U.S. Shoots Down Fourth Flying Object; China Also Near Shooting Down Object

Inflation or disinflation | Farm bill update | CFTC report snafu | Biden snubs Fox on interview

Washington Focus

House out, Senate in. The House is out for two weeks — think about that the next time people say there isn’t much time to write a farm bill or get annual appropriations completed on time. The Senate is in.

Biden partisanship? President Joe Biden did not give an interview with Fox or any of its sister networks as part of its Super Bowl coverage this weekend. The decision breaks with the tradition of presidents sitting for pre-game interviews with the network hosting the most-watched sporting event of the year. Former President Donald Trump refused to do a sit-down with game-day host NBC in 2018.

White House officials offered a sit-down to Fox Soul, a streaming service targeting Black viewers. The New York Times (link) called it “an effort by Mr. Biden’s aides to sidestep the news anchors on Fox News, but evade criticism for dodging an interview.”

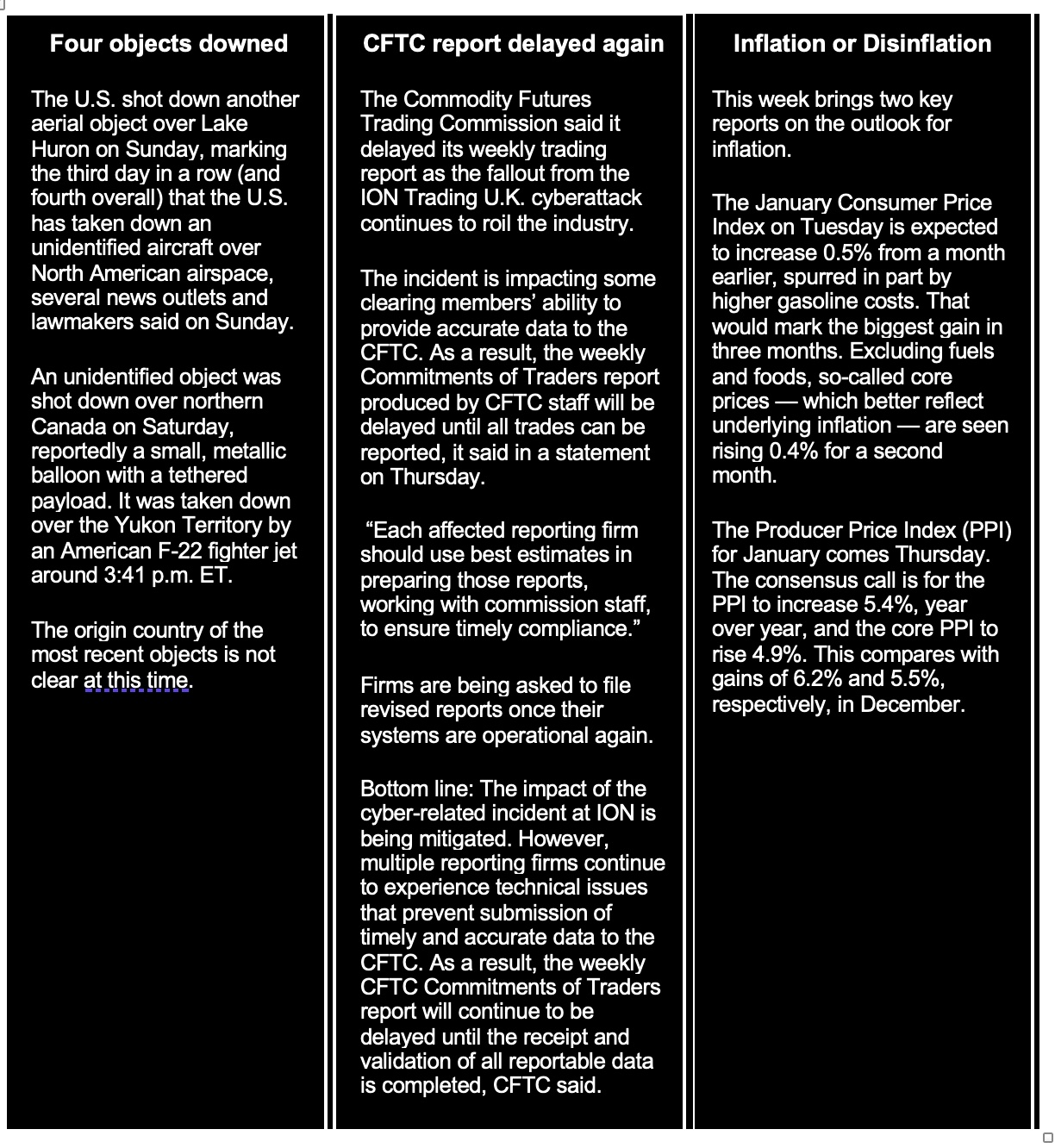

Make it four objects shot down thus far. The U.S. shot down another aerial object over Lake Huron on Sunday, marking the third day in a row (and fourth overall) that the U.S. has taken down an unidentified aircraft over North American airspace.

Canadian Prime Minister Justin Trudeau announced that an unidentified object was shot down in its airspace Saturday. That came after the U.S. on Friday shot down a "high-altitude" object that violated its airspace above territorial waters near Alaska and after the Pentagon destroyed a balloon believed to be sent by the Chinese government and suspected to have been used for surveillance.

NORAD downed the object over Yukon following Trudeau's order. Canadian forces are now working to recover and analyze the wreckage of the object, per Trudeau, who said he has spoken with President Biden.

American officials believe that aerial objects shot down by the U.S. were balloons , Senate Majority Leader Chuck Schumer (D-N.Y.) said Sunday. During an appearance on ABC’s This Week, Schumer said he was briefed on the incidents by National Security Advisor Jake Sullivan on Saturday night. When asked if the objects shot down on Friday and Saturday were balloons, Schumer acknowledged that’s what he was told.

