Biden Meets McCarthy Wednesday to Discuss Debt Limit

FOMC decision Wednesday | Jobs report Friday | Farm bill hearing in Senate

Washington Focus

FOMC meeting results come Wednesday, the Employment report is on Friday and there will be continued talk about the need for a debt limit hike or suspension. Meanwhile, action continues regarding a new farm bill, with a hearing in the Senate Ag Committee Wednesday on the trade and horticulture titles.

President Joe Biden will meet Wednesday with House Speaker Kevin McCarthy (R-Calif.) to discuss the debt limit. McCarthy said in a recent interview that House Republicans "won't touch Medicare or Social Security" in their negotiations with the White House over spending cuts and raising the federal debt limit.

FDA Commissioner Robert Califf this week will details his response to reform the agency’s food programs. The push is on for Califf hire a deputy commissioner for foods, with authority over all food-related programs.

The House is set to debate several measures this week that would end policies spurred by the Covid-19 pandemic, including the national emergency declaration and expansion of federal telework initiated in March 2020. The Rules Committee is scheduled to meet today on those bills. The panel is set to meet tomorrow on a nonbinding resolution that would denounce all forms of socialist policies in the US. A simple majority would be required for any amendments and for adoption or passage of the measures.

House Oversight and Accountability hearing on Covid spending fraud set for Feb. 1, the same that the House Judiciary Committee is holding a hearing on the “Biden Border Crisis.” Witness list for the Covid hearing: Michael Horowitz, chair of the Pandemic Response Accountability Committee; Gene Dodaro, comptroller general, U.S. Government Accountability Office; David M. Smith, assistant director, Office of Investigations, U.S. Secret Service. “We owe it to Americans to identify how hundreds of billions of taxpayer dollars spent under the guise of pandemic relief were lost to waste, fraud, abuse, and mismanagement,” panel chair James Comer (R-Ky.) said in a statement.

Former New York Fed President William Dudley speaks at the Economic Club of New York on Wednesday.

The Organization of the Petroleum Exporting Countries and its allies will meet virtually on Wednesday to discuss their next output hike. Reports signal a change is unlikely, as the price of oil has climbed this year amid hopes that oil demand will hit record levels as China reopens. The group last year agreed to cut output by 2 million barrels per day from November through 2023.

The House late last week passed a bill to limit President Joe Biden's ability to use the Strategic Petroleum Reserve. The president would first have to develop a plan to boost production from federal lands through oil and gas leases before withdrawing from the reserve. The measure passed along party lines and is not expected to make it far in the Senate, especially since the White House has already said Biden would veto the legislation.

President Biden on Monday will travel to Baltimore to highlight projects funded by the bipartisan infrastructure law, including the replacement of the 150-year-old Baltimore and Potomac Tunnel to improve the flow of rail traffic.

February 2 is Groundhog Day.

Monday, Jan. 30

- National Sustainable Agriculture Coalition winter meeting, through Wednesday. USDA Secretary Tom Vilsack to speak.

- President Joe Biden delivers remarks on how Bipartisan Infrastructure Law funding will replace the 150-year-old Baltimore and Potomac Tunnel to address the largest bottleneck for commuters on the Northeast Corridor between Washington, DC and New Jersey."

- House Republican agenda. National Press Club Newsmaker Program discussion on the Republican House agenda regarding oversight.

- Black Sea navigation. German Marshall Fund of the United States virtual discussion on "Troubled Water — Navigating the Black Sea," focusing on the region's economic potential, which hinges on maritime security and freedom of navigation.

- Western aid for Ukraine. Washington Post Live virtual discussion on "New Western Aid for the War in Ukraine and Russian Military Shake-up."

- U.S./China relations. Quincy Institute for Responsible Statecraft virtual discussion on "Blinken's Trip to Beijing: U.S./China Relations at a Crossroads."

- Russia-Ukraine war. Johns Hopkins University Paul H. Nitze School of Advanced International Studies virtual discussion on "The Russian War in Ukraine: What Was Accomplished in Minsk 2014-2022 and Why Did the Peace Process Ultimately Fail?"

