Senators: Biden Admin. Should Pursue Enforcement Acton Against Canada & Mexico

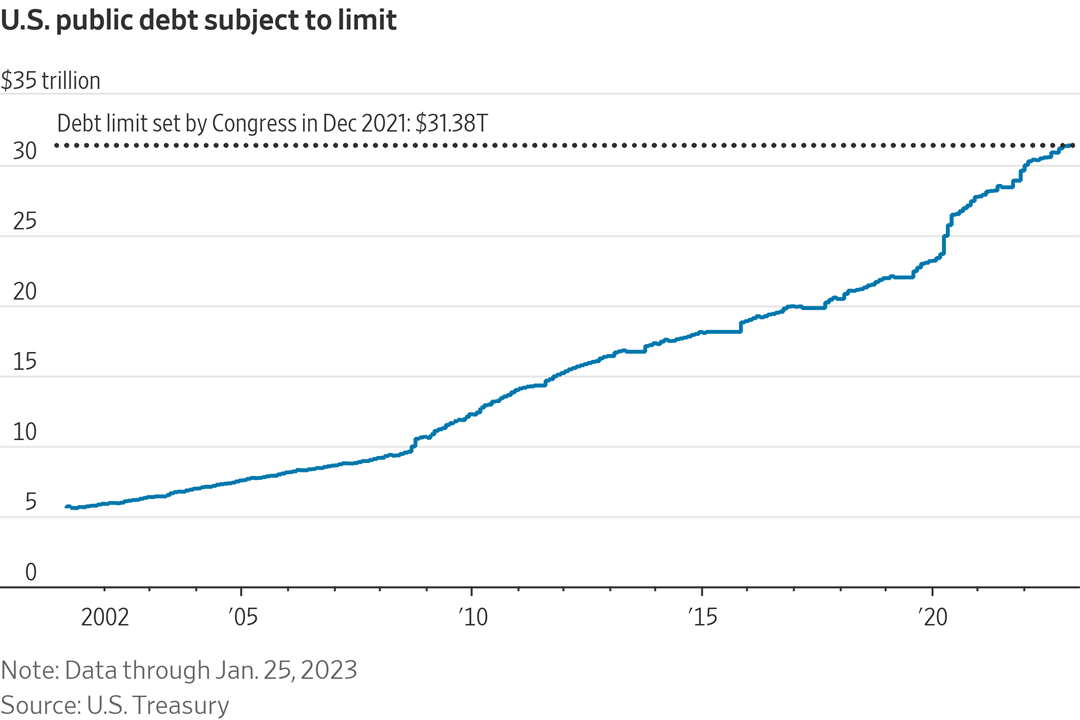

Report: House GOP leaders considering short-term extension federal debt ceiling

|

In Today’s Digital Newspaper |

Equities: Global stock markets were mostly higher overnight in quieter overnight trading. U.S. stock indexes are pointed toward weaker openings. Investors are now turning to the release of data on core inflation, personal income and spending, and pending home sales — all due today.

Major U.S. stock indices registered gains on Thursday after a barrage of economic updates. The Dow finished up 205.57 points, 0.61%, at 33,949.41. The Nasdaq gained 199.06 points, 1.76%, at 11,512.41. The S&P 500 rose 44.21 points, 1.10%, at 4,060.43.

Outside markets today see the U.S. dollar index near steady. Nymex crude oil futures prices are higher and trading around $82.25 a barrel. Meantime, the yield on the benchmark U.S. 10-year Treasury note is presently fetching 3.561%.

U.S. consumer spending falls more than expected. Personal spending in the U.S. dropped 0.2% in December, worse than market forecasts of a 0.1% fall, and following a revised 0.1% decline in November. Consumer spending is cooling due to high interest rates and prices for goods and services and as the holiday season wrapped up.

Meanwhile, core PCE prices rose 0.3%, slightly above 0.2% in November but matching expectations.

The core PCE annual rate, which is the Federal Reserve’s preferred gauge of inflation, fell to an over one-year low of 4.4% in December of 2022 from 4.7% in the prior month, in line with market forecasts.

The personal consumption expenditure price index in the U.S. increased by 5% year-on-year in December of 2022, the least since September of 2021 and below 5.5% in November. Prices for goods were up 4.6.% and prices for services increased 5.2%. Food cost went up 11.2% and energy prices increased 6.9%. Compared to the previous month, the PCE Price Index rose by 0.1%.

