U.S. Unveils New Covid-19 Testing Requirements for Travelers from China

Energy prices continue lower on effects of rising Covid-19 cases in China on oil demand

|

In Today’s Digital Newspaper |

Hong Kong joined mainland China in rolling back Covid-19 restrictions, with the financial hub ending social distancing, obligatory vaccine proof and almost all testing requirements for visitors effective today. Meanwhile, the U.S. said it will require travelers from China to submit a negative Covid-19 test beginning Jan. 5.

ExxonMobil sued the European Union over the bloc’s new windfall tax on oil companies. The lawsuit, filed by the American oil major’s Dutch and German subsidiaries on Wednesday, argues that the Council of the EU lacks the legal authority to impose the tax — aimed at the extra profits fossil-fuel firms are enjoying because of high energy prices — because that belongs only to sovereign countries.

Russia on Thursday morning launched more than 100 missiles at Ukraine, hitting capital Kyiv and other cities, according to Reuters. Authorities cut power in the Odesa and Dnipropetrovsk regions as Ukraine looks to avoid further damage to its energy infrastructure. The latest Russian barrage came as Vladimir Putin’s government rejected a peace proposal from Ukraine. Moscow wants Ukrainian President Volodymyr Zelenskyy’s government to recognize the regions of the country Russia has illegally annexed, but that’s a non-starter for Ukraine.

The number of Americans filing new claims for unemployment benefits rose by 9,000, to 225,000 in the week ending Dec. 24, in line with market expectations.

Covid-19 issues in China are still hampering manufacturing of Apple's iPhone. The main parts of the Zhengzhou facility are operating at about 70% capacity.

Vietnam posted a growth rate of more than 8% for 2022, easily surpassing even its own official target of 6-6.5%.

Japanese families will now receive 1 million yen ($7,500) per child, up more than threefold, along with other financial incentives if they leave the capital of Tokyo for elsewhere in the country.

The World Gold Council reports central bank gold buying at the highest rate since 1967, with Russia and China likely the leaders.

Southwest Airlines will limit new bookings as it tries to resume normal operations. CEO Bob Jordan said he is optimistic that Southwest can get on track before next week, as the airline continues to fly a reduced schedule to get its people and planes in position to recover. Airline executives and labor leaders point to inadequate technology systems, in particular the system it relies on to reassign crews after flight disruptions, as one reason for the debacle.

Mitch Daniels could join crowded field of Indiana Republicans hoping to succeed Braun.

Rep. Jamie Raskin (D-Md.) announced he has a "serious but curable form of cancer."

A tent processing center is going up in El Paso, Texas, to increase migrant processing capacity by about 1,000, according to a spokesperson for U.S. Customs and Border Protection. Meanwhile, the U.S. is set to use Title 42 to expel “many” migrants from Cuba, Nicaragua and Haiti.

|

MARKET FOCUS |

Equities today: Global stock markets were flat to weaker overnight. U.S. stock indexes are pointed toward firmer openings. In Asia, Japan -0.9%. Hong Kong -0.8%. China -0.4%. India +0.4%. In Europe, at midday, London -0.1%. Paris +0.1%. Frankfurt +0.2%.

U.S. equities yesterday: U.S. stocks opened higher Wednesday, but they turned lower stayed down. The Dow was down 365.85 points, 1.1%, at 32875.71. The S&P 500 dropped 446.03 points, 1.2%, at 3,783.22. The Nasdaq fell 139.94 points, 1.35%, at 10,213.29; Apple was off 3%.

A factor weighing on equities is the jump in bond yields. The yield on the benchmark 10-year U.S. Treasury note rose above 3.8% to its highest level since mid-November on Tuesday, and remained there on Wednesday.

For December, the Dow is currently down around 4.4%, the S&P 500 6.9%, and the Nasdaq 100 11.4%, putting three benchmarks on the way for their worst annual performances since 2008.

In energy markets, oil prices settled lower Wednesday as investors assessed the effects of rising Covid-19 cases in China on oil demand. Front month contracts for both Brent crude, the international standard, and West Texas Intermediate, the U.S. standard, fell. WTI crude futures fell to below the $78 per barrel level, retreating from the three-week high of $81 in the previous session. Meanwhile, oil refineries on the Texas Gulf Coast are trying to resume operations after freezing temperatures forced a halt last week, drawing back concerns about low supply. For the year, WTI crude futures are set to close 2022 only marginally higher, despite reaching a 14-year high of $120 per barrel in March.

