GOP House Hurdles to Approve New Speaker Speak Volumes About Issues Ahead

OMB completes review of final rule from USDA covering pandemic assistance programs

|

In Today’s Digital Newspaper |

Russian leader Vladimir Putin launched a deadly New Year’s Eve attack on Ukrainian cities and called the war a “sacred duty” in a national address. Meanwhile, Sergei Shoigu, Russia’s defense minister, claimed that victory in his country’s war with Ukraine was “inevitable.” But he admitted that Russia would begin 2023 in a “difficult military-political situation.”

A Ukrainian strike on a Russian military facility in the occupied town of Makiyivka killed 63 troops, Russia said, making it one of the deadliest losses acknowledged by Moscow. Ukraine put the toll around 400 and warned of more Russian attacks later this week.

The Office of Management and Budget (OMB) Dec. 28 completed its review of a final rule from USDA covering Pandemic Assistance Programs... we may finally soon get a USDA announcement about Phase 2 of the Emergency Relief Program, among other announcements.

International Monetary Fund Managing Director Kristalina Georgieva warned that the global economy faces “a tough year, tougher than the year we leave behind… We expect one-third of the world economy to be in recession,” Georgieva told CBS’s ‘Face the Nation’ in an interview aired Jan. 1. “Why? Because the three big economies — U.S., EU, China — are all slowing down simultaneously.”

A top Chinese public-health official warned of widespread Covid-19 outbreaks in more-vulnerable rural areas as millions of citizens prepare to travel home for the Lunar New Year holiday. Meanwhile, China economic data continues negative with clear impacts due to its prior zero-Covid policy.

China’s Manufacturing PMI fell to 49.0 in December from 49.4 in November while the U.K.’s Manufacturing PMI came in at 45.3 vs. (E) 44.7 last month.

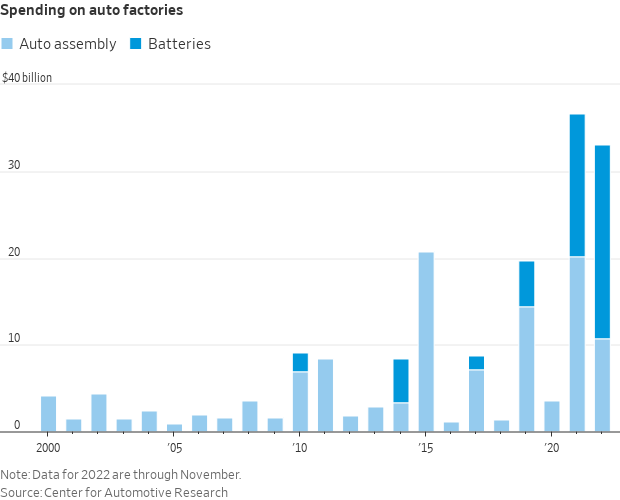

The automotive sector’s shift to electric vehicles is helping drive one of the biggest factory-building booms in the U.S. in years.

House Republicans unveiled a new rules package that outlines the proposed changes GOP lawmakers plan to make as they regain control of the House, which could be taken up this week as the chamber’s new term begins. But first, House GOP members remain at odds over a coming Speaker vote midday today.

After House GOP members can agree on a new Speaker, the first vote House Republicans plan to take will be to repeal IRS funding included in legislation passed by Democrats last August. It will go nowhere in the Dem-controlled Senate.

A major multi-hazard storm is barreling across the U.S. bringing the risk of strong tornadoes and flooding to the South, and ice and snow to the Plains and Upper Midwest today.

Buffalo Bills safety Damar Hamlin is in critical condition after suffering a cardiac arrest during a game (postponed) on Monday, the team said. He collapsed on the field shortly after making a tackle.

|

MARKET FOCUS |

Equities today: Global stock markets were mixed overnight. U.S. Dow opened about 75 points higher. In Asia, Japan closed. Hong Kong +1.8%. China +0.9%. India +0.2%. In Europe, at midday, London +2%. Paris +1.1%. Frankfurt +1.2%.

Of note: Today is the one-year anniversary of the S&P 500 hitting its all-time closing high.

