China to Take ‘Forceful Measures’ if Pelosi Visits Taiwan

Putin holds summit talks in Tehran with Iran and Turkey | No update on freeing Ukraine grain

|

In Today’s Digital Newspaper |

Russian leader Vladimir Putin holds summit talks in Tehran with the Iranian and Turkish presidents today about the Syrian conflict — but the Russian president’s war in Ukraine will be the focus. The struggle to unblock grain exports from Ukraine’s Black Sea ports that were upended by Putin’s invasion will dominate discussions with his Turkish counterpart Recep Tayyip Erdogan, who’s pushing to broker an agreement. Erdogan hopes to help avert a global food crisis by creating a safe naval corridor for grain exports through the Black Sea. In Tehran the Turkish president hopes to persuade Putin to agree to a deal.

Coincidence? Iran’s national energy company reportedly signs an agreement with the Russian state-owned energy giant Gazprom. The memorandum of understanding is worth about $40 billion according to Iran’s oil ministry news agency

U.S. long-range artillery is helping hold back Russia’s advance, Ukraine military chief says.

The European Union doesn’t expect Russian gas supplies to Europe through the Nord Stream pipeline to restart when scheduled maintenance ends this week. European leaders looking for alternatives to Russian fossil fuels signed deals with Azerbaijan, Algeria and the United Arab Emirates.

Today, Senate Majority Leader Chuck Schumer (D-N.Y.) is expected to get the ball rolling with a procedural vote on a bill that would provide $52 billion in grants for semiconductor manufacturing, plus other tax credits for the industry. Draft legislation would block semiconductor subsidies for companies making advanced chips in China.

Treasury Secretary Janet Yellen called for a reorientation of the world’s trading practices in the wake of Russia’s invasion of Ukraine, pushing again for countries to become less reliant on China for critical components.

The U.S. International Trade Commission on Monday voted to reject steep duties on ammonium nitrate fertilizers from Trinidad and Tobago and Russia, going against a recommendation for tariffs from the Commerce Department. Now some in the ag sector and its allies in Congress are pressuring the Biden administration to waive duties on phosphate fertilizer from Morocco.

Gasoline for less than $4 a gallon is back, at least in some areas. Nearly 1 in 5 gas stations is charging under the $4 mark for a gallon of regular gas, according to a recent survey. That's about 24,000 stations nationwide, mostly in the Southeast and in oil patch states like Texas and Oklahoma. Overall, the national average has fallen 10%, or 50 cents, since hitting the record high of $5.02 a gallon seven weeks ago — but it's still at a high mark of $4.52 a gallon. All 50 states have an average price of more than $4, with South Carolina at the cheapest average of $4.02. California has the highest average at $5.90 a gallon.

Gas prices are falling, but the current U.S. hot weather will be more expensive than usual because electricity prices jumped in the past year and have shown no signs of slowing. This will translate to $540 in electric bills for the average American household between June and August, a $90 increase from a year ago.

Looking to salvage his environmental agenda, President Biden is considering declaring a national climate emergency as soon as this week, according to the Washington Post. The decision could redirect funds for clean energy projects and restrict offshore drilling, or even curtail the movement of fossil fuels aboard ships, trains and pipelines. Biden may also use the Defense Production Act to ramp up output of renewable energy products and systems. Numerous court challenges are expected if Biden unfolds his latest climate change move.

The Justice Department and Cargill and Continental Grain are discussing potential concessions that could clear the way for the companies to acquire poultry processor Sanderson Farms, the Wall Street Journal reports.

Infectious-diseases expert Anthony Fauci, 81, said he is likely to retire by the end of President Biden’s term.

Most Americans are not happy with President Joe Biden and his handling of the economy, according to a new CNN poll. Biden's approval rating in the poll stands at 38%, with 62% disapproving -- and his approval ratings for handling the economy are even lower.

Election Day 2022 is 112 days away. Election Day 2024 is 840 days away.

|

MARKET FOCUS |

Equities today: Global stock markets were mixed overnight. U.S. Dow opened up around 230 points. In Asia, Japan +0.7%. Hong Kong -0.9%. China flat. India +0.5%. In Europe, at midday, London +0.3%. Paris -0.1%. Frankfurt flat.