- Secretary of State Blinken’s trip to China. Center for Strategic and International Studies (conference call briefing on "Previewing Secretary Blinken's China Visit."

- House Rules Committee organizes. House Rules Committee meeting to organize for the 118th Congress.

- Russia-Ukraine war and its impacts. Institute of World Politics lecture on "Lessons Learned from the Russo-Ukraine War and How They Can be Applied to a U.S./China Conflict."

Tuesday, Jan. 31

- GMO corn trade issue with Mexico. National Corn Growers Association hosts a meeting on Capitol Hill on Mexico’s announcement it would ban biotech corn in 2024 or 2025. Speakers include House Ways and Means Committee member Adrian Smith (R-Neb.), NCGA President Tom Haag and USDA trade counsel Jason Hafemeister.

- Deadline for Bureau of Reclamation for Colorado River states to agree to water usage reductions.

- Bipartisan Policy Center webinar, “Making Food and Nutrition Security a SNAP.”

- SNAP and nutrition programs. Bipartisan Policy Center virtual discussion on "Making Food and Nutrition Security a SNAP (Supplemental Nutrition Assistance Program)."

- House Committee organization meetings. House Ways and Means, Oversight and Reform, Judiciary, Education and Labor Committees hold meetings to organize for the 118th Congress.

- Western sanctions on Russia. The Atlantic Council virtual discussion on "The real impact of Western sanctions on Russia."

- China/Japan relations. Center for Strategic and International Studies (virtual discussion on "Assessing the Future Trajectory of China-Japan Relations."

- USDA equity commission. USDA virtual meeting of the Equity Commission with presentations by the Rural Community Economic Development and Agriculture Subcommittees; and deliberations and voting of recommendations to be included in an interim report.

- Winter and the war in Ukraine. German Marshall Fund of the United States (virtual discussion on "A Tale of Two Winters: How Winter is Shaping the War in Ukraine."

- Energy and climate issues. Center for Strategic and International Studies (virtual discussion on "Global Update on Energy and Climate."

- FTC merger reviews. Competitive Enterprise Institute discussion on "the Federal Trade Commission's (FTC) forthcoming merger review guidelines."

- Russian invasion of Ukraine. Johns Hopkins University Paul H. Nitze School of Advanced International Studies discussion on "Holding Russia Liable for Invading Ukraine —Can It Be Done?"

Wednesday, Feb. 1

- NCBA Convention and trade show, New Orleans.

- Pandemic spending. House Oversight and Government Reform hearing.

- Trade and agriculture. Senate Agriculture Committee hearing on the “Farm Bill 2023: Trade and Horticulture,” with Alexis Taylor, USDA undersecretary for trade and foreign agricultural affairs; Jenny Moffitt, USDA undersecretary for marketing and regulatory programs.

- Chinese buying U.S. farmland. Hudson Institute virtual discussion on "Food and Farmland Security in the 118th Congress," focusing on the Chinese acquisition of American farmland.

- Agenda for the 118th Congress. Axios discussion on "the agenda for the newly minted 118th Congress."

- Organizing for the 118th Congress: House. House Transportation and Infrastructure, Financial Services Committees meet to organize for the 118th Congress.

- Organizing for the 188th Congress: Senate. Senate Environment and Public Works Committee meeting to organize for the 118th Congress.

- Covid spending oversight. House Oversight and Accountability Committee hearing on "Federal Pandemic Spending: A Prescription for Waste, Fraud and Abuse."

- Ukraine refugees. Wilson Center's Refugee and Forced Displacement Initiative discussion on "Responding to the Ukrainian Refugee Plight: The EU and U.S. Perspectives."

- Energy issues. United States Energy Association webinar on "Integration of Distributed Energy Resources onto the Grid with XM and PJM."

- Border situation. House Judiciary Committee hearing on "The Biden Border Crisis: Part I."

