Last-Minute Ag Add-Ons to Omnibus Spending Bill Could Up Odds of 2023 Farm Bill ALL

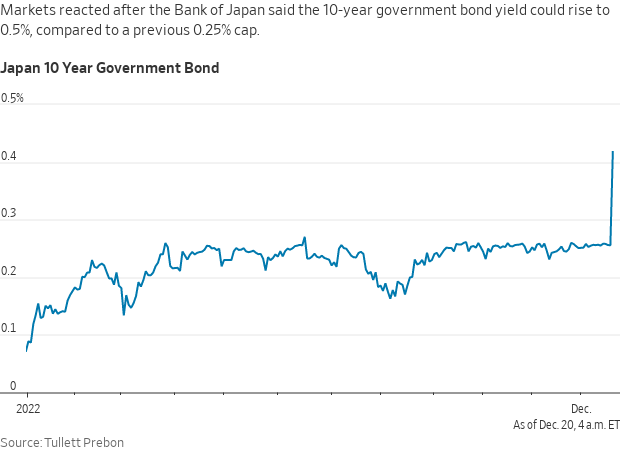

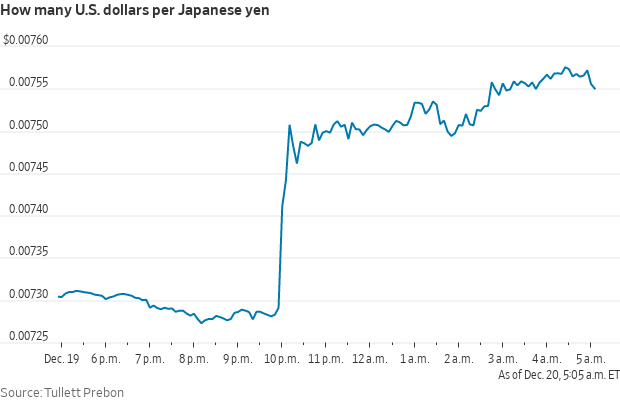

Bank of Japan shocks with announcement of effective interest rate increase

|

In Today’s Digital Newspaper |

The Bank of Japan made a surprise decision to let a benchmark interest rate rise to 0.5% from 0.25%. The yen surged 3.5% against the greenback. Japan's move is "widely seen as the beginning of a potential end to their ultra-loose monetary policy," Deutsche Bank's Jim Reid said. "That policy has made them a big outlier compared to other central banks this year, having maintained rates at the zero lower bound whilst others embarked on their biggest tightening cycle in a generation… Indeed, it’s important not to underestimate the impact this could have, because tighter BoJ policy would remove one of the last global anchors that’s helped to keep borrowing costs at low levels more broadly," Reid added.

With the text for a $1.7 trillion omnibus spending package released early this morning, the move is now on to get both chambers to vote on it… Senate first. There were several ag sector items of note in the package, as we have detailed in our special report and in updates today — see Policy section. Of note: inclusion of some food and nutrition funding and climate change programs could up the odds of getting a farm bill in 2023, some say.

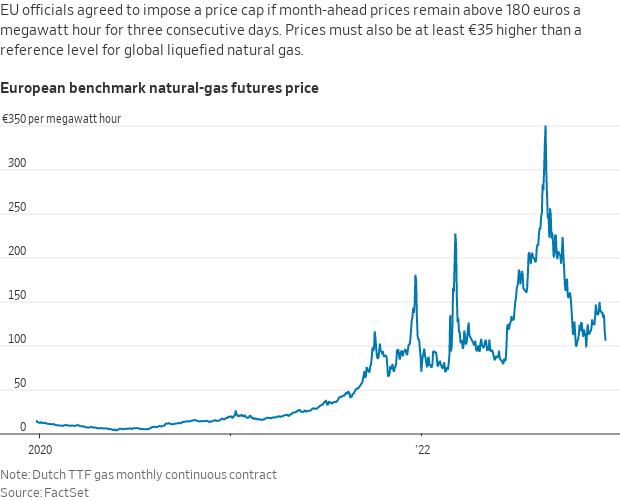

EU nations agree on a price cap for natural gas. Energy ministers agreed to impose a limit if month-ahead prices remain above 180 euros, or about $191, per megawatt-hour for three consecutive trading days. But traders worry that the cap, which can be applied beginning Feb. 15 and would affect certain natural gas contracts, may distort markets rather than limit prices. Details in Energy section.

