Biden to Unveil Student Debt Forgiveness Plan Estimated to Cost At Least $300 Billion

White House unveils $3 billion military aid package for Ukraine

|

In Today’s Digital Newspaper |

USDA daily export sale: 517,000 metric tons of soybeans to China during the 2022-2023 marketing year.

White House officials have told congressional allies the president plans to cancel $10,000 in student debt for those earning less than $125,000 a year, or around double that for married couples. Officials expect Biden to extend the moratorium on loan repayments, which then-President Trump paused in 2020 in response to Covid, until the end of the year. Republicans will quickly claim that Biden’s move to erase billions in aggregate debt could stoke inflation. Biden’s expected debt decision would cost $300 billion, according to an analysis from the Penn Wharton Budget Model. We have a lot more on this in the Policy section.

It is becoming evident that recession is either here or coming in more than a few countries, including the United States. U.S. companies reported a sharp drop in business activity in August in a broad-based decline led by services companies. High inflation, material shortages, delivery delays and interest-rate rises all weighed on business activity, the S&P Global survey said. Meanwhile, the White House said it expected slower economic growth and higher inflation than previously forecast, citing an Omicron-fueled coronavirus wave and Russia’s invasion of Ukraine. On Tuesday, Macy’s and Nordstrom became the latest retailers to lower their financial goals for the year, citing risks of a steeper economic downturn and slowdown in consumer spending. Meanwhile, some 20 million U.S. households, or one out of every six homes, are missing utility payments. Outside the U.S., new surveys also saw business activity fall in Europe and Japan.

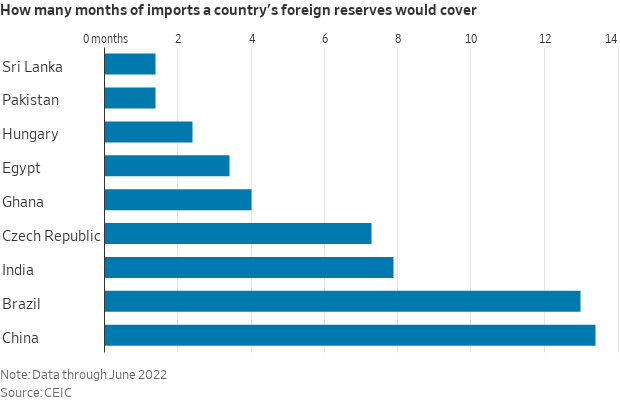

Emerging markets are burning through foreign currency at the fastest rate since 2008, raising the risk of a wave of defaults.

Today is both Ukraine’s Independence Day and six months since Russia’s invasion of the nation. Ukraine President Volodymyr Zelenskyy declared that Ukraine would liberate all its lands from Russia. The country had been reborn, he said, and is fighting valiantly for a future independent from Moscow, its longtime overlord. The U.S. warned of a potential escalation in Russian attacks on civilian areas in Ukraine to coincide with the country’s Independence Day today, urging Americans to leave as soon as possible.

White House announces another $3 billion military aid to Ukraine. “The United States of America is committed to supporting the people of Ukraine as they continue the fight to defend their sovereignty,” President Biden said in a statement, outlining that the money will go to air defense systems, artillery systems, munitions and other war-fighting material.

Extreme heat in China is causing widespread problems, with authorities across the Yangtze river basin scrambling to limit damage to power, crops and livestock. Details in China section.

Chinese export hub Yiwu, where factories churn out two-thirds of the world’s Christmas products, has re-emerged from 10 days of Covid lockdown.

California lawmakers are racing to hammer out a plan to keep the state’s last nuclear plant online, citing anticipated power shortages for years to come.

Some Senate Democrats are calling for USDA to rethink efforts on methane digesters. An item below details two letters on the topic, one to USDA and the other to the EPA.

The Inflation Reduction Act could trim climate-related damages by up to $1.9 trillion through 2050, according to a White House Office of Management and Budget report. The law's benefits include reducing the impact of extreme weather events, such as property damage from sea level rise, and lowering overall carbon emissions by up to 40% below 2005 levels by 2030.

Texas-based Freeport LNG expects to return to 85% production from its liquefied natural gas export facility by late November instead of a restart originally planned for October, following a June explosion at the facility that forced a temporary shutdown. The company warned that it could face construction delays as it works to resume the processing of up to 2.1 billion cubic feet of natural gas per day at the facility.

Germany is suspending green farming rules to boost ag output. Details in Policy section.

Commercial flock confirmed with HPAI in California. Details below.

In Tuesday primaries, Democrats in Florida chose former governor Charlie Crist to face the GOP's Ron DeSantis in November, while Val Demings will fight to unseat Sen. Marco Rubio. In Manhattan's redrawn 12th district, Rep. Jerrold Nadler beat fellow incumbent Carolyn Maloney. In Oklahoma, Republicans chose a nominee to serve out the remainder of retiring Sen. Jim Inhofe's term ahead of a special general election. House Democrats are giddy after winning a special election in New York last night, holding onto a seat that had been heavily favored to swing into the GOP column. Democrats are pointing to abortion and the Supreme Court’s decision striking down Roe v. Wade as the key to Tuesday’s victory, and possibly the House this fall, but Republicans are still expected to win control of the House, according to most election prognosticators. We have more in Politics & Elections section.

