Upbeat U.S. Economic Reports Strengthen Case for Fed to Continue Hiking Rates

Big U.S. cotton sales cancellations to China | Senate tries to deal with omnibus hurdle

|

In Today’s Digital Newspaper |

Big U.S. cotton sales cancellations to China. Weekly USDA Export Sales data for the week ended Dec. 15 included large cancellations of U.S. cotton export sales to China and continued soybean sales. Activity for China for 2022-23 included net corn sales of 8,581 tonnes, net soybean sales of 550,745 tonnes, and net reductions of 144,426 running bales of cotton (cancellations of 160,300 bales). For 2022, activity included net reductions of 107 tonnes of beef and 2,061 tonnes of pork, with net sales for 2023 of 2,018 tonnes of beef and 4,798 tonnes of pork.

Ukrainian President Volodymyr Zelensky expressed gratitude for U.S. support in an impassioned address to Congress during his first overseas trip since the Russian invasion of his country began. In his speech Wednesday, Zelensky called for more U.S. help and stronger sanctions against Moscow, telling lawmakers Ukraine "will never surrender," and that their support "is not charity" but an investment in democracy. Earlier in the day, President Joe Biden announced the U.S. will send Kyiv a Patriot missile defense system as part of an additional $1.8 billion assistance package, and Zelensky reiterated that air defense systems are crucial to countering Russian attacks. Meanwhile, Russian President Vladimir Putin declared there would be a substantial investment in his military as the war drags on.

Explosions killed two people in Russian-held areas of eastern Ukraine and injured at least two prominent figures. They appear to demonstrate that Ukraine has the ability to obtain intelligence and strike high-value targets in the area.

Congress’s spending package is being held up by a fight over border policy. Senate Democratic leaders hope to break an impasse this morning over the sprawling spending bill. “We are very close but we’re not there yet,” Senate Majority Leader Chuck Schumer (D-N.Y.) said. Sen. Mike Lee (R., Utah) said he was demanding a vote on preserving Title 42, the pandemic-era policy that allows migrants to be sent back to Mexico after crossing the U.S. border illegally, at a simple-majority threshold as a condition for allowing votes on the omnibus bill to proceed. Quick action will depend on whether all 100 senators can agree to forgo the debate time built into Senate procedures and proceed to a final vote, giving senators leverage to negotiate for amendment votes.

Britain had the worst-performing economy of any G7 country in the third quarter, according to the Office for National Statistics. Its economic output fell by 0.3% between July and September, 0.8% lower than the same period in 2019 (before the pandemic). Business investment fell by 2.5%. Most economists polled by Reuters predicted that the economy would contract further. Combined with rising inflation and interest rates has led some economists to say the country could suffer its worst recession since the 1990s.

Parts of China hit hard by rising Covid-19 cases have resorted to rationing the amount of medicine for sale down to the pill as the country faces a huge wave of infections. Local versions of Tylenol and Advil — some of the most common drugs used to alleviate flu-like symptoms — are nearly impossible to get at drugstores across China, fueling anger and concern

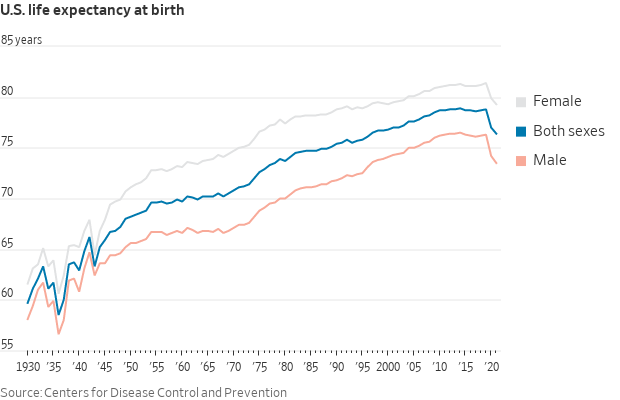

In the U.S., Covid-19 and other causes have driven life expectancy down to 76.4 years, the lowest it has been since 1996, CDC data shows.

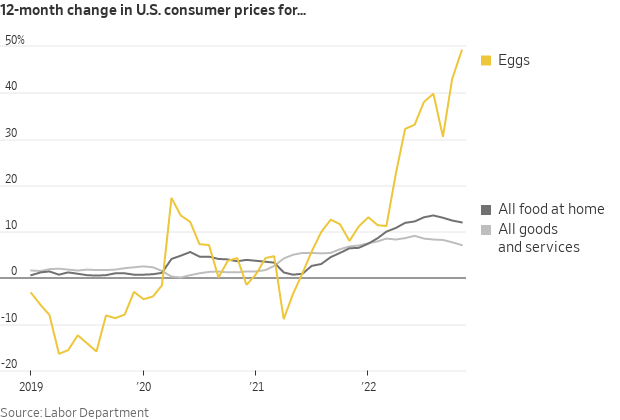

Egg prices are hitting records and outpacing increases for other supermarket items, driven by an avian-influenza outbreak in the U.S. We have updates on both… and USDA this morning releases its latest Food Price Outlook report.