Schumer said Sunday that the U.S. would be able to use debris from the first incident “to piece together this whole, whole surveillance balloon, and know exactly what’s going on. “Look, I think the Chinese were humiliated. I think the Chinese were caught lying,” he said. “And I think it’s a real — it’s a real step back for them, yes. I think they’re going to have to — I think they’re probably going to have to get rid of it or do something because they look really bad. And they’re not just doing the United States. This is a crew of balloons, we saw one in South America, they’ve probably been all over the world.” Beijing has denied allegations and claimed that the balloon was merely gathering weather data.

The Washington Post notes (link) that we’re likely going to detect more objects because we’ve “opened the filters”: “The incursions in the past week have changed how analysts receive and interpret information from radars and sensors, a U.S. official said Saturday, partly addressing a key question of why so many objects have recently surfaced.

Upshot: The Chinese spy balloon incident has GOP saying no cuts to defense. Meanwhile, the Commerce Department blacklisted six Chinese makers of balloon and airship equipment, which the agency alleged is connected to intelligence gathering by the People’s Liberation Army. The move underscores U.S. concerns that China’s craft are wired for a new age in surveillance. Link for more on that via the WSJ.

Now China shooting down an object? Officials in China are preparing to shoot down an object flying over waters near the port city of Qingdao, which is home to a major naval base for the People’s Liberation Army, according to reports. Link to Bloomberg item.

Note this: The number of Chinese migrants illegally crossing into the U.S. during the last three months of 2022 skyrocketed by over 700% compared to the same period a year earlier, data shows. The Customs and Border Protection apprehended 1,862 Chinese nationals trying to cross the U.S./Mexico border during the last quarter of 2022, according to numbers provided by Customs and Border Protection. Just 229 migrants were seized from the southern border during those same months in 2021. The DHS is keeping an eye out for potential spies, a source told Fox, especially after the recent spy balloon incident.

The Wall Street Journal editorial board wrote (link): “Are we seeing these objects now only because we are suddenly looking for them? Are they sent by foreign actors, or someone else? Do they pose a threat, and we don’t mean only to civilian air traffic? What the hell is going on up there, Mr. President?”