U.S. equities Friday: The Dow lost 73.55 points, 0.2%, to 33,147.25. The S&P 500 fell 9.78 points, 0.3%, to 3,839.50, while the Nasdaq declined 11.61 points, 0.1%, to 10,466.48. All three benchmarks pared deeper losses from earlier in the day.

For the year, the S&P 500 posted a 19% decline, its biggest pullback since 2008. The Dow dropped 8.8% and the Nasdaq slid 33%.

European stocks posted their worst year since 2018. The Russia/Ukraine war, rapidly rising interest rates, and a global economic slowdown significantly strained the European economy. That led to the region’s EuroStoxx 600 index falling 12.76% this year, marking its worst annual decline since 2018. With these factors failing to abate in the new year, many strategists expect the European stock market to remain under pressure in the year ahead.

The yield on the benchmark 10-year U.S. Treasury note ended at 3.826%, from 3.833% Thursday. Bond yields ended sharply higher compared with where they 2022. The yield on the 10-year note closed out 2022 with its largest one-year yield gain on record, according to Dow Jones Market Data, based on data starting in 1977.

Brent crude, the international benchmark for oil prices, rose 2.9% to $85.91 a barrel and posted a 10% gain for the year.

Agriculture markets Friday: All three major indexes posted modest losses Friday, capping their worst year since 2008.

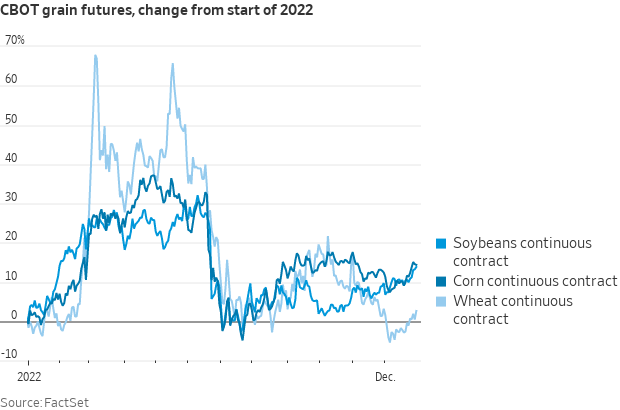

- Corn: March corn fell 1 cent to $6.78 1/2 after reaching a high of $6.85, the highest intraday price since Nov. 7, but was up 12 1/4 cents on the week.

- Soy complex: March soybean futures rose 7 3/4 cents to $15.24 and hit a six-month high. For the week, March beans rose 39 1/2 cents. March meal futures gained $12.50 to $4.71, hitting a contract high and for the week rising $19.70. March bean oil fell 229 points to 64.07 cents and closed at a technically bearish weekly low close. For the week, March bean oil lost 58 points.

- Wheat: March SRW futures surged 18 cents to $7.92 Friday; that represented a weekly gain of 16 cents. March HRW futures climbed 21 1/2 cents to end the week at $8.88, which marked a weekly rise of 13 1/4 cents. March spring wheat jumped 24 3/4 cents to $9.38 3/4, a 7 cent rise from last Friday.

- Cotton: March cotton rose 76 points to 83.40 cents, after trading as high as 84.64 and was down 181 points on the week.

- Cattle: February live cattle dipped 95 cents to $157.90, with the closing quote representing a gain of just 15 cents since last Friday, with January feeders slipping 10 cents to $183.50; a weekly decline of 50 cents.

- Hogs: February lean hog futures fell 97 1/2 cents to $87.70, near mid-range but at a technically bearish weekly low close. For the week, February hogs lost 12 1/2 cents.

Ag markets today: Grain and livestock markets will reopen at 9:30 a.m. ET following the extended holiday weekend. As of 7:30 a.m. ET, front-month crude oil futures were trading around 75 cents lower, and the U.S. dollar index was about 1,200 points higher.

Technical viewpoints from Jim Wyckoff:

On tap today:

• S&P Global's U.S. manufacturing index for December is out at 9:45 a.m. ET.

• U.S. construction spending for November is expected to fall 0.4% from the prior month. (10 a.m. ET)

• USDA Grain Export Inspections report, 11 a.m. ET.

• U.S. House of Representatives is scheduled to convene today, opening the 118th Congress, Noon ET.

