Policy Wonks Get Ready for CBO’s Updated Forecasts Released Wednesday

Top Republicans are mulling budget cuts to all but Medicare and Social Security

|

In Today’s Digital Newspaper |

U.S. fighter jets scrambled three days in a row to shoot down a trio of unidentified aerial objects high above North America. A jet shot down an unidentified object near Lake Huron on Sunday, marking the third time in a week that the U.S. military has taken down objects in North American airspace. On Saturday, an unidentified object was downed over northern Canada, a day after another object had been shot down over Alaska. A Chinese surveillance balloon was taken down by F-22s off the coast of South Carolina last weekend. With no indication at this point that the unidentified objects have any connection to China, the pressure is building on President Biden to address the nation on the situation.

Meanwhile, China alleged that the U.S. has flown high-altitude balloons through its airspace more than 10 times since the start of 2022, adding fuel to an escalating diplomatic standoff between the countries.

Russian paramilitary forces said they had captured a settlement on the outskirts of Bakhmut, the eastern Ukrainian city that Moscow has been pushing to encircle.

U.S. seeks critical-mineral pacts with Japan, U.K. to curb China. The U.S. gov’t is exploring narrowly focused trade pacts on critical minerals with Japan and the U.K., besides talks with the European Union, the latest salvo in its push to counter Chinese influence in key sectors, officials familiar with the matter said.

Turkish authorities widened a crackdown on those allegedly involved in shoddy construction practices and looting in cities devastated in last week’s earthquakes, as the death toll surpassed 35,000.

Tomorrow is the deadline U.S. trade officials have given Mexico regarding the GMO corn trade skirmish.

The European Commission posted its winter forecast this morning, saying the eurozone economy will avert recession as the cost-of-living crisis eases.

The secretary general of OPEC urged energy giants to invest $500 billion annually to meet global needs. Meanwhile, flush with record profits, U.S. oil and gas companies are expected to embark on an M&A boom this year.

A new Securities and Exchange Commission rule promises to remove many of the loopholes that allowed corporate insiders to hide behind prearranged trading plans when buying or selling their companies’ shares.

President Biden appears set to run in 2024, but many Democratic voters have doubts.

Concerns about Biden’s age and abilities are front of mind for some Democrats, even those who think the 80-year-old president has done well during his first two years in office, according to recent polling and Wall Street Journal interviews with more than two dozen people around the country who voted for Biden in 2020.

|

MARKET FOCUS |

Equities today: Global stock markets were mixed overnight, with European shares mostly higher and Asian shares mostly lower. U.S. stock indexes are pointed toward narrowly mixed openings. As for the earnings slate, key reports include updates from consumer goods brands with figures out from Nestlé, Coca-Cola, Krispy Kreme and Kraft Heinz. In Asia, Japan -0.9%. Hong Kong -0.1%. China +0.7%. India -0.4%. In Europe, at midday, London +0.4%. Paris +0.8%. Frankfurt +0.4%.

U.S. equities Friday: The Dow rose 169.39 points, 0.5%, to 33,869.27. The Nasdaq Composite fell 71.46 points, 0.6%, to 11,718.12. The S&P 500 rose 8.96 points, 0.2%, to 4,090.46. The S&P 500 suffered its worst weekly loss in nearly two months as market action was dominated by concerns about the Federal Reserve.

For the week, the Dow slipped 0.2% for its second straight weekly drop, the S&P 500 fell 1.1% to snap two consecutive weeks of gains, and the Nasdaq Composite dropped 2.4%.

Investors are fleeing U.S. stock funds. They have pulled a net $31 billion from U.S. equity mutual funds and exchange-traded funds in the past six weeks.

Yields on the benchmark 10-year U.S. Treasury note rose to their highest in more than a month following an auction Thursday of 30-year bonds that saw weak demand.

WTI crude futures advanced 2.5% on Friday to regain the $80/barrel level after Russia said it will cut oil output by 500,000 barrels a day (or 5%) next month. Brent futures (climbed 2.4% to $86.50/bbl.

