SCOTUS Ruling Could Push Dems to Approve Another Reconciliation Package

Rail shipment woes get ag sector attention | Dockworker contract expires late today

|

In Today’s Digital Newspaper |

Most markets have normal hours today, closed Monday. Most financial and commodity markets will observe normal trading hours today except for the bond market as the Securities Industry and Financial Markets Association is recommending an early close for the bond market of 1 pm CT. U.S. markets and U.S. gov’t offices will be closed Monday in observance of the Independence Day holiday.

Russian missiles struck Ukraine’s Odessa region, killing at least 18 people including two children, according to Ukrainian officials. President Biden pledged to support Ukraine for “as long as it takes,” as Russia’s war drags on and Western countries pour billions of dollars in arms and humanitarian aid into the conflict.

Wheat prices are starting to come down, helped by fine farm weather and a rush of Russian grain ships.

Supreme Court justices restricted the EPA's ability to curb power-plant emissions, dealing a major blow to Joe Biden's climate change agenda. Bottom line: In this and other recent rulings, the Supreme Court is reining in the power of federal regulators. “When Congress seems slow to solve problems, it may be only natural that those in the Executive Branch might seek to take matters into their own hands,” Justice Neil Gorsuch wrote in his concurring opinion. “But the Constitution does not authorize agencies to use pen-and-phone regulations as substitutes for laws passed by the people’s representatives.” Impact: federal agencies will now likely have to adhere to congressional statutes. This will likely boost odds the Democrats will push another reconciliation package that will include energy-related funding and programs. Another likely impact: Experts expect more challenges to what Roberts' opinion calls the "administrative state.” One near-term target could be the SEC's drive to issue climate risk disclosure requirements.

Regarding Roe v. Wade, President Biden said he would support an exception to the Senate's filibuster rules to pass legislation ensuring privacy and abortion rights, calling the court "destabilizing" to the nation, an effort that would face obstacles because of key Democrats’ opposition to the move. Senate Minority Leader Mitch McConnell (R-Ky.) had some direct comments on Biden’s remarks — see Congress section below.

In the court’s next term, which will begin in October, SCOTUS will decide on another batch of landmark cases involving affirmative action, gay rights, environmental protections, and election law. The Supreme Court agreed to consider whether state lawmakers have the authority to adopt voting rules for federal elections without oversight by state courts.

President Joe Biden said he supports scrapping the filibuster, which requires 60 votes to pass legislation in the Senate, to codify abortion rights. Biden, a long-time defender of the filibuster, called for a similar exception in January to pass voting-rights legislation. Speaking in Madrid where NATO wrapped up its summit, the president said the Supreme Court’s decision to overturn Roe v Wade was “destabilizing” and condemned the court’s “outrageous behavior.”

Inflation is surging in the eurozone. The European Central Bank on Friday said year-over-year inflation rose 8.6% in June. The ECB is expected to raise rates for the first time in 11 years later this month and is projected to follow through with another increase in September.

Although gas prices have declined from last month’s $5-per-gallon highs, it may not last. “We still could see a super spike in gas prices later this summer, should a hurricane threaten Gulf Coast oil refineries or oil platforms,” said Patrick De Haan, GasBuddy’s head of petroleum analysis.

Rail shipment woes are growing, and it’s caught the attention of lawmakers and others. We have more details on this below.

EPA’s proposed changes for using atrazine COULD still change following a 60-day comment period. So, aggies should not push the alarm bells yet.

|

MARKET FOCUS |

Most markets open normal hours today, closed Monday. Most financial and commodity markets will observe normal trading hours today except for the bond market as the Securities Industry and Financial Markets Association is recommending an early close for the bond market of 1 pm CT. U.S. markets and U.S. gov’t offices will be closed Monday in observance of the Independence Day holiday.

Equities today: Global stock markets were mostly lower overnight. U.S. Dow opened around 40 points lower, then went slightly higher and then lower again, with trading volume likely lower on the day. In the first half of this year American stock markets fell by the largest amount since 1970. By Thursday the S&P 500 had plunged by 20.6%. The Nasdaq dropped by 29.5%, its worst first-half ever. Meanwhile consumer spending in America slowed in May for the first time this year, suggesting that the economy has contracted for the second consecutive quarter. In Asia, Japan -1.7%. Hong Kong closed. China -0.3%. India -0.2%. In Europe, at midday, London flat. Paris +0.2%. Frankfurt +0.1%.

What’s ahead: An analysis by S&P Dow Jones Indices found that there’s minimal, if any, correlation between the S&P’s performance in its first half with its second half. The 12 bear markets since World War II — other than the current one — lasted an average of 10 months from market peak to trough, with an average drop of 34%. If this bear market follows that pattern, it wouldn’t hit bottom until October.

