Lots of Questions Remain Re: Talks on Resuming Ukraine Grain Shipments

Crop insurance experts give suggestions to House panel to further improve program

|

In Today’s Digital Newspaper |

Russia has restarted natural gas flowing through the Nord Stream 1 pipeline into Europe, at reduced capacity. That helped to pressure crude oil prices. Meanwhile, the European Commission proposed a plan to reduce gas use in Europe by 15% until next spring. It said the move was to protect itself from further gas supply cuts from Russia, due to what it described as “the Kremlin’s weaponization of gas exports.” The flow of Russian gas, which provides 40% of EU consumption, was less than one-third the normal average last month.

Russian Foreign Minister Sergey Lavrov gave an insight into Russia’s overall plans for Ukraine in comments to state media on Wednesday. Lavrov said that peace talks were currently impossible but blamed the West rather than Ukraine for avoiding negotiations. Lavrov said that Russian goals for territorial control had shifted since March from beyond the Donbas to include the Kherson and Zaporizhzhia regions “and a number of other territories.” Lavrov added that “geographical tasks” will extend further into Ukrainian territory if Western nations continue to supply long-range weapons.

President Joe Biden on Wednesday said he'll talk to China's Xi Jinping within 10 days.

The European Central Bank (ECB) lifted its key rate by a bigger-than-expected half point as it followed the Federal Reserve in picking up the fight against inflation. The move, which brings the deposit rate to 0% from -0.5%, comes as the continent copes with an energy crisis. Another move higher is likely to follow in September. The ECB first set the rate below zero, an unusual move for a central bank, in 2014, and has kept it in negative territory until today. The bank has already ended its multitrillion-euro programs to buy bonds.

President Biden announced various climate-related executive actions on Wednesday, days after his proposed climate legislation ran aground in Congress. One directive promotes offshore wind development in the Gulf of Mexico, historically a site of oil-and-gas drilling, and in waters along America’s south-eastern coast. Biden stopped short of declaring a national climate-change emergency, as some activists had hoped.

Make the crop insurance program better and avoid big mistakes like means testing and pay limits were the clear conclusions of a House Ag subcommittee hearing Wednesday. Details in Policy section.

Natural gas prices are rising again as a heat wave is forecast to linger possibly into August.

Port protest: Truck drivers pledged to continue to block operations at a container port in Oakland, Calif., and unionized dockworkers are refusing to cross the picket line.

Existing home sales fall for fifth straight month as recession fears rise. Meanwhile, home prices in the U.S. hit a new all-time high in June, despite the lack of affordability that's pushing buyers out of the market. The median home price was $416,000 last month, up 13.4% from one year ago, according to a report from the National Association of Realtors.

Senators urge EPA to raise volumes for biodiesel in RFS. A bipartisan group of U.S. senators is urging the EPA to require more diesel made from biomass in U.S. fuel mandates for 2023 and 2024.

The Wall Street Journal reported that the Biden administration is planning to drop Nicaragua from the list of countries eligible for low-tariff shipments of sugar into the U.S., stepping up pressure on the government of President Daniel Ortega, who has close ties to Russian President Vladimir Putin.

A bipartisan Senate group proposes legislation to prevent attempts to overturn elections. The measures aim to guarantee a peaceful transition from one president to the next, after the Jan. 6 attack on the Capitol exposed how the current law could be manipulated to disrupt the process.

Mario Draghi resigned as Italy’s prime minister, a move that raises the prospect of snap elections as soon as early October.

Race to become UK's next prime minister is down to 2 contenders. Former finance minister Rishi Sunak and foreign secretary Liz Truss will battle it out to become Britain's next prime minister after they won the final lawmaker vote, setting up the last stage of the contest to replace Boris Johnson.

The House Jan. 6 panel holds its eighth public hearing tonight at 8 p.m. ET, focusing on activities inside the White House that day, with an account of activities inside the White House during a 187-minute period following former President Donald Trump’s speech to his supporters that day at the Ellipse.

President Biden's job approval rating is down to 31%, the lowest in his roughly year-and-a-half in office, according to a recent Quinnipiac poll.

Election Day 2022 is 110 days away. Election Day 2024 is 838 days away.

|

MARKET FOCUS |

Equities today: Global stock markets were mostly weaker overnight. The U.S. Dow opened around 150 points lower and is currently down around 50 points. In Asia, Japan +0.4%. Hong Kong -1.5%. China -1%. India +0.6%. In Europe, at midday, London -0.4%. Paris +0.4%. Frankfurt -0.4%.

U.S. equities yesterday: The Dow added 47.79 points, 0.2%, to 31,874.84. The Nasdaq advanced 184.50 points, 1.6%, to finish the day at 11,897.65. The S&P 500 rose 23.21 points, 0.6%, to 3,959.90. All major averages reached their highest point since early June. Wednesday marked the highest closing level for the Nasdaq since June 8 — and the highest since June 9 for the Dow and the S&P 500.

Agriculture markets yesterday:

- Corn: December corn fell 5 1/4 cents to $5.90, the lowest closing price since $5.86 1/2 on July 12.