In Ukraine, Russia launched a fresh wave of drone attacks as the country struggled to repair energy infrastructure. Kherson in Ukraine’s south continued to bear the brunt of Russia’s campaign of strikes against residential areas, while the eastern city of Bakhmut has become the main battlefield in the war.

The January 6 committee on Monday referred former President Donald Trump to the Justice Department on at least four criminal charges. The committee laid out the case that Trump's direct involvement in efforts to overturn the 2020 election made him responsible for the violence that unfolded at the U.S. Capitol on January 6, 2021, and unfit to hold future office. Attorney General Merrick Garland is set to make the ultimate call on any charging decisions.

The Supreme Court temporarily blocked President Biden from ending a Trump-era border policy. Chief Justice John Roberts temporarily extended a policy that bars asylum applicants from entering the U.S. to protect the American population from Covid-19, issuing a brief order that maintains the status quo while the Supreme Court considers an emergency request from Republican-led states to keep the exclusions in place. The Biden administration was given until 5 p.m. ET today to file its legal response.

|

MARKET FOCUS |

Equities today: Global stock markets were mixed to weaker overnight. U.S. stock indexes are pointed toward narrowly mixed openings. In Asia, Japan -2.46%. Hong Kong -1.33%. China -1.58%. India -0.17%. In Europe, at midday, London -0.07%. Paris -0.27%. Frankfurt -0.46%.

U.S. equities yesterday: The Dow finished down 162.92 points, 0.49%, at 32,757.54. The Nasdaq fell 159.38 points, 1.49%, at 10,546.03. The S&P 500 was down 34.70 points, 0.90%, at 3,817.66.

Investors have poured $118.9 billion into U.S. stocks and exchange-traded funds this year — one of the highest levels on record in EPFR data going back to 2000.

Wells Fargo agreed to a $3.7 billion settlement with the Consumer Financial Protection Bureau (CFPB), the regulator said Tuesday. “Wells Fargo’s rinse-repeat cycle of violating the law has harmed millions of American families,” Rohit Chopra, head of the CFPB, said in a release. “The CFPB is ordering Wells Fargo to refund billions of dollars to consumers across the country. This is an important initial step for accountability and long-term reform of this repeat offender.”

Agriculture markets yesterday:

- Corn: March corn fell 5 3/4 cents to $6.47 1/4, the contract’s lowest close since $6.44 on Dec. 9.

- Soy complex: March soybeans fell 20 1/4 cents to $14.60 3/4, the contract’s lowest close since Dec. 6. March soymeal fell $14.10 to $446.10, also near a two-week low. March soyoil rose 95 points to 63.41 cents.

- Wheat: March SRW fell 5 cents to $7.48 1/2, the contract’s lowest close since Dec. 9. March HRW wheat fell 1/2 cent to $8.43 1/2. March spring wheat fell 1 1/4 cent to $9.08 1/4.

- Cotton: March cotton rose 216 points to 84.08 cents, the contract’s highest close since 84.59 cents on Dec. 6.

- Cattle: February live cattle rose 27.5 cents to $156.05. January feeder cattle fell $1.675 to $182.10.

- Hogs: February lean hogs fell 7.5 cents to $85.70, after earlier rising to $86.55, the highest intraday price since Dec. 7.

Ag markets today: Corn and soybeans firmed amid mild corrective buying during a lightly traded overnight session. Wheat traded mostly firmer. As of 7:30 a.m. ET, corn futures were trading 1 to 2 cents higher, soybeans were 1 to 3 cents higher, SRW wheat futures were 1 to 2 cents lower, while HRW and HRS wheat were both 4 to 6 cents higher. Front-month crude oil futures were around $1 higher, and the U.S. dollar index was about 675 points lower.