Agriculture markets Friday:

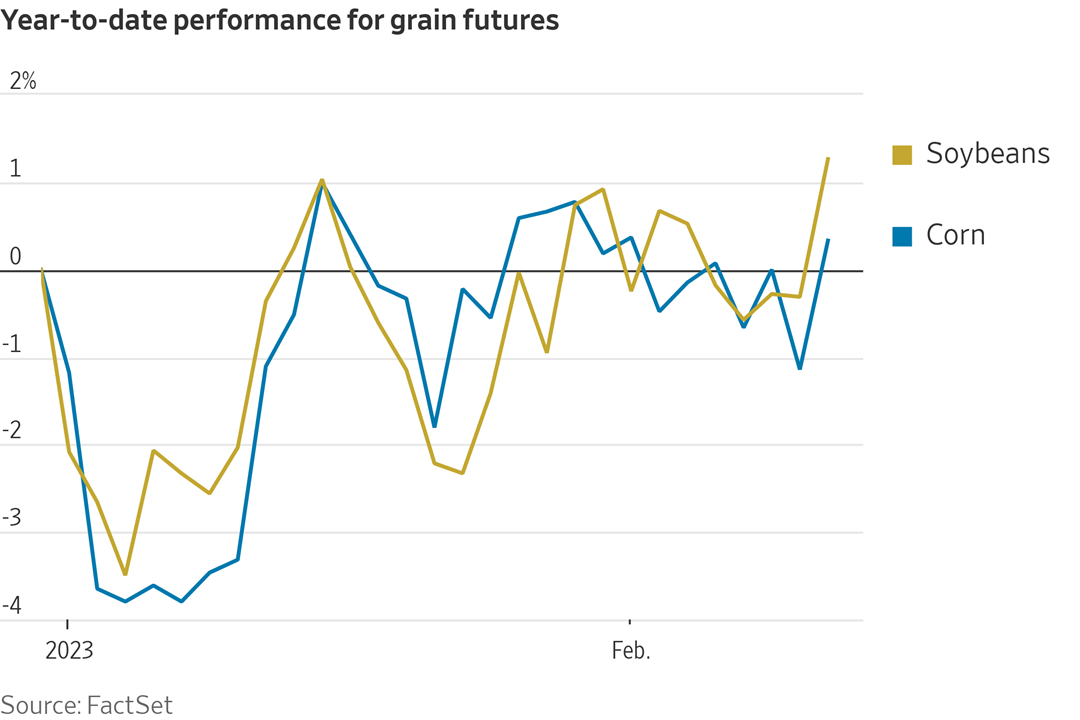

- Corn: Corn closed 9 3/4 cents higher to $6.80 1/2, ending the session above 10-, 20- and 100-day moving averages and was up 3 cents on the week.

- Soy complex: March soybean futures rose 23 1/4 cents to $15.42 1/2, near the daily high and posted an eight-month high close. For the week, March beans gained 10 1/2 cents. March soybean meal futures closed up $3.90 to $499.40, near the session high and hit a contract high. On the week, March meal rose $2.90. March soybean oil rose 150 points to 60.54 cents and on the week rose 148 points.

- Wheat: March SRW surged 28 3/4 cents to $7.86, marking the highest close since Dec. 30 and is up 29 1/4 cents on the week. Hard red wheat ended the session up 30 cents at $9.09, while March spring wheat rose 13 3/4 to $9.31.

- Cotton: March cotton futures closed down 23 points to 85.27 cents and nearer the session high. For the week, March cotton fell 16 points.

- Cattle: Nearby February live cattle futures gained 37.5 cents to $161.20 Friday, while most-active April advanced 32.5 cents to $163.95. That marked a 17.5-cent weekly decline. In contrast, March feeder futures slid 42.5 cents to $186.40, with the closing quote representing a weekly rise of 30 cents.

- Hogs: Expiring February hog futures inched up 5 cents to $75.875 to end the week, whereas most-active April ended the day unchanged at $83.325. That represented a weekly drop of $3.15.

Ag markets today: Soybeans are firmer this morning, while corn and wheat are weaker following two-sided trade overnight. As of 7:30 a.m. ET, corn futures were trading 1 to 2 cents lower, soybeans were fractionally to 2 cents higher and wheat futures were mostly 6 to 9 cents lower. Front-month crude oil futures were near unchanged, and the U.S. dollar index was around 100 points lower this morning.

Technical viewpoints from Jim Wyckoff:

On tap today:

• Federal Reserve governor Michelle Bowman speaks at a conference for community bankers at 8 a.m. ET.

