Important Ag Sector Add-ons Possible in Pending Huge Omnibus Spending Package

WOTUS | U.S./Mexico GMO corn trade clash | Bird flu | China update | 30x30

|

In Today’s Digital Newspaper |

USDA daily export sales:

- 132,000 metric tons of soybeans to unknown destinations during the 2022-2023 marketing year,000 metric tons of soybeans for delivery to unknown destinations during

- 141,000 metric tons of corn for delivery to Mexico during the 2022-2023 marketing year

This is Congress’ last week and of course it’s jam-packed with last-minute details regarding the huge omnibus spending bill coming for fiscal year 2023. The U.S. ag sector is closing watching for the add-ons which coverage ag aid, crop insurance and perhaps year-round E15.

Russian President Vladimir Putin’s visit to Belarus this week is stoking fears of a widening conflict. Belarus’s leader has signaled that he isn’t planning to promise troops to the Russian president. So what’s up? On Sunday, a rocket strike killed at least one person in Russia’s Belgorod region near Ukraine, as Russia’s defense minister made a rare visit to the Ukrainian war zone where he reportedly inspected troops and their provisions.

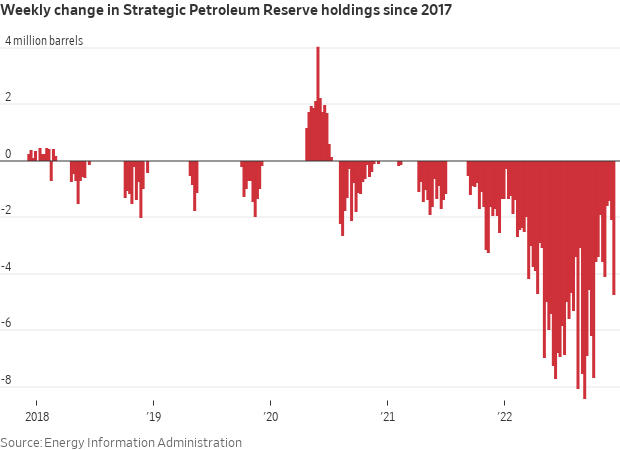

The Department of Energy is purchasing 3 million barrels of oil to replenish the U.S. strategic reserve and strengthen energy security as oil prices — and gas price s— have declined since summer. President Joe Biden's administration initially tapped into the reserve to counter an energy crisis sparked in part by Russia's invasions of Ukraine.

Incoming House Energy and Commerce Chairwoman Cathy McMorris Rodgers (R-Wash.) said in an interview that Republicans on the committee plan to prioritize the security of U.S. electric grids and ensuring that critical infrastructure isn't vulnerable to cyberattacks.

Around 190 nations, aiming to stem rampant biodiversity loss, reached a sweeping deal to protect 30% of the planet’s land and oceans. Overall, the deal lays out a suite of 23 conservation targets. The most prominent one, the measure placing broad areas of land and sea under protection, is known as 30x30. Countries also agreed to manage the remaining 70% of the planet to avoid losing areas of high importance to biodiversity and to ensure that big businesses disclose biodiversity risks and impacts. While the U.S. sent a team to the talks, it could only participate from the sidelines because the country is not a party to the Convention on Biological Diversity. Republicans, who are typically opposed to joining treaties, have blocked its passage.

Some new WOTUS rule info is expected this week from EPA. But if you are confused about this topic, as most people are, there are more announcements ahead. Some info below.

Elon Musk says he will step down as Twitter's CEO if he's voted out by a poll he tweeted Sunday. According to the poll, the option "yes" won by a margin of 57% to 43% — and Musk has said he would abide by the results.

|

MARKET FOCUS |

Equities today: Global stock markets were mixed to weaker overnight. U.S. Dow opened slightly lower but then swung higher. In Asia, Japan -1.05%. Hong Kong -0.5%. China -1.92%. India +0.76%. In Europe, at midday, London +0.55%. Paris +0.83%. Frankfurt +0.66%.