The always-anxious U.S. ag sector lobbyists and farm groups are breathing more calmly… for now… as one of two pending trade official nominees was confirmed by the Senate, with progress on the other. More in Personnel section.

We have an update on the U.S./Mexico GMO corn trade clash in the Trade section.

Benjamin Netanyahu narrowly made the deadline to form a new government in Israel. His six-party coalition will be made up of far-right and ultra-Orthodox partners. It will be the most right-wing administration in the country’s history. Once ratified by Israel’s parliament, the new deal will return Netanyahu to power, after he was ousted last year.

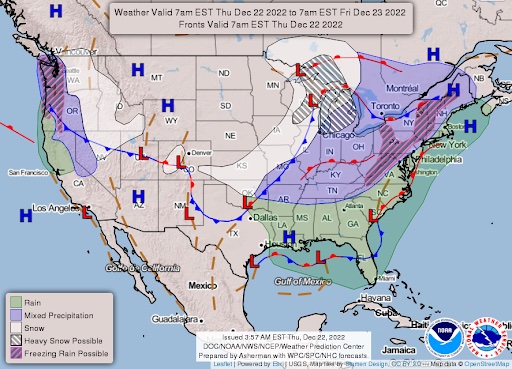

Airlines are already canceling and delaying flights to get out of the way of a massive winter storm that is threatening to bring treacherous weather across the country right before the holiday weekend. That could disrupt plans for the 113 million people who plan to travel between Friday and Jan. 2, according to AAA. Airlines have canceled more than 1,200 flights for today to, within and out of the U.S. and 704 flights for Friday, FlightAware.com said as of 6:30 a.m. Eastern on Thursday.

The storm, named Elliott, is expected to bring heavy snowfall, rain, extreme winds, and dangerous wind chills through Christmas Eve on Saturday, the National Weather Service said. Two-thirds of the country will see temperatures as much as 30 degrees below normal.

Some are calling Elliott a “bomb cyclone” because of the expected rapid drop in barometric pressure, said Bob Oravec, a lead forecaster at the NWS. Great Lakes states could get a foot of snow, and strong winds could cause power outages in the eastern half of the U.S.

|

MARKET FOCUS |

Equities today: Global stock markets were mixed overnight. U.S. Dow opened around 170 points lower and is currently around 340 points lower. Memory-chip maker Micron Technology's shares are under pressure after it warned that the pandemic-driven demand boom continues to deflate. In Asia, Japan +0.46%. Hong Kong +2.71%. China -0.46%. India -0.27%. In Europe, at midday, London +0.38%. Paris +0.10%. Frankfurt +0.02%.

U.S. equities yesterday: The Dow gained 526.74 points, 1.60%, at 33,376.48. The Nasdaq was up 162.26 points, 1.54%, at 10,709.37. The S&P 500 rose 56.82 points, 1.49%, at 3,878.44. Nike was the top performer in both the Dow and S&P 500 on Wednesday with its 12% stock-price rally. The sportswear giant's upbeat earnings report lifted other apparel retailers, too: Foot Locker and Under Armour rose 9.7% and 5.2%, respectively.

The S&P 500 is down more than 18% since Jan. 1, the worst year since 2008.

Agriculture markets yesterday:

- Corn: March corn rose 10 1/4 cents to $6.62 1/4, the contract’s highest close since $6.67 on Nov. 30.

- Soy complex: March soybeans rose 4 3/4 cents to $14.84 1/2, the contract’s highest close since Dec. 14. March soymeal rose $3.40 to $452.70. March soyoil fell 2 points to 64.83 cents.

- Wheat: March SRW wheat rose 17 1/4 cents to $7.67 3/4, the contract’s highest close since Dec. 2. December HRW wheat rose 17 cents to $8.64. March spring wheat rose 11 3/4 cents to $9.27 3/4.

- Cotton: March cotton rose 46 points to 88.30 cents, the highest close since Sept. 23.

- Cattle: February live cattle rallied $2.125 to $157.70 after posting a contract high at $157.975. January feeder futures edged up 20 cents to $183.825.

- Hogs: February lean hogs rose $4.15 to $88.40, the contract’s highest close since Dec. 5.

Ag markets today: Corn, soybean and wheat futures held in tight ranges in a lightly traded overnight session. As of 7:30 a.m. ET, corn futures were trading steady to a penny higher, soybeans were 1 to 2 cents lower, winter wheat futures were 6 to 8 cents higher and spring wheat was 3 to 4 cents higher. Front-month crude oil futures were around $1.25 higher, and the U.S. dollar index was near unchanged.

Technical viewpoints from Jim Wyckoff:

On tap today:

• U.S. jobless claims are expected to rise to 220,000 in the week ended Dec. 17 from 211,000 one week earlier. (8:30 a.m. ET) UPDATE: The number of Americans filing new claims for unemployment benefits rose by 2,000 to 216,000 in the week ending December 17th, below market expectations of 220,000 and extending signals of a stubbornly tight labor market. The seasonally unadjusted gauge fell by 4,064 to 247,867. The 4-week moving average which removes week-to-week volatility fell by 6,250 to 221,750.