- Soy complex: November soybeans dropped 26 cents to $13.32 1/4, the lowest closing price since July 6. August soyoil tumbled 186 points to 60.03 cents, while August soymeal inched up $1.50 to $436.50.

- Wheat: September SRW wheat rose 7 1/4 cents to $8.19 1/2, the contract’s highest closing price since July 11. September HRW wheat rose 1 1/4 cents to $8.70 1/2. September spring wheat fell 5 1/2 cents to $9.24 1/4.

- Cotton: December cotton rose 43 points to 92.81 cents and near mid-range after reaching the highest intraday price in over a week.

- Cattle: August live cattle rose 2.5 cents to $135.75, while August feeder cattle fell 92.5 cents to $177.825.

- Hogs: August lean hogs surged $2.05 to $114.875, the highest closing price since April 22. The latest CME Lean Hog Index climbed $1.02 to $115.91, a 13-month high. Today’s index is expected to rise another 46 cents.

Ag markets today: Corn and soybean futures overnight extended losses from the two previous days. Wheat futures also weakened. As of 7:30 a.m. ET, corn futures were trading 7 to 10 cents lower, soybeans were 13 to 16 cents lower, winter wheat futures were mostly 1 to 2 cents lower and spring wheat was 2 to 7 cents lower. Front-month U.S. crude oil futures were down nearly $4 and the U.S. dollar index was near unchanged this morning.

Technical viewpoints from Jim Wyckoff:

On tap today:

• European Central Bank is expected to raise interest rates for the first time in more than a decade. (8:15 a.m. ET) UPDATE: The European Central Bank on increased interest rates for the first time in 11 years. The ECB, the central bank of the 19 nations that share the euro currency, surprised markets by pushing its benchmark rate up by 50 basis points, bringing its deposit rate to zero. Economists had expected a smaller hike of 25 basis points. The euro rose to a session high on news of the more aggressive rate hike, to trade at $1.0257. The ECB had previously signaled it would be increasing rates in July and September as consumer prices keep surging. The ECB’s deposit rate is now 0%, the main refinancing operations rate is 0.5% and the marginal lending facility is at 0.75%.

• U.S. jobless claims are expected to fall to 240,000 in the week ended July 16 from 244,000 one week earlier. (8:30 a.m. ET)

• Philadelphia Fed's manufacturing survey is expected to increase to 1.6 in July from minus 3.3 one month earlier. (8:30 a.m. ET)

• USDA Weekly Export Sales report, 8:30 a.m. ET.

• Conference Board's leading economic index for June is expected to fall 0.6% from the prior month. (10 a.m. ET)

U.S. home prices hit record of $416,000 in June. The median existing home price hit another record in June, rising to $416,000, up 13.4% from the previous year and increasing from a revised $408,400 in May. Sales declined for the fifth straight month as higher interest rates pushed more buyers out of the market. Sales of previously owned homes fell 5.4% in June from the prior month to a seasonally adjusted annual rate of 5.12 million, the weakest rate since June 2020, the National Association of Realtors said Wednesday. June sales fell 14.2% from a year earlier.

Properties remained on the market 14 days in June, the fewest in records going back to 2011. The inventory of homes for sale has increased but remains low with a three-month supply of unsold homes. Total inventory at the end of June stood at nearly 1.26 million units, a 9.6% increase from May.

Half of hourly workers have no emergency savings at all. Of hourly workers surveyed, 83% said they had less than $500 in emergency savings.

BOJ keeps rates unchanged despite higher inflation forecast. The Bank of Japan (BOJ) projected inflation would exceed its target this year in fresh forecasts issued on Thursday but maintained ultra-low interest rates and signaled its resolve to remain an outlier in a wave of global central banks’ policy tightening. BOJ Governor Haruhiko Kuroda said he had “absolutely no plan” to raise interest rates or hike an implicit 0.25% cap set for the bank’s 10-year bond yield target. “The economy is in the midst of recovering from the pandemic. Japan’s worsening terms of trade are also leading to an outflow of income,” Kuroda told a news conference. “As such, we must continue with our easy policy to ensure rising corporate profits lead to moderate wage and price growth,” he said.

Market perspectives:

• Outside markets: The U.S. dollar index is slightly down in early U.S. trading. The yield on the 10-year U.S. Treasury note is fetching 3.04%. Crude oil futures are moving lower, with U.S. crude around $95.15 per barrel and Brent around $102.20 per barrel. Gold and silver futures were lower, with gold around $1,681 per troy ounce and silver around $18.21 per troy ounce.

• Hot weather lifts natural gas prices, reversing last month’s plunge and reviving a key driver of inflation. Natural gas futures have jumped 48% this month — including 10% on Wednesday — to $8.007 per million British thermal units. While that is below a 14-year high hit in June, gas has bounced back to more than twice the price of a year ago, adding cost pressure across the economy.