• USDA Grain Inspections report, 11 a.m. ET.

• Wendy Sherman, U.S. deputy secretary of state, hosts a trilateral meeting between the United States, Japan, and South Korea.

• Japan releases fourth-quarter gross domestic product data at 6:50 p.m. ET.

CBO on Wednesday, Feb. 15, will release the federal debt and statutory limit information, an updated edition of a recurring report, describing the current debt situation and CBO’s expectation about when the Treasury will no longer be able to pay its obligations fully if the debt limit is not raised.

CBO will also release updated forecasts on budget and economic projections, which will be used for the new farm bill baseline.

60: The number of years that careers are soon expected to span. Millennials and the generations behind them are starting to think about their careers in a totally different way from their elders. As people live longer, healthier lives, the traditional 40-year career will become a thing of the past (I must be in the new wave as I’m working on year 51 of my career). Link for more.

Market perspectives:

• Outside markets: The U.S. dollar index was slightly firmer. Nymex crude oil futures prices are weaker and trading around $79.00 a barrel. The yield on the benchmark U.S. 10-year Treasury note was at 3.732%.

• West Coast port-labor talks drag on as cargo drops. Talks for a new labor pact between West Coast dockworkers and their employers are stretching into a 10th month, but with no agreement in sight and volumes dropping, patience is wearing thin. The sides haven’t announced major progress since they struck a tentative agreement on health benefits just three weeks after the prior contract expired July 1. Executive Director Gene Seroka said West Coast ports risk losing even more cargo to other regions without a deal, especially as the container-shipping industry kicks off its own contract talks over issues like freight rates and vessel space at the end of the month.

• NCC: Cotton acreage to fall sharply. U.S. cotton producers intend to plant 11.4 million cotton acres this spring, down 17% from 2022, according to the National Cotton Council’s (NCC’s) annual survey. Using five-year average abandonment rates along with a few state-level adjustments to account for current dry conditions, cotton harvested area would total 8.8 million acres – a 22.6% abandonment rate. Using the five-year average state-level yield would generate a cotton crop of 15.7 million bales.

• U.S. agriculture industry is projecting another strong year, with elevated crop prices and China’s rebound from Covid-19 expected to boost farmers, chemical suppliers and grain traders, the Wall Street Journal reports (link). Grain-trading middlemen, including Archer Daniels Midland and Bunge, said demand for crops, vegetable oils and livestock feed will remain strong in 2023.

• Ag trade: The Philippines purchased 110,000 MT of feed wheat expected to be sourced from Australia.

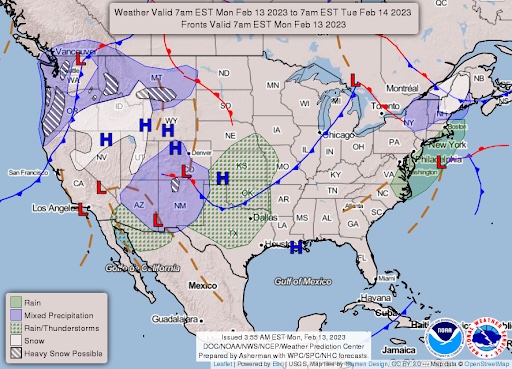

• NWS weather outlook: Unsettled weather will sprawl across the West through the next couple of days with heavy mountain snows over the Four Corners and along the Cascades... ...A low pressure system will trigger an expanding area of showers and thunderstorms across the mid-section of the country Monday night into Tuesday... ...Snow is forecast to expand across the northern Plains to the upper Midwest Tuesday night into Wednesday morning with strengthening winds.

Items in Pro Farmer's First Thing Today include:

• Beans firmer, corn and wheat weaker this morning

• Crop stress builds in Argentina

• Brazil soybean harvest, safrinha corn planting increase but still lag

• Eurozone economic growth forecast increased, inflation decreased

• Russia raises wheat export tax

• China sells all wheat at auction

• Bullish cash cattle hopes

• Cash hog index continues to rise

|

RUSSIA/UKRAINE |

— Summary: Ukraine is bracing against Russian offensives while it waits for more aid.