Election Day 2022 is 76 days away. Election Day 2024 is 804 days away.

|

MARKET FOCUS |

Equities today: Global stock markets were mixed to weaker overnight. U.S. Dow opened slightly lower. Macy’s Inc. and Nordstrom became the latest retailers to lower their financial goals for the year, citing risks of a steeper economic downturn and slowdown in consumer spending. Overall inventory levels remained elevated, Macy’s said, but were down 7% from the first quarter. Macy’s said sales have been lower since Father’s Day. In Asia, Japan -0.5%. Hong Kong -1.2%. China -1.9%. India +0.1%. In Europe, at midday, London -0.3%. Paris flat. Frankfurt -0.2%.

U.S. equities yesterday: The Dow fell 154.02 points, .047%, at 32,909.59. The Nasdaq eased 0.27 point, 0.00%, at 12,381.30. The S&P 500 was off 9.26 points, 0.22%, at 4,128.73.

Agriculture markets yesterday:

- Corn: December futures surged 26 1/4 cents to $6.55 1/4, the contract’s highest closing price since June 28.

- Soy complex: November soybeans rose 25 3/4 cents to $14.61, the contract’s highest closing price since June 29. September soymeal rose $8.00 to $468.50. September soyoil rose 82 points to 69.59 cents.

- Wheat: December SRW wheat rose 12 1/4 cents to $8.00 1/2, the contract’s highest closing price since Aug 16. December HRW wheat rose 13 cents to $8.79. December spring wheat climbed 13 cents to $8.79.

- Cotton: December cotton futures fell 191 points to 112.23 cents per pound, the lowest closing price since Aug. 12.

- Cattle: October live cattle gained 10 cents to $144.60 following two-sided trading. Feeder futures sank as corn and soybean futures rallied, with the September contract down $1.90 to $182.45.

- Hogs: October lean hogs fell $1.075 to $92.90, the contract’s lowest closing price since July 15. Pork cutout values plunged $11.14 early Tuesday to $106.47, led by a drop of over $47 in bellies.

Ag markets today: December corn futures rose to the highest price since late June and soybeans and wheat also rose amid concern over dry weather. As of 7:45 a.m. ET, corn futures were trading 6 to 8 cents higher, soybeans were 6 to 14 cents higher, and wheat was 10 to 18 cents higher. Front-month crude oil futures were up slightly under $1 and the U.S. dollar index was about 200 points higher and near a 20-year high.

Technical viewpoints from Jim Wyckoff:

On tap today:

• U.S. durable-goods orders for July are expected to increase 1% from the prior month. (8:30 a.m. ET)

• U.S. pending home sales for July are expected to fall 3% from the prior month. (10 a.m. ET)

• Bank of Korea is expected to lift its benchmark interest rate by 25 basis points to 2.5% at its policy meeting. (9 p.m. ET)

Recession perspective. “There’s a view that as long as it’s not like 2008, it’s not a big deal, but this recession will be worse than people are thinking, and I worry it will be more prolonged,” says Nancy Lazar, chief global economist at Piper Sandler.

