ICAC Announces Temporary Pause in Monthly Forecast of Season-Average Cotton Prices

Russia accuses U.S. of dangerously escalating the war

|

In Today’s Digital Newspaper |

Private exporters reported sales of 352,000 MT of soybeans for delivery to Pakistan — 55,000 MT for delivery during MY 2021-2022 and 297,000 MT for delivery during MY 2022-2023.

Due to cotton price volatility, the International Cotton Advisory Council announced a temporary pause in its monthly forecast of season-average cotton prices and said it would decide in August whether to resume the estimates.

President Joe Biden will meet with NATO’s chief. Discussions today will focus on Russia’s invasion of Ukraine, which is fast approaching its 100th day.

Russian forces now control 70% of the eastern city of Severodonetsk, boosting Moscow’s aim of seizing the entire Donbas area of Ukraine.

Kremlin spokesman Dmitry Peskov accused the U.S. of dangerously escalating the war, raising the specter not only of increased fighting in the country, but potentially spreading it beyond Ukraine’s borders. “The U.S. is deliberately and diligently pouring oil on the fire,” Peskov said, commenting on the U.S. decision to provide four U.S.-made High Mobility Artillery Rocket Systems (HIMARS) to Ukraine. It will take around three weeks for the U.S. and NATO to train the Ukrainians on HIMARS.

Some progress is being made in talks to get Ukrainian grain moving back into world commerce via the Black Sea. Turkey reportedly will aid in removing mines from the Black Sea. Ukrainian officials want assurances that removing mines will not leave their coast unprotected from Russia naval vessels. But Russia is unlikely to agree to any major controls on their naval operations in the Black Sea.

The Biden administration said it is working to get temporary storage containers to help salvage some of the around 20 million tons of grain that are currently stuck inside Ukraine. Still, as these efforts are underway, the U.S. and its international partners are no closer to finding a quick and absolute solution to lifting the Russian blockade.

Contract talks between West Coast port operators and dockworkers resumed after an unexpected 10-day break. Meanwhile, North European container ports say they are running at capacity with the peak shipping season still to come.

OPEC+ meets today and Saudi Arabia is reportedly poised to pump more oil, according to the Financial Times.

President Biden warned there is little the administration can do in the short term to lower high energy and food prices. Biden said instead of direct action to bring down gas or food prices, he is looking to ease the financial burden in other areas, like prescription drugs and child care.

House Republicans are planning to unveil a six-part strategy today aimed at lowering gasoline prices and addressing climate change while pushing for an "all of the above" approach to energy production and offering no emissions targets

Biden met virtually with baby formula manufacturers as data suggest shortage is worsening.

The Education Department is wiping out $5.8 billion in student loans from borrowers who attended Corinthian Colleges. It’s its biggest student loan forgiveness action ever.

John Hinckley Jr., who shot former President Ronald Reagan, is to be released from custody.

Election Day 2022 is 159 days away. Election Day 2024 is 887 days away.

|

MARKET FOCUS |

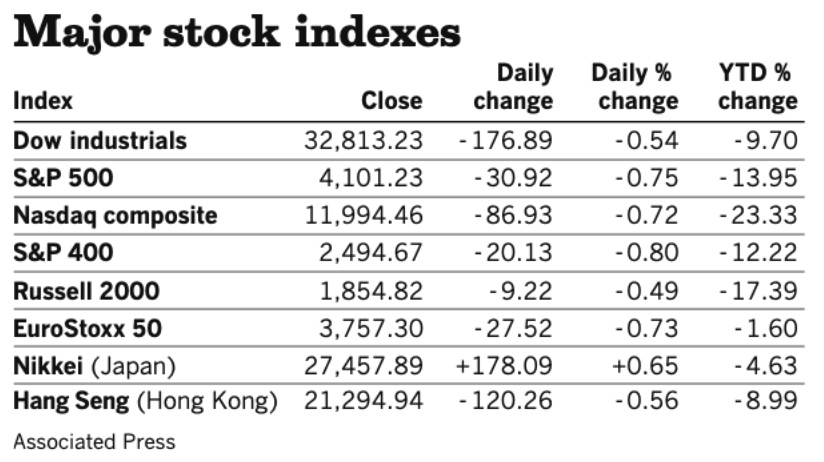

Equities today: Global stock markets were mixed overnight. U.S. Dow opened slightly higher and is currently trading around 100 points lower. Major Asian stock indexes closed mostly lower, Europe was up at midday.

U.S. equities yesterday: The Dow finished down 176.89 points, 0.54%, at 32,813.23. The Nasdaq fell 86.93 points, 0.72%, at 11,994.46. The S&P 500 lost 30.92 points, 0.75%, at 4,101.23.

U.S. equities attracted $18.8 billion in net inflows in May, with tech, dividend-income and healthcare stocks among the gainers, according to Jefferies. A drawdown of $29 billion in April had been the first monthly outflow this year.

