House Expected to Clear $1.7 Trillion FY 2023 Omnibus Spending Measure Today

Supply chain back to normal | Weather outside is frightful | PCE inflation slows | Food prices

|

In Today’s Digital Newspaper |

Christmas holiday Monday. U.S. gov’t offices are open today (Dec. 23) and most markets will trade normal hours except for the bond market that will close at 2 p.m. ET. Markets and U.S. gov’t offices will be closed Monday, Dec. 26, in observance of Christmas since the holiday falls on a Sunday. Markets and U.S. gov’t offices will reopen Dec. 27. The Monday holiday will adjust release schedules for some updates from USDA next week.

USDA daily export sales:

• 124,000 metric tons soybeans to unknown destinations during 2022-2023 marketing year

• 150,000 metric tons corn to Mexico during the 2022-2023 marketing year

U.S. PCE inflation slows as the personal consumption expenditure price index in the U.S. increased by 5.5% YOV in November, the least since October of 2021 and below 6% in September. The core index which is the Fed’s preferred gauge of inflation also declined to 4.7%, in line with forecasts. Meanwhile, consumer spending edged up a meagre 0.1% in November while income went up 0.4%.

House will vote today on the FY 2023 omnibus spending package. We have details in Policy section, including a review of some major ag sector items in the measure.

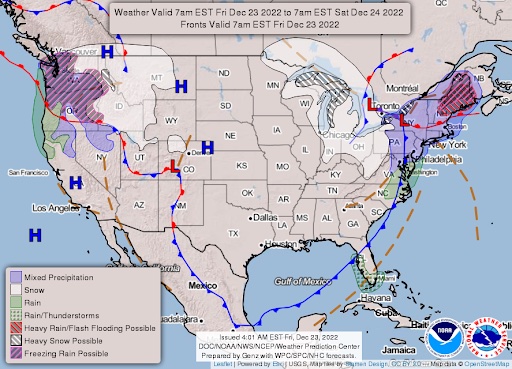

Over 3,100 flights in the U.S. have been canceled as Winter Storm Elliott brings snowfall, wind gusts and freezing temperatures to parts of the country and throws a wrench into Americans’ holiday travel plans. The storm also brought record-low temperatures in Montana and Wyoming this week; The temperature in Lincoln, Montana, set a daily low at -49 degrees F, while the coldest recorded wind chill was in Malta, Montana, where it dropped to an astounding -72 degrees F.

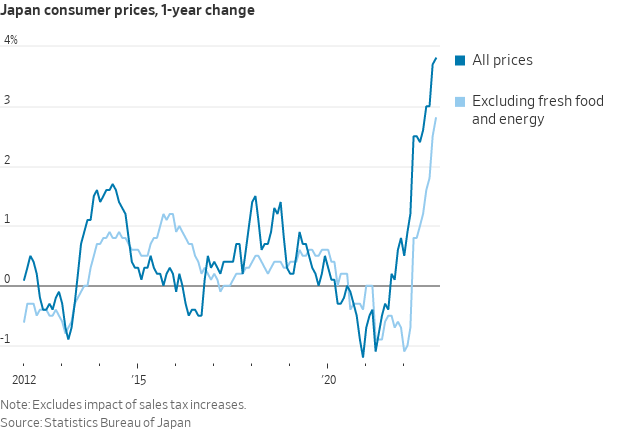

Japan’s consumer inflation hit a 40-year high, fueling speculation that the country’s central bank could tighten its ultra-loose monetary policy.

America’s population grew 0.4% this year, new Census Bureau figures show, continuing historically slow growth that has added pressure to a tight labor market.

USDA raises forecast of grocery inflation in 2023. Grocery prices will rise 3.5% in the new year, nearly double the long-term average but a major easing from this year’s 11.5%, said USDA Thursday in its Food Price Outlook. We have details below.

Ukraine’s military said it was inflicting heavy losses on Russian forces in the south of the country in an area that military analysts suggest could be the next target for a Ukrainian offensive. We have more on the Russia/Ukraine war in today’s dispatch.

The House Committee’s highly anticipated 845-page report released Wednesday blamed former President Donald Trump alone for triggering the deadly riots as he attempted to overturn the results of the 2020 election, and recommended the 2024 hopeful be barred from holding government.