• USDA reports: Cotton System Consumption and Stocks; Fats & Oils: Oilseed Crushings, Production, Consumption and Stocks; Grain Crushings and Co-Products Production. 3 p.m. ET.

IMF: gloomy year ahead. “We expect one-third of the world economy to be in recession. Why? Because the three big economies — U.S., E.U., China — are all slowing down simultaneously.” — Kristalina Georgieva, managing director of the International Monetary Fund, delivered a gloomy year-ahead outlook. Link for details.

This week the legal minimum wage in Mexico increased to 207.44 pesos ($10.66) a day, or 312.41 pesos for workers in the northern border area abutting the United States. Mexicans will welcome the extra cash, which represents a 22% rise on last year’s figure. Between 2018 and 2020 the poverty rate increased from 42% to 44% of the population, and the pandemic then made things worse. President Andrés Manuel López Obrador has continually increased the minimum wage since taking office in 2018. By 2026, he says, it should be sufficient to buy food for a family of four.

The automotive sector’s shift to electric vehicles is helping drive one of the biggest factory-building booms in the U.S. in years. About $33 billion in new auto-factory investment was pledged in the country across the first 11 months of 2022, the Wall Street Journal reports (link), adding to the $37 billion in new investments announced in 2021. The annual figure from the Center for Automotive Research shows a more than eightfold increase from two decades ago. The WSJ article says, “That’s a dramatic sign of how rapidly new supply chains are being established, and how new electric-vehicle assembly and battery plants are also changing the map for auto production in the U.S. About two-thirds of the new auto investment revealed over the past two years is going to sites in the U.S. South, the data shows, tilting activity away from the Great Lakes region and creating a new eco-system of sector suppliers.”

Market perspectives:

• Outside markets: The U.S. dollar index was firmer. The yield on the 10-year U.S. Treasury note was lower, trading around 3.75%, with a lower tone in global government bond yields. Crude oil futures moved lower, with US crude around $79.40 per barrel and Brent around $85 per barrel. Gold and silver futures were putting up solid gains, with gold around $1,843 per troy ounce and silver around $24.55 per troy ounce.

• The Russian ruble weakened past 73 per U.S. dollar in early January, the lowest since late April, and pared the slight gains for the currency in the prior year as lower export demand amid a declining economy stressed the strict capital controls in place to support the currency.

• Wheat, soybean, corn prices expected to have choppy 2023. Russia’s invasion of Ukraine sent U.S. grain futures soaring early in 2022 before their recent retreat. A Wall Street Journal article (link) says the new year promises to be another volatile one. “Futures for wheat and soybeans reached record highs earlier in 2022, and corn futures notched their highest level in more than a decade. The war stifled supply, and so did dry weather in many crop-growing areas. Now, grain prices have fallen close to where they started 2022. For 2023, the outlook is uncertain, in part because prices hinge so much on a war for which no end seems to be in sight.”

• Palm oil hits one-month high. Malaysian palm oil futures were trading above the MYR 4,200 per tonne mark in early January, a level not seen in more than a month, supported by expectations of lower production and tighter supplies from rivals. Indonesia, the world's biggest palm oil producer, announced that palm oil producers can now export only six times the domestic sales requirement as it wants to ensure ample domestic supplies. Indonesian officials anticipated weaker seasonal production in Q1 of 2023 while extending a policy to allow imports of vegetable oils such as palm oils. Keeping a lid on prices were prospects of weak export demand from Malaysia, with shipments in December likely falling between 1.7% and 2.8% from the prior month, cargo surveyors said.

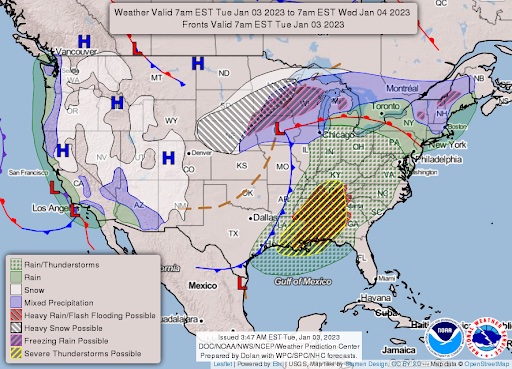

• A major multi-hazard storm is barreling across the U.S. bringing the risk of strong tornadoes and flooding to the South, and ice and snow to the Plains and Upper Midwest today. This comes just days after the storm system walloped California with dangerous flooding, forcing water rescues and evacuations. More than 12 million people across the South are currently under flood watches this morning, with the heaviest rainfall expected in parts of southwest Alabama and southeast Georgia. Meanwhile, more than 15 million people are under winter weather alerts from Utah to Wisconsin. Officials are urging people in the Plains to avoid unnecessary travel and to pack emergency kits in their vehicles to stay prepared.

