Last-Ditch Speaker Effort by McCarthy Could Take Days to Complete Unless Glitch Surfaces

Biden to visit border, speak today on border security and enforcement, hold Cabinet meeting

|

In Today’s Digital Newspaper |

The U.S. auto industry just had its worst sales year in more than a decade. Only 13.7 million vehicles were sold in 2022, according to the research firm Wards Intelligence, marking an 8% decrease from the previous year and the lowest overall figure since 2011. Sales had even surpassed 17 million vehicles for five consecutive years before the coronavirus pandemic erupted in early 2020. Of note: Toyota lost its sales crown to General Motors in 2022. Details in Market section.

Rising rates and autos: Financing a vehicle is growing more expensive than ever for consumers, according to car shopping experts at Edmunds. 15.7% of new car buyers had a monthly payment of more than $1,000 last quarter — marking a record high for the industry — compared to 10.5% in Q4 of 2021 and 6.7% in Q4 of 2020.

FOMC Minutes: With risks to inflation remaining elevated, no FOMC participant expected that it would be appropriate to reduce the federal funds rate target range in 2023. There was also discussion about balancing the risks of not tightening enough, which would lead to surging inflation expectations, and the lagged cumulative effect of continuous policy tightening, which could lead to unnecessary cuts in economic activity.

Amazon’s layoffs will affect over 18,000 employees, making it the largest in a recent wave of cutbacks at major tech companies. This comes as Facebook-parent Meta recently announced 11,000 job cuts, the largest in the company’s history. Twitter also announced widespread job cuts after Elon Musk bought the company for $44 billion. Salesforce this week also said it would cut 10% of its staff.

California declared a state of emergency yesterday as it is being hit by a third powerful rainstorm in a week. The ground is soaked, and rivers are filling, leaving the state especially vulnerable to flooding and other chaos. Most parts of Northern and central California are under a flood warning. California Gov. Gavin Newsom issued a statewide emergency declaration Wednesday, as nearly 200,000 homes and businesses in California remain without power this morning.

Ukrainian President Volodymyr Zelenskyy said his forces have pushed Russian troops from the outskirts of the eastern battleground city of Bakhmut.

Omicron subvariant XBB.1.5 has become the dominant Covid-19 variant in the U.S. in a matter of months, accounting for more than 40% of all cases in the country and at least 75% of all cases in the Northeast alone. The highly contagious strain’s dominance has contributed to the rise of hospitalizations across the nation.

|

MARKET FOCUS |

Equities today: Global stock markets were mixed overnight. The Dow opened around 150 points lower. Investors and Fed officials will be closely watching tomorrow’s jobs report. In Asia, Japan +0.4%. Hong Kong +1.3%. China +1%. India -0.5%. In Europe, at midday, London +0.4%. Paris -0.1%. Frankfurt -0.1%.

U.S. equities yesterday: The Dow increased 133.40 points, 0.4%, to 33,269.77. The S&P 500 rose 28.83 points, 0.75%, to 3,852.97. The Nasdaq climbed 71.78 points, 0.69%, to 10,458.76. All three opened in the green before briefly turning negative in midmorning trading after manufacturing activity dropped to its lowest level since May 2020. The Labor Department also said Wednesday morning that job openings topped estimates in November, a sign that demand for labor remained strong in the final months of 2022.

Agriculture markets yesterday:

- Corn: March corn fell 16 3/4 to $6.53 3/4, nearer the session low, marking the lowest close since Dec. 20.

- Soy complex: March soybeans fell 8 3/4 cents at $14.83 1/2. March soybean meal lost $2.40 at $462.70. March bean oil was down 35 points at 62.85 cents.

- Wheat: March SRW wheat fell 30 cents at $7.45 1/2. March HRW wheat lost 28 1/2 cents at $8.40 3/4. Prices closed near the session lows and hit two-week lows. March spring wheat futures slid 15 3/4 cents to $9.03 1/2.

- Cotton: March cotton fell 270 points to 80.44 cents, nearer the session low, marking the lowest close since Dec. 12.

- Cattle: February live cattle futures rose 42.5 cents to $157.275 Wednesday, while most-active March feeder futures leapt $3.45 to $188.225.

- Hogs: Nearby February lean hog futures led the complex lower Wednesday, dropping $1.00 to $84.075.