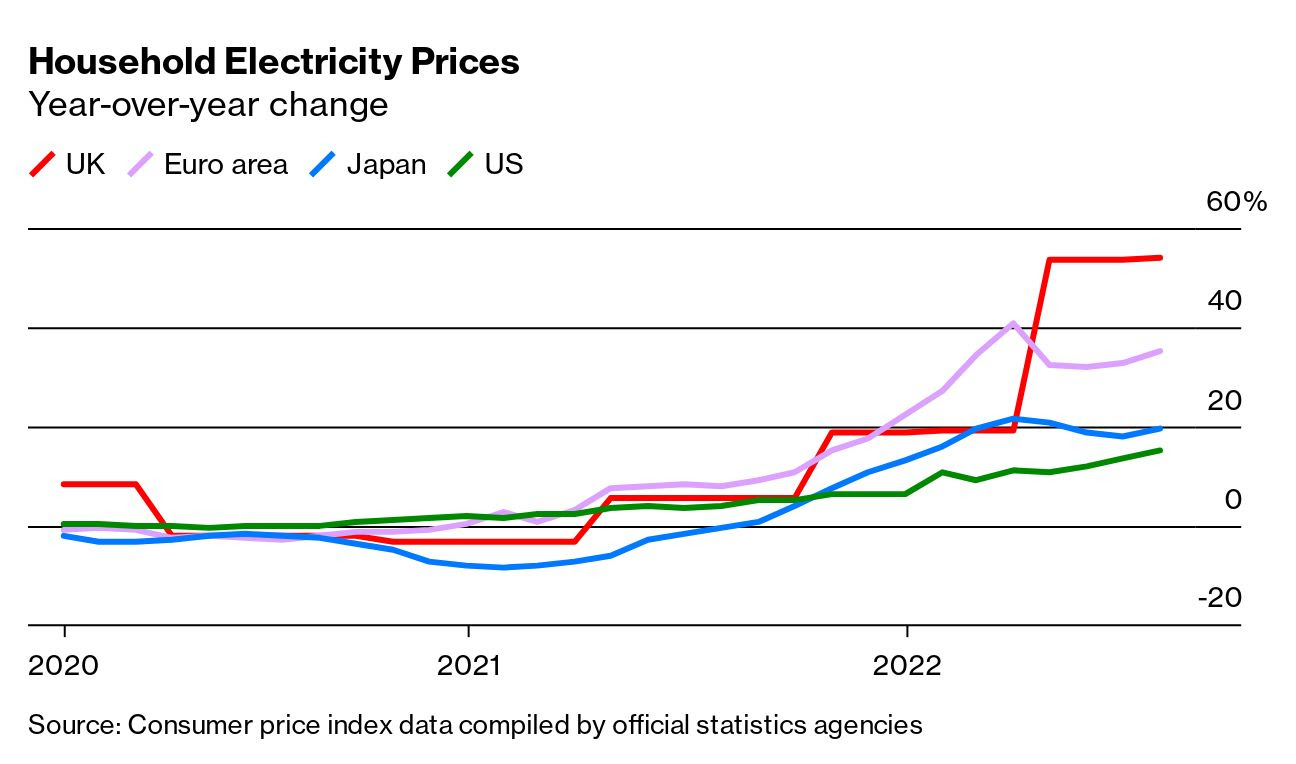

Some 20 million U.S. households, or one out of every six homes, are missing utility payments amid a blistering surge in electricity prices. A national energy association said it's the worst crisis it's ever documented, mirroring even more severe woes in Europe.

Logistics update. The average amount of time that rail-bound containers waited to leave the ports of Los Angeles and Long Beach rose to 16.4 days in July, compared with 13.3 days a month early and 11.3 days a year earlier, according to the latest figures from the Pacific Merchant Shipping Association. Almost 76% of them have dwell times longer than five days, up from 53% a year earlier.

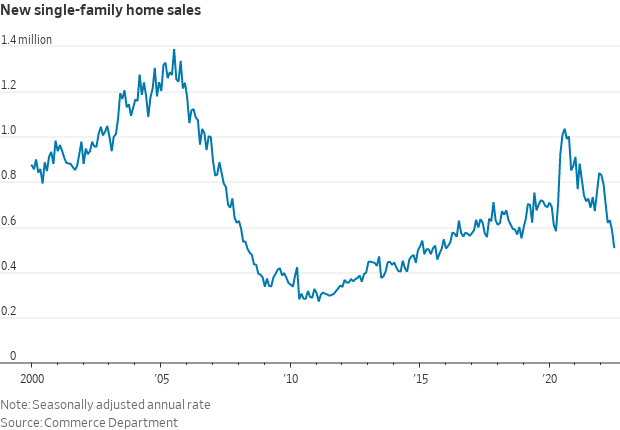

U.S. new home sales fell to the slowest pace in more than six years in July, the latest indication that a steep rise in prices and higher mortgage rates are hobbling the housing market. Single-family home sales dropped to an annual rate of 511,000 in July, the Commerce Department said Tuesday, the lowest level since January 2016. "The housing market has shifted abruptly. The combination of sharply higher prices, higher mortgage rates and slower income growth has sharply reduced affordability," said Wells Fargo economist Mark Vitner.

Emerging markets burn through currency reserves. Emerging markets are burning through stockpiles of U.S. dollars and other foreign currency at the fastest rate since 2008, raising the risk of a wave of defaults across the world’s most fragile economies, the Wall Street Journal reports (link). Central banks around the world are using reserves to defend their currencies against the rallying U.S. dollar and to cover higher import bills for food and fuel. While larger emerging markets such as China, India and Brazil are well-positioned to ride out the storm with huge stockpiles of foreign currency, others countries are on the cusp of running out.

The U.S. will hold the first in-person meetings with ministers from 13 Indo-Pacific nations in Los Angeles Sept. 8-9 under its economic initiative designed to counter China’s influence in the region. USTR Katherine Tai and Commerce Secretary Gina Raimondo will host the session, focusing on discussions on trade, supply chains, clean energy, decarbonization, and infrastructure, tax and anti-corruption.

OMB: Deficits, economic growth lower in the near term, inflation up. The White House's annual update to its most recent budget forecasts forecast a brighter near-term picture for federal finances but a somber outlook for inflation and economic growth, according to a report in Congressional Quarterly. The Office of Management and Budget (OMB) in a report issued Tuesday sees the deficit for the current fiscal year dropping to just over $1 trillion, a $383 billion improvement from its prior forecast. It is also $1.7 trillion lower than the previous fiscal year's budget shortfall, a drop that OMB Director Shalanda said is the "single largest nominal decline in the federal deficit in American history."