Technical viewpoints from Jim Wyckoff:

On tap today:

• U.S. housing starts are expected to fall to an annual pace of 1.4 million in November from 1.425 million one month earlier. (8:30 a.m. ET)

The Bank of Japan adjusted its yield cap in a surprise tweak to its ultra-loose monetary policy. Yields on ten-year bonds will now have an upper limit of 0.5%, up from 0.25%. Forecasters had predicted no such change. The BoJ’s commitment to maintaining its yield cap is seen as an anchor helping to keep borrowing costs low around the world. The yen surged against the dollar in response.

Meantime, the BoJ viewed the economy is likely to recover, with the impact of Covid and supply-side issues waning while downward pressure persisted from high commodity prices and slowdowns in foreign economies. The YOY rate of CPI (all items less fresh food) is likely to rise in 2022, due to rises in cost of food, energy, and durable goods, before easing in the middle of FY 2023. The board reiterated it will take extra easing measures if needed, and expect short-and long-term rates to stay at their present or lower levels.

Bernstein: Fed policy aligns with Biden’s push for “steady, stable growth.” In an interview for CNBC’s Squawk Box, Jared Bernstein, a member of the White House Council of Economic Advisers, was asked about the impact of the Fed’s policies on the job market. Bernstein said, “We know history is just absolutely littered with economies that have been brought to their knees by compromising the independence of the central bank. I do think that the model that that Fed is kind of following ... slower GDP growth — that’s the transition to steady, stable growth that President Biden talked about months ago — that leads into slower job growth, which we’ve seen. We did have a strong 260,000 job gain in November, but that was hundreds of thousands below the previous November. ... I think if you look along that trajectory, you can see the data flow supportive of that transitional model.”

How economist Dr. Vince Malanga sizes up U.S. economy: “The debate now is whether the economy is headed for a second dip recession, which we think is most likely if the FOMC remains strident in its quest for 2% inflation. Whether a soft landing of trend growth, low inflation, and minimal disruption to labor markets and profits is achievable may depend on the Fed becoming more flexible and quickly. Finally, there’s the stagflation scenario herein growth is weak, but inflation remains stubbornly high, forcing continued significant monetary restraint. This we think is the least likely outcome… A worst-case approach would be to continue ignoring market signals until the economy is clearly in a ditch. Then it would have to reverse course by adding liquidity and risk undoing the progress on inflation that is being made. Given the unknowns associated with balance sheet reduction and the lagged effect of actions already taken, we think it is past time for discretion to be the better part of valor.”

With $3 trillion in goods traveling through Chicago every year, the city is the busiest rail hub in the U.S. A WSJ video report (link) takes a look at the region that sees 25% of all freight trains moving in the U.S., and 50% of all intermodal trains. That makes Chicago a crucial part of U.S. supply chains, and it raises the stakes when weather, cargo congestion or work stoppages are threatened.

Market perspectives:

• Outside markets: The U.S. dollar index was weaker despite most global currencies being weaker against the greenback. The yield on the 10-year US Treasury note was higher, trading around 3.66%. Crude was higher, with U.S. crude around $75.70 per barrel and Brent around $80.15 per barrel. Gold and silver futures were higher, with gold around $1,808 per troy ounce and silver around $23.82 per troy ounce.

• The national average for regular gasoline dropped to $3.12 a gallon today, according to AAA. Gas prices haven't been this low since July 2021. After moving steadily higher last year, pump prices spiked early in 2022 following Russia's Feb. 24 invasion of Ukraine, and the national average topped out at a record of $5.02 a gallon in June. But prices have since cooled off and the decline has accelerated in recent weeks. Twenty-one states already have averages below $3 a gallon, including Ohio, North Carolina and Colorado, data shows.

• 2.83: Average days’ wait for handling of containers arriving at the ports of Los Angeles and Long Beach in November, the shortest dwell time since July 2020, according to the Pacific Merchant Shipping Association. Meanwhile, the ports of Los Angeles and Long Beach are ending the container dwell fee they announced last year but never imposed.

• Union Pacific says it is pausing the shipment embargoes that have drawn shipper anger and regulator inquiries. Link for details.

• Huge 6.4-magnitude earthquake rocks Northern California. The earthquake struck off the coast of Northern California on Tuesday, the United States Geological Survey (USGS) said.

