Yellen: Looking to ‘Reconfigure’ Tariffs Imposed on Chinese Goods Under Trump

SNAP/food stamp funding continues as contentious issue among House Ag panel members

|

In Today’s Digital Newspaper |

USDA daily export sale: Private exporters reported sales of 143,000 MT of soybeans for delivery to unknown destinations — 500 MT is for delivery during MY 2021-2022 and 142,500 MT is for delivery during MY 2022-2023.

More U.S. soybean, upland cotton sales to China. USDA data for the week ended June 2 saw U.S. export sales of soybeans and upland cotton at notable levels for both old- and new-crop delivery. Activity for 2021-22 included net sales of 73,200 tonnes of sorghum, 128,900 tonnes of soybeans, 114,500 running bales of upland cotton and net reductions of 5,200 tonnes of corn. For 2022-23, net sales of 261,000 tonnes of soybeans and 66,100 running bales of upland cotton. For 2022, net sales of 5,200 tonnes of beef and 600 tonnes of pork were reported.

Russian troops shelled the Ukrainian city of Kharkiv and other border towns overnight, bringing new violence to a region trying to rebuild after months of bombing. Ukraine has said attacks are being launched from inside Russia.

The U.S. and its allies are looking to restrain global oil prices, the WSJ reported. (U.S. gas prices topped $5 nationally.) Meanwhile, a natural-gas export plant under construction in Siberia suffered another setback as a Japanese government-owned bank suspended loans to the project. Also, Europe’s natural gas prices surged after a fire at a large export terminal in the U.S. may wipe out deliveries to a market that’s on high alert over tight Russian supplies. The Freeport liquefied natural gas facility in Texas, which makes up about a fifth of all U.S. exports of the fuel, will remain closed for at least three weeks.

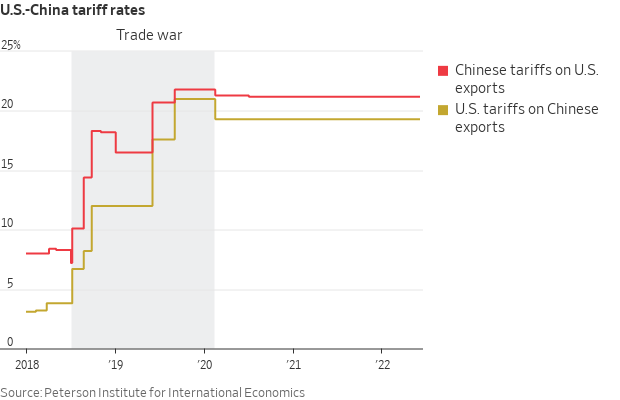

Treasury Secretary Janet Yellen said the Biden administration is considering reducing tariffs on China to ease inflation.

The European Central Bank (ECB) plans to raise interest rates by a quarter percentage point in July, the first increase in more than a decade, and go further in September. Policymakers have been spurred into action across the eurozone as inflation has outpaced economists’ expectations. The ECB's press release also includes the latest staff projections, showing that inflation is now expected to come in at 6.8% in 2022, 3.5% in 2023 and 2.1% in 2024. GDP growth is expected to come in at 2.8% in 2022, 2.1% in 2023 and 2.1% in 2024. Stagflation is the word in the eurozone.

Russia’s annual rate of inflation fell in May for the first time since the invasion of Ukraine, indicating a surge in prices that hobbled the economy is beginning to ebb.

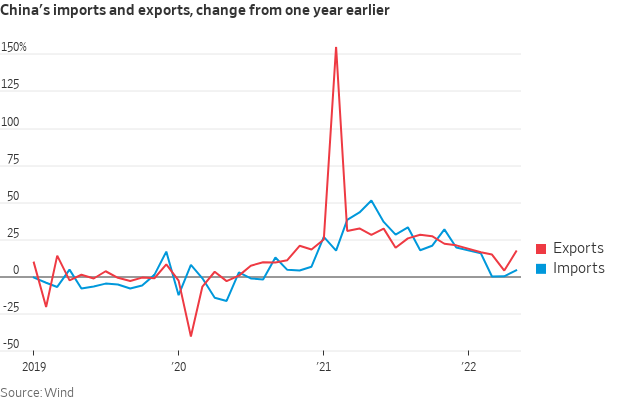

China’s exports in May were up 17% from a year earlier as Covid-19 restrictions eased, adding to signs of economic recovery after months of punishing lockdowns. We also have ag trade details in China section.

President Biden, speaking at the Summit of the Americas, laid out an economic-recovery agenda that he said aims to include regional investments, bolstering supply chains and expanding clean-energy jobs and trade relations among the countries. Biden laid out an economic-recovery agenda and called for increasing access to private capital for countries in the region.

Federal Trade Commission Chairwoman Lina Khan said the agency is considering a new regulation to restrict the use of noncompete clauses by companies, which she said hurt lower-wage workers and can stifle competition for talent.

Wall Street criticizes the SEC’s proposed changes to stock-trading rules. Brokerages and trading firms pushed back at plans from the regulator’s chairman, Gary Gensler. They said that the current system was working well and benefited individual investors by allowing for zero-commission trades.

SNAP/food stamp funding discord again surfaced among House Ag panel Republicans during a hearing Wednesday.

Vilsack adviser nominated for U.S. chief agricultural negotiator. President Biden nominated Doug McKalip on Wednesday to be the U.S. chief agricultural negotiator, working with U.S. trade representative Katherine Tai.

The House passed a broad set of gun-control measures, but with little GOP support it isn't likely to pass in the Senate. At a hearing, parents and other witnesses shaken by mass shootings asked lawmakers to take action.

Biden administration prepares to distribute 10 million Covid-19 shots to children under 5.

An armed man was arrested near Supreme Court Justice Brett Kavanaugh’s home Wednesday and charged with attempted murder after making threats against the justice, authorities said.

President Biden, on "Jimmy Kimmel Live" on Wednesday, said he isn't going to issue an executive order on guns but may issue one if Roe v. Wade is overturned.

A series of public hearings over the Jan. 6, 2021, Capitol attack will begin today with an evening session. The televised hearings will include previously unreleased video of testimony from Trump family members and former top aides.

|

MARKET FOCUS |

Equities today: The Dow opened around 85 points lower and then went even lower... around 155 points lower. In Asia, Japan flat. Hong Kong -0.7%. China -0.8%. India +0.8%. In Europe, at midday, London -0.4%. Paris -0.2%. Frankfurt -0.5%.

U.S. equities yesterday: The Dow fell 269.24 points, 0.81%, at 32,910.90 after being unable to break into positive territory at all during the session. The Nasdaq lost 88.96 points, 0.73%, at 12,086.27. The S&P 500 was down 44.91 points, 1.08%, at 4,115.27.

Proposed changes to U.S. stock-trading rules outlined by the SEC on Wednesday ran into pushback from brokerages and trading firms, which said the market performs well for ordinary investors, who enjoy benefits such as zero-commission trades. SEC Chairman Gary Gensler argued that there’s a cost to the current system: “Two or three highly concentrated market makers are buying your order flow.” The proposals would seek to make the lucrative business of executing trades more competitive.

Agriculture markets yesterday:

- Corn: July corn futures rose 7 1/2 cents to $7.64 1/2, the contract’s highest closing price since May 27, while December corn rose 3 3/4 cents to $7.17 3/4.

- Soy complex: July soybeans rose 11 3/4 cents to $17.40 after posting a contract high. July soymeal fell $1.80 to $415.60. July soyoil rose 150 points to 82.94 cents.

- Wheat: July SRW wheat rose 3 cents to $10.74 3/4. July HRW wheat rose 5 3/4 cents to $11.55. July spring wheat rallied 7 1/4 cents to $12.34 1/2.

- Cotton: July cotton surged 367 points to 140.62 cents per pound, while December rose 266 points to 122.54 cents

- Cattle: June live cattle August cattle rallied $3.40 to $137.525, a six-week closing high. August feeders surged $3.20 to $175.65. Sources reported cash trading about $1.00 above week-ago levels in primary feedlot areas.

- Hogs: July lean hogs fell $1.325 to $107.95, the contract’s lowest closing price since May 25, while August hogs fell $1.20 to $105.90.

Ag markets today: Corn and soybean futures pulled back overnight from strong gains earlier this week. Wheat also traded lower. As of 7:30 a.m. ET, corn futures were trading 5 to 8 cents lower, soybeans were 10 to 13 cents lower, SRW wheat futures were 17 to 19 cents lower, HRW wheat was 12 to 14 cents lower and spring wheat was 9 to 12 cents lower. Front-month U.S. crude oil futures were just below unchanged and the U.S. dollar index was around 135 points lower this morning.

Technical viewpoints from Jim Wyckoff:

On tap today:

• European Central Bank releases a policy statement at 7:45 a.m. ET. See details below.

• U.S. jobless claims are expected to rise to 210,000 in the week ended June 4 from 200,000 one week earlier. (8:30 a.m. ET)

• USDA Weekly Export Sales report, 8:30 a.m. ET.

• China's consumer price index for May is expected to increase 2.15% from one year earlier and its producer-price index is forecast to rise 6.3%. (9:30 p.m. ET)

• President Biden is set to deliver remarks at the IV CEO Summit of the Americas in Los Angeles at 11 a.m. PT He is scheduled to meet with Canadian Prime Minister Justin Trudeau at 11:45 a.m., and at 1:30 p.m. Biden and Vice President Kamala Harris are set to meet with leaders of Caribbean nations. Biden will deliver remarks at 2 p.m., then meet with Brazilian President Jair Bolsonaro at 3:30 p.m. At 7:45 p.m. Biden and the first lady will host a dinner for heads of state.

ECB announces coming rate hikes and that net asset purchases will end as of July 1.

- Reinvestments of the Pandemic Emergency Purchase Program will continue at least until the end of 2024 and will remain the main instrument against a widening of yield spreads.

- The policy rate remains unchanged, but the ECB announced it “intends” to hike rates by 25bp in July and 25bp in September.

- ING Economics says the door for a rate hike of 50bp in September is wide open as the statement says, “If the medium-term inflation outlook persists or deteriorates, a larger increment will be appropriate at the September meeting.”

President Joe Biden announced plans for a new economic partnership with Latin America which would see the U.S. engage more with the region. Biden was speaking at a regional summit in Los Angeles, but to a smaller audience than he would have hoped. Several Latin American leaders stayed away in protest over his decision to exclude Cuba, Venezuela and Nicaragua from the confab.

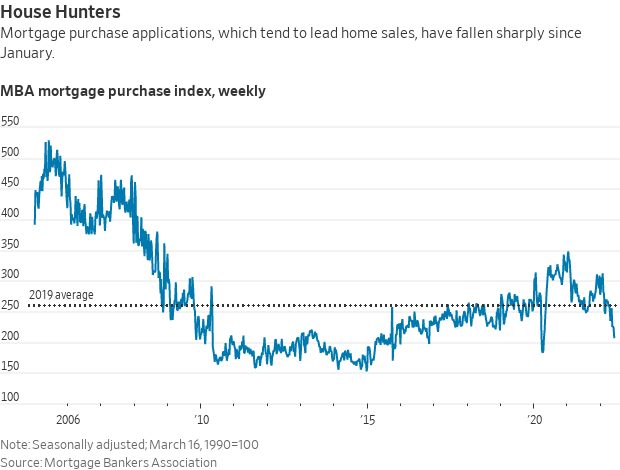

A measure of mortgage applications fell to its lowest level in 22 years last week, another sign the U.S. housing market is cooling as the Federal Reserve raises interest rates to contain inflation. Applications fell 6.5% in the week ended June 3, the fourth consecutive week of declines, according to the Mortgage Bankers Association. Refinance and purchase activity fell 6% and 7%, respectively. Higher interest rates have been weighing on demand for refinances all year, but now there are signs the slowdown has spread to purchase demand as well.

Across Africa, surging fuel prices are straining businesses from bakeries to airlines and adding pressure on consumers already burdened by spiraling food costs and the economic disruptions caused by the continuing Covid-19 pandemic. While Subsaharan Africa hosts an estimated 125 billion barrels of crude-oil reserves, almost all oil produced there is exported and then imported again as refined fuel at much higher prices. That has made African countries especially vulnerable to the sharp increase in global fuel prices triggered by Russia’s war against Ukraine. Meanwhile, the predominance of small-scale informal traders in many African economies means that fuel-price increases are typically passed on to consumers quickly, the Wall Street Journal reports (link).

U.N.: Global food import costs will hit record and higher input costs could worsen situation. The U.N. Food and Agricultural Organization (FAO) said in a new report (link) that global food imports will hit a record $1.8 trillion in 2022, up $51 billion from 2021, as higher commodity and transportation costs are garnering most of the increase. FAO said that $49 billion of the forecast increase is from higher prices. Animal fats and vegoils are the biggest contributor, the FAO Food Outlook report detailed. Rising input costs are also contributing to lower production, with the FAO Global Input Price Index (GIPI) launched in 2021 at an all-time high, rising faster than the FAO Food Price Index over the past 12 months.

Conclusion: The situation does “not augur well for a market-led supply response that could conceivably rein in further increases in food prices for the 2022/23 season and possibly the next.”

Semiconductors are the subject of major national security anxieties as they are a foundation of digital devices but in everything from cars to military equipment. Over half the world’s chip-making capacity — and far more for the most advanced designs — is in Taiwan, which faces growing pressure from mainland China, itself an increasingly powerful player in the industry. As of 2020, according to a report by the Semiconductor Industry Association, the U.S. had 12% of global manufacturing capacity.

Market perspectives:

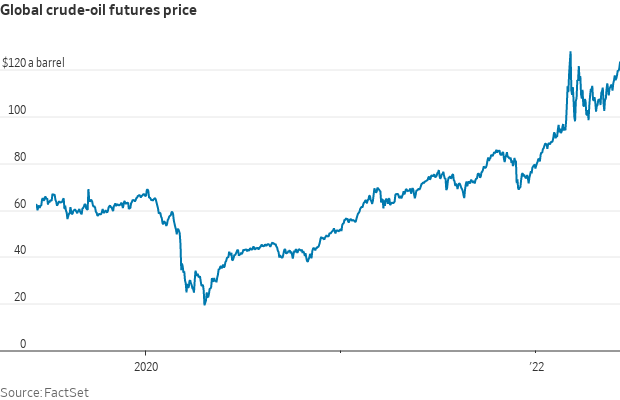

• Outside markets: The U.S. dollar index weakened ahead of jobless claims data, with the yen falling to fresh 20-year lows against the greenback (see related item). The yield on the 10-year US Treasury note has moved up to trade above 3.04%. U.S. crude was around $122 per barrel and Brent around $123.60 per barrel. Gold and silver futures are under pressure, with gold under $1,847 per troy ounce and silver under $21.95 per troy ounce.

• Japanese yen touched 134 yen to the dollar Wednesday, the lowest level since February 2002. Japan’s currency is just close to breaking down to a 24-year low. The yen’s current slide may spark turmoil on the scale of the 1997 Asian Financial Crisis if it declines as far as 150 per dollar, according to veteran economist Jim O’Neill. Speculators are gathering around the beleaguered currency and positioning is by no means extended, suggesting there’s still room for bears to pile in. Some 74% of Japanese business managers say a weak yen is having a negative impact on the nation’s economy. Link to more via Bloomberg.

IMF: The fall in the Japanese yen to 20-year lows is a “significant” depreciation that reflects market fundamentals, including that Japanese monetary policy is not on a path toward tightening like the U.S. and other major economies, International Monetary Fund (IMF) Japan Mission Chief Ranil Salgado said today. "We believe that the yen's movements reflect fundamentals," Salgado said in an online event. "We see both positive and negative effects in yen depreciation." The yen’s depreciation will help the country as the Bank of Japan (BOJ) seeks to boost inflation to its 2% goal, but will also hurt importers, businesses and households by increase costs, he added. "Inflation in the medium-term will remain well below the BOJ's target once the cost-push factors go away," Salgado said. "We consider it appropriate for the BOJ to maintain monetary easing until inflation is achieved in a stable and durable manner."

• U.S. and its allies are searching for ways to limit further surges in global oil prices, attempting to balance efforts to cut off Russia’s revenue from its energy sales while shielding the global economy from a possible recession, the Wall Street Journal reported (link). Treasury Secretary Janet Yellen said this week that the U.S. was involved in “extremely active” talks with European allies about efforts to form a buyers’ cartel and set a cap on the price of Russian oil. A goal in the talks is to keep Russian oil available on global markets to buyers such as India and China, which could help stabilize prices already trending at roughly double prepandemic levels, while constructing a mechanism Western countries could use to restrict Russian revenues from the sales. An idea under discussion among the Group of Seven wealthy nations is to turn to insurers to try to set a price cap.

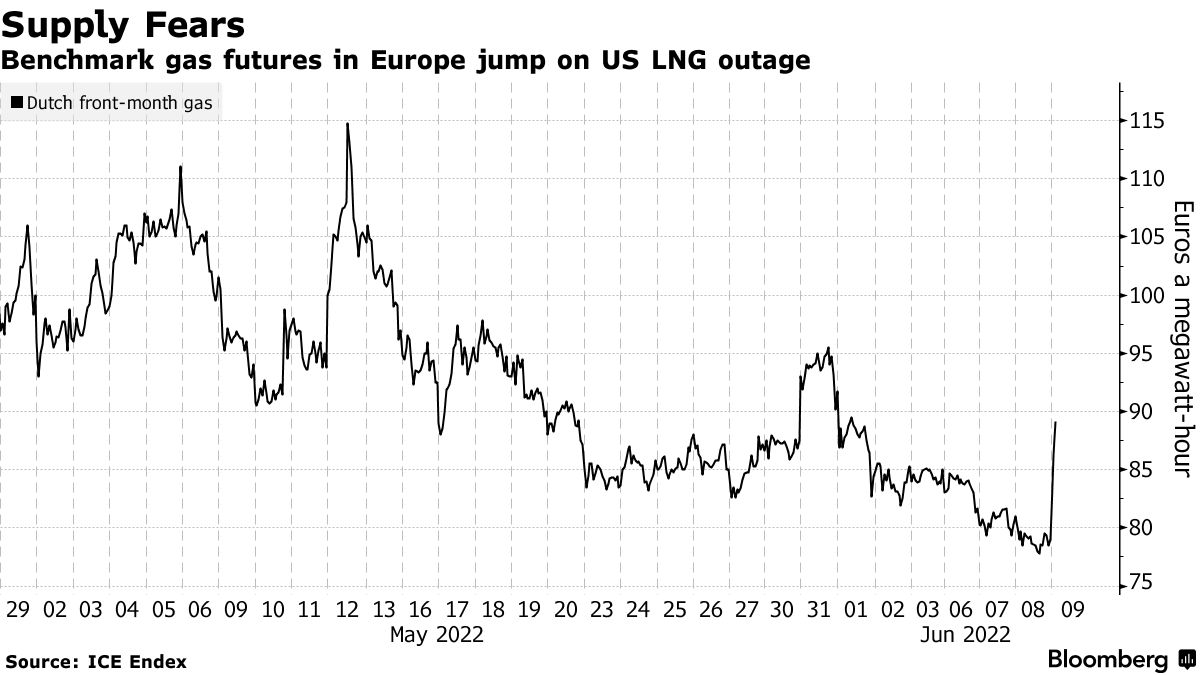

• European gas soars as fire in U.S. compounds Russia supply concern. Europe’s natural gas prices surged after a fire at a large export terminal in the U.S. may wipe out deliveries to a market that’s on high alert over tight Russian supplies. Benchmark futures traded in Amsterdam snapped a six-day falling streak, while U.K. prices jumped up to 39%. The Freeport liquefied natural gas facility in Texas, which makes up about a fifth of all U.S. exports of the fuel, will remain closed for at least three weeks. The U.S. sent nearly 75% of all its LNG to Europe in the first four months of this year. The U.S. Energy Information Administration said the Freeport facility loaded 21 cargoes of LNG in March that carried an estimated 64 billion cubic feet of gas to Europe, South Korea, and China.

• Funding for ports and shipyards. Senate Commerce Committee leaders are seeking to authorize $1.6 billion in the next fiscal year for ports, security, and shipyards in legislation meant to aid maritime workers and infrastructure after recent supply-chain bottlenecks.

• Recent hail in Texas impacted a large portion of cotton acres, sources advise. They also say the region needs more rain and that a greater number of cotton farmers are “open” on their cotton sales, waiting to see what kind of crop they produce.

• Ag trade: Japan purchased 146,990 MT of wheat in its weekly tender, including 88,483 U.S. and 58,507 MT Canadian.

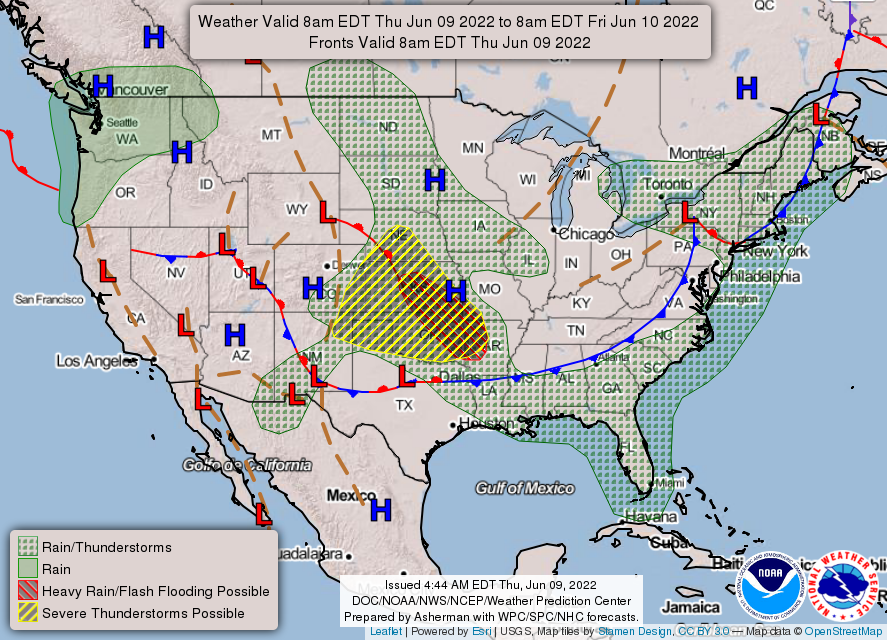

• NWS weather: There is a Slight Risk of severe thunderstorms and excessive rainfall over parts of the Central/Southern Plains through Friday morning... ...There is a Slight Risk of severe thunderstorms over parts of the Lower Mississippi/Tennessee Valleys/Central Gulf Coast from Friday into Saturday morning... ...Excessive heat over parts of Central/Southern California and the Southwest on Friday and Saturday as record high temperatures persist over southeastern Texas.

Items in Pro Farmer's First Thing Today include:

• Price pressure overnight

• No agreement to export Ukrainian grain

• Firm cuts EU wheat export forecast

• France cuts wheat export outlook

• Exchange lowers Argentine wheat crop forecast

• Cash cattle prices firm

• Hog traders remain cautious

|

RUSSIA/UKRAINE |

— Summary: President Volodymyr Zelenskyy, Ukraine’s president, said the “brutal battle” for Severodonetsk will determine the fate of the Donbas region, which has become the front line of Russia’s invasion. About 15,000 civilians are said to be trapped in Severodonetsk and the nearby city of Lysychansk. Meanwhile, the mayor of the occupied city of Mariupol spoke of an “unending caravan of death” with up to 100 dead bodies being found in every flattened block of flats.

- Removing sea mines near Ukraine’s key ports could take months, adding to complications already faced by hundreds of stranded seafarers following Russia’s invasion of the country. “Even if the ports wanted to reopen tomorrow it would take some time until ships could enter or depart,” Peter Adams, special advisor on maritime security at the International Maritime Organization, said in an interview with Bloomberg. Russian ships have blocked Ukraine’s Black Sea access, essentially halting seaborne exports of staples from grains to chicken and worsening a global food crisis. Efforts to reopen the ports are stumbling, with no sign of progress from Turkey’s efforts to broker a deal.

- Biden administration is struggling over how to deal with a looming food crisis sparked by Russia’s invasion of Ukraine. The administration is divided over a proposal to suspend sanctions on Belarus’s potash fertilizer industry in hopes that the Russian ally would allow a rail corridor for Ukraine’s grain. The WSJ reports (link) that the seemingly intractable logistics come as international food markets are likely to face serious shortages this year. The conflict has trapped much of the grain destined for export inside Ukraine and allegedly led to Russian looting. One effort faltered as Russian and Turkish officials couldn’t reach an agreement to create a sea lane to export grain from Ukraine across the Black Sea. Some brokers and shipowners say Moscow instead wants to institutionalize illegal trade in grains and other cargoes by offering below-market prices to steady clients.

— Market impacts:

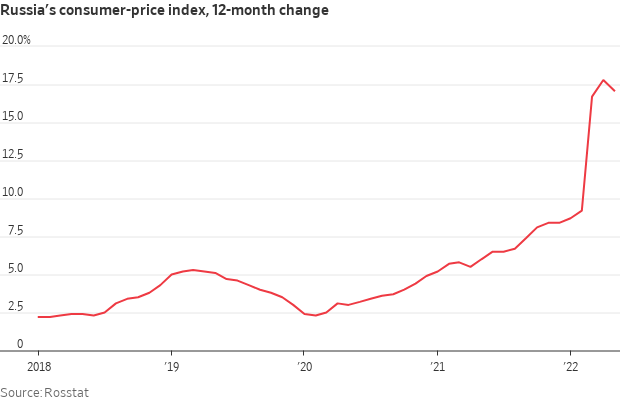

- Russia’s annual rate of inflation fell in May for the first time since the country’s invasion of Ukraine on Feb. 24, indicating a surge in prices that hobbled the economy is beginning to ebb. Russia’s statistics agency on Wednesday said consumer prices were 17.1% higher in May than a year earlier, a slight slowdown from the 17.8% rate of inflation recorded in April. Consumer prices rose rapidly in the weeks after Western governments responded to the invasion with a package of sanctions that has since been expanded, weakening the ruble and pushing the cost of imports higher. The central bank has since reversed the ruble’s decline.

|

POLICY UPDATE |

— SNAP/food stamp funding discord again surfaced among House Ag panel Republicans during a hearing Wednesday. In some prior farm bills, the initial votes on them failed largely due to differences over food stamp program (SNAP) funding. Warning that “pandemic aid is morphing into endemic aid,” the Republican leader on the House Agriculture Committee said on Wednesday that it was time to rein in food stamp spending. Other farm-state Republicans called for stricter eligibility rules to push people into the workforce and said SNAP “promotes a perverse business of poverty.”

SNAP would cost $1.1 trillion over the next decade, according to the Congressional Budget Office. Rep. Glenn Thompson (R-Pa.), the senior Republican on the Agriculture Committee, has called such spending levels exorbitant and said his “concern that pandemic aid is morphing into endemic aid” through proposals to make permanent the emergency allotments authorized by Congress in pandemic relief packages. The allotments cost $2.8 billion in February. “To say I disagree with those calls is an understatement,” said Thompson. “We do not need to spend for the sake of spending. … [S]ometimes our best intentions cause irreparable hardship for families that we aim to help.

Liberal House Rules chairman Jim McGovern (D-Mass.) said it would be a “missed opportunity” if the temporary increases in SNAP benefits were allowed to expire. “Let me be clear: I will not support any farm bill that guts the nutrition safety net for millions of Americans. … We need to find way to strengthen the program.”

Facts and figures: 41.2 million people are enrolled in SNAP, with average benefits of $233 per person, per month.

Links: Hearing video | Written testimony

|

PERSONNEL |

— Biden taps McKalip for USTR ag trade negotiator. President Biden announced he will nominate Doug McKalip to be chief agricultural negotiator in the Office of the U.S. Trade Representative (USTR), which requires Senate confirmation. McKalip is a senior adviser to USDA Secretary Tom Vilsack and served in the Obama administration both as an aide to Vilsack and acting chief of staff and as senior adviser for agriculture and rural affairs at the White House Domestic Policy Council. He served as director of the White House Rural Council and coordinated the executive branch-wide response to the 2012-2013 drought. He also was confidential assistant to the secretary, and director of legislative and public affairs for the National Resources Conservation Service.

Biden recently nominated Alexis Taylor to be USDA undersecretary for trade and foreign agricultural affairs.

|

CHINA UPDATE |

— Parts of Shanghai were locked down yet again, as China’s biggest city continues its pyrrhic battle with Covid-19. Minhang district, home to 2 million people, was the latest to be quarantined. Meanwhile, many temporary testing stations — which must be within a 15-minute walk for Shanghainese — are being made permanent. Last week China’s government declared victory against the virus in Shanghai following a costly two-month lockdown.

— China soybean imports surge. China imported 9.7 MMT of soybeans in May, up 29.7% from the previous month and 0.6% above year-ago, as some cargoes delayed at ports by Covid restrictions were unloaded. Through the first five months of this year, China imported 38.0 MMT of soybeans, down 0.4% from the same period last year.

— China’s meat imports remain sluggish. China’s meat imports in May were virtually unchanged from the previous month at 590,000 MT, though that was down 24.7% from last year. China doesn’t provide a breakdown of meat imports by category in its preliminary data, though the sharp year-over-year reduction was due to reduced pork imports. Through the first five months this year, China imported 2.85 MMT of meat, down 34.2% from the same period last year.

|

TRADE POLICY |

— Treasury Secretary Janet Yellen said the Biden administration is considering ways to reconfigure tariffs on imports from China as a means of helping to ease decades-high inflation. Yellen, speaking at a House Ways and Means Committee hearing on Wednesday, said she expected the administration to have additional information on its plans in the coming weeks, although there is no firm timeline. Yellen told lawmakers that while some of the tariffs are important to protect U.S. national security, the cost of certain duties on China ended up being paid by Americans. When the tariffs were enacted, before the pandemic, annual inflation was trending near 2%.

— Chinese exports to the rest of the world surged in May as Covid-19 restrictions eased, adding to signs of recovery in the world’s second-largest economy after months of punishing pandemic lockdowns. The year-over-year rebound in exports suggests overseas orders for Chinese goods had piled up while factories were idle and port traffic collapsed amid stringent Covid containment measures in major cities, most notably Shanghai.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— New Zealand announced a plan to tax sheep and cow burps to address one of its biggest alleged sources of greenhouse gases. The country had been criticized for not including agriculture in its emissions-trading scheme, when almost half of its emissions, mainly methane, come from the sector, some reports note. New Zealand is home to 5 million people, but 26 million or so sheep and 10 million cattle.

— Atlas buys Foster Farms. Private equity firm Atlas Holdings purchased family-owned Foster Farms, a California chicken processor, and hired Donnie Smith as chief executive, the same job he held at Tyson Foods from 2009-16. Link for details via Food Dive.

— U.S. baby formula crisis has been getting worse. Out-of-stock rates spiked to 74% nationally for the week ended May 28, up from 70% the previous week, based on data from the retail tracking firm Datasembly. In 10 states, the rates were 90% or higher. While incoming shipments and rebooted production give some reason to hope the crisis could improve in coming weeks, for now it’s still taking a heavy toll on families. Link to Businessweek article.

Meanwhile, a former employee alleged problems at Abbott’s Sturgis, Mich., baby-formula plant in February 2021, earlier than previously known, according to a government official, a person familiar with the matter and documents viewed by the WSJ. A complaint filed under OSHA’s whistleblower-protection program claimed equipment was failing and formula was being released without adequate evidence it was safe. The shutdown of the plant a year later has contributed to a severe U.S. formula shortage. Abbott said it investigated but has been unable to confirm the claims.

|

CORONAVIRUS UPDATE |

— Summary:

- Global cases at 533,684,323 with 6,305,006 deaths.

- U.S. case count is at 85,214,036 with 1,010,520 deaths.

- Johns Hopkins University Coronavirus Resource Center says there have been 589,852,206 doses administered, 221,567,092 have been fully vaccinated, or 67.25% of the U.S. population.

— Moderna hopes to launch a new Covid-19 booster shot this fall targeting both the original coronavirus strain and the omicron variant, after promising early results from clinical trials.

— Biden administration is gearing up to roll out Covid-19 vaccines for children under age 5, the last age group still ineligible. If approved by federal regulators, the vaccinations could begin as soon as June 21. An FDA advisory committee will meet June 14 and 15 to review the data, and the CDC will follow on June 17 and 18 before the CDC director makes a recommendation. Five million doses have initially been made available for preorders by states, community health centers and pharmacies; another five million will be made available under the administration’s plan.

— A study of AstraZeneca’s Covid-19 antibody treatment found it cut the risk of severe disease when given soon after symptoms develop, paving the way for its broader use.

|

POLITICS & ELECTIONS |

— Politics 101. "You really can’t win an election with a bumper sticker that says: ‘Well, we can’t do much, but the other side is worse,’” Sen. Bernie Sanders (I-Vt.) said in criticism of the Democratic Party.

— Axne race now ‘leans Republican.’ Despite Democratic Rep. Cindy Axne of Iowa having a larger campaign fund, the redrawn 3rd House District in Iowa “may be too red” for her in the race against the Republican nominee, Zach Nunn. That race, formerly a toss-up, is now rated “leans Republican” according to Sabato’s Crystal Ball (link).

|

CONGRESS |

— House voted 223-204 to pass a package of gun bills introduced after the deadly shootings in Buffalo and Uvalde. But the "Protecting Our Kids Act" doesn't have 60 votes to break a Senate filibuster.

|

OTHER ITEMS OF NOTE |

— Thailand removed marijuana from its banned narcotics list, becoming the first country in Southeast Asia to allow the production and sales of the drug. People will now be able to consume cannabis-infused dishes, but smoking the stuff is still banned. The government hopes the move will boost agriculture and tourism. A law to further relax drug legislation is being considered in parliament.

— An armed California man arrested outside the home of Supreme Court Justice Brett Kavanaugh early Wednesday was charged with attempted murder.