China Slashes 5-Year Mortgage Rate as Property Crisis, Drought Deepen

Drought, other bad weather now key focus in ag markets around the world

|

In Today’s Digital Newspaper |

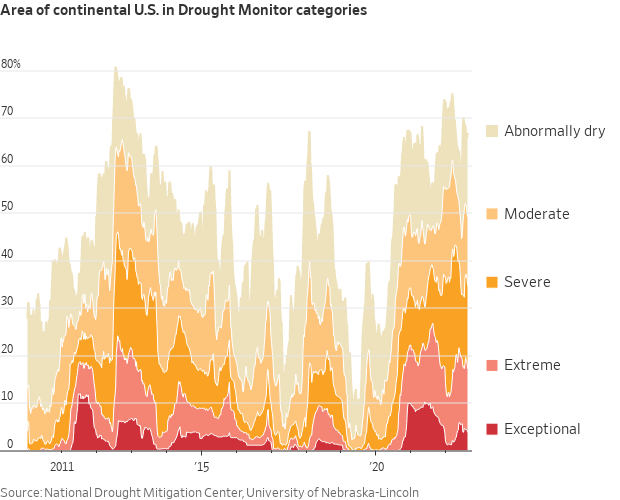

In early Monday calls and emails, two things are evident: Drought and bad weather around the world are getting more attention among ag market traders. For example, the Chinese province of Sichuan just announced it would extend industrial power cuts and activate its highest emergency response, impacting several global manufacturers like Apple, Foxconn, Toyota and Volkswagen. The vital Yangtze, the longest river in Asia, reached its lowest level on record for August, affecting supply of hydropower and causing widespread shortages. Over in Europe, cargo ships have had to reduce their loads due to critically low levels of the Rhine. Separately, agricultural forecasters in the U.S. now expect farmers to lose more than 40% of the cotton crop, while many acres of farmland are being left unplanted because of water shortages. On the financial side, while the focus is clearly on Fed Reserve Chairman Jerome Powell’s speech at a confab Friday morning, equity traders are again widely discussing another major move down in the markets, saying the recent rally was a bear trap.

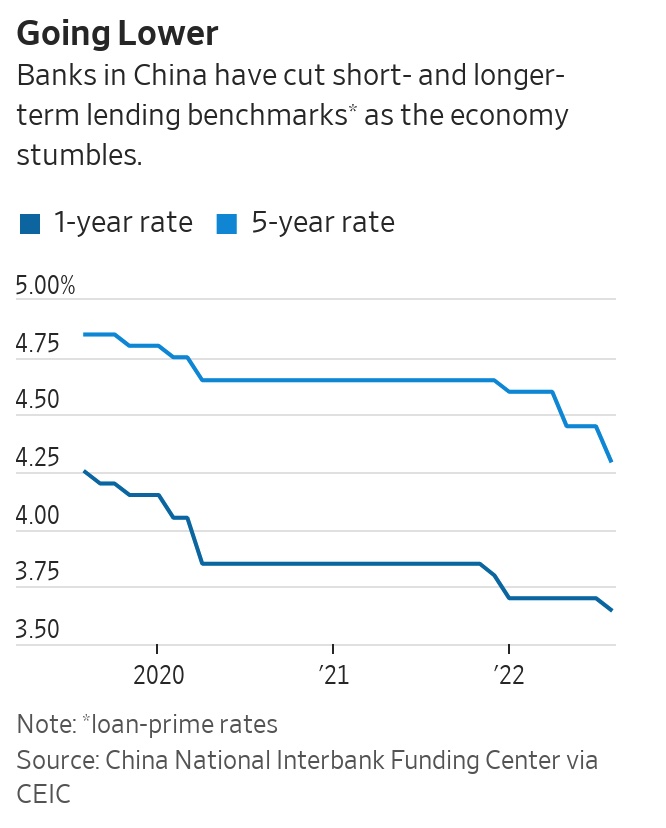

In China, banks lowered the one-year and five-year loan prime rates on Monday, following a decision by the nation’s central bank last week to cut a key policy rate. The move was to revive the beleaguered property sector and reignite the economy, but economists say interest-rate cuts will probably do little to revive growth in China’s flagging economy. The Chinese demand outlook is weighing on oil, which sank below $90 a barrel in New York. Meanwhile, traders are monitoring Iran nuclear talks that could lead to more supplies.