Agriculture markets yesterday:

- Corn: March corn rose 8 cents to $6.82 3/4, the contract’s highest close since $6.86 3/4 on Nov. 4.

- Soy complex: March soybeans jumped 25 1/4 cents to $15.14 1/4, the contract’s highest close since $15.29 on June 17. March soymeal surged $13.50 to $461.30, the contract’s highest close since Dec. 9. March soyoil fell 142 points to 64.97 cents.

- Wheat: March SRW wheat rose 11 cents to $7.85 1/2, the contract’s highest close since Nov. 30. March HRW wheat rose 3 cents to $8.82 1/4, a four-week closing high. March spring wheat fell 1/4 cent to $9.34.

- Cotton: March cotton fell 98 points to 83.26 cents, the contract’s lowest close since Dec. 16.

- Cattle: February live cattle fell 7.5 cents $157.80, nearer the session low. March feeders rose 60 cents to $186.00.

- Hogs: February lean hogs fell 67 1/2 cents to $90.80 and near mid-range. The CME lean hog index fell 13 cents to $78.60, the lowest since late January.

Ag markets today: Concerns with surging Covid cases in China triggered risk aversion in markets overnight, including grain and soy futures. As of 7:30 a.m. CT, corn futures were trading 2 to 3 cents lower, soybeans were mostly 3 to 5 cents lower and wheat futures were 10 to 14 cents lower. Front-month crude oil futures were around $1.25 lower, and the U.S. dollar index was more than 200 points lower this morning.

The number of Americans filing new claims for unemployment benefits rose by 9,000, to 225,000 in the week ending Dec. 24, in line with market expectations of 222,000. The 4-week moving average which removes week-to-week volatility was little changed at 221,000, still pointing to a tight labor market. Markets will want to see this number move higher towards 250,000 (and ultimately 300,000). If claims remain stubbornly low, that could weigh on stocks.

Covid-19 issues in China are still hampering manufacturing of Apple's iPhone. The main parts of the Zhengzhou facility are operating at about 70% capacity.

Vietnam posted a growth rate of more than 8% for 2022, easily surpassing even its own official target of 6-6.5%. Its economy had grown by 2.6% the year before, despite strict lockdowns and shortages at factories. The new figure is even more astonishing considering reduced global demand for Vietnam’s exports — and owes much to supply chains’ migration from China.

Japan wants residents to leave Tokyo and is paying them more than ever to do so. Families will now receive 1 million yen ($7,500) per child, up more than threefold, along with other financial incentives if they leave the capital for elsewhere in the country, the Japan Times reported (link). Authorities have long sought to address the growing depopulation of rural areas — increasingly abandoned by young people in search of jobs and opportunities — and address huge overcrowding in Tokyo, home to around 11% of Japan’s people in 0.6% of its total land.

Technical viewpoints from Jim Wyckoff:

U.S. pending home sales fall for sixth month. The contracts to buy previously owned homes in the U.S. declined by 4% in November, a sixth consecutive monthly decline and much worse than forecasts of a 0.8% drop, largely because interest rates climbed. That pushed the Pending Home Sales Index to 73.9, the lowest since 2001 excluding the drop in the early months of the pandemic.

Market perspectives:

• Outside markets: The U.S. dollar index was weaker, with the euro and British pound stronger against the greenback. The yield on the 10-year US Treasury note rose, trading around 3.88%, with a mixed to lower tone in global government bond yields. Crude was lower, with U.S. crude around $78.20 per barrel and Brent around $83.25 per barrel. Gold futures were lower while silver posted gains, with gold around $1,814 per troy ounce and silver around $24.05 per troy ounce.

• U.S. dollar flexed its muscle in 2022. Despite a recent downturn, the dollar index enjoyed one of its strongest years ever, up almost 9% year-to-date, as the Federal Reserve focused on stubbornly high inflation with an aggressive tightening. The U.S. central bank hiked its federal-funds rate by a cumulative 4.25% this year, the most since 1980, bringing borrowing costs to the highest level in 15 years while pledging that rates would need to go even higher in 2023. This dollar’s strength was seen across the board, with some of the most pronounced buying activity against the yen, given the widened gap in interest rates.