Agriculture markets yesterday:

- Corn: July corn futures tumbled 22 1/4 cents to $7.31 1/4, the contract’s lowest close since April 1. December corn fell 20 cents to $6.91 1/2, also the lowest settlement since April 1.

- Soy complex: July soybeans rose 7 cents to $16.90 1/4. July soymeal fell $2.10 to 412.70. July soyoil rose 19 points to 78.11 cents.

- Wheat: July SRW wheat fell 46 1/4 cents to $10.41 1/4, the contract’s lowest closing price since April 7. July HRW wheat fell 37 1/4 cents to $11.28 1/4, a four-week low. July spring wheat plunged 50 1/2 cents to $11.97.

- Cotton: July cotton fell 292 points to 136.06 cents per pound and new-crop December fell 402 points to 118.43 cents.

- Cattle: August live cattle rose $2.525 to $132.90. August feeder futures soared $4.60 to $169.725.

- Hogs: June lean hogs surged $1.825 to $109.80, while July hogs rallied $4.425 to $112.425, the contract’s highest settlement since April 28.

Ag markets today: Corn and wheat futures posted corrective gains overnight after sharp losses Wednesday, while soybeans built on yesterday’s gains. As of 7:30 a.m. ET, corn futures were trading 2 to 4 cents higher, soybeans were mostly 6 to 9 cents higher and wheat futures were mostly 12 to 18 cents higher. Front-month U.S. crude oil futures were around $3 lower and the U.S. dollar index was more than 300 points lower this morning.

Technical viewpoints from Jim Wyckoff:

On tap today:

• ADP's employment report, due at 8:15 a.m. ET, is expected to show the U.S. private sector added 299,000 jobs in May.

• U.S. jobless claims, due 8:30 a.m., are expected to hold at 210,000 in the week ended May 28, unchanged from one week earlier. UPDATE: New applications for unemployment benefits dropped last week, marking four months of historically low claims in a tight U.S. labor market. Initial jobless claims, a proxy for layoffs, fell to 200,000 last week from the previous week’s revised level of 211,000, the Labor Department said Thursday.

• U.S. labor-productivity data, due at 8:30 a.m. ET, is expected to fall at a 7.5% annual pace for the first quarter, unchanged from an earlier reading.

• U.S. factory orders for April, due at 10 a.m., are expected to increase 0.6% from the prior month.

• Federal Reserve Bank of Cleveland President Loretta Mester speaks on the economic outlook at 1 p.m.

• South Korea's consumer price index for May, which is set to be released at 7 p.m., is expected to increase 5.1% from one year earlier.

• Biden administration: President Biden is scheduled to join a meeting at 11:15 a.m. E.T. with NATO Secretary-General Jens Stoltenberg and U.S. National Security Advisory Jake Sullivan to discuss preparations for the NATO Summit in Madrid this month. At 5:30 p.m. Mr. Biden is set to depart the White House for Rehoboth Beach, Del. Vice President Kamala Harris is set to announce at 1:20 p.m. the administration’s plan to cancel all student debt held by people who attended now-defunct Corinthian Colleges (see related item below).

Eurozone reported its April producer price index was up a stunning 37.2%, year-on-year. Most of that was rising energy costs but excluding energy the PPI was still up 15.6% annually. Meanwhile, Croatia is on track next year to become the 20th nation to adopt the euro, and the first since 2015.

Eight of the past 11 extended cycles of interest rate rises by the Federal Reserve have eventually ended in recession, according to Deutsche Bank analysts. Meanwhile, Jamie Dimon said U.S. consumers still have six to nine months of spending power. The JPMorgan CEO also warned that an economic "hurricane" still looms despite pandemic stimulus funds that continue to pad household finances. His comments appeared at odds with JPMorgan strategist Marko Kolanovic, who wrote on the same day that “there will be no recession.”

How the Fed's portfolio runoff will work. The Federal Reserve began the process Wednesday of shrinking its $8.9 trillion asset portfolio. Link to a WSJ article that answers some questions about the process.

From the KC Fed Beige Book recap: Contacts at craft breweries noted that higher wheat costs may lead to losses as consumers substitute to lower cost options.

Scraping by on $250,000. More than a third of Americans earning at least $250,000 annually say they are living paycheck to paycheck, with more than half of millennials earning four times the median U.S. salary saying they have little left every month.

Food crisis may ease: U.N. Secretary-General. While calling for decisive action to keep food and energy flowing from the Black Sea region, U.N. Secretary-General Antonio Guterres said, “I think there is progress” in the negotiations to mitigate a world food crisis. But he said any breakthrough was not imminent and could still be some time off. Guterres called for "quick and decisive action to ensure a steady flow of food and energy," including "lifting export restrictions, allocating surpluses and reserves to vulnerable populations and addressing food price increases to calm market volatility." Link for details.