Quiet overnight commodity trade. Corn and soybeans posted two-sided trade in light overnight price action, while wheat faded. As of 7:30 a.m. ET, corn futures were trading narrowly mixed, soybeans were fractionally to 2 cents higher, SRW wheat futures were 1 to 2 cents lower, HRW wheat was 4 to 6 cents lower and HRS wheat was 2 to 4 cents lower. Front-month crude oil futures were more than $1.00 higher and the U.S. dollar index was modestly firmer this morning.

Policy:

- Top House Democrat Hakeem Jeffries (D-N.Y.) is open to talks about federal spending with Speaker Kevin McCarthy (R-Calif.), but first wants to see Republicans’ proposal for reductions, and a commitment to take the possibility of defaulting on U.S. debt off the table. “We can have a conversation about future spending,” Jeffries told reporters on Thursday. The House minority leader said before any talks can begin, GOP House members have to coalesce around a concrete demand. “Show us the plan. What is your plan to address your concerns?” Jeffries said. “They want to have a conversation and we don’t even have a document in front of us for which to have a discussion around what future investments in the American people should look like.”

- House Republican leaders are considering proposing a short-term extension of the federal debt ceiling to delay the risk of a default until Sept. 30, Bloomberg reported, citing a person familiar with their deliberations. The strategy is merely an option under consideration, and it isn’t clear whether the Democratic-controlled Senate or White House would agree to such a brief delay.

Russia/Ukraine:

- Russia reacts to news that western tanks would be sent to Ukraine from Germany, the United States, and other allies by both downplaying the decision and threatening Ukraine and its allies. “The potential it gives to the Ukrainian armed forces is clearly exaggerated. Those tanks will burn just like any others,” said Dmitri Peskov, spokesperson for the Kremlin. The Russian Embassy in Berlin, however, called the decision to send tanks “extremely dangerous” and said it “takes the conflict to a new level of confrontation.” The Russian embassy claimed that Germany had demonstrated it was “not interested in a diplomatic solution to the Ukrainian crisis.”

- Ukrainian President Volodymyr Zelenskyy called for more sanctions on Russia. “This Russian aggression can and should be stopped only with adequate weapons. The terrorist state will not understand anything else. Weapons on the battlefield. Weapons that protect our skies,” he said Thursday. “New sanctions against Russia, i.e., political and economic weapons. And legal weapons — we need to work even harder to establish a tribunal for the crime of Russian aggression against Ukraine.”

- Ukraine grain shipments via export deal top 18 MMT. As of Jan. 26, the total tonnage of grain and other foodstuffs exported from three Ukrainian ports via the Black Sea grain deal stood at 18.4 MMT, according to the Joint Coordination Center. A total of 1,354 voyages – 678 inbound and 676 outbound – have been inspected.

- U.S. working to speed up Black Sea grain, fertilizer exports. U.S. Undersecretary of State for Political Affairs Victoria Nuland said Washington is working to increase exports of Russian and Ukrainian grains and fertilizers to the countries in dire need under the Black Sea export initiative. “We are working at every level with the World Food Program as you know to speed both food and fertilizer to countries that would normally be consumers of Ukraine and, frankly, Russia’s output to ensure that they can plant this year,” Nuland said at hearings of the United States Senate Committee on Foreign Relations. “Secretary [Antony] Blinken is particularly focused on ensuring that we are working on this problem not just for today but for tomorrow,” she said.

- U.S., EU discussing Russian oil price cap. Treasury Secretary Janet Yellen said the U.S. and European Union were in the middle of discussions on a Russian crude oil price cap. She hoped the two sides would reach an agreement by Feb. 5.

- Russia raises fertilizer export quota. Russia said on Friday it had increased export quotas for mineral fertilizers by nearly 500,000 MT. The quotas will be valid until May 31.

- Russia raises wheat export tax. Russia’s wheat export tax for Feb. 1-7 will be 4,365.3 rubles ($62.98) per metric ton based on an indicative price of $308.80. That’s up from a rate of 4,283.2 rubles per metric ton the previous week.

