Nitrogen Prices Fall but Risk is Real

Nitrogen Prices Fall but Risk is Real

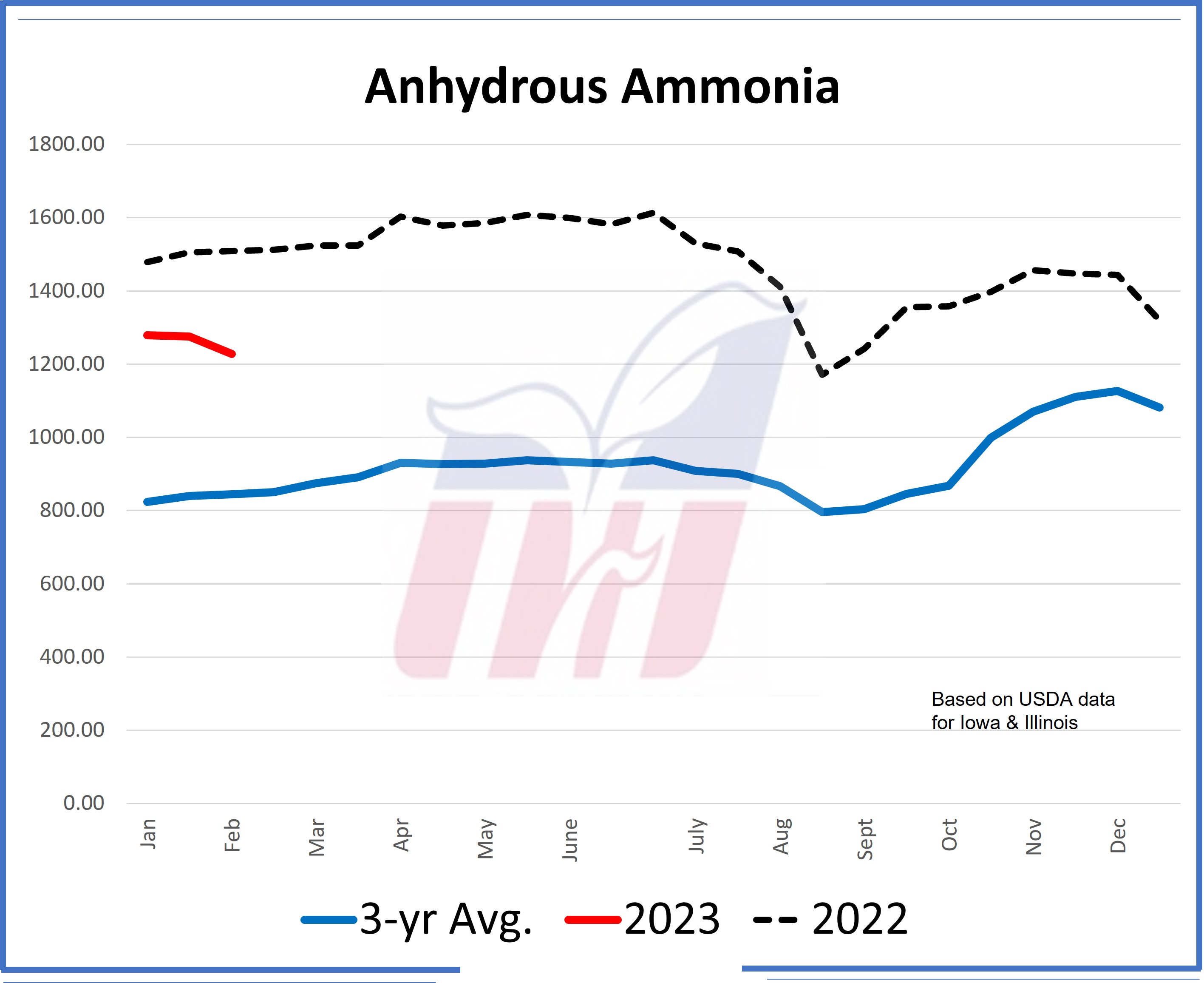

- Anhydrous is $281.25 below year-ago pricing -- lower $47.22/st this week at $1,227.50.