U.S. equities Friday: All three major indices booked weekly losses, with the Dow down 1.7%, the Nasdaq was down 2.7%, and the S&P 500 lost 2.1%. On Friday, the Dow lost 281.76 points, 0.85%, at 32,920.46. The Nasdaq was down 105.11 points, 0.97%, at 10,705.41. The S&P 500 declined 43.39 points, 1.11%, at 3,852.36. The Nasdaq and S&P 500 index closed the week below their 50-day moving averages. The week featured the Federal Reserve, European Central Bank and Bank of England all turn more hawkish as inflation remains stubbornly high. Of note, San Francisco Fed President Mary Daly said the Fed still has a "long way to go" to get inflation down to 2%. Trading was especially volatile on Friday with $2.6 trillion worth of options expiring as part of triple witching day.

Fed Chair Jerome Powell’s key quote from last week’s FOMC: “"We need to be honest with ourselves that there's inflation. 12-month core inflation is 6% CPI. That's three times our 2% target. Now it's good to see progress, but let's just understand we have a long ways to go to get back to price stability," Fed Chair Jerome Powell said during a press conference. "I don’t think anyone knows whether we’re going to have a recession or not, and, if we do, whether it’s going to be a deep one or not. It’s just - it’s not knowable... The historical record cautions strongly against prematurely loosening policy. We will stay the course, until the job is done."

Upshot: A reduction in pace of rate hikes is not a pivot, and the Fed's quantitative tightening program is likely to continue for the foreseeable future. With the Fed tightening into a deeply inverted treasury yield curve, the near-term environment is risk-off.

The 10-year Treasury yield fell 9 basis points to 3.48%. Despite the hawkish Fed talk, markets expect a quarter-point hike in February and in March, but with a growing chance that there will no move in March.

Crude last week. U.S. crude oil futures rose nearly 5% to $74.29 a barrel last week.

Barron's named its top ten equity picks for 2023. The list for the new year includes Alcoa (AA), Alphabet (GOOG, GOOGL), Amazon, Bank of America (BAC), Berkshire Hathaway (BRK.A), (BRK.B), Comcast (CMCSA), Delta Air Lines (DAL), Medtronic (MDT), Madison Square Garden Sports (NYSE:MSGS), and Toll Brothers (NYSE:TOL). Two of the stocks, Amazon and Berkshire, are holdovers from the outperforming 2022 list.

Agriculture markets Friday:

- Corn: March corn futures fell 1/2 cent to $6.53, up 9 cents on the week but down 14 cents so far this month.

- Soy complex: January soybeans rose 6 1/2 cents to $14.80, down 3 3/4 cents for the week. January soymeal rose $7.70 to $463.00, up $8.60 for the week. January soyoil fell 46 points to $63.36 cents, up 335 points for the week.

- Wheat: March SRW wheat fell 3 3/4 cents to $7.53 1/2, up 19 1/4 cents for the week. March HRW wheat fell 16 1/2 cents to $8.44, still up 11 cents for the week. March spring wheat fell 9 1/4 cents to $9.09 1/2.

- Cotton: March cotton rose 93 points to 81.96 cents, the contract’s highest close since Dec. 6 and a gain of 101 points for the week.

- Cattle: February live cattle rose 92.5 cents to $155.775, up 22.5 cents for the week. January feeder cattle rose 72.5 cents to $183.775, down 15 cents for the week.

- Hogs: February lean hog futures rallied $4.125 to $85.775, the contract’s highest close since Dec. 7 and a $1.775 weekly advance.

Ag markets today: Corn and soybean futures faced pressure overnight after weekend rains fell on some dry areas of South America, while wheat showed a mixed tone. As of 7:30 a.m. ET, corn futures were trading mostly around 4 cents lower, soybeans were 9 to 10 cents lower, SRW wheat was around 2 cents higher, HRW wheat was a penny lower and HRS wheat was 2 cents lower to a penny higher. Front-month crude oil futures were around 60 cents higher and the U.S. dollar index was about 100 points lower.

Technical viewpoints from Jim Wyckoff:

On tap today:

• National Association of Home Builders housing market index is expected to tick up to 34 in December from 33 one month earlier. (10 a.m. ET)

• USDA Grain Export Inspections report, 11 a.m. ET.