Personnel:

- Deputy USDA Secretary Jewel Bronaugh will exit USDA in the coming weeks. Bronaugh says her resignation will give her more time with her family. She also pointed to her work as co-chair of USDA’s first-ever Equity Commission. USDA Secretary Tom Vilsack said Bronaugh “has accomplished a lot during her tenure at USDA and much of her work will be felt well into the future,” while House Ag Committee Ranking Member David Scott (D-Ga.) praised her work at USDA and recalled that she is the first African American woman to serve in the deputy secretary role. Meanwhile, American Farm Bureau Federation (AFBF) President Zippy Duvall said Bronaugh has “long been someone who understands the needs of farmers and rural communities, and we’ve appreciated her leadership.”

- EPA Administrator Michael Regan is considering stepping down, Reuters reported last night, citing four unidentified people familiar with the matter, but a final decision has not been made nor are plans imminent. The EPA said Regan had no plans to depart. "The administrator doesn't have any plans to step down. He's committed to continuing to advance President Biden's historic climate and environmental agenda," said Maria Michalos, an EPA spokesperson and one of Regan's top aides.

China:

- Japan and the Netherlands are set to join the U.S. in limiting China’s access to advanced semiconductor machinery, forging a powerful alliance that will undercut Beijing’s ambitions to build its own domestic chip capabilities. U.S., Dutch and Japanese officials are set to conclude talks as soon as today on a new set of limits to what can be supplied to Chinese companies, the people said.

Trade Policy:

- Biden administration should pursue enforcement action against Canada and Mexico where necessary, Senate Finance leaders Ron Wyden (D-Ore.) and Mike Crapo (R-Idaho) said in a letter, citing Mexico’s nationalist energy policy and compliance shortcomings by Canada over tariff-rate quotas on dairy products, among other issues. The pact’s “full potential remains unrealized,” they said. The senators said the USTR “must ensure that the United States gets what it bargained for” and asked trade chief Katherine Tai to take “decisive action to ensure full compliance” with every chapter of the pact. The letter comes a day after Deputy U.S. Trade Representative Jayme White met with his Mexican and Canadian counterparts in San Diego and emphasized the importance of making meaningful progress in the ongoing talks over Mexico’s energy policy under the USMCA that went into effect in 2020, replacing the two-decade-old NAFTA.

USTR responds. The U.S. has repeatedly urged Mexico and Canada to follow through on their commitments under the USMCA, including through the Rapid Response Labor Mechanism to enforce workers’ rights in Mexico and by requesting dispute consultations with Canada over its dairy policies, a USTR spokesperson said in a statement. The agency continues to seek resolution on those issues, including through White’s meeting this week, and will continue to implement the USMCA, the spokesperson said.

Mexico President Andres Manuel Lopez Obrador denies that his policies violate the pact, saying the U.S. must respect Mexico’s sovereignty. The U.S. says Mexico’s energy policy privileges Mexican state-owned oil producer Petroleos Mexicanos and the electricity provider known as CFE over private companies in areas including natural gas distribution and power generation, including wind and solar companies. The U.S. says this violates the USMCA, treats American companies unfairly, hurts US economic interests and discourages investment by clean-energy companies. If a panel were to rule against Mexico, it might have to pay tariffs on as much as $30 billion in exports. The U.S. first lodged the complaint in July, with Canada also protesting Mexico’s electricity policy. “USTR must use the USMCA dispute-settlement process to push Mexico to abandon these discriminatory policies,” Wyden and Crapo said.

On the long-running dairy issue with Canada, the U.S. in December requested dispute-settlement consultations for a third time over Ottawa’s quotas that many American producers say shuts them out of the Canadian market, saying it has found more areas of “deep concern” and that the nation’s measures are inconsistent with its obligations under the trade pact.

The senators also pushed the USTR for resolution on Mexico’s imposition of export tariffs on white corn, environmental, and digital-trade issues.

Energy and Climate Change:

- DOE: $118 million in biofuel project investments. The Department of Energy (DOE) announced it awarded $118 million across 17 projects that look to pilot and scale up advanced biofuel production technologies including those that support sustainable aviation fuel (SAF) production and look to reduce greenhouse gas emissions (GHG) associated with corn ethanol production. The largest award was $80 million for a biorefinery that would end up producing 1.2 million gallons fully integrated biomass to cellulosic sustainable aviation fuel (SAF). Another project was awarded $8.5 million to establish a pilot plant at an existing ethanol plant to lower the carbon intensity of corn-based ethanol and increase ethanol yield by 50%. The projects approved by DOE combined would produce several million gallons of biofuel annually, DOE said. Given the scope of some of the projects, it will take time for them to be brought on line and produce products like SAF.