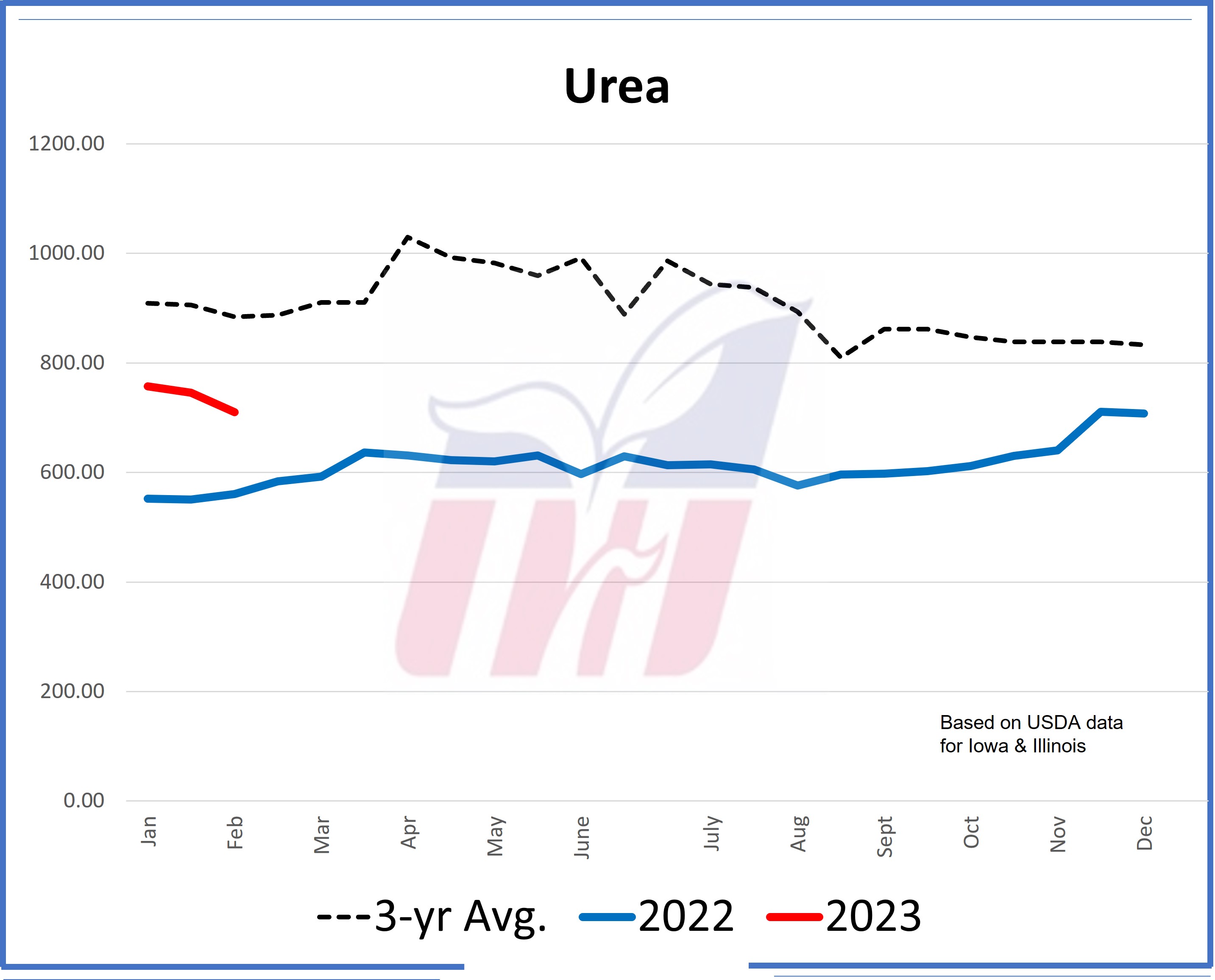

- Urea is $174.24 below the same time last year -- off $35.21/st this week at $710.12.

