Rishi Sunak Takes Over as U.K. Prime Minister

Assessments of Chinese leader Xi Jinping begin following Party Congress

|

In Today’s Digital Newspaper |

Europe is entering a challenging winter, with Russia’s war in Ukraine threatening access to energy, but a mild start to the heating season and high storage levels have boosted optimism. Natural-gas prices are below approximately $130 a megawatt-hour from an August peak near $350.

The Chinese yuan fell to a 14 year low overnight. More in China section.

The U.K.’s new prime minister Rishi Sunak and his wife Akshata Murthy, the daughter of an Indian tech billionaire, have a collective net worth higher than the personal fortune of King Charles III. Forbes breaks down the assets and investments that make up their wealth (link).

The Justice Department charges two people with spying for Huawei. Prosecutors said that the Chinese intelligence officials had unsuccessfully tried to obtain inside information about the U.S. investigation into the telecom giant. The charges were among several unveiled by federal law enforcement officials, who accused China of meddling in U.S. affairs.

The Biden administration is reportedly preparing a debt-ceiling contingency plan. White House and Congressional aides have started discussing a raising of the U.S. debt ceiling during the lame-duck session after the midterm elections, according to Axios (link). It would be an effort to prevent Republicans from using debt-ceiling negotiations as a threat should they win control of the House.

Nearly two-thirds of business economists polled in the National Association for Business Economics (NABE) October business conditions survey say the U.S. is already in a recession or is more likely to be in one than not over the next year. It’s the latest in a series of gloomy predictions as the Fed battles soaring inflation and fears of impending job losses grow.

USDA ups food price forecasts for 2022 and 2023. Details in food industry section.

Election Day 2022 is 14 days away — 8,213,556 early votes already cast as of late Monday, per the United States Elections Project. Election Day 2024 is 743 days away.

|

MARKET FOCUS |

Equities today: Global stock markets were mixed overnight but Asian shares were mostly down. U.S. stock indexes are headed for weaker openings. Google, Microsoft, Coca-Cola and dozens of other big companies report earnings today. Coca-Cola raised its full-year outlook as earnings beat expectations. In Asia, Japan +1%. Hong Kong -0.1%. China flat. India -0.5%. In Europe, at midday, London -0.5%. Paris +0.3%. Frankfurt -0.8%.

U.S. equities yesterday: The Dow rose 417.06 points, 1.34%, at 31, 499.62. The Nasdaq gained 92.90 points, 0.86%, at 10,952.61. The S&P 500 rose 44.59 points, 1.19%, at 3,797.34.

Agriculture markets yesterday:

- Corn: December corn fell 2 3/4 cents to $6.81 1/2, around the middle of the day’s range.

- Soy complex: November soybeans fell 23 1/2 cents to $13.72. December soymeal fell $9.20 to $408.70. December soyoil rose 37 points to a four-month high at 71.87 cents.

- Wheat: December SRW wheat fell 12 cents to $8.38 3/4. December HRW wheat dropped 10 1/4 cents to $9.38. December spring wheat futures fell 3 3/4 cents to $9.57 3/4.

- Cotton: December cotton fell 300 points to 76.13 cents, the lowest close for a nearby contract since December 2020.

- Cattle: October live cattle rose $1.125 to $151.60, the highest close for a nearby contract since June 2015. December live cattle rose $1.70 to $154.125, a lifetime-high close. January feeder cattle rose $1.575 to $181.95.

- Hogs: December lean hogs fell $1.20 to $87.925, down from last Friday’s two-month high.

Ag markets today: Corn and wheat traded lower overnight on followthrough selling, while soybeans faced two-sided trade. As of 7:30 a.m. ET, corn futures were trading 2 to 3 cents lower, soybeans are fractionally on either side of unchanged and wheat futures were 6 to 9 cents lower. Front-month crude oil futures were around $1.35 lower and the U.S. dollar index was modestly firmer.

Technical viewpoints from Jim Wyckoff:

On tap today:

• S&P CoreLogic Case-Shiller home price index is due at 9 a.m. ET.

• Conference Board's consumer confidence index, due at 10 a.m. ET, is expected to decline in October from the prior month.

• Federal Reserve Bank of Richmond releases its Business Activity Survey for October. (10 a.m. ET)

• Fed Reserve governor Christopher Waller speaks. (1:55 p.m. ET)

Rishi Sunak officially became British Prime Minister after meeting with King Charles III at Buckingham Palace today, making him the third person to hold the position in just two months as Britain is embroiled in economic crisis and political turmoil. “There is no doubt we face profound economic challenges,” Sunak said on Monday. “We now need stability and unity, and I will make it my utmost priority to bring my party and country together.” He is the first person of color to assume the position and the youngest to do so in two centuries. A former British Treasury chief, Sunak is replacing the deeply unpopular Liz Truss, whose plan to make unfunded tax cuts roiled markets and ultimately forced the Bank of England to step in.

He has divulged few details on his proposed policies, although given the country’s precarious economic outlook, most expect higher taxes and reduced spending. In terms of economic policy, Sunak will have a wide range of issues to contend with from spending and reducing the deficit to immigration and the U.K.'s relationship with the EU. Based on his resume, he's likely to prioritize fiscal conservatism and trim spending where possible, even if that entails deep cuts. He also backed Brexit in the 2016 referendum, but wasn't a hardliner, and will face pressure to solve a dispute related to the Northern Ireland Protocol.

Sunak backgrounder: Before entering politics, Sunak worked as an analyst at Goldman Sachs and was a partner at hedge funds like the Children's Investment Fund Management and Theleme Partners. He was first elected as a Conservative MP for a constituency in North Yorkshire in 2015, but then worked his way up inside the party. Sunak served as Chief Secretary to the Treasury from 2019 to 2020 and as Chancellor of the Exchequer from 2020 to 2022 under former Prime Minister Boris Johnson.

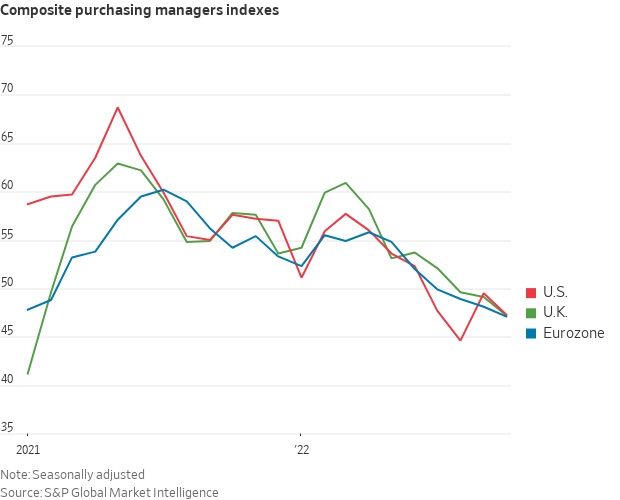

Key index shows contracting economic activity. S&P Global said its composite output index for the U.S., which includes services and manufacturing activity, fell to 47.3 in October from 49.5 in September, its second-fastest pace of decline since 2009 excluding early 2020 at the start of the Covid-19 pandemic. An index below 50 signals contracting economic activity while above 50 signals growth.

Business activity in the U.S. and Europe fell in October, according to surveys of purchasing managers published by S&P Global. German factories made the biggest output cuts since the early part of the pandemic and U.S. firms reported that the strong dollar had weighed on exports. Surveys in Australia pointed to the first monthly contraction since January.

Fed preparing for another 75-bps rate hike in November. The Federal Reserve will go for its fourth consecutive 75 basis point interest rate hike on Nov. 2, according to economists polled by Reuters, who said the central bank should not pause until inflation falls to around half its current level. Its most aggressive tightening cycle in decades has brought ever bigger recession risks. Still, a strong majority of economists (86 of 90) predicted policymakers would hike the federal funds rate by three quarters of a percentage point to 3.75%-4.00% next week as inflation remains high and unemployment is near pre-pandemic lows.

CME Fed funds futures ahead of Tuesday market action and economic updates had a 97.3% probability for a 75-basis-point increase with a 50-basis-point increase given 2.7% probabilities.

The Federal Reserve is among central banks that are now sitting on paper losses on their massive bond holdings, which were accumulated as part of their rescue efforts in recent years. The U.S. Treasury will see a “stunning swing,” going from receiving about $100 billion last year from the Fed to a potential annual loss rate of $80 billion by year-end, according to Amherst Pierpont Securities LLC.

Florida Department of Agriculture issues preliminary loss figures from Hurricane Ian. Detailed figures from the state include:

- $676 million for citrus, including fruit loss (up to $304 million) and tree loss ($371 million).

- Storm is likely to have destroyed 8% to 11% of Florida citrus trees, which would be more than 6.1 million trees.

- Other fruit and vegetable losses are pegged at up to $231 million, a loss of about 10% to 15%, while losses for row crops were put at about $160 million with horticultural crops seeing losses of around $297 million.

- Losses for animal agriculture are seen at around $492 million which includes damage to things like barns, fences, equipment and roads besides losses of livestock and damage to forage production areas.

USDA said earlier this month their estimates of U.S. citrus production were completed before Hurricane Ian arrived and the Florida citrus production figures released Oct. 12 did not reflect potential damage from the storm and that the next update on citrus production will come Dec. 9. They also noted that the “full impact of the storm may not be reflected until future reports.”

Market perspectives:

• Outside markets: The U.S. dollar index was weaker, with the euro and Japanese yen both weaker against the greenback. Yield on the 10-year U.S. Treasury note was lower, trading under 4.17%, with a mostly weaker tone in global government bond yields. Crude was under pressure, with U.S. crude around $83.75 per barrel and Brent around $90.45 per barrel. Gold and silver were seeing slight, with gold around $1,647 per troy ounce and silver around $18.86 per troy ounce.

• The world is "truly in the middle of the first global energy crisis," according to Fatih Birol, head of the International Energy Agency. The dire warning comes as LNG markets tighten due to Russia's war in Ukraine, as well as OPEC's recent decision to cut supply by 2 million barrels per day (or about 2% of global supply). "[It is] especially risky as several economies around the world are on the brink of a recession, if that we are talking about the global recession... I found this decision really unfortunate."

Impact: "It is not the United States that will suffer most under high energy prices," continued Birol. "It is mainly emerging and developing countries because their import fees go up and they have a weaker currency [compared to the dollar] that will cause a lot of hardship. It is countries in Africa, Asia and Latin America — mainly oil and energy importing countries."

Birol noted that turning to other sources of energy and renewables will not only help the world achieve climate goals, but that energy security should be the number one driver of the energy transition. In fact, additional low-carbon sources would have helped ease the current crunch, and a quicker transition is the best way to stave off the global energy crisis.

• LA port chief says labor deal still likely but months away. A labor deal between 22,000 dockworkers at U.S. West Coast ports and their employers may take several months to reach, but service disruptions while negotiations continue are unlikely, Port of Los Angeles Executive Director Gene Seroka, whose port is the nation’s busiest, said in an interview at Bloomberg’s New York headquarters Monday. Seroka said he isn’t worried about the chance the parties will fail to reach a deal. “I think the probability of work disruption is extremely low,” he said.

• Palm oil hits two-month high. Malaysian palm oil futures rose above MYR 4,200 on Tuesday, trading at levels not seen in two months, supported by a broad rebound in vegetable oils and weakness in the ringgit. Vegetable oils rose sharply as increasingly aggressive Russian attacks in Ukraine hampered hopes that Ukraine would be able to produce and export usual quantities of soyoil and sunflower oil. In the meantime, palm oil supply was also jeopardized as storms and flood risks during the incoming monsoon season sparked concerns of harvesting disruptions, risking output in major producers of South-East Asia. Keeping a lid on prices were signs of weak export demand from Malaysia, with palm oil shipments from Oct. 1-20 falling between 4.3% and 8.4% from the same period in September, according to two cargo surveyors.

• Ag trade: South Korea purchased 68,000 MT of optional origin corn, excluding the Black Sea region. Taiwan tendered to buy 38,515 MT of U.S. milling wheat.

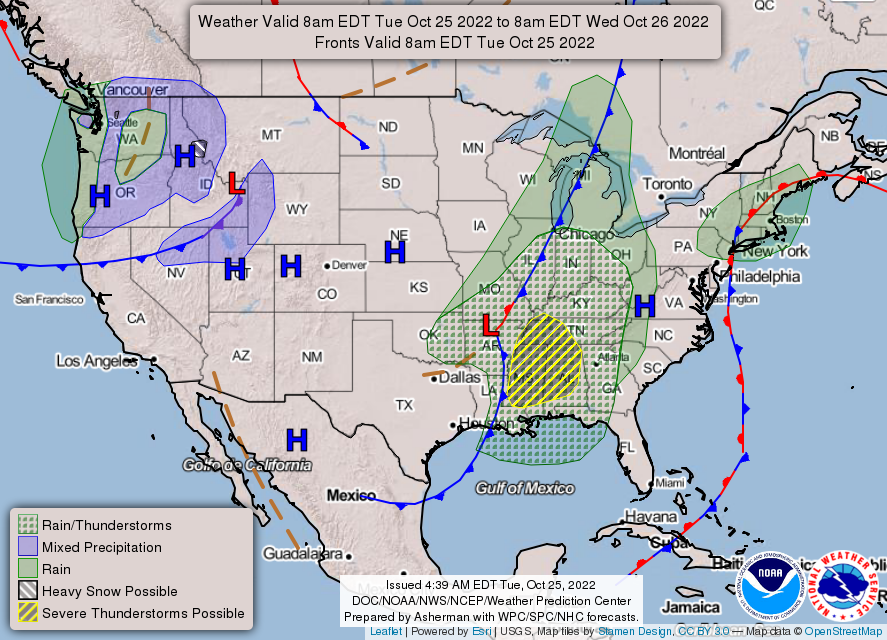

• NWS weather: There is a Slight Risk of severe thunderstorms over parts of the Lower Mississippi/Tennessee Valleys and Southeast through Wednesday morning... There is a Marginal Risk of excessive rainfall over parts of the Western Ohio Valley and Middle /Lower Mississippi Valley through Wednesday morning... ... Snow for parts of the Cascades and the Northern Rockies.

Items in Pro Farmer's First Thing Today include:

• Mostly lower price tone this morning

• China’s economy saddled by Covid restrictions

• China surveys banks of FX positioning

• Cash cattle hit new high for the year

• Cash hog fundamentals firming

|

RUSSIA/UKRAINE |

— Summary: EU and G7 nations hold a Ukraine reconstruction conference. Also, European Union energy ministers are set to debate details of a possible price cap on natural gas when they meet today. The cap would put a lid on energy prices that have risen rapidly as a result of Russia's economic war with the West. EU talks so far have been contentious with Italy, France and a dozen other countries pushing for a cap on wholesale prices. Germany and several others have pushed back, saying a cap would divert supplies to other buyers.

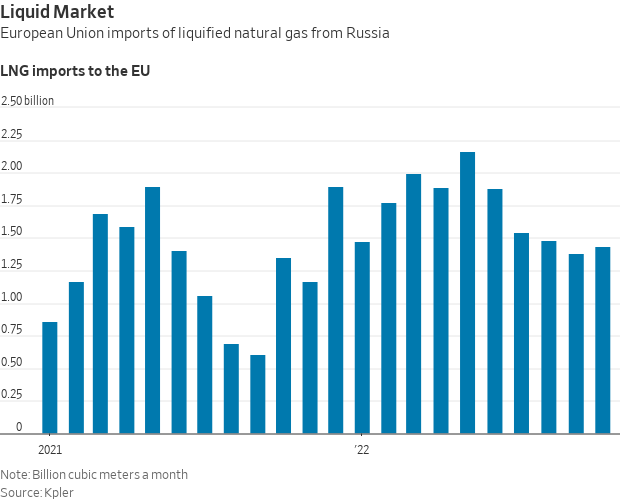

- Europe continues to buy Russian liquefied natural gas, or LNG, the WSJ reports (link). LNG moves by ship and can be sent from far-flung regions. Importers say LNG sales aren’t covered by Russian sanctions and the imports will help cushion the blow from higher energy prices. But Russian exports could be constrained by a ban on selling technologies to Russia that could expand the industry.

- European natural gas prices fall. Dutch TTF gas futures have slipped below €100 ($98.54) per megawatt hour, down some 20% from last week, to their lowest levels since Russia began restricting supply in June. Analysts cited warmer-than-usual weather and EU countries filling gas stores to near-full capacity.

- Ukraine grain exports could rise nearly 9% this month. Ukraine’s exports of agricultural products could reach 7.5 MMT in October, a rise of 8.7% from the 6.9 MMT it exported last month, the deputy chair of the Ukrainian Agrarian Council said on Tuesday. The official didn’t give a commodity-by-commodity breakdown of his export forecast.

- Ukraine keeps winter wheat area unchanged despite planting delays. Ukraine maintained its forecast for winter wheat seedings at 3.8 million hectares despite planting delays due to unfavorable weather. The ag ministry said farmers had planted 3.1 million hectares to winter wheat as of Oct. 25. Another 500,000 hectares of other winter grains had been sown. Planted area will be down significantly from last year when Ukraine seeded 6.5 million hectares to winter wheat.

- Ukrainian authorities have accused Russia of undermining the Black Sea grain deal by holding up ships, thereby limiting the amount of grain reaching other countries. According to the United Nations, there is currently a logjam of over 150 cargo ships. Officials are now scrambling to extend the fragile agreement, which is set to end around Nov. 19.

- WNBA star Brittney Griner's appeal of nine-year prison sentence rejected by Russian court. The basketball star has been imprisoned since her Feb. 17 arrest on charges of entering Russia with vape cartridges, which her lawyers said were prescribed to her as part of treatment for chronic pain and other conditions.

|

POLICY UPDATE |

— ERP payouts at $7.09 billion as of Oct. 23; specialty crop payouts top $1 billion. Payments under the Emergency Relief Program (ERP) totaled $7.09 billion as of Oct. 23, up from $7.03 billion the prior week, according to USDA data. The total includes $6.08 billion in non-specialty crop payments ($6.04 billion prior) and now over $1 billion in payments for specialty crops — $1.03 billion ($991.3 million prior). There have been 280,580 approved applications paid. There are still payments to be issued under a second effort via the Phase 1 ERP payments and Phase 2 of ERP that are still to come.

|

CHINA UPDATE |

— The yuan continues to tumble, hitting the weakest level against the dollar since 2007. The currency has now fallen 13% this year and the recent sell-off followed a 7% decline in the Hang Seng index. “Traders are losing faith in China following Xi’s radical shake up at the National Congress. The leader used the meeting to fill the Politburo with loyal hardliners committed to zero-Covid and unfriendly market policies,” said broker SP Angel. China’s central bank reacted to the yuan’s weakness by moving the upper limit for cross-border financing, with the aim of boosting foreign capital inflows. On Monday there was a worldwide sell-off of Chinese tech stocks in reaction to President Xi Jinping’s tightening grip on power.

— Xi fully in charge… now what? After securing an unusual third term at the helm of China’s ruling Communist Party, Xi Jinping will now have to show he can guide the country’s ailing economy back to strength. Recent economic data show an economy struggling to overcome this year’s Covid lockdowns.

Markets tumbled Monday in a sign of investor wariness in Xi and his team of economic advisors (loyalists). The absence of Chinese Premier Li Keqiang and other pro-growth technocrats from China's key decision-making body disappointed foreign investors. China watcher Bill Bishop says: “Yes they may all be “yes men” and so the risk of policy errors increases, but they also may be able to push policy changes faster and more effectively, for good or bad, and the new Politburo has several experienced engineering and technology managers who may be a perfect ft for a more ‘techno-nationalist’ government.”

Bishop listed some of the key themes from the Party Congress that appear to be contributing to the anxiety include:

- Xi’s dominance;

- no signal of change from dynamic zero-Covid;

- more focus on self-reliance and technology competition;

- emphasis on national security;

- role of the state in the economy;

- a shifting assessment of the geopolitical environment that may signal a judgement that significant conflict, likely with the U.S. again, is possible;

- new language about Taiwan and Common Prosperity in the Party Constitution, among several other issues.

Key question: Can Xi continue to consolidate economic power in the state and be able to arrest China’s slow-motion housing-market meltdown. If Xi as expected continues to favor state support on sectors favored by Beijing’s drive for self-reliance, it could mean slower productivity growth and a more isolated leadership, with fewer voices cautioning against overreach. That will increase uncertainty.

— Two Chinese intelligence officers were charged with trying to bribe a U.S. law-enforcement official to obtain inside information about the racketeering case against China’s Huawei Technologies. The Chinese Embassy in Washington could not immediately be reached for comment, the Wall Street Journal reported. The two men — who remain at large — paid $61,000 in bitcoin to an FBI agent they believed to be a mole. The firm, identified only as a Chinese telecoms giant in the complaint, was confirmed to be Huawei by several news outlets.

The legal move, announced by the Justice Department, comes as China’s leader Xi Jinping is expected to meet President Joe Biden in Asia in November for their first face-to-face meeting as heads of state.

|

ENERGY & CLIMATE CHANGE |

— Yellen downplays hopes on EV tax credit changes. Treasury Secretary Janet Yellen is dousing expectations that the agency will provide relief to foreign automakers lobbying against stringent limits on a popular electric-vehicle tax credit. “I’ve heard a lot about the concerns of the Koreans and Europeans about those rules, and we’ll certainly take them into account,” but “the legislation is what it is,” Yellen told reporters Monday, referring to the $7,500 consumer tax credit restricted only to vehicles built in North America. “We have to implement the law that was written.”

“We’re early on in the process for writing rules,” Yellen said. “I gave my assurance that we would listen to their concerns and see what was in the range of the feasible as we implement the rules.”

There’s more: The Inflation Reduction Act has other requirements that will prove challenging for automakers. The bill denies a subsidy after 2023 to automakers that use battery components manufactured in China and other “foreign entities of concern.” Beginning in 2025, that prohibition extends to the use of any critical mineral in a battery that is extracted or processed by those countries.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Visits to McDonald’s restaurants jumped 37.1% the week after it rolled out adult Happy Meals, which include either a Big Mac or 10-piece chicken McNugget entree, french fries, a drink, and a toy. Chipotle, which reports earnings after the markets close today, is expected to have a 14% gain in sales from the same period last year, while McDonald’s, which reports on Thursday, is expected to see an 8% drop in sales, according to FactSet.

— USDA ups food price forecasts for 2022 and 2023. USDA raised their forecast for food price inflation in 2022 and 2023 from their September forecasts, now seeing 2022 prices for all food rising 9.5% to 10.5% (9% to 10% prior), food at home (grocery store) prices moving up 11% to 12% (10.5% to 11.5% prior) and food away from home (restaurant) prices rising 7% to 8% (6.5% to 7.5% prior). While USDA still sees smaller increases in 2023, they upped their forecasts to all food prices rising 3% to 4% (2.5% to 3.5% prior), grocery store prices increasing 2.5% to 3.5% (2% to 3% prior) and restaurant prices moving up 4% to 5% (3% to 4% prior).

|

HEALTH UPDATE |

— Summary:

- Global Covid-19 cases at 628,134,175 with 6,579,953 deaths.

- U.S. case count is at 97,239,469 with 1,067,882 deaths.

- Johns Hopkins University Coronavirus Resource Center says there have been 632,905,664 doses administered, 265,591,330 have received at least one vaccine, or 80.61% of the U.S. population.

|

POLITICS & ELECTIONS |

— House rating change: Rep. Sean Patrick Maloney (D) moves from Lean D to Toss Up via a change by House editor David Wasserman of the Cook Political Report with Amy Walter. He says Dems admit the DCCC chair is now in serious danger in #NY17. Link for more.

|

OTHER ITEMS OF NOTE |

— Justice Clarence Thomas temporarily blocked a subpoena of Sen. Lindsey Graham (R-S.C.) to testify in a probe of efforts to subvert President Biden’s 2020 victory in Georgia. The Supreme Court is set to consider the claim of congressional immunity.

— Jamie Dimon, the boss of JPMorgan Chase, said he believes that America and Saudi Arabia will “remain allies” despite recent tensions. Dimon is currently in Riyadh, Saudi Arabia’s capital, for the Future Investment Initiative conference. American bankers have flocked to “Davos in the desert” but officials from the Biden administration are notably absent amid a continued spat over oil production.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 | New farm bill primer |