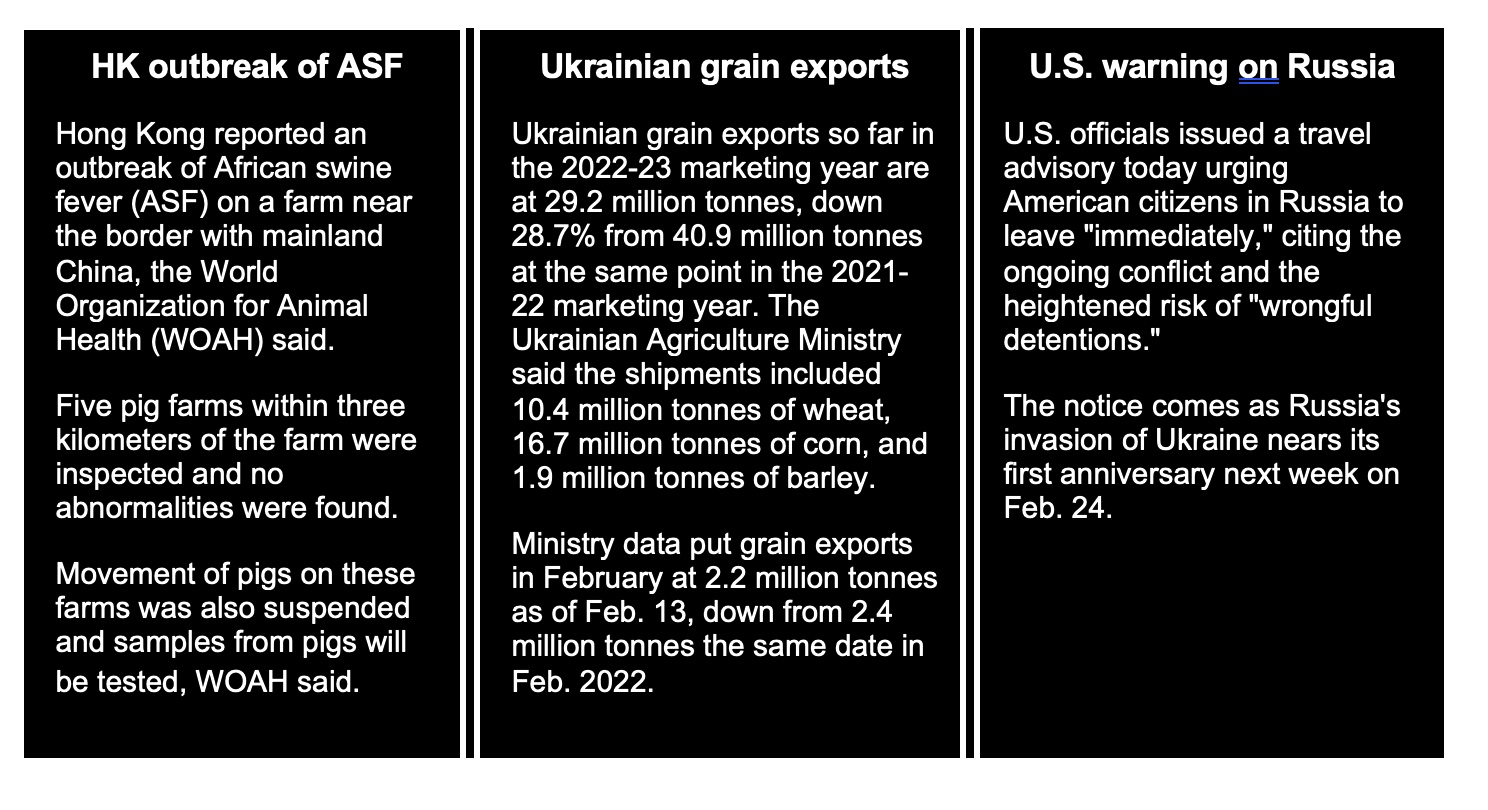

- Russian paramilitary group Wagner said it had captured a settlement on the outskirts of Bakhmut, the eastern Ukrainian city that Moscow has been pushing to encircle for months. Ukrainian officials didn't acknowledge any loss of new territory. Even as the Russian side has seized the initiative in the fighting in recent weeks, its gains have been slow — and costly in men and materiel — as Kyiv’s forces work to weather the assault while they wait on the arrival of additional Western weapons shipments.