• NWS weather: Heavy snow and rain/freezing rain over parts of the Northern Plains into the Upper Mississippi Valley/Upper Great Lakes... ...There is an Enhanced Risk of severe thunderstorms over parts of the Lower Mississippi Valley/Southeast on Tuesday and a Slight Risk of severe thunderstorms over parts of the Southeast/Eastern Gulf Coast on Wednesday... ...There is a Slight Risk of excessive rainfall over parts of the Central Gulf Coast/Tennessee Valley/Southern Appalachians on Tuesday and a Moderate Risk of excessive rainfall over parts of the Northern/Central California Coast on Wednesday... ...Snow for the Sierra Nevada Mountains, Great Basin, Southwest, and Central Rockies; Temperatures will be 20 to 35 degrees above average from Middle/Lower Mississippi Valley eastward to parts of the Lower Great Lakes/Mid-Atlantic.

Items in Pro Farmer's First Thing Today include:

• No overnight grain trade

• Weekend rains in Argentina, but dry outlook

• Mild slowdown expected in soy, corn crush for November

• India will soon decide on selling wheat reserves to control inflation

• Brazil soy exports slow, corn shipments rise in December

• Cash cattle expected to trade higher

• Cash hog index drops

|

RUSSIA/UKRAINE |

— Summary: Some Russian lawmakers demanded punishment for the country’s military commanders after 63 servicemen were killed by a Ukrainian attack in Makiivka, a Russian-occupied town in the Donbas region. Some Ukrainian reports put that figure in the hundreds. Meanwhile Volodymyr Zelenskyy, Ukraine’s president, said that Russia was planning a prolonged attack using Iranian-made drones, to “exhaust” his country. On Monday he said Ukraine’s air force had shot down nearly 90 such drones in two days.

- Ukraine grain exports fall 30% in first half of 2022-23. Ukraine exported 22.6 MMT of grain in the first half of the 2022-23 marketing year, down 29.8% from the same period last year. That total included 12.5 MMT of corn (up 15.7%), 8.4 MMT of wheat (down 47.0%) and 1.6 MMT of barley (down 68.8%).

- How Russia’s war on Ukraine is worsening global starvation is an article in today’s New York Times (link). Moscow is blocking most shipments from Ukraine, one of the world’s largest wheat producers, and its attacks on the country’s energy grid also disrupt the flow of food, the item details. “Hulking ships carrying Ukrainian wheat and other grains are backed up along the Bosporus here in Istanbul as they await inspections before moving on to ports around the world. The number of ships sailing through this narrow strait, which connects Black Sea ports to wider waters, plummeted when Russia invaded Ukraine 10 months ago and imposed a naval blockade. Under diplomatic pressure, Moscow has begun allowing some vessels to pass, but it continues to restrict most shipments from Ukraine, which together with Russia once exported a quarter of the world’s wheat.”

|

POLICY UPDATE |

— Additional pandemic aid review completed by OMB. The Office of Management and Budget (OMB) Dec. 28 completed its review of a final rule from USDA covering Pandemic Assistance Programs. The programs cover paying farmers for eligible losses. The plans also make updates to regs for the Coronavirus Food Assistance Program (CFAP); Biomass Crop Assistance Program (BCAP); Emergency Conservation Program (ECP); Emergency Assistance for Livestock, Honeybees, and Farm-Raised Fish Program (ELAP); Livestock Forage Disaster Program (LFP); Livestock Indemnity Program (LIP); Noninsured Crop Disaster Assistance Program (NAP); and payment eligibility provisions. It is likely that after completion of this review by OMB, USDA will be announcing more actions (Phase 2) under the Emergency Relief Program (ERP) that have been delayed so far.

|

CHINA UPDATE |

— Britain, France, Israel, South Korea and Spain joined the list of countries restricting travelers from China, with some demanding proof of vaccination and others negative covid-19 test results. America, Italy and Japan had already done so. The World Health Organization (WHO) is pleading with China to release more regular information about the spread of the disease, as it rolls up its isolation policy. The EU’s health chief suggested that the bloc should restart widespread genomic sequencing of new cases of Covid-19, to detect any new variants.