U.S. equities yesterday: The Dow lost 253.88 points, 0.82%, at 30,775.43. The Nasdaq declined 149.16 points, 1.33%, at 11,028.74. The S&P 500 was down 33.45 points, 0.88%, at 3,785.38.

Agriculture markets yesterday:

- Corn: December corn futures plunged 34 cents to $6.19 3/4, the contract’s lowest close since $6.12 on March 3. Corn ended near a four-month low.

- Soy complex: November soybeans fell 20 1/4 cents to $14.58. August soyoil sank 249 points to 67.01 cents and August soymeal rose $6.20 to $435.50.

- Wheat: September SRW wheat tumbled 46 cents to $8.84 and September HRW wheat fell 39 1/2 cents to $9.51 3/4, both near four-month closing lows. September spring wheat fell 38 1/2 cents to $9.90.

- Cotton: December cotton gained 136 points to 98.84 cents per pound.

- Cattle: August live cattle rose 40 cents to $132.575, while August feeder cattle rose $2.45 to $176.225.

- Hogs: August lean hog futures fell $1.475 at $102.10, the contract’s lowest closing price since $98.975 on May 12. Hog futures sank to a seven-week closing low. The CME lean hog index is expected to fall 42 cents today to $100.84.

Ag markets today: Corn and wheat futures worked mildly higher overnight following Thursday’s sharp losses. Soybeans extended yesterday’s sharp loses. As of 7:30 a.m. ET, corn futures were trading mostly 3 to 5 cents higher, soybeans were 4 to 10 cents lower and wheat futures were mostly 3 to 7 cents higher. Front-month U.S. crude oil futures were around $2 higher and the U.S. dollar index was up more than 300 points this morning.

Technical viewpoints from Jim Wyckoff:

On tap today:

• S&P Global's U.S. manufacturing index for June is expected to tick down to 52 from a preliminary reading of 52.4. (9:45 a.m. ET)

• Institute for Supply Management's manufacturing index is expected to fall to 54.3 in June from 56.1 one month earlier. (10 a.m. ET)

• U.S. construction spending for May is expected to climb 0.3% from the prior month. (10 a.m. ET)

• Baker Hughes rig count is out at 1 p.m. ET.

• CFTC Commitments of Traders report, 3:30 p.m. ET.

The Federal Reserve Bank of Atlanta’s closely watched GDPNow tracker estimated that output contracted 1% during the second quarter. It would mark the second straight quarterly contraction. Two straight quarters of contraction wouldn’t itself indicate a recession has occurred, though it is a rule of thumb some analysts use. Recessions are determined by a panel at the National Bureau of Economic Research, a nonprofit academic group.

$7.7 billion is how much Americans are expected to spend this year on 4th of July cookouts and BBQs, according to the NRF Independence Day Data Center (link). This year, the Center estimates Americans will spend about $80.74 per person on food alone, about $7.7 billion in total, about $200 million more than they projected last year, likely due in part to inflation.

Meanwhile, around 35,000 people are estimated to convene on the corner of Surf and Stillwell avenues in Coney Island to watch the Nathan's Famous Fourth of July Hot Dog-Eating Contest. Millions more will watch the ESPN telecast of the event, which has been formally going on since 1972. Keep an eye on defending men's champion, Joey "Jaws" Chestnut, who ate 76 hot dogs during last year's showdown.

The eurozone's annual rate of inflation accelerated again in June, reaching its highest level in history. Consumer prices rose 8.6% on year in June after climbing 8.1% in May, according to a first estimate released Friday by Eurostat, the European Union's statistics agency. Russia's attack on Ukraine has fueled a climb in energy prices and they were the main driver of the on-year increase.

Dockworker contract expires late today (8 p.m. ET). The contract between the International Longshore and Warehouse Union, which represents 22,400 workers at 29 ports from San Diego to Seattle, and the Pacific Maritime Association, representing the shipping terminals, is set to expire on Friday. The union members primarily operate machinery like cranes and forklifts that move cargo containers on and off ships. Representatives of the two sides previously said that they didn’t expect a deal by the deadline but that they were dedicated to working toward an agreement. The ILWU and port employers have issued a joint statement pledging labor peace, and no strike or lockout as the talks continue. The National Retail Federation, which represents companies like Walmart and Target, and the Agriculture Transportation Coalition are among the industry groups pressing for a quick agreement. Automating the movement of containers at the ports, resulting in fewer jobs, appears to be a key issue in the talks, which have been ongoing since May.

Now what? Some shippers are already rerouting goods from the ports of Los Angeles and Long Beach to the East Coast to minimize risks heading into the peak fall shopping season. For now, the union can either extend the agreement while talks continue or have members work without a contract, and without guardrails against potential work slowdowns.

In May, the Port of Los Angeles had its third-busiest month ever, handling nearly one million shipping container units, largely stocked with imports from Asia. Twenty-one ships were waiting to dock outside the local ports this week, down from 109 in January, according to the Marine Exchange of Southern California.