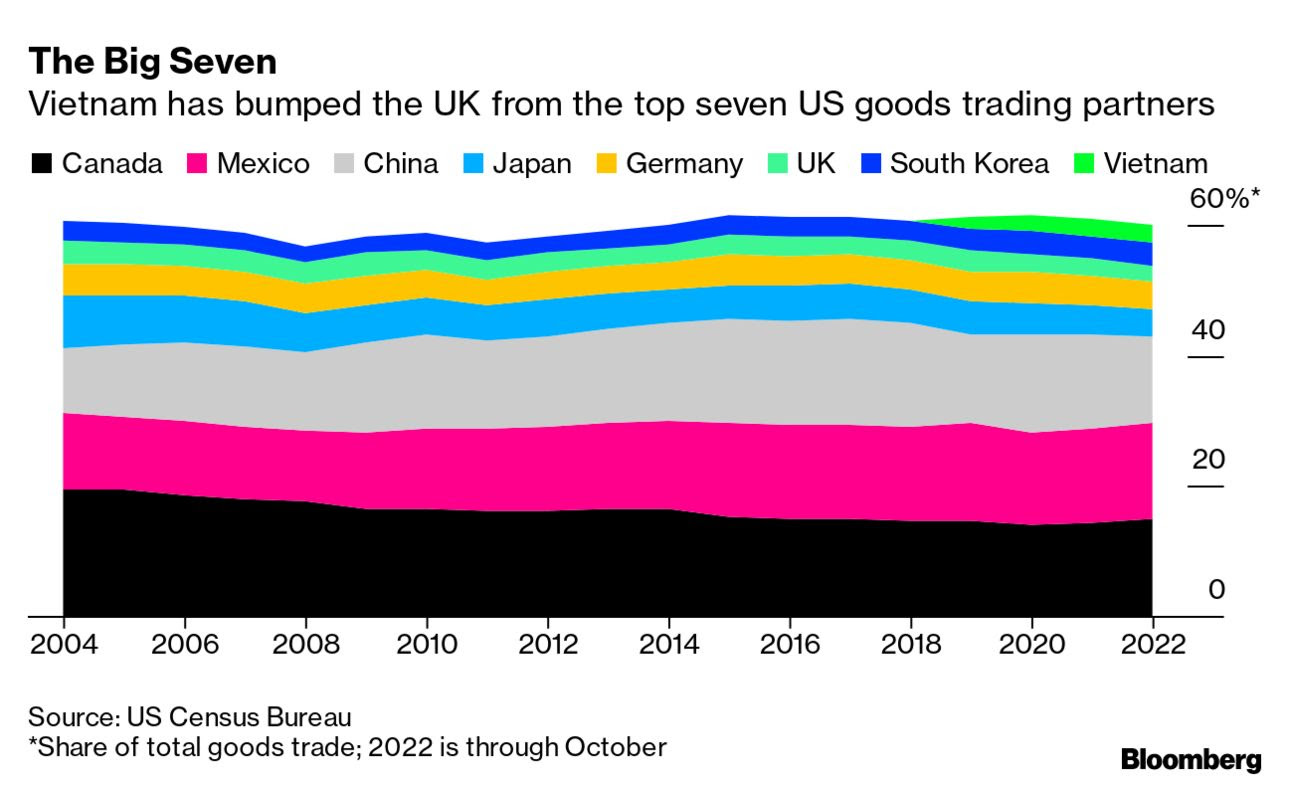

Vietnam is on track this year to bump Britain from its long-time place among the US’s top seven goods trading partners, which would be the first time the U.K. hasn’t been in that group in records going back at least to 2004. The U.K.’s share of the U.K. merchandise trade slid to 2.6% through the first 10 months of this year while Vietnam’s rose to 2.7%, according to Census Bureau data.

Market perspectives:

• Outside markets: The U.S. dollar index was weaker, with the euro and British pound firmer against the greenback. The yield on the 10-year US Treasury note was higher, trading around 3.55%, with a mostly firmer tone in global government bond yields. Crude was higher, with U.S. crude around $74.65 per barrel and Brent around $79.50 per barrel. Gold and silver were firmer, with gold around $1,801 per troy ounce and silver around $23.39 per troy ounce.