Ag markets today: Corn, soybeans and wheat firmed overnight amid mild corrective buying following sharp losses the first two trading sessions of the new year. As of 7:30 a.m. ET, corn futures were trading 1 to 2 cents higher, soybeans were steady to 2 cents higher and wheat futures were 5 to 8 cents higher. Front-month crude oil futures were around $1.50 higher and the U.S. dollar index was trading near unchanged this morning.

Technical viewpoints from Jim Wyckoff:

President Biden is scheduled to deliver remarks at 11:15 a.m. ET on border security and enforcement. Biden is set to hold a Cabinet meeting at 3 p.m. ET.

President Biden confirms plan to make first U.S./Mexico border trip. President Biden said Wednesday he plans to make his first visit as president to the U.S./Mexico border next week to observe the effects of record-breaking illegal immigration. “That’s my intention,” Biden said during a trip to Kentucky when asked if he was “going to the border.” The Wall Street Journal reported earlier Wednesday, citing “people familiar with the discussions,” that “the White House [was] strongly considering adding a visit” when Biden travels to Mexico City on Monday and Tuesday for meetings with the leaders of Canada and Mexico.

The visit is meant to help head off criticism of the president from Republicans and border-state leaders — but it could raise liabilities for Biden, who has sought to keep his distance from the humanitarian emergency that critics blame on his policies. Vice President Kamala Harris’ trip in June 2021 to Guatemala and Mexico was overshadowed by her struggle to explain her own reluctance to visit the border, which she ultimately did weeks later in her role as Biden’s designee to stem the migrant surge.

Background. Biden presided over nearly 2.4 million illegal border-crossing arrests in fiscal year 2022, which ended Sept. 30, up from 1.7 million in fiscal 2021, fewer than 500,000 in 2020 and nearly 1 million in 2019. Those figures do not include migrants who evaded arrest. Biden has not visited the border as president and it’s unclear if he ever made a specific border visit during his five-decade political career.

Private businesses in the U.S. created 235,000 jobs in December of 2022, well above market forecasts of 150,000 (ADP report). Service providers added 213,000 led by leisure and hospitality (123,000). Professional and business services grew by 52,000, while education and health services added 42,000. The goods-producing sector increased by 22,000. Job losses were seen for trade, transportation and utilities (-24,000), natural resources and mining (-14,000) and financial activities (-12,000). In 2022, payroll growth average was nearly 300,000 a month. “The labor market is strong but fragmented, with hiring varying sharply by industry and establishment size. Business segments that hired aggressively in the first half of 2022 have slowed hiring and in some cases cut jobs in the last month of the year,” Nela Richardson, ADP chief economist said. Meanwhile, annual pay was up 7.3% year-over-year in December, below 7.6% in November.

U.S. trade gap lowest in over two years. The U.S. trade deficit narrowed to $51.5 billion in November of 2022, the lowest since September of 2020, and below forecasts of a $73 billion gap. It reflected a decrease in the goods deficit of $15.3 billion to $84.1 billion and an increase in the services surplus of $1.0 billion to $22.5 billion. Total exports were down 2% to $251.9 billion, led by falls in sales of natural gas, crude oil, nonmonetary gold, civilian aircraft and travel while shipments rose for pharmaceutical preparations, telecommunications, computer, and information services and charges for the use of intellectual property. Meanwhile, imports of goods and services declined 6.4% to $313.4 billion, due a broad-based decrease, namely pharmaceutical preparations, cell phones, crude oil, passenger cars, computers and travel.

U.S. jobless claims fall to three-month lows. The number of Americans filing for unemployment benefits dropped to 204,000 in the week ending December 31, from the previous week's revised level of 223,000 and below market expectations of 225,000. It was the lowest number since late September, suggesting the labor market remains tight and might contribute further to inflationary pressure in the world's largest economy.