Market perspectives:

• Outside markets: The U.S. dollar index is higher in early U.S. trading. The yield on the 10-year U.S. Treasury note is fetching 2.954%. U.S. crude is around $108.25 per barrel and Brent around $111.80 per barrel. Precious metals are under pressure, with gold under $1,786 per troy ounce and silver under $19.55 per troy ounce.

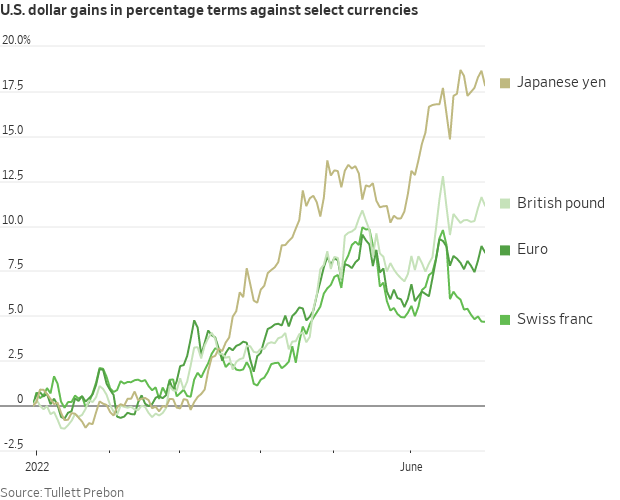

• The WSJ Dollar Index, which measures the dollar against a basket of 16 currencies, has increased 8.7% this first half of the year. That puts it on pace for its best first half since 2010, when it gained 8.8%. Investors seeking refuge from volatile financial markets have been piling into the dollar as a safe bet, driving its surge to multidecade highs. The Federal Reserve’s aggressive rate increases are also boosting the dollar. Money managers and hedge funds tend to favor currencies with fast-acting central banks because they believe those countries will either keep inflation under control or step in to shore up financial markets when they are in trouble.

• Bitcoin headed south again, this time to under $19,000. The nearly 60% drawdown since the end of March is the largest since the third quarter of 2011.

• OPEC+ raised oil production rates, as expected, but that wasn't enough for President Biden. He wants Gulf allies to boost output when he meets with them during a trip to Saudi Arabia in July. In the meantime, he warned Americans will just have to stomach high gasoline prices for "as long as it takes."