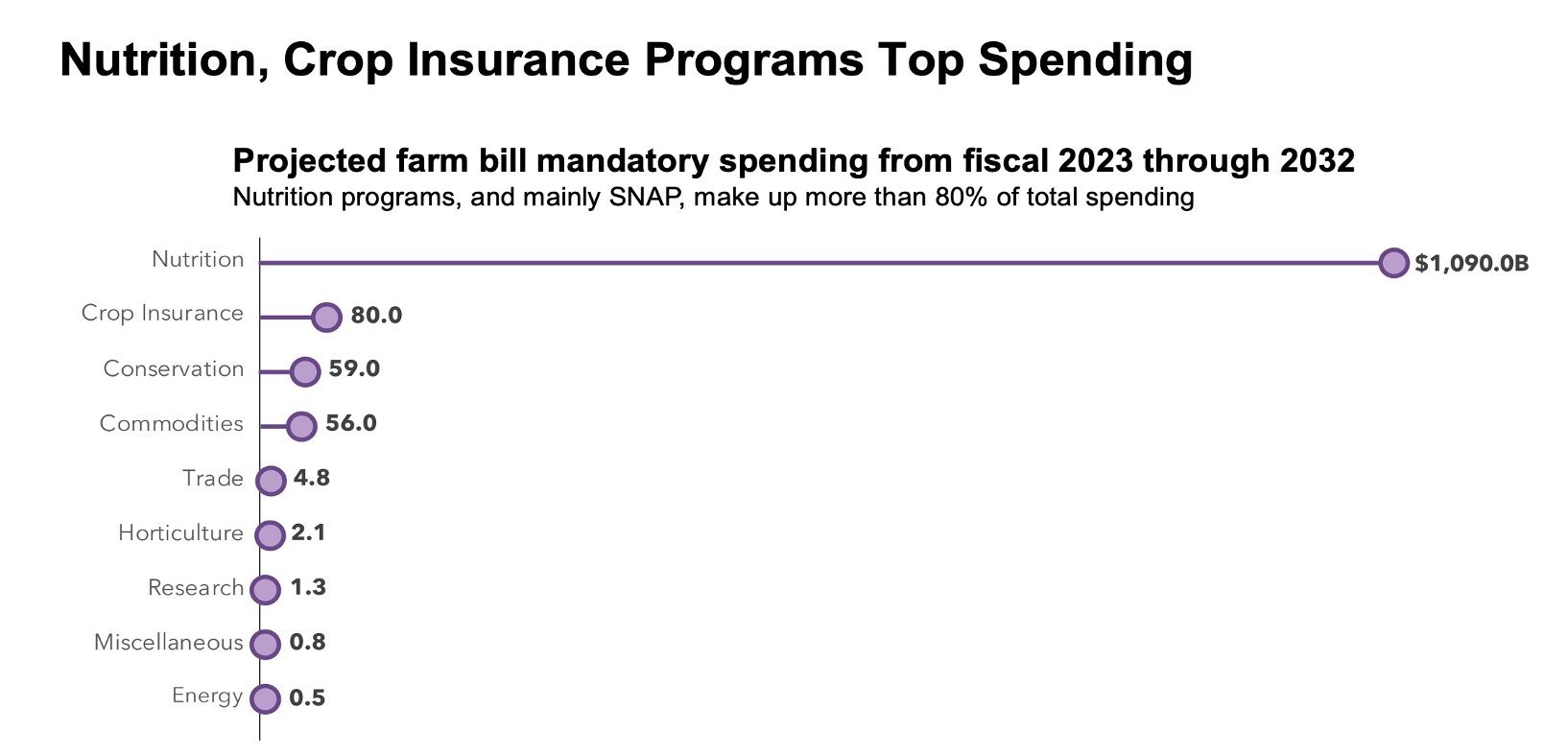

The new farm bill timeline will get important information this Wednesday when the Congressional Budget Office (CBO) unveils its 10-year budget cost estimate for existing farm bill programs, including the Supplemental Nutrition Assistance (food stamp) Program, which accounts for over 80% of farm bill spending.

CBO’s forecasts will be a governor on the need for additional Title I spending to fix a very anemic safety net… unless Congress authorizes a boost in funding. While most observers think getting additional funding is a pipedream, some Republican farm-state lawmakers are already trying to woo GOP leaders to do just that. Problem: The $31.4 trillion debt and hefty costs to service that debt are big hurdles.

Note: CBO has already sharply increased its cost estimates for SNAP in part because of the controversial Thrifty Food Plan (TFP) update, a big Biden administration maneuver that a Government Accountability Office report released in December (link) showed, according to GOP farm panel leaders, the process USDA used for modifying the TFP in 2021 was “marred by egregious executive overreach, lacked an economic peer-review process, and included flawed — even legally questionable — decision-making.” (Link for statement.) That ought to make for some farm bill debates ahead. The 2018 Farm Bill included a provision requiring USDA to re-evaluate the TFP by 2022 and at five-year intervals thereafter. That was a gift for those pushing a huge increase in funding for the program.