• Oil prices fall on China concerns. Oil prices extended losses for a third session and tanked on Thursday amid concerns that the end of China’s zero-Covid policy could lead to a surge in cases across the globe and trigger worldwide restrictions. Crude is heading for the first back-to-back quarterly loss since 2019 but is still up nearly 3% on the 2022 year.

• The World Gold Council reports central bank gold buying at the highest rate since 1967, with Russia and China likely the leaders. “Sanctions on Russia and strained relations between the West and China have led to both countries adopting a policy of ‘de-dollarization’ to rely less on the policies of the U.S. central bank and government,” said broker SP Angel in a morning email dispatch. According to the World Gold Council, central banks bought 399 metric tons of gold in the third quarter, compared to 186 metric tons in the first quarter and 88 metric tons in the first quarter of 2022. Officially, Turkey led buying with 29 metric tons in the third quarter, though many central banks including China and Russia do not always report gold holdings. Gold is on track to close the year slightly lower, having rallied to as high as $2,070 an ounce in March on economic fears, before hitting an over two-year low of almost $1,600 an ounce in September as major central banks embarked on a historic tightening campaign to combat inflation.

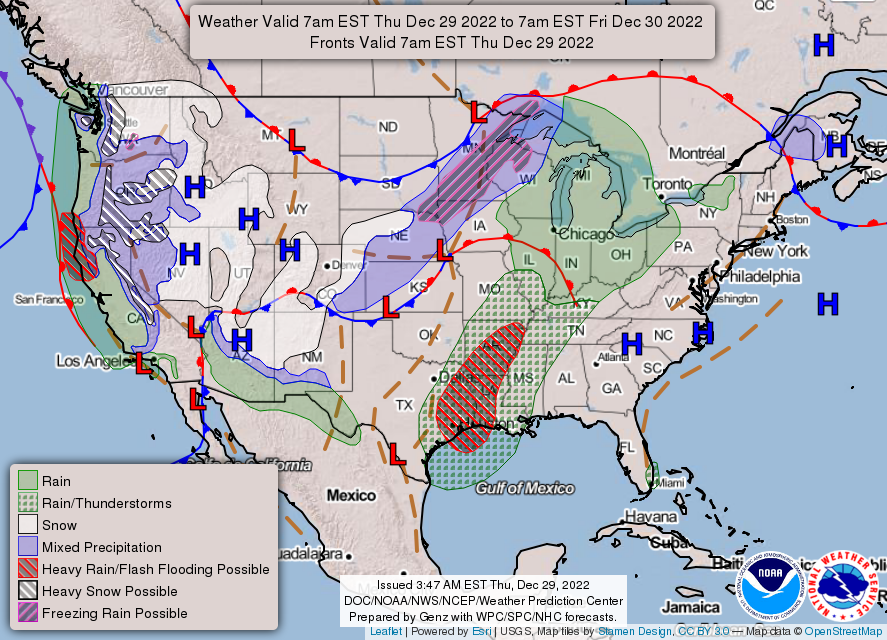

• NWS weather: ...Heavy rain and mountain snow to enter the West today and continue through the end of the week... ...Increasing shower and thunderstorm chances across parts of the Gulf Coast and lower Mississippi Valley... ...Well above average temperatures forecast throughout the central and eastern United States...

Items in Pro Farmer's First Thing Today include:

• Grains pressured by broader risk aversion

• New China grain reserves company will begin operations in January (details below)

• China moves to step up supervision of banks’ custody business

• India extends policy to import refined palm oil at lower duty

• Slow developing cash cattle market

• Big jump in cash hog index

|

RUSSIA/UKRAINE |

— Summary: Russia carried out a "massive missile attack" on Ukraine, a regional official said. Russia fired more than 120 missiles, a Ukrainian presidential official said. The mayor of Kyiv warned residents of possible power and water outages as a result of the attacks. Officials reported the activation of air defense systems, including in Kharkiv in the northeast, Mykolaiv in the south, as well as Zhytomyr and Poltava in central Ukraine. The attacks come after Russia's foreign minister said Moscow will not negotiate with Kyiv based on Ukrainian President Volodymyr Zelenskyy's proposed peace formula.

Ten months into Moscow’s invasion, the war is “stuck,” with the two sides battling each other to a standstill, the head of the Ukrainian military intelligence agency told the BBC. Russian forces have in recent weeks intensified their bombardment of Kherson, a recently liberated city in southern Ukraine, while Bakhmut — where some of the fiercest fighting is underway — is “covered with blood,” Zelenskyy said.