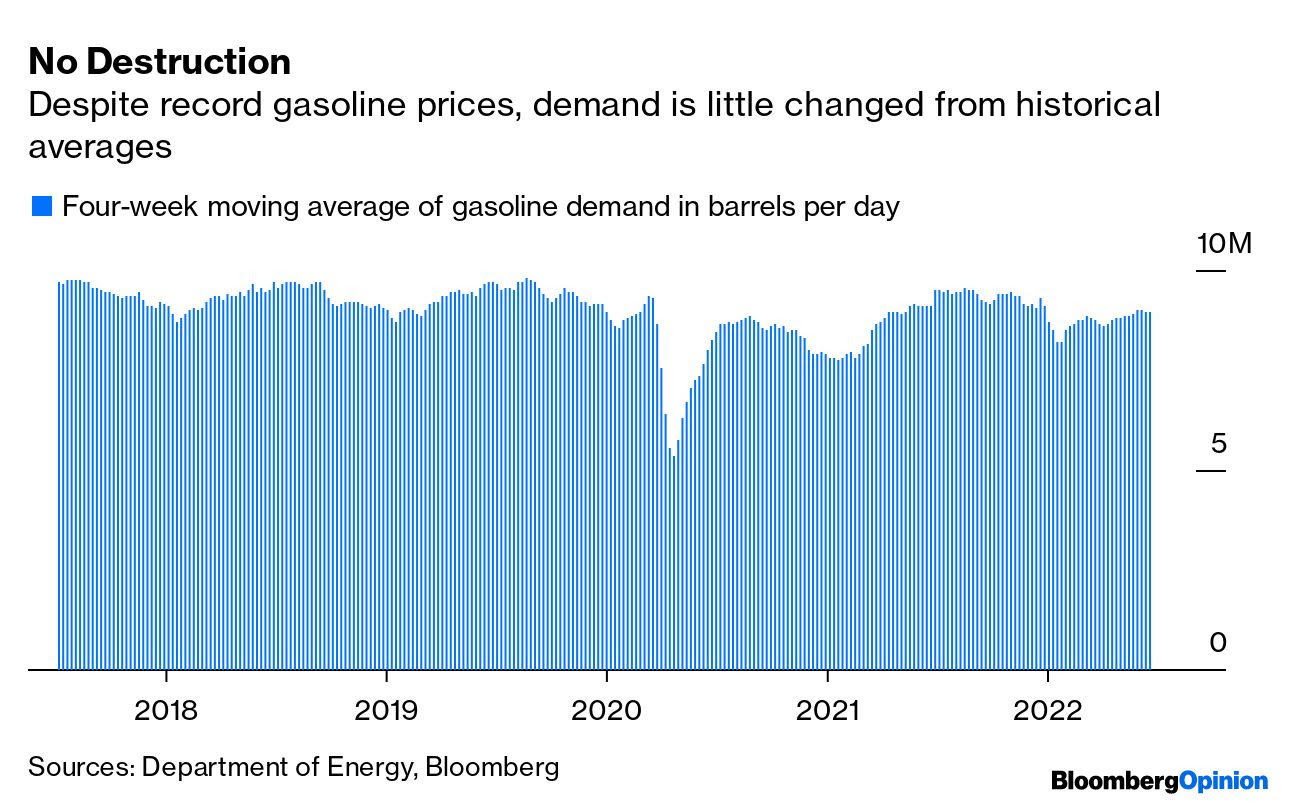

• Gasoline demand may get a bump this July 4th weekend as a record number of drivers hit the road. About 42 million people are expected to travel, topping 2019 levels by half a million, AAA says. Average pump prices fell to $4.857 a gallon as of yesterday from $5.016 in mid-June.

• $55 a barrel oil? Dhaval Joshi, chief strategist for BCA Research’s Counterpoint, predicts that oil prices will halve to around $55 a barrel if they follow the pattern laid out in previous recessions.

• The Port of Oakland told owners of cargo containers they are over-extending their welcome. Oakland beginning today will cut the number of days from seven to four that cargo containers can stay at the marine terminal tariff-free, and potentially start raising penalties, CNBC reported. The objective is to reduce congestion at the port. "Our belief is that the rates are still low because customers are still using the terminals as storage facilities," Danny Wan, executive director for the Port of Oakland, told CNBC.

• Lawmakers send bipartisan letter to STB on poor rail service; concerns mount over ag shipment woes. Reps. Jim Costa (D-Calif.) and Ralph Norman (R-S.C.) led a bipartisan letter (link) sent June 29 to the Surface Transportation Board (STB) outlining lawmakers’ concerns about deficient rail service that has impeded agricultural shipments. More than 50 lawmakers signed the letter, which highlighted poor service experienced by feed mills, integrated livestock and poultry operations, and other agricultural operations. “This has led to shutdowns and slowdowns at ethanol plants, soybean crushers, flour mills, and livestock and poultry feed mills that are severely challenging agricultural supply chains and leading to lower prices for producers and higher food prices for consumers,” they wrote. “Instances of severely delayed feed deliveries to farmers to support these operations are all too common, and at grain export destinations, vessels endure long loading wait times due to delayed train delivery. During this time the grain exporter, not the railroad, pays demurrage charges to the shipping company.”

Lawmakers also said the “ability for the fertilizer and grain and feed industries to ship by rail is imperative for curbing the impending food shortages many parts of the world are facing. For these reasons, timely and uninterrupted fertilizer and grain rail shipments are vital to the country’s interests.”

Link to AgWeb item by Tyne Morgan which notes rail bottlenecks in the U.S. are not improving, and in some cases, growing more severe.

• Salmon prices could outperform broad agriculture commodities in the second half as the total harvest for the year is poised to drop for the first time since 2016.

• Ag trade: South Korea bought a total of 126,000 MT of optional origin corn from two separate tenders.