Reality: Higher interest rates = more funding spent on servicing the nation’s $31.4 trillion debt. The Treasury’s spending on interest on the debt was $261 billion in the first four months of this fiscal year, a 33% increase from $196 billion spent in the same period last year, according to the department. The fiscal deficit that has widened to $460 billion, up 78% from $259 billion in the same four months of last fiscal year. In another forecast of the cost of servicing the debt, the Congressional Budget Office said the Treasury’s spending on interest on the debt is up 41% to $198 billion in the first four months (Oct. through January) of this fiscal year compared with $140 billion in the same period last year.

As for CBO’s farm bill forecasts, they are just that, and frequently are well off the mark in either direction. It’s a lot like USDA’s farm income projections in February for the year ahead. In the farm bill case, CBO looks out 10 years… good luck taking these forecasts too seriously, which is why the farm bill is frequently out of date so soon after it is written.

The talk, talk, talk ahead of a new farm bill continues this week, when the House Agriculture Committee goes on the road Tuesday for a listening session at the World Ag Expo in Tulare, California. Frankly, there is very little new that will come out of these listening sessions and hearings. Based on many talks with farmers, their real “farm program” is crop insurance and that is where their focus remains.

Meanwhile, the Senate Agriculture Committee holds a hearing Thursday on SNAP and other nutrition assistance programs. One can write the food stamp hearing headline already: Dems wants more funding for SNAP and no onerous work requirement pushed by Republicans.

National Association of State Departments of Agriculture winter policy conference is held Monday through Wednesday. Look for talk about (1) farm bill needs, (2) trade policy, especially relative to Mexico and the need for more free trade agreements, and (3) biofuels.

USDA Secretary Tom Vilsack travels to Louisiana on Monday and Tuesday. He will participate in events highlighting how the Biden administration has addressed the climate crisis, addressing land management and water supply challenges in the West, and improving producers and forest landowners’ resilience, and building an economy from the bottom up and middle out and creating new jobs and opportunities, including for small and underserved producers and businesses.

Vilsack will deliver a keynote address Monday at the National Association of Conservation Districts’ (NACD) 77th Annual Meeting in New Orleans. USDA says he will announce “historic new resources” that USDA is making available to expand agricultural producers and forest landowners’ ability to adopt climate-smart agricultural practices, and “a new, comprehensive, and multi-state strategy to address key water and land management challenges across the West.”

Low carbon transportation fuels. The Senate Environment and Public Works Committee on Wednesday will hold a hearing titled "The Future of Low Carbon Transportation Fuels and Considerations for a National Clean Fuels Program." \

EPA action. Last December, the Environmental Protection Agency proposed expanding the federal Renewable Fuel Standard (RFS) to benefit electric vehicle automakers and charging network operators, allowing them to apply for biofuel compliance credits for using renewable energy to power EVs. More recently, a group of Midwest lawmakers wrote a letter to President Biden, calling on his administration to allow for the sale of more ethanol-heavy fuel year-round instead of only in the summertime months. Proponents of the E15 blend argue it reduces emissions because it burns more cleanly, while opponents say it contributes to more pollution because of the higher ethanol content.

The panel will feature testimony from Geoff Cooper, president of the Renewable Fuels Association; Chris Spear, president of the American Trucking Association; and Michael Graff, chairman of American Air Liquide Holdings Inc.

The Commodity Futures Trading Commission (CFTC) will hold an open meeting Wednesday and will consider proposed rulemaking on risk management regulations, as well as an order regarding record-keeping and data systems. An update hopefully will be forthcoming from CFTC regarding the fallout from the ION Trading U.K. cyberattack (see black box item above).

Nominations:

- The Senate Committee on Commerce, Science and Transportation will examine the nomination of Gigi B. Sohn on Tuesday to become a commissioner of the Federal Communications Commission. Sohn, the co-founder of open internet nonprofit Public Knowledge, was originally nominated by President Joe Biden in 2021 but had her candidacy stall in committee.

- The Federal Trade Commission will host a public forum on Thursday that will examine the agency's proposed rule to prohibit employers from imposing noncompete clauses on their workers. The forum will include speakers who have been subject to noncompete restrictions and business owners who have experience with the clauses.

NATO defense ministers are scheduled on Tuesday to begin a two-day meeting in Brussels amid the backdrop of the devastating earthquake that struck Turkey and Syria and the ongoing war in Ukraine. Ministers of defense from NATO invitees Finland and Sweden, as well as Ukraine's defense minister, will be in attendance.