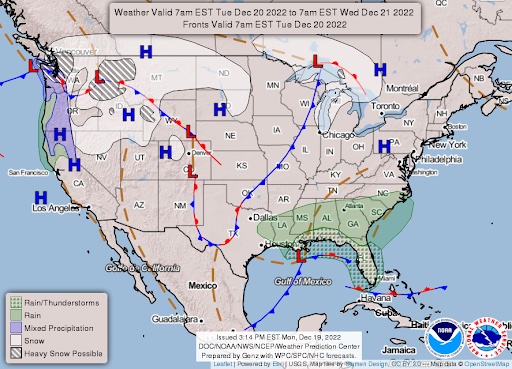

• More than 80% of U.S. will face temperatures below freezing this week. More than 25 million people across much of the central and northwestern U.S. are under wind chill alerts. Heavy snow is expected today in several states including Montana, North Dakota, South Dakota and most of Minnesota – where the high temperatures will remain below zero, according to the National Weather Service. This week, more than 80% of the Lower 48 will experience temperatures below freezing, with cities as far south as Atlanta, Houston and Orlando currently included on that list.

• NWS weather: Heavy snow likely across parts of the Pacific Northwest and northern Rockies through midweek... ...Bitter cold and dangerous wind chills over the northern Plains to surge southward into the central U.S. by Thursday... ...Light to moderate snow combined with gusty winds to overspread much of the central Plains and Upper Midwest beginning on Wednesday.

Items in Pro Farmer's First Thing Today include:

• Modest corrective buying overnight

• Consultant again lowers Argentine soybean crop forecast

• World Bank cuts China’s growth outlook (see China section for details)

• Packers continue to reduce cattle slaughters

• Cash hog fundamentals weaken

|

RUSSIA/UKRAINE |

— Summary: Vladimir Putin, Russia’s president, admitted that the situation in the four regions of Ukraine that his country annexed in September is “extremely difficult.” Putin also called for increased surveillance in Russia and its borders to tackle the “emergence of new threats.” On Monday, Putin traveled to Belarus to meet Alexander Lukashenko, his counterpart there.

- A Russian court ordered the seizure of a hotel owned by the oligarch Oleg Deripaska, reportedly after the Kremlin asked him to stop criticizing the war in Ukraine.

|

POLICY UPDATE |

— Text of $1.7 trillion omnibus spending package released. Link to our special report on the topic released earlier. The package consists of all 12 annual appropriations bills Congress, and would fund the government through the remainder of fiscal 2023, which runs until the end of September. The Senate will vote first and intends to pass the measure before Thursday, leaving the House no time to demand changes before the Christmas holiday. Link to text (4,155 pages).

— The omnibus package includes funding for specialty crops and remarks on crop insurance/A&O. Some $25 million is being made available for specialty crop equitable relief and report language directing USDA to use its legal authority to index all A&O (crop insurance program) for inflation and provide equitable relief for specialty crops going forward.

Perspective: This provides immediate and meaningful relief for specialty crops under crop insurance and is a very strong statement by Congress that USDA must correct two big A&O problems going forward. A&O has not been adjusted for inflation since 2015 and an industry insider informs that specialty crop A&0 “has been decimated due to a flaw in the SRA that inflicts disproportionate cuts on specialty crop A&O when row crop prices rise.”

— More on rice grower aid in omnibus package. As previously noted, the legislation provides $250 million for USDA to make a one-time payment to U.S. rice producers who planted rice in 2022. A recent study (link) conducted by Texas A&M University that looked specifically at the increase in fertilizer prices across an array of commodities, found rice farms would be hit hardest by rising costs. A second study (link) conducted by the university focused solely on the impact of rising input costs found that two thirds of the rice farms they monitor will fail to breakeven in 2022.

— More info on pandemic assistance to cotton merchandisers. The omnibus spending package provides $100 million for USDA to make payments to merchandisers of cotton that endured significant financial losses caused by pandemic-related supply chain challenges. Cotton merchandisers serve as the link between producers and textile mills. Those that purchased cotton from U.S. producers, or marketed cotton on their behalf, and experienced economic losses during the pandemic would qualify for this relief.