- Defense ministers from North Atlantic Treaty Organization countries are set to meet in Brussels this week together with their Ukrainian counterpart.

- Biden to travel to Poland this month ahead of first anniversary of Russia’s invasion of Ukraine. During the Feb. 20-22 trip, President Biden will meet with President Andrzej Duda and leaders of the Bucharest Nine, a group of eastern flank NATO Allies, to reaffirm the U.S. commitment to NATO, the White House said. Biden also will deliver remarks ahead of the “one-year anniversary (Feb. 24) of Russia's brutal and unprovoked invasion of Ukraine.”

|

POLICY UPDATE |

— Top Republicans are mulling budget cuts to all but Medicare and Social Security, according to House Oversight Committee Chair James Comer (R-Ky.), echoing comments we had on this topic on Friday. “Everything else is on the table" in talks over raising U.S. gov’t borrowing limits, Comer said on Sunday. "We need to shore those programs up. They're running out of money. But at the end of the day, those programs are going to be off the table with respect to cuts, but everything else is on the table," Comer said in an interview on ABC's This Week with George Stephanopoulos.

|

CHINA UPDATE |

— China accused the U.S. of "illegally" flying high-altitude balloons into its airspace more than 10 times since January 2022, as bilateral tensions flare following Chinese spy balloon shot down by American fighter jets after traveling across the continental U. S. The accusation, made by the Chinese Foreign Ministry without evidence, comes less than a day after China said it was preparing to shoot down an unidentified object flying near its eastern coast.

Ministry spokesperson Wang Wenbin claimed it is “common for U.S. balloons to illegally enter other countries’ airspace… Since last year alone, American high-altitude balloons have illegally crossed China’s airspace more than 10 times without the approval of relevant Chinese authorities,” Wang said.

Wang also accused the U.S. of frequently sending warships and planes to carry out close-range reconnaissance against China, which he claimed amounted to a total of 657 times last year — and 64 times this January in the South China Sea. “For the longest time, the U.S. has abused its own technological advantages to carry out large-scale and indiscriminate wiretapping and theft of secrets from all over the world, including from its allies,” Wang said, adding that the U.S. is “without a doubt the world’s largest surveillance habitual offender and surveillance empire.”

— China lashes out at the move by the U.S. Commerce Department on Friday to add six Chinese companies tied to the Chinese military’s aerospace programs to its Entity List, restricting them from obtaining U.S. technology without government authorization. "China is strongly dissatisfied with this and resolutely opposes it. We will take necessary measures to resolutely safeguard the legitimate rights and interests of Chinese enterprises and institutions,” Ministry spokesperson Wang Wenbin said. He accused the U.S. of “hyping up and exaggerating” the situation and “using it as a pretext to illegally sanction Chinese enterprises and institutions.”

— Washington and its allies are considering punishing Beijing with stiffer restrictions on products it needs to advance its military and economic might, after a suspected spy balloon traversed the U.S. Current and former security officials say the balloon, which the U.S. said carried antennas and sensors for collecting intelligence and communications, underscores the national-security threat posed by China and will build political support for stronger protections of U.S. technology.

— Rep. Ro Khanna (D-Calif.) said he plans trips to China and Taiwan this year to stabilize the U.S./Chinese trade relationship and strengthen ties to Taiwan's semiconductor industry.

|

ENERGY & CLIMATE CHANGE |

— Energy Information Administration recently projected that battery storage capacity in the country will likely more than double in 2023 as developers plan to add 9.4 gigawatts of storage to the existing 8.8 gigawatts of capacity. Around 71% of the new battery storage capacity this year will be located in California and Texas, which have significant renewable energy capacity.