Another GOP candidate to enter the presidential 2024 sweepstakes. Former South Carolina Gov. Nikki Haley is expected on Wednesday to announce in Charleston that she’s running for president, Haley would be the second big-name Republican to jump into the 2024 presidential race, with former President Donald Trump launching his bid last fall.

Selected events on tap this week:

Monday, Feb. 13

- U.S. and world trade issues. Washington International Trade Association virtual 2023 Washington International Trade Conference with the theme "A New Framework for Trade.” Runs through Tuesday. World Trade Organization Deputy Director-General Angela Ellard delivers remarks on "WTO Update."

- Energy issues. National Association of Regulatory Utility Commissioners 2023 Winter Policy Summit, with Monday highlights including Energy Secretary Jennifer Granholm speaking on "The Changing Energy Landscape and Regulatory Challenges.”

- Global impacts of war in Ukraine. Henry L. Stimson Center holds event on "The End of History? Global Implications of the War in Ukraine."

- CFTC meeting. Commodity Futures Trading Commission meeting of the Global Markets Advisory Committee.

- Indo-Pacific trade issues. Deputy Secretary of State Wendy R. Sherman; Japanese Vice Minister Mori Takeo; and Republic of Korea First Vice Minister Cho Hyundong hold a joint media availability after a trilateral meeting to "discuss collaboration on support to Ukraine and other pressing global challenges and concrete ways to expand the trilateral partnership to deliver on the shared vision of a free, open, and prosperous Indo-Pacific."

Tuesday, Feb. 14

- President Joe Biden and Treasury Secretary Janet Yellen deliver remarks to the National Association of Counites.

- Global trade and development. World Bank and the Peterson Institute for International Economics discussion on "Driving Global Trade for Development."

- U.S. and world trade issues. Final day of the Washington International Trade Association 2023 Washington International Trade Conference with the theme "A New Framework for Trade.”

- Ukraine defense issues. Defense Secretary Lloyd J. Austin III delivers opening remarks at a meeting of the Ukraine Defense Contact Group.

- Antitrust activity. U.S. Chamber of Commerce conference on "Antitrust and Competition Policy — The Year Ahead."

- War in Ukraine. The Atlantic Council holds a virtual discussion on "What does Ukraine need to win in 2023?"

- Crypto protections for digital assets. Senate Banking, Housing and Urban Affairs Committee hearing on "Crypto Crash: Why Financial System Safeguards are Needed for Digital Assets."

- FCC nominee. Senate Commerce, Science and Transportation Committee hearing on the nomination of Gigi Sohn to be a commissioner of the Federal Communications Commission.

- Extreme heat. Washington Post Live virtual discussion on "How Extreme heat is Impacting the US and the World."

Wednesday, Feb. 15

- CBO budget outlook. Congressional Budget Office (news briefing on the release of reports titled: "The Budget and Economic Outlook: 2023 to 2033" and the "Federal Debt and the Statutory Limit, February 2023."

- U.S./U.K. trade agreement. Center for Strategic and International Studies virtual discussion on "U.S./U.K. Trade Agreement: Now is the Time."

- Economic impact of climate risks. Senate Budget Committee hearing on "Climate-Related Economic Risks and Their Costs to the Federal Budget and the Global Economy."

- China/Russia relations. Carnegie Endowment for International Peace virtual discussion on "China-Russia Relations One Year into the Ukraine War."

- EU energy security. Center for Strategic and International Studies (virtual discussion on "European Union Energy Security."

- China and critical minerals. Peterson Institute for International Economics virtual discussion on "Challenging China's Critical Mineral Dominance."

- CFTC meeting. Commodity Futures Trading Commission (CFTC) meeting by teleconference.

- Global security challenges. Senate Armed Services Committee hearing on "Global Security Challenges and Strategy."

- Low carbon/clean fuels. Senate Environment and Public Works Committee hearing on "The Future of Low Carbon Transportation Fuels and Considerations for a National Clean Fuels Program."

- SEC meeting. Securities and Exchange Commission (SEC) teleconference.

- IRS nominee. Senate Finance Committee hearing on the nomination of Daniel I. Werfel to be commissioner of the Internal Revenue Service.

- Supply chains. International Trade Administration teleconference of the Advisory Committee on Supply Chain Competitiveness to discuss major competitiveness.