- 22%: That is how much Russia's seaborne crude exports dropped in December from the average for the first 11 months of 2022, according to commodities-data firm Kpler. The country shipped about 2.5 million barrels of crude each day by sea this month as a U.S.-backed price cap of $60 a barrel came into effect and the European Union banned most imports. "Winter weather has also impacted Russian crude loadings this month," Smith added, "so the lower export number could be a function of weak Chinese demand and inclement weather."

|

CHINA UPDATE |

— U.S. to require Covid tests for travelers coming from China. The Biden administration announced Wednesday that it will require anyone arriving by air from China (including Hong Kong and Macau) provide a negative Covid test, following a surge of Covid-19 cases across China as Beijing has eased its strict zero-Covid rules. Under the new rules, which will take effect on Jan. 5, anyone two years and older will need to show a negative result from a test taken within two days of their departure from airports in mainland China, Hong Kong and Macau, administration officials said in a briefing.

The U.S. will also ask passengers flying to the U.S. from Seoul, Toronto and Vancouver if they have been in China during the previous 10 days. If so, they will also have to submit a negative test within two days of their departure to the U.S.

U.S. officials said that Chinese authorities have been withholding critical information about the viruses spreading across China right now, and that those viruses could lead to new variants taking hold globally. “As of this morning, the percentage of reported cases that are sequenced and shared by the PRC is .036%, compared to about 4.4% of the U.S. cases,” one of the officials said. “We don’t know — we won’t know — the nature of the variants that might be circulating.” China’s National Health Commission (NHC) said it would stop releasing data on daily Covid-19 caseloads from Sunday, without providing an explanation.

Lunar New Year, which begins Jan. 22, is usually China’s busiest travel season, and China announced Tuesday it will resume issuing passports for tourism for the first time since the start of the pandemic in 2020.

— China’s health care system is already straining to cope due to years not planning and a focus on containment over treatment. Based on the omicron BA.2 subvariant’s 0.3 percent fatality rate, 250 million people infected means 750,000 likely deaths, observers note. At this rate of exponential growth, they say the first wave could hit 60% of the Chinese population by the end of January. That could mean 900 million infections — and 2.7 million deaths. It’s possible that the strain currently spreading in China could be less lethal.

— More and more companies are shifting their supply chains away from China. Apple plans to make some MacBooks in Vietnam next year, Nikkei reported, while major international automakers aim to gradually shift production away from China, according to the Financial Times. Both moves are driven by the twin risks of growing political tensions between Beijing and major Western capitals, and China’s fluctuating Covid-19 strategy — until recently draconian in its restrictions, and now suddenly free-flowing and open.

— New China grain reserves company will begin operations in January. China state-owned grains trader COFCO said a new joint venture it has set up with state stockpiler Sinograin to manage the country’s grain reserves will officially begin operations next month. The China Enterprise United Grain Reserve Co. Ltd was established in September, according to COFCO, and is part of Beijing’s efforts to improve the efficiency of its grain reserves and better ensure food security.

— China to adjust trade tariffs on some goods. China will adjust import and export tariffs on some goods from Jan. 1 to speed and promote development and expand domestic demand, the finance ministry said. Export tariffs on aluminum and aluminum alloys will be raised. The current import tariff will stay on seven types of coal until March 31, with tariffs adopted for most favored nations from April 1. As competition grows with the U.S. on technology issues, China will further reduce the tariffs for most favored nations on 62 types of information technology products from July 1.