— Final comments to EPA from U.S. farm & biofuel officials on 2023-2025 Renewable Fuel Standard (RFS) (link):

- Comment excerpt from Tom Haag, President of the National Corn Growers Association (NCGA):

“As producers of the primary feedstock for low carbon ethanol, corn farmers contribute to the success of the RFS through higher corn yields and enhanced sustainability. By producing more corn with less land and fewer resources, famers cut the carbon intensity of ethanol while we meet food, feed, export and fuel needs. As EPA opens a new phase of the RFS, NCGA supports EPA’s proposal of annual increases in volumes, including an implied conventional biofuel volume of 15.25 billion gallons, recognition that ethanol plays a critical role in cutting GHG emissions and our energy security. With continued pressure on energy security and costs, and the need to accelerate GHG emission reductions, however, biofuels can contribute even more. We ask EPA to continue working with us on complementary policies to advance higher ethanol blends, enabling ethanol to do more to cut emissions and costs.” (Link to NCGA newsroom) - Quote from Emily Skor, CEO of Growth Energy:

"A stronger RFS will move America closer to a net-zero future, deliver savings at the pump for working families, strengthen U.S. energy security, and drive investment in rural communities. We support the agency’s commitment to expanding the role of biofuels, and we urge EPA to leverage this opportunity to update the science that will guide federal climate efforts moving forward. We cannot allow old, inaccurate information to hold back progress or delay important decisions on programs like the RFS. The path ahead is clear, and EPA must remain firmly on track to meet its June 14 deadline for a final rule." (Link to full Growth Energy news release) - Comment excerpt from Geoff Cooper, President and CEO of the Renewable Fuels Association (RFA):

“Moving forward, expanding the use of low-carbon renewable fuels like ethanol is the most immediate and effective strategy for meeting the Administration’s carbon reduction goals. Once finalized, the 2023-2025 RVOs will further enhance the energy security, carbon reduction, and economic benefits that have already been realized under the RFS program. … The RFS has been a tremendous success. It has bolstered energy security by reducing demand for petroleum imports; it has reduced greenhouse gas emissions by replacing petroleum with low-carbon, renewable alternatives; it has lowered fuel prices for American consumers; and it has created jobs and spurred economic development across the country.” (Link to full RFA news release) - Quote from Kurt Kovarik, Vice President of federal affairs for Clean Fuels Alliance America (formerly NBB):

“The clean fuels industry today meets a significant portion of the nation’s demand for heavy duty on-road fuels, helping to lower diesel fuel prices that impact the costs of all consumer goods. The industry is investing to double production, based on signals from the administration in the SAF Grand Challenge and pledge to cut carbon emissions in half. Flatlined volumes for the RFS threaten to undermine our industry’s investments as well as derail the administration’s goals for domestic energy security, jobs, economic opportunities, and environmental gains. In finalizing the overdue rules for 2021 and 2022, Administrator Regan committed to increase availability of homegrown fuels, put the RFS program back on track, and deliver certainty and stability. December’s proposed volumes for biomass-based diesel and advanced biofuels contradict this sentiment.” (Link to full Clean Fuels Alliance America news release) - Comment excerpt from Dustin Marquis, Director of Government Relations, Marquis Management (Hennepin, Illinois):

“Marquis has a long history of driving innovation in biofuel production with a diverse portfolio of multi-generational, family-run companies focused on continual innovation in creating a sustainable world. Our goal is to become a carbon-neutral industrial complex, and we are currently developing an on-site carbon capture and sequestration (CCS) project. … Accordingly, we encourage the EPA to take into consideration, and account for, a fuel producer's efforts to reduce the carbon intensity of their fuel, including CCS and conservation programs targeted at soil sequestration of carbon. An important step in recognizing the benefits of these measures is for the EPA to use the best available science to calculate ethanol's lifecycle greenhouse gas emissions.” (Link to Marquis Energy) - Comment excerpt from Ray Curry, President, International Union, United Automobile, Aerospace and Agricultural Implement Workers of America (UAW):

“The UAW supports the Renewable Fuel Standard (RFS) program as it is vital for our nation’s farmers and helps address the climate crisis by reducing carbon emissions. … Roughly 16,000 UAW members work in the agricultural implement manufacturing sector, many of whom proudly build farm equipment used to plant, cultivate, and harvest crops that become biofuels and bio-products. Our members manufacture combines, tractors, and the products needed by the emerging biofuel industry as well as hay harvesting and baling equipment, cotton pickers, sprayers, tillage and planters. … These jobs enable workers to provide for their families and contribute to a healthy local economy. We respectfully urge EPA to not put high-skilled and specialized agricultural manufacturing jobs at risk.” (Link to UAW newsroom)

- Comment excerpt from Brooke Coleman, Executive Director of the Advanced Biofuels Business Council (ABBC):