Darya Dugina, a journalist and the daughter of the far-right Russian ideologue Alexander Dugin, was killed in a suspected car bombing near Moscow on Saturday evening. Dugin, who is close to Russian President Vladimir Putin, is likely to have been the main target of the attack but is reported to have made a last-minute change of plans. Ukraine has denied involvement, while Russia’s foreign ministry said any evidence linking Kyiv to the attack would be considered “state terrorism.”

Another U.S. lawmaker landed in Taiwan. The governor of Indiana and a delegation arrived yesterday for an economic development trip to talk about semiconductor investments.

On Friday, Fed Chair Jerome Powell will deliver a major talk as part of the Jackson Hole Economic Symposium. The No. 1 issue this year: inflation.

The Federal Reserve will raise rates by 50 basis points in September amid expectations inflation has peaked and growing recession worries, according to economists in a Reuters poll, who said the risks were skewed towards a higher peak.

A new NABE survey shows business economists are skeptical the Fed can bring inflation down to its target without sinking the economy.

European natural gas prices surge on Russian supply fears. Natural gas futures contracts rose as much as 16% after Moscow said it would shut the Nord Stream pipeline for three days later this month, for what it said were repairs. The news raised questions again as to whether Germany, Europe’s biggest customer of Russian gas, would have enough energy supplies for the winter.

Severe droughts in the U.S., China and Europe are adding more pressure to global trade. We have more on this WSJ item below.

Brazil’s coffee farmers anticipate a poor harvest this year, the fallout from drought and frost last year.

On the policy front, USDA is seeking comments on information collection re: climate-smart commodities.

America’s freight-railroad regulator is considering aggressive new rulemaking to fix shipping delays.

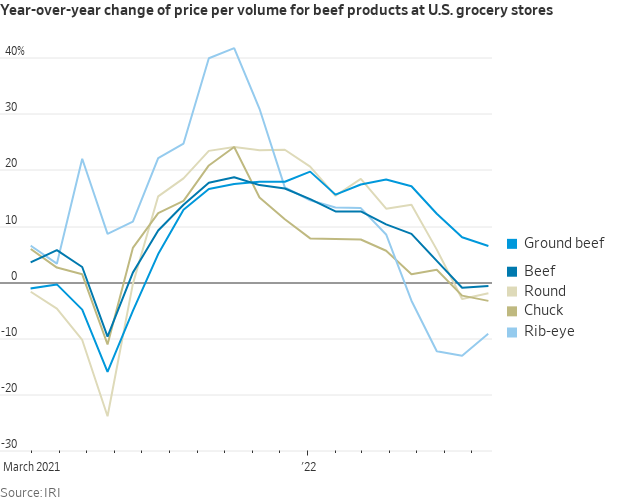

Beef prices are declining as demand for higher-end cuts softens and staffing levels at meatpacking plants improve.

Canada is urging farmers to reduce fertilizer emissions to curb greenhouse gases, triggering a backlash.

The chicken Big Mac was such a hit in the U.K. for McDonald’s that it’s coming to the U.S.

Tesla is getting set to increase the price of its premium driver-assistance system, which the company calls Full Self-Driving, by 25% next month.

President Joe Biden spoke with heads of government from Britain, France and Germany about reviving a nuclear deal with Iran. They also spoke about the war in Ukraine and the importance of protecting the Zaporizhia nuclear power plant, the site of intense shelling in recent weeks.

South Korea and the United States kicked off their biggest joint military drills since 2017.

|

MARKET FOCUS |

Equities today: Global stock markets were mostly lower overnight. U.S. stock indexes are pointed toward lower openings. Key for markets this week is the Fed’s symposium at Jackson Hole, Wyoming. Fed Chairman Jerome Powell speaks on the economic outlook at 10 a.m. ET Friday and is expected to re-state the Fed’s resolve to keep raising interest rates to get inflation under control. We'll get a second take on Q2 GDP on Thursday, and an update on the Fed's preferred gauge of inflation on Friday. In Asia, Japan -0.5%. Hong Kong -0.6%. China +0.6%. India -1.5%. In Europe, at midday, London -0.3%. Paris -1.3%. Frankfurt -1.6%.

U.S. equities Friday: The Dow fell 292.30 points, 0.86%, at 33,706.74. The Nasdaq was down 260.13 points, 2.01%, at 12,705.22. The S&P 500 declined 55.26 points, 1.29%, at 4,228.48.