• U.S. gross domestic product for the third quarter is expected to grow at a 2.9% annual pace from the prior quarter, unchanged from an earlier reading. (8:30 a.m. ET) UPDATE: The U.S. economy grew an annualized 3.2% on quarter in Q3 2022, better than 2.9% in the second estimate, and rebounding from two straight quarters of contraction in the first half of the year. It reflects an upward revision to consumer spending and nonresidential fixed investment that were partly offset by a downward revision to private inventory investment.

• USDA Weekly Export Sales report, 8:30 a.m. ET.

• USDA Food Price Outlook, 9:00 a.m. ET.

• Conference Board's leading economic index for November is expected to fall 0.5% from the prior month. (10 a.m. ET)

• Kansas City Fed's manufacturing survey is expected to fall to minus 8 in December from minus 6 one month earlier. (11 a.m. ET)

U.S. corporate profits unexpectedly rise in Q3. Corporate profits in the United States increased 0.8 percent to USD 2.54 trillion in the third quarter of 2022, following a 6.2 percent gain in the previous period and compared with preliminary estimates of a 0.2 percent drop. Net cash flow with inventory valuation adjustment, the internal funds available to corporations for investment, rose 6.2 percent to USD 3.14 trillion, while net dividends fell 3.2 percent to USD 1.68 trillion. Meanwhile, undistributed profits climbed 9.8 percent to USD 0.86 trillion.

The U.K. economy shrank by a steeper-than-expected 0.3% in the third quarter, the Office for National Statistics said Thursday. Economists expect the economy to contract at a similar pace for the next three quarters, according to FactSet estimates.

The Bank of Japan may surprise the markets again by beginning to tighten its monetary policy as early as January, said a Japanese former vice finance minister who is a prominent economic commentator. Link for details.

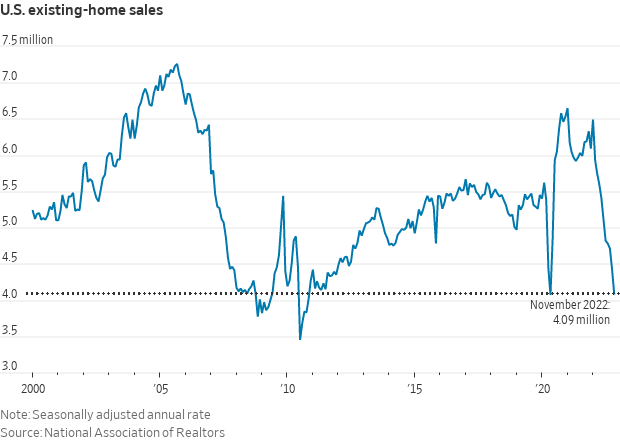

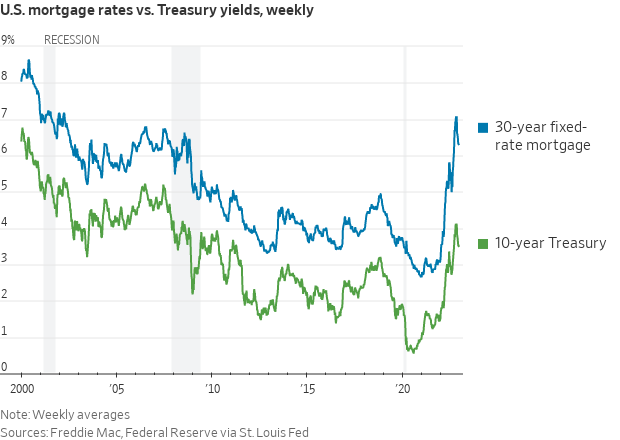

U.S. home sales notched their longest streak of declines in 23 years last month. Data released Wednesday showed existing home sales dropped for a 10th consecutive month in November. November's annualized sales pace dipped 7.7% from October, and 35.4% compared to the previous year, the National Association of Realtors (NAR) said. "The residential real estate market was frozen in November, resembling the sales activity seen during the Covid-19 economic lockdowns in 2020," NAR chief economist Lawrence Yun said. "The principal factor was the rapid increase in mortgage rates, which hurt housing affordability and reduced incentives for homeowners to list their homes." Earlier this year, mortgages climbed above 7%, and are currently hovering around 6.52%.

Lumber prices this week hit a new low for the year. The building commodity has fallen almost 70% this year. Meanwhile, homebuilder sentiment dropped for a 12th straight month in December to its lowest mark since 2012, excluding pandemic months in 2020.