- Infrastructure and supply chain challenges. House Transportation and Infrastructure Committee (Rep. Peter DeFazio, D-Ore.) hearing on "The State of Transportation Infrastructure and Supply Chain Challenges."

- Climate change and Africa. Center for Strategic and International Studies discussion on "The Vision for Adapted Crops and Soils," focusing on the impact of climate change in Africa.

- Pandemic oversight. House Energy and Commerce Oversight and Investigations Subcommittee hearing on "Challenges and Opportunities to Investigating the Origins of Pandemics and Other Biological Events."

Thursday, Feb. 2

- USDA Equity Commission meeting.

- U.S. policy and the global economy. Institute for Policy Studies briefing on "The Impact of U.S. Policy on the Global Economy."

- DOE implementation of Infrastructure law. Senate Energy and Natural Resources Committee on the "Department of Energy's Implementation of the Infrastructure Investment and Jobs Act."

- Organizing for the 188th Congress: Senate. Senate Commerce, Science and Transportation Committee meeting to organize for the 118th Congress.

- Democrats’ winter meeting. Democratic National Committee holds its 2023 Winter Meeting; runs through Saturday.

- Coal and energy. United States Energy Association virtual discussion on "Cost and Performance Baseline for Fossil Energy Plants Volume 1: Bituminous Coal and Natural Gas to Electricity."

- Germany and the war in Ukraine. Carnegie Endowment for International Peace discussion on "One Year On: Germany's Foreign Policy Shift and the War in Ukraine."

Friday, Feb. 3

- President Joe Biden and Vice President Kamala Harris deliver remarks to the Democratic National Committee Winter meeting.

- World food issues. Wilson Center's China Environment Forum virtual "Green Tea Chat" discussion with 2020 World Food Prize Winner Rattan Lal, professor of soil science at Ohio State University, on "Digging into Soil for Food Security and Climate."