— Disaster aid funding. The omnibus package includes $40.6 billion for drought, hurricanes, flooding, wildfire, natural disasters and other matters — $3.7 billion in disaster aid for farmers to cover eligible 2022 crop and livestock losses, with $494.5 million of that to be used for livestock losses due to drought or wildfires.

— Other major ag-related add-ons to omnibus package include:

- Summer Meals Program Modernization: Updates the summer food service program to permanently allow states to provide non-congregate meals and summer electronic benefit (EBT) options nationwide to eligible children in addition to meals provided at congregate feeding sites. Non-congregate meals, such as grab-and-go or home delivery, would be provided in rural areas to eligible children, and summer EBT benefits would be capped at $40 per child per month. This provision is fully offset and based largely on the Hunger-Free Summer for Kids Act, which Boozman authored and introduced earlier this Congress.

- Growing Climate Solutions Act: Incorporates updated language from the Growing Climate Solutions Act, which directs USDA to establish a program to register entities that provide technical assistance and verification for farmers, ranchers and foresters who participate in voluntary carbon markets with the goal of providing information and confidence to producers.

- Pesticide Registration Improvement Act (PRIA 5) Reauthorization: Reauthorizes pesticide registration and review process user-fee programs administered by the Environmental Protection Agency (EPA) and increases registration and maintenance fees to support a more predictable regulatory process, create additional process improvements, and provide resources for safety, training, bilingual labeling, and other services to advance the safe and effective use of pesticides.

- Pesticide Registration Review Deadline Extension: Extends deadline for EPA to complete registration review decisions for all pesticide products registered as of October 1, 2007. EPA is facing a significant backlog of pesticide registrations due to a variety of factors over the past several years, which raises potential implications for continued access to numerous crop protection tools. The agency will be allowed to continue its registration review work through October 1, 2026, as a result of this extension.

- Supplemental Nutrition Assistance Program (SNAP) EBT Skimming Regulations and Reimbursement: Requires USDA to coordinate with relevant agencies and stakeholders to investigate reports of stolen SNAP benefits through card skimming, cloning and other similar fraudulent methods. This provision aims to identify the extent of the problem, develop methods to prevent fraud and improve security measures, and provide replacement of benefits stolen through these fraudulent actions.

- Livestock Mandatory Reporting Extension (LMR) Extension: Extends livestock mandatory reporting requirements until September 30, 2023. LMR requires meat packers and importers to report the prices they pay for cattle, hogs, and sheep purchased for slaughter and prices received for meats derived from such species to USDA who then publishes daily, weekly, and monthly public reports detailing these transactions.

- Commodity Futures Trading Commission (CFTC) Whistleblower Program Extension: Enables CFTC to continue payment of salaries, customer education initiatives and non-awards expenses related to the whistleblower program to ensure it can continue to function even when awards obligated to whistleblowers exceed the program fund’s balance at the time of distribution.

— Some ag sector items that did NOT make the omnibus package:

- Nothing for the proposed farmworker labor reforms from Sen. Michael Bennet (D-Colo.) and others.

- Also left out: Legislation to reform cattle markets or appoint a special investigator at USDA to investigate possible anti-competitive behavior in the meatpacking sector.

— A slate of expired and expiring tax provisions are not included in the omnibus spending package after lawmakers failed to come to an agreement on expanding the child tax credit and some key business tax breaks. Tax breaks favored by industry, including one for research and development, and more favorable tax rules for interest expenses and capital expenditures, were not included. Another 28 temporary tax benefits that have already expired or will at year end, known as extenders, also failed to make the legislation.

Next Congress. House Republicans, who will take over the Ways and Means Committee in the new Congress, said one of their top priorities next year will be extending the research and development break. It’s possible that the break wouldn’t need a larger legislative vehicle because of the amount of bipartisan support backing it, Rep. Adrian Smith (R-Neb.) said.

— Biden administration releases plan to reduce homelessness by 25% over two years. The 100-plus-page plan, which officials said includes input from communities around the country and feedback from hundreds of unhoused people, comes as homelessness in the nation reaches crisis levels.