• National average gas price hit $4.467 per gallon as of Wednesday, a decline of more than 50 cents from a record high of $5.016 per gallon on June 14. However, prices are still well above where they were one year ago, when a gallon at the pump cost $3.166. Despite the steep costs still facing American motorists, White House economic adviser Jared Bernstein and others have touted the administration’s efforts to combat gas prices that helped drive inflation to a four-decade high of 9.1% in June.

Traders and others are debating whether the gas prices peaked when the average price hit $5.01 in June. If so, some note it would be to two major factors: lower demand as people cut back on road travel and continue to work from home, and supply growth. Others say there are still plenty of variables that could lead to another price spike, including the potential for hurricanes disrupting production in the Gulf of Mexico.

• Rail security. The White House is inviting railroad executives to an early August briefing on cybersecurity threats to critical infrastructure, according to Deputy National Security Adviser Anne Neuberger. Major passenger and freight railroads face new requirements on cyber breaches.

• Trucker protest at California port. California’s third-busiest port shut down some of its gates and marine terminals for a third day Wednesday as truckers protesting a gig-work law that could take 70,000 drivers off the road blocked access to the operation. Management at the Oakland International Container Terminal decided to close operations due to the independent trucker protest, and the port’s three other marine terminals are effectively shut down for trucks, port spokesman Robert Bernardo said. Some vessel-labor operations were under way. SSA Marine Inc., the largest terminal operator at Oakland, shut down all operations for the day Tuesday, he said.

• Ag trade: South Korea purchased 304,000 MT of corn from two separate tenders, with all of it expected to be sourced from South America and/or South Africa. Meanwhile, Egypt bought Russian and French wheat in their tender. The trade price was well below U.S. offers earlier in the week.

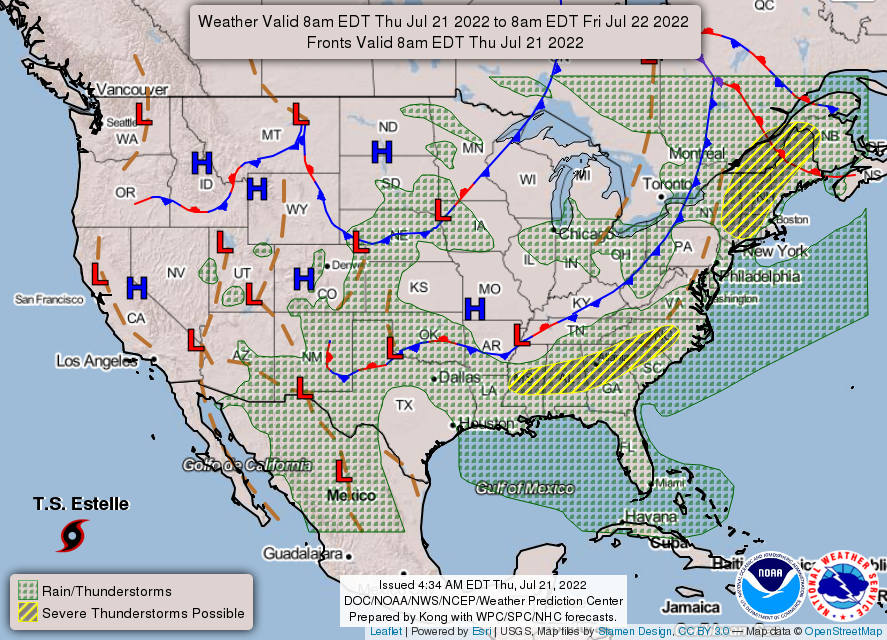

• NWS weather: Dangerous heat to continue impacting portions of the southwestern, south-central, and eastern U.S.... ...Severe thunderstorms possible across the sections of the Northeast and the Southeast today... ...Monsoonal moisture to bring locally heavy rains and isolated flash flooding across portions of the Southwest into the southern Rockies.

Items in Pro Farmer's First Thing Today include:

• Corn, beans extend price declines

• Turkey says talks to resume Ukrainian grain exports going well (details below)

• Steady/weaker cash cattle trade

• Cash hog index continues to firm

|

RUSSIA/UKRAINE |

— Summary: Western officials believe that Russia will likely begin another major offensive in Ukraine early next year, including a possible effort to advance on the blockaded strategic port city of Odesa, to seize the country’s southwestern coast and cut off Ukraine from the sea, Foreign Policy reported (link). If Russian forces were to take the port, current and former officials warn, it would represent a devastating blow to Ukraine’s war efforts and give Moscow a greater stranglehold over critical global food supplies that have dwindled since the war began.

- A spokesman for the U.S. State Dept. it would not let the “annexation by force” of Ukraine “go unchallenged.” On Wednesday Sergei Lavrov, Russia’s foreign minister, said that the country’s objectives in Ukraine now extend beyond the eastern Donbas region, a sign that Russia is expanding its war goals. Its next targets include Kherson and Zaporizhzhia in the south.

- Treasury official sees price cap on Russian oil by December. A price cap on Russian oil should go into effect alongside the December implementation of the European Union’s restrictions on insurance for the commodity, a Biden administration official said Wednesday night. “We are following on what the Europeans have done,” Deputy Treasury Secretary Wally Adeyemo told the Aspen Security Forum in Colorado.