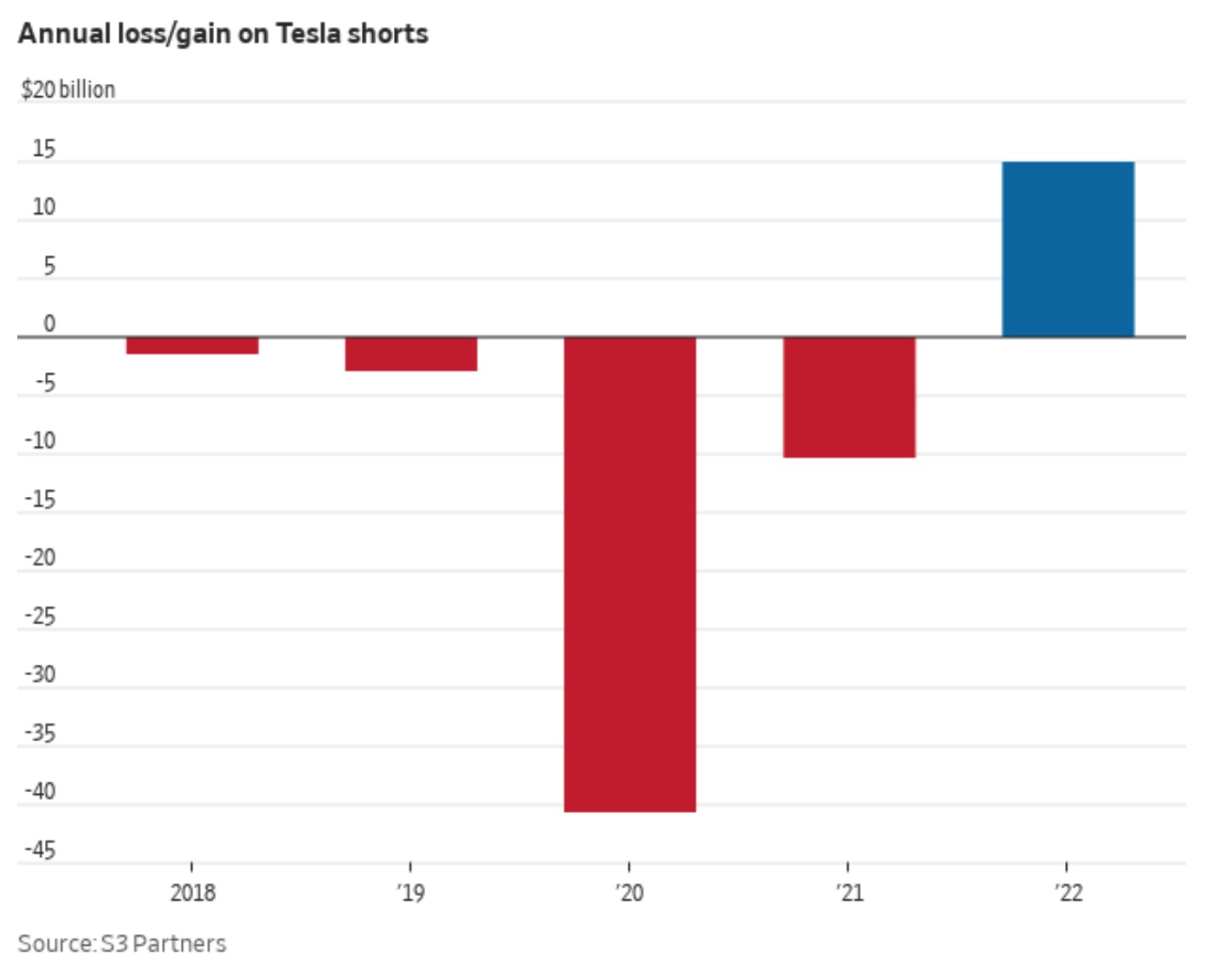

Tesla doubled discounts on Model 3 or Model Y cars that are delivered this month to $7,500. It's also offering 10,000 miles of free supercharging. Meanwhile, investors shorting Tesla shares are sitting on collective gains of $15 billion in 2022, according to data from S3 Partners. The formerly high-flying stock has plunged this year as interest rates rise and investors worry Elon Musk’s attention is divided following his takeover of Twitter.

Ocean shipping industry’s switch to cleaner fuels is complicating ocean logistics and raising shipping costs. Carriers are spending billions of dollars on low- and no-carbon ships, the Wall Street Journal reports (link), with no clear idea how quickly they can recoup expenses or which alternate fuel will prevail. A.P. Møller-Maersk is awaiting 19 ships that run on methanol while Mediterranean Shipping and Germany’s Hapag-Lloyd are ordering ships powered by liquefied natural gas. Other ship owners are looking into ammonia. The International Maritime Organization says the shipping industry must cut carbon emissions in half by 2050. Its members are considering a levy that would subsidize a global build-out of alternative fueling stations and the European Union is raising taxes on ship operators that use high carbon-emitting fuels. Some developing countries are warning that more expensive carbon-neutral fuels will make commodities exports more expensive.

Background: The new regulation seeks to lower carbon emissions by having container ships, tankers, bulkers, car carriers and other vessels operate more efficiently. It is a product of the United Nations’ International Maritime Organization (IMO) that has been in the works for years and debated ad nauseam within shipping circles.

One issue: According to Oldendorff, one of the world’s largest dry bulk shipping companies, “Ship owners and operators are already trying to increase fleet productivity by reducing empty legs, so they can carry more cargoes per year.” A bulker that carries soybeans from the U.S. Gulf to China, then picks up a cargo of coal in Indonesia and drops it off in Europe on its way back toward the Atlantic Basin for another load will emit less carbon per ton of cargo than a bulker that goes from the U.S. to China, then sails empty all the way back to the U.S. The same “triangulation” concept applies to all shipping markets. “Even though a ship consumes more fuel during laden voyages, the improved utilization [via triangulation] decreases the emissions per ton carried, which is beneficial for the environment and should be the objective,” argued Oldendorff. That is not how the new regulations work. Link for details.