Tesla CEO Elon Musk said he will not sell any more Tesla stock for about two years. While speaking in a Twitter Spaces audio chat, Musk also said he expects the economy to be in "serious recession" in 2023, reducing demand.

|

MARKET FOCUS |

Equities today: Global stock markets were mixed to firmer overnight. U.S. Dow opened around 50 points lower and is currently down around 125 points. Trading was quieter overnight, and volumes are likely to be low on this last trading day before the Christmas holiday over the weekend. PCE inflation, which the Fed tracks closely, slowed in November to the lowest since August last year and the core also fell in line with forecasts. Meanwhile, personal spending barely rose last month, and durable goods orders shrank the most in two years. Stock futures initially sank right after the release, but recovered to trade in positive territory, although market volatility is set to continue. In Asia, Japan -1.03%. Hong Kong -0.44%. China -0.24%. India -1.61%. In Europe, at midday, London +0.32%. Paris +0.44%. Frankfurt +0.17%.

U.S. equities yesterday: All three major indices finished lower in the wake of positive U.S. economic news that could prompt the Fed to continue to raise rates more than expected in 2023. “The data was stronger across the board, and if there’s anything the Fed does not want to see these days, it’s better than expected data,” said Paul Hickey of Bespoke Investment Group. The Dow ended down 348.99 points, 1.05%, at 33,027.49. The Nasdaq declined 233.25 points, 2.18%, at 10,476.12. The S&P 500 lost 56.05 points, 1.45%, at 3,822.39.

Government bond yields slipped. Ten-year Treasury notes traded at a yield of 3.669%, down from 3.684% Wednesday.

Crude-oil prices fell after earlier trading up on shrinking U.S. inventories and signs of a drop in Russian exports. Brent-crude futures, the global benchmark, fell 1.5% to $80.98 a barrel.

Agriculture markets yesterday:

- Corn: March corn fell 1 3/4 to $6.60 1/2 after rising to a three-week high overnight.

- Soy complex: March soybeans fell 12 1/2 cents to $14.72. March soymeal fell $4.40 to $448.30. March soyoil fell 82 points to 64.01 cents.

- Wheat: March SRW wheat fell 5 1/2 cents to $7.62 1/4. March HRW wheat rose 2 cents to $8.66, the contract’s highest close since Dec. 2. March spring wheat fell 5 1/2 cents to $9.22 1/4.

- Cotton: March cotton futures dropped the 400-point daily limit to 84.30 cents

- Cattle: February live cattle fell 40 cents to $157.30. March feeder cattle gained 72.5 cents to $186.45.

- Hogs: February lean hog futures rose 65 cents to $89.05, the contract’s highest close since Dec. 5.

Ag markets today: Corn, soybeans and wheat firmed after trading lower early in the overnight and are near their highs this morning. As of 7:30 a.m. ET, corn futures were trading mostly 3 to 4 cents higher, soybeans were 4 to 6 cents higher, winter wheat futures were 5 to 7 cents higher and spring wheat was 2 to 3 cents higher. Front-month crude oil futures were around $2 higher and the U.S. dollar index was about 150 points lower this morning.

Technical viewpoints from Jim Wyckoff:

On tap today:

• U.S. consumer spending for November is expected to rise 0.2% from the prior month, and personal income is forecast to increase 0.3%. Follow our coverage here. (8:30 a.m. ET) UPDATE: Consumer spending edged up a meagre 0.1% in November while income went up 0.4%.

• Personal-consumption expenditures price index excluding food and energy for November is expected to rise 0.2% from one month earlier and 4.6% from one year earlier. (8:30 a.m. ET) UPDATE: U.S. PCE inflation slows as the personal consumption expenditure price index in the U.S. increased by 5.5% YOV in November, the least since October of 2021 and below 6% in September. The core index which is the Fed’s preferred gauge of inflation also declined to 4.7%, in line with forecasts.

• U.S. durable goods orders for November are expected to fall 1.1% from the prior month. (8:30 a.m. ET) UPDATE: Durable goods orders in the U.S., which measure the cost of orders received by manufacturers of goods meant to last at least three years, fell by 2.1% month-over-month in November 2022. It was the sharpest decrease since April 2020 and well above market forecasts of a 0.6% decline, swinging from the downwardly revised 0.7% increase in the prior month. Orders fell sharply for transportation equipment (-6.3% VS 1.9% in October) amid declines in nondefense aircraft and parts (-36.4% vs 4.7%) and defense aircraft and parts (-8.6% vs 18.2%). Excluding transportation, new orders edged 0.2% higher from the 0.1% increase in October, supported by machinery (0.3% vs 1.4%), computers and electronic products (0.6% vs -0.2%), and fabricated metal products (0.1% vs stall). Meanwhile, orders fell for primary metals (-0.4% vs -0.7%).