- Nord Stream 1 pipeline restarted gas deliveries on schedule, brining respite for Europe. Shipments returned to 40% of capacity, their level before flows were halted for 10 days of planned maintenance, data from the pipeline operator showed. Still, there is little expectation of a full revival of supplies amid issues related to gas turbines for the link. Russian President Vladimir Putin has indicated that flows could fall to 20% as soon as next week. Only two turbines at a compressor station in Russia, which feeds the pipeline, are currently working, he said, and one of them needs to go for maintenance this month. Flows could drop unless a replacement component sent from Canada arrives in Russia soon, following sanctions-related delays, according to Putin.

- Ukraine is asking Western investors to postpone more than $20 billion of debt, underscoring the financial strains imposed on Kyiv by the war with Russia. Kyiv this week said it wanted to push back payments of interest and principal on a clutch of dollar- and euro-denominated government bonds, with a combined face value of nearly $20 billion, by two years.

- Turkey says talks to resume Ukrainian grain exports going well. Talks between Turkey, Russia, Ukraine and the United Nations on resuming Ukrainian grain exports through the Black Sea are going well so far, Turkish Foreign Minister Mevlut Cavusoglu said today, adding he was hopeful about reaching a deal. Cavusoglu said he hoped to be able to announce “good news” on the talks in the coming days but added there were still minor issues being discussed between the parties.

Perspective: The following are key issues/questions our sources have raised on this topic:

- Even if a deal is signed... hurdles to restarting exports.

- A signed agreement and actual resumption of exports are two very different things.

- Putin in the past has said Ukraine will use grain to buy weapons.

- Removing Western sanctions has been absent in the reporting on the prospective deal, but will Putin raise this again later?

- Small technical items said to remain. Those are always the hardest and could scuttle the deal.

- Difficulty in getting this deal means overall peace is nearly impossible.

- What does Turkey get out of this? Turkey obviously wants food out of the deal... they provide passage/support, they get grain. Turkey is one of the countries most vulnerable to the supply shortages resulting from the war in Ukraine. Located on the southern side of the Black Sea, Turkey relies on Russia and Ukraine for more than 80% of its wheat imports and is a key trade passage connecting Europe’s breadbasket to Africa and the Middle East.

- Will Ukraine sign off and if so, what kind of protections are there relative to their ports and not wanting to open the door for a Russian attack.

- How much of the earlier 22 MMT stuck has already "left" and been sold by Russia.

- Why has Turkey been so adamant on the likelihood of a deal while the U.N. remains more cautious?

|

POLICY UPDATE |

— Farm Service Agency updates Livestock Indemnity Program (LIP) payments. Prior to 2020, there was one weight class for non-adult beef cattle under 400lbs that provided a fair indemnity for younger calves lost to a natural disaster. Today, the LIP has two weight classes for calves under 400 lbs., the lowest being under 250 lbs. The payment rate according to LIP policy is set at 75% of the fair market value, which puts the estimated average market price at $233. Previously, the rate for this program for calves under 250 lbs. was $175. As of July 18, the payment rates for beef have been updated to use the same price as the 251-to 399 lb. livestock. The rate is now set at $474.38 per head for cattle weighing less than 250 pounds. LIP payments previously paid for the livestock types of beef, beefalo, buffalo/bison, and dairy under 250 pounds and 250 to 399 pounds will be recalculated to pay the updated amount once the updated amounts are loaded into the LIP software. If no update to the application was made, no further action is required. Link to details.

— Biden vows to use executive actions to fight climate risks. Calling climate change a “clear and present danger,” President Joe Biden on Wednesday announced executive actions to fight climate change even as his bigger clean energy legislative effort in Congress has stalled, though he stopped short of declaring a national climate emergency. "Let me be clear: Climate change is an emergency," he said. "In the coming weeks, I'm going to use the power I have as president to turn these words into formal, official government actions through the appropriate proclamations and regulatory power that a president possesses."

Speaking at a former coal-burning power plant in Somerset, Mass., Biden proposed 700,000 acres of offshore wind energy development in the Gulf of Mexico and support for wind projects off the Atlantic Coast and Florida’s Gulf Coast. The Gulf of Mexico proposal could power more than three million homes. Biden also unveiled $2.3 billion for the Federal Emergency Management Agency to help areas experiencing extreme weather.

New guidance was issued for helping low-income families pay for heating and cooling costs, while additional actions will be announced in the "coming weeks."

— Crop insurance hearing again shows bipartisan support for risk management tool. Despite attempts by some activists to place means tests and pay limits on crop insurance availability, a House Ag subcommittee (link) on Wednesday made clear that such poison pills will not be successful and instead looked for ways to further improve the program.

Highlights of the hearing:

- Bob Haney, executive director of AgriSompo North America, told subcommittee members that federal subsidies for crop insurance were better for farmers than the ad hoc disaster payouts that were more common in the 1980s and 1990s. “Our industry protects all types and sizes and covers 130 different commodities,” he said in a written statement. “We believe crop insurance is one of the best tools to protect farmers against Mother Nature … and is a farmer’s first line of defense against climate change.”

