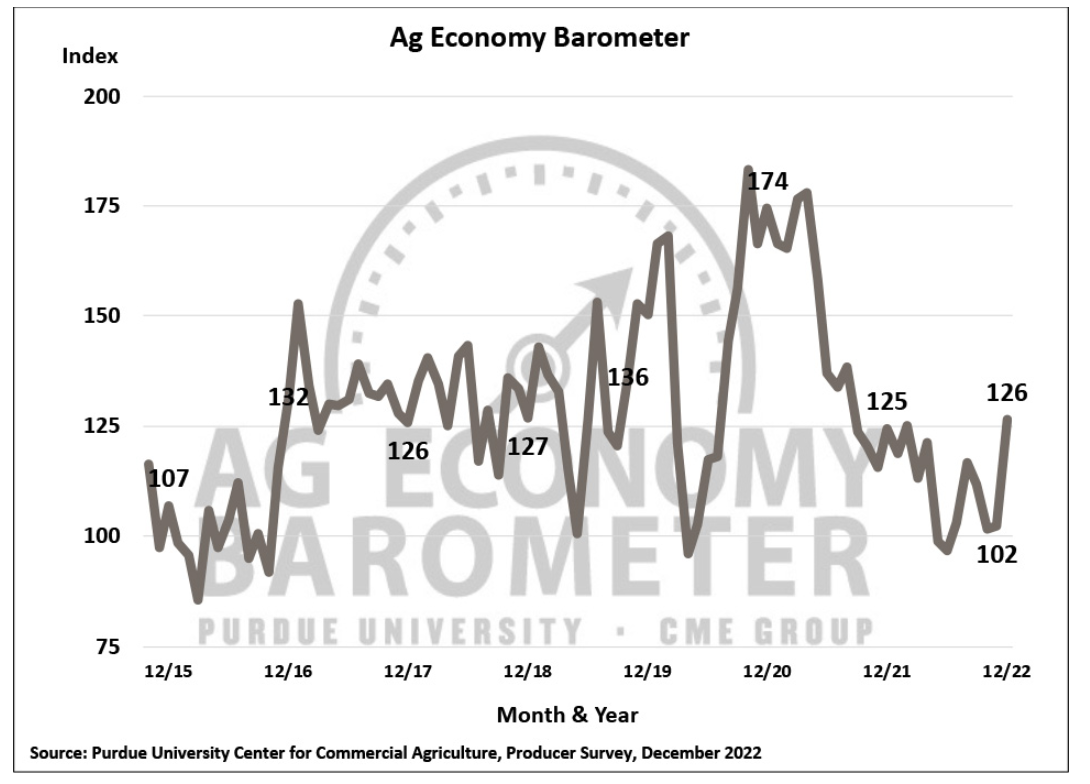

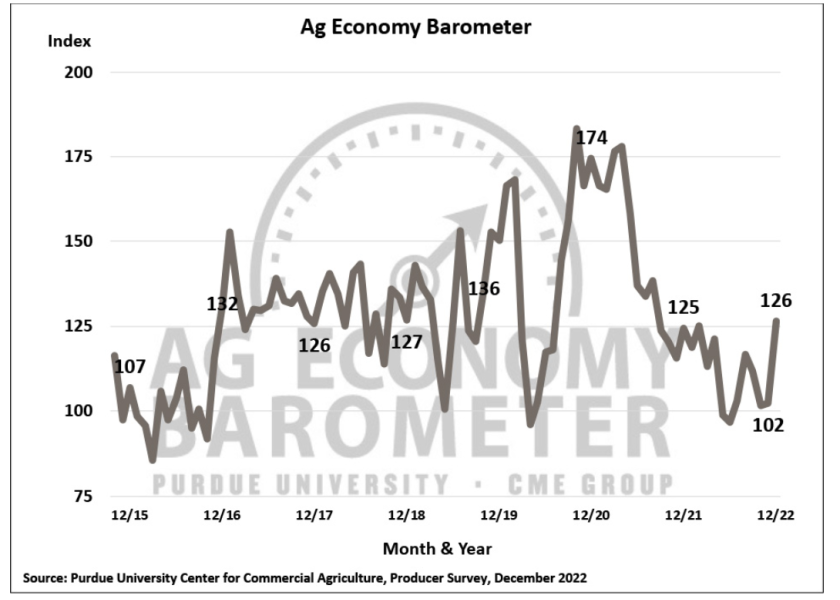

Farmer sentiment rebounds, but 2023 outlook is weaker

The Purdue University/CME Group Ag Economy Barometer closed out 2022 on a more positive note, rallying 24 points in December to a reading of 126, the highest for the year. U.S. farmers were more optimistic about both their current situation and expectations for the future. The Current Conditions Index jumped 37 points to a reading of 135, while the Future Expectations Index increased 18 points to a reading of 122.

The improvement in current sentiment was motivated by producers’ stronger perception of current financial conditions on their farms as the Farm Financial Performance Index climbed 18 points above the prior month’s reading to reach 109, which was the only time in 2022 that the index was above 100. The turnaround in the Financial Performance Index was driven by a sharp increase in the percentage of producers who expect better performance. The change in perception among producers regarding their farms’ financial situation could be attributable to producers taking time to estimate their farms’ 2022 income following the completion of the fall harvest. The improved assessment of farm financial conditions was consistent with USDA’s forecast for strong net farm income in 2022.

Despite the improvement in farmers’ perception of their financial situation, both the short-term and long-term farmland value indices continued to drift lower in December. The short-term index fell five points to 124 while the long-term index declined from 144 to 140. Although both farmland value indices remain in positive territory, when examined over the course of the last year it’s clear that sentiment among producers about farmland values has shifted.

Looking to the year ahead, the December survey asked producers to compare their expectations for their farm’s financial performance in 2023 to that of 2022. Producers indicated they expect financial performance in 2023 to fall below this year. Responses to the question about 2023 provide a financial performance index value that is 18 points lower than for responses from the question asking producers to compare 2022 to 2021. Rising costs and narrowing margins are key reasons for the lower index in 2023. Concerns about costs continue to be top of mind for producers’ when asked to look ahead to the upcoming year. For example, nearly half (47%) of the crop producers in this month’s survey said they expect farmland cash rental rates in 2023 to rise above the prior year. And in a related question, 45% of producers cited higher input costs as their top concern in 2023 followed by rising interest rates (22% of respondents) and lower crop or livestock prices (13% of respondents).

Click here to view the full report.