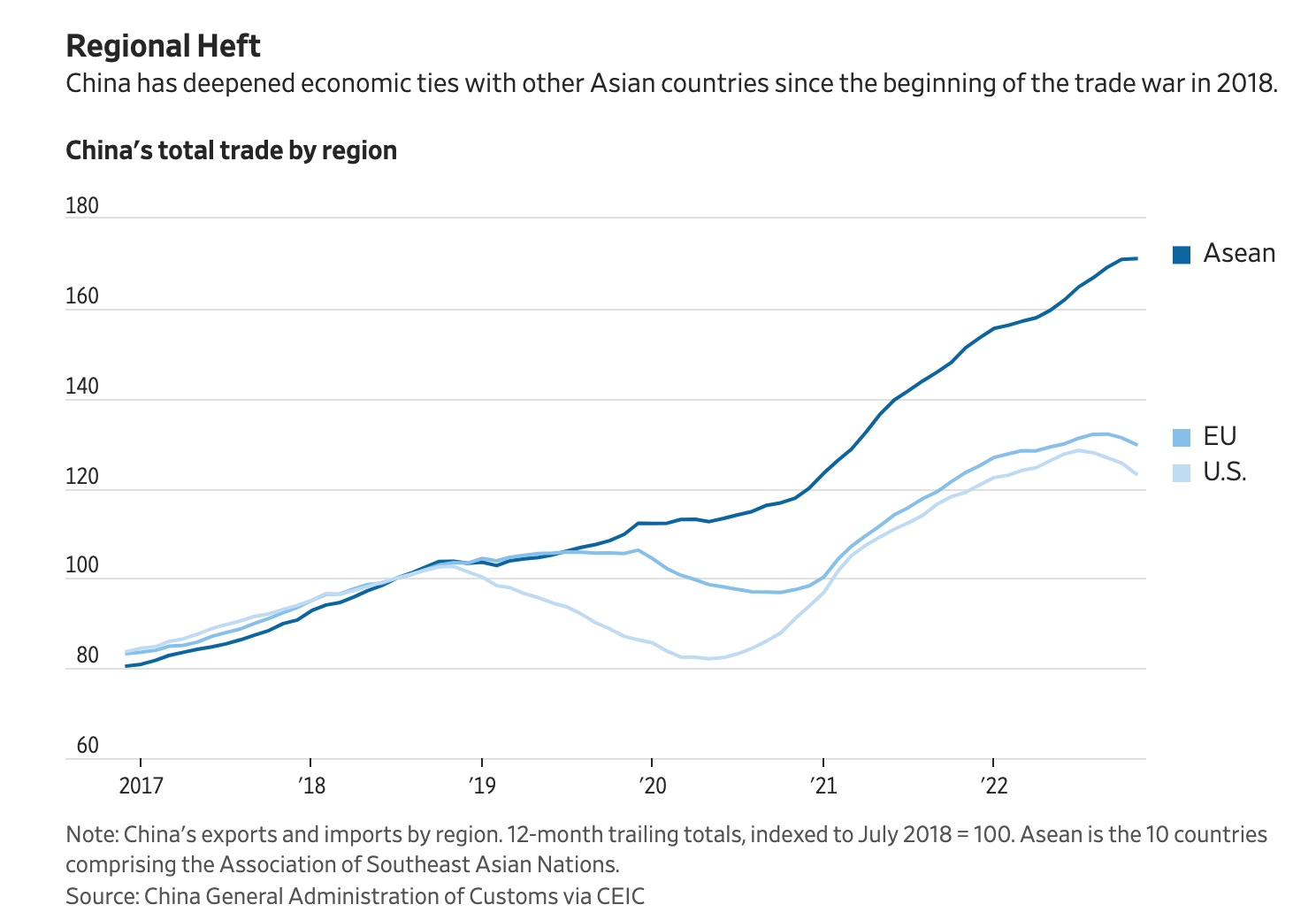

— China has increased trade with the rest of Asia as the U.S. pushes for decoupling. China’s total trade — exports plus imports — with 10 of its neighbors in Southeast Asia has grown 71% since July 2018, when the U.S. first placed tariffs on a range of Chinese goods, according to a WSJ analysis (link). Behind the trend, economists say, are powerful economic forces that tend to bind smaller economies to bigger ones as well as China’s dominant role as a supplier of the kind of affordable goods that fast-growing countries need, such as cars and machinery. The upshot is the U.S. will find it hard to nudge Asia away from China without more concrete steps to boost trade with its own huge domestic market.

|

ENERGY & CLIMATE CHANGE |

— ExxonMobil sues EU in move to block new windfall tax on oil companies. The moves come in a bid to force the EU to scrap the bloc’s new windfall tax on oil groups, arguing Brussels exceeded its legal authority by imposing the levy. The lawsuit is the most significant response yet against the tax from the oil industry, which has been targeted by western governments amid a surge in energy prices following Russia’s invasion of Ukraine. The Financial Times first reported the lawsuit on Wednesday.

The windfall profits tax is "counter-productive,” discourages investments and undermines investor confidence, Exxon spokesperson Casey Norton said on Wednesday. Exxon will factor in the tax as it considers future multibillion-euro investments in Europe’s energy supply and transition, he said. "Whether we invest here primarily depends on how attractive and globally competitive Europe will be," Norton said. Windfall profit taxes imposed by Europe could cost at least $2 billion through the end of 2023, Chief Financial Officer Kathryn Mikells said in a call to analysts on Dec. 8.