|

FOMC Minutes: Higher rates for longer as focus remains on inflation. According to the minutes of the Dec. 13-14 Federal Open Market Committee (FOMC), officials were unified that restrictive monetary policy stance remains necessary and that no officials backed a rate reduction in 2023 as they said no shift in monetary policy until inflation “clearly” is on the path toward its 2% target and that the slowing of the rate of increase in rates is not a sign the Fed’s resolve is weakening on inflation. There were differences over how much pent-up savings from the pandemic era might fuel continued growth. "A couple" saw excess savings as likely to support consumption for a while, while others saw that savings were low — and falling fast — among low-income households, while high-income households may spend more slowly. Minutes didn’t reveal info on what might prompt officials to raise rates by another 0.5 point at their meeting next month or to reduce the pace of increases once more, raising them instead by 0.25 point. Bottom line: "A number" of Fed officials emphasized that it was important to communicate that slower rate increases are "not an indication of any weakening of the Committee's resolve" to bring inflation down. "No participants" anticipated that it would be appropriate to begin cutting rates in 2023, contrary to financial market expectations that rate cuts are coming late this year. Amazon said it would drastically expand its planned layoffs to 18,000 jobs as it seeks to rein in costs. Coupled with Salesforce’s plans to lay off about 8,000 employees, the New York Times says, “it’s the latest sign that tech giants are still grappling with the consequences of overhiring during the pandemic boom.” Amazon’s cuts amount to around 6% of its corporate work force and will be focused on human resources and what the e-commerce giant calls its Stores division: its main online site, its field operations and warehouses, its physical stores and other consumer teams. (Hourly warehouse workers aren’t part of the tally.) That’s up from the roughly 10,000 the company had been weighing earlier. Salesforce is also laying off 10% of its employees and cutting back on office space. Byron Wien and Joe Zidle: The ten surprises of 2023. Byron Wien is Blackstone Vice Chairman & Senior Managing Director, Private Wealth Solutions. Joe Zidle is Chief Investment Strategist & Senior Managing Director, Private Wealth Solutions. The two write: “Our definition of a Surprise is an event which the average professional investor would assign a one-third chance of taking place, but which we believe has a 50% or better chance of happening. Our goal is not simply to be contrarian, or even to get a high score (although we are gratified when we do). Instead, we aim to stretch our own thinking and that of our readers.” Ten surprises of 2023: |

|

|

|

|

|

|

|

The “also rans” of 2023: |

|

Market perspectives:

• Outside markets: The U.S. dollar index was slightly higher. The yield on the 10-year US Treasury note was firmer, trading around 3.69%. Crude oil was higher, with U.S. crude around $74.25 per barrel and Brent around $79.40 per barrel. Gold and silver futures were under, with gold around $1,850 per troy ounce and silver around $23.57 per troy ounce.

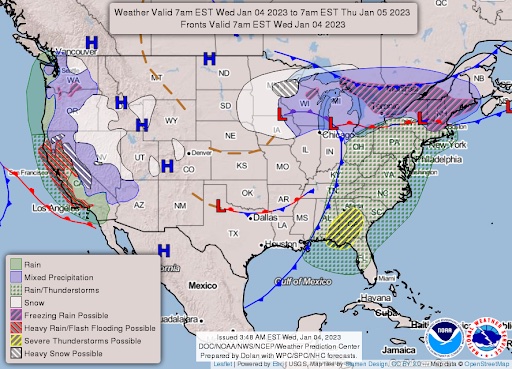

• Northern California braces for another powerful storm as Gov. Newsom (D-Calif.) declares state of emergency. The powerful storm is expected to bring strong winds and drench the already-battered region with heavy rain today, prompting Gov. Newsom to declare a state of emergency to “support response and recovery efforts.” Wednesday’s storm is the third atmospheric river that’s hit California in the last two weeks. The successive storms have brought a deluge of water to the drought-stricken state, prompting concerns of life-threatening debris flows and flooding. “We anticipate that this may be one of the most challenging and impactful series of storms to touch down in California in the last five years,” said Nancy Ward, director of the Governor’s Office of Emergency Services. “If the storm materializes as we anticipate, we could see widespread flooding, mudslides, and power outages in many communities.” Forecasters say the most severe portion of the storm will likely hit in the afternoon, with precipitation lasting through Thursday. Wednesday’s so-called Pineapple Express storm comes on the heels of a New Year’s Eve storm that dumped more than 5 inches of rain in San Francisco. It was the area’s second wettest day in more than 170 years of records, officials said.

