Rail Strike Averted but Tentative Deal Must be Ratified by Union Members

Putin acknowledges China may have ‘questions and concerns’ about the war

|

In Today’s Digital Newspaper |

President Biden: Railroads, unions reach tentative deal averting strike. The White House and federal officials, working around-the-clock with railroad unions and railway companies, late Wednesday struck a tentative deal ahead of a Friday deadline to avert a rail strike that threatened massive disruption and price hikes across the United States. The tentative deal affecting more than 100,000 workers must be ratified by the union members, who agreed not to strike in the interim. The Association of American Railroads said the deal would give rail employees a 24% wage increase during the five-year period from 2020 through 2024 and an immediate payout that averages around $11,000. While the contract covers around 60,000 workers, it still needs to be ratified by the holdout unions, and a sick-leave policy needs to be ironed out. About 40% of long-haul trade is transported by rail, and a strike could have idled more than 7,000 trains, while costing the U.S. economy an estimated $2 billion per day. Ag sector groups are out with statements applauding the developments and the people behind them.

Russian President Vladimir Putin and Chinese leader Xi talked with each other today for the first time since the war began in Ukraine on Feb. 24. Of note, Putin acknowledged China may have ‘questions and concerns’ about the war. Details in China section, which also contains information about a measure passed by the U.S. Senate Foreign Relations panel that China is closely watching.

Ukrainian President Volodymyr Zelenskyy was involved in a car accident in Kyiv on Wednesday, but emerged with "no serious injuries," a statement from his office said.

Russia struck water infrastructure with cruise missiles Wednesday in Ukrainian President Volodymyr Zelenskyy’s hometown. Ukrainian authorities said that they had managed to stave off flooding. Meanwhile, there are signs the Kremlin may also be redeploying forces to protect Crimea, which Russia annexed as the main prize of its 2014 campaign, in the event Ukraine is able to break through its lines.

G7’s grand plan to squeeze Russia oil windfall hinges on tanker shipping. Details in Russia/Ukraine section.

Treasury Secretary Janet Yellen will announce the IRS will hire 5,000 workers to shore up its customer service. Details in Personnel section.

USDA’s Foreign Ag Service successfully released a lot of weekly export sales data today after recent glitches in its new system of reporting. Here are some details regarding China:

For the most two recent weeks, activity for China was reported across several commodities.

For the week ending Sept. 1, net sales for 2022-23 were 65,000 tonnes of wheat, 14,251 tonnes of corn, 692,597 tonnes of soybeans, and 61,016 running bales of upland cotton. Activity for 2022 of a net reduction of 626 tonnes of beef and net sales 17,066 tonnes of pork were also reported.

For the week ended Sept. 8, sales activity to China included net sales of 64,693 tonnes of wheat, 914 tonnes of corn, and 411,713 tonnes of soybeans. Activity for 2022 included net reductions of 1,034 tonnes of beef and net sales of 4,745 tonnes of pork.

Economic news in today’s dispatch:

- U.S. retail sales, a measure of spending at stores, online and in restaurants, rose 0.3% in August from the prior month.

- Japan recorded its highest-ever trade deficit in August as imports soared and the yen slumped.

- The Bank of Japan carried out a rate check on the yen.

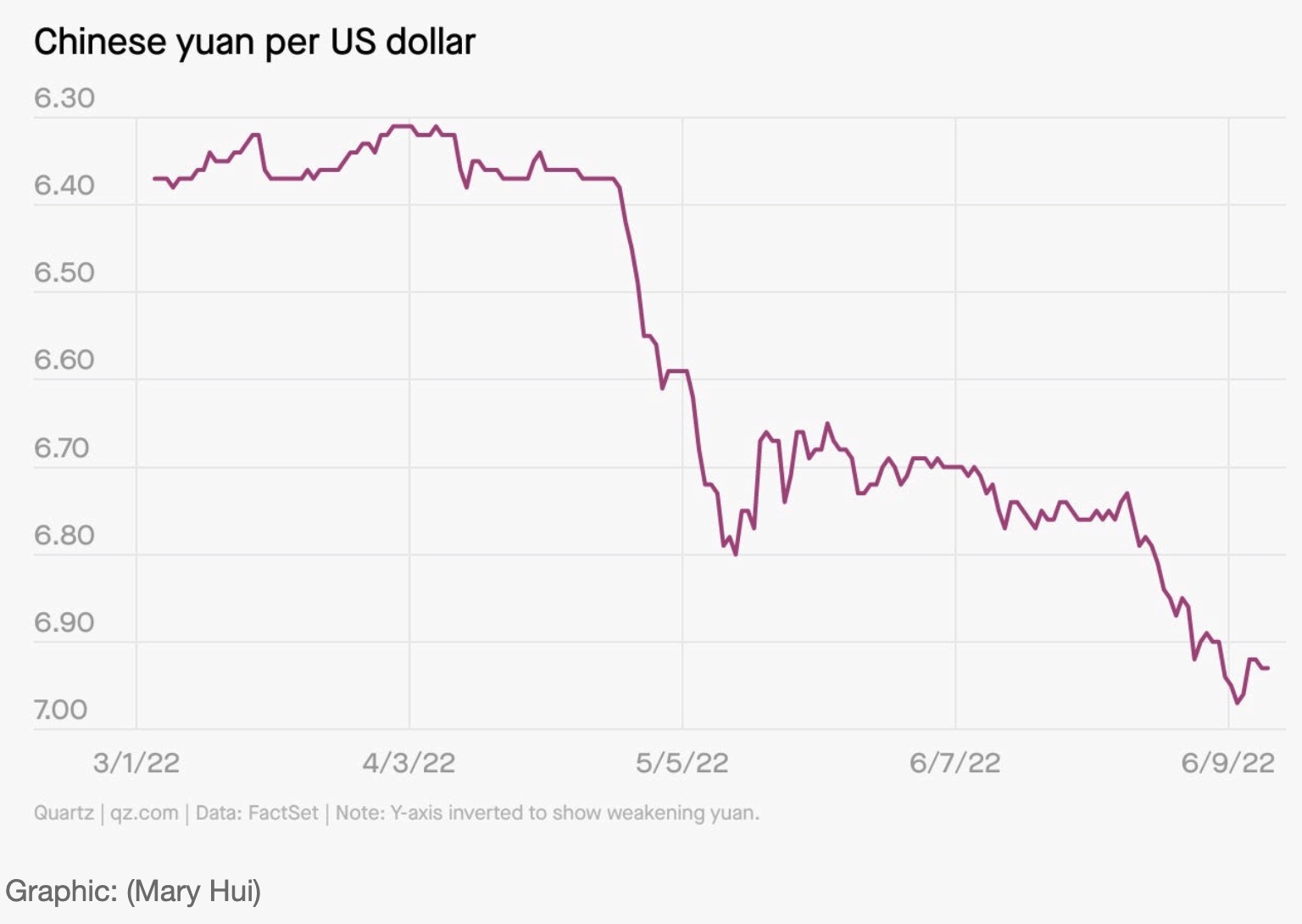

- The Chinese yuan has dropped 9.5% this year against the U.S. dollar, sliding closer to what some analysts deem as the significant seven-dollar mark.

- Europe factory output contracts.

- U.S. mortgage rates climb above 6% for first time since 2008.

- Odds for a bigger FOMC U.S. rate rise of 1% are fading, according to CME Fed funds futures, with 26% odds for a 1% rise and 74% odds for an increase of 0.75%.

USDA releases $1.9 billion for food banks and school meals. Details below.

The European Union wants to raise $140 billion in windfall taxes from energy companies. The aim is to soften the hit consumers are enduring from surging prices. Details in Energy & Climate Change section.

The Biden administration will withhold $130 million in foreign security assistance to Egypt over human rights concerns. The assistance is a fraction of an estimated $1.3 billion in aid the U.S. generally gives Egypt annually, and the move to withhold it is an effort to symbolically penalize Cairo for its human rights record while also aiming to maintain diplomatic ties with this Middle Eastern ally, the WSJ reports.

The U.S. Dept. of Energy denies report on price trigger to restock SPR. A report that the Biden administration was proposing a plan to purchase oil when crude fell below $80 per barrel to restock the Strategic Petroleum Reserve (SPR) is being denied by the Department of Energy (DOE). Dept. of Energy: SPR purchase plan doesn’t include trigger price. DOE issued a statement on the matter. More in Energy section.

If you wonder if wheat prices could surge again you might want to look at estimates of Pakistan’s wheat production. Some sources signal they are way too high. Details in Market section.

FY 2023 sugar TRQ information was released. Details below.

Five of 27 senators identified as having potential conflicts of interest for their financial dealings in industries that could be affected by their committee work are members of the Agriculture Committee. Details in Congress section.

Some juicy election coverage was reported by Punchbowl who revealed comments from Senate Majority Leader Chuck Schumer (D-N.Y.) at a Washington DC restaurant earlier this week that the Dems would lose the House but keep the Senate. We wonder what House Speaker Pelosi has to say about that, especially with her recent comments predicting the Dems will keep control of the chamber. Details in Politics & Elections section.

Sen. Ron Johnson (R-Wis.) is narrowly leading his Democratic challenger, Lt. Gov. Mandela Barnes, in a new Marquette University poll of the battleground state. Details below.

A Wall Street Journal survey conducted in late August found that Latino voters would pick a Democratic candidate for Congress over a Republican by 11 percentage points. That’s a narrower lead than the 34-point advantage Democrats held in 2018, according to AP VoteCast

Florida Republican Gov. Ron DeSantis is claiming credit for sending two planes carrying migrants to Martha's Vineyard in Massachusetts Wednesday. Meanwhile, more than 100 migrants were bused from Texas to Vice President Kamala Harris's residence in Washington, D.C., on Thursday, with many praising the process of getting bused further into the country as being “very good.”

Who convinced Donald Trump to try to buy Greenland? We have the answer below.

Election Day 2022 is 53 days away. Election Day 2024 is 782 days away.

|

MARKET FOCUS |

Equities today: Global stock markets were mostly slightly higher overnight. U.S. Dow opened around 70 points lower and is currently down around 20 points. Labor Department negotiators, rail operators and union representatives reached a tentative agreement early this morning that may avert a debilitating U.S. nationwide train strike. S&P 500 futures ticked up initially on the news. In Asia, Japan +0.2%. Hong Kong +0.4%. China -1.2%. India -0.7%. In Europe, at midday, London +0.3%. Paris -0.5%. Frankfurt -0.1%.

U.S. equities yesterday: All three major indices ended with modest gains following their sharp losses Tuesday. The Dow closed up 30.12 points, 0.10%, at 31,135.09. The Nasdaq gained 86.10 points, 0.74%, at 11,719.68. The S&P 500 moved up 13.32 points, 0.34%, at 3,946.01.

Agriculture markets yesterday:

- Corn: December futures fell 10 1/2 cents to $6.82 1/4.

- Soy complex: November soybeans fell 23 2/3 cents to $14.55. December soymeal fell 70 cents to $423.10, while December soyoil fell 186 points to 64.87 cents.

- Wheat: December SRW wheat rose 11 3/4 cents to $8.72 1/4 and December HRW wheat gained 13 1/4 cents to $9.47, both two-month closing highs. December spring wheat rose 6 3/4 cents to $9.38.

- Cotton: December cotton rose 39 points at 102.71 cents.

- Cattle: October live cattle fell 45 cents to $144.35. October feeders rose 90 cents to $181.425. Live cattle fell as wholesale beef extended a slump. Choice boxed beef fell $2.46 early Wednesday to $254.20, the lowest price since mid-March.

- Hogs: October lean hogs fell $1.05 to $94.70, down from a four-week-high close Tuesday.

Ag markets today: Corn and soybeans mildly rebounded overnight from losses the two previous days, while wheat pulled back from recent gains. As of 7:30 a.m. ET, corn futures were trading around a penny higher, soybeans were 2 to 4 cents higher, SRW wheat futures were 5 to 8 cents lower, HRW wheat was 3 to 5 cents lower and HRS wheat was steady to fractionally lower. Front-month crude oil futures were around $1.50 lower and the U.S. dollar index was trading near unchanged but is now firmer.

Technical viewpoints from Jim Wyckoff:

On tap today:

• U.S. retail sales are expected to hold flat in August following a flat reading in July (8:30 a.m. ET) UPDATE: Retail sales, a measure of spending at stores, online and in restaurants, rose 0.3% in August from the prior month, the Commerce Department said Thursday. July spending was revised down to a 0.4% decline from a previous flat reading.

• Initial claims for unemployment benefits are expected to rise slightly to 225,000 in the week ended Sept. 10. (8:30 a.m. ET)

• Import prices are seen falling 1.2% in August following a 1.4% decline in July. (8:30 a.m. ET)

• USDA Weekly Export Sales report, 8:30 a.m. ET. This week’s release will include data for the previous four weeks: Data for weeks ending on Aug. 18 and Aug. 25 will be combined and released under week ending Aug. 25; Data for weeks ending on Sept. 1 and Sept. 8 will be listed individually; Links will be provided to the August 25 and September 1 reports. Weekly Highlights text will be included only for the weeks ending periods Sept. 1 and Sept. 8.

• Industrial production is expected to remain unchanged in August following a 0.6% increase in July. (9:15 a.m. ET)

• Biden Administration: President Biden delivers remarks at the United We Stand summit at the White House at 3:30 p.m. ET "to counter the corrosive effects of hate-fueled violence." He attends the Congressional Hispanic Caucus Institute Gala tonight in Washington.

Japan recorded its highest-ever trade deficit in August as imports soared and the yen slumped. Imports increased by an annual rate of 50% in the year up to August, driven by the rising cost of buying energy from overseas. That resulted in a deficit of $19.7 billion. The yen has fallen by nearly 20% over the past six months to its lowest value against the dollar in 24 years (see related item on the yen).

Federal Reserve officials are unlikely to raise interest rates by a super-sized 100 basis points when they meet next week, according to JPMorgan Chase & Co. chief U.S. economist Michael Feroli. Investors fully expect a 75 basis-point increase when Fed officials gather Sept. 20-21 and see a roughly one-in-three chance they will opt for the bigger move, according to pricing in federal fund futures contracts.

Europe factory output contracts. Eurozone industrial production fell 2.3% in July from the previous month, the first decline since March as factories struggle with high energy costs caused by the ongoing war in Ukraine. Russia has blocked its natural gas from reaching Europe, driving up production costs and threatening the livelihood of some manufacturers. Many economists expect high energy costs will tip Europe’s main economies into recession in the coming months.

U.S. mortgage rates climb above 6% for first time since 2008. An industry gauge of average fixed 30-year mortgage interest rates climbed to 6.01%, according to weekly Mortgage Bankers Association data. It marks the first time since November 2008 that the trade group’s measure of mortgage rates was higher than 6%. Higher interest rates mean more expensive home loans for prospective home buyers and homeowners interested in refinancing. The trade group’s index tracking the volume of loans for purchasers remained near two-year lows last week, and refinance application volumes are at their lowest since October 2000.

The typical U.S. asking rent in August was about $2,090, about 12.3% higher than in August 2021 and still well above historical averages, according to the Zillow Observed Rent Index. Zillow senior economist Jeff Tucker expects asking rent growth to cool this winter. But higher mortgage interest rates are forcing people out of the home-buying market and into the rental market, the National Association of Realtors said.

Market perspectives:

• Outside markets: The U.S. dollar index is slightly up in early U.S. trading. The yield on the 10-year U.S. Treasury note is fetching 3.439%. Two-year Treasuries offered yields of as much 35 basis point over the 30-year rate on Thursday, sending the inversion of the curve to levels last seen in 2000. Crude is under pressure, with U.S. futures just over $87 per barrel and Brent futures at around $92.50 per barrel. Gold and silver futures were under pressure ahead of Retail Sales figures, with gold around $1,695 per troy ounce and silver around $19.38 per troy ounce.

• The Bank of Japan carried out a rate check on the yen, which rose in value to 142.9 yen to one U.S. dollar following the news from a low of 145 yen to one U.S. dollar earlier that day, Kyodo News reported Sept. 14. The government said it is concerned about sharp, one-sided moves with the yen as people are buying U.S. dollars and that a rate check is the first step before direct intervention. Traders are now watching to see if Japan continues to issue verbal warnings without acting. If so, it would lose some credibility and some investors will continue to sell the yen and buy the dollar.

• Pakistan’s wheat production could be a lot lower than most, including USDA, are projecting, according to several sources. Aid agencies and officials warn that Pakistan’s cataclysmic floods could spread waterborne diseases and increase food shortages, further straining a population already reeling from climate disaster and record inflation. Months of brutal flooding have inundated Pakistan, submerging one third of its territory and transforming once-populated lands into shrinking islands. The deluge has now displaced more than 33 million people, authorities estimate, while roughly 1,500 people have been killed. “It is simply heartbreaking. No picture can convey the scope of this catastrophe,” U.N. Secretary-General António Guterres said on Wednesday after visiting the country, while noting the floods’ human toll and scale of destruction. “The flooded area is three times the size of my entire country, Portugal.”

Under government estimates, it could take as many as six months for the flooding to recede — a timeline that could have worrying consequences as waterborne diseases spread.

— FY 2023 sugar TRQ information released. USDA announced via the Federal Register (link) information on the fiscal year (FY) 2023 in-quota aggregate quantity of certain sugars, syrups, and molasses at 222,000 metric tons raw value (MTRV). This quantity includes the minimum amount the U.S. committed to under the WTO of 22,000 MTRV, of which 20,344 MTRV is established for any sugars, syrups and molasses, and 1,656 MTRV is reserved for specialty sugar. An additional amount of 200,000 MTRV is added to the specialty sugar TRQ for a total of 201,656 MTRV. The FY 2023 specialty sugar TRQ will be opened in five tranches, with the first totaling 1,656 MTRV to open October 3. The second tranche of 60,000 MTRV will open on October 10, while the third tranche of 60,000 MTRV will open on January 20, 2023; the fourth tranche of 40,000 MTRV will open on April 14, 2023. The fifth tranche of 40,000 MTRV will open on July 14, 2023. USDA said the second, third, fourth, and fifth tranches will be “reserved for organic sugar and other specialty sugars not currently produced commercially in the U.S. or reasonably available from domestic sources.”’

• Ag trade: Japan purchased 97,373 MT of wheat from its weekly tender, including 31,120 MT U.S. and 66,253 MT Canadian. Saudi Arabia tendered to buy 535,000 MT of wheat.

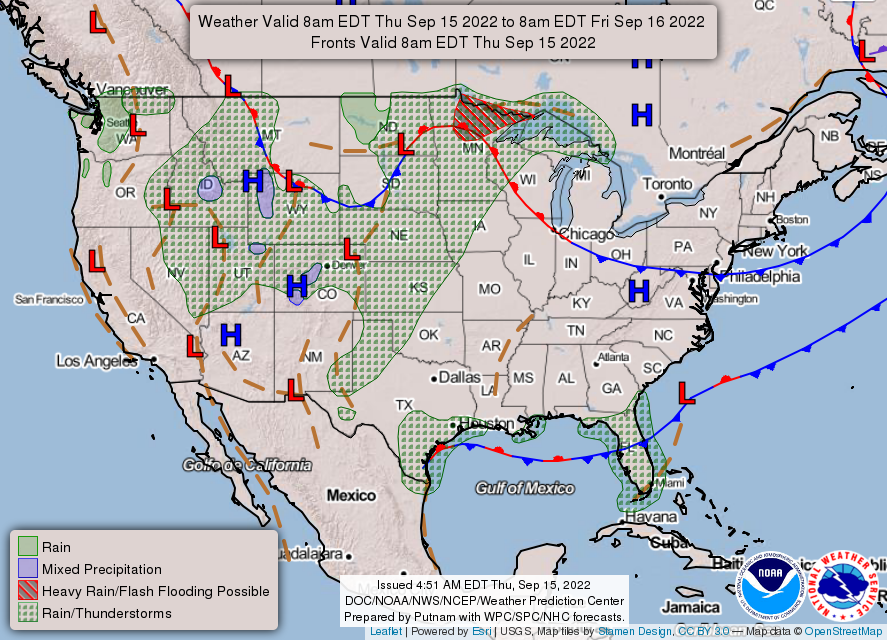

• NWS weather: Heavy to excessive rainfall possible across parts of the Central Great Basin/Northern Rockies today and into the Upper Midwest/Great Lakes through Friday... ...Daily rounds of showers and storms likely across Florida... ...Warming trend begins in Central Plains while West and Northeast continue to experience below average temperatures.

Items in Pro Farmer's First Thing Today include:

• Light corrective trade overnight

• China pauses monetary policy easing (details in China section)

• NOPA August crush expected to be down from month-ago, but up from last year

• Firm raises EU wheat crop forecast, but cuts export outlook

• Kazakhstan lifts restrictions on wheat, flour exports

• Indonesia lowers palm oil reference price, export tax

• Slow developing cash cattle trade

• Cash hog index down, but pace off losses slows

|

U.S. RAIL SITUATION |

— White House reaches tentative agreement to avert national rail strike. In a statement (link), President Joe Biden said the agreement will guarantee “better pay, improved working conditions, and peace of mind around their health care costs” for the workers. "The agreement is also a victory for railway companies who will be able to retain and recruit more workers for an industry that will continue to be part of the backbone of the American economy for decades to come," Biden said in the statement.

A Department of Labor official confirmed that a deal “that balances the needs of workers, businesses, and our nation’s economy” was reached in the early hours of the morning on Thursday after 20 consecutive hours of negotiations between rail companies and union negotiators. “Secretary Walsh and the Biden administration applaud all parties for reaching this hard-fought, mutually beneficial deal,” a labor official said. “Our rail system is integral to our supply chain, and a disruption would have had catastrophic impacts on industries, travelers and families across the country.”

The details of the tentative agreement reached on Thursday morning have not been shared, and could still be voted down by members who need to ratify the agreement to settle the matter. Earlier this week, two unions rejected proposed tentative agreements brokered by labor leaders, indicating broader anger among union members about the deal proposed by Biden’s board.

The Association of American Railroads, in a statement thanking the involvement by Labor Secretary Marty Walsh, Transportation Secretary Pete Buttigieg and USDA Secretary Tom Vilsack, said “new contracts provide rail employees a 24% wage increase during the five-year period from 2020 through 2024, including an immediate payout on average of $11,000 upon ratification, following the recommendations of Presidential Emergency Board (PEB) No. 250. All tentative agreements are subject to ratification by the unions’ membership.”

|

RUSSIA/UKRAINE |

— Summary: Ukraine’s ambassador to America described the country’s recent counter-offensive against Russian forces as a “major turning-point” in the war. At least 150,000 Ukrainians in more than 300 settlements have been liberated from Russian occupation since Sept. 6, according to one official. On Tuesday night Olaf Scholz, Germany’s chancellor, urged Vladimir Putin, Russia’s president, to withdraw his troops from Ukraine “as soon as possible.” Meanwhile, Ukraine President Volodymyr Zelenskyy emerged unscathed from a car accident in Kyiv, the capital. He was returning from the city of Izyum, which was liberated during Ukraine’s recent counter-offensive.

- Russia bombed the water system of Kryvyi Rih, a southern Ukrainian town, including a dam. Officials advised a mass evacuation. Volodymyr Zelensky, Ukraine’s president, called the Russian army “weaklings who fight civilians.”

- G7’s grand plan to squeeze Russia oil windfall hinges on tanker shipping. According to American Shipper (link): Tanker shipping buy-in will be pivotal to success or failure. The G7 plan would cap the price of Russian exports and levy U.S. sanctions against companies that transport Russian petroleum priced over the cap. Even if Russia is willing to sell its exports at or below a price capped by its geopolitical opponents — a big if — the plan won’t work unless enough tanker owners participate. Time is short. The price cap goes into effect Dec. 5. Tanker owners are already negotiating cargoes for October loadings. The preliminary guidance released Friday by the Office of Foreign Assets Control (OFAC) — the U.S. agency that enforces sanctions — was light on details. The stakes are high. If the G7 plan backfires, global markets will have less crude and diesel, fuel prices will rise, and available tanker cargoes will decline.”

|

POLICY UPDATE |

— Thompson strongly reacts to USDA’s ‘unilateral’ climate investment. Rep. Glenn "GT" Thompson (R-Pa.), ranking member of the House Ag Committee, warned USDA Secretary Tom Vilsack following an announcement from him that USDA has awarded billions to "Partnerships for Climate-Smart Commodities" projects via the Commodity Credit Corporation (CCC). Thompson in a statement said: "The Biden administration is unilaterally spending billions of dollars without congressional input. While I am sure there are worthy projects, USDA is abusing the authorities of the Commodity Credit Corporation (CCC) to stand up a 'pilot program' while ignoring the significant issues facing farmers and ranchers. It’s as though Secretary Vilsack is intent on having Congress once again limit his ability to use the CCC."

|

PERSONNEL |

— Treasury Secretary Janet Yellen will announce the IRS will hire 5,000 workers to shore up its customer service. Yellen will speak today during her first visit as Treasury secretary to an IRS facility, as the tax collection agency prepares an $80 billion overhaul with funds that were approved through the so-called Inflation Reduction Act that Congress passed last month. “By hiring 5,000 additional customer service representatives, we will also cut phone wait times in half — from an average wait of nearly 30 minutes during the 2022 filing season to less than 15 minutes,” Yellen plans to say. In the most recent tax-filing season, about 900,000 taxpayers were served face to face, and Yellen will say she expects that total to rise to 2.7 million next year.

|

CHINA UPDATE |

— Putin acknowledges China may have ‘questions and concerns’ about the war. President Vladimir Putin of Russia said Moscow understood that China had “questions and concerns” about the war in Ukraine, according to the Interfax news agency — an admission from Putin that Beijing may not fully approve of Russia’s invasion of Ukraine. He made the remark as he met with Xi Jinping, the leader of China, today in Uzbekistan. China has tried to stake out a neutral position on the invasion publicly, even as it has echoed the Kremlin’s rhetoric about Russia being treated unfairly by the West. The Russian leader said that he appreciated the “balanced stance” of China on Ukraine, and would give detailed “explanations of our stance” to address Chinese concerns at their meeting, the Interfax news agency reported.

— A Senate foreign policy panel approved new support for Taiwan, including $4.5 billion in military aid. Democrats and Republicans approved the Taiwan Policy Act (TPA). Were President Biden to sign the bill into law, China, which regards the island as a breakaway region, would erupt in outrage. The Senate Foreign Relations panel passed, 17-5, a sweeping bill to provide $6.5 billion to fund weapons and other support for Taiwan as the Chinese military escalates its aggressive activity around the country. The bill — which still requires approval by the full Senate and the House — marks the first time the U.S. would directly finance the provision of weapons to Taiwan. The TPA also creates a $2 billion loan facility to help Taipei buy weapons, and it makes Taiwan eligible for a program that would help the country stockpile weapons in advance for any possible future conflict with China. The bill would also require the White House to impose sanctions on at least five Chinese state-owned banks if the U.S. president determines that China has “engaged in a significant escalation in aggression” against Taiwan, such as a blockade or the seizure of its outer islands.

China slammed the legislation ahead of the vote, accusing the U.S. of diluting the “One China” policy.

— The Chinese yuan has dropped 9.5% this year against the U.S. dollar, sliding closer to what some analysts deem as the significant seven-dollar mark. The Fed’s anticipated 75-point rate hike next week could cause the yuan to tumble even further. One factor behind the yuan’s poor performance is China’s ongoing economic woes, from a struggling real estate sector to disruptions caused by its strict zero-Covid policy.

— China pauses monetary policy easing. China’s central bank partially rolled over maturing medium-term policy loans while maintaining its interest rates. The pause in monetary easing came as the yuan bears increasing downside pressure after the People’s Bank of China (PBOC) surprised markets in August by lowering key rates, a move that further widened policy divergence with other major central banks that are raising rates aggressively. PBOC said it will keep the rate on 400 billion yuan ($57.46 billion) worth of one-year medium-term lending facility (MLF) loans to some financial institutions unchanged at 2.75%. With 600 billion yuan worth of such loans maturing on the same day, that resulted in a net withdrawal of 200 billion yuan from the banking system.’

|

ENERGY & CLIMATE CHANGE |

— European Commission proposals. The European Commission (EC) proposed emergency policy measures to collect an estimated $140 billion in windfall taxes from certain energy firms, and then reallocate it to cushion consumers and businesses against painfully high energy bills. It also outlined mandatory reductions in electricity use. “This is not only a war unleashed by Russia against Ukraine,” said European Commission President Ursula Von der Leyen. “This is a war on our energy, a war on our economy, a war on our values and a war on our future.”

The European Commission announced a new package of emergency measures Wednesday to help tackle its worsening energy crisis, including steps to curb historic electricity prices for consumers and avoid a bloc-wide supply crisis this winter.

The plan includes a windfall tax on fossil fuel companies, mandatory electricity rationing for countries during hours of peak consumption, and extending emergency credit lines for power companies.

The excess profits from energy companies would be redistributed to individuals and small businesses. It also calls for cross-border agreements to help distribute the clawed-back windfall revenue across multiple countries. “In these times it is wrong to receive extraordinary record profits benefiting from war and on the back of consumers,” von der Leyen said.

Addressing members of the European Parliament, von der Leyen said leaders are working to comprehensively overhaul the EU's power market, which links electricity prices to the cost of natural gas. “Consumers should reap the benefits of low-cost renewables,” she said. “So, we have to decouple the dominance of the price of gas on the price of electricity.” (Instead, she said, EU leaders will work to find a more “representative” benchmark for prices.)

EU energy ministers convened in Brussels Friday for an emergency meeting to discuss how to accelerate the bloc’s transition away from Russian fossil fuels and shield consumers from crippling energy prices, which have spiked nearly tenfold in the last 12 months.

What’s not in the plan: A cap on natural gas price. Differences have emerged regarding whether such a gas cap would be applied only to Russian imports, which threatened a complete cutoff of all Russian energy supplies, or whether it would be a broader cap on all gas imports. Germany, the Netherlands, and Denmark opposed an overall gas cap, citing fears of market competition. EU Energy Minister Kadri Simson agreed, noting, “There is very strong competition in the [liquefied natural gas] market and now it is very important that we can replace the decreasing Russian volumes with alternative suppliers.” But Italy, Austria, and Greece are strongly opposed to a Russian-only gas cap, fearing a complete supply cutoff from Moscow.

Next step: Leaders will convene Sept. 30 to vote on the energy package, which will require approval of all 27 member states, a not-so-easy task.

Bottom line: S&P Global Commodity Insights’ Laurent Ruseckas told the Financial Times (link), the new EU proposals are “all extraordinarily complex” and “would be impossible to work out and implement in time for winter even if there were political consensus behind them — which there isn’t.” The EC said that the European Union’s securities watchdog agency would put forth temporary market fixes by Sept. 22 to address liquidity concerns faced by energy firms. The package of actions put forth by the EC must still be ratified by EU member countries which will take place Sept. 30.

— Dept. of Energy: SPR purchase plan doesn’t include trigger price. The Department of Energy says its plan to restock the nation’s emergency oil supply (SPR) doesn’t include a trigger price, and that such purchases aren’t likely to occur until after fiscal 2023, which ends Sept. 30. 2023. Bloomberg News reported Tuesday that administration officials have discussed refilling the Strategic Petroleum Reserve, or SPR, when crude prices dip below $80 a barrel, with an eye toward protecting U.S. oil-production growth and preventing oil prices from plummeting.

In a statement released Wednesday, the Energy Department pointed to its previously released plans. “Claims that we are currently considering buying oil once it dips below $80 a barrel are inaccurate,” Charisma Troiano, a department spokeswoman, said in the statement. “The Department of Energy proposed an approach months ago to replenish the Strategic Petroleum Reserve, and that approach does not include any such trigger proposal. As we said then, we anticipate that replenishment would not occur until well into the future, likely after fiscal year 2023.”

— Inflation Reduction Act has sparked a new market for selling and purchasing renewable-energy tax breaks. The tax-credit sales mark a shift in the U.S. strategy for attracting public and private capital to renewable-energy projects. These transferable tax credits break with policy makers’ longstanding reluctance to create anything like a liquid market in tax breaks, reports the Wall Street Journal (link). The program contains echoes of a 1981 law that effectively let companies sell investment tax breaks, a feature that Congress repealed the following year.

— Iowa Corn on investment roadshow to support direct-ethanol fuel cells research. In South Dakota, the Mitchell Republic reports (link) Iowa Corn is on a roadshow in the Dakotas as well as Minnesota, Iowa, Missouri, Wisconsin, Illinois, Indiana, Michigan, Nebraska and Kansas seeking investment from industry partners to support research into direct-ethanol fuel cells.

— European parliamentarians vote to raise share of renewables to 45% by 2030. In Belgium, on Wednesday, MEPs voted to raise the share of renewables in the EU’s final energy consumption to 45% by 2030, under the revision of the Renewable Energy Directive (RED) — a target also backed by the European Commission under its "RepowerEU" package.

— Bids from vacated offshore oil, gas lease sale restored. The Interior Department's Bureau of Ocean Energy Management on Wednesday accepted 307 bids totaling nearly $190 million from a November 2021 Gulf of Mexico oil and natural gas lease sale that had been invalidated by a federal judge over inadequate consideration of climate change impacts. "We are pleased that the Department of the Interior has finally offered the first offshore leases of this administration, but it is disappointing that it took 19 months and an act of Congress to get us to this point," said American Petroleum Institute Vice President of Upstream Policy Cole Ramsey.

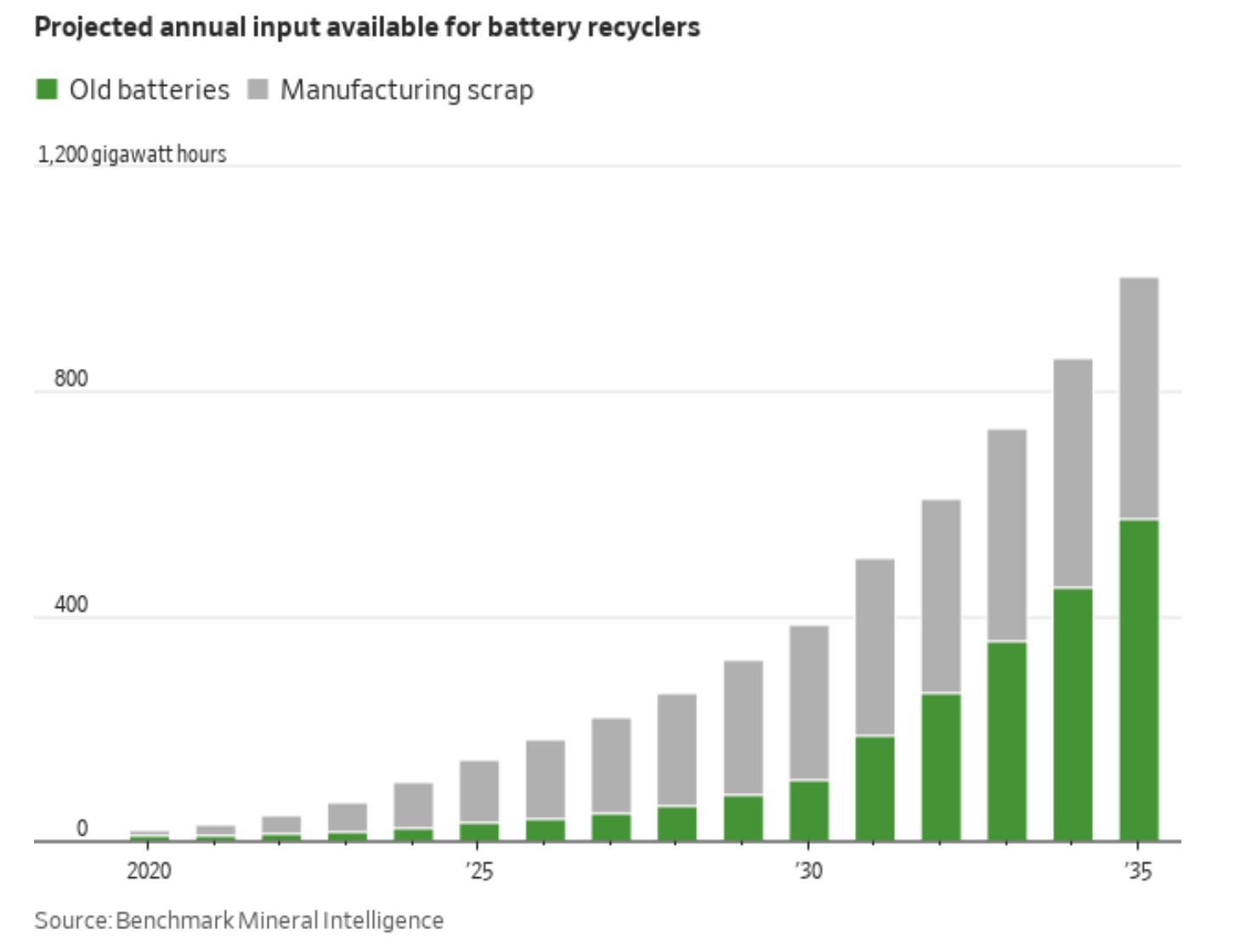

— The burgeoning electric-vehicle supply chain is starting to go circular. Jaguar Land Rover and South Korea's SK Group are among the investors putting more than $300 million into a startup that aims to serve an emerging center of battery production in the Southeastern U.S. The Wall Street Journal reports (link) the investments are a bet by big auto makers that recycled material from old batteries will help supply the metal they need to build electric cars. Ascend Elements says it has an efficient way to turn lithium-ion batteries into new components, making it the latest in a set of upstarts spending billions of dollars to supply battery makers with the materials they need. Disposal of old batteries is a question looming over the electric-vehicle business. The recyclers say they can solve that problem while delivering more of the materials that go into battery production.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— USDA releases $1.9 billion for food banks and school meals. Emergency food providers, such as food banks and school meal programs, will receive an additional $1.9 billion for the purchase of U.S.-grown foods, USDA said Wednesday. Link for details. Earlier this week, USDA announced plans to purchase rice for distribution to a variety of domestic food assistance programs, including charitable institutions, to help address the worsened risk of hunger and food insecurity caused by disruptions in the domestic food supply chain resulting from the Covid-19 pandemic.

|

HEALTH |

— Summary:

- Global Covid-19 cases at 610,425,326 with 6,520,534 deaths.

- U.S. case count is at 95,490,512 with 1,052,214 deaths.

- Johns Hopkins University Coronavirus Resource Center says there have been 610,686,563 doses administered, 224,367,691 have been fully vaccinated, or 68.10% of the U.S. population.

— Johns Hopkins University is scaling back its Covid tracking. The Covid-19 dashboard introduced in January 2020 has been increasingly hampered by a reduction in data reporting, according to university officials who run the project. Starting Sept. 21, it will update global case, death and vaccine data daily rather than every hour. It will cease reporting testing numbers, which have become less reliable as people shift to at-home tests. The platform will also start pulling vaccination data from sources such as the CDC rather than trying to collect it directly from local health agencies.

— Finish line for pandemic in sight: WHO. Tedros Adhanom Ghebreyesus, director-general of the World Health Organization, urged countries to take key actions like reaching 100% Covid-19 vaccination levels among the elderly because the “finish line” for the pandemic is in sight. The world has “never been in a better position to end the pandemic,” he said, calling on governments to seize the opportunity to finally put an end to the 32-month-long global health crisis.

— The WHO placed the U.S. on the list of countries where polio, a dangerous disease that can cause paralysis or death, is circulating due to the outbreak in New York that highlights the consequences of the growing anti-vaccine movement. The U.S. is the lone country from the Americas to receive the classification and one of few wealthy ones. Other nations on the list include Somalia, Burkina Faso, Uganda, Ethiopia and Ghana.

|

POLITICS & ELECTIONS |

— Pelosi again predicts Dems will maintain control of the House. Speaker Nancy Pelosi (D-Calif.) reiterated her prediction that House Democrats will expand their majority in the Nov. 8 election, suggesting that pundits routinely misjudge her political prowess. Pelosi: “We fully intend to hold the House. And even though there are some among you who belittle my political instinct and the rest, I got us here twice to the majority, and I don’t intend to [give] it up.”

— Schumer predicts Dems will lose House, keep Senate. Senate Majority Leader Chuck Schumer (D-N.Y.) privately told a group of Democratic senators Monday night that Speaker Nancy Pelosi (D-Calif.) is “in trouble” and Democrats are going to lose the House. Punchbowl says the comments came during a dinner at Trattoria Alberto, an Italian restaurant on Capitol Hill. Punchbowl reported that Schumer said that if the election were held today there was “a 60% chance we hold the Senate, and a 40% chance we hold the House.” Schumer also said he believed Trump would run for election in 2024.

Schumer said Democrats won’t be able to win the Senate race in Iowa. Democrat Mike Franken, a former Navy vice admiral, is running against longtime GOP Sen. Chuck Grassley. He also said the Arizona Senate race would tighten if tech billionaire Peter Thiel started spending money to boost Republican Blake Masters.

Schumer criticized former New York Democratic Gov. Andrew Cuomo over redistricting, blaming Cuomo for Democrats failure to pick up House seats during redistricting, Punchbowl reported.

— Sen. Ron Johnson (R-Wis.) is narrowly leading his Democratic challenger, Lt. Gov. Mandela Barnes, in a new Marquette University poll of the battleground state. Johnson is up on Barnes 49%-48% among registered voters. It’s a substantial shift from the poll’s August results, which showed Barnes leading 52%-45%. The August poll was conducted following Barnes’ Democratic primary victory. All of Barnes’ opponents dropped out and endorsed him prior to Election Day. NRSC Chair Rick Scott (Fla.) also told Republican senators during a party lunch that an internal GOP poll showed Johnson leading Barnes by four points.

— Biden approval rises ahead of midterms: AP-NORC poll. AP: “President Joe Biden’s popularity improved substantially from his lowest point this summer, but concerns about his handling of the economy persist, according to a poll from the Associated Press-NORC Center for Public Affairs Research. “Support for Biden recovered from a low of 36% in July to 45% driven in large part by a rebound in support from Democrats just two months before the November midterm elections.”

— Latino voters, once solidly Democratic, are splitting along economic lines. The shift toward the Republican Party has been especially pronounced among working-class Latinos, whose votes have the potential to reshape the political parties. Voters and analysts say the economic boom during much of former President Donald Trump’s presidency and high inflation under President Biden contribute to a more favorable view of the Republican Party, helping change the perception in many families that it’s socially unacceptable to consider backing Republican candidates. Link to more via the WSJ. Meanwhile, the New York Times currently has a big poll underway. It reports that this Times/Siena poll has a twist: a Hispanic “oversample,” which it says is “a fancy way of saying that we surveyed a lot more Hispanic voters than we normally do.”

— Who convinced Donald Trump to try to buy Greenland? Turns out it was Ron Lauder, the cosmetics billionaire and the former president’s college classmate. Link to NYT article for details.

|

CONGRESS |

— Today’s schedule:

The Senate will meet at 10 a.m. ET to resume consideration of Sarah Merriam’s nomination to be U.S. circuit judge for the Second Circuit, post-cloture. At 11:30 a.m. ET, the Senate will vote on confirmation of the Merriam nomination. At 1:45 p.m. ET, the Senate will vote on David Pekoske’s confirmation to be Transportation Security Administration administrator. SEC Chair Gary Gensler will testify before the Senate Banking Committee at 10 a.m. ET

The House will meet at noon ET to consider various legislation, with first/last votes expected between 1:45 p.m. and 3:30 p.m. ET.

— Nancy Pelosi promises a vote on investing rules for Congress. The House speaker said she would bring legislation meant to curb trading by lawmakers to the House floor this month. The announcement comes a day after the NYT reported (link) that nearly 100 lawmakers had reported trades that posed potential conflicts of interest. Five of 27 senators identified as having potential conflicts of interest for their financial dealings in industries that could be affected by their committee work are members of the Agriculture Committee.

|

OTHER ITEMS OF NOTE |

— Florida flew about 50 migrants to Martha’s Vineyard, escalating a tactic in which Republican-led states have shipped migrants to liberal bastions to protest illegal immigration.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Election predictions: Split-ticket | Congress to-do list |