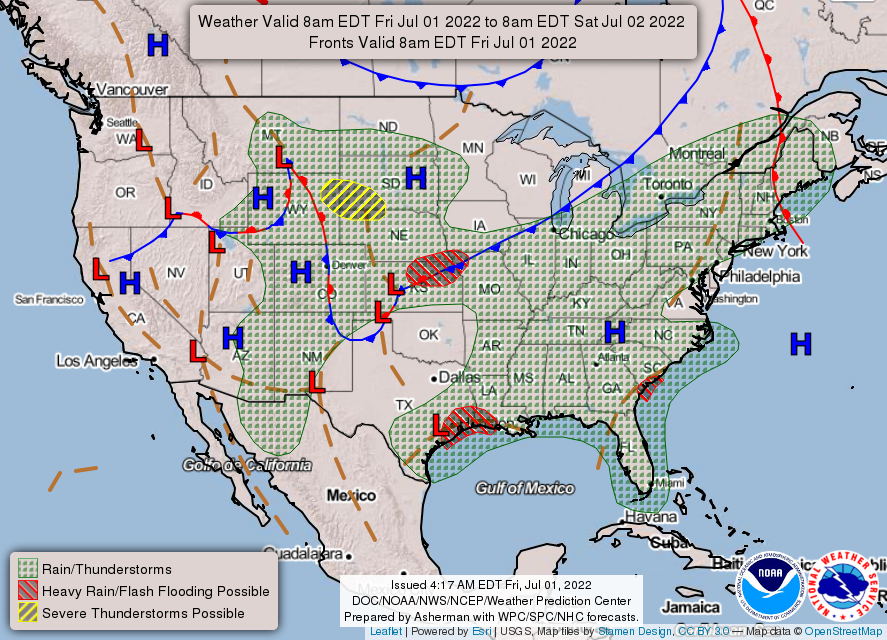

• NWS weather: Classic summer weather pattern to take hold of most of the CONUS through the weekend and Independence Day ...Excessive Rainfall expected from the Upper Texas Coast to the central Gulf Coast, Lower Missouri Valley and portions of the Georgia South Carolina coast; Severe storms to track across portions of the Northern/Central Plains today and the Mid-Atlantic/Northeast on Saturday... ...Monsoonal moisture to keep producing spotty showers and storms in the Southwest and southern/central Rockies; t-storms possible in the Northwest this weekend.

Items in Pro Farmer's First Thing Today include:

• Modest corrective buying in corn and wheat, followthrough selling in soybeans

• Record May soybean crush expected

• Argentine trucker strike ends

• EU slashes wheat production, but still sees record exports

• Cash cattle, futures diverging

• Cash hog index peaking?

|

RUSSIA/UKRAINE |

— Summary: President Biden and NATO leaders pledged to support Ukraine for "as long as it takes," although few were willing to offer an actual timeframe for an end to the conflict. Russian President Vladimir Putin’s strategy now appears to be to wait things out. He expects Western resolve to falter and the Ukrainian government to crumble. “The work is going smoothly, rhythmically,” Putin said yesterday about the military campaign. “There is no need to talk about the timing.” President Joko Widodo of Indonesia said he had delivered to Putin a written message from President Volodymyr Zelenskyy, the BBC reported. Europe’s leaders are increasingly asking how the war may end.

- Britain said it would give Ukraine an additional $1.2 billion in military support, nearly doubling its contribution.

- Russian missile strikes hit an apartment building and a recreation center near Odesa, killing 18 people. Vladimir Putin signed a decree to transfer rights to Sakhalin-2 to a new Russian company, potentially forcing Shell and others to abandon the natural gas project.

- WNBA star Brittney Griner is set to stand trial in Russia today for illegal cannabis possession and could face 10 years in prison if convicted. Despite assurances from Secretary of State Antony Blinken that his staff is working to bring Griner home, her wife told the AP that she’s frustrated about the US government’s handling of the case.

— Market impacts:

- Good weather and an increase in Russian grain ships sailing in the Black Sea have eased world wheat prices, the Wall Street Journal reported (link). Monthly departures of bulk carriers laden with cargo leaving Russia’s Black Sea port of Novorossiysk have largely remained the same over the past year, averaging around 60 a month, according to data from MarineTraffic.

- On Thursday, the first grain cargo to leave the Russian-occupied Ukrainian port of Berdyansk set sail, according to an official in the newly installed Russia-backed government in the Russian-controlled Zaporizhzhia region of Ukraine. The official said the 7,000 tons of grain was government-owned and that the ship was sailing to “friendly countries.” Russian trading firms with their own fleet of vessels have filled the gap, according to Eduard Zernin, chairman of the Russian Union of Grain Exporters. But with the new-crop Russian wheat harvest begins in September, without Western trade financing, Russian ports could become another bottleneck in global food-supply chains, said Arnaud Petit, director of the International Grains Council. Mid-September to December is when the bulk of grains exports from Russia occur.

- Ahead of talks on unblocking grain shipments, a Ukrainian negotiator said a deal would work only if Kyiv had the military power to enforce it.

|

POLICY UPDATE |

— China competition bill still in flux. The measure, which includes $52 billion for the domestic chip industry, is facing uncertainty in Congress amid controversy over it being tied to a broader spending package. "Let me be perfectly clear: there will be no bipartisan USICA as long as Democrats are pursuing a partisan reconciliation bill," tweeted Senate Minority Leader Mitch McConnell (R-Ky.). "Senate Republicans are literally choosing to help China outcompete the U.S. in order to protect big drug companies," responded White House Press Secretary Karine Jean-Pierre. "This takes loyalty to special interests over working Americans to a new and shocking height. We are not going to back down in the face of this outrageous threat."

|

CHINA UPDATE |

— Live hog futures traded in Dalian have surged to their strongest in a year, while wholesale prices are at a six-month peak. Higher costs look set to linger as the latest virus outbreak is brought under control and meat consumption rebounds. And supply issues around China’s favorite meat, which has the biggest weighting among foodstuffs in the consumer price index, could mean that pork prices are at the start of a longer-lasting, cyclical upswing that poses an inflation risk to the wider economy, according to Ming Ming, chief economist at Citic Securities Co.