• University of Michigan consumer sentiment index for December is expected to hold at 59.1, unchanged from a preliminary reading. (10 a.m. ET)

• U.S. new-home sales are expected to fall to an annual pace of 600,000 in November from 632,000 one month earlier. (10 a.m. ET)

• CFTC Commitments of Traders report, 3:30 p.m. ET.

Japan’s core inflation rose at the fastest pace in nearly 41 years in November, fueling market speculation that the Bank of Japan would look to tighten monetary policy in 2023. Core consumer prices — a measure that covers all prices except fresh food — rose 3.7% from a year earlier in November, the fastest pace since December 1981.

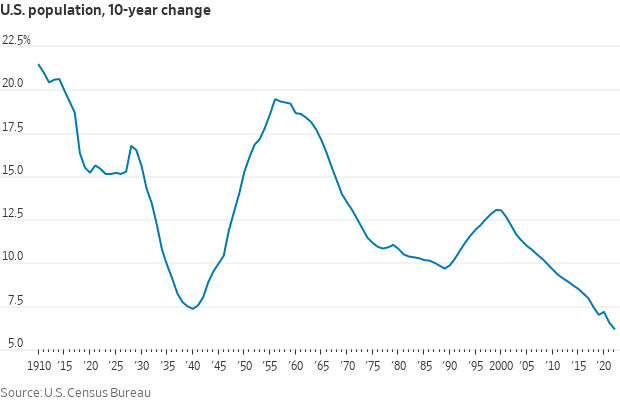

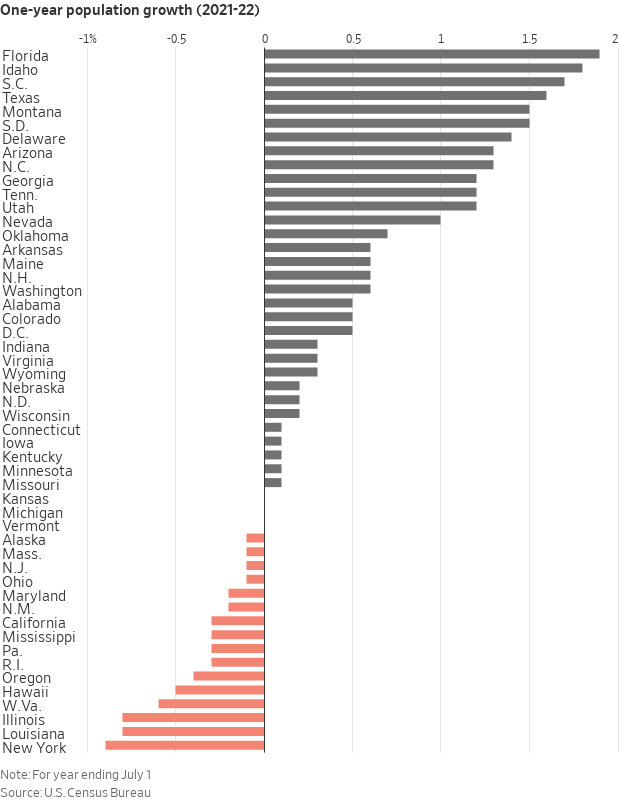

America’s population grew 0.4% this year, Census Bureau figures released Thursday show, continuing historically slow growth that has added pressure to a tight labor market. The slight uptick, in the third year of the pandemic, was still greater than the unprecedented low rate of 0.1% recorded in 2021. The U.S. added 1.3 million people in the year that ended July 1 for a total population of 333.3 million. That included 245,000 more births than deaths, a surplus that has long supplied much of the nation’s growth. The other component, which measures people moving in and out of the country, grew by one million.

USDA ups 2023 food price inflation outlook. Reason: Rise in grocery prices. Levels for all food and grocery store prices are up one percentage point from USDA’s initial July outlook, with projections for 2022 maintained at prior levels with adjustments in some food price categories. HPAI has been a key factor elevating egg price inflation, USDA said in its report.

Prices for all foods are expected to increase 3.5% to 4.5% in 2023, up from a prior outlook of 3% to 4% and a full percentage point above the level initially forecast by USDA in July. Major factor behind the increased outlook is in food at home (grocery) prices, now seen up 3% to 4%, up from 2.5% to 3.5% in November and like all food prices, up a full percentage point from USDA’s initial expectation. Food away from home (restaurant) prices were held at an increase of 4% to 5%, where they have been since October and are now up a full percentage point from the initial outlook in July.

USDA’s Economic Research Service (ERS) held its 2022 food price inflation outlook steady in their December update, keeping the increases at 9.5% to 10.5% for all foods, 11% to 12% for grocery store prices and 7% to 8% for restaurant prices, levels that have been unchanged since they were raised to those marks in October.

