Clock Ticking for Lawmakers to ‘Rush’ to Get Things Done Before Adjourning

FY 2023 funding | Ag disaster aid | WRDA | Nominations

Washington Focus

Lawmakers will not adjourn this Congress until must-have issues are dealt with, or punted to the new Congress next year. Some of the major topics include:

- Fiscal year (FY) 2023 funding. It looks like Congress will again do a huge omnibus bill loaded with funding and special add-ons. The Appropriations panel leaders of both chambers will have two weeks to broker a full-year government funding agreement or a temporary continuing resolution (CR) before current government funding expires Dec. 16. While they’ve been exchanging offers on top-line defense and domestic spending figures, a deal isn’t imminent.

- Ag disaster funding via a revised Emergency Relief Program (ERP) for eligible 2022 crops and livestock is a very likely candidate to be attached to the omnibus. No specific dollar amount has been reported yet, but the past few have totaled billions of dollars. This time, some farm-state lawmakers have heard from their farmer state’s farmers who have complained about the initial way USDA apparently wanted to unfold Phase 2 of ERP for 2020 and 2021 crops and livestock. Look for changes for this part of the program. Last week, some commodity groups wrote key lawmakers requesting an ERP extension to cover losses for 2022. Of note, the letter said: “The 2023 Farm Bill presents an opportunity to strengthen the farm safety net to reduce, if not eliminate, the need for ad hoc programs, and we are working toward this end. However, including an extension of ERP for 2022 losses would serve as a critical bridge to the next Farm Bill. The approach taken under Phase I of ERP worked well for producers and we encourage Congress to use this model for future relief, including for Phase II as well as 2022 losses, except where a unique approach for a commodity is required.”

- Some other issues could be included as part of the omnibus package. One possibility: a push for year-round E15.

- Nominations: Two major ag-related trade officials have still not been approved by the Senate for various reasons, one being a senator’s hold. That will eventually change, and the always-worried ag sector will have yet another issue in the settled category.

A lingering Water Resources Development Act (WRDA) measure will be completed, especially since a must-have National Defense Authorization Act (NDAA) is being attached to it. The defense measure is an annual bill that sets both spending levels and policy priorities for the Dept. of Defense. As for WRDA, shippers want to see whether language accelerates replacement of locks and dams and other infrastructure. The Senate earlier this year passed an amended version of WRDA, which the House will look to clear in a package with NDAA after the two chambers worked out compromises on both. The biennial legislation authorizes waterway improvements and spending for flood control and coastal resilience across the country. The Senate version would increase the federal Treasury cost share for inland waterways projects from 65% to 75%.

An Electoral Count Act will clear Congress. It’s a bipartisan overhaul of the law that details how electoral votes should be counted by lawmakers.

Also on the list of legislation this week are HR 3648, to ease green card access for legal immigrants, and HR 7946, to give deported veterans a new opportunity to become legal US residents.

An issue that will not be settled this year is increasing or suspending the national debt. House Republicans want to punt that until the new Congress, thinking they have more leverage on this issue when they control the House chamber. The U.S. gov’t is not expected to breach the debt limit until the second half of 2023… and when lawmakers know they have additional time, they almost always take it.

Other issues that will face late-session hurdles include:

- Still more funding for Ukraine, as some Republicans want a more detailed look at the amount of use of additional funding.

- Reforming the permitting process for energy projects that sometime centrist Sen. Joe Manchin (D-W.Va.) thought he was going to get when he caved and eventually supported the Democrat-pushed Inflation Reduction Act, which is really a nearly $370 billion climate change funding measure.

- Renewing a few corporate tax breaks and the expanded child tax credit. Biggest hurdle: not enough time to work out compromises on both.