We commend EPA staff for their perseverance and for getting the RFS back on track via the recently finalized (2020-2022) and proposed multiyear proposals that could stabilize the program through 2025. … The U.S. biofuels industry is one of the largest renewable energy sectors in the country, employing hundreds of thousands of workers in biofuel production, transport and supplier industries. A recent report found that that the U.S. biofuel industry supports at least 30,000 union jobs, primarily in agriculture, manufacturing, transportation and utilities, construction, and professional and business services. … A strong RFS will accelerate the administration’s economic and national security goals and bring back clean fuel investments lost over the last decade.” (Link to ABBC)

— Energy Dept. to loan $2 billion for EV battery recycling plant. As part of the agency's Advanced Technology Vehicles Manufacturing loan program, the Department of Energy conditionally awarded a $2 billion loan to Redwood Materials Inc. to help build a $3.5 billion battery recycling and remanufacturing facility in Nevada, to boost domestic production of critical materials for electric vehicle batteries. The company, founded in 2017 by former Tesla Inc. Chief Technical Officer JB Straubel, is on track to become one of the largest battery recyclers in the world, and is planning to build a similar $3.5 billion recycling facility in South Carolina. Link for details via Reuters.

— U.S. expected to finalize EV charger rule this week. The Dept. of Transportation is expected to finalize a requirement that will mandate electric vehicle chargers to meet the combined charging system standard in order to qualify for subsidies from a $7.5 billion federal program, Reuters reports, citing unnamed administration officials. Link for details.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— World bird flu toll accelerating at faster pace than last year. About 100 million poultry died or were culled due to avian influenza between the start of October and Feb. 3, according to the World Organization for Animal Health. That’s more than triple the number in the same period a year earlier, which ended with record losses from the disease. Farmers and officials face a significant challenge in reining in the deadly virus.

Coops across Europe and North America have suffered severe outbreaks, and cases are escalating in South America — including Bolivia, which borders major chicken producer Brazil. “The more the virus circulates in animals, the higher is the risk for humans,” the World Health Organization’s Sylvie Briand said. Link for details via Bloomberg.

|

HEALTH UPDATE |

— Summary:

- Global Covid-19 cases at 672,929,054 with 6,854,115 deaths.

- U.S. case count is at 102,850,877 with 1,114,378 deaths.

- Johns Hopkins University Coronavirus Resource Center says there have been 670,306,507 doses administered, 269,208,743 have received at least one vaccine, or 81.71% of the U.S. population.

— The U.S. gov’t agreed to buy 1.5 million more doses of Novavax’s Covid-19 vaccine, the company said, part of preparations for the end of government purchases and the start of a commercial market for the shots.

|

POLITICS & ELECTIONS |

— Poll results show tepid support for another Biden run. As President Biden prepares for an expected re-election bid, many of his party’s voters aren’t on board. Concerns about Biden’s age and abilities are front of mind for some Democrats, even those who think the 80-year-old president has done well during his first two years in office, according to recent polling and Wall Street Journal interviews (link) with more than two dozen people around the country who voted for Biden in 2020. A recent poll from the Associated Press-NORC Center for Public Affairs showed that 62% of Democrats didn’t want Biden to seek a second term, while 37% did. A Washington Post-ABC poll showed that 58% of Democrats and Democratic-leaning independents would prefer to nominate someone other than Biden, while 31% favored nominating Biden.

|

CONGRESS |

— Congress’ schedule: Link to our The Week Ahead released on Sunday.

|

OTHER ITEMS OF NOTE |

— Want to work at home and not the company’s office? Plug in your personal priorities and use the WSJ’s interactive tool (link) to discover places that might be your remote-work paradise — even if they’re not on your radar. Link to WSJ methodology used. A nugget: After Silicon Valley layoffs, D.C. is a better place to get a tech job (link).

— Ending the pandemic emergency could undermine the rationale for President Biden’s student-debt forgiveness plan. Unable to pass the proposal in Congress last year, the White House relied on expanded executive powers tied to the emergency declaration to enact the plan, and Biden said his intent was to “address the financial harms of the pandemic.” The Supreme Court will hear arguments on Feb. 28 in a case that could decide the fate of the program.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 | New farm bill primer | China outlook | Omnibus spending package |