U.S. equities yesterday: All three major indices finished lower after slipping into negative territory during afternoon trading. The Down lost 215.65 points, 0.69%, at 31,072.61. The Nasdaq declined 92.37 points, 0.81%, at 11,360.05. The S&P 500 was down 32.31 points, 0.84%, at 3,830.85.

Agriculture markets yesterday:

- Corn: December corn futures rose 7 cents to $6.10 3/4.

- Soy complex: November soybeans rose 38 cents to $13.80 1/4, the highest close in a week. August soymeal ended $3.50 higher at $434.50. August soybean oil rose 312 points to 63.20 cents.

- Wheat: September SRW wheat rose 36 cents to $8.12 3/4 and September HRW wheat rose 36 1/2 cents to $8.74. September spring wheat jumped 32 1/4 cents to $9.39.

- Cotton: December cotton surged 429 points to 93.00 cents per pound, the contract’s highest closing price in a week.

- Cattle: August live cattle rose 70 cents to $135.625. August feeder cattle rose 32.5 cents to $176.675.

- Hogs: August lean hogs rose $2.30 to $112.125, the contract’s highest closing price since April 28. The next CME lean hog index is projected up another 74 cents to $114.89 (as of July 15), near a 13-month high.

Ag markets today: Corn futures nearly wiped out corrective gains from the previous four days overnight, while soybeans and wheat gave back a portion of yesterday’s price strength. As of 7:30 a.m. ET, corn futures were trading 16 to 18 cents lower, soybeans were 16 to 19 cents lower and wheat futures were 8 to 11 cents lower. Front-month U.S. crude oil futures were around $2 lower, and the U.S. dollar index was down more than 900 points this morning.

Technical viewpoints from Jim Wyckoff:

On tap today:

• U.S. housing starts, due at 8:30 a.m. ET, are expected to increase to an annual pace of 1.57 million in June from 1.549 million one month earlier.

• Federal Reserve Vice Chair Lael Brainard speaks on the Community Reinvestment Act at 2:35 p.m.

• A Russia-Turkey-Iran summit in Tehran. Russian President Vladimir Putin, Turkish President Recep Tayyip Erdogan and Iranian President Ebrahim Raisi will meet in Tehran for talks primarily focused on stabilizing Syria. Regarding the ongoing war in Ukraine, the three leaders are also expected to discuss how to ensure the safe passage of Ukrainian and Russian grain exports from the Black Sea to mitigate global food shortages and rising prices.

Quarles: Fed should have hiked rates before taper finished. The Federal Reserve should have started hiking interest rates before it was done tapering its bond purchases to avoid falling behind on the fight against inflation, Randal Quarles, the Fed’s former vice chair for supervision, said. Policymakers were focused on unwinding the central bank’s asset purchases in a predictable manner to avoid disrupting markets, Quarles said during an interview published Monday.

A rise in the U.S. dollar has taken the punch out of the surge in commodities. Prices of oil, metals and agricultural products have tumbled since early June after shooting up following Russia’s invasion of Ukraine. In part, the recent fall reflects investors’ fears that a demand-busting recession is around the corner. But it is also because most commodities are priced in dollars, so a rallying dollar makes commodities more expensive for buyers around the world, dragging on demand.

People who aren’t U.S. citizens accounted for $59 billion worth of home purchases in the year leading up to March, per the National Association of Realtors. That’s a 9% jump from the year before and the first increase in three years.

USAID announces food/nutrition/development aid for countries in Horn of Africa; aid for Ukraine. The U.S. Agency for International Development (USAID) announced Monday it was providing nearly $1.3 billion in aid and support for Ethiopia, Kenya and Somalia — part of the Horn of Africa — where unprecedented drought means more than 18 million need humanitarian assistance, according to USAID Administration Samantha Power. Link to Africa aid; Link to Ukraine aid.

USAID will provide additional humanitarian and development assistance, including a $1.18 billion increase in humanitarian aid. USAID will provide emergency food, including sorghum, yellow split peas and vegetable oils where local markets are not open and provide cash to families to buy food staples from local markets.

USAID will also provide community-level screening aimed at early detection of acute malnutrition in children and will provide a specialized peanut-based nutritional supplement to such children via mobile outreach clinics, and also provide Super Cereal Plus, a corn-soy blend food supplement, for use at home.