— China adjusts sow herd data for May. China’s ag ministry said its sow herd fell more than 8% in May compared with a year ago, more than the almost 5% decline previously estimated. But total size of the breeding herd at 41.92 million head did not change, according to data on the ministry website.

— China’s factory sector expands most in 13 months. The Caixin/Markit manufacturing purchasing managers index (PMI) rose to 51.7 in June, the first expansion of China’s factory sector in four months and the fastest growth in 13 months. China’s manufacturing activity was buoyed by the easing of Covid restrictions. The recovery suggested in the Caixin/Markit survey, which focused on more export-oriented and small firms in coastal regions, was stronger than China’s official PMI, which also showed expansion in the vast manufacturing sector.

|

ENERGY & CLIMATE CHANGE |

— Supreme Court curbs EPA’s power to regulate emissions and fight climate change. The Supreme Court has made it more challenging for the Environmental Protection Agency to regulate greenhouse gases and fight climate change, as justices ruled Thursday in favor of Republican-led states and coal companies that asked the court to limit how much the EPA can control emissions from power plants. The court ruled 6-3 along ideological lines that the EPA does not have the authority under the Clean Air Act to create caps for greenhouse gas emissions. The consolidated cases are known as West Virginia v. EPA.

Chief Justice John Roberts wrote for the court’s conservatives. “Capping carbon dioxide emissions at a level that will force a nationwide transition away from the use of coal to generate electricity may be a sensible ‘solution to the crisis of the day’ " Roberts wrote, referring to a court precedent. “But it is not plausible that Congress gave EPA the authority to adopt on its own such a regulatory scheme.”

Justice Elena Kagan, writing for the dissenters, countered: “Today, the Court strips the EPA of the power Congress gave it to respond to ‘the most pressing environmental challenge of our time,’ " referring to another precedent.

GOP-led states and coal companies had sued the Biden administration to limit how much the EPA can regulate emissions from power plants, even though the administration hasn’t actually come up with a rule for those emissions yet. The challengers wanted the Supreme Court to preemptively decide how far the Biden administration can go in terms of regulating the emissions, though the White House argued the court shouldn’t rule against the administration while the issue is still “abstract.”

"The only question before the Court is more narrow: whether the 'best system of emission reduction' identified by EPA in the Clean Power Plan was within the authority granted to the Agency in Section 111(d) of the Clean Air Act," the majority opinion read. "For the reasons given, the answer is no."

“Today’s news is also a big win for our economy and agriculture in America, as the EPA has been among the worst offenders of usurping congressional authority,” said Arkansas Rep. Rick Crawford, a Republican member of the House Agriculture and Transportation committees. “With the court’s decision today, the EPA, and ultimately other agencies, will have their wings clipped.”

Impacts. While the case was focused on the EPA, critics have warned the court’s ruling could be used to stymie other federal agencies’ abilities to impose regulations and make policies themselves, rather than Congress. “Almost everything about these cases … [is] manufactured in an effort to return to an era free from oversight by the government,” Sens. Sheldon Whitehouse (D-R.I.), Richard Blumenthal (D-Conn.), Elizabeth Warren (D-Mass.) and Bernie Sanders (I-Vt.) wrote in a brief to the court.

Bottom line: The ruling delivers a blow to Democrats and environmental groups, who want the agency to crack down on emissions from power plants and other sources to mitigate climate change. Also, companies across the board could face a patchwork of rulings by different courts, rather than one agency’s decision, former FCC official Blair Levin told the Washington Post. New York Times writer Coral Davenport told the paper’s Climate Forward newsletter that to meet President Biden’s pledge to cut greenhouse gases 50% from 2005 levels by 2030, most experts say the United States would need a combination of new legislation and aggressive regulations. “This decision takes one of those tools and makes it far less effective,” she said. But the move will likely increase the push in Congress by Democrats to clear a reconciliation package that includes energy-related programs and funding. Also, the court is set to hear a similar case on Waters of the United States laws later this year.

— Final 2020, 2021 and 2022 RFS levels published in Federal Register. The final Renewable Fuel Standard (RFS) levels for 2021 and 2022 and revised 2020 standards were published today (link) in the Federal Register. EPA announced the plan June 3, including an alternative compliance plan for small refiners. The alternative compliance plan was published June 8, but the final RFS levels were not published until today. They are effective August 30.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Transplant trials: The FDA is devising plans to allow clinical trials testing the transplantation of pig organs into humans. Link for details via the WSJ.

— Win for Iowa CAFOs. The Iowa Supreme Court gave livestock farms partial immunity from lawsuits alleging that water pollution or odors from the farms create a nuisance. Link for details.

|

CORONAVIRUS UPDATE |

— Summary:

- Global Covid-19 cases at 547,540,328 with 6,333,052 deaths.

- U.S. case count is at 87,623,762 with 1,017,266 deaths.

- Johns Hopkins University Coronavirus Resource Center says there have been 592,269,252 doses administered, 221,924,152 have been fully vaccinated, or 67.35% of the U.S. population.

