OECD Issues Bleak Warning About Global Economy | British Pound Takes a Pounding ALL

House Ag panel Republicans want some answers on alleged Biden/USDA overreach using executive actions

|

Italy goes hard right Italy will have its first far-right government since Mussolini. Giorgia Meloni will become Italy’s first female prime minister. Fratelli d’Italia, Meloni’s party, is projected to be the winner. It will be weeks before the new Italian parliament is seated and a new gov’t formed. EU officials warned Italy last week of consequences should it veer away from democratic principles.

|

GOP on Biden ag overreach House GOP Ag Committee members sent a letter to USDA Secretary Tom Vilsack questioning the Biden administration’s overreaching executive actions on use of the CCC, controversial livestock and poultry marketing reforms and other actions to advance “some of its most radical priorities.” |

6.29% Average rate on a 30-year fixed mortgage. Millions of Americans have locked in lower borrowing costs, making them reluctant to sell and look for something bigger, newer or nicer. As of July 31, nearly nine of every 10 first-lien mortgages had an interest rate below 5% and more than two-thirds had a rate below 4%, according to mortgage-data firm Black Knight Inc. |

Bear market’s next step New lows are expected for U.S. equities as many analysts do not see a bottom yet. Meanwhile, yields on the 10-year Treasury surged more than 10 basis points for a new 11 year-high of 3.829% on Friday, while the 2-year Treasury hit a 15-year record of 4.266% — deepening the yield curve inversion to some 50 basis points, the widest gap in more than 30 years. |

|

In Today’s Digital Newspaper |

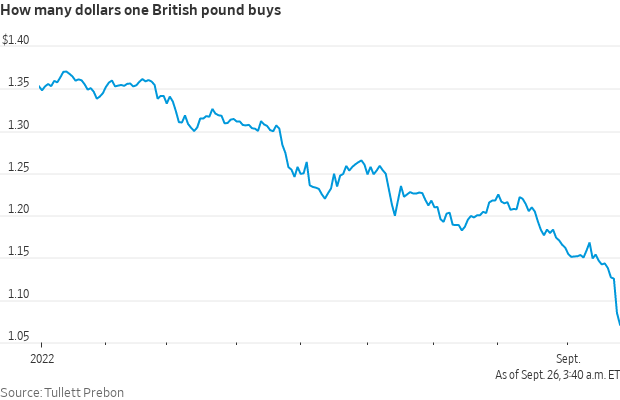

The British pound is taking a pounding as it hit a record low against the U.S. dollar amid concerns among investors about the new U.K. government's approach to tax cuts and economic growth. It plunged almost 5%. The bulk of the currency’s slide in Asian trading took place in a frantic 20-minute selloff, evoking a flash crash by traders.

Oil prices plunged to their lowest levels since January early Monday, with the price of international benchmark Brent crude slipping below $85 a barrel.

OECD’s latest economic outlook says the global economy is slowing faster than it had previously anticipated. The club of rich countries expects growth to “remain subdued” for the rest of this year, before “slowing further” in 2023 to just 2.2%. It blames Russia’s invasion of Ukraine, monetary tightening around the world and the lockdowns associated with China’s Covid-19 policy for the downbeat forecast.

Russia’s invasion of Ukraine will cost the global economy at least $2.8 trillion in lost output by the end of next year, the OECD calculates.

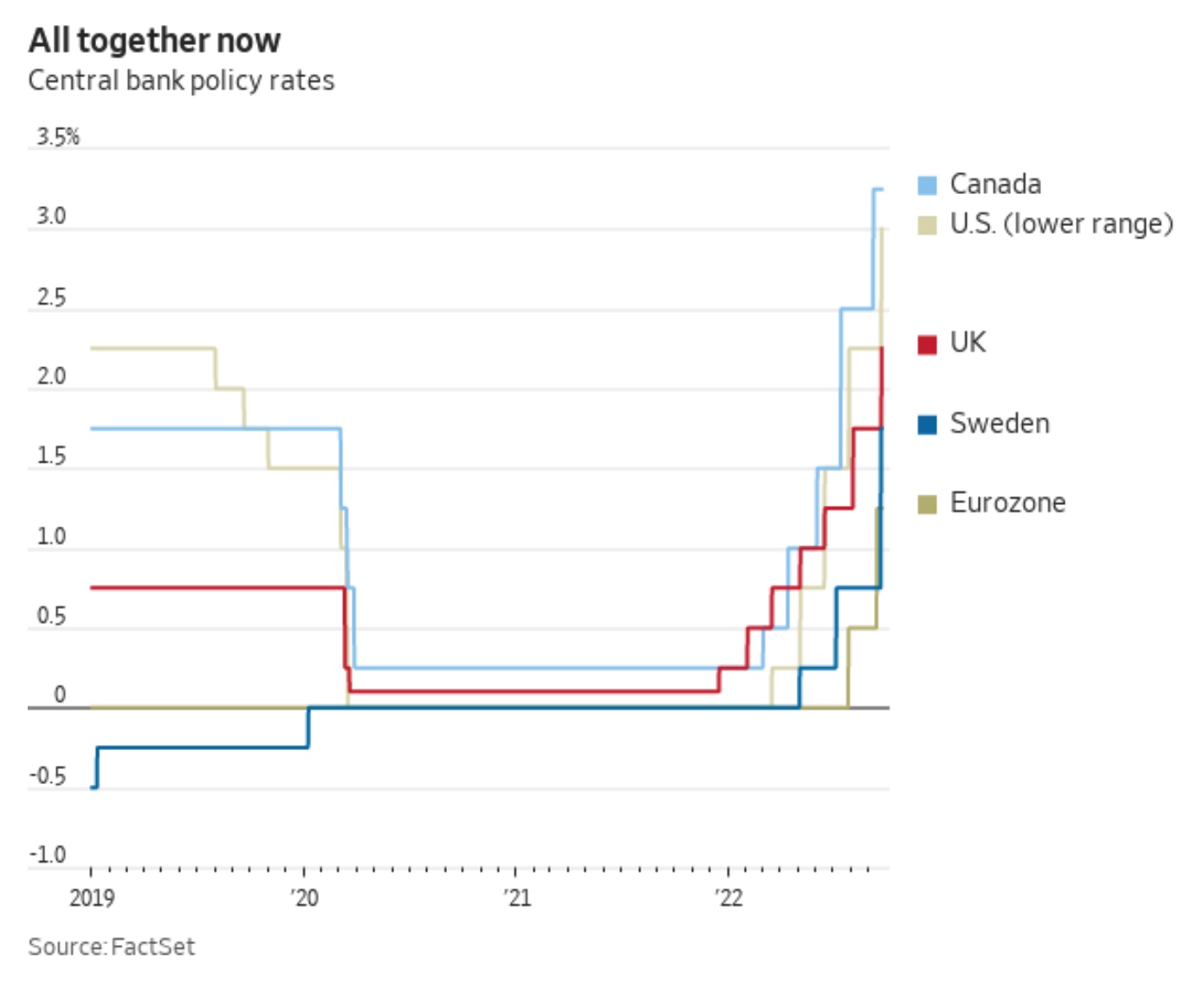

Fast and furious… Central banks around the world are raising their key interest rates in the most widespread tightening of monetary policy on record.

WSJ calls Biden trade policy a failure and a missed opportunity in reaching a deal with the U.K.

Dough McKalip has hit a snag with a Democratic senator that could postpone his Senate approval vote to be the Chief Agricultural Negotiator, Office of the United States Trade Representative (USTR). Details in Personnel section.

House Ag Committee Republicans sent a letter to USDA Secretary Tom Vilsack on what the lawmakers say is executive action overkill by the White House and USDA, including Vilsack’s aggressive use of the CCC as an ATM machine.

If you were confused Friday about the EPA announcement on glyphosate, you were not alone. Bottom line: glyphosate can still be used.

Another cotton industry analyst takes on USDA NASS’ cotton estimates.

Another reason has surfaced for still higher farmland values and interest: The WSJ notes we’re running out of land that’s easy for building new houses (reasons cited below). Thus, the look at farmland.

Who’s on the hook for the new U.S. corporate minimum tax? Just six companies — including Amazon and Berkshire Hathaway — would have paid half of the estimated $32 billion in tax revenue the new levy would have generated had it been in place last year, researchers found. The 15% tax is set to take effect in January. Link to report.

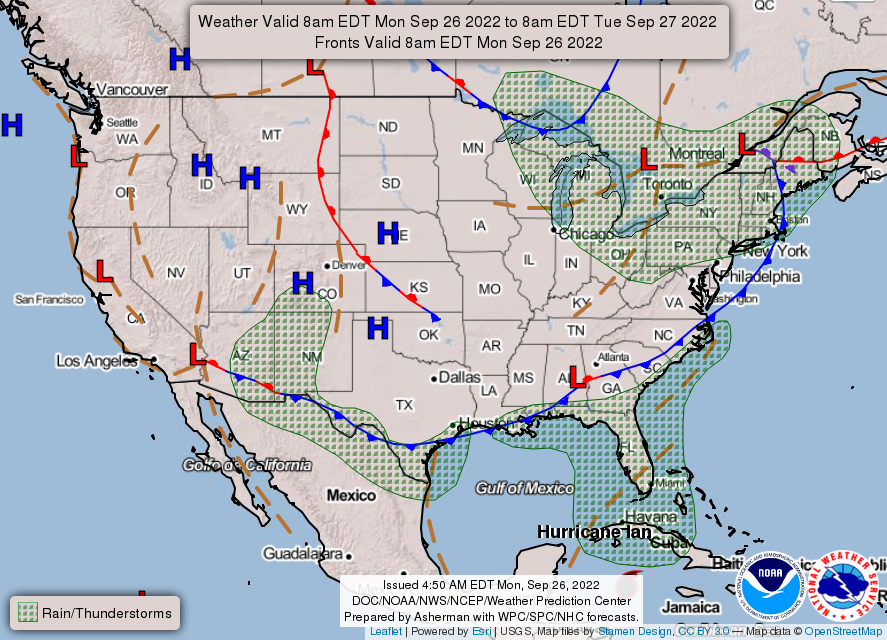

Storm Ian became a hurricane as it churned through the Caribbean, bringing the threat of flooding to parts of Cuba and tornadoes to southern Florida.

Pfizer CEO tests positive for Covid-19 for second time in two months.

Antigovernment protests in Iran gathered strength Sunday with demonstrations in many cities amid growing unrest.

DART, a space probe, will be crashed into Dimorphos, a small rock in orbit around a larger one, Didymos. The intention of the Double Asteroid Redirection Test (DART) is to shorten Dimorphos’ orbital period, now 11.9 hours, by about ten minutes. That will test the feasibility of deflecting such an asteroid, should one be discovered which threatens to collide with Earth. If something the size of hit Earth it could take out half a continent.

Election Day 2022 is 43 days away. Election Day 2024 is 771 days away.

|

MARKET FOCUS |

Equities today: Global stocks and bonds fall, in a volatile start to the week amid recession fears. It’s upscale funk for U.S. equities as traders are digesting comments from Atlanta Fed President Rafael Bostic, who told CBS’ Face the Nation that he expected some job losses from the Fed’s campaign against price increases – but “smaller than what we’ve seen in other situations.” In Asia, Japan -2.66%. Hong Kong -0.37%. China -0.4%. India -1.17%. In Europe, at midday, London -0.03%. Paris +0.16%. Frankfurt +0.18%.

U.S. equities Friday: Plunge. The Dow ended down 486.27 points, 1.62%, at 29.950.41, ending less than 1% above the 29,278.05 it needs to fall below to enter a new bear market. The Dow fell at one point more than 826 points and flirted with bear market territory on an intraday basis. The Dow notched a new low for the year and closed below 30,000 for the first time since June 17. The Nasdaq dropped 198.88 points, 1.80%, at 10,867.93. The S&P 500 fell 64.76 points, 1.72%, at 3,693.23. The S&P and Nasdaq finished at their lowest levels since June, while the Dow notched a new year-to-date low.

Big losses for week…again. Global economic worries, rising Treasury bond yields and a stronger U.S. dollar combined to press stocks sharply lower. The major averages capped their fifth negative week in six, with the Dow giving up 4%. The S&P and Nasdaq shed 4.65% and 5.07%, respectively.

S&P 500 spirals 23% this year, and economists at Goldman project it will sink another 3% by December and could take more than a year to recover losses. The tech-heavy Nasdaq has plummeted 32% since January, the Dow nearly 20%.

Worst year for buying the dip since the 1930s: WSJ (link). Instead of rebounding after a tumble, stocks have kept falling, burning investors who stepped in to try to buy shares on sale. The S&P 500 has dropped 1.2% on average this year in the week after a one-day loss of at least 1%, the biggest such decline since 1931. In the days ahead, data on consumer spending will provide investors with clues on how high prices are shaping Americans’ behavior and the extent to which interest-rate increases are rippling through the economy.

It could be worse. On this day in 1955, President Dwight D. Eisenhower suffered a heart attack, and the stock market had a coronary right with him, plunging by 6.62% — which even today remains one of the worst daily losses of the past 100 years.

10-year Treasury yield rallied at a Friday session peak of 3.829% before settling at 3.695%, while the 2-year Treasury yield climbed as high as 4.27% before ending at 4.201%.

Agriculture markets Friday:

- Corn: December corn futures fell 11 1/2 cents to $6.76 3/4, down 1 cent for the week and the lowest closing price since $6.68 1/2 on Sept. 8.

- Soy complex: November soybeans sank 31 1/4 cents to $14.25 3/4, down 22 3/4 cents for the week and the contract’s lowest close since Sept. 9. December soymeal dropped $5.60 to $423.30 and December soyoil fell 278 points to 63.68 cents.

- Wheat: December SRW wheat fell 30 1/4 cents to $8.80 1/2 but still rose 20 3/4 cents for the week. December HRW wheat dropped 29 cents to $9.50 1/2, up 15 1/4 cents for the week. December spring wheat fell 28 1/2 cents to $9.49 1/4.

- Cotton: December cotton fell the 400-point daily limit to 92.54 cents, down 675 points for the week.

- Cattle: December live cattle fell 80 cents to $148.55, down $2.425 for the week and the contract’s lowest close since Aug. 31. November feeder cattle rose 20 cents to $178.25.

- Hogs: December lean hogs fell $2.875 to $82.80, the lowest close since Sept. 12.

Ag markets today: Outside markets and global economic concerns weighed on grain and soy markets overnight. As of 7:30 a.m. ET, corn futures were trading 4 to 5 cents lower, soybeans were 6 to 8 cents lower, SRW wheat was 12 to 13 cents lower, HRW wheat was 6 to 19 cents lower and HRS wheat was mostly 7 to 9 cents lower. Front-month crude oil futures were around 80 cents lower and the U.S. dollar index was more than 550 points higher, scoring a fresh 20-year high.

Technical viewpoints from Jim Wyckoff:

On tap today:

• European Central Bank President Christine Lagarde appears at a European Parliament committee hearing at 9 a.m. ET.

• Dallas Fed's manufacturing survey for September is out at 10:30 a.m. ET.

• USDA Grain Export Inspections report, 11 a.m. ET.

• Federal Reserve speakers: Boston's Susan Collins to the Greater Boston Chamber of Commerce at 10 a.m. ET, Atlanta's Raphael Bostic at a Washington Post Live event at 12 p.m. ET, Dallas's Lorie Logan to the Independent Bankers Association of Texas at 12:30 p.m. ET, and Cleveland's Loretta Mester at a Massachusetts Institute of Technology event at 4 p.m. ET.

• USDA Crop Progress report, 4 p.m. ET.

• Rosh Hashana, the Jewish New Year, one of Judaism’s holiest days, commemorating the creation of the world, is celebrated.

• NASA’s Double Asteroid Redirection Test (Dart) mission to deliberately crash a spacecraft into an asteroid is expected to begin.

• OECD publishes its forecast of the near-term prospects for the global economy in its interim economic outlook (see item below).

• U.S. Vice President Kamala Harris visits Japan (for state funeral of former PM Shinzo Abe) and South Korea until Sept. 29.

• President Joe Biden is scheduled to host the Atlanta Braves at the White House at 11:45 a.m. ET to celebrate their 2021 World Series victory. At 4:15 p.m. ET he is set to deliver remarks at the third meeting of the White House Competition Council.

Recession predictor’s 60-year success. A Federal Reserve study in 2018 found every recession in the past 60 years has been preceded by a yield curve inversion, and analyst Tom Essaye of the Sevens Report says the widening gap between 2-year and 10-year Treasurys is "screaming that a serious economic contraction is coming," adding "everyone should be preparing" for a material economic slowdown in the coming months and quarters. In a Friday note, Bank of America economists said they expect the economy will fall into a recession in the first half of next year, with real GDP falling 1% after adding 5% last year, and unemployment rising to 5.6% — potentially wiping out more than a year of job gains.

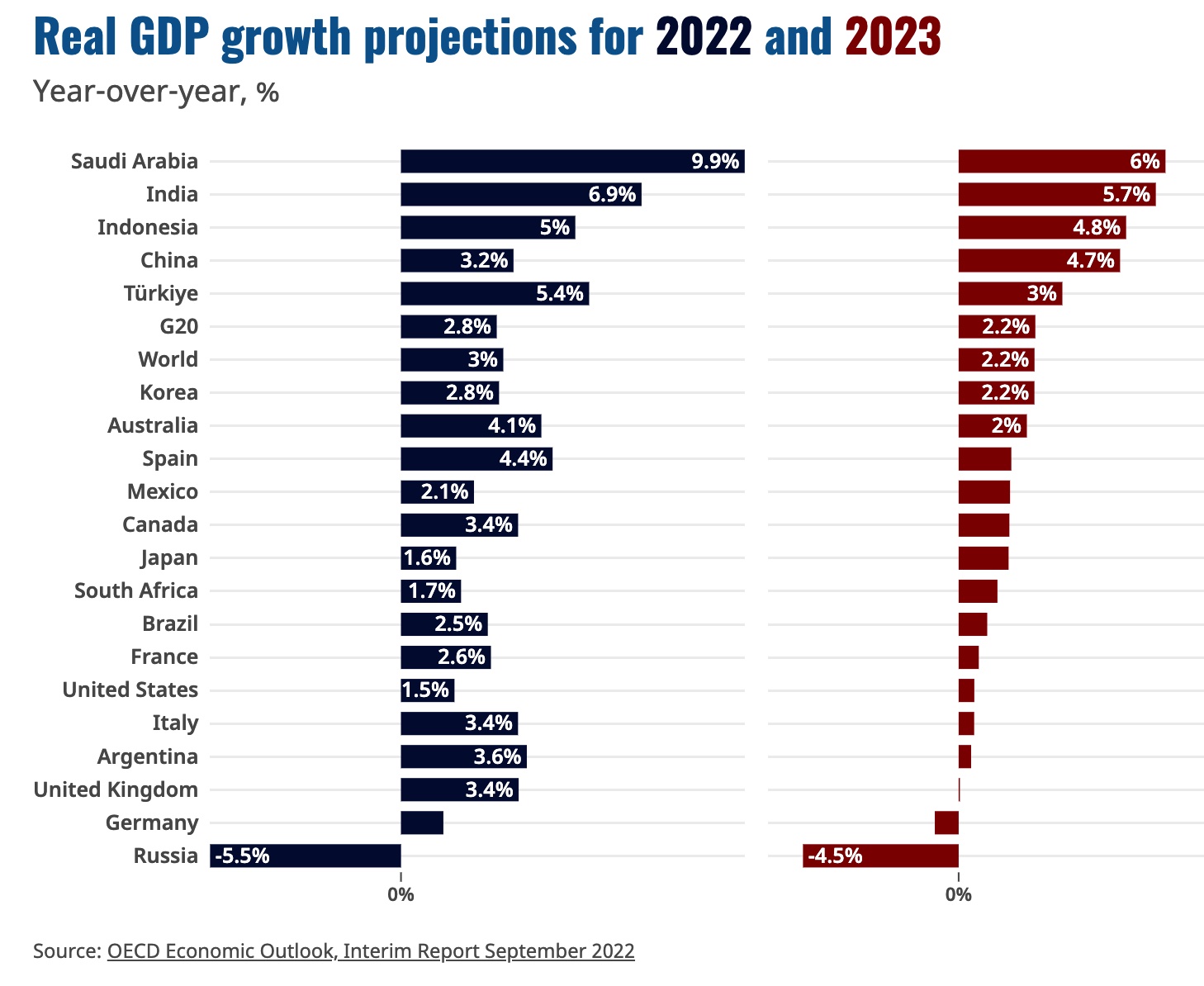

OECD: World economy to slow more than anticipated. Global economic growth is expected to slow sharply to 2.2% next year, revised down from a forecast in June of 2.8%, and compared with a 3.0% expansion projected for 2022, says the Organization for Economic Cooperation and Development (OECD). The Paris-based policy forum said that disruptions to energy supplies due to the war in Ukraine and the generalized tightening of monetary policy are weakening the economic outlook, as inflation remains high for longer than expected.

Russia’s invasion of Ukraine will cost the global economy $2.8 trillion in lost output by the end of next year — and even more if a severe winter leads to energy rationing in Europe, according to the OECD.

The Eurozone's GDP growth is seen easing to only 0.3% in 2023 (vs June forecast of 1.6%) from 3.1% this year, with Germany's Russian-gas dependent economy contracting 0.7% (vs June forecast of 1.7% growth).

The U.S. economy should grow only 0.5% next year (vs June forecast of 1.2%), compared to 1.5% in 2022.

China's GDP should advance 4.7% (vs June forecast of 4.9%) after advancing 3.2% this year amid shutdowns related to the pandemic and property market weakness.

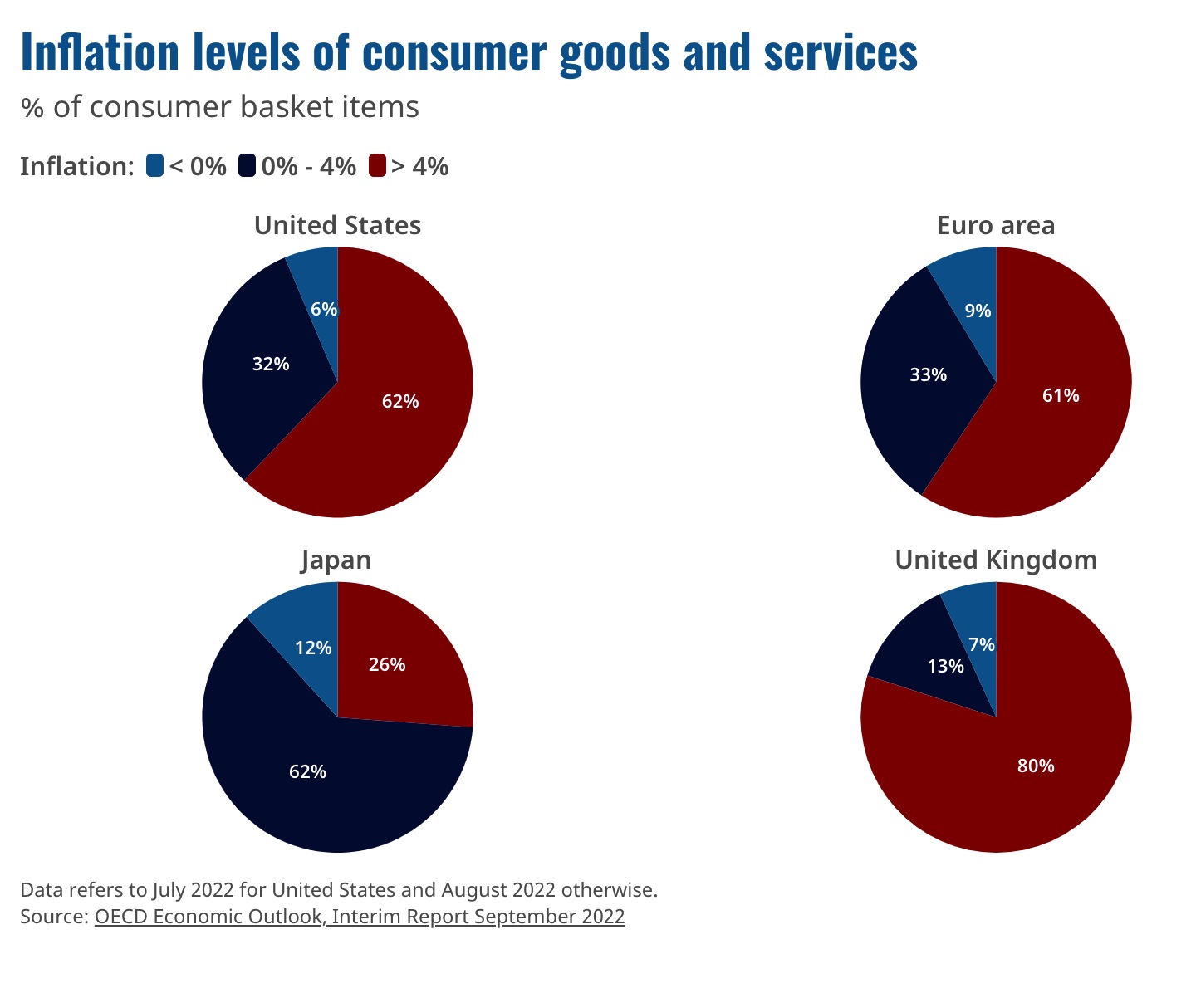

Central banks around the world are raising key interest rates in the most widespread tightening of monetary policy on record. Some economists fear they may go too far if they don’t consider their collective impact on global demand. According to the World Bank, the number of rate increases announced by central banks around the world was the highest in July since records began in the early 1970s.

Short sellers upended a small farm real-estate company. Farmland Partners’ shares plummeted after a report said the company was in trouble. Prosecutors and regulators have been examining what happened. Link to Wall Street Journal story.

Is the U.S. actually running out of land to build homes? The U.S., despite being a country of wide open spaces, is short on land. Or at least land where people can live, says a Wall Street Journal reports (link). Reasons: Land-use restrictions and a lack of public investment in roads, rail and other infrastructure have made it harder than ever for developers to find sites near big population centers to build homes. In the Sunbelt, the average price of vacant land per acre more than doubled in the past two years through the second quarter, according to Land.com, a land-listing website owned by real-estate firm CoStar Group. The lack of supply and the strong demand mean land prices will likely continue to rise in the long term. The story relates how this is putting more focus on the move to buy farmland for other purposes.

Market perspectives:

• Outside markets: The U.S. dollar index is higher and pushed to another 20-year high in early U.S. trading. Treasuries extended their worst bond slide in decades as a dollar gauge rose to yet another record. European equities also dropped after sliding into a bear market on Friday. The yield on the 10-year U.S. Treasury note is rising and presently fetching 3.673%. The 2-year Treasury note yield is 4.285%. Oil fell again, with Brent sliding below $85 a barrel at one point and U.S. crude under $78 per barrel. Gold and silver futures are lower with gold around $1,642 per troy ounce and silver under $18.90 per troy ounce.

• The British pound fell to its lowest level against the U.S. dollar since currency moved to a decimal system in 1971. The exchange rate plummeted, approaching $1.03 per pound during early trading on Asian markets and recovered slightly to $1.07 on Monday morning. The pound has been in freefall since U.K. chancellor Kwasi Kwarteng announced a package of major tax cuts and other budget outlays requiring up to £70 billion in borrowing. (That figure was worth approximately $79.5 billion last Thursday; at one point on Monday morning its value had fallen to $72.5 billion.)

• Aluminum hits 1-1/2-year low. Aluminum futures were trading below the $2,200 per tonne mark, a level not seen in over a year and down more than 40% from their March record peak as fears of a demand-sapping global recession and a stronger dollar continued to hang over the market.

• Oil prices tanked on Friday, posting a fourth straight week of declines, and falling to their lowest level since January amid rising fears that a looming economic downturn will hurt global demand in energy markets. The price of U.S. benchmark West Texas Intermediate slid roughly 5% to trade at $79 per barrel, reaching its lowest point since January amid mounting recession fears. Meanwhile, the price of international benchmark Brent crude fell below $87 per barrel, also on track for its lowest close since January.

• UAE agrees LNG deal with Germany. The United Arab Emirates (UAE) has agreed a deal to supply liquefied natural gas to Germany as Chancellor Olaf Scholz visited the Gulf state as part of a regional tour seeking to drum up alternatives to Russian energy. The supplies will be the first delivered to a new import terminal on Germany’s northern coast.

• Maduro: Venezuela ready to send oil to the world. President Maduro explained, “Venezuela is ready and willing to fulfil its role and supply, in a stable and secure manner, the oil and gas market that the world economy needs.” Its output currently stands at around 700,000 bpd compared to 2.3 million bpd two decades ago. This comes from U.S. sanctions imposed on the trading of Venezuelan crude, which previously provided around 96% of the country’s income. Maduro believes the country could rapidly boost its output by several hundred thousand barrels of oil a day, but continued exports would necessitate investments in oil equipment.

• European Union’s working gas in storage 86% full as of Sept. 19, at 960.26 terawatt hours, according to data from the Gas Infrastructure Europe’s Aggregated Gas Storage Inventory (link). The European Commission had proposed measures to ensure supply security at reasonable prices for the winter, including a minimum 80% gas storage level by Nov. 1. European benchmark Dutch TTF gas futures were at 182.90 euros ($182.85) per megawatt-hour on Sept. 21, down 47% from a record of more than €346 in late August. U.S. natural-gas prices have fallen by 20% to $7.779 per million British thermal units on Sept. 21, from a 14-year high settlement of $9.68 on Aug. 22. Link to Reuters item.

• Chicago lumber futures tumbled to level not seen since September 2021 as it plunged towards the $450 per thousand board feet mark, down almost 70% from their March peak. Reason: housing market’s sharp slowdown amid soaring rates.

• Why doesn’t USDA’s NASS know this re: U.S. cotton? Another cotton industry analyst tells Pro Farmer:

“I have a very hard time agreeing with USDA NASS’ recent estimate on cotton production and harvested acres. Yield I do believe they are pretty on par given a national average ranges between 750-850 lbs on average.

“Harvested acres I vastly question….my reasoning is this: To date the Sept NASS report shows 7,714,450 harvested acres, yet when you review the USDA Crop Acreage Report for Sept., which is actual producer certified data through 578’s, it shows harvested acres at 7,190,469, so essentially over 500,000 acres less being harvested than what NASS is reporting and that number will continue to go up as we are now in the process of producers looking at boll counts or production to count through crop insurance and additional acres will be failed.

“If you simply assume the producer certified acreage data at 7,190,469 and maintain the same national yield by NASS of 832 lbs, that pegs U.S. upland production at 12,463,479 bales versus what NASS has reported lately of 13,372,000.

“Long answer short: USDA NASS traditionally does not make many revisions to their production estimates going forward this year other than maybe tweaking yield. However, based on hard data from 578 reports and failed acres continuing to ensue going into harvest….the NASS yield component maybe accurate but their production estimate and harvested acreage estimate are more than likely very generous compared to where we will end up by the end for the production season.”

• Judge clears U.S. Sugar purchase of Imperial Sugar. U.S. Judge Maryellen Noreika issued a decision Friday ruling in favor of U.S. Sugar Corporation purchasing Imperial Sugar Company, rejecting the argument made by the U.S. Dept. of Justice (DOJ) the purchase would drive up sugar prices for households and other users of sugar. DOJ argued that allowing the $315 million deal to go through would give US Sugar some 75% of refined sugar sales in the southeast U.S.

• Ag trade: South Korea purchased 135,000 MT of corn from unspecified origins. Taiwan tendered to buy 51,800 MT of U.S. milling wheat. The U.N. World Food Program tendered to buy 100,000 MT of milling wheat to be donated to poorer countries.

• Pakistan’s flood disaster tab. The World Bank has committed $2 billion in aid to Pakistan (against estimated damages of $30 billion) as it grapples with extreme flooding that has killed at least 1,600 people, displaced nearly 8 million more, and fueled fears of spreading waterborne diseases.

• Ian forecast to become 'major' hurricane, could slam Florida. Florida Gov. Ron DeSantis declared a state of emergency. AccuWeather meteorologists are warning that the storm could slam the west coast of Florida — an often-missed target. The U.S. database show that about 160 hurricanes, excluding tropical storms, that have affected Florida. Only 17 have made landfall on the west coast north of the Florida Keys. Most storms typically travel northeast or northwest, not up the coast, AccuWeather Senior Weather Editor Jesse Ferrell said. There is no record of a hurricane ever having tracked entirely up the west coast of Florida since records began in 1944. But Ian appears like to take a "very unusual track," he told USA Today.

• NWS weather: Threat of a major hurricane increasing along the west coast of Florida by Wednesday... ...Cool and unsettled weather expected to persist across the Northeast and Great Lakes over the couple of days... ...Well above average temperatures forecast throughout the West, with excessive heat impacting parts of southern California.

Items in Pro Farmer's First Thing Today include:

• SRW futures lead overnight losses in grain, soy futures

• China’s soymeal prices hit record-high (details in China section)

• China attempts to halt yuan slump

• Cattle on Feed Report mostly neutral

• Cash hog fundamentals weaken

|

RUSSIA/UKRAINE |

— Summary: The long haul. If no peaceful negotiation can be reached which legalizes Russia’s occupation, the Kremlin can continue to attack random targets in Ukraine with the single goal of preventing the country’s reconstruction, say some observers.

- More than 2,000 people have now been arrested for participating in sweeping demonstrations. Across the country, protesters chanted “Send Putin to the trenches!” and “No to war!” Hourslong lines have formed to enter Mongolia, Finland, Georgia, and Kazakhstan, although Russia’s European Union neighbors — Finland, Lithuania, Latvia and Estonia — have decided to shut their doors to fleeing citizens.

Putin’s response: Ramping up the cost of dissent, implementing new laws that punish those who desert, surrender, or resist fighting with a potential 10-year sentence. More: offering citizenship to foreigners who enlist and attempting to recruit Ukrainians in Russian-occupied territories. - White House warns Putin: Don’t you dare. President Joe Biden’s administration has privately told the Kremlin that any use of nuclear weapons in the war in Ukraine would have “catastrophic consequences” for Russia, White House National Security Adviser Jake Sullivan said. Russian President Vladimir Putin renewed his warnings of a nuclear threat as he mobilized hundreds of thousands of reservists after Ukrainian forces recaptured a swath of Russian-occupied territory. Those nuclear threats are “a matter that we have to take deadly seriously,” Sullivan said on CBS’s Face the Nation on Sunday. Sullivan said the U.S. also has made it clear in public that it would “respond decisively if Russia uses nuclear weapons.’’

- NYT writer David Brooks on Russia’s losses in war on Ukraine, citing American intelligence officials: “Somewhere between 80,000 and 110,000 Russian troops have been killed or wounded in the past seven months. Russia has lost 50% of its prewar military tanks. It’s lost 20% to 30% of its infantry fighting vehicles and a tenth of its advanced fighter planes. The Russians have also burned through huge amounts of precision munitions. Morale is awful.”

American policymakers preparing for how Putin could escalate the war. Brooks writes (link), “if he pretends Russia itself is being invaded. He could lob missiles onto American installations in Poland and elsewhere in Central and Eastern Europe. He could escalate in space by destroying satellites. He could launch a missile strike against a NATO ally. And of course, he could use a tactical nuclear weapon — perhaps on a Ukrainian town, on a Ukrainian military unit or just in an open field to show he means business. The intent would be to intimidate the West into ceasing all support for Ukraine.” - Eight ships carrying 131,300 tons of ag products to Africa, Asia and Europe were set to leave the ports of Odesa and Chornomorsk on Saturday, Ukraine’s Infrastructure Ministry said. Six ships sailed early in the morning and formed a caravan, with two more on the way. Since the safe-transit agreement brokered by Turkey and the U.N. was reached between Ukraine and Russia in late July, 221 ships have left Ukraine’s ports on the Black Sea with 4.7 million tons of agriculture products, chiefly grains.

|

POLICY UPDATE |

— Glyphosate interim decision withdrawn. It took a while Friday for even smart people to understand what occurred as news broke that the Environmental Protection Agency (EPA) withdrew an interim decision for glyphosate (link), the active ingredient in Roundup. EPA said it will complete its registration review in 2026. The decision followed a June opinion from the U.S. Court of Appeals for the 9th Circuit that vacated the human health portion of EPA’s interim decision after finding the cancer analysis was flawed. It also remanded, but did not vacate, the agency’s ecological risk assessment after finding that the interim decision should not have been issued without an “effects determination” detailing impacts on threatened and endangered species. EPA had been facing an Oct. 1 deadline to complete its registration, but the withdrawal was expected, Roundup maker Bayer said.

EPA says withdrawing doesn't mean it's necessarily changing its position on the human-health assessment. EPA said the court action does not mean the conclusion was "either incorrect or cannot be used as support for a future decision following reconsideration in accordance with the court's decision." However, the agency said it intends to "revisit and better explain" its evaluation of glyphosate's potential carcinogenic effects on people.

What it means after taking out the gov’t gobbledygook: “It’s important for farmers to know that label restrictions for glyphosate are not changing right now,” said Laura Campbell, senior conservation and regulatory relations specialist for Michigan Farm Bureau. “We’ll be watching this closely and make sure that the EPA is hearing from stakeholders in agriculture about the safety of glyphosate, the protective measures we use for the environment and the devastating impacts that further restrictions would have.”

— GOP Ag panel members focus on Biden administration’s executive overreach. In another blast at the Biden administration, Rep. Glenn "GT" Thompson, ranking member of the House Ag Committee, was joined by every Republican member of the committee in sending a letter (link) to USDA Secretary Tom Vilsack questioning the Biden administration’s overreaching executive actions. “As you are aware, a recent Supreme Court decision, West Virginia v. EPA, clarified the limitations of certain agency action. Given this administration's concerning reliance on executive actions to advance some of its most radical priorities, we are compelled to underscore the implications of West Virginia v. EPA and to remind you of the limitations on your authority,” the letter said. “Relatedly, we are requesting information regarding USDA’s efforts to review recent and pending agency actions in light of this important holding.”

Other complaints: “We remain concerned that a variety of USDA’s recent and pending actions rely on specious statutory interpretation to achieve political goals well beyond Congressional intent. From repeated abuses of the Commodity Credit Corporation Charter Act to controversial livestock and poultry marketing reforms, the potential effects of these actions are far reaching and of enormous economic significance to our nation’s farmers, ranchers, foresters, and consumers… As the committee of jurisdiction overseeing your agency, we intend to exercise our oversight authority to ensure the Biden administration does not continue to exceed Congressional authorizations.”

Prediction: If the GOP wins control of the House after Nov. 8 election, a major change of focus will take place in the Ag panel. And, USDA Secretary Vilsack will face lots of questions and appearances before the panel.

— Disaster aid doesn’t appear to be hitching a ride on the CR, despite President Joe Biden’s request for $6.5 billion in emergency funds ($1.5 billion for ag disasters). Senate Appropriations Vice Chairman Richard Shelby (R-Ala.) said the request for emergency aid could likely wait until December negotiations on a full-year funding bill. That would likely include funds for Puerto Rico, which was hit by Hurricane Fiona, and funds to help those affected by flooding in Senate Minority Leader Mitch McConnell’s home state of Kentucky. Ag disaster funding is also expected.

FEMA’s Disaster Relief Fund had $15.1 billion on hand at the end of August and was projected to have $13 billion on hand at the end of September, according to its monthly report released Sept. 8.

— Black farmers are skeptical about federal loan aid designated as discrimination funding in the health, climate and tax law, the WSJ reports (link). The congressional funding provisions are intended to reckon with what courts and government investigations have found to be a history of discrimination by USDA. For many Black farmers, they will have to see the money to believe it.

|

PERSONNEL |

— It appears McKalip has hit a snag after being advanced by the Senate Finance Committee earlier this month to be the Chief Agricultural Negotiator, Office of the United States Trade Representative (USTR). Sen. Bob Menendez (D-N.J.), the only senator not to vote for Dough McKalip to advance from committee, is holding up the nomination over transparency concerns at USTR. The senator told Politico that he’s opposing the nomination “as a way to send the clearest signal that he firmly believes Americans deserve honest and transparent trade policy that prioritizes the economic interests of the country and cracks down on waste, fraud, and abuse.” He signed a letter in May with five others (Ds & Rs) complaining about USTR relative to their negotiations at the WTO, saying they have not briefed congressional committees.

|

CHINA UPDATE |

— China’s soymeal prices hit record-high. Soymeal prices in China are at record highs as rising demand from farmers follows months of lackluster soybean imports. Chinese soymeal prices surged to an average of 5,352 yuan ($747.94) per metric ton on Friday. China’s soybean crushers have scaled back purchases of soybeans in recent months due to high global prices and poor demand from the livestock industry. Some plants, especially in northeast China, have halted operations due to a shortage of beans, said a Beijing-based soybean trader told Reuters. Soymeal stocks have fallen for 10 consecutive weeks to 493,000 MT in the week ended Sept. 17, well below the five-year average of 845,000 MT, according to Shanghai JC Intelligence Co Ltd.

— China attempts to halt yuan slump. The People’s Bank of China (PBOC) said it would raise the foreign exchange risk reserves for financial institutions when purchasing FX through currency forwards to 20% from the current zero, starting on Sept. 28, to “stabilize FX market expectations and strengthen macro prudential management.” The move to resume FX risk reserves would effectively raise the cost of shorting the yuan. Spot yuan hardly budged on the announcement. PBOC again set firmer-than-expected official guidance for the 23rd straight trading session, at 7.0298 per dollar — the weakest level since July 7, 2020.

— U.S., U.K. seek U.N. human rights debate about China’s Xinjiang. Countries including the U.S. and the United Kingdom are calling for a debate at the United Nations Human Rights Council to discuss concerns about China’s treatment of Uyghurs and other Muslims in the far western region of Xinjiang. A group of countries had been considering action at the ongoing council meeting in Geneva following the release of a much-anticipated U.N. report published last month which stipulates that “serious human rights violations have been committed” in Xinjiang that may amount to crimes against humanity. The so-called “draft decision” reviewed by Reuters seeks a debate during the council's next session that begins in February.

|

TRADE POLICY |

— WSJ editorial slams Biden’s trade policy, saying it “has largely been a failure, hardly better than Donald Trump’s, and the latest proof is the collapse of hope for a bilateral deal with the United Kingdom.” Link to editorial.

Facts and figures: The U.K. is the fifth largest market for American goods, and eight largest source of U.S. goods imports, according to the Office of the U.S. Trade Representative. While the European Union collectively is the U.K.’s largest trading partner, Britain trades more with the U.S. than any single nation.

Key quote: U.K. PM Liz Truss “has inherited a dismal status quo created by leaders on both sides of the Atlantic. Though the Trump administration started work on a deal, it never got far, and President Biden seems too afraid of the politics of trade… Truss will now have to focus on her daring domestic reform agenda, but it’s too bad Mr. Biden let growth in trade slip away.”

|

ENERGY & CLIMATE CHANGE |

— 156 million: Number of carbon credits purchased by companies, governments and individuals last year, a record, according to a Wall Street Journal analysis (link). There is currently a surplus of 705 million credits, but that could turn to shortage as businesses, acting to meet their climate pledges partly by offsetting the emissions they can’t eliminate on their own, boost demand.

— Gov’t roadmap for SAF development. The Biden Administration released its plans for boosting Sustainable Aviation Fuel (SAF) production. The report (link) lists various challenges ahead and calls for “coordination of U.S. government support” for oilseed cover crops and other near-term lipid crops.

The goals:

- Achieving a minimum of a 50% reduction in life cycle greenhouse gas emissions compared to conventional fuel.

- Meeting a goal of supplying sufficient SAF to meet 100% of aviation fuel demand by 2050.

- scale up the production of SAF to 35 billion gallons per year by 2050. A near-term goal of 3 billion gallons per year is established as a milestone for 2030.

— France to halt export financing for fossil fuels in 2023. France will not provide gov’t export financing guarantees for all fossil fuel projects starting in 2023, Finance Minister Bruno Le Maire announced Monday. The action is linked to French commitments at the U.N. climate conference in Glasgow last year to end public financing for some fossil fuel projects at the end of 2022. The budget for 2023 states that export guarantees will no longer be given from January for all upstream and downstream fossil fuel projects.

|

HEALTH UPDATE |

— Summary:

- Global Covid-19 cases at 615,165,589 with 6,537,126 deaths.

- U.S. case count is at 96,071,001 with 1,056,416 deaths.

- Johns Hopkins University Coronavirus Resource Center says there have been 161,172,307 doses administered, 268,373,101 receiving at least one dose, or 81.45% of the U.S. population.

— Pfizer CEO Albert Bourla announces he tested positive for Covid-19 — again. Bourla, who last tested positive for the virus in August, was waiting to receive his bivalent booster vaccine. "I’m feeling well & symptom free," Bourla wrote in a tweet. "While we’ve made great progress, the virus is still with us." The CDC approved Pfizer's 30-microgram bivalent booster shot on Sept. 1 for people over the age of 12. As of Thursday, the CDC reported that 4.4 million people had received this updated booster, or roughly less than 2% of the U.S. population. Moderna has a 50-microgram dose approved for people over the age of 18.

|

POLITICS & ELECTIONS |

— 2022 U.S. midterm elections’ huge price tag. Democrats and Republicans are pouring record amounts into their campaigns as they vie for control of the two houses of Congress. Accounting for inflation, total spending by all House and Senate candidates will surpass the 2018 record of around $3 billion by at least $50 million at the current pace of spending, according to a Financial Times analysis of OpenSecrets campaign finance data and available Federal Election Commission filings. These totals do not include spending by outside groups, such as super Pacs, which can add billions more dollars to elections. The Center for Responsive Politics estimates about $5.7 billion was spent in the 2018 midterms, including outside investments. In Pennsylvania, where Democrats hope to flip a Republican Senate seat, candidates have already spent more than $80 million, making it the most expensive race so far this cycle.

— Biden beats Trump again, this time in federal judges appointed. As of Sept. 20, Biden had notched 83 federal judges confirmed by the Senate. At this point in his presidency, Donald Trump had 69 appointees confirmed, according to NBC News (link). If continued at this pace, Biden is on track to beat Trump's historic number of appointees.

— Psaki: Dems know 'they will lose' if midterms are referendum on Biden. Former White House press secretary Jen Psaki said Democrats fully know "they will lose" if the 2022 midterm elections are a referendum on President Joe Biden. Psaki made her prediction during an appearance on NBC's Meet the Press as she shared her opinions on the strengths and weaknesses of the Democrats going into the November 8 elections. In her view, Democrats are vulnerable on the issues of crime and the economy, while they hold the high ground on "extremism." Psaki left this White House in the spring and took a job at MSNBC as host for a show starting next year. She was succeeded in the briefing room by her principal deputy, Karine Jean-Pierre.

— CBS News on Sunday lowered its projection of a Republican House majority after the midterms as Democrats see glimmers of hope to salvage their standing in November’s elections. CBS’ model continues to predict Republicans will flip Democrats’ razor-thin majority in the House, but CBS now estimates Republicans will win 223 seats, down from 226 in August and 230 in July (218 seats are needed for control). CBS’ latest model is in line with other analysts, who generally suggest that Democrats’ standing has improved in recent months.

— Italy lurches to the right. Giorgia Meloni's Brothers of Italy party is the most far-right government since the fascist era of Benito Mussolini. Her alliance, which also includes Matteo Salvini’s League and Silvio Berlusconi’s Forza Italia, claimed about 43% of the vote, according to projections for RAI, the public broadcaster. Meloni, whose party originated in the neofascism movement of the postwar era, has criticized the “LGBT lobby” and called for a naval blockade of immigrants. At the same time, she’s moved closer to the center on issues like controlling Italy’s massive debt burden and supporting Ukraine against Russia. Ahead: European Commission chief Ursula von der Leyen warned of consequences should Italy veer away from democratic principles. She claims the party has ridded itself of fascist elements, and it seeks to make the European Union less bureaucratic. The election was called following the collapse in late July of Mario Draghi’s broad-based administration.

|

CONGRESS |

— Congress’ schedule:

The House returns on Wednesday.

Senators meet late Tuesday to take up a legislative vehicle for a bill to fund the government.

|

OTHER ITEMS OF NOTE |

— NASA spacecraft will deliberately crash an asteroid on Monday to see how the impact affects the space rock's motion. The DART mission — or the Double Asteroid Redirection Test — will be NASA's first full-scale demonstration of deflection technology designed to protect the planet from nefarious space objects. The crash has been compared to a golf cart ramming into a pyramid. Link on how to watch it.

— Swelling protests, crackdown in Iran. The largest antigovernment protests in Iran since 2009 garnered strength on Saturday, spreading to as many as 80 cities. Crackdowns are escalating, including opening fire on crowds. Protests were fueld by the death of Mahsa Amini, a 22-year-old woman arrested by on accusations of violating the hijab mandate. The demonstrations have now gone on for 10 days and at least 41 people have died, state media said. The White House is facing pushback on still holding nuclear talks.

— North Korea test-fired a short-range ballistic missile on Sunday, South Korean officials said, right before U.S. Vice President Kamala Harris began her trip to Japan and South Korea. South Korea’s military said the act was a “grave provocation,” while the U.S. Indo-Pacific Command said it was not an “immediate threat to U.S. personnel or territory, or to our allies.”

After a five-month suspension, freight-train operations between China and North Korea appeared to have resumed, according to South Korean officials. China, which accounts for more than 90% of North Korea’s trade, had halted crossings because of covid-19 infections in the border city of Dandong.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Election predictions: Split-ticket | Congress to-do list |