Funding for veterinary services, animal fodder and supplements to keep livestock alive and healthy is part of the package and the agency will conduct disease outbreak investigations and water sanitation help and water deliveries.

A portion of the funding for the effort comes via the Ukraine aid package approved earlier this year. Meanwhile, USAID also announced more than $169 million in aid for Ukraine for additional emergency food and cash assistance, safe drinking water, logistical support and more. The U.S. has provided more than $1.4 billion in humanitarian aid to Ukraine, according to USAID.

Market perspectives:

• Outside markets: The U.S. dollar index is solidly lower again in early U.S. trading. The yield on the 10-year U.S. Treasury note is fetching 2.995%. U.S. crude was around $101 per barrel and Brent around $104.80 per barrel. Gold was firmer at around $1,712 per troy ounce and silver weaker was around $18.75 per troy ounce.

• German firm says it will need a gov’t bailout. Uniper, one of Germany’s largest power producers, said that higher gas prices and rising demand for power as temperatures rise had burned through nearly all of the company’s cash, and it was going to need a government bailout.

• NEC’s Deese touts drop in the price of gas, forecasts further reductions. In an appearance on CNN, NEC Director Brian Deese said, “We’ve now seen gas prices fall for 34 straight days. They’re down about 50 cents. That’s positive. What it means is that for a typical household, you’re probably generating savings of about $50 a month. And all over the country, there’s about 20,000 gas stations where gas is now retailing for less than $4 a gallon. ... We should continue to see retail gas prices at the pump fall through the rest of the month. Hopefully we’ll get down closer to that $4 a gallon number nationwide.” Deese, on MSNBC’s Morning Joe, said, “We know that gas prices really take a bite out of people’s pocketbooks and also capture a lot of media attention. When gas prices were going up your network and others covered it constantly; now gas prices are coming down. This is the longest sustained period of gas price reductions in over a decade. ... So that is ...good news for the American people and we anticipate the gas prices should keep coming down over the course of the month.” In an appearance on CNBC’s Squawk Box, Amos Hochstein, President Biden’s special coordinator for energy affairs, said, “We need to address the current energy prices, and we’re doing exactly that – and I think quite effectively. ... Oil prices are down from their peaks. ... The president has done everything that we can.”

• 13.3 is the average number of days inbound ocean containers waited at the ports of Los Angeles and Long Beach for rail transport in June, a record high, according to the Pacific Merchant Shipping Association.

• Wheat’s plunge. War between agricultural giants Russia and Ukraine drove futures prices for wheat at the Chicago Board of Trade up by $4 a bushel in March, but prices since then have fallen back below prewar levels, dropping more than $5 a bushel, or 40%.

• Egypt’s state buyer cut the acceptable protein level for U.S. SRW and soft white wheat in its tender that closes today to 10.5% as a way of generating more offers for U.S. supplies.

• A dangerous heatwave has hit parts of Europe with officials claiming that thousands of lives could be at risk this week. Temperatures may hit record levels in 15 different regions Tuesday as record temperatures are expected in the U.K., France, Greece, and Spain —countries where only 1% of their residents have air conditioning. Wildfires have blazed through France, Spain, Portugal, and Greece over the past week.

