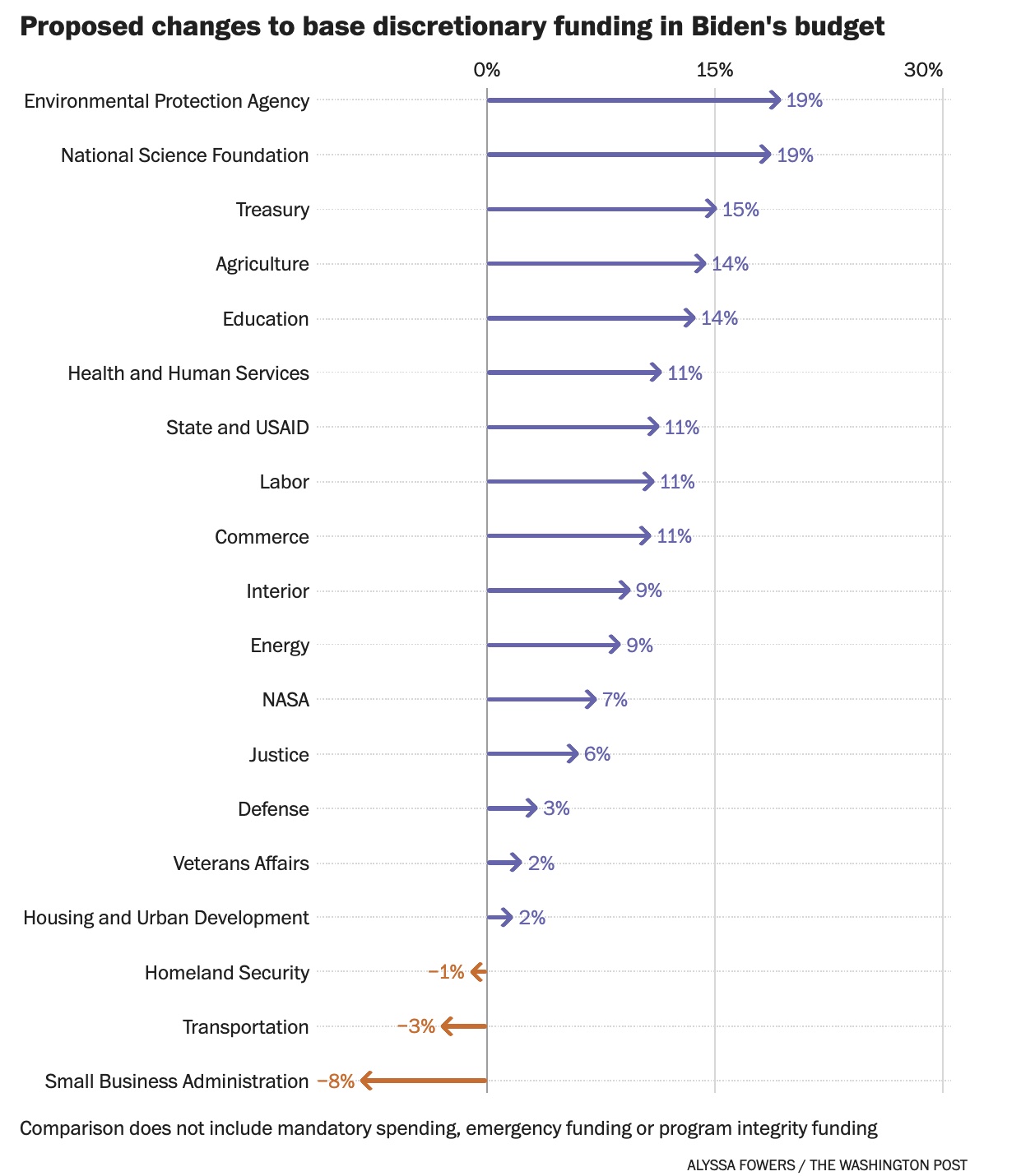

— President Joe Biden’s fiscal year (FY) budget proposals call for a $6.8 trillion budget plan to increase spending on the military and a wide range of new social programs while also reducing future budget deficits. Biden's 2024 budget mostly rehashed the president's earlier proposals to expand the social safety net and to pay for it by raising taxes on the wealthy and corporations. He wants to restore the expanded child tax credit and make permanent enhanced ObamaCare subsidies. And he wants to provide universal free preschool, make college more affordable and establish a national paid family and medical leave program. However, the proposed budget has no chance of making it through the Republican-controlled House. It could still frame upcoming political battles on Capitol Hill, where the GOP has yet to unveil its own spending plan. Link to White House fact sheets.