- U.S. and China. Brookings Institution discussion on the U.S. approach to the People's Republic of China.

- IRA energy provisions. Resources for the Future discussion on "Future Generation: Exploring the New Baseline for Electricity in the Presence of the Inflation Reduction Act."

- U.S. electricity. Department of Energy meeting of the Electricity Advisory Committee including a focus on the North American Resiliency Model (NAERM).

- U.S. border crisis. House Energy and Commerce Health Subcommittee and Oversight and Investigations Subcommittee joint field hearing on "President Biden's Border Crisis is a Public Health Crisis."

Thursday, Feb. 16

- Farm Bill 2023: Nutrition programs. Senate Ag Committee. Witnesses: Stacy Dean, USDA deputy undersecretary for food, nutrition, and consumer services, and Cindy Long, administrator of the Food and Nutrition Service.

- War in Ukraine and energy security. Brookings Institution virtual discussion on "Keys to Climate Action: How developing countries could drive global success and local prosperity."

- Trade laws and enforcement. Senate Finance Committee hearing on "Ending Trade that Cheats American Workers by Modernizing Trade Laws and Enforcement, Fighting Forced Labor, Eliminating Counterfeits, and Leveling the Playing Field."

- China invasion of Taiwan. Heritage Foundation discussion on "China and Ukraine: A Time for Truth," focusing on the outcome of any Chinese invasion of Taiwan.

- Russia disinformation on Ukraine. Radio Free Europe/Radio Liberty virtual discussion on "Clearing the Air: Russian Disinformation and the War in Ukraine."

- U.S. electricity. Department of Energy meeting of the Electricity Advisory Committee with a focus on hurricane resilience and other energy issues.

- Climate and developing countries. Brookings Institution virtual discussion on "Keys to Climate Action: How developing countries could drive global success and local prosperity."

- U.S. energy issues. House Energy and Commerce Energy, Climate, and Grid Security Subcommittee field hearing on "American Energy Expansion: Improving Local Economies and Communities' Way of Life."

- Black Sea security. University of Maryland's Center for International and Security Studies at Maryland Global Forum on "Black Sea Security Conundrum: Implications of Russia's War on Ukraine."

- Russian and Western relations. Johns Hopkins University Paul H. Nitze School of Advanced International Studies virtual Global Risk Conference on "Russia and the West: All Bridges Burned?"

- Impacts on Ukraine from war. Wilson Center Kennan Institute for Advanced Russian Studies discussion on "The Implications of Russia's War on Ukraine: Identity, Politics, Governance."

- Biden’s Ukraine strategy. Carnegie Endowment for International Peace (virtual discussion on "Inside Look at Biden's Ukraine Strategy."

Friday, Feb. 17

- Russian war in Ukraine. Center for Strategic and International Studies virtual discussion on "One Year Later: Assessing Russia's War in Ukraine."

- U.S. fiscal health. Bipartisan Policy Center virtual discussion on "Beyond the Debt Limit: A Discussion of the Fiscal Health of the U.S."

Economic Reports and Fed Speakers for the Week

The week ahead will focus on inflation and interest rates with the Consumer Price Index (Tuesday) and Producer Price Index (Thursday) reports due.

Monday, Feb. 13

- Federal Reserve Governor Michelle Bowman will speak at the American Bankers Association Conference for Community Bankers.

- Cleveland Fed will host a panel of central banking economists and researchers to discuss how the Fed lowers inflation.

- EU, European Commission publishes its winter interim economic forecast.

Tuesday, Feb. 14

- National Federation of Independent Business releases the Small Business Optimism Index for January. Consensus estimate is for a 90 reading, roughly even with December’s. The index has had 12 consecutive monthly readings below the 49-year average of 98, as inflation remains top of mind for small-business owners.

- Bureau of Labor Statistics (BLS) releases the Consumer Price Index for January. Economists forecast that the CPI will increase 6.2%, year over year, three-tenths of a percentage point less than in December. The core CPI, which excludes volatile food and energy prices, is seen coming in at 5.4%, down from 5.7%.

Wednesday, Feb. 15

- MBA Mortgage Applications

- National Association of Home Builders releases its Housing Market Index for February. Expectations are for a 35 reading, even with January’s. The index is above its recent trough from December, ending a streak of 12 consecutive monthly declines, but home-builder sentiment remains dour.