Exxon said it invested $3 billion in the past decade in refinery projects in Europe. The projects are helping it deliver more energy products at a time when Europe struggles to reduce its imports from Russia. "We will continue to work with EU leaders to address these issues. Thoughtful policy is critical," the company said.

— Indonesia delays B35 blending mandate to Feb. 1. Indonesia will start its mandatory 35% palm oil biodiesel blending requirement on Feb. 1, a month later than initially planned, the energy ministry said. The start date for the B35 program was delayed “to ensure that supply, infrastructure, everything is ready,” energy ministry director Edi Wibowo said. Indonesia will maintain next year’s biodiesel allocation for domestic consumption at 13.15 million kiloliters, with Wibowo noting “excess January allocation will be used if there is an increase in demand.”

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

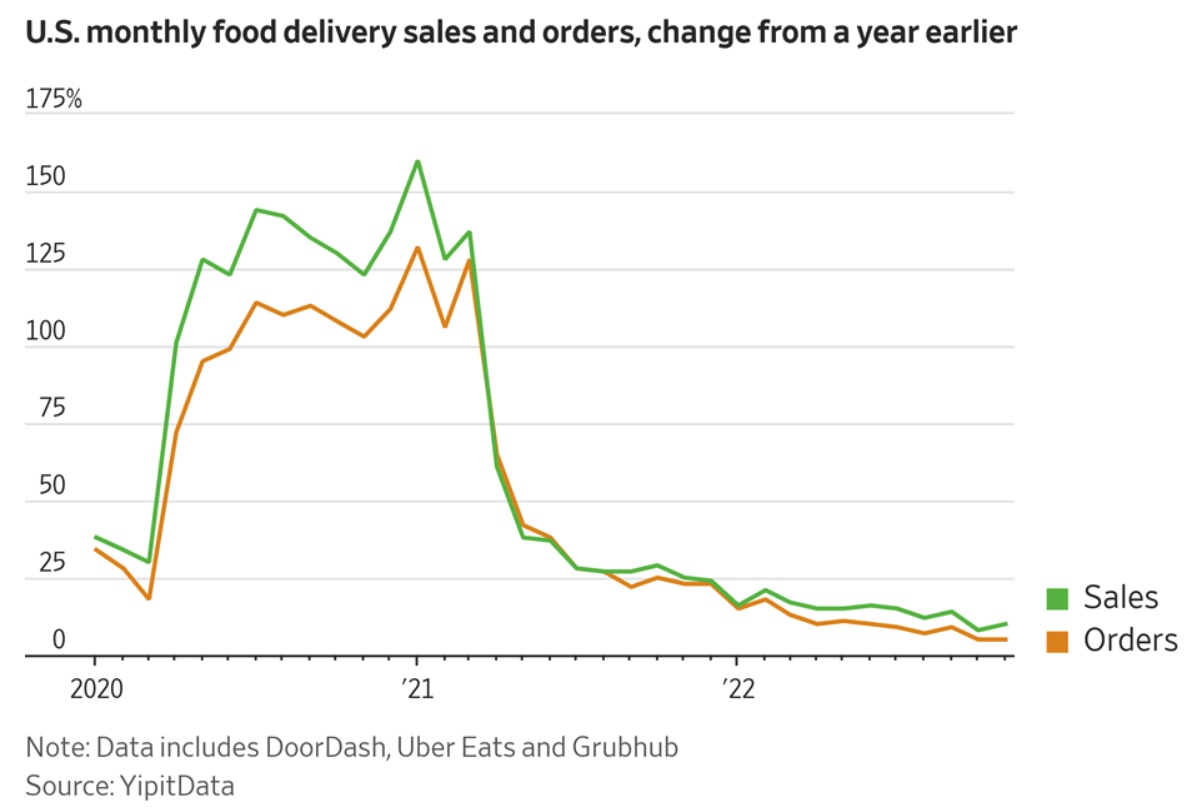

— Consumers are changing their food-delivery habits. Consumers continue to spend more on the biggest food-delivery apps DoorDash and Uber Eats, but growth is slowing and people are spending more cautiously, analysts and industry executives said, the WSJ reports (link). DoorDash’s CEO said some consumers are moving from expensive restaurants to fast food, while others are cutting back on the number of items in a restaurant order. Restaurant executives say some customers are picking up more of their food to avoid delivery fees.