— FDA told Covid-19 vaccine makers to modify their next boosters to better target Omicron subvariants as well as the ancestral strain of the virus. The BA.4 and BA.5 subvariants have been spreading rapidly around the U.S. and have been able to partly elude even shots modified to target the original Omicron subvariant that the drugmakers have been working on. The new FDA directions would force vaccine makers to pivot quickly to focusing on the subvariants, because they have been focused on new shots targeting the original Omicron strain since it emerged late last year.

— North Korea blamed its Covid outbreak on "alien things" that were probably sent by balloon across its border with the South. Its neighbor, which sends leaflets including some that are critical of Kim Jong Un via balloons across the border, rejected claims that the virus could be spread that way.

|

POLITICS & ELECTIONS |

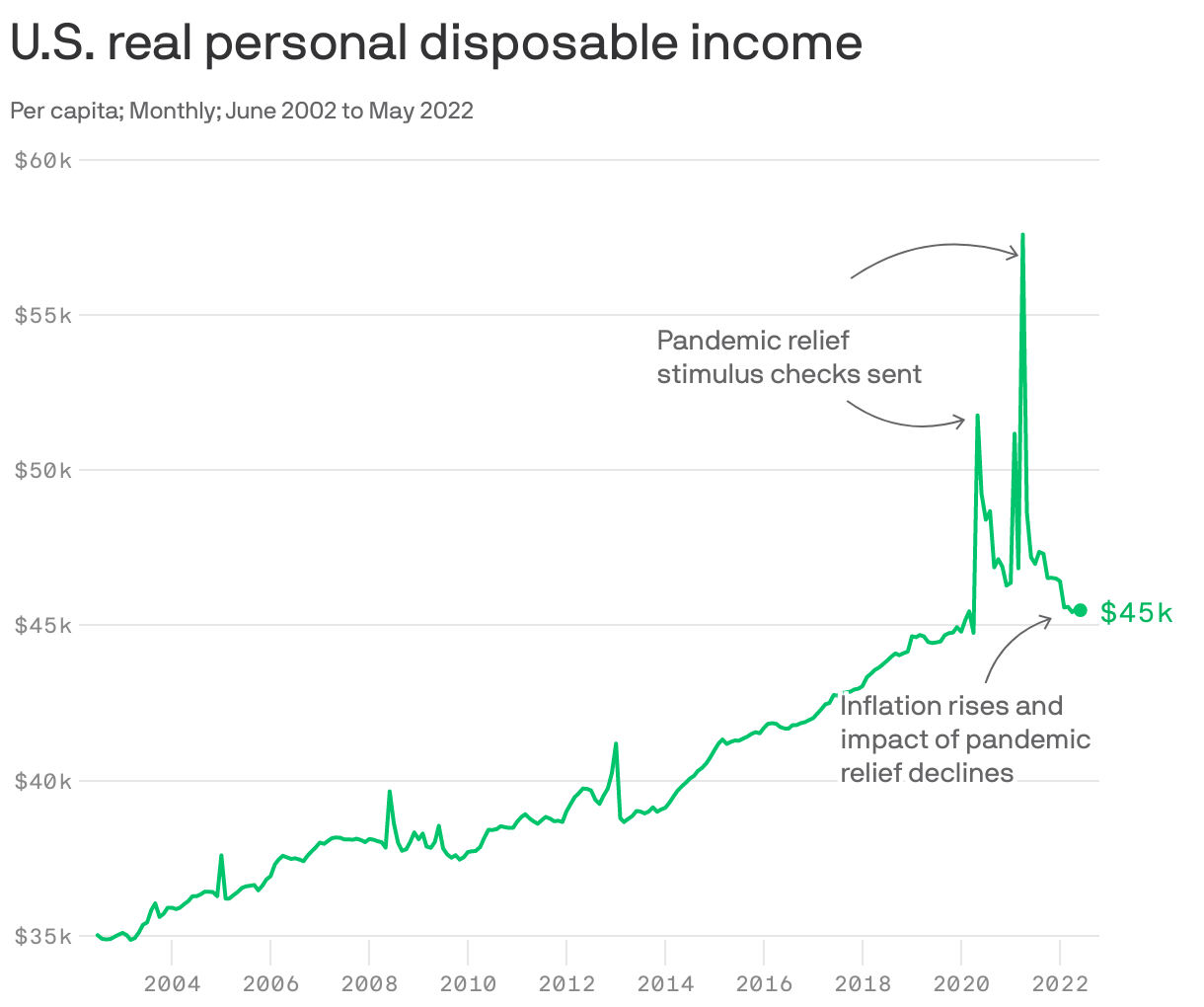

— A key indicator of the financial health of Americans has declined steadily for the last 14 months, in yet another ominous sign from the economy that Democrats will face tough midterm elections, Axios notes. Government data out yesterday shows real per capita disposable income — the money consumers can spend after accounting for taxes and inflation — is dropping sharply. Real — inflation-adjusted — per capita disposable income fell to $45,490 in May, down 3.6% from the previous year. Since March 2021 — when the last round of stimulus checks artificially puffed personal disposable income to a record high level of nearly $57,000 — real incomes are down 20%.