For the week, the Dow was off 0.2% while the Nasdaq lost 2.6% and the S&P 500 was off 1.2%.

Agriculture markets Friday:

- Corn: December corn rose 7 1/2 cents to $6.23 1/4, down 19 cents for the week.

- Soy complex: November soybeans fell 1 1/4 cent to $14.04, down 50 1/4 cents for the week. September soymeal fell 70 cents to $448.70. September soyoil rose 164 points to 67.90 cents.

- Wheat: September SRW rose 21 3/4 cents to cents to $7.53 1/4, down 52 3/4 cents for the week. September HRW wheat rose 32 1/4 cents to $8.44 3/4. September spring wheat rose 22 cents to $8.74 3/4.

- Cotton: December cotton rose 331 points to 116.01 cents, up 242 points for the week.

- Cattle: October live cattle rose 50 cents to $145.25, up 75 cents for the week. September feeders fell 52.5 cents to $184.75, still up $1.375 for the week.

- Hogs: October lean hog futures fell 17.5 cents to $93.125, down $6.90 for the week and the contract’s lowest closing price since July 5. Friday’s CME lean hog index fell 2 cents to $120.60, the sixth drop in the past seven sessions, and is expected to drop another 31 cents today.

Ag markets today: Soybeans posted correct gains overnight following last week’s decline as traders watched prospects for additional Midwest rain. Corn and wheat traded narrowly mixed. As of 7:30 a.m. ET, corn futures were trading 1 cent lower to 2 cents higher, soybeans were 7 to 9 cents higher and wheat was 4 cents lower to 3 cents higher. Front-month crude oil futures were up slightly and the U.S. dollar index was about 200 points higher.

Technical viewpoints from Jim Wyckoff:

On tap today:

• USDA Grain Export Inspections report, 11:00 a.m. ET.

• USDA Secretary Tom Vilsack and Agriculture Undersecretary Jenny Moffit announce details of the new organic transition program, which helps growers shift to organic production from conventional farming. 11:30 a.m. ET.

• USDA Crop Progress report, 4:00 p.m. ET.

• President Joe Biden is at Rehoboth Beach, Del., until Wednesday.

Droughts are hurting the world's largest economies. Severe droughts across the Northern Hemisphere — stretching from the farms of California to waterways in Europe and China — are further snarling supply chains and driving up the prices of food and energy, adding pressure to a global trade system already under stress, the Wall Street Journal reports (link). Parts of China are experiencing their longest sustained heat wave since record-keeping began in 1961, leading to manufacturing shutdowns owing to lack of hydropower. The drought affecting Spain, Portugal, France and Italy is on track to be the worst in 500 years. In the American West, a drought that began two decades ago now appears to be the worst in 1,200 years. For some of the world’s biggest economies, this summer’s droughts are hurting industries including electricity generation, agriculture, manufacturing and tourism. That is compounding existing strains such as supply-chain disruptions stemming from the Covid-19 pandemic and pressure on energy and food prices from the war in Ukraine, the WSJ article concludes.

Business economists doubt soft Fed landing. Numbers from the National Association of Business Economists show that three-quarters of respondents doubt the Fed can bring inflation down to its stated target of 2% without setting off a recession. Link for details.

Inflation watch: Tesla raises the price of Full Self-Driving, again. Elon Musk tweeted last night that the electric carmaker’s software would cost $15,000 starting next month, up 25%. It’s the second price increase this year for the feature, which is under scrutiny from federal and state regulators following accidents involving the driving mode.

Market perspectives:

• Outside markets: The U.S. dollar index is firmer and hit a five-week high in early U.S. trading. The USDX is back the 20-year high scored in July. The yield on the 10-year U.S. Treasury note is fetching 2.981%. Futures remain lower but have lifted off their lows. U.S. crude is around $90.35 per barrel and Brent around $96.25 per barrel. Gold and silver futures are under pressure, with gold under $1,744 per troy ounce and silver under $18.73 per troy ounce.

• Biden administration warns New England governors of regional fuel shortage. The region’s oil and fuel stockpile is low, and the White House believes this could lead to disruptions during a treacherous New England winter. The Department of Energy sent letters to each of the six New England governors urging them to begin shoring up their oil supplies in advance of the coming winter and the peak of hurricane season. Stockpiling now, the Energy Department says, will prevent strain on the system during extreme weather. On the East Coast, gasoline inventories are at their lowest point in nearly a decade, Secretary of Energy Jennifer Granholm wrote in the letter, and in New England, the diesel supply is roughly 63% below the five-year average, she added. Should an extended winter storm pummel the East Coast, New England, which relies on home heating oil more than any other part of the country, could find its energy supply chain disrupted.