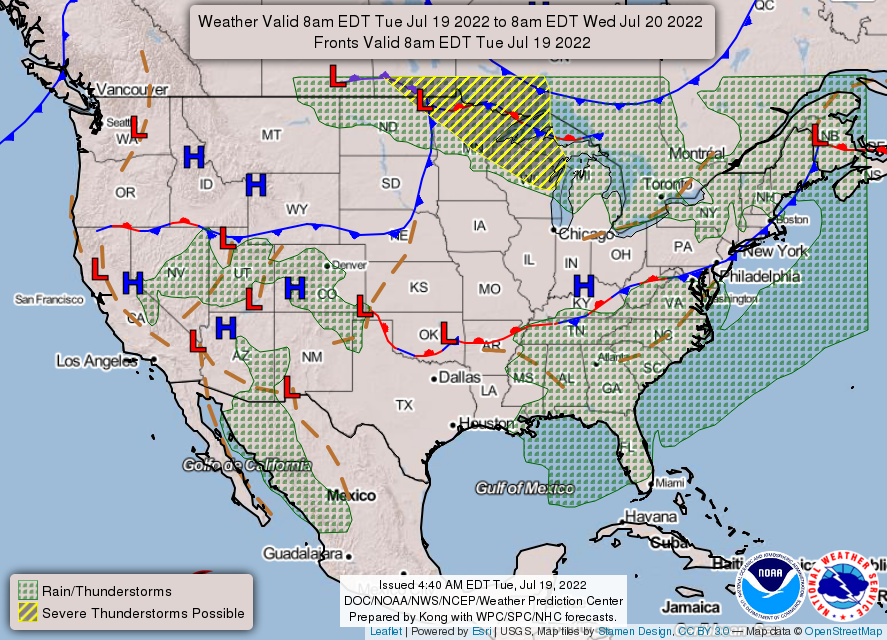

• NWS weather: Dangerous heat to continue through midweek across the south-central U.S., building across the Northeast on Wednesday...- ...Severe thunderstorms possible from portions of the Upper Midwest into the upper Great Lakes today and then the Ohio Valley on Wednesday... ...Monsoonal moisture to bring locally heavy rains and isolated flash flooding across portions of the Southwest, Great Basin and Southern Rockies.

Items in Pro Farmer's First Thing Today include:

• Sharp price pressure overnight

• Corn, soybean CCI ratings decline to the lowest of the year

• Consultant switches back to neutral/lower bias toward U.S. corn, soybean yields

• Russia to start stockpiling grain in August

• EU to ease Russian sanctions to allow food trade (details in Russia/Ukraine section)

• Consultant raises Argentine corn crop estimate

• Selective retailer beef buys

• Pork cutout weakens

|

RUSSIA/UKRAINE |

— Summary: Russia's invading forces are having some trouble with Ukraine's long-range artillery. So on day 146 of Vladimir Putin's Ukraine invasion, his defense chief officially prioritized the destruction of Western-supplied weapons, according to Moscow's state-run media TASS.

- Commercial shipping is still blocked in the northwestern portion of the Black Sea, Ukraine's armed forces say. And overall, Russia's Ukraine invasion is estimated to "cost roughly $1 trillion in global output this year," the Wall Street Journal reported Sunday, citing a report from the British Economist Intelligence Unit. "Russia's official inflation rate soared to 15.9% in June — far higher than in the U.S. and Europe — government figures show. Analysts anticipate that unemployment will rise later this year," the WSJ reports. The Associated Press has more on the expected economic impacts to both Europe and Russia, here.

- European Commission said it does not expect Russia’s Gazprom to restart gas supplies through the Nord Stream 1 pipeline as scheduled on Thursday. The pipeline was closed last week for maintenance, though some suspect Russia is wielding it as a political tool in retaliation for EU sanctions. Gazprom earlier declared force majeure to European buyers, warning that it could not fulfil its supply obligations.

- Yellen: Oil-cap plan blunts concerns over Russian reprisals. Treasury Secretary Janet Yellen said her plan to limit Russia’s oil earnings can overcome fears among potential partners that President Vladimir Putin may retaliate. “Russia’s going to face an insurance and financial services ban at the end of the year that is going to end up shutting in between 3 and 5 million barrels, we estimate,” she said. “So why should they retaliate for an initiative that enables their oil to continue to flow through to world markets at a price that is profitable?”

- EU to ease Russian sanctions to allow food trade. The European Union will amend its sanctions on Moscow on Wednesday by allowing the unfreezing of some funds of top Russian banks that may be required to ease bottlenecks in the global trade of food and fertilizers, a draft document showed. Under the changed regulation, which is expected to be adopted by EU envoys on Wednesday, EU nations will be able to unfreeze previously blocked economic resources owned by top Russian lenders VTB, Sovcombank, Novikombank, Otkritie FC Bank, VEB, Promsvyazbank and Bank Rossiya, the document said.

Separately, under new sanctions to be adopted on Wednesday, Sberbank, Russia’s largest bank, will also become subject to the freezing of its assets, except for resources needed for food trade, an EU official told Reuters. The draft document said money could be released “after having determined that such funds or economic resources are necessary for the purchase, import or transport of agricultural and food products, including wheat and fertilizers.”