Economic Reports for the Week

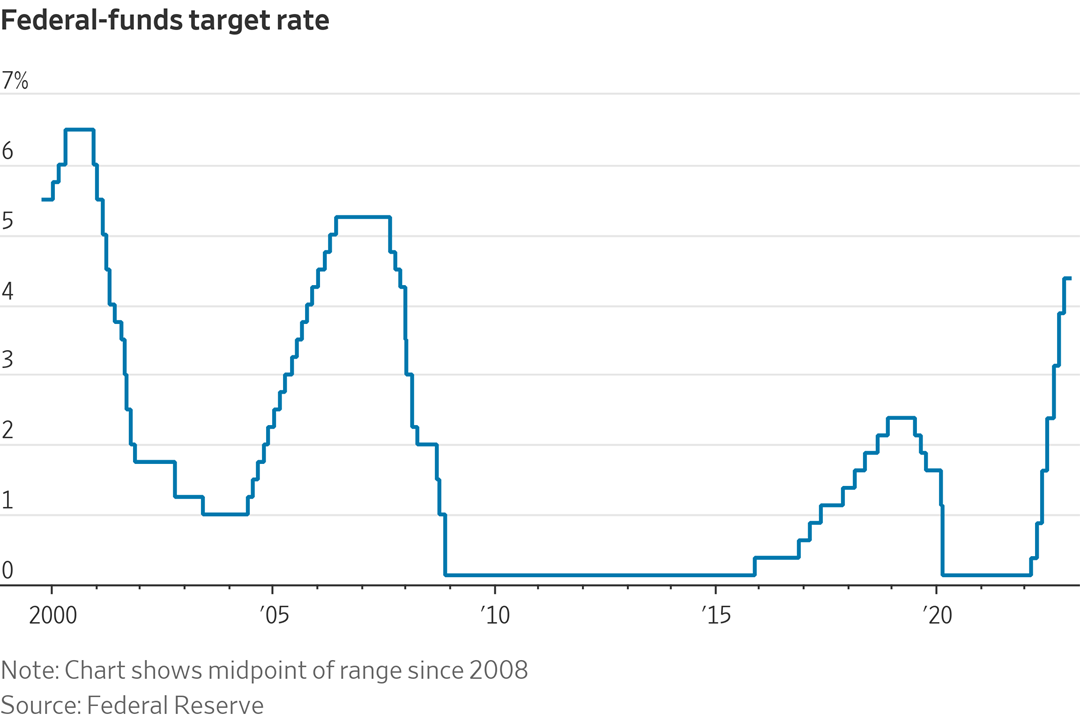

In focus: the highly anticipated interest-rate decision from the Federal Reserve on Wednesday and the new job-market data on Thursday and Friday. Futures markets are betting on a 99% chance of a quarter-point rate hike this week. Bill Adams, chief economist for Comerica Bank, says: “With cooler inflation and increased signs that the economy may have in fact turned, financial markets are pricing in a smaller quarter percentage point rate hike for the Fed’s decision next week — and are now also pricing in the possibility that the Fed holds rates unchanged at their following decision in March.”

The economic-data highlight of the week will be Friday's jobs report for January.

Monday, Jan. 30

- Dallas Fed Manufacturing Survey

Tuesday, Jan. 31

- International Monetary Fund publishes its world economic outlook update

- Institute for Supply Management releases the Chicago Business Barometer for January. Consensus estimate is for a 45.5 reading, roughly even with December. The index has had four consecutive readings below 50, indicating a contracting economy.

- S&P CoreLogic releases the Case-Shiller National Home Price Index for November. Economists forecast a 7% year-over-year rise, compared with 9.2% increase previously.

- Employment Cost Index: Swollen gains of 1% and more over the last five quarters have been signaling substantial wage-push pressures. A sixth 1% or more, at 1.1%, is expected for the fourth quarter.

- Consumer Confidence: After jumping 7 points in December, the consumer confidence index is expected to firm only 0.7 of a point to 109.0 in January.

- The European Union’s statistics agency releases fourth-quarter gross domestic product for the 19-nation eurozone. The combination of a mild winter, energy-conservation efforts and moves by governments to find new natural-gas suppliers—not to mention hundreds of billions of euros in fiscal support — appear to have propped up the eurozone economy.

- S&P Global releases January surveys of purchasing managers measuring economic activity in China’s manufacturing sector. The December manufacturing index fell slightly from the prior month, reflecting a faster contraction, as Covid-19 outbreaks disrupted factory activity.

Wednesday, Feb. 1

- MBA Mortgage Applications

- Federal Open Market Committee (FOMC) announces its monetary-policy decision. The central bank is widely expected to raise the federal-funds rate by 25 basis points to 4.5%-4.75%. Wall Street is eager to hear from Fed Chairman Jerome Powell and glean any hints as to when the FOMC might pause its interest-rate hiking campaign.

- ADP releases its National Employment Report for January. Expectations are for the economy to add 170,000 jobs after an increase of 235,000 in December.

- Bureau of Labor Statistics (BLS) releases the Job Openings and Labor Turnover Survey (JOLTS). The consensus call is for 10.3 million job openings on the last business day of December, 158,000 fewer than in November.

- ISM Manufacturing Index: At 48.4 in December, the ISM manufacturing index has been gradually and consistently deteriorating. January's consensus is 48.0.

- Construction Spending: After edging 0.2% higher in November, construction spending for December is expected to slip 0.1%. Spending has been flat in recent months as gains in non-residential construction have been offset by declines on the residential side.

- The EU’s statistics agency releases January inflation figures for the eurozone. The bloc’s consumer prices were 9.2% higher in December from the same month a year earlier as lower energy costs, due to warmer weather, eased price pressures.

Thursday, Feb. 2

- Jobless claims for the January 28 week are expected to come in at 193,000 versus 186,000 in the prior week which, for the second week in a row, was much lower than expected.

- Productivity and Costs: Nonfarm productivity is expected to rise to a 2.4% annualized rate in the fourth quarter versus growth of 0.8% in the third quarter. Unit labor costs, which rose 2.4% in the third quarter, are expected to rise to a 1.5% rate in the fourth quarter.