249,255: Cars moving in U.S. intermodal rail transport for the week ending Dec. 17, down 7.5% from 2021, according to the Association of American Railroads.

Goldman Sachs chief economist Jan Hatzius says he doesn't expect the Federal Reserve to cut interest rates in 2023, mostly because he's more optimistic than most about the economy's ability to sidestep a recession. Speaking to CNBC, Hatzius predicted that a recession will likely be avoided as tighter financial conditions and tighter monetary policy constricts the labor market and cuts into GDP growth — but not enough to trigger a downturn. This will, in turn, keep the Fed from reducing interest rates during the year, as the lack of a recession will lower the pressure for stimulus. "I think the hurdle for (the Fed) to cut (interest rates) in a non-recessionary environment with inflation still above the target, I think it's going to be relatively high," he said. "As I look forward into 2023, even with additional hikes, we have an extra 75 basis points of hikes in here, similar to the Fed's forecast, I think the drag from financial conditions will be smaller."

Market perspectives:

• Outside markets: The U.S. dollar index was weaker with the euro slightly higher against the greenback and most other foreign rivals lower. The yield on the 10-year US Treasury note eased to trade around 3.65%. Crude oil prices were up, with U.S. crude around $79.40 per barrel and Brent around $83.75 per barrel. Gold and silver futures were narrowly mixed, with gold firmer around $1,827 per troy ounce and silver weaker around $23.98 per troy ounce.

• Crude-oil prices rose Thursday, on shrinking U.S. inventories and signs of a drop in Russian exports. On Wednesday, government data showed U.S. commercial crude-oil stockpiles slid by 5.9 million barrels to 418.2 million barrels last week. They're about 7% below the five-year average.

• Cryptocurrency miners have seen their share prices wiped out this year as crypto prices plunged, and surging electricity bills lifted costs. The latest blow came on Wednesday as miner Core Scientific filed for bankruptcy protection.

• Ag trade: Japan purchased 144,441 MT of milling wheat in its weekly tender, including 83,881 MT from the U.S. and 60,560 MT from Canada. Iraq purchased 150,000 MT of milling wheat, including 100,000 MT from Australia and 50,000 MT from the United State. Taiwan purchased 56,000 MT of U.S. milling wheat.

• NWS weather: Powerful winter storm to produce widespread disruptive and potentially crippling impacts across the central and eastern United States... ...Record-breaking cold and life-threatening wind chills over the Great Plains to overspread the eastern half of the Nation by Friday... ...Significant freezing rain possible across parts of western Oregon and Washington beginning tonight.

Items in Pro Farmer's First Thing Today include:

• Light trade overnight

• Cold Storage Report out this afternoon

• Slow developing cash cattle trade despite weather

• Cash hog index drops

|

RUSSIA/UKRAINE |

— Summary: Ukraine President Volodymyr Zelenskyy pressed Congress for tanks, planes and other weapons. It's not charity, "it's investment in global security," the Ukrainian president said in Washington, where he was seeking to win support from skeptical GOP lawmakers. Said Zelenskyy: “We have artillery. Is it enough? Honestly, not really.” His remarks also centered on Iran’s supplying of drones to Russia. “That is how one terrorist has found the other,” Zelensky said. “It is just a matter of time before they strike against your other allies.”

- Vladimir Putin, the Russian president, acknowledged that his country’s military lacked the equipment and technology necessary to win but pledged to increase funding for the war.

- Western intelligence officials have found no conclusive evidence to blame Russia for the Nord Stream pipeline bombing. Who bombed the undersea gas pipeline in late September remains one of the biggest mysteries of the Ukraine war. And though world leaders were quick to point the finger at Moscow, a growing number of countries investigating the attack now doubt the Kremlin was responsible for the brazen act of sabotage.

- Cargo insurance for shipments via the Ukraine grain export corridor to remain steady in 2023, according to an underwriter with Lloyd’s of London. Ascot leads 21 insurers that are part of the facility, and the steady rates were announced even as war and other insurance rates are expected to rise sharply next year due to the ongoing conflict. “The ‘AsOne’ Black Sea facility will continue unabated with no planned increases to rating,” Chris McGill, head of cargo for Ascot, told Reuters. “This is against a supply driven, rate-hardening environment in the marine war market.”