• The weak yen and rising inflation are putting pressure on Japan's central bank to raise rates, but doing so could send interest costs on the government’s massive debt soaring.

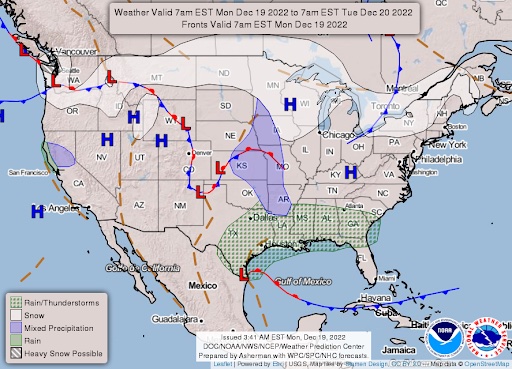

• NWS weather: Bitterly cold temperatures to overtake the eastern Washington and the Northern Rockies with dangerously cold wind chills across the Northern Plains... ...Snow for higher elevations of the Northwest, Upper Great Lakes, and interior Northeast... ...Damp and stormy along the Gulf Coast; confidence is growing in a powerful winter storm to impact much of the eastern two-thirds of the country late week.

Items in Pro Farmer's First Thing Today include:

• Corn and soybeans weaker, wheat mixed overnight

• Southern Brazil gets weekend rains

• Russia ships wheat to Syria via sanctioned ships (see Russia/Ukraine section)

• Bigger EU + UK wheat crop expected in 2023

• ECB official: Changing inflation target would hurt credibility

• Limited cash cattle trade likely

• Cash hog index weakens

|

RUSSIA/UKRAINE |

— Summary: Russian President Vladimir Putin heads for Belarus on Monday, fueling Ukrainian fears he intends to pressure his ally to join a new offensive, as Russian drones attacked Kyiv in the latest assault targeting key infrastructure, Ukrainian officials said. Belarus allowed its territory to be used as a launchpad for Moscow's invasion of Ukraine, but has not joined the fighting directly. Earlier Volodymyr Zelenskyy, Ukraine’s president, said his country was ready for “all possible defense scenarios” as Russian troops prepared to conduct exercises in neighboring Belarus.

- Russian drones assaulted Kyiv yet again, targeting critical infrastructure before dawn Monday. It’s the third aerial attack on the Ukrainian capital in six days, and it left three areas in the region without power, according to Governor Oleksiy Kubela.

- Russian ruble fell to a more than six-month low against the dollar, hampered by concerns about the nation’s export revenue amid sanctions and lower oil prices.

- Russia still considering response to oil price cap. The Kremlin said on Monday it was still considering what measures it would adopt in response to the West’s $60 per barrel price cap on Russia’s oil exports, state-run TASS news agency reported. Moscow had originally planned to publish a presidential decree outlining its response — including a possible ban on selling oil to countries that comply with the cap — last week, Kremlin spokesman Dmitry Peskov had told reporters. But Peskov said on Monday Russia was still weighing other options.

- Russia ships wheat to Syria via sanctioned ships. Using a low-profile fleet of ships under U.S. sanctions, Syria has this year sharply increased wheat imports from the Black Sea peninsula of Crimea that Russia annexed from Ukraine, Reuters reported. With sanctions making it more complicated for Syria and Russia to trade using mainstream sea transport and marine insurance, the two countries are increasingly relying on their own ships to move the grain, including three Syrian vessels that are subject to sanctions imposed by Washington. Wheat sent to Syria from the Black Sea port of Sevastopol in Crimea increased 17-fold this year to just over 500,000 MT.

- FAO: War increasingly hits farm households in Ukraine. One of every four rural Ukrainian households in an FAO survey said it has reduced or stopped agricultural production due to the Russian invasion, with the figure rising to 40% in some oblasts. Link for details. “Ukraine’s agriculture sector is an important source of livelihoods for the roughly 13 million Ukrainians living in rural areas,” said Pierre Vauthier, head of the FAO’s Ukraine country office. The FAO survey of 5,200 households focused on those involved in backyard and small-scale farming.

|

POLICY UPDATE |

— Some new WOTUS information likely this week. The Environmental Protection Agency (EPA) this week is expected to issue its final rule which would put in place a revised definition of Waters of the U.S. (WOTUS), the first in its two-step process to replace the Navigable Waters Protection Rule (NWPR) put in place by the Trump administration.