But U.S. economic growth is clearly slowing amid higher inflation and interest rates than the White House budget office previously expected. Growth in inflation-adjusted gross domestic product (GDP) is now predicted to cool down to 1.4% this year and 1.8% in 2023 from the prior 3.8% and 2.5% readings the White House said it expected in March.

Inflation as measured by the consumer price index is seen at 6.6% in the fourth quarter of 2022 compared to a year earlier, compared with 2.9% in the March budget. That is above the Congressional Budget Office's most recent estimate of 4.7%, but in line with private sector forecasts.

The OMB updated forecast doesn't factor in the enactment of the fiscal 2022 budget reconciliation (IRA)), which is expected to reduce deficits by nearly $300 billion over a decade; a new $278 billion veterans’ health care and disability expansion program for those exposed to toxic substances; and the $79 billion "chips-plus" law providing grants and tax credits for domestic semiconductor manufacturing development. It also used data available in early June; as a result the three most recent consumer price index readings aren't factored in, or the advance second quarter GDP estimate, which shows a 0.9% contraction in economic activity.

The forecast also doesn't include potentially expensive administrative actions. For example, the Biden administration is said to be nearing a decision to eliminate up to $10,000 in debt for certain student borrowers with federal loans, a move that could cost upwards of $300 billion depending on eligibility, the Penn Wharton Budget Model estimated. (See related item.)

Market perspectives:

• Outside markets: The U.S. dollar index is firmer in early U.S. trading, after hitting a 20-year high on Tuesday. Meantime, the yield on the 10-year U.S. Treasury note is fetching 3.046%. Bond yields have been on the rise recently. Crude has moved higher, with U.S. crude around $94.70 per barrel and Brent around $101.30 per barrel. Gold and silver were under pressure ahead of economic reports with gold around $1,757 per troy ounce and silver around $18.87 per troy ounce.

• Restart of LNG export terminal again delayed. Freeport LNG said that it will restart its liquefied natural gas (LNG) exports in mid-November, a delay of more than a month from its prior plans. Freeport now expects to have 85% of its capacity online by mid-November and be fully operational by March. Natural gas futures eased after the announcement as the delay will keep more supplies available domestically. The Freeport LNG export terminal has been offline since June after a fire at the facility. The terminal accounts for about 20% of all U.S. LNG exports.

• Day 2 Pro Farmer Crop Tour results for Nebraska and Indiana. Scouts on day 2 of Tour determined an average corn yield of 158.53 bu. per acre in Nebraska, down from both last year’s 182.35 bu. per acre estimate and the three-year Tour average of 176.68 bu. per acre. Soybean pod counts in a 3’x3’ square came in at 1,063.72 for Nebraska, down from both 1,226.43 in 2021 and the three-year Tour average of 1,245.06.

In Indiana, samples yielded an average corn yield of 177.85 bu. per acre, down from both 193.48 bu. per acre in 2021 and the three-year Tour average of 178.26 bu. per acre. Soybean pod counts in a 3’x3’ square totaled 1,165.97 for Indiana, down from 1,239.72 in 2021 but above the three-year average of 1,148,26.

On Day 3 of the Crop Tour, scouts on the western leg will sample fields in western Iowa and southern Minnesota, and scouts on the eastern leg will sample Illinois and eastern Iowa.

• Logistics: 16.4 is the average number of days imported containers at the ports of Los Angeles and Long Beach waited for inland rail transport in July, up from 13.3 days in June to the highest level the Pacific Merchant Shipping Association has recorded.

• Europe’s drought is probably the continent’s worst in 500 years, an EU agency warned. The European Drought Observatory said that 47% of the union’s landmass is subject to the warning, with vegetation affected in 17%. River shipping, hydropower and agriculture are all under strain. Concomitant droughts in the U.S., Britain and China mean that international markets offer little relief. Link to Bloomberg article for details. Link to more info.