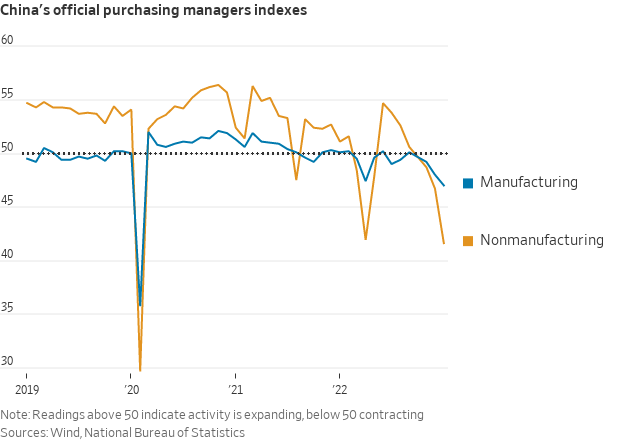

— The Caixin China General Manufacturing PMI fell to 49.0 in December 2022, the lowest since September and compared with the market consensus of 48.8 as a spike in Covid cases disrupted production. It was the fifth straight month of a drop in factory activity, with output, new orders, and export sales all declining further. Also, buying activity shrank the most since April, while employment dropped for the ninth month running without sign of a significant rebound, and backlogs of work fell for the third time in four months. Delivery times lengthened for the sixth month running with a solid rate of deterioration. On inflation, input prices rose slightly, due to a rise in some materials, notably metals. However, firms continued to lower their selling prices, to boost competitiveness and gain new business. Finally, the sentiment was at a 10-month peak, amid anticipation of rising output as the pandemic situation improves.

Meanwhile, China’s official manufacturing purchasing managers index fell to 47.0 in December, the lowest level since February 2020. Far worse was the official nonmanufacturing PMI, which covers service-sector and construction activity, which plunged to 41.6 from 46.7 in November, China’s National Bureau of Statistics said. The 50 level on the index separates expansion from contraction.

— The EU reportedly offered free Covid-19 vaccines to China to help manage the vast outbreaks that surged as it relinquished its zero-Covid policy. Officials from the European Commission told the Financial Times that it would contribute variant-optimized doses to supplement China’s response, which relies on less-effective Chinese vaccines. The WHO has deemed the country’s vaccination coverage insufficient.

— Nearly 28% of the 524 passenger arrivals from mainland China at Taiwan’s top international airport tested positive for Covid on the first day Taiwan required travelers from the mainland to take a saliva-based test upon arrival.

— China to boost spending in 2023 economic revival drive, top planner says. China’s top economic planner aims to help boost domestic consumption and woo more foreign investors this year as it seeks to revive the country’s Covid-hit economy. In a People’s Daily interview published on Sunday, Zhao Chenxin, deputy chairman of the National Development and Reform Commission (NDRC), said authorities would align fiscal, monetary, industrial, technology and social policies to promote growth. The government would also give support to previously tightly regulated sectors such as property and internet companies as part of a wider push to increase consumer spending. In Sunday’s report, Zhao admitted that the foundations for an economic recovery were not solid, and the pandemic continued to affect economic operations. But he said his agency was determined to put consumer spending center stage. “We must increase the revenue of urban and rural households. Particular support should be given to low and medium-income families who are more willing to spend but affected more by the pandemic,” he said.

|

HEALTH UPDATE |

— Summary:

- Global Covid-19 cases at 661,245,870 with 6,692,650 deaths.

- U.S. case count is at 100,759,251 with 1,092,679 deaths.