Will the global food crisis get political? Ian Bremmer of Eurasia Group shared his insights on the topic with GZERO. Here is what he said:

“Yeah, I think it's interesting. Right now it's political in the sense that a lot of the developing countries are blaming the West for not caring about them, refusing equitable redistribution through the pandemic and through the Russia war and as a consequence, focusing more on how they can take care of themselves, which means more protectionism. But that protectionism is of course political. It is willingness to accept lack of efficiency and not getting the best price to ensure that your population is fed, that your population is taken care of. And I think going forward, there's going to be a lot more of that. It'll be interesting to see whether or not the developing world is equally angry at the West for this as they are with the Chinese for lots of investments on the ground in their countries to get access to food for the Chinese population. Because of course they're significant importers too. And in places like Sub-Saharan Africa, the Chinese are writing all the big checks, but they're also the ones taking out a lot of the resources in a way that the Europeans and the Americans were 50 years ago and that led to a lot of backlash against the advanced industrial democracy. So we'll watch how all that plays out, but certainly the food crisis is a deeply political crisis.”

Vertical farms attract dollars. “Record high fertilizer prices, war-borne grain shortages and poor weather have created extraordinarily challenging conditions to meet growing global food demand,” the investment research firm PitchBook wrote in a recent report (link). “Biofertilizers, field robotics and indoor farming technologies will be essential in overcoming these challenges.” There was record investment in agtech last year, and the deals keep coming. V.C.s invested $10.5 billion across 751 deals in agtech start-ups in 2021, a deal value increase of more than 58% over 2020, PitchBook says. That uptick came as climate extremes hurt farming yields, and as awareness of scarcity grew because of pandemic-related supply chain issues. This year, the pressure to find new, sustainable growing methods has intensified, so vertical farming start-ups — mostly indoor operations that grow crops in stacked racks instead of fields — are finding funding.

Perspective: Vertical farms save space, can be built almost anywhere, are climate-controlled and easy to automate, and they require less water, nutrients and soil than a traditional field. But high-tech farms cost a lot to build, consume huge amounts of energy if poorly designed and can’t accommodate all crops. Perishable produce like leafy greens, berries, and tomatoes flourish in vertical farms, while the grains the world relies upon don’t grow well indoors.

Market perspectives:

• Outside markets: The U.S. dollar index is lower in early trading. The yield on the 10-year U.S. Treasury note is fetching 2.915%.

• OPEC+ meets today. A report from the Financial Times overnight (link/paywall) suggested that Saudi Arabia told the West it was prepared to raise oil production if Russia's output fall substantially under the weight of sanctions. Another report from the Wall Street Journal on Tuesday outlined that OPEC+ could suspend Russia from a supply deal due to economic fallout from the invasion of Ukraine and its ability to pump more crude. The oil group is set to meet today for its June meeting, and while it's expected to maintain production, leader Saudi Arabia may announce an immediate supply boost or bring forward production increases (previously set for September) if the climate is right.

• President Biden sees no quick fix on gas prices. The U.S. has no immediate way to slash the price Americans are paying for gasoline and is considering other proposals such as trying to set a lower price for sale of Russian crude, Biden told reporters at the White House on Wednesday. Meanwhile, Biden is likely to visit Saudi Arabia later this month as part of an international trip for NATO and Group of Seven meetings, Meanwhile, Biden is likely to visit Saudi Arabia later this month as part of an international trip for NATO and Group of Seven meetings, with record high U.S. gas prices weighing on the Democrats’ political prospects. Saudi Arabia and other OPEC members may boost oil output to offset a drop in Russian production, a move that could take some pressure off surging global inflation and pave the way for an ice-breaking visit to Riyadh by Biden. Families of victims in the Sept. 11, 2001, terrorist attacks are pressing President Biden to raise accountability for the attacks when he meets with Saudi Crown Prince Mohammed bin Salman.

• Malaysia on Wednesday suspended all poultry exports due to an acute shortage of feed. The ban has caused anxiety in next-door neighbor Singapore.

• Coming impact of still higher diesel prices. “It’s not going to be as much of a trickle; it’s going to be more like Niagara Falls as the increases start to come in,” says Tom Kloza of OPIS, a Dow Jones & Co. energy information-services company, on the potential impact of rising diesel prices on consumer goods.

• Oil should be around $70 as demand drops and a recession looms, according to Citi. The firm cut its demand expectations by 1.4 million barrels for this year as economic turmoil looms. In an interview with Bloomberg (link), Citi's head of commodity research broke down why oil is overvalued at $120 a barrel.