But USDA made revisions within the food categories used for grocery prices, including lowering the outlook for poultry to an increase of 14% to 15% (14.5% to 15.5% prior) and for vegoils to 18% to 19% (18.5% to 19.5% prior), cereal and bakery products to an increase of 12.5% to 13.5% (13% to 14% prior) and for other food to a rise of 12% to 13% (12.5% to 13.5% prior).

USDA said poultry prices decreased 0.8% in November, following a 1.1% decrease in October, but they are still 13.1% above November 2021. “Before October, poultry prices had increased for 12 consecutive months partially due to high costs of wholesale poultry meat,” USDA noted. There were upward adjustments for eggs, putting the increase at a rate of 30.5% to 31.5%, up a full percentage point on each end of the range due to the ongoing highly pathogenic avian influenza (HPAI) situation which has been rising in egg layer flocks. “This decrease in the egg-layer flock is expected to increase wholesale and retail egg prices for the coming months,” USDA said. Prices in November were up 49.1% from year-ago marks.

USDA made several increases in 2023 food categories. The ongoing HPAI situation has USDA also raising its forecast for 2023 egg prices, now putting the expected rise at 4% to 5% versus an outlook for 2% to 3% in November. That marks a sizable rise from USDA’s initially outlook for 2023 which was for egg prices to be unchanged — down 0.5% to up 0.5%.

Fruits and vegetable prices are expected up 1% to 2% (unchanged to up 1% prior), with USDA saying “elevated prices for wholesale fresh vegetables are expected to place upward pressure on retail prices in the coming months.”

USDA sees vegoil prices rising in 2023 by 5% to 6% even though they lowered the level of increase for 2022. There was no explanation given for the increase.

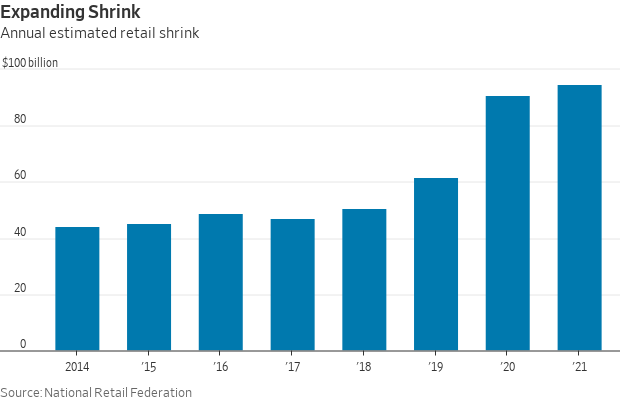

One more problem for retailers: shoplifting. The National Retail Federation estimates that shrink — an industry term for loss in inventory — amounted to roughly 1.4% of retail revenue in 2021, or roughly $94.5 billion. Most of that shrink is caused by theft.

Market perspectives:

• Outside markets: The U.S. dollar index was weaker amid strength in several foreign currencies versus the greenback. The yield on the 10-year U.S. Treasury note was higher, trading around 3.71%, with a mixed tone in global government bond yields. Crude was showing solid gains, with U.A. crude around $79.20 per barrel and Brent around $83.10 per barrel. Gold and silver were, with gold around $1,804 per troy ounce and silver around $23.93 per troy ounce.

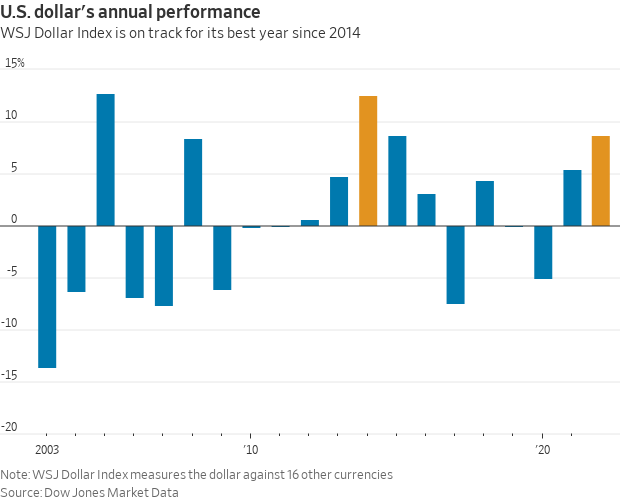

• The dollar's had a banner year, fueled by Federal Reserve interest-rate increases. One variable for the currency in 2023, investors say, is the mammoth spending European governments are expected to launch to shield their economies from high energy costs.