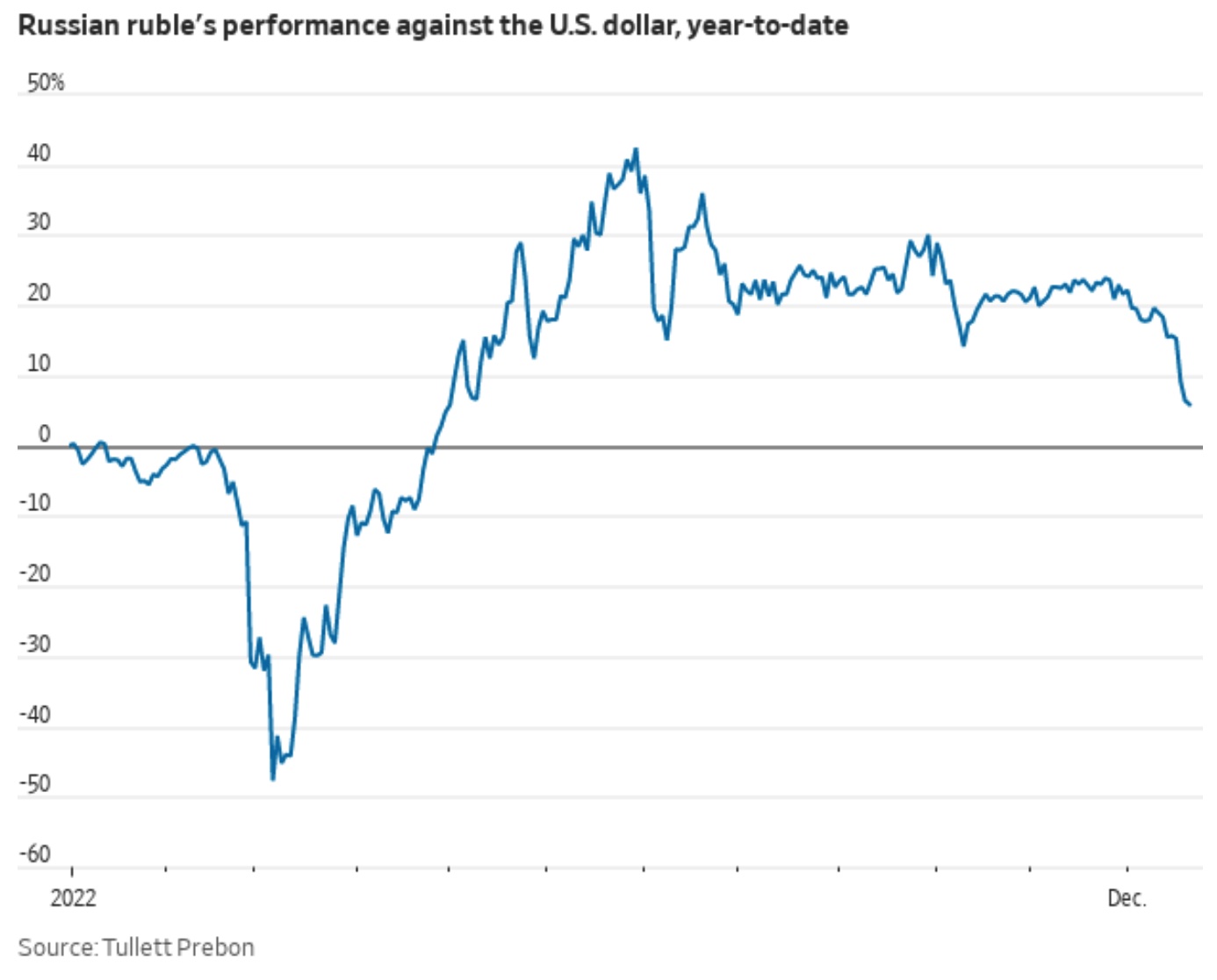

Banks are typically requiring various insurance policies to be in place for ships entering the three ports that are part of the Black Sea grain corridor, the news service noted, including hull and cargo war coverage which is renewed every seven days. - The Russian ruble has fallen 15% against the U.S. dollar in December, making it the worst performer among the 49 currencies tracked by the Wall Street Journal. The oil-and-gas windfall that helped drive the ruble sharply higher this year is fading as the West ratchets up energy sanctions.

|

POLICY UPDATE |

— Senate nears agreement on omnibus. Senate Majority Leader Chuck Schumer (D-N.Y.) said Republicans and Democrats are on the brink of an agreement that would allow the Senate to finish work on the $1.66 trillion omnibus spending bill. He scheduled a nomination vote for 8 a.m. ET in a bid to put the finishing touches on the potential deal. The two sides need a time agreement because without it, debate over this sprawling, 4,155-page package could drag into next week. Government funding runs out Friday night.

Potential glitch to omnibus passage: Sen. Mike Lee (R-Utah) has an amendment that would extend the Biden administration’s use of Title 42 authority at the border. Title 42 restricts asylum claims for migrants seeking safe haven in the United States. The Trump and Biden administrations have used this authority to quickly expel millions of migrants since the start of the Covid-19 pandemic, but it is about to expire unless the Supreme Court rules otherwise. Lee’s amendment was going to be considered at a 51-vote threshold, and there’s a good chance it would pass. The parliamentarian has ruled that the amendment can be considered under a 51-vote threshold, which dramatically raises the stakes on the proposal. Sources say the issues will eventually be rectified.

— Included in omnibus package: $785 million for migrant services such as food and shelter. Majority Leader Chuck Schumer (D-N.Y.) wants the cash doled out to cities by the Federal Emergency Management Agency. Awards will supposedly be determined through a competitive process, but Politico reports that his hometown of New York will likely get a “substantial share” of the cash. Expect other Democratic strongholds to join the queue.