• Warning signs that the U.S.’ electrical grid can't handle the summer heat. Last month, the North American Electricity Reliability Corporation, a nonprofit electrical grid watchdog, issued a new report warning that two-thirds of the United States face a heightened risk of power outages this summer. Part of the problem is adverse weather conditions. A drought in the West has diminished hydroelectric capacity, and a drought in the Missouri River basin is denying thermal generators the natural cooling they need to stay operational. But a Washington Examiner report says not all of the grid’s troubles are related to weather. “Government regulations and taxes designed to reduce carbon emissions have also caused a huge loss in generating capacity from power plants reliant on fossil fuels. The Midcontinent Independent System Operator (covering a 15-state region extending north from the Gulf through the Midwest) alone has 3.2 gigawatts less power capacity this summer than it did last year, all due to the retirement of fossil fuel power plants.” “We are headed for a reliability crisis,” Mark Christie, a Republican-appointed commissioner on the Federal Energy Regulatory Commission, said, noting that utilities are being forced to move too quickly to supposedly “renewable” energy sources such as wind and solar. “We’re just not ready yet,” Christie warned.

• California drought worsens. Major restrictions on outdoor water use have gone into effect for Southern Californians as the state attempts to conserve. Declining reservoir levels and reduced snowpack have led to a severe three-year drought and officials fear that some communities won't even have enough water to get through the summer. "Some would consider this a wake-up call. I disagree," said California's Natural Resources Secretary Wade Crowfoot. "The alarm's already gone off." California authorities have urged people to recycle water, take shorter showers, and only run dishwashers and washing machines when full, but the messaging has fallen on deaf ears. According to State Water Resources Control Board, average urban water use even rose nearly 19% in March, compared to the same month in 2020.

• International cotton advisory group gives up on predicting volatile cotton prices. Pointing to “many variables and unknowns,” the International Cotton Advisory Council announced a temporary pause in its monthly forecast of season-average cotton prices and said it would decide in August whether to resume the estimates. Link for details.

• Ag trade: Egypt bought 465,000 MT of wheat, including 175,000 MT from Russia, 240,000 MT from Romania and 50,000 MT from Bulgaria. Algeria purchased around 90,000 MT of milling wheat from an unspecified origin.