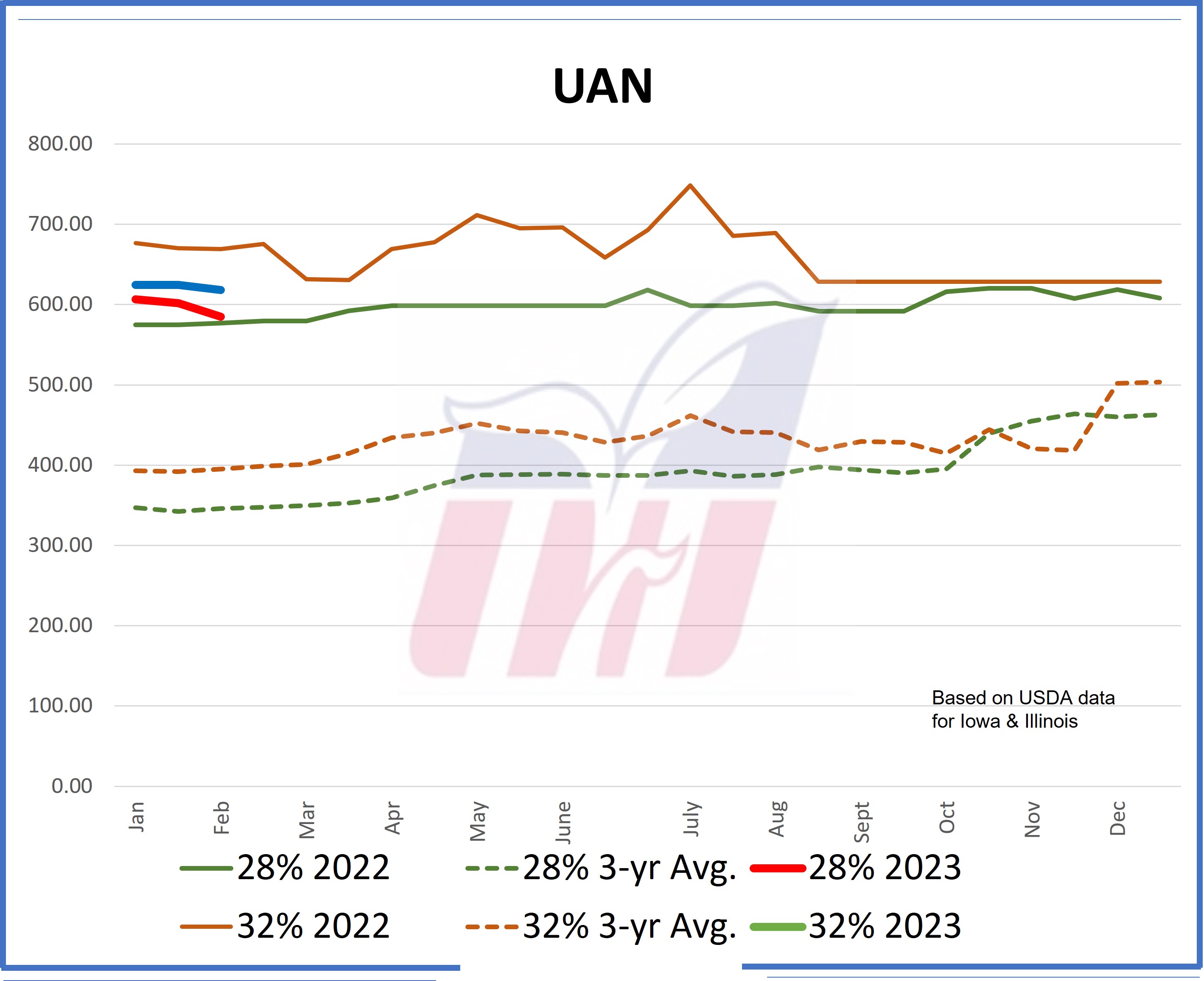

- UAN28% is $7.76 above year-ago -- lower $17.07/st this week at $584.76.

- UAN32% is priced $51.33 below last year -- lower $6.75/st this week at $618.00.