- Census Bureau reports on retail sales for January. The consensus expectation is that retail spending increased 1.4%, month over month. Excluding autos, spending is seen up 0.7%. Both figures decreased by 1.1% in December.

- The Fed releases January industrial-production figures, which measure the output of factories, mining and utilities. U.S. industrial production declined 0.7% in December from the previous month, its second consecutive monthly drop.

- Empire State Manufacturing

- Business Inventories

- Atlanta Fed Business Inflation Expectations

- The U.K.’s Office for National Statistics releases January inflation figures. The U.K. consumer-price index rose 10.5% in December from a year earlier, a slowdown from the previous month’s 10.7% increase.

Thursday, Feb. 16

- Jobless Claims: The Labor Department reports the number of worker filings for unemployment benefits in the week ended Feb. 11. Initial jobless claims climbed in the prior week, but remained at a historically low level.

- BLS releases the Producer Price Index for January. The consensus call is for the PPI to increase 5.4%, year over year, and the core PPI to rise 4.9%. This compares with gains of 6.2% and 5.5%, respectively, in December.

- Census Bureau reports residential construction statistics for January. Expectations are for a seasonally adjusted annual rate of 1.37 million housing starts, slightly lower than the December figure.

- Philadelphia Fed Mfg.

- Fed Balance Sheet

- Money Supply

- Fed Governor Lisa Cook will speak at the Brookings Institution for its annual research reception highlighting the economics and finance work of Black women.

- St. Louis Fed President James Bullard will discuss the economic outlook at a Jackson (Tenn.) Chamber event.

- Cleveland Fed President Loretta Mester gives remarks at the Global Interdependence Center.

Friday, Feb. 17

- Conference Board releases its Leading Economic Index for January. Economists forecast a 0.3% month-over-month decline. The index has fallen for nine straight months. The trajectory of the LEI signals a recession in the next 12 months, according to the Conference Board.

- Import & Export Prices

- Federal Reserve monetary policy report.

Key USDA & international Ag & Energy Reports and Events

Focus: The International Grains Council releases its monthly market update Thursday and Russia’s Sochi city will host a grains conference during the week.

Monday, Feb. 13

Ag reports and events:

- Export Inspections

- Feed Grains: Yearbook Tables

Energy reports and events:

- World Government Summit, Dubai (through Feb. 15)

- Earnings: Galp Energia

Tuesday, Feb. 14

Ag reports and events:

- Meat Price Spreads

- Dairy Monthly Tables and Dairy Quarterly Data

- Livestock, Dairy, and Poultry Outlook

- Sugar and Sweeteners Outlook

- France farm ministry’s report on output in 2022 and winter plantings in 2023

- EU weekly grain, oilseed import and export data

Energy reports and events:

- API weekly U.S. oil inventory report

- BNEF Forum Seoul 2023

- OPEC monthly oil market report

- Earnings: Devon Energy

- Holiday: Qatar

Wednesday, Feb. 15

Ag reports and events:

- Broiler Hatchery

- USDA Agricultural Projections to 2032

- Turkey Hatchery

- Vegetables, Annual

- Malaysia’s Feb. 1-15 palm oil export data

- FranceAgriMer’s monthly grains balance sheet report

Energy reports and events:

- EIA weekly U.S. oil inventory report

- U.S. weekly ethanol inventories

- Genscape weekly crude inventory report for Europe’s ARA region

- IEA-IEF-OPEC Symposium, Riyadh. Speakers include IEA Executive Director Fatih Birol and OPEC Secretary General Haitham Al Ghais

- IEA monthly oil market report

- WTI March options expire

Thursday, Feb. 16

Ag reports and events:

- Weekly Export Sales

- Tree Nuts: World Markets and Trade

- International Grains Council’s monthly report

- Port of Rouen data on French grain exports

- Russia Grain Conference, Sochi

Energy reports and events:

- EIA natural gas storage change

- Insights Global weekly oil product inventories in Europe’s ARA region

- Earnings: Repsol; Centrica; Cenovus

Friday, Feb. 17

Ag reports and events:

- CFTC Commitments of Traders report (see update in black box above)

- Peanut Prices

- Food Expenditure Series

- Farms and Land in Farms

- Potato Stocks

- FranceAgriMer’s weekly crop conditions reports

Energy reports and events:

- Baker Hughes weekly U.S. oil/gas rig counts

- Earnings: Mol Group

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 | New farm bill primer | China outlook | Omnibus spending package |