The Department of Energy also sent letters to seven major oil companies in the United States, asking them to hold onto their stocks to help offset the shortage. Granholm has been meeting regularly with their top executives to coordinate efforts.

• A poor harvest in the world’s largest coffee producer threatens to push the cost of a cup of joe even higher. Farmers in Brazil are dealing with the fallout from freakish weather last year, where plantations endured first drought and then frost. Some say that their crop of higher-end arabica coffee beans will be less than half what it could be in a good year.

• Major North American freight railroads face growing scrutiny from regulators as they implement their operating efficiency plans. The Surface Transportation Board is considering aggressive new rulemaking to force railroads to share tracks and expand competition for their customers, the Wall Street Journal reports (link). The steps are coming as complaints from rail customers about meltdowns in service are growing and delays in shipments of raw materials are infuriating politicians who are anxious about goods shortages and inflation. That has pressed STB Chairman Martin Oberman and the five-member board into a more combative stance. The railroads are pushing back, saying they face the same staff shortages plaguing other industries and are taking steps to hire more workers and upgrade equipment. The board now is requiring the railroads to submit weekly performance reports. But bigger rules changes in the works could shift the carriers’ business landscape for years to come.

The railroads and others in the industry will gather this week in Kansas City, Mo., for the National Grain Car Council meeting and the STB is asking for updates from the rail carriers on how they are prepared for this fall's grain harvest.

• Pro Farmer Crop Tour begins today. Scouts will be sampling corn and soybean fields across the seven Crop Tour states over the next four days. Follow along with updates on our website and by searching #pftour22 on Twitter. Scouts on the eastern leg of the tour are making their way today from Dublin, Ohio to Noblesville, Indiana. Those on the western leg are scouting fields between Sioux Falls, South Dakota and Grand Island, Nebraska. Look for preliminary route reports from Tour leaders in Pro Farmer’s “Evening Report” and on our website. We’ll release the Tour results for Ohio and South Dakota and stream the nightly results on our site tonight. The Pro Farmer corn and soybean crop estimates will be released Friday at 1:30 p.m. CT.

• Canada is urging farmers to reduce fertilizer emissions to curb greenhouse gases, triggering a backlash. The government of Justin Trudeau is proposing a 30% reduction by 2030 from 2020 levels in emissions from fertilizer as part of a plan to reduce greenhouse gases. Some farmers say that the plan could force them to use less fertilizer and reduce crop yields, which would impair Canada’s ability to ease a global food crisis triggered by the war in Ukraine. “We are really committed to the fight against climate change,” said Marie-Claude Bibeau, Canada’s minister of Agriculture and Agri-Food. Fertilizer use “is one activity we have identified that can have a significant impact on reducing emissions.” Canada is the eighth-largest exporter of agricultural products and seafood in the world. It is a major producer of wheat and one of the world’s biggest exporters of pulse crops like peas and beans. Canada is also a major producer of potash, a fertilizer, and canola oil and seed, used to make animal feed and vegetable alternatives to sunflower oil.

Background. The Canadian government’s proposal is part of its plan for a 45% reduction in greenhouse-gas emissions by 2030. Canada’s agricultural sector is responsible for roughly 10% of total emissions, according to Canadian government statistics. Almost a fifth of those industry emissions come from fertilizer.

Consequences: Canada says its target is a recommendation, said a spokeswoman for Agriculture and Agri-Food Canada. Farmers who don’t comply with the Canadian recommendations won’t face any consequences, said the spokeswoman for the agriculture department, according to the Wall Street Journal. They would, however, forgo some of the 1.5 billion of Canadian dollars, in financial aid and grants the government has made available to farmers to subsidize the purchase of new, greener farming equipment, help farmers transition to greener cultivation techniques and help companies develop new technologies to lower farming emissions.