The new plan was released through the U.S. Interagency Council on Homelessness (link), and it details that homelessness is rising after steady declines from 2010 to 2016. More than 1.2 million people experienced ‘sheltered homelessness’ in 2020, the most recent year data was available.

|

PERSONNEL |

— Senate voted 45-39 to confirm Federal Deposit Insurance Corporation Acting Chairman Martin Gruenberg to a six-year term as chair, marking his second stint as the FDIC's leader and following three previous assignments as acting chair. Republicans Jonathan McKernan, who currently serves as senior counsel at the Federal Housing Finance Agency, and Travis Hill, who worked under former FDIC Chair Jelena McWilliams as a senior adviser, were also confirmed, making for a full board.

|

CHINA UPDATE |

— State Department recently created a new Office of China Coordination, which diplomats are informally calling the "China House," State Secretary Antony Blinken announced late last week. The office will lead to better coordination, which in turn will mean "nimbler and more consistent policy from the State Department," the department said in the announcement. Link for details.

— China is scrambling to strengthen its health-care system as Covid-19 spreads through the country. Officials in several cities are building “fever clinics” at hospitals to treat patients. Five Covid-related deaths were reported on Tuesday, but the true figure is likely to be far higher. State media said the country should return to “normalcy” within a few months.

— People's Bank of China (PBoC) left its key lending rates unchanged for the fourth straight month at the December meeting, as widely expected, amid a slowdown in economic activity due to rising Covid infections and efforts from the government to stabilize its economy in 2023 and maintain ample liquidity in financial markets to meet key targets. The one-year loan prime rate (LPR), which uses for corporate and household loans, was held unchanged at 3.65%; while the five-year rate, a reference for mortgages, was maintained at 4.3%. The central bank last week maintained its medium-term policy rate at 2.75% while partially rolling over maturing loans. China last cut both LPRs in August to support the economy.

— World Bank cuts China’s growth outlook. The World Bank has cut its China growth outlook for this year and next, citing impacts of the loosening of strict Covid-19 policy and persistent property sector weakness. World Bank expects China’s economy to grow 2.7% in 2022, before recovering to 4.3% in 2023 as it reopens following the worst of the pandemic. In September, it forecast China’s growth at 2.8% this year and 4.5% next year. “China’s growth outlook is subject to significant risks, stemming from the uncertain trajectory of the pandemic, of how policies evolve in response to the Covid-19 situation, and the behavioral responses of households and businesses,” the bank said in its report. “Persistent stress in the real estate sector could have wider macroeconomic and financial spillovers.” China also faces highly uncertain global growth prospects and heightened geopolitical tensions.

— Chinese-owned Fufeng USA said it would proceed with construction of a $700 million corn milling plant in Great Forks, North Dakota, after a national security committee said it would not block the project. Link for details via the South China Morning Post.

|

ENERGY & CLIMATE CHANGE |

— EU energy ministers reach deal on gas price cap. EU energy ministers have reached an agreement to cap gas prices in the bloc when they hit €180 per megawatt hour (equivalent of $191) for three days despite fears that such an intervention could cause greater volatility in the market. The ceiling — equivalent to around $275 a barrel in oil terms — is almost €100 per MWh less than the European Commission first proposed last month when it suggested a mechanism to limit prices when they reached €275 per MWh for 10 consecutive days. That proposal was branded “a joke” by several ministers as it would not have been activated even when prices in the bloc hit record highs in August.

Details: The cap would only come into effect under certain conditions. Under the current proposal, the EU price cap would not fall below €188/MWh, even in the event that the LNG reference price falls to far lower levels. However, the EU gas price cap would move with the LNG reference price if it increased to higher levels, while remaining €35/MWh above the LNG price. This system is designed to ensure the bloc can bid above market prices to attract gas in tight markets. Once triggered, the cap will prevent trades being done on the front-month to front-year TTF contracts at a price higher than €35/MWh above a reference price that comprises existing LNG price assessments.

French energy minister Agnès Pannier-Runacher on Monday suggested that the price cap could be implemented with a small delay to ensure it doesn’t destabilize financial markets. She said energy ministers would be rigorous and cautious to ensure the plan doesn’t lead to a significant increase in margin payments.

The measure must now go through the EU’s legal procedures and can be implemented from Feb. 15 to temper prices ahead of the next gas storage filling season.