Anhydrous ammonia fell on softness in natural gas futures amid EIA predictions of lower Henry Hub values in the coming year. Urea  fell less aggressively but as of this week is priced in-line with NH3 at the retail level. UAN solutions, 28% in particular, are conspicuously priced at a stark premium to both urea and NH3. Farmers have likely been slow to book spring and summer product, hoping for lower prices later on. This would account for the decline in nitrogen prices as supplies build. Obviously, February is the heart of the offseason for Midwestern farmers and one would expect some price softness during such a time. But the three year averages tracked by Pro Farmer do not show that to be the case. Historically, NH3, UAN and urea have all firmed into spring starting in January according to their respective 3-year averages.

fell less aggressively but as of this week is priced in-line with NH3 at the retail level. UAN solutions, 28% in particular, are conspicuously priced at a stark premium to both urea and NH3. Farmers have likely been slow to book spring and summer product, hoping for lower prices later on. This would account for the decline in nitrogen prices as supplies build. Obviously, February is the heart of the offseason for Midwestern farmers and one would expect some price softness during such a time. But the three year averages tracked by Pro Farmer do not show that to be the case. Historically, NH3, UAN and urea have all firmed into spring starting in January according to their respective 3-year averages.

Last year at this time urea and UAN prices were hinting at price softness but ultimately, Russia's invasion of Ukraine put an end to that fledgling downside potential. I would point out the one-year anniversary of the Russia/Ukraine war is later this month. There are rumors the Kremlin may use the opportunity to escalate their attacks. Much has also  been made about the ground in Ukraine being frozen, allowing heavy military equipment and troops to move over hard ground. The coming Ukrainian spring thaw also adds imperative to Putin's war effort and suggest an escalation would likely come sooner rather than later. Even without an escalation, fertilizer supplies around the globe will remain at risk until some resolution can be forged, which is likely a long way off.

been made about the ground in Ukraine being frozen, allowing heavy military equipment and troops to move over hard ground. The coming Ukrainian spring thaw also adds imperative to Putin's war effort and suggest an escalation would likely come sooner rather than later. Even without an escalation, fertilizer supplies around the globe will remain at risk until some resolution can be forged, which is likely a long way off.

Based on the 3-year averages, anhydrous, UAN and urea are moving counter-seasonally. UAN28% is wildly overpriced compared to NH3 with 32% not far behind. The question is, does 28% fall to correct its premium to NH3, or does NH3 firm to right the spread? In the current environment, where energy prices remain volatile, global politics are heating up and good 'ol fashioned spring demand is set to increase, the current nitrogen price softness is to be rewarded. USDA's ERS is predicting a roughly 15% decline in 2023 net farm income relative to 2022. The American Farm Bureau Federation predicts a 16% fall in profits alongside a 4% gain in inputs.

Bottom line: Global factors continue to fuel upside risk in wholesale fertilizer markets. The current price softness in retail prices is likely the combination of lower natgas prices and farmers dragging their feet to book spring product. The counter-seasonal nature of this price move coupled with UAN's premium to anhydrous and urea should not lull farmers into complacency. Those farmers dragging their feet, waiting for lower fertilizer prices would do well to observe the sharp downturn prices have recently taken and recognize what could be a very rare opportunity to book fertilizer ahead of spring price strength.