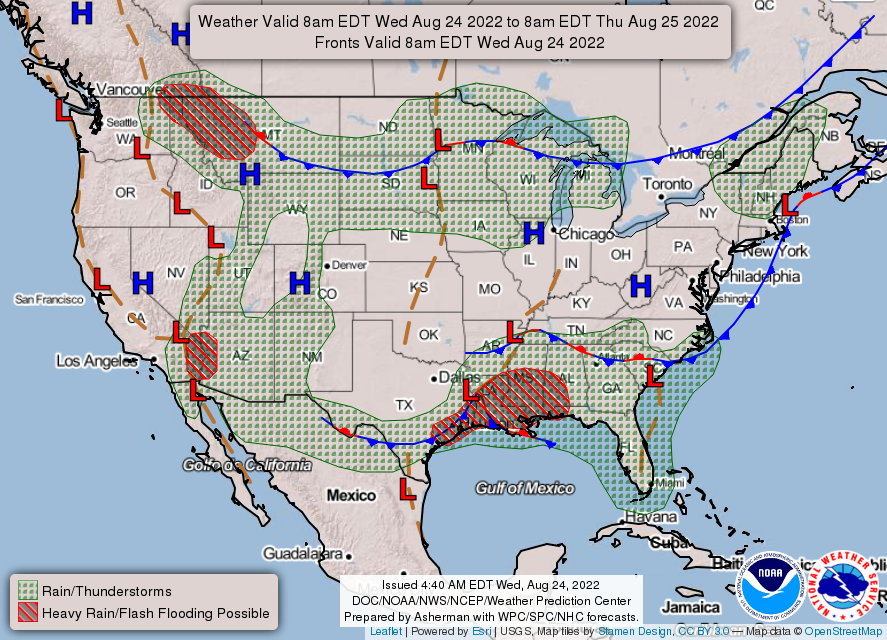

• NWS weather: Heavy Rain and Flash Flooding threats over the lower Mississippi Valley may shift farther east into Alabama... ...Above average temperatures to continue from the inland valleys of California into the Great Basin and Pacific Northwest, while below average temperatures expected across the South from the Southern Plains into the Southeast.

Items in Pro Farmer's First Thing Today include:

• Corn futures extend rally to two-month high overnight

• China baking under high temperatures (see details in China section)

• Central bankers convene in Jackson Hole facing critical questions

• Cattle traders waiting for cash trade to develop

• Hog futures fail to sustain early upswing

|

POLICY UPDATE |

— President Biden is expected to announce today that he will cancel some federal student loan debt for tens of millions of Americans through a long-awaited executive action, which would provide unprecedented relief for borrowers but will draw political and legal challenges. Biden is also expected to extend the pandemic pause on student loan payments, likely through the end of the year. Loan payments were set to resume for millions of borrowers after Aug. 31. Nearly 44 million people collectively owe $1.7 trillion in federal student loans. Only 37.9% of Americans graduate from college.

The plan reportedly will forgive around $10,000 of student debt for borrowers who make under $125,000 a year or around double that for married couples, which includes the vast majority of the 40 million people with student debt. The action could render up to 15 million borrowers whose balances are under $10,000 entirely free of student debt.

Buying votes? Support from younger voters could help boost Democrats’ showing in the upcoming balloting. But a backlash could also be seen from voters who chose not to go to college because of the cost, don't have loans or already paid them off.

Forgiving student debt will cost between $329 billion and $933 billion over 10 years, according to a new analysis, with the majority of relief going toward borrowers in the top 60% of earners. A model estimates a program that forgave $10,000 of debt per individual with an income cap of $125,000 costs $329 billion over 10 years. A debt forgiveness program with an income cap of $125,000 that forgave up to $50,000 per individual would cost the government $933 billion over 10 years. The latest Penn Wharton Budget Model (link) was released Tuesday ahead of Biden’s long-anticipated announcement.

The Penn Wharton Budget Model found:

- It would provide disproportionate benefits to working- and middle-class households.

- The poorest fifth of Americans, earning less than about $29,000 per year, would get a much smaller boost.

- The top 10% would be almost entirely excluded depending on how relief is designed.

Background. Any cancellation would come at a time when the U.S. unemployment rate has fallen to 3.5% and is even less among college graduates with a bachelor's degree, with the rate averaging 2.9% in July. The Biden administration has already canceled nearly $32 billion of the $1.7 trillion in outstanding federal student debt by expanding existing forgiveness programs for public-sector workers, disabled borrowers and students who were defrauded by for-profit colleges.

Bottom line: Studies have shown that the debt load puts recent graduates off buying houses and starting a family, a point liberal Democrats cite when arguing for relief. But two well-known economists and former top advisers to President Barack Obama say providing relief now is a bad idea. Jason Furman, a Harvard professor who headed the Council of Economic Advisers in Obama’s second term, tweeted that he sees a debt-cancellation move nullifying the deflationary powers of the Inflation Reduction Act. Larry Summers, a Treasury secretary under President Bill Clinton and former Obama economic adviser, tweeted, “Student loan debt relief is spending that raises demand and increases inflation.” He added that the current moratorium on loan repayments benefits “highly paid surgeons, lawyers and investment bankers.”

Different opinions in Congress. While Sen. John Thune (R-S.D.) called canceling student debt “grossly unfair” to those who paid off their loans, Sen. Elizabeth Warren (D-Mass.) said it would narrow the racial wealth gap among borrowers and help working families buy their first home or save for retirement.

— Germany suspends green farming rules to hike ag output. German state ministers approved a proposal to relax environmental farming rules to protect food security, citing the war in Ukraine. The measure, proposed by federal Agriculture Minister Cem Özdemir, would exempt German farmers from implementing certain environmental requirements of the new Common Agricultural Policy (CAP), and can use fallow land to raise crops like cereals, sunflowers, legumes — but not corn and soybeans. Mandatory crop rotations would also be suspended. The German Agriculture Ministry says it could boost German wheat production by 3.4 million tonnes. Under the now-suspended plan, producers were to keep at least 4% of their land out of production to preserve biodiversity and soil health.