• NWS weather: There is a Slight Risk of excessive rainfall over parts of California on Thursday and Friday... ...Heavy snow for the Sierra Nevada Mountains and snow over parts of the Cascades, Great Basin, and Central Rockies... ...There is a Moderate Risk of excessive rainfall over parts of the California Coast on Wednesday and a Slight Risk of excessive rainfall over parts of California on Thursday... ...Temperatures will be 15 to 20 degrees above average over parts of the Northeast/Mid-Atlantic... A front will move onshore over the West Coast, bringing a plume of moisture over Southern California on Thursday. Furthermore, a second plume of moisture will move onshore over the Northwest and Northern California on Friday.

Items in Pro Farmer's First Thing Today include:

• Modest corrective buying overnight

• Turkey calls for ceasefire in Ukraine (details in Russia/Ukraine section)

• IMF official: U.S. inflation has not turned the corner yet

• Argentine farmers sold soybeans before year-end 2022

• China opening border with Hong Kong on Sunday

• Choice beef prices pull back but still record-high for January

• Big pork movement again

|

RUSSIA/UKRAINE |

— Turkey calls for ceasefire in Ukraine. Turkish President Tayyip Erdogan told Russian President Vladimir Putin in a phone call that peace efforts in the Russia/Ukraine war should be supported by a unilateral ceasefire and a “vision for a fair solution.” Erdogan reminded Putin of the positive outcomes of the grains corridor deal and said he also will speak to Ukraine’s Volodymyr Zelenskyy to discuss the Black Sea grain and fertilizer initiative. Erdogan also said he may meet Syrian President Bashar al-Assad as part of peace efforts after the highest-level talks in public between Ankara and the Damascus government since the Syrian war began in 2011.

- The U.S. is considering sending armored fighting vehicles to assist Ukrainian forces, while France said it will also send light armored combat vehicles. The Western-style tanks will be "very important in order to restore security for all Ukrainians and peace for all Europeans," Ukrainian President Volodymyr Zelenskyy said.

- Russian President Vladimir Putin has dispatched one of his country's most modern warships armed with advanced hypersonic missiles that travel more than five times the speed of sound — making them hard to detect and intercept. "I am sure that such powerful weapons will reliably protect Russia from potential external threats and will help ensure the national interests of our country," Putin said on the deployment via state media, without specifically mentioning the conflict in Ukraine.

|

POLICY UPDATE |

— Commerce Dept. determines conditions met in sugar suspension agreement with Mexico. The Department of Commerce’s International Trade Administration (ITA) this week published a notice (link) that Ingenio Tala S.A. de C.V. and Ingenio Tamazula S.A. de C.V. were in compliance with the terms of the Agreement Suspending the Antidumping Duty Investigation on Sugar from Mexico during the period of review from Dec. 1, 2020-Nov. 30, 2021. The agency also published a notice (link) that Mexico and the companies were in compliance with the Agreement Suspending the Countervailing Duty Investigation on Sugar from Mexico during the same period. DOC also preliminarily determined that the CVD Agreement met the applicable statutory requirements during the period of review.

|

PERSONNEL |

— Biden plans to renominate former Mayor Eric Garcetti to be U.S. ambassador to India after Garcetti’s confirmation failed to advance through the U.S. Senate last year.

|

CHINA UPDATE |

— China’s government allowed three government-backed firms and the country's largest steel producer to resume imports of Australian coal, Reuters reported Jan. 4. Domestic demand for coal will rise once China reopens its borders and abandons quarantine measures on Jan. 8, which could imperil manufacturing industries if coal supplies are insufficient to cover the surge. As a result, Beijing is likely easing its ban on imports of Australian coal to ensure that production will continue unabated. China introduced a ban on key Australian imports, including coal, in 2020 after former Australian Prime Minister Scott Morrison demanded an investigation into the origins of Covid-19. Before the ban, Australia accounted for 30% of Chinese coal imports, namely high-quality thermal and coking/metallurgical coal.

— China starts sending Covid data to WHO again. The World Health Organization (WHO) received data from China on new Covid-19 hospitalizations after a reporting gap, with figures on Thursday showing a nearly 50% increase in the week to Jan. 1. The health agency received no data from China in the weeks after Beijing lifted its zero-Covid policy in early December, prompting some health experts to question whether it might be hiding information on the extent of its outbreak. China on Thursday insisted it had been transparent with the international community about its Covid data. WHO officials are meeting with Chinese scientists today as part of a wider briefing among member states on the global Covid-19 situation as concerns grow about the rapid spread of the virus in the world’s No. 2 economy.

