Farm Groups File Legal Challenge to EPA’s WOTUS Rule

High stakes debt limit hike/suspension issue unfolds | Why Phase 2 of ERP is unworkable

|

In Today’s Digital Newspaper |

A traveling format again today as I am in Scottsdale, Arizona, to attend and speak at the TEGMA meeting.

USDA daily export sale: 195,000 MT corn to Mexico during MY 2022-2023.

Equities: Global stock markets were mixed but mostly lower overnight. U.S. Dow opened around 170 points lower. In Asia, Japan -1.4%. Hong Kong -0.1%. China +0.5%. India -0.3%. In Europe, at midday, London -1%. Paris -1.3%. Frankfurt -1.3%.

On Wednesday, economic data released before the open provided pressure on markets as traders noted the reduced activity and continued inflationary pressures. Despite seeing initial gains, the Dow finished down 613.89 points, 1.81%, at 33,296.96. The Nasdaq was down 138.10 points, 1.24%, at 10,957.01. The S&P 500 fell 62.11 points, 1.56%, at 3,928.86.

Outside markets: The U.S. dollar index was weaker in early activity with the euro firmer against the greenback. The yield on the 10-year U.S. Treasury note was weaker, trading around 3.40%, with a mixed tone in global government bond yields. Crude was weaker, trading around $79.10 per barrel and Brent was trading around $84.60 per barrel. Gold and silver futures were mixed, with gold firmer around $1,909 per troy ounce and silver was trading around $23.45 per troy ounce.

On Wednesday, oil prices snapped an eight-day winning streak, to close just below $80 a barrel Wednesday. Natural gas prices continued to drop, falling to their lowest closing in 19 months. The 10-Year U.S. Treasury yield declined 0.16 percentage point, to 3.37% — its lowest yield since Sept. 12. Other bond yields fell, as well, as their prices rose.

Initial jobless claims at 4-month low. The number of Americans filing new claims for unemployment benefits fell by 15,000 to 190,000 last week, the lowest in four months and well below expectations of 214,000. The result further consolidated evidence of a tight labor market despite high borrowing costs. The 4-week moving average, which removes week-to-week volatility, fell by 6,500 to 206,000.

The CEO of Aramco worries China’s reopening will strain global oil supplies. A pickup in demand could leave the world vulnerable if there’s another shock like the war in Ukraine, according to Amin Nasser. “We should be worried about the mid to long term,” he told CNBC.

Mixed grain price action overnight. Corn, soybean and wheat futures showed mild followthrough selling during most of the overnight session, but price action has turned narrowly mixed early this morning. As of 7:30 a.m. ET, corn futures were fractionally to a penny lower in most contracts, while soybeans and wheat were a penny lower to 1 cent higher. Front-month crude oil futures were around 50 cents lower and the U.S. dollar index was about 175 points lower this morning.