• WTI crude futures extended gains to more than 2% to above $79 per barrel on Friday, on the prospect of lower crude supplies from Russia. Russia’s Baltic oil exports are predicted to decline by 20% month-on-month in December and the country may reduce output by 500,000 to 700,000 barrels a day in early 2023 after the European Union and G7 nations imposed sanctions and a price cap on Russian crude. The oil market is set to gain for the second straight week, on signs of tightening U.S. crude supplies and an improving demand outlook in top crude importer China. Latest data showed that U.S. crude inventories fell by 5.89 million barrels last week, much more than market forecasts for a 1.66-million-barrel drop. But investors remain worried about surging Covid cases in China that could disrupt economic activities, as well as the prospect of a global economic slowdown next year.

• Things to keep an eye on, from Richard Crow, grain analyst and trader: xx

1) Argentina crops

2) Finishing rains for Brazil beans and their next corn crop plantings

3) Ukraine war — the ability to plant crops, a down supply there is expected

4) Will Russia be able to ship wheat as expected

5) Spring rains for the U.S. HRW crop

6) Will the U.S. get the increased plantings expected

7) Growth of renewable fuels

• Amid expansion, Savannah port overhauls ocean terminal. The Port of Savannah plans to invest $410 million in upgrading one of its terminals to accommodate larger ships, while transforming the port’s infrastructure, by 2025, to deal almost exclusively with container cargo, according to USDA’s Grain Transportation Report. Approved by the Georgia Ports Authority’s governing board on Dec. 5, the project will convert the ocean terminal to handle container cargo, and the terminal’s berths will be upgraded to service two large ships simultaneously, using eight new ship-to-shore cranes. Although incoming cargo has begun to subside amid inflation and shifting consumer habits, August and October were two of the Savannah port’s busiest months ever. Between January and October of 2022, the Port of Savannah exported approximately 40,000 TEUS of containerized grain, making it the fifth largest gateway for exporting containerized grain.

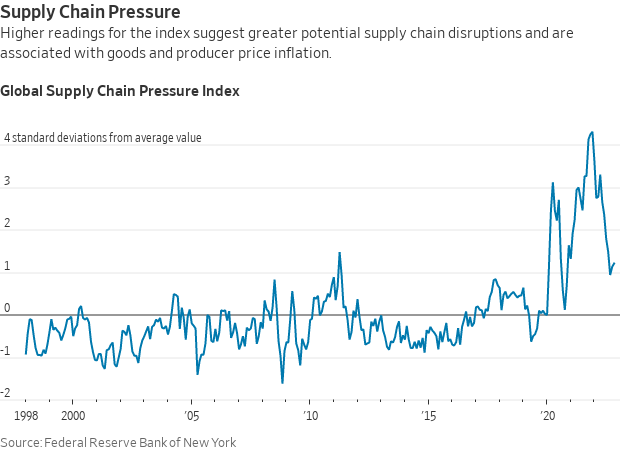

• Signs growing that global supply-chain crisis is over. From the docks of Southern California and Europe to the parcel hubs in the Midwest and the store shelves in New York, signs are growing that the global supply-chain crisis is over, the Wall Street Journal reports (link). The Covid-19 pandemic that spawned product shortages, shipping bottlenecks and soaring transport costs may not be gone, but the WSJ reports goods are moving around the world again, reaching companies and consumers. Despite widespread government and industry attempts to unwind the bottlenecks, the real break may have come in the demand slowdown that has eased the pressure on strained operations. U.S. container imports reached their lowest level in November since early 2020, and shipping heavyweight Maersk Line projects demand will decline next year from 2% to 4%. Freight rates that busted shipper budgets last year are sliding and broader costs for suppliers heading into 2023 are also retreating.

• California water crisis. Groundwater overpumping is accelerating in California’s Central Valley, which could potentially devastate a critically important water source for the state. Link for details.

• NWS weather: Historic winter storm to produce widespread disruptions to large portions of the nation heading into the holiday weekend... ...Over 200 million people, or roughly 60% of the U.S. population, are under some form of winter weather warnings or advisories across the U.S.... ...Powerful Arctic front to continue to sweep across the eastern third of the nation today, while temperatures will begin to rebound across the Northern Rockies and High Plains this weekend... ...Heavy Snows to blanket the Great Lakes region into northern N.Y. State and northern New England.

Items in Pro Farmer's First Thing Today include:

• Price strength overnight

• Argentina’s crop condition ratings decline again

• India ‘deeply engaged’ in developing GM seeds for 13 crops

• India may cut fertilizer subsidy to save money.