- Johns Hopkins University Coronavirus Resource Center says there have been 663,822,575 doses administered, 268,363,272 have received at least one vaccine, or 81.45% of the U.S. population.

|

POLITICS & ELECTIONS |

— Rep. Kevin McCarthy (R-Calif.) could fail in his bid for House Speaker when Congress votes on Tuesday, as the GOP congressman faces strong opposition from some of the party’s more libertarian-like members that could derail the vote — even after he granted a key concession during a last-minute conference call on Sunday. McCarthy agreed to make it easier for lawmakers to potentially oust him in the future, granting a demand from his opponents that just five lawmakers from the majority party can force a no-confidence vote for the Speaker. Link to McCarthy letter.

The House GOP released a rules package on Sunday (link) that also contains other rules that some lawmakers have pushed for, like creating a new committee to investigate the Biden Administration’s purported “weaponization” of the Justice Department and FBI. Among other things, the proposed rules would also allow the House Ethics Committee to take ethics complaints from the public, kill congressional staffers’ unionization efforts and outlaw remote hearings, among other measures. Link to section-by-section of the proposed rules package.

Meanwhile, nine GOP lawmakers released a letter (link) after the conference call Sunday saying that while McCarthy’s entreaties toward them are “welcome” and the “progress made thus far has been helpful,” it still isn’t enough to address their concerns.

Some lawmakers plan to vote against McCarthy even if he gives into all of lawmakers’ demands, Politico reported Monday, such as Rep. Matt Gaetz (R-Fla.), who is one of five “Never Kevin” lawmakers who have already come out against McCarthy.

218 is the number of votes McCarthy needs to clinch the speakership, and Republicans hold a 222-seat majority in the House. It is possible that threshold could be lowered if some lawmakers are absent for the vote, which would make it easier for McCarthy to be elected.

If McCarthy fails in multiple rounds of votes for House Speaker, Roll Call reports (link) that some more moderate Republicans have discussed the possibility of working with Democrats to elect Rep. Fred Upton (R-Mich.) as Speaker instead. Upton retired from Congress at the end of 2022, but House Speakers aren’t legally required to be sitting members of Congress. Meanwhile, the New York Times lists several potential McCarthy replacements in an article (link).

— Democrats have already selected their leadership for the new Congress. Rep. Hakeem Jeffries (D-N.Y.) will succeed Rep. Nancy Pelosi of California as the party’s leader, making him the first Black person to lead a major political party in Congress. Reps. Katherine Clark (D-Mass.) and Pete Aguilar (D-Calif.) were elected to the No. 2 and 3 positions in the Democratic minority, respectively.

— Luiz Inácio Lula da Silva, Brazil’s newly elected president, tightened gun controls and curbed goldmining in the Amazon rainforest by revoking decrees introduced by his predecessor, Jair Bolsonaro. Lula also shut down an ongoing study about the viability of privatizing Petrobras, the state-owned oil company. In his first address to Congress, he said Bolsonaro’s policies had caused “national destruction.”

|

CONGRESS |

— House schedule: Incoming House Majority Leader Rep. Steve Scalise (R-La.) revealed a list of legislation that he will bring up for Republicans to consider on the House floor when they assume control of the lower chamber on Jan. 3.

— Top priorities in 2023. AP and the NORC Center for Public Affairs Research (link) are out with a poll (link) asking Democrats, independents and Republicans their top priorities for the government to work on in 2023.

- Inflation and the economy were the only issues near the top of all three lists:

Democrat's top 5:

- Environment/climate change

- Gun issues

- Economy (general)

- Inflation

- Education

Independents' top 5:

- Inflation

- Economy (general)

- Unemployment/jobs

- Immigration

- Health care reform

Republicans' top 5:

- Immigration

- Inflation

- Economy (general)

- Crime/violence

- Gas prices/oil/energy costs

|

OTHER ITEMS OF NOTE |

— 2022 was another banner year for ransomware and other cyberattacks, which can be costly crises for companies. In 2022, the average cost of a data breach in the U.S. was $9.4 million, up from $9 million the prior year. Link to Forbes article on cyber experts offering insights on the threats businesses may face in 2023, along with recommended protective measures.

— Buffalo Bills safety Damar Hamlin suffered a cardiac arrest during Monday night’s game against Cincinnati, which was suspended and later postponed. His heartbeat was restored on the field, before he was taken to University of Cincinnati Medical Center, the team said (link). He is "currently sedated and listed in critical condition," the team said.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 | New farm bill primer | China outlook | Omnibus spending package |