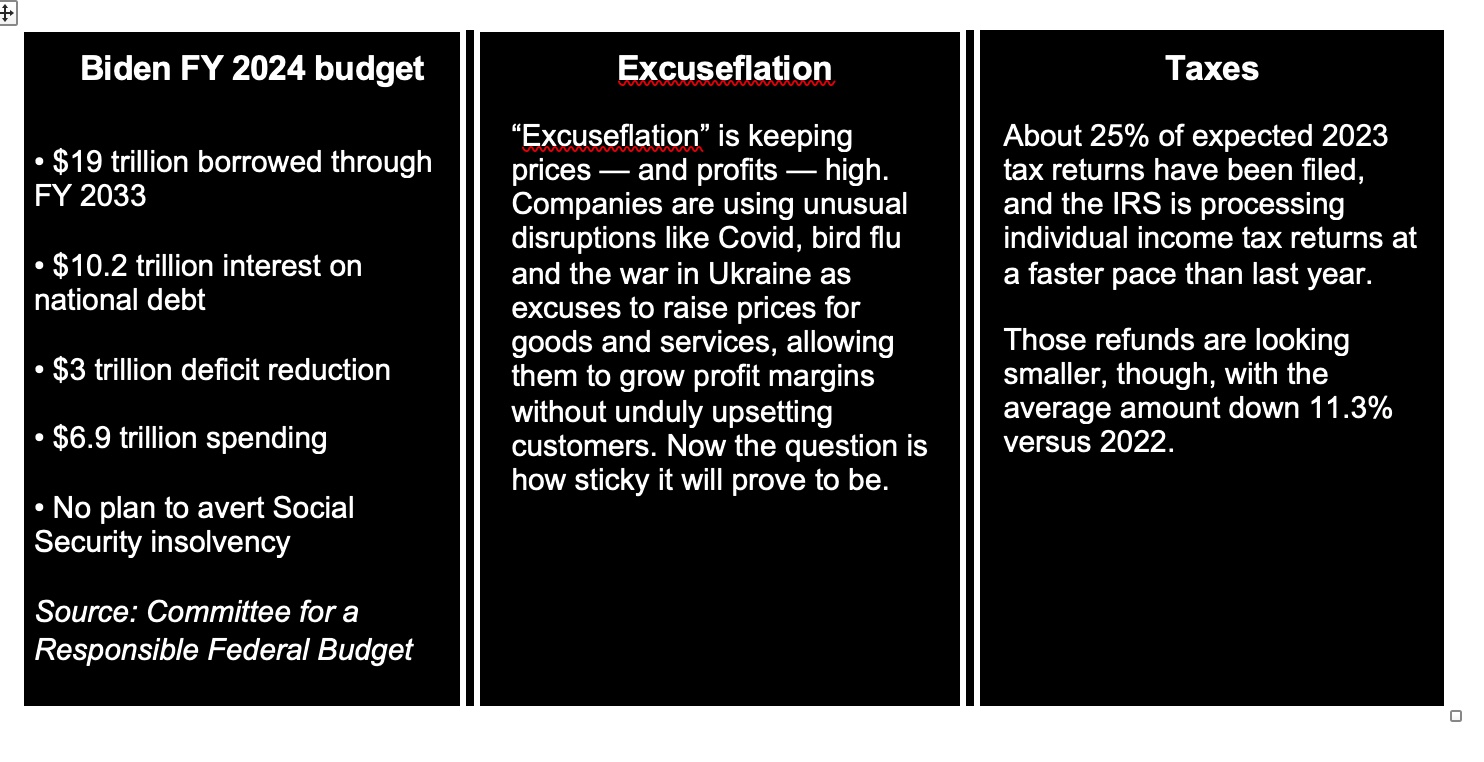

Bottom line for Biden’s FY 2024 budget

- $19 trillion borrowed through FY 2033

- $10.2 trillion interest on national debt

- $3 trillion deficit reduction

- $6.9 trillion spending

- No plan to avert Social Security insolvency

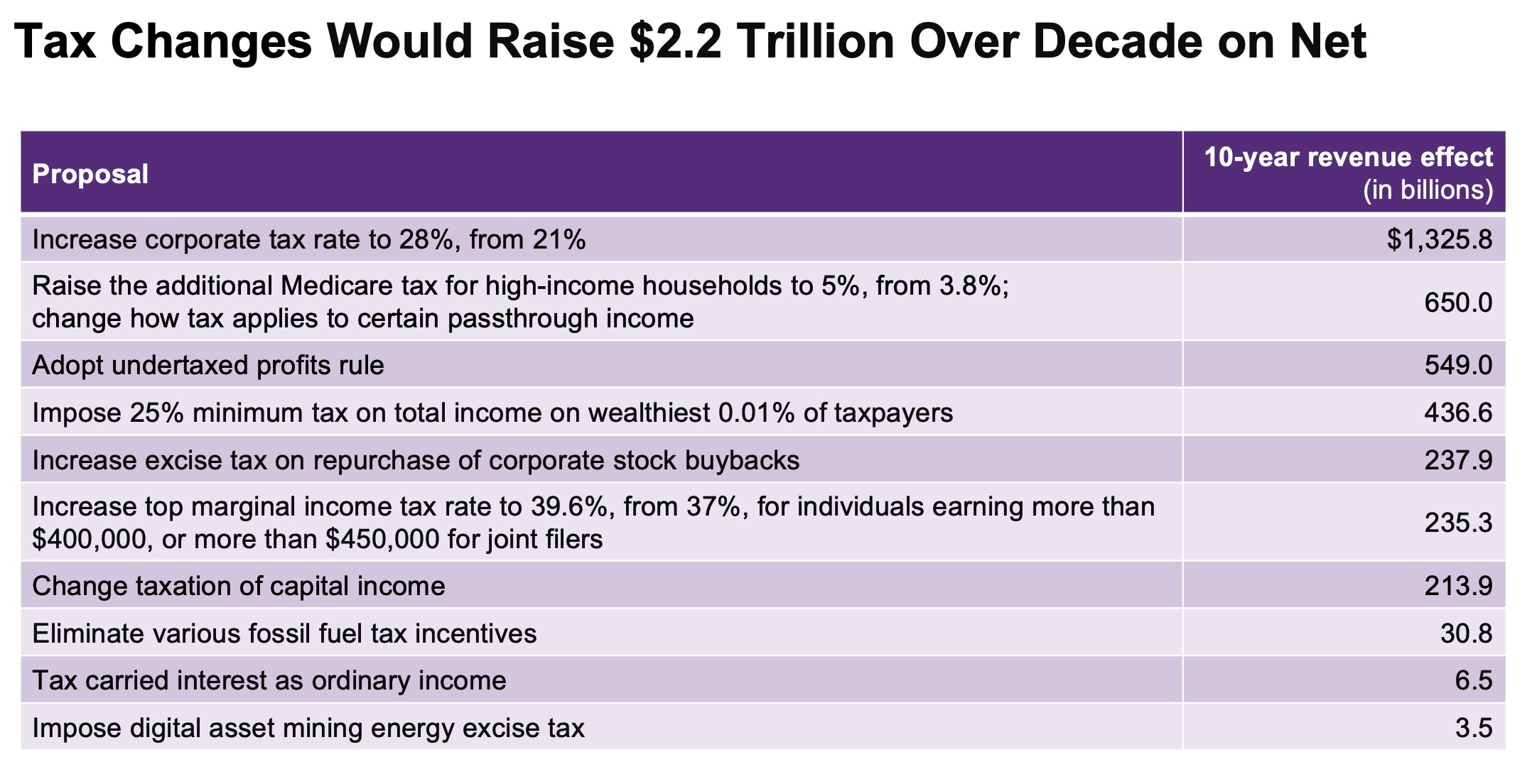

— Tax hike proposals in Biden budget. Biden’s budget proposed plans to put about $3 trillion toward tackling the nation’s deficits over the next 10 years with pitches for tax hikes targeting the wealthiest Americans and corporations. Some tax hike details:

- Estate, Gift Taxes: Biden wants to strengthen the tax rules governing estate and gift taxes, making the system more difficult for wealthy individuals and trusts to avoid taxes. He stops short of calling for a reversal of Trump’s estate tax changes, which drastically reduced the number of people who have to pay the levy.

- Capital Gains: Increase the capital-gains rate to 39.6% from 20% for people earning at least $1 million to equalize the taxation of investment and wage income. Increase the 3.8% ObamaCare tax to 5% for those earning at least $400,000, to shore up the Medicare Trust Fund, meaning the richest taxpayers would pay a 44.6% federal rate on investment income and other earnings. Calls for taxing assets when an owner dies, ending a tax benefit that allowed the unrealized appreciation to go untaxed when transferred to an heir.

- Carried Interest: The carried-interest tax break used by private equity fund managers to lower their tax bills would be eliminated under the Biden plan. Under current law, investment fund managers can pay the 20% capital-gains rate on a portion of their incomes that would otherwise be subjected to the 37% top individual-income rate.

Chart source: Bloomberg

— Biden proposals that caught our eye:

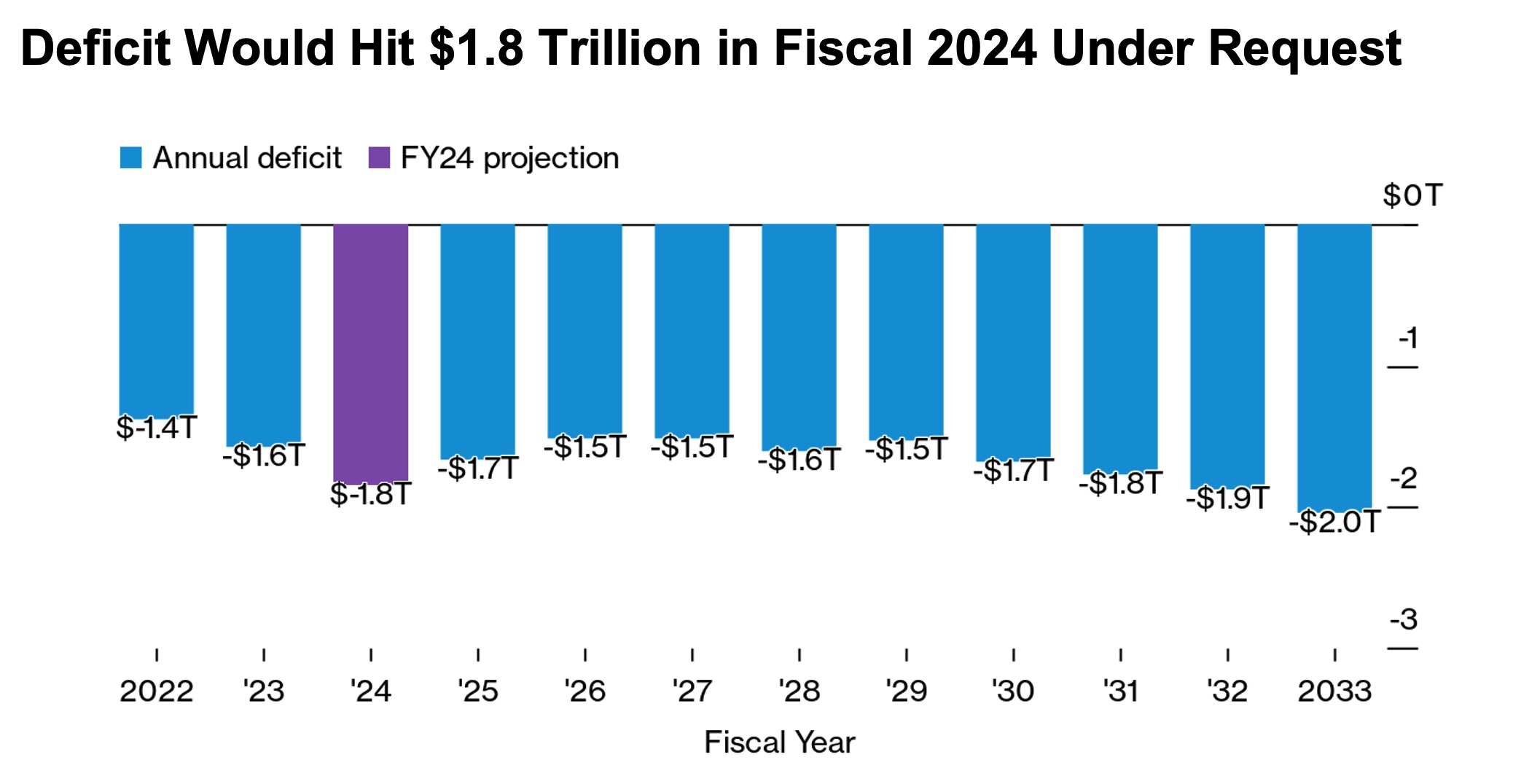

- Projects the annual deficit actually would gradually increase from $1.38 trillion in fiscal 2022 to $1.9 trillion in fiscal 2025. (See deficit graphic above.)

- $2.6 trillion worth of new spending, including the restoration of the expanded child tax credit that would give families as much as $3,600 per child, compared with the current level of $2,000. That credit would be “fully refundable,” which means households could receive all of that sum even if they don’t owe any taxes.

- Proposed tax increases on wealthy people and large corporations would cut deficits by $2.9 trillion over the next decade. It would raise $4.7 trillion from higher taxes, with an additional $800 billion in savings from changes to programs.

- Pentagon budget request for $842 billion is a 3.2% increase on what Congress enacted last year, below the top end of analysts’ expectations. With inflation in the sector running around 5%, the proposal represents a cut in real terms.

- Additional $7 billion for further military support for Ukraine and $23.6 billion for the Energy Department as part of the modernization of sea, land and air-based nuclear weapons. Further support for Ukraine is expected by analysts to come in the form of supplemental requests to Congress for additional funds to provide weapons directly and replenish U.S. and allies’ stocks.

- Proposes a 5.2% average pay raise for both civilian federal employees and military service members next year, and over the 4.6% pay hike feds received in 2023, and the highest proposed pay hike federal workers have seen since the Carter administration implemented a 9.1% average pay increase in 1980. The proposal falls short of the 8.7% average pay raise supported by some congressional Democrats and federal employee groups.

- Calls for funding to hire an additional 350 border patrol agents, $535 million for improved technology and $40 million to combat fentanyl trafficking.

- Requests more than $7 billion to support refugees and unaccompanied minors in the U.S., and an emergency fund of $7 billion more to help them. In fiscal year 2022, the administration resettled 25,000 refugees — just 20% of the 125,000 slots it had allocated.

- Calls for big increases in funding to speed up permitting for renewable energy, including $60 million to accelerate federal approvals of offshore wind farms.

— Biden administration sees inflation receding rapidly over the coming two years, amid slower growth and higher unemployment. Link for White House statement.

- The Biden administration assumes GDP will grow only 0.4% this year, with the jobless rate rising to 4.3% and 4.6% in 2024. (It was 3.4% in January.)

- Growth returns to roughly its trend rate of 2.1% in 2024.

- Slowdown is enough to bring inflation down to 4.3% in 2023 and 2.4% in 2024.

- Assumes that 10-year Treasury yields will stabilize at 3.4% later in the decade, compared with 3.8% in the CBO forecasts.

— Biden administration’s priorities for USDA for FY 2024 focus on conservation, research, lending and the farm bill. USDA would ease housing costs in rural areas, continue to work on climate change under the president’s budget request. More detailed information is scheduled for release next week. Link for White House issued details. Link to our special report released Thursday.

— FDA budget request: More spending for oversight of food products. The Food and Drug Administration (FDA) is requesting $7.2, with an increase of $372 million in budget authority above the FY 2023 enacted level. The request also includes a $150 million increase in new user fees.

- Focus on strengthening food and nutrition programs, especially for infants and young children, with a request for $128.2 million in food safety and nutrition modernization, including food labeling and food safety oversight.