• Beef, pork stocks follow seasonal patterns in November

• Cattle on Feed, Hogs & Pigs Reports out this afternoon

• Steady cash cattle prices

• February hogs build premium to cash hog index

|

RUSSIA/UKRAINE |

— Summary: The U.S. is set to provide training for Ukrainian troops soon on the newly announced Patriot missile systems, a senior US defense official said. The Patriot system costs between $450 and $550 million, the Pentagon said, while each missile costs approximately $4 million. U.S. officials said they will also soon start an expanded training program for Ukrainian forces to train approximately 500 soldiers per month on larger combat operations.

- Israel has intelligence showing Iran is secretly planning to "widen and broaden" its shipments of sophisticated weapons to Russia for the war in Ukraine, the head of Israel's national intelligence agency said Thursday.

- Russian President Vladimir Putin on Thursday called the Russian invasion of Ukraine a “war” for the first time, setting off an uproar among antiwar Russians who have been prosecuted for merely challenging the Kremlin-approved name — Putin used the term “special military operation” in his early morning announcement on Feb. 24, the day his full-scale invasion began. “Our goal is not to spin this flywheel of a military conflict, but, on the contrary, to end this war,” Putin said during a televised news conference following a government meeting on Thursday. “This is what we are striving for.”

- Blinken thanks Turkey for work on Black Sea grain initiative. U.S. Secretary of State Antony Blinken, in a call on Thursday with Turkish Foreign Minister Mevlut Cavusoglu, thanked Ankara's efforts to ensure continuation of the UN-brokered Black Sea grain initiative, the State Department said. The two diplomatic leaders also underscored the importance of NATO unity in supporting Ukraine's defense against Russia's invasion, the State Department said, adding Blinken also expressed concern over the situation in Syria.

- European weapons manufacturers are struggling to produce enough ammunition for Ukraine and the continent. That jeopardizes NATO’s defense capacity and its support for Kyiv, officials and industry leaders say, according to the Wall Street Journal (link). Inadequate production capacity, labor shortages, supply-chain problems, high financing costs and environmental regulations are to blame. Ukraine’s battle against the Russian invasion is consuming ammo at rates unseen since World War II.

- North Korea has sent a large arms delivery to Wagner Group, the Russian mercenary force fighting in Ukraine. National Security Council spokesman John Kirby said North Korea last month shipped infantry rockets and missiles to Wagner, in the first acknowledgment by U.S. officials that the arms sale had been completed, and detailed Wagner’s growing influence inside Ukraine on behalf of Russia.

- Russian wheat export tax surges. Russia’s wheat export tax for Dec. 28-Jan. 10 will be 4,160.9 rubles ($61.09) per metric ton based on an indicative price of $312.80. That’s up sharply from a rate of 3,333.8 rubles per metric ton the previous week and the highest rate since the last week of August.

|

POLICY UPDATE |

— House expected to vote on omnibus gov’t spending bill after Senate clears measure. The House is expected to vote on a massive $1.7 trillion spending bill today as lawmakers look to avoid a gov’t shutdown before rushing home for the holiday break. The Senate passed the measure Thursday, just ahead of tonight's funding deadline, along with a bill to extend the deadline by one week to provide enough time for the bill to be formally processed and sent to President Joe Biden's desk.

The Senate passed the fiscal year $1.7 trillion 2023 budget that would fund the government until September 30, 2023. The budget, passed 68-29 in the upper chamber less than 48 hours before the current funding measure was set to expire, includes $858 billion in defense spending and $773 billion in what’s referred to as non-defense spending, including $45 billion in funding for Ukraine amid its war with Russia. Some 18 Senate Republicans voted for the measure.

— Highlights of some key ag-sector funding from the omnibus:

- $3.7 billion in farm disaster aid, to cover eligible 2022 crop and livestock losses, with $494.5 million to be used for livestock losses due to drought or wildfires, as part of overall $40.6 billion for disasters.

- Requires USDA to make a one-time payment to each rice producer on a U.S. farm in the 2022 crop year. The measure would rescind $250 million from the fiscal 2021 omnibus and reappropriate it for the payments. USDA would determine payment rates based on yield history and acreage.

- Authorizes $100 million for the USDA to make pandemic assistance payments to cotton merchandisers that purchased cotton from a U.S. producer from March 1, 2020, through the measure’s enactment date.

- Includes the Growing Climate Solutions Act, which authorizes USDA to oversee the registration of farm technical advisers and carbon-credit verification services

- Includes the SUSTAINS Act, which allows corporations and other private entities to contribute funding for conservation projects and authorize USDA to match the donations.