- A deal is expected to be signed as soon as this week to resume Ukraine’s Black Sea grain exports, although U.N. Secretary-General Antonio Guterres warned last week that there was still work to be done to reach a final agreement. Turkish Defense Minister Hulusi Akar on Monday acknowledged there were still “small problems” unresolved. "An agreement was reached on a plan, general principles for shipping grain and food products... A meeting on this within the week is probable," Akar said. He detailed that what he called technical matters — setting up a monitoring center in Istanbul, identifying safe routes, and checkpoints at port entries and exits — were to be discussed this week. Russian leader Vladimir Putin holds summit talks in Tehran with the Iranian and Turkish presidents today and the Russian president’s war in Ukraine will be the main focus.

Turkey is one of the countries most vulnerable to the supply shortages resulting from the war in Ukraine. Located on the southern side of the Black Sea, Turkey relies on Russia and Ukraine for more than 80% of its wheat imports and is a key trade passage connecting Europe’s breadbasket to Africa and the Middle East. Last week, Ankara announced it had reached a deal with Russia, Ukraine, and the U.N. to establish a safe corridor for grain shipments. Remaining issues in the deal will likely be smoothed out during the summit, and if finalized, could relieve pressure amid a global food crisis.

|

POLICY UPDATE |

— White House supports stopping semiconductor companies from expanding certain investments in China if they take new subsidies to build plants in the CHIPS bill, renamed legislation the Senate is set to begin debating today. Senators pushed for the inclusion of language that would encourage non-Chinese 5G equipment manufacturing. Lawmakers in both parties are working to secure language to overhaul the National Science Foundation. Others are working to insert commerce and national security provisions into the bill. As for timing, Senate Democrats will be able to move the CHIPS package on a House message. This parliamentary tactic will allow Senate Majority Leader Chuck Schumer (D-N.Y.) to bypass one cloture vote.

|

PERSONNEL |

— Fauci says he plans to retire by end of Biden's current term. Dr. Anthony Fauci plans to retire by the end of President Joe Biden's current term in office, the government's top infectious disease expert told CNN on Monday. Fauci said he does not currently have a specific retirement date in mind nor has he started the process of retiring. Fauci has been the director of the National Institute of Allergy and Infectious Diseases (NIAID) for 38 years and has served under seven presidents.

|

CHINA UPDATE |

— South China Morning Post: China asks European leaders to meet Xi in November. But will they accept? Top European leaders have been invited to meet Chinese President Xi Jinping in Beijing in November but have yet to decide whether to accept. Invitations have been sent to German Chancellor Olaf Scholz, French President Emmanuel Macron, Italian Prime Minister Mario Draghi and Spanish Prime Minister Pedro Sánchez, according to the South China Morning Post, citing a senior source familiar with the situation. Link to article. The trips would mark a return to Beijing for Western European leaders following almost three years of a zero-Covid policy that has prevented in-person diplomacy The proposed date would be right after the 20th party congress, providing indirect confirmation Xi Jinping will get a third term as president.

Xi has repeatedly pushed for European “strategic autonomy” from the United States. But fundamental disagreements between Beijing and Brussels on Xinjiang, Ukraine, and several other wedge issues have pushed Europe closer to Washington. The G7 and NATO, both heavily European, have become increasingly critical of Beijing.

— China’s government warned it would take “forceful measures” if Nancy Pelosi, speaker of the House, visits Taiwan. The Financial Times reported (link) that Pelosi (D-Calif.) plans to visit the island, which China claims, next month. Pelosi would be the most senior American lawmaker to visit Taiwan since Newt Gingrich travelled to the island as speaker in 1997. Pelosi’s office told the Washington Post on Tuesday: “We do not confirm or deny international travel in advance due to long-standing security protocols.” Pelosi had planned to lead a congressional delegation to Taiwan, the democratic island claimed by Beijing, in April but delayed her trip to Asia after contracting the coronavirus. The WaPo notes that Pelosi has been a vocal critic of China and met virtually in January with Taiwan’s vice president, William Lai Ching-te, when he was in the United States. He thanked her for championing human rights and called her a “true friend” of Taiwan.