- After the infant formula shortage and contamination scandal this past year, FDA’s budget looks to strengthen the infant formula supply chain and improve the agency’s ability to respond to food shortages.

- FDA wants Congress to give it new authority to establish binding contamination limits in food and efficiently update such limits as new scientific information becomes available. It also wants Congress to require industry to test final food products marketed for consumption by infants and children for toxic elements and allow FDA access to those records.

- User fees: FDA is asking Congress to allow it to collect fees from manufacturers and importers of tobacco products. The budget also requests an additional $100 million in funding to support regulatory activities, including for oversight of e-cigarettes.

— Would a big boost in farm bill reference prices for corn, soybeans, wheat be a stealth increase, resulting in few if any payments ahead? Speaking at the Commodity Classic this week in Orlando, Florida, Texas A&M University economist Bart Fischer estimated a 10% increase in reference prices would cost about $20 billion over 10 years. A 20% increase would cost more than $50 billion. But especially with corn and soybeans, farmers and others say even a big boost would not likely mean many if any payouts for most years. Said one observer: “Why would the ag sector take all those costs that the Congressional Budget Office score it at and not get much for it. Wouldn’t that funding be better elsewhere?”

In the House Ag Committee estimates letter this week (link), they noted: “The current policies were designed in the 2014 Farm Bill using 2012 cost of production data. Today, the combination of spiking input costs and outdated policy has rendered the commodity title ineffective. Consider the four crops that represent the largest acreage in the U.S.: corn, soybeans, wheat, and cotton. The forecast season average farm price of each commodity would need to fall by roughly 23, 30, 21, and 52 percent, respectively in 2023 to trigger any support under current law. If left unchanged, while production costs remain sticky, many producers would be bankrupt before Title I support provides assistance.”

Bottom line: A safety net should not be measured by how much payments are made when commodity prices are high. Rather it should be measured by whether it kicks in to help producers when prices decline. It’s similar to insurance. One doesn’t buy insurance to receive an indemnity. One buys insurance for the protection.

— Vilsack wants USDA top move away from ‘lender of last resort’ to be ‘lender of first opportunity.’ USDA also wants to broaden its lending program via legislative changes it wants enacted that it said will be budget neutral. “Agricultural producers know Farm Service Agency (FSA) as the lender of last resort, but FSA is now striving to be the lender of first opportunity, providing the resources to succeed and helping producers receive the assistance they need to continue farming, to build and maintain their competitive-edge, and to access more, new, and better markets to achieve a robust and competitive agriculture sector,” the budget said.

Details. USDA is proposing to boost the limit for microloans from $50,000 to $100,000. They also want to eliminate the limit on the number of years a borrower can apply for direct operating direct farm ownership loans. The farming experience required for direct farm ownership loans would be reduced from three years to one year, with a waiver of the experience requirement for farmers with an established mentor.

Background. Would USDA have the staffing power to be able to accomplish the Vilsack initiative? Data for 2021 (most current available) indicates that of total farm real estate debt in the U.S. of $324.3 billion, FSA accounts for $10.8 billion of that total. The Farm Credit System held $158.1 billion in real estate debt with commercial banks having $100.8 billion. For non-real estate loans (operating loans, etc.), FSA accounts for $3.4 billion of the $149.9 billion total. The Farm Credit System held $56.6 billion of that debt with commercial banks holding $65.1 billion.

— Other nuggets from Biden’s FY 2024 budget proposals:

Energy/Climate Change:

- Includes $24 billion in funding for climate resilience and conservation, with the funding aiming to help communities combat climate change disasters like floods, wildfires, storms, extreme heat and drought, although the provision and other climate-related funding will likely face strong opposition by House Republicans. Biden's proposal also includes $6.5 billion for energy storage and transmission projects, $1.8 billion for environmental justice initiatives, and $311 million to remediate orphaned oil and gas wells and reclaim old mining lands, while also calling for an end to oil and gas industry subsidies.

- $11.9 billion for climate and clean energy R&D, a 20% increase

- $8.8 billion for the Office of Science, a 9% increase, for climate innovation

- $8.3 billion to clean up communities affected by nuclear weapons production

- $2 billion for clean energy workforce and infrastructure projects

Commerce:

- $2.1 billion for next generation weather satellites, a $371 million boost.

- $1.6 billion for the Census Bureau, a $121 million increase.

- $375 million for NIST’s Industrial Technology Services, a $163 million boost.

- $231 million for NOAA climate research programs and $60 million to expand offshore wind permitting activities.