|

RUSSIA/UKRAINE |

- Summary: U.S. intelligence agencies believe Russia is likely to increase attacks, according to a warning declassified and sent by the State Department. Ukraine’s civilian infrastructure and government facilities could be targeted in the coming days, it said. Both Ukrainian and American officials have been concerned that possible Russian missile attacks could be timed to Independence Day and in response to a string of Ukrainian assaults on Russian military targets in Crimea. President Volodymyr Zelenskyy warned over the weekend that “Russia may try to do something particularly nasty, something particularly cruel.” He vowed that there would be a “strong response” to any attack. Meanwhile, the White House this morning pledged an additional $3 billion in arms — the largest single installment of U.S. security assistance since Russia’s invasion — to coincide with the national holiday. The U.S. has provided $10.6 billion in military assistance to President Volodymyr Zelenskyy's government since the beginning of the Biden administration, including 19 lots of weapons taken directly from stocks in the Defense Department. Separately, the U.N.’s nuclear watchdog said it would assess security at Zaporizhia, the site of Europe’s largest nuclear plant — and intense shelling — over the next few days.

- Today marks the six-month anniversary of Russia’s invasion of Ukraine. Russia has failed to meet any of its military objectives: conquering Kyiv, the capital, capturing the eastern Donbas region or seizing Ukraine’s coastline. Around 15,000 Russians have been killed, according to the Pentagon, roughly the same number that died in the Soviet Union’s decade-long occupation of Afghanistan. The frontlines have barely moved in recent weeks, though Ukraine hopes to push Russian troops out of Kherson, a city in the south, in the coming months. Both armies are exhausted.

- Today is also the 31st anniversary of Ukraine's independence from the Soviet Union. In lieu of a parade, central Kyiv was decorated with the husks of burned-out Russian armored vehicles.

- What Ukrainians think. A new poll from the Razumkov Center think tank in Kyiv found 92% of Ukrainians believe Ukraine will ultimately be victorious. But a plurality expect it to take more than a year.

- Ukraine grain production poised to drop sharply. Ukraine's 2022 grain harvest could shrink to 52.5 to 55.4 MMT from a record 86 MMT due to the Russian invasion cutting harvested area, Reuters reported, citing analyst APK-Inform said. The consultancy said the harvest could include up to 18.2 MMT of wheat, 29.9 MMT of corn and 5.9 MMT of barley. It said a smaller harvest and logistics difficulties could cut 2022-23 July-June exports to between 22.9 and 39.6 MMT depending on logistics situation.

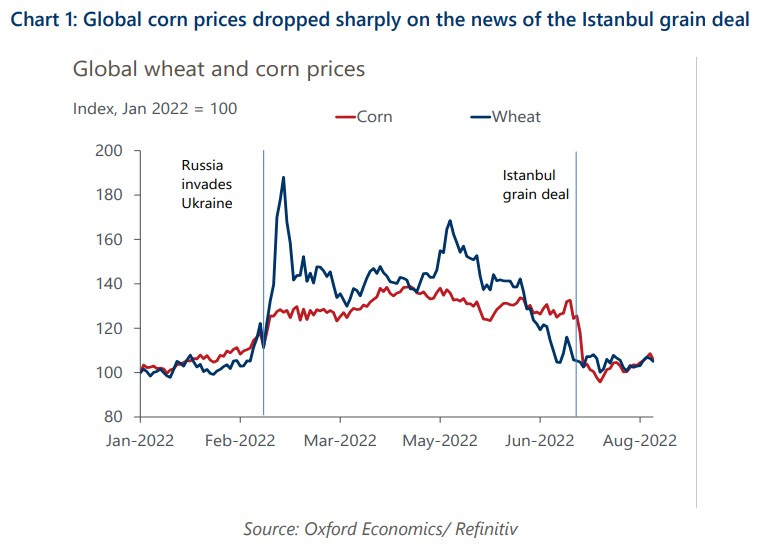

- The grain export deal between Russia and Ukraine would provide much-needed relief to the Ukraine and global economies — but heavy political and operational risks provide limits to those benefits in the medium term, according to Evghenia Sleptsova at Oxford Economics, who sees the Turkey-brokered arrangement triggering a boost in Ukraine’s grain exports to around 4.7 million tonnes per month by the end of this year and raising its economic growth by about 4.3% compared to March-July 2022, in an optimistic scenario. But Ukraine’s grain shipments, which have plunged by about two-thirds since Russia’s invasion, show a much weaker increase of about 2.8 million tonnes per month compared to 1.6 million tonnes in July and only a 1.6% GDP boost compared to the lows of March-July, Sleptsova writes.

|

CHINA UPDATE |

— China’s historic drought and accompanying energy power crisis are forcing factories to shut down and raising longer-term questions about the country’s reliance on hydropower, the country’s largest source of clean energy. Extreme heat in China is causing widespread problems, with authorities across the Yangtze river basin scrambling to limit damage to power, crops and livestock. China's heatwave, stretching past 70 days, is its longest and most widespread on record, with around 30% of the 600 weather stations along the Yangtze recording their highest temperatures ever by last Friday. Chongqing's agriculture bureau also drew up emergency measures to protect livestock at more than 5,000 large-scale pig farms, which have faced “severe challenges.” Damage to crops and water scarcity could “spread to other food-related sectors, resulting in a substantial price increase or a food crisis in the most severe case,” a professor at City University of Hong Kong said. China's National Meteorological Centre downgraded its national heat warning to “orange” on Wednesday after 12 consecutive days of “red alerts,” but temperatures are still expected to exceed 40 Celsius (104 Fahrenheit) in Chongqing, Sichuan and other parts of the Yangtze basin.