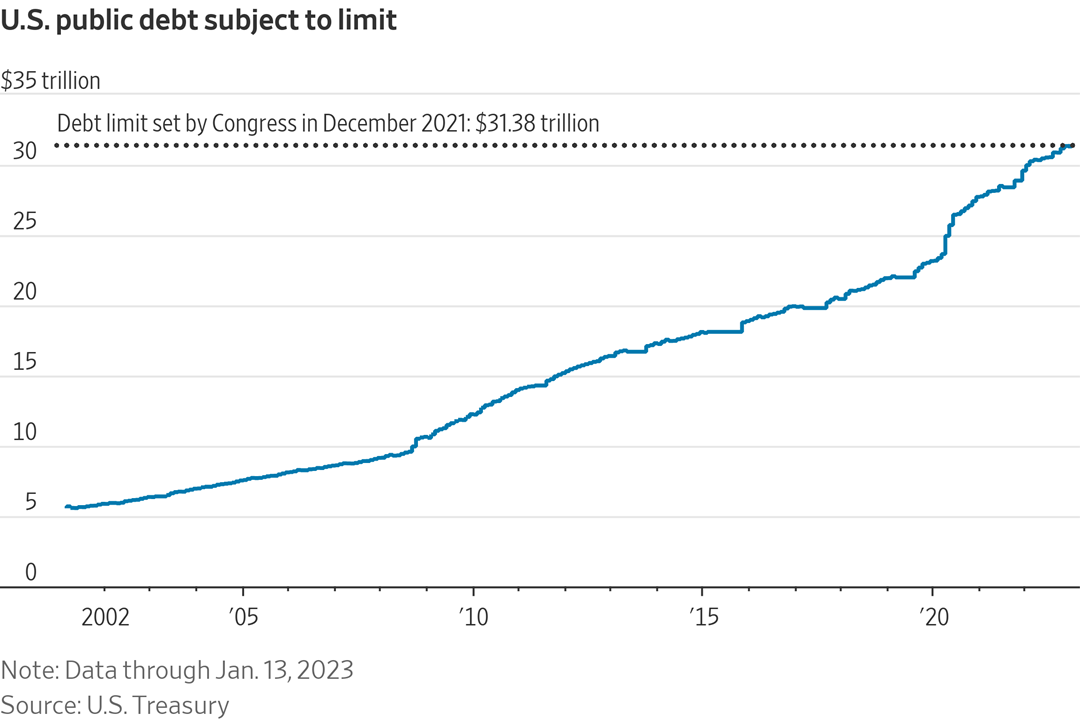

The Treasury Department will begin taking special measures to keep paying the government’s bills today as the divided Congress braces for a potentially lengthy and difficult debate over raising the debt ceiling. With the federal government about to run up against the debt limit, the Treasury Department has said it expects to start deploying extraordinary measures. Those accounting maneuvers will allow the Treasury to keep paying obligations to bondholders, Social Security recipients and others until at least early June, giving lawmakers and the Biden administration roughly five months to pass legislation raising or suspending the debt limit. Established by Congress, the debt ceiling is the maximum amount the federal government can borrow to finance obligations that lawmakers and presidents have already approved. The debt ceiling currently stands at $31.4 trillion and has been modified more than 100 times since World War II. Extraordinary measures have been deployed at least nine times in the last 20 years.

Upshot: Republicans want to cut costs as part of a deal to raise the debt ceiling, while Democrats don’t want to negotiate.

Japan logged its largest recorded annual trade deficit, of around ¥20trn ($155 billion), in 2022. The main cause was high import costs, which rose by 39% as energy prices soared and the yen weakened, in part because the central bank has maintained an ultra-loose monetary policy while other countries have tightened theirs. Japan has scant natural resources so relies heavily on imported fuel.

Russia/Ukraine:

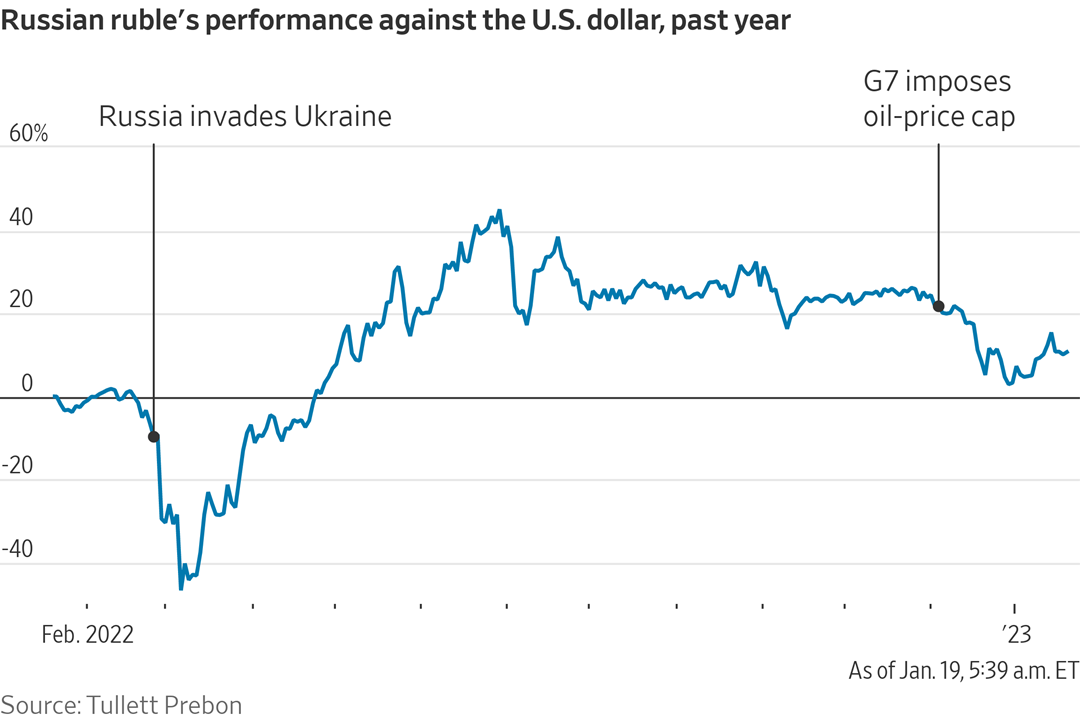

- The Russian ruble is showing signs of weakness after a run that made it one of 2022’s best-performing currencies. Its direction from here will be an indicator of how Russia’s economy is holding up under an intensifying raft of Western sanctions. A sharp decline could reignite Russia’s longstanding inflation problems and complicate the Kremlin’s efforts to channel resources to the war in Ukraine.

The ruble has fallen 12% against the dollar since the start of December, cutting its gains from the past year roughly in half. The currency began to slide last month after a European Union oil embargo went into effect alongside a U.S.-led effort to cap the price for Russian crude at $60 a barrel.

- Ukrainian President Volodymyr Zelenskyy again called upon Western allies and partners to send more weapons to Ukraine to help fight Russia. This comes as the U.S. is set to finalize a $2.5 billion military aid package for Ukraine that includes a first shipment of Stryker combat vehicles, according to reports. The package is not expected to include tanks or the long-range missiles sought by Kyiv. U.S. officials say the Biden administration also intends to provide $125 million in additional energy support for Ukraine. According to Zelenskyy, the additional weapons are crucial as Russia is likely to launch another series of drone attacks soon.

- Russia has no plans to lower grain export quota. Russia’s ag ministry says it has no plans to lower its grain export quota, according to state-run Interfax news agency. There’s speculation Russia could lower its export quota after President Vladimir Putin earlier this week said his country needed to maintain stable food reserves, by restricting some exports if necessary, but did not provide specific details. The ministry expects the country to export 55 MMT to 60 MMT of grain in 2022-23.

- Russia proposes hiking soy export tariff to spur more domestic crushing. Russia’s ag ministry proposed raising export tariffs on soybeans from 20% to 50% to stimulate domestic processing capacity in the country’s Far East region, the head of its oil and fat producers’ union told Reuters. The tariff would make raw soy exports, predominantly to neighboring China, unprofitable and incentivize firms to invest in soy processing facilities. Last year, the Far East region accounted for 2.3 MMT of Russia’s 6 MMT of total soybean production.

China updates:

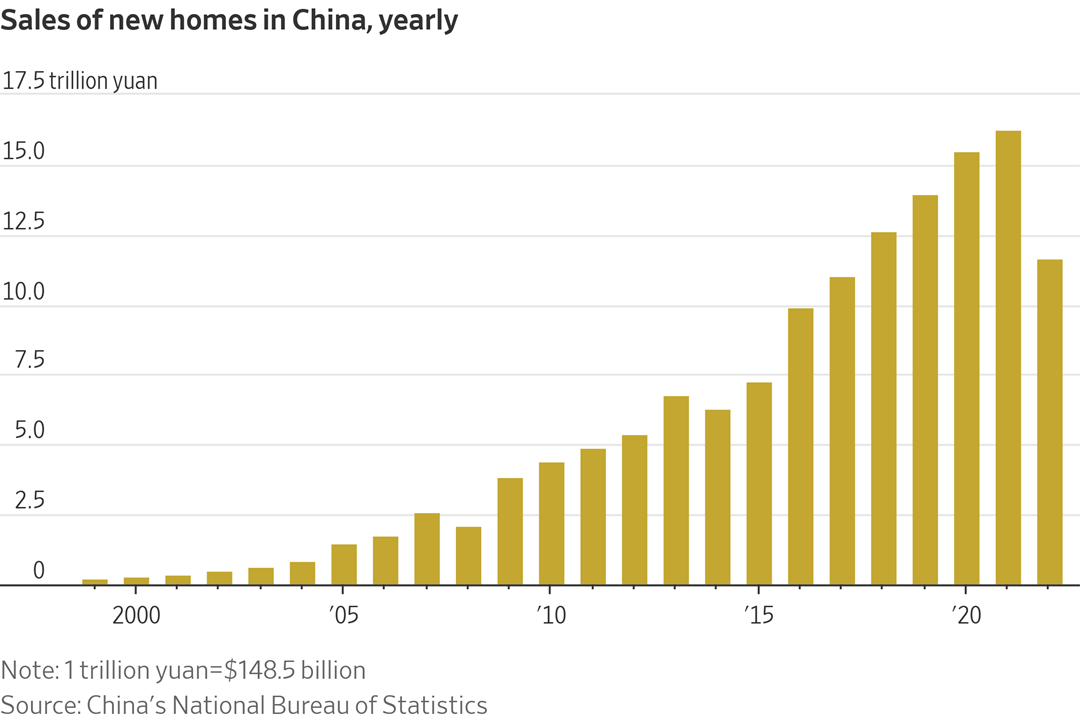

- China’s giant property bubble has burst. China’s housing market flipped from being a growth driver to an economic drag in 2022, with sales slumping, prices falling and widespread job losses. The prognosis for this year isn’t much better. The Wall Street Journal (link) looks at data showing China’s property bubble has burst, and what that means for Beijing’s efforts to get its economy back on firmer footing.

- China’s health authority said that demand for critical care for Covid-19 patients had peaked, with 40% fewer people in hospital on Jan. 17 than on Jan. 5. For the first time since 2019 people may travel freely during the holidays surrounding the lunar new year on Sunday, potentially increasing infections. Meanwhile, Hong Kong announced that it will scrap mandatory quarantine from Jan. 30.

- Yellen plans China trip. Treasury Secretary Janet Yellen will travel to China soon, a step that the WSJ says (link) is aimed at rebuilding the U.S./China relationship.

Policy updates:

- USDA sets proposal on cattle/bison electronic ID tags. USDA published a proposed rule (link) which would amend U.S. animal disease traceability regulations to require eartags in cattle and bison that are both visually and electronically readable — electronic identification (EID) tags. Some changes have been made to a prior APHIS plan, including now the agency using the term EID tags instead of radio frequency identification (RFID) tags. APHIS said that is to accommodate the potential for future technologies other than RFID relative to the tags. The EID system is aimed at helping the U.S. cattle industry deal with the emergency response to animal disease events, with APHIS concluding that while foot and mouth disease (FMD) and other diseases have been largely excluded from the U.S., “exclusion of every high impact disease through every pathway of introduction is likely an unachievable task.”

Under the proposed rule, APHIS would require tags to be used that are both visually and electronically readable for interstate movement of cattle and bison six months after a final rule is published in the Federal Register. Comments on the APHIS proposed rule are due Mar. 20. There is not yet a definitive date when the plan will finally be in place.