Defense: - Prioritize China as “America’s pacing challenge” in line with defense strategy

- $37.7 billion to maintain the nuclear deterrent and triad

- $9.1 billion for Pacific Deterrence Initiative to support allies in region

- $6 billion to support Ukraine, NATO, regional partners to counter Russia

- Provide 5.2% pay increase for servicemembers and civilian workforce

Homeland Security:

- About $25 billion for CBP and ICE, including $535 million for border security technology for ports of entry and funds to hire 350 Border Patrol Agents

- $4.7 billion for new contingency fund to respond to migration surges along Southwest border

- $1.1 billion increase to fully fund TSA pay equity initiative

- $865 million for USCIS to reduce immigration benefit request backlog and improve processing to advance administration's goal of admitting 125,000 refugees

Interior:

- $5.7 billion for climate adaptation, mitigation, and resilience

- Funding for Endangered Species Act activities would increase from $23.4 million to about $27 million, more than 15%

- $4.7 billion for tribal programs, including $717 million for public safety needs

- $3.8 billion for the National Park Service, including $32 million for equity initiative

- $314 million to reduce catastrophic wildfire risks

- Increase environmental permitting capacity to expedite delivery of infrastructure

- Boost federal firefighter pay to minimum of $15 per hour

State Department:

- $12.5 billion in mandatory funding to out-compete China in the Indo-Pacific

- $10.9 billion for global health, including pandemic preparedness

- $10.5 billion for humanitarian assistance, including for refugee resettlement

- $8 billion for sub-Saharan Africa initiatives

- $3 billion for international climate finance, $1.6 billion for Green Climate Fund

- $2.3 billion for partnerships in Indo-Pacific region

- $753 million for Ukraine to counter Russia and meet security, economic needs

Transportation:

- $76.1 billion for highway and transit formula programs, including $60.1 billion for highways

- $1.5 billion for the Consolidated Rail Infrastructure and Safety Improvements grant program, as well as $850 million to fund projects that improve rail safety

- $16.5 billion in discretionary budget authority for the FAA, and more than $500 million increase for the National Airspace System for a total of $3.5 billion

- Proposes policy priorities for FAA reauthorization, including consumer protection

Treasury: - $14.1 billion for the IRS, a $1.8 billion increase, which would include:

- $642 million to expand customer service outreach and taxpayer experience

- $290 million for IRS Business Systems Modernization to accelerate digital tools

- $341 million for CDFI Fund to provide low-income and underserved communities access to credit, capital, and financial support

- $332 million to restore staffing for department’s core policy offices to 2016 levels

EPA: - $5 billion for greenhouse gas emissions reduction, climate resiliency

- $4 billion for drinking water infrastructure upgrades, a $1 billion increase

- $1.8 billion for several environmental justice initiatives, including Justice40

- $356 million for the Superfund program to clean up contaminated lands

- $219 million for lead service line replacement, a $163 million boost

- $170 million for PFAS prevention, remediation, and research

- Add more than 2,400 employees to increase staffing capacity

U.S. Army Corps of Engineers: - $7.4 billion, a 14.4% decrease

- Budget says request complemented by money in 2021 infrastructure law

|

PERSONNEL |

— The Senate confirmed Daniel Werfel to be the new commissioner of the IRS.