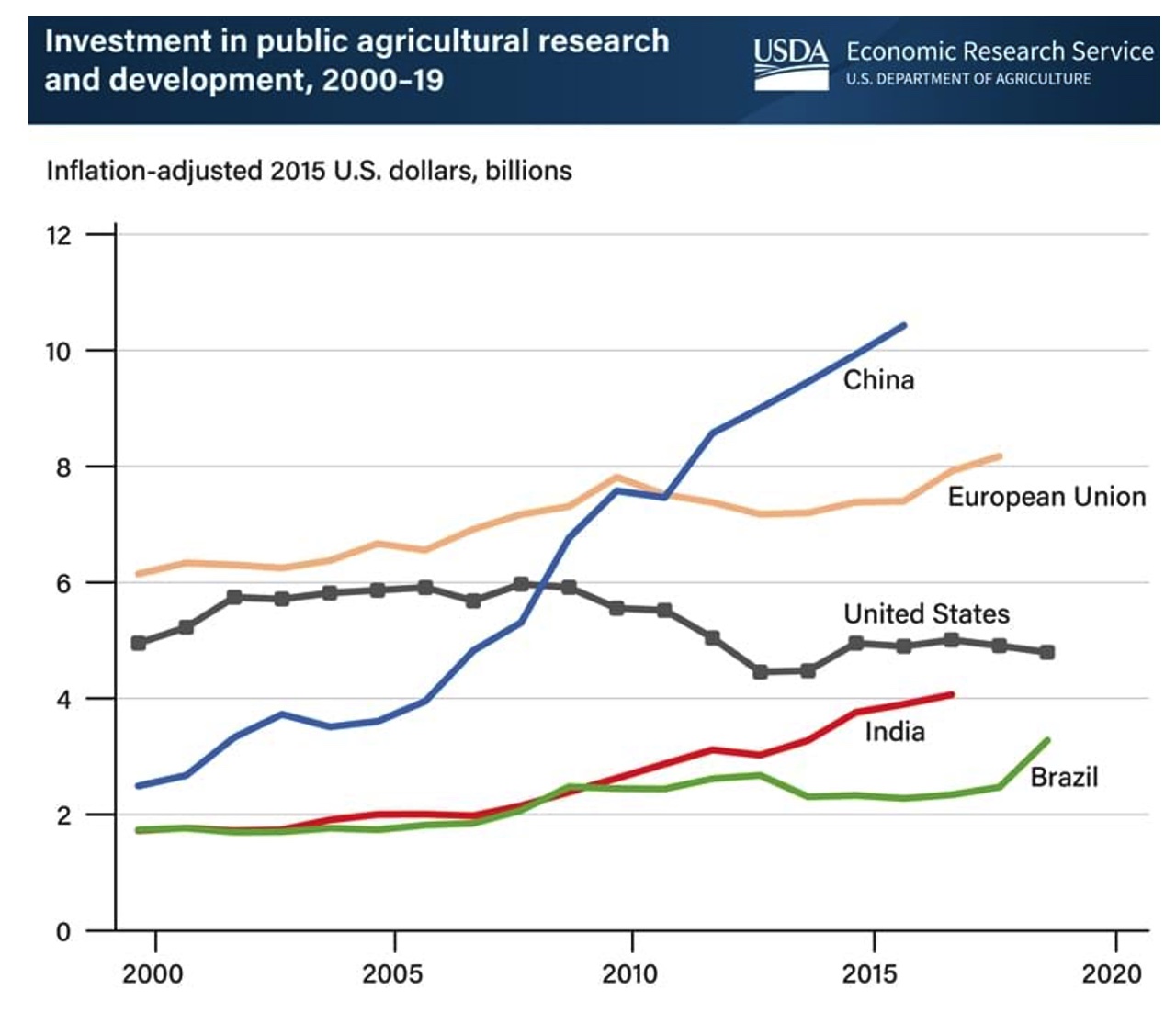

The Senate Ag Committee continues its new farm bill hearings, with the focus this Tuesday on ag research programs. This topic always gets a lot of talk during a farm bill debate but frequently finds funding far less than needed or expected in the waning days of a farm bill debate. Look at the graphic below which shows China and the European Union not spending more on such research than does the United States.