- Reauthorizes the Pesticide Registration Improvement Act, which imposes fees for maintenance and registration of active ingredients. It boosts registration and maintenance fees 30% and allows EPA to raise fees by 5% in 2024 and 2026.

- Make permanent a summer EBT (food stamp) program to provide up to $40 a month per child. It allows grab-and-go or home delivery of meals to kids in rural areas as an alternative to meals in group settings Any summer meals benefits issued to a household in the summer of 2023 couldn’t exceed $120 per child. USDA would be required to establish a program beginning in the summer of 2024 and annually thereafter to issue EBT benefits to eligible households to ensure continued access to food when school isn’t in session in the summer. Link for details.

- $25 million for specialty crop equitable relief.

- Directs USDA to index all administrative and operating expense in the crop insurance program for inflation.

- Aid for Food for Peace ($1.8 billion) and McGovern-Dole International Food for Education ($248 million) programs.

- Army Corps Emergency Funding: $1.48 billion is included on top of annual appropriations funding for the Army Corps of Engineers to make necessary emergency repairs and navigation improvements needed after extreme weather events, including the ongoing low-water event on the Mississippi River.

- Agricultural research: Ag research funding would increase by $175 million to $3.45 billion in 2023, including monies for Agricultural Research Service, National Institute of Food and Agriculture, Agriculture and Food Research Initiative, and Sustainable Agriculture Research and Education program.

- Rural Development: USDA's ReConnect loan and grant program for rural broadband would get $348 million for fiscal 2023.

|

PERSONNEL |

— As expected, the Senate on Thursday confirmed Doug McKalip, President Biden’s nominee to serve as Chief Agricultural Negotiator for the Office of the U.S. Trade Representative. McKalip most recently was a policy adviser at USDA. Sen. Bob Menendez (D-N.J.) had placed a hold on McKalip’s nomination over concerns about transparency at the Office of the U.S. Trade Representative, where the chief agricultural trade negotiator is based, but he lifted it Wednesday after a meeting with USTR Katherine Tai. “We face many challenges and opportunities, and I am confident that Doug is the right leader to help us tackle these issues at a critical moment for America,” Tai said in a statement after the confirmation. “Doug is a government professional with experience in agricultural issues,” said American Farm Bureau Federation President Zippy Duvall in a statement, adding that he’s “well suited to represent farmers’ interests on the international stage.” “Their responsibilities within those roles, and how they work with farmers to help us with trade, markets and more, are essential to our day-to-day jobs out on the farm — and touch every farm state in the country,” said American Soybean Assn. president Daryl Cates in a statement following McKalip’s confirmation.

Senators noted the situation in Russia will likely color much of McKalip’s tenure as agricultural negotiator. “I’ve had the opportunity to visit with him, and I’ve also worked with him about situations regarding food security from the Ukraine war, so I’m very much supportive,” said Sen. John Boozman (R-Ark.), the ranking member of the agriculture committee, in a September hallway interview with Bloomberg.

This follows Wednesday’s confirmation of Alexis Taylor as USDA’s Undersecretary for Trade and Foreign Agricultural Affairs.

José Emilio Esteban was also confirmed by voice vote Thursday to be the USDA’s undersecretary for food safety.

|

CHINA UPDATE |

— China plans to cut quarantine requirements for overseas travelers in January, according to reports, as the country dismantles the last vestiges of its zero-Covid policy. Officials are considering scrapping hotel quarantine in favor of three days’ health monitoring for arrivals.

— U.S. urges China to share information about its Covid outbreak. Secretary of State Antony Blinken called for “transparency for the international community” in a call with his Chinese counterpart amid concerns that Beijing may be playing down the number of deaths. China’s top health authority reportedly estimated that 37 million people were infected on a single day this week, which would make the outbreak the world’s largest by far.

— China’s soaring Covid infections are keeping people home and causing a slump in travel and economic activity. Subway passenger numbers have plummeted recently in cities including Shanghai and Guangzhou as infections surged. Congestion levels across 15 major cities are 56% below the level in January 2021, according to the benchmark used in an index compiled by BloombergNEF based on Baidu traffic data.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Food donation liability eased. Congress passed and sent to President Biden the Food Donation Improvement Act, which would expand legal protections for food makers, retailers, farmers, and restaurants that donate food directly to needy people. Link for details.

|

HEALTH UPDATE |

— Summary:

- Global Covid-19 cases at 656,164,943 with 6,675,372 deaths.

- U.S. case count is at 100,303,996 with 1,090,014 deaths.

- Johns Hopkins University Coronavirus Resource Center says there have been 660,400,812 doses administered, 267,907,969 have received at least one vaccine, or 81.31% of the U.S. population.