— China's U.S. debt holdings slip under $1 trillion. For the first time in 12 years, Chinese holdings of U.S. debt fell under the $1 trillion benchmark. That means Japan is now the biggest international holder of American notes, at $1.2 trillion. The new Treasury Department data, which reflects debt holdings as of May, comes as the Federal Reserve battles four-decade-high inflation with aggressive interest rate hikes. China has also sought to diversify its holdings of foreign debt.

— China reported almost 700 new cases of Covid-19 on Monday, its highest tally in nearly two months. Most cases were recorded in the southern region of Guangxi and the northwestern province of Gansu. Lockdowns have been imposed in both places. In Shanghai, the financial capital, officials launched a campaign to test around 20 million people to prevent another lockdown.

|

TRADE POLICY |

— ITC: urea ammonium nitrate (UAN) solutions from Russia and Trinidad and Tobago do not injure U.S. industry. The U.S. International Trade Commission (ITC) today revoked U.S. anti-dumping and anti-subsidy duties on ammonium nitrate fertilizer solutions from Russia and Trinidad and Tobago, voting to find that the U.S. domestic producers are not injured by these imports. The finding will end U.S. anti-dumping duties of up to 122.93% on Russian urea nitrate fertilizer solutions and 111.71% on imports from Trinidad and Tobago imposed by the Commerce Department.

Background: The Commerce Department announced the final duty rates on June 21 as part of an investigation launched in June 2021 after a petition from CF Industries Nitrogen of Deerfield, Illinois. The Commerce Department said that in 2021, the U.S. imported $262.6 million worth of ammonium nitrate fertilizer duties from Russia and $231.1 million from Trinidad and Tobago.

CF Industries comments. “We are disappointed that the International Trade Commission has determined the U.S. UAN industry has not been harmed by the unfair trade practices from state-subsidized entities underpinning UAN imports from Russia and Trinidad that were clearly established through thorough and impartial investigations by the U.S. government,” said Tony Will, president and chief executive officer, CF Industries Holdings, Inc. Unfortunately, this outcome will perpetuate an unlevel playing field for a domestic industry that has invested billions of dollars in the U.S. to ensure American farmers have a reliable source of UAN fertilizer.”

Bottom line: Had the commission found that U.S. fertilizer producers were being injured by the Russian and Trinidad and Tobago imports, the duties would have been locked in for five years. The decision could help ease shortages and price increases for fertilizers brought on by Russia's war in Ukraine, both major fertilizer exporters. Some in the ag sector and its allies in Congress are now pressuring the Biden administration to waive duties on phosphate fertilizer from Morocco.

— Treasury Secretary Janet Yellen called for a reorientation of the world’s trading practices in the wake of Russia’s invasion of Ukraine, pushing again for countries to become less reliant on China for critical components like semiconductors. Speaking in Seoul, South Korea, Yellen explored so-called “friend-shoring,” a proposed paradigm shift that would have the U.S. and its allies trade more closely with one another and less with geopolitical rivals. She said supply disruptions during the Covid-19 pandemic, as well as the war in Ukraine, have exposed the danger of depending too heavily on a single producer.

|

ENERGY & CLIMATE CHANGE |

— Senate Democrats continue to urge President Joe Biden to declare a “climate emergency.” Biden is considering declaring a national climate emergency as soon as this week, the Washington Post reports (link), citing three unidentified people familiar with the matter. Such a move could give Biden broad executive authority to redirect funds for clean energy projects, restrict offshore drilling or curtail the movement of fossil fuels. Bloomberg reports that some environmentalists say they expect the Interior Department to take drastic measures to cut fossil fuel development once Manchin’s vote is no longer a concern and after voters, possibly swayed by federal oil leasing’s effects on gasoline prices, have already cast ballots. The WaPost notes “Some climate activists have urged the White House in recent months to deploy an emergency declaration to maximum effect, arguing that it would allow the president to halt crude oil exports, limit oil and gas drilling in federal waters, and direct agencies including the Federal Emergency Management Agency to boost renewable-energy sources.

Any new executive action on climate also could face a significant court challenge, which could affect the future of environmental regulations. Last month, the Supreme Court cut back the federal government’s powers to regulate power plants’ carbon emissions. Sen. Ron Wyden (D-Ore.), the leader of the Senate Finance Committee, said in a statement Monday that lawmakers at least should explore renewing tax credits that boost cleaner technology. “While I strongly support additional executive action by President Biden, we know a flood of Republican lawsuits will follow,” Wyden said. “Legislation continues to be the best option here. The climate crisis is the issue of our time and we should keep our options open.”