Senate Democrats plan to hold leadership elections Thursday, when current leaders are expected to maintain their positions. Democrats agreed earlier this week to Majority Leader Chuck Schumer’s (D-N.Y.) proposal to eliminate the assistant leader position in exchange for the creation of a deputy conference secretary post. Schumer previously told colleagues he plans to nominate Sen. Patty Murray (D-Wash.), the current assistant leader, as Senate president pro tempore. The largely ceremonial role would place her third in line for the presidency.

A new permanent FDA deputy commissioner for foods is reportedly one recommendation in a report from an independent commission coming Tuesday of an overhaul of FDA’s human foods programs.

A trip to Brazil. National Security Adviser Jake Sullivan and officials from the National Security Council and State Department travel Monday to Brazil to meet, according to the White House, on “how the United States and Brazil can continue to work together to address common challenges, including combatting climate change, safeguarding food security, promoting inclusion and democracy, and managing regional migration.”

The final undecided Senate race of 2022 will be settled following the Dec. 6 runoff race in Georgia between. Incumbent Sen. Raphael Warnock (D-Ga.) and challenger Herschel Walker (R-Ga.). Warnock holds a narrow lead over Walker among those likely to vote in the runoff, according to a new CNN Poll conducted by SSRS. Warnock finished narrowly ahead of Walker in November but without the majority needed to avoid a runoff.

Monday, Dec. 5

- Trade policy: U.S./EU. Officials from the United States and the European Union will meet for the third Trade and Technology Council meeting amid high tension over the Inflation Reduction Act's goal of promoting American manufacturing. European leaders, including French President Emmanuel Macron, have voiced concerns over provisions in the legislation aimed at boosting U.S. manufacturing of clean energy technology, which they say comes at a cost of damaging European industries already suffering with high energy costs.

- American Seed Trade Association CSS & Seed Expo 2022. In Chicago.

- WRDA/Defense authorization. House Rules Committee meeting to consider legislation combining the Water Resources Development Act of 2022 and the National Defense Authorization Act for FY 2023, which began Oct. 1.

- Midterm elections. The Wall Street Journal holds its CEO Council Summit, focusing on the outcome of the midterm elections and global politics, with Secretary of State Antony Blinken and White House Chief of Staff Ron Klain to deliver remarks.

Tuesday, Dec. 6

- Antitrust. The Wall Street Journal is hosting its CEO Council. Federal Trade Commission Chair Lina Khan will participate in a discussion titled "The Antitrust Outlook," where she will talk about how the FTC can better scrutinize Big Tech companies while maintaining U.S. leadership in innovation. Also speaking: International Monetary Fund Deputy Managing Director Gita Gopinath.

- Almond Conference Dec. 6-8 at the SAFE Credit Union Convention Center in downtown Sacramento.

- Farm bill: Research. Senate Ag Committee hearing on farm bill research programs.

- New farm bill. Farm Foundation virtual forum on “What to Expect From the 2023 Farm Bill.”

- Renewable energy. The International Energy Agency (IEA) virtual media briefing on a new report, “Renewables 2022,” forecasting “the deployment of renewable energy technologies in electricity, transport and heat to 2027.”

- USTR Tai. U.S. Trade Representative (USTR) Katherine Tai delivers remarks at the President's Advisory Commission on Asian Americans, Native Hawaiians, and Pacific Islanders.

- Climate crisis. House Select Committee on the Climate Crisis hearing, “Solving the Climate Crisis: Key Accomplishments, Additional Opportunities, and the Need for Continued Action.”

- Carbon capture. Atlantic Council virtual discussion on “European carbon capture & storage strategy.”

- Senate runoff to determine the winner in the U.S. Senate race between incumbent Sen. Raphael Warnock (D-Ga.) and Republican challenger Herschel Walker.

Wednesday, Dec. 7

- Climate risk disclosure. Commissioner Hester Peirce of the Securities and Exchange Commission will discuss the agency's proposed climate risk disclosure rules at the American Enterprise Institute on Wednesday.

- Immigration policy. Former Treasury Secretary Robert Rubin and Sen. Joe Manchin (D-W.Va.) are among the speakers at a Hamilton Project event Wednesday on reforms to immigration policy in relation to the U.S. economy.

- Food traceability. FDA webinar on food traceability rule.

- CFTC agriculture advisory panel. Commodity Futures Trading Commission (CFTC) meeting of the Agricultural Advisory Committee.

- China report. Bipartisan Policy Center virtual discussion on “U.S./China Economic and Security Review Commission's Annual Report.”

- House Ways and Means priorities. PunchBowl News discussion with Rep. Jason Smith (R-Mo.) about his role on the House Ways and Means Committee and the committee's priorities going into 2023.

- Animal drug user fees. Food and Drug Administration teleconference on the Animal Drug User Fee Act, focusing on proposed recommendations for the reauthorization of the Animal Drug User Fee Act (ADUFA V) for FY 2024-2028.

- GOP goals for the next Congress. Washington Post Live virtual discussion on “The 2022 Midterms and GOP Goals in the Next Congress.”

Thursday, Dec. 8

- Energy issues. Resources for the Future Energy Insights 2022 conference. Through Dec. 9.

- Sanctions impact. Wilson Center's Global Europe Program virtual discussion on “From freezing to seizing? The future of sanctions.”

- U.S. sanctions on Russia. U.S. Institute of Peace virtual discussion on “The History and Future of U.S. Sanctions Policy: What the Evolution of U.S. Sanctions Can Tell Us About Promoting Peace in Ukraine and Beyond.”

- Trends for 2023. Washington International Trade Association virtual discussion on “20 Trends for 2023,” focusing on “notable global trends and risks for 2023.”

Friday, Dec. 9

- CDC and the pandemic. The Cato Institute holds a discussion on “Performance Review: Evaluating the CDC in the Wake of the Covid Pandemic.”

- China competition. Center for Strategic and International Studies (virtual discussion on “The China Innovation Challenge,” focusing on China's “policy on patent enforcement and licensing through patent law, competition law, and standardization initiatives.”

Economic Reports for the Week

No Fedspeak this week as we're in the official blackout period ahead of the Federal Open Market Committee meeting that runs Dec. 13-14. Fed watchers will key on the upcoming Producer Price Index report as an inflation gauge.

Monday, Dec. 5

- Institute for Supply Management releases its Services Purchasing Managers’ Index for November. The consensus estimate is for a 53 reading, slightly lower than October’s 54.4. That was the lowest figure for the index since May 2020, as the services sector of the economy continues to slow.

- Factory orders are seen rising to a 0.7% gain in October that would follow a 0.4% gain in September. Durable goods orders for October, which have already been released and are one of two major components of this report, rose 1.0% in the month which was stronger than expected.

- IHS Markit Services PMI — Final. A little less contraction is the call for the PMI service's November final, at a consensus 46.3 versus 46.1 at mid-month.

Tuesday, Dec. 6

International Trade in Goods and Services. A deficit of $80.0 billion is expected in October for total goods and services trade which would compare with a $73.3 billion deficit in September. Advance data on the goods side of October's report showed a more than $7 billion deepening in the deficit.

Wednesday, Dec. 7

- MBA Mortgage Applications

- Federal Reserve reports consumer credit data for October. In September, total consumer debt rose at a seasonally adjusted annual rate of 6.4% and topped $4.7 trillion for the first time.

- Productivity and costs. The second estimate for third-quarter nonfarm productivity is expected to show a 0.4 percent rise versus a scant 0.3 percent annualized gain in the first estimate. Unit labor costs, which slowed from 8.9 percent in the second quarter to 3.5 percent in the first estimate for the third quarter, are expected to rise at a 3.3 percent rate in the second estimate.

- Bank of Canada announces its latest monetary-policy decision, after delivering a smaller-than-expected half-percentage-point increase at its previous meeting. The central bank said higher rates were weighing on consumption and economic growth.

Thursday, Dec. 8

- Department of Labor reports initial jobless claims for the week ending on Dec. 3. Jobless claims averaged 228,750 in November and have crept higher from historically low levels since earlier this March.

- Fed Balance Sheet

- Money Supply

- China’s National Bureau of Statistics releases November figures on consumer inflation and producer prices. Prices charged by Chinese companies at the factory gate fell 1.3% in October compared with a year earlier, the country’s first year-over-year decline in producer-price inflation since December 2020.

Friday, Dec. 9

- Bureau of Labor Statistics releases the Producer Price Index for November. Economists forecast the PPI to rise 7.2%, year over year, after an 8% jump in October. The core PPI, which excludes volatile food and energy prices, is expected to increase 5.9%, slower than the 6.7% gain previously. Softer-than-expected CPI and PPI readings in the past month have raised hopes that the Fed pivot — or at least pause — is almost here.

- University of Michigan releases its Consumer Sentiment Index for December. The consensus estimate is for a 57.5 reading, about one point above November’s.

- Wholesale Inventories (Preliminary). The second estimate for October wholesale inventories is a build of 0.8%, unchanged from the first estimate.

Key USDA & international Ag & Energy Reports and Events

Friday brings USDA’s updated WASDE and other related reports.

Monday, Dec. 5

Ag reports and events:

- Export Inspections

- Amber Waves, December issue

- Malaysia’s Dec. 1-5 palm oil exports

- Holiday: Thailand

Energy reports and events:

- Sanctions on Russian crude oil exports due to come into effect. An array of measures will be implemented including:

— An EU import ban on seaborne crude oil, with some exemptions

— A UK import ban on seaborne crude oil

- The EU, G7 and Australia are also due to implement a price cap that will affect access to maritime services including shipping an insurance

Tuesday, Dec. 6

Ag reports and events:

- America's Diverse Family Farms: 2022

- Purdue Agriculture Sentiment

- EU weekly grain, oilseed import and export data

- Australian crop report & Abares agricultural commodities

Energy reports and events:

- API weekly U.S. oil inventory report

- EIA monthly Short-Term Energy Outlook

Wednesday, Dec. 7

Ag reports and events:

- Broiler Hatchery

- Livestock and Meat International Trade Data

- U.S. Agricultural Trade Data Update

- China’s first batch of November trade data, including soybean, edible oil, rubber and meat imports

Energy reports and events:

- EIA weekly U.S. oil inventory report

- U.S. weekly ethanol inventories

- Genscape weekly crude inventory report for Europe’s ARA region

- China’s first batch of November trade data, including oil, gas and coal imports, oil products imports & exports

Thursday, Dec. 8

Ag reports and events:

- Weekly Export Sales

- Port of Rouen data on French grain exports

- Vietnam’s customs releases Nov. coffee, rice and rubber export data

- EU Agricultural Outlook conference, Dec. 8-9, Brussels

- Brazil’s Conab data on area, yield and output of corn and soybeans

- Holiday: Argentina, Chile

Energy reports and events:

- EIA natural gas storage change

- Insights Global weekly oil product inventories in Europe’s ARA region

Friday, Dec. 9

Ag reports and events:

- CFTC Commitments of Traders report

- Peanut Prices

- WASDE

- Cotton Ginnings

- Crop Production

- Cotton: World Markets and Trade

- Grain: World Markets and Trade

- Oilseeds: World Markets and Trade

- World Agricultural Production

- China’s agriculture ministry (CASDE) releases monthly report on supply and demand for corn and soybeans

- FranceAgriMer weekly update on crop conditions

- Cane crush and sugar production data by Brazil’s Unica (tentative)

- Holiday: Argentina

Energy reports and events:

- Baker Hughes weekly U.S. oil/gas rig counts

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 | New farm bill primer | China outlook |