— CDC publishes order requiring negative Covid tests from China travelers. The U.S. Centers for Disease Control and Prevention (CDC) published a notice in the Federal Register relative to the new requirement for a “negative pre-departure Covid-19 test results or documentation of recovery from Covid-19 for aircraft passengers traveling to the United States from the People's Republic of China or departing from a designated airport if the passenger has been in the People's Republic of China” within the 10 days prior to their departing for the U.S. Designated airports are listed as Incheon International Airport (ICN) in Seoul, Republic of Korea; Toronto Pearson International Airport (YYZ) in Canada; Vancouver International Airport (YVR) in Canada; and other airports that CDC may list. The order takes effect today with it being published.

|

ENERGY & CLIMATE CHANGE |

— GM reclaims title as America's top automaker after a 2.5% jump in sales last year. GM said Wednesday it sold 2.27 million vehicles in the U.S. in 2022, up by 2.5% over 2021, including a 41.4% increase during the fourth quarter. Analysts expect overall U.S. auto industry sales to have declined by 8% and 10% last year compared to 2021. Toyota said it sold 2.1 million vehicles in the U.S. last year, down 9.6% from 2021. Toyota edged out GM in sales by 114,034 vehicles in 2021 — dethroning the Detroit automaker for the first time since 1931 when it surpassed Ford Motor.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— A Sacramento County Superior Court judge put a temporary hold on a new California law boosting protections for fast-food workers that was set to go into effect Jan. 1. The order comes in response to a lawsuit filed Thursday by a coalition of major restaurant and business trade groups that is backing an effort to overturn the law, called Assembly Bill 257, through a referendum on the California ballot in November 2024. If the referendum qualifies for the ballot, it would block AB 257 until voters have a say. The coalition, called Save Local Restaurants, took issue with the state Department of Industrial Relations’ effort to implement AB 257 on Jan. 1, arguing that because the referendum effort is well underway, it renders the law unenforceable. Implementing the law could set a harmful precedent that threatens voters’ right of referendum, the coalition said.

— USDA Vilsack to announce new funding for expanding meat processing capacity. States receiving investments: California, Illinois, Iowa, Kansas, Kentucky, Maine, Montana, Nebraska, New York, Ohio, Oklahoma, South Carolina, Texas, Virginia, Washington and Wisconsin. USDA says the funding is to make “agricultural markets more accessible, fair, competitive, and resilient for American farmers and ranchers.”

— Court agrees to expedited review in Albertsons payout case. The Washington Supreme Court granted Albertsons request for an expedited review of a temporary restraining order that is blocking the payout of a $4 billion dividend to shareholders. The court will hold a Jan. 17 hearing to review the order that has held up the payment for nearly two months. Washington State Attorney General Bob Ferguson filed suit to block the payout, arguing it would weaken Albertsons as they move forward with a proposed merger with Kroger. A similar lawsuit was filed by attorneys general of Washington D.C., California and Illinois and that is pending in the U.S. Court of Appeals for the District of Columbia Circuit.

|

HEALTH UPDATE |

— Summary:

- Global Covid-19 cases at 662,428,036 with 7,508,803 deaths.

- U.S. case count is at 101,044,032 with 1,095,235 deaths.

- Johns Hopkins University Coronavirus Resource Center says there have been 663,822,575 doses administered, 268,363,272 have received at least one vaccine, or 81.45% of the U.S. population.

— Walgreens will sell abortion pills. The pharmacy giant said it would dispense mifepristone, becoming the first national chain to do so after the FDA announced new rules for dispensing the drug. CVS and Rite Aid said they were still reviewing the agency’s new policy.

|

OTHER ITEMS OF NOTE |

— Biden administration proposed to dramatically increase fees for many employment-based visas while keeping prices for people applying to become U.S. citizens relatively static. The proposal would push more of the cost of funding the agency that oversees the nation’s immigration system onto companies that employ foreign workers and ensure that asylum seekers continue to pay nothing to apply for protections in the U.S. The plan, which also includes new fee exemptions for victims of human trafficking and other crimes, reflects the administration’s values.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 | New farm bill primer | China outlook | Omnibus spending package |