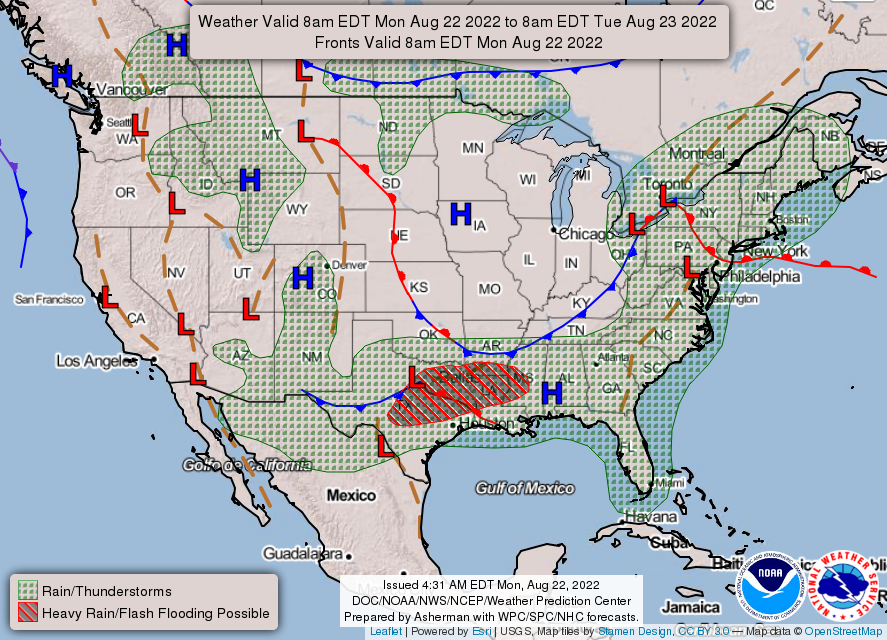

• NWS weather: Heavy rain impacting northern Texas early today is forecast to shift toward the lower Mississippi Valley Tuesday and Wednesday... ...Scattered thunderstorms with locally heavy downpours are expected to move through a large portion of the East Coast over the next couple of days... ...Heat in the Northwest will spread east into the northern and central Plains as the heavy rain across the South keeps daytime temperatures cool.

|

RUSSIA/UKRAINE |

— Summary: Some 27 ships loaded with grain have left Ukraine’s Black Sea ports since August 1 under an export deal brokered by the U.N. and Turkey, which has laid “the groundwork for a permanent peace environment,” Turkey’s Defense Minister said in a speech on Saturday. Meanwhile, Ukraine is showing off wrecked Russian tanks in Kyiv for this year’s Independence Day celebrations. And, Russia appears to be amassing missiles in Belarus in preparation for an attack on Ukraine, according to an independent military intelligence group.

- Russian authorities opened a murder investigation after the daughter of influential, ultra-nationalist philosopher Alexander Dugin was killed by a car bomb near Moscow. Ukrainian President Volodymyr Zelenskyy warned that "Russia may try to do something particularly nasty" ahead of the national holiday on Wednesday, which will be marked without the usual official celebrations to avoid creating potential targets. If the car bombing is tied to the war it would mark the first time since February that the violence unleashed on Ukraine has reached the Russian capital, touching the family of a Kremlin ally near one of Moscow’s most exclusive districts.

- "Six Months that Changed the World". Here are ways the war in Ukraine has changed the geopolitical landscape, from Britain's New Statesman (link):

• "The conflict has jolted American attention back to Europe" and revitalized NATO.

• "It has disrupted flows of staple commodities — oil and gas, grain and fertilizer — and contributed to rising inflation, a looming global recession and humanitarian crises in poor countries."

• "It has reshaped how powers further afield, notably China, view the decades ahead."

Bottom line: The war, "six months in but far from over," reflects the lost "optimism of the immediate post-Cold War years," writes the magazine's Jeremy Cliffe.

The next six months of the war will hinge on whether Ukraine can muster a counteroffensive in the south, winning back territory and proving to the West that it’s deserving of more military aid, Johns Hopkins professor Hal Brands argued in Bloomberg Opinion. Link for details.

- Germany’s nuclear power. German Economy Minister Robert Habeck said on Sunday that Germany would not extend the lifespan of the country’s three remaining nuclear power plants to offset declining gas imports, saying the savings would be negligible. Habeck said he was open to keeping one Bavarian power plant online if stress tests showed it was necessary to maintain electrical grid stability.