- Factory orders are expected to rise 2.2% in December that would follow November's steep 1.8%. Durable goods orders for December, which have already been released and are one of two major components of this report, surged 5.6% in the month on a burst of aircraft orders.

- Fed Balance Sheet

- Money Supply

- Motor Vehicle Sales: New vehicle sales in January are forecast by Cox Automotive to show a gain. Light new-vehicle sales are expected to rise 2.7% from a year ago, but fall 19.8% from last month. The research firm expects the seasonally adjusted annual rate to finish near 15.6 million, a large increase from the 13.3 million pace seen in December. Meanwhile, S&P Global Mobility forecast battery electric vehicle share is expected to reach 7.4% in January to mark a record high mix level. Tesla's downward price adjustments are said to be a notable factor. "While this is the first shot in a price war, the reaction of other auto companies will determine whether the January mix level will be a blip in the trend or a dynamic tipping point in the electrification progress of the market," noted S&P.

- The Bank of England announces its latest interest-rate decision as the U.K. combats high inflation. The central bank raised rates by a half-percentage point in December and signaled caution about raising rates much higher.

- The European Central Bank announces its latest monetary-policy decision. The ECB raised interest rates by a half-percentage point in December following four consecutive increases of 0.75 percentage point and announced plans to reduce its multitrillion-dollar bondholdings starting in March.

Friday, Feb. 3

- BLS releases the jobs report for January. Economists forecast a 190,000 increase in nonfarm payrolls, after a 223,000 gain in December. The unemployment rate is expected to edge up to 3.6% from 3.5%.

- The ISM services index sank abruptly in December, to a much lower-than-expected 49.6. January's consensus is for a modest rebound, to an expected 50.4.

Key USDA & international Ag & Energy Reports and Events

Tuesday brings the Cattle inventory report. On Friday, FAO releases its monthly reports on food prices and grain production.

Monday, Jan. 30

Ag reports and events:

- Export Inspections

- Egg Products

Energy reports and events:

- North Sea crude loading programs for March are due

- BP publishes annual energy outlook

- BNEF Summit, San Francisco (two days)

Tuesday, Jan. 31

Ag reports and events:

- State Stories

- Agricultural Prices

- Cattle

- Sheep and Goats

- Malaysia’s January palm oil export data

- EU weekly grain, oilseed import and export data

Energy reports and events:

- API weekly U.S. oil inventory report

- OPEC+ Joint Technical Committee

- Earnings: Exxon Mobil 4Q; Marathon Petroleum 4Q; Phillips 66 4Q

- French unions hold coordinated strikes and protests, including the energy sector, over government’s planned pension reforms.

- Brent March futures expire

Wednesday, Feb. 1

Ag reports and events:

- Broiler Hatchery

- Cotton System Consumption and Stocks

- Fats & Oils: Oilseed Crushings, Production, Consumption and Stocks

- Flour Milling

- Grain Crushings and Co-Products Production

- Holiday: Malaysia

Energy reports and events:

- EIA weekly U.S. oil inventory report

- U.S. weekly ethanol inventories

- Genscape weekly crude inventory report for Europe’s ARA region

- OPEC+ Joint Ministerial Monitoring Committee

Thursday, Feb. 2

Ag reports and events:

- Weekly Export Sales

- Port of Rouen data on French grain exports

Energy reports and events:

- EIA natural gas storage change

- Insights Global weekly oil product inventories in Europe’s ARA region

- Earnings: OMV FY 2022; Shell; ConocoPhillips

Friday, Feb. 3

Ag reports and events:

- CFTC Commitments of Traders report

- Peanut Prices

- Dairy Products

- FAO World Food Price Index

- FAO Grain Supply and Demand Brief

Energy reports and events:

- Baker Hughes weekly U.S. oil/gas rig counts

- Earnings: Lyondellbasell 4Q results

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 | New farm bill primer | China outlook | Omnibus spending package |