|

CHINA UPDATE |

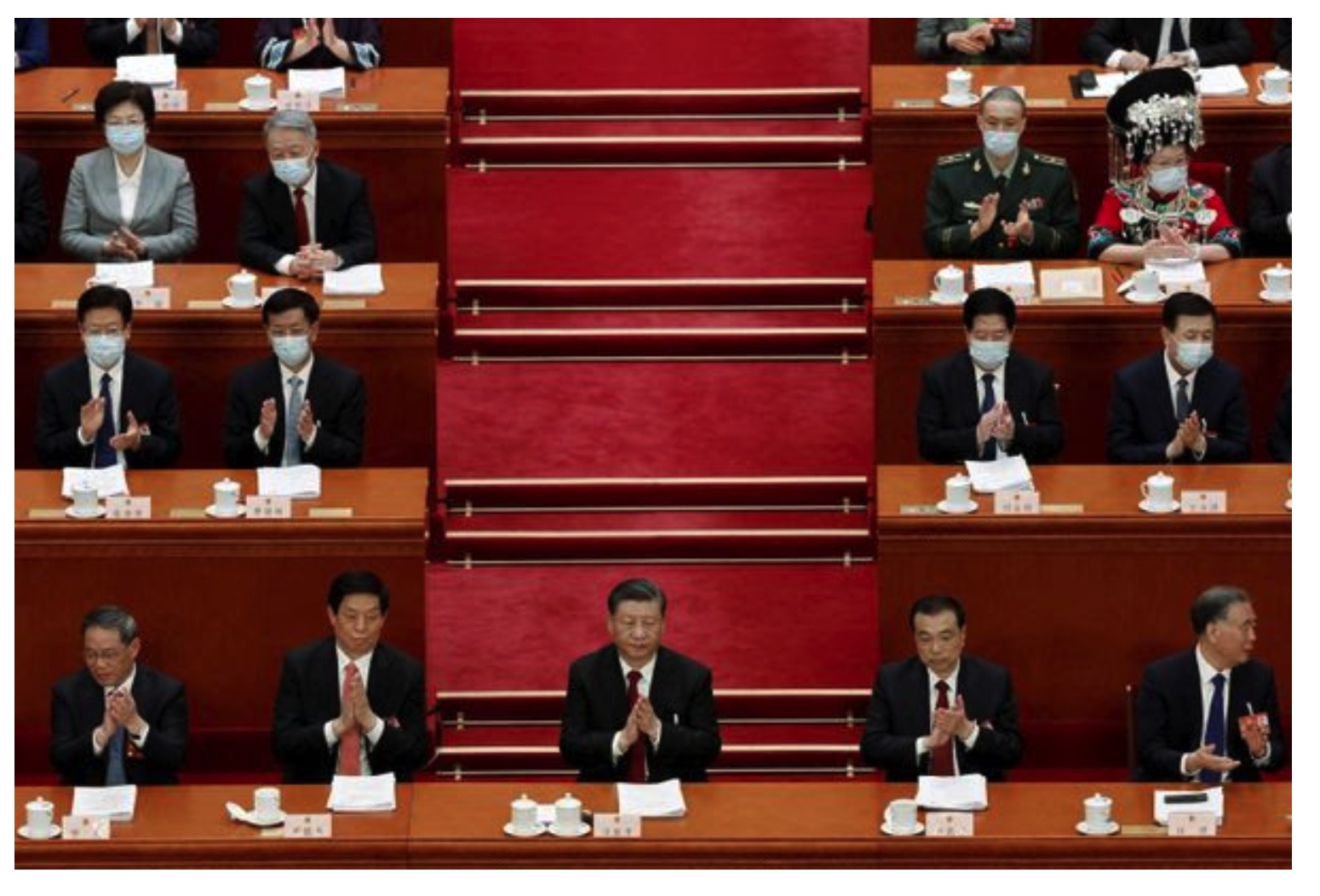

— Xi Jinping formally began a precedent-breaking third term as China’s president after his re-appointment was unanimously rubber-stamped. He received a unanimous 2,952 votes followed by a standing ovation in the country’s parliament. The confirmation means he will lead the country until 2028 at least. Over the next two days, China’s parliament is expected to formally appoint other senior officials—all of them Xi’s loyalists.

A thirst for power. Keeping your tea hot is a symbol of political relevance in China, and President Xi Jinping is setting himself apart at this year’s National People’s Congress by having … two tea cups placed before him (and just one for everyone else).

— China’s new bank loans fall but beat expectations. Chinese banks extended 1.81 trillion yuan ($260 billion) in new yuan loans in February, down from January’s record but higher than economists expected. Chinese banks tend to front-load loans at the beginning of the year to get higher-quality customers and win market share, so a pullback from January’s record levels was expected. Outstanding yuan loans grew 11.6% in February from a year earlier compared with 11.3% growth in January. Broad M2 money supply grew 12.9% from a year earlier.

— Chinese soybean subsidies force buyers to shell out more for peanuts. Groundnut has become the country’s best-performing agricultural commodity as drought also hits production. Link for details via the Financial Times.

— U.S. intelligence agencies warn of China’s efforts to expand its power. China sees a partnership with Russia as a way to challenge, and potentially weaken, the United States, a new threat assessment said. Avril D. Haines, the director of national intelligence who appeared before a Senate committee to present the threat assessment, said China believes it can achieve its goals of dominating its region and expanding its global reach “only at the expense of U.S. power and influence.”

“The People’s Republic of China, which is increasingly challenging the United States economically, technologically, politically and militarily around the world, remains our unparalleled priority,” Haines said.

Officials in the Biden administration made public intelligence that China was considering a secret provision of lethal aid along with both public and private messages to Beijing that such support would cross a line. Officials have warned that Washington would impose economic sanctions on Beijing if that support were to go ahead.

Key question. At the Senate Intelligence Committee hearing, Sen. Angus King, independent of Maine, asked Haines if the relationship between China and Russia was a temporary marriage of convenience or a long-term love affair. Haines said it was not simply a temporary partnership but added that it had “some limitations… We don’t see them becoming allies, the way we are with allies in NATO,” Haines said.

|

TRADE POLICY |

— Source: White House in initial talking stage to push new trade agreements ahead. A Biden administration contact says in the next few months the White House could finally ask Congress to renew Trade Promotion Authority (TPA), which allows trade agreements to be voted on with amendments.

Meanwhile, USDA Secretary Tom Vilsack says enforcing existing trade agreements is important for building public support for TPA and, eventually, new trade agreements. “We have to rebuild trust around the country in trade,” he told those attending the Pork Industry Forum in Orlando, Florida. “The way you do that is by enforcing the trade agreements you have,” he said, noting U.S. actions this week to begin consultations with Mexican officials on their biotech corn ban.

|

ENERGY & CLIMATE CHANGE |

— Interior delays 5-year offshore drilling plan until December. In court documents filed this week, the Interior Department said it will take until December to finalize a five-year plan for offshore oil and natural gas development in federal waters, drawing fire from sometimes centrist Sen. Joe Manchin (D-W.Va.), the American Petroleum Institute (API) and oil industry executives. API had asked the US Court of Appeals for the D.C. Circuit to give the department until Sept. 30 to complete the long-delayed program, but department officials claim additional time is needed to review public comments and conduct analyses.

— Energy secretary extends olive branch to oil industry. Energy Secretary Jennifer Granholm made a conciliatory gesture toward oil executives during her appearance at the CERAWeek conferencey, commending the industry for increasing production and acknowledging that "oil and gas is going to remain a part of our energy mix for years to come." Granholm also emphasized that any future withdrawals from the Strategic Petroleum Reserve would be limited to situations of major disruption, such as the Ukraine war.