EPA will put a pre-2015 definition of WOTUS in place with adjustments to reflect U.S. Supreme Court rulings.

Next step: Another new definition of WOTUS, but that is still pending as EPA is expected to reflect a pending U.S. Supreme Court decision when it announces that plan

|

PERSONNEL |

— McCain for WFP chief. President Biden backs Cindy McCain, the U.S. ambassador to U.N. agencies for food and agriculture, to be executive director of the World Food Program (WFP).

|

CHINA UPDATE |

— Former USTR Bob Lighthizer: U.S. needs to change the way it does business with China. Writing in the New. York Times (link), Lighthizer says: “America’s China policy does need to change. The ruthless repression of its Covid-policy protesters is the latest proof of that, but the greater urgency is that the status quo has things moving to the disadvantages of the United States as well as to the benefit of China. An incremental shift is not enough.”

Other key quotes:

- “In our economic competition, China is winning. We transfer well over $300 billion to the country annually in trade deficits, and China uses it to build its military, improve its competitiveness and buy our assets — increasingly our technology companies and even our farms.”

- “The U.S. objective should be to continue trade and economic activity beneficial to us and to discourage any part that is not. For example, trade in agricultural products, raw material and some consumer and pharmaceutical goods can be mutually beneficial. Importing to the United States computers, automobiles and telecommunications equipment is not.”

- “Strategic decoupling has several aspects. First, we should progressively impose tariffs on all of China’s imports into the United States until we have balanced trade. Second, we should disentangle our technology.”

— China’s pork imports rise in November but still below year-ago. China imported 180,000 MT of pork in November, up 20,000 MT (12.5%) from October but 11.1% below year-ago. For the first 11 months of this year, China imported 1.56 MMT of pork, down 56% from the same period last year.

— U.S. extended its reprieve on tariffs for some goods from China as the Biden administration reviews the need for the duties introduced by former President Donald Trump. The exclusions — due to expire at the of the year — will apply to 352 products and run through Sept. 30, the Office of the U.S. Trade Representative said in a statement Friday. The goods include pumps, compressors, air and water purifiers, valves and a variety of motors. Exemptions from the duties will lapse for 197 other products. The USTR earlier this year got hundreds of requests for the tariffs to continue, and in November opened a public web portal to receive comments for two months as it undertakes a review of the need for the tariffs. The deadline for comment is Jan. 17.

— China reported its first Covid-related deaths in weeks on Monday amid rising doubts over whether the official count was capturing the full toll of a disease that is ripping through cities after the government relaxed strict anti-virus controls. According to reports from Beijing, the capital, hospitals are overwhelmed, and funeral homes are cremating more people than usual. Chinese experts have warned that the worst is yet to come. Wu Zunyou, the chief epidemiologist at the Chinese CDC, said the country is being hit by the first of three expected waves of infections this winter. Speaking at a conference in Beijing on Saturday, Wu said the current wave would run until mid-January. The second wave is expected to last from late January to mid-February next year, triggered by the mass travel ahead of the Lunar New Year holiday, which falls on January 21. A third wave of cases would run from late February to mid-March as people returned to work after the week-long holiday, Wu said.

“The very few Covid deaths reported so far are suspiciously low,” said William Schaffner, an infectious disease expert at Vanderbilt University’s medical school in Tennessee. He said a rapid increase in infections is typically followed by a rise in Covid-related deaths a week or two later.

— An index capturing business confidence in China fell to its lowest level in a decade in November.

|

TRADE POLICY |

— Global trade experts. The Peterson Institute for International Economics will host several global trade experts for a discussion, "Can free trade agreements improve labor conditions?" on Wednesday.

— Update on U.S./Mexico GMO corn trade clash. To avert a potential shutoff of U.S. corn exports to Mexico, a senior-level Mexican delegation told U.S. officials they wanted to ensure self-sufficiency in corn for tortillas. U.S. officials said Mexico “presented some potential amendments” to its presidential decree against imports of genetically modified corn beginning in January 2024 (with a possible extension to 2025). “There was a joint recognition that time is of the essence, and we must determine a path forward soon,” said U.S. Trade Representative Katherine Tai and USDA Secretary Tom Vilsack in a statement after the meeting on Friday. The Mexican Foreign Ministry said meetings will continue “to arrive at a mutual understanding in January that gives legal certainty to all parties.”