— Some of the most widely used decongestants don’t work, several studies have found, prompting doctors and researchers to call on the FDA to end sales of the over-the-counter drugs. Link for details.

|

POLITICS & ELECTIONS |

— Attached to the massive omnibus spending bill were updates to the 1887 Electoral Count Act, that make it harder to overturn a certified presidential election — as was attempted by former President Donald Trump and his allies. The revisions stipulate that the vice president’s role in certifying the vote count is purely ceremonial.

— Jan. 6 Committee report concludes: Donald Trump was the “central cause” of the Capitol riots. The former president carried out “a multipart plan to overturn the 2020 presidential election,” the Jan. 6 House committee said in its final report. The panel also issued several recommendations to ensure something similar could not happen again. The committee has already referred Trump to the Justice Department on at least four criminal charges, while saying in its executive summary it had evidence of possible charges of seditious conspiracy and conspiring to injure or impede an officer. Committee Chairman Bennie Thompson, a Mississippi Democrat, said he has "every confidence that the work of this committee will help provide a road map to justice."

— Senate Republican leader Mitch McConnell said former President Donald Trump’s power is on the wane and called on him to back off Senate primaries. Link for details.

|

CONGRESS |

—Santos says he will comment on allegations he fabricated background next week. Rep.-elect George Santos (R-NY) broke his silence on Thursday, vowing that he would come forward next week to address questions surrounding his background. In a statement on Twitter, Santos wrote, “I have my story to tell and it will be told next week.” The New York Times reports that before now, “Santos has refused to answer any questions...about his past and finances, and has only pointed to a statement released by his lawyer that accused the Times of attempting to smear him.”

— From Dave Wasserman, House editor of the Cook Political Report with Amy Walter: “By my math, women and minorities will be 20% of the House GOP conference in 2023 - the highest share ever — and up from just 10% two years ago.”

— Push for labor reforms to continue in 2023. Despite another fruitless congressional session, supporters of labor reforms that include legal status for undocumented farmworkers and modernizing the H-2A guestworker visa “will not give up seeking these important changes,” said Jim Bair, president of the U.S. Apple Association.

— House Democrats announce committee ranking members for the next Congress:

• Administration: Rep. Joe Morelle

• Agriculture: Rep. David Scott

• Appropriations: Rep. Rosa DeLauro

• Armed Services: Rep. Adam Smith

• Budget: Rep. Brendan Boyle

• Education and Labor: Rep. Bobby Scott

• Energy and Commerce: Rep. Frank Pallone

• Ethics: Rep. Susan Wild

• Financial Services: Rep. Maxine Waters

• Foreign Affairs: Rep. Gregory Meeks

• Homeland Security: Rep. Bennie Thompson

• Judiciary: Rep. Jerrold Nadler

• Natural Resources: Rep. Raúl Grijalva

• Oversight & Reform: Rep. Jamie Raskin

• Rules: Rep. Jim McGovern

• Science, Space and Technology: Rep. Zoe Lofgren

• Small Business: Rep. Nydia Velázquez

• Transportation and Infrastructure: Rep. Rick Larsen

• Veterans’ Affairs: Rep. Mark Takano

• Ways and Means: Rep. Richard Neal

|

OTHER ITEMS OF NOTE |

— Cotton AWP moves higher. The Adjusted World Price (AWP) for cotton is at 75.57 cents per pound, effective today (Dec. 23), up from 72.25 cents per pound the prior week. This is the highest AWP level since it was at 77.78 cents per pound the week of Nov. 18.

— NASA and Russia's space agency, Roscosmos, are weighing options on how to bring home several people from the International Space Station after a Russian Soyuz spacecraft docked there sprang a leak last week. None of the seven people currently on board the ISS -- including three Russian cosmonauts -- were in danger because of the leak, but it's unclear whether the spacecraft will be able to make a trip back to Earth with its crew on board. That trip had been scheduled for March 2023, but Roscosmos is now evaluating whether to fly its next Soyuz mission to the ISS empty -- and move the launch up two to three weeks so the spacecraft could serve as an alternate rescue vehicle.

— Elon Musk repeated that he’ll stop selling Tesla shares, after his disposal of almost $40 billion of his holdings contributed to the stock’s slide to a two-year low. “I won’t sell stock until — I don’t know — probably two years from now, definitely not next year under any circumstances, and probably not the year thereafter,” Musk said during a Twitter Spaces live-audio conversation late Thursday. He added that he thinks 2023 will bring about “quite a serious recession.”

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 | New farm bill primer | China outlook | Omnibus spending package |