— Buried in the $1.7 trillion spending bill moving through Congress are over $15 billion in earmarks. The omnibus spending package moving through Congress contains more than 7,200 earmarks for projects in lawmakers’ home states and districts. Link to a New York Times account detailing some of them.

|

PERSONNEL |

— Senate clears one USDA nominee; action on trade, food safety nominees awaited. The Senate approved the long-stalled nomination of Alexis Taylor to be USDA undersecretary for trade and foreign agricultural services after holds on the nomination were removed in negotiations Wednesday. She was cleared by the Senate via unanimous vote, prompting several lawmakers and groups to quickly issue statements hailing the move.

Two other nominees linger, for now. The nominations of Jose Emilio to be USDA undersecretary for food safety and Doug McKalip to be the chief agricultural negotiator at the Office of the U.S. Trade Representative (USTR) are still pending as holds remain on their nominations. But signals surfaced they are likely to be lifted and cleared by the Senate before they exit for the year.

— Senate approves Tracy to be next U.S. ambassador to Russia. The Senate cleared the nomination of Lynne Tracy to be the U.S. ambassador to Russia via a vote of 93-2, with five lawmakers not voting — Sens. John Barrasso (R-Wyo.), Richard Burr (R-N.C.), Ted Cruz (R-Texas), John Hickenlooper (D-Colo.), and Richard Lummis (R-Wyo.). Her confirmation was fully expected as she faced little controversy during her confirmation process.

|

CHINA UPDATE |

— China probably has 1 million Covid infections and 5,000 deaths every day, according to Airfinity. The current wave may see daily cases rise to 3.7 million in January. Even so, the country is said to be planning to cut quarantine requirements for overseas travelers.

A hospital in Shanghai reportedly told staff that it expects half of the city’s 25m people to become infected with Covid-19 by the end of December. The virus has been sweeping through China since the government moved away from its “zero-covid” policy following widespread protests. Local authorities have reported only 390,000 cases or so, a figure many think is an underestimate.

|

TRADE POLICY |

— Update on U.S./Mexico GMO corn trade clash. Mexico’s agriculture minister said an informal agreement already existed. Minister Victor Villalobos said U.S. officials were satisfied with a proposal to delay a ban on the import of GMO corn until 2025, according to a published report. President Andrés Manuel López Obrador signed a decree in late 2020 to end imports of GMO corn by 2024. Ahead of a U.S./Mexico meeting last week, López Obrador reportedly offered to wait until 2025 to ban imports of yellow corn, used in livestock feed, which makes up bulk (around 80%) of U.S. corn shipments. White corn is used in making tortillas, an everyday food in Mexico. “Our U.S. counterparts considered this response satisfactory,” said Villalobos at an event on Wednesday, Reuters reported. “We submitted a document for discussion, possible in the second half of January, where this issue will be definitively resolved.” The timeline for restrictions on corn imports could be adjusted again in the future depending on domestic production levels, he said.

As for USDA, it referred questioners to “the public statement following last week’s meeting with Mexican officials.” In a joint statement, U.S. trade representative Katherine Tai and USDA Secretary Tom Vilsack said the Mexican delegation had presented “some potential amendments” to the GMO corn decree on Friday. “We agreed to review their proposal closely and follow up with questions or concerns in short order. There is a joint recognition that time is of the essence, and we must determine a path forward soon,” said USTR Katherine Tai and Vilsack.

— WTO rules for Hong Kong in its trade dispute with U.S. A World Trade Organization (WTO) panel finds that U.S. broke trade rules in forcing Hong Kong goods to be relabeled ‘Made in China.’ Link for details.

|

ENERGY & CLIMATE CHANGE |

— Environmental groups sue to stop sale of oil, gas drilling rights sale off the coast of Alaska. Environmental groups filed suit in federal court in Alaska seeking to halt the planned sale of oil and gas drilling rights on nearly 1 million acres in the Cook Inlet Dec. 30. The Department of Interior (DOI) had scrapped the sale earlier this year, but provisions in the Inflation Reduction Act (IRA) ordered the Biden administration to hold the oil and gas lease sales if there were sales of rights for wind energy in the Gulf of Mexico.

The groups want the court to vacate the environment review as they maintain it violates federal environmental law as it does not consider impacts to threatened species including the Cook Inlet beluga whale and humpback whales.

There are currently 14 active federal leases in the Cook Inlet, but no production is taking place. The only operating oil and gas platforms in the area are all in state waters.

— European gas prices fall to over 6-month low. Natural gas prices in Europe extended losses for a fifth day, with front-month Dutch gas futures trading at €93 MWh, the lowest in over six months as record LNG imports, increased wind generation, and fuller-than-normal stockpiles eased concerns about shortages. At the same time, supplies from Russia sent through Ukraine have been stable and the weather forecasts show higher chances for a mild January.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Egg prices are hitting records, driven by an avian-influenza outbreak that has killed tens of millions of chickens and turkeys this year across nearly all 50 states (see next item). Wholesale prices of Midwest large eggs hit a record $5.36 a dozen in December, according to the research firm Urner Barry. Retail egg prices have increased more than any other supermarket item so far this year. USDA will also update its forecast for food prices today and the HPAI situation is likely to result in an upward adjustment to egg prices which are typically one of the most volatile food price categories.