Perspective: Some countries have pushed back on the plan, arguing it could inadvertently lead to shortages. For now, the WSJ notes, it sets up a potential fight with the exchange that runs the biggest market in European natural-gas futures and that has threatened to move. The cap will apply to month-ahead, three months-ahead and year-ahead derivative contracts. EU officials say it could be suspended if risks to the flow of gas within Europe emerge.

— Oregon approves a ban on the sale of gasoline and diesel cars from 2035. Oregon became the fourth U.S. state to approve a ban on the sale of gasoline and diesel-powered cars from 2035. The move is part of efforts on the part of Oregon’s authorities to reduce emissions by 50% by 2035 and further by 90% by 2050. The quota, covering plug-in hybrids, battery electric vehicles, and hydrogen fuel cell cars, will be 35% of all sales for 2026, rising to 100% by 2036.

Besides Oregon, California, New York, and Washington have also approved bans on the sales of internal combustion engine cars, all from 2035. States are planning financial support for this move away from internal combustion as a mode of transportation.

Sales of new ICE cars after 2035 will still be allowed but the cars would need to be purchased out of state. Sales of used ICE vehicles will also be allowed, in the state.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— HPAI infections advance in commercial egg layer flocks. USDA’s Animal and Plant Health Inspection Service (APHIS) confirmed new cases of highly pathogenic avian influenza (HPAI) in three commercial table egg layer flocks since Dec. 14 totaling nearly 4 million birds. Dec. 14 confirmations included commercial egg layer flocks in Franklin County, Washington (1,015,500 birds) and Moody County, South Dakota (1,332,100 birds), Dec. 16 in Weld County, Colorado (1,400,000 birds). This brings total birds affected by HPAI this year to 57.53 million birds in 47 states, including 301 commercial flocks and 401 backyard flocks. The most recent confirmations in commercial operations have continued to be in turkey and commercial egg layer flocks, ones where populations of birds are older.

|

HEALTH UPDATE |

— Summary:

- Global Covid-19 cases at 654,051,231 with 6,667,985 deaths.

- U.S. case count is at 99,950,512 with 1,087,672 deaths.

- Johns Hopkins University Coronavirus Resource Center says there have been 657,927,289 doses administered, 267,654,789 have received at least one vaccine, or 81.23% of the U.S. population.

— RSV, influenza and Covid-19 are driving demand for pain and fever reducers for children. Parents and caregivers are struggling to find over-the-counter fever reducers, and some drugstores are imposing purchase limits on children’s cold and flu medicines as pediatric cases surge. Sales of children’s over-the-counter medication are up 80% compared with the same four-week period a year earlier, mainly due to demand, according to market-research firm IRI. Parents and caregivers also have fewer pediatric pain relievers to choose from, with the number of options down 7% compared with a year ago.

|

POLITICS & ELECTIONS |

— A judge dismissed part of a lawsuit filed by Kari Lake, the defeated Republican candidate for Arizona governor, but will allow her to call witnesses to prove that she lost because of misconduct by election officials. Link for details.

|

CONGRESS |

— House committee investigating the Capitol riot of Jan. 6, 2021, recommended that the Justice Department charge Donald Trump with four federal crimes. They are obstruction of justice, conspiracy to defraud the United States, aid to an insurrection and making false statements to the government. The referrals carry no legal weight; prosecutors are conducting their own probe of the former president’s efforts to overturn the 2020 election.

|

OTHER ITEMS OF NOTE |

— Supreme Court keeps Title 42 border policy in place for now. The Supreme Court on Monday put a temporary hold on a lower court order that would end the so-called Title 42 policy this week, as the justices consider a request from more than a dozen Republican-led states to preserve the pandemic-related border restrictions. In a brief order, signaling that the court wants to act quickly, Justice John Roberts asked the Biden administration to respond to an emergency appeal filed by several Republican-led states seeking to keep the policy in place to slow an expected increase in migrant crossings. Roberts' move means the policy, which allows officials to swiftly expel migrants at the U.S. border, will stay in effect at least until the justices decide the emergency application.

— Wait until 2024. The image of King Charles III will start appearing on British money in 2024.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 | New farm bill primer | China outlook | Omnibus spending package |