The Biden administration is threatening a USMCA challenge of the Mexican decree.

During Friday’s meeting in Washington, Mexico “explained its food security policy, highlighting three goals: To preserve Mexico’s biocultural heritage as the birthplace of more than 60 varieties of corn; to continue to ensure self-sufficiency in corn for tortillas; and to strengthen food security in North America,” said the Foreign Ministry. The delegation was led by four government ministers.

“The Mexican delegation presented some potential amendments to the decree in an effort to address our concerns. We agreed to review their proposal closely and follow up with questions or concerns in short order,” Tai and Vilsack said.

The decree would bar imports of genetically modified corn beginning in 2024 (possibly 2025) and prohibit use of glyphosate, the weedkiller used in combination with many of the GMO corn varieties.

Another meeting. Mexican Foreign Minister Marcelo Ebrard, who took part in talks with Tai and Vilsack, separately met Secretary of State Antony Blinken and national security adviser Jake Sullivan to prepare for President Biden’s trip to Mexico and the tri-national North American Leaders Summit in January in Mexico.

|

ENERGY & CLIMATE CHANGE |

— EV chargers: The California Energy Commission approved a $2.9 billion investment plan to install 90,000 new electric vehicle chargers across the state to ensure that California will meet its goal of deploying 250,000 chargers by 2025.

— U.S. fuel economy for 2021 model year vehicles stayed flat from the previous year's record-setting mark, at 25.4 miles per gallon, while greenhouse gas emissions fell by 2 grams per mile to a new low of 347, according to the Environmental Protection Agency's annual Automotive Trends Report.

— SPR exchange. The Energy Department announced Friday it had entered into an exchange agreement for 1.8 million barrels of oil from the Strategic Petroleum Reserve with Exxon Mobil and Phillips 66 to “address potential supply disruptions” to areas affected by the shutdown of the Keystone pipeline.

— European Union clinches a deal on a carbon border tax. Members of the bloc agreed on how to create a tool that will force foreign companies to pay for the cost of their carbon emissions. The tax is a key element of the EU’s climate emissions goals, but trading partners accused Brussels of protectionism. "From 2027 on, it's crunch time. Everybody needs to reduce emissions by then or will have to pay a lot," said the lead negotiator for the European Parliament, Peter Liese, as quoted by Reuters.

The EU will phase out free CO2 permits by 2034, deeming them no longer necessary to protect European producers from overseas competition after it also approved a so-called carbon border tax targeting that same competition of producers from jurisdictions with lower emission standards than the bloc. The EU also will be gradually reducing the number of CO2 permits available for purchase in a further effort to stimulate investment in low-carbon energy. Some 90 million permits will be removed from the system in 2024, followed by another 27 million in 2026.

The carbon deal is provisional and has to be approved by the European Parliament and the Council of Europe.

— U.S. scores $4 billion windfall on oil-reserve sales. Emergency releases from the U.S. Strategic Petroleum Reserve (SPR) are slated to end this month, concluding an unusual attempt to lower gas prices after Russia’s invasion of Ukraine sent oil prices soaring. Over the release period, Washington sold 180 million barrels of crude at an average of $96.25 apiece, well above the recent market price of $74.29 — meaning the U.S., for now, is almost $4 billion ahead, according to the Wall Street Journal (link).

— Top priority: electricity grids. Incoming House Energy and Commerce Chairwoman Cathy McMorris Rodgers (R-Wash.) said in an interview that Republicans on the committee plan to prioritize the security of U.S. electric grids and ensuring that critical infrastructure isn't vulnerable to cyberattacks. Republicans indicated that the committee will take a friendly approach to fossil fuels, and GOP Rep. Kelly Armstrong of North Dakota said she sees an opportunity to do some permitting reform. Link for details.