— Key export hub resumes business. The export hub Yiwu, where factories churn out two-thirds of the world’s Christmas products, has re-emerged from 10 days of Covid lockdown. On Sunday, Yiwu authorities lifted most lockdown measures imposed since Aug. 11. As of Sunday, 98% of the city’s larger industrial enterprises had resumed operations, and industrial electricity consumption hit pre-outbreak levels. Logistics data indicate the number of total freight orders from Yiwu in the first half of August plummeted 61.8% from the previous month.

|

TRADE POLICY |

— Indonesia extends palm oil export levy. Indonesia said it will extend the palm oil export levy waiver to Oct. 31, according to Trade Minister Zulkifli Hasan, in a bid to boost prices for palm oil to farmers. A maximum export levy of $240 per tonne on crude palm oil was to have started in September. The export levy is besides a separate export tax.

|

ENERGY & CLIMATE CHANGE |

— Japan’s prime minister, Kishida Fumio, said on Wednesday that his country will consider building a new generation of nuclear-power reactors as it prepares to restart plants left idle since the Fukushima disaster of 2011. The global surge in energy prices helped prompt an about-face. There remains work to be done, Kishida implied, in convincing the public that this counts towards Japan’s “green transformation.”

— Some Senate Democrats call for USDA to rethink efforts on methane digesters. Five Senate Democrats want USDA to back away from plans to encourage the installation of methane digesters at livestock operations, warning USDA Secretary Tom Vilsack in a letter (link) that the effort will result in more consolidation in agriculture and the U.S. food industry. The lawmakers cited costs for a methane digester range from $400,000 to $5 million and “would not be economic viable without significant public subsidies and incentives.” They argued that money spent on subsidizing methane digesters are funds that “cannot be spent on alternative manure management strategies or regenerative agriculture practices.”

Details: The letter from Sens. Cory Booker (D-N.J.), Kirsten Gillibrand (D-N.Y.), Elizabeth Warren (D-Mass.) Bernie Sanders (I-Vt.), and Ed Markey (D-Mass.) seeks answers from USDA to several questions on subsidizing methane digesters, including questions relative to environmental justice, whether subsidies would benefit agribusiness and fossil fuel corporations and on additional concentration in the livestock industry.

The same five Dems sent a letter (link) to EPA regarding the potential that methane digesters could be considered an electrification pathway under the Renewable Fuel Standard (RFS) and allow biogas from concentrated animal feeding operations (CAFOs) to be a qualified feedstock and generate electric renewable identification numbers (e-RINs).

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— “We believe food prices reached their highest level in the second quarter of 2022,” World Bank Senior Agriculture Economist John Baffes said last week in an interview with the Japan Times (link), noting that the World Bank’s Food Price Index has dropped by roughly 12% since its high in April.

— Commercial flock confirmed with HPAI in California. USDA’s Animal and Plant Health Inspection Service (APHIS) said a commercial broiler breeder flock of 33,900 birds in Fresno County, California, has highly pathogenic avian influenza (HPAI), marking the 21st state to have HPAI in a commercial operation. With three infections in commercial flocks in Utah last month, there are now four U.S. flocks still under active quarantine in the U.S.

— Food assistance advocates, weeks before a White House summit on fighting hunger nationwide, are divided over how and whether to restrict access to the government’s Supplemental Nutrition Assistance Program (SNAP/food stamps). The White House conference — the first since 1969 — slated for next month sets an ambitious goal to end hunger, increase healthy eating, and get more Americans exercising by 2030.

— USDA extends WIC waivers for infant formula to Dec. 31. With shortages continuing in parts of the country, USDA extended on Tuesday a series of waivers that give WIC households additional options for buying infant formula. The waivers were set to expire on Sept. 30 but now would run through the end of the year.

|

CORONAVIRUS UPDATE |

— Summary:

- Global Covid-19 cases at 597,740,914 with 6,458,187 deaths.

- U.S. case count is at 93,755,395 with 1,041,491 deaths.

- Johns Hopkins University Coronavirus Resource Center says there have been 607,588,353 doses administered, 223,684,995 have been fully vaccinated, or 67.89% of the U.S. population.

— Pfizer's Covid vaccine 73.2% effective in kids under 5, new data shows. Pfizer and BioNTech's vaccine was 73.2% effective in preventing Covid-19 among children aged 6 months through 4 years, new data from the companies showed, two months after the U.S. rollout of the shots began for that age group.

|

POLITICS & ELECTIONS |

— Some results from Tuesday primaries in three states:

- In Florida, Democrats voting chose a former Republican governor of the state, Charlie Crist, as their champion in the race to unseat the incumbent Republican, Ron DeSantis. DeSantis is popular, and often mentioned hopefully as an alternative to Donald Trump in future presidential races. Crist vowed last night: "On Day One of my administration, I will sign an executive order protecting a woman’s right to choose."