- AFBF, others, file legal challenge to new WOTUS rule. American Farm Bureau Federation (AFBF) President Zippy Duvall commented today on AFBF’s legal challenge to the new Waters of the United States (WOTUS) rule. AFBF joined 17 other organizations representing agriculture, infrastructure and housing, as well as county and state Farm Bureaus in filing suit. “Farmers and ranchers share the goal of protecting the resources we’re entrusted with. Clean water is important to all of us. Unfortunately, the new WOTUS rule once again gives the federal government sweeping authority over private lands. This isn’t what clean water regulations were intended to do. Farmers and ranchers should not have to hire a team of lawyers and consultants to determine how we can farm our land. The new rule is vague and creates uncertainty for America’s farmers, even if they’re miles from the nearest navigable water. We believe a judge will recognize these regulations exceed the scope of the Clean Water Act, and direct EPA to develop rules that enable farmers to protect natural resources while ensuring they can continue stocking America’s pantries.”

- Phase 1 of ERP ‘nearly perfect’ but Phase 2 unworkable. That’s the conclusion of a letter and background information on the topic Pro Farmer obtained from an interested observer. Link to the information.

Food Industry:

- Fake meat was supposed to save the world, but it became just another fad. Beyond Meat and Impossible Foods wanted to upend the world’s $1 trillion meat industry. But plant-based meat is turning out to be a flop. Link for details via Bloomberg.

Kerry to announce launch of U.S. natural resources survey. At the World Economic Forum in Davos, U.S. climate envoy John Kerry, will launch an initiative called the National Strategy to Develop Statistics for Environmental-Economic Decisions to take stock of the nation's natural resources, such as the value of land, air, water and natural assets, in an effort to paint an accurate picture of America's output. The initiative will be led by co-chairs Commerce Secretary Gina Raimondo, Office of Management and Budget Director Shalanda Young and Arati Prabhakar, the director of the Office of Science and Technology Policy. Link for more via Bloomberg.

Reuters: Energy Secretary Jennifer Granholm warned Republicans on the House Energy and Commerce Committee that a measure to limit the presidential authority to release oil from the nation's Strategic Petroleum Reserve (SPR) would "significantly weaken this critical energy security tool" and lead to supply shortages in times of crisis and higher gasoline prices. The measure, called the Strategic Production Response Act and recently introduced by committee Chair Cathy McMorris Rodgers (R-Wash.), would only allow SPR oil releases in case of a severe supply interruption. Link to details via Reuters.

Congress:

- Republicans hold their second-narrowest House majority (222-212) since at least 1963 — beat only by the 107th Congress (2001-2003), where the majority held just 220 seats, according to Pew Research Center (link).

- Just two weeks into the session, three House members have announced Senate bids. Another — Rep. Jesús "Chuy" García (D-Ill.) — is running for Chicago mayor. At least a half dozen other House members are weighing bids for Senate or governor.

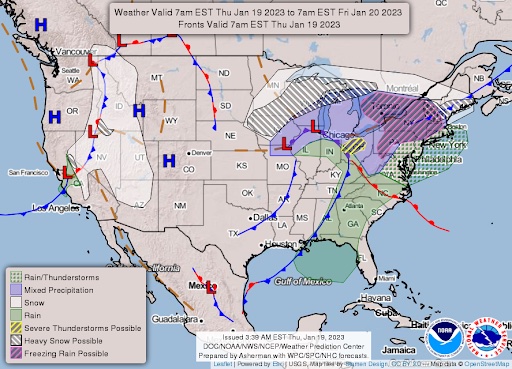

NWS weather: Winter storm continues for the Upper Midwest/Great Lakes Thursday with heavy, blowing snow leading to dangerous travel conditions... ...Snow and a wintry mix expected for portions of the Interior Northeast/New England late Thursday into Friday... ...Unseasonably warm temperatures for the Ohio Valley into the Southeast Thursday... ...Light to moderate snow showers forecast for the Interior West as temperatures remain well below average in the region.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 | New farm bill primer | China outlook | Omnibus spending package |