Health:

- Sen. Angus King (I-Maine) has Covid again. King tested positive for Covid on his way to the airport back to Maine. “I’ve been vaccinated and boosted, so I feel alright – just sorry to not make it home this weekend,” King said on Twitter. The 78-year-old also tested positive for Covid in August 2021.

- Global cases of Covid-19 are at 669,948,874 with 6,821,438 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 102,260,961 with 1,107,559 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 667,815,331 doses administered, 268,765,902 have received at least one vaccine, or 81.57% of the U.S. population.

- Only about 15% of the U.S. population has gotten their updated Covid-19 booster shots, signaling low vaccine uptake across the country. To help increase that number, a panel of independent experts that advises the FDA voted on Thursday to harmonize Covid-19 vaccines to improve and simplify the process.

Politics & Elections:

- Rep. Adam Schiff (D-Calif.), 62, announced his campaign for Senate. Democratic Sen. Dianne Feinstein, 89, hasn’t announced her intentions yet, but other Democrats have entered the race. Rep. Katie Porter (D-Calif.) is running, while Reps. Rep. Barbara Lee (D-Calif.) and Ro Khanna (D-Calif.) are looking at whether to challenge The top two candidates will advance to the general election regardless of party. House Speaker Kevin McCarthy (R-Calif.) this week removed Schiff from the Intelligence Committee over Trump–related issues.

- Senate 2024 races. The Cook Political Report with Amy Walter is out with their 2024 Senate Race Ratings. Three races start in the Toss Up column — Arizona, West Virginia and Ohio.

Regarding the 2024 presidential contest, Walter says Trump and DeSantis get all the attention, but Georgia Gov. Brian Kemp “is strongly positioned for 2024.” The University of Georgia School of Public and International Affairs survey found the GOP Governor’s approval rating at 62%, including 34% approval from Democrats and 49% among independents.

Congress:

- Newly elected Sen. John Fetterman (D-Pa.) was assigned to the Agriculture, Banking, Environment, Aging and Joint Economic committees.

- Sen. Peter Welch (D-Vt.), the only other new Democrat in the chamber, will be on the Agriculture, Commerce, Judiciary and Rules panels.

- House Ag Committee Chairman Glenn “GT” Thompson (R-Pa.) added a 28th Republican member, Randy Feenstra of Iowa. Feenstra won a seat on Ways and Means this year, and had to get a waiver to stay on Ag. Democrats will have 24 members on the panel.

- Thompson reorganized the Ag Committee panels. Forestry will get its own panel, and nutrition programs now fall under the subcommittee that oversees specialty crop programs and international food aid. Livestock, dairy and poultry are under a single subcommittee. Livestock issues had previously been grouped with foreign agriculture.

Other items of interest:

- Cotton AWP moves higher. The Adjusted World Price (AWP) for cotton is at 75.05 cents per pound, effective today (Jan. 27), up from 72.43 cents per pound the prior week. The AWP has remained at 70 cents or more for the past 11 weeks, keeping it well above the 52-cent mark that would trigger farm program benefits.

- Classified documents. The National Archives is formally asking former presidents and vice presidents to re-check their personal records for any classified documents or other presidential records. This comes in the wake of classified documents discovered in the homes of former President Donald Trump, former Vice President Mike Pence and President Joe Biden over the last year.

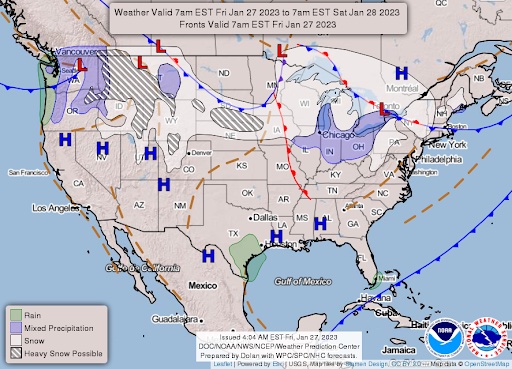

NWS weather outlook: Heavy snow impacting the northern Rockies and northern High Plains to spread into parts of the central Plains and Midwest tonight... ...Arctic air surging southward into the central United States this weekend to produce potentially dangerous wind chills... ...Instances of heavy rain and flash flooding possible throughout the Gulf Coast and Southeast on Sunday.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 | New farm bill primer | China outlook | Omnibus spending package |