- Crop insurance industry consultant Alex Offerdahl said one possibility is to make margin policies more attractive. Rep. G.T. Thompson (R-Pa.), ranking member of the House Ag Committee, continues to express interest about this topic.

- Tom Haag of the National Corn Growers Association noted that during the run-up to the 2018 Farm Bill, his group’s priority was to “maintain support for a robust crop insurance program.” That priority continues with this farm bill, he said. Haag added that crop insurance agents are the farmers’ key advisors not just on crop insurance but on all farm programs.

- Kathy Fowler, a crop insurance agent from Memphis, Texas and a member of the Crop Insurance Professionals Association, the nation’s crop insurance agents organization, called AGI means testing and pay limits on crop insurance a “non-starter” and warned that these policies would ultimately hurt small farmers because midsized and larger full time farmers would no longer be in crop insurance or the risk pool, increasing overall risk and resulting in premium rate increases for those left in the pool. Fowler also noted that the current A&O structure for specialty crops is flawed and resulting in a 40% cut in A&O on such policies and commended Chairman Sanford Bishop (D-Ga.) and Ranking Member Andy Harris (R-Md.) on the Ag Appropriations Subcommittee for including a one-year fix to the problem. Nearly all of the Members of the Subcommittee voiced their support for the provision.

- Fowler and Haney also said that while farmers benefitted from the various ad hoc disaster payments funded since the 2018 Farm Bill, lawmakers should avoid establishing a permanent disaster program in the new farm bill legislation. "(Private insurers) actually don't want to see the creation of a program that would double-pay farmers for the same loss," Haney said. "This would indirectly discourage the purchase of crop insurance and possibly lead to changes in farming practices that could lead to potential instances of fraud, waste and abuse."

- Lawmakers were advised to be cautious when considering climate-related crop insurance moves. Thompson said such initiative should instead be linked to conservation programs. “The more a farmer can increase their yields or mitigate losses, the better their coverage options will be. And we don't need to cherry pick certain practices that might only work in specific regions of the country and use crop insurance to try and force all farmers into adopting the practice,” Thompson said. “We already provide nearly $6 billion per year in locally-led, incentive-based conservation programs to Title II (conservation) of the Farm Bill — that is the appropriate place to have these conversations not in Title XI, crop insurance,” Thompson added. Thompson opposes plans to use crop insurance to incentivize conservation or climate practices, saying they would "hijack the crop insurance program to carry out a half-baked environmental experiment… We don't need to use crop insurance as a carrot or a stick to force their hand."

- Stakeholders applauded the 508(h) process as helping to promote innovative new crop insurance products that respond to the evolving needs of farmers. Other now widely used crop insurance products like revenue insurance, dairy coverage and products for specific crops and livestock were all conceived as 508(h) experiments, with 89% of policies sold today originating as 508(h) proposals.

- Rep. Austin Scott (R-Ga.) praised the success of crop insurance, but said he hears from producers that higher levels of coverage are often too expensive for the costs. "Many fruit and vegetable farmers in my area do not have crop insurance policies available to them, leaving the Noninsured Crop Disaster Assistance Program — or NAP — as their only risk management option."

|

CHINA UPDATE |

— Biden comments on Pelosi’s planned trip to Taiwan in August. President Joe Biden told the White House pool “The military thinks it’s not a good idea right now.” Pelosi’s office on Wednesday was silent on what she would do. Link to WSJ article on the topic.

— President Biden expects to speak to Chinese leader Xi Jinping in the next 10 days as the U.S. mulls lifting some tariffs on Chinese imports. But an official downplayed that, saying the talks would focus on bilateral, regional and global issues.

— China faces growing pressure to address mortgage protests. Home buyers in Wuhan demonstrated Wednesday outside a bank regulator’s office, as some people threaten to stop mortgage payments on delayed housing projects. Link for details via the WSJ. Link to Economist article on topic.

— China reckons with its first overseas debt crisis. The Belt and Road Initiative has seen a surge in loans going bad, prompting Beijing to issue countries with emergency credit. Link for more from the Financial Times.

— How China’s rare earth dominance spurs U.S. and its allies to diversify supply chain of critical minerals. The U.S. is taking a harder line in efforts to end its dependency on China for critical minerals, but the erosion of China’s world-leading market share cannot happen overnight, despite rising geopolitical tensions. Link for more info.

— Reuters: U.S. probes China's Huawei over equipment near missile silos. The Biden administration is investigating Chinese telecoms equipment maker Huawei over concerns that U.S. cell towers fitted with its gear could capture sensitive information from military bases and missile silos. Link for details.