|

CONGRESS |

— McConnell blasts Biden for advocating filibuster abortion carve-out after Roe. Senate Minority Leader Mitch McConnell (R-KY) on Thursday slammed President Joe Biden’s remarks supporting breaking the filibuster to codify Roe v. Wade, calling it an inappropriate attack against the Supreme Court. Earlier Thursday, during a press conference at a NATO summit in Spain, the president called for the Senate to make an exception to the chamber's rule requiring 60 votes to proceed with legislation. In the 50-50 Senate, that effectively means no legislation to protect abortion rights can be brought to a vote. Biden's comment drew praise from liberal lawmakers who have been highly critical of the high court’s decision to overturn the landmark abortion decision. "The foremost thing we should do is make it clear how outrageous this decision was," Biden said. "I believe we have to codify Roe v. Wade in the law, and the way to do that is to make sure that Congress votes to do that."

McConnell on Thursday said that such a move would damage the Senate as an institution and that Biden's critique was “unmerited and dangerous… Attacking a core American institution like the Supreme Court from the world stage is below the dignity of the president," McConnell said. "He’s upset that the court said the people, through their elected representatives, will have a say on abortion policy. That does not destabilize democracy — it affirms it. By contrast, it is behavior like the president’s that undermines equal justice and the rule of law.”

Centrist Sens. Joe Manchin (D-W.Va.) and Kyrsten Sinema (D-Ariz.) have both previously pushed back on the idea of breaking the filibuster.

— Sen. Leahy recovering from hip surgery. Sen. Pat Leahy (D-Vt.) had surgery to repair a broken hip he suffered in a fall this week. This means he will not be present in the U.S. Senate and that will further complicate Democrats’ efforts to move any contentious legislation. Leahy plans to retire at the end of his current term.

|

OTHER ITEMS OF NOTE |

— Biden administration can get rid of Trump’s ‘Remain in Mexico’ Policy, Supreme Court rules. The Biden administration can rescind the Trump administration’s “Remain in Mexico” policy that forced asylum seekers to stay out of the U.S. as they awaited an immigration hearing, the Supreme Court ruled Thursday, after conservative federal judges had previously thwarted the White House’s attempts to get rid of the controversial policy. The vote was 5 to 4, with Chief Justice John Roberts writing for himself and Justice Brett Kavanaugh, and the court’s three liberals, Stephen Breyer, Sonia Sotomayor and Elena Kagan. Justices Clarence Thomas, Samuel Alito Jr., Neil Gorsuch and Amy Coney Barrett dissented. The case is Biden v. Texas.

— Cotton AWP posts significant decline. The Adjusted World Price (AWP) for upland cotton fell to 116.83 cents per pound, effective today (July 1), taking the AWP to its lowest mark since the week of March 18 when it was 113.26 cents per pound. Meanwhile, USDA said that Special Import Quota #11 will be established July 7 for 50,978 bales of Upland Cotton, applying to supplies purchased not later than October 4 and entered into the U.S. not later than Jan. 2, 2023.

— EPA is proposing revising its registration for atrazine, a herbicide essential to farming. “We are disappointed by EPA’s decision,” said Iowa farmer and National Corn Growers Association (NCGA) President Chris Edgington. “We can feed and fuel the world and fight climate change, but we can’t do these things without modern farming tools, and atrazine is a tool that is critical to our work.” The latest development marks a step backward in EPA’s commitment to transparency and the use of the best available science, Edgington said. However, he noted that EPA listened to growers’ requests and agreed to additional scientific review. The proposal has a 60-day public comment period.

— Recep Tayyip Erdogan demanded that Sweden extradite 73 people whom Turkey accused of terrorism or risk losing his support to join NATO. Turkey’s president said Sweden promised to deport them, though no such commitment appeared in the countries’ joint memorandum (with Finland) about NATO accession on Tuesday. The ultimatum, issued at the end of the alliance’s summit in Madrid, threatened to re-open a dispute that appeared resolved just days ago.

— Wastewater beer. “NEWBrew” is no ordinary beer. The new Singapore blond ale is made with recycled sewage, Bloomberg reports. The idea of processing sewage into drinking water, once largely resisted, has been gaining support in the past decade as the world’s supply of fresh water is increasingly under stress. Key to expanding the technology is to persuade the public that, once the water has been processed, it’s just water. Some who have sampled NEWBrew say they find that it’s a refreshing, light-tasting ale that’s perfect for Singapore’s tropical climate.