- Russian state-owned energy exporter Gazprom PJSC said it would shut down the Nord Stream natural-gas pipeline to Germany for three days of maintenance later this month, ratcheting up the pressure on energy-starved Europe.

|

POLICY UPDATE |

— A student loan announcement is imminent. Education Secretary Miguel Cardona said on Meet the Press that a highly anticipated decision on federal student loan payments would come “within the next week or so.” A pause on student loan payments has been in effect since March 2020 after being extended several times, helping about 30 million borrowers boost their credit score. But with the moratorium expiring on August 31, it’s decision time for the Biden administration.

— USDA seeking comments on information collection re: climate-smart commodities. USDA wants public comment on its Partnership for Climate-Smart Commodities effort and the information gathering that will result from the effort. The notice (link) in today’s Federal Register says comments will be received through Sept. 21 on the information gathered for the effort to “support the production and marketing of climate-smart commodities through a set of pilot projects that provide voluntary incentives through partners to producers and landowners, including early adopters, to implement climate-smart production practices, activities, and systems on working lands; measure and quantify, monitor and verify the carbon and greenhouse gas (GHG) benefits associated with those practices; and develop markets and promote the resulting climate-smart commodities.” The information will be used by USDA to “determine whether recipients meet the eligibility requirements to be a recipient of grant funds and to report on the progress related to the funding opportunity requirements.”

|

PERSONNEL |

— Biden’s nominee to lead the National Archives, Colleen Shogan, faces hurdles to confirmation as GOP senators vow to “absolutely demand answers” from the former Library of Congress official after the National Archives sparked the search of Trump’s home.

|

CHINA UPDATE |

— China cut its mortgage lending rate for the second time this year as the country’s central bank seeks to limit the fallout from a property sector liquidity crisis. The five-year loan prime rate was lowered to 4.3% from 4.45% on Monday, exceeding the median forecast from economists polled by Bloomberg and equaling a rate cut in May that was the largest on record. The one-year Loan Prime Rate or LPR, which is also based on domestic Chinese lending rates and primarily used to price corporate loans, was cut to 3.65% from 3.7%. The larger-than-expected reduction to the benchmark mortgage rate helped bolster the Hang Seng Mainland Properties index in Hong Kong but did little to boost wider markets. The larger cut to the five-year rate vs the one-year rate suggests Chinese officials via commercial banks are aiming to signal their support for China’s ailing real-estate market.

Background. Banks last lowered the one-year LPR in January, and the five-year rate, used to price longer-term loans such as mortgages, was lowered in May.

— Indiana Gov. Eric Holcomb and state commerce officials met with Taiwanese President Tsai Ing-wen today in Taipei, marking the third visit by a U.S. delegation this month. The delegation follows House Speaker Nancy Pelosi (D-Calif.) who garnered Beijing’s fury at the beginning of August and a group of U.S. lawmakers led by Sen. Ed Markey (D-Mass.) later in the month. Holcomb’s office said the trip was focused on economic development. Last week, the office of the U.S. Trade Representative announced a fresh round of trade talks, which are expected to begin in the fall.

— Washington Post: Chinese leader asked Biden to prevent Pelosi from visiting Taiwan. The trip exposed tensions between the House Speaker and administration officials, who had warned of China’s potential response. Pelosi felt the trip was an important statement to make. Link for details.

— Heatwaves and a drought punishing southwestern China prompted authorities to extend restrictions on the use of industrial power into this week, according to Caixin, a financial-news service. Temperatures across the country have driven up consumer demand for electricity, while drying reservoirs in mountainous Sichuan province have aggravated a crunch on hydropower. Output in Sichuan and Chongqing has been hampered for weeks.