— The war in Ukraine is influencing the Chinese government's considerations on "how and when" — not whether — to invade Taiwan, CIA Director Bill Burns said yesterday. "I wouldn't underestimate President Xi's determination to assert China's control" over the self-governing island, Burns told NBC's Andrea Mitchell at the Aspen Security Forum in Colorado. Burns doesn't expect an imminent invasion but said: "The risks of that become higher, it seems to us, the further into this decade that you get." Burns said the lesson China is likely taking from Vladimir Putin's "strategic failure" in Ukraine "is that you've got to amass overwhelming force."

|

TRADE POLICY |

— “Ooooh, I’m so scared” — Mexican President Andrés Manuel López Obrador, in response to the trade fight started by the U.S., which accused his government of favoring its state-owned utility and oil company at the expense of American businesses. The Mexican president was paraphrasing a line of a popular song by a musician of his tropical Tabasco state. He then ordered his staff to play the song at the news conference.

— USTR allocates additional FY 2022 raw cane sugar TRQ volume, FY 2023 raw cane sugar, sugar-containing products TRQ allocations. The Office of the U.S. Trade Representative (USTR) today released the allocation for the additional 90,718 metric tons raw value (MTRV) of additional in-quota quantity raw cane sugar for the remainder of fiscal year (FY) 2022. The 90,718 MTRV will be allocated among 25 countries (link).

USTR also announced the by-country allocations for raw cane sugar and sugar-containing products for FY 2023 TRQs. USDA previously established the FY 2023 in-quota quantity for raw cane sugar at 1,117,195 MTRV (link). As for the 64,709 tonnes of the TRQ for sugar-containing products, USTR said 59,250 tonnes is allocated to Canada with the remaining 5,459 tonnes allocated to other countries on a first-come, first-serve basis.

Comments: The Wall Street Journal reported (link) that the Biden administration is planning to drop Nicaragua from the list of countries eligible for low-tariff shipments of sugar into the U.S., stepping up pressure on the government of President Daniel Ortega, who has close ties to Russian President Vladimir Putin.

|

ENERGY & CLIMATE CHANGE |

— Oil groups warn Biden on climate emergency, war on crude. More than a dozen oil and gas groups are warning President Biden that declaring a climate emergency and curtailing fossil fuels would conflict with his other political priorities. Biden should instead resist calls to use a climate emergency declaration to advance “false climate solutions,” the American Exploration Production Council and other organizations say in a letter (link) to the president Wednesday. “So-called climate policies, such as banning exports or restricting domestic production, moves us backwards and will drive up both costs and global emissions,” the letter said.

— Biden seeks to boost farm, construction vehicle electrification. The Biden administration wants to spur the electrification of the transportation sector beyond traditional cars. The Energy Department plans today to announce it will spend $96 million to reduce emissions by pushing forward the technology and charging infrastructure needed to electrify tractors, construction equipment, planes, trains, boats, and other off-road vehicles. The funding will also be focused on alternative fuels.

— More BEVs for Postal Service. The U.S. Postal Service yesterday significantly boosted its commitment to replace its aging delivery fleet with more electric vehicles. The agency now says that at least half of the 50,000 vehicles it plans to purchase from Oshkosh Defense will be battery electric vehicles (BEVs). The Postal Service also said it will purchase another 34,500 vehicles from other manufacturers, "including as many BEVs as are commercially available." Of the total 84,500 vehicles to be purchased, more than 40% will be electric.

— Biodiesel/RFS bill introduced. A bipartisan Senate group wants the EPA to require more diesel made from biomass in U.S. fuel mandates for 2023 and 2024. Sens. Amy Klobuchar (D-Minn.) and Chuck Grassley (R-Iowa) and 22 others want higher volumes in new quotas in the Renewable Fuel Standards (RFS) program. Biodiesels “add to our country’s critical fuel supplies, which helps to moderate fuel prices,” the senators wrote in a letter (link) to the EPA, adding that a multiyear rule will provide the predictability and market signals the industry needs to grow. The letter underscores increasing pressure on the Biden administration to utilize biofuels at a time when soaring energy costs have stalled climate goals.

The senators note that production of clean-burning, homegrown biofuels supports 13% of the value of soybeans grown in the U.S. – giving soybean growers another important market for their crop. In addition, Argonne National Laboratory’s GREET model estimates renewable diesel reduces greenhouse gas emissions by roughly 74% when compared to petroleum diesel.

Grassley and Klobuchar were joined on the letter by Sens. Patty Murray (D-Wash.), John Thune (R-S.D.), Tina Smith (D-Minn.), Roger Marshall (R-Kan.), Debbie Stabenow (D-Mich.), Joni Ernst (R-Iowa), Tammy Duckworth (D-Ill.), Roy Blunt (R-Mo.), Tammy Baldwin (D-Wis.), Susan Collins (R-Maine), Mazie Hirono (D-Hawaii), Jerry Moran (R-Kan.), Sherrod Brown (D-Ohio), Deb Fischer (R-Neb.), Jeanne Shaheen (D-N.H.), Josh Hawley (R-Mo.), Ron Wyden (D-Ore.), Kirsten Gillibrand (D-N.Y.), Dick Durbin (D-Ill.), Maggie Hassan (D-N.H.), Angus King (I-Maine) and Bernie Sanders (I-Vt.).