Democrats also opted for Val Demings as their challenger for the Senate; she will face Marco Rubio. Demings, who was Orlando's first female police chief, has a chance to become Florida's first Black female senator. - In New York City, Jerry Nadler defeated Carolyn Maloney in a battle between powerful, long-serving House Democrats after a redrawn map combined their districts. The loss ended Maloney's 29-year congressional career. Maloney's defeat marks at least 13 incumbents who have lost primaries this cycle. Maloney complained that she was the victim of “sexist systems and misogyny” as her supporters vented their wrath at her victorious opponent.

- In New York’s suburbs, Sean Patrick Maloney, chair of the Democratic House campaign committee, beat Alessandra Biaggi, a progressive state senator endorsed by Alexandria Ocasio-Cortez.

- Pat Ryan, a Democratic county executive in New York’s Hudson Valley, won a special House election, according to the Associated Press, in a contest that was seen as a potential test of the impact that the recent Supreme Court decision on abortion might have on the midterm elections. The result will keep the swing-district seat, which was formerly held by Lt. Gov. Antonio Delgado, under Democratic control. Ryan was able to keep his early lead, ultimately winning 52% of the vote to Marc Molinaro’s 48%, with nearly 95% of votes cast. Ryan now heads to Washington to serve out the remaining four months of Delgado’s term. It was his second bid for Congress: He ran in 2018 against Delgado, coming in second in a crowded primary. Ryan will be seeking a full term in Congress in November, but — in a confusing redistricting-year twist — it will not be in the 19th District. His home lies within the new boundaries of the 18th District, where he is running in November. His Republican opponent in that race will be Assemblyman Colin Schmitt of New Windsor. Despite Molinaro’s loss in the 19th District, he, too, will be seeking a full term in Congress in November — in the district’s new contours. Some analysts note Ryan’s upset in the special election is a huge boost for Democrats nationally, considering both parties saw Molinaro ($1.4 million raised) as the clear favorite back in June.

Bottom line from analysts at the Cook Political Report with Amy Walter: “What should be most worrying for Republicans is that NY-19 is the kind of district they need to win to have any chance of rolling up big numbers in November. With few Democrats sitting in Trump districts, Republicans’ success depends on picking off Democrats in CD’s Biden carried by six points or less. Not that long ago, that looked feasible. In November, for example, GOP gubernatorial candidate Glenn Youngkin carried Virginia’s 2nd CD, held by Democrat Elaine Luria, by 11 points — a 13-point swing in the GOP direction from 2020. Like New York’s 19th, Luria's Norfolk-based CD went for Biden by just under 2 points in 2020.” The group concludes the “Red wave looks more like a ripple.” - New York 23rd Congressional District special election results saw Joseph Sempolinski, Republican, winning against Democrat Max Della Pia, who came closer than expected to pulling off an upset in the race.

- In Oklahoma, the only other state holding elections on Tuesday, Trump-endorsed Rep. Markwayne Mullin won a special runoff election to become the Republican nominee for the Senate seat now held by the retiring Jim Inhofe.

|

CONGRESS |

— A top House Republican wants Congress to get the chance to review any revival of the Iran nuclear deal. “It is completely unreasonable for this administration to think that a review could be favorable without a robust history of engagement with Congress,” Rep. Michael McCaul (R-Texas), the House Foreign Affairs Committee’s ranking member, said in a letter Tuesday to Biden. The Biden administration is working on its reaction to the latest position taken by Iran in the nuclear talks brokered by the European Union EU) between the two, but a U.S. official said there are still issues ahead. “Gaps still remain, but should we reach an agreement to return to the deal, Iran would have to take many significant steps to dismantle its nuclear program,” a senior U.S. official said.

|

OTHER ITEMS OF NOTE |

— The IRS launched a nationwide safety review after what Commissioner Charles Rettig called an "abundance of misinformation and false social media postings" over agency funding. Link for details via the New York Times.

— A judge on Tuesday gave former president Donald Trump’s lawyers until Aug. 26 to explain the legal basis for his request of a neutral third-party to review documents seized from his estate by the FBI.

— Berkshire Hathaway could owe billions of taxes under new law. Warren Buffett’s Berkshire Hathaway may have to start paying taxes on annual unrealized gains in its $327 billion equity portfolio because of the new 15% corporate minimum tax included in the Inflation Reduction Act signed recently by President Joe Biden. Berkshire had $58.6 billion of unrealized investment gains in its stock portfolio after the stock market rally in 2021. No taxes were paid on those paper profits. Robert Willens, a tax consultant, calculated a $50 billion unrealized gain in one year would likely be a tax bill of $7.5 billion. The new alternative corporate minimum tax applies to companies with over $1 billion in annual earnings. It takes effect in 2023.