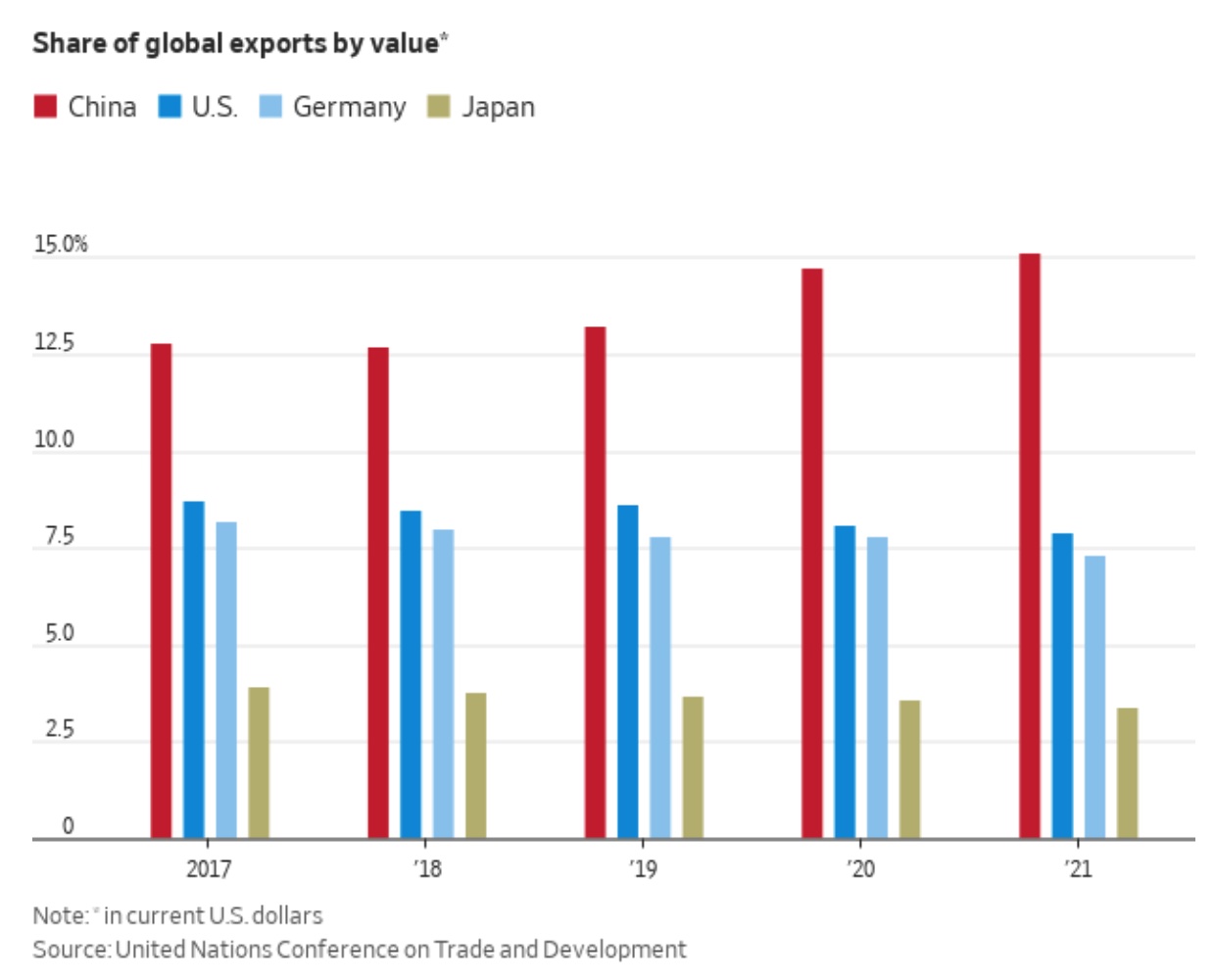

— The pandemic bolstered China’s position as the world’s dominant supplier of manufactured goods. China’s share of global goods exports by value increased over the course of the pandemic, to 15% by the end of 2021 from 13% in 2019, while major competitors’ shares shrank, suggesting China’s gains came at the expense of others.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Chicken Big Mac to be tested by McDonald’s after an upbeat U.K. trial. McDonald's will be testing a chicken Big Mac in select Miami-area locations later this month, the company confirmed to USA Today. The menu item was first introduced in the United Kingdom earlier this year and met with much positive feedback, selling out less than two weeks. "We're always looking to give our fans more ways to enjoy the classic menu items they know and love," McDonald's said in a statement. "Made with two crispy tempura chicken patties, our iconic Big Mac sauce, and topped off with pickles, shredded lettuce, and American cheese, this sandwich brings some of our fans' favorite flavors together for the perfect bite."

McDonald’s, the world’s largest restaurant chain, today is announcing a major shake-up of its board of directors. Sheila Penrose will retire after more than 15 years, and three new executives will join: Anthony Capuano of Marriott International, Jennifer Taubert of Johnson & Johnson and Amy Weaver of Salesforce.

Meanwhile, Wendy’s locations in Michigan, Ohio, and Pennsylvania will not put lettuce on sandwiches while the CDC investigates an E. coli outbreak that has sickened at least 37 people.