— EPA’s RFS draws species protection suit. EPA’s renewable fuels rule will increase strain on land and wildlife protection, according to a petition filed Wednesday by the Center for Biological Diversity. The group claims that the agency failed to fully consider how increased pesticide and fertilizer use to grow corn necessary for Renewable Fuels Standard (RFS) compliance would negatively impact the environment.

— Ford is preparing to slash as many as 8,000 roles in the coming weeks as it tries to boost profits to fund its push into EVs. The cuts will come in the Ford Blue unit responsible for producing internal combustion engine vehicles, as well as other salaried operations.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— An extremely rare orange lobster was discovered in a shipment to a Red Lobster restaurant in Florida. The chance of finding an orange lobster is said to be one in 30 million. Link for details.

— The Rhine is inches from being too shallow for shipments. Germany’s Rhine River — a major transport route for food shipments — is inches away from becoming too shallow for barge traffic. Link to Bloomberg item.

|

CORONAVIRUS UPDATE |

— Summary:

- Global Covid-19 cases at 566,846,895 with 6,380,970 deaths.

- U.S. case count is at 90,046,834 with 1,025,741 deaths.

- Johns Hopkins University Coronavirus Resource Center says there have been 595,594,121 doses administered, 222,682,315 have been fully vaccinated, or 67.59% of the U.S. population.

— Japan recorded more than 150,000 Covid cases in a single day for the first time, the Asahi Shinbum reports (link).

— The latest Covid surge has reignited a debate about mandatory masking in California, the Los Angeles Times reports: “The University of California, Irvine, and the San Diego Unified School District reinstated indoor mask requirements on Monday, the same day that Bay Area Rapid Transit lifted its mandate. Health officers across the country seem reluctant to hand down any new orders, but officials in Los Angeles County, home to about a quarter of Californians, are planning for an indoor mask mandate to take effect later this month.”

|

POLITICS & ELECTIONS |

— Liz Truss and Rishi Sunak are the two candidates to become the U.K.’s next prime minister. Former Finance Minister Sunak maintained his lead, winning 137 votes, while Foreign Secretary Truss came in second with 113 votes. The results of the final vote, which falls to Conservative Party members, are set to be announced by Sept. 5 at the latest, with Boris Johnson expected to remain in place as caretaker prime minister until then. Truss is currently favored by British betting companies to prevail in the head-to-head race among party members. In the last leadership election, approximately 160,000 party members (less than 0.3% of the British population) voted to determine the next prime minister.

— The unity government of Prime Minister Mario Draghi of Italy fell apart, leaving the country careening toward a new season of political chaos. Draghi resigned today after his coalition imploded but will remain as a caretaker.

— Quinnipiac finds a record-low 31% job approval rating for President Biden in its latest survey of registered voters. Some 71% don’t want him to run again in 2024; 64% say the same for Trump. Link for details.