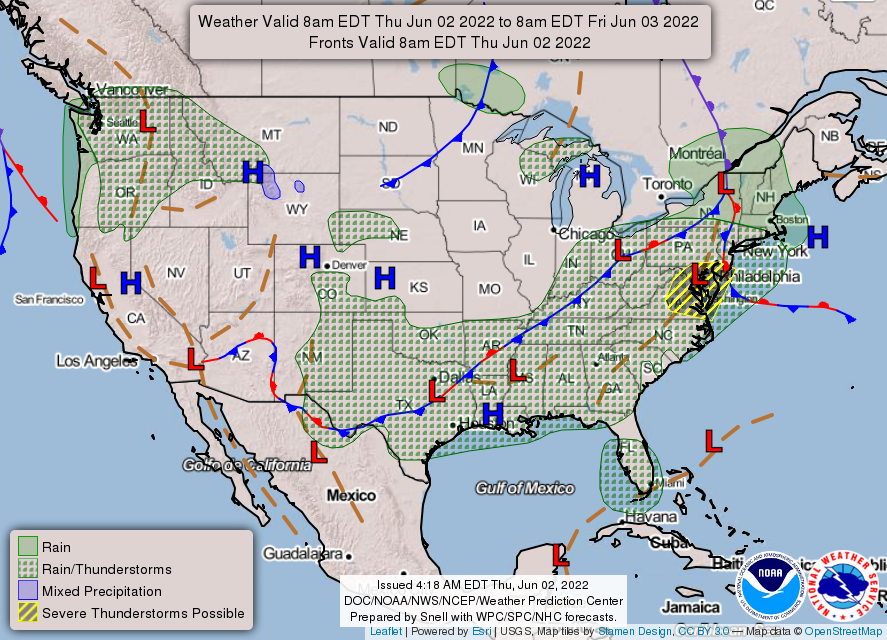

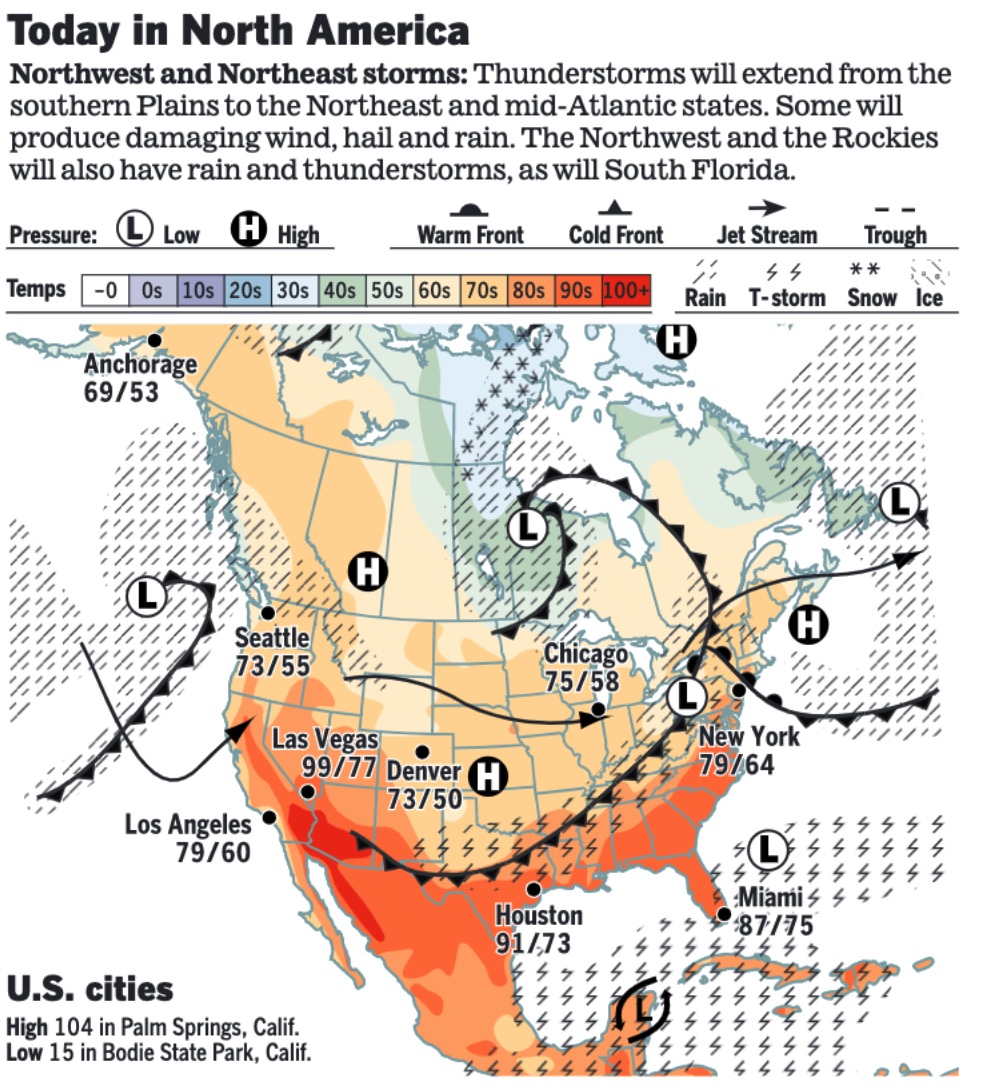

• NWS weather: Numerous areas of showers and thunderstorms to impact the southern and eastern U.S. today with cooler temperatures arriving to end the week... ...Some severe weather will be possible across portions of the Mid-Atlantic states today... ...A tropical depression or tropical storm is likely to develop over the southeast Gulf of Mexico and approach south Florida by this weekend... ...Very heavy rainfall and concerns for flash flooding will exist over south Florida for Friday and Saturday.

Items in Pro Farmer's First Thing Today include:

• Firmer tone overnight

• Ukraine working with UN to restore grain exports (details in Russia/Ukraine section)

• India allows small wheat exports, but some stocks still stuck at ports

• Another bumper Aussie wheat crop expected

• China soybean auctions continue

• Strong futures rally firms up cash cattle bids

• String of cash hog index strength ends

|

RUSSIA/UKRAINE |

— Summary: Russia is looking to consolidate gains in the South and seems to be making incremental progress toward taking greater control of the Donbas. Ukraine, meanwhile, is trying to hold Russia back and exploring counter-offensives in Kherson province, which borders Crimea and represents Russia’s westernmost advance in the war. Ukrainian President Volodymyr Zelenskyy does not seem to be in the mood to negotiate just yet. He compared Henry Kissinger’s call for talks with the appeasement of Adolf Hitler in 1938.

- The decision by the U.S. to supply advanced weapons to Ukraine has sparked concern that Russia may retaliate. Russian officials called the decision a "direct provocation" after the U.S. and the U.K. agreed to provide missile systems to Kyiv capable of hitting targets 50 miles away. NATO, however, does not foresee a Russian retaliation.

- Putin thinks time is on his side in war with Ukraine. Russian President Vladimir Putin appears to be counting on international solidarity with Ukraine to fracture first, as economies around the world come under pressure from inflation and food shortages exacerbated by the war, as well as from divergent domestic political and security interests. “The current state of the global economy shows that our position is right and justified,” Putin said in an address late last month to a forum of the Eurasian Economic Union, a Moscow-dominated alternative to the European Union that includes Armenia, Belarus, Kazakhstan and Kyrgyzstan. “These advanced economies have not had such inflation for the past 40 years; unemployment is growing, logistics chains are breaking and global crises are growing in such sensitive areas as food,” Putin said. “This is no joke.”

- Hundreds of Russian soldiers have escaped the fighting in Ukraine or refused to take part during the early stages of the war, placing Russian authorities in a bind over how to punish deserters without drawing more attention to the issue, the Wall Street Journal reports (link). The Russian military is short on manpower and is seeking recruits to help turn the tide in Ukraine, where the domestic intelligence agency is hunting for Russia supporters and agents. Meanwhile, Ukrainian security services are hunting for citizens that they view as abetting Russia.

- Some Russian companies and wealthy individuals are moving to Dubai after the UAE decided not to enforce sanctions on Moscow.

- Companies that help Russian oligarchs hide their assets are under scrutiny. A U.S. government task force is looking at two firms run by a Russia-born entrepreneur, Evgeniy Kochman, that manage yachts and villas for the rich, according to a New York Times investigation. Kochman’s Imperial Yachts oversaw the construction of a superyacht that U.S. officials say is linked to Vladimir Putin.

— Market impacts:

- Ukraine working with U.N. to restore grain exports. Ukraine is working with international partners to create a United Nations-backed mission to restore Black Sea shipping routes and export Ukrainian ag products, foreign ministry spokesman Oleg Nikolenko said. “We call on countries whose food security may suffer more from Russian aggression against Ukraine to use their contacts with Moscow to force it to lift the blockade of Ukrainian seaports and end the war,” Nikolenko wrote on Facebook.

- WSJ: European sanctions targeting Russian oil may be no match for the crude shipping sector’s sometimes-murky supply chains. Crude carriers and refiners already appear to be getting Russian products to global markets by obscuring their origins, and the Wall Street Journal reports (link) that some fuels believed to be partially made from Russian crude landed in New York and New Jersey last month. Shipping records and industry analysts say the cargoes were brought through the Suez Canal and across the Atlantic from Indian refineries, which have been big buyers of Russian oil. It’s one example of how shipping processes are being manipulated to obscure the origins of Russian oil to keep it flowing. The oil is being concealed in blended refined products and it’s being transferred between ships at sea, a page out of the playbook used to buy and sell sanctioned Iranian and Venezuelan crude.

- Russia’s factories suffered a sharp fall in output in April, with sagging auto production leading a 61% drop from last year’s output.

|

POLICY UPDATE |

— Biden administration is awarding millions of dollars to expand and improve the nation’s rail tracks to reduce freight congestion and speed up the supply chain as shippers decry what they see as poor service. The Transportation Department announced it will spend almost $370 million in grants for 46 projects in 32 states and Washington, D.C.

|

PERSONNEL |

— New Coast Guard chief is first woman to lead branch. Admiral Linda Fagan was sworn in Wednesday as the new commandant of the US Coast Guard, becoming the first female service chief in the U.S. armed forces. Fagan, the branch’s 27th commandant, has served on all seven continents over 36 years in the Coast Guard.

|

CHINA UPDATE |

— China announced a $120 billion investment in its infrastructure. It’s part of Beijing’s effort to stimulate the economy following months of harsh Covid lockdowns. Meanwhile, Beijing’s calls for faster implementation of growth-boosting policies have intensified with data showing China’s economy continued to decline in May. China has aimed most financial support this year at corporations rather than households.

|

ENERGY & CLIMATE CHANGE |

— Aviation industry pushes for green jet fuel incentives (SAF). The aviation industry warned that efforts to expand sustainable aviation fuel may be stalled if Congress doesn’t enact a tax incentive and invest more on production facilities. Lobbyists said the industry may not be able to meet the joint Biden administration and industry target of 3 billion gallons of sustainable aviation fuel (SAF) available per year by 2030, up from around 5 million last year, without a blender’s tax credit that they have lobbied Congress to pass. Such a tax break was included in the stalled Build Back Better bill and may be included in restarted negotiations with Sen. Joe Manchin (D-W.Va.), as we previously reported. Besides tax credits, industry officials are looking at other initiatives for advancing sustainable aviation fuel. R&D programs can also be expanded in appropriations bills and even potential provisions in the any farm bill.

Industry comments. “There’s no doubt that today’s volatility in oil prices and the uncertainty in our markets reinforce our need of greater SAF production,” Billy Nolen, acting chief of the Federal Aviation Administration, said Wednesday, referring to sustainable aviation fuel. Meanwhile, Southwest Airlines announced Wednesday that they were investing in a sustainable aviation fuel pilot project backed by the Energy Department.

But environmental groups are urging the U.S. to reconsider its plans to develop sustainable aviation fuel because of concerns about the plans’ inclusion of crop-based biofuels, which are derived from soy and other agricultural products.

— EPA on track to issue RFS details Friday. June 3 is EPA’s deadline under a legal settlement with advocates for corn-based ethanol. Likely details according to various reports:

- EPA is expected to retroactively lower already established targets for 2020, partly to adjust for pandemic-battered fuel demand that year. But levels are not expected to vary greatly from the marks the agency proposed in December 2021.

- The final rule is set to include slightly higher-than-proposed targets for biofuel blending in 2021, based on updated consumption data that year. The initial proposal, coming weeks before the end of the year, did not reflect final government data on renewable fuel demand in 2021.

- EPA officials have told industry representatives to expect final 2022 quotas to be aligned with that initial proposal, which laid out a requirement for using 20.77 billion gallons of renewable fuel this year (15 billion gallons of corn-based ethanol). The proposed 2022 quota would represent the highest-ever biofuel target EPA has established under the renewable fuel program since its creation 17 years ago.

Reaction: Oil refiners said the proposed 2022 mandate, which requires biofuel to make up at least 11.8% of transportation fuels, would end up boosting prices at the pump. It would raise industry compliance costs and strain the available pool of biofuel credits that refiners use to prove they have fulfilled annual quotas. Most gasoline sold in the U.S. is made up of 10% ethanol. Meanwhile, ethanol and biodiesel producers have lobbied the White House to boost targets, arguing the proposed quotas underestimate potential production.

Comments: EPA is seen issuing a decision on pending small refinery exemptions (SREs), potentially rejecting most if not all of those. EPA is also expected to release a proposed rule to establish an alternative RIN retirement plan for small refiners which was cleared by the Office of Management and Budget earlier this week after a brief review.

— USPS sees potential to expand EVs in fleet. The U.S. Postal Service said it sees the potential to expand the number of EVs in its fleet. USPS will soon publish a notice of intent to supplement the final environmental impact statement for Next Generation Delivery Vehicles to determine if changes to its delivery fleet mix are warranted, according to an emailed statement. House Oversight Chair Carolyn Maloney (D-N.Y.), who has urged the agency to rethink its plan to purchase gas-powered vehicles, applauded the announcement in a press release.

— Oil company exits from Arctic Refuge drilling rights. Regenerate Alaska, one of only two private companies to buy drilling rights in the Arctic National Wildlife Refuge during an auction last year, has forfeited the territory and asked the U.S. gov’t for its money back. The decision reflects waning interest in oil development inside the refuge’s 1.56-million-acre coastal plain, amid pressure from indigenous groups, litigation and regulatory uncertainty.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— In meeting with infant formula makers, Biden says he learned of severity of shortage in April. The New York Times reports (link) that the nationwide infant formula shortage “is getting worse, with an increasing number of retailers and online sellers posting out-of-stock notices.” President Biden met on Wednesday with executives of five baby food companies, and announced new shipments of formula from Europe to help restock American shelves. During Wednesday’s virtual meeting with executives from formula makers ByHeart, Bubs Australia, Reckitt Benckiser Group, Perrigo Company and Nestle SA’s Gerber, Biden suggested their ranks should grow, as his administration presses ahead with efforts to boost imported supplies to help ease a nationwide shortage. Biden said, “We need more new entrants in the infant formula market.” Abbott, which closed one of their plants at the end of February after a voluntary recall, setting off the shortage,” was notably absent from the meeting.

Biden said that he was not briefed on the prospect of nationwide shortages of infant formula for about two months. But several of the executives participating in a meeting with the president at the White House on Wednesday told him they foresaw problems as soon as Abbott issued its recalls. When a reporter pointed out that the formula executives had just told him they foresaw the impact of the shutdown” Biden said, “They did. I didn’t. ... Here’s the deal. ... I became aware of this problem sometime in early April, about how intense it was. We did everything in our power from that point on.”

|

CORONAVIRUS UPDATE |

— Summary:

- Global cases at 530,742,543 with 6,294,852 deaths.

- U.S. case count is at 84,444,990 with 1,007,703 deaths.

- Johns Hopkins University Coronavirus Resource Center says there have been 587,821,662 doses administered, 221,350,544 have been fully vaccinated, or 67.18% of the U.S. population.

— Haaland Covid positive: The Interior Department said in a release Secretary Deb Haaland Wednesday tested positive for Covid-19 and has canceled her West Coast travel plans.

— New variants are poised to keep Covid-19 circulating at high levels throughout the summer, new research suggests. The next influx of infections will probably come from the newer Omicron subvariants BA.4 and BA.5, two closely related viruses that were first characterized in South Africa and that landed in the US around late March, according to the gene sequence sharing site GISAID. The CDC said BA.4 and BA.5 together accounted for an estimated 6% to 7% of new infections in the US in late May and are more likely to lead to breakthrough infections, even in people who've had Covid-19 before. Without upgraded vaccines or boosters, some medical professionals believe a lot of Americans will get sick in the coming weeks to months.

|

POLITICS & ELECTIONS |

— Texas Republicans poised to flip Democratic congressional seat in special election June 14. Politico reports (link) that Democrats’ “South Texas problem” is “on the verge of getting worse.” Republicans are positioned “to flip former Rep. Filemon Vela’s (D-Texas) seat in a special election this summer, a victory that will further reduce Speaker Nancy Pelosi’s (D-Calif.) already miniscule majority and send a jolt of momentum through the GOP’s bid to turn the entire Rio Grande Valley red in the midterms.” The special will advance the top two candidates to a likely August runoff if no one receives 50% of the vote — a probable scenario because two Democrats and two Republicans have filed. The top Democratic candidate for the special is Daniel Sanchez. But due to redistricting, Rep. Vicente Gonzalez will be the nominee for the next full two-year term in the redrawn version of that district. Says Politico: “Democrats can either pour money in to protect a battleground seat that will not exist in January, once redistricting goes into effect — or they risk handing the GOP tangible proof of their ascendancy in the region that they are targeting aggressively in the fall midterms.” The special election will be held under the old 34th District lines, which President Joe Biden carried by 4 points. But by the midterms, the new map transforms the district into one Biden carried by nearly 16 points. Mayra Flores, a respiratory-care practitioner who is married to a border patrol agent, is running in both the special and for the full two-year term. Democrats have a different candidate in each election.

— Supreme Court on Tuesday temporarily blocked the counting of some mail-in ballots in Pennsylvania, which could affect the Republican Senate primary between David McCormick and Mehmet Oz.

— House Republicans are planning to unveil a six-part strategy today aimed at lowering gasoline prices and addressing climate change while pushing for an "all of the above" approach to energy production and offering no emissions targets. The plan was created by a task force assembled by House Minority Leader Kevin McCarthy (R-Calif.) to prepare a policy agenda that addresses climate change in case Republicans retake the House in the 2022 midterm elections. Link for details via Politico.

— More than two-thirds of Americans want to uphold Roe v. Wade, and most favor women having access to legal abortion for any reason, according to a new Wall Street Journal poll that shows a four-decade evolution in the country’s viewpoints regarding the procedure. The findings are from a poll conducted with NORC at the University of Chicago, a nonpartisan research organization that measures social attitudes. The poll was taken after the leak of a draft opinion that suggests the Supreme Court might be preparing to overturn the 1973 decision that established the constitutional right to an abortion.

— A WSJ poll finds that some 57% of respondents say a woman should be able to get an abortion for any reason.

|

OTHER ITEMS OF NOTE |

— Biden administration will cancel the largest amount of student debt to date. Student debt totaling about $5.8 billion will be canceled for half a million people who attended the now-bankrupt Corinthian Colleges. Around 560,000 student loan borrowers who attended Corinthian Colleges will soon get their balances cleared, senior Biden administration officials say. Formerly one of the largest for-profit education companies, the schools have been accused of predatory and unlawful practices, and faced numerous lawsuits. Former students of the colleges who still have a student loan balance should be refunded for previous payments made on their debt, senior administration officials said on Wednesday. To date, the Biden administration has approved $25 billion in loan forgiveness for 1.3 million borrowers. The news comes as the White House is mulling whether to move ahead with broad based student loan forgiveness. Most recently, officials were leaning toward wiping out $10,000 for all borrowers who earn below $150,000, but a spokesperson for the administration said they’ve haven’t come to any decision yet.

— Hinckley to get full freedom 41 years after shooting Reagan. A federal judge gave his final blessing Wednesday to full freedom for John Hinckley, the man who shot President Ronald Reagan in 1981, capping a four-decade journey through the court system for the once mentally ill Hinckley.

— Hospital hack. The FBI blamed hackers working for the Iranian government for an attempted cyberattack on Boston Children’s Hospital last summer.

— Doctors transplant a 3-D printed ear made from the recipient’s own cells. Link for details.

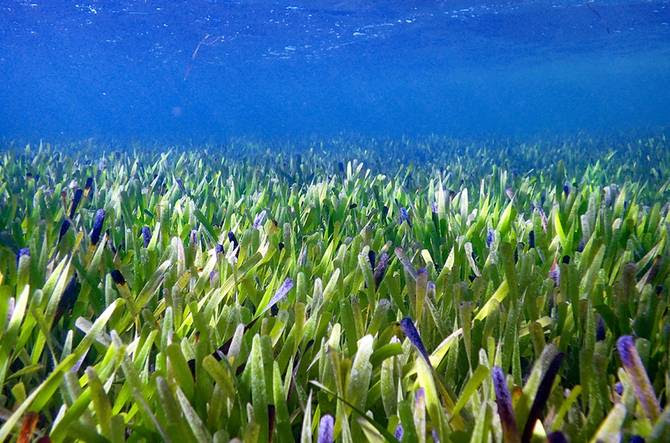

— Scientists have found what’s believed to be the largest single plant on Earth. An underwater meadow of seagrass off the coast of Western Australia spans 77 square miles—equivalent to 20,000 football fields or three Manhattans. And it all started from a single seed 4,500 years ago.