— Imported baby formula will be subject to tariffs again in the new year, after the expiration of exemptions implemented amid a nationwide shortage. Milk producers say the supply has improved enough, though some parents are still reporting empty shelves.

|

HEALTH UPDATE |

— Summary:

- Global Covid-19 cases at 659,159,390 with 6,685,127 deaths.

- U.S. case count is at 100,582,858 with 1,091,473 deaths.

- Johns Hopkins University Coronavirus Resource Center says there have been 651,223,261 doses administered, 268,143,349 have received at least one vaccine, or 81.39% of the US population.

|

POLITICS & ELECTIONS |

— Federal and county prosecutors probing Rep.-elect George Santos. Federal prosecutors with the U.S. Attorney's office for the Eastern District of New York are looking into the finances and financial disclosures of GOP Rep.-elect George Santos (R-N.Y.) after he admitted to fabricating significant parts of his resume ahead of his successful bid for Congress, CBS News reported. The congressman-elect said he still intends to take his seat in the House come January.

— Mitch Daniels could join crowded field of Indiana Republicans hoping to succeed Braun. Politico reports (link) that in Indiana, at least six prominent Republicans are “weighing a shot at a coveted seat being vacated by Republican Sen. Mike Braun as he runs for governor.” Politico adds that “the biggest factor hovering over the race” is “the possibility of a political comeback by Mitch Daniels, the outgoing Purdue University president whose eight years as governor shaped nearly two decades of Republican rule in the state.” Politico describes Daniels as “a classic Reagan conservative with mainstream moderate impulses known for advocating a truce on the culture wars and being critical of Trumpism.” Other potential candidates include Rep. Jim Banks (R-Ind), the former chairman of the Republican Study Committee, Attorney General Todd Rokita, and Jennifer-Ruth Green, “the Black Air Force veteran who came within 5 points of defeating Democratic Rep. Frank Mrvan in the state’s 1st Congressional District in November.”

|

CONGRESS |

— Rep. Jamie Raskin, 60, says he’s been diagnosed with cancer (lymphoma). Raskin, a Democrat who represents part of Maryland, said in a statement the news of his “serious but curable form of cancer” came after several days of tests. “I have been diagnosed with Diffuse Large B Cell Lymphoma, which is a serious but curable form of cancer,” he said. “I am about to embark on a course of chemo-immunotherapy on an outpatient basis at Med Star Georgetown University Hospital and Lombardi Comprehensive Cancer Center. Prognosis for most people in my situation is excellent after four months of treatment.” He noted he expected to work while fighting the disease, but that he was cautioned by doctors to “reduce unnecessary exposure to avoid Covid-19, the flu and other viruses.”

— Jan. 6 committee withdraws its subpoena of Trump. The House committee investigating the Jan. 6 attack on the Capitol on Wednesday withdrew the subpoena it had issued to former president Donald Trump, conceding that the lawmakers had run out of time to obtain his documents or testimony.

|

OTHER ITEMS OF NOTE |

— A tent processing center is going up in El Paso, Texas, to increase migrant processing capacity by about 1,000, according to a spokesperson for U.S. Customs and Border Protection. The facility is expected to be operational in January. To prepare for the possible lifting of Title 42, the Department of Homeland Security announced it would be adding 10 soft-sided facilities to boost its processing capacity. The facility going up in El Paso is one of them. Title 42 was set to end this month, but remains in limbo after the Supreme Court issued an order allowing the policy to remain in effect while legal challenges play out -- a process that could stretch out for months.

— U.S. set to use Title 42 to expel “many” migrants from Cuba, Nicaragua and Haiti. Reuters reports (link) the Biden administration is planning to use Title 42 restrictions to expel many Cuban, Nicaraguan and Haitian migrants caught at the southwest border back to Mexico, while simultaneously allowing some to enter the United States by air on humanitarian grounds, according to three U.S. officials familiar on the matter. The new rules for those from the three nations “would be modeled on an existing program for Venezuelans launched in October. The program allows up to 24,000 Venezuelans outside the United States to apply to enter the country by air through ‘humanitarian parole’ if they have U.S. sponsors. ... Two officials said the policy shift... could come as soon as this week.”

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 | New farm bill primer | China outlook | Omnibus spending package |