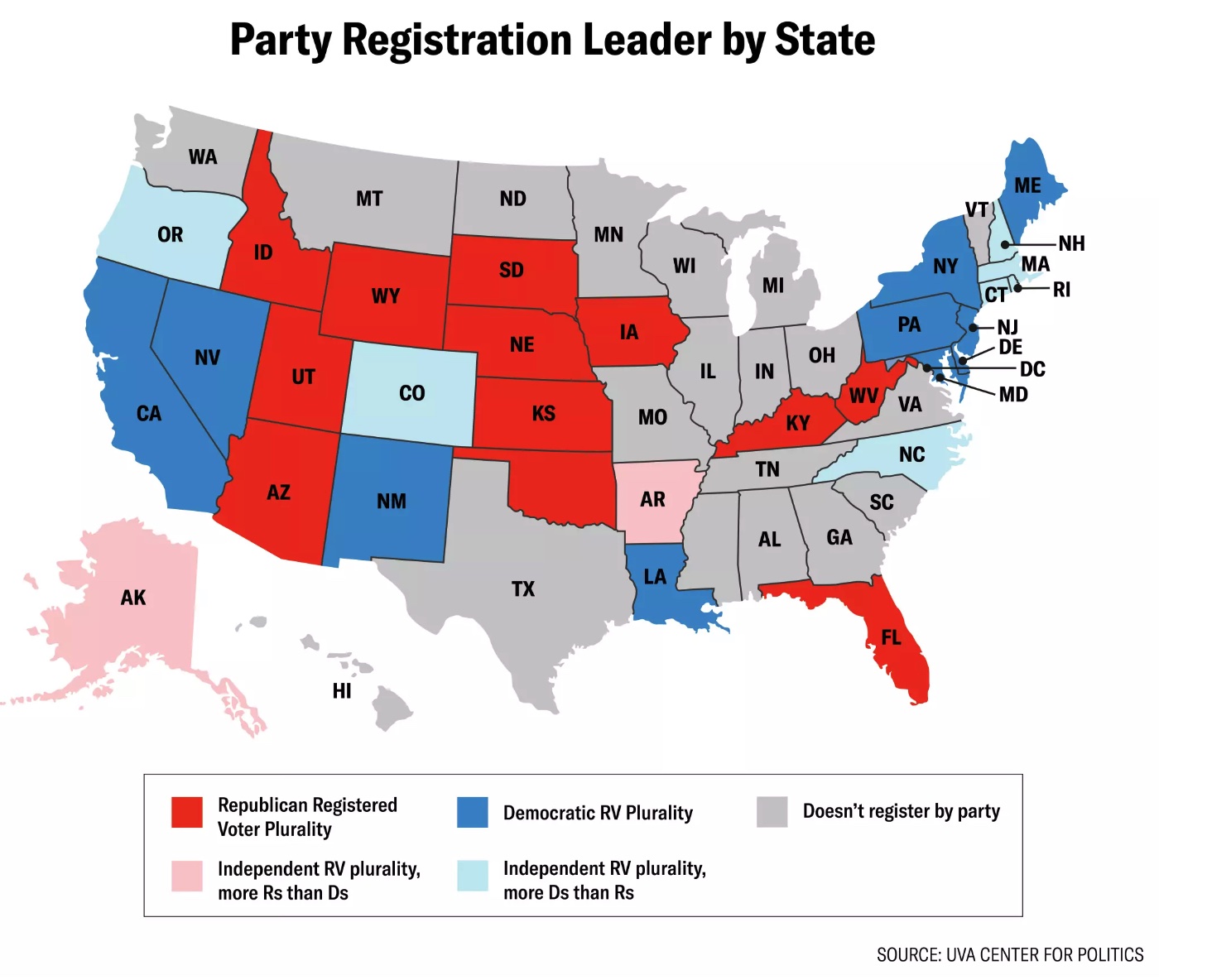

— Republicans are attracting more registered voters in states where Democrats have long held a registration advantage —reflecting one of many ways in which the current political landscape is tilting toward the GOP. Registered Republicans now outnumber Democrats in Florida, Kentucky, and West Virginia after years of trailing, according to data from Sabato’s Crystal Ball at the University of Virginia Center for Politics that was shared first with the Washington Examiner. Republicans now lead in registered voters in 12 states, compared to 10 states and Washington D.C., where Democrats have the plurality of registered voters. Self-proclaimed independents have the edge in nine states.

|

CONGRESS |

— Leahy has second surgery related to hip fracture. Senate Appropriations Chair Pat Leahy (D-Vt.) underwent a second surgery Tuesday after fracturing his hip in a fall in late June. Leahy’s surgical team found it necessary to perform an additional surgery to help advance his recovery. His office said the senator was back in his rehabilitation room by Tuesday evening and is “once again working diligently with the physical therapists to return home as soon as possible.”

— House passes six-bill funding package. The House passed a six-bill government funding package totaling just over $400 billion — about a fourth of discretionary funds for fiscal 2023 — by a 220-207 vote. The bill includes funds for Agriculture-FDA, Energy and Water, Financial Services, Interior-Environment, Military Construction-VA, and Transportation-HUD programs. Combined, the 12 House measures include more than 4,000 proposed earmarks totaling over $8 billion. Senate Democratic leaders said they wouldn’t be marking up any of the appropriations measures before recess, making it likely that a stopgap will be needed.

— Pelosi backs Senate’s semiconductor (Chips) bill, sees vote next week. House Speaker Nancy Pelosi (D-Calif.) backed a compromise Senate bill that provides subsidies for the semiconductor industry, and said she plans for a House vote on it as soon as next week. The bill funnels $52 billion to chipmakers and Pelosi’s backing greatly boosts chances of passage before the August congressional recess. In the Senate, John Cornyn (R-Texas), a chief proponent of the proposal, predicted the cloture vote on the measure at a 60-vote threshold would come in the Senate early next week with final passage on Wednesday.

— A bipartisan group of U.S. senators introduced two bills to reform election laws, seeking to block a repeat of then-President Donald Trump's failed attempt to overturn his 2020 election loss to Democratic President Joe Biden. The legislation, among other things, would make clear that the vice president has only a ceremonial role in certifying election results.

|

OTHER ITEMS OF NOTE |

— A Twitter worker accused of spying for Saudi Arabia heads to trial. Ahmad Abouammo is charged with acting as an agent of a foreign power inside the U.S., committing wire fraud and laundering money. The Justice Department says he misused his access to Twitter user data, gathering the personal information of political dissidents and passing it to Saudi Arabia in exchange for a luxury watch and hundreds of thousands of dollars.

— Attorney General Merrick Garland threatened to sue states over abortion access and said the Justice Department will seek the dismissal of a Texas lawsuit challenging federal rules requiring hospitals to perform abortions in emergency situations. Georgia’s ban on most abortions after around six weeks of pregnancy took effect after a federal appeals court cleared the way for the 2019 law to be enforced.

— Comic-Con returns. For the first time since the pandemic, over 100,000, many dressed as their favorite characters, will descend on San Diego for Comic-Con, a jamboree for fans of caped crusaders, animated robots and toys of all kinds.