— Two additional HPAI cases boost total birds affected to 57.8 million. USDA’s Animal and Plant Health Inspection Service (APHIS) announced two additional cases of highly pathogenic avian influenza (HPAI) in commercial operations — a commercial turkey meat bird flock in Hanson County, South Dakota (31,800 birds) and a commercial table egg layer flock in Weld County, Colorado (260,000 birds), bringing the total affected birds to 57.82 million including 303 commercial and 404 backyard flocks. Despite the infections and flock destruction, Emily Metz of the American Egg Board said table egg supplies have been more stable this year compared with prior HPAI outbreaks.

— USDA trademarks organic seal. The Agricultural Marketing Service registered the USDA organic seal trademark with the U.S. Patent Office to further safeguard the seal, already under federal protection, against misuse. Link for details.

|

HEALTH UPDATE |

— Summary:

- Global Covid-19 cases at 655,452,089 with 6,672,794 deaths.

- U.S. case count is at 100,184,506 with 1,089,340 deaths.

- Johns Hopkins University Coronavirus Resource Center says there have been 660,400,812 doses administered, 267,907,969 have received at least one vaccine, or 81.31% of the U.S. population.

— Life expectancy in the U.S. fell again last year to the lowest level since 1996, federal data showed, after Covid-19 and opioid overdoses drove up the number of deaths. Covid-19 was the third-leading cause of death for a second consecutive year in 2021, the Centers for Disease Control and Prevention said Thursday, and a rising number of drug-overdose deaths also dragged down life expectancy. Overdose deaths have risen fivefold over the past two decades. The death rate for the U.S. population increased by 5%, cutting life expectancy at birth to 76.4 years in 2021 from 77 years in 2020. Before the pandemic, in 2019, life expectancy at birth in the U.S. was 78.8 years. The decline in 2020 was the largest since World War II.

— U.S. Dept. of Health and Human Services announced Wednesday it will allow states to access Tamiflu doses from the national stockpile to meet surging demand as the U.S. faces a severe and early flu season. There have been at least 15 million cases of the flu this year, according to the Centers for Disease Control and Prevention.

|

POLITICS & ELECTIONS |

— Virginia State Sen. Jenn McClellan easily won Democrats' snap primary to nominate a successor to the late Rep. Don McEachin, the party announced early Thursday morning. She beat fellow state Sen. Joe Morrissey winning 85% of the vote to just 14$ for Morrissey. As the Democratic nominee in a bright-blue district, McClellan is almost certainly headed to Congress. She would be the first Black woman elected to Congress in Virginia.

— Netanyahu on the brink of power in Israel. Benjamin Netanyahu, Israel’s longest-serving prime minister, announced yesterday that he had succeeded in forming a coalition government. It is set to bring him back to power at the helm of the most right-wing administration in Israeli history, 18 months after he left office.

— Romney considering 2024 re-election Senate bid. Politico reports (link) that while many of Sen. Mitt Romney’s (R-Utah) Senate colleagues “assume his willingness to break from his party —and Donald Trump —means he’s planning for only one term,” they “may be surprised.” Politico says there is “no more prominent GOP Trump foil these days than Romney. And with the former president weakened, Senate Minority Leader Mitch McConnell, no fan of Trump himself, is among the top Republicans exhorting Romney to seek another six-year term in 2024.” Politico says Romney is “considering it.” Romney told Politico that whether he could win is “frankly, not a question in my mind. ... I’ve faced long odds: Getting the nomination in 2012 was a long shot, becoming a Republican governor in one of the most liberal states in America, Massachusetts. ... So I’m convinced that if I run, I win. But that’s a decision I’ll make.”

|

CONGRESS |

— House Democrats meet today to finalize committee ranking members for the next Congress, including settling who will be the top Democrat on the Committee on Oversight and Reform. The election for Oversight ranking member is now a two-person race between Reps. Jamie Raskin (D-Md.) and Gerry Connolly (D-Va.).

|

OTHER ITEMS OF NOTE |

— Netflix plans to put an end to password-sharing arrangements starting in 2023, asking people who share accounts to pay to do so. The effort is part of Netflix’s answer to slowing growth but risks angering consumers.

— French President Emmanuel Macron urged Europe to reduce its reliance on the U.S. for security. Macron, speaking to three reporters on his return to Paris from a summit in Amman, Jordan, called for Europe to take a more assertive role within the North Atlantic Treaty Organization and develop its own defensive capabilities to secure peace in the region, the Wall Street Journal reports (link).

— YouTube to pay $2.5 billion per year for NFL Sunday Ticket. As reported last night by multiple outlets, YouTube is closing in on a deal for Sunday Ticket, the out-of-market package that DirecTV has exclusively broadcast since 1994, when it debuted. John Ourand of Sports Business Journal reports that YouTube will pay $2.5 billion per year for the package.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 | New farm bill primer | China outlook | Omnibus spending package |