— A huge amount of money is going to be spent in the U.S. on clean fuels and other technology via the Inflation Reduction Act (IRA). It will direct some $370 billion in tax benefits to U.S. development of solar, wind, geothermal and other renewable energy technologies, and Europe can’t afford to see its transition slow due to high power costs and need for lots of supply. European energy companies want the continent to come up with its own incentives. “It would be great to see the European Union policy move from stick to carrot," said Josu Jon Imaz, CEO of Spanish energy provider Repsol. "We don't need banning technologies, we don't need restrictions, we need to be attractive." Patrick Pouyanne, CEO of French energy giant TotalEnergies told the CERAWeek conference the IRA was an "invitation to accelerate green infrastructure,” saying it differs from Europe, where more regulation is paramount. "All of the capital from advanced countries and even developing countries is flooding to America to take part of the investment that stems from the IRA," said Takajiro Ishikawa, CEO of Mitsubishi Heavy Industries Americas.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— IMF: Global food crisis may persist with prices still elevated after year of war. With two of the world’s largest exporters of wheat and other crucial crops entering a second year of war, many vulnerable countries still face heightened food insecurity. Fragile and conflict-affected states, home to 1 billion people, are at particular risk, writes Jeff Kearns, Managing Editor, IMF Blog (link).

— As U.S. mulls vaccinating poultry for bird flu, chicken industry could stand in the way. Broiler producers are concerned about trade implications, but fears that the virus will mutate or spread to humans may spur a new plan of action, according to a FoodDive article (link).

— South American countries form group to tackle bird flu. Representatives of six South American countries — Argentina, Brazil, Bolivia, Chile, Paraguay and Uruguay — created a technical committee to address avian influenza outbreaks. The Southern Cone’s Permanent Veterinary Committee (CVP) is organizing the efforts to create a regional response to bird flu. Several of the countries have reported bird flu cases and a statement creating the group said it appeared the virus was “here to stay.” Peru, Colombia and Ecuador also joined the meeting, the statement said.

|

HEALTH UPDATE |

— Summary: This marks the final update of the Covid-19 situation relative to data on the number of cases, deaths and vaccinations as the Center for Systems Science and Engineering at Johns Hopkins University announced in February that they were ending the data gathering effort as of today, stating that the pandemic trajectory had changed. They will continue to have their archived data available to researchers.

- Global Covid-19 cases at 676,598,540 with 6,881,921 deaths.

- U.S. case count is at 103,802,726 with 1,123,836 deaths.

- The Johns Hopkins University Coronavirus Resource Center said that there have been 672,076,105 doses administered, 269,554,116 have received at least one vaccine, or 81.81% of the U.S. population.

|

POLITICS & ELECTIONS |

— Florida Governor Ron DeSantis will make his first trip to the early nominating state of Iowa today as he tests the waters for a presidential bid, only days before fellow Republican and former President Donald Trump is slated to campaign there.

|

CONGRESS |

— Don’t get too excited about House vote Thursday on WOTUS rule. The House voted 227-198 to overturn "waters of the United States" (WOTUS) protections under the Clean Water Act finalized by the Biden administration in December, driven by House Republicans that have long said the regulations are an environmental overreach and a burden to business. But President Biden has said he would veto the measure if it lands on his desk and the vote count shows not enough muster to override any veto. So, this is an “etch-a-sketch” news development that really awaits a coming Supreme Court ruling on the matter.

— Norfolk Southern CEO Alan Shaw apologized to lawmakers for the train derailment that spilled toxic chemicals near East Palestine, Ohio, last month, saying: “I am determined to make this right.” He said the company will reimburse residents and clean up the site. Lawmakers said Norfolk Southern could have spent the money it saved by cutting workers and repurchasing shares to hire inspectors, install more temperature detectors, and repair its tracks. “We’re going to move away from a near-term focus solely on profits and take a long-term view,” Shaw said. A Barron’s analysis found that Norfolk Southern has cut its spending on train inspection, repair, and maintenance more aggressively than other large railroads, by an average of 8% annually from 2017 to 2021. Norfolk Southern told Barron’s it invests about $1 billion a year to maintain its infrastructure. Sen. Sherrod Brown (D-Ohio), said Norfolk Southern cut one-third of its workforce over the past decade and put profit over people. The National Transportation Safety Board has started an investigation into the company’s “safety culture.”

Bottom line: Norfolk Southern has pledged more than $20 million to help affected Ohio families, in what Shaw called “just the down payment.” He has personally created a $445,000 college scholarship fund for East Palestine students.

|

OTHER ITEMS OF NOTE |

— NASA is tracking a newly discovered asteroid roughly the size of an Olympic swimming pool that has a "small chance" of hitting Earth in 2046. Several scientists say the object is not particularly concerning because it will probably shift orbit in the coming decades.

— Donald Trump could face criminal charges over Stormy Daniels payment. The Manhattan district attorney’s office has told the former president that he can testify before a grand jury that’s hearing evidence that he paid hush money to the porn star. It’s the strongest signal yet that prosecutors are nearing an indictment in the case.

— Saudi Arabia and Iran agreed to re-establish diplomatic ties, a major realignment between regional rivals. The conflict between the two nations has long shaped politics and trade in the Middle East. Link for more via the New York Times.

— Cotton AWP. The Adjusted World Price (AWP) declined to 71.95 cents per pound, effective today (March 10), from 72.73 cents the prior week.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum |