Vilsack Not Sure if FAS Able to Release Weekly Export Sales Report Thursday; ‘Mistakes Happen’

Crude prices continue to plunge but IEA eyes more SPR releases

|

In Today’s Digital Newspaper |

USDA daily export sale: 167,000 metric tons of soybeans to China during the 2022-2023 marketing year.

USDA Secretary Tom Vilsack says he's not sure if the Foreign Agricultural Service (FAS) will be able to release its normal Weekly Export Sales report on Thursday, although he gave no date of its return. Glitches last Thursday forced FAS to take down and retract some of the data released. "We're going to make sure we've got it fixed and I appreciate the fact when they made the mistake, we owned up to it," Vilsack said during media availability at the Farm Progress Show. "Mistakes happen."

An estimated 1 million acres were taken out of USDA’s Conservation Reserve Program, or CRP, and will return to agricultural production in 2023, USDA Secretary Tom Vilsack said at the Farm Progress Show in Iowa. USDA in May said farmers could take land out of CRP early in part after Russia’s invasion of Ukraine shrank crop supplies on the world market and sent prices soaring. (Vilsack's remarks don't make clear whether those acres were taken out early or not... but they are 2023 anyway.)

New York Fed President John Williams on Tuesday told rhe Wall Street Journal that rates will need to rise to a point where they will restrain the economy to get inflation under control. “We’re going to need to have restrictive policy for some time; this is not something that we’re going to do for a very short period of time and then change course,” Williams said. Details below.

U.S. jobs openings and a consumer confidence gauge both topped forecasts, pointing to strength in household and labor demand. The Conference Board’s August index of sentiment rose to a three-month high, and the report also showed firmer buying plans for appliances and cars. Job vacancies, meanwhile, unexpectedly increased to 11.2 million in July. All eyes are now on how much the Fed chooses to hike in September. A key barometer will come Friday with the Employment report.

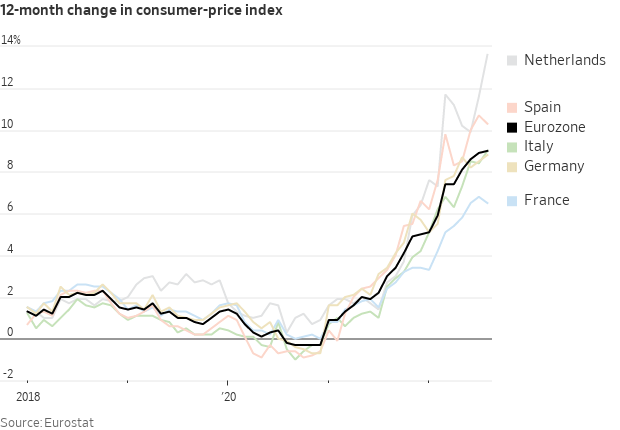

Eurozone inflation accelerated to another all-time high, strengthening the case for the European Central Bank to consider a jumbo interest-rate hike when it meets next week. Consumer prices in the 19-nation currency bloc jumped 9.1% from a year ago in August, beating the 9% median estimate in a survey of economists, led by energy and food. Money markets put the probability of a 75 basis-point ECB hike at more than 60%.

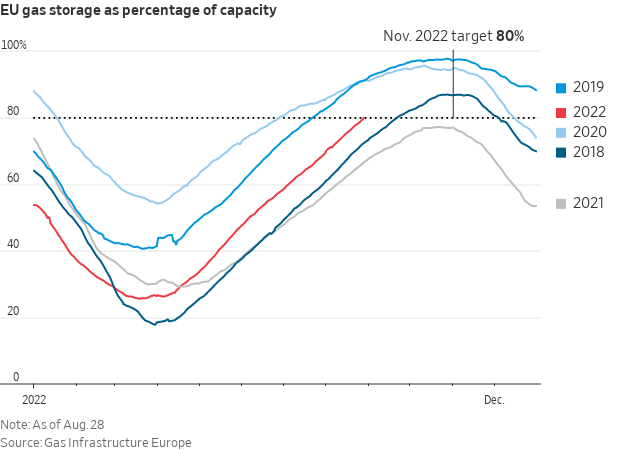

Russia halts gas flows to Europe again, as Ukraine tries to turn the war with its southern offensive. But Ukrainian officials have cautioned against excessive optimism, saying the offensive will be slow and grinding. Separately, IAEA inspectors left Kyiv for the occupied Zaporizhzhia nuclear-power plant early today, pledging to establish a permanent mission there. Other details in Russia/Ukraine section.

Energy prices continue to tumble on fears of a recession. Details in Market section.

Chinese leader Xi Jinping is preparing to extend his hold on power at the Communist Party’s October congress.

China’s Communist Party said it plans to hold a twice-in-a-decade congress beginning Oct. 16, kicking off final preparations for a party conclave where Xi Jinping is expected to extend his stint as paramount leader, departing from the decade-long cycle that his predecessor set. Xi is due to deliver a policy address that charts China’s priorities for the next five years, and China watchers say Xi would likely promote allies into top posts.

On the ag policy front, the seemingly endless taxpayer funding of various USDA climate-smart programs was addressed by USDA Secretary Tom Vilsack on Tuesday. Details in Policy section.

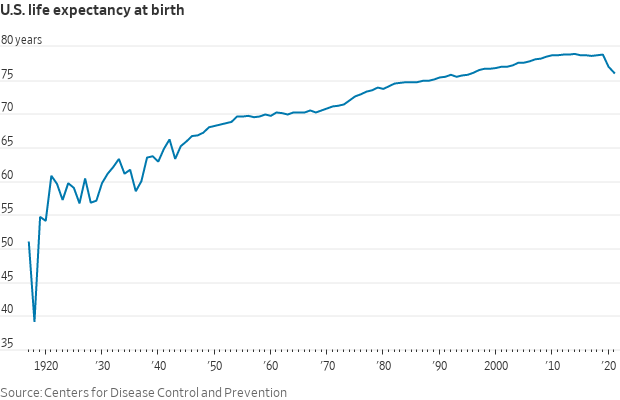

The average life expectancy in the U.S. has fallen to 76, from nearly 79 in 2019 — the steepest decline in almost a century.

Attorney General Merrick Garland barred all Department of Justice political appointees from attending campaign events — plus partisan events on election night — as the agency’s investigation into Trump garners extreme public attention.

Artemis I Launch: NASA will again try to send its towering rocket to the moon on Saturday, after engine-related problems delayed the initial attempt Monday.

Election Day 2022 is 69 days away. Election Day 2024 is 797 days away.

|

MARKET FOCUS |

Equities today: Global stock markets were mostly lower overnight. U.S. Dow opened slightly higher but then turned lower. In Asia, Japan -0.4%. Hong Kong flat. China -0.8%. India closed. In Europe, at midday, London -1.2%. Paris -0.8%. Frankfurt -0.5%.

U.S. equities yesterday: The Dow lost 308.12 points, 1%, to 31,790.87. The S&P 500 shed 44.45 points, 1.1%, to close at 3,986.16. The Nasdaq retreated 134.53 points, 1.1%, to 11,883.14.

Agriculture markets yesterday:

- Corn: December corn fell 5 3/4 cents to $6.77 1/4.

- Soy complex: November soybeans fell 5 1/4 cents to $14.32 1/2, the contract’s lowest closing price since Aug. 19. December soymeal dropped $2.60 to $424.50. December soyoil fell 9 points to 65.35 cents.

- Wheat: December SRW wheat fell 22 1/2 cents to $8.20 1/4. December HRW wheat fell 14 3/4 cents to $8.97 3/4. December spring wheat fell 12 3/4 cents to $9.20 1/2.

- Cotton: December cotton fell 496 points to 112.20 cents, the contract’s lowest closing price since Aug. 23.

- Cattle: October live cattle rose 92.5 cents to $143.825. October feeder cattle gained $2.20 to $183.275.

- Hogs: October lean hog futures rose $1.35 to $93.60, the highest closing price in over a week.

Ag markets today: Corn, soybean and wheat futures built on Tuesday’s losses during overnight trade. As of 7:30 a.m. ET, corn futures were trading 8 to 9 cents lower, soybeans were around 8 cents lower and wheat futures were 2 to 8 cents lower. Front-month crude oil futures were around $2.50 lower and the U.S. dollar index was about 225 points higher this morning.

Technical viewpoints from Jim Wyckoff:

On tap today:

• ADP's employment report is expected to show that private-sector employers added 300,000 jobs in August. (8:15 a.m. ET)

• Chicago purchasing managers index is expected to tick down to 52 in August from 52.1 one month earlier. (9:45 a.m. ET)

• Federal Reserve speakers: Cleveland's Loretta Mester on the economic outlook and monetary policy at 8 a.m. ET, Dallas's Lorie Logan at a town hall at 6 p.m. ET, and Atlanta's Raphael Bostic at a Georgia Fintech Academy event at 6:30 p.m. ET.

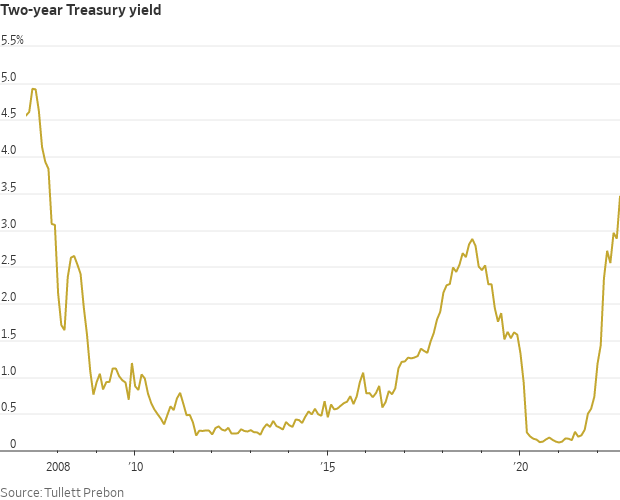

Fed’s Williams: Rates will stay high for a while. Federal Reserve Bank of New York President John Williams said Tuesday that the U.S. central bank will need to push its short-term interest-rate target to a point where it will restrain the economy and maintain that stance for a while as part of its bid to lower inflation. “Our focus is on getting inflation back down to 2%” and the current level of price pressures is “far too high,” Williams said at a Wall Street Journal event. To get inflation down in an economy with strong labor markets and continued forward momentum, Williams said the central bank will very likely need to take monetary policy into an area where it holds back economic activity. That could bring the central bank’s interest-rate target range above 3.5%, up from its current range of 2.25% to 2.5%. Williams didn’t comment about the size of the rate rise he would like to see at the Fed’s policy meeting next month, but he pushed back on the idea the central bank might soon be able to reverse course and lower rates. “We’re going to need to have restrictive policy for some time; this is not something that we’re going to do for a very short period of time and then change course,” he said. “We’ll continue through next year” with a restrictive policy stance and “it’s going to take some time before I would expect to see adjustments of rates downward.”

Inflation in the eurozone rose to a fresh record in August, underscoring the economic shock dealt by Russia’s war in Ukraine and increasing the pressure on the European Central Bank to respond by raising interest rates aggressively next week. Eurozone consumer prices were 9.1% higher than a year earlier, a pickup from the 8.9% rate of inflation recorded in July, the European Union’s statistics agency said Wednesday. That is the highest rate since records began in early 1997. Inflation in the 19-nation eurozone has surpassed U.S. levels in recent weeks as Russia’s actions curtailed Europe’s energy supplies and drove up prices.

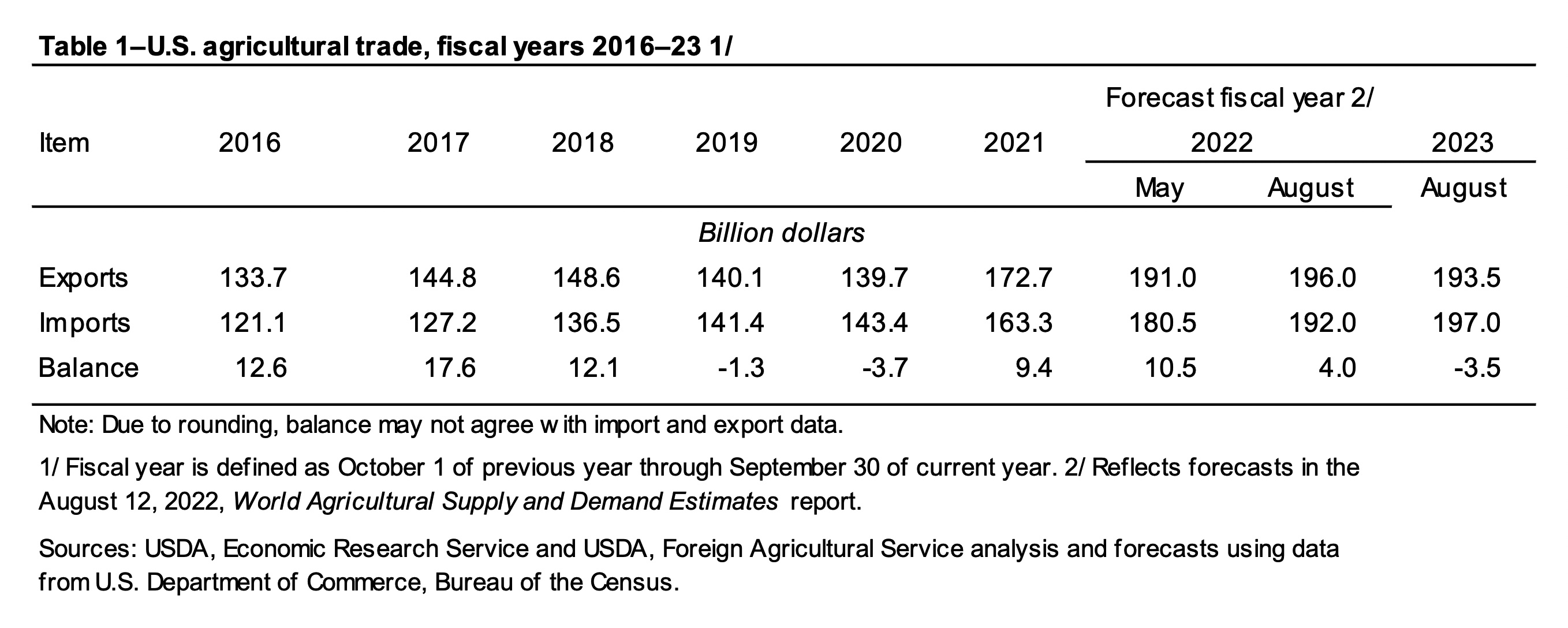

USDA cuts FY 2022 ag trade forecast, expects deficit in FY 2023. USDA raised its forecasts for ag exports and imports in fiscal year (FY) 2022, calling for a record for both. USDA increased its FY 2022 ag export outlook by $5 billion from May to $196.0 billion, which would be up $23.3 billion from last year. The ag import forecast was raised $11.5 billion to $192.0 billion. That would leave an ag trade surplus of $4.0 billion, down $6.5 billion from the implied level in USDA’s May outlook and $5.4 billion below FY 2021. Link for details.

USDA’s initial forecast for FY 2023 projects ag exports will decline $2.5 billion from this year to $193.5 billion and ag imports will rise another $5 billion to a record $197.0 billion. That would leave an ag trade deficit of $3.5 billion, the first deficit in two years. USDA said the lower export forecast was primarily driven by lower exports of cotton, beef, and sorghum that are partially offset by higher exports of soybeans and horticultural products. The higher ag import outlook for FY 2023 is due to an expected rise in imports of grains and feed products, horticultural products, and sugar and tropical products.

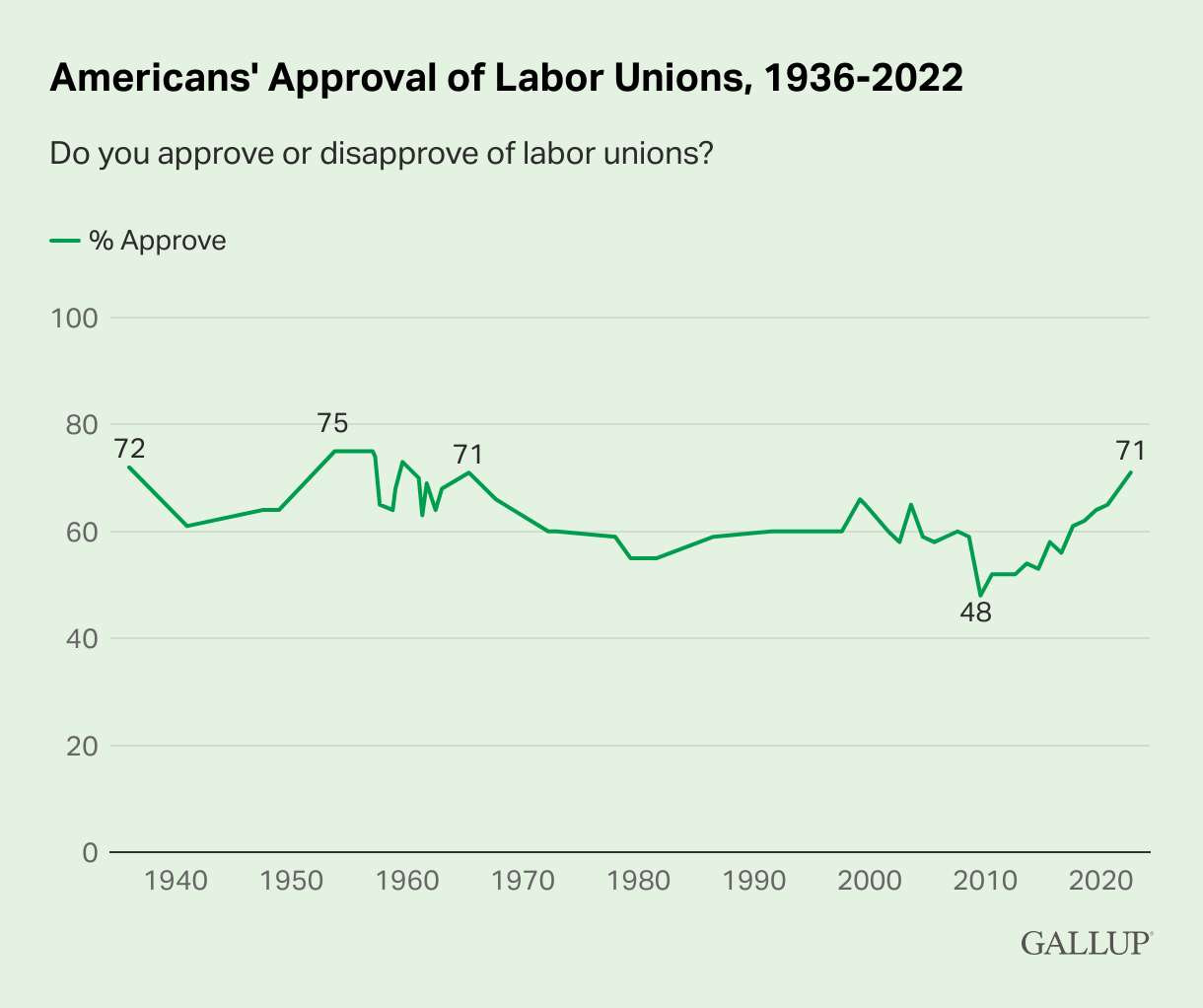

Labor unions reach highest level of approval in U.S. since 1965: Gallup. Some 71% of poll respondents said they approve of such organizations, up from 68% last year. Prior to the pandemic, 64% of poll respondents said they approved of unions. Support for unions peaked in the 1950s, when three in four Americans said they approved of unions, Gallup data showed (link).

Life expectancy in the U.S. dropped in 2021 for a second consecutive year as Covid-19 and overdoses drove up mortality rates, preliminary data showed. Americans’ life expectancy last year fell 0.9 year on average to 76.1 years, according to data from the Centers for Disease Control and Prevention released Wednesday. It was a smaller drop than in 2020, when life expectancy decreased 1.8 years, the data showed, but the combined figures for the two years were the largest since the 1920s.

Market perspectives:

• Outside markets: The U.S. dollar index is higher in early U.S. trading. Meantime, the yield on the 10-year U.S. Treasury note is fetching 3.151%. Crude is lower, with U.S. crude around $89.00 per barrel and Brent around $95.05 per barrel. Gold and silver futures were lower, with gold around $1,725 per troy ounce and silver around $17.89 per troy ounce.

• Hawkish Fed interest-rate policy has continued to spook bond markets, sending the yield on the two-year Treasury note to its highest end-of-day level on Tuesday since 2007. Wednesday morning it rose further, to 3.479% from 3.466%.

• U.S. diesel prices are back above $5. Low inventories sent the national average diesel price in the U.S. back above $5, the first weekly price increase in more than two months. Distillate fuel inventories in the Northeast are particularly low, with supplies of diesel fuel and heating oil in New England currently 63% below the five-year average. There is a growing fear that an extreme weather event could significantly disrupt distillate supply in the Northeast. Link for details.

• Canada moves to defend Line 5 oil pipeline. Canada is invoking for the second time in less than a year a 1977 pipeline treaty with the U.S. to protect Enbridge's Line 5 oil conduit in Wisconsin from the Bad River Band tribe's legal push to have it shut down. Canadian Foreign Minister Melanie Joly warned that a shutdown would raise energy prices, threaten jobs and hurt communities along the pipeline route. Link to more via Reuters.

• IEA eyes more SPR releases. With the 180-million-barrel US SPR release coming to an end in November, the head of IEA Fatih Birol advocated more strategic stock releases, saying that members should consider them whenever the prospect of supply disruption emerges.

• Ag trade: Algeria purchased an unspecified amount of milling wheat that is expected to be sourced from Russia. Taiwan tendered to buy 65,000 MT of corn that can be sourced from the U.S., Brazil, Argentina or South Africa.

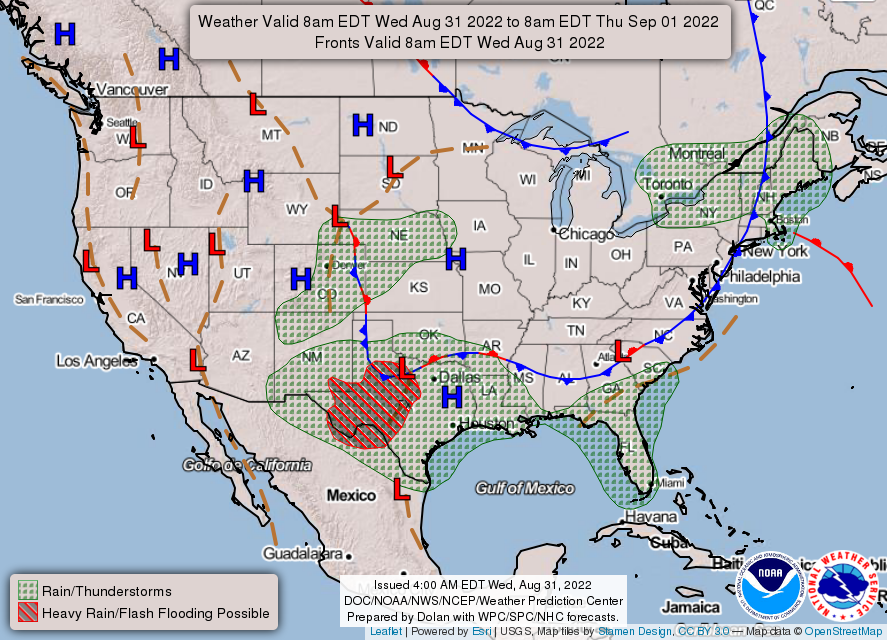

• NWS weather: Prolonged and record heat wave likely across the Western U.S.... ...Slight to moderate risk of excessive rainfall across parts of Texas.

A prolonged and potentially record-setting heat wave is building over the Western U.S. More than 55 million people are currently under heat alerts from Southern California through the San Joaquin Valley and into portions of the Northwest, including 20 of the most populated cities up and down the West Coast. According to the National Weather Service, dangerously hot temperatures today may extend through Labor Day and could exceed 110 degrees Fahrenheit in parts of the Southwest.

Items in Pro Farmer's First Thing Today include:

• Followthrough selling overnight

• China’s manufacturing PMI rises, but factory sector still contracting (details below)

• Indonesia tweaks palm oil export tax rules

• Still good retailer demand for beef, especially on lower prices

• Pork cutout, cash hog prices continue to slide seasonally

|

RUSSIA/UKRAINE |

— Summary: U.N. nuclear inspectors have arrived in Kyiv. To reach the Russian-occupied Zaporizhzhia power plant, they must travel through a battlefield. Vladimir Putin is using the threat of a strike on the nuclear plant to intimidate his enemies, intelligence officials say. Meanwhile, Ukraine said it has destroyed bridges and ammunition depots and pounded command posts in a surge of fighting in the Russian-occupied south, fueling speculation Tuesday that its long-awaited counteroffensive to try to turn the tide of war is underway. Russia said it inflicted heavy casualties in return.

- Russia is having trouble with Iranian-made drones, according to the Biden administration. Russia has faced technical problems with Iranian-made drones acquired from Tehran this month for use in its war with Ukraine, according to Biden administration officials. The officials, who spoke on the condition of anonymity to the Associated Press to discuss the U.S. intelligence assessment, did not detail the “numerous failures.” They added that the U.S. assessed that the delivery of Mohajer-6 and Shahed-series unmanned aerial vehicles over several days this month is likely part of a Russian plan to acquire hundreds of Iranian UAVs. The Washington Post first reported that Russia had faced technical problems with the Iranian drones.

- Plan for EC electricity market intervention not expected to be ready for weeks. Bloomberg reports (link) that European Commission President Ursula von der Leyen “promised an ‘emergency intervention’ in the bloc’s runaway electricity markets, but diplomats say that any significant steps will take weeks to hash out and implement.” According to Bloomberg, the EC “is still in the process of devising various options for how the bloc could try to bring down the price of electricity, which is about 10 times higher than it was a year ago.” Reuters reports (link) that Kremlin spokesman Dmitry Peskov maintained on Tuesday that “nothing stands on the way of Russian gas exports to Europe via the Nord Stream 1 pipeline apart from technological problems caused by Western sanctions...a day before another planned maintenance shutdown.” Gazprom “has announced it will shut the pipeline for three days from Wednesday to undertake maintenance of a single pumping unit at the Portovaya compressor station.”

Reuters reports (link) that the government of France “accused Moscow on Tuesday of using energy supplies as ‘a weapon of war’ after Russia’s Gazprom cut deliveries to a major French customer and said it would shut its main gas pipeline to Germany for three days this week.” France’s Energy Transition Minister Agnes Pannier-Runacher said: “Very clearly Russia is using gas as a weapon of war and we must prepare for the worst case scenario of a complete interruption of supplies.” Reuters says (link) that France, “once Europe’s top power exporter, may not produce enough nuclear energy this winter to help European neighbors seeking alternatives to Russian gas, and may even have to ration electricity to meet its own needs.” Reuters adds that “this year, for the first time since French records began in 2012, France has become a net power importer as its own production of nuclear energy hit a 30-year low.” - Gazprom, Russia’s state-owned energy giant, turned off the Nord Stream 1 pipeline to Germany on Wednesday, per schedule, ostensibly for a few days’ repair. It also said it would suspend its supply of natural gas to Engie, a utility firm based in Paris, on Thursday. Gazprom blamed a billing dispute, though a French minister as previously noted said that Russia is simply “using gas as a weapon of war.”

- Former Soviet Union President Mikhail Gorbachev has died at age 91, according to multiple reports, more than three decades after he led an unprecedented era of economic reform in the Soviet state that preceded the fall of communism in eastern Europe. It was widely reported earlier this summer that Gorbachev was suffering from a serious kidney ailment. Gorbachev, who had been in declining health suffering from acute diabetes, had been undergoing treatment at a hospital. He spent the last decades of his life traveling and speaking on international affairs and the hazards of pollution and the global arms industry.

|

POLICY UPDATE |

— Vilsack announces three grant recipients for ‘climate smart’ products; other grant recipients will be announced the week of Sept. 13. The over $1 billion the federal government is devoting to voluntary efforts to reduce agriculture’s adverse effects on the environment is a better long-term strategy than mandating new rules for farmers, USDA Secretary Tom Vilsack said Tuesday at the Farm Progress show in Boone, Iowa.

“The challenge, Vilsack said, is how do you increase production sustainably? How do you increase production but at the same time do it in a climate-smart way?”

Regarding the $1 billion to support new “climate smart” products, Vilsack announced three grant recipients during the Farm Progress Show.

The University of Missouri will work with farmers to build climate-resilient cropping and livestock systems. “Most of the climate-smart practices will be incentivized in this project and will contribute to building better soil health, sequester more soil carbon. While the nutrient management approaches will result in reduced fertilizer use and the impacts of fossil fuels and nitrous oxide.”

South Dakota University is funding market opportunities for live beef and bison commodities that will use climate-smart grazing and land practices. “They’re plan is to quantify, monitor and verify carbon and GHG benefits associated with climate-smart agricultural production in relation to practices on beef and bison.”

The Iowa Soybean Association will work with producers to implement climate-smart practices on millions of acres of corn, soy and wheat to market those crops with companies like Pepsi.

Vilsack said other grant recipients will be announced the week of Sept. 13. He noted requests from more than 1,000 applications topped $20 billion. “It said to me that we are really on to something here. Our farmers and ranchers are really interested in creating new revenue streams. They’re interested in reducing their greenhouse gas input. They’re interested in figuring out ways to be more productive. They can improve soil health. They can improve water quality. They can improve livestock quality.”

|

CHINA UPDATE |

— China’s ruling Communist Party will hold its national congress from Oct. 16, according to state media, an event that will usher in the top leadership for the next five years. The date was set during a monthly meeting of the Politburo, and we first alerted this on Tuesday. The South China Morning Post notes that “The announcement usually indicates that most of the closed-door negotiations on key positions are over, though there could be last-minute adjustments. The most important decisions are usually made ahead of the party congress, which largely serves as a formal occasion to legitimize and communicate those decisions to delegates.” Xi is expected to begin a third term as the party’s leader at the end of the congress, which would make him the first to do so since the rule of Mao Zedong. Xi told key officials in July that this year’s party congress would be held “at a critical moment in our new journey of building a socialist, modern country” and would decide the nation’s course for the next five years and beyond. He also warned of challenges at home and abroad that he said were “more complex than ever.”

— Taiwan warned it would “counter-attack” Chinese forces that entered its territory and refused to leave. China has increased its military drills around Taiwan following the recent visit of House Speaker Nancy Pelosi (D-Calif.). On Tuesday the self-governing island, which Beijing claims as its own, fired warning shots at a Chinese drone for the first time. Taiwan said China was still carrying out military drills around the island. Link for details.

— China’s manufacturing PMI rises, but factory sector still contracting. China’s official purchasing managers index (PMI) rose to 49.4 in August from 49.0 in July, though that was still below the 50.0-point mark that signals contraction. The latest figure was the second straight month of contraction in factory activity, amid a resurgence of Covid-19 cases, new lockdowns in some cities and power rationing due to the worst heatwaves in decades.

|

TRADE POLICY |

— South Korea notes concerns on U.S. EV tax credits. A South Korean trade official raised the nation’s concerns with elements of the Inflation Reduction Act related to tax credits for electric vehicles at a meeting with U.S. counterparts. South Korean Deputy Trade Minister Ahn Sung-il and Deputy U.S. Trade Representative Sarah Bianchi “agreed the two sides would keep in close contact on this issue over the coming weeks,” the Office of the U.S. Trade Representative said in an emailed statement after the officials met.

|

ENERGY & CLIMATE CHANGE |

— Kerry sounds very conciliatory toward China. U.S. climate envoy John Kerry said in an interview with the Financial Times (link) he was hopeful that the U.S. and China could resume talks on climate change before the November COP27 climate summit in Sharm el-Sheikh. China broke off talks in retaliation for House Speaker Nancy Pelosi’s visit to Taiwan in August. Even before that, China had sounded fairly dismissive of the agreement that Kerry had touted on climate cooperation. Xi Jinping said straightforwardly in January that climate goals should not disrupt life and that China, the world’s largest emitter, must “overcome the notion of rapid success” on lowering emissions. Kerry, though, said in the interview that China had “generally speaking, outperformed its commitments… They had said they will do X, Y and Z and they have done more,” he said. He specifically cited China’s development and production of renewable energy.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— FDA to hold listening session Oct. 18 on animal feed claims. The virtual public listening session is on FDA’s regulation of animal foods that make certain environmental and production claims, including reduced greenhouse gas emissions, growth promotion and feed efficiency. The session is part of FDA’s review of the Center for Veterinary Medicine’s policy and procedures manual for the regulation of animal foods with drug claims. FDA wants feedback on how the existing policy could be updated to reflect evolving scientific knowledge and to promote innovation.

— USDA announces $21.9 million in grants awarded to further strengthen meat and poultry supply chains. USDA’s Agricultural Marketing Service (AMS) today announced an additional $21.9 million of funding is being awarded to 111 grant projects through the Meat and Poultry Inspection Readiness Grant Program (MPIRG), bringing total funding to $54.6 million. This year’s awards will fund projects in 37 states. Link for details.

|

CORONAVIRUS UPDATE |

— Summary:

- Global Covid-19 cases at 602,382,621 with 6,491,316 deaths.

- U.S. case count is at 94,380,993 with 1,044,763 deaths.

- Johns Hopkins University Coronavirus Resource Center says there have been 604,656,568 doses administered, 223,914,723 have been fully vaccinated, or 67.96% of the U.S. population.

|

POLITICS & ELECTIONS |

— David Wasserman's latest House overview. The House editor for the Cook Political Report with Amy Walter sees the most likely outcome as a GOP net gain of 10-20 seats — down considerably from the spring, when he said the GOP looked poised to gain 20-35 seats.

Says Wasserman: “If forced, here's how we would roughly rank order the five factors driving this climate shift:

“1. The Dobbs ruling helping Democrats match or even overtake the GOP base in enthusiasm

“2. Steadily falling gas prices taking some bite out of Republicans' "Biden-flation" message

“3. Republican primaries pulling candidates to the right or producing weakened nominees

“4. The Mar-a-Lago search and January 6 hearings shifting media focus from President Biden to Donald Trump, hampering GOP efforts to make November a referendum on the incumbent

5. Legislative breakthroughs — including the Inflation Reduction Act, CHIPS bill and gun safety bill — restoring wavering Democrats' faith in Biden's ability to pass an agenda.”

— DOJ bans officials from partisan political events in wake of bias claims. Attorney General Merrick Garland announced new bans on political involvement from Justice Department officials in the wake of widespread accusations of bias being directed toward the agency. “Although longstanding Department policy has permitted non-career appointees to attend partisan political events, e.g., fundraisers and campaign events, in their personal capacities if they participated passively and obtained prior approval, under the new policy, non-career appointees may not participate in any partisan political event in any capacity,” Garland declared in a Tuesday statement (link). “In the past, when the Department has further limited attendance at partisan political events during Presidential election years, it has allowed an exception for non-career appointees who had close family members who were running for partisan offices, or similar situations," he added. "The new policy permits no exceptions.”

Garland also noted that prior DOJ policy “allowed non-career employees to passively attend campaign events and other partisan political events in their personal capacities on the evening of Election Day.” He said now “non-career appointees may not attend partisan political events, even on the evening of Election Day.”

Republicans on Tuesday responded to reports that a top-level FBI agent, Timothy Thibault, had resigned from the bureau last week. Anonymous sources within the FBI told some news outlets that Thibault, the FBI Assistant special agent in charge, no longer works for the law enforcement agency. He was walked out of the building on Friday, which is the standard procedure, the reports said.

Sen. Chuck Grassley (R-Iowa), whose letters to the FBI’s leadership repeatedly referenced alleged political bias on behalf of Thibault, said the agent “undermined the work and reputation of the FBI” and cast “a shadow over all the bureau’s work that he was involved in,” according to a statement from his office issued Tuesday morning. Grassley accused him of “opening an investigation into Trump based on liberal news articles” and “shutting down investigative activity into Hunter Biden that was based on verified information.” The senator previously referenced those allegations against Thibault in letters to the FBI director, citing bureau whistleblower complaints against Thibault and other top leaders. Neither Thibault nor the FBI has issued responses to Grassley’s specific claims about alleged political bias. Grassley’s statement promised more congressional investigations into the FBI and called on the DOJ’s inspector general to further look into bias at the bureau. Previously, Thibault was flagged by Grassley in letters to the agency for previously sharing a Twitter post calling Trump “a psychologically broken, embittered, and deeply unhappy man.” And in other letters, Grassley accused Thibault of potentially violating federal laws and rules established by the FBI. Citing whistleblower claims, Grassley also alleged that there’s evidence Thibault had partisan bias when handling investigations into the Trump campaign and Hunter Biden, the son of President Joe Biden.

|

OTHER ITEMS OF NOTE |

— Iranian navy tries to steal U.S. unmanned vessel at sea. An American unmanned surface vessel in the Persian Gulf was almost taken in the dead of night Monday by an Iranian ship before U.S. Navy forces intervened, according to officials.

— World Health Organization’s top director in Asia, Dr. Takeshi Kasai, has been put on leave after staff members accused him of racist, abusive and unethical behavior, The Associated Press reports.

— NASA said it would try again to launch its Artemis rocket on Saturday. An attempt to do so on Monday was thwarted by a problem with an engine — possibly a faulty sensor. Mission managers said one of the rocket's four engines could not reach the proper temperature range that is required for the engine to start at liftoff. Several other issues, including storms and a hydrogen leak, also caused delays that prevented liftoff during Monday's launch window. The new two-hour launch window opens at 2:17 p.m. ET on Sept. 3. There is still a backup opportunity for the mission to launch on Sept. 5 as well.

— The man who sold the most valuable sports card of all time. Anthony Giordano got a record $12.6 million for a 1952 Topps Mickey Mantle. After holding onto it for 31 years, Giordano recently sold his 1952 Topps Mickey Mantle for that high price through Heritage Auctions. It was the largest amount ever paid for a sports card at auction — topping the Honus Wagner sale of $7.5 million in early August. It's also the most money ever paid at auction for any sports memorabilia period —more than the $9.3 million coughed up for the Diego Maradona "Hand of God" jersey. Link to more from MLB News.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Election predictions: Split Ticket |