Meanwhile, EPA Administrator Michael Regan will speak at the weekly New Dem Coalition lunch to discuss actions Congress and the administration can take to curb climate change.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— The Justice Department is discussing with Cargill and Continental Grain potential concessions, including how farmers and plant workers are paid, that could clear the way for the companies to acquire Sanderson Farms, the Wall Street Journal reports (link), citing people familiar with the matter. Cargill, an agribusiness giant with meat, grain and food-ingredients businesses, and Continental, an agricultural investment firm, agreed in August to acquire the poultry processor for $4.5 billion. The details of an agreement between the companies and the Justice Department could change, and the deal could fall apart.

Perspective: 15% is the share of U.S. chicken production that a new competitor formed by combining Sanderson with Wayne Farms, a poultry company owned by Continental, would represent under the proposed deal.

|

CORONAVIRUS UPDATE |

— Summary:

- Global Covid-19 cases at 563,7147,805 with 6,371,654 deaths.

- U.S. case count is at 89,677,275 with 1,024,266 deaths.

- Johns Hopkins University Coronavirus Resource Center says there have been 599,289,113 doses administered, 222,582,315 have been fully vaccinated, or 67.58% of the U.S. population.

— Wrist sensors can detect covid before symptoms emerge. The tech could help curb the spread of the virus. Link for details.

|

POLITICS & ELECTIONS |

— CNBC survey: 30% approve of Biden’s handling of the economy. The latest CNBC All-America Economic Survey found that President Biden’s “overall and economic approval numbers have reached the lowest levels of his presidency and fallen further than that of either of his two predecessors.” Biden’s “economic approval dropped 5 points from the prior survey in April to just 30%. The president’s economic record is supported by just 6% of Republicans, 25% of independents and 58% of Democrats, a very low number for his own party.” Biden’s overall approval rating “came in at 36%, 1 point lower than [former President Donald] Trump’s worst rating.”

— CNN poll: Biden’s disapproval rating at 62. A new CNN poll conducted by SSRS, says “nearly 7 in 10 say President Joe Biden hasn’t paid enough attention to the nation’s most pressing problems.” The president’s “approval rating in the poll stands at 38%, with 62% disapproving” while “his approval ratings for handling the economy (30%) and inflation (25%) are notably lower.” CNN says that “with midterm elections approaching, the poll finds no indication that Biden’s standing with the public is improving — and among some critical constituencies, it is worsening.” Biden’s approval numbers among Democrats “have softened by 13 points since the spring (from 86% in a late April through early May poll to 73% now).” His “approval rating among Democrats for handling the economy is also on the decline (62% approve, down from 71% this spring). And on inflation, it is barely above water (51% of Democrats approve, 47% disapprove).”

|

CONGRESS |

— Ukrainian First Lady Olena Zelenska will address Congress on Wednesday at 11 a.m. ET, House Speaker Nancy Pelosi’s office announced. All members of the House and Senate are invited to attend the address, which will take place in the Capitol Visitor Center. Zelenska met with Secretary of State Antony Blinken on Monday.

— Jan. 6 panel extension. The House committee investigating the Jan. 6, 2021, attack on the U.S. Capitol, which had planned to finish its inquiry by September, will extend that deadline because more information keeps coming in.

— Aides to eight of the most progressive (liberal) members of the House file petitions to form unions. It is the first substantial action by congressional staff to organize collectively for better working conditions and paves the way for House aides to negotiate working conditions, paid and sick leave, and promotion policies without the threat of retaliation — a right federal workers already have.

|

OTHER ITEMS OF NOTE |

— A man sued a company over a lifetime sock warranty… Bass Pro Shops may not actually offer “the last sock you’ll ever need to buy.”

— The board of the Pulitzer Prizes rejected Donald Trump’s request to toss out wins for coverage of Russian interference in the 2016 election and Russian ties to his presidential campaign.

— Drone superhighway. The U.K. is setting up a 164-mile airspace corridor for what it calls a drone superhighway. Link for details.