— Negotiators at the U.N. Biodiversity Conference struck a historic deal to protect 30% of land and water deemed important for biodiversity by 2030, up from the current 17% and 10% protected terrestrial and marine areas, respectively. Link for details.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— HPAI hits 56 million. Highly pathogenic avian influenza (HPAI) was confirmed on two large egg farms, each with more than 1 million hens, in South Dakota and Washington State, driving U.S. losses to 56 million birds in domestic flocks since February. Link for USDA info.

— Krispy Kreme has begun testing new technology in its shops that would cut back on repetitive labor, and expects to automate about 18% of its total doughnut production over the next 18 months, according to Chief Financial Officer Josh Charlesworth. The company expects the investment, which has so far cost $6 million, to produce $2 million in annual savings. Krispy Kreme’s capital expenditures during the third quarter totaled $23.5 million.

|

HEALTH UPDATE |

— Summary:

- Global Covid-19 cases at 653,184,231 with 6,665,931 deaths.

- U.S. case count is at 99,892,545 with 1,087,410 deaths.

- Johns Hopkins University Coronavirus Resource Center says there have been 657,927,289 doses administered, 267,654,789 have received at least one vaccine, or 81.23% of the U.S. population.

|

POLITICS & ELECTIONS |

— Sometimes centrist Sen. Joe Manchin (D-W.Va.) said he has “no intentions” of switching political parties, but didn’t rule out the possibility in the future. He suggested on CBS’s Face the Nation that his decision could depend on how policies develop under a bipartisan infrastructure bill and the Inflation Reduction Act.

|

CONGRESS |

— Last major task for Congress: Pass the roughly $1.7 trillion omnibus spending measure, with several add-ons important to the ag sector. Final passage should occur by week’s end.

The massive bill is expected to total around $1.7 trillion and could be released as early as Monday. It would fund government agencies and programs and allow those agencies to distribute grants and contracts to the private sector. Lawmakers are planning to add a bipartisan bill that would expand incentives for retirement savings — the legislation is expected to raise the starting age for required minimum distributions from tax-deferred accounts, encourage enrollment in retirement plans and expand savings incentives for low-income households. It is also likely to include new limits on aggressive tax deals known as syndicated conservation easements.

The bill is expected to include an update to the 1887 Electoral Count Act, which requires Congress to convene for a joint session after a presidential election, on Jan. 6, to count and ratify the electoral votes certified by the 50 states and District of Columbia. The vice president, serving as president of the Senate, has the duty to count the votes. After the last election, then-President Donald Trump pressured his vice president, Mike Pence, to reject some electors unilaterally, which Pence refused to do. The bill would make clear that Congress’ role in ratifying states’ Electoral College votes is ministerial and that the vice president’s role is merely to count the votes publicly. It also would dramatically raise the threshold to sustain an objection to a state’s electors.

What’s next? The Senate will take up the measure first. House Democrats, who have a narrow 218-213 majority because of recent resignations and the death of a lawmaker, will likely need to pass the bill mostly by themselves and can’t afford to lose more than a few votes because most Republicans will vote against it. House Republican leader Kevin McCarthy (R-Calif.) has said Congress needs to cut spending and advocated for pushing talks into next year so that his party could be more involved when they take the majority in January.

— Donald Trump has weighed in on GOP leader Kevin McCarthy’s (R-Calif.) bid to be the House’s next speaker, calling on his supporters in Congress to stop their opposition tactics against the California congressman.

— The House committee investigating the Jan. 6 attack on the Capitol will hold what is likely to be its last public hearing, in which it will debate criminal referrals to the Dept. of Justice. The committee’s final report will be made public on Wednesday, with an executive summary expected sometime today.

|

OTHER ITEMS OF NOTE |

— Elon Musk loses his own Twitter poll. If he sticks to his word, Elon Musk’s time as CEO of Twitter could be up soon. “Should I step down as head of Twitter? I will abide by the results of this poll,” the billionaire tweeted Sunday. The poll expired Monday morning and it showed, by a sizable margin, that Twitter users wanted him to resign.

— Argentina beat France to win the World Cup. Argentina prevailed 4-2 after a penalty shootout, giving superstar Lionel Messi the one major trophy that had eluded him for 15 years.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 | New farm bill primer | China outlook |