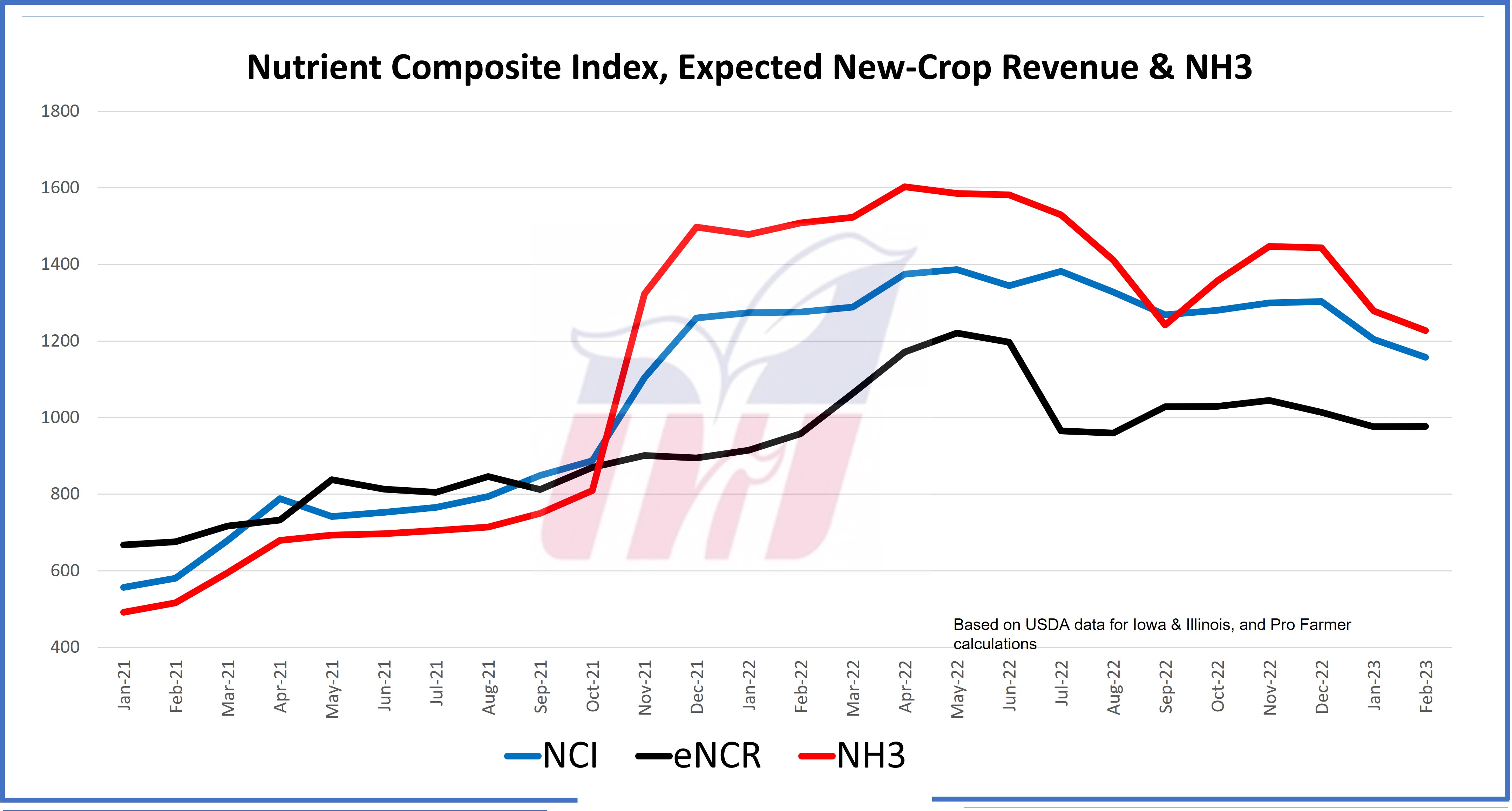

December 2023 corn closed at $5.90 on Thursday, February 9. That places expected new-crop revenue (eNCR) per acre based on Dec '23 futures at $977.45 with the eNCR23/NH3 spread at -250.05 with anhydrous ammonia priced at a premium to expected new-crop revenue. The spread narrowed 36.97 points on the week.

|

Nitrogen pricing by pound of N 5/14/18 |

Anhydrous $N/lb |

Urea $N/lb |

UAN28 $N/lb |

UAN32 $N/lb |

|

Midwest Average |

$0.74 |

$0.79 |

$1.04 1/2 |

$0.96 |

|

Year-ago |

$0.78 |

$0.98 1/2 |

$1.03 1/2 |

$0.95 1/2 |

|

Nitrogen |

Expected Margin |

Current Price by the Pound of N |

Actual Margin This Week |

Outstanding Spread |

|

Anhydrous Ammonia (NH3) |

0 |

74 cents |

0 |

0 |

|

Urea |

NH3 +5 cents |

79 cents |

+5 cents |

0 |

|

UAN28% |

NH3 +12 cents |

$1.04 |

+30 cents |

+18 cents |

|

UAN32% |

NH3 +10 cents |

96 cents |

+12 cents |

+2 cents |