— Beef is getting cheaper, bringing some economic relief to U.S. consumers. Prices of beef, typically among the costliest grocery store purchases, are falling after more than a year of increases, as consumer demand softens for some cuts. Supplies are improving due to better staffing at meat plants, and supermarkets are offering more discounts on rib-eye, New York strip and other often-expensive products, according to the WSJ (link). Retail beef prices fell 0.7% for the four-week period ended Aug. 7, compared with the same period a year ago, according to data from research firm Information Resources Inc. That decline came after beef prices fell 1% during the prior four-week period, which was the first monthly decline since June 2021.

|

CORONAVIRUS UPDATE |

— Summary:

- Global Covid-19 cases at 596,211,108 with 6,453,854 deaths.

- U.S. case count is at 93,642,099 with 1,041,149 deaths.

- Johns Hopkins University Coronavirus Resource Center says there have been 607,588,353 doses administered, 223,684,995 have been fully vaccinated, or 67.89% of the U.S. population.

— Pfizer was ordered by U.S. regulators to test the effects of an additional course of Paxlovid among people who experience a rebound in Covid after treatment, putting the drug through new studies as reports of the mysterious phenomenon continue to mount.

|

POLITICS & ELECTIONS |

— Trump gets an FBI bump. An NBC News poll out yesterday shows Trump tightening his hold on Republicans. Several polls show him rising against Florida Gov. Ron DeSantis, who had been surging in key states. The poll was conducted after the FBI searched Trump’s Florida home and recovered documents marked as “top secret” earlier this month. Link to poll results. Meanwhile, the survey doesn’t show a significant improvement in the President Joe Biden’s standing, with 42% of registered voters approving of Biden’s job performance and 55% disapproving. In May, Biden’s job approval stood at 42% among registered voters and 39% among all adults. The poll was also conducted after a strong stretch for President Biden, which included Congress passing climate and health care legislation and the Bureau of Labor Statistics reporting that 528,000 jobs had been created last month.

— A caucus of Indiana Republicans in the future 2nd district elected Rudy Yakym III to replace the late Rep. Jackie Walorski (R) on the ballot in November after she and two of her staffers died in a car accident. Yakym won on the first ballot. Republicans from the current 2nd district also nominated him for the Nov. 8 special election. The reliably red district will make Yakym a favorite against Democrat Paul Steury and Libertarian William Henry. The November election will both decide who will complete the last few weeks of Walorski’s term and choose a successor for the 118th Congress.

— New York state’s congressional primaries on Tuesday include several high-profile battles, but the key one is House Judiciary Committee Chair Jerry Nadler and Committee on Oversight and Reform Chair Carolyn Maloney in the 12th District. New York is losing a seat due to redistricting following the 2020 census. The latest poll shows Nadler with a big lead, and he’s got the New York Times’ endorsement. Senate Majority Leader Chuck Schumer (D-N.Y.) is backing him as well.

In the 17th District, Rep. Sean Patrick Maloney — chair of the Democratic Congressional Campaign Committee — is facing off against New York State Sen. Alessandra Biaggi. SPM, as he is known, is backed by Speaker Nancy Pelosi, while Biaggi is backed by Rep. Alexandria Ocasio-Cortez (D-N.Y.) and progressive groups.

— Rep. Liz Cheney (R-Wyo.) said she will go beyond challenging former President Donald Trump’s hold on the Republican Party to include opposing candidates who promote Trump’s claim that the 2020 election was stolen. She cited as potential targets Sens. Ted Cruz of Texas and Josh Hawley of Missouri, and Florida Gov. Ron DeSantis, all of whom are Republicans with presidential ambitions.

|

OTHER ITEMS OF NOTE |

— U.S., South Korea revive live military drills after four years. The 11-day joint exercises will start Monday and are expected to feature jet fighters soaring in the skies, tanks rumbling down roads and thousands of soldiers simulating a conflict with the Kim Jong Un regime. The U.S. and South Korea argue the exercises are defensive in nature. But the drills have long irritated North Korea, which considers them a rehearsal for an invasion.

— President Biden discussed the negotiations to revive the Iran nuclear deal in a call Sunday with German Chancellor Olaf Scholz, French President Emmanuel Macron and British Prime Minister Boris Johnson, the White House said. The leaders also talked about Ukraine.

— Health officials in California will now refer to monkeypox as “mpox” or “MPX,” amid criticism that the name is stigmatizing and discriminatory. “When you remove the monkey imagery, people seem to understand more quickly that there